- What Is KYC Automation?

- Key Components of KYC Automation

- Why Institutions Adopt It

- Challenges of Manual KYC Processes

- Cost of Manual KYC vs Automated KYC

- Advantages of KYC Automation

- 1. Faster and More Consistent Verification

- 2. Higher Accuracy Through AI-Based Decisioning

- 3. Stronger Compliance and Regulatory Alignment

- 4. Reduced Operational Cost

- 5. Improved Scalability for High-Volume Operations

- 6. Enhanced Customer Experience

- 7. Foundation for Future AI-Driven Compliance Innovation

- 19 Automated KYC Use Cases

- KYC Automation Tools

- 1. Intelligent Data Verification

- 2. Automated Due Diligence

- 3. Continuous Compliance Workflow

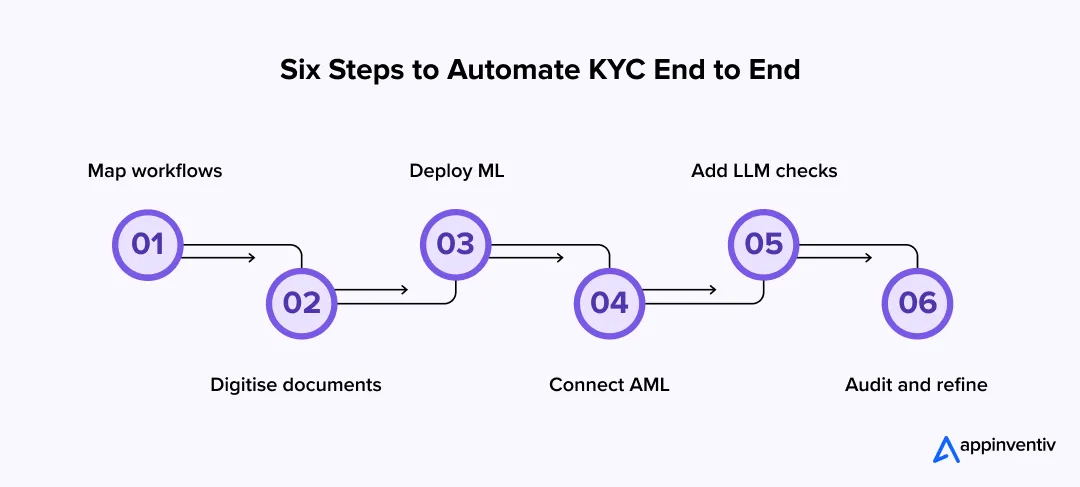

- Step by Step Guide To KYC Automation

- 1. Start by figuring out what you actually want to automate

- 2. Turn documents into clean, searchable data

- 3. Bring in machine learning to support identity checks

- 4. Connect AML screening with the KYC flow

- 5. Use LLMs where your rules fall short

- 6. Build a habit of checking the system, not just using it

- Best Practices for KYC Automation

- 1. Revisit Your Models From Time to Time

- 2. Keep Privacy Rules Front and Centre

- 3. Make Sure Every Step Leaves a Trace

- 4. Link Automation to the Bigger KYC Picture

- How Appinventiv Enables Digital KYC Transformation

- FAQs

Key takeaways:

- KYC automation cuts verification from days to minutes and keeps checks consistent across teams.

- AI and ML reduce manual errors, catch risk earlier, and make compliance far easier to scale.

- Manual KYC drains time, increases cost, and slows onboarding — automation fixes all three.

- Automated workflows handle spikes in customer volume without compromising accuracy.

- Strong KYC tools bring AML, screening, document checks, and monitoring into one clean workflow.

In the banking and fintech world, compliance has become a heavyweight cost. According to McKinsey’s 2025 benchmark study, many financial institutions allocate 10–15 % of their full-time workforce solely to KYC/AML tasks. McKinsey & Company Every form, document check, and manual verification step pulls away time and attention from growth.

That’s why organisations are shifting toward KYC automation and full-scale KYC process automation initiatives. By weaving in AI for KYC, they’re not just speeding things up — they’re transforming how identity verification works. Automated systems handle document capture, risk scoring, and case routing with precision, creating smarter workflows and stronger compliance.

