- How Can Enterprises Define Approaches to Implementing Smart Contracts in Insurance?

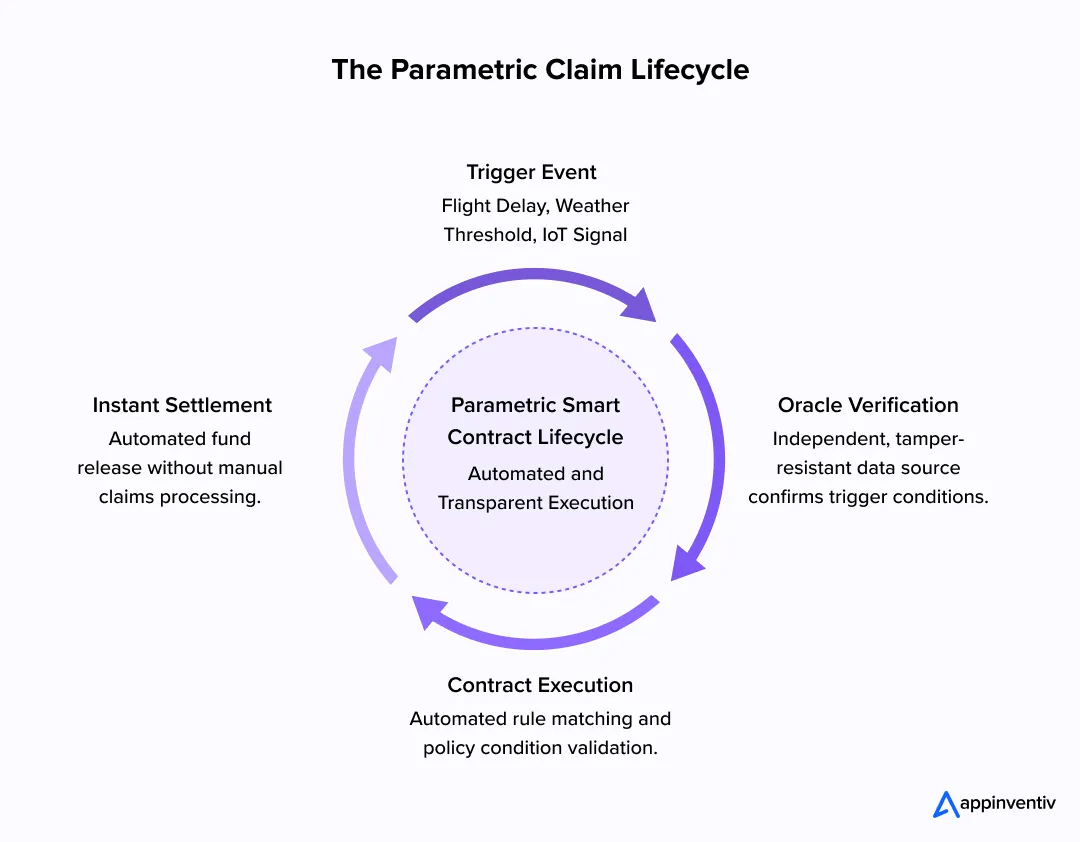

- 1. Parametric-First Adoption For Controlled Automation

- 2. Hybrid Smart Contract Systems For Core Insurance Operations

- 3. Platform-Driven Innovation For Emerging Insurance Models

- What Smart Contract Frameworks For Insurance Should Engineering Leaders Evaluate?

