- Why the UK Insurance Sector is Embracing AI

- How to Build an AI Powered Insurance Software in the UK

- Step 1: Define the Vision and Target Segment

- Step 2: Identify and Prioritise AI Use Cases

- Step 3: Choose the Right Architecture and Technology Stack

- Step 4: Design a Transparent and User-Friendly Interface

- Step 5: Build Data Pipelines and AI Models

- Step 6: Integrate Compliance and Security from Day One

- Step 7: Test, Validate, and Ensure Fairness

- Step 8: Deploy and Continuously Improve

- Step 9: Manage Change and Build Adoption

- Core Features of AI-Powered Insurance Software

- 1. Automated Claims Intake and Processing

- 2. Predictive Underwriting and Risk Scoring

- 3. AI-Based Fraud Detection and Anomaly Alerts

- 4. Personalised Policy Recommendations

- 5. Customer Engagement and Virtual Assistance

- 6. Real-Time Analytics and Business Dashboards

- 7. Compliance and Audit Monitoring

- 8. Seamless Integrations and Scalability

- Real Business Use Cases in the UK Insurance Context

- 1. Aviva: Smarter Claims Processing and Operational Efficiency

- 2. Zurich UK: AI-Powered Fraud Detection and Loss Prevention

- 3. Mind Foundry & Aioi Nissay Dowa Insurance (ANDE-UK): Continuous Learning for Fraud Governance

- 4. Aviva & Direct Line Group: Personalised Underwriting and Risk Assessment

- 5. AXA UK: Regulatory Compliance Through Explainable AI

- Cost to Develop AI-Powered Insurance Software in the UK

- Estimated Cost Breakdown

- Factors That Influence Cost

- How Appinventiv Builds AI-Driven Insurance Software in the UK

- Frequently Asked Questions

Key takeaways:

- AI is changing how UK insurers handle claims, spot fraud, and serve customers.

- Big names like Aviva and Zurich UK are already using it to save money and settle claims faster.

- To build AI insurance software that works, you need good data, proper compliance, and a system people actually want to use.

- Expect to spend between £40,000 and £235,000+, depending on your custom InsurTech software solutions in the UK.

- Working with an experienced development partner like Appinventiv helps UK insurers create platforms that meet regulations and deliver results.

For UK insurers today, the challenges are clear. Claims still get processed by hand in many places. Fraudsters are getting better at what they do. Customers want the same quick service they get from their bank or their phone provider—they won’t wait around anymore.

Add in strict rules from the Financial Conduct Authority, tougher data protection laws, and outdated systems that cost a fortune to maintain, and it’s clear that change isn’t optional anymore.

This is why AI insurance software development in the UK isn’t just nice to have—it’s essential. It’s not just technology for the sake of it, but a business enabler: faster claims, better risk-scoring, reduced fraud, better customer experience—and improved ROI.

