- What AI Agents in Finance Really Are and Why the Middle East Is Ready for Them

- AI Automation for Financial Services in Middle East: High-Impact AI Agent Use Cases

- 1. Multilingual and Cross Channel Customer Service

- 2. SME Lending and Faster Credit Decisioning

- 3. Sharia Aligned Islamic Finance Journeys

- 4. Fraud Detection, AML, and Cross Border Compliance

- 5. Treasury, Liquidity, and Market Risk Support

- 6. Embedded Finance and Instant Digital Journeys

- 7. Internal Operations and Workforce Support

- Why These Use Cases Matter Now

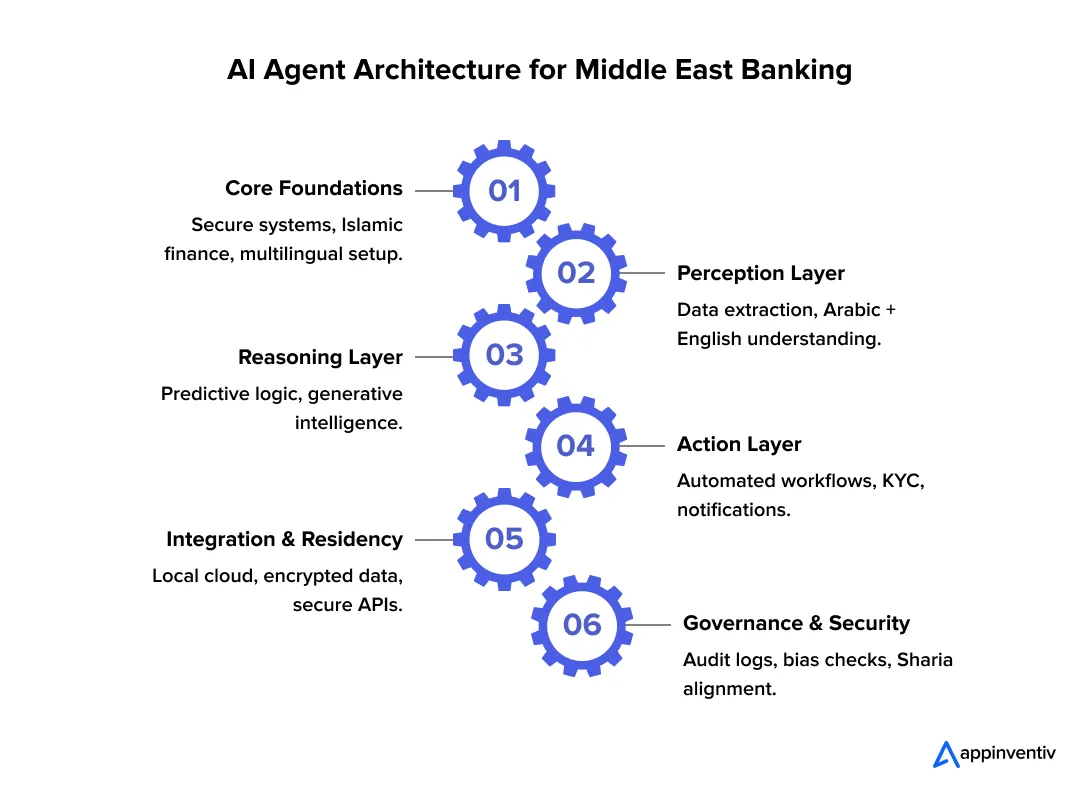

- AI Agent Development for Finance: Reference Architecture for Banking Systems

- Core Foundations of AI Architecture in Finance

- Perception Layer and Multilingual Understanding

- Reasoning and Generative Intelligence Layer

- Action Layer and AI Workflow Automation in Banking

- Integration and Data Residency Considerations

- Governance, Security, and Oversight

- Why This Architecture Matters for the Middle East

- How to Build an AI Finance Agent Platform in the Middle East?

- 1. Identify High Value Use Cases and Define Clear Scope

- 2. Assess Data Quality, Cloud Readiness, and Integration Constraints

- 3. Build a Secure and Compliant AI Foundation

- 4. Design and Orchestrate AI Agents for Middle East Workflows

- 5. Pilot in Controlled Environments and Validate Real World Behavior

- 6. Scale Across Business Lines and Regional Markets

- A Roadmap Built for the Middle East

- Challenges of AI Adoption in Middle East Finance and How Banks Are Handling Them

