- An Overview of Sustainable Banking: Why It Matters to Go Green

- Sustainability Banking App Ideas for Businesses

- ESG Investment Tracker App

- Carbon Footprint Analyzer App

- Green Lending Marketplace App

- Ethical Savings Gaming App

- Socially Responsible Investing Community

- Impact Investing Platform App

- Green Rewards & Loyalty App

- Spending Planner App

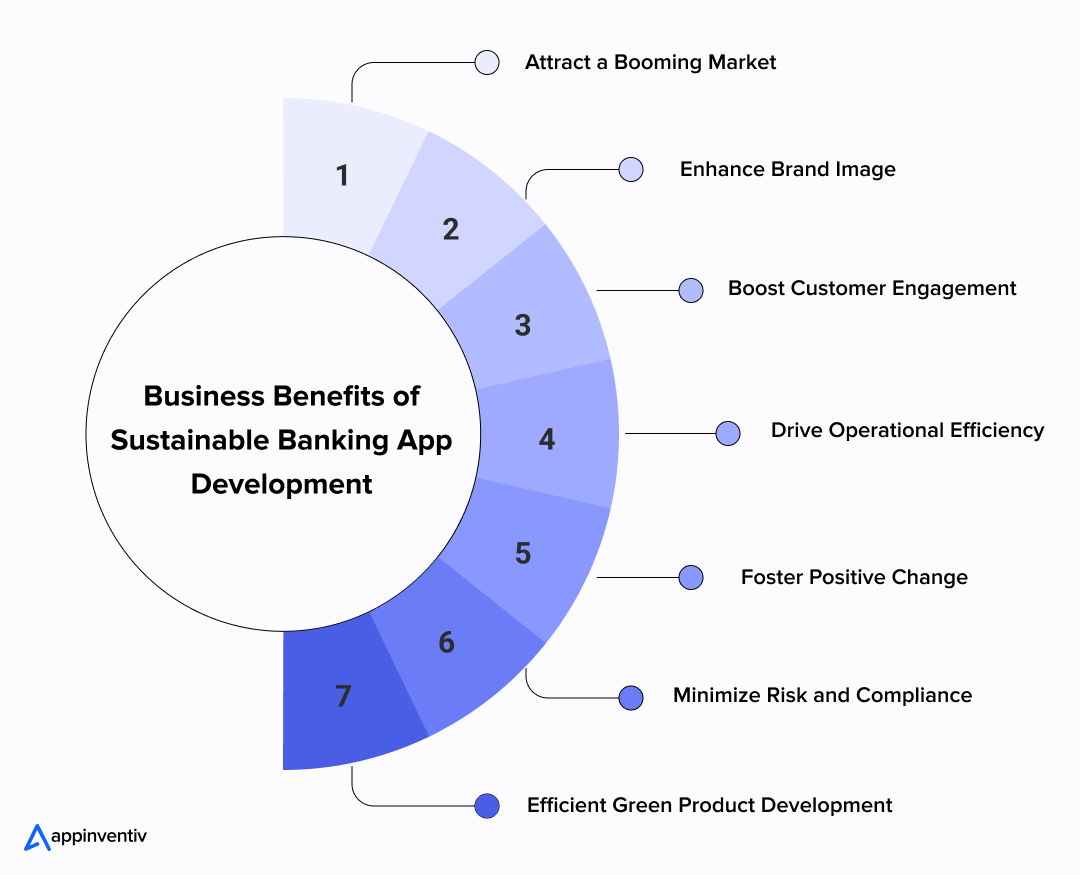

- Benefits of Developing Sustainable Banking Apps for Businesses

- Attract a Booming Market

- Enhance Brand Image

- Boost Customer Engagement

- Drive Operational Efficiency

- Foster Positive Change

- Drive Operational Efficiency

- Minimize Risk and Compliance

- Efficient Green Product Development

- Beyond Benefits: Sustainable Banking Use Cases in the Corporate World

- Green Corporate Lending

- Sustainable Supply Chain Finance

- Green Bonds & Social Bonds

- ESG Integration in Risk Management

- Financing for Sustainable Organizations

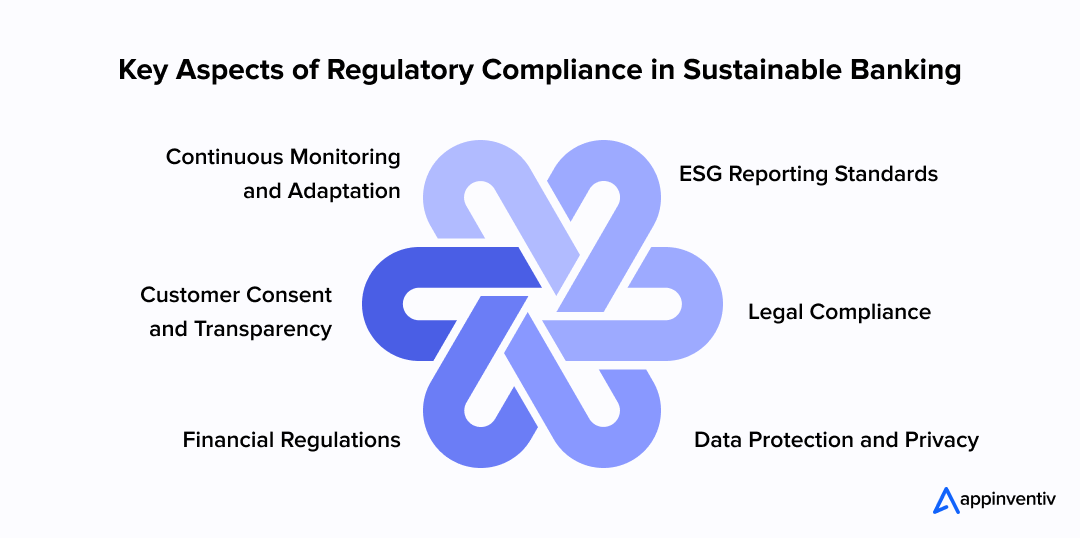

- Understanding Regulatory Compliance for Sustainable Banking

- ESG Reporting Standards

- Legal Compliance

- Data Protection and Privacy

- Financial Regulations

- Customer Consent and Transparency

- Continuous Monitoring and Adaptation