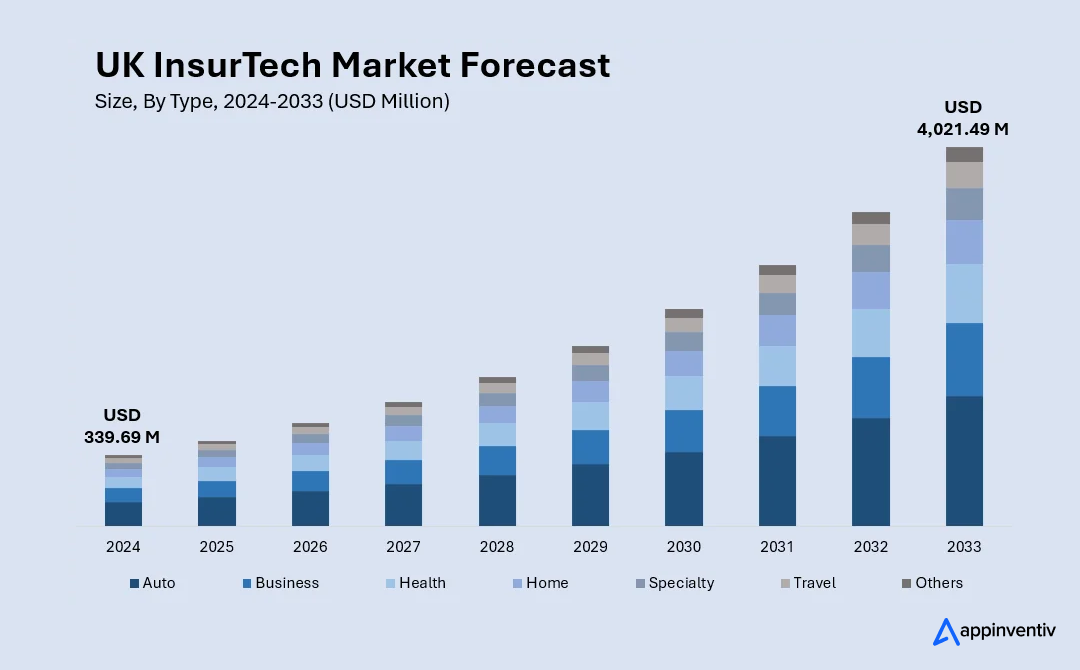

In the UK insurance sector, 95% of firms are already using AI or plan to start soon. Meanwhile, the UK InsurTech market is expected to grow by 31.6% every year from 2025 to 2033.

The message is simple: insurers that don’t adopt smarter technology will struggle to keep up.

In this guide, tailored for the UK market and board-level decision-makers, we will walk you through how to build an artificial intelligence insurance platform in the UK, tuned to today’s demands. We’ll cover the full life-cycle—from vision to deployment—with a sharp focus on your goals: operational efficiency, regulatory certainty, and competitive differentiation.

Let’s begin by exploring why UK insurers are turning to intelligent automation—and then move quickly into how to build AI powered insurance software in the UK.

72% of UK insurers, say fragmented and unstructured data is the biggest barrier to AI transformation. – As per CityAM

Why the UK Insurance Sector is Embracing AI

The UK insurance industry is at a turning point. Tougher regulations, shifting customer expectations, and fiercer competition are pushing insurers to rethink how they operate. AI-powered insurance software solutions in the UK are growing quickly—it’s fast, flexible, and gets results.

Recent research shows UK customers are warming up to AI. The number of people happy to have AI to price their policies jumped from 31% in 2024 to 37% in 2025. This shift encourages insurance companies to adopt AI more across the board—pricing, claims, fraud checks, and customer service.

Another strong driver is cost pressure. According to Aon’s 2024 UK Insurance Market Overview, the sector is still dealing with tight margins and soft market conditions. AI in the insurance industry in the UK helps cut costs without cutting corners. It speeds things up and gets more accurate results—two things that matter when everyone’s competing on price.

Then there’s regulation. The Financial Conduct Authority is cracking down on fairness and transparency, especially when decisions are automated. That pushed insurers to build AI regulatory compliance insurance software in the UK that they can actually explain and defend. When done right, AI in the insurance industry in the UK can help firms stay compliant and deliver better service at the same time.

The UK also has an advantage: it’s the second-biggest InsurTech hub in the world. Insurers here can partner with tech firms and startups easily. That makes it faster to test new ideas and roll them out.

The reality is simple: AI isn’t just another piece of tech for UK insurers. It’s what keeps them in the game. From catching fraudsters to building policies that actually fit individual customers, AI helps firms do what they do best—only faster and smarter—while staying compliant and giving customers what they expect today.

