- Fintech Outsourcing Through a Market Lens: What Businesses Must Know

- What Global Research Is Signaling to Fintech Leaders

- Fintech Week’s Take: Outsourcing Has Moved to the Front Office

- Benefits of Fintech Development Outsourcing for Businesses

- Execution Moves Forward Without Internal Gridlock

- Specialized Skills Without Long-Term Hiring Commitments

- More Control Over Timelines and Planning

- Flexibility Across Different Product Phases

- Faster Progress on AI and Data-Led Initiatives

- Lower Delivery Risk Through Repeated Experience

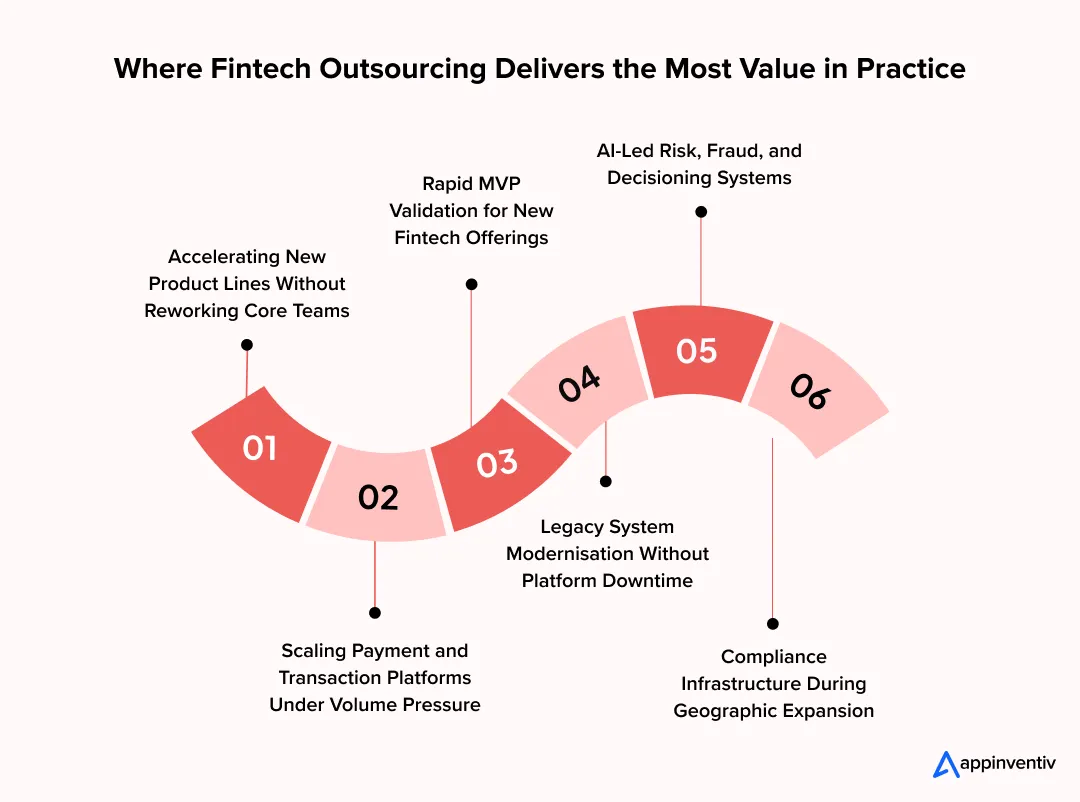

- Fintech Outsourcing Use Cases Businesses Are Actively Adopting

- Accelerating New Product Lines Without Reworking Core Teams

- Scaling Payment and Transaction Platforms Under Volume Pressure