- Seeing Green: Real-World Sustainable Banking in Action

- Triodos Bank (Netherlands)

- Amalgamated Bank (USA)

- State Bank of India (India)

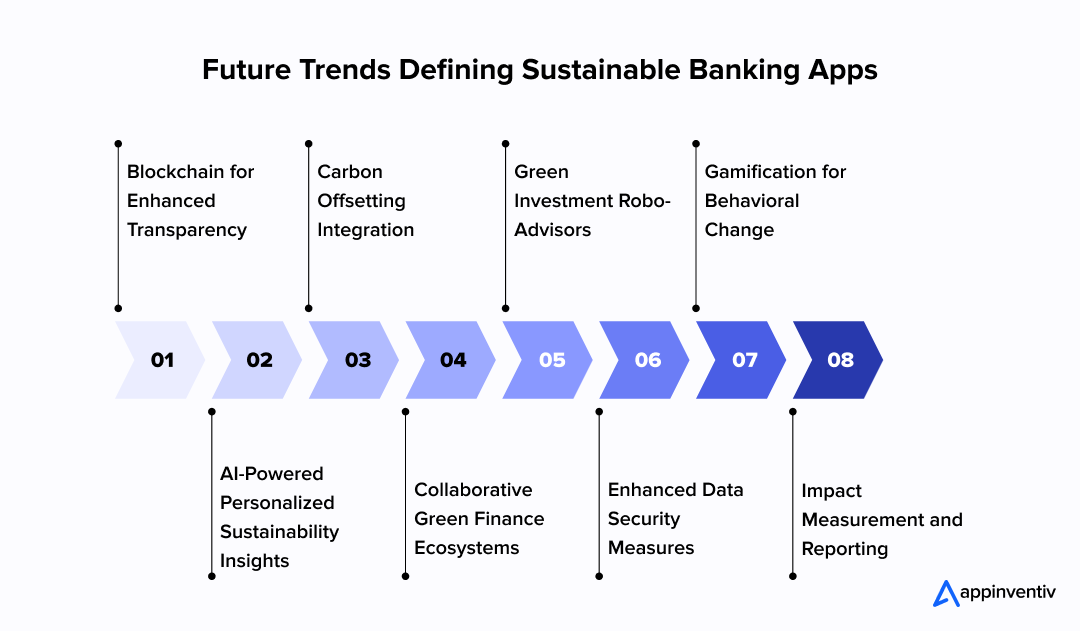

- Future Trends for Sustainable Banking Apps: Redefining Green Finance

- Blockchain for Enhanced Transparency

- AI-Powered Personalized Sustainability Insights

- Carbon Offsetting Integration

- Collaborative Green Finance Ecosystems

- Green Investment Robo-Advisors

- Enhanced Data Security Measures

- Gamification for Behavioral Change

- Impact Measurement and Reporting

- Navigating the Currents: Challenges and Solutions in Sustainable Banking

- The Murky Waters of ESG Data

- Balancing Today's Gains with Tomorrow's Needs

- The Labyrinth of Regulations

- Avoiding the Trap of "Greenwashing"

- Why is Appinventiv Your Trusted Partner for Sustainable Banking App Development?

- FAQs

- Sustainable banking is a win-win, aligning the financial sector’s growth with global sustainability goals.

- Banks adopting sustainable investment banking practices position themselves to capitalize on growing eco-conscious consumer demand.

- The green banking network is expanding rapidly, with more institutions focusing on green products and sustainable finance solutions.

