- Key Features Every Successful FinTech App Needs in Australia (2026)

- How to Develop a FinTech App in Australia: A Step-by-Step Guide

- Selecting the Right Tech Stack for Your FinTech App

- Costs of Developing a FinTech App in Australia

- Challenges in Finance App Development & How to Overcome

- 1. Regulatory compliance

- 2. Security at every stage

- 3. Smooth user experience

- 4. Working with third-party services

- 5. Costs and timelines

- Key Trends and Opportunities for FinTech Apps in Australia

- How Appinventiv Can Help Build Your Successful FinTech App in Australia

- FAQs

- Building a FinTech app in Australia requires understanding compliance, security, and user needs- focus on simplicity and trust.

- AI integration in FinTech apps will be essential by 2026, but it must deliver real value and not just be a flashy feature.

- Developing a secure mobile banking app means embedding security from day one and ensuring compliance with AUSTRAC (Australian Transaction Reports and Analysis Centre) requirements.

- Payment integration and seamless user experience are key to retaining users in the competitive FinTech space.

- Costs to build a FinTech app in Australia vary, but prioritizing essential features and scalability ensures a successful launch.

Australia’s financial sector is changing fast. Most Australians now manage their money on their phones, checking balances, paying bills, and investing. That’s created a real opportunity to build a FinTech app in Australia. But here’s the thing: just building something that works won’t cut it anymore. The apps that win solve actual problems. They save people time. They make financial decisions less stressful. That’s what you’re aiming for.

If you’re thinking about how to develop a FinTech app in Australia, you’ll face strict regulations. That’s not a bad thing; people are trusting you with their money. You’ll need technology that scales, and more than anything, you need to earn trust. One security issue or confusing experience can tank even the best idea. Start with what matters: What problem are you solving? Which features will people use daily? How do you innovate without breaking compliance rules?

AI in fintech apps in Australia will be everywhere by 2026. But tech alone doesn’t win customers. Your challenge is making AI genuinely helpful, not just impressive on paper. This guide walks you through how to develop a fintech app in Australia that works in today’s competitive market. We’re talking compliance, technology decisions, building trust, and features people will actually use. No fluff—just what you need to know.

Let us guide you through the entire process of developing a successful fintech app in Australia.

