- How Data Analytics is Shaping the Future of Insurance

- Key Components of Insurance Data Analytics

- Data Collection

- Data Integration

- Data Analysis

- Prescriptive Analysis

- Data Visualization

- Data Analytics Innovation in Insurance: Analyzing the Key Benefits

- Personalized Customer Experiences

- Stronger Risk Evaluation and Underwriting

- Operational Efficiency

- Fraud Prevention and Identification

- Streamlined Claims Processing

- Adherence to Regulations

- Product Profitability Analysis

- Revenue Comparison

- Data Analytics in Insurance: Practical Applications and Use Cases

- Geico’s Personalized Pricing Models

- Allstate’s Claims Fraud Detection

- Progressive’s Telematics and Usage-Based Insurance

- Prudential Financial’s Customer Segmentation and Personalization

- AIG’s Risk Assessment and Underwriting

- Allianz SE’s Predictive Risk Modeling

- UnitedHealth Group’s Social Determinants of Health Analytics

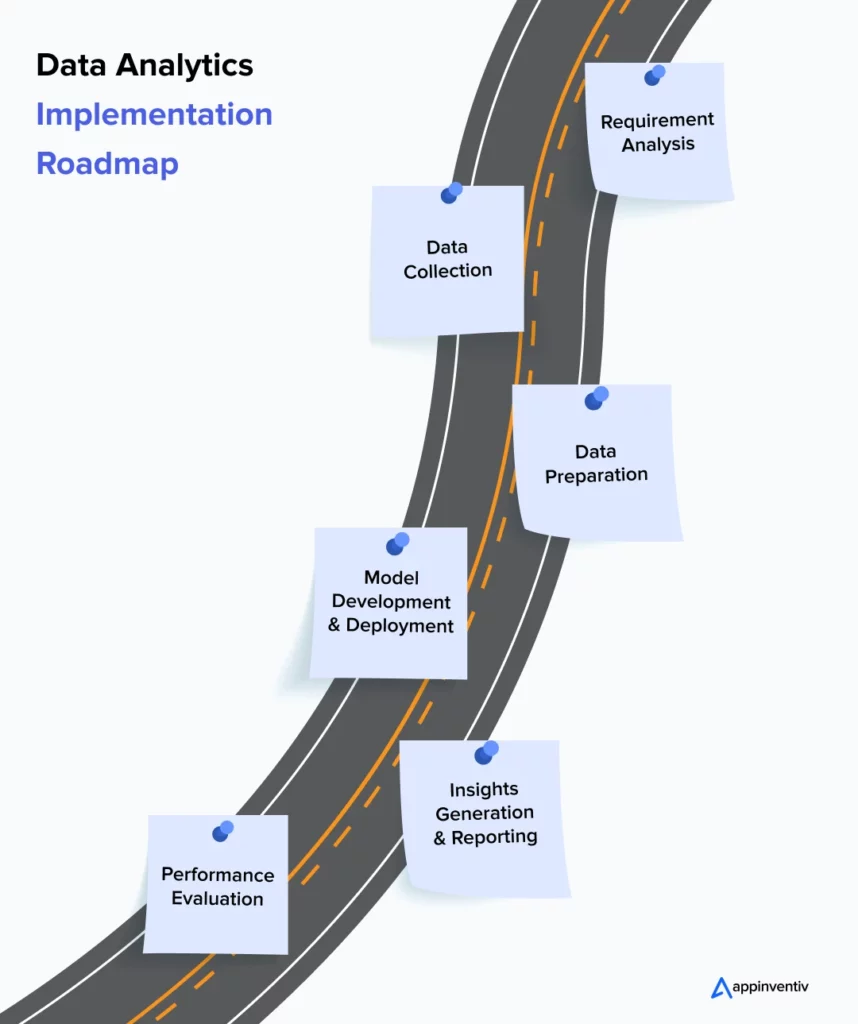

- How to Implement Data Analytics in the Insurance Business?

- 1. Requirement Analysis

- 2. Data Collection

- 3. Data Preparation (Extraction, Cleaning, and Processing)

