- AI in Fintech in Australia: Role & Impact in Financial Services and Market Dynamics

- Understanding the Necessity of AI in Fintech in Australia

- AI as a Strategic Growth Driver

- Scalability and Continuous Innovation

- Higher Returns and Lower Costs

- Customer Loyalty Through Personalization

- Staying Ahead of Risks

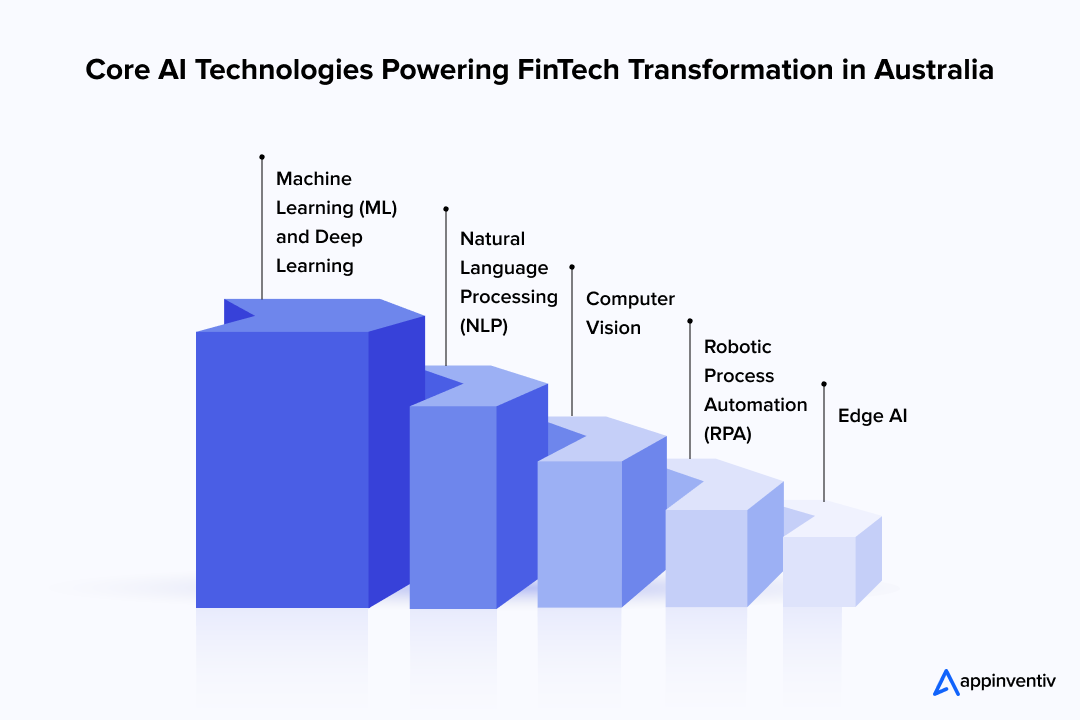

- Key AI Technologies Transforming Australia's FinTech Sector

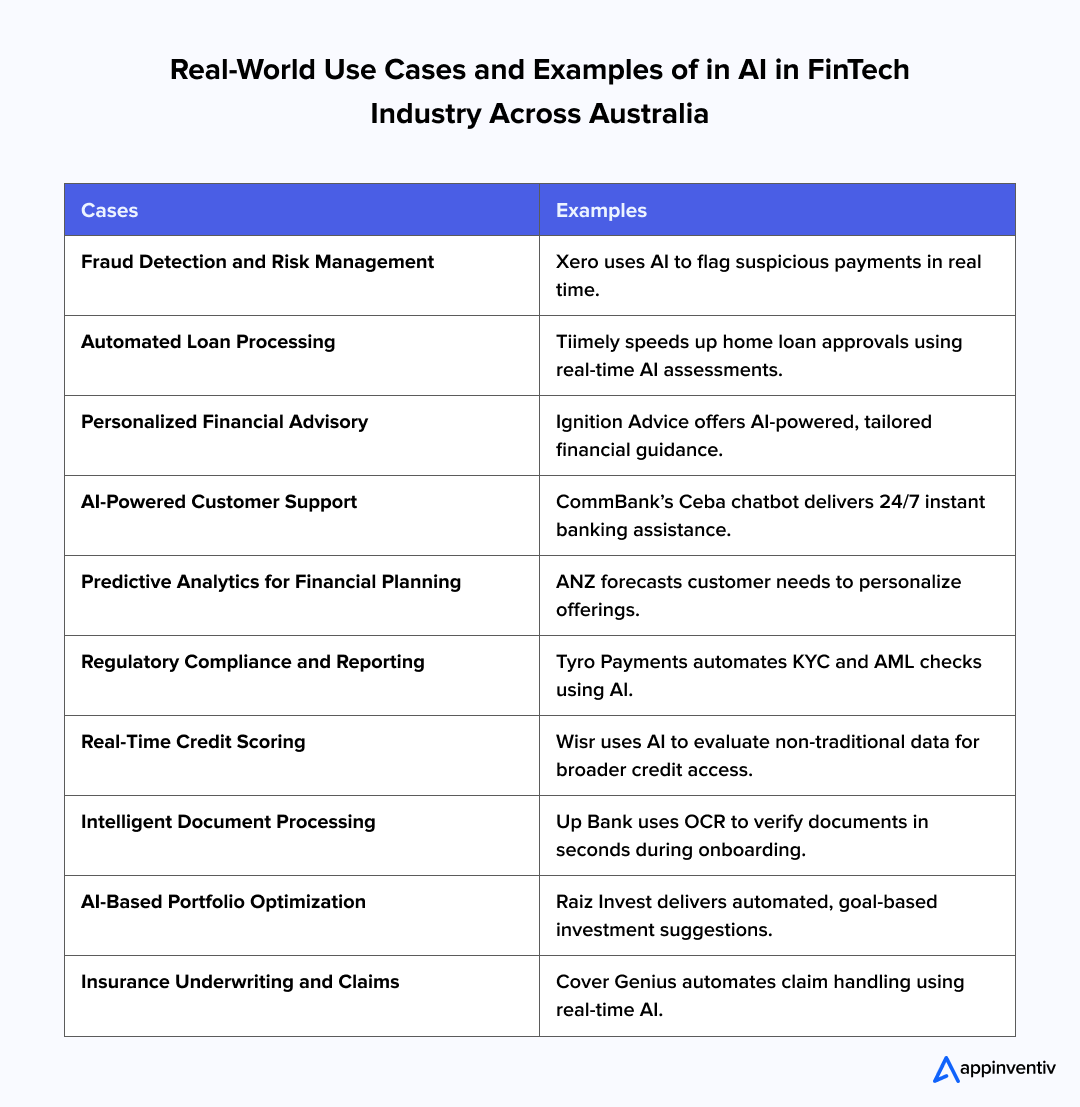

- 10 Use Cases and Benefits of AI in Australia's FinTech Industry

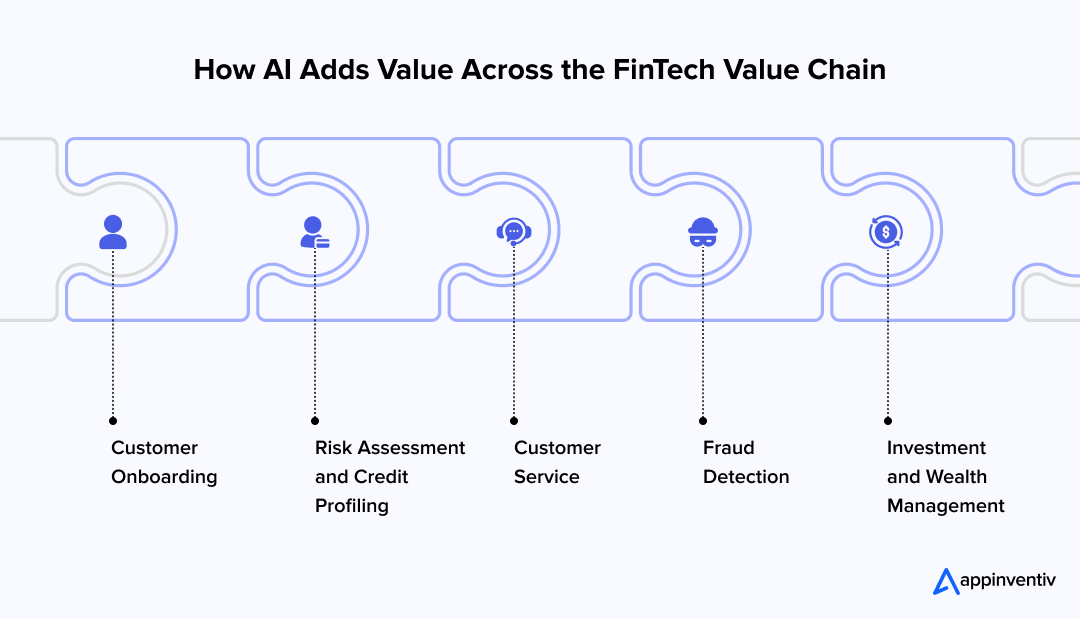

- How AI Transforms Every Stage of the FinTech Value Chain?