- Rapid MVP Validation for New Fintech Offerings

- Legacy System Modernisation Without Platform Downtime

- AI-Led Risk, Fraud, and Decisioning Systems

- Compliance Infrastructure During Geographic Expansion

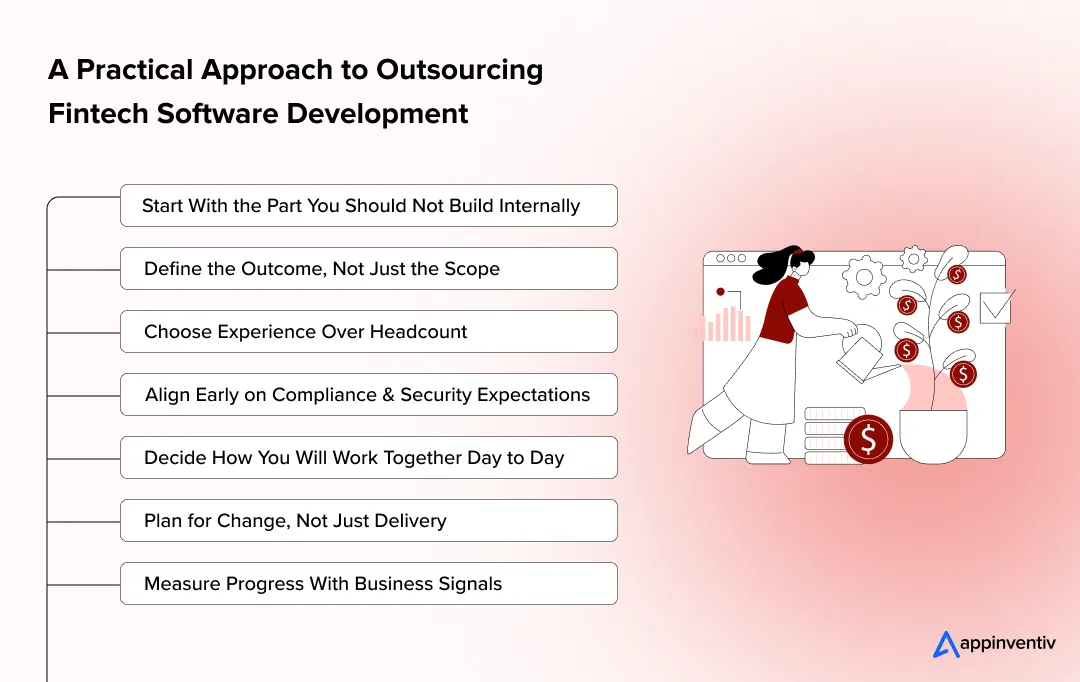

- How to Outsource Fintech Software Development

- Start With the Part You Should Not Build Internally

- Define the Outcome, Not Just the Scope

- Choose Experience Over Headcount

- Align Early on Compliance and Security Expectations

- Decide How You Will Work Together Day to Day

- Plan for Change, Not Just Delivery

- Measure Progress With Business Signals

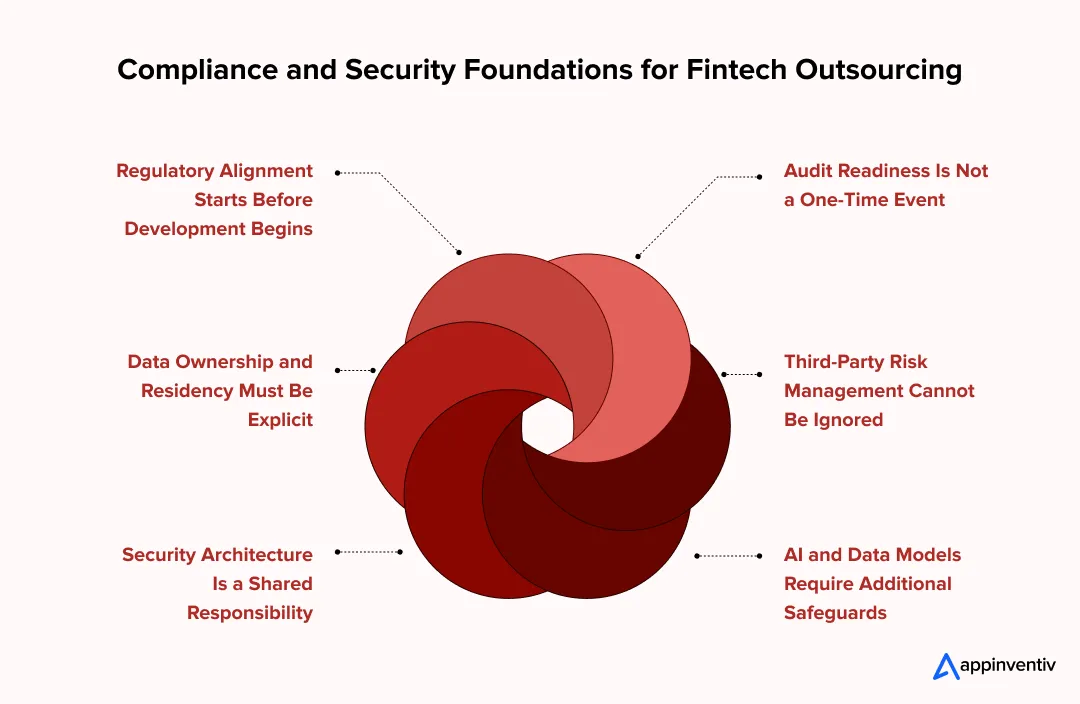

- Compliance and Security Considerations for Outsourced Services in the Fintech Industry