- Digital innovation and FinTech play a crucial role in advancing sustainable banking, offering scalable and efficient ways to integrate sustainability into financial operations.

- Investing in sustainable finance products not only meets consumer demand but also ensures long-term financial stability and a competitive market edge.

Imagine Maria, who runs a popular coffee shop in Seattle. She sources her beans ethically and dreams of growing her business worldwide. However, when it was time to expand, instead of approaching a traditional bank, she chose a lender that prioritizes sustainable banking, offering special “green loans” for eco-conscious businesses. This loan wasn’t just about money; it helped her install solar panels, which cut energy costs and carbon emissions. It shows how finance can directly help build a better world.

This is the essence of sustainable banking: integrating environmental, social, and governance (ESG) principles into every banking decision. It’s about looking beyond quick profits to create a future where businesses, communities, and the environment all thrive together. From local startups to global enterprises, sustainable banking examples prove it is not just a good idea; it’s smart business.

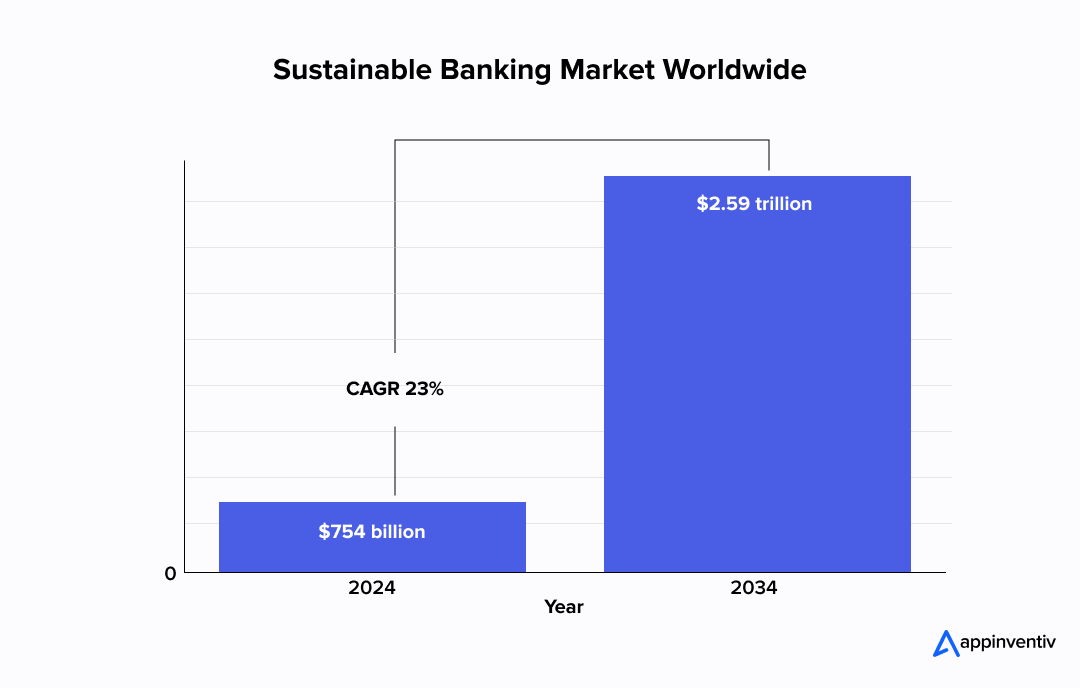

The numbers speak volumes: a Grand View Research report shows it’s set to jump from $754 billion in 2024 to a huge $2.59 trillion by 2030, growing at a rapid 23% annually. Clearly, the old focus on profit alone is changing.

Today, green banking redefines how financial institutions operate, invest, and serve. By weaving in ESG principles, banks are creating innovative sustainable banking solutions and making responsible investments that tackle climate change, promote fairness, and ensure ethical practices. It’s a major shift from traditional models, embracing a complete approach where financial success, a healthy environment, and social well-being are all linked.

In this blog, we’ll dive into how sustainable banking and finance networks are transforming the FinTech world, share real-world green banking examples, and explain why this movement is building a resilient future for the financial sector. Let’s get to it.

Let Appinventiv help you craft eco-friendly solutions that make a real difference.

An Overview of Sustainable Banking: Why It Matters to Go Green

Green banking encompasses sustainable and responsible practices within the banking sector. It involves incorporating ESG criteria into banking operations, advocating for responsible lending, and aligning financial activities with long-term sustainability goals.

Also recognized as a “Green Opportunity” by McKinsey, sustainable banking is experiencing a significant rise in consumer demand for climate-related financial products. The survey revealed that nearly 40% of US consumers are interested in these offerings.

Contrary to the belief that green products are offered at discounts, the survey highlighted that consumers are willing to pay more for products that demonstrate a measurable impact. This indicates a widespread appeal for green offerings in the market. The increasing market share can be attributed to the increasing investments in businesses with sustainable practices.