- 1. Customer Onboarding

- 2. Risk Assessment and Management

- 3. Customer Service

- 4. Fraud Detection

- 5. Investment and Wealth Management

- AI in FinTech in Australia: Step-by-Step Process to Integrate in Operations Successfully

- Step 1: Set clear goals

- Step 2: Check your readiness

- Step 3: Choose one area to focus on

- Step 4: Try it out with a small project

- Step 5: Work with the right partners

- Step 6: Use your data wisely

- Step 7: Train your team

- Step 8: Grow at your own pace

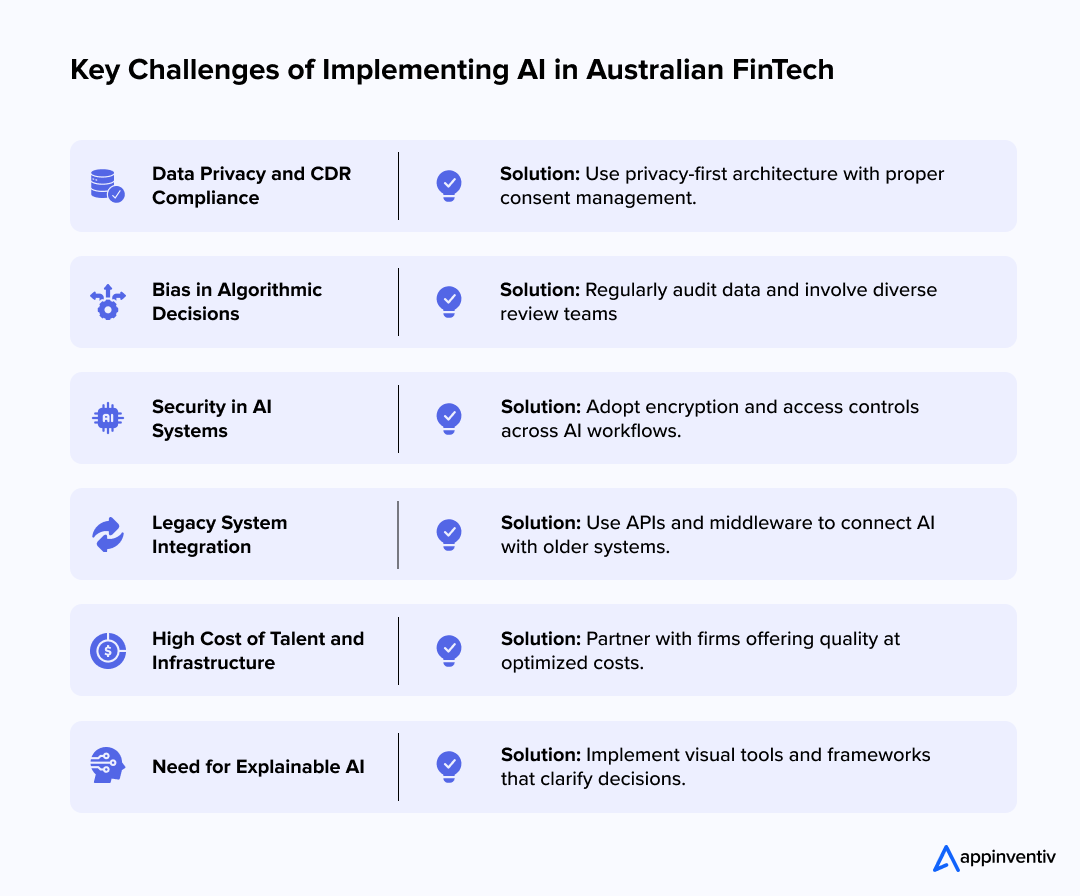

- Challenges of Implementing AI in Australian Finance Industry

- Data Privacy and CDR Compliance

- Bias in Algorithmic Decision Making

- Security Concerns in AI Workflows

- Legacy System Integration in Traditional Banks

- High Cost of AI Talent and Infrastructure

- Need for Explainable AI in Financial Decisioning

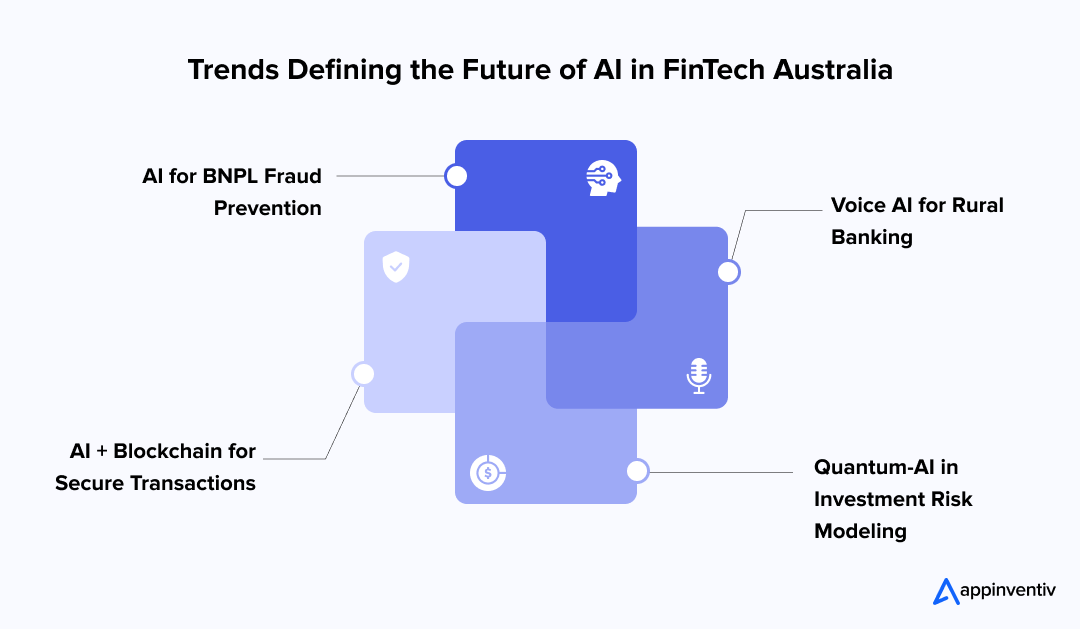

- Future Outlook: The Next Wave of AI in FinTech in Australia

- Enhance FinTech Innovation in Australia with Appinventiv’s Custom AI Solutions

- FAQs

Australia’s financial industry is quietly transforming, and AI is playing a major role in this change. What once sounded like futuristic speculation is now a practical tool reshaping everything, from how credit is assessed to how fraud is spotted before it happens. Whether it’s finance powering smart loan approvals or banking detecting anomalies in real time, AI in fintech in Australia is already well underway.

A recent survey shows that 72% of Australian financial firms are already using AI tools. Out of these, 42% say AI meets their expectations, and 20% report even better results than they imagined. To say the least, the use of AI applications in the finance industry is not just a trend but a new way of doing business.

But why is artificial intelligence in the FinTech industry in Australia gaining momentum so quickly?

Because it’s practical, it’s efficient. From automated reporting systems to intelligent financial forecasting, the role of AI in finance in Australia is expanding quickly. This surge is driven not only by efficiency and cost savings but by demand for smarter, faster decision-making. As businesses prepare for the future of AI in fintech in Australia, areas like tax, treasury, and risk are next in line for transformation.

Now, here’s the real question:

Where does your business stand in all this?

If you’re curious to explore the comprehensive role of AI in finance in Australia, the emerging AI use cases in FinTech industry, and how to stay ahead of the curve with the latest AI in FinTech trends across Australia, this guide has you covered. We’ll break down all the needed information related to AI in FinTech Australia – benefits, use cases, and look at what’s coming next in the future of AI in the finance industry in Australia, and show how real companies are using AI solutions for finance in Australia today.

Let us help you cut FinTech operational costs with AI-powered automation—no extra headcount needed.

AI in Fintech in Australia: Role & Impact in Financial Services and Market Dynamics