- Public And Consortium Blockchain Frameworks For Scalable Insurance Products

- Permissioned Smart Contract Frameworks For Regulated Enterprise Environments

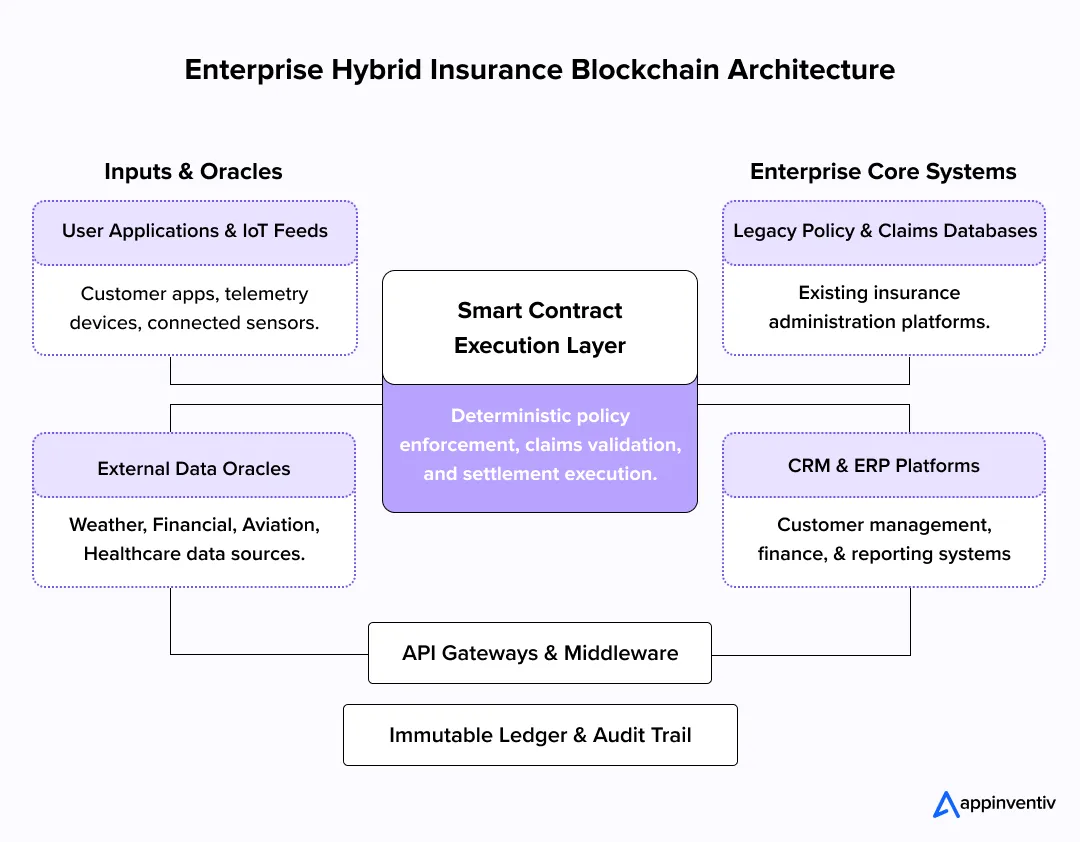

- Enterprise Approaches to Building Insurance Blockchain Infrastructure

- What Are the Architectural Components of a Smart Contract Solution for Insurance?

- 1. Smart Contract Execution Layer

- 2. Decentralized Application And Orchestration Layer

- 3. Oracle And External Data Integration Layer

- 4. Off-Chain Processing And Enterprise Integration Layer

- 5. Identity Regulatory Compliance in Smart Contracts Insurances

- 6. Security, Monitoring, And Audit Layer

- Insurance-Specific Smart Contract Components

- What Are the Development Phases of a Smart Contract for Insurance Companies?

- Phase 1: Use-Case Qualification and Feasibility Modeling

- Phase 2: Architecture and Protocol Design

- Phase 3: Smart Contract Engineering and System Development

- Phase 4: Security Assurance and Regulatory Alignment

- Phase 5: Controlled Pilots and Ecosystem Onboarding

- Phase 6: Enterprise Rollout and Long-Term Governance

- What Tech Stack Supports Enterprise Smart Contract Development?