- 1. Data Fragmentation Across Legacy and Cloud Systems

- 2. Limited Arabic Language Intelligence

- 3. Sharia Alignment for Islamic Finance Journeys

- 4. Regional Regulations and Data Residency Rules

- 5. Limited Internal AI Expertise

- 6. Concerns About Over Automation

- A Practical, Real World Path Forward

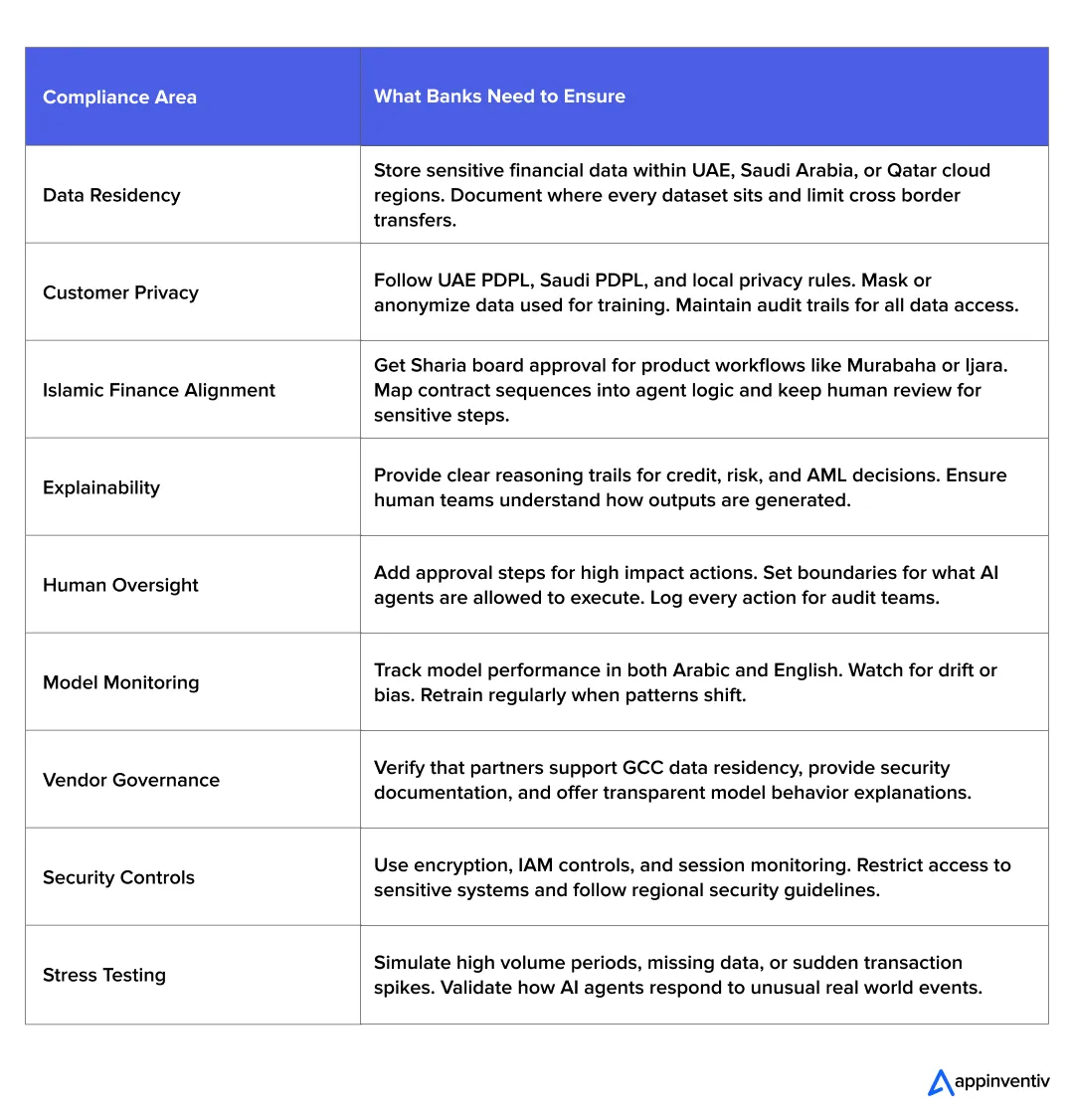

- Compliance Checklist for Middle East Banks Deploying AI Agents

- Partner Selection Checklist for Middle East Banks Deploying AI Agents

- How Appinventiv Helps Middle East Financial Institutions Implement AI Agents

- FAQs

- Q. How can banks use AI agents to automate workflows?

- Q. What does AI agent development for finance architecture look like in banks?

- Q. What should CIOs consider before they build an AI finance agent platform in UAE ?

- Q. How much is the AI agent development cost for finance institutions?

Key takeaways:

- AI agents are becoming a core part of finance workflows in the Middle East, supporting lending, compliance, customer service, and Islamic banking journeys.

- A strong AI architecture includes secure data access, multilingual understanding, generative reasoning, and guided actions with governance at every step.

- Banks must balance innovation with data residency, Sharia alignment, and Arabic language intelligence to adopt AI responsibly.

- AI agent development cost for finance typically range from 146,000 AED to 1,469,000 AED ($40K to $400K), depending on workflow depth and regulatory complexity.

- With clear planning and oversight, AI agents help accelerate banking digital transformation across the UAE, Saudi Arabia, Qatar, and the wider GCC.

