- Why the Market for AI in Predictive Analytics Is Hitting Its Moment

- How AI Predictive Analytics Actually Works Inside the Enterprise

- Core technologies behind AI-based predictive analytics

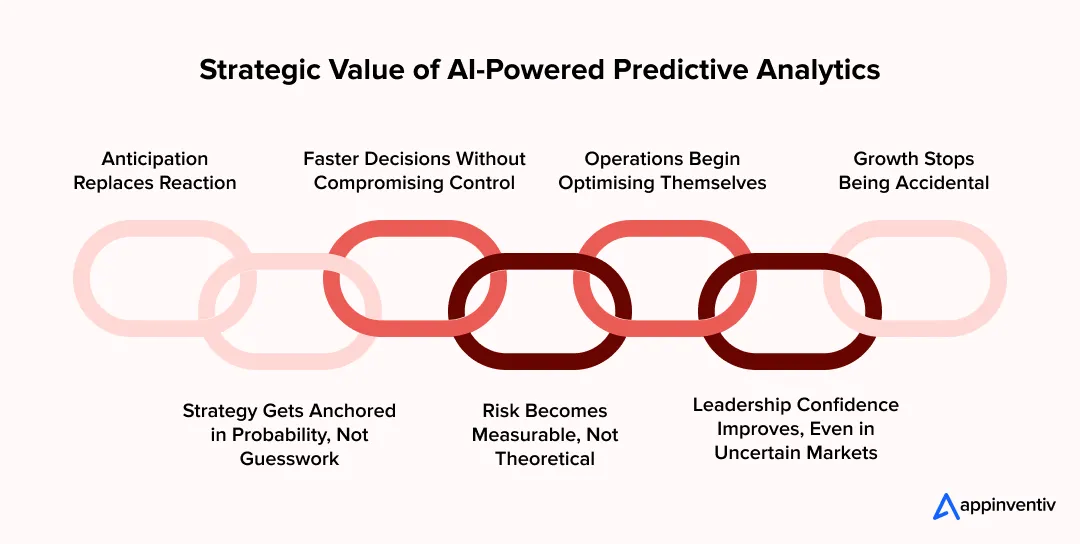

- The Business Impact of AI-Powered Predictive Analytics: A Glimpse into the Benefits

