- How Blockchain is Revolutionizing Fintech: Understanding the Benefits of Blockchain in the Fintech Industry

- Enhanced Security

- Increased Transparency

- Reduced Costs

- Faster Transactions

- Improved Traceability

- Enhanced Efficiency

- Access to New Markets

- Customization as per Requirements

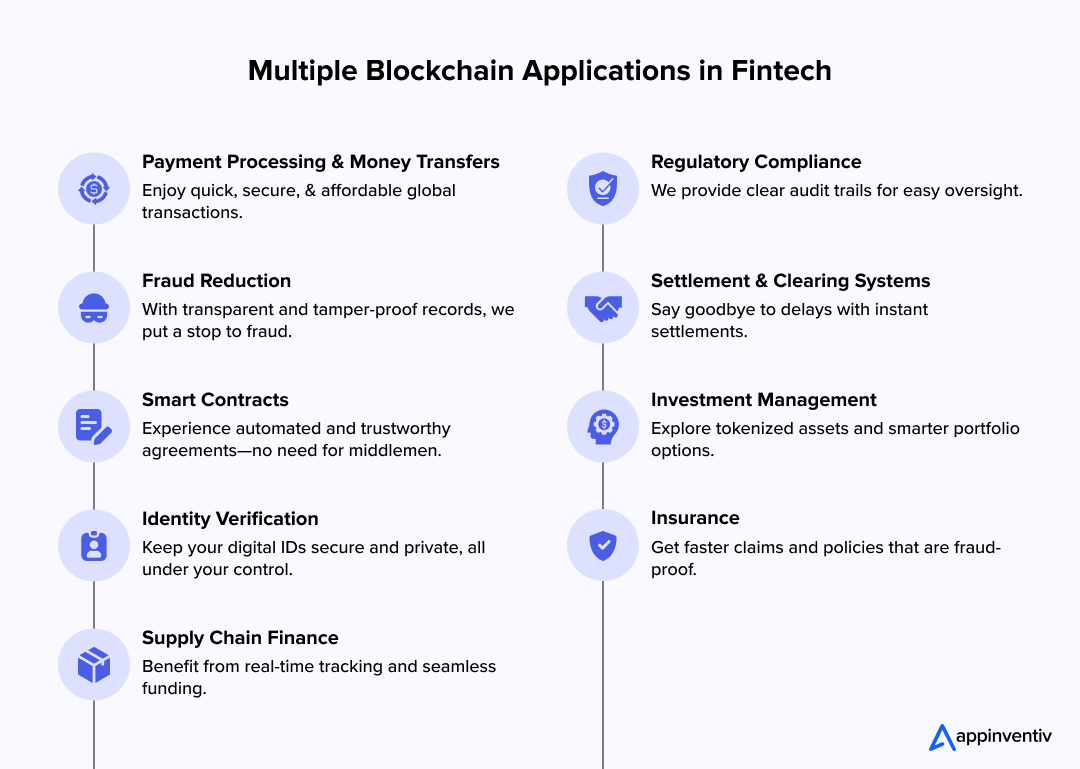

- Use Cases of Blockchain Technology in Fintech: Grasping the Full Spectrum of Disruption and Innovation

- Payment Processing and Money Transfers

- Fraud Reduction

- Smart Contracts

- Identity Verification

- Supply Chain Finance

- Regulatory Compliance

- Settlement and Clearing Systems

- Investment Management

- Insurance

- Challenges with Blockchain in Fintech: Navigating Technical Hurdles

- Regulatory Uncertainty

- Integration with Existing Systems

- Security Concerns

- Privacy Issues

- Energy Consumption

- Lack of Skilled Professionals

- What Should a Blockchain-Based Financial Solution Look Like?