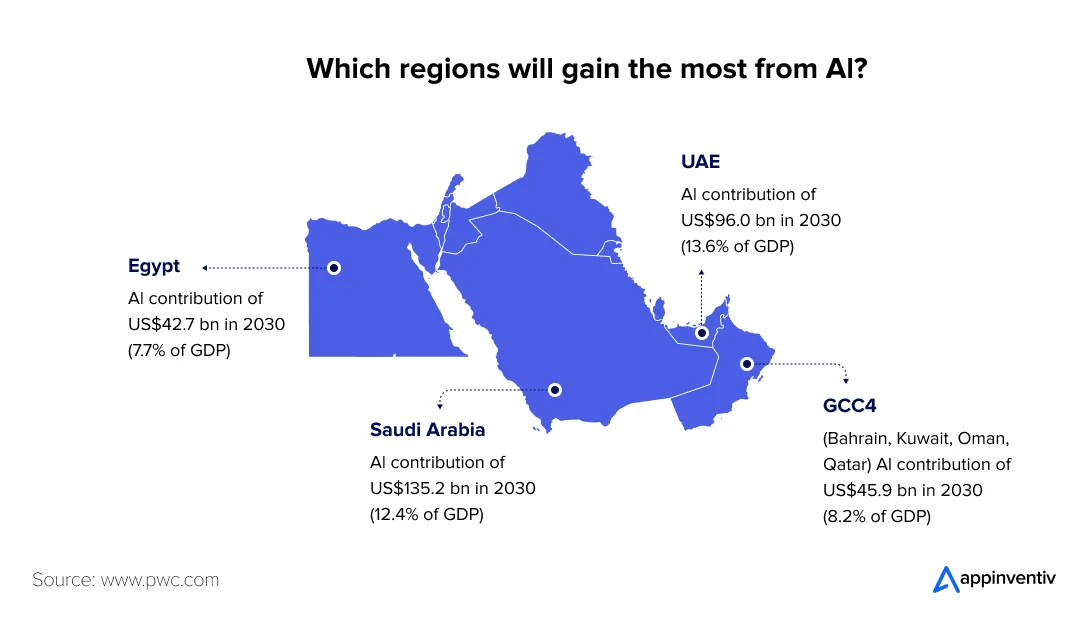

Banks and financial institutions across the Middle East are at a turning point. Walk into any strategy meeting in Dubai, Riyadh, Doha, or Manama, and you will hear the same shift in tone. Leaders are no longer asking if AI belongs in finance. They are asking how quickly they can scale it without losing accuracy, trust, or regulatory alignment. PwC estimates that AI could add close to 320 billion dollars to the Middle East economy by 2030, which explains why every major bank is exploring new ways to turn intelligence into real operational value.

So far, most of that progress has come from traditional AI systems that do one task at a time, such as scoring credit, flagging fraud, or answering simple customer queries. These tools help, but they do not think ahead. They wait for input, then react. What Middle East institutions need now are agents that can observe what is happening, reason through different possibilities, and take the next best action while staying within regulatory boundaries. A recent KPMG study found that nearly half of UAE organizations already have active AI initiatives in their finance functions, reflecting how quickly the region is moving toward more advanced, autonomous financial workflows.

That is where AI agents in finance come in. They handle far more than simple predictions. They monitor live transactions, support multilingual customer interactions, assist with Sharia aligned product journeys, and reduce pressure on front line teams. For most GCC institutions, building these agents starts around forty thousand dollars for a narrow pilot and can reach four hundred thousand dollars for enterprise wide deployments. As the Middle East continues its push toward open finance, cloud adoption, and real time customer experiences, these agents are becoming the natural next step in the region’s financial transformation.

Stay ahead of the curve

What AI Agents in Finance Really Are and Why the Middle East Is Ready for Them

Traditional AI in banking has always been reactive. It can record a transaction, answer a basic query, or flag possible fraud, but it waits for input before doing anything. AI agents in finance work in a very different way. They observe what is happening, understand context, plan the next steps, and take action across systems without losing accuracy or control. This continuous reasoning makes them far more suitable for the complex workflows that define Middle East finance.

The region’s financial landscape also creates a perfect environment for these agents. Banks in the UAE, Saudi Arabia, Qatar, and Bahrain must support multilingual experiences, Sharia aligned products, and fast cross border remittances across Asia and Africa. Many institutions already use AI in finance in the Middle East, but traditional tools struggle with the volume and diversity of these demands. This is why more leaders are exploring AI agents in banking to support lending decisions, compliance tasks, treasury monitoring, and richer customer service.

Together, these trends show why AI adoption in the Middle East has moved from experiments to real implementation. Banks want intelligence that reduces manual effort while staying aligned with local regulations, cultural context, and Islamic finance requirements. AI agents offer that blend of autonomy and control, making them a natural next step in the region’s financial evolution.