- 4. Model Development and Deployment

- 5. Insights Generation and Reporting

- 6. Performance Evaluation and Optimization

- Addressing Challenges in Insurance Data Analytics

- Integrity and Quality of Data

- Adherence to Regulations

- Scalability

- AI Model Complexity

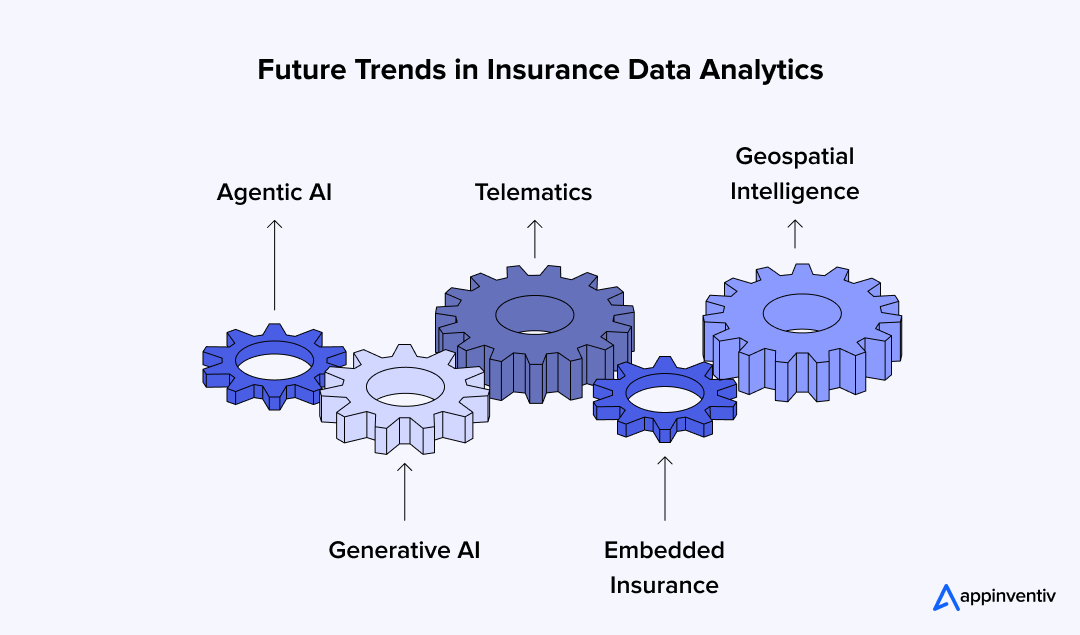

- The Future of Data Analytics in the Insurance Industry

- Agentic AI

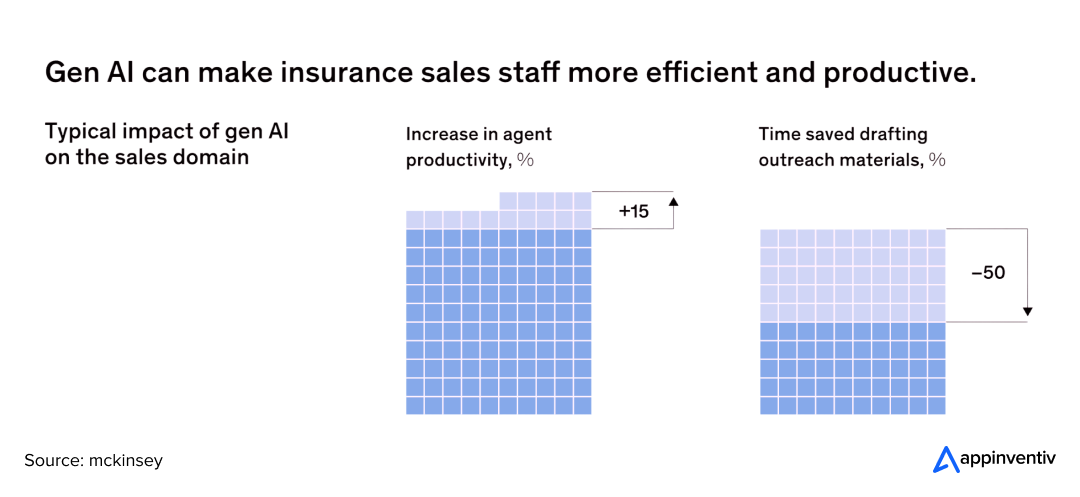

- Generative AI

- Telematics

- Embedded Insurance

- Geospatial Intelligence

- Embrace Data-Driven Innovation in Your Insurance Business with Appinventiv

- FAQs

Key takeaways:

- The insurance business is changing from traditional methods, where fixed risk checks and guesswork are being replaced by live, behavior-based analytics that give much better insights.

- When you put analytics into every step of the insurance process, from underwriting and pricing to fraud identification, it brings real business value and improves operational efficiency.

- Companies that use advanced data analytics in insurance can spot fraud faster and handle claims better, which saves billions every year and increases customer trust.

- Insurance companies that go with these data-focused approaches get a leg up on competitors by giving more accurate pricing, faster claims processing, and personal solutions that keep customers coming back and feeling great about their choice.

As the insurance industry accelerates its digital transformation, insurers must adapt quickly to evolving customer expectations to remain competitive. However, many face persistent challenges such as inaccurate risk assessments, undetected fraud, and subpar customer experiences. Insurance data analytics provides a powerful solution, enabling insurers to leverage vast datasets to improve decision-making, enhance operational efficiency, and deliver greater value to policyholders.

With advanced analytics, insurers can get risk evaluation right more often, identify fraudulent activities faster, and give customers experiences that feel made just for them. This information-based approach not only makes claims processing work better but also makes underwriting more precise, so policy pricing hits the mark.

