- AI-Driven Personalization in Banking: Middle East Leads the Way

- AI Personalized Banking Development: Personalization vs Hyper-Personalization

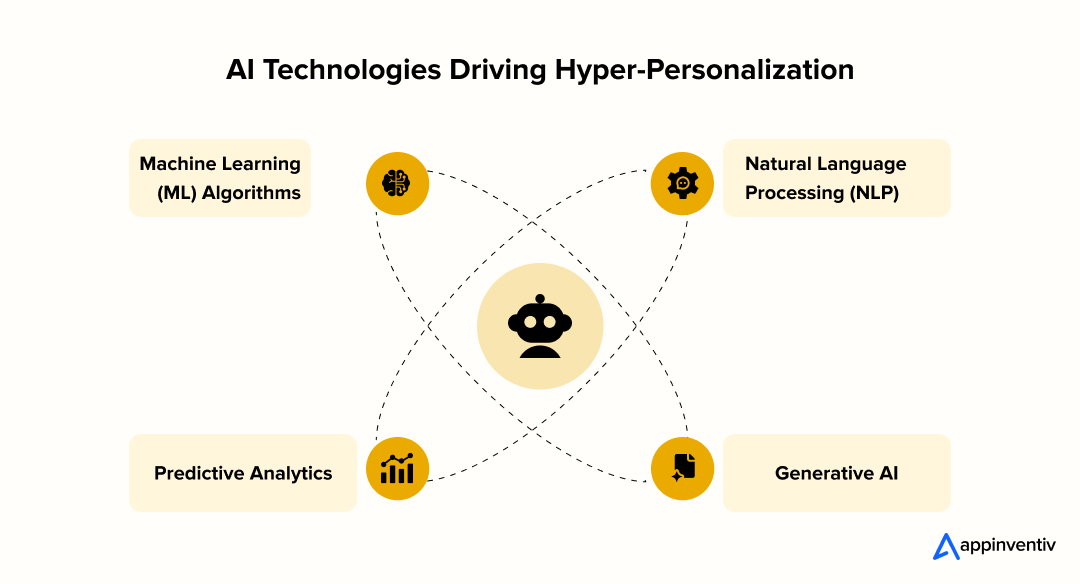

- The AI Toolkit: Core Technologies Powering Hyper-Personalization in Banking

- Machine Learning (ML)

- Predictive Analytics

- Generative AI

- Natural Language Processing (NLP)

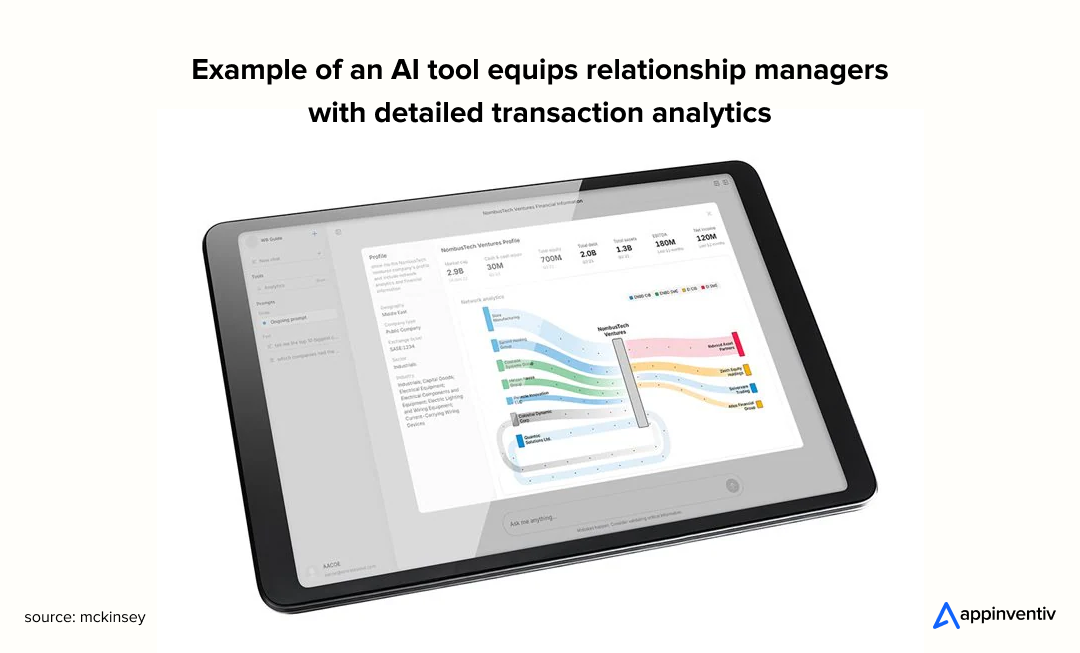

- From Data to Action: Four Key Types of AI Insights

- Country-Specific Use Cases & Examples of Hyper Personalization in Banking with AI: Real Banks, Real Results, Real Numbers