- Regulatory Alignment Starts Before Development Begins

- Data Ownership and Residency Must Be Explicit

- Security Architecture Is a Shared Responsibility

- Audit Readiness Is Not a One-Time Event

- Third-Party Risk Management Cannot Be Ignored

- AI and Data Models Require Additional Safeguards

- Key Outsourcing Risks in Fintech Development That Require Early Planning

- Cost of Outsourcing Fintech Development: What Leaders Should Expect

- Typical Cost Ranges Leaders See in Practice

- What Actually Drives Cost in Fintech Outsourcing

- Why Cheaper Is Rarely Cheaper in Fintech

- How CFOs and CTOs Typically Frame the Decision

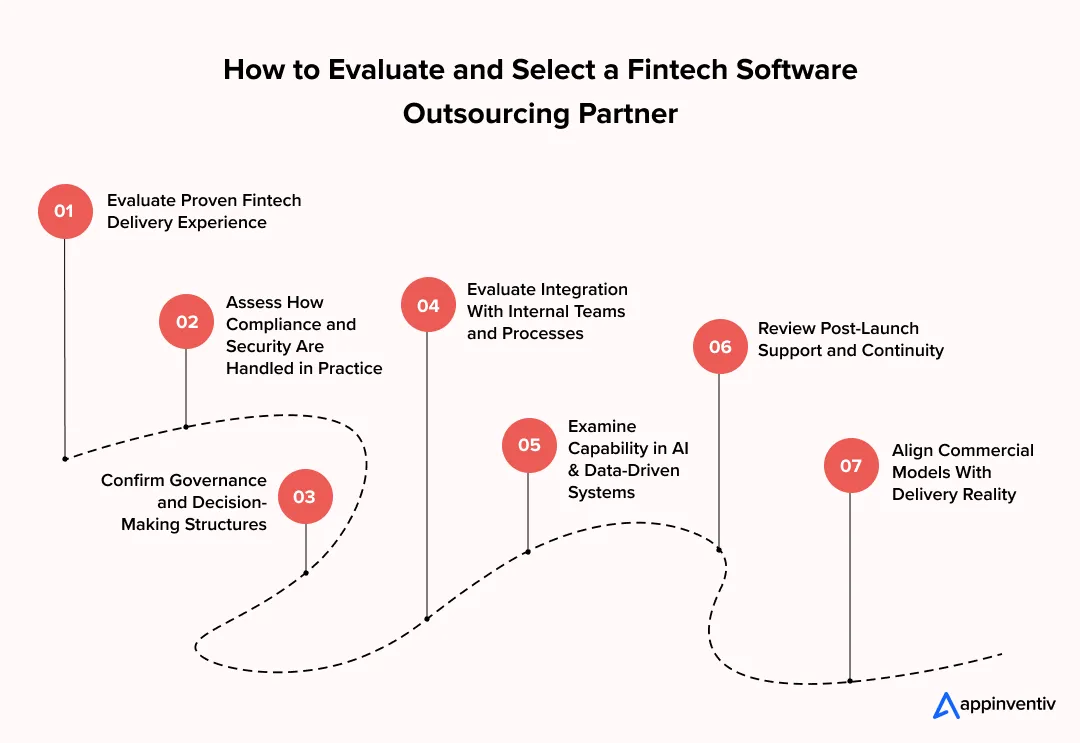

- How to Choose the Right Fintech Software Outsourcing Firm

- Step 1: Evaluate Proven Fintech Delivery Experience

- Step 2: Assess How Compliance and Security Are Handled in Practice

- Step 3: Confirm Governance and Decision-Making Structures

- Step 4: Evaluate Integration With Internal Teams and Processes

- Step 5: Examine Capability in AI and Data-Driven Systems

- Step 6: Review Post-Launch Support and Continuity

- Step 7: Align Commercial Models With Delivery Reality

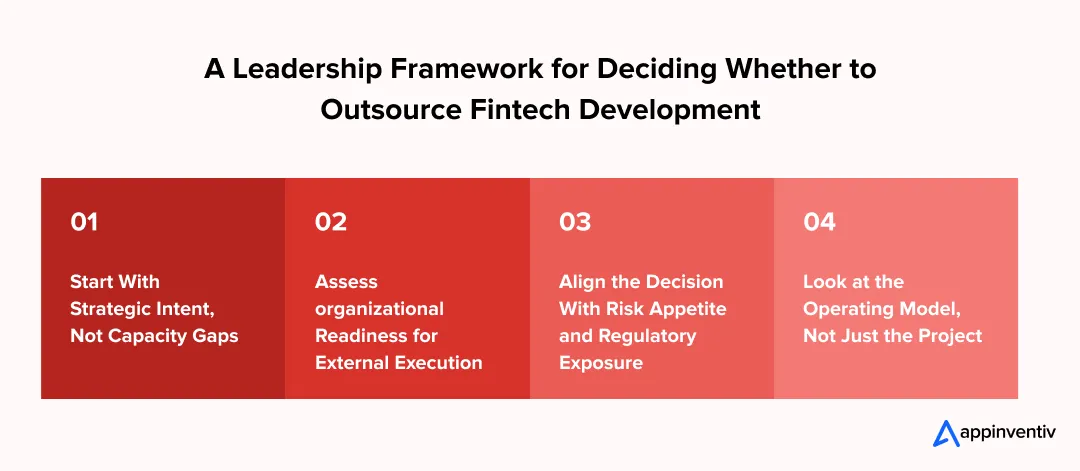

- Should You Outsource Fintech Development? A Decision Framework for CTOs, CIOs, CEOs, and CFOs

- Start With Strategic Intent, Not Capacity Gaps

- Assess organizational Readiness for External Execution

- Align the Decision With Risk Appetite and Regulatory Exposure

- Look at the Operating Model, Not Just the Project

- Why Appinventiv Is the Right Fintech Software Outsourcing Partner

- FAQs

Key takeaways:

- Fintech development outsourcing is no longer a cost tactic. It has become a core execution model for teams balancing speed, compliance, and scale.

- The most successful fintechs outsource selectively, keeping core IP and decision-making in-house while extending execution capacity externally.

- Cost predictability in fintech outsourcing comes from clear scope, governance, and regulatory alignment, not from low hourly rates.

- Compliance and security must be designed into fintech outsourcing engagements from the start, not layered in after development begins.

- Outsourcing works best when treated as an operating model decision, aligned with long-term product evolution and regulatory exposure.

- Choosing the right fintech software outsourcing partner depends more on domain maturity and delivery discipline than on technical skill alone.

Fintech teams are not short on ideas. They are short on time, certainty, and room for error. Regulations keep shifting, customer expectations reset every year, and legacy systems refuse to move at the same pace as the market. For many leaders, the real problem is not building something new, it is keeping up without burning teams out or blowing timelines.

This is where fintech development outsourcing starts showing up in real boardroom conversations. Not as a cost-saving trick, but as a way to regain execution speed. When internal teams are tied up with compliance work, platform stability, or endless integrations, progress stalls. Outsourcing becomes less about delegation and more about survival.

CEOs and CTOs are also dealing with a quieter issue. Hiring specialist talent has become harder, slower, and more expensive. Payments engineers, risk experts, and AI-focused architects do not stay on the market for long. Thus, fintech software outsourcing allows leaders to access that depth without locking themselves into permanent overheads or risky hiring cycles.

This guide looks at fintech engineering outsourcing through a 2026 lens. Not theory, not buzzwords, but practical decisions leaders are making right now. From fintech product development outsourcing to AI-driven builds and enterprise-scale programs, we will break down what works, what fails, and how to approach outsourcing without losing control of your product or your vision.

If you are rethinking execution speed, internal bottlenecks, or parallel delivery without breaking governance, we can help!

Fintech Outsourcing Through a Market Lens: What Businesses Must Know

Fintech is entering 2026 with a very different operating reality than even two years ago. The market is no longer rewarding experimentation alone. It is rewarding execution at scale, predictability, and the ability to adapt continuously without destabilising core systems. That shift is visible not just in product strategies, but in how fintech organizations are choosing to build and run technology itself.

What we are seeing now is a structural change. Fintech development outsourcing is no longer an edge tactic used during peak workloads. It is becoming part of the default operating model for both fast-growing fintechs and established financial institutions modernizing their stacks. And paving the way for digital transformation. This momentum is being shaped from the top down.

What Global Research Is Signaling to Fintech Leaders

Gartner’s recent CFO-focused research heading into 2026 points to a clear recalibration. Finance leaders are expected to fund growth and AI initiatives while simultaneously absorbing sustained cost pressure. According to Gartner analysts, organizations that incorporate outsourcing into their digital transformation strategy are better positioned to balance these competing demands, particularly when finance technology investments are involved.

This is not framed as outsourcing for savings alone. Gartner’s leadership commentary increasingly positions outsourcing as a way to secure access to specialised finance and technology capabilities without slowing down strategic agendas.