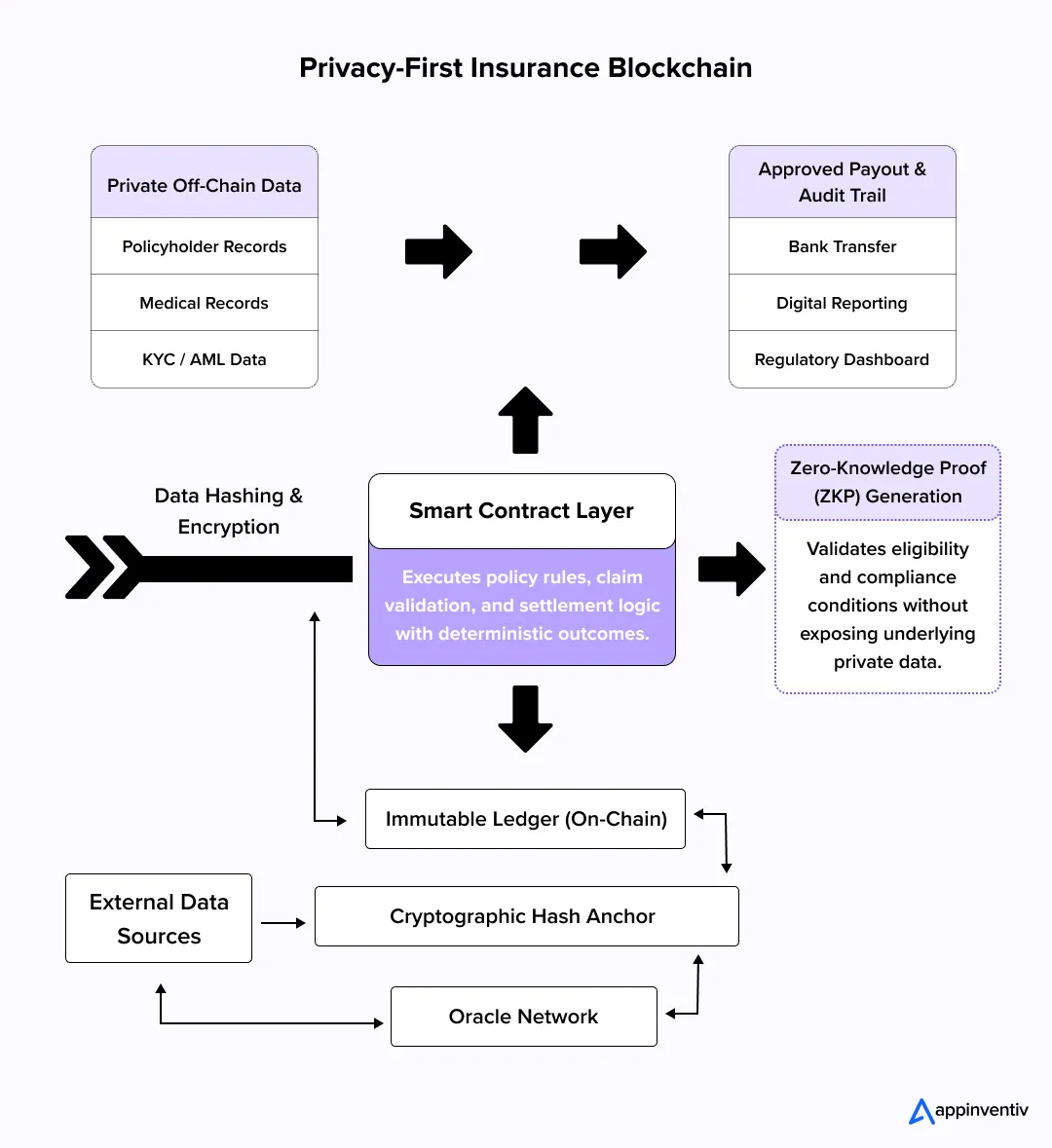

- Solving The Privacy Challenge With ZKP and Off-Chain Hashing

- What Benefits Do Blockchain Smart Contracts Deliver for Insurance Companies?

- What Challenges With Smart Contracts in Insurance Must Enterprises Address?

- What Are Real Examples of smart contract solutions for Insurance?

- 1) AXA - Fizzy Flight-Delay Insurance

- 2) Etherisc - Parametric Crop and Travel Insurance Pilots

- 3) Arbol - Parametric Reinsurance Automation

- Practical Lessons For Enterprise Adoption Of Smart Contracts In Insurance

- How Appinventiv Builds Enterprise-Grade Insurance Smart Contract Ecosystems

- Frequently Asked Questions

- Q. What is a smart contract in insurance?

- Q. How the Insurance Industry succeeds with smart contracts?

- Q. How much does it cost to deploy a smart contract in insurance?

- Q. How long does it take to implement smart contracts in insurance?

- Q. What is the ROI of smart contracts in insurance operations?

- Q. Are smart contracts legally enforceable?

Key takeaways:

- Most enterprises are moving toward hybrid setups to maintain control over compliance, privacy, and day-to-day operations.

- Parametric products usually deliver the quickest returns and face fewer regulatory hurdles, making them a natural place to start.

- At enterprise scale, success depends on strong governance, proven security, and tight integration with existing systems.

- When done right, smart contracts shorten settlement cycles, cut reconciliation effort, and reduce friction between multiple parties.

- Over time, programmable insurance platforms also make it easier to launch new products and open new revenue paths.

Most insurance teams reach a point where the old ways start slowing everything down. Claims take weeks. Fraud is often caught after money has already moved. Audits still mean pulling data from multiple systems and reconciling it by hand. Meanwhile, customers expect real-time updates, and regulators want clearer trails. All of it puts pressure on your operations, not just your products, but the systems running underneath them.

Smart contracts in insurance are starting to change how insurers deal with that pressure. Global investment reflects this shift. The smart contracts market is projected to reach approximately $815.86 billion by 2034, growing at a CAGR of over 82%, driven largely by enterprise adoption of automated, tamper-resistant execution systems.

Instead of treating policy rules as documents people interpret later, they can be built directly into secure blockchain programs. Eligibility checks, claim validation, and payouts can run automatically. Every step is recorded. When a claim is approved, there is no scramble across emails and spreadsheets to explain what happened.

Still, this is not about deploying a few isolated contracts. Enterprise use means fitting smart contracts into your existing policy systems, claims tools, compliance processes, and security controls. Architecture, governance, and integration matter as much as the code.

This article walks through how large insurers can design and scale smart contract systems, from strategy and development to real-world implementation.

With smart contracts projected to reach $815.86B by 2034, insurers must modernize execution layers now.

Also Read: Explained: What are Smart Contracts and Their Applications

How Can Enterprises Define Approaches to Implementing Smart Contracts in Insurance?

For large insurers, the primary question is not whether to use smart contracts in the insurance industry, but where automation delivers defensible ROI without creating regulatory or operational risk. The implementation approach must align product structure, data reliability, and enterprise control models.

