- Understanding Insurance CRM for Businesses: A Quick Glimpse into the Basics

- Benefits of Insurance CRM Software Development for Businesses

- Streamlined Operations

- Improved Sales Strategies

- Enhanced Data Security

- Increased Profitability

- Better Collaboration Across Departments

- In-Depth Analytics and Reporting

- Higher Customer Retention

- Improved Scalability

- Major Use Cases of Insurance CRM Software for Businesses

- Features to Add in Your Insurance CRM Software

- Basic Features of Insurance CRM Software

- Advanced Features of Insurance CRM Software

- How to Develop or Integrate a Robust Insurance CRM Software?

- Define Business Requirements

- Choose the Right CRM Solution

- Plan System Architecture & Design

- Develop & Customize the CRM

- Integrate with Existing Systems

- Ensure Compliance and Data Security

- Test Thoroughly

- Deploy and Gather Feedback

- Cost to Develop or Integrate an Insurance CRM Software

- Insurance CRM Software Development/Integration Challenges

- Challenge: Integration Complexity

- Challenge: Data Security and Compliance

- Challenge: User Adoption

- Challenge: Scalability

- Challenge: Maintaining Data Quality

- Why Appinventiv is the Right Partner for Developing or Integrating Insurance CRM Software for Your Business

- Innovative Approach to Customization

- Expertise in Mobile Integration

- Advanced Data Security Protocols

- Integration of AI and Machine Learning

- Proven Track Record

- FAQs

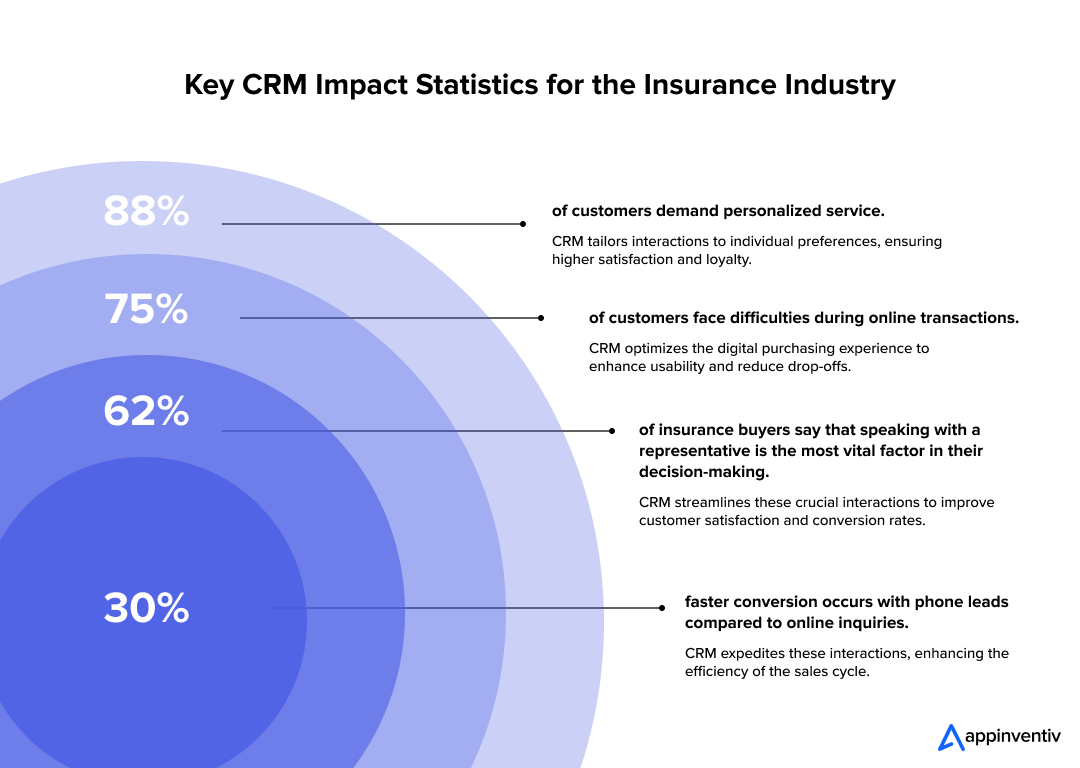

Ever wondered why some insurance companies consistently outperform others in customer satisfaction? The secret often lies in their ability to effectively manage customer relationships through sophisticated CRM (Customer Relationship Management) software. In an industry where major policyholders consider switching providers due to inadequate communication, the stakes for maintaining strong client connections are incredibly high.

Insurance CRM software transforms this challenge into an opportunity by providing tools that enhance interaction quality and frequency. With features tailored to the insurance sector, these systems offer agents a comprehensive view of each customer’s profile, including past interactions, preferences, and policy details. This 360-degree view empowers agents to deliver personalized service that aligns closely with individual customer needs, boosting satisfaction and loyalty.