The increasing power of AI in accounting and finance in Australia is changing the old banking models and fueling digital innovation. With more intelligent algorithms and predictive analytics, AI in banking is revolutionizing everything, ranging from customer care to fraud detection and credit scoring. This era of innovation is enhancing risk estimation and empowering banks and FinTechs to design more inclusive and personalized financial products.

More significantly, the role of AI in finance in Australia is more than automation. It’s creating real change by extending financial services to underserved communities, making markets more transparent, and providing early movers a substantial competitive advantage. As we discuss the benefits of AI in the FinTech industry in Australia, it is evident that this technology is transforming the way services are being delivered and creating new standards for the future of AI in the finance industry in Australia.

According to a KPMG report, Australian companies quickly adopt AI in their financial operations. Around 76% of firms are already using or testing AI for financial reporting, which is more than the global average of 72%. This puts Australia third worldwide after Canada and the UK in terms of leveraging AI in Fintech. This number is expected to reach 100% in the next three years, showing a strong move toward AI-powered finance.

The report also points to a sharp rise in the focus on generative AI in finance in Australia. Right now, only 9% of Australian companies use GenAI, but over 52% expect it to become their top tech priority for financial reporting by 2027. This shows a growing belief in GenAI’s ability to detect issues, automate reporting, and boost overall efficiency.

These shifts clearly show that AI is no longer a future ambition but a present-day necessity. For financial institutions, adopting AI in Australia today means staying relevant, resilient, and ready for what’s next.

Understanding the Necessity of AI in Fintech in Australia

Clear, measurable benefits drive the rise of artificial intelligence in finance in Australia. From boosting returns to staying future-ready, here are the key reasons why FinTech firms are making AI a core part of their strategy.

AI as a Strategic Growth Driver

In today’s ultra-competitive financial climate, the race for FinTech AI is no longer a trend—it’s a strategic imperative. With shifting customer expectations that are moving at breakneck speed and fast-tracked technology breakthroughs, AI in the Australian FinTech sector enables companies to deliver faster, smarter, and more intuitive solutions. For Australian FinTech firms, artificial intelligence isn’t just about optimization, it’s a pathway to long-term relevance and leadership.

Scalability and Continuous Innovation

Forward-thinking CEOs and CTOs in Australia are already integrating AI finance solutions into their strategic roadmaps. This empowers their platforms to be scalable, agile, and consistently innovative. In a time-sensitive business environment, it becomes crucial to ensure that AI enterprise solutions align with overall business objectives to foster growth and long-term sustainability.