- UAE: Leading the Charge with Emirates NBD

- Saudi Arabia: Securing the Future with AI

- Kuwait: Exploring AI for Compliance and Risk Management

- Qatar: AI-Powered Innovation in Financial Services

- Bahrain: Streamlining Digital Banking with AI

- Egypt: AI in Credit Scoring and Customer Service

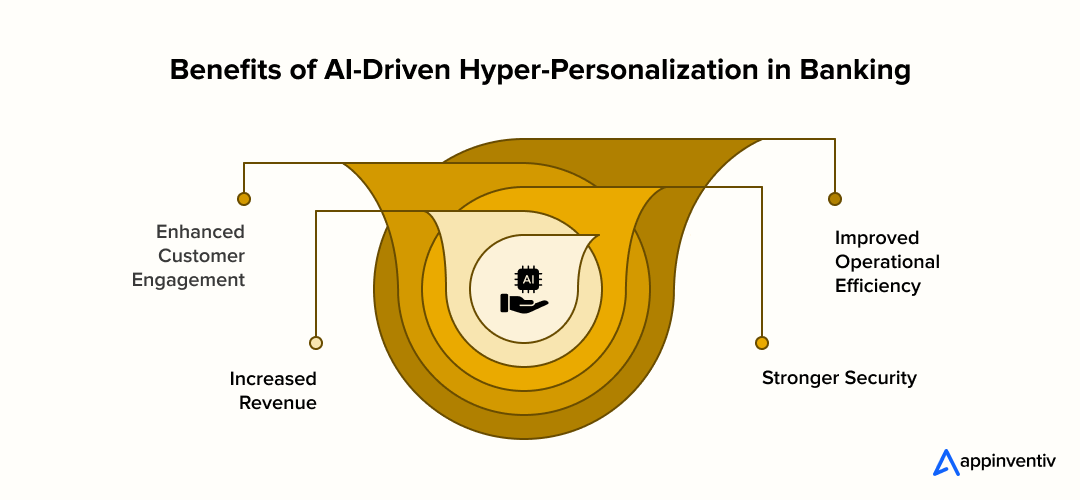

- Key Benefits of AI in Banking Personalization

- Customer Engagement That Goes Beyond Clicks

- Operations That Actually Run Smoothly

- Security That Stops Problems Before They Start

- Revenue Growth Through Smarter Timing

- Competitive Advantages That Compound

- Implementation Roadmap: Your Step-by-Step Blueprint for AI Success

- 1. Assessing Business Needs and Defining Objectives

- 2. Identifying the Right AI Technologies

- 3. Data Collection and Analysis

- 4. Building and Training the AI Models

- 5. Integration with Existing Systems

- 6. Monitoring and Continuous Improvement

- Challenges in Creating Hyper-Personalized Banking with AI and How to Solve Them

- Legacy Systems That Weren't Built for This

- Regulatory Compliance That Actually Works

- Building Teams That Can Actually Execute

- The Data Privacy Paradox

- The Real Cost and ROI of AI in Personalized Banking

- What the Investment Looks Like

- What Banks Gain in Return

- Partner with Appinventiv to Build the Future of Hyper-Personalized Banking with AI

- Your Next Step?

- FAQs

- Q. What is hyper personalization in banking with AI?

- Q. How much does AI in personalized banking cost?

- Q. What is the ROI of AI in banking personalization?

- Q. What are the top AI use cases in personalized banking?

- Q. How does AI improve customer experience in banking?

Key takeaways:

- Banks are shifting from generic marketing to relationship-first models with AI.

- Hyper-personalization in the ME is no longer a theory; it’s happening in the Dubai, Riyadh, Doha, and other regions.

- The cost of AI implementation in banking ranges between $40,000 and $600,000 / AED 146,800 and AED 2,202,000 or more.

- Implementation is a step-by-step process: from defining goals to integrating with legacy systems.

- Partnering with the right AI development company ensures scalability, compliance, and long-term success.

Here is what is happening right now in Emirates NBD branches across Dubai. Customers walk in expecting traditional service, but instead encounter bankers who already understand their financial needs before any conversation begins. These bankers know when someone is researching car refinancing options and have tailored recommendations prepared. This isn’t because customers called ahead; it’s because AI systems have been watching their browsing patterns and spending habits.