- Anticipation Replaces Reaction

- Strategy Gets Anchored in Probability, Not Guesswork

- Faster Decisions Without Compromising Control

- Risk Becomes Measurable, Not Theoretical

- Operations Begin Optimising Themselves

- Leadership Confidence Improves, Even in Uncertain Markets

- Growth Stops Being Accidental

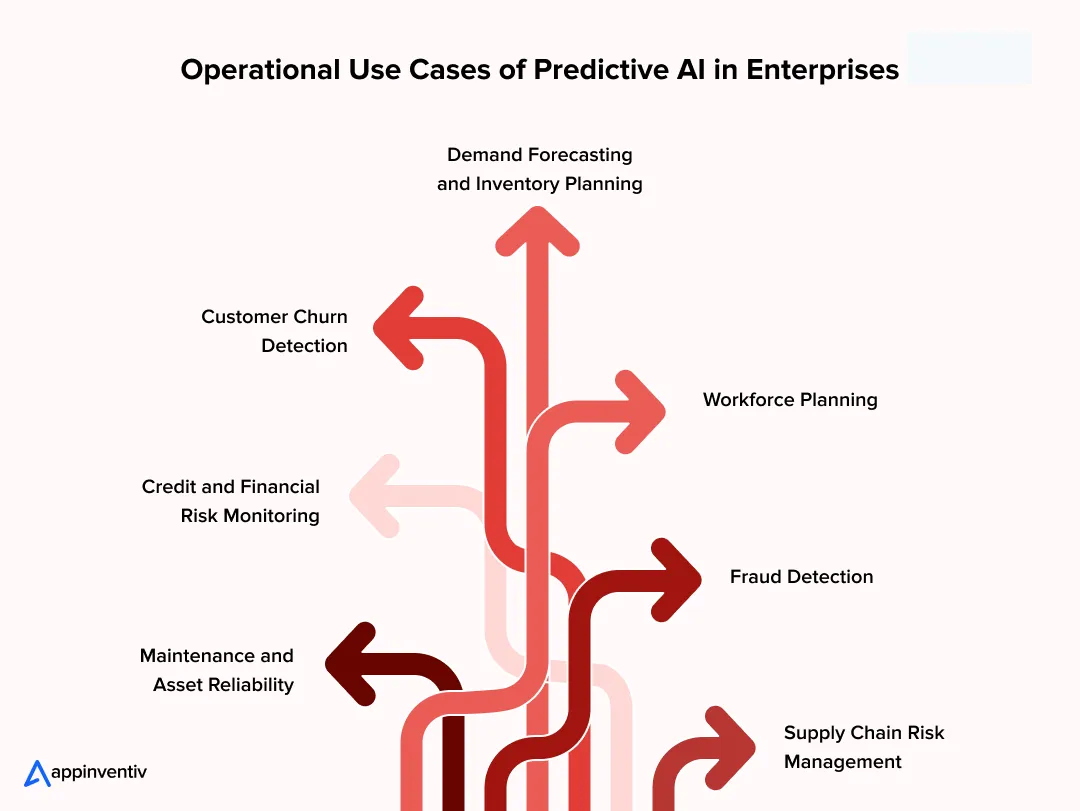

- How Enterprises Actually Use Predictive AI: Understanding the Use Cases

- Customer Churn Detection

- Credit and Financial Risk Monitoring

- Maintenance and Asset Reliability

- Workforce Planning

- Fraud Detection

- Supply Chain Risk Management

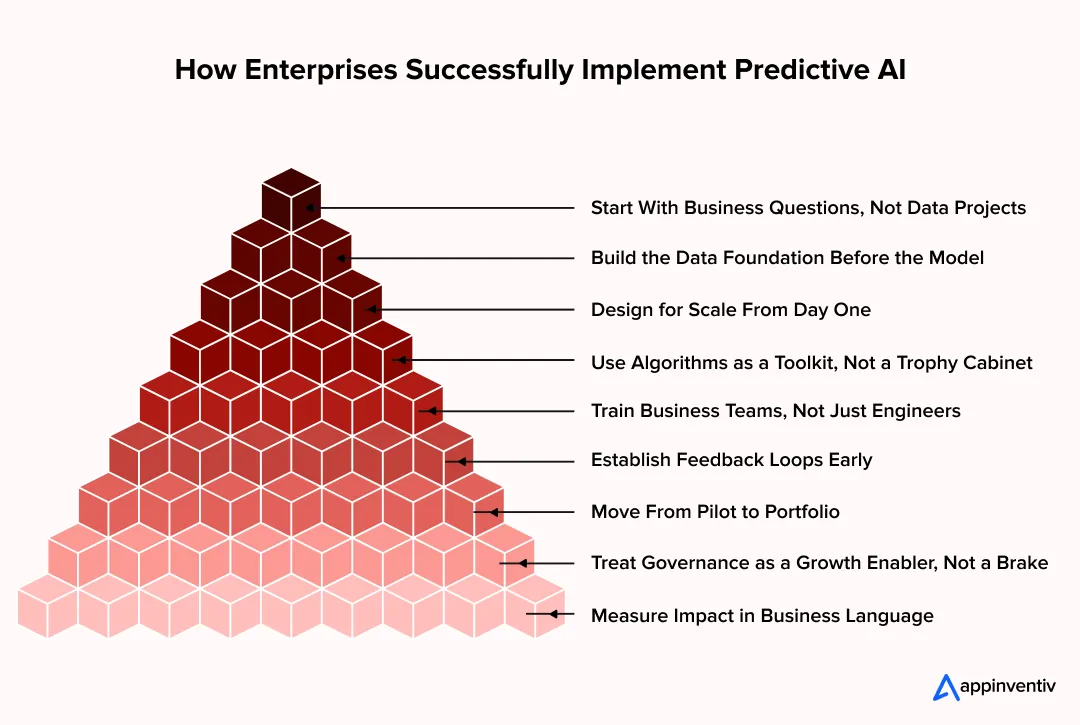

- How Leaders Implement AI in Predictive Analytics Without Burning Time or Budget