Higher Returns and Lower Costs

The benefits of AI in FinTech industry in Australia are being experienced in tangible, measurable terms. AI-facilitated automation is decreasing operational costs by as much as 30% while simultaneously improving customer experiences. From intelligent chatbots that drive down support volumes to predictive algorithms that improve loan underwriting, AI is powering efficiency and innovation in tandem.

Customer Loyalty Through Personalization

Most importantly, AI in Australian finance industry is paying for itself by driving retention and opening up new revenue streams. Personalization powered by AI for finance in Australia not only improves user engagement but also creates more loyal customers.

Staying Ahead of Risks

Conversely, postponing AI implementation can be harmful. With AI and finance in Australia increasingly coupled, businesses that do not adapt could lose their competitive advantage. Without AI, businesses stand to lose cost benefits, lag behind compliance innovations, and disappoint customers. In an industry where digital dexterity is crucial, caution can be expensive.

Key AI Technologies Transforming Australia’s FinTech Sector

Australia’s FinTech landscape is evolving fast, and AI is at the core of this transformation. From smarter automation to real-time analytics, these key technologies are redefining how financial services operate and deliver value.

Machine Learning (ML) and Deep Learning

Machine learning and deep learning are revolutionizing the way AI in the FinTech industry in Australia works. By enabling complex predictive analytics, these technologies are a prerequisite for accurate credit scoring, personalized financial recommendations, and detecting fraud. With the capabilities of AI for finance in Australia growing, ML and deep learning models update themselves in real-time to provide more accurate insights, helping companies manage risk and build better customer experiences.

Natural Language Processing (NLP)

NLP is another robust solution changing customer service in the Australian finance industry. By powering virtual assistants and intelligent chatbots, NLP is enhancing customer engagement with banks. These AI-powered tools are capable of understanding and answering customers in real-time, allowing for speedier and efficient service interactions, as well as simplified ones. Therefore, AI banking in Australia is becoming more user-friendly and convenient, influencing customer satisfaction and engagement.

Computer Vision

Computer vision plays a pivotal role in the FinTech industry, especially in identity verification and document processing. By analyzing and interpreting images, artificial intelligence in the FinTech industry ensures that identity verification is both secure and efficient, enhancing security without compromising the customer onboarding process. Automating document review with AI not only saves time but also reduces human error in financial operations. These advancements streamline processes, improve accuracy, and bolster security measures in the financial sector.

Robotic Process Automation (RPA)

Robotic Process Automation or RPA is among the most powerful drivers of AI in FinTech in Australia. By using RPA, routine processes such as data entry, generating reports, and checking compliance are streamlined. RPA not only makes the operation more efficient but also minimizes the risk of human mistakes. As a result, AI applications in finance in Australia boosting productivity and allowing teams to focus on more strategic, high-value tasks.

Edge AI

For data processing in real time, Edge AI is becoming imperative. By enabling instant decision-making at the point where data is generated, it supports fast responses in areas like fraud detection and loan approvals. Edge computing is most suitable for applications requiring low latency and high performance, and it’s helping companies stay agile and responsive in an increasingly accelerating market.

- 75% of Australian companies are already using or testing AI in financial reporting.

- By 2027, 100% are expected to adopt AI in this space.

- GenAI use in financial reporting is set to jump from 9% to 52% as a top tech priority.

- Over half of businesses see AI as key to accuracy, speed, and strategic insights in reporting.

We can help you turn these numbers into real, competitive advantages.

10 Use Cases and Benefits of AI in Australia’s FinTech Industry

Let’s examine 10 use cases, benefits, and examples of AI in the fintech industry in Australia.

1. AI-Powered Fraud Detection and Risk Management

- Use Case: With the humongous growth in online transactions, AI in the FinTech industry in Australia is essential to tracking financial activity in real-time to detect and prevent fraudulent activity. Using advanced ML algorithms, AI can detect patterns of unusual transactions indicative of fraud.

- Benefit: By detecting fraud in real time, AI helps prevent financial losses and builds stronger customer trust which is critical for standing out in Australia’s highly competitive banking sector.

- Example: Xero has embraced AI to detect suspicious payments and invoices, giving companies an automated tool to ensure they are not a victim of fraud, while giving peace of mind to users and stakeholders.

2. Automated Loan Processing

- Use Case: Loan approval procedures are traditionally long and time-consuming, involving high levels of manual intervention. AI applications in finance in Australia have revolutionized the process by rapidly determining creditworthiness through thorough data analysis, enabling instant loan approvals.

- Benefit: AI-powered automated loan processing speeds up approval times, reduces operational costs, and makes lending more accessible to a broader audience by streamlining the entire process.

- Example: Tiimely employs AI to assess home loan applications in real-time, enabling rapid approvals and efficient processing.

