- Overview of Healthcare Software in the Middle East

- A Comprehensive View of the Costs Involved in Developing Healthcare Software

- Cost Breakdown by Development Stage

- How to Estimate Healthcare Software Development Costs

- Time and Effort Estimates

- Factors Affecting Healthcare Software Development Costs

- UI and UX Complexity for Clinical and Non-Clinical Users

- Backend Complexity: Data Models, APIs, and Scalability

- Third-Party Integrations

- Security Requirements for Healthcare Data

- Compliance Requirements in the Middle East

- Platform Selection: Web, Mobile, Cloud, or Hybrid

- Technologies Used: AI, Analytics, and Interoperability

- Feature Complexity and Customisation Depth

- Challenges of Building Healthcare Software in the Middle East and How Enterprises Address Them

- Features Involved in Developing Healthcare Software

- Basic Features

- Advanced Features (Competitive Differentiators)

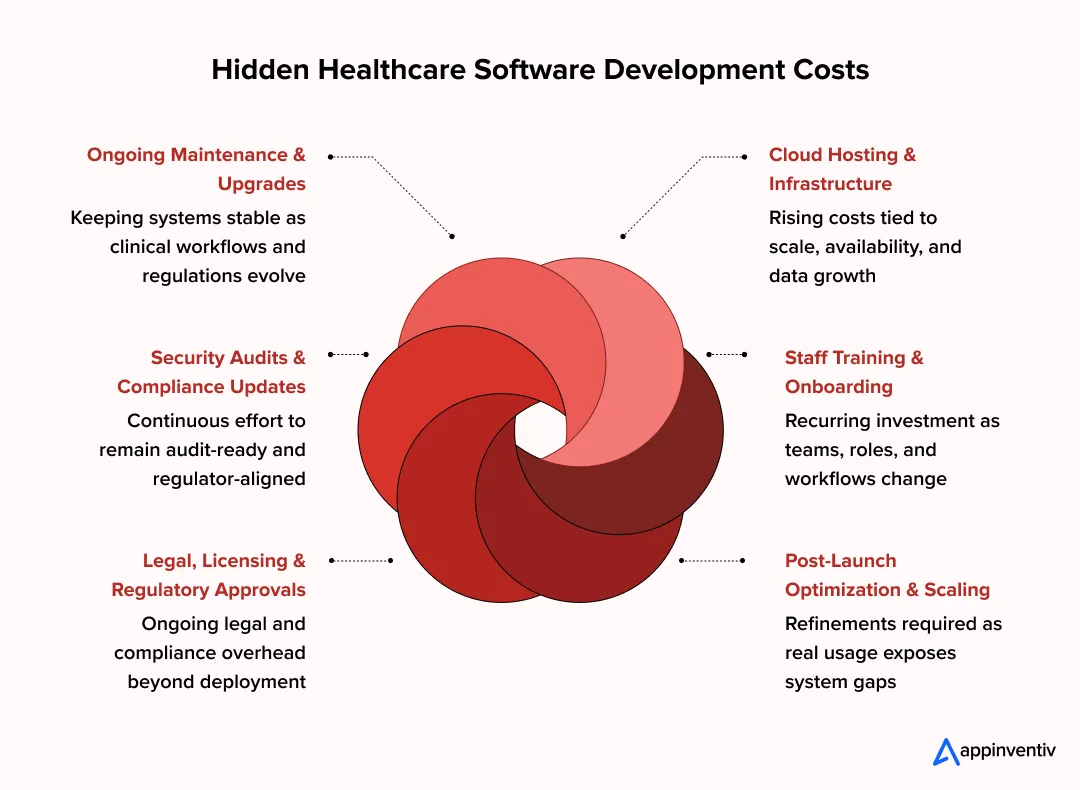

- Hidden Healthcare Software Development Costs

- Ongoing Maintenance and Upgrades

- Cloud Hosting and Infrastructure

- Security Audits and Compliance Updates

- Staff Training and Onboarding

- Legal, Licensing, and Regulatory Approvals

- Post-Launch Optimization and Scaling

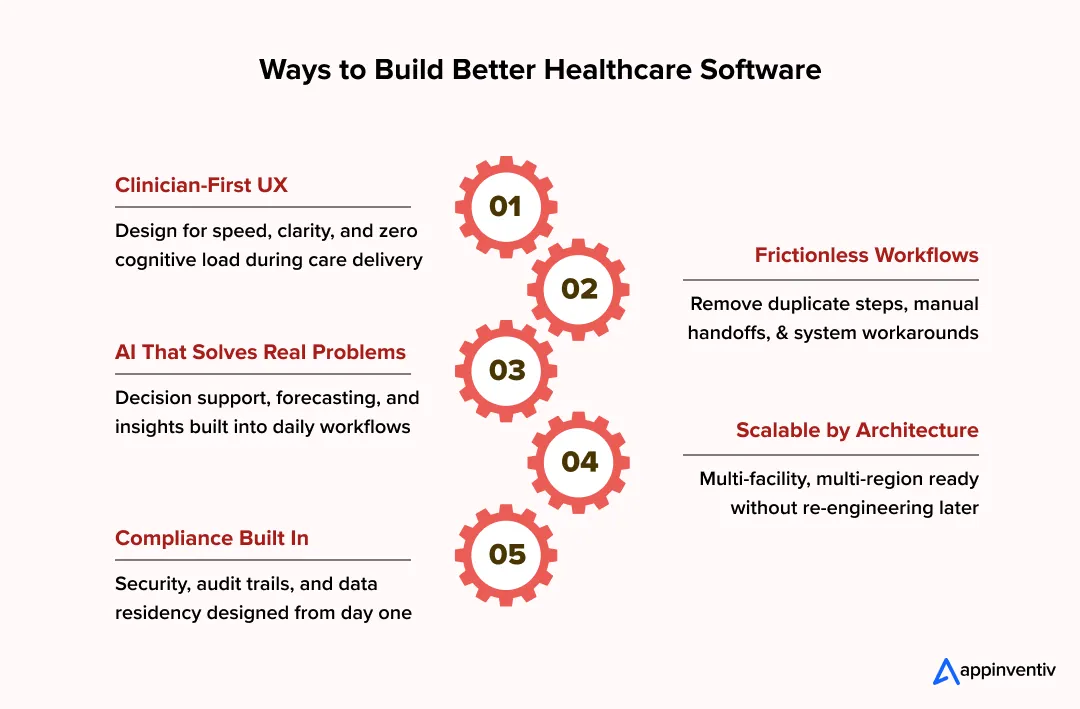

- Ways to Optimize Healthcare Software Development Costs

- Build and Validate an MVP First

- prioritize Compliance-Critical Features

- Use Modular Architecture

- Leverage Cross-Platform Development Where Appropriate

- Outsource Strategically with Local Compliance Oversight

- How to Develop Healthcare Software in the Middle East

- Requirements and Compliance Discovery

- Design and Architecture Planning

- Development and Integrations

- Testing and Validation

- Deployment and Scaling

- How Appinventiv Has Delivered Healthcare Software That Works in Practice

- YouComm Health App – Improving Patient Engagement Without Complexity

- Soniphi Vitality – Turning Health Signals Into Actionable Insight

- Health-E People – Structured Health Assessments That Scale

- DiabeticU – Supporting Chronic Care Through Consistent Workflows

- What These Projects Have in Common

- Revenue Models for Healthcare Software

- Why Partner with a Healthcare Software Development Company in the Middle East

- FAQs

Key takeaways:

- Healthcare software costs in the Middle East range widely because compliance, integrations, and scale matter more than features alone.

- Enterprise healthcare platforms cost more upfront but reduce long-term risk by replacing fragmented legacy systems.

- Regulatory alignment and data residency decisions shape architecture and budget from day one.

- Phased delivery and MVP-led rollouts help control cost, adoption risk, and operational disruption.

- The biggest savings come from building governance, interoperability, and scalability early, not retrofitting later.

If you are leading digital transformation for a hospital group or clinic network in the Middle East, cost is never the only concern. What usually matters more is whether today’s investment will still work under regulatory change, growth, and operational pressure. Many healthcare leaders are now questioning legacy platforms and asking a practical thing. What does healthcare software development in the Middle East really cost in 2026, and what drives that number?

This question is coming up as the region accelerates healthcare modernisation. Governments and private providers are investing heavily in digital health platforms that can scale across facilities and services. The Middle East healthcare IT market reached about $44.5 billion by 2034, driven by EMRs, telemedicine, analytics, and AI-enabled systems. The shift is clearly toward connected platforms, not standalone tools.

Cost planning becomes complex because healthcare software development cost in the Middle East depends on more than features or timelines. In the Middle East, the final budget is often shaped by things teams do not see upfront, such as regulatory checks, data hosting constraints, integration dependencies, and how ready internal staff are to work with new systems. organizations operating in the UAE or Saudi Arabia usually feel this when projects move from planning into real hospital environments. This guide focuses on those realities, so decisions are based on how costs actually build up, not on ideal scenarios.