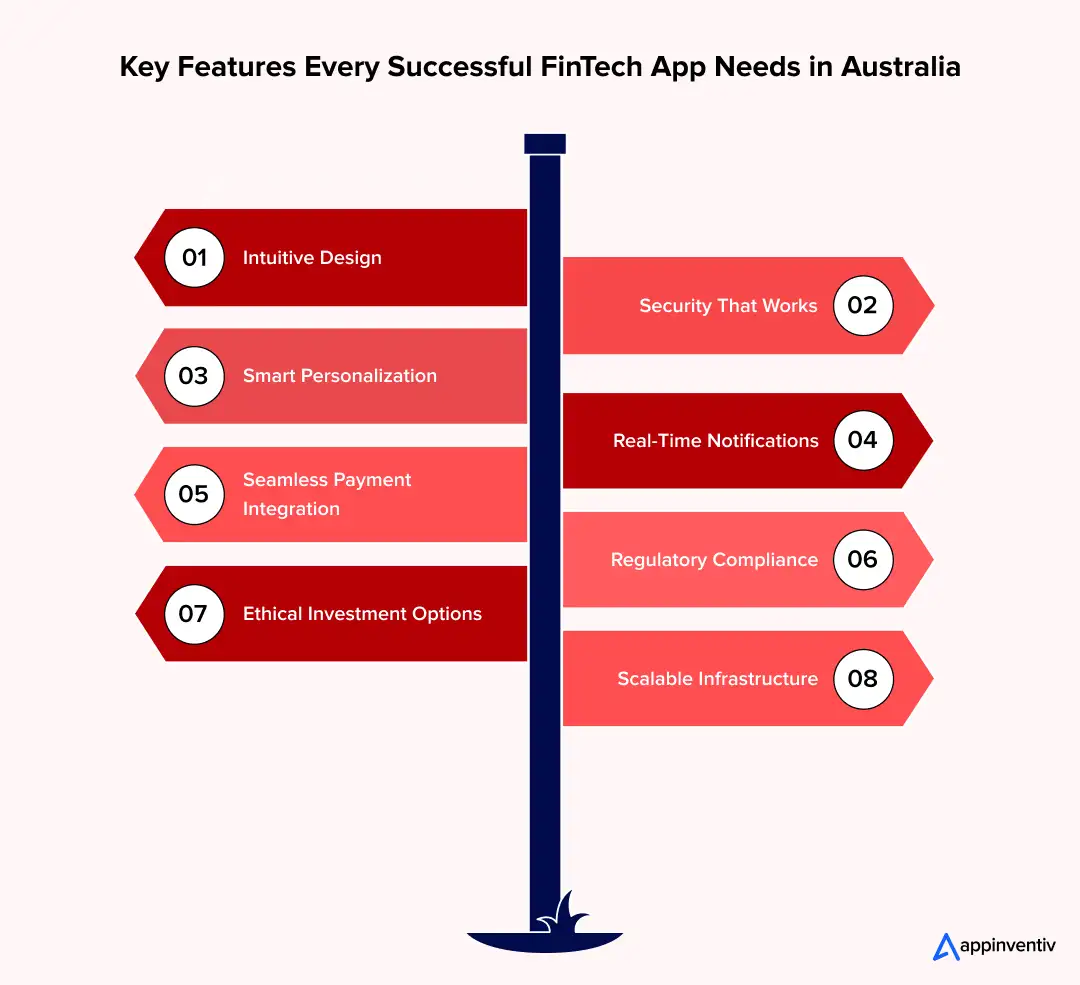

Key Features Every Successful FinTech App Needs in Australia (2026)

Australia’s fintech world is growing fast, and to stand out, your app needs to deliver real value. As digital finance continues to evolve, here are the must-have features for Aussie fintech apps in 2026:

- Intuitive Design: Australians won’t tolerate clunky interfaces. Your app should feel obvious from the first tap. If tracking expenses or sending money takes more than a few seconds, people will find an alternative. Speed and simplicity win.

- Security That Works: People won’t use your app if they don’t trust it. Biometric authentication, encryption, and multi-factor verification aren’t optional extras. Get security wrong once, and you’re done.

- Smart Personalization: AI in fintech apps in Australia should make the app smarter for each user. That means relevant spending insights, investment suggestions that match their goals, and alerts that actually matter. Generic experiences don’t cut it anymore.

- Real-Time Notifications: Users expect instant updates. Transaction alerts, spending warnings, portfolio changes, they want to know what’s happening with their money as it happens.

- Seamless Payment Integration: Your app needs to work with Apple Pay, Google Pay, and other digital wallets. Friction at checkout costs you users.

- Regulatory Compliance: Mobile fintech app compliance requirements aren’t suggestions. Compliance protects your business and builds credibility. Cut corners here, and you’ll pay for it later.

- Ethical Investment Options: A growing number of Australians care where their money goes. ESG investing and sustainable funds aren’t niche anymore; they’re expected.

- Scalable Infrastructure: The tech stack required for fintech apps should be built for growth from day one. Your architecture should handle new features and increased users without major overhauls.

By focusing on these key features, you’ll be on your way to creating a fintech app in Australia that not only meets the needs of Aussie users but also stands out in the crowded market. Keep it simple, secure, and user-friendly, and you’ll have an app that truly makes a difference.