Another World Bank Report states that Green bonds, which are a key instrument in sustainable banking, have grown from virtually non-existent a decade ago to a $2.5 trillion market in 2023, highlighting the increasing demand for sustainable investment opportunities.

Modern consumers, particularly Gen Z, are driving this transformation. Research shows that 67% of consumers want their banks to implement more environmentally friendly initiatives, from paperless banking to comprehensive carbon offset programs. This demographic shift creates an unprecedented opportunity for forward-thinking financial institutions.

For businesses looking to capitalize on this movement, partnering with an experienced FinTech app development company is crucial to build next-gen eco-friendly platforms. By getting innovative fintech solutions, modern enterprises can distinguish themselves from their competitors and meet the ever-changing demands of environmentally conscious consumers. Let’s know in detail how implementing eco-friendly applications contributes to long-term success.

[Also Read: From Idea to Launch, Know How to Start a FinTech Company]

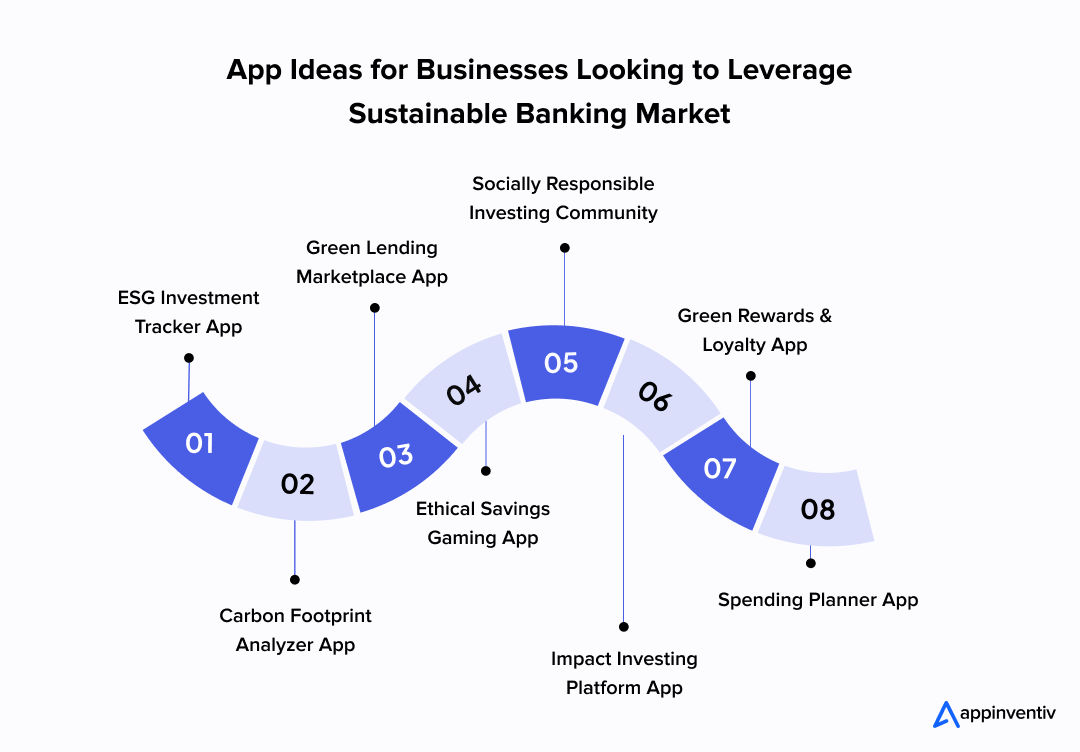

Sustainability Banking App Ideas for Businesses

Now that you know the benefits of leveraging sustainability in the banking industry, let’s uncover some ideas for sustainable banking solutions development. These ideas will help enhance your offerings, improve customer engagement, and have a positive impact on both the environment and society.

ESG Investment Tracker App

Imagine giving users a clear window into their ESG investments. Businesses can create an ESG Investment Tracker App where folks can watch and manage their portfolios, getting real-time updates on how their chosen companies perform on environmental, social, and governance factors.

How will it work?

This app helps users make truly informed investment choices that align with their personal values. By offering clear insights and championing responsible investing, businesses can easily meet the growing demand for such tools. This ultimately earns customer trust and builds lasting loyalty in sustainable investment banking.

Carbon Footprint Analyzer App

Looking for clever sustainability banking app ideas? Why not build an app that crunches a user’s carbon footprint? It’d analyze their spending habits, travel choices, and energy use. With a bit of AI smarts, the app could even pinpoint areas to improve and offer personalized tips to shrink its impact. It can even suggest renewable energy plans or carpooling.

How will it work?

The app will empower customers to really own their environmental impact. It’ll give them practical steps to reduce it, allowing businesses to stand beside them as a genuinely eco-conscious partner on their journey toward a greener lifestyle.