This becomes especially critical for organizations planning multi-facility rollouts, government integrations, or long-term platform modernization rather than one-off applications.

IMARC notes that healthcare IT growth in the Middle East is being driven by mandated digitisation, EMR standards, and national health data programs, not optional upgrades.

Overview of Healthcare Software in the Middle East

Healthcare software adoption across the Middle East is accelerating because providers are under pressure to scale fast without compromising compliance or care quality. Hospital groups, clinic networks, and government health systems are moving away from fragmented tools toward integrated platforms that support visibility, automation, and long-term control. For many organizations , healthcare software development in the Middle East has become a strategic requirement rather than an IT upgrade.

What is driving adoption

- National digital health strategies and government-led modernisation program s

- Rapid population growth and higher demand for chronic and preventive care

- Mandatory digitisation of records, billing, and reporting in key markets

- Rising focus on healthcare digital transformation cost Middle East as a measurable investment, not an expense

Market performance and regional momentum

- Strong digital health investments across GCC and wider MENA

- UAE and Saudi Arabia leading adoption through large-scale hospital digitisation

- Qatar and neighbouring markets expanding telemedicine and analytics platforms

- Growing interest in healthcare software ROI Middle East from enterprise operators

Common healthcare software categories

- Hospital Information Systems supporting clinical, operational, and financial workflows

- EMR and EHR platforms aligned with regional compliance requirements

- Telemedicine app for remote consultations and follow-up care

- Pharmacy management systems integrated with hospital operations

Core technologies in use

- Cloud infrastructure with regional data residency controls

- AI and analytics for clinical insights and operational optimisation

- Interoperability standards to support system integration across providers

This foundation sets the context for understanding how healthcare software development cost in the Middle East is shaped by scale, regulation, and technology choices.

As these platforms expand across facilities, regions, and regulatory boundaries, cost planning becomes less about development hours and more about architecture, compliance readiness, and long-term operational control.

A Comprehensive View of the Costs Involved in Developing Healthcare Software

For healthcare leaders in the Middle East, cost conversations almost never start with code or features. They usually begin with bigger questions around regulatory risk, future expansion, and how many legacy systems the new platform will need to live alongside. As more organizations introduce intelligence into clinical and operational workflows, AI powered healthcare software development cost has become part of that discussion. Especially for teams planning automation, forecasting, or predictive analytics, the real concern is not just what it costs to build, but how well it holds up once those capabilities are live.

In markets like the UAE and Saudi Arabia, healthcare software is expected to last years, not release cycles. That expectation alone reshapes how healthcare software development costs in the Middle East should be viewed.

Across real-world projects, the total investment typically ranges between AED 147,000 and AED 1,470,000 (USD 40,000 to USD 400,000). Where your project falls depends on complexity, compliance depth, and how many downstream systems the platform must support.

For healthcare leaders, the real cost question is not the initial build, but whether the platform can scale across facilities, remain compliant as regulations evolve, and support advanced capabilities like AI without expensive rework.