- Start With Business Questions, Not Data Projects

- Build the Data Foundation Before the Model

- Design for Scale From Day One

- Use Algorithms as a Toolkit, Not a Trophy Cabinet

- Train Business Teams, Not Just Engineers

- Establish Feedback Loops Early

- Move From Pilot to Portfolio

- Treat Governance as a Growth Enabler, Not a Brake

- Measure Impact in Business Language

- The Real Obstacles Leaders Face When Rolling Out Predictive Intelligence

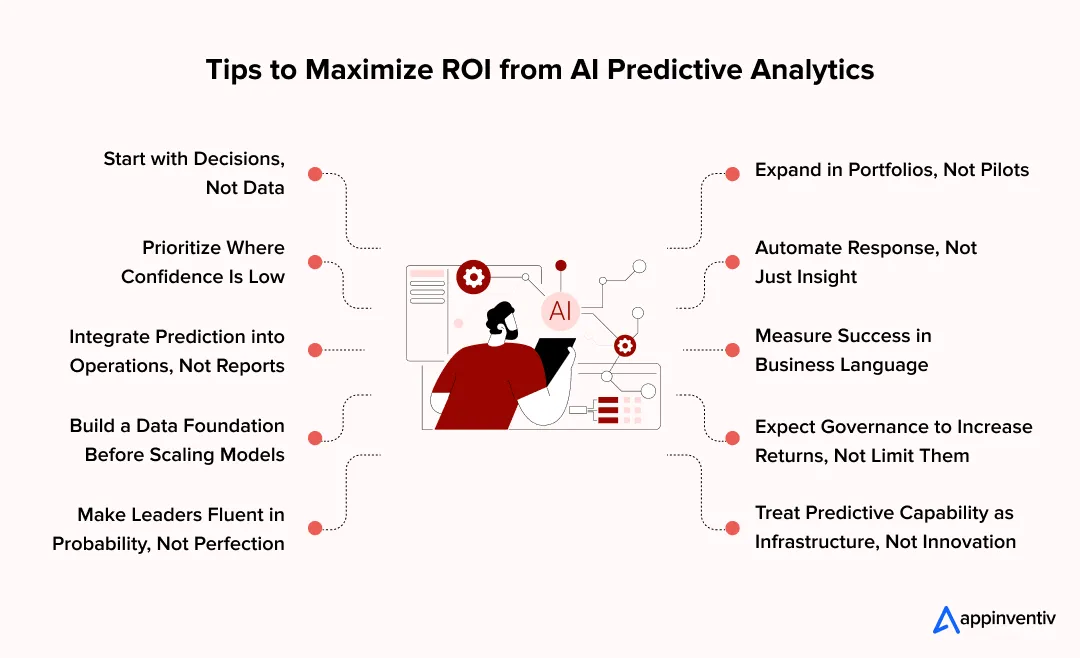

- Tips to Maximize ROI from AI-Powered Predictive Analytics

- Start with Decisions, Not Data

- Prioritize Where Confidence Is Low

- Integrate Prediction into Operations, Not Reports

- Build a Data Foundation Before Scaling Models

- Make Leaders Fluent in Probability, Not Perfection

- Expand in Portfolios, Not Pilots

- Automate Response, Not Just Insight

- Measure Success in Business Language

- Expect Governance to Increase Returns, Not Limit Them

- Treat Predictive Capability as Infrastructure, Not Innovation

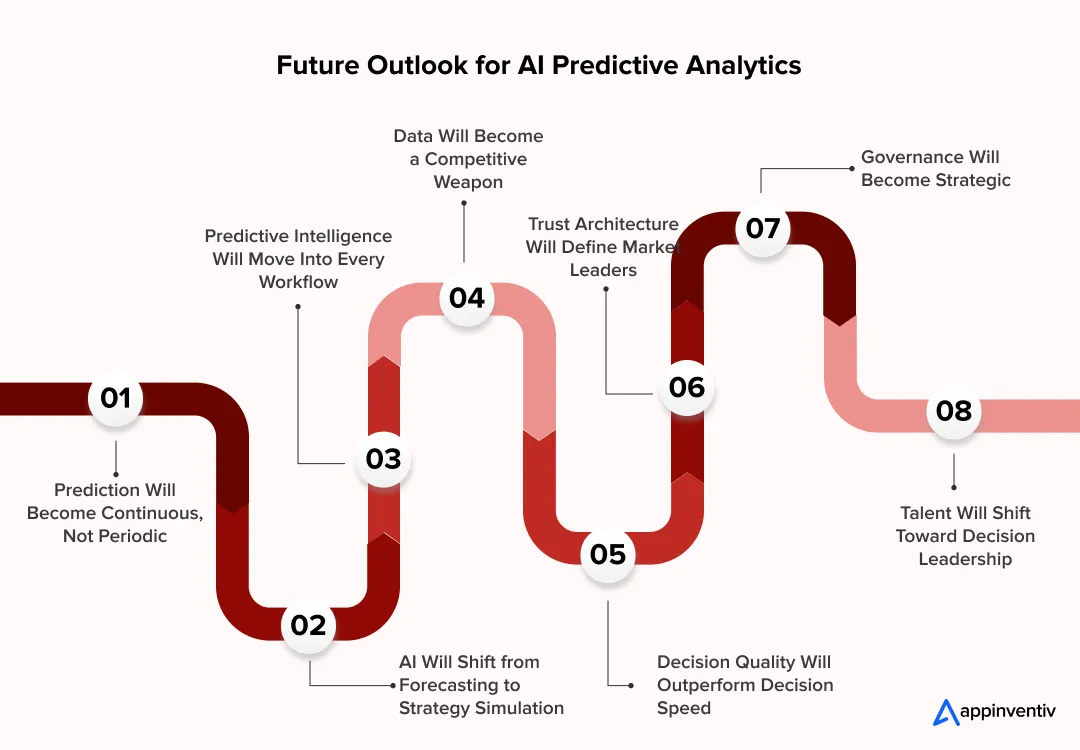

- The Future of AI Predictive Analytics: What to Expect Next?

- Prediction Will Become Continuous, Not Periodic

- AI Will Shift from Forecasting to Strategy Simulation

- Predictive Intelligence Will Move Into Every Workflow

- Data Will Become a Competitive Weapon

- Decision Quality Will Outperform Decision Speed

- Trust Architecture Will Define Market Leaders

- Governance Will Become Strategic

- Talent Will Shift Toward Decision Leadership

- How Appinventiv Helps Enterprises Operationalize AI-Powered Predictive Analytics

- FAQs

Key takeaways:

- Predictive intelligence shifts leadership from reacting to events toward anticipating outcomes

- Market adoption, infrastructure readiness, and data availability make this the right time to scale predictive capability

- Continuous, AI-powered prediction delivers significantly higher value than static historical analytics

- Business impact emerges only when predictive systems are embedded into core operations and workflows

- Organizational readiness and data architecture failures cause more breakdowns than technology does

- Predictive capability must be treated as long-term enterprise infrastructure, not as an experimental initiative

You can feel it in every boardroom conversation. Revenue looks fine, but the confidence behind it is thinner than it used to be. Forecasts miss more often. Markets react faster. Customer behavior changes without warning. Your teams work harder, but decisions still arrive a little too late. Most enterprises are not struggling because they lack data. They are struggling because they cannot see what is coming next. When growth depends on reacting faster than competitors, “wait and watch” quietly becomes the most expensive strategy in the room.

This is where AI predictive analytics changes the discussion. Not as another software layer, and not as a dashboard exercise, but as a decision advantage. Leaders are moving beyond reports that explain yesterday and toward systems that model tomorrow. Instead of asking “what happened,” the smarter question becomes “what happens next if we do nothing?” With AI guiding forecasting, businesses are no longer guessing which market, product, or customer segment matters most. They are seeing momentum build before the rest of the market does.

What makes today different is maturity. We are well past experimentation. Models now learn from customer behavior, operational signals, financial patterns, and external forces in near-real time. The result is insight that informs pricing, demand planning, risk management, workforce strategy, and expansion decisions with a level of clarity traditional analytics never offered. For leadership teams, this is not about data science theory. It is about reducing blind decisions and committing capital with confidence.

In this blog, we break down how enterprises use predictive intelligence to move from reacting to leading. You will see where machine learning creates an edge, how foresight becomes part of daily operations, and why predictive thinking now sits at the center of modern leadership. We also explore how to turn insight into action, avoid common blind spots, and build growth that is intentional rather than reactive.

Upgrade your growth strategy with predictive intelligence built for scale.

Why the Market for AI in Predictive Analytics Is Hitting Its Moment

At a simple level, AI in predictive analytics is about moving from “reports that explain the past” to systems that constantly learn from data and flag what is likely to happen next. Classic predictive models already use historical data and statistics to forecast demand, churn, defaults, or failures. When you layer modern AI and machine learning on top of that, you get predictive analytics that doesn’t just score risk or opportunity, but keeps updating those scores as fresh signals come in from customers, markets, and your own operations.

The market is already moving in that direction at serious speed. The global predictive analytics market was valued at $18.89 billion in 2024 and is projected to cross $82.35 billion by 2030, growing at a CAGR of 28.3% from 2025 to 2030. A big share of that expansion is being driven by AI-first use cases in finance, retail, manufacturing, and healthcare, where predictive analytics in business is shifting from “nice-to-have” pilots to core planning, pricing, and risk engines.