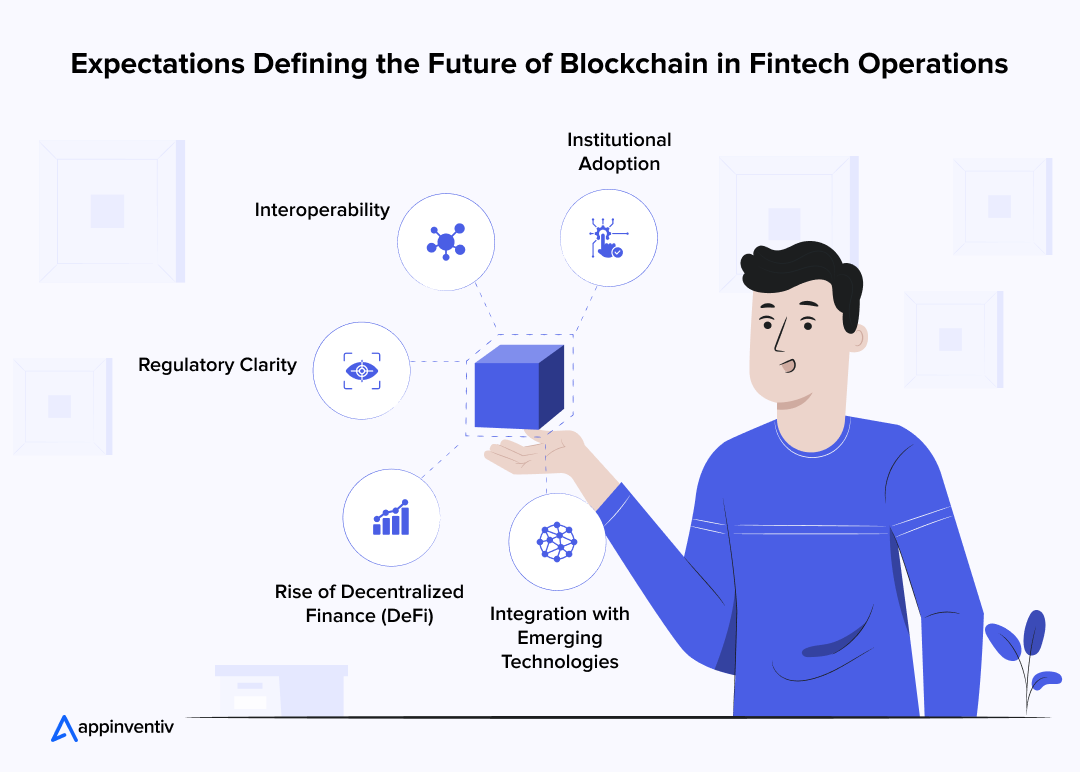

- Future of Blockchain in Fintech: Charting New Horizons

- Institutional Adoption

- Interoperability

- Regulatory Clarity

- Integration with Emerging Technologies

- Rise of Decentralized Finance (DeFi)

- Why Appinventiv is the Most Reliable Partner for Leveraging Blockchain in Fintech

- FAQs

Since its inception, blockchain has been a disruptive technology that has steadily evolved, rising above its origin as the backbone of cryptocurrency transactions to become a transformative force in various industries. One sector where its impact is particularly intense is fintech.

Businesses across this dynamic industry, most commonly known for their rapid adaptation and innovation, have adopted blockchain to revolutionize traditional financial processes, enhancing security, transparency, and efficiency.

As blockchain technology integrates into the fintech ecosystem, it is transforming the traditional financial landscape, which has been long criticized for its lack of transparency and slow transaction speeds. By introducing decentralized ledgers and smart contracts, blockchain streamlines processes, cuts out intermediaries, and speeds up transactions. This transformation enhances efficiency and reduces costs, making high-quality financial services more accessible to a wider audience.

The rise of blockchain in fintech represents more than a passing trend; it has become a significant market force. Industry experts anticipate the fintech blockchain market could reach a valuation of $46.87 billion by 2030. The increasing demand for secure and transparent financial transactions drives this economic growth.

Furthermore, the recent success of World Liberty Financial underscores the significant potential and growing investor confidence in blockchain applications within fintech. As a decentralized finance (DeFi) platform backed by Donald Trump, World Liberty Financial has successfully raised $550 million through token sales, drawing interest from over 85,000 investors.

This monumental fundraising effort highlights the robust market demand and the expanding scope for blockchain innovations in financial services. Simply put, blockchain is now setting the stage for an economic revolution, and frankly, which business don’t want to be a part of that?