Cost Breakdown by Software Complexity

Different levels of software maturity introduce very different cost structures. What looks affordable at launch can become expensive to replace or retrofit later.

| Software Complexity Level | Typical Use Cases | Cost Range (AED) | Cost Range (USD) | Compliance & Risk Profile |

|---|---|---|---|---|

| Basic Healthcare Software (Single-Module Systems) | Appointment scheduling, patient intake, basic reporting for clinics or diagnostic centres | AED 147,000 – 294,000 | USD 40,000 – 80,000 | Minimal clinical risk, lighter regulatory exposure, limited DHA or internal compliance needs |

| Mid-Complexity Platforms (Multi-Module Clinical Systems) | EMR, billing, pharmacy, lab coordination, role-based access across hospital groups or specialist networks | AED 367,000 – 735,000 | USD 100,000 – 200,000 | Stronger compliance alignment, audit readiness, integration with insurance and internal systems |

| Enterprise-Grade Healthcare Systems (Multi-Facility, Regulated Platforms) | Multi-hospital operations, labs, cross-region healthcare platforms with interoperability and uptime guarantees | AED 1,100,000 – 1,470,000 | USD 300,000 – 400,000 | Designed for DHA healthcare software compliance and regional regulatory authorities |

Basic Healthcare Software (Single-Module Systems)

These systems solve a specific operational problem such as appointment scheduling, patient intake, or simple reporting. They are common in standalone clinics, diagnostic centres, or as pilot deployments within larger healthcare groups.

- Typical cost range: AED 147,000 to AED 294,000 (USD 40,000 to USD 80,000)

- Minimal clinical risk and limited regulatory exposure

- Often used where DHA or internal compliance requirements are lighter

- Enterprise pain point: limited scalability and eventual replacement cost

While lower in upfront spend, many organizations outgrow these systems quickly as reporting, audit, or integration needs increase.

Mid-Complexity Platforms (Multi-Module Clinical Systems)

These platforms support multiple workflows such as EMR, billing, pharmacy, lab coordination, and role-based access. They are common across hospital groups and specialist networks expanding across cities or emirates.

- Typical cost range: AED 367,000 to AED 735,000 (USD 100,000 to USD 200,000)

- Stronger compliance alignment and audit readiness

- Integration with insurance, billing, and internal systems

- Enterprise pain point: balancing speed of rollout with clinical safety

This is where healthcare software development in Middle East projects begin to face real governance, training, and data consistency challenges.

Enterprise-Grade Healthcare Systems (Multi-Facility, Regulated Platforms)

Enterprise systems operate across hospitals, clinics, labs, and sometimes countries. They must handle high transaction volumes, regulatory audits, interoperability in healthcare, and uptime guarantees.

- Typical cost range: AED 1,100,000 to AED 1,470,000 (USD 300,000 to USD 400,000)

- Designed for DHA healthcare software compliance and regional regulators

- Built for long-term scalability, security, and reporting

- Enterprise pain point: upfront cost versus long-term operational resilience

These platforms often replace fragmented legacy systems and become the backbone of digital health operations.

Cost Breakdown by Development Stage

Each stage of development carries its own cost and risk profile. Skipping depth early almost always increases spends later.

Planning and Discovery

This phase determines whether the system aligns with real clinical workflows or fails post-launch. In the Middle East, discovery must also factor in regulatory expectations and local hosting constraints.

- Includes stakeholder interviews, workflow mapping, compliance analysis

- Cost impact: 10 to 15%

- Pain point: underinvestment here leads to rework and audit risk

UX and UI Design

Healthcare UX must support speed, accuracy, and stress-heavy environments. Poor design directly impacts adoption by clinicians and administrators.

- Role-based workflows for doctors, nurses, admins, and finance

- Multilingual considerations in some GCC markets

- Cost impact: 10 to 20%

Frontend and Backend Development

This is where most of the budget is allocated. It includes core functionality, data models, APIs, and access controls.

- Handles patient data, workflows, and business logic

- Must support scale without degrading performance

- Cost impact: 40 to 50%

Integrations and Interoperability

Integration complexity is a major cost driver in the Middle East, especially when dealing with insurers, labs, pharmacies, or government systems.

- Billing, insurance, analytics, EMR integrations

- Regional interoperability standards and APIs

- Cost impact: 10 to 15%

Testing and Validation

Healthcare systems cannot rely on surface-level testing. Clinical accuracy and security validation are mandatory.

- Functional, security, and compliance testing

- User acceptance testing with real workflows

- Cost impact: 8 to 12%

Deployment and Post-Launch Support

Launch does not end the cost curve. Enterprises must plan for stabilisation, optimisation, and regulatory updates.

- Hypercare support during rollout

- Monitoring, patches, and early enhancements

- Cost impact: 5 to 10%initially

How to Estimate Healthcare Software Development Costs

Cost estimation becomes clearer when broken into structured components rather than assumptions.

A commonly used estimation model is:

Total Cost = (Team Size × Monthly Rate × Project Duration) + Compliance + Integrations

Variables that shift cost significantly include:

- Number of facilities and users

- Depth of regulatory and audit requirements

- Integration with national or insurer systems

- Level of AI, analytics, or automation

This approach helps leadership teams model realistic budgets for custom healthcare software development costs in the UAE.

Time and Effort Estimates

Timelines vary significantly based on complexity and compliance depth.

Typical delivery timelines

- Basic systems: 3 to 4 months

- Mid-complexity platforms: 5 to 7 months

- Enterprise systems: 8 to 12 months or longer

What extends timelines

- Compliance reviews and regulatory approvals

- Cloud data migration from legacy systems

- Training and phased rollouts across facilities

Understanding these dynamics allows healthcare organizations to approach medical software development in ME with clearer expectations, controlled risk, and stronger long-term returns.