On the AI side, the adoption curve has already bent. McKinsey notes that roughly 65% of organizations are now using generative AI in at least one business function, up from about one-third a year earlier, and expects companies to reach near “data ubiquity” by 2030, with data embedded in most systems and decision points. That environment is tailor-made for integrating AI in predictive analytics for proactive growth: once data is flowing through every channel and process, the real advantage comes from how intelligently you can turn that stream into forward-looking signals.

PwC’s 2025 AI Business Predictions point in the same direction from a strategy lens. Nearly half of technology leaders (49%) say AI is already fully integrated into their core business strategy, not just sitting in isolated innovation labs. That tells you where the boardroom is heading. AI is no longer framed only as automation or experimentation; it is becoming the fabric for how growth bets are chosen and resourced. In that context, AI for predictive analytics stops being a data team topic and becomes one of the main levers shaping portfolio, capital allocation, and market entry decisions.

Infrastructure trends are lining up behind this shift too. IDC predicts that by 2027, 45% of large Asia/Pacific enterprises (A2000) will deploy performance-intensive, software-driven, scale-out storage and unified data management specifically to accelerate insights for AI and analytics. In plain language, big companies are rebuilding their data backbone so AI tools for predictive analytics don’t choke on volume, latency, or fragmented data. That kind of spending doesn’t happen for side experiments; it happens when leaders see predictive intelligence as part of the core operating model.

Put all of this together and you get a fairly clear signal: the ecosystem around AI-driven predictive analytics for enterprises is reaching scale. The technology is mature enough, the market is big and growing, leadership attention is high, and the data and infrastructure foundations are being upgraded in real time. That is why now is the moment to decide whether predictive analytics for business growth is something you bolt on later, or a capability you intentionally build into your strategy before your competitors do.

From market momentum, one thing is clear: enterprises are not just buying tools, they are rebuilding how decisions get made. If predictive technology is becoming part of the operating fabric, the next question is unavoidable.

So let’s step inside it.

How AI Predictive Analytics Actually Works Inside the Enterprise

At a practical level, AI predictive analytics does not work like a crystal ball. It works like a constantly learning system that absorbs signals, tests scenarios, and re-ranks priorities based on probability, not instinct. The moment new data arrives, models update. When external conditions shift, forecasts adjust. That is the difference between static reporting and predictive analytics that behaves like a living decision engine.

At the foundation is data. Not just structured data from ERP systems and CRMs, but also behavioral signals, logs, text, sensor feeds, transactions, and market data. The modern context of AI in predictive analytics depends on the ability to unify and learn from all of it simultaneously. This is why the quality of your data architecture often matters more than the model you choose.

Once that data is flowing, the system trains a collection of models, not just one. Each model focuses on a different question and refines its predictions continuously as new information enters the system.

Core technologies behind AI-based predictive analytics

These are the main engines working behind the scenes inside most enterprise deployments:

- Machine learning

Algorithms learn from patterns in historical and real-time data to forecast demand, risk, churn, and performance outcomes.

- Regression models

Used to predict numeric outcomes such as revenue, pricing impact, or demand volumes based on multiple variables.

- Classification algorithms

Used to group outcomes into categories like high risk vs low risk, likely churn vs stable customer, or fraud vs legitimate transaction.

- Time-series forecasting models

Track trends and seasonality across financials, inventory, usage behavior, or operational activity.

- Clustering algorithms

Group customers, products, or behaviors into segments that were not previously visible.

- Neural networks and deep learning

Used where patterns are complex, nonlinear, or hidden inside large systems such as logistics networks or user behavior data.

- Natural language processing (NLP)

Extracts prediction value from text like emails, reviews, support tickets, and contracts.

- Reinforcement learning

Models learn from outcomes over time and improve decision logic based on what produces better results.

Key system layers that make predictive models enterprise-ready

- Anomaly Detection

Flags unusual demand spikes, transactions, and operational failures early.

- Ensemble Learning

Combines multiple models to improve accuracy and reduce error risk.

- Feature Engineering

Converts raw data into meaningful inputs that models can actually learn from.

- Model Monitoring and Drift Detection

Prevents silent failure when market behavior changes.

- Simulation and Scenario Modeling

Tests strategic decisions before they are made in the real world.

- Decision Intelligence Layers

Turn predictions into action-ready recommendations.

- Feedback Loops

Ensure systems learn from outcomes and improve continuously.

- Data Pipelines and Orchestration

Keep models running in real time without manual effort.

- Explainability Frameworks

Make predictions transparent and defensible.

- Model Version Control

Prevent faulty logic from governing live business decisions.

This is what turns standard modeling into AI-powered predictive analytics. You are no longer relying on a single forecast model or static assumption. You are operating with a constantly recalibrating intelligence layer.

Now, not all predictive systems behave the same way. Many organizations believe they are using advanced forecasting when they are still operating with static models refreshed periodically. That distinction matters operationally. A system that updates quarterly does not compete with a system that learns continuously. A system that reacts is not equal to a system that anticipates.

To lead with foresight instead of hindsight, leadership must know whether their predictive capability is truly adaptive or simply automated reporting with historical bias. The differences below define whether an enterprise operates late or leads early.

Predictive Analytics vs AI-Powered Predictive Analytics

| Dimension | Traditional Predictive Analytics | AI-Powered Predictive Analytics |

|---|---|---|

| Data input | Historical data only | Historical and real-time data |

| Learning pattern | Static models | Continuous learning |

| Refresh cycle | Periodic retraining | Self-updating models |

| Forecast type | Single outcome | Probability ranges |

| Change handling | Responds after impact | Anticipates before impact |

| Complexity handling | Linear relationships | Nonlinear interactions |

| Scalability | Limited | Enterprise-scale |

| Integration | Reporting systems | Embedded workflows |

| Error correction | Manual | Automated |

| Leadership value | Explains the past | Shapes the future |

The Business Impact of AI-Powered Predictive Analytics: A Glimpse into the Benefits

When organizations adopt predictive intelligence, the change is not cosmetic. It shows up in timing, confidence, and control. Decisions stop being debated purely on instinct and start being shaped by real probability. This is where AI predictive analytics moves from a technical capability to a leadership advantage.