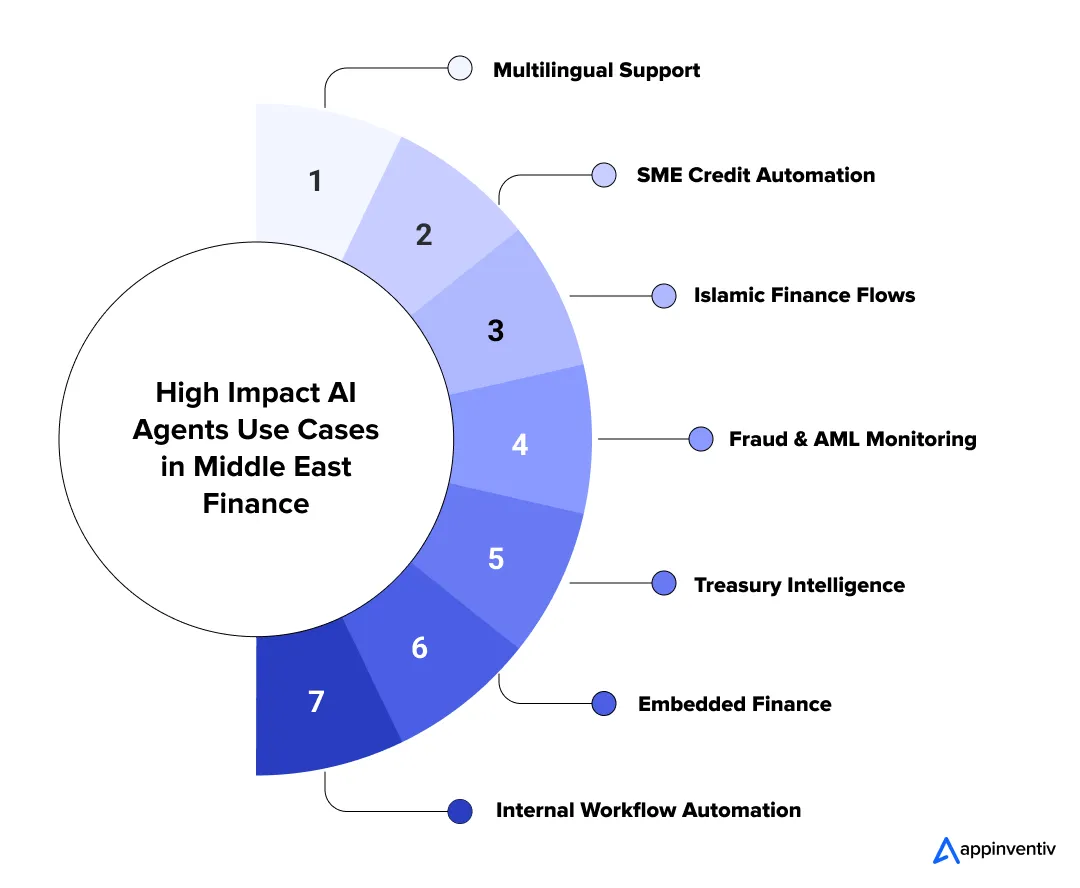

AI Automation for Financial Services in Middle East: High-Impact AI Agent Use Cases

The Middle East financial sector is moving through one of its fastest periods of transformation. Customers expect instant responses, regulators expect stronger controls, and banks are expected to offer both speed and accuracy at the same time. This is why AI agents in finance are gaining traction across the GCC. They are not simple bots. They observe, interpret, and act across entire workflows, which makes them ideal for markets that combine multilingual communication, Islamic finance, and heavy cross border activity. Below are the most relevant use cases shaping the region today.

1. Multilingual and Cross Channel Customer Service

Banks in the UAE, Saudi Arabia, Qatar, and Bahrain serve a mix of Arabic speaking customers, expatriates, and high net worth clients. This creates a service environment where one conversation may shift from Arabic to English in seconds.

How AI agents help:

- Understand and respond in both Arabic and English

- Handle queries across mobile apps, websites, WhatsApp, and call centers

- Keep conversation history intact across channels

- Escalate high priority cases to human agents with a full summary

- Personalize responses based on customer profile and product usage

With rising expectations around digital support, this is one of the strongest AI agents use cases in Middle East banking, especially for institutions with large customer volumes.

2. SME Lending and Faster Credit Decisioning

SMEs are the backbone of GCC economies, especially in Saudi Arabia and the UAE. Yet lending to SMEs often involves heavy documentation and manual evaluation. This slows down approvals and creates friction for businesses that need quick access to capital.

AI agents in banking improve this entire flow.

What agents can do:

- Collect VAT filings, POS data, salary transfers, and bank statements

- Analyze cash flow patterns and seasonality

- Prepare risk notes and decision summaries for credit teams

- Verify compliance with KSA and UAE lending regulations

- Support Sharia aligned products by checking contract rules and profit structures

- Integrate crypto payment gateway data, including wallet transactions, stablecoin settlements, and on-chain payment records

For banks trying to balance growth with risk, these agents help shorten loan decision cycles without lowering standards. This is one of the best examples of AI in finance in the Middle East creating real operational impact.

3. Sharia Aligned Islamic Finance Journeys

Islamic finance introduces rules that do not exist in conventional banking. Loans become Murabaha contracts. Leasing becomes Ijara. Profit calculations replace interest. Every product requires specific sequencing, documentation, and approval flows.

AI agents are especially useful in this space because they reduce manual checking and improve consistency.

They can support:

- Murabaha, Ijara, and Mudaraba applications

- Eligibility checks against Sharia board guidelines

- Profit calculations with correct formulas

- Verification that contract steps follow the right sequence

- Drafting of standardized Sharia compliant documents

Islamic banks across the GCC are exploring these capabilities as part of their broader AI adoption in Middle East programs.

4. Fraud Detection, AML, and Cross Border Compliance

The Middle East manages significant cross border payment flows across Asia, Africa, and Europe. This creates more exposure to fraud, money laundering, and sanctions risk. Traditional rules based systems generate large volumes of alerts, which burden compliance teams.