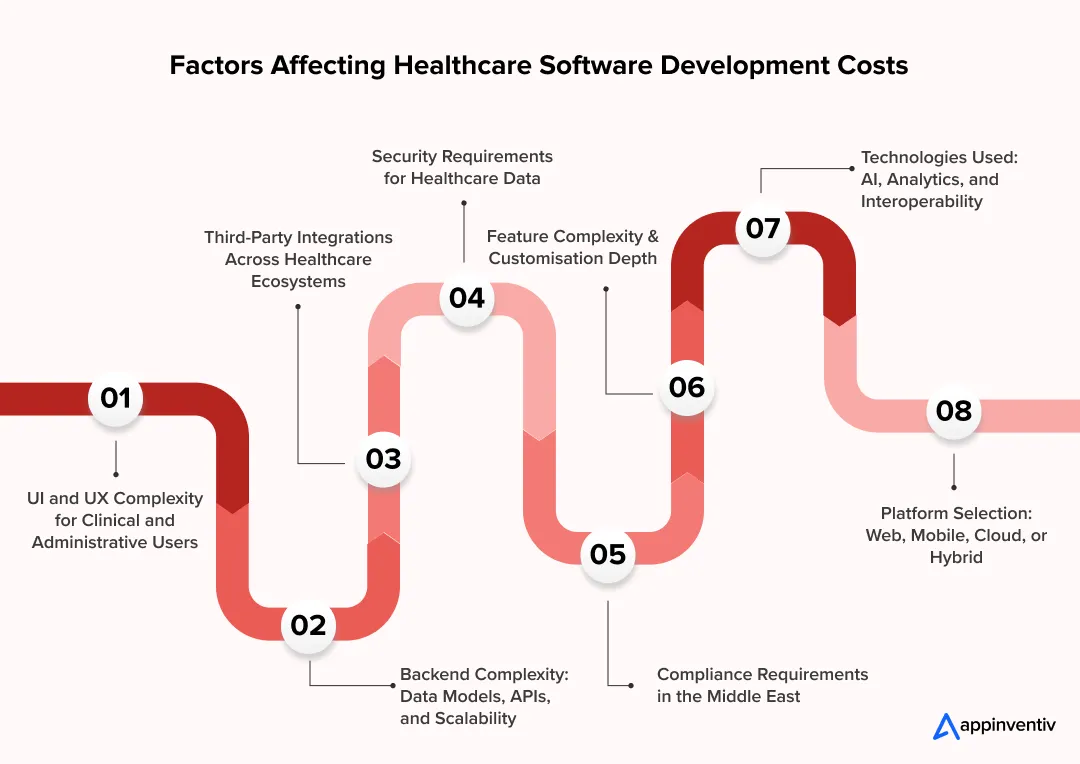

Factors Affecting Healthcare Software Development Costs

In the Middle East, healthcare software rarely becomes expensive because of a single feature. Costs rise when systems are expected to replace legacy platforms, meet strict regulatory expectations, and still scale across hospitals, clinics, and regions without breaking under pressure.

Most enterprise teams feel this early. What looks straightforward on paper becomes complex once real workflows, real data, and real compliance obligations enter the picture. Below are some of the common factors affecting the cost of healthcare software development in ME.

UI and UX Complexity for Clinical and Non-Clinical Users

Healthcare software must support the distinct needs of clinical, administrative, and operational users without slowing care delivery. So, to make the process efficient the healthcare software needs to be designed in a way that it offers speed, clarity and zero friction.

Design effort increases when:

- Interfaces must support fast, error-free clinical actions

- Admin and finance users need dashboards, approvals, and reporting

- Arabic and English experiences must feel equally intuitive

- Safety patterns are required to prevent costly or dangerous mistakes

When UX is rushed, adoption slows and retraining costs quietly pile up after launch.

Backend Complexity: Data Models, APIs, and Scalability

The backend is where healthcare software either holds up over time or quietly collapses under growth.

In Middle East healthcare environments, systems must cope with growing patient volumes, multiple facilities, and regulatory reporting that changes over time.

Cost increases when teams need:

- Deep clinical data models rather than simple records

- Secure healthcare APIs that connect departments and external platforms

- Architecture that supports expansion without performance drops

- High availability and recovery planning from day one

Fixing backend shortcuts later is usually far more expensive than building it right early.

Third-Party Integrations

Very few healthcare organizations are starting from scratch. New software almost always has to fit into an existing ecosystem.

Each integration brings its own cost, not just to build but to maintain.

Common integration pressure points include:

- Existing EMR or EHR platforms with legacy structures

- Insurance and billing systems with local rules

- Labs, pharmacies, and imaging systems running on older tech

- External reporting or regulatory platforms

When documentation is weak or systems are outdated, integration effort rises quickly.

Security Requirements for Healthcare Data

Security decisions shape both development cost and long-term risk.

Healthcare data cannot rely on generic protection models. Systems must actively control who sees what, when, and why.

Cost drivers often include:

- Role-based identity and access management aligned with clinical responsibilities

- Strong encryption across storage and data movement

- Continuous logging and monitoring for audit readiness

- Secure API gateways protecting internal and external integrations

Security gaps are rarely cheap to fix once systems are live.

Compliance Requirements in the Middle East

Compliance in the Middle East shapes architecture from day one. It is not a final review step. Healthcare software must align with country-specific regulations that affect hosting, data access, and system design.

Key compliance considerations include:

- UAE: DHA healthcare software compliance, HIPAA equivalent regulations UAE such as PDPL, local health authority guidelines, and strict controls around patient data handling

- Saudi Arabia: NPHIES integration requirements, national health data standards, and Saudi PDPL obligations

- Qatar and other GCC states: Ministry of Public Health (MoPH) regulations, data residency expectations, and audit readiness

Platforms must also support long-term record retention, traceability, and controlled data visibility. Ignoring compliance early often leads to rework or delayed approvals.

Platform Selection: Web, Mobile, Cloud, or Hybrid

Platform choices shape both cost and flexibility.

Many healthcare organizations operate hybrid environments because legacy systems cannot be replaced overnight and regulations still demand control.

Cost varies depending on:

- Web platforms for internal operations

- Mobile tools for clinicians or patient engagement

- Cloud infrastructure for scale and analytics

- Hybrid setups that balance control and modernisation

Poor platform alignment often creates fragmented systems that cost more to manage over time.

Technologies Used: AI, Analytics, and Interoperability

Advanced technology can unlock value, but only when it is governed properly.

Costs rise when systems include:

- AI models for automation, prediction, or clinical support

- Analytics layers for operational and clinical insight

- AI agent Interoperability frameworks for data exchange across platforms

- AI in data governance to ensure transparency and compliance

Without clear guardrails, advanced tech adds risk instead of return.

Feature Complexity and Customisation Depth

Enterprise healthcare software rarely succeeds as a standard product. Real operations demand flexibility, but unchecked customisation drives cost.

Effort increases when teams require:

- Facility-specific clinical workflows

- Country-level billing or insurance logic

- Granular permissions and approval chains

- Extensibility for future digital initiatives

The most successful platforms balance configuration with structure rather than rebuilding everything from scratch.