A good example of this is Deloitte’s Insuresense™ platform, a top-notch insurance data analytics solution. The platform brings together advanced artificial intelligence and machine learning abilities to help insurers handle their data better, spot new risks, and make smarter underwriting choices. With its power to work with big datasets, the platform lets insurers give faster, more accurate risk analysis, making customers happier and cutting down on operational waste.

Again, McKinsey reports show that top performers in the insurance business are beating competitors by building advanced data analytics underwriting abilities, creating real business value. For example, using analytics in underwriting, leading insurers have gotten a 3 to 5 point improvement in loss ratios.

Additionally, these companies have seen a 10 to 15% jump in new business premiums and a 5 to 10% boost in keeping profitable customers. This proves that data analytics isn’t just a tool but a strategic weapon that can push insurers toward better efficiency and competitive advantage.

In this blog, we look at the pivotal role of insurance data analytics, key components, its impact on sector innovation, key use cases, and adoption challenges. Let’s delve deeper into these critical aspects.

How Data Analytics is Shaping the Future of Insurance

Data analytics transforms the insurance sector by offering a more in-depth understanding of market trends, risk assessment, and consumer behavior. Here’s how data analytics is shaping the future of insurance:

- Insurers can use large volumes of data to improve pricing strategies, streamline the claims process, and make better underwriting decisions.

- Data analytics for insurance companies allows customization of products and services that ensure alignment with clients’ evolving needs by analyzing patterns and predicting potential risks.

- Data analytics for insurance companies allows customization of products and services that ensure alignment with clients’ evolving needs by analyzing patterns and predicting potential risks. Similarly, building a custom claim management system enables insurers to streamline operations while maintaining data-driven decision-making.

- Data-driven strategy enhances customer satisfaction and engagement while also boosting profits, highlighting the expected growth of the insurance sector with advancing technology.

- Companies can monitor industry changes to spot opportunities and threats early, giving them advantages over competitors.

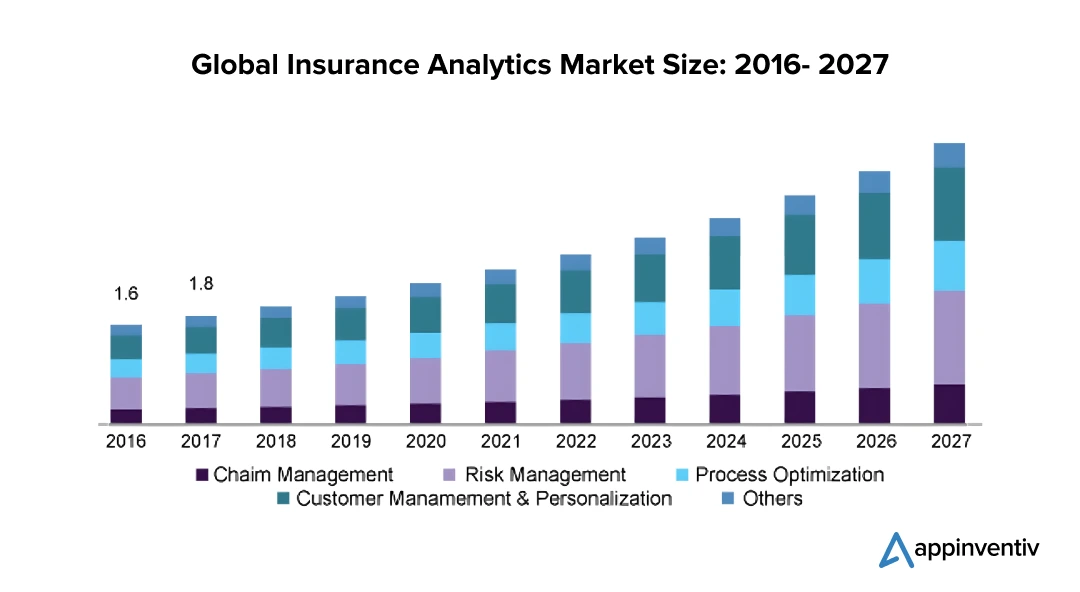

This integration of data analytics in the insurance industry is significantly driving market growth. By adopting advanced analytical tools and techniques, insurers obtain a market advantage through enhanced risk management and operational efficiency. According to a report by Grand View Research, the global insurance analytics market is expected to develop at a CAGR of 11.7% from its estimated valuation of $18.3 billion in 2016 to 2027.

The growing need for sophisticated fraud detection tools and individualized insurance products drives this expansion. Additionally, advancements in artificial intelligence and machine learning algorithms are set to enhance data analytics capabilities further, equipping insurers with even more sophisticated decision-making tools. This growth is reshaping the insurance landscape and creating new opportunities for innovation and customer-focused strategies.

Rising market competition prompts insurance companies to modernize their business models, streamline operations, and improve processes. Moreover, the rapid advancement of digital infrastructure and the surge in fraudulent activities within the insurance sector is expected to elevate the demand for analytics solutions. With financial policies and regulations constantly evolving globally, insurance providers are increasingly turning to analytics to better manage and control their operations.

