- The Market Signal: Why UAE’s Real Estate Is Ready for Crypto Disruption

- What Crypto Exchange Integration Really Means for Property Transactions

- How Dubai Enables This - Regulation, Free Zones & Institutional Openness

- Is It Compliant? Here’s What You Need to Launch Legally

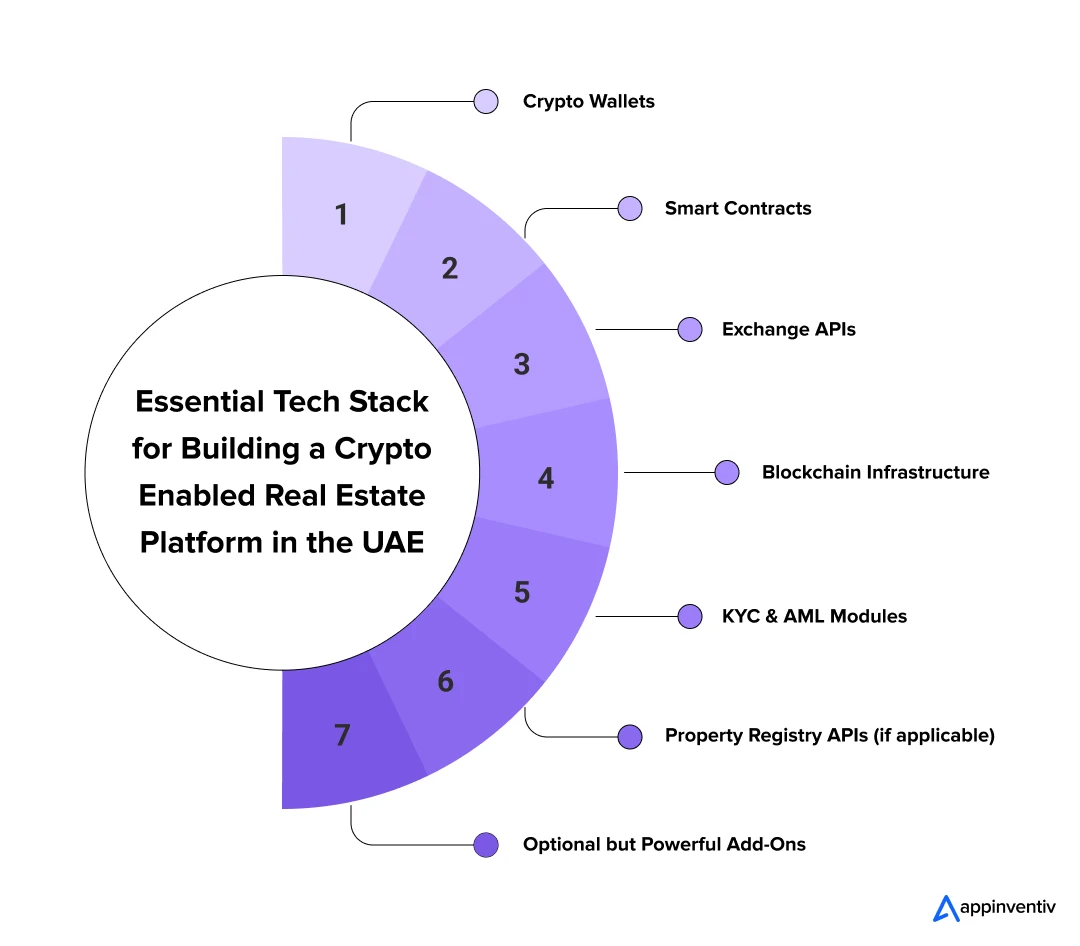

- What You’ll Need to Build or Integrate: The Full Tech Stack

- 1. Crypto Wallets

- 2. Smart Contracts

- 3. Exchange APIs

- 4. Blockchain Infrastructure

- 5. KYC & AML Modules

- 6. Property Registry APIs (if applicable)

- Optional but Powerful Add-Ons:

- Why It’s Worth It. The Value of Cryptocurrency in Real Estate UAE Across the Ecosystem

- For Buyers: A Smoother Path Into UAE Real Estate

- For Sellers: Liquidity from a Non-Traditional Buyer Pool

- For Developers: Smarter Fundraising, Better Marketing

- For Platform Owners: Monetization at Every Step

- What’s Already Happening: UAE Real-World Examples

- If they’re doing it…

- How Leading Teams are Approaching Crypto Integration in Real Estate

- A Practical Checklist to Launch a Crypto Real Estate Platform in the UAE

- Phase 1: Model & Scope Definition (1–2 weeks)

- Phase 2: Regulatory Alignment & Licensing (3–6 weeks)

- Phase 3: Platform Build & Integration (8–12 weeks)

- Phase 4: Pilot & Controlled Launch (2–4 weeks)

- How to Move Forward Without Costly Missteps

- How Appinventiv Approaches Building Crypto-Ready Real Estate Platforms

- How Appinventiv Can Help You Build the Future of Real Estate Transactions

- Here’s how we support your vision, end to end:

- A Strategic Play for the Bold and Prepared

- FAQs

- Q. How is crypto changing real estate in the UAE?