This is a prime example of AI personalization banking in action, where banks use data-driven insights to anticipate customer needs in real time.

Think about how Netflix knows exactly what show you’ll binge next, or how Amazon suggests products you didn’t even know you needed. Well, banks across the Middle East figured out they could do the same thing with financial app development services and the results? They’re making serious money while their customers are actually happy for once.

The numbers behind this transformation are pretty crazy. According to McKinsey research, AI could create as much as $150 billion in value across the Middle East alone, equivalent to 9% of the combined GDP in the Gulf Cooperation Council countries. That’s not gradual growth; that’s explosive demand from banks realizing their old “spray and pray” marketing approach doesn’t work anymore.

But here’s what makes this really interesting. Emirates NBD didn’t just buy some fancy software and call it a day. They partnered with McKinsey, built over 100 AI models, and hired 70 people just for their analytics team. Their goal? Getting five to seven times return on every dollar they spend on AI. Pretty ambitious, right?

Meanwhile, traditional banks are still sending the same mortgage offers to everyone who walks through their doors. The smart ones realized customers don’t want generic banking—they want banking that actually understands their lives.

In cities like Riyadh, Abu Dhabi, and Doha, something interesting started happening. Banks stopped guessing what customers wanted and started knowing instead. They stopped reacting to customer needs and started predicting them. Most importantly, they stopped treating banking like a product business and started treating it like a relationship business.

So what’s really going on here? How are some banks turning customer data into experiences that people actually love? And more importantly for anyone running a bank—what’s this costing, and what kind of returns can you actually expect?

In this post, we’ll dive into why AI is so important for banks, how it’s delivering hyper-personalized experiences, and why it’s a smart move for banks to invest in it now. We’ll also take a closer look at how Middle Eastern banks in different cities are leading the charge with AI in banking.

Don’t let legacy systems hold you back from this growth wave.

AI-Driven Personalization in Banking: Middle East Leads the Way

The Middle East is no longer just a follower in the global tech race; it’s a leader. The region, particularly cities like Dubai and Riyadh, is making massive investments in technology and infrastructure, creating a fertile ground for AI innovation in the financial sector. This strategic foresight has positioned the Middle East as a global hub for AI in financial services personalization.

Take the UAE, for example. The government’s push for digital transformation, including the Dubai AI Strategy, has created a vibrant ecosystem where financial institutions are not just adopting AI but pioneering its use. A recent survey by Gartner reveals that 58% of finance functions are now using AI in 2024, a significant jump from 2023, and the Middle East is a key contributor to this growth. This trend is a clear indicator that the region’s banks are serious about leveraging technology to gain a competitive edge.

Meanwhile, Saudi Arabia’s digital banking market is projected to reach an impressive $278.19 million by 2033, a testament to the nation’s ambitious Vision 2030, which prioritizes digital transformation and financial inclusion. This surge in digital adoption is creating a massive opportunity for AI solutions for hyper-personalized banking.

AI Personalized Banking Development: Personalization vs Hyper-Personalization

Before diving deeper into the technologies behind hyper-personalization, it’s important to clarify the difference between personalization and hyper-personalization. Here are the key differences between personalization and hyper-personalization

Personalization is rule-based. Banks tailor communication using basic customer data, such as purchase history or demographic information. A typical example would be sending a credit card promotion based on recent spending behavior.

Hyper-personalization goes much further. It relies on AI, machine learning, and real-time analytics to anticipate customer needs and adjust services instantly. Instead of static recommendations, the experience adapts dynamically, creating interactions that feel relevant, timely, and predictive.

Here are the key differences at a glance:

| Aspect | Personalization | Hyper-Personalization |

|---|---|---|

| Data Used | Basic information (purchase history, demographics) | Real-time behavioral data, predictive insights, contextual cues |

| Approach | Rule-based targeting | AI- and analytics-driven, continuously adapting |

| Customer Experience | Generic but relevant messages (emails, offers) | Proactive, intuitive, and highly tailored interactions |

| Outcome | Improved engagement | Stronger trust, higher loyalty, and deeper relationships |

The AI Toolkit: Core Technologies Powering Hyper-Personalization in Banking

So, what are the technologies making this level of personalization possible? It’s not one piece of software. It’s a mix of different technologies, each doing its bit, and together they create experiences that feel surprisingly personal. Think of it like an orchestra, every instrument has a role, but it’s the harmony that makes it powerful.