In this blog, we will delve into the transformative impact of blockchain in fintech. We will explore how blockchain is applied across various financial services and highlight specific use cases. In addition, we will also discuss the real benefits this technology provides, like improved security and efficiency, and look at the challenges of adopting blockchain in the finance industry.

So, let’s understand how blockchain is reshaping the financial landscape, making it more inclusive, secure, and efficient.

How Blockchain is Revolutionizing Fintech: Understanding the Benefits of Blockchain in the Fintech Industry

Blockchain has enabled inclusive, open, and secure business networks that will allow digital security to be issued within a short period at lower unit costs and greater customization. Over the last few years, blockchain technology in fintech has matured radically. Let’s look at the major benefits of blockchain in the fintech industry below.

Enhanced Security

Blockchain offers robust security by using advanced cryptography to secure data transactions. This makes tampering with records exceedingly difficult, thus safeguarding against fraud and unauthorized activity.

Increased Transparency

All transactions recorded on the blockchain are transparent and easily verifiable by all network participants. This open visibility helps build trust and accountability, as every action is traceable and permanent.

Reduced Costs

Reduced costs are one of the major benefits of blockchain in finance. By eliminating the need for intermediaries such as banks, blockchain in the finance industry reduces the fees typically associated with financial services, lowering the cost for your end users.

Faster Transactions

Blockchain technology in fintech streamlines transaction processes, enabling near-instantaneous settlements, particularly in cross-border transactions, which traditionally take several days.

Improved Traceability

Blockchain creates an immutable audit trail of every transaction, which is especially beneficial for complex financial operations involving multiple parties. This traceability is crucial for compliance, fraud prevention, and verifying the assets’ authenticity.

Enhanced Efficiency

By automating many routine processes through smart contracts, blockchain reduces manual intervention and the potential for human error, thus increasing the overall efficiency of financial operations.

Access to New Markets

Blockchain in the finance industry facilitates easier access to services for people in remote or underserved regions, potentially bringing millions into the formal economy and fostering financial inclusion.

Customization as per Requirements

Thanks to smart contracts, financial products and services can be customized to fit individual needs and executed automatically, providing tailored financial solutions that meet diverse client requirements.

After looking into the major benefits of blockchain in finance, let’s now move ahead and understand the role of blockchain in fintech in detail below.

Use Cases of Blockchain Technology in Fintech: Grasping the Full Spectrum of Disruption and Innovation

Blockchain technology is reshaping the fintech landscape by offering innovative solutions to long-standing challenges. Let’s explore various blockchain use cases in financial services:

Payment Processing and Money Transfers

Blockchain technology facilitates real-time, secure, cost-effective cross-border payments by eliminating traditional banking intermediaries. This streamlined process speeds up transactions and reduces the costs of international transfers.

Real Example: BitPesa

BitPesa, a renowned fintech company, utilizes blockchain technology to enable businesses to send and receive payments to and from Africa easily. By leveraging blockchain, BitPesa provides a faster, more cost-effective alternative to traditional banking and payment services, facilitating transactions in multiple currencies across African countries and beyond.

Also Read: Blockchain in Banking – Key Opportunities and Challenges for Businesses

Fraud Reduction

Fraud reduction is the most sought-after use case of blockchain in the fintech industry. The immutable and transparent nature of blockchain ensures that all transactions are recorded securely and cannot be altered. This significantly reduces the possibility of fraud, as every transaction is verifiable and permanent.

Real Example: JPMorgan

JP Morgan uses blockchain to improve the security of its payment system, reducing the risk of internal fraud and unauthorized alterations.

Smart Contracts

Smart contracts on blockchain automatically execute commercial agreements when predetermined conditions are met without any human intervention. This automation increases efficiency, reduces errors, and ensures compliance with the terms of the contract.

Real Example: Santander

Santander has pioneered the use of blockchain for bond issuance, which automates the execution and settlement of bonds through smart contracts.