1. Parametric-First Adoption For Controlled Automation

Most enterprise teams start with claims driven by clear, objective data, a weather trigger, a delayed flight, or a sensor-driven shipment update. When a verified threshold is crossed, something is supposed to happen.

Smart contracts for insurance with parametric triggers fit naturally in this space. The rules are clear enough to encode into smart contracts, so payouts can run automatically once trusted data is received. Insurers often run this logic on enterprise-ready blockchains while oracle networks supply tamper-resistant external inputs.

Your underwriting and compliance processes stay in place. What changes is how execution happens. The result is straightforward:

- Faster claims resolution

- Lower manual handling effort

- Reduced exposure to certain types of fraud

This is why parametric products are usually the first step. They compress cycle times, remove routine friction, and let teams demonstrate the value of automation before expanding into more complex policies.

2. Hybrid Smart Contract Systems For Core Insurance Operations

For complex retail, health, and commercial insurance lines, enterprises typically deploy hybrid smart contract-based insurance systems. Smart contracts enforce policy state, settlement rules, and audit trails, while off-chain systems handle risk scoring, document review, and exception management.

In this model:

- Smart contracts manage policy issuance, endorsements, and settlement finality

- Off-chain engines drive underwriting automation and fraud detection

- Core systems integrate via Ethers.js/Web3.js middleware layers

This approach supports regulatory compliance, GDPR constraints, and governance, while enabling blockchain-grade immutability and multi-party transparency.

3. Platform-Driven Innovation For Emerging Insurance Models

Forward-looking insurers are exploring popular smart contract use cases in insurance, including:

- Usage-based insurance (UBI) powered by IoT telemetry

- Microinsurance and peer-to-peer risk pools

- DeFi-inspired insurance protocols and DAO-governed mutuals

- Tokenized or NFT-based policy representations for lifecycle traceability

These models typically leverage EVM-compatible chains, layer-2 networks like Arbitrum and Optimism for cost control, and cross-chain interoperability frameworks to support ecosystem-scale distribution.

What Smart Contract Frameworks For Insurance Should Engineering Leaders Evaluate?

Selecting the right smart contract framework is a long-term infrastructure decision, not a tooling preference. For insurance enterprises looking to build insurance smart contracts, the framework determines data privacy controls, transaction economics, regulatory alignment, ecosystem access, and the ability to integrate with core systems.

Most insurance smart contract initiatives fall into two architectural directions: public/consortium EVM ecosystems and permissioned enterprise ledgers.

Public And Consortium Blockchain Frameworks For Scalable Insurance Products

Platforms such as Ethereum, Polygon, Binance Smart Chain, and Avalanche dominate insurance innovation because of their EVM compatibility, mature developer ecosystems, and deep tooling support.

They enable insurers to:

- Rapidly build and audit smart contracts for insurance products using Solidity and OpenZeppelin libraries

- Deploy to layer-2 networks like Optimism and Arbitrum to control transaction costs

- Integrate standardized Oracle infrastructure (Chainlink) for parametric claims

- Support cross-chain settlement and ecosystem partnerships for smart contracts for insurance

These frameworks are strategically suited for:

- Parametric and on-demand insurance

- Travel and climate insurance

- Reinsurance and cross-border settlement platforms

- Tokenized policy and liquidity-backed insurance models

However, public and consortium chains require careful governance design, privacy layers, and transaction-economics modeling to meet enterprise compliance and data residency expectations.

Permissioned Smart Contract Frameworks For Regulated Enterprise Environments

For insurers prioritizing data sovereignty, internal governance, and regulatory isolation, platforms such as Hyperledger Fabric and Corda are often foundational.

These frameworks support:

- Fine-grained access control and private channels

- Deterministic transaction costs

- Native enterprise identity management

- Direct integration with KYC/AML, policy administration, and claims platforms

Teams that build insurance smart contracts in Fabric-based architectures use Chaincode (Go/Java) to enable business-rule enforcement across consortium members. Corda is often selected where insurers require bilateral data visibility and contract-centric transaction models, such as in reinsurance or broker networks.

These frameworks are strategically aligned with:

- Core policy lifecycle automation

- Inter-insurer settlement networks

- Regulator-observable audit infrastructures

- Closed-ecosystem innovation programs

Enterprise Approaches to Building Insurance Blockchain Infrastructure

For insurers, the real question is not which blockchain to choose, but how the infrastructure should be designed to support compliance, governance, performance, and long-term growth. In practice, most enterprise programs settle into two architectural paths:

- EVM-compatible environments built for programmable automation and high transaction volumes

- Permissioned enterprise ledgers focused on privacy, identity control, and controlled multi-party workflows

Both can be tailored to enterprise needs. The right direction depends on whether your priority is ecosystem-driven product innovation or tightly governed internal automation.