- Q. What are the legal rules for buying or selling property with crypto in Dubai?

- Q. What does it cost to build a Real estate crypto payment gateway in Dubai?

Key takeaways:

- Emerging crypto trends in real estate for the UAE market are set to disrupt Dubai’s property landscape, proving that crypto is more than just a passing trend.

- The UAE offers one of the clearest regulatory landscapes for crypto-real estate models, thanks to VARA, DMCC, DIFC, and ADGM.

- Compliance isn’t a hurdle, it’s a launchpad. With the right licenses and KYC/AML in place, you’re built to scale.

- The tech stack is modular: wallets, smart contracts, exchange APIs, and identity tools are all ready to plug and play.

- Appinventiv helps founders build blockchain-powered platforms that meet UAE legal standards and market needs.

The intersection of cryptocurrency and real estate in the UAE is no longer theoretical. What started as experimental payments and headline-grabbing purchases is now evolving into structured, regulated transaction models that serious builders are actively deploying.

This shift matters most to a specific group of decision-makers. Founders planning crypto-enabled property platforms, real estate developers exploring faster settlement and global liquidity, platform owners building transaction infrastructure, and investors evaluating regulated exposure to digital assets are all facing the same question: how do you integrate crypto into real estate in the UAE without breaking compliance, trust, or scalability?

Dubai’s regulatory clarity, rising cross-border property demand, and growing crypto-native capital have turned this from a “future trend” into a near-term execution decision. For those already past the curiosity stage, the challenge is no longer whether crypto belongs in real estate, but how to design the right model, choose the right integration path, and move forward without costly missteps. Hire technology firm here

This guide breaks down how crypto exchange integration is being used across UAE real estate today, what regulatory and technical foundations are required, and what early movers are already doing differently to make it work.

The Market Signal: Why UAE’s Real Estate Is Ready for Crypto Disruption

Dubai doesn’t just follow global trends – it sets them. Especially in real estate, where the skyline rises as fast as investor interest. And if the last few years have proven anything, it’s that this market is hungry for speed, scale, and smarter ways of transacting – the kind traditional systems simply can’t keep up with anymore.

That’s where crypto exchange real estate UAE comes in – not as a gimmick, but as a serious enabler.

The UAE has positioned itself uniquely at the crossroads of digital finance and high-value asset markets. With HNWIs and institutional investors actively relocating to Dubai, there’s a visible appetite for modern, frictionless investment tools. Many of these buyers already hold significant crypto portfolios and are increasingly seeking ways to deploy them into tangible assets like property.

In parallel, Dubai’s real estate sector continues to attract billions in inflows, much of it from overseas. This alone makes the case for faster, cross-border, low-fee transaction systems, add to that the government’s forward-looking approach – from VARA’s establishment to free zones actively courting Web3 and blockchain real estate ventures – and you’re looking at a policy and tech environment built for innovation.

Real estate enterprises and entrepreneurs looking at this market can no longer afford to ask if crypto payment integration in Dubai property will play a role in real estate – the better question now is how soon and in what form. Because whether it’s full-fledged property sales in Bitcoin or tokenized real estate funds tied to smart contracts, technologies like OTC crypto exchange integration is already shaping what comes next.

The infrastructure is here. The market is ready. Let’s put your platform at the center of it.

What Crypto Exchange Integration Really Means for Property Transactions

When most people hear “crypto in real estate,” their minds jump straight to someone buying a penthouse with Bitcoin. While that’s part of the picture, the real transformation goes much deeper – and it’s far more strategic from a platform-building perspective.

Crypto exchange real estate UAE isn’t just about accepting digital currencies as payment. It’s about embedding blockchain-based transaction logic into the entire property lifecycle – from offer to ownership transfer – with the exchange acting as a key facilitator rather than a peripheral tool.

Let’s break that down.

At the core, it starts with enabling fiat-to-crypto (and vice versa) transactions directly within the real estate platform. Think of a buyer who wants to pay in USDT while the seller prefers AED. With exchange integration, that conversion is seamless – processed instantly via APIs connected to major platforms like Binance or BitOasis, removing the friction of off-platform wallet swaps.

Then comes the escrow wallet layer. Instead of traditional bank-based escrows with manual releases, blockchain-based wallets can be programmed to release funds automatically when predefined property milestones are met – like final approvals, title deed transfers, or snag list completion. This reduces dependency on middlemen and significantly accelerates deal timelines.