Yet, the process of CRM integration/implementation or custom insurance CRM software development isn’t without its hurdles. Both require meticulous strategy and adjustment, ensuring it seamlessly interacts with existing IT infrastructure. The transition can be complex, involving not just technical deployments but also comprehensive training for staff to navigate the new tools effectively.

In this blog, we will explore the multifaceted benefits of insurance CRM Software, delve into its essential features, and guide you through the implementation steps. We will also provide a detailed analysis of the costs involved, helping you make an informed decision about this strategic investment.

We can help you integrate or develop a CRM that can streamline your workflows, enhance customer satisfaction, and boost your bottom line.

Understanding Insurance CRM for Businesses: A Quick Glimpse into the Basics

Insurance Customer Relationship Management (CRM) software is a specialized tool designed to help insurance companies manage and enhance their interactions with clients. At its core, Insurance CRM integrates various functionalities that streamline tracking, managing, and analyzing customer interactions across multiple channels.

CRM in the insurance industry serves as a central repository for all customer-related information, ensuring that every detail, such as personal policy details, past communications, and more, is just a few clicks away for agents and customer service representatives.

So, what Insurance CRM can do beyond mere data storage? Well, it provides powerful analytics tools that enable businesses to understand customer behaviors and preferences better. With these insights, businesses can tailor their marketing and customer service efforts more precisely, which is crucial in an industry where personalization can significantly impact client satisfaction and retention.

Moreover, these systems often include automation features that handle routine tasks like sending renewal reminders or policy updates, freeing agents to focus on more complex customer needs.

The global market for Insurance CRM Software is on the rise. Valued at approximately $2.5 billion in 2023, it’s projected to grow to about $6.2 billion by 2032, with a yearly growth rate of 10.5%. This surge is propelled by insurance companies increasingly adopting digital solutions to enhance their customer service and streamline operations, thereby boosting the demand for advanced CRM systems.

According to a McKinsey report, personal P&C insurance accounted for about $1.1 trillion in 2023 for US citizens and is expected to reach a premium of around $1.35 trillion by the end of 2025. Thus, if you are still looking to understand whether it’s the right time to invest in insurance CRM software for your business, the trends and projections suggest that now is the perfect moment to act. With the market growing rapidly and the technology evolving to offer even more comprehensive solutions, investing in Insurance CRM software can significantly boost your ability to meet customer needs effectively.

Simply put, this tool not only improves your operational efficiencies but also positions you to take full advantage of the shift towards digitalization in the insurance industry. By implementing a robust CRM system, your business can enhance customer engagement, streamline management processes, and stay ahead in the competitive insurance market.

With that settled, let’s move on and look at the multiple benefits of adopting insurance CRM software in detail below.

Benefits of Insurance CRM Software Development for Businesses

Implementing Insurance CRM software brings a multitude of benefits that can transform the way insurance companies operate and interact with their customers. Below are some key advantages of CRM insurance software development that all stakeholders must understand.

Enhanced Customer Service

Enhanced Customer Service

Insurance CRM systems provide a complete view of customer interactions, enabling agents to respond more effectively and personally. This personalized attention can significantly increase customer satisfaction and loyalty.

Streamlined Operations

By automating routine tasks such as policy renewals and client communications, CRM software frees up staff to focus on more complex and revenue-generating activities. This efficiency helps reduce overhead costs and speed up service delivery.

Improved Sales Strategies

With detailed insights into customer behavior and preferences, insurance firms can tailor their marketing and sales strategies to better meet the needs of their target audience. This targeted approach often results in higher conversion rates and more successful campaigns.

Enhanced Data Security

Insurance CRMs help securely manage sensitive client information. With advanced security measures in place, these systems ensure that all client data is protected against unauthorized access, thereby complying with regulatory standards.

Increased Profitability

One of the major advantages of CRM integration in insurance software is improved business profitability. By improving operational efficiency and customer retention, Insurance CRM software directly contributes to increased revenue streams and reduced operational costs. This is achieved by automating key processes, streamlining customer communication, and providing comprehensive analytics that help identify sales opportunities and optimize marketing strategies.

Better Collaboration Across Departments

Insurance CRM systems facilitate improved communication and data sharing among different departments. This synchronization helps ensure that everyone from sales to customer service is on the same page, leading to more cohesive and informed customer interactions.

In-Depth Analytics and Reporting

CRMs offer powerful analytics tools that provide deep insights into business performance, customer trends, and market conditions. These reports help businesses make data-driven decisions to enhance their strategies and operations.

Higher Customer Retention

By using Insurance CRM to consistently deliver personalized and timely services, businesses can significantly improve customer retention. Satisfied customers are more likely to remain loyal and recommend the company to others.