How to Develop a FinTech App in Australia: A Step-by-Step Guide

Building a high-impact fintech app in Australia isn’t easy, but it’s definitely doable with a clear, methodical approach. Based on our experience, success doesn’t lie in groundbreaking ideas but in flawlessly executing the basics. Here’s a step-by-step guide to help in finance app development in Australia that works:

- Start with Voice-of-Customer Research

Your initial step is a rigorous consultation with potential users. What critical pain points are driving frustration with existing solutions? Where does the current experience fail? We have seen development derailed by projects solving non-existent problems. Spend a month just listening before committing resources to code.

- Select Technology for Longevity

When it comes to the tech stack, your choices will stick with you for the long haul. Sure, new frameworks look tempting, but fintech apps need reliable, proven technology that ensures secure transaction processing and real-time data. Choose stable tech that can grow with your app, ensuring it’s maintainable and scalable for the long term.

- Prioritize Intuitive Design

The interface must be utterly simple. If a core function requires more than three taps, the design must be re-evaluated. Users should not hesitate when managing money; transfers, balance checks, and bill payments must be effortless. Rigorously test your prototype and correct every moment of user confusion immediately.

- Security Must Be Architected, Not Added Later

A single security failure can end a fintech business. AUSTRAC compliance mandates customer verification, transaction monitoring, and AML/CTF reporting, all of which must be built into the core architecture from day one. For regulated financial products, APRA standards such as CPS 234 and CPS 230 also shape requirements around information security, operational resilience, and third-party risk. Security is not an enhancement. It is the cost of entry in Australia’s fintech ecosystem.

- Ensure AI Serves a Defined Business Purpose

In practice, AI in FinTech uses machine learning and data models to automate decision-making, manage risk, and personalise financial experiences. Common uses include fraud detection, transaction monitoring, credit assessment, and real-time insights, with the focus on accuracy and efficiency rather than added complexity. While Intelligent automation in fintech is essential, it must deliver demonstrable value to users. Is it identifying relevant spending patterns or catching unusual transactions? That’s effective. Implementing a non-functional chatbot in business is a waste of resources. Every AI feature must solve a specific, high-value problem.

- Guarantee Flawless Payment Integration

Your mobile banking app must seamlessly integrate with Apple Pay, Google Pay, and other digital wallets. Payment failures at checkout can lose you customers in an instant, and it’s rare to get a second chance. Test every payment gateway integration under real-world conditions to make sure it works perfectly.

- Commit to Exhaustive Testing

Don’t launch until your app is genuinely ready. That means going through a rigorous beta phase and tracking down every possible bug. Mobile fintech app compliance requirements and performance testing, especially under stress (e.g., poor connectivity or peak usage), are critical. You also need independent security testing experts to ensure your app is as safe as possible.

- Launch Signals the Start of an Iteration

Post-launch is when the actual work begins. You will receive unexpected feedback and vital feature requests. Establish proactive support channels and genuinely incorporate user input. Your roadmap must evolve based on validated user data, not your original assumptions.

These are some of the steps to build a fintech app. Successfully developing a finance app in Australia takes more than just writing code. It requires a commitment to security, seamless user experiences, and continuous feature refinement.

From ideation to launch, we’re here to help you develop a mobile banking app that works for you and your users.

Selecting the Right Tech Stack for Your FinTech App

Choosing the right tech stack required for Aussie fintech apps is a decision that will affect your app for years to come. If you pick the wrong one, you’ll be stuck with a messy infrastructure that’s hard to maintain and scale. Pick the right tech stack, and you’ll set yourself up for success.

- Security Isn’t Negotiable: This should be obvious, but it’s worth repeating: financial apps that aren’t secure don’t survive. You need proper encryption, secure payment processing, and multi-factor authentication baked in from the start. AUSTRAC compliance isn’t optional—build for it from day one or regret it later.

- Build for Tomorrow’s Load, Not Today’s: Your initial user numbers won’t stress any tech stack required for fintech apps. The question is what happens at 10x growth. Can your infrastructure handle it without a complete rebuild? Choosing scalable technologies now saves you from costly migrations so you can focus on product improvements.