Most efficiency gains come not from the choice of token, but from integrating conversion, escrow, and compliance directly into the transaction flow rather than managing them manually or off-platform.

Now, pair that with smart contracts – digital agreements coded to execute when conditions are fulfilled. Imagine a smart contract that triggers payment release the moment a title deed is digitally confirmed by the Dubai Land Department. The margin for error? Nearly zero. The trust factor? Inbuilt.

Lastly, there’s KYC and AML compliance, which is non-negotiable in the UAE crypto real estate transactions. But integration doesn’t mean cutting corners – rather, it allows entrepreneurs to embed KYC flows directly into the transaction journey, leveraging tools like Jumio or ShuftiPro that are already compliant with VARA and mainland standards.

So, when we talk about crypto-powered real estate platform UAE, we’re talking about more than payment convenience. We’re looking at a new architecture for real estate transactions – one that is programmable, verifiable, borderless, and fast. And for entrepreneurs, that opens up not just product innovation, but new business models altogether.

How Dubai Enables This – Regulation, Free Zones & Institutional Openness

If you’re building anything crypto-related in the UAE – particularly in the high-stakes, high-value real estate market – you’re not stepping into the unknown. You’re stepping into one of the most regulated yet innovation-ready jurisdictions in the world when it comes to digital assets.

There’s a common myth among first-time founders and even experienced investors: that regulatory uncertainty could stall innovation in this space. But in the UAE – and especially in Dubai – that narrative simply doesn’t hold up anymore.

Let’s start with VARA – the Virtual Assets Regulatory Authority – established in 2022 under Dubai’s government. Unlike many global regulators still figuring out how to approach crypto, VARA was designed specifically to enable virtual asset activity while ensuring market integrity and consumer protection. It has introduced a comprehensive licensing framework covering custodians, brokers, exchanges, and advisory firms – including those with real estate-linked use cases.

So, if you’re building a crypto-powered real estate platform in the UAE that handles wallet-to-wallet transfers, holds funds in crypto escrow, or integrates with an exchange for property purchases, you have a legal path to operate – not in theory, but through clearly outlined licenses.

But legal clarity is just one part of what makes Dubai uniquely positioned.

The broader regulatory and economic environment is entrepreneur-first. Consider DMCC (Dubai Multi Commodities Centre), which has launched a dedicated Crypto Centre – home to over 600 blockchain and Web3 startups. Companies can get crypto-specific licensing, access to legal and compliance advisors, and even support in connecting with institutional capital.

Over in DIFC (Dubai International Financial Centre), which operates under its own legal jurisdiction, regulators are actively refining digital asset law under common law principles. This appeals particularly to global investors and businesses seeking international legal compatibility. DIFC’s fintech sandbox, Innovation Hub, and progressive licensing tracks make it a prime choice for entrepreneurs building platforms with smart contract automation or tokenized real estate models.

Not to be left out, ADGM (Abu Dhabi Global Market) was actually one of the first jurisdictions globally to issue clear digital asset guidelines, and it continues to enhance its framework with global standards in mind. Whether you want to operate a regulated exchange, issue tokens backed by property, or test new escrow structures, ADGM offers a structure for it – often faster than what you’d find in the West.

And here’s the real unlock: smart contracts are now legally recognized in the UAE. This is significant. Many jurisdictions allow smart contracts to run on-chain but don’t grant them enforceability in traditional courts. The UAE, however, has built legal bridges between the code and the courtroom. So if your transaction terms are coded into a blockchain contract – and that contract is executed – you’re backed by enforceable law, not just blockchain logic.

To top it off, the UAE is actively encouraging innovation in crypto payment integration Dubai property through sandbox-style regulatory environments. If you’re pioneering a new model that doesn’t yet fit traditional licensing categories – like fractionalized property sales via NFTs or DeFi lending against real estate assets – you can approach regulators to test it in a controlled, monitored setting before going to market. That kind of access to regulators is rare and valuable – especially when you’re building at the intersection of finance, law, and property.

Put simply, Dubai isn’t tolerating crypto innovation – it’s inviting it, and backing it with legal, institutional, and infrastructural support. As long as your model is compliant, transparent, and consumer-protective, the environment is not just viable – it’s genuinely fertile for scaling.

Partner with us!

Is It Compliant? Here’s What You Need to Launch Legally

Let’s face it – no matter how innovative your idea about a custom blockchain platform for crypto real estate transactions in Dubai is, it won’t go far in the UAE without ticking the regulatory boxes. This isn’t the kind of market where you build first and ask questions later. And honestly, that’s a good thing. Because in Dubai, if you’re looking to launch something at the intersection of crypto and real estate, compliance isn’t a blocker – it’s your competitive edge.