Improved Scalability

As a business grows, so does its need to manage increasing amounts of customer data and interactions. Insurance CRM software can scale to accommodate growth, ensuring that businesses can continue to efficiently manage their expanding customer base without a drop in service quality.

After looking into the major benefits of adopting insurance CRM software development for businesses, let’s move ahead and look at the use cases and features of developing CRM software for insurance agents in detail below.

Major Use Cases of Insurance CRM Software for Businesses

Insurance CRM software is a versatile and powerful tool designed to optimize the various facets of an insurance company’s operations. It not only supports daily administrative and customer service tasks but also provides strategic benefits that can significantly enhance business performance.

Let’s delve into the specific use cases of Insurance CRM to understand how this technology can transform the insurance sector.

| Use Case | How It Helps Businesses | Real-World Example |

|---|---|---|

| Customer Segmentation | Insurance agency CRM software development paves the way for the development of a product that helps firms organize customers by policy type, demographics, or risk to deliver more personalized marketing and service. | State Farm uses CRM to segment customers effectively, enhancing targeted communications and increasing customer satisfaction. |

| Claims Processing | Makes managing claims faster and less labor-intensive, enhancing customer satisfaction during these critical times. | Allianz leverages CRM to speed up claims processing, significantly reducing turnaround times and improving client retention. |

| Lead Management | Tracks and manages sales leads, boosting conversion rates through timely follow-ups and personalized interactions. | AXA uses CRM to enhance lead management, ensuring that potential customers receive the right attention and boosting conversion rates. |

| Policy Renewal Automation | Automates sending renewal reminders, making the renewal process more efficient and improving renewal rates. | Progressive Insurance utilizes CRM to automate renewal notifications, which has resulted in higher renewal rates and customer loyalty. |

| Customer Service Enhancement | Offers a complete view of all customer interactions across different channels, enabling faster and more informed responses. | MetLife employs CRM to provide exceptional service by giving their agents a complete view of each customer’s interaction history, improving resolution times and customer satisfaction. |

| Feedback Collection and Analysis | Streamlines the gathering and analysis of customer feedback, allowing for quick service adjustments based on customer insights. | Prudential Financial integrates CRM to gather and analyze customer feedback efficiently, helping them refine their offerings and service strategies continually. |

Features to Add in Your Insurance CRM Software

Creating effective Insurance CRM software involves integrating essential operational features with advanced functionalities that utilize cutting-edge technology for strategic advantages. Here’s a closer look at the basic and advanced features that should be considered:

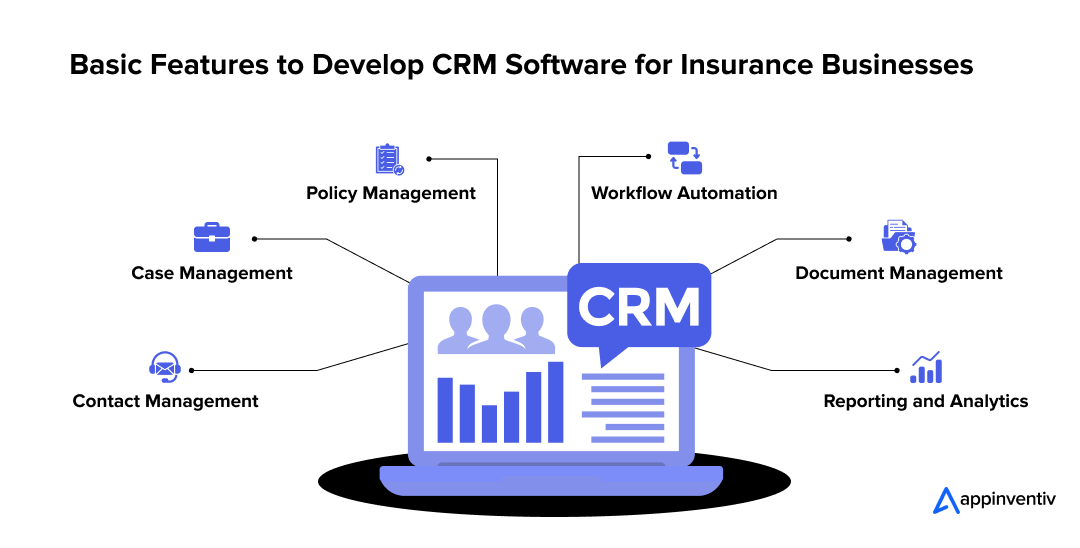

Basic Features of Insurance CRM Software

Insurance CRM software is equipped with a suite of basic features that cater to the essential needs of managing customer relationships effectively within the insurance sector. Let’s take a look at them below:

Contact Management

Contact Management

The foundation of any CRM, this feature allows for the centralized management of customer profiles, including contact details, demographic information, and historical interactions, ensuring all data is easily accessible.