Also Read: How Blockchain Technology is Transforming the Insurance Industry

Comparison: Public vs. Permissioned Frameworks

| Dimension | Public/Consortium (EVM) | Permissioned (Fabric/Corda) |

|---|---|---|

| Primary Focus | Product Scale & Ecosystem | Compliance & Privacy |

| Identity | Anonymous/Pseudonymous | Native KYC/Enterprise ID |

| Throughput | High (on L2s) | Very High (Private) |

| Ideal For | Travel/Climate/B2C | Reinsurance/B2B Settlement |

| Dimension | Public/Consortium (EVM) | Permissioned (Fabric/Corda) |

| Primary Focus | Product Scale & Ecosystem | Compliance & Privacy |

| Identity | Anonymous/Pseudonymous | Native KYC/Enterprise ID |

| Throughput | High (on L2s) | Very High (Private) |

What Are the Architectural Components of a Smart Contract Solution for Insurance?

At enterprise scale, smart contracts in the insurance industry do not operate as isolated blockchain scripts. They function as part of a distributed insurance execution architecture that must integrate with core policy systems, regulatory workflows, identity frameworks, and real-world data pipelines.

Architectural design determines whether smart contract insurance remains an MVP or becomes production infrastructure. A robust insurance smart contract architecture is typically structured across six tightly governed layers.

1. Smart Contract Execution Layer

This layer contains the policy logic, coverage conditions, claims-validation rules, and settlement instructions encoded in smart contracts. It is built using enterprise-grade contract languages such as Solidity, Vyper, Rust, or Chaincode, depending on whether the insurer is deploying EVM-compatible environments or permissioned ledger architectures.

Key engineering priorities include:

- Deterministic execution and upgrade governance

- Modular contract design for product versioning

- Gas and computation optimization

- Embedded access control and role segregation

- Event logging for regulatory auditability

Security engineering at this layer incorporates reentrancy protection, overflow checks, pausability, and formal verification pipelines before production deployment.

2. Decentralized Application And Orchestration Layer

Above the contract layer sits the insurance dApp and orchestration tier, which coordinates how internal teams, distribution partners, and customers interact with smart contracts.

This layer includes:

- Policy administration portals

- Claims and underwriting dashboards

- Broker and partner integration interfaces

- Workflow engines for human-in-the-loop approvals

It is responsible for transaction construction, digital signing, exception handling, and lifecycle orchestration, typically built using secure Web3 integration libraries and enterprise middleware services.

3. Oracle And External Data Integration Layer

Insurance automation is only as reliable as the data that triggers it. The oracle layer connects smart contracts to weather systems, IoT feeds, aviation systems, healthcare records, financial indices, and logistics platforms.

Enterprise-grade Oracle architecture includes:

- Redundant multi-source data pipelines

- Cryptographic data attestation

- Latency monitoring and anomaly detection

- Fail-safe dispute and override mechanisms

This layer is critical for parametric insurance, usage-based insurance, and real-time claims automation.

4. Off-Chain Processing And Enterprise Integration Layer

Core insurance intelligence remains off-chain. This layer integrates smart contracts with:

- Policy administration systems

- Underwriting engines

- Fraud detection platforms

- Document management systems

- Payment and treasury infrastructure

- CRM, ERP, and regulatory reporting tools

It enables hybrid smart contract systems, where automation executes deterministically on-chain while probabilistic and judgment-driven processes remain within enterprise control boundaries.

5. Identity Regulatory Compliance in Smart Contracts Insurances

This layer embeds regulatory and enterprise controls directly into the system:

- KYC/AML verification services

- Role-based access frameworks

- GDPR-aligned data segregation

- Policyholder consent management

- Regulator-observable audit trails

It ensures that regulatory compliance smart contracts insurance systems align with InsurTech regulations, data protection regimes, and internal risk governance standards.

As financial platforms scale across regions, compliance operations often become growth bottlenecks. An Australian enterprise wallet provider faced this when manual KYC workflows, fragmented regulatory controls, and region-specific data rules slowed onboarding and audit readiness.

Appinventiv restructured the core platform around a centralized compliance layer, enabling automated verification, geo-aware data governance, and real-time audit visibility across markets.

6. Security, Monitoring, And Audit Layer

Enterprise deployments require continuous assurance:

- Smart contract auditing and formal verification

- Runtime monitoring and anomaly detection

- Incident response tooling

- Version governance and kill-switch controls

This layer protects against logic exploits, economic attacks, and integration failures, which represent the largest risk surface in smart contract–based insurance systems.

This architecture-centric approach enables insurers to move beyond experimentation toward scalable, compliant, and regulator-ready smart contract insurance platforms.