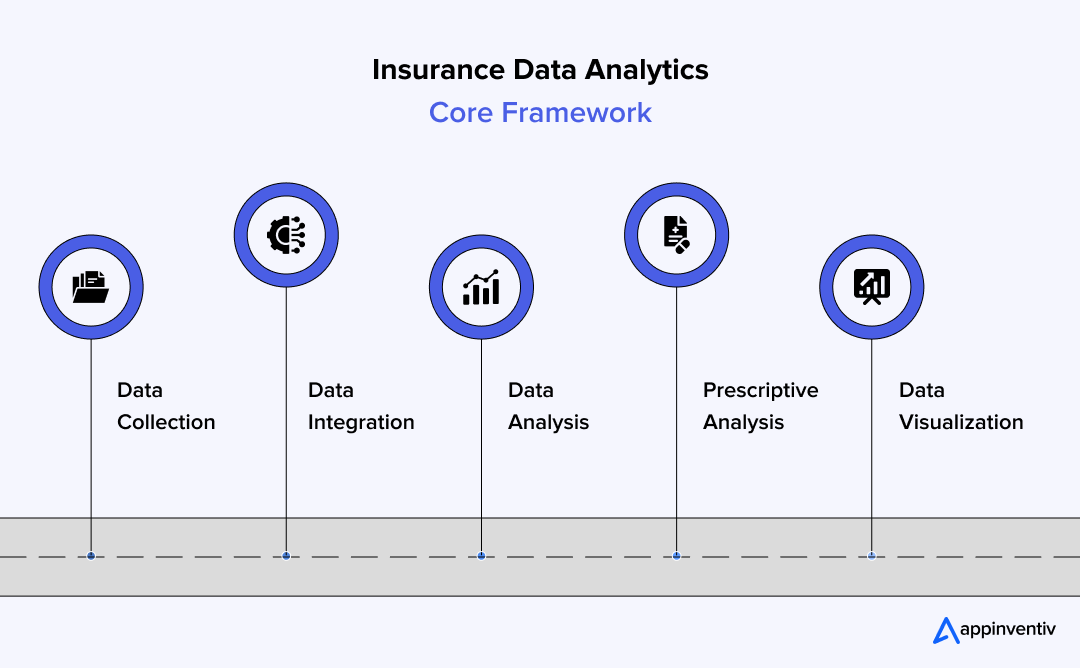

Key Components of Insurance Data Analytics

Data and analytics in insurance give companies a powerful way to tap into huge amounts of information for smarter choices and smoother operations. Here are some of the key components that build the foundation for a more flexible approach to underwriting, fraud detection, and customer service, helping businesses achieve better outcomes.

Data Collection

Insurance companies start by pinpointing the exact problems they want to solve, whether that’s setting better premium rates, catching fraudulent claims, predicting which customers might leave, or making claims processing run smoother. Having a crystal clear target shapes everything that follows in the insurance data analytics journey. Smart data collection means gathering exactly the right information to tackle your biggest business headaches.

Data Integration

Those old legacy systems are sitting on gold mines of information. Getting that data out, cleaning it up, and making it useful takes real know-how and solid analytics tools. This step means hunting down mistakes, tossing out duplicates, dealing with weird outliers, plugging gaps where information is missing, and getting everything organized properly. When you nail data integration, data analytics in insurance becomes a powerful tool that actually drives smart business decisions.

Data Analysis

Once you’ve got your data sorted, you can dig into it using different approaches:

- Descriptive Analysis: Shows you what went down in the past.

- Diagnostic Analysis: Helps you figure out why something happened.

- Predictive Analysis: Takes your historical information and uses it to spot future trends, which is huge in predictive analytics in insurance for anticipating claims and sizing up risk.

Prescriptive Analysis

Gives you solid advice on what to do next. These approaches help insurers spot patterns, understand root causes, see what’s coming, and figure out the best moves. When companies tap into data analytics for insurance, they can really boost their underwriting and claims handling.

Data Visualization

With so many different people involved at insurance companies, getting your findings across clearly is everything. Data analytics in the insurance sector needs visual tools that turn complicated numbers into something everyone can actually understand. Data visualization helps you make quick decisions while keeping everything transparent and clear across all departments.

Data Analytics Innovation in Insurance: Analyzing the Key Benefits

By leveraging advanced analytical tools, insurers can develop innovative products, make data-driven decisions, and enhance operational efficiency, ultimately resulting in increased customer satisfaction and competitive advantage. Let’s have a detailed look at some of the benefits of data analytics in insurance.

Personalized Customer Experiences

Data insights give insurers the ability to craft policies that truly match what individual customers want and need. Through analytics, companies can group customers by their preferences and habits, opening the door for marketing that really connects with each person. This is where data analytics in insurance theme analysis plays a crucial role, helping insurers identify customer trends and preferences for more targeted, effective strategies.

When insurers tap into predictive analytics to forecast customer requirements, they can step in early with exactly the right services and support. This personal approach builds a more engaged and satisfied customer community, strengthening both satisfaction and long-term relationships.