Below are the business-level outcomes enterprises typically unlock once they leverage machine learning for predictive analytics in their operations.

Anticipation Replaces Reaction

With traditional analytics, leaders respond after performance shifts. With AI in predictive analytics, the shift is visible before it fully shows up in results. Early signals from customer behavior, financial patterns, or operational data surface risks and opportunities while there is still time to change course. That ability to act early is what creates separation in competitive markets.

Strategy Gets Anchored in Probability, Not Guesswork

Growth initiatives rarely fail because they were poorly executed. They fail because the assumptions behind them were wrong. AI Predictive analytics in strategic decision making allows leadership teams to test scenarios before capital is allocated. Market entry plans, pricing moves, and capacity decisions can be stress-tested against thousands of simulated outcomes rather than leadership consensus alone.

Faster Decisions Without Compromising Control

AI does not remove leaders from decision-making. It removes delay. When AI for predictive analytics in business is embedded into workflows, executives receive early warnings and recommendations instead of static reports. This shortens planning cycles, improves responsiveness, and keeps leadership focused on direction rather than diagnosis.

Risk Becomes Measurable, Not Theoretical

Every enterprise carries risk. The difference is visibility. AI-driven predictive analytics transforms risk from a vague concern into something measurable and trackable. Whether it is credit exposure, supply chain instability, or demand volatility, risk moves from being discussed emotionally to being managed analytically.

Operations Begin Optimising Themselves

Once forecasting becomes continuous, operations respond automatically. Inventory adjusts, staffing models recalibrate and schedules update in line with demand. This is where predictive analytics for operational optimization becomes real. Systems do not just report inefficiencies; they anticipate them and correct course before disruption occurs.

Leadership Confidence Improves, Even in Uncertain Markets

Markets shift. Regulations change. Competitors evolve. The leaders who stay ahead are not the ones with perfect forecasts but with early visibility. The benefits of AI predictive analytics for business leaders show up most clearly during uncertainty. When volatility rises, predictive insight becomes the difference between reacting late and moving early.

Growth Stops Being Accidental

Without foresight, growth is reactive. With predictive intelligence, growth becomes engineered. How AI predictive analytics help business growth is not about isolated wins. It is about aligning investment, operations, and strategy around signals instead of assumptions. Over time, this is what turns growth into a discipline rather than a gamble.

How Enterprises Actually Use Predictive AI: Understanding the Use Cases

Predictive systems don’t show up inside companies as “technology initiatives.” They sneak in through operations, finance, customer management, and planning functions. Most teams are not trying to “build AI.” They are trying to stop waste, reduce surprise, and avoid being blindsided by the next quarter. This is where predictive intelligence earns its place.

Below are the ways large organizations are quietly using predictive models in everyday decision-making.

Demand Forecasting and Inventory Planning

Demand Forecasting and Inventory Planning

Forecasting used to mean lining up last year’s numbers and arguing over whether this year would be better or worse. Predictive models change that process entirely. They absorb recent sales patterns, seasonality, geography, promotions, logistics delays, and market behaviour, and then constantly adjust projections as data changes. The result is not a single number for the quarter, but a living picture of what demand is likely to look like week by week.

[Also Read: AI for Demand Forecasting: Use Cases, Benefits, and Implementation]

Retailers and manufacturers use this to position stock closer to demand, reduce over-ordering, and avoid the operational chaos that comes from reacting too late. When forecasting becomes dynamic, inventory planning stops being guesswork and starts behaving more like navigation.

Amazon is one of the best-known examples. It pre-positions products across fulfilment centres based on predicted buying patterns even before a customer places an order. The company’s systems do not just respond to demand; they anticipate where demand will emerge.

Customer Churn Detection

Most businesses only realise they lost a customer after the relationship is over. By then, the conversation is pointless. Predictive systems allow companies to spot retreating behaviour early, while something can still be done about it.

Subtle signals such as reduced usage, slower engagement, hesitation to renew, or shifting interaction patterns become indicators long before cancellation happens. Business teams use these signals to trigger personalised offers, content changes, or support interventions when there is still time to repair the relationship.

Spotify does this continuously. Its platform tracks how listeners interact with music, how often they return, and what they skip. When engagement drops, the product does not wait. It reshapes recommendations and nudges with the aim of recovering attention before the user drifts away for good.

Credit and Financial Risk Monitoring

Traditional financial risk is often reviewed in fixed cycles. Monthly reviews, quarterly audits, annual stress tests. Predictive models compress that timeline dramatically. Risk becomes something that is watched continuously rather than reviewed occasionally.

Banks and lenders analyse transaction behaviour, repayment patterns, income movement, portfolio exposure, and macroeconomic signals simultaneously. This allows risk teams to react early, adjust exposure, or change policies before losses escalate.

JPMorgan uses predictive systems across credit portfolios to surface warning signs earlier and apply corrective measures before account health deteriorates beyond recovery. For large institutions, even small gains in early prediction create outsized impact.

Maintenance and Asset Reliability

In asset-heavy industries, breakdowns are not just inconvenient. They are expensive. Predictive intelligence allows companies to catch deterioration before it becomes a failure.

Sensors installed in equipment track temperature shifts, vibration changes, pressure anomalies, and usage patterns. When models detect deviation from normal behaviour, maintenance teams are alerted early. Machines are serviced before they collapse, rather than after damage spreads.

General Electric applies this approach across aircraft engines and energy infrastructure. Equipment health is constantly monitored and analysed so issues surface while they are still manageable, not after they become crises.

Workforce Planning

Staffing decisions are rarely random, yet they are often reactive. Predictive systems bring foresight into workforce management by forecasting workload rather than reacting to it.

Enterprises anticipate periods of high demand, staff fatigue cycles, seasonal spikes, and operational bottlenecks. Scheduling moves from reactive to strategic, helping leaders balance capacity without burning teams out or bloating payrolls.