AI agents in finance can reduce that pressure.

Capabilities include:

- Real time monitoring of payments and account activity

- Fraud detection by tracking and flagging unusual transactions using patterns and context

- Preparation of case summaries for analysts

- Categorizing alerts by risk level

- Drafting suspicious activity reports for human review

- Supporting FATF aligned monitoring for GCC banks

This blend of autonomy and control helps institutions comply with regional expectations while keeping analysts focused on high value work.

5. Treasury, Liquidity, and Market Risk Support

Treasury teams across the GCC manage liquidity positions, FX exposure, and interest rate sensitivities that shift daily. Oil price movements add another layer of volatility that global models do not always capture.

AI agents help by acting as always active analytical partners.

They can:

- Track liquidity ratios in real time

- Simulate the impact of market or oil price changes

- Flag potential breaches ahead of time

- Suggest rebalancing options for different portfolios

- Prepare draft reports for treasury managers

This type of real time intelligence supports more stable financial operations in a region where market conditions change quickly.

6. Embedded Finance and Instant Digital Journeys

The GCC is seeing rapid growth in travel platforms, mobility services, food delivery apps, and e-commerce. These sectors want banking features to blend directly into their user journeys.

AI agents make these embedded finance experiences possible.

Agents can:

- Run instant KYC and affordability checks

- Recommend products such as BNPL, micro loans, or credit lines

- Automate onboarding flows with minimal user effort

- Maintain regional compliance during every step

- Personalize offers based on user behavior

This trend supports modern AI adoption in Middle East fintech ecosystems, where speed and user experience matter most.

7. Internal Operations and Workforce Support

Banks across the UAE and KSA are under pressure to do more with leaner teams. AI agents in finance help by reducing repetitive tasks and creating smoother internal workflows.

Common applications:

- Preparing meeting notes for relationship managers

- Drafting summaries of large customer portfolios

- Updating CRM systems

- Preparing compliance checklists

- Assisting new employees with policy and process queries

This type of support frees up time for teams to focus on complex decisions rather than routine steps.

Why These Use Cases Matter Now

Across all these examples, one common thread stands out. The region is ready for systems that can think through financial processes instead of just reacting to them. With rising expectations around digital banking, stronger regulations, and growing pressure on operational efficiency, AI agents in finance offer Middle Eastern institutions a practical way to modernize without losing control or cultural fit.

Also Read: Agentic AI ROI and deployment guide

AI Agent Development for Finance: Reference Architecture for Banking Systems

Building AI agents for Middle East financial institutions requires more than smart models. It needs a structured and compliant AI architecture in finance that can support local regulations, Islamic finance requirements, multilingual interactions, and fast moving digital ecosystems. Below is a breakdown of the core layers that make this architecture work across the GCC.

Core Foundations of AI Architecture in Finance

A modern architecture starts with a foundation that allows AI agents to observe data, reason through workflows, and take safe actions. The objective is to create a setup where intelligence can operate continuously while staying aligned with Middle East regulations.

Key elements include:

- Secure access to core banking and payment systems

- Integration with Islamic finance engines

- Support for Arabic and English text and voice interactions

- Structured data pipelines for clean and reliable inputs

- Cloud infrastructure located within UAE, KSA, or Qatar

- Strong access controls and continuous monitoring

This foundation ensures that AI agents in finance can function smoothly across high volume, high trust processes.

Perception Layer and Multilingual Understanding

This layer helps agents gather information from multiple systems and customer interactions. It is especially important for banks that serve both Arabic and English speaking communities.

The perception layer handles:

- Reading data from core banking, CRM, and payments

- Extracting information from documents and forms

- Understanding Arabic content, including dialect variations

- Identifying intent in customer messages

- Detecting early signs of risk or fraud

Strong multilingual capabilities are essential for AI in finance in the Middle East, given the region’s diverse customer base.

Reasoning and Generative Intelligence Layer

This is where agents think. The reasoning engine combines predictive models with generative AI in finance to analyze information, interpret patterns, and prepare meaningful outputs.

This layer supports:

- Summarizing customer conversations

- Drafting credit analysis notes

- Interpreting financial statements

- Suggesting next steps for complex workflows

- Providing explanations for decisions

- Supporting generative AI in Middle East finance, including Arabic reports

It helps institutions move from simple automation to deeper intelligence.

Action Layer and AI Workflow Automation in Banking

Once the agent understands the situation, it takes the next action through a secure integration layer.

Agents may:

- Trigger loan processing steps

- Update CRM records

- Send customer notifications

- Draft compliance alerts

- Assist with onboarding and KYC checks

This is where AI workflow automation in banking becomes visible. Agents support teams by handling routine steps with accuracy and consistency.

Integration and Data Residency Considerations

Middle East regulations require financial data to stay within the region unless special approvals exist. This shapes architectural decisions.

Institutions must consider:

- Cloud regions in UAE, Saudi Arabia, and Qatar

- Local data storage and encryption requirements

- Secure APIs connecting all systems

- Isolation of sensitive datasets

- Controlled access for internal teams

Following these guidelines helps institutions remain compliant across different Middle East jurisdictions.