This isn’t purely an efficiency game. It’s about reducing error, enhancing accuracy, and building a compliance engine that scales. In other words, know your customer (KYC) automation is becoming a key driver in modern financial services. As companies embrace digital KYC transformation, the next section will break down why traditional manual processes are no longer fit for purpose.

What Is KYC Automation?

KYC automation is a more organised way for institutions to manage identity verification. Instead of checking every document manually, the process moves through a series of defined steps that collect information, validate details, and apply the same rules to every customer. This helps institutions work faster and maintain a steady level of accuracy even as their customer base grows.

Key Components of KYC Automation

KYC automation is built on a set of capabilities that work together to make verification faster, more reliable, and easier to manage. Each component handles a specific part of the process, reducing manual effort and improving consistency. These elements form the foundation for a scalable and well-governed compliance workflow.

- Automated document verification: Modern systems read identity documents, pull out the key information, and confirm those details with reliable data sources. This cuts down on repetitive work and reduces the number of checks that usually slow teams down.

- Machine learning for identity verification: Machine learning models look at images and document traits to spot inconsistencies or signs of tampering. When issues surface early, teams spend less time correcting or reviewing cases later in the process.

- LLM-supported risk analysis: Large language models in finance help make sense of information that isn’t structured, such as statements or uploaded notes. They highlight the points that matter, which allows reviewers to evaluate cases more clearly.

- AML and KYC workflow integration: When AML checks and KYC verification run together, institutions can screen sanctions data, politically exposed persons lists, and other risk indicators in a single workflow. This makes the review more complete and reduces the gaps that often appear when systems operate separately.

Why Institutions Adopt It

Institutions choose KYC automation because it brings more control to a process that can otherwise vary from one reviewer to another. With a defined workflow, verification becomes more consistent and easier to track. It also reduces unnecessary follow-ups during onboarding, which helps both teams and customers move through the process with fewer delays.

Another advantage is the ability to scale. Digital channels can generate sudden spikes in onboarding volume, and manual teams often struggle to keep pace. Automated workflows give institutions a steadier way to handle higher volumes without needing large increases in operational staff. Since each step is recorded automatically, audit reviews and compliance checks also become clearer and more dependable.

Challenges of Manual KYC Processes

Talk to anyone working in compliance, and you’ll hear the same thing — manual KYC is slow, repetitive, and expensive. Teams spend hours chasing missing documents, retyping data, and comparing mismatched information across systems. What should take minutes often turns into days.

According to McKinsey’s analysis, banks dedicate up to 15% of their total workforce to KYC and AML-related tasks. These are skilled professionals who could be focusing on strategy or customer engagement but are instead tied up in paperwork. The outcome is predictable — long onboarding queues, inconsistent verification, and KYC compliance costs that never stop growing.

Here’s what typically goes wrong in a manual KYC process:

- Time-consuming operations: Endless document reviews, repetitive checks, and multiple system entries slow everything down.

- Human error: Different reviewers apply compliance rules differently, which leads to audit inconsistencies.

- Rising operational cost: Every additional step or recheck adds to overhead without improving accuracy.

- Compliance risks: Missed red flags or outdated watchlist data can invite penalties or reputation damage.

- Poor customer experience: Long onboarding cycles frustrate users and increase drop-off rates.

These issues often become even more visible in fraud-heavy environments, something we’ve covered in our analysis of AI in financial fraud prevention. Apart from that much of this friction disappears once institutions aim for efficiency with KYC automation, where repetitive tasks shift to systems and teams focus on higher-value decisions.

Cost of Manual KYC vs Automated KYC

Manual KYC processes carry a significant operational burden. Most institutions depend on large verification teams that work across fragmented systems, which increases time per case and creates inconsistencies. As volumes rise, these inefficiencies directly influence compliance budgets, audit performance, and customer onboarding timelines.

KYC automation changes the structure of this workflow. Automated systems extract information, validate documents, and complete database checks in minutes. The process becomes repeatable, traceable, and considerably more accurate.

A comparison highlights the performance gap:

| Parameter | Manual KYC | Automated KYC |

|---|---|---|

| Average verification time | 3–5 days | A few minutes |

| Cost per verification | 15–20 USD | 1–3 USD |

| Accuracy | About 85 percent | Over 98 percent |

| Compliance risk | High | Low |

Key factors behind the cost difference include:

- Resource dependency: Manual operations rely on extensive staffing, while automation reduces headcount requirements for routine tasks.