Insurance-Specific Smart Contract Components

At an execution level, insurance smart contract platforms are built from specialized functional components that govern policies, claims, data inputs, and compliance.

| Component | Enterprise Function |

|---|---|

| Policy Engine | Encodes coverage rules, exclusions, premiums, endorsements, and policy state transitions |

| Claims Engine | Automates eligibility checks, claim validation logic, and settlement execution |

| Oracle Hub | Ingests, validates, and reconciles real-world data used to trigger underwriting and payouts |

| Underwriting Automation Layer | Connects risk models, pricing logic, and eligibility workflows to smart contracts |

| Compliance and Audit Layer | Manages regulatory reporting, immutable audit trails, and supervisory visibility |

| Identity and Access Control Layer | Enforces enterprise roles, customer verification, and operational permissions |

| Settlement and Finance Layer | Handles escrow logic, payout orchestration, and reconciliation workflows |

| Governance and Upgrade Layer | Controls versioning, emergency actions, contract upgrades, and change management |

What Are the Development Phases of a Smart Contract for Insurance Companies?

For insurers, building smart contracts is not a coding exercise. It is an enterprise transformation program that touches regulated processes, financial controls, customer data, and multi-party ecosystems. Successful programs follow a phased engineering and governance model.

Phase 1: Use-Case Qualification and Feasibility Modeling

Enterprises begin by identifying smart contracts for insurance functions where deterministic execution delivers immediate business value—such as parametric claims, policy endorsements, or settlement reconciliation.

This phase includes:

- Process decomposition of underwriting, claims, and settlement flows

- Regulatory and data-residency assessment

- Oracle dependency and data authority mapping

- Cost modeling for transaction execution and infrastructure

- Risk classification across legal, compliance, and cyber domains

The outcome is a business-justified smart contract roadmap, not a proof of concept.

Phase 2: Architecture and Protocol Design

Here, insurers design the target insurance smart contract architecture, including:

- On-chain execution models and virtual machine selection

- Oracle and off-chain automation frameworks

- Identity, access control, and compliance instrumentation

- Interoperability and integration patterns

- Governance and upgrade mechanisms

Threat modeling, regulatory alignment, and privacy-by-design principles are embedded before any production code is written.

Phase 3: Smart Contract Engineering and System Development

Engineering teams implement:

- Policy and claims smart contracts

- Middleware services and event processors

- Underwriting and automation microservices

- Enterprise API and data synchronization layers

Development emphasizes:

- Modular contract design

- Gas and execution optimization

- Secure access control frameworks

- Extensive automated testing and simulation

This phase establishes the core insurance smart contract platform.

Phase 4: Security Assurance and Regulatory Alignment

Before exposure to live insurance workflows, enterprises conduct:

- Independent smart contract audits

- Formal verification of high-risk execution paths

- Reentrancy and logic-abuse testing

- Compliance validation against insurance and financial regulations

- Supervisory reporting and audit-trail certification

Security and compliance sign-off are treated as release gates, not parallel tracks.

Phase 5: Controlled Pilots and Ecosystem Onboarding

Insurers deploy smart contracts into sandboxed environments, onboarding:

- Selected product lines

- Restricted customer cohorts

- Internal claims and operations teams

- Initial distribution or reinsurance partners

Performance, dispute rates, execution costs, and exception handling are measured against baseline operations.

Phase 6: Enterprise Rollout and Long-Term Governance

At scale, insurers operationalize:

- Contract lifecycle management and upgrade governance

- Continuous monitoring and incident response

- Regulatory reporting pipelines

- Multi-party operating models

- Long-term platform and ecosystem expansion

Smart contracts transition from innovation initiatives into core insurance execution infrastructure.

Also Read: An Entrepreneur’s Guide on the Blockchain Technology and Its Uses

Our smart contract development services support compliance-first builds from feasibility through production deployment.

What Tech Stack Supports Enterprise Smart Contract Development?

To be production-ready, an insurance smart contract system has to deal with a real tension. You need the transparency that blockchains are good at, but you also have to protect sensitive customer and health data under rules like GDPR and HIPAA. That only works when the platform is built in layers, where public verification is kept separate from private information.

| Layer | Industry Standard Tooling & Frameworks |

|---|---|

| Execution Networks | Ethereum (L2s like Arbitrum/Optimism), Polygon, Hyperledger Fabric, Corda |

| Smart Contract Logic | Solidity (EVM), Rust (Solana/Polkadot), Go (Hyperledger Chaincode) |

| Security & Verification | OpenZeppelin (Libraries), Slither (Static Analysis), Certora (Formal Verification) |

| Oracle & Data Feeds | Chainlink (Decentralized Oracles), Pyth Network, First-party API Gateways |

| Data Privacy | Zero-Knowledge Proofs (zk-SNARKs), IPFS (Encrypted Off-chain Storage) |

| Enterprise Middleware | Web3.js, Ethers.js, The Graph, Kafka, MuleSoft |

Also Read: Blockchain Technology: All Set To Revamp the Future of Transactions

Solving The Privacy Challenge With ZKP and Off-Chain Hashing

Teams building insurance systems on blockchain quickly run into this. GDPR allows customers to request the erasure of their data. Blockchains do not forget. That tension means sensitive information cannot live directly on-chain.