Identity Verification

Identity verification is one of the sought-after applications of blockchain in fintech that has paved the way for increased adoption of blockchain-powered solutions. Blockchain provides a secure and efficient method for identity verification by storing personal data on a decentralized network, which can be accessed and verified anywhere without risk of tampering or identity theft.

Real Example: HSBC

HSBC has integrated blockchain to streamline the Know Your Customer (KYC) process, which enhances the security and speed of identity verification while maintaining customer privacy.

Supply Chain Finance

Blockchain enhances transparency and trust in supply chains by providing a permanent, unchangeable record of the transaction history and product provenance, accessible by all parties involved. This capability is vital for financing decisions as it reduces the risk of fraud and ensures that goods are sourced ethically.

Real Example: Ant Financial

Ant Financial uses blockchain to streamline supply chain interactions and finance by providing real-time data on goods as they move through the supply chain, enhancing the reliability of the information for creditors and reducing credit risk.

Regulatory Compliance

Blockchain in fintech can help institutions meet strict regulatory compliance requirements by providing an immutable and transparent record of financial transactions. Blockchain financial technology simplifies providing necessary documentation to regulatory bodies and ensures accuracy and compliance.

Real Example: Goldman Sachs

Goldman Sachs utilizes blockchain technology to manage and report complex derivatives transactions, helping them comply with international regulations that demand high transparency in financial operations.

Settlement and Clearing Systems

Blockchain applications in finance also help with settlement and clearing systems. Blockchain significantly reduces the time and cost of settling and clearing securities, ensuring instant settlements on a secure ledger.

Real Example: Australian Securities Exchange (ASX)

Australian Securities Exchange (ASX) is replacing its current settlement and clearing system with a blockchain-based system to speed up transactions, reduce costs, and enhance the security of trade settlements.

Investment Management

Blockchain enhances investment management by offering a secure, transparent platform for tracking investments and reducing associated transaction fees.

Real Example: Vanguard

Vanguard has integrated blockchain to manage some of its index funds, improving the security and accuracy of its investment records while potentially lowering operational costs.

Insurance

Blockchain technology can transform the insurance industry by making the underwriting and claims process more transparent and efficient.

Real Example: MetLife

MetLife is utilizing blockchain to simplify life insurance claims and automate payments, which helps reduce fraud and improve claims processing efficiency.

After looking into the various examples of blockchain in fintech, let’s move ahead and look into the major challenges of implementing blockchain in fintech.

- JPMorgan: Instant dollar-euro conversions on Kinexys blockchain; processing over $2B daily.

- Visa: Launching a digital token platform with BBVA; pilot scheduled for 2025.

- Mastercard: Crypto Credential service in 13 countries.

- Morgan Stanley: Exploring direct crypto trading.

- Goldman Sachs: Holding $700M+ in spot Bitcoin ETFs and advancing market making.

- BlackRock: Billions in spot Bitcoin ETF investments.

As traditional finance is merging with digital innovation, now is the time to invest in blockchain.