In practical terms, hospital software development cost in the UAE rises when systems are expected to replace legacy platforms, meet strict compliance, and still support future growth. Teams that invest early in solid architecture and governance usually avoid the cycle of patching, rebuilding, and escalating costs later.

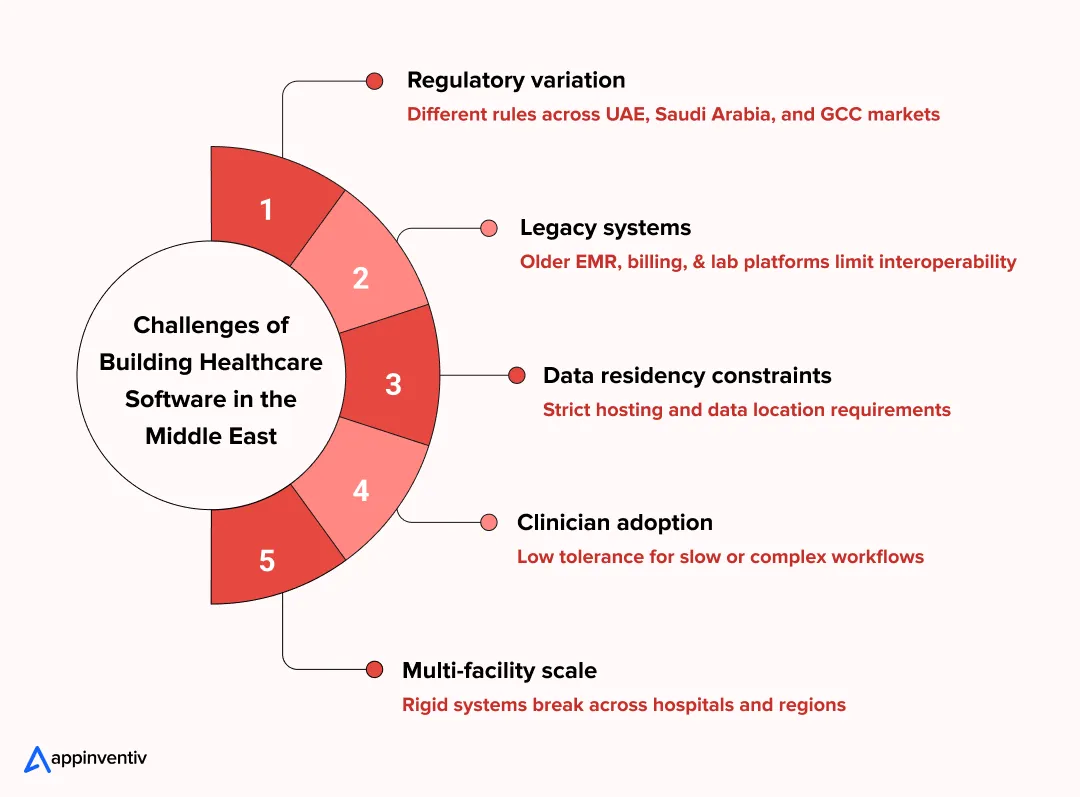

Challenges of Building Healthcare Software in the Middle East and How Enterprises Address Them

Most challenges in Middle East healthcare software projects do not show up on day one. They tend to appear slowly, once planning moves into real hospitals, real users, and real regulatory reviews. Teams with experience in the region usually manage this better because they design for those pressures early instead of fixing issues after go-live.

- Navigating complex and evolving regulations

Healthcare rules are not uniform across the UAE, Saudi Arabia, and the wider GCC. Hosting decisions, access permissions, reporting structures, and even UI flows are affected by local authority expectations.

How enterprises address it:

Regulatory and compliance teams are brought in during discovery, not at the end. Architecture, audit trails, and data access rules are shaped upfront so approvals are not a last-minute scramble.

- Integrating with legacy clinical and operational systems

Many healthcare providers still depend on EMR, billing, lab, or pharmacy systems that were built long before interoperability was a priority. Replacing everything at once is rarely realistic.

How enterprises address it:

Integrations are planned in stages. API layers are added carefully so existing systems can continue running while newer platforms are introduced without interrupting patient care.

- Meeting data residency and hosting requirements

Data location rules often limit where healthcare information can be stored or processed, which narrows infrastructure choices and affects performance planning.

How enterprises address it:

Hybrid or regionally hosted cloud environments are designed early. This allows teams to meet residency obligations while still leaving room for future scale and analytics.

- Driving adoption among clinicians and staff

Even well-engineered systems fail if they slow people down. Clinicians and support staff are already stretched, and tolerance for friction is low.

How enterprises address it:

Workflows are observed on the ground rather than assumed. Interfaces are built for speed and error reduction, and pilot rollouts are used to adjust the system before wider deployment.

- Scaling across facilities and borders

Large healthcare groups rarely operate the same way in every location. Rigid platforms struggle once they meet local variation.

How enterprises address it:

Systems are built with configurable rules, permissions, and workflows. This allows local flexibility without breaking the core platform or governance model.

When these challenges are accounted for early, healthcare software development in the Middle East becomes far more manageable. Costs are easier to control, compliance risks reduce, and platforms are far more likely to support growth instead of becoming the next legacy system.

From legacy system modernisation to AI-ready, compliant platforms, we help healthcare organisations build software that scales across facilities and regulations.

Features Involved in Developing Healthcare Software

When healthcare organizations plan new software, features are usually discussed first. What matters more, though, is how those features behave in real environments. In the Middle East, systems must support busy clinical teams, strict governance, and long-term expansion without forcing repeated rebuilds.

Most platforms begin with a stable operational core, then evolve as digital maturity increases.

Basic Features

These capabilities support everyday healthcare operations. Without them working reliably, no advanced functionality delivers value.

- Patient registration and profiles:

Patient records need to stay consistent across visits, departments, and facilities. This includes demographics, identifiers, consent details, and visit history, all accessible without duplication or manual reconciliation.

- Appointment scheduling

Scheduling tools manage bookings, cancellations, reminders, and clinician availability. In high-volume settings, even small inefficiencies here quickly affect patient flow and staff workload.

- Medical records management:

Clinical documentation must be easy to access but tightly controlled. Systems typically store notes, prescriptions, lab results, and imaging references while enforcing clear access rules.