Walmart uses predictive models to forecast store traffic and transaction volume. Staffing levels adjust based on what is coming, not what already happened the week before.

Fraud Detection

Fraud is no longer slow or predictable. It evolves daily. Predictive systems are built to learn those changes faster than human teams ever could.

Instead of scanning transactions after damage is done, modern systems flag irregular behaviour instantly. Patterns that don’t look right are isolated within seconds. This keeps losses low and trust intact without adding friction for genuine customers.

PayPal processes enormous transaction volumes every day, and its systems analyse activity patterns continuously to block fraud while allowing legitimate payments to move freely.

Supply Chain Risk Management

Global supply chains fail quietly before they fail loudly. The early signs exist in shipping delays, inventory volatility, supplier health, and geopolitical patterns. Predictive intelligence stitches these signals together.

Procurement and operations teams use forward-looking insight to reroute orders, adjust contracts, or shift suppliers while alternatives still exist.

[Also Read: Leveraging Predictive Analytics to Optimize Supply Chain Performance: Benefits and Strategies]

Unilever applies predictive models across its supplier network to spot disruption risks before they cascade into shortages or production halts. For global businesses, this visibility is often the difference between continuity and chaos.

How Leaders Implement AI in Predictive Analytics Without Burning Time or Budget

Most predictive initiatives fail not because the technology is complex, but because the rollout is wrong. Leaders either push too much too fast, or treat predictive systems like side projects instead of business capabilities. Implementing AI in predictive analytics works best when it feels like operational change, not an IT upgrade.

Start With Business Questions, Not Data Projects

The fastest way to kill momentum is by starting with “What data do we have?” instead of “What decision keeps us up at night?” Predictive systems must be anchored to real business problems first. Revenue volatility, supply chain uncertainty, customer loss, or capital risk are far better starting points than abstract analytics initiatives.

Enterprises using AI for predictive analytics effectively begin with one or two decisions that truly matter. Every model, dataset, and algorithm is then built backwards from those priorities.

Build the Data Foundation Before the Model

Predictive intelligence is only as strong as the data feeding it. In many organisations, data is scattered, inconsistent, or outdated. Before expecting reliable forecasts, leadership teams need to stabilise how data is generated, cleaned, and shared across systems.

For AI-based predictive analytics to work, enterprises must unify operational data, financial data, and customer signals into a single architectural view. Without that, even the most advanced models will quietly drift into irrelevance.

Design for Scale From Day One

One working model is not a strategy. It is a prototype. Implementation becomes real only when forecasting works inside daily operations, not inside pilot environments.

Successful teams treat AI predictive analytics like infrastructure. That means building integration into workflows such as planning, procurement, finance, and sales. Predictions must surface where decisions are made, not inside dashboards that leadership never opens.

Use Algorithms as a Toolkit, Not a Trophy Cabinet

Executives do not need the “best model.” They need the right ones working together.

An effective setup blends several approaches:

- Regression for forecasting numeric outcomes

- Classification for yes/no risk decisions

- Time-series analysis for trend behaviour

- Clustering for discovering hidden segments

- Machine learning where patterns are complex and constantly shifting

The goal is not algorithm beauty. It is reliable across business conditions.

Train Business Teams, Not Just Engineers

Predictive capability fails when only the data team understands it. Leaders must treat education as part of implementation. Decision-makers need to understand how predictions are generated and where uncertainty exists.

This is especially critical for AI predictive modeling for enterprises, where models inform budget approval, hiring, strategic direction, and performance evaluation. Smart companies create cross-functional ownership, not isolated analytics teams.

Establish Feedback Loops Early

Every predictive system improves with feedback. If teams ignore outcomes or fail to correct faulty assumptions, models stagnate.

Enterprises that succeed build routine performance checks. Forecasts are evaluated. Assumptions are audited. Predictions are compared against reality. This is what turns AI-driven predictive analytics into a long-term advantage instead of a one-time experiment.

Move From Pilot to Portfolio

The first implementation should never be the last. Predictive capability expands by design, not accident.

Once one use case stabilises, others should follow. Demand forecasting evolves into supply planning. Churn analysis grows into revenue optimization. Risk modelling becomes capital strategy.

This is how leaders move from experimentation to building a proactive growth strategy with predictive analytics.

Treat Governance as a Growth Enabler, Not a Brake

Trust defines the success of any intelligence system. Privacy, security, and accountability must be built into the foundation.

Leading enterprises treat governance as part of system design, not an afterthought. When controls are embedded early, scaling becomes easier, faster, and safer.

Measure Impact in Business Language

No predictive program survives unless outcomes are visible. Leaders should track results in revenue stability, operational resilience, capital efficiency, or risk exposure.

This is the real answer to how to use predictive analytics for growth. Not adoption. Not hype. Measurable movement in business outcomes.

The Real Obstacles Leaders Face When Rolling Out Predictive Intelligence

Predictive initiatives don’t fail in the model. They fail in the organization. Most challenges show up long before the first prediction is ever wrong. They appear in how companies collect data, govern systems, trust outputs, and align teams. Leaders who move fast without confronting these realities end up with “smart tools” that nobody relies on.

