- FinTech App Development Cost Analysis

- Costs Based on Complexity Levels

- Costs Based on Development Stages

- Factors Impacting FinTech App Development Cost in the UK

- Complexity of UI/UX Design

- Backend Development Complexity

- Third-Party Integrations

- Security Measures

- Compliance Requirements

- Platform Selection

- Technology Stack

- Complexity of Features

- Hidden App Development Costs

- App Maintenance

- App Hosting

- App Promotion and Marketing

- Legal and Licensing Fees

- How to Optimize FinTech App Development Costs

- 1. Developing an MVP (Minimum Viable Product)

- 2. Prioritizing Necessary Features

- 3. Leverage Cross-Platform Development

- 4. Outsource to Cost-Effective Regions

- How to Make Money from Your FinTech App: Different Revenue Models

- Freemium and Subscription

- Transaction-Based Fees

- Partnerships and Advertisements

- Lending Interest

- How to Develop a FinTech App in the UK

- 1. Understand Your Market

- 2. Find Your Unique Spot

- 3. Craft a Compelling UI/UX

- 4. Don’t Skip the Legal Stuff

- 5. Outsource an IT Partner

- 6. Start Small with an MVP

- 7. Iterate and Evolve

- Real-Life Example: Mudra Fintech App

- How Appinventiv Excels in Building a FinTech App

- FAQs

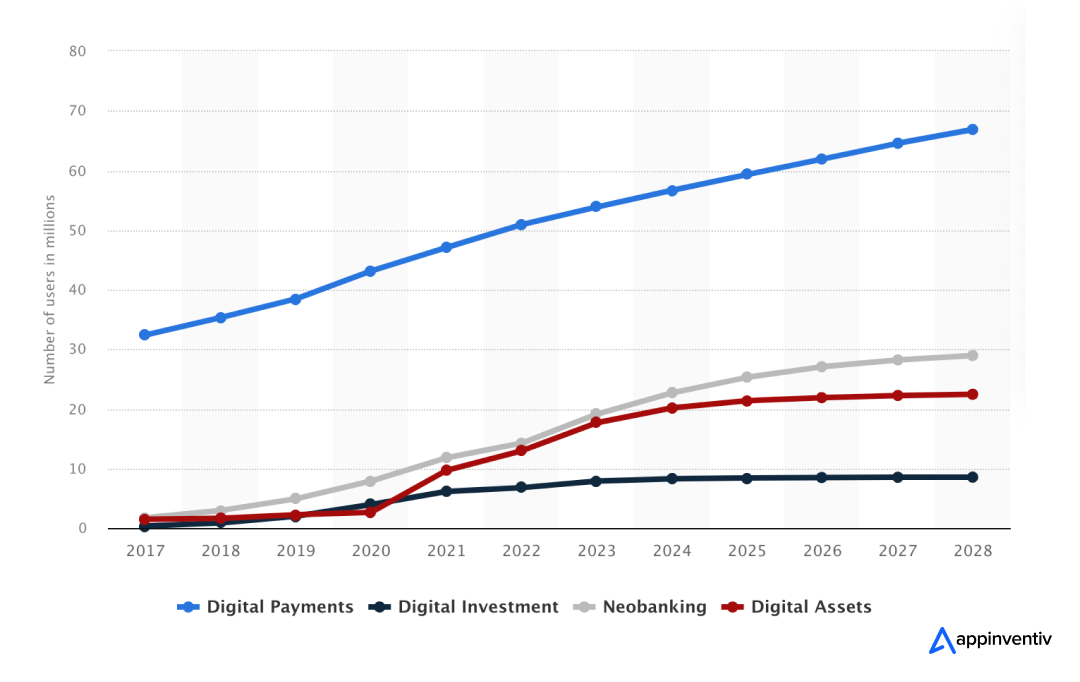

The demand for FinTech apps in the UK has skyrocketed in recent years as digital-first financial services have become integral to modern consumers’ lives.

How? According to a Plaid report, over 86% of UK consumers now use at least one FinTech platform, ranging from mobile banking to investment solutions, highlighting a rapid shift in how people manage their money.

This transformation trend is further emphasized by Statista data, which shows the digital payments segment alone reached an estimated 56.66 million users in 2024 and is projected to surpass 66.87 million by 2028.

These facts and figures demonstrate the unparalleled growth and adoption rates of innovative financial technologies, paving the way for even greater opportunities in the FinTech sector.

However, businesses looking to capitalize on this digital transformation often face a crucial question: How much does it cost to build a FinTech app in London, UK? The answer is not fixed.