- Billing and reporting:

Billing modules support invoicing, insurance processing, and financial reporting. Accuracy matters, not just for revenue, but for audits and regulatory reviews.

Advanced Features (Competitive Differentiators)

As organizations scale or replace legacy systems, advanced features shift from optional to necessary. These capabilities usually separate basic digital tools from enterprise healthcare platforms.

- Telemedicine and remote consultations:

Virtual care tools support follow-ups, specialist access, and remote consultations. When built into the core system, they reduce fragmentation and improve continuity of care.

- AI-driven diagnostics or analytics:

AI in healthcare in ME is increasingly used to support clinical insights and operational planning. This can include predictive analytics, workload forecasting, or decision support, provided governance is built in.

- Interoperability with national health systems:

Healthcare platforms often need to exchange data with government or regional systems. Secure interoperability ensures reporting accuracy and alignment with national digital health initiatives.

- Role-based access and audit trails:

Access control must reflect real clinical responsibilities. Detailed audit trails help organizations demonstrate compliance and investigate issues when required.

- Multi-facility management:

Healthcare groups operating across multiple sites need central visibility without losing local control. Multi-facility features support consistent governance, shared reporting, and controlled data access.

In practice, these features determine whether healthcare software simply digitises existing processes or becomes a foundation for long-term operational control and digital growth.

Hidden Healthcare Software Development Costs

When teams estimate healthcare software development cost in the Middle East, the focus is usually on the build. What often gets missed are the costs that appear once the platform is live and supporting real patients, clinicians, and regulators. These are not edge cases. They are part of owning healthcare software in the region.

Planning for them early protects budgets and delivery timelines later.

Ongoing Maintenance and Upgrades

Healthcare systems cannot remain unchanged for long. Clinical practices shift, regulations evolve, and user expectations increase as adoption grows.

- Fixes that emerge only after real clinical usage

- Performance tuning as patient and data volumes increase

- Small but continuous feature updates driven by frontline feedback

- Refactoring legacy components to avoid long-term instability

Skipping maintenance usually leads to higher healthcare software development costs in the Middle East over time.

Cloud Hosting and Infrastructure

Most healthcare platforms across the Middle East operate on cloud or hybrid infrastructure to support scale and availability. Infrastructure spend grows quietly as usage increases.

- Compute and storage linked to patient records and imaging

- Backup environments and disaster recovery setups

- High-availability configurations for critical clinical systems

- Monitoring tools to track uptime, latency, and failures

These costs become more visible as platforms expand across facilities or regions.

Security Audits and Compliance Updates

Security and compliance are ongoing responsibilities, not launch milestones. Healthcare software must remain audit-ready at all times.

- Regular penetration testing and vulnerability assessments

- Updates to meet new health authority or regulatory guidance

- Adjustments to access controls as teams and roles change

- Incident response planning and documentation reviews

For regulated environments, this directly impacts healthcare digital transformation cost in the Middle East.

Staff Training and Onboarding

Even well-designed platforms need structured onboarding. Staff turnover and workflow changes make training a recurring requirement.

- Initial system training for clinical and administrative users

- Refresher sessions after feature or policy updates

- Documentation and internal support materials

- Change management to reduce resistance and workarounds

Underestimating training often reduces healthcare software ROI in the Middle East.

Legal, Licensing, and Regulatory Approvals

Healthcare software frequently relies on licensed tools and regulated integrations. Legal involvement continues well beyond deployment.

- Licensing fees for third-party platforms and services

- Legal reviews around data handling and vendor agreements

- Regulatory approvals when expanding into new facilities or services

- Documentation updates for inspections and audits

These costs tend to increase as organizations scale or regionalize systems.

Post-Launch Optimization and Scaling

Real-world usage always exposes gaps that were not visible during development. Scaling safely requires further investment.

- Optimising performance under peak clinical load

- Refining workflows based on clinician feedback

- Architecture updates to support new hospitals or clinics

- Additional integrations as digital maturity increases

This phase often determines whether healthcare software becomes a long-term asset or a recurring problem.

In practice, the cost of healthcare app development in the Middle East extends far beyond launch. Organizations that factor in these hidden costs early are better positioned to scale, stay compliant, and protect their investment as healthcare operations grow.

Ways to Optimize Healthcare Software Development Costs

Cost optimization in healthcare software is not about cutting corners. It is about making disciplined technical and delivery decisions that reduce rework, control risk, and protect compliance. In Middle East healthcare environments, the smartest cost savings usually come from structure and sequencing, not from lowering quality.

Build and Validate an MVP First

Launching everything at once is one of the fastest ways to inflate healthcare software development costs in the Middle East. An MVP approach allows teams to validate real workflows before committing to large-scale builds.

- Focus on core clinical and operational use cases

- Test adoption with real users in live environments

- Identify gaps early before architecture hardens

- Reduce wasted spend on low-impact features

A well-scoped MVP lowers both delivery risk and long-term cost.

prioritize Compliance-Critical Features

Not every feature carries the same regulatory weight. In Middle East healthcare systems, compliance-related capabilities should be treated as non-negotiable foundations.

- Data access controls and audit logging

- Secure patient data storage and transmission

- Reporting aligned with health authority requirements

- Clear consent and traceability mechanisms

Building compliance first avoids expensive redesigns later.

Use Modular Architecture

Monolithic systems are harder and more expensive to evolve. Modular architecture helps organizations control cost as platforms grow.

- Independent modules for clinical, billing, and analytics

- Easier upgrades without full system disruption

- Faster onboarding of new facilities or services

- Lower long-term maintenance overhead

This approach is especially useful when modernizing legacy systems.

Leverage Cross-Platform Development Where Appropriate

Not every interface needs to be built separately. For certain use cases, cross-platform development can reduce both time and cost.

- Shared codebases for internal dashboards and admin tools

- Faster iteration cycles across web and mobile

- Reduced testing and maintenance effort

- Consistent user experience across devices

Clinical performance and safety should always guide where this is applied.

Outsource Strategically with Local Compliance Oversight

Many organizations reduce custom healthcare software development cost in ME by combining global engineering with regional governance.

- Use offshore teams for development and testing

- Maintain local oversight for compliance and data policies

- Keep architecture and security decisions close to stakeholders

- Ensure alignment with regional health regulations

This hybrid approach balances cost efficiency with regulatory control.