- Real-Time Matters More Than You Think: Users expect their balance to update instantly. Transactions should reflect immediately. Delays erode trust faster than almost anything else in finance. Whatever stack you choose needs to handle real-time data processing without hiccups.

- Stay Flexible: The fintech landscape changes. New payment methods emerge. Regulations shift. Your mobile fintech app compliance requirements and tech stack should let you adapt without rewriting everything. Look for mature, well-supported technologies that play nicely with third-party integrations. Avoid getting locked into proprietary systems that limit your options later.

- Performance Affects Retention: Slow apps get deleted. Clunky interfaces drive users to competitors. Your fintech app development cost in Australia is directly related to how responsive your app feels. Test across different devices and connection speeds—performance on your office Wi-Fi doesn’t reflect what users experience.

Get your tech stack right, and you’ve solved a lot of future problems before they start. Rush this decision, and you’ll pay for it in the form of technical debt.

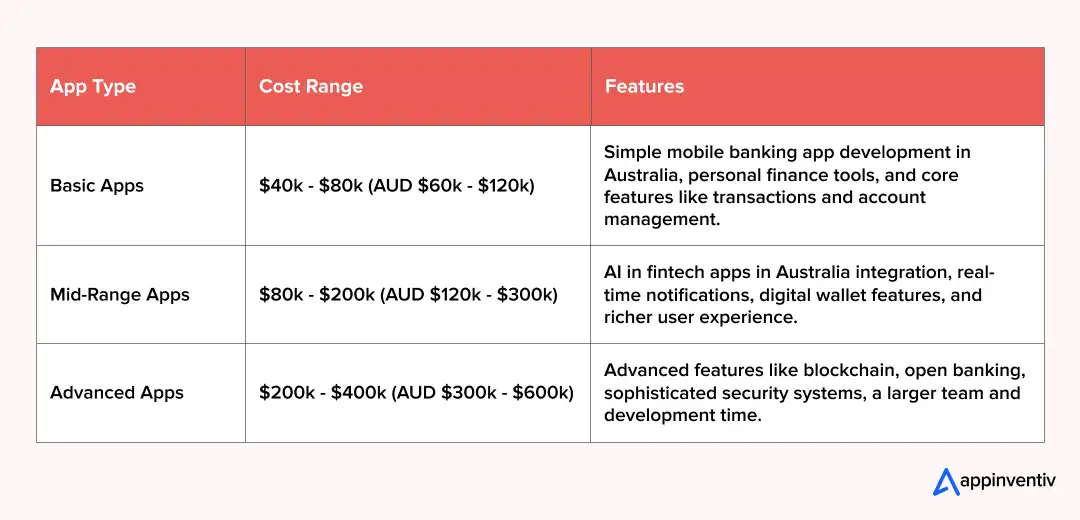

Costs of Developing a FinTech App in Australia

When an organization decides to build a fintech app in Australia, the necessary investment varies widely. It’s a direct reflection of your product’s ambition and technical depth. Executives should budget for core development costs, typically ranging from AUD 60,000 to AUD 600,000. The fundamental task is making sure this capital delivers maximum competitive value.

Always remember that the final number is a sum of its parts: the quality of your design, the chosen tech stack for fintech apps, essential third-party integrations, and non-negotiable security needs. In the intensely competitive Australian fintech industry, investing in quality development is a strategic necessity, not an option. It is the factor that guarantees platform stability and security, and, most importantly, ensures the enduring trust of your customer base.

Also Read: Cost to Build a FinTech App: What You Need to Know

Challenges in Finance App Development & How to Overcome

Building a finance app in Australia involves more than writing code. Teams need to balance user expectations with the realities of regulation, security, and delivery timelines. The following points highlight common pressure areas and practical ways to manage them during finance app development in Australia.