Case Management

Helps track and resolve customer inquiries and claims, providing tools to assign tasks, set reminders, and monitor the status of each case to enhance service efficiency.

Policy Management

Enables comprehensive management of insurance policies, including issuance, adjustments, renewals, and cancellations, ensuring accuracy and compliance.

Workflow Automation

Automates repetitive tasks such as data entry, billing, and compliance checks, which helps reduce human errors and free up staff to focus on higher-value activities.

Document Management

Streamlines the storage, retrieval, and management of documents related to customers and policies, ensuring that all paperwork is digitized and easily accessible.

Reporting and Analytics

Generates customizable reports and dashboards that provide insights into sales performance, customer satisfaction, and operational efficiency, enabling informed decision-making.

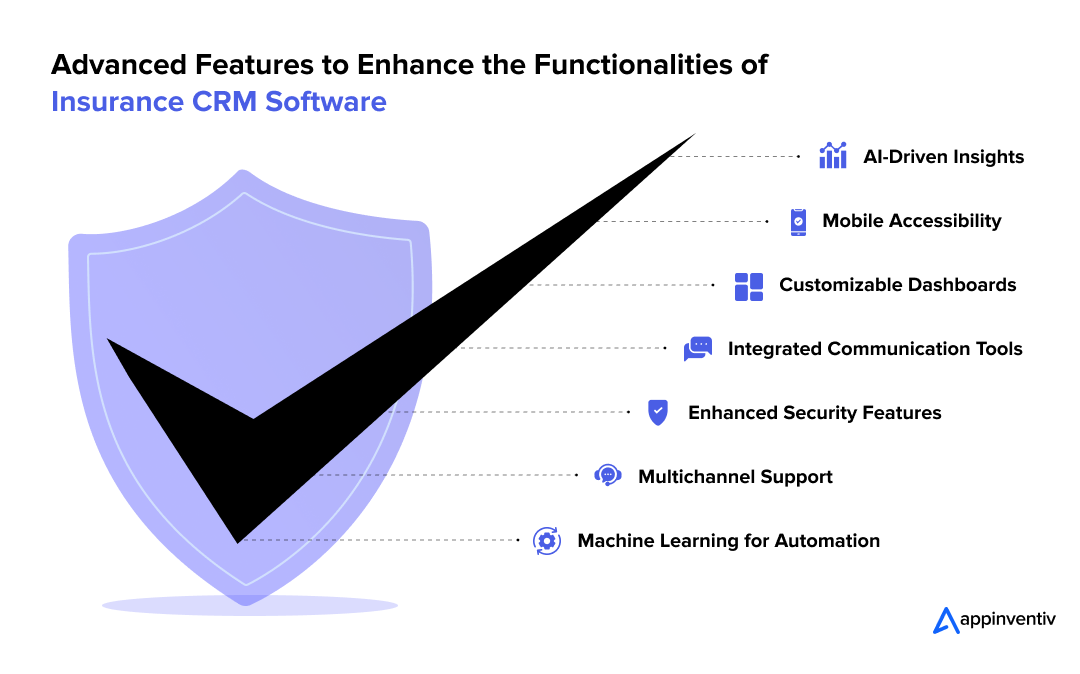

Advanced Features of Insurance CRM Software

Moving beyond the essentials, the advanced features of Insurance CRM software utilize cutting-edge technology to provide deeper insights, enhance user experience, and offer more precise control over complex processes. Let’s look at the advanced features to be integrated when developing CRM software for insurance agents:

AI-Driven Insights

AI-Driven Insights

Leverages artificial intelligence to analyze large datasets, predict customer behavior, identify sales opportunities, and offer proactive service suggestions, enhancing strategic decision-making.

Mobile Accessibility

Offers a mobile version of the CRM that allows agents and managers to access and update customer information from anywhere, increasing the flexibility and responsiveness of the team.

Customizable Dashboards

Advanced dashboards that can be tailored to individual user needs, displaying key performance indicators and real-time data essential for day-to-day operations.

Integrated Communication Tools

Facilitates seamless communication channels within the CRM, including email, SMS, and social media integrations, allowing consistent and trackable customer interactions.

Enhanced Security Features

Incorporates robust security measures such as encryption, role-based access controls, and audit trails to protect sensitive customer information and ensure compliance with industry regulations.

Multichannel Support

Multichannel support is one of the major features that businesses must incorporate during the custom insurance CRM software development process. It supports interactions across various channels, including phone, email, live chat, and social media, providing a consistent and holistic view of customer interactions.

Machine Learning for Automation

Utilizes machine learning algorithms to automate complex decision-making processes, such as risk assessment or claim processing, based on historical data and trends.

Businesses must understand that the overall insurance CRM software development costs can vary as per the integration of advanced features.