[Also Read: Building Energy Management Systems for Carbon Neutrality]

Green Lending Marketplace App

Businesses have the opportunity to develop a platform that connects users with banks or lenders specializing in green and sustainable lending. This platform can simplify the loan application process, providing convenient access to financing for eco-friendly initiatives such as home solar installations or electric vehicle purchases.

How will it work?

The app will provide a user-friendly interface for individuals interested in exploring loan options designed for environmentally conscious projects. By tapping into this market, businesses can leverage the growing demand for eco-friendly financing and position themselves as facilitators of positive change.

Ethical Savings Gaming App

Here’s another solid idea for sustainability banking apps: an ethical savings gaming app. Businesses could create an interactive mobile app that makes achieving savings goals fun, all while incorporating ethical considerations. Users would earn rewards for choosing sustainable and ethical savings options as they set and achieve their savings targets.

How will it work?

The app would weave in gaming elements, inviting users on an ethical savings journey complete with achievable milestones and rewards. By using this gamified approach, businesses can promote ethical finance and environmental awareness. It helps them engage users effectively and become leaders in promoting both financial and environmental well-being.

Socially Responsible Investing Community

Businesses have the opportunity to drive innovation by creating a social platform that allows users to connect, share insights, and collaborate on socially responsible investing strategies. This platform fosters a strong sense of community among users who share common values, serving as a central hub for discussions on sustainable finance trends.

How will it work?

The app will enable businesses to demonstrate their dedication to sustainable finance and engage with an expanding community of environmentally conscious investors. This initiative strengthens the business’s position as a catalyst for positive change.

Impact Investing Platform App

Imagine building a dedicated platform that directly links investors with truly impactful sustainable projects. This could be a powerful bridge for sustainable investment banking, letting both individuals and institutions put their money into initiatives with clear environmental or social benefits. Examples include new renewable energy farms, sustainable farming efforts, or affordable housing. It goes beyond general ESG funds to offer direct, tangible investment opportunities.

How will it work?

The app would feature a curated marketplace of pre-vetted sustainable projects, complete with detailed impact reports, financial projections, and transparency metrics. Users could browse, invest directly (via equity, debt, or crowdfunding models), and then track the real-world progress and impact of their chosen ventures.

Green Rewards & Loyalty App

Businesses could create an innovative app that actually rewards users for making environmentally conscious financial decisions. This goes beyond just tracking spending; it actively encourages greener choices through banking products. Picture earning points for using public transport, opting for paperless statements, or investing in green and sustainable banking products. These points could then be swapped for eco-friendly goods, donated to environmental charities, or even used for discounts on green services.

How will it work?

The app would connect with a user’s bank accounts, keeping track of specific behaviors (such as lower utility bills or opting for digital banking). A points system, badges, and leaderboards could make the experience fun and tangible, turning sustainability into a rewarding journey. Users would also get personalized tips for even greener financial actions.

Spending Planner App

Businesses could innovate by crafting an app that sorts a user’s spending based on its environmental and social effects. Using machine learning, the app would suggest sustainable alternatives and reveal the social and environmental consequences tied to each spending category.

How will it work?

This app uses advanced data analysis to sort spending patterns, giving users a detailed look at the impact of their financial choices. It makes the experience more engaging for users and solidifies a business’s dedication to ethical and sustainable finance practices, ultimately drawing more attention in the market.

It is vital to understand that each of these sustainable FinTech app ideas will address the changing needs within the FinTech space. Investing in these digital solutions can help businesses meet consumer expectations and contribute to a positive environmental impact that can easily enhance their brand reputation.

Benefits of Developing Sustainable Banking Apps for Businesses

The business case for sustainability in financial services extends far beyond moral imperatives. Here’s why sustainable banking represents one of the most compelling opportunities in the economic landscape:

Attract a Booming Market

Sustainable banking apps speak directly to eco-conscious consumers – a market segment that’s growing incredibly fast. By going green, businesses can really stand out from the competition and draw in this expanding customer base. It’s simply smart business.

Enhance Brand Image

Developing innovative apps that highlight your commitment to sustainability truly strengthens your brand. It not only showcases responsible banking but also draws in socially aware investors and top talent. By leading in this space, you build trust and become known as a reliable, responsible brand.

Boost Customer Engagement

You’ll find users more engaged with interactive features like tracking their progress, earning gamified rewards, and getting personalized impact reports. These elements aren’t just for boosting app usage; they genuinely make customers happier and more satisfied.

Drive Operational Efficiency

Adopting sustainable practices often smooths out internal processes and helps you use resources more efficiently. For example, building financial tools that promote paperless transactions directly cuts down on operational costs and lessens your environmental footprint.