1. Regulatory compliance

Finance is heavily regulated, and violating one rule can delay the entire project. AUSTRAC anti-money laundering processes, privacy controls, and data storage rules all apply.

How to overcome: Bring compliance experts into the earliest planning meetings. Treat mobile fintech app compliance requirements as part of the initial architecture, so nothing is added at the last minute.

2. Security at every stage

In finance app development in the Australian market, security is directly tied to reputation. One incident can undermine user trust overnight.

How to overcome: Use encryption, two-factor authentication, and biometrics by default. Independent security reviews and continuous monitoring help catch issues before they become real problems.

3. Smooth user experience

People want a clean experience when handling money. Slow screens or confusing options cause drop-offs.

How to overcome: Keep layouts simple and test often. Remove unnecessary steps and examine user behaviour across devices. When creating a fintech app in Australia, clarity supports long-term adoption.

4. Working with third-party services

Fintech depends on outside systems for payments, risk checks, AI tools, and data feeds. Keeping everything in sync can be tricky.

How to overcome: Select reliable partners and test integrations thoroughly before launch. A flexible architecture reduces disruption when service providers update their systems.

5. Costs and timelines

Building advanced features, such as AI, in fintech apps or blockchain systems adds time and cost. Projects often expand quickly without proper controls.

How to overcome: Start with essential features and build in phases. A team experienced in finance app development in Australia can help keep budgets realistic and milestones achievable.

Releasing a fintech app in Australia takes planning, discipline, and constant attention to user needs. When compliance, security, and experience are handled with care, challenges become manageable steps toward a reliable product.

Key Trends and Opportunities for FinTech Apps in Australia

Fintech in Australia is moving fast, and users expect financial apps to keep pace. The most successful platforms focus on real market needs rather than trends for the sake of trends. The points below show where the demand is growing and how fintech app development in Australia can respond.

- Mobile first is now mobile mandatory: People expect financial tools to work smoothly on their phones from the very first tap. A mobile banking app development in Australia must offer quick access, clean navigation, and reliable performance. Slow screens or confusing flows push users away much faster than before.

- Using AI where it makes a difference: AI in fintech apps is valuable when it improves decisions or reduces risk. Practical uses include helping users understand their spending, spotting unusual activity, and giving timely suggestions. AI should make the app feel more helpful, rather than adding features that lack a clear purpose.

- Payment flows that work every time: Digital payments are the standard, not an extra. Payment integration in fintech apps needs to work without friction across wallets, cards, and services such as Apple Pay and Google Pay. A simple, predictable payment experience is one of the biggest drivers of repeat use.

- Buy Now, Pay Later (BNPL) continues to shape consumer finance: Australia remains one of the most mature BNPL markets globally. Users expect flexible, interest-free instalment options embedded directly into checkout and wallet experiences. For fintech app development in Australia, BNPL features must balance seamless UX with responsible lending checks, real-time credit assessment, and strict compliance with evolving consumer protection regulations. When designed carefully, BNPL can drive higher transaction volumes without increasing financial risk.

- Sustainable finance is gaining attention: More Australians are seeking ethical investment options and clear information about where their money goes. Including sustainable finance options can help a fintech app earn trust and long-term engagement. Transparency matters as much to this group as returns do.

- Open banking as a real opportunity: With open banking, users can manage financial data in one place and stay in control. Well-implemented open banking apps can provide better insights and more relevant services. Compliance is essential, but so is designing flows that feel simple for everyday users.

Fintech app development in Australia that pays attention to these areas is better prepared for long-term adoption. Whether it is AI in fintech apps, smoother payments, or open banking features, focusing on practical improvement gives an app a clear edge in a competitive market.

With the latest AI in fintech apps, Australia and mobile fintech app compliance requirements, we help you keep your app on top.

How Appinventiv Can Help Build Your Successful FinTech App in Australia

Building a fintech app in Australia isn’t easy, especially with the rapid changes in the market. You need a partner who truly understands the industry and knows how to get results. That’s where Appinventiv comes in.