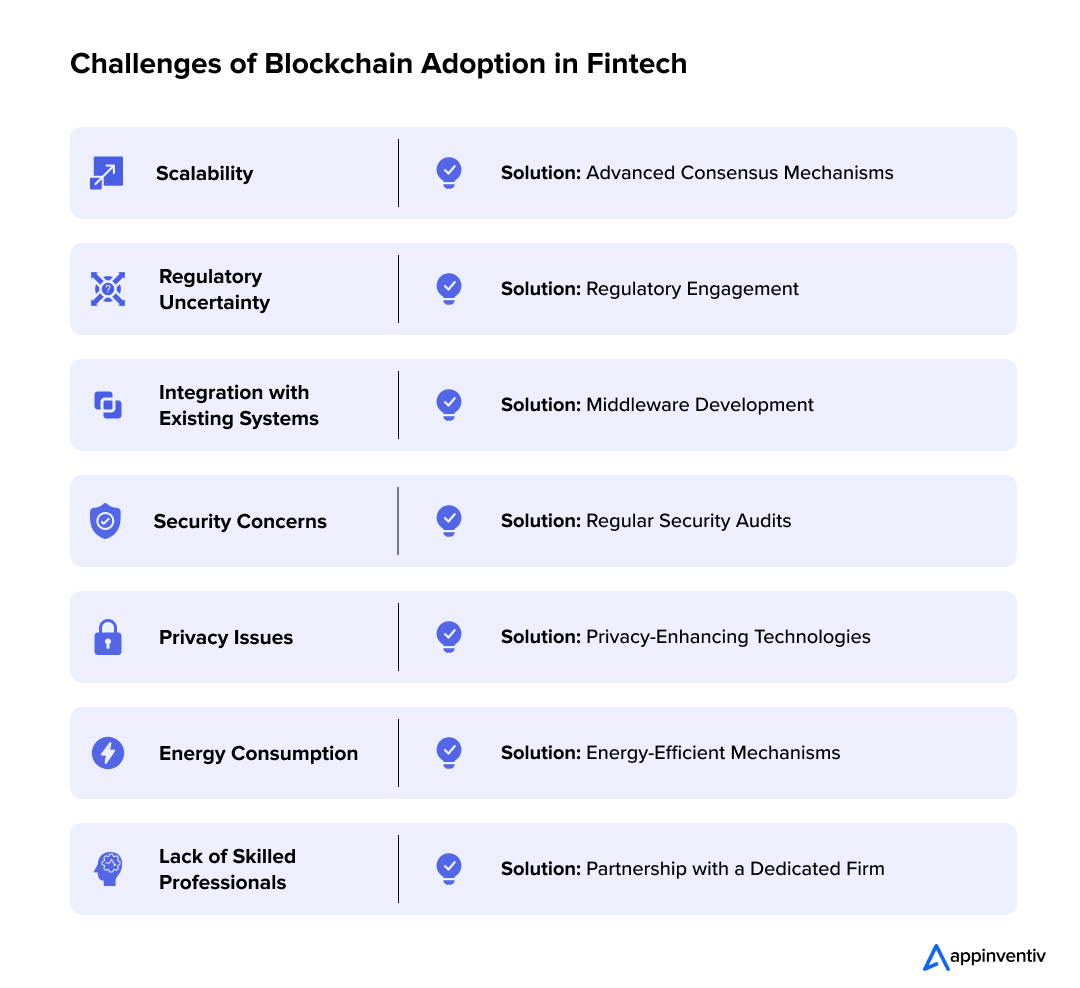

Challenges with Blockchain in Fintech: Navigating Technical Hurdles

Implementing blockchain in fintech brings tremendous benefits, but it also comes with its own set of challenges. Overcoming these challenges is essential for leveraging blockchain’s full potential in financial services.

Scalability

Scalability

Blockchain solutions that use proof of work struggle with transaction speed and network scalability. This can limit its application in high-frequency trading environments or when handling large volumes of transactions.

Solution: Implementing newer consensus mechanisms can help improve transaction speeds and scale the network to handle more transactions simultaneously.

Regulatory Uncertainty

The regulatory environment for blockchain is always evolving, which creates uncertainty for fintech companies. This lack of clarity can hamper the adoption as firms may be unsure of the legal implications of deploying blockchain financial technology solutions.

Solution: Active engagement with regulatory bodies and participating in blockchain standards development can help shape the regulatory landscape and clarify compliance requirements.

Integration with Existing Systems

Integrating blockchain technology with existing financial systems can be complex and costly. Legacy systems are not always compatible with new blockchain solutions, which can lead to significant operational challenges.

Solution: Developing middleware and APIs that seamlessly connect blockchain platforms with existing financial systems can mitigate integration issues, ensuring smoother transitions and functionality.

Security Concerns

While blockchain is known for its security, it is still susceptible to vulnerabilities such as code flaws or security breaches at the endpoint level.

Solution: Regular security audits, employing best practices in cybersecurity, and training staff on blockchain security measures can help strengthen the overall security of implementing blockchain in the finance industry.

Privacy Issues

Privacy is one of the main challenges of integrating blockchain in fintech. Blockchain’s transparency can sometimes be at odds with privacy requirements, especially in sectors like finance, where confidentiality is crucial.