From a market perspective, this is critical:

- CFOs are being measured on value creation, not just efficiency

- Boards expect AI and data initiatives to move faster, not later

- Internal capacity constraints are assumed, not debated

Outsourcing fits into this equation as a structural enabler, not a temporary fix.

Fintech Week’s Take: Outsourcing Has Moved to the Front Office

Industry commentary from This Week in Fintech reinforces this shift in a more operational context. Their analysis frames outsourcing as “the new front office,” highlighting how modern fintechs are embedding external partners directly into customer-facing and revenue-critical workflows.

This reflects a broader change in how outsourcing is perceived:

- It is no longer confined to background operations

- It increasingly touches CX, compliance workflows, and real-time decisioning

- It operates closer to the product and the customer than ever before

In other words, outsourcing is becoming infrastructure.

Taken together, these signals point to a clear reframing happening across fintech leadership teams:

- Outsourcing is no longer treated as a downstream execution choice

- It is discussed alongside platform strategy, AI roadmaps, and operating models

- Decisions are being made earlier in the product and scaling lifecycle

This is why fintech software outsourcing is showing up in strategic planning discussions, not just delivery conversations.

The market is not waiting for organizations to “get ready.” It is already rewarding those that have aligned their execution models with this reality. For fintech leaders looking ahead, the question is no longer whether outsourcing belongs in the strategy, but how deliberately it is integrated into it.

Benefits of Fintech Development Outsourcing for Businesses

Fintech outsourcing works when it removes friction, not when it adds layers. In 2026, businesses are not outsourcing because they cannot build. They are outsourcing because building everything internally no longer makes sense at market speed. Fintech engineering outsourcing has become a way to stay responsive without turning execution into a bottleneck.

Below are the benefits leaders usually see once outsourcing is done with intent.

Execution Moves Forward Without Internal Gridlock

Most fintech teams are already busy keeping systems stable, compliant, and live. New initiatives compete for the same people. When companies outsource development for fintech initiatives, progress does not depend on internal availability alone. Work moves in parallel. Internal teams stay focused on core responsibilities instead of context-switching every sprint.

This is why outsourcing is often used alongside in-house teams, not instead of them.

Specialized Skills Without Long-Term Hiring Commitments

Fintech products demand niche experience. Payments, lending, risk engines, data pipelines, security reviews. Hiring for all of this internally is slow and expensive. Finance software outsourcing allows businesses to tap into teams that already work inside regulated environments and understand financial systems.

For larger organizations, enterprise fintech software development outsourcing offers access to this depth without locking the business into permanent overhead.

More Control Over Timelines and Planning

Unclear ownership and shifting priorities derail delivery faster than technical issues. With a well-structured outsourcing model, scope, timelines, and responsibilities are agreed early. That makes execution more predictable.

It also brings clarity around fintech development outsourcing costs. Leaders know what they are funding, when milestones are hit, and where adjustments need approval.

Flexibility Across Different Product Phases

Outsourcing is not limited to one stage of growth. Early teams use fintech MVP development outsourcing to test ideas quickly. Growth-stage fintechs rely on outsourcing to extend platforms or launch new capabilities without disrupting live systems.

The same approach supports scale-up and modernization without forcing a one-size-fits-all model.

Faster Progress on AI and Data-Led Initiatives

AI is now part of most fintech roadmaps, whether teams are ready or not. AI fintech development service provider allows businesses to move ahead on analytics, automation, and intelligence without waiting for internal AI maturity.

This keeps momentum while leadership retains ownership of strategy and data governance.

[Also Read: Revolutionizing Fintech With AI: Key Use Cases]

Lower Delivery Risk Through Repeated Experience

Many execution risks only appear after launch. Compliance gaps, performance issues, integration failures. Teams offering fintech outsourcing services have usually seen these problems before. That experience matters. It reduces avoidable mistakes and late-stage rework that cost time and credibility.

For leadership, this reduction in execution risk often carries more weight than short-term efficiency gains.

Fintech Outsourcing Use Cases Businesses Are Actively Adopting

Fintech outsourcing shows up in defined, repeatable scenarios. These are not theoretical use cases. They are patterns visible across high-growth fintechs and regulated financial institutions that have already crossed the experimentation phase.

Accelerating New Product Lines Without Reworking Core Teams

When fintechs introduce new lending products, payment flows, or embedded finance offerings, internal teams are usually anchored to existing platforms. Outsourcing is used to execute parallel product lines without disrupting live systems.

Industry example:

Revolut has publicly discussed relying on external development partners during multi-market product rollouts. Core product ownership remained internal, while execution capacity was extended externally to support faster launches.

Scaling Payment and Transaction Platforms Under Volume Pressure

Payments infrastructure does not fail gracefully. As transaction volumes increase, fintechs often outsource non-core components such as payments gateway integrations, merchant tooling, or reconciliation layers to manage scale without destabilising the transaction engine.

Industry example:

Stripe has worked with external engineering partners to support platform expansion and ecosystem tooling during rapid growth phases, a common fintech software outsourcing approach at scale.

Rapid MVP Validation for New Fintech Offerings

Speed to validation matters more than architectural perfection at early stages. Fintech MVP outsourcing is frequently used to test new propositions before committing internal teams or long-term budgets.

Industry example:

Monzo leveraged external development capacity in its early phase to accelerate feature experimentation while internal teams focused on regulatory readiness and banking operations.

[Also Read: How much does it cost to build a mobile banking app like Monzo?]

Legacy System Modernisation Without Platform Downtime

Mature fintechs and financial institutions face structural constraints. Rebuilding legacy systems internally while maintaining uptime is rarely practical. Outsourcing enables parallel modernisation with controlled risk.

Industry example:

PayPal has engaged external technology partners for backend modernisation and service refactoring initiatives, supporting gradual transformation without interrupting transaction continuity.

AI-Led Risk, Fraud, and Decisioning Systems

AI initiatives often outpace internal capability development. It allows firms to deploy analytics, fraud detection, and decisioning systems while internal teams retain governance and model oversight.

Industry example:

Ant Financial has partnered with specialised external providers to strengthen fraud detection and credit decisioning models across markets, accelerating deployment without internal bottlenecks.