| Challenge | What It Breaks Inside the Business | How Leadership Teams Redirect It |

|---|---|---|

| Fragmented data ownership | Departments create conflicting projections because each function pulls from different data foundations. Finance, operations, and sales debate whose numbers to trust, delaying decisions and weakening accountability | Establishes enterprise data ownership mapped to business outcomes, not IT structures |

| Poor data reliability | Models produce unstable outputs that collapse under scrutiny, causing leaders to lose confidence | Introduces mandatory data quality gates tied to performance metrics |

| Legacy systems blocking scale | Algorithms work in pilots but fail in production environments due to integration bottlenecks | Introduces abstraction layers between old systems and analytics engines |

| Analytics without authority | Predictions exist, but no one is accountable for acting on them | Assigns ownership at senior leadership level |

| Organizational distrust of algorithms | Employees revert to intuition under pressure, ignoring predictive output when stakes rise | Builds transparency into model logic |

| Inability to interpret probabilities | Leadership expects certainty where only likelihood exists, misusing forecasts | Trains executives in probabilistic thinking |

| Overengineering | Teams build complex models that do not improve decisions | Refocuses design around outcome impact |

| AI Model collapse | Predictions degrade without feedback | Enforces retraining cycles |

| Governance after deployment | AI Compliance risk surfaces late | Embeds AI governance into architecture |

| Scattered initiatives | Disconnected pilots waste budget | Consolidates initiatives under strategic roadmap |

| Ethical and regulatory exposure | AI decisions violate emerging regulations unknowingly | Aligns systems with policy monitoring and compliance automation while ensuring responsible practices |

| Algorithmic bias exposure | Predictions reinforce hidden bias in hiring, pricing, and risk decisions, damaging trust and compliance | Deploys auditing frameworks and fairness checkpoints across models to reduce AI bias |

Explore how we turn operational uncertainty into strategic control.

Tips to Maximize ROI from AI-Powered Predictive Analytics

AI only creates value when it changes decisions, not when it produces dashboards. Many enterprises invest in AI predictive analytics and still struggle to show business impact because the strategy lives too close to technology and too far from outcomes. ROI comes from how predictive intelligence is embedded into leadership decisions, operating models, and investment logic. The following principles separate companies that experiment from those that scale.

Start with Decisions, Not Data

High-ROI programs begin with a business decision that matters.

Revenue forecasting, pricing strategy, risk exposure, or customer retention should come first. Data strategy comes second. AI for predictive analytics works best when it is built around a real business event that leadership already cares about. If the question is unclear, the outcome will always be noise.

Prioritize Where Confidence Is Low

AI predictive analytics creates the most value where uncertainty is highest.

If leadership already trusts a decision, automation adds little. But when outcomes are unpredictable or volatile, predictive systems earn their place. This is why predictive analytics for business growth often starts in pricing, supply chains, fraud, forecasting, and churn.

Integrate Prediction into Operations, Not Reports

Forecasts only deliver ROI when they change actions.

Prediction that sits in reports rarely moves the business. AI in predictive analytics creates value when it connects directly to workflows such as buying, hiring, pricing, and inventory decisions. That is where insight converts into execution.

Build a Data Foundation Before Scaling Models

Enterprises often focus on algorithms too early.

In reality, AI-powered predictive analytics fails due to fragmentation, not technical gaps. Unifying operational, financial, and customer data increases return far more than upgrading models. When data flows without friction, models learn correctly. When it does not, predictions quietly decay.

Make Leaders Fluent in Probability, Not Perfection

Prediction is not certainty. It is direction.

Leadership teams who understand predictive analytics in strategic decision making use likelihood ranges rather than debating single numbers. Decisions grow stronger when leaders interpret probability instead of demanding precision.

Expand in Portfolios, Not Pilots

One working model does not justify enterprise investment.

ROI comes when use cases compound. Successful teams move from forecasting to procurement optimization, from churn prediction to pricing strategy, and from demand planning to risk modeling. This is how AI-driven predictive analytics for enterprises becomes a growth engine rather than a side project.

Automate Response, Not Just Insight

The highest-return programs do not just warn. They act.

When AI tools for predictive analytics connect with automation systems, predictions trigger inventory adjustments, workforce rescheduling, or policy updates automatically. This is where returns multiply.

Measure Success in Business Language

If ROI is framed only in technical terms, leadership loses interest.

Executives track AI-based predictive analytics outcomes in revenue uplift, cost prevention, reduced exposure, and faster decisions. That metric shift is how investment earns trust.

Expect Governance to Increase Returns, Not Limit Them

Systems without governance decay. Systems with transparency scale.

Explainability, model monitoring, and accountability increase adoption. Predictive systems grow faster when leadership understands how conclusions are reached.

Treat Predictive Capability as Infrastructure, Not Innovation

Programs positioned as experiments fight for budget year after year.

Programs positioned as operational architecture get funded. When leadership frames AI predictive analytics as infrastructure, investment becomes strategic rather than reactive.

The Future of AI Predictive Analytics: What to Expect Next?

Predictive analytics is no longer evolving quietly. It is moving toward becoming the central nervous system of enterprise decision-making. What changes next is not whether leaders will use predictive intelligence, but how deeply it will shape strategy, capital allocation, and operational design.

Prediction Will Become Continuous, Not Periodic

Forecasting will stop running on monthly and quarterly cycles. Systems will update constantly as customer behavior, financial conditions, and operations change. Leadership will no longer “review” predictions. They will operate inside them.

AI Will Shift from Forecasting to Strategy Simulation

The most advanced enterprises will use predictive systems not just to anticipate outcomes, but to test strategic choices before execution. Market entry, pricing shifts, acquisitions, and workforce changes will be modeled before capital is committed.

Predictive Intelligence Will Move Into Every Workflow

HR, finance, procurement, and operations will no longer work from static plans. Forecasts will adjust schedules, budgets, and resource allocation automatically. Prediction will sit inside the tools employees already use.

Data Will Become a Competitive Weapon

Organizations with owned, structured, and behavioral data will outperform those that rely on publicly available models alone. Competitive advantage will belong not to companies that adopt AI fastest, but to those who feed it the most relevant data.

Decision Quality Will Outperform Decision Speed

As markets saturate with automation, advantage will come from judgement rather than tooling. Leaders who ask better questions will outperform those who simply automate faster. Predictive discipline will matter more than prediction itself.

Trust Architecture Will Define Market Leaders

As predictive systems influence pricing, risk, and capital, transparency will become mandatory. Companies that can defend how decisions are made will gain stakeholder trust faster than those who cannot explain outcomes.

Governance Will Become Strategic

Risk management will no longer be a compliance role. It will become integral to leadership strategy. Predictive models will be audited with the same discipline as financial reporting.