Machine Learning (ML)

Machine Learning in banking is usually the first piece people mention, and for good reason. It’s the part that spots patterns in mountains of data: how people spend, save, borrow, even when they’re most likely to check their app. Over time, it starts predicting what might come next. That’s why some banks can flag unusual card activity instantly or know when to suggest a new savings option.

Predictive Analytics

If machine learning is the engine, predictive analytics is the steering wheel. It doesn’t just look back at what you’ve done, it predicts what you’ll want tomorrow. For instance, if your balance has been climbing steadily and you have been browsing flight deals, your bank might send a push notification with a personalized offer for a high-yield travel savings account.

Generative AI

The newest and most disruptive technology on the block. Generative AI doesn’t just analyze data; it creates. This could involve drafting personalized emails, generating financial summaries, or tailoring reports to meet the specific needs of individual clients. Banks finally have a way to scale personalization so it doesn’t feel mass-produced.

Also Read: Generative AI in Finance: Pioneering Transformations

Natural Language Processing (NLP)

NLP is the reason chatbots no longer feel like talking to a bad IVR system. It lets AI handle real conversations, answering questions, walking customers through forms, and even giving simple financial advice. Done well, it makes customer service faster and less frustrating, without replacing the human touch when it’s really needed.

From Data to Action: Four Key Types of AI Insights

Now that we’ve covered the core technologies driving hyper-personalized banking, let’s explore how these AI tools actually translate data into actionable insights. Here’s how banks use AI to gain valuable insights:

- Descriptive: What happened? For example, spotting spending trends.

- Diagnostic: Why did it happen? Like understanding sudden changes in saving habits.

- Predictive: What will happen next? AI can forecast when a customer might need a loan.

- Prescriptive: What should we do about it? AI can recommend the next best product or action to take.

With an in-depth understanding of how AI for hyper-personalized banking works, let’s move further to explore the various use cases of AI in the Middle East banks.

Country-Specific Use Cases & Examples of Hyper Personalization in Banking with AI: Real Banks, Real Results, Real Numbers

Now that we know how AI works behind the scenes, let’s zoom in on real-world examples of artificial intelligence in digital banking. How are banks actually putting these technologies to use? We’ll take a look at some standout countries in the Middle East, where AI is already reshaping the banking landscape.

UAE: Leading the Charge with Emirates NBD

Let’s start with the UAE. This country has been a pioneer when it comes to integrating AI into banking. According to a recent report, 71% of financial institutions in the UAE have either deployed or enhanced their AI capabilities in the last year.

One great example comes from Emirates NBD, one of the largest banks in the UAE. They have implemented predictive AI to offer hyper-personalized services services, showcasing the power of AI personalization banking. For instance, their system can analyze a customer’s spending habits and proactively offer tailored financial advice, such as recommending investment opportunities or even suggesting savings plans before the customer thinks to ask.

This isn’t just about sending personalized emails. It’s about anticipating needs, making suggestions in real-time, and providing personalized banking experiences that feel completely in tune with the customer’s financial goals.

Saudi Arabia: Securing the Future with AI

In Saudi Arabia, AI adoption is climbing fast, with 93% of KSA firms expressing interest in integrating artificial intelligence. The Saudi National Bank has turned to AI agents for fraud detection, analyzing transaction data in real time to spot suspicious behavior before it becomes a problem. For customers, that means stronger protection, and for the bank, it builds trust. But it’s not just about security. AI development service provider in Saudi Arabia helps businesses tailor financial products to individual preferences, elevating the role of AI in banking customer experience well beyond compliance.

Kuwait: Exploring AI for Compliance and Risk Management

Kuwait is another country where AI is being explored for regulatory compliance and risk management. For instance, the Central Bank of Kuwait has prioritized AI in areas like risk management and compliance. Meanwhile, the National Bank of Kuwait is applying AI to improve credit scoring systems.

By assessing broader datasets than traditional models, the bank can make more accurate and fair lending decisions. This is an important step in making financial services more inclusive.

Qatar: AI-Powered Innovation in Financial Services

Qatar has taken a supportive approach to innovation, with regulators opening sandboxes to test new technologies. Qatar National Bank is a prime example, using AI for wealth management. Their platforms track customer behavior and suggest investment strategies tailored to each profile. This isn’t mass-market wealth management; it’s AI-driven personalization in banking that makes once-exclusive services more widely accessible.

Bahrain: Streamlining Digital Banking with AI

Moving on to Bahrain, the country’s banking sector is deeply invested in AI to streamline operations. The Bank of Bahrain and Kuwait is leveraging AI to automate routine banking tasks, like loan approvals, to make them faster and more efficient. This not only reduces wait times for customers but also cuts down operational costs for the bank.