Stronger Risk Evaluation and Underwriting

The application of big data analytics in insurance gives insurers access to huge amounts of historical information, leading to far more accurate risk evaluation. Insurance companies can also identify upcoming risks and market shifts through predictive analytics, supporting them in making wiser underwriting decisions.

Live data analysis creates flexible pricing models that mirror today’s risk environment, maintaining rates that stay both competitive and reasonable. The enhanced precision in risk assessment with AI and underwriting produces superior outcomes, reducing the likelihood of setting product prices either too high or too low.

Operational Efficiency

Insurance data analytics brings down operating costs by finding problem areas and handling routine tasks automatically. Analytics makes resource management simpler and ensures both budget and staff are utilized in the most effective ways.

Daily operations get tracked and tweaked using live performance numbers. Better operational efficiency works out well for both policyholders and the insurance company by lowering costs and making service delivery run more smoothly.

Fraud Prevention and Identification

Data analytics in the insurance industry catches fraudulent activities by picking up on weird patterns and sketchy behaviors, seriously reducing the number of phony claims. As time goes on, learning models keep getting better at catching fresh fraud schemes.

Automated systems save both resources and time by quickly marking suspicious claims for a closer look. When insurers put FinTech data analytics for fraud detection and prevention to work properly, they can protect their finances and keep policyholder trust strong.

Streamlined Claims Processing

Automated data processing speeds up claims handling, cutting down settlement times by a lot. Insurance data analytics can spot holdups and problem areas, letting insurers make their claims processes work better.

Live updates and clear communication boost customer satisfaction and trust in the system even more. Data analytics insurance claims processing not only improves operational efficiency but also lets insurers give their customers faster and more dependable service.

Adherence to Regulations

Data analytics in the insurance sector makes compliance easier by spotting and reducing risks tied to regulatory requirements. Automated data gathering and reporting ensure accurate and timely compliance reporting.

Thorough data documentation and audit trails help regulatory audits go smoothly and work better. When insurers build data analytics into their compliance strategies, they can lower the risk of non-compliance and make sure they meet all regulatory obligations.

Product Profitability Analysis

Insurers can get a clear picture of how well their insurance products make money by using data analytics to check product profitability. When they look at income, claims payouts, operating costs, and customer acquisition expenses for each product, insurers can see which InsurTech products generate the most revenue and which ones need work.

Insurance companies can put their development energy into making their best-performing offers even better using profitability analysis insights. Insurance data analytics helps insurers meet client needs while making more money.

Revenue Comparison

Data analytics for insurance lets companies do detailed revenue comparison across different channels and parts of the insurance business. When they examine revenue streams from various products, geographic spots, client types, or sales methods, insurers can spot income patterns and growth opportunities.

This comparison helps insurance companies put resources where they count most, invest in profitable areas, and improve their sales tactics.