- Error rates: Automated verification lowers rework and reduces the likelihood of audit exceptions.

- Scalability: Workflows remain consistent even as customer volumes increase.

- Regulatory alignment: Automated systems maintain updated screening lists and reduce the risk of non-compliance.

Over time, KYC compliance automation helps institutions strengthen control while lowering operational overhead. It also enables compliance teams to shift attention from routine checks to higher-value risk assessment activities.

Institutions exploring automation at scale can also review our breakdown of AI development cost, which covers the technical layers behind cost-efficient automation.

Advantages of KYC Automation

Financial institutions handle large volumes of customer data every day. As verification demands grow, manual methods no longer provide the consistency or scale required. This is why many organisations are moving toward KYC process automation. Automated workflows help teams complete verification with fewer touchpoints and a much clearer structure. They also reduce the operational strain that comes with repetitive checks and fragmented systems.

Alongside operational gains, automation strengthens the institution’s wider compliance posture. Every step becomes easier to track, review, and audit. As regulations evolve and customer expectations rise, know your customer automation gives businesses a more stable and predictable verification environment. Below are some of the key benefits of KYC automation:

1. Faster and More Consistent Verification

Automation reduces verification time by completing routine steps in minutes. Document capture, data extraction, and initial screening move through a defined flow instead of passing between multiple reviewers. This improvement is particularly useful for institutions that manage high onboarding volumes or work across several product lines. It also gives teams the ability to handle peak periods without compromising accuracy.

Consistency is another major advantage. Automated decisions follow predefined rules, which keeps outcomes uniform across customer segments and internal teams. Instead of depending on individual judgment, institutions gain a repeatable approach that supports operational fairness and regulatory alignment. This is one of the key reasons KYC automation for banks has seen strong adoption.

2. Higher Accuracy Through AI-Based Decisioning

With AI for KYC, verification moves beyond basic data checks. Machine learning models identify document discrepancies, detect tampering, and validate identity attributes at a finer level of detail. These capabilities reduce errors that typically surface during audits or post-onboarding reviews. They also ensure that high-risk cases move to human review much earlier.

Using machine learning for identity verification also strengthens fraud detection. Models learn from past behaviours, helping institutions identify patterns that manual teams might overlook. This shift provides the foundation for AI-driven KYC automation, where risk scoring becomes more reliable and less time-consuming.

A closer look at how ML is shaping financial decisioning can be found in our article on machine learning in banking.

3. Stronger Compliance and Regulatory Alignment

Compliance teams spend significant time maintaining documentation and ensuring procedures match regulatory standards. Automation eases this workload. Each verification step is recorded, screened, and validated within the system. This supports cleaner audit trails and reduces the risk of missed checks. As organisations scale operations, KYC compliance automation becomes a structural advantage rather than an optional enhancement.

Integrating AML screening improves oversight further. Through AML and KYC automation integration, institutions conduct sanctions checks, PEP reviews, and risk scoring within a unified workflow. This approach reduces fragmentation between systems and ensures customer risk is assessed more consistently.

4. Reduced Operational Cost

Manual verification depends on large teams and repeated reviews. As customer volumes increase, these costs grow quickly. Automation lowers this dependency by processing routine checks through systems rather than additional staff. Over time, this change reduces the institution’s overall compliance expenditure and stabilises long-term cost structures.

The financial benefits extend beyond headcount. Automated workflows reduce rework caused by inconsistencies or incomplete documentation. This creates fewer bottlenecks and fewer escalations, making KYC automation for financial institutions a cost-effective approach in both the short and long term.

5. Improved Scalability for High-Volume Operations

Institutions working across multiple channels often face sudden spikes in demand. Manual workflows struggle during these surges, which affects onboarding time and customer satisfaction. Automated systems, supported by KYC API integration, handle these variations more smoothly and maintain consistent performance even during high-load periods.

Scalability also supports business expansion. Once automated workflows are in place, institutions can introduce new products, markets, or customer segments with lower operational risk. This level of flexibility is difficult to achieve through manual methods alone.

6. Enhanced Customer Experience

Faster verification directly improves onboarding. Customers submit fewer documents, face fewer follow-ups, and complete the journey in significantly less time. This clarity reduces friction, which leads to higher completion rates and improved customer satisfaction.