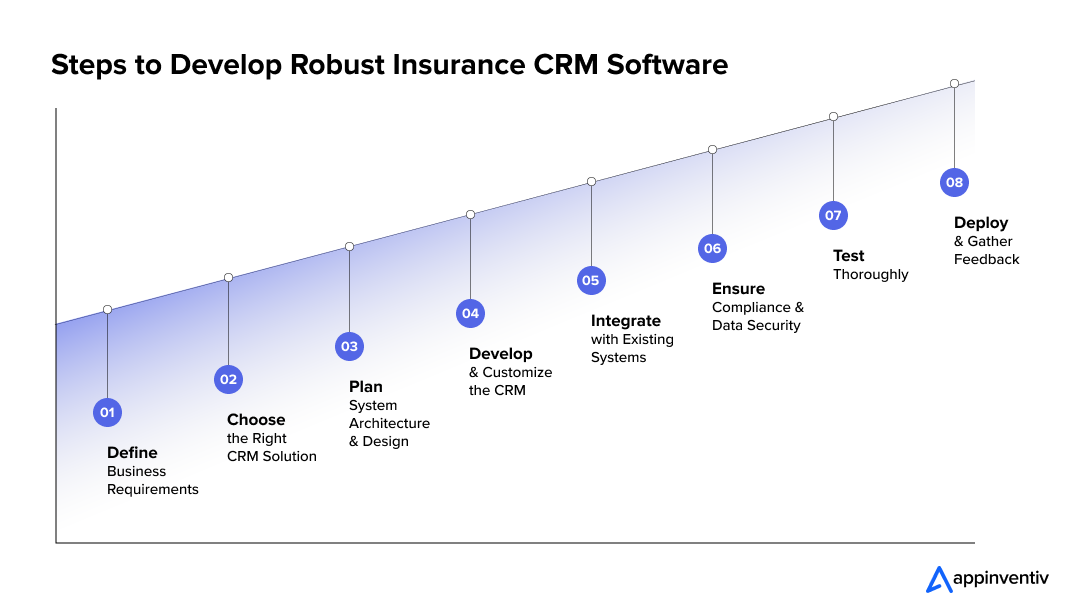

How to Develop or Integrate a Robust Insurance CRM Software?

Developing robust Insurance CRM software tailored to the insurance industry involves strategic steps to ensure efficiency, scalability, and security. Insurance businesses can choose to develop a CRM from scratch or integrate with established platforms like Salesforce, Microsoft Dynamics, Oracle CRM, or HubSpot, which offer customization to meet specific needs. Below are the key stages of the insurance CRM integration and insurance CRM software development process:

Define Business Requirements

Begin by identifying the specific requirements of your business. This involves understanding the key pain points in customer relationship management within your insurance operations. Gather input from various stakeholders such as sales teams, customer service representatives, and management to ensure the CRM caters comprehensively to all your needs.

Choose the Right CRM Solution

At this stage, businesses must decide whether to develop a custom CRM tailored specifically to their unique requirements or integrate an existing platform such as Salesforce, Microsoft Dynamics, or HubSpot. While these platforms offer adaptability and a faster time-to-market, custom development allows for specific tailoring of functionality and integration, aligning precisely with a company’s operational needs.

Plan System Architecture & Design

Design the system architecture to support scalability and integration with existing systems. This involves selecting a robust technology stack that ensures reliable performance and accommodates future growth and technological advancements.

Develop & Customize the CRM

During this phase of insurance CRM solutions development, develop core functionalities such as account and contact management, interaction tracking, workflow automation, and data reporting. For businesses using existing platforms, this stage involves customizing and extending the platform’s capabilities to meet specific insurance operational needs.

Integrate with Existing Systems

Whether developed from scratch or based on an existing platform, the CRM should integrate seamlessly with other systems like ERP and accounting software. This integration enhances data coherence and operational efficiency, providing a unified view of customer interactions.

Ensure Compliance and Data Security

It is essential to ensure that the CRM complies with industry-specific regulations such as GDPR in Europe or HIPAA in the United States. For instance, the health insurance CRM software development process must implement strong security protocols to protect sensitive customer information.

Test Thoroughly

Conduct comprehensive testing to catch and resolve any issues before the CRM goes live. Testing should include functional verification, usability tests, performance assessments, and security audits.

Deploy and Gather Feedback

If possible, roll out the CRM in phases to manage the transition smoothly. Collect feedback from users to identify areas for improvement and continue refining the system over time.

After looking at the major steps that make up the insurance CRM software development lifecycle, let’s move ahead and look into the overall cost of availing insurance from software development services.

Cost to Develop or Integrate an Insurance CRM Software

The cost of developing or integrating an Insurance CRM software can vary widely, typically ranging from $40,000 to $300,000 or more. This broad range is influenced by several factors, including the complexity of the features required, the choice of technology stack, and whether the solution is customized or built from scratch.