On top of that, AI helps enhance customer experiences. By analyzing customer data, banks in Bahrain can create highly personalized communication strategies, offering clients relevant products based on their specific needs and financial behavior.

Egypt: AI in Credit Scoring and Customer Service

Finally, in Egypt, banks are diving into AI technologies for everything from credit scoring to customer service. Cairo Bank is using AI to enhance its credit assessment process, ensuring that loans are granted based on a more accurate evaluation of a customer’s financial standing.

At the same time, Egyptian banks are using AI-powered chatbots to improve customer service. These chatbots handle everything from basic account queries to more complex banking issues, offering customers a quicker and more convenient way to get help.

From the UAE to Egypt, AI is driving change in the banking sector across the Middle East. These countries are not just catching up with global trends; they’re leading the way in AI-driven innovation. Whether it’s personalized financial advice, enhanced fraud detection, or smarter loan assessments, AI in financial services personalization is becoming a game-changer.

Key Benefits of AI in Banking Personalization

When banks implement personalized banking AI solutions correctly, the benefits show up across every part of their operations. But let’s skip the theoretical stuff and look at what’s actually happening.

Customer Engagement That Goes Beyond Clicks

Emirates NBD’s 300% improvement in digital user engagement tells only one part of the story. But the deeper story is that customer interactions became genuinely meaningful. Instead of customers hunting through menus to find relevant services, the platform anticipates what they need and presents solutions proactively.

This isn’t about generating more clicks for vanity metrics; it’s about better outcomes for customers. When users receive relevant recommendations at the right time, they are more likely to engage with financial products that genuinely align with their immediate needs.

Operations That Actually Run Smoothly

AI-powered customer service delivers one of the clearest ROI opportunities in banking. Banks with comprehensive chatbot systems handle nearly 60-80% of routine customer questions without any human involvement. Each automated interaction costs roughly $0.50-$ 2.00, compared to $15-$ 25 for human-handled support.

But the real value comes from quality improvements, not just cost savings. AI systems give customer service representatives complete context about each customer’s situation, preferences, and history before conversations even begin. This preparation leads to faster problem resolution and much better customer satisfaction.

Security That Stops Problems Before They Start

AI is not just changing how banks serve customers; it’s also redefining how they protect them. For example, Arab Financial Services (AFS), a fintech backbone serving banks, reported zero fraud losses among its client banks, crediting this remarkable outcome to its AI-powered, real-time monitoring systems.

Imagine an AI setup that acts like a vigilant guard, analyzing every transaction instantly, spotting anomalies, and preventing potential threats before they escalate. That’s the kind of protection AFS’s tools are providing. And when banks can trust AI to stop fraud in its tracks, it not only saves money, it builds customer confidence in invaluable ways.

Revenue Growth Through Smarter Timing

The role of AI in banking customer experience includes spotting revenue opportunities that human analysts consistently miss. AI systems analyze comprehensive customer data to predict when customers are likely to need specific products with remarkable accuracy.

This predictive capability completely transforms how banks approach relationship management. Instead of generic sales campaigns that annoy customers, banks can approach them at optimal moments with offerings that actually make sense. This dramatically improves conversion rates.

Competitive Advantages That Compound

In mature banking markets, hyper personalization in banking with AI serves as a key differentiator that attracts and keeps customers. Banks offering genuinely personalized experiences gain significant competitive advantages, especially in markets where traditional product offerings have become commoditized.

The network effects of personalization systems create additional competitive advantages. As AI systems accumulate more customer interaction data, they become more accurate in their recommendations and predictions. This improvement cycle makes it increasingly difficult for competitors to replicate the same level of personalization without making similar investments and building comparable data assets.

Implementation Roadmap: Your Step-by-Step Blueprint for AI Success

You’ve got the vision for AI-driven hyper-personalization in banking, but now comes the hard part: how to actually make it happen. Transforming your bank’s operations with AI is not an overnight task. It is a step-by-step, systematic approach that is entirely achievable with the right approach. Here is a step-by-step process that banks can follow to integrate AI in banking and deliver personalized customer experiences at scale.

1. Assessing Business Needs and Defining Objectives

The first step in any AI journey is to understand what you are trying to achieve. What specific pain points are you looking to solve? Do you want to improve customer satisfaction, automate operations, reduce fraud, or have any specific use case in mind? It’s crucial to have a clear understanding of your business goals before embarking on your AI project development.

2. Identifying the Right AI Technologies

Once you know what you want to achieve, the next step is to figure out which AI tech stack will best meet your project needs.