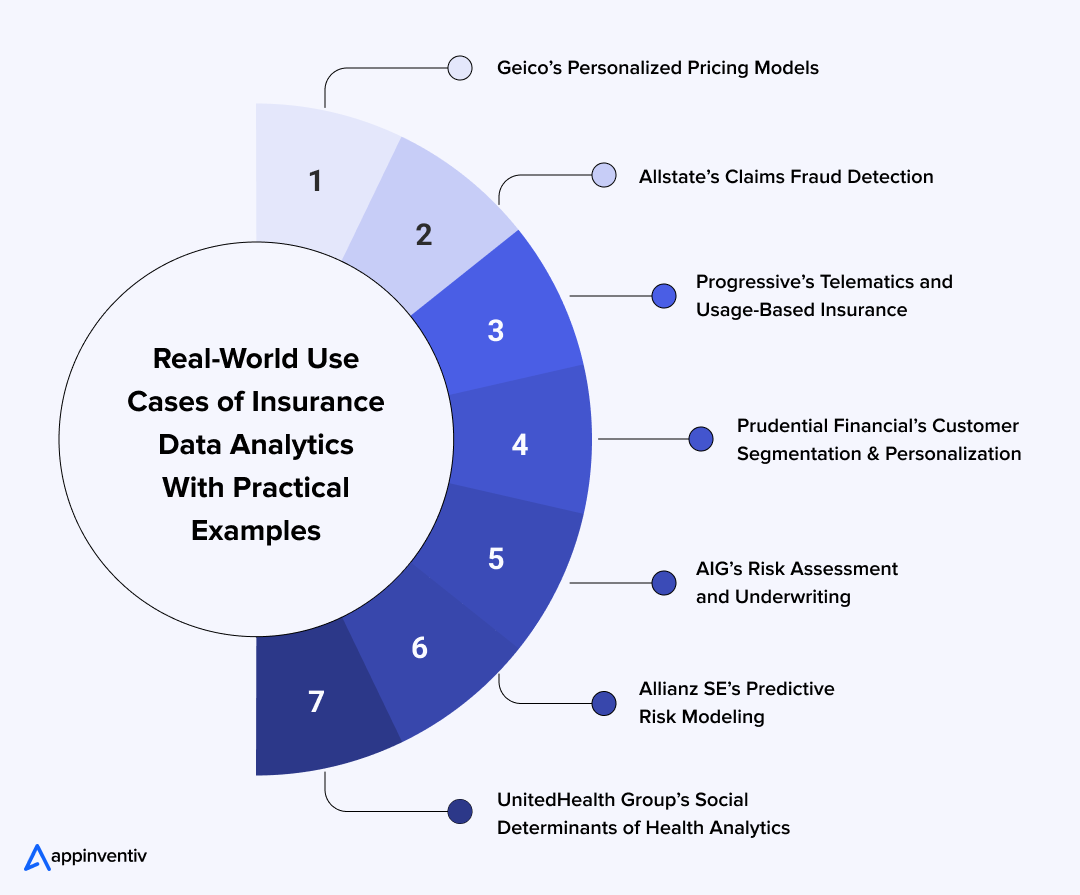

Data Analytics in Insurance: Practical Applications and Use Cases

Insurance data analytics have significantly benefited numerous FinTech organizations in optimizing their insurance-related operations. These use cases exemplify the strategic insights and operational efficiencies insurers achieve through advanced data analytics technologies. Let’s have a look at some of the top data analytics in insurance use cases:

Geico’s Personalized Pricing Models

Geico taps into advanced data analytics to create personalized pricing models that improve vulnerability assessment and make customers happier with custom premiums. This method puts Geico in a stronger competitive spot in the insurance sector by matching pricing with each person’s risk profile.

It also helps Geico respond fast to market shifts and what customers want, keeping their pricing strategies both flexible and smart.

Allstate’s Claims Fraud Detection

Allstate puts advanced analytics to work, spotting and stopping fraudulent claims in its day-to-day operations. By going through claim data, looking for patterns and weird stuff, Allstate can catch potentially fraudulent activities right away.

This gets ahead of the problem approach, cuts down on money lost, while making Allstate look more reliable and trustworthy in insurance services. Always working to get better at fraud detection means Allstate keeps things fair and runs claims handling well, which makes their policyholders trust them more and feel better about their service.

Progressive’s Telematics and Usage-Based Insurance

Progressive takes telematics in insurance and data analytics and uses them for usage-based insurance (UBI) products like Snapshot. By gathering real-time driving information through telematics devices, Progressive tweaks premiums based on how people drive, which encourages safer driving and keeps customers happier.

This way of doing things brings more openness and gives savings opportunities that match how each person drives. Progressive shows they care about innovation in insurance by putting technology to work for both the company and its customers.

Prudential Financial’s Customer Segmentation and Personalization

Prudential Financial takes advanced data analytics in life insurance and sorts customers by how they act, what they want, and big moments in their lives. This deep understanding helps Prudential give personalized insurance products and financial advice that works for each customer’s particular situation.

When they provide solutions made just for you, Prudential gets customers more engaged and keeps them coming back. Their smart way of using data insights puts Prudential out front in giving personalized financial services that shift with what their many different customers actually need.

AIG’s Risk Assessment and Underwriting

AIG puts advanced data analytics to work improving its risk assessment and underwriting processes. By looking through large volumes of data, including market patterns, customer details, and risk profiles, AIG makes its underwriting choices more accurate.

This method helps with pricing strategies and increases profits by effectively managing risks. Using insights from data keeps AIG ahead of the competition in the insurance sector, constantly improving its underwriting processes to provide strong and lasting insurance solutions around the world.

Allianz SE’s Predictive Risk Modeling

Allianz uses advanced data science to build better predictive models that spot risks like debt, cash flow problems, and possible bankruptcies. By mixing insights from data with expert judgment, Allianz finds businesses that might not pay what they owe.

This proactive approach helps the company reduce financial risks while building its reputation as a dependable global insurer. It also makes sure Allianz stays strong in changing markets by adjusting strategies to new risk situations.

UnitedHealth Group’s Social Determinants of Health Analytics

UnitedHealth Group uses predictive analytics to tackle social factors that affect health, looking at things like housing, food, and getting to community services. By finding people who need extra help early, the company connects them with real-time assistance through advocates and local resources.

This forward-thinking strategy cuts healthcare expenses while creating stronger support networks for members who face everyday challenges. The company’s use of data analytics in health insurance helps bridge gaps between medical treatment and the real-world factors that keep people healthy.

How to Implement Data Analytics in the Insurance Business?

It is important to weave a strategic roadmap to integrate data analytics in the insurance companies. If you are not sure how to do it, here is a breakdown of integral steps involved in the implementation process.

1. Requirement Analysis

Begin by determining the prioritized business issues and objectives where data analytics will have the greatest impact. Regardless of whether you are interested in risk analysis, fraud detection, or customer retention, having a good understanding of what you need most and where you are getting in trouble will assist you in developing the right plan.