Integrating an existing platform like Salesforce or Microsoft Dynamics can be less costly compared to developing a custom solution from the ground up. These platforms offer a foundation with core functionalities already in place, which can significantly reduce both development time and costs. However, they may involve recurring licensing fees and might require additional customization to fully meet specific business needs. It is also vital for businesses to understand that CRM integration for insurance software not only needs to align technically with existing systems but also must adhere to industry-specific regulations and security standards.

On the other hand, developing a custom CRM allows businesses to tailor every aspect of their system to perfectly match their operational requirements and customer management processes. While this approach may have a higher initial cost due to the extensive development and testing required, it offers complete control over the system’s functionality, integration capabilities, and future scalability without the constraints or ongoing costs associated with licensed CRM platforms.

If an insurance business like yours wishes to develop a custom CRM software, you must understand that smaller solutions with basic functionalities may fall at the lower end of the spectrum, while extensive, custom-developed systems with advanced features like AI analytics and comprehensive integration capabilities can drive costs significantly higher.

Additionally, ongoing costs such as maintenance, updates, and training should be considered as part of the total investment. These are critical for ensuring the CRM remains effective and secure over time, adding to the initial development costs.

Since there are several factors that affect the overall development budget of building an insurance CRM software from scratch, you need to understand in detail how each element contributes to the final cost. This comprehensive understanding ensures that businesses like yours can allocate their resources wisely, avoid unexpected expenses, and optimize their investment according to their specific operational needs and strategic goals.

By breaking down each cost factor, you can more accurately forecast your budget, tailor the CRM to match your requirements, and ensure you get the best value for their investment.

| Factor | Impact on Cost |

|---|---|

| Feature Complexity | More complex features like real-time data analytics or AI-driven insights integrated during the process to develop CRM software for insurance agencies require more resources, increasing the insurance CRM software development costs. |

| Customization Level | Heavily customized solutions are more expensive than off-the-shelf systems due to the additional development time and resources needed. |

| Integration Needs | Integrating the CRM with existing systems such as ERP or other software increases costs based on the complexity of the integration. |

| Technology Stack | Advanced technology stacks incorporated during the insurance CRM software development process may involve higher licensing and development costs. |

| Number of Users | Systems designed for a large number of users may require more robust infrastructure and security measures, thus increasing the insurance CRM software development costs. |

| Maintenance and Support | Ongoing support and maintenance services are essential for operational stability and can vary in cost based on the level of service required. |

[Also Read: Hiring Dedicated CRM Software Developers – A Step-by-Step Process and Costs]