Governance, Security, and Oversight

Governance is a core part of scaling AI agents in banking. Regulators expect clarity, explainability, and safe boundaries for each agent’s behavior.

Banks apply governance through:

- Human approval for high risk decisions

- Model validation and drift monitoring

- Auditable logs of every action

- Bias testing and fairness checks

- Policy engines that restrict agent actions

- Alignment with Sharia guidelines for Islamic finance

This layer ensures that AI agents in finance in the Middle East remain predictable and trustworthy.

Why This Architecture Matters for the Middle East

A complete architecture supports the region’s growing demand for real time decisioning, autonomous workflows, and hyper-personalized banking experiences with AI. With strong governance and local cloud infrastructure, Middle East institutions can scale intelligent systems that understand the cultural, regulatory, and operational realities of GCC finance. This approach lays the foundation for long term AI maturity and sustainable digital transformation.

How to Build an AI Finance Agent Platform in the Middle East?

Implementing AI agents in finance in the Middle East is not a plug and play initiative. Banks and financial institutions in the Middle East must balance innovation with regulation, cultural expectations, Sharia compliance, and data residency laws. A strong and realistic roadmap by an AI development services provider in Saudi Arabia, the UAE, Qatar, Bahrain, Kuwait, Oman, and across the Middle East helps teams follow a focused approach that reflects the maturity patterns to move from pilot ideas to enterprise scale systems without disrupting daily operations. Below is a Middle East focused approach that reflects the maturity patterns seen across the UAE, Saudi Arabia, Qatar, Bahrain, Kuwait, and Oman.

1. Identify High Value Use Cases and Define Clear Scope

The first step is to choose use cases that fit business priorities, regulatory comfort, and data availability. With the rapid rise of AI adoption in Middle East financial ecosystems, leaders must avoid choosing use cases only because they seem trending.

Best practices include:

- Prioritize workflows that rely on repetitive or rule-based steps

- Select areas where agents can reduce manual effort without increasing risk

- Start with customer service, SME lending, onboarding, or compliance

- Validate that training data exists in both Arabic and English

- Check that selected use cases align with local regulatory expectations

A defined scope prevents teams from overengineering early pilots.

2. Assess Data Quality, Cloud Readiness, and Integration Constraints

Middle East institutions often work across hybrid environments. Data may sit in on-prem systems, local cloud regions, or regional platforms.

Teams should evaluate:

- Data cleanliness and labeling quality

- Gaps in Arabic language datasets

- Availability of transaction, CRM, and behavioral data

- Cloud regions required for data residency (UAE, KSA, Qatar)

- API maturity for integrating core systems

- Security classification for sensitive financial information

This assessment creates the baseline for the Financial AI implementation roadmap stage that follows.

3. Build a Secure and Compliant AI Foundation

Before agents can make decisions, institutions need a strong base that includes infrastructure, custom MLOps, governance, and model monitoring. This ensures safe adoption without increasing operational or regulatory risk.

The foundation includes:

- A cloud or hybrid environment aligned with national data laws

- MLOps pipelines for training, testing, deployment, and rollback

- Encryption, identity management, and audit trails

- A policy engine to limit agent actions

- Human oversight points for high impact decisions

- Sharia compliance guidelines for Islamic finance evaluations

This stage determines how safely and reliably AI agents in finance can operate inside the bank.

4. Design and Orchestrate AI Agents for Middle East Workflows

Once the foundation is ready, teams can design the agents themselves. Each agent must have a clear role, constraints, and escalation path.

Design steps include:

- Define the exact AI responsibility of each agent

- Map every step of the workflow where the agent will operate

- Include Arabic and English NLU capabilities

- Ensure reasoning engines and generative models follow regulatory rules

- Add guardrails for credit, AML, and customer facing interactions

- Integrate with Islamic finance engines when required

This is where the strategy begins turning into operational reality.

5. Pilot in Controlled Environments and Validate Real World Behavior

Pilots help measure the accuracy, safety, and user experience of agents before scaling them. Many GCC institutions use UAE or Bahrain sandboxes to test early versions.

During the pilot phase, banks should:

- Run parallel testing with human teams

- Compare decisions, summaries, or alerts generated by agents

- Monitor how well the agent handles Arabic content

- Evaluate time savings and error reduction

- Capture feedback from compliance, credit, and operations teams

- Adjust prompts, rules, and workflows based on performance

Pilots help refine both the agent and the overall governance model.

6. Scale Across Business Lines and Regional Markets

Once confident in accuracy and safety, institutions can expand agent adoption.

Scaling includes:

- Rolling out agents to additional branches or countries

- Localizing workflows for KSA, UAE, or Qatar specific rules

- Enhancing models with more data from real usage

- Training employees to collaborate with agents

- Setting up ongoing model monitoring and policy updates

This final phase completes the AI implementation roadmap and sets the stage for long term automation, efficiency, and customer experience improvements across the region.

A Roadmap Built for the Middle East

Every step of this process reflects the realities of GCC banking. Institutions need speed, but they also need accuracy, transparency, and trust. A structured, region aware roadmap allows financial organizations to scale AI agents in finance without compromising on governance or customer safety. With the right foundation and oversight, agents become reliable partners that support teams, reduce manual effort, and create more responsive financial journeys for customers across the Middle East.