Solution: Utilizing privacy-enhancing technologies such as zero-knowledge proofs or private channels within blockchain frameworks can help reconcile the need for transparency with privacy demands.

Energy Consumption

The high energy consumption associated with some blockchain operations, especially those relying on extensive computational work for mining, raises sustainability concerns.

Solution: Shifting towards more energy-efficient consensus mechanisms like proof of stake or using renewable energy sources for mining operations can help reduce the carbon footprint of blockchain activities.

Lack of Skilled Professionals

There is a lack of skilled professionals who understand the applications of blockchain in the fintech market, which can slow down development and innovation.

Solution: Partnering with a firm that offers dedicated blockchain app development services across similar projects can help businesses leverage a pool of proficient talent in blockchain technology and financial applications, fostering faster and more innovative development.

These firms can help businesses understand the importance of blockchain in fintech and guide them in developing robust, future-proof solutions. Companies can overcome talent gaps, accelerate innovation, and stay competitive in the evolving digital landscape by offering expert advice, tailored strategies, and ongoing support.

What Should a Blockchain-Based Financial Solution Look Like?

In an era where digital innovation is key, a blockchain-based financial solution can revolutionize the way transactions and data handling are conducted in the fintech industry. To truly harness the potential of blockchain technology in finance, it’s crucial to understand what features such a solution should encompass.

| Feature | How does it help? |

|---|---|

| Distributed Ledger | Utilizes a ledger maintained across multiple nodes to ensure transparency and redundancy. |

| Cryptographic Security | Employs advanced cryptographic techniques to secure data and transactions against tampering and fraud. |

| Consensus Algorithms | Uses mechanisms like Proof of Work or Proof of Stake to validate transactions and maintain ledger integrity. |

| Smart Contracts | Enables automatic execution of contractual terms and conditions embedded in code on the blockchain. |

| Peer-to-Peer Network | Operates on a decentralized network that allows direct interaction between participants without intermediaries. |

| Cross-Chain Interoperability | Supports transactions and interactions across different blockchain systems, enhancing flexibility. |

| Data Masking | Helps meet compliance and privacy requirements. |

| Asset Tokenization | Allows physical and digital assets to be represented and traded on the blockchain. |

| API Integrations | Provides interfaces for integrating with external systems and applications, broadening usability. |

Future of Blockchain in Fintech: Charting New Horizons

Blockchain continues to gain traction in the fintech world, driving innovation in areas like digital payments, lending, and asset management. As the technology matures, it is expected to give rise to entirely new financial models that redefine how we transact and invest.

Institutional Adoption

Major banks and financial institutions will increasingly deploy blockchain to streamline complex transactions. This will lead to faster settlements, reduced costs, and greater trust among global stakeholders.

Interoperability

Different blockchain networks will work more harmoniously, allowing data and assets to move seamlessly across platforms. This unified infrastructure will pave the way for broader, more efficient digital markets.

Regulatory Clarity

Governments worldwide are expected to introduce clearer guidelines for blockchain-based financial services. As regulations solidify, more traditional businesses will confidently explore blockchain solutions.

Integration with Emerging Technologies

Blockchain will merge with AI, IoT, and other cutting-edge tools to create advanced fintech ecosystems. This can unlock powerful new applications, offering automated lending, autonomous supply chain finance, etc.

Rise of Decentralized Finance (DeFi)

DeFi platforms will continue evolving, offering innovative products like yield farming, decentralized exchanges, and peer-to-peer lending. This expansion of the blockchain in the finance industry will open the financial system to more participants, fostering greater inclusivity.

Why Appinventiv is the Most Reliable Partner for Leveraging Blockchain in Fintech

We hope this blog has helped you understand how blockchain revolutionizes the financial industry, introduces efficiencies, enhances security, and provides unprecedented transparency. With its vast potential to disrupt and innovate, now is the ideal time to leverage blockchain technology in finance. Embracing this technology can set your operations apart, offering cutting-edge solutions to your clients.

If you want to harness blockchain’s power, partnering with a reliable and experienced firm like Appinventiv is your ideal solution. As a leading blockchain development company, we stand out with our deep expertise and a proven track record of successful blockchain implementations across various sectors, including fintech.