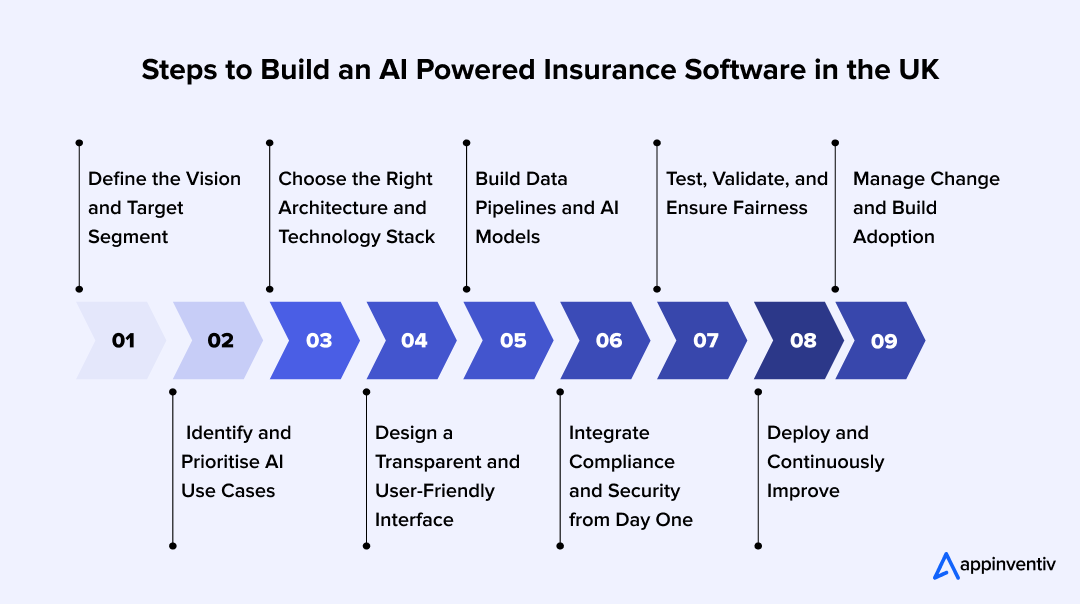

How to Build an AI Powered Insurance Software in the UK

Building AI-powered insurance software solutions in the UK goes beyond just automation. It’s about setting up a system that actually understands your data, gets smarter over time, and improves things for your business and your customers. You need a solid plan, careful work, and you can’t skip compliance with UK financial regulations.

Here’s how insurers can build an artificial intelligence insurance platform in the UK that works well and stays compliant.

Step 1: Define the Vision and Target Segment

Start by getting clear on what you want. Who’s this for—brokers, policyholders, underwriters?

Set goals you can measure. Faster claims? Lower fraud losses? Better personalisation? These targets will guide every choice you make down the line.

Step 2: Identify and Prioritise AI Use Cases

List where AI insurance software development in the UK can actually help. For custom AI insurance software in the UK, the most common ones include:

- Claims automation: to reduce processing time.

- Fraud detection: to identify false claims early.

- Predictive underwriting: to assess risk more accurately.

- Customer service bots: for quick, reliable support.

Pick one or two high-impact areas first. Get those right before expanding.

Step 3: Choose the Right Architecture and Technology Stack

Decide where your platform will run. Whether it will be launched on your own servers, the cloud, or a bit of both.

Data privacy is essential, so many insurers go with UK-based cloud providers or choose platforms that are already compliant. It includes AWS UK, Azure UK Region, or Google Cloud London.

Pick tools that make it easy to add AI and link up with what you’re already running—your CRM, underwriting tools, policy management systems.

Step 4: Design a Transparent and User-Friendly Interface

AI alone can’t win customer trust; design does. For custom insurance software development in the UK, interfaces must clearly show how data is used and how decisions are made.

Build clean dashboards for underwriters and claims teams. For customers, create portals that explain policies, track claims, and suggest options—all in plain English, no jargon.

Step 5: Build Data Pipelines and AI Models

Good data is everything. Pull in structured data like claims history and payments, plus unstructured stuff like emails, call recordings, and documents.

Build AI data analytics solutions for insurance in the UK that can classify, predict, and spot patterns. Use algorithms you can explain, not black boxes.

Wherever you can, use UK or EU data. It keeps you on the right side of GDPR and local data rules.

Step 6: Integrate Compliance and Security from Day One

The FCA and PRA expect transparency when decisions are automated. You need to show your work.

Build in features that log every decision your models make, track user consent, and automatically handle data retention.

Enterprise insurance software development in the UK needs to protect everything. This includes encryption, tight access controls, and round-the-clock monitoring.

Step 7: Test, Validate, and Ensure Fairness

Before you go live, test everything. Check if your models are accurate, fair, and unbiased.

Run scenarios: fake claims, missing customer info, surprise audits.

This makes sure you build an artificial intelligence insurance platform in the UK that works in the real world and holds up under scrutiny from regulators and customers.

Step 8: Deploy and Continuously Improve

Launch an MVP first—one focused feature, like claims automation. Watch how it performs. Get feedback. Retrain your models regularly with fresh data.

This approach allows you to scale responsibly while ensuring compliance and user confidence.

Step 9: Manage Change and Build Adoption

Technology by itself won’t transform anything—it’s your people who make the difference. Train your staff so they actually get how AI can help them work better and faster.

Bring data scientists, underwriters, and compliance teams into the same room. Once people realise automation is there to lighten their load, not replace them, buy-in happens naturally.