Challenges of AI Adoption in Middle East Finance and How Banks Are Handling Them

Banks across the Middle East are excited about what AI agents in finance can do, but the journey is not without a few bumps. Most of these challenges come from the region’s own mix of legacy systems, cultural diversity, and strict regulatory rules. None of them are deal breakers, but they do shape how quickly institutions can move.

1. Data Fragmentation Across Legacy and Cloud Systems

Many banks still operate on fragmented technology stacks built over decades. Customer profiles, transaction histories, and product data often reside in disconnected systems, limiting the context AI agents need to act confidently. When data is incomplete or inconsistent, even advanced models struggle to deliver reliable outcomes.

Banks in the UAE and Saudi Arabia are addressing this through phased legacy system modernization. Core systems are being gradually decoupled, shared data layers are introduced, and sensitive workloads are migrated to compliant regional cloud environments.

Technology partners typically support this transition by designing interoperable architectures, implementing secure data pipelines, and leading data quality programs that prepare information for intelligent consumption. In several regional transformations, this groundwork has proven more impactful than the AI layer itself.

2. Limited Arabic Language Intelligence

Most off-the-shelf AI systems are optimized for English, which limits their effectiveness in a region where communication frequently switches between Arabic and English, often within the same interaction. Dialect variation further complicates matters, particularly in customer service and relationship management workflows.

To close this gap, banks are training and fine-tuning language models using proprietary datasets: customer conversations, internal documentation, and region-specific terminology.

Specialized technology teams assist by building bilingual NLP pipelines, curating high-quality Arabic corpora, and continuously refining model performance through feedback loops. Over time, this enables AI agents to interpret intent more accurately rather than relying on literal translations.

3. Sharia Alignment for Islamic Finance Journeys

Islamic finance introduces a distinct operational layer. Products such as Murabaha or Ijara follow prescribed sequences, and any deviation can lead to non-compliance. Applying conventional lending logic to these journeys risks regulatory and reputational exposure.

Banks are mitigating this by embedding Sharia principles directly into AI-driven workflows. Product logic is codified step by step, decision boundaries are enforced through rule-based guardrails, and human oversight is retained for sensitive approvals.

Technology partners often work alongside Sharia boards to translate these principles into executable system logic, ensuring AI supports decision-making without overstepping its mandate.

4. Regional Regulations and Data Residency Rules

Data residency remains one of the most influential constraints on AI adoption in the GCC. Regulations in the UAE, KSA, Qatar, and other markets dictate where financial data can be stored and processed, shaping both infrastructure choices and system design.

To remain compliant, banks are prioritising local cloud regions, end-to-end data encryption by default, and tightly controlled access models. External engineering teams typically help operationalise these requirements by designing architectures that respect national boundaries while still enabling analytics, automation, and AI experimentation. This balance allows institutions to innovate without compromising regulatory trust.

5. Limited Internal AI Expertise

While leadership teams are aligned on AI strategy, execution often slows due to skill gaps in areas such as MLOps, prompt design, and lifecycle monitoring. Moving from pilot initiatives to enterprise-wide deployment requires capabilities that many banks are still developing.

Banks are responding through a mix of internal upskilling, selective hiring, and collaboration with experienced technology partners. In practice, this often includes co-building early AI agents, establishing monitoring frameworks, and transferring operational knowledge to internal teams. Over time, this approach reduces dependency while accelerating maturity.

6. Concerns About Over Automation

Financial institutions remain cautious about granting AI too much autonomy, particularly in high-impact decisions. Transparency, auditability, and human accountability remain non-negotiable.

To address this, banks are designing AI agents with clearly defined scopes. Approval checkpoints, explainability layers, and detailed activity logs are standard practice. Technology partners play a key role here by implementing governance frameworks that align automation with human control, ensuring efficiency gains do not come at the cost of oversight.

A Practical, Real World Path Forward

Individually, these challenges may seem significant. Together, they explain why AI automation in Middle East financial services is accelerating, not slowing down. Rising regulatory complexity, bilingual and Sharia-aligned banking journeys, and the limits of manual oversight are pushing institutions toward more intelligent, governed systems.

Banks across the region are responding with disciplined execution—cleaner data foundations, stronger Arabic language intelligence, Sharia-aware workflows, and robust governance. With the right mix of internal leadership and external expertise, AI agents are enabling controlled automation that fits the region’s regulatory, cultural, and operational realities, shaping a form of intelligent banking designed for how financial services actually work in the Middle East.

Compliance Checklist for Middle East Banks Deploying AI Agents

Financial institutions in the Middle East operate in one of the most tightly regulated environments in the world. When banks introduce intelligent systems, compliance teams need full clarity on how data is stored, how decisions are made, and whether every workflow respects regional rules. This checklist brings all of those expectations together in a simple view so teams across risk, IT, and operations can stay aligned from day one.

Partner Selection Checklist for Middle East Banks Deploying AI Agents

Middle East banks need AI partners who understand the region’s unique mix of data laws, Islamic finance rules, and bilingual customer journeys. A simple checklist helps teams filter out partners who look good on paper but fail under real GCC conditions.