2. Data Collection

The following procedure is applied to collect good and relevant data sourced by different means. It includes internal outputs (policy records, claims history) and the external information flows (social media, IoT, third-party databases). Being able to have the right and sufficient data is the cornerstone of any analytics project.

3. Data Preparation (Extraction, Cleaning, and Processing)

After you have pulled information from different sources, you now need to clean it and present it for implementation in a successful manner. Eliminating discrepancies, managing gaps in the data, clearing up the duplicates, and formatting data to make it efficient and ready to run the next steps.

4. Model Development and Deployment

Once you’ve got your data ready, you can build and roll out the analytical model within your current systems for live insights and smart choices. But before you put it to work, check it out carefully using four main approaches: descriptive analysis, diagnostic analysis, predictive analysis, and predictive analytics.

5. Insights Generation and Reporting

Look through the processed data to come up with useful insights. Share what you find with the right people through interactive dashboards and reports so everyone can make smarter choices based on real information across departments.

6. Performance Evaluation and Optimization

Keep an eye on how well your data analytics models are working. Analyze how well it is performing using the KPIs you set up ahead of time and tweak your approach when you need to, so you get better accuracy, efficiency, and business results.

Addressing Challenges in Insurance Data Analytics

Data analytics for insurance presents various challenges, but effective solutions exist to overcome them and unlock valuable insights for the industry. Addressing these challenges involves ensuring efficient data management and leveraging advanced tools to enhance decision-making and operational efficiency in the industry.

Integrity and Quality of Data

In analytics, ensuring data accuracy and integrating diverse data sources creates tough problems. Various data sources, formats, and quality levels can make analyzing information and making choices harder.

You need solid data governance systems to get past these roadblocks. Insurers can make sure their data stays reliable by implementing standard ways to collect, store, and check information. This setup makes analytical insights more dependable and useful for smart decision-making by adding data integration, validation, and cleaning steps.

Adherence to Regulations

A big problem in insurance data analytics is handling sensitive customer information while sticking to tough regulatory rules. Laws like GDPR and HIPAA require careful handling of data security and privacy. You need compliance management systems that automate monitoring and reporting tasks.

These tools make compliance work easier by giving you complete reporting abilities, live data access tracking, and automatic audits. When insurance companies use these technologies together, they can follow regulatory rules and keep strong data security practices in place.

Scalability

As insurance companies grow their analytics setup to handle more data, ensuring smooth operations becomes crucial. Old school IT systems might struggle to process and look at information quickly when the amounts keep getting bigger.

Using cloud computing in insurance gives insurance companies scalable and flexible ways to handle their data analytics. Cloud platforms provide you with flexibility and room to grow, letting insurers expand what they can do with analytics as needed, without paying a lot upfront. This method ensures that data is processed, analyzed, and stored effectively, helping insurers use big data in insurance for useful insights and better choices.

Also Read: Application Scalability – Future-Proofing Your App for Long-Term Success

AI Model Complexity

One of the biggest problems with predictive analytics in insurance is building and keeping analytical models that properly account for different risk factors. For these models to give you insights you can trust, they need to look at many variables and possible outcomes.

Insurance companies can use AI and machine learning to build complex prediction models that make risk assessment and decision-making better. These AI models can look through huge amounts of data, spot patterns and trends, and adapt in real-time when risk factors shift, which means you get more accurate and flexible risk management approaches.

Reach out to our specialists and discover how data analytics can benefit your insurance business.

The Future of Data Analytics in the Insurance Industry

The future of data analytics in insurance is getting shaped by new technologies that give insurers more accurate, flexible, and personal tools for making decisions. Here’s how these changes will transform the insurance world:

Agentic AI

Agentic AI is a next-level type of artificial intelligence that takes automation and decision-making much further. Unlike regular AI, which just looks at information, Agentic AI can make choices on its own, handle complicated tasks, and work with other systems without people getting involved.

In the insurance business, it could handle claims processing by itself, change policies instantly based on new risk information, and make underwriting decisions better by predicting what individual policyholders will need down the road.

Also Read: Agentic AI in Finance: Revolutionizing Efficiency & Security

Generative AI

In insurance, Generative AI can build personalized policies, create custom risk models, and run different future scenarios to check potential risks more accurately. As represented by an illustration below, the use of generative AI in the FinTech and insurance sectors can hugely improve employee productivity by saving time on routine tasks.

By automatically creating policy documents and underwriting reports, insurers can work more efficiently and give customers a more personal experience. Plus, Generative AI can help catch new fraud patterns by creating fake fraudulent information and finding weak spots in the system before real fraud happens.

Telematics

Telematics technology is changing auto insurance by gathering live information about how people drive. This information lets insurers offer usage-based insurance (UBI), where what you pay gets decided by how safely and how much you drive.

When telematics is integrated with data analytics, insurers can judge risk more accurately, change pricing on the fly, and offer more personalized policies based on how each person drives.

Embedded Insurance

Embedded insurance smoothly puts coverage right into buying goods or services, like travel, electronics, or car purchases. By using data analytics, insurers can offer custom policies at the time of purchase, giving customers instant, personalized coverage.