When done correctly, cost optimization strengthens delivery rather than weakening it. Healthcare organizations that plan architecture, compliance, and delivery strategy together tend to achieve better outcomes with more predictable healthcare software development cost in Middle East markets.

How to Develop Healthcare Software in the Middle East

Healthcare software development in the Middle East is best approached as a controlled transformation program rather than a one-off build. Regulatory alignment, legacy environments, and multi-stakeholder operations require a delivery model that is deliberate, staged, and auditable.

What follows is a high-level view of how successful healthcare platforms are typically delivered in the region.

Requirements and Compliance Discovery

This phase sets the boundaries of what can and cannot be built. In Middle East healthcare projects, compliance discovery often runs in parallel with functional discovery.

Teams usually focus on:

- Understanding clinical, operational, and reporting workflows

- Identifying applicable regulations, authority guidelines, and data residency rules

- Reviewing existing systems and data dependencies

- Clarifying governance expectations and approval paths

Strong discovery reduces downstream friction with regulators and internal stakeholders.

Design and Architecture Planning

Once requirements are clear, architecture decisions shape the platform’s lifespan. This stage is where long-term scalability and control are defined.

Typical activities include:

- Selecting cloud, hybrid, or controlled hosting models

- Designing system boundaries between core modules and integrations

- Planning interoperability with EMR, billing, lab, and pharmacy systems

- Defining security, access, and audit structures

Architecture missteps here are costly to correct later.

Development and Integrations

Development is usually executed in controlled increments, not as a single release. This allows teams to validate assumptions early.

Delivery often involves:

- Building priority clinical and administrative modules first

- Integrating existing healthcare and insurance platforms

- Applying secure API patterns and data validation

- Running regular reviews with clinical and IT stakeholders

Incremental delivery keeps systems aligned with real-world use.

Testing and Validation

In healthcare, testing extends beyond functionality. Systems must behave predictably under regulatory scrutiny and operational stress.

Validation typically covers:

- End-to-end workflow testing across roles

- Security, privacy, and access control checks

- Load and performance testing

- User acceptance testing in near-live conditions

This stage is critical for reducing launch risk.

Deployment and Scaling

Deployment is treated as an operational event, not just a technical one. Careful rollout protects patient care and staff confidence.

Common practices include:

- Phased deployment by facility or department

- Structured training and go-live support

- Active monitoring during early usage

- Planned scaling as adoption increases

A controlled rollout ensures stability while enabling growth.

Taken together, this approach helps organizations manage healthcare software development in the Middle East with fewer surprises, clearer governance, and systems that are built to last rather than patched over time.

How Appinventiv Has Delivered Healthcare Software That Works in Practice

When healthcare leaders explore healthcare software development, the real question is rarely about features alone. What matters is whether the system works under real conditions, with real users, regulatory pressure, and long-term operational demands. Appinventiv’s healthcare portfolio reflects this reality, with products built around adoption, scalability, and compliance rather than surface-level functionality.

The following case studies highlight how different healthcare challenges were addressed through thoughtful design, stable architecture, and clear governance.

YouComm Health App – Improving Patient Engagement Without Complexity

YouComm Health App was designed to streamline the process of maintaining patient and care team relationships. Instead of spreading communication across multiple tools, the platform brings scheduling, updates, and care coordination into a single experience.

What stands out in this project is the focus on clarity. Patients are not overwhelmed, and providers are not slowed down by unnecessary steps. For healthcare organizations operating at scale, this approach reduces friction while improving consistency in patient communication.

Soniphi Vitality – Turning Health Signals Into Actionable Insight

Soniphi Vitality focuses on continuous health monitoring using sensor and audio-based inputs. The platform translates complex signals into insights that users can actually understand and act on.

From a delivery perspective, this project demonstrates how advanced analytics and AI-driven logic can be implemented without compromising data protection or user trust. It is a strong example of how innovation can be balanced with governance in regulated healthcare environments.

Health-E People – Structured Health Assessments That Scale

Health-E People was designed to help individuals and providers assess health risks and track progress over time. The challenge here was structure. Health data needed to be organized, repeatable, and meaningful across different user groups.

The resulting platform shows how careful data modelling and workflow design can support long-term engagement. It also highlights the importance of presenting health insights in a way that supports decision-making rather than just data collection.

DiabeticU – Supporting Chronic Care Through Consistent Workflows

DiabeticU addresses one of the most demanding areas of healthcare: long-term condition management. The platform brings together tracking, reminders, and personalized guidance into a single system that patients can realistically use every day.

From an enterprise perspective, the value lies in reliability. The system supports secure data handling, predictable workflows, and the ability to scale without redesigning the core platform. This makes it a strong reference point for organizations planning condition-specific healthcare solutions.

What These Projects Have in Common

Across these healthcare platforms, the same principles appear again and again:

- Software designed around real user behavior, not assumptions

- Architecture that supports growth without repeated rework

- Secure handling of sensitive health data from the outset

- Technology choices that solve practical problems, not just showcase innovation

These case studies reflect a delivery mindset focused on durability and outcomes. For healthcare organizations evaluating new platforms, they offer a realistic view of what it takes to build software that remains useful long after launch.

Revenue Models for Healthcare Software

In the Middle East, healthcare software is almost never priced using a single formula. The model usually takes shape after practical questions are answered. Who owns the platform. How tightly it is regulated. And how long the organisation expects to run it before another major overhaul. For most providers, predictability and control matter far more than chasing the lowest upfront number.

- Subscription-based models

Subscriptions are common where healthcare platforms are delivered as managed or SaaS solutions. Clinics and private providers often prefer this route because it keeps costs steady and easy to forecast. Updates, support, and platform improvements are bundled in, which reduces the need for frequent contract resets or surprise maintenance conversations. - Licensing and enterprise contracts

Large hospital groups tend to think in longer cycles. Licensing or multi-year enterprise agreements fit that mindset better. These contracts usually cover custom builds, integrations, and ongoing support under a single commercial structure. The value here is clarity. Everyone knows what is included, what is not, and how long the arrangement is expected to last. - Usage-based or modular pricing

Some organizations prefer to grow into a platform rather than commit everything upfront. Usage-based or modular pricing supports that approach. Costs are tied to active users, facilities, or specific capabilities like telemedicine or analytics. This makes it easier to expand gradually, especially when adoption varies across departments or locations. - Government and public-sector procurement models

Public healthcare systems usually follow formal procurement routes such as tenders or framework agreements. In these cases, pricing is only one part of the decision. Compliance readiness, service continuity, and vendor accountability often carry more weight than feature velocity. Long-term reliability tends to win over aggressive short-term pricing.