How to choose the right partner for AI agent development for finance in the Middle East

- Local data residency support in UAE, Saudi Arabia, or Qatar cloud regions so financial data never leaves national borders.

- Strong Arabic language intelligence that handles GCC dialects and mixed Arabic English conversations.

- Understanding of Islamic finance workflows, especially Murabaha, Ijara, and other Sharia aligned processes.

- Clear alignment with regional regulations such as UAE PDPL, Saudi PDPL, AML rules, and national data privacy laws.

- Enterprise grade security, including encryption, identity controls, audit logs, and secure API practices.

- Smooth integration with core banking systems, CRMs, payment rails, and Islamic finance engines.

- Explainable AI decision making, not black box outputs that compliance teams cannot review.

- Model monitoring and drift detection tools that work across Arabic and English datasets.

- Customization options to adapt workflows for UAE, KSA, or Qatar rules when needed.

- Proven BFSI experience, showing they can operate in real banking environments, not just generic AI settings.

How Appinventiv Helps Middle East Financial Institutions Implement AI Agents

Banks in the Middle East need AI systems that match the region’s regulatory demands, bilingual environments, and Islamic banking rules. With 1000+ digital projects delivered in the Middle East, 35+ industries served, and 10+ years of regional experience, Appinventiv helps institutions move from isolated automation tools to advanced AI agents in finance that support real decision making inside GCC banking workflows.

Our strength comes from combining AI, data engineering, and cloud native systems to build agents that can read documents, understand Arabic as well as English, and operate safely across lending, onboarding, compliance, and customer engagement journeys. Because we work closely with Islamic banking teams, we also design AI driven workflows that respect Murabaha, Ijara, and other Sharia aligned structures, ensuring integrity at every step.

As an AI consulting and strategy company in Dubai, we have supported large scale transformation programs across the UAE, Saudi Arabia, and Qatar. Our work on regional AI finance agent platform such as Edfundo and high traffic hospitality ecosystems shows how we blend intelligence, security, and customer experience in a way that fits Middle East expectations.

For financial institutions preparing to adopt AI agents, Appinventiv offers complete support from strategy and design to deployment and ongoing governance.

If your team is exploring this journey, we can help you build a roadmap that feels practical, secure, and ready for the region.

FAQs

Q. How can banks use AI agents to automate workflows?

A. Banks across the GCC use ai agents in finance in the Middle East to automate tasks that previously required manual review. These agents help collect documents, analyze transactions, update CRM systems, support multilingual customer queries, and prepare credit or compliance summaries. They reduce pressure on frontline teams and create smoother, faster banking journeys that align with ongoing Banking digital transformation efforts in the region.

Q. What does AI agent development for finance architecture look like in banks?

A. The architecture of AI agents in finance usually includes four layers. A perception layer that reads data from core banking systems, a reasoning layer powered by predictive and generative models, an action layer that executes workflow steps, and a governance layer that ensures security, accuracy, and explainability. This structure allows financial institutions to build reliable intelligence that fits the regulatory, cultural, and multilingual needs of Middle East markets.

Q. What should CIOs consider before they build an AI finance agent platform in UAE ?

A. CIOs in the UAE should evaluate data readiness, Arabic language coverage, Sharia aligned product flows, and cloud regions that meet local data residency rules. They also need clear governance controls so AI behaves safely in credit, AML, and customer facing decisions. Addressing these points early helps avoid common AI adoption challenges in finance and ensures a clean path from pilot to production.

Q. How much is the AI agent development cost for finance institutions?

A. The cost of deploying AI agents varies based on complexity, the number of workflows involved, and the level of regulatory integration required. In most Middle East projects, initial pilots begin around 146,000 AED ($40K), while large scale, enterprise wide deployments can reach 1,469,000 AED ($400K). These investments reflect the level of engineering, training, and compliance needed for AI automation in BFSI Middle East environments.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

AI in Smart Homes in Australia: Use Cases, Cost & Real-World Impact

Key takeaways: The adoption of AI in Australian smart homes is primarily dictated by energy economics, insurance risk mitigation, and the evolving needs of an ageing population. AI development costs in smart homes range from AUD 70,000 to AUD 700,000+, depending on grid integrations, compliance engineering, and AI model complexity. Adherence to the Privacy Act…

Enterprise AI Integration in the Middle East: Scaling with Expert Architects

Key takeaways: Middle Eastern enterprises lead in AI adoption, driven by strong government support and investment in digital infrastructure. Successful AI integration requires robust data governance, compliance with local regulations, and tailored architectural design. Addressing talent gaps, localization needs, and legacy system challenges is crucial for scalable AI deployments. Systems integrators and big data architects…

Top Enterprise Use Cases for Agentic RAG in eCommerce Transformation

Key takeaways: Agentic RAG in eCommerce combines retrieval, generation, and autonomous decision-making, enabling AI systems to plan, reason, and act on real-time data for smarter automation and personalization. This approach powers advanced use cases like dynamic merchandising, personalized recommendations, automated customer care, and intelligent pricing, improving efficiency and customer experience. Enterprises benefit from enhanced operational…