By looking at purchase and behavior information, insurers can guess the best insurance options for each customer, making the whole thing smooth and easy to use.

Geospatial Intelligence

Geospatial intelligence is a real game-changer for checking risks in property and disaster insurance. By bringing in geographic information, satellite pictures, and environmental factors, insurers can predict and judge risks like floods, wildfires, and earthquakes much better.

When you combine geospatial information with machine learning programs, you get more precise risk models that make pricing and underwriting decisions work better.

Embrace Data-Driven Innovation in Your Insurance Business with Appinventiv

Data analytics will keep changing the insurance world by making threat assessment more accurate, customer interactions more personal, and operations run smoothly. Progress in predictive analytics, AI, and machine learning will help insurers spot trends coming, cut down risks before they happen, and create new products.

When insurance companies connect real-time information from Internet of Things (IoT) devices, they will gain insights into customer behaviors and what people want that has not been seen before. This will likely help insurers get ahead of competitors and set higher bars for keeping customers satisfied and delivering good service.

Appinventiv, as a leader in data analytics consulting services, leads this change by providing fresh solutions that get the most out of data. We use advanced analytics tools and methods that help insurance businesses reach new levels of personal customer interactions, better risk management approaches, and smarter decision-making processes. With a focus on data-driven innovation, we equip insurance businesses to stay ahead of change and achieve sustainable success.

When you team up with an insurance software development services company like Appinventiv, you can leverage data analytics to fuel digital transformation, enhance efficiency, and build an insurance business designed for tomorrow.

Reach out to our experts today and step into the future of insurance with Appinventiv’s innovative, data-driven solutions.

FAQs

Q. How is data analysis used in insurance?

A. Here are some of the top data analytics in insurance examples and their practical applications:

- Customer personalization: When companies dig into data, they can see what their clients actually want and how they act, which lets them build services and solutions that really fit what each person is looking for.

- Security Threat assessment: By analyzing historical data and spotting patterns, insurers can better judge and predict what problems might pop up. This really pays off when they’re making underwriting choices and figuring out prices.

- Claims Management: Analytics can make processing faster and cheaper by handling reviews automatically and identifying areas for improvement.

- Fraud Detection: When insurers put advanced analytics to work, they can catch and reduce fraud losses by noticing odd patterns and behaviors that show someone might be gaming the system.

- Industry Insights: Going through data helps insurers make good plans and develop new products by showing them what’s going on in the business, who buys from them, and what their competition is doing.

Q. What is the role of data analytics in insurance sales?

A. The use of data analytics in insurance plays a big part in insurance sales by giving companies insights into how customers act, predicting claims, fine-tuning pricing, catching fraud, and making operations run better.

It helps insurers shape sales strategies around what each customer actually needs, forecast claims more accurately, and set prices that stay competitive while making money. This approach also lets companies spot and stop fraud before it happens, plus make sales processes work smoothly for better performance and happier customers.

Q. What are some challenges of implementing big data in insurance?

A. Implementing big data analytics in the insurance industry presents challenges like managing diverse data sources, ensuring data quality and security, meeting regulatory requirements, and overcoming organizational resistance. Solutions include implementing strong data governance practices, utilizing advanced analytics for seamless data integration, adopting compliance management systems, and fostering an environment conducive to innovation and adaptation.

These approaches empower insurers to effectively leverage big data, thereby improving decision-making, operational efficiency, and customer satisfaction, while maintaining regulatory compliance and safeguarding data integrity.

Q. How does the traditional insurance process differ from insurance analytics?

A. Traditional insurance processes rely on manual assessments, historical data, and standard risk models for underwriting, claims, and pricing decisions. In contrast, insurance analytics uses advanced technologies like AI, machine learning, big data and other emerging technologies to analyze real-time and historical data. This enables more accurate security review, personalized pricing, fraud detection, and proactive customer engagement.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How to Hire Data Engineers for Your Enterprise? All You Need to Know

Key takeaways: Hiring data engineers individually slows execution and increases delivery risk at enterprise scale. Partnerships give faster access to senior talent without long recruitment cycles or retention issues. Cost depends more on capability and responsibility than salary alone. The right hiring model directly affects business speed, stability, and ROI. Partnering with experienced teams converts…

How Data Analytics is Shaping the Future of UK Businesses Across Sectors

Key Takeaways Data has moved from support to strategy. UK companies no longer treat analytics as an add-on; it’s shaping how they forecast demand, design products, and compete for customers. Every sector is finding its own rhythm. From retail and healthcare to energy and education, organizations are using data differently, but the goal is the…

Is Your Business Model Compliant with the EU Data Act? A Checklist for C-Suite Executives

Data has quietly become the backbone of modern business. Whether it’s a retailer predicting what you’ll buy next week or a car maker tracking vehicle performance in real time, every decision today leans on streams of information. But with that power comes a tough question: who really owns the data, and who gets to use…