Compliance Infrastructure During Geographic Expansion

Regulatory expansion creates immediate, non-negotiable requirements. Many fintechs outsource compliance tooling, reporting layers, and audit readiness systems to meet timelines without slowing product development.

Industry example:

Wise has used external partners to support compliance and reporting infrastructure during regional expansions, allowing internal teams to remain focused on customer-facing systems.

How to Outsource Fintech Software Development

Outsourcing fintech software development is not a handoff. It is a design decision. The difference between success and regret usually comes down to how early leadership sets boundaries, ownership, and intent. This is how fintech businesses that outsource well approach it.

Before engaging with outsourcing partners, companies should establish a comprehensive FinTech product development process that clearly defines core IP, compliance requirements, and technical specifications.

Start With the Part You Should Not Build Internally

Before you talk to partners, decide what must stay in-house. Core IP, proprietary algorithms, risk logic, or strategic decision layers usually belong internally. Everything else is a candidate for execution support.

Teams that outsource development for fintech projects successfully are clear about this line early. It prevents scope creep, trust issues, and confusion later.

Define the Outcome, Not Just the Scope

Fintech outsourcing breaks down when requirements are written like internal tickets. Instead of listing tasks, define outcomes. What should exist at the end. What must be production-ready. What needs to pass audits.

This approach works especially well in fintech software development outsourcing, where delivery quality matters more than velocity alone.

Choose Experience Over Headcount

The right fintech software outsourcing firm is not the one with the biggest bench. It is the one that has already shipped in regulated environments similar to yours. Payments, lending, KYC, fraud, reporting – context matters.

Ask for examples that match your use case, not generic fintech credentials.

Align Early on Compliance and Security Expectations

Fintech outsourcing compliance and security cannot be an afterthought. Data handling, access controls, audit trails, and regulatory alignment need to be agreed before the first line of code is written.

Strong fintech outsourcing bake these requirements into delivery workflows rather than treating them as checkpoints at the end.

Decide How You Will Work Together Day to Day

Outsourcing fails quietly when communication models are vague. Decide how decisions are made, who approves changes, and how risks are escalated. Treat the outsourced team as an extension, not a black box.

Plan for Change, Not Just Delivery

Fintech products rarely ship once and stop. Roadmaps evolve. Regulations shift. Usage patterns change. Build flexibility into contracts and engagement models so teams can adapt without renegotiating everything.

This mindset separates sustainable fintech product development outsourcing from short-term execution deals.

Measure Progress With Business Signals

Track progress using signals that matter to the business. Stability, readiness for audits, integration success, and time to iteration. Not just story points or hours logged.

This also helps keep the outsourcing costs aligned with value delivered, not just effort spent.

Compliance and Security Considerations for Outsourced Services in the Fintech Industry

In fintech, outsourcing decisions are judged less by delivery speed and more by how well risk is controlled over time. Compliance and security are not parallel tracks here. They are embedded into architecture, access models, and delivery governance from day one. When fintech outsourcing fails, it is usually because these foundations were treated as contractual clauses instead of operating principles.

Regulatory Alignment Starts Before Development Begins

Outsourced teams must operate within the same regulatory perimeter as internal teams. This includes understanding which regulations apply, how they intersect, and where accountability sits.

Common regulatory frameworks fintechs must account for include:

- PCI DSS for payment data and card processing environments

- GDPR and equivalent data protection laws for personal and financial data

- SOC 2 Type II for operational and data security controls

- ISO/IEC 27001 for information security management systems

- Local financial regulators such as FCA, OCC, MAS, RBI, or APRA depending on geography

In effective outsourcing engagements, regulatory mapping happens upfront. Not after architecture is decided.

Data Ownership and Residency Must Be Explicit

Data handling is one of the fastest ways outsourcing can go wrong. Fintechs must define where data lives, who can access it, and under what conditions.

This includes:

- Clear data residency rules aligned with regional regulations

- Segregation of production, staging, and development environments

- Role-based access control tied to least-privilege principles

In an enterprise environment, these controls are usually enforced through identity management systems rather than informal access agreements.

Security Architecture Is a Shared Responsibility

Security does not transfer with outsourcing. Accountability remains internal, even if execution does not. That distinction matters.

Strong fintech outsourcing services operate within predefined security architectures that include:

- Secure API gateways and encrypted service-to-service communication

- Mandatory encryption at rest and in transit

- Centralised logging and monitoring for audit readiness

- Secure secrets management rather than hard-coded credentials

Outsourced teams are expected to comply with these standards, not define their own.

Audit Readiness Is Not a One-Time Event

Fintech systems are audited repeatedly. Outsourced development must support this reality.

That means:

- Maintainable documentation aligned with regulatory expectations

- Clear change logs and version control histories

- Traceability between requirements, code changes, and approvals

Fintech development outsourcing works long-term only when audit support is treated as ongoing operational work, not a scramble before inspections.

Third-Party Risk Management Cannot Be Ignored

Regulators increasingly scrutinise third-party relationships. Fintechs must assess outsourcing partners as extensions of their risk surface.

This typically involves:

- Vendor risk assessments and periodic reviews

- Security questionnaires aligned with internal controls

- Contractual clauses covering breach notification and remediation

Fintech outsourcing compliance and security is not just technical. It is also contractual and procedural.

AI and Data Models Require Additional Safeguards

When outsourcing AI-driven components, the risk profile changes. Model behaviour, data bias, and explainability become compliance issues.

AI fintech development outsourcing must account for:

- Clear ownership of models and training data

- Explainability and auditability of automated decisions

- Controls around model updates and drift

Regulators increasingly expect visibility into how automated systems influence financial outcomes.

Key Outsourcing Risks in Fintech Development That Require Early Planning

Outsourcing in fintech works when risks are acknowledged early, not when they are discovered mid-delivery. The same factors that make fintech software outsourcing attractive, speed, specialization, scale, also introduce challenges that leadership teams must actively manage. Ignoring them does not stop progress, it only makes issues surface later, when course correction is expensive.