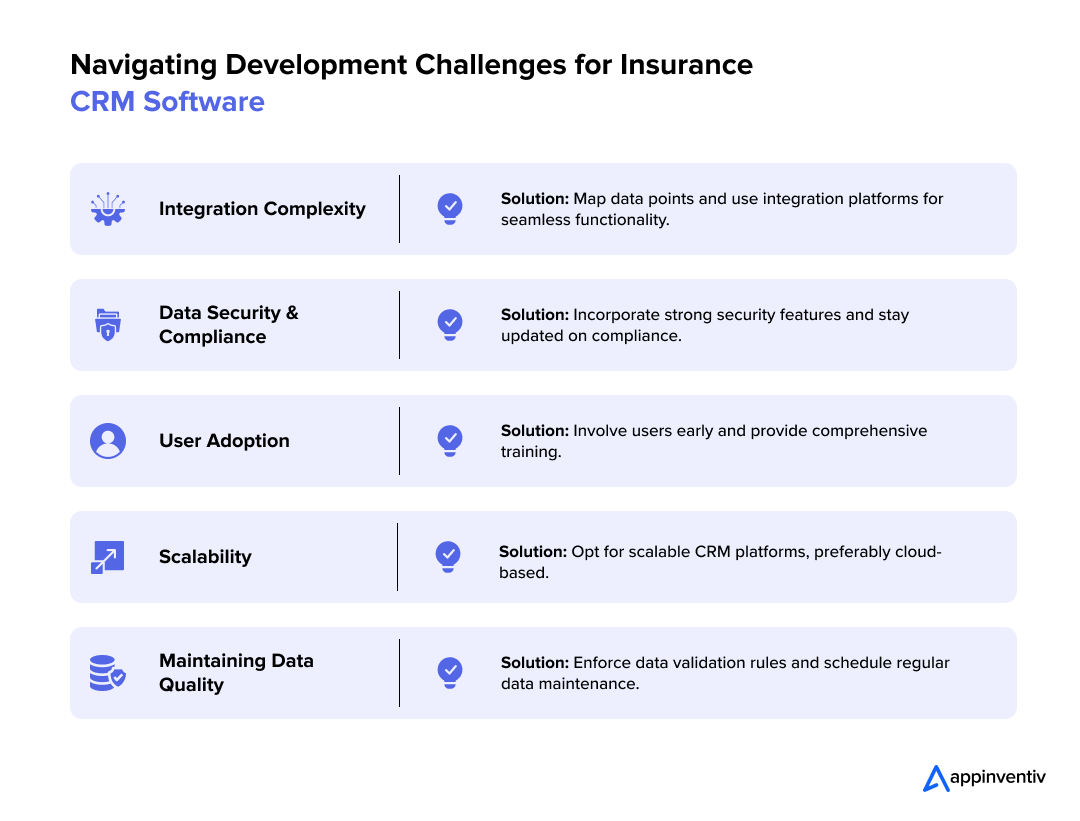

Insurance CRM Software Development/Integration Challenges

Implementing and developing CRM software for insurance companies comes with its own challenges that can impact the project’s timeline and effectiveness. Understanding these challenges and preparing solutions in advance can help ensure a smoother implementation and more successful outcome.

Challenge: Integration Complexity

Integrating CRM software with existing insurance systems, such as policy management systems and databases, can be complex and time-consuming. Mismatched data formats and legacy systems can complicate this process even further.

Solution: To overcome integration issues, thoroughly map out all data points and system connections before development begins. Employing middleware or specialized integration platforms can also help bridge gaps between the CRM software and existing systems, ensuring seamless data flow and functionality.

Challenge: Data Security and Compliance

Insurance companies handle sensitive customer data that must be protected according to various compliance standards, such as GDPR or HIPAA. Ensuring data security while developing and implementing a CRM can be challenging, especially with evolving cybersecurity threats.

Solution: Address security from the outset by designing the CRM with robust security features, such as encryption, secure access controls, and regular security audits. Additionally, staying updated on compliance requirements and incorporating them into the CRM’s design will help mitigate risks.

Challenge: User Adoption

Even the most well-designed CRM system can fail if the end-users do not fully adopt it. Resistance to change and lack of training can hinder the successful deployment of new technology.

Solution: Facilitate user adoption by involving end-users early in the design process to ensure the system meets their needs and is user-friendly. Provide comprehensive training sessions and create detailed user guides to help staff become comfortable and proficient with the new CRM.

Challenge: Scalability

Ensuring software scalability is one of the major challenges in developing insurance CRM software. As insurance companies grow, their CRM software needs to handle an increasing amount of data and more complex business processes without performance degradation.

Solution: Plan for scalability from the beginning. Pave the way for custom insurance CRM software development that can easily be scaled up to accommodate more users and larger data volumes. Cloud-based solutions are often preferable for their scalability and flexibility.

Challenge: Maintaining Data Quality

Poor data quality can render a CRM in the insurance industry ineffective, leading to bad customer experiences and decision-making based on inaccurate information.

Solution: Implement rigorous data validation rules within the CRM to ensure that only accurate and up-to-date data is entered. Regular data cleaning and maintenance should also be scheduled to keep the system efficient and reliable.

Why Appinventiv is the Right Partner for Developing or Integrating Insurance CRM Software for Your Business

We hope our blog has clarified the substantial benefits and use cases of Insurance CRM software. Partnering with a firm like Appinventiv can further enhance these advantages, tailoring a solution that perfectly aligns with your specific needs.

As a leading insurance software development company, we are equipped to develop a custom CRM from scratch or offer integration with existing platforms like Salesforce, Microsoft Dynamics, or HubSpot, depending on your requirements. Here are a few compelling reasons why we are your ideal partner for this transformative journey, whether you are looking to build a bespoke solution or seeking a seamless integration that leverages established technologies.

Innovative Approach to Customization

Our experts understand that one size does not fit all. We specialize in custom insurance CRM software development specifically tailored to the unique needs of your insurance business. Our approach ensures that every feature and functionality serves a specific purpose that aligns with your operational objectives and customer engagement strategies.

Expertise in Mobile Integration

In today’s mobile-first world, having a CRM that’s accessible on the go is crucial. Appinventiv excels in integrating mobile technologies with CRM systems, providing your agents and customers with seamless access to information and services from their smartphones. This capability enhances user engagement and increases operational flexibility.

Advanced Data Security Protocols

With stringent data protection regulations and insurance CRM software development best practices, we prioritize the security of your data above all. Our custom CRM development services are powered by the latest security protocols that ensure your customer data is always protected from unauthorized access and breaches.

Integration of AI and Machine Learning

We can integrate advanced AI capabilities into your Insurance CRM, enhancing customer relationship management and operational efficiency. AI can automate complex processes, provide predictive insights, and personalize customer interactions at scale.

| AI Application Area | Benefits |

|---|---|

| Customer Segmentation | Automate the segmentation process based on behavior, increasing marketing efficiency and personalization. |

| Claims Processing | Use AI to streamline claims assessments, reducing processing time and improving accuracy. |

| Fraud Detection | Implement AI and ML algorithms to detect and prevent fraudulent activities before they affect your bottom line. |

| Customer Service | Deploy AI-powered chatbots and virtual assistants to provide 24/7 customer support, enhancing customer satisfaction. |

Proven Track Record

We have a proven track record of delivering high-quality software solutions across various industries, including insurance. Our portfolio includes successful implementations that have driven growth, efficiency, and customer satisfaction for our clients.