As UK insurers move toward digital-first ecosystems, mobile accessibility is now a customer expectation. A well-structured mobile app ensures seamless policy access, faster claims, and better engagement.

Build intelligent, FCA-compliant insurance systems tailored for the UK market.

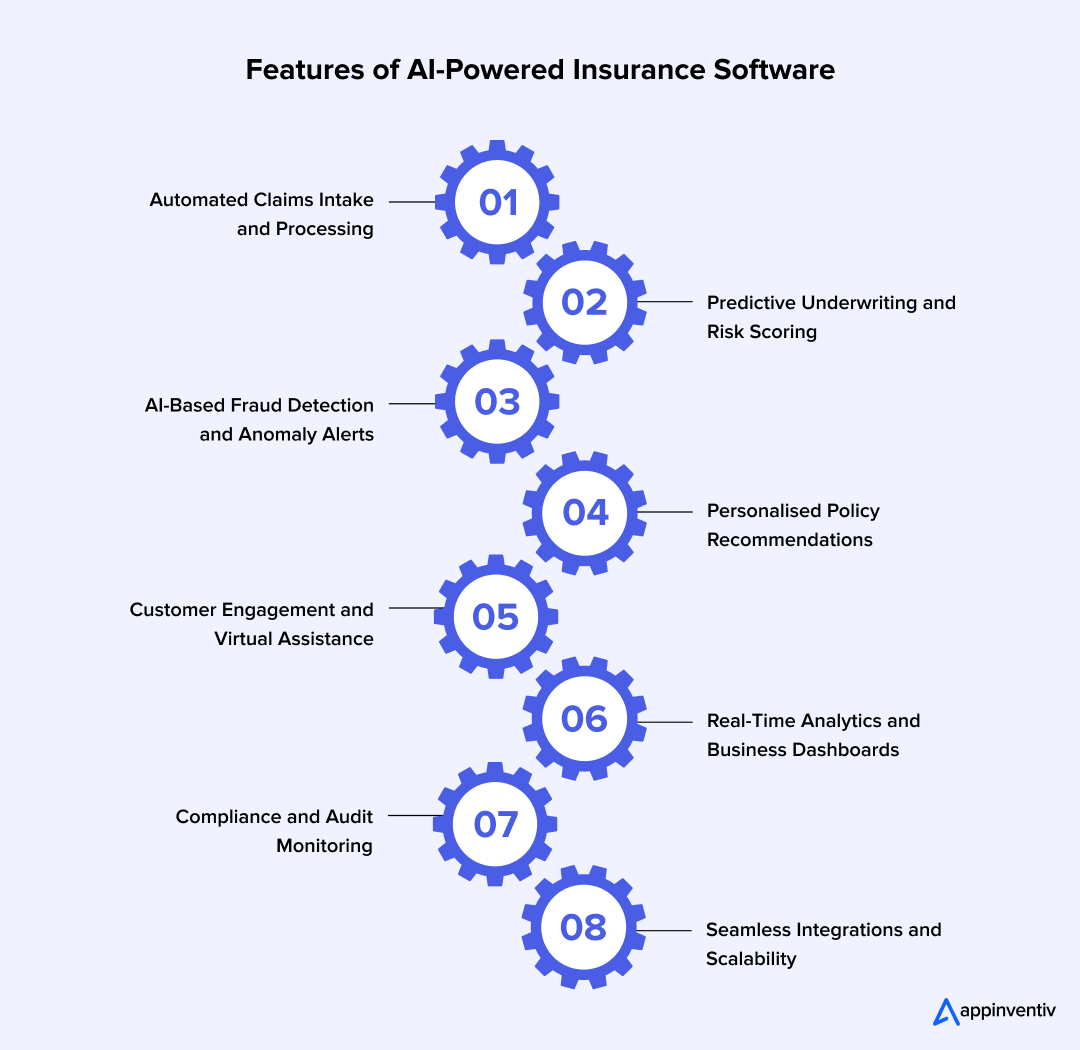

Core Features of AI-Powered Insurance Software

Building AI driven insurance software in the UK is not only about automation. It’s about creating a smart system that helps you decide faster, serve customers better, and stay on the right side of regulations. Here are the features that make it work for UK insurers.

1. Automated Claims Intake and Processing

Claims handling eats up time. AI speeds things up by checking documents, assessing damage, and sorting claims automatically.