Understanding these challenges when outsourcing fintech development upfront allows businesses to structure engagements that hold up under regulatory scrutiny, scale pressure, and evolving product demands.

| Challenge | What It Means | How It Impacts the Business | How It Is Typically Addressed |

|---|---|---|---|

| Loss of architectural clarity | External teams build without full context of long-term platform direction | Systems become harder to scale, refactor, or integrate later | Clear internal ownership of architecture, with outsourcing teams executing within defined boundaries |

| Misalignment on compliance expectations | Vendors interpret regulatory needs differently or too narrowly | Rework, audit failures, delayed launches | Early regulatory mapping and shared compliance documentation across teams |

| Communication gaps across teams | Decisions, assumptions, or changes are not surfaced in time | Missed requirements, delivery friction, slower iterations | Structured communication cadence and defined escalation paths |

| Dependency risk on external partners | Critical knowledge sits outside the organization | Reduced internal control and flexibility over time | Knowledge transfer plans and shared documentation from day one |

| Security responsibility confusion | Assumption that security shifts to the vendor | Increased exposure during audits or incidents | Explicit ownership models for security controls and approvals |

| Cost creep beyond initial estimates | Scope expands without structured change control | Fintech development outsourcing cost becomes unpredictable | Milestone-based pricing and formal change management |

| Inconsistent delivery quality | Different standards between internal and outsourced teams | Fragmented codebase and uneven system reliability | Unified coding standards, reviews, and shared quality gates |

| Limited domain understanding | Vendors lack deep fintech or regulatory experience | Slower onboarding and higher supervision effort | Choosing a fintech software outsourcing firm with proven domain experience |

| AI model governance gaps | Outsourced AI systems lack explainability or control | Regulatory and reputational risk | Clear AI ownership, auditability, and model oversight frameworks |

| Vendor lock-in risk | Over-reliance on one partner for critical systems | Reduced negotiation power and slower future transitions | Modular architecture and contract flexibility |

Building fintech products means planning for audits, data security, and uninterrupted operations. Our engagement model supports scale while maintaining regulatory alignment and system integrity.

Cost of Outsourcing Fintech Development: What Leaders Should Expect

Fintech development outsourcing cost is rarely about the headline rate. It is about predictability, risk containment, and how much internal bandwidth the business frees up in return. Leaders who approach cost as a one-time comparison usually end up surprised later. Those who treat it as an operating model decision rarely are.

At an executive level, fintech software outsourcing costs are shaped by three variables: what you outsource, how you structure the engagement, and how regulated your environment is.

Typical Cost Ranges Leaders See in Practice

While exact figures vary by geography and scope, most fintech service providers fall within these broad ranges:

- Fintech MVP development outsourcing

$60,000 – 150,000

Used for validation builds, pilots, or early-stage product testing. Costs stay lower when scope is tightly controlled and compliance requirements are limited. - Core product or platform development outsourcing

$150,000 – 400,000+

Covers customer-facing fintech products, payment flows, dashboards, and integrations. Compliance, security reviews, and scalability requirements push costs upward. - Enterprise fintech software development outsourcing

$400,000 – 1M+ annually

Common for regulated platforms, multi-region products, or long-running programs. This typically includes architecture support, compliance alignment, and ongoing enhancements. - AI-powered fintech development outsourcing

$100,000 – 300,000+, depending on model complexity

Costs increase with data preparation, model governance, explainability requirements, and audit readiness.

These are not fixed prices. They are planning ranges leaders use to size decisions before moving into vendor discussions.

What Actually Drives Cost in Fintech Outsourcing

Several factors consistently influence the budget more than hourly rates including:

Regulatory Exposure

PCI DSS, GDPR, SOC 2, or regional financial regulations add review cycles, documentation, and controls.

Integration complexity

Connecting to banks, payment networks, legacy cores, or third-party APIs increases effort and testing time.

Security expectations

Encryption, audit logging, access control, and monitoring are non-negotiable in fintech software development.

Delivery model

Fixed-scope projects offer cost certainty but less flexibility. Time-and-material models provide adaptability but require tighter governance.

Internal readiness

Clear requirements and decision ownership reduce rework. Ambiguity raises cost regardless of vendor quality.

Why Cheaper Is Rarely Cheaper in Fintech

Low-cost outsourcing models often hide downstream expenses. Rework after audits, missed compliance details, or weak architecture decisions usually cost more than the initial savings.

This is why experienced leaders focus less on unit rates and more on total delivery cost over the product lifecycle. In fintech, the most expensive outcome is a system that ships quickly but cannot scale, adapt, or pass regulatory scrutiny.

How CFOs and CTOs Typically Frame the Decision

For most leadership teams, the cost question becomes less about “how cheap” and more about:

- Can we forecast spending with confidence?

- Does this reduce pressure on internal teams?

- Are we paying for execution or for rework later?

- Is risk priced into the engagement, or deferred?

When fintech engineering outsourcing is structured correctly, cost becomes a controlled variable rather than a moving target.

How to Choose the Right Fintech Software Outsourcing Firm

Choosing the right company is a strategic decision that shapes delivery velocity, regulatory exposure, and long-term platform stability. While many vendors can demonstrate technical skill, far fewer are equipped to operate inside the constraints that define modern fintech environments. The difference becomes visible not at kickoff, but once compliance reviews, integration dependencies, and evolving requirements begin to stack up.

Leaders who approach fintech outsourcing with this context in mind tend to focus on operational maturity rather than surface credentials.

Step 1: Evaluate Proven Fintech Delivery Experience

Fintech software development introduces complexities that general software teams are not always prepared for. Payment flows, customer data handling, audit trails, and regulatory controls influence architectural and delivery decisions from the outset.

When evaluating a fintech software outsourcing company, look for teams that can clearly articulate:

- Products they have delivered in regulated financial environments

- Decisions shaped by compliance, security, or audit requirements

- Trade-offs they made to balance speed with regulatory alignment

This depth of experience reduces supervision overhead and shortens onboarding time in outsourcing engagements.