3. Personalized Financial Advisory Services

- Use Case: AI draws on enormous financial datasets, examining user consumption patterns, investment patterns, and money goals to give hyper-personalized recommendations. By offering customized financial planning, AI allows clients to invest wisely.

- Benefit: This customization develops higher client engagement, satisfaction, and loyalty, allowing financial institutions to build their image as good financial consultants in a very competitive business marketplace.

- Example: Ignition Advice, a Sydney-based FinTech firm, provides digital financial advice solutions using AI to deliver personalized recommendations at scale. Their platform helps banks and insurance companies offer tailored advice based on individual customer profiles, helping users make informed financial decisions.

4. AI-Driven Customer Support

- Use Case: Customer service in the Australian financial sector has been transformed with AI-driven solutions such as chatbots and virtual assistants. These AI solutions for finance in Australia are capable of addressing queries in real-time, giving instant responses to all kinds of customer queries, from basic account information to complex financial guidance.

- Benefit: Not only does this improve the customer experience but also reduces support costs by reducing human intervention. By leveraging AI and finance in Australia, businesses can offer their customers faster service while saving on operating costs.

- Example: Commonwealth Bank of Australia (CommBank) introduced the virtual assistant “Ceba” to its mobile banking app, giving customers instant, effective responses to banking-related questions 24/7.

5. Predictive Analytics for Financial Planning

- Use Case: Predictive analytics powered by AI in Australian finance industry helps in forecasting market trends of the future and customer behavior. It plays a critical role in making proactive financial decisions and creating strategies that can endure market volatility more easily.

- Benefit: By predicting future financial needs, AI enables firms and individuals to make better, fact-based decisions, avoiding risks associated with uncertain financial contexts and attaining better financial preparedness.

- Example: ANZ Bank uses AI to examine data of customers and foretell future financial requirements and, as a result, offers customized banking products and services based on future financial aspirations of customers, increasing customer satisfaction and loyalty.

6. Regulatory Compliance and Reporting

- Use Case: With rising regulations in the financial industry, generative AI in finance in Australia has stepped in to mechanize compliance processes. AI-based solutions will be able to monitor transactions in in real time to ensure that they comply with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML regulations.

- Benefit: This reduces the cost of compliance, decreases the risk of regulatory audit or fines, and ensures that the financial institutions will always remain on the right side of the law.

- Example: Tyro Payments uses AI to conduct automated real-time AML and KYC checks, achieving regulatory compliance swiftly and error-free and enhancing operations transparency.

7. Real-Time Credit Scoring and Risk Profiling

- Use Case: Traditional credit scoring methods often rely on limited data, excluding individuals with thin credit histories or no formal banking background. AI is transforming FinTech in Australia by leveraging non-traditional data such as mobile usage patterns and transaction behavior to assess creditworthiness in real time and extend financial access to underserved populations.

- Benefit: By offering greater credit access, AI brings financial prospects to historically marginalized communities, decreasing the default rate for financial institutions.

- Example: Wisr uses AI to analyze alternative data and approve credit to customers who do not have conventional credit records, creating possibilities for more inclusive finance.

8. Intelligent Document Processing for Onboarding

- Use Case: Technologies like Natural Language Processing (NLP) and computer vision simplify document processing at customer onboarding. AI technology can read and validate data in documents like IDs, bank statements, and payslips on its own, reducing human effort required for document verification.

- Benefit: Onboarding is quicker, there are fewer mistakes, and both the customer and the bank have a smoother experience.

- Example: Up Bank uses AI-driven Optical Character Recognition (OCR) technology to electronically verify documents during customer onboarding, reducing onboarding from days to seconds.

9. AI-Based Portfolio and Wealth Optimization

- Use Case: AI can provide customized investment advice by reviewing past market performance and personal preference. AI can rebalance portfolios and recommend timely rebalancing, enabling users to match their investments with their financial goals and risk tolerance.

- Benefit: This allows individuals to accumulate wealth in a passive manner, requiring little effort to minimize risks and deliver maximum returns.

- Example: Raiz Invest, a micro-investing app, utilizes AI to develop personalized investment strategies that encourage regular small investments and enable users to accumulate wealth over the long term.

10. AI for Insurance Underwriting and Claims Processing

- Use Case: AI is making insurance processes efficient by evaluating risk profiles, underwriting policies, and handling claims through large data sets, ranging from historical claims to real-time inputs. It saves time and expense that are incurred in conventional underwriting and claims processing.

- Benefit: AI accelerates the processing of claims, improves business efficiency, and reduces the risk of fraud.

- Example: Cover Genius uses AI to enable automated adjudication of insurance claims, particularly in industries like e-commerce and travel, through real-time, efficient, and transparent claims processing.

How AI Transforms Every Stage of the FinTech Value Chain?

AI isn’t just a backend upgrade but is reshaping how FinTech companies operate, engage customers, and manage risk. Here’s a look at how AI is used in the finance industry in Australia across the value chain.