For example, computer vision can look at a photo of a damaged car and estimate repair costs. A chatbot for insurance customer service in the UK can gather basic claim details in minutes. This reduces manual work and shortens settlement cycles.

2. Predictive Underwriting and Risk Scoring

Old-school underwriting leans on static data and past averages. AI looks wider—driving habits, lifestyle, credit scores, even live sensor feeds.

You get sharper pricing and better risk groups. With predictive analytics insurance claims in the UK, you stay competitive on premiums without blowing up your loss ratios.

3. AI-Based Fraud Detection and Anomaly Alerts

Fraud costs UK insurers millions, especially now that claims are digital and photos can be faked. When you build an AI fraud detection system for insurance in the UK, it spots dodgy patterns in claims, transactions, and customer profiles.

It learns from past fraud cases and flags weird behaviour instantly—so you can stop losses before they happen.

4. Personalised Policy Recommendations

Every customer has unique coverage needs. AI recommendation engines look at behaviour, purchase history, and past claims to suggest the right policies or extras.

With an insurance policy management system in the UK, businesses can achieve better conversion rates, stronger relationships, and offers that actually make sense.

5. Customer Engagement and Virtual Assistance

AI chatbots and voice assistants are becoming standard in the insurance market. They answer policy questions, walk people through renewals, and book claims appointments.

When a business develops an insurance AI chatbot in the UK, it offers round-the-clock availability. No wait times. Customers stay happy, and your team doesn’t get swamped.

6. Real-Time Analytics and Business Dashboards

Good decisions need good visibility. AI dashboards pull insights from claims, underwriting, and customer interactions into one screen.

Track what matters—claim turnaround times, fraud detection rates, customer sentiment—all live. Make calls faster, backed by data.

7. Compliance and Audit Monitoring

In a regulated market like the UK, compliance isn’t optional. AI insurance software development in the UK logs every automated decision, builds audit trails, and flags data-privacy risks before they become problems.

Keeps you square with the FCA and GDPR. Shows regulators and customers you’re serious about transparency.

8. Seamless Integrations and Scalability

Modern digital insurance platforms in the UK don’t work alone. AI systems connect easily with CRMs, broker portals, and external databases.

Everything flows—underwriting, claims, customer service. And when your business grows, the system grows with it.

Put these features of AI powered insurance software together, and you’ve got a platform built for what’s next—accurate, compliant, and built around your customers.

Real Business Use Cases in the UK Insurance Context

AI InsurTech software in the UK has moved well past the testing phase. Major insurers and newer tech-focused firms are now using it to fix problems they’ve been dealing with for years—slow claims, rising fraud, outdated processes.

Here are some real examples of what’s working for insurance automation software in the UK.

1. Aviva: Smarter Claims Processing and Operational Efficiency

Aviva, one of the UK’s biggest insurers, runs over 80 AI models to handle claims. They assess who’s at fault, flag fraud, and send cases to the right teams.

The result? A reduction of 23 days in claim-assessment time and improved efficiency in claim routing by nearly 30%, according to McKinsey’s research.

This initiative helped Aviva enhance customer satisfaction and achieve estimated annual savings of over £60 million — proving that automation and precision can coexist in high-stakes operations.

2. Zurich UK: AI-Powered Fraud Detection and Loss Prevention

Zurich Insurance Group’s UK division faced an increasing number of fraud cases, particularly in motor claims involving manipulated accident photos.

To counter this, Zurich deployed AI tools capable of detecting inconsistencies in images and verifying metadata in real time.

The outcome was impressive — the insurer prevented an estimated £78.5 million in fraudulent claims within a year.

By integrating AI into fraud detection, Zurich not only reduced financial losses but also improved trust and transparency with genuine policyholders.

3. Mind Foundry & Aioi Nissay Dowa Insurance (ANDE-UK): Continuous Learning for Fraud Governance

Oxford-based AI firm Mind Foundry worked with Aioi Nissay Dowa Insurance (Europe) to build an AI insurance platform in the UK for fraud detection that keeps learning from fresh data.

Unlike older rule-based systems that get outdated fast, this one adjusts as fraudsters change their tactics—so it stays accurate over time.

The partnership also introduced stronger governance controls, aligning with the UK government’s AI assurance standards for fairness and accountability.

4. Aviva & Direct Line Group: Personalised Underwriting and Risk Assessment

UK insurers like Aviva and Direct Line Group are testing AI underwriting tools that look at driving habits, lifestyle, and claims history to figure out risk.