For instance:

- If you are looking to improve customer service, chatbots and NLP tools could be your go-to choice.

- If you want to enhance fraud detection, machine learning and predictive analytics will be your best bet. They can help you analyze transaction patterns and identify risks.

- If you aim to automate routine tasks, RPA is the best choice as it can speed up back-office functions like loan approvals and account management.

3. Data Collection and Analysis

AI thrives on data. So, this step is crucial. Before you implement any AI models in your banking operation, you need to gather high-quality data. This data could come from various sources, including:

- Customer transaction history

- Interaction logs (online or in-branch)

- Social media activity

- Behavioral patterns and preferences

It’s essential to ensure your data is clean, organized, and relevant. Poor data will only lead to poor AI results. So, invest in good data governance and ensure that your data is secure and compliant with data privacy regulations like GDPR or CCPA.

4. Building and Training the AI Models

This is where the magic happens. AI models need to be trained using the data you have collected. Machine learning algorithms will analyze the data to find patterns and make predictions based on historical information. Whether it’s forecasting spending behavior, detecting fraud, or personalizing product recommendations, the AI model gets better over time as it learns from the data.

Training the models can take time, and it’s an iterative process. The more data you feed the system, the smarter it becomes. And, as your models improve, so will the personalization and accuracy of the services you offer.

5. Integration with Existing Systems

Now comes the tricky part: integrating AI with your legacy systems. Many banks still rely on outdated technology, and they can’t afford to rip out infrastructure overnight. However, they can use API integration layers to connect AI tools with existing cores. Run pilot programs such as fraud detection or customer onboarding, as starting points. Gradually, they can scale as results prove themselves.

6. Monitoring and Continuous Improvement

AI is not a “set it and forget it” tool. After implementing the AI solutions, the next and ongoing step is to monitor their performance and make adjustments as needed. AI models need continuous feedback to improve. For instance, customer interactions may change over time, and your AI tools should evolve with them.

This ongoing process of feedback and fine-tuning will help you create an even better hyper-personalized customer experience.

Remember, implementing AI for hyper-personalized banking is not a quick fix; it’s a journey. It requires foolproof planning, careful execution, ongoing monitoring, and a willingness to adapt. But when done right, the rewards are huge: a more personalized, efficient, and secure banking experience for both your customers and your team.

Challenges in Creating Hyper-Personalized Banking with AI and How to Solve Them

Every bank implementing hyper personalization in banking with AI runs into the same challenges. The difference between expensive failures and profitable successes often lies in how institutions handle these predictable obstacles. To help you overcome these challenges, here are the most common challenges and the solutions that leading banks are already applying.

Legacy Systems That Weren’t Built for This

Challenge: Many banks still operate on infrastructure designed decades ago. These legacy systems weren’t built for real-time data streaming, which makes it difficult to plug in modern AI solutions.

Solution: The successful approach isn’t ripping out and replacing everything. Doing so will take years and cost hundreds of millions. Instead of ripping out entire systems, successful banks are layering API-based integration platforms on top of existing cores. These act as bridges, standardizing formats and providing real-time access to customer data. This incremental approach allows banks to capture the benefits of AI solutions for hyper-personalized banking while modernizing their architecture over time.

Regulatory Compliance That Actually Works

Challenge: AI brings efficiency, but it also adds complexity to compliance. Regulators demand transparency in how algorithms make decisions, particularly in areas such as credit scoring and lending.

Solution: Rather than treating compliance as an obstacle to innovation, leading banks incorporate regulatory requirements directly into their AI algorithms. Fair lending algorithms automatically exclude protected characteristics while maintaining predictive accuracy. Real-time monitoring systems detect potential bias immediately and alert compliance teams.

Building Teams That Can Actually Execute

Challenge: The global shortage of AI talent makes it difficult for banks to build strong internal teams capable of managing both technology and business objectives.

Solution: The most effective institutions are blending internal capacity with external partnerships. For instance, Emirates NBD assembled a 70-person analytics unit while continuing to work with outside experts for specialized skills. The lesson here is clear: you don’t need to hire every expert in the market. A hybrid model where internal teams understand banking priorities and external partners bring technical depth delivers the best results.

The Data Privacy Paradox

Challenge: This is the biggest headache most banks face: customers want personalized experiences, but worry about how their data gets used. It’s a genuine paradox: the more personalized the service, the more data analysis required, which makes privacy-conscious customers nervous.

Solution: Smart banks solve this by being transparent about their data usage instead of trying to hide it. Leading institutions such as Emirates NBD have introduced clear opt-in models, allowing customers to set their personalization preferences.