The UAE, particularly through VARA (Virtual Assets Regulatory Authority), has made it very clear what’s allowed, what’s regulated, and what’s non-negotiable. So before you start sketching out product flows or token models, it’s worth knowing what licenses you’ll need – and why they matter.

Here’s a simple breakdown:

- If your platform lets users pay for property using crypto or facilitates asset conversion (say, USDT to AED), you’re looking at a Broker-Dealer license.

- If you’re holding funds on behalf of buyers or sellers – for example, through a crypto escrow wallet – you’ll need Custodial Services clearance.

- And if you’re building a full-on marketplace for tokenized assets or properties traded via crypto, you’re in Exchange license territory.

In practice, licensing follows a defined sequence. The transaction model is first mapped to a licensing category under VARA, followed by an initial compliance review. Once approved in principle, custody structure, KYC flows, and AED settlement logic are validated before full operational clearance is granted.

These aren’t just legal formalities – they shape how your business operates and how much trust it commands. And in a high-value space like real estate, trust is the whole game.

Now, crypto alone doesn’t close a property deal. You’ll still be interacting with the Dubai Land Department for title registrations, ownership transfers, and document verification. While DLD hasn’t issued a crypto-specific framework just yet, they do require transactions to ultimately settle in AED for registration. So your system needs to have on-ramping and off-ramping – meaning it should allow the buyer to pay in crypto, convert that seamlessly into AED, and finalize the deal in line with local property law.

Let’s talk about KYC and AML, because that’s where many platforms stumble. The UAE takes financial crime seriously – and so should you. Every buyer or seller using your platform will need to go through full Know Your Customer and Anti-Money Laundering checks. But that doesn’t mean you need a compliance team of 10. You can integrate tools like Jumio or ShuftiPro that plug into your user onboarding journey, verify identities in minutes, and keep your records regulator-ready.

In terms of timelines, payment-only models typically clear regulatory review faster, while platforms involving custody, escrow, or tokenized assets take longer due to additional scrutiny. Most compliant crypto-real estate platforms move from initial review to operational readiness within a few months, depending on scope.

And then there’s the question everyone asks: Can smart contracts even hold up legally here?

Short answer? Yes. Longer answer? Yes – if structured properly.

Smart contracts are now legally recognized across the UAE, especially under the DIFC’s digital asset framework and within VARA’s broader vision. That means if you’re automating an escrow release through blockchain in UAE real estate logic, and both parties have agreed to the terms – that smart contract holds the same weight as a traditional one. This is huge, because it lets you automate trust in a transaction-heavy industry that’s historically relied on intermediaries and manual paperwork.

The most common regulatory risks arise from unclear custody models, incomplete AML coverage, or misalignment between crypto settlement and property registration rules. These are typically mitigated by defining custody responsibility upfront, embedding transaction monitoring directly into platform workflows, and ensuring crypto payments ultimately settle in AED for registration with the Dubai Land Department.

So no – compliance isn’t a hurdle you “deal with later.” It’s the foundation you build into your cryptocurrency in real estate UAE products from day one. And if you get it right, it doesn’t slow you down – it makes your platform more credible, more scalable, and far more appealing to both investors and regulators alike.

What You’ll Need to Build or Integrate: The Full Tech Stack

At this point, you’re probably asking the right question: “Okay, but what do I actually need to build this?”

And the good news is – you don’t need to reinvent everything from scratch. Most of what powers a crypto-powered real estate platform in the UAE today is modular, meaning you can build smart or partner strategically. But what you do need is a clear architecture – because this isn’t just a payment gateway add-on. You’re rethinking how real estate transactions are initiated, secured, verified, and completed.

Here’s what the tech stack for UAE crypto real estate transactions looks like under the hood:

1. Crypto Wallets

You’ll need to support both self-custodial (user-managed wallets like MetaMask or Trust Wallet) and platform-managed wallets (especially for users who are new to crypto). The latter comes with more regulatory responsibility – since you’re technically holding funds on behalf of users – but it also makes the experience smoother for mainstream buyers.

You can also choose based on your audience. Are you targeting crypto-fluent investors? Or global buyers new to digital assets who need a more familiar experience?

2. Smart Contracts

This is the brain of your platform. Smart contracts can automate everything from escrow fund releases to milestone-based payouts (e.g., 20% on booking, 50% on DLD approval, 30% on handover). They also allow for tokenized ownership structures, fractional sales, or even rental flows – if your platform expands in that direction.

You’ll likely build on Ethereum or Polygon, depending on your needs for cost vs decentralization. In either case, smart contract development isn’t just about writing code – it’s about risk management, testing, and ensuring that terms are legally mirrored in your user agreements.

3. Exchange APIs

To make crypto real estate transactions in the UAE usable in the property space, you need real-time integration with exchanges. Platforms like Binance, BitOasis, or Ramp Network can let users convert crypto to AED or vice versa without leaving your interface. This is especially useful when the DLD requires settlements in fiat.