Strong healthcare platforms are planned before code is written. If you want clarity on cost, risk, and long-term ownership, start with the right conversation.

Why Partner with a Healthcare Software Development Company in the Middle East

Healthcare software projects in the Middle East rarely fail because of technology choices alone. They struggle when local regulations, data residency rules, and real hospital operations are underestimated. Teams building healthcare software development in Middle East markets like the UAE or Saudi Arabia need partners who already understand how regional health authorities work, how approvals happen, and where projects typically slow down.

This is where cost, compliance, and scale start pulling in different directions. Appinventiv has spent years navigating that balance, delivering 1000+ digital projects in the Middle East, modernizing 500+ enterprise workflows, and supporting 12+ government and compliance programs. That experience helps avoid redesigns and compliance fixes that usually surface too late in the project lifecycle.

The real test comes after go-live. With 10+ years of regional experience, 35+ industries served, a 95% client satisfaction rate, 20+ strategic partnerships in the UAE, and 3+ regional excellence centers, Appinventiv works as a custom software development company in Dubai focused on systems that stay reliable, compliant, and scalable long after deployment.

If you are planning healthcare software development in the Middle East and want early clarity on cost, compliance, and long-term ownership, a short conversation with our experts can save months of rework later.

FAQs

Q. How much does it cost to build healthcare software in the Middle East?

A. Healthcare software development in the Middle East usually falls between AED 147,000 and AED 1,470,000 (USD 40,000 to USD 400,000). The wide range exists because cost is shaped by more than features. Regulatory scope, number of facilities, data residency rules, integrations with insurers or national platforms, and legacy system replacement all influence the final investment. A single-clinic platform looks very different from an enterprise system built to operate across hospitals, labs, and regions.

Q. What is the typical timeline and budget for enterprise healthcare software in the Middle East?

A. Enterprise healthcare platforms are rarely built or deployed in one straight line. Most organizations plan delivery in phases to reduce risk and disruption.

What teams usually plan for:

- Timeline: 8 to 12 months for enterprise-grade systems

- Budget drivers: compliance reviews, integrations, training, phased rollouts

- Reality check: data migration and approvals often extend timelines

The more facilities and regulators involved, the more important structured rollout becomes.

Q. What compliance and data regulations should be considered before building healthcare software in the Middle East?

A. Compliance planning starts before architecture decisions are finalized. In Middle East healthcare environments, regulations directly affect hosting, access control, and system design. UAE-based projects must align with DHA healthcare software compliance and PDPL-aligned privacy rules, while Saudi Arabia introduces additional national data and interoperability requirements. Treating compliance as an upfront design constraint avoids costly redesigns later.

Q. How do hospitals and healthcare startups in the Middle East plan software development differently?

A. Both groups build healthcare software, but they optimise for different pressures.

Typical differences in approach:

- Hospitals: focus on governance, interoperability, and long-term stability

- Startups: prioritize MVP speed, validation, and early adoption

- Common ground: both now recognize the benefits of building healthcare software in Middle East markets with compliance-ready foundations

Startups that ignore compliance early usually pay more later.

Q. When does it make sense to build custom healthcare software instead of buying off-the-shelf solutions?

A. Custom software makes sense when off-the-shelf tools start forcing workarounds. This usually happens when organizations need deeper integrations, regional compliance alignment, or workflows that do not match generic systems. For multi-facility operators and regulated providers, custom platforms reduce long-term friction and licensing dependency, even if the upfront investment is higher.

Q. What are the most common risks in healthcare software development in the Middle East and how can they be mitigated?

A. Most risks are operational, not technical.

Common challenges and how enterprises address them:

- Compliance gaps: solved by involving regulatory experts during discovery

- Legacy system integration: handled through phased API-based migration

- Low clinician adoption: reduced with workflow-led UX design and pilots

- Cost overruns: controlled through MVP-first delivery and modular builds

Risk drops sharply when assumptions are tested early.

Q. How long does it typically take to deploy enterprise-grade healthcare software in the Middle East?

A. Deployment is usually gradual. Large healthcare groups roll out software facility by facility to protect patient care and staff confidence. While development may finish within a year, full deployment often continues beyond that, especially when training, approvals, and post-launch optimization are included. Treating deployment as an operational program , not a switch flip, leads to better outcomes.

Q. What should healthcare organizations prepare internally before starting software development?

A. Successful healthcare software development in the Middle East starts with internal alignment. organizations that prepare workflows, clarify ownership, and assess legacy readiness move faster and spend less over time.

What helps most before kickoff:

- Clear documentation of clinical and admin workflows

- Early compliance ownership and decision paths

- Realistic expectations around training and change management

This preparation directly improves delivery speed and long-term ROI.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Healthcare 4.0: Redefining the Future of Connected Care and Clinical Intelligence

Key Takeaways Healthcare 4.0's ecosystem is autonomous and patient-centric, integrating AI, IoT, and cloud computing. AI-driven clinical intelligence enhances personalized care for healthcare professionals and improves patient outcomes through predictive analytics. IoT and AI are being implemented in smart hospitals to improve operational efficiency, resource management, and patient care. Connected care enables better patient empowerment…

How To Build A Custom Behavioral Health Software? Costs, Features & Compliances

Key Takeaways Custom behavioral health software development supports the unique needs of therapy work that many general EHR tools do not cover well. Start with the foundational modules. Clinical notes, scheduling, billing, and security should be the first modules you build. Treatment plans and consent controls are important for safe and organized care, so they…

How Custom Healthcare App Development is Powering Digital-First NHS Care

Key Highlights: NHS teams are moving fast toward digital-first care, and custom apps are filling gaps that the standard NHS App cannot cover. Custom healthcare apps help reduce workload, cut waiting times, and improve how patients access care across Trusts and ICS regions. UK rules such as DTAC, NHS DSP Toolkit, NHS Login, and UK…