Foster Positive Change

Businesses hold the power to spark real positive change, simply by empowering customers to make thoughtful, eco-conscious choices. Think of sustainable banking apps as catalysts for a more responsible financial world, actively shaping a greener future. Giving customers the right information and tools for sustainable financial decisions creates a beautiful ripple effect across society.

Drive Operational Efficiency

Sustainable practices often lead to streamlined processes and resource optimization. For example, businesses can develop financial tools that promote paperless transactions, thereby reducing operational costs and environmental impact.

Minimize Risk and Compliance

Getting ahead by weaving ESG principles into your core business operations is key to sidestepping environmental and social risks. With sustainable banking apps, you can even automate compliance checks and reporting. This smart move keeps your business in line with regulations, saving time and resources, and steering clear of potential headaches.

Efficient Green Product Development

FinTech is a game-changer here: it lets you build and launch innovative sustainable banking products—like green loans, carbon-offsetting debit cards, or platforms for impact investing—at a remarkable pace. The real bonus? This often comes with much lower operational costs compared to older, traditional systems.

Now that we have looked into the multiple benefits of sustainable banking app development, let’s dive into more details on compliances that ensure businesses align with environmental, social, and governance (ESG) principles.

Beyond Benefits: Sustainable Banking Use Cases in the Corporate World

While we often talk about apps making green banking easier for everyday users, its real influence stretches much further, deeply reshaping how banks work with businesses. This is not just about consumer convenience; it’s about shifting the very foundation of corporate finance. With that said, let’s dive deeper into some significant sustainable banking use cases.

Green Corporate Lending

Banks are increasingly offering sustainable banking products like special green loans or loans tied to sustainability goals for companies. These often come with better terms if the borrower meets specific ESG performance targets – such as reducing emissions, improving worker conditions, or adopting a circular economy model.

Sustainable Supply Chain Finance

Financial institutions are creating solutions to help companies fund their supply chains in a greener way. This might mean offering better financing to suppliers who meet certain ESG criteria, or even using blockchain to track ethically sourced materials transparently.

Green Bonds & Social Bonds

A core component of sustainable investment banking involves banks helping companies issue green and social bonds. These specifically raise money for environmental or social projects – like building renewable energy plants or affordable housing. It’s about directing huge amounts of capital towards initiatives that make a real difference.

ESG Integration in Risk Management

Banks are now weaving ESG criteria right into how they assess credit and manage overall risk. This involves carefully looking at climate risks within a loan portfolio or the social risks linked to a particular industry. It ensures a more complete and robust approach to finance, making the bank more resilient.

Financing for Sustainable Organizations

Beyond just funding individual projects, banks are becoming true partners for sustainable organizations. They offer comprehensive financial services specifically designed for businesses with strong ESG commitments, helping them grow and reach their broader sustainability goals.

Now that you know all the nitty-gritty of sustainability in financial services, odds are optimum that you like leveraging these advantages for your business. So, if you are looking for ways to build green apps for your organization but are not sure how to do it right, our Green App Development Guide is for you. It covers everything – process, cost, challenges, and more – to make an informed decision.

Understanding Regulatory Compliance for Sustainable Banking

The regulatory landscape for green banking continues evolving rapidly, requiring businesses to stay ahead of complex and often overlapping requirements. Understanding these frameworks is crucial for any organization developing sustainable banking solutions. Let’s examine multiple aspects of regulatory compliance in sustainability in financial services.

ESG Reporting Standards

Sustainable banking apps must transparently communicate their environmental and social impact. Established frameworks like the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD) provide comprehensive guidelines for ESG reporting. These frameworks define metrics and methodologies for evaluating sustainability performance, increasing the overall investor and stakeholder confidence.

Legal Compliance

Navigating the legal landscape is crucial when businesses are considering diving into sustainable banking app development. Apps must comply with relevant financial and environmental regulations, encompassing areas like ethical investments, responsible lending, and environmental protection. It is vital to understand that ensuring legal compliance safeguards both users and the business.

Data Protection and Privacy

The protection of financial and personal data is of utmost importance due to its sensitive nature. To ensure this, it is crucial to implement robust data protection measures, such as those outlined in the General Data Protection Regulation (GDPR). These measures establish stringent standards for secure data handling and user privacy.

Implementing robust cybersecurity protocols, obtaining informed consent for data usage, and providing clear disclosures on data practices are essential elements that can help businesses in building user trust.

Financial Regulations

It is essential to adhere to regional financial regulations, which cover digital transactions, online banking, and financial data security. By complying with these regulations, a sustainable FinTech app can demonstrate responsible financial conduct and uphold financial security.

Customer Consent and Transparency

In order to comply with regulations, it is necessary to obtain customer consent for data usage and provide clear explanations on how the information is utilized. To empower users and enable them to make informed decisions about their participation, it is crucial to have user-friendly privacy policies and accessible data management tools.

With the integration of technology in sustainability banking, users can have control over their data and exercise their rights effectively.