Look for APIs that support:

- Instant conversion

- Regulatory reporting

- Stablecoin support (like USDT, USDC)

4. Blockchain Infrastructure

Ethereum may be the default, but it’s not the only choice. Polygon offers lower transaction fees and strong compatibility with Ethereum tools. If you’re thinking about long-term scalability – like fractionalized assets or NFT-based deeds – your choice of chain will directly affect speed, cost, and user experience.

Some platforms also consider private or permissioned chains for internal logic, especially when interfacing with traditional institutions.

5. KYC & AML Modules

Compliance isn’t just paperwork – it’s code too. You’ll need to integrate services that can verify user identities (passport, biometrics, proof of funds), perform sanctions checks, and keep audit trails.

Vendors like Jumio, ShuftiPro, and IDnow offer APIs that plug into your onboarding process, so you don’t have to build verification flows from scratch. Look for providers that are already recognized by UAE regulators – this will save you time during licensing.

Most teams avoid building every layer from scratch. Compliance, identity verification, and exchange access are typically handled through established vendors, while transaction orchestration, escrow logic, and platform workflows are built in-house to retain control and flexibility.

6. Property Registry APIs (if applicable)

Now, this part is still evolving. Direct integration with Dubai Land Department (DLD) or municipal property registries isn’t fully open yet, but we’re seeing early signals. If and when APIs become available, they’ll allow platforms to sync title deeds, ownership changes, and verification checks in real time.

Until then, your platform needs to be able to export clean, compliant reports that a DLD rep or legal team can review – and be ready to plug in when government APIs roll out.

Optional but Powerful Add-Ons:

- Stablecoin Payment Rails: For buyers who want to pay in USDT or USDC rather than volatile tokens

- NFT-based Property IDs: For tokenized or fractional ownership models

- Real-time dashboards for compliance teams and auditors

The key takeaway here? You don’t need to build everything in-house. What you need is a well-structured, compliant tech stack, and smart partnerships with vendors who know the regulatory terrain in the UAE.

This is no longer a theoretical concept – it’s a buildable product, and the tools are already in your reach.

Why It’s Worth It. The Value of Cryptocurrency in Real Estate UAE Across the Ecosystem

For all the architectural planning and regulatory alignment, the most important question remains: where does the real value lie? The answer becomes clear once you look at how crypto exchange integration in UAE real estate changes the dynamics for everyone involved – not just financially, but operationally.

Early crypto-enabled real estate platforms are already showing where the value comes from in practice. Settlement cycles tend to shorten for cross-border buyers, transaction drop-offs reduce once escrow logic is automated, and operational overhead declines as fewer intermediaries are involved in payment handling and reconciliation.

This isn’t just about smoother payments. It’s about enabling speed, liquidity, access, and control – four things the traditional property ecosystem often struggles with.

For Buyers: A Smoother Path Into UAE Real Estate

A buyer sitting in Singapore or Zurich can now complete a Dubai property transaction without ever wiring funds through a traditional bank. Through an integrated platform, they connect their wallet, complete KYC, pay in stablecoins like USDT, and see the AED equivalent held in smart escrow – all within the same interface.

What would have taken a week of forex approvals, paperwork, and banking delays can now happen in a matter of hours. And because compliance is built-in – not an afterthought – the transaction stays fully above board.

For crypto-native investors and even early-stage digital entrepreneurs, this level of efficiency that cryptocurrency in real estate UAE offers is more than convenience – it’s permissionless access to a stable, appreciating real asset. They don’t have to exit the crypto economy to enter the property market – they just bridge across securely.

For Sellers: Liquidity from a Non-Traditional Buyer Pool

On the seller side, the value is just as tangible. A property listed with crypto-enabled checkout suddenly attracts a new kind of buyer – not the one waiting on mortgage approval, but the one with liquid digital assets ready to deploy.

These buyers are often looking to move quickly, hedge against volatility, or simply diversify their portfolio. By offering them a compliant, escrow-backed payment route, sellers can cut out weeks of back-and-forth and close deals with faster settlement times and reduced fall-through risk.

Especially in off-plan sales or resale of high-end inventory, this kind of liquidity can have a direct impact on cash flow and inventory turnover – something traditional marketing doesn’t always solve.

For Developers: Smarter Fundraising, Better Marketing

For developers, the opportunity for crypto exchange integration UAE real estate runs deeper than payment rails.

Imagine being able to tokenize a luxury development – breaking it into fractional stakes that are marketed globally, with each stake tied to a smart contract that outlines ownership rights and revenue share. These digital tokens could be sold before the project even breaks ground, allowing for early-stage capital to flow in from retail and crypto investors alike.