As a leading FinTech development company in Australia, we’ve successfully developed and deployed over 3000+ digital products and earned a 74% recurring client base. Our strong reputation for turning fintech ideas into reality speaks for itself. Whether you’re developing a mobile banking app, a lending platform, or a brand-new investment tool, we’re here to guide you through the process, from the initial concept to launch and beyond.

At Appinventiv, we do more than just handle the tech. We’re committed to building fintech apps that people actually want to use. We ensure your app is secure, compliant, and offers an excellent user experience. With deep expertise in fintech solutions and digital wallet integration, we can help create an app that meets the needs of today’s Australian users.

If you’re ready to create a fintech app in Australia, Appinventiv is the FinTech development company in Australia you can trust. With our experience and focus on delivering high-quality solutions, we’ll help you build an app that not only meets but exceeds expectations.

FAQs

Q. How much does it cost to develop a FinTech app in Australia in 2026?

A. There is no fixed number because every build is different. A small mobile banking app in Australia might be around AUD 40,000 to AUD 80,000. Projects that need AI integration, blockchain features, or open banking tools can move up toward AUD 200,000 to AUD 400,000. Costs usually come down to the features, compliance work, and the tech stack required for Aussie fintech apps.

Q. What factors influence the cost of FinTech app development in Australia?

A. A few things drive cost right away. Feature depth, security requirements, and AUSTRAC compliance are usually at the top. Adding digital wallet flows, real-time alerts, or AI to fintech apps in Australia will push prices higher. Time and the tech stack required for fintech apps also matter because some frameworks take longer to build and test.

Q. How do I ensure my fintech app’s security?

A. Security is best handled at the start, not at the end of the project. Use encryption, multi-factor authentication, and biometric login from day one. Regular security testing and following AUSTRAC guidelines help reduce risk. In finance app development in Australia, treating security as part of the architecture rather than a single feature usually prevents problems later.

Q. Do I need approval to launch my fintech app in Australia?

A. Yes. There are regulatory steps before you can go live. You will need to meet anti-money laundering (AML) rules, follow data protection laws, and check local financial regulations. Working with a fintech development company in Australia can help you understand what applies to your product and avoid delays.

Q. What compliance and regulatory requirements apply to FinTech apps in Australia?

A. Most fintech apps must comply with AUSTRAC for anti-money laundering and counter terrorism financing. Privacy laws, including the Privacy Act 1988, also apply. If you are building wallet features or banking tools, mobile fintech app compliance requirements should guide your planning rather than being added afterward.

Q. How long does it take to build a FinTech app in Australia?

A. Timelines vary. A basic app can be built in a few months. More advanced projects with AI integration, digital payments, and open banking might take six to twelve months. Testing and regulatory checks during fintech app development in Australia can also add time, depending on complexity.

Q. Can AI be integrated into a FinTech app in 2026?

A. Yes, and it is becoming common. Data-driven models are already being used for spending insights, credit scoring, and fraud detection across Australian fintech products. By 2026, most finance tools will use some type of AI, even if it is behind the scenes, to support users and improve decision-making.

Q. What is the process to create a successful fintech app?

A. The process usually starts with research and planning. Then you choose the tech stack required for Aussie fintech apps, design secure screens, and start building payment and AI features. Testing happens throughout development. Adjusting based on user feedback is important in fintech app development in Australia because small changes can improve trust.

Q. What types of apps are best to develop in the fintech industry?

A. Popular choices include mobile banking apps, personal finance tools, lending platforms, digital wallets, and investment products. Pick the type that fits a real need in the Australian market and aligns with available regulatory options.

Q. When should I launch my Australian fintech app in 2026?

A. Launch once you complete compliance checks, security testing, and a beta release. Make sure all mobile fintech app compliance requirements are addressed before publishing. Taking the time for last round fixes usually leads to a smoother public launch.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…