On the technical side, privacy-by-design systems, such as anonymization and federated learning, allow AI to learn from customer patterns without exposing raw personal data. This builds trust while still enabling highly tailored services

The Real Cost and ROI of AI in Personalized Banking

Implementing AI in personalized banking isn’t a one-size-fits-all exercise. The cost varies widely depending on how far a bank wants to go. However, it is an investment that pays off with a lucrative ROI in the long run.

What the Investment Looks Like

On average, implementing AI in banking ranges between $40,000 and $600,000 / 146,800 and AED 2,202,000 or more, depending on the complexity of the project. The wide range comes down to three things:

- The features being deployed (simple automation vs. advanced forecasting).

- Compliance requirements that add complexity in highly regulated regions.

- The amount of customization needed to fit legacy systems and unique business needs.

Put simply: a pilot project may look affordable, but scaling AI across the enterprise is a major strategic investment.

For instance, a simple project with basic features costs around $40,000–$100,000 / AED 146,800 to AED 367,000. On the other hand, a full-scale, enterprise-level system, combining fraud detection, predictive analytics, and end-to-end personalization and other advanced features for a multinational bank, can easily exceed the budget of $600,000 / AED 2,202,000.

Here is a breakdown of the AI implementation cost and timeline, based on the varying project complexity.

| Project Complexity | Features | Estimated Cost (USD) | Estimated Cost (AED) | Timeline |

|---|---|---|---|---|

| Basic / MVP |

| $40,000 – $100,000 | AED 146,800 – AED 367,000 | 4 – 6 months |

| Mid-Range |

| $100,000 – $200,000 | AED 367,000 – AED 734,000 | 6 – 8 months |

| Advanced |

| $200,000 – $400,000 | AED 734,000 – AED 1,468,000 | 8 – 12 months |

| Enterprise-Level |

| $400,000 – $600,000 | AED 1,468,000 – AED 2,202,000 | 12 – 18 months |

What Banks Gain in Return

The payoff is where the story gets interesting. When done right, hyper personalization in banking with AI generates lucrative returns quickly.

- Revenue Growth

By serving the right product at the right time, banks can lift cross-sell and up-sell revenue by 15–25%. Customers respond better when offers feel relevant rather than generic.

- Customer Retention

Users stay with banking institutions that “get” them. When services feel tailored, whether it’s advice, product offers, or support, customers are less likely to shop around. AI gives banks the ability to deliver that sense of recognition at scale, turning personalization into a powerful loyalty driver.

- Operational Efficiency

Behind the scenes, AI quietly removes friction. Fraud checks that once took hours now happen instantly. Onboarding steps that used to pile up can be streamlined. Even customer service shifts from repetitive calls to focused problem-solving. The result isn’t just lower costs, it’s a system that runs smoother while staff focus on tasks that truly need human judgment.

Partner with Appinventiv to Build the Future of Hyper-Personalized Banking with AI

The journey toward hyper personalization in banking with AI is no longer optional. It’s what separates banks that lead from those that lag. Across the Middle East, banking firms are already proving how AI delivers stronger engagement, efficient operations, and deeper customer loyalty and with custom AI personalised banking app development, banks can build apps that deliver predictive insights and truly tailored experiences for every customer.

But strategy matters. Without the right tech partner, AI can quickly turn into fragmented pilots instead of an enterprise-wide transformation. This is where we come in. At Appinventiv, we bring 10+ years of industry experience in building AI-powered financial products, from early-stage prototypes to full-scale banking ecosystems. Our approach balances compliance, innovation, and measurable ROI.

Here’s what sets us apart as a leading AI development company in Dubai:

- Domain credibility: Deep expertise in banking and financial services personalization.

- Proven track record: Partnerships with institutions across the Middle East and beyond.

- Scalable delivery: From MVPs to advanced enterprise-grade AI deployments.

- Compliance-first: Architectures designed for GDPR, CCPA, PSD2, and local ME regulations.

Our commitment is not theoretical. Our portfolio is a practical, proven example of it. Take Edfundo, for instance, a UAE-based startup focused on financial literacy for kids. We helped Edundo across ideation, design, development, and deployment. The result? The development of the world’s first financial intelligence hub for kids.

The app we built helped the client

- Secure $500,000 in pre-seed funding to validate the business vision.

- Prepare for a $3 million seed round, setting the stage for rapid growth.

- Form strategic partnerships with Visa and NymCard to strengthen market credibility.

- Envision the product as a SaaS-based platform that opens new revenue streams.