Step 2: Assess How Compliance and Security Are Handled in Practice

In fintech, compliance and security cannot be abstract assurances. They must be embedded into daily delivery processes. Leaders should understand how outsourced teams handle sensitive data, access control, and regulatory reviews throughout the development lifecycle.

Key indicators include:

- Clearly defined data access and environment segregation

- Security reviews integrated into development workflows

- Established processes for adapting to regulatory changes

Reputed fintech service providers treat compliance as a continuous discipline, not a final gate.

Step 3: Confirm Governance and Decision-Making Structures

Outsourcing relationships deteriorate when accountability is unclear. Architectural choices, scope changes, and risk escalations require predefined ownership.

In enterprise fintech software development, this becomes especially important due to the number of internal stakeholders involved. An effective software development outsourcing company operate within clearly defined governance models that outline:

- Decision ownership across architecture, security, and delivery

- Escalation paths for risks and delays

- Change management processes aligned with business priorities

This structure helps prevent delivery drift and misaligned expectations.

Step 4: Evaluate Integration With Internal Teams and Processes

Outsourcing successful fintech development services depends on how well external teams integrate into existing workflows. Outsourced teams should operate as extensions of internal teams rather than isolated delivery units.

Leaders should assess:

- Willingness to align with internal tools, standards, and release cycles

- Communication cadence with product, engineering, and compliance teams

- Transparency in progress reporting and issue escalation

This alignment is critical for maintaining consistency across distributed teams.

Step 5: Examine Capability in AI and Data-Driven Systems

As AI becomes embedded in fintech products, outsourcing partners must demonstrate more than model-building expertise. It introduces governance, explainability, and data ownership considerations that demand mature handling.

Relevant questions include:

- Ownership and control of AI models and training data

- Explainability of automated decisions for audits

- Controls around model updates and long-term maintenance

Partners who treat AI as a regulated capability rather than a standalone feature are better suited for fintech environments.

Step 6: Review Post-Launch Support and Continuity

Delivery does not end at launch. Fintech platforms evolve under regulatory change, customer growth, and operational feedback. Leaders should understand how partners support systems beyond initial delivery.

Indicators of maturity include:

- Ongoing support during audits and compliance reviews

- Structured knowledge transfer to internal teams

- Adaptability to regulatory and market changes

Step 7: Align Commercial Models With Delivery Reality

Cost challenges in fintech development often stem from misaligned expectations rather than delivery failures. Clear commercial structures help manage change without friction.

Leaders should clarify:

- How the overall cost is structured

- How scope changes are evaluated and priced

- Exit and transition terms to reduce long-term dependency

This alignment supports predictable delivery and reduces downstream risk.

[Also Read: Software Development Outsourcing Tips From 15 Industry Experts]

Appinventiv’s Insight

Across large fintech programs, the most consistent failures do not come from weak engineering skills but from partners underestimating regulatory depth, decision latency, and system interdependencies. Teams that succeed tend to treat outsourcing as an operating model choice rather than a staffing decision, aligning delivery, compliance, and governance before execution begins. This shift in mindset often matters more than vendor scale or brand recognition.

Should You Outsource Fintech Development? A Decision Framework for CTOs, CIOs, CEOs, and CFOs

Outsourcing fintech development is rarely a yes or no question. It is a sequencing and prioritisation decision. Leaders who approach it as a binary choice often oversimplify a much more nuanced reality. The more useful question is whether outsourcing strengthens execution at the current stage of the business, without weakening control, accountability, or regulatory posture.

This framework is designed to help leadership teams reach that decision with clarity.

Start With Strategic Intent, Not Capacity Gaps

Outsourcing works best when it supports a clearly defined business objective. Whether the focus is accelerating delivery, entering new markets, or modernising platforms, fintech development outsourcing should be tied to an outcome that matters at the leadership level.

Key questions to ask internally:

- Is this work execution-heavy or a source of long-term differentiation?

- Will outsourcing allow internal teams to stay focused on strategy and governance?

- Does timing matter enough that waiting would create competitive drag?

When outsourcing aligns with intent rather than urgency, outcomes tend to be more predictable.

Assess organizational Readiness for External Execution

Custom fintech software outsourcing places demands on internal clarity. Decision ownership, documentation, and escalation paths must be established before work begins. Without this foundation, even experienced fintech service providers struggle to operate efficiently.

Readiness signals include:

- Clear ownership of architecture and product decisions

- Defined compliance and security expectations

- Comfort operating with shared delivery responsibility

This is especially important in enterprise fintech software development, where multiple stakeholders influence outcomes.

Align the Decision With Risk Appetite and Regulatory Exposure

Outsourcing does not reduce regulatory responsibility. It changes how execution is carried out under that responsibility. Leaders must be comfortable managing third-party risk alongside internal controls, particularly in regulated environments where audits and reviews are continuous.

Here, fintech outsourcing compliance and security considerations should be treated as design constraints, not follow-up checks.

Look at the Operating Model, Not Just the Project

The most durable outsourcing decisions are made with the operating model in mind. This includes how knowledge is retained, how change is managed, and how dependency is controlled as the product evolves.

Outsourcing that fits cleanly into the operating model becomes repeatable. Outsourcing that sits outside it becomes friction.

How Leaders Typically Weigh the Trade-Offs

At this point, most leadership teams want a balanced view of what outsourcing introduces into the organization. Not as a list of positives and negatives, but as a realistic comparison of what changes when execution is shared externally.

The table below reflects how fintech leaders commonly evaluate the decision in practice.