This also creates buzz. Real estate crypto payment gateway Dubai projects that embrace blockchain aren’t just building properties – they’re building stories. In a city like Dubai, where design, brand, and innovation often define sales velocity, tech-forward positioning adds real commercial value.

Developers can also automate milestone-based fund releases through smart escrow – reducing reliance on manual inspections or disbursement processes, while maintaining transparency across every phase of the build.

For Platform Owners: Monetization at Every Step

If you’re the one building the platform – the actual rails on which these transactions run – you’re not just solving a problem. You’re sitting on top of multiple monetization layers, many of which are recurring.

From a platform perspective, returns tend to come from repeatable transaction-linked revenue and reduced settlement effort, rather than one-off crypto usage, which is why consistent integration matters more than occasional acceptance.

- Transaction fees on exchange integrations.

- Custodial fees for crypto wallets.

- Charges for deploying and managing smart contracts.

- Premium onboarding for high-value users.

- API access to third-party developers or agents.

- Escrow release services tied to specific milestones.

From a business standpoint, the return on crypto exchange integration is best viewed as transaction infrastructure ROI rather than speculative upside.

ROI ≈ (Transaction-linked fees + Escrow services + Premium platform features) − (Compliance + Integration cost)

In practice, even moderate transaction volumes can justify the investment. A platform facilitating a few hundred high-value property transactions annually can generate recurring revenue through exchange margins, escrow automation, and platform commissions, while simultaneously reducing manual settlement effort and third-party dependency.

Because the entire cryptocurrency payment gateway Dubai operates on traceable logic, it also opens up new data-driven opportunities: compliance dashboards, investor insights, transaction analytics – all of which can be packaged as premium features or partner tools.

What starts as a transaction platform can evolve into a financial infrastructure layer – one that serves not just users, but the broader property, legal, and fintech ecosystem as well.

In short, this isn’t just about enabling crypto exchange integration in UAE real estate. It’s about reimagining the flow of trust, capital, and ownership across an industry that’s been overdue for change. And when you make that shift work across all sides – buyer, seller, developer, and operator – you’re no longer chasing opportunity. You’re defining it.

For platform owners, the key advantage is that revenue scales with usage rather than inventory, making crypto-enabled transaction rails a compounding asset as volume grows.

What’s Already Happening: UAE Real-World Examples

The best way to believe in something is to see it in motion, and in Dubai, crypto-based real estate is more than talk-it’s happening, right now. Here are a few examples of real estate firms in UAE accepting crypto and blockchain as a whole in their transformation journey.

DAMAC was among the first major developers to embrace crypto. It’s now possible to buy luxury properties-including off-plan villas and apartments-with Bitcoin, Ethereum, or USDT. Transactions are processed through wallets, converted into AED, and secured via escrow, all with full DLD registration.

Just this year, DAMAC deepened its crypto strategy by partnering with Umisiri Africa. Together, they enabled buyers to acquire prime UAE homes starting at around $500,000 using BTC, ETH, or USDT. They’re also launching property purchases via XRP with a rewards model structured on smart contracts deployed over the XRP Ledger - proof that crypto is not just accepted, but strategically embedded into incentive models.

Ellington and Binghatti-two trendsetting developers-have been quietly welcoming investors interested in crypto real estate transactions UAE too. Ellington participated in the “Dubai Crypto Estate” event designed to attract Web3 capital, while Binghatti is officially recognized as a developer that sells to crypto-based buyers. Their approach: enable investor interest and build partnerships without media fanfare-but with intention.

On the payments side, Binance Pay has integrated real estate payments into its platform. Buyers can now select a Dubai property and check out using Binance’s crypto-payment gateway.

A major milestone came in late May 2025 with the launch of Prypco Mint, the first government-backed tokenized real estate platform in MENA. Enabled by DLD, VARA, and Dubai Future Foundation (and backed by Zand Digital Bank), it allows UAE residents to buy fractional property ownership starting at just AED 2,000. Though currently operating in AED, it’s built on the XRP Ledger and designed for future cross-border participation.

The icing on the cake? DAMAC’s $1 billion asset-tokenization deal with MANTRA was recently announced. This visionary agreement leverages blockchain in UAE real estate to turn real-world assets (RWAs) into tokens tradable on MANTRA’s platform-making major real estate portfolios accessible to institutional and retail crypto investors.

If they’re doing it…

- Established developers (DAMAC, Ellington, Binghatti) are not just accepting crypto-they’re structuring deals around it.

- Big platforms like Binance are enabling the check-out experience.

- Multiple government-backed real estate tokenization software UAE live and operational.

- Institutional-level examples of real estate firms in UAE accepting crypto are being set up through asset tokenization deals.

That means the opportunity isn’t waiting-it’s here. And if you’re building a compliant, tech-enabled platform, the proof points are now more than enough to say: if they’re doing it, so can you.