Get in touch with us to leverage innovation, expertise, and a commitment to excellence in every project. We ensure that your Insurance CRM software not only meets the industry standards but also sets new benchmarks in customer relationship management.

FAQs

Q. How much does it cost to develop or integrate an insurance CRM software?

A. The cost of custom insurance CRM software development can vary widely, typically ranging from $40,000 to $300,000 or more. This variation depends on several factors, such as the complexity of the desired features, the level of customization required, the choice of technology stack, and whether the CRM needs to be integrated with existing systems. An additional budget for maintenance and updates should also be considered in the total insurance CRM software development cost.

Q. What should be the right strategy for an insurance business- integrating CRM or developing it from scratch?

A. Choosing between CRM integration for insurance software and development from scratch depends on your business’s specific needs, budget, and timelines.

Integration of Insurance CRM Software: This approach involves using an existing platform, which can be quicker and generally less costly. It leverages robust, tested features that can be deployed rapidly.

Pros of Integration:

- Faster Deployment: Utilizes pre-built systems for quicker implementation.

- Lower Initial Costs: Generally less expensive than custom development due to reduced labor.

- Proven Reliability: Uses established platforms known for stability.

Cons of Integration:

- Limited Customization: May not fully match specific business needs.

- Dependence on Vendor: Reliant on third-party updates and support.

- Potential Compatibility Issues: May require adjustments to work with existing systems.

Development of the Insurance CRM from Scratch: Developing a custom CRM allows for complete customization, tailored exactly to fit your business processes and requirements. This approach is beneficial for meeting unique workflows or specialized needs.

Pros of Development from Scratch:

- Fully Customized: Tailored specifically to fit all business needs and processes.

- Scalability: Easier to scale and modify as your business evolves.

- Independence: No reliance on external vendors for core functionalities.

Cons of Development from Scratch:

- Higher Costs: More expensive due to the need for extensive development and testing.

- Longer Development Time: Takes more time to develop and stabilize before going live.

- Resource Intensive: Requires outsourced development expertise.

The choice between insurance CRM integration and custom development should align with what best meets your company’s operational demands and strategic ambitions, whether that involves quick deployment or a perfectly tailored solution.

Q. How can an insurance CRM system help businesses improve ROI?

A. An insurance CRM system can significantly improve ROI by enhancing customer relationship management, streamlining operations, and enabling more targeted marketing strategies. It helps businesses increase sales conversions through effective lead management and follow-ups.

Additionally, insurance CRM solutions development can pave the way for a product that reduces operational costs by automating routine tasks and improving the efficiency of customer service processes. Over time, these improvements lead to higher customer retention rates, more efficient use of resources, and, ultimately, an increase in profitability.

Q. How can a custom insurance CRM be integrated with existing systems for insurance businesses?

A. A custom insurance CRM can be integrated with existing systems such as policy management software, accounting tools, and other legacy systems to provide a cohesive operating environment. This integration involves mapping data across systems to ensure seamless data flow and compatibility.

Middleware or API management tools are often used to facilitate this integration, allowing for real-time data exchange and reducing the chances of errors. Effective integration enables insurance businesses to leverage their existing technological investments while maximizing the benefits of the new CRM system.

Custom Development or White Label Solutions: Which is Right for Your Business?

Key takeaways: 77% of companies are prioritizing digital transformation; the right tech approach is crucial for staying competitive. Custom development offers tailored solutions for unique needs, flexibility, and long-term scalability. Whereas, white-label solutions provide quick market entry, cost-efficiency, and easy customization for standard needs. Appinventiv’s expertise helps you navigate custom development vs white-label to choose…

ERP Integration in Australia - Why It Is Essential and How to Do It Right

Key takeaways: ERP integration enables operational efficiency, reduced costs, and enhanced decision-making. Healthcare, finance, manufacturing, retail, and all the other sectors are benefiting from ERP integrations in Australia. While ERP integration can be costly, ranging from AUD 45,000 - AUD 450,000, it leads to significant long-term savings and scalability. Compliance with Australian regulations is critical,…

Predictive Analytics Software Development - Features, Benefits, Use Cases, Process, and Cost

Key Takeaways Predictive analytics helps businesses shift from “what has happened” to "what will happen," enabling proactive strategies rather than reactive ones. Real-time analytics and AI integration are driving the growth of predictive analytics, making it more accurate, accessible, and critical for business success. Custom predictive analytics solutions can enhance customer satisfaction, reduce costs, and…