Pros and Cons of Outsourcing Fintech Software Development:

| Aspect | Pros | Cons |

|---|---|---|

| Delivery speed | Enables parallel execution across products, regions, or platforms without stalling internal roadmaps | Requires disciplined coordination to avoid duplicated or misaligned work |

| Talent access | Immediate access to fintech-specific skills across payments, compliance, security, and AI | Domain knowledge initially resides outside the organization |

| Cost control | Outsourcing cost is easier to forecast when structured around milestones | Scope ambiguity can still increase spend if governance is weak |

| Scalability | Teams can be scaled up or down based on product phase or regulatory timelines | Rapid scaling can strain quality controls if standards are not enforced |

| Internal focus | Internal teams stay focused on architecture, strategy, and regulatory ownership | Demands clear boundaries on what should never be outsourced |

| Compliance execution | Experienced partners bring audit-ready processes and regulatory awareness | Compliance coordination requires upfront effort and alignment |

| Risk management | Proven delivery frameworks reduce execution and rework risk | Third-party risk must be actively monitored and reviewed |

| AI initiatives | AI accelerates analytics, fraud, and automation programs | AI governance, explainability, and model ownership must be clearly defined |

| Long-term flexibility | Modular outsourcing supports evolving product and market needs | Over-dependence on a single vendor can reduce future flexibility |

How the Final Decision Is Usually Made

For most organizations, the decision to outsource fintech development is not permanent or absolute. It is contextual. Leaders who succeed treat outsourcing as a controlled extension of capability, not a replacement for it.

When fintech software development outsourcing is aligned with strategy, governance, and regulatory expectations, it becomes a practical lever for scale, not a source of uncertainty.

Why Appinventiv Is the Right Fintech Software Outsourcing Partner

We hope this guide has helped clarify how fintech development outsourcing actually works in practice, from cost and compliance to delivery and long-term control. By this point, it should be clear that outsourcing is most effective when it is structured deliberately, not treated as a shortcut.

At Appinventiv, we support outsource fintech software development services in a way that keeps ownership, accountability, and regulatory alignment firmly with our clients. Our teams have delivered fintech platforms across payments, digital banking, lending, embedded finance, and AI-led systems, operating within PCI DSS, GDPR, SOC 2, and region-specific financial frameworks.

Our work with Mudra, an AI-driven budgeting platform for millennials, reflects this approach. We helped design and build a real-time budgeting application that uses AI to track expenses, set goals, and trigger spending alerts as behaviour changes. The platform launched across more than 12 countries and saw strong repeat usage within the first month.

For a European retail bank, we delivered an AI-powered support system tightly integrated with their existing banking platform. The system resolved routine customer queries instantly while routing complex cases to the right teams. This reduced manual processing by 35 percent and improved customer retention by 20 percent, directly strengthening operational efficiency without disrupting core systems.

With Edfundo, a fintech platform focused on financial education for children, we built an application that allows kids to save, spend, and track pocket money under parental oversight, supported by embedded learning journeys. The platform helped Edfundo secure $500K in pre-seed funding and earn recognition as FinTech Startup of the Year.

Across these engagements, what clients value most is how we work. We integrate closely with internal teams, operate within established governance models, and design systems that can withstand audits, scale pressure, and regulatory change without constant rework. Our focus always stays on predictable execution and long-term stability.

If you are evaluating outsourcing fintech services and want to explore how this model could work for your organization, get in touch with us to discuss your requirements, constraints, and goals in a focused, practical conversation.

FAQs

Q. What can a fintech provider outsource?

A. Most fintech companies do not outsource everything, and they do not need to. Outsourcing is usually applied where execution intensity is high and strategic differentiation is low.

In practice, fintech development outsourcing commonly covers:

- Product and feature development outside the core IP layer

- Payment integrations, APIs, and platform extensions

- Compliance tooling, reporting systems, and audit support

- AI-driven modules such as fraud detection or analytics

- Fintech MVP development outsourcing for early validation

Q. How should a business outsource fintech software development?

A. Outsourcing fintech software development works best when it is structured as an extension of internal delivery, not a handoff. The goal is controlled execution, not delegation.

A practical approach usually includes:

- Defining what stays in-house versus what is outsourced

- Aligning on compliance, security, and governance early

- Selecting a custom fintech software outsourcing company with relevant domain experience

- Establishing clear decision ownership and escalation paths

Q. What should be considered when choosing a fintech outsourcing partner?

A. Choosing a partner in fintech is less about capability and more about operating maturity. Technical skill alone is not enough in regulated environments.

Key considerations typically include:

- Prior experience in fintech software outsourcing

- Understanding of compliance and regulatory constraints

- Proven delivery under audit and security requirements

- Ability to integrate with internal teams and processes

Q. How is intellectual property protected in fintech outsourcing?

A. IP protection in fintech outsourcing is a design decision, not a clause added at the end of a contract. Ownership and access need to be explicit from day one.

Protection is usually enforced through:

- Clear IP ownership clauses in contracts

- Restricted access to core proprietary logic

- Segregation of code repositories and environments

- Strong governance over documentation and knowledge transfer

Q. Should fintech development be outsourced or built in-house?

A. This is rarely an either-or decision. Most fintech organizations use a hybrid model that balances control with execution speed.

The decision often depends on:

- Whether the work is core to long-term differentiation

- Internal capacity and delivery timelines

- Regulatory exposure and risk appetite

- The maturity of internal governance structures

Q. How much does it cost to outsource fintech development?

A. Fintech development outsourcing cost varies widely based on scope, compliance requirements, and delivery model. There is no single price that fits all use cases.

Typical cost drivers include:

- Product complexity and integrations

- Regulatory and security requirements

- Engagement model and duration

- Use of AI or advanced data systems

Q. How long does outsourced fintech product development take?

A. Timelines depend more on clarity than scale. Well-defined scope and governance shorten delivery cycles significantly.

In most cases:

- MVP builds takes around 4 to 6 months

- Core product development spans multiple quarters

- Enterprise fintech software development is ongoing and iterative

Q. How do you choose the right outsourcing partner for fintech development?

A. The right partner is one that understands fintech constraints as well as fintech ambition. Delivery confidence matters more than promises.

Leaders typically evaluate partners based on:

- Track record in regulated fintech environments

- Approach to fintech outsourcing compliance and security

- Governance, communication, and transparency

- Ability to support long-term product evolution

Q. What should you look for in a fintech outsourcing company?

A. A strong fintech outsourcing company brings more than engineers. It brings predictability, accountability, and domain understanding.

What usually matters most is:

- Experience across fintech product development outsourcing

- Familiarity with audits, compliance, and risk management

- Clear delivery ownership and escalation models

- Alignment with how your organization actually operates

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…