These insights let them offer pricing that fits the customer and suggest policies that make sense. Better retention. Happier customers. Especially useful in competitive areas like motor and home insurance.

5. AXA UK: Regulatory Compliance Through Explainable AI

AXA UK has been exploring explainable AI tools to meet the Financial Conduct Authority (FCA) requirements for transparency in automated decisions.

Their models now generate decision logs and bias-detection reports, ensuring compliance while improving the audit process.

This has positioned AXA as a front-runner in responsible AI adoption — balancing innovation with accountability.

These examples show that AI insurance software solutions in the UK are not limited to cost reduction. It’s about speed, accuracy, and trust — three pillars that define the next phase of digital transformation in the UK insurance industry.

Cost to Develop AI-Powered Insurance Software in the UK

Developing AI-powered insurance software in the UK involves multiple stages — from research and design to deployment and compliance validation. Each phase adds value, but it also adds to the cost. Your final budget depends on what you’re building, the features you need, and the amount of data you’re working with.

Below is a realistic breakdown for enterprise insurance software development in the UK.

Estimated Cost Breakdown

| Development Stage | Estimated Cost Range | Key Inclusions |

|---|---|---|

| Discovery & Requirement Analysis | £15,000 – £25,000 | Market research, competitor mapping, project roadmap |

| UI/UX Design | £10,000 – £20,000 | Wireframes, interface design, usability testing |

| AI Model Development | £35,000 – £60,000 | Data collection, model training, validation |

| Backend & API Integration | £25,000 – £50,000 | Server setup, third-party integrations, cloud deployment |

| Compliance & Security Modules | £10,000 – £25,000 | FCA/GDPR frameworks, encryption, access control |

| Testing & Quality Assurance | £15,000 – £30,000 | Performance, bias, and regulatory testing |

| Deployment & Maintenance (Year 1) | £10,000 – £25,000 | Cloud deployment, MLOps setup, monitoring |

Factors That Influence Cost

Some factors that may impact the cost of an AI insurance software development in the UK are:

Scope of AI Use Cases

Adding more modules—like fraud detection, claims automation, and personalised policies—pushes the cost up. You need more data, bigger infrastructure, and more rounds of testing.

Data Availability and Quality

Clean, structured data lowers development time. Projects requiring heavy data preprocessing or synthetic data generation cost more.

Compliance and Governance Requirements

FCA and GDPR compliance add extra layers of model validation, bias testing, and audit logging — essential but time-intensive.

Integration with Legacy Systems

Plugging new AI models into your existing insurance CRM software or policy systems isn’t always straightforward. It can add real complexity to the backend.

AI Model Complexity

Basic rule-based automation is cheaper. Predictive models and deep-learning systems cost more—they need serious computing power and specialised skills.

Development Partner’s Expertise and Location

UK-based development teams typically charge £80 – £120 per hour, while offshore or hybrid teams (like Appinventiv’s model) offer similar quality at a more optimised cost structure.

Average Timeline

A full AI insurance software development in the UK usually takes 6 to 10 months from design to launch. Big enterprise insurance software solutions in the UK can go past a year, especially if you’re rolling multiple AI features into one system.

Book a free strategy session with our UK team and discover how Appinventiv can build your bespoke solution that delivers both efficiency and differentiation.

How Appinventiv Builds AI-Driven Insurance Software in the UK

Building an AI driven insurance software in the UK is not only about the right technology—it’s about the right partner who understands the complexities of Fintech software development in the UK, compliance, and customer expectations. That’s where Appinventiv steps in.

With over 1,600 tech experts and 3,000+ digital solutions delivered worldwide, Appinventiv has worked with some of the biggest names in business to build systems that blend automation, security, and smart technology. We know InsurTech, predictive analytics, MLOps, and AI development services—and we’ve helped companies use them to transform how they work with data.

We take a clear, structured approach that fits what UK insurers need:

- FCA, ISO, and GDPR-compliant development so your platform ticks every legal and ethical box.

- Custom AI models built around your specific needs—underwriting, claims, fraud detection, whatever matters most.

- Easy integration with your current CRMs, policy systems, and older infrastructure.

- Models that keep learning through MLOps pipelines, so your software gets sharper with every data cycle.

- We keep up with the latest technologies like blockchain, machine learning, deep learning models, metaverse, AR/VR, and more.