Most enterprise architectures handle this in two ways.

- Off-chain data hashing: Personal data stays in secure, encrypted databases. Only a cryptographic fingerprint is written to the blockchain, which allows integrity checks without exposing private details.

- Zero-knowledge proofs: With ZKP systems like zk-SNARKs, a customer can prove they meet a requirement without revealing the actual data, such as confirming eligibility without sharing an exact age or score.

Together, these approaches preserve blockchain auditability while meeting privacy obligations.

What Benefits Do Blockchain Smart Contracts Deliver for Insurance Companies?

Smart contracts in the insurance industry create value by changing how agreements are executed, tracked, and enforced, not by ripping out existing systems.

When they sit inside an enterprise architecture, they act as programmable control layers that automate high-friction workflows, coordinate multiple parties, and keep a single execution record across the policy lifecycle.

For large insurers, the upside shows up in operational efficiency, financial control, and new product design, provided implementations stay aligned with regulatory and governance requirements.

Key enterprise benefits include:

- Claims cycle-time compression: Automated rule execution and event-triggered settlements reduce manual claims handling, enabling near-real-time payouts for eligible cases and materially lowering claims backlogs.

- Fraud exposure reduction: Immutable transaction histories, deterministic execution, and cryptographically verifiable data inputs narrow manipulation vectors and reinforce forensic auditability.

- Operational cost optimization: Smart contract–based automation reduces administrative overhead, reconciliation workloads, and third-party processing costs across underwriting, claims, and settlements.

- Multi-party process synchronization: Shared execution logic and distributed ledgers streamline coordination between insurers, reinsurers, brokers, and service partners without centralized reconciliation layers.

- Accelerated product innovation: Enterprises can launch parametric, usage-based, and microinsurance products faster by encoding coverage logic directly into programmable policy infrastructure.

- Regulatory traceability and audit readiness: Built-in immutability and event logs create real-time audit trails, supporting supervisory oversight, compliance reporting, and dispute resolution.

Also Read: 10 Ways to Embrace Blockchain for Business Transformation

What Challenges With Smart Contracts in Insurance Must Enterprises Address?

While smart contracts in insurance offer structural advantages, enterprise adoption introduces new categories of operational, regulatory, and technological risk. Insurers that succeed treat these risks as engineering and governance problems, not barriers.

Regulatory And Legal Uncertainty

Insurance operates under jurisdiction-specific supervisory frameworks, and smart contract execution is not uniformly recognized as legally binding. Enterprises embed regulatory alignment, legal wrappers, audit trails, and supervisory visibility layers into system design. Smart contracts operate as execution engines beneath legally enforceable policy structures, not as replacements.

Oracle And Data-Trust Risk

Automated payments are as reliable as the data that triggers them. Compromised, delayed, or biased inputs can cause erroneous settlements. Implement multi-source oracle architectures, cryptographic attestation, anomaly detection, and human-override governance for high-impact claims.

Security Vulnerabilities And Financial Exposure

Smart contracts are immutable once deployed. Logic flaws, reentrancy vectors, and access-control errors can lead to irreversible financial loss. Adopt formal verification, staged audits, modular upgrade frameworks, continuous monitoring, and emergency control mechanisms as mandatory enterprise standards.

Privacy, Data Protection, And Compliance Conflicts

Blockchain immutability can clash with GDPR, data minimization, and insurance confidentiality requirements. Use off-chain data custody, selective disclosure mechanisms, encryption layers, and permissioned execution environments aligned to regulatory expectations.

Organizational And Governance Complexity

Smart contract systems introduce new ownership models spanning IT, legal, risk, and operations. Define cross-functional governance structures, lifecycle ownership, and incident-response models before production deployment.

Addressing these challenges transforms smart contracts from experimental automation into enterprise-grade insurance execution infrastructure.

Also Read: Blockchain for Enterprise: Use Cases, Features, Platforms and Potential Challenges

Architects governed secure systems before smart contracts entered regulated insurance operations.

What Are Real Examples of smart contract solutions for Insurance?

Early work across enterprise insurers and insurance tech teams shows a clear pattern. Smart contracts deliver the strongest results in parametric and trigger-based insurance, where clean data signals, automated execution, and fast settlements create immediate, practical value.

1) AXA – Fizzy Flight-Delay Insurance

AXA launched Fizzy in 2017 as a smart contract-powered parametric flight-delay product. Payouts were automatically triggered when verified flight data crossed predefined thresholds, removing manual claims processing. Although later discontinued for commercial reasons, Fizzy remains one of the first documented smart contract deployments by a global insurer.