Continuous Monitoring and Adaptation

As the sustainable banking regulatory landscape continues to evolve, it is crucial to stay informed about new regulations and adjust practices accordingly. Implementing effective monitoring systems to manage regulatory analysis ensures the app remains compliant over time.

By building compliance into the foundation of sustainable banking applications, businesses can focus on innovation while maintaining the trust and legal protection essential for long-term success.

Seeing Green: Real-World Sustainable Banking in Action

It’s one thing to talk about green banking in theory, quite another to see it alive and thriving in the real world. From specialized ethical lenders to large financial players, many banks are showing us how sustainability in the financial sector isn’t just a concept, but a powerful, tangible force for good. Here are a few examples that truly stand out, demonstrating various ways banks are embracing green and sustainable banking:

Triodos Bank (Netherlands)

If you’re looking for a pioneer, look no further than Triodos Bank. They are well-known for their incredible transparency, letting you see exactly where your money goes – funding everything from renewable energy projects to organic farms. It’s all about making a clear, positive social and environmental impact.

Amalgamated Bank (USA)

They call themselves “the bank for change-makers,” and for good reason. Amalgamated Bank runs on 100% clean energy and has been carbon neutral for years. Beyond their own operations, they actively use their funds to back causes that champion workers’ rights, social justice, and environmental protection.

State Bank of India (India)

Even banking giants are going green. SBI was a trailblazer in India, issuing green bonds to fund crucial renewable energy projects. On the operational side, they’ve rolled out “Green Channel Counters” for paperless banking and even invested in windmills to power their own branches. It shows their comprehensive commitment to green and sustainable banking.

Future Trends for Sustainable Banking Apps: Redefining Green Finance

The future of sustainable banking apps is bound to empower environmentally conscious users and bring about positive change. Let’s explore some technological innovations in green banking that will shape this evolving FinTech landscape.

Blockchain for Enhanced Transparency

Sustainable FinTech apps leverage blockchain technology to ensure verifiable tracking of financial transactions and supply chains. Businesses can adopt blockchain solutions to ensure transparency in their operations, build trust, and facilitate responsible green investments.

AI-Powered Personalized Sustainability Insights

The future of sustainable banking is bound to be revolutionized by AI-powered apps. Artificial intelligence will provide users with tailored suggestions for eco-friendly choices. Businesses can integrate AI-driven analytics into their apps to offer personalized insights on carbon footprint reduction, green investment opportunities, and sustainable lifestyle practices.

Also Read: How Do Green AI Applications Support Sustainability?

Carbon Offsetting Integration

Businesses are expected to incorporate carbon offsetting options within their app functionalities that will empower users to compensate for their carbon footprint while managing their finances.

Collaborative Green Finance Ecosystems

Some reports suggest that collaboration platforms that connect users, businesses, and environmental organizations will emerge. Businesses can explore collaborations within the sustainable finance ecosystem, creating platforms that promote collective impact and user engagement.

Green Investment Robo-Advisors

Robo-advisors that specialize in green and ethical investments are bound to gain traction in the future. Businesses can integrate green investment robo-advisory features into their apps, providing users with automated, sustainable investment guidance.

Enhanced Data Security Measures

Robust data security will be paramount when it comes to sustainable banking apps. Businesses can adopt advanced encryption technologies and biometric authentication in their apps to ensure the security of sensitive financial and personal data, building user trust.

Gamification for Behavioral Change

Gamification techniques will be employed to monetize sustainable financial behaviors. Businesses can integrate gamified elements into their apps, motivating users to make eco-conscious choices through rewards and challenges.

Impact Measurement and Reporting

Sophisticated impact measurement and reporting tools will be developed. Businesses can enhance their apps with tools that provide users with detailed insights into the environmental and social impact of their financial decisions.

Our services can propel your business in the flourishing world of sustainable finance!

Navigating the Currents: Challenges and Solutions in Sustainable Banking

The journey towards fully integrated sustainable banking, much like navigating a vast ocean, isn’t without its storms. Yet, with clear purpose and advanced strategies, financial institutions can overcome these challenges, ensuring that sustainable finance and banking become not just a noble aspiration but a robust reality.

The Murky Waters of ESG Data

One of the biggest hurdles in sustainability in the financial sector is simply getting good, consistent data. Companies often report their environmental and social impact differently, making it challenging for banks to accurately assess risks or measure their impact.

Solution:

- Invest in AI and machine learning for data collection and analysis.

- Form strategic FinTech partnerships for specialized analytics.

Balancing Today’s Gains with Tomorrow’s Needs

Traditional banking often fixates on quick profits. Shifting to sustainable banking, which involves long-term investments in green projects, can feel like a conflict, raising the dilemma: “Do we focus on today’s bottom line or tomorrow’s greener world?”

Solution:

- Develop some sustainable banking products like green bonds that create lasting financial strength.

- Utilize a smart pricing strategy for green banking to benefit both planet and profit.