Also Read: How is Metaverse Presenting New Opportunities for Insurance Businesses?

Our work with BFSI and financial clients across Europe has proven one thing—AI adoption delivers measurable ROI when backed by a strong strategy and reliable execution. We don’t just build software; we build solutions that drive growth and customer confidence.

Frequently Asked Questions

Q. What is the best way to build AI insurance software in the UK?

A. Begin by getting clear on what you want to achieve and make sure compliance is covered from day one. Decide what role your AI insurance software development in the UK will play—speeding up claims, spotting fraud, sharpening underwriting, or all three. Then choose your tech setup based on what meets FCA and GDPR requirements.

Work with a development partner who’s done this before—someone who understands AI, knows how to handle data properly, and gets how insurance companies operate. That’s how you end up with a platform that works well and earns trust from both regulators and customers.

Q. How much does AI-powered insurance software cost in the UK?

A. The development cost for AI-powered insurance software in the UK typically ranges from £120,000 to £235,000+. It depends on how complex it gets, how many AI modules you need, and how deep the integration goes.

Costs go up when you add compliance features, heavy data processing, and advanced analytics.

Q. How long does it take to build insurance software with AI in the UK?

A. A basic MVP takes around 6 to 8 months. Full enterprise systems with multiple AI features can take a year or more to implement. The timeline depends on your data, how complex the AI models are, and how many features you’re building.

Q. What features does AI insurance software need in the UK?

A. The core features are automated claims processing, predictive underwriting, fraud detection, personalised policy suggestions, and compliance tracking.

For AI insurance software development in the UK, you also need FCA audit logs, GDPR-ready data management, and dashboards that explain how AI makes decisions.

Q. How to integrate AI into existing insurance systems in the UK?

A. Start by spotting which legacy systems could use automation—claims management, customer service, that sort of thing. Use APIs, cloud connectors, and middleware to enable AI to communicate with your existing CRMs, data warehouses, and policy platforms.

No need to rip everything out and start over.

Q. What are the regulatory requirements for AI insurance software in the UK?

A. You need to meet FCA rules, PRA standards, and GDPR for data privacy. Your system should explain how AI makes decisions, check for bias, track consent, and properly protect data.

Q. How to choose an AI insurance software development partner in the UK?

A. Find someone who’s done this before—AI and financial software, ideally in regulated industries. They should understand FCA compliance, know their way around data security, and support you from model training through to launch.

Appinventiv, for example, has delivered over 3,000 digital solutions worldwide, many in regulated sectors.

Q. What are the benefits of AI in insurance software for UK insurers?

A. The benefits of AI powered insurance software include making things faster and more efficient. Claims get processed quickly. Fraud losses drop. Underwriting becomes more accurate and personalised. And you stay on the right side of regulators while cutting costs and improving results.

Q. What risks are involved when building AI insurance software in the UK?

A. Watch out for biased models, compliance slip-ups with FCA or GDPR, and poor data quality. You can avoid most of this with transparent algorithms, regular audits, and good governance. Working with a partner who knows regulated AI development helps a lot.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How AI Chatbots for eCommerce are Driving 3x More Sales in 2026

Key takeaways: AI chatbots for eCommerce have a direct impact on revenue. When aligned with buying intent, they lift conversions, increase order value, and drive repeat purchases. The strongest impact comes from personalization and guided selling, helping shoppers decide faster and buy with greater confidence. Abandoned cart recovery is a major revenue driver in 2026.…

AI-Powered Booking Optimization for Beauty Salons in Dubai: Costs, ROI & App Development

Key Highlights AI booking optimization improves utilization, reduces no-shows, and stabilizes predictable salon revenue streams. Enterprise salon platforms enable centralized scheduling, customer insights, and scalable multi-location operational control. AI-enabled booking platforms can be designed to align with UAE data protection regulations and secure payment standards. Predictive scheduling and personalization increase customer retention while significantly reducing…

Data Mesh vs Data Fabric: Which Architecture Actually Scales With Business Growth?

Key takeaways: Data Mesh supports decentralized scaling, while Data Fabric improves integration efficiency across growing business environments. Hybrid architectures often deliver flexibility, governance, and scalability without forcing premature enterprise-level complexity decisions. Early architecture choices directly influence reporting accuracy, experimentation speed, and future AI readiness across teams. Phased adoption reduces risk, controls costs, and allows architecture…