2) Etherisc – Parametric Crop and Travel Insurance Pilots

Etherisc developed smart contract-based parametric insurance products for crop risk and flight delays. In pilot programs, automated payouts were triggered based on independent weather and travel data, demonstrating reduced administrative overhead and transparent claims execution, particularly in microinsurance and emerging-market contexts.

3) Arbol – Parametric Reinsurance Automation

Arbol built a smart contract-driven parametric reinsurance platform that automates policy lifecycle events and loss calculations using validated weather data. The solution illustrates how smart contracts can streamline reinsurance settlements while improving auditability and data trust.

Beyond parametric products, the real enterprise impact of smart contracts is emerging at the settlement and transaction infrastructure layer, where insurers face challenges similar to banks in managing high-volume, multi-party financial flows.

Legacy cores struggle to support programmable digital assets without reconciliation risk. An Asian banking institution faced this while introducing crypto services. Appinventiv built a unified ledger and custody architecture that enabled crypto and fiat transactions within a single controlled system, demonstrating how programmable execution layers can modernize settlement infrastructure relevant to insurance claims and reinsurance workflows.

Practical Lessons For Enterprise Adoption Of Smart Contracts In Insurance

Successful insurers treat smart contracts as regulated insurance infrastructure, not experimental tools. The checklist below captures the core execution principles consistently observed across real-world insurance deployments.

How Appinventiv Builds Enterprise-Grade Insurance Smart Contract Ecosystems

Appinventiv combines full-cycle product engineering with blockchain R&D through its smart contract development services to deliver compliant, scalable solutions for insurers, including complex enterprise implementations of smart contracts in insurance.

We design protocol-agnostic architectures, implement deterministic policy execution, and integrate secure oracle and middleware layers so that smart contracts operate as core insurance infrastructure, not experiments.

Key capabilities and track record:

- Blockchain solutions deployed: 150+

- Smart contracts audited: 10+

- Years in blockchain R&D: 8+

- Partnerships with leading protocols: 8+

- Industries mastered: 35+

- Global recognitions and awards: 15+

Business impact delivered:

- Security assurance in deployments: 99.90%

- Faster settlement times: 2x

We have executed enterprise programs and pilots with brands such as Mudra, Nova, Empire, and AVATAS. Our delivery model pairs cross-functional teams in engineering, security, legal, and actuarial functions to manage compliance, governance, and operational readiness from prototype to production.

If you are evaluating a pilot or planning a platform migration, Appinventiv, as an insurance software development company, offers a pilot-to-scale engagement that includes feasibility modeling, architecture design, formal verification, and a regulated rollout plan.

Contact our enterprise team to schedule a strategy workshop and pilot scoping session.

Frequently Asked Questions

Q. What is a smart contract in insurance?

A. A smart contract is a tamper-resistant program that encodes policy rules, eligibility criteria, and payout logic. It executes deterministically when predefined conditions are met, typically fed by validated external data (oracles). In enterprise settings, smart contracts are part of hybrid stacks—on-chain execution for finality and off-chain systems for underwriting, fraud detection, and compliance.

Q. How the Insurance Industry succeeds with smart contracts?

A. Insurers succeed by targeting objective, triggerable products (parametric, UBI), proving oracle integrity, and adopting hybrid on-chain/off-chain flows. Success requires governance, legal alignment, security assurance, and explicit KPIs (cycle time, dispute rate, cost per claim). Pilot, measure, and iterate—don’t treat smart contracts as a substitute for commercial and regulatory design.

Q. How much does it cost to deploy a smart contract in insurance?

A. Costs vary by scope. A focused pilot (parametric product, middleware, Oracle setup, audit) typically ranges from the low hundreds of thousands of USD. Enterprise platform builds—including governance, integration, formal verification, and regulatory work—can run into the low millions. Key cost drivers: Oracle redundancy, audit/formal verification, integration complexity, and ongoing operational SLAs.

Q. How long does it take to implement smart contracts in insurance?

A. Timelines depend on scope and regulatory complexity. Typical phases: discovery and feasibility (4–8 weeks); prototype/MVP (2–4 months); controlled pilot (3–6 months); production rollout and ecosystem onboarding (6–18 months). Complex, multi-jurisdictional platforms often follow 12–24 month roadmaps from initiation to stabilized operations.

Q. What is the ROI of smart contracts in insurance operations?

A. ROI is achieved through faster settlements, lower claims-handling costs, and reduced fraud-related leakage. Expect measurable operational improvements within 6–18 months for focused pilots; full platform ROI (including new-product revenue) typically materializes over 12–36 months. Track cycle time, cost-per-claim, dispute frequency, and product velocity as primary KPIs.

Q. Are smart contracts legally enforceable?

A. Legal recognition varies by jurisdiction. Best practice is to treat smart contracts as execution layers under legally binding policy documents or “legal wrappers.” Ensure contract language, audit trails, and supervisory reporting satisfy local regulators. Engage legal and compliance teams early and use hybrid designs that preserve human-readable, enforceable records alongside on-chain execution.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…