How Leading Teams are Approaching Crypto Integration in Real Estate

Across the UAE, early crypto–real estate initiatives follow a clear pattern. The platforms gaining traction are not experimenting with standalone crypto payments. Instead, they are embedding exchange integration, escrow automation, and compliance directly into transaction workflows.

Recent implementations in the region show three consistent characteristics:

- Crypto is integrated at the platform level, not bolted on as a checkout feature

- Fiat settlement, compliance, and auditability remain central to the design

- Exchange APIs, smart escrow, and KYC are treated as core infrastructure

These projects demonstrate that success in crypto-enabled real estate depends less on choosing a blockchain and more on aligning regulation, transaction design, and platform architecture from the start.

A Practical Checklist to Launch a Crypto Real Estate Platform in the UAE

Launching a crypto-enabled real estate platform works best when approached in clear phases, with dependencies handled upfront.

Phase 1: Model & Scope Definition (1–2 weeks)

- Decide whether crypto will act as a payment option or the primary settlement layer

- Define custody responsibility (non-custodial vs managed escrow)

- Identify target users and transaction types (sales, off-plan, fractional, rentals)

Dependency: Business model clarity is required before licensing or architecture decisions.

Phase 2: Regulatory Alignment & Licensing (3–6 weeks)

- Map transaction flows to the appropriate VARA licensing category

- Define AED on-ramp and off-ramp requirements for property registration

- Select KYC and AML verification partners

Dependency: Licensing scope directly impacts wallet design, escrow logic, and compliance tooling.

Phase 3: Platform Build & Integration (8–12 weeks)

- Integrate crypto exchange APIs for conversion and settlement

- Implement wallet infrastructure and escrow smart contracts

- Embed KYC, AML, and transaction monitoring into user flows

- Conduct security and compliance testing

Dependency: Compliance and custody logic must be built before front-end transaction flows.

Phase 4: Pilot & Controlled Launch (2–4 weeks)

- Launch with limited inventory or user access

- Monitor settlement speed, compliance logs, and transaction behavior

- Refine workflows before scaling to higher volumes or advanced models

Dependency: Real transaction data is required before scaling or expanding the platform’s scope.

Approached this way, crypto gateway integration becomes a structured rollout rather than a speculative build. The result is a real estate platform that can move faster, attract global capital, and scale confidently within the UAE’s regulatory framework.

How to Move Forward Without Costly Missteps

If you’re planning to integrate crypto into a real estate platform in the UAE, the outcome depends less on the technology itself and more on the early decisions around scope and compliance.

Start by locking the role crypto will play in your transaction flow. Whether it sits as a payment option or becomes the core settlement layer will shape licensing, custody responsibility, and platform design.

Then move into execution with a clear sequence:

- Define regulatory scope early to align transaction flows with the right VARA licensing path

- Design compliance-first architecture, treating KYC, custody, and AED settlement as foundational layers

- Build modularly, so that exchange APIs, wallets, and smart contracts can scale or adapt without rework

- Pilot before scaling, using a limited rollout to validate settlement speed and compliance workflows

Approached this way, crypto exchange integration shifts from an experiment to a structured build decision, reducing risk while creating a clear path to scale in the UAE market.

How Appinventiv Approaches Building Crypto-Ready Real Estate Platforms

To understand execution differences, it helps to compare how crypto–real estate platforms are typically built versus how enterprise-grade teams approach them.

| Capability Area | Generic Blockchain Firms | Appinventiv |

|---|---|---|

| Crypto–Real Estate Use Cases | Broad, multi-industry focus | Real estate–specific transaction models |

| UAE Regulatory Alignment | High-level guidance | Designed around VARA, AED settlement, and custody rules |

| Crypto Exchange Integration | Payment-layer integration | Embedded conversion, escrow, and reporting |

| Smart Contract Design | Generic contract logic | Milestone-based, legally mapped escrow |

| Compliance Architecture | External or post-build | Built into user and transaction flows |

| Platform Scalability | Feature-driven | Modular, exchange-agnostic infrastructure |

| Execution Experience | Prototype or MVP-led | Production-grade platforms |

How Appinventiv Can Help You Build the Future of Real Estate Transactions

Whether you’re exploring crypto real estate transactions UAE or envisioning a full-stack platform that tokenizes property, one thing is clear: building in this space isn’t about MVPs – it’s about market readiness. And that’s where Appinventiv’s crypto payment gateway development in UAE real estate expertise comes in.

We help forward-looking enterprises and entrepreneurs design, develop, and deploy projects around blockchain in UAE real estate that are built not just for functionality, but for regulatory alignment, security, and scale – especially in complex industries like real estate.