The Labyrinth of Regulations

The rules governing sustainable finance in banking are constantly changing and vary widely across different countries. Navigating this complex, fragmented patchwork of disclosures and compliance standards is incredibly demanding for global banks.

Solution:

- Establish dedicated ESG compliance teams.

- Leverage AI-powered intelligent applications to track and automate reporting.

Avoiding the Trap of “Greenwashing”

With growing interest in sustainable banking, there’s also the danger of “greenwashing”—when a bank or product claims to be eco-friendly without genuinely delivering. This erodes trust and can lead to serious reputational damage.

Solution:

- Implement stringent internal controls and third-party verification for sustainable banking solutions.

- Communicate clearly and honestly, avoiding vague environmental jargon, to build integrity in green and sustainable banking.

Why is Appinventiv Your Trusted Partner for Sustainable Banking App Development?

With all the evidence mentioned above in this blog, which reflects how crucial green banking is for today’s eco-conscious consumers and forward-thinking companies alike, it’s clear: the future of finance is green, and the time to act is now.

Here at Appinventiv, we truly get it. As a leading provider of FinTech app development services, we possess an in-depth understanding of ESG principles integral to sustainable banking. Our team of 1600+ tech experts can seamlessly integrate these principles into the banking apps, providing you with a next-gen platform that not only meets today’s regulatory standards but also addresses tomorrow’s demands.

With a proven track record of delivering 3000+ successful solutions for diverse industries, including banking and finance, we can be your trusted tech partner to transform your sustainable banking visions into reality and drive a greener future.

Get in touch with our team now and learn how we can propel your business to the forefront of green banking.

FAQs

Q. What is sustainability in banking?

A. Sustainability in the banking industry means integrating social, environmental, and governance (ESG) values into the core operations of banks. This includes responsible lending, prioritizing investments aligned with long-term environmental and social goals, and promoting eco-conscious practices in the financial ecosystem.

Q. How can sustainable banking benefit businesses?

A. Sustainable FinTech development offers multiple benefits for businesses. It not only enhances brand image but also attracts customers who prioritize responsible banking practices. Additionally, sustainable banking principles can drive operational efficiency by streamlining processes and promoting sustainable practices, leading to cost savings.

Q. How does sustainable banking differ from traditional banking?

A. Traditional banking primarily focuses on maximizing financial returns for shareholders, often with a narrower view of risk and impact. Its success metrics are largely confined to economic indicators.

On the other hand, green banking broadens this scope significantly. While still aiming for profitability, it intentionally considers ESG factors as core to its decision-making. This means assessing the environmental footprint of loans, the social impact of investments, and the governance practices of client companies.

Traditional banking might lend to a coal-fired power plant if it’s profitable; sustainable banking prioritizes funding renewable energy projects. It’s a fundamental shift from a purely transactional model to one that seeks to create shared value, understanding that long-term financial health is intrinsically linked to environmental and social stability.

Q. What are the emerging trends for sustainable banking in 2025?

A. In 2025 and beyond, sustainable banking is poised for dynamic evolution, driven by technological advancements and heightened global awareness. Key emerging trends include:

- Hyper-personalized Green Products

- Advanced ESG Data and Reporting

- Deep Integration of Climate Risk

- Blockchain for Transparency

- Nature-Positive Finance

- The Rise of Circular Economy Finance

Q. What is the role of digital innovation and FinTech in advancing sustainable banking?

A. Digital innovation and FinTech play crucial roles in advancing green banking by making ESG principles accessible, measurable, and actionable for everyday consumers. Technology enables real-time carbon footprint tracking, automated ESG compliance monitoring, transparent impact reporting, and personalized recommendations for sustainable financial decisions.

FinTech solutions also democratize access to sustainable banking products, allowing smaller institutions to compete with larger banks in offering comprehensive ESG-focused services. Open banking initiatives and API integrations are fostering collaborative green finance ecosystems that amplify the impact of individual sustainable choices through connected financial networks.

Q. What is the cost of sustainable banking app development?

A. The cost of sustainable banking app development varies widely, much like building a house! A basic sustainable banking app for carbon footprint analysis or ethical savings might cost $40,000 – $90,000. However, for complex platforms with AI, real-time ESG tracking, or a comprehensive green lending marketplace, the cost ranges from $100,000 to over $400,000. Factors like features, design, and security all play a big role in determining sustainable banking app development costs.

Q. What is the timeline for implementing sustainability in financial services?

A. Implementing sustainability in financial services is a journey, not a sprint. It typically unfolds in stages:

- Awareness & Assessment: 1-2 months to understand current impact.

- Strategy Design: 2-3 months to set goals and governance.

- Integration & Implementation: 3 months to 1 year to embed ESG into operations, launch sustainable banking products, and refine sustainable banking practices.

- Measurement & Reporting: A continuous process of tracking and transparently communicating progress.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…