A streamlined process also strengthens brand perception. When verification moves smoothly, customers view the institution as reliable and efficient. As more organisations turn to know your customer automation, this experience becomes a differentiator, not just an operational advantage.

7. Foundation for Future AI-Driven Compliance Innovation

Automation creates a stable foundation for advanced compliance capabilities. Systems that support automated KYC verification make it easier to introduce predictive analytics, document intelligence, and behaviour-based risk scoring. These capabilities help institutions identify complex risks that become harder to detect as digital activity grows.

A structured workflow also speeds up the adoption of new technologies. Organisations can expand capabilities through dedicated modules or integrations, enabling automated KYC solutions development without redesigning the entire verification process. This flexibility helps institutions stay aligned with emerging regulatory requirements.

19 Automated KYC Use Cases

KYC automation touches many parts of the verification process and gives institutions a more dependable way to manage customer data at scale. As more activity shifts to digital channels, these tools help teams keep checks accurate, reduce repetitive tasks, and maintain a steady compliance standard across different business units.

Below are the automated KYC use cases highlighting where automation creates measurable operational value.

- Customer Onboarding

Automated checks collect and validate customer information in one flow, reducing delays and helping teams work with cleaner data from the start. - Transaction Monitoring

Transactions are reviewed as they occur, and anything unusual is flagged for attention. Teams no longer have to rely solely on end-of-day reviews. - Digital Wallet Verification

Identity documents and basic checks run in the background, allowing wallet users to activate accounts quickly while still meeting compliance rules. - Customer Due Diligence (CDD)

Information gathering and basic risk scoring become more structured, which makes reviews easier and records more reliable. - Enhanced Due Diligence (EDD)

High-risk profiles undergo deeper checks across multiple sources. The process becomes faster and more consistent without skipping essential steps. - AML Screening

Customer details are checked against sanctions and global watchlists automatically. This keeps institutions aligned with ongoing regulatory updates. - Data Enrichment

External data sources help confirm or fill gaps in customer information, giving teams a more complete and accurate profile. - Age and Identity Authentication

Companies that need age or identity verification use automation to confirm eligibility quickly and reduce manual oversight. - Fraud Scoring

Behavioural patterns and transaction trends are analysed for fraud detection using AI. Higher-risk cases are escalated before issues build up. - Biometric Verification

Facial or fingerprint checks help confirm that the person onboarding is genuine. This reduces impersonation attempts and strengthens control. - Compliance Reporting

Reports are generated automatically from the system logs. Teams save time and gain cleaner documentation for internal and external reviews. - Sanctions Screening

Customers are matched against updated sanctions lists in real time. This helps avoid unintended interactions with restricted individuals or entities. - Risk-Based KYC

Verification steps adjust according to customer risk level, keeping the process efficient and aligned with regulatory expectations. - Continuous Monitoring

Profiles are monitored regularly for changes in behaviour or risk. Alerts help teams act quickly when something looks different from a customer’s usual pattern. - Cross-Border Compliance

Workflows adapt to country-specific KYC rules. This makes it easier for global institutions to maintain consistent onboarding practices. - Third-Party Due Diligence

Vendors and partners are screened through automated checks to confirm their compliance posture and reduce ecosystem risk. - Regulatory Updates

Screening rules and verification steps update automatically when regulations change. Institutions avoid manual rework and stay aligned with new requirements. - Identity Refresh and Re-Verification

When customer information changes, automated rechecks update records and validate new documents without slowing day-to-day operations. - High-Volume Campaign Onboarding

Product launches and seasonal demand spikes are handled smoothly. Automation processes large onboarding volumes without creating backlogs.

KYC Automation Tools

KYC automation tools give organisations a cleaner, more dependable way to handle verification without leaning too heavily on manual checks. Instead of moving data between different systems or depending on large review teams, these platforms keep the entire process in one place.

The idea is simple: reduce the repetitive work, make decisions more consistent, and give compliance teams better visibility across a customer’s journey. Most platforms share a few key features of KYC automation tools, such as intelligent document handling, built-in due diligence modules, and continuous compliance workflows that keep reviews consistent.

1. Intelligent Data Verification

Most tools start by turning documents into structured data that teams can actually use. They read IDs, compare faces, and extract details with the help of OCR and machine learning. It’s a straightforward way to remove the small tasks that usually slow onboarding down. Once this information is cleaned and verified, the rest of the process becomes easier to manage.