1. Customer Onboarding

AI streamlines KYC checks, accelerating onboarding while being compliant. With AI verifying identities and scanning documents, processing is faster and manual errors are decreased.

2. Risk Assessment and Management

AI processes massive amounts of data to determine creditworthiness and identify financial risk. With alternative data, AI provides an enhanced risk profile to make informed lending decisions.

3. Customer Service

AI-powered chatbots provide 24/7 customer support, handling a range of inquiries from account management to product details, ensuring efficient and continuous service.

4. Fraud Detection

AI identifies suspicious transactions in real-time by recognizing patterns and flagging potentially fraudulent activity, helping to prevent financial loss.

5. Investment and Wealth Management

AI-driven algorithms offer personalized investment advice, optimizing portfolios and providing users with tailored wealth management strategies.

AI in FinTech in Australia: Step-by-Step Process to Integrate in Operations Successfully

Integrating AI in FinTech should start with the right strategy and end with measurable results. Here’s a step-by-step process that can help businesses unlock AI’s full potential across their financial operations.

Step 1: Set clear goals

Begin by deciding what you want AI to help you with. It could be faster customer support, better credit checks, or safer transactions.

Step 2: Check your readiness

Look at your current systems, data, and team skills. Make sure you have the basic setup needed to support AI tools.

Step 3: Choose one area to focus on

Pick a part of your business where AI can make a quick and clear difference, like fraud detection or customer onboarding.

Step 4: Try it out with a small project

Test the AI solution in a small way first. This helps you see what works and make changes before using it everywhere.

Step 5: Work with the right partners

Team up with firms like Appinventiv that has a prior record of developing AI tools for finance. They can guide you and help create custom software or apps that fit your needs.

Step 6: Use your data wisely

Make sure your data is clean, organized, and safe. You can also use shared customer data under rules like Australia’s Consumer Data Right to improve your AI results.

Step 7: Train your team

Help your employees understand how AI works and how to use it. This builds trust and makes it easier to manage AI in daily work.

Step 8: Grow at your own pace

Once your first project is successful, start adding AI to other parts of your business and keep checking how it performs.

Challenges of Implementing AI in Australian Finance Industry

AI is changing the finance industry in Australia, but it doesn’t come without challenges. From strict regulations to data quality issues, businesses need to be prepared for what lies ahead.. Let us look at the challenges of AI in fintech in Australia:

Data Privacy and CDR Compliance

Ensuring compliance with data privacy regulations, especially Australia’s Consumer Data Rights (CDR), is crucial. Financial institutions must prioritize customer consent and secure data handling when developing AI models to avoid legal and reputational risks.

Solution: Use privacy-first data architectures and implement consent management tools that align with CDR standards to stay compliant.

Bias in Algorithmic Decision Making

AI models are only as good as the data they’re trained on. Bias in data can lead to unfair outcomes in areas like credit scoring and loan approvals, necessitating ongoing efforts to ensure algorithms are free from discrimination.

Solution: Regularly audit AI models, diversify training datasets, and involve cross-functional teams to identify and reduce bias.

[Also Read: Preventing AI Model Collapse: Addressing the Inherent Risk of Synthetic Datasets]

Security Concerns in AI Workflows

AI systems in FinTech are prime targets for cyberattacks. Ensuring robust security measures, including encryption and access control, is essential to protect sensitive financial data from breaches and unauthorized access.

Solution: Implement end-to-end encryption, role-based access controls, and continuous monitoring to secure AI pipelines.

Legacy System Integration in Traditional Banks

Many established financial institutions rely on outdated systems that may not be compatible with advanced AI technologies. Integrating AI into these legacy systems without disrupting operations can be a significant challenge.

Solution: Use middleware or APIs to bridge legacy systems with AI tools, and gradually migrate to more flexible, cloud-native infrastructure.

High Cost of AI Talent and Infrastructure

The demand for skilled AI professionals in the finance sector is high, making talent acquisition expensive. Additionally, implementing AI requires significant investment in infrastructure, which may be challenging for smaller firms to afford.

Solution: Partner with a trusted AI development firm that delivers high-quality solutions at optimized costs, ensuring value without compromising on performance or compliance.

Need for Explainable AI in Financial Decisioning

As AI-driven decision-making becomes more prevalent in areas like lending and investment management, ensuring the transparency and interpretability of AI models is critical. Financial institutions must adopt explainable AI to provide clear and understandable justifications for automated decisions to both regulators and customers.

Solution: Use explainable AI frameworks and visual dashboards that simplify decision logic and help build trust with users and regulators.

Future Outlook: The Next Wave of AI in FinTech in Australia

As AI continues to evolve, the Australian FinTech sector stands on the brink of a transformative leap, where innovation isn’t just optional, it’s inevitable. Here are some of the emerging AI in FinTech trends across Australia.