Here’s how we support your vision, end to end:

- Crypto Exchange Integration

We enable seamless on/off-ramping between fiat and digital currencies via APIs from Binance, BitOasis, or Ramp – with KYC and transaction monitoring baked in. - Smart Contract Development & Audit

From milestone-based escrow to automated ownership transfers, we build, test, and legally map smart contracts that reduce friction while staying enforceable under UAE law. - KYC/AML Module Integration

We help you integrate with trusted ID verification and compliance services (e.g., Jumio, ShuftiPro) so your platform meets the UAE’s financial integrity standards. - Custom Wallets & Payment Flows

Whether you want platform-managed wallets, self-custodial flows, or hybrid options, we design crypto transaction layers that are secure, intuitive, and regulator-ready. - Tokenized real estate Dubai Platforms

Planning to fractionalize real estate assets? We’ve built token issuance systems on Ethereum, Polygon, and XRPL, enabling both primary sales and secondary trading. - Blockchain Architecture + UAE-Specific Compliance Support

From choosing the right chain to ensuring your backend supports the licensing model that VARA compliant crypto real estate platform should have, our experts build for speed, scalability, and regional trust.

In a fast-evolving market like the UAE – where crypto regulation, real estate demand, and tech adoption are all converging – your window to build is open now. Appinventiv’s blockchain app development services ensure you don’t just launch, but lead. Connect with us!

A Strategic Play for the Bold and Prepared

Dubai doesn’t wait for innovation – it builds for it. The regulatory clarity is here. The infrastructure is here. And most importantly, the market is ready.

We’re at a rare intersection where technology, demand, and government policy are aligned, creating the perfect conditions for crypto exchange real estate UAE to become more than a side story. From DAMAC’s early moves to government-backed tokenized real estate Dubai pilots, the signals aren’t just promising -they’re real.

But this isn’t a space for casual players. It’s for entrepreneurs who move quickly and responsibly. Those who take the time to understand compliance, invest in the right tech stack, and create user journeys that bridge Web3 payment innovation with real-world outcomes.

Because the ones who build today aren’t just enabling transactions – they’re shaping the next chapter of real estate in the UAE. And in markets like this, early movers don’t just succeed. They define the standard others follow.

FAQs

Q. How is crypto changing real estate in the UAE?

A. It’s doing more than just adding a new way to pay. Crypto exchange integration UAE real estate is reshaping how deals are closed – especially for global buyers who don’t want to deal with international wires, slow bank processes, or currency limitations. With exchange integration, smart escrow, and even tokenized ownership models becoming real options, we’re seeing a shift from traditional sales workflows to tech-enabled, borderless transactions. Dubai’s regulatory backing just speeds it all up.

Q. What are the legal rules for buying or selling property with crypto in Dubai?

A. In Dubai, things are surprisingly structured. If your platform or business is touching crypto – through payments, custody, or is built around tokenized real estate Dubai – you’ll need to align with VARA’s licensing framework. Think of it like applying for a brokerage or custodian license, depending on what you do. On the real estate side, the Dubai Land Department still expects final registration to happen in AED, which means your system needs a built-in fiat conversion flow. As long as you meet KYC, AML, and licensing requirements, the process is very much above board.

Q. What does it cost to build a Real estate crypto payment gateway in Dubai?

A. Cost of crypto exchange integration UAE real estate depends on how far you want to go. If you’re just adding crypto payments to a property portal, costs are fairly modest -maybe just exchange integration, wallet setup, and KYC. But if you’re building a full-stack platform with escrow, tokenization, smart contracts, and regulatory dashboards, you’re looking at a more serious build. For something scalable and UAE-compliant, the cost to build a Real estate crypto payment gateway in Dubai would fall in the $80K to $150K+ range, depending on custom features and integrations. Think of it not just as software, but as infrastructure for the next wave of property deals.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

FinTech Leaders’ Guide to Crypto Payment Gateway Development in the Middle East

Key takeaways: The UAE has emerged as one of the most active crypto payment markets in the Middle East driven by clear regulations and strong government support. Building a compliant crypto payment gateway in the UAE requires careful alignment with regulatory bodies like VARA and the Central Bank. Integration with local banking rails, robust AML/KYC…

Step-by-Step Guide to Crypto Trading Bot Development in 2026

Key takeaways: Crypto trading bot development in 2026 functions as full-scale trading systems, not experimental scripts. They require the same engineering discipline as any financial platform. Execution quality drives results more than strategy logic. Latency control, order handling, and risk limits shape real-world performance. AI-based strategies work only when supported by reliable data flows, controlled…

Decentralized Exchange (DEX) Development: Features, Implementation Cost, and Enterprise ROI

Key Takeaways The development of a decentralized exchange will enable businesses to provide secure and user-controlled trading, improve transparency, and minimize the use of intermediaries. The cost of DEX development can vary depending on the platform's features, the chosen network, and regulatory requirements, and the approximate cost is about $50,000, with higher costs for customization,…