2. Automated Due Diligence

Screening is another area where automation makes a noticeable difference. These systems check customers against sanctions lists, PEP data, and other risk indicators as soon as the information is submitted. A built-in scoring engine weighs the results and highlights profiles that may need attention. This keeps reviews consistent and saves teams from digging through multiple databases.

3. Continuous Compliance Workflow

Modern platforms don’t stop after the initial check. They keep an eye on customer activity and surface important changes when they occur. APIs help different systems talk to each other, so updates move quickly and nothing gets lost. Only the cases that genuinely require human judgment are pushed forward, which keeps the workload manageable and the process steady.

For teams exploring end-to-end solutions, our guide on compliance management software development explains how these tools fit into larger architectures.

Step by Step Guide To KYC Automation

Automating KYC is not one big switch you flip. It works better when you break it into smaller pieces and stabilize each one before moving to the next. Most teams already know where the daily friction points are, automation simply helps put those pieces in order.

This section breaks down the practical steps to automate KYC process end-to-end, allowing teams to improve efficiency without disrupting the existing workflow.

1. Start by figuring out what you actually want to automate

Before touching any tools, sit down with the current workflow and trace how information moves. Where does the process slow down? Which checks always end up being repeated? Who touches the data more than they should?

Most institutions realise that 60–70% of their KYC steps are routine. Pick those first instead of trying to rebuild everything in one go.

2. Turn documents into clean, searchable data

KYC will stall if the underlying documents are messy. Use OCR and document AI to pull details from IDs and forms so reviewers aren’t retyping the same fields all day.

Once you have clean digital inputs, the rest of the automation flow becomes much easier to manage. It’s the one step you shouldn’t rush.

3. Bring in machine learning to support identity checks

After digitisation is in place, introduce ML to verify images, match faces, and catch early signs of tampering. These models don’t “take over” the review; they simply reduce the mechanical work that slows the team down.

Leave the exceptions to human reviewers in the beginning. Their decisions help the model become more reliable over time.

4. Connect AML screening with the KYC flow

Most organisations still treat AML as a separate lane. It’s more efficient when both run in one chain. As soon as customer data comes in, it should pass through sanctions, PEP, and watchlist checks without manual triggers.

Simple API connections can move this information around so nothing has to be stitched together later.

5. Use LLMs where your rules fall short

There will always be documents or statements that don’t fit a template. That’s where LLMs help by reading through comments, declarations, or supporting notes and flagging anything that doesn’t add up.

Think of this layer as a second pair of eyes that spots small inconsistencies reviewers may not have time to notice.

6. Build a habit of checking the system, not just using it

Once the setup is live, run regular reviews. Check where the system is being too strict or too lenient. See which alerts actually led to action and which ones didn’t add value.

Keep clean logs and decision records as they make audits more manageable and help compliance teams explain how the system arrived at any given outcome.

Best Practices for KYC Automation

KYC automation works well only when the basics are looked after regularly. The technology can take over a lot of the repetitive work, but the control and judgement still sit with the organisation. These habits help keep the system steady as it grows.

1. Revisit Your Models From Time to Time

AI models don’t stay accurate forever. New document types appear, customer behaviour changes, and risk patterns shift. Every few months, take a look at how the system is performing and refresh the model with newer data.

This small routine helps avoid bias and keeps decisions aligned with what’s actually happening in the field.

2. Keep Privacy Rules Front and Centre

Customer data moves through several steps during verification, so privacy checks need to stay tight. Standards like GDPR, PDPL, and FinCEN give you the baseline.

Whenever you add or change a workflow, pause and confirm that only the essential data is being stored and only the right teams can see it. It’s easier than fixing gaps later.

3. Make Sure Every Step Leaves a Trace

An automated system must show how it arrived at a decision. Keep clear logs of document checks, alerts, overrides, and anything the system flags.

These records make it easier to explain things to auditors and help internal teams understand why the system reacted in a certain way.

4. Link Automation to the Bigger KYC Picture

KYC automation isn’t meant to sit alone. It works best when it fits into your broader KYC process optimization plan.

When updates in onboarding, screening, or monitoring are connected, the whole process becomes more stable and easier to scale across products and regions.

We’ve seen similar governance patterns emerge across enterprises, something we explored in our guide to enterprise AI adoption strategies.