Our team has extensive knowledge and practical experience developing and deploying blockchain solutions. Whether it’s creating secure platforms for transactions, integrating smart contracts, or ensuring compliance with global financial regulations, we can help you cover all bases.

As a dedicated fintech software development company, we will work closely with you to understand your specific needs and tailor our solutions to meet your requirements effectively. We recently developed a blockchain-based Empire hotel booking app that allowed users to make hotel bookings without involving any direct or indirect intermediaries, thereby eliminating unjustified money transactions.

Contact us to explore how blockchain technology in fintech can transform your service offerings and give you a competitive edge in the rapidly Evolving landscape fintech startup ideas.

FAQs

Q. What is blockchain in fintech?

A. Blockchain in fintech refers to using blockchain technology to improve financial services. It provides a secure, decentralized way to record transactions and manage data without relying on traditional middlemen. By automating processes with smart contracts and creating tamper-proof records, blockchain helps reduce costs, speed up transactions, and boost transparency.

Q. How blockchain is changing finance?

A. Blockchain technology is significantly reshaping the fintech industry. Eliminating the need for middlemen helps reduce costs and speeds up transactions. It also enhances the identity verification, making it quicker and more secure. These improvements, coupled with blockchain’s security and transparency, are helping to modernize financial services, making them more efficient and accessible to a broader audience.

This digital transformation opens up new possibilities for innovation in financial transactions and services, setting the stage for a more connected and technologically advanced financial landscape.

Q. Which Blockchain platform is best for the financial service industry?

A. Ethereum, Hyperledger Fabric, Quorum, Corda, and Ripple are some of the blockchain platforms that can be considered for revamping financial services. However, it is best to understand the potential of each and choose the platform that boosts your business growth.

Q. How to integrate blockchain in a finance app?

A. There are various ways to integrate blockchain technology in finance apps. However, they are quite complex and tricky. So, it is advised to turn towards leading blockchain and fintech applications development companies with extensive experience in this field. These companies can offer customized blockchain solutions tailored to your app’s requirements.

They can ensure secure, efficient, and scalable integration that aligns with your financial operations and objectives. Partnering with an esteemed blockchain consulting company will also provide access to ongoing support and updates, which is crucial for maintaining the functionality and security of your blockchain applications as technology evolves.

Q. What is the difference between fintech and blockchain?

A. Fintech and blockchain are related but different. Fintech stands for financial technology and refers to any technology used to improve financial services, like digital banking, online trading, or mobile payments. Blockchain is a type of technology known mainly for supporting cryptocurrencies like Bitcoin.

It works as a secure, decentralized record of transactions spread across many computers. While blockchain in fintech can make transactions safe and transparent, fintech includes a wide range of technologies, not just blockchain.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does It Cost to Develop a Crypto Wallet App Like Metamask?

Key takeaways: Developing a MetaMask-like crypto wallet can cost anywhere from $30,000 to $250,000+, depending on the complexity of features and integration. The cost breakdown includes development, security, integration with blockchain networks, and ongoing maintenance. A customized wallet opens up new revenue opportunities, brand differentiation, and long-term business growth. Since its launch in 2016, MetaMask…

How Much Does it Cost to Build a Blockchain App in the UAE?

Key takeaways: The UAE blockchain market is rapidly expanding, with the BFSI sector capturing over 50% of the market share. As blockchain adoption accelerates, development costs in the UAE range from AED 55,000 to AED 1.85 million, depending on app complexity and features. Factors such as platform selection, security measures, and third-party integrations directly impact…

How Blockchain Integration Is Optimizing Business Processes in Dubai

Key takeaways: Blockchain is a strategic enabler in Dubai, transforming traditional business workflows by enhancing efficiency, transparency, and automation beyond cryptocurrency applications. Dubai’s supportive regulatory environment and government initiatives (e.g., VARA, Dubai Blockchain Strategy) create a clear, innovation-friendly framework, accelerating blockchain adoption. Integration with legacy systems through modular blockchain solutions enables enterprises to modernize operations…