- Scale the solution into a white-label product, expanding its reach across markets.

This project highlights our ability to blend AI-driven personalization, robust design, and strategic scalability. Through custom AI personalised banking app development, we deliver solutions that provide highly tailored experiences, scalable architecture, and measurable ROI exactly what modern banking institutions need today.

Your Next Step?

The ROI of AI in hyper-personalized banking is proven. The only question left is: when will your institution take the leap? With Appinventiv as your banking software development company, you gain not just a technology provider, but a team of 1600+ tech experts that helps you:

- Identify high-impact use cases.

- Implement AI without disrupting legacy systems.

- Scale personalization across all customer touchpoints.

So, why wait? Let’s partner and redefine banking together; secure, personalized, and future-ready.

FAQs

Q. What is hyper personalization in banking with AI?

A. Think about walking into a bank where they already know what you need. That’s what hyper personalization in banking with AI does. It looks at hundreds of different things about how you use money, when you shop, and what you buy, and creates a banking experience just for you.

Regular banks put everyone into big groups like “young professionals” or “retirees.” But AI banking treats every person as an individual. It’s like having a banker who remembers everything about your financial life and suggests exactly what makes sense for your situation.

Q. How much does AI in personalized banking cost?

A. On average, AI in personalized banking costs range between $40,000 and $400,000 / AED 146,800 and AED 1,468,000 or more. However, it is just a rough estimate. The actual cost can vary widely depending on several critical factors. For instance:

- A small project (a chatbot for customer queries) is on the lower end.

- Adding predictive models, fraud detection, and system integration pushes it into mid-range territory.

- A full rollout across all channels, such as mobile, web, and in-branch, typically falls at the higher end, often reserved for large institutions.

So it’s less about a fixed “price tag” and more about matching scope to ambition.

Q. What is the ROI of AI in banking personalization?

A. Banks that get this right see their money multiply by 3-7 times within about two to three years. Why? Because customers buy more products when they’re relevant, banks spend less on operations since AI handles routine stuff, fewer customers leave, and fraud gets caught faster.

Q. What are the top AI use cases in personalized banking?

A. Smart banks focus on a few key areas where AI in personalized banking really shines. Here are some of the most remarkable AI use cases in hyper-personalized banking:

- Customer service gets a huge boost because AI can predict what people need help with before they even call.

- Fraud detection happens in real-time as suspicious transactions get flagged instantly.

- Product recommendations actually make sense because they’re based on how customers really behave, not just their age or income.

- Credit decisions happen faster using information beyond traditional credit scores.

- Chatbots handle basic questions 24/7 without anyone getting frustrated.

Each of these areas saves money while making customers happier.

Q. How does AI improve customer experience in banking?

A. AI enhances the banking experience by making every interaction more efficient and relevant. Customers no longer face long processes or repetitive requests for information. Intelligent systems draw on past behavior, transaction history, and preferences to deliver context-aware responses in real time.

From a practical standpoint, this means:

- Faster resolution of service requests through AI-driven assistants.

- Personalized recommendations that match individual financial goals.

- Proactive support, such as alerts on unusual activity or timely reminders.

- Consistency across channels, ensuring customers receive the same quality of service online, on mobile, or in-branch.

The result is a banking that feels reliable and customer-centric; one where clients recognize that their bank understands their needs and can act on them proactively.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Build AI Chatbot With RAG Integration: Appinventiv’s End-To-End Development Framework

Key takeaways: RAG chatbots improve enterprise AI accuracy by grounding responses in verified internal business knowledge. Governance, security, and explainability become critical as AI shifts from pilots to enterprise infrastructure. Investment typically ranges $50K–$500K depending on data integration, compliance, and deployment complexity. Strong data engineering and architecture discipline matter more than standalone model capability for…

The Enterprise Buyer’s Checklist Before Hiring an AI Development Partner

Key takeaways: Choosing an AI development partner is less about technical demos and more about real-world fit, governance, and operational reliability. Internal alignment on outcomes, data ownership, and integration realities is essential before engaging any enterprise AI partner. Strong partners demonstrate delivery maturity through governance controls, security discipline, and lifecycle management, not just model accuracy.…

Proving the ROI of Copilot AI Sales Enablement Software for Global Teams

Key Takeaways The ROI of Copilot AI sales enablement software shows up in revenue moments, not in generic productivity reports. Organizations that treat Copilot as an AI-powered sales enablement platform tied to sales process maturity see measurable outcomes within two quarters. Global sales teams require region-aware deployment models to avoid uneven adoption and misleading ROI…