How Appinventiv Enables Digital KYC Transformation

KYC automation becomes effective only when the technology behind it fits smoothly into an organisation’s existing compliance workflow. That’s the lens we bring to every engagement at Appinventiv. As a banking software development company, we help financial institutions replace slow, manual checks with a more connected system built on AI, OCR, and structured verification flows. The goal is simple: cleaner data, fewer delays, and an onboarding process that teams can trust across regions and product lines.

Our work with fintech and lending platforms reflects this approach. Whether it’s stabilising document verification, improving risk scoring, or creating a unified onboarding journey, we focus on practical changes that teams can adopt without disruption.

With experience gained from over a thousand digital products and a strong base of 1600+ experts, we support clients not only with delivery but also with ongoing improvements in screening, reporting, and model governance. This is the core of our fintech consulting services — solving today’s pain points while preparing institutions for what comes next.

As AI models and LLM-based analysis begin to reshape how identity, behaviour, and risk are evaluated, organisations need a KYC setup that can adapt without frequent rebuilds. We help institutions create that foundation by pairing automation with clear governance and a long-term view of compliance. If your organisation is planning its next step toward digital verification, we can help guide that transition with the right mix of technology and operational clarity.

FAQs

Q. How do you implement KYC automation?

A. Most teams start by looking at where their current process gets stuck — missing documents, repeated checks, too many handoffs. Once the problem areas are clear, the next step is to digitise the documents, bring in OCR, and add ML-based identity checks. After that, AML screening and audit logs are connected so everything lives in one flow. Rolling this out in phases usually keeps things stable.

Q. How are automated KYC checks handled inside a digital system?

A. The system reads the document, pulls the needed information, and runs identity and sanctions checks in the background. Anything that looks unclear or unusual gets flagged for a human reviewer. Straightforward cases move through on their own, which keeps the workload lighter.

Q. Why has KYC automation for banks become a necessity?

A. Banks deal with heavy onboarding pressure and tight regulatory timelines. Manual reviews simply don’t keep pace anymore. Automation helps them finish checks faster, stay consistent across branches and products, and reduce the strain on compliance teams who already have too much on their plate.

Q. What’s the real ROI of KYC automation for financial institutions?

A. Most of the return shows up in routine places — fewer manual hours, fewer errors, shorter onboarding queues, and smoother audits. Over time, the reduction in operational cost and the improvement in compliance accuracy make the investment worthwhile.

Q. How does KYC automation cut onboarding time without increasing risk?

A. It speeds up the predictable parts: data capture, basic verification, and early risk scoring. People only step in when the system spots something unusual. Because every case follows the same rules, the process gets faster but stays controlled.

Q. What compliance risks come with not automating KYC?

A. Manual KYC often leads to missed red flags, outdated screening data, inconsistent reviews, and documentation gaps. These issues stack up and can lead to fines, failed audits, or customer onboarding delays.

Q. How does AI improve accuracy during KYC verification?

A. AI can spot the small discrepancies like altered images, mismatched details, behaviour patterns that don’t look right. It catches issues early and cuts down the false positives that normally slow reviewers down.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Banking Technology Consulting: A Strategic Roadmap for Core Modernization and Guaranteed ROI

Key takeaways: Banking modernization is now a strategic necessity, not a technology upgrade. Most banks lose value due to legacy complexity, fragmented data, and slow compliance response. Structured banking technology consulting delivers measurable gains in cost, stability, and governance. Core modernization succeeds when roadmaps, risk, and regulatory alignment are clearly defined. ROI comes from reduced…

How Gamification in Banking Helps Enterprises Build Lasting Customer Loyalty

Key takeaways: A winning banking gamification strategy isn't about badges; it’s about using behavioral psychology to form daily financial habits. Industry leaders like DBS Bank and Revolut prove the concept works, driving higher savings and millions in user acquisition. The cost to implement gamification in banking and financial services ranges between $40,000 and $400,000 or…

How to Modernize Legacy Systems in Banking: Key Strategies and Steps

Key takeaways: Legacy systems burn cash and slow things down, so modernization is essential to stay compliant and competitive. Methods like replatforming, refactoring, or a hybrid approach let banks upgrade piece by piece without breaking everything. Tech trends like cloud computing, AI, and blockchain make modernization happen faster, fixing efficiency, customer service, and safety. Banks…