Talent Will Shift Toward Decision Leadership

The next leadership generation will be evaluated not on experience alone, but on their ability to interpret probability, manage uncertainty, and lead with foresight. Predictive literacy will be leadership currency.

How Appinventiv Helps Enterprises Operationalize AI-Powered Predictive Analytics

Most organizations do not fail at predictive analytics because they lack ambition. They fail because execution breaks between strategy and systems. As a leading AI consulting services provider, we operate in that gap. Our focus is not on delivering models. It is on building predictive capability that lives inside business operations. From data architecture to model design and system integration, we work where decisions are actually made. That is how predictive intelligence stops being a concept and becomes part of daily leadership workflow.

What sets us apart is how theory is translated into production. Many teams build experiments. We build environments that run at enterprise scale. Predictive models are integrated into planning systems, logistics platforms, finance tools, and customer applications so intelligence does not stay trapped in reports. Whether the objective is forecasting demand, detecting risk, or improving customer outcomes, AI-powered predictive analytics for executives and business leaders is embedded where it can change decisions in real time.

We also understand that predictive systems collapse without a strong data foundation. That is why our work starts at the architecture level. Data pipelines, governance frameworks, and monitoring layers are engineered before complexity enters the model. This ensures accuracy does not decay, trust does not break, and predictions survive market shifts. Predictive intelligence becomes reliable not because the algorithm is advanced, but because the system is built to be resilient.

Finally, we operate with a business mindset, not a technical one. Every deployment is measured in impact, not activity. Revenue stability, operational control, reduced risk, and faster decisions define success. That is what AI predictive analytics is supposed to deliver when done correctly. We approach every engagement as a long-term partnership, not a build-and-handover project. The goal is not adoption; its advantage. Get in touch with our experts to assess how predictive analytics can become part of your decision fabric, not just another system in your stack.

FAQs

Q. What is AI predictive analytics, and how does it drive business growth?

A. AI predictive analytics is the use of artificial intelligence and machine learning to analyze historical and real-time data to estimate what is likely to happen next. Instead of showing what already happened, it produces forward-looking insight about customer behavior, demand, risk, pricing outcomes, and operational performance.

Businesses use it to move from reactive decisions to anticipatory action. Rather than adjusting strategy after results decline, leadership teams see early signals and act before impact becomes visible in financials. That shift is how growth becomes intentional instead of reactive. Over time, predictive systems help enterprises allocate capital better, reduce costly surprises, and scale decisions with confidence rather than assumption.

Q. How can executives leverage AI predictive analytics to improve decision-making?

A. Executives can leverage AI-based predictive analytics by utilizing data-driven insights to guide strategic decisions. By analyzing trends and patterns, they can forecast market shifts, optimize resource allocation, and personalize customer experiences. Predictive models help identify potential risks and opportunities, enabling proactive actions rather than reactive measures. This empowers executives to make more informed, timely decisions, align business objectives with market dynamics, and drive growth with greater accuracy and efficiency.

Q. What are the key benefits of implementing AI predictive analytics for proactive growth strategies?

A. Implementing AI-powered predictive analytics for proactive growth strategies offers several key benefits:

- Informed Decision-Making: Provides actionable insights for better resource allocation and strategic planning.

- Risk Prevention: Identifies potential issues early, enabling businesses to take proactive measures.

- Customer Insights: Helps anticipate customer needs and behaviors, enabling personalized experiences.

- Competitive Advantage: Forecasts market trends and shifts, allowing businesses to stay ahead of competitors.

- Operational Efficiency: Optimizes processes, reduces costs, and improves productivity, contributing directly to predictive analytics for business growth.

Q. How do I integrate AI predictive analytics into my existing business processes?

A. To integrate AI in predictive analytics for proactive growth within existing business processes, start by identifying key areas where predictive insights can add value, such as sales forecasting, customer behavior, or inventory management. Next, ensure that data is clean, structured, and accessible across departments. Choose the right AI tools or platforms that align with your business needs and integrate them into your current systems. Collaborate with data experts to develop and train models, then continuously monitor and refine them to improve accuracy. Finally, foster a data-driven culture within your team to embrace AI’s potential for smarter decision-making.

Q. How to use predictive analytics for growth?

A. To use predictive analytics for growth, start by defining the key business areas you want to optimize, such as customer acquisition, retention, or operational efficiency. Collect and clean historical data from relevant sources, ensuring it’s accurate and well-structured. Next, implement AI-based predictive analytics models using advanced analytics tools to forecast trends, customer behaviors, or market conditions. Leverage these insights to make data-driven decisions, enhance marketing strategies, improve customer experiences, and streamline operations. Continuously monitor results and refine your models for improved predictions, driving sustainable growth over time.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Build AI Chatbot With RAG Integration: Appinventiv’s End-To-End Development Framework

Key takeaways: RAG chatbots improve enterprise AI accuracy by grounding responses in verified internal business knowledge. Governance, security, and explainability become critical as AI shifts from pilots to enterprise infrastructure. Investment typically ranges $50K–$500K depending on data integration, compliance, and deployment complexity. Strong data engineering and architecture discipline matter more than standalone model capability for…

The Enterprise Buyer’s Checklist Before Hiring an AI Development Partner

Key takeaways: Choosing an AI development partner is less about technical demos and more about real-world fit, governance, and operational reliability. Internal alignment on outcomes, data ownership, and integration realities is essential before engaging any enterprise AI partner. Strong partners demonstrate delivery maturity through governance controls, security discipline, and lifecycle management, not just model accuracy.…

Proving the ROI of Copilot AI Sales Enablement Software for Global Teams

Key Takeaways The ROI of Copilot AI sales enablement software shows up in revenue moments, not in generic productivity reports. Organizations that treat Copilot as an AI-powered sales enablement platform tied to sales process maturity see measurable outcomes within two quarters. Global sales teams require region-aware deployment models to avoid uneven adoption and misleading ROI…