- AI in Buy Now, Pay Later (BNPL) Fraud Prevention

AI is increasingly being used to monitor BNPL transactions for fraudulent activities, enhancing security and minimizing risks associated with delayed payments and fraud. - Voice AI for Banking in Rural Australia

Voice-powered AI solutions are set to transform banking in rural and remote areas, offering easy and accessible services for customers who may not have regular internet access.

[Also Read: How much does it cost to build an AI voice generator and text-to-speech reader app like Speechify?]

- Quantum-AI Modeling for Investment Risk

Quantum computing combined with AI is poised to revolutionize investment risk analysis, enabling more accurate predictions and insights for smarter investment decisions. - AI + Blockchain for Transparent, Secure Transactions

The integration of AI and blockchain will create more transparent, secure, and efficient transaction processes, increasing trust and reducing fraud in the financial ecosystem.

Enhance FinTech Innovation in Australia with Appinventiv’s Custom AI Solutions

Appinventiv empowers FinTech companies in Australia to scale faster, innovate smarter, and stay compliant through practical AI solutions tailored to the region’s financial ecosystem. As a trusted leader in artificial Intelligence development services in Australia, we deliver custom-built tools that solve real business problems.

1. AI-Powered Investment Platforms That Adapt to Your Users

We develop intelligent robo-advisory systems that analyze risk profiles, market data, and user preferences to deliver real-time, personalized investment recommendations. This not only enhances customer trust but also boosts platform stickiness and engagement.

2. Conversational AI for Always-On Banking

Our AI-driven chatbots and voice assistants handle everything from transactional queries to financial advice, ensuring your customers receive instant, accurate support 24/7. This reduces operational costs while improving service availability.

3. Built-In Compliance with CDR and Open Banking

Navigating Australia’s regulatory framework is complex. As a leading provider of FinTech software development services in Australia, we build AI engines specifically designed to align with Consumer Data Right (CDR) and Open Banking standards in Australia, enabling secure data exchange and audit-ready systems.

4. Proactive Fraud Detection & Smarter Credit Scoring

Appinventiv deploys predictive AI models that identify anomalies in transaction behavior and assess borrower credibility in real-time. This reduces fraud exposure and accelerates lending decisions, without compromising risk.

5. Frictionless Onboarding with Intelligent Document Processing

Our AI solutions automate document analysis for KYC, AML, and identity verification, reducing onboarding time from days to minutes and lowering drop-off rates.

Whether you’re optimizing operations or building new FinTech products, Appinventiv’s AI expertise ensures your product is future-ready, scalable, and aligned with industry standards.

Get in touch with us to build something game-changing—together.

FAQs

Q. Is AI regulated in Australia’s FinTech sector?

A. Yes, AI in Australia’s FinTech sector is regulated under frameworks like the Consumer Data Rights (CDR) and Open Banking, ensuring compliance with data privacy, security, and ethical standards.

Q. What are the best use cases to start with AI in FinTech?

A. AI use cases in Fintech have revolutionized the picture of AI in Finance in Australia. Some of the best use cases to start with AI in FinTech are chatbots, fraud detection, credit scoring, and regulatory compliance. These areas offer quick wins by improving efficiency, reducing manual work, and enhancing the customer experience. For instance, AI-powered chatbots can handle customer queries around the clock, while fraud detection systems can spot suspicious transactions in real time.

Q. Can startups afford to integrate AI?

A. Yes, startups can start with affordable, scalable AI solutions like cloud-based platforms or AI-as-a-Service, focusing on high-impact areas to minimize costs and prove ROI.

For example, Tiimely, an Australian startup, uses AI to automate home loan approvals. By leveraging AI from the start, they were able to reduce manual effort, speed up processing, and deliver a seamless experience, all without the need for massive infrastructure.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Key takeaways: AI reconciliation for enterprise finance is helping finance teams maintain control despite growing transaction complexity. AI-powered financial reconciliation solutions surfaces mismatches early, improving visibility and reducing close-cycle pressure. Hybrid reconciliation logic combining rules and AI improves accuracy while preserving audit transparency. Real-time financial reconciliation strengthens compliance readiness and reduces manual intervention. Successful adoption…

How to Develop an AI Chatbot for Education Platforms in UAE: Architecture, Cost, and Timeline

Key Takeaways AI chatbots are helping UAE institutions handle repetitive queries, reduce response delays, and improve the availability of student support. Bilingual capability, PDPL compliance, and integration with LMS and student systems are essential for successful deployment. Costs typically range from AED 150,000 to AED 1.47M ($40K–$400K), depending on integrations, personalization, and language support. AI-powered…

How AI in Healthcare Administration Cut Staff Workload by 40%

Key takeaways: AI automates claims, scheduling, intake, and documentation, cutting repetitive work and freeing staff to focus on oversight and patient coordination. AI validation tools flag incomplete records before submission, reduce avoidable denials by 10–20%, and improve clean-claim performance, enhancing revenue predictability. EHR and note-processing AI reclaim thousands of staff hours in large health systems,…