On average, custom FinTech app development costs in the UK range between $30,000 and $300,000 (£24,000 to £240,000) or more.

However, this is a rough estimate; the actual cost can increase or decrease depending on various factors (details later).

In this article, we will break down these factors to give you an in-depth understanding of the cost of custom FinTech app development in the UK.

FinTech App Development Cost Analysis

The cost of developing a FinTech app in the UK can vary significantly based on its complexity, development stages, and time requirements. Here’s a detailed breakdown of FinTech app development costs:

Costs Based on Complexity Levels

The complexity of a FinTech app plays a critical role in determining its development cost and timeline. Each level of complexity introduces additional features, technologies, and integrations, which influence the overall budget.

Here is a table depicting the breakdown of timelines and costs for each category:

| App Complexity | Average Cost | Average Timeline |

|---|---|---|

| Simple solution with basic features | $30,000-$50,000 | 4-6 months |

| Medium complex platform with Moderate features | $50,000-$120,000 | 4-9 months |

| A highly complex system with advanced features | $120,000-$300,000+ | 9 months to 1 year or more |

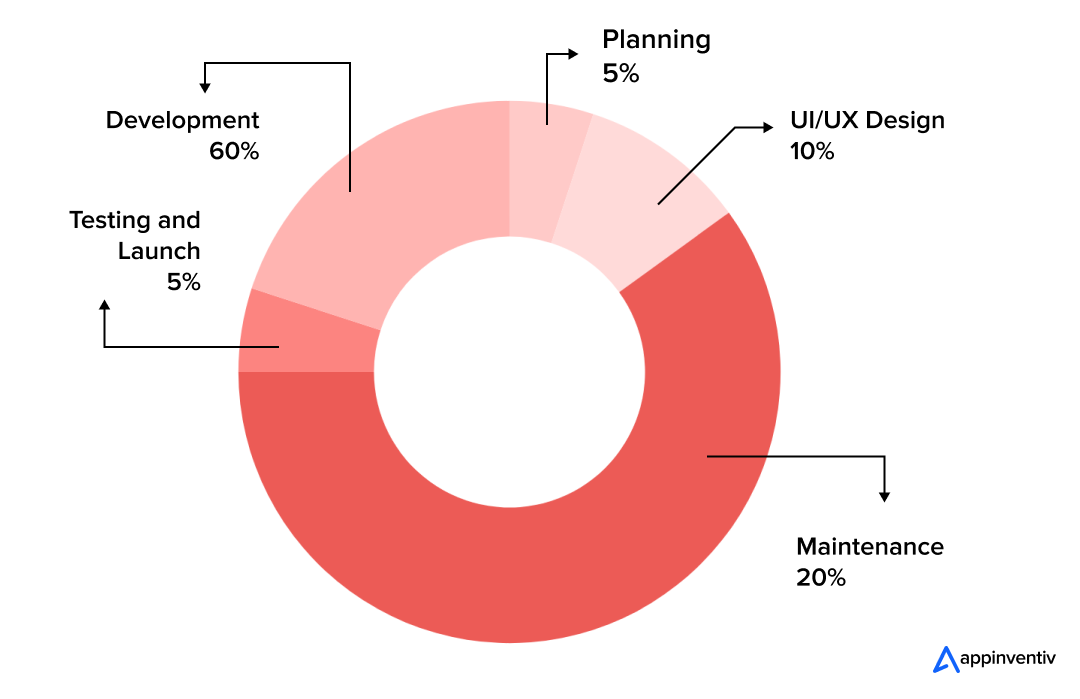

Costs Based on Development Stages

Developing a FinTech app is a multi-phase process, with each stage contributing to the overall timeline, complexity, and cost. Understanding the timeline and cost associated with these stages ensures a clear roadmap and budget alignment.

Here is a table outlining the costs, timelines, and activities involved in each stage:

| Stage | Details | Timeline | Cost Range |

|---|---|---|---|

| Planning | Market research, app scope, and requirement analysis. | 2–4 weeks | $3,000–$15,000 |

| UI/UX Design | Wireframing, prototypes, and design layouts. | 4–6 weeks | $6,000–$30,000 |

| Development | Front-end, back-end, and third-party integrations. | 3–9 months | $20,000–$200,000+ |

| Testing and Launch | QA testing, bug fixes, and deployment in app stores. | 2–4 weeks | $3,000–$20,000 |

| Maintenance | Regular updates, security patches, and performance upgrades. | Ongoing | $8,000–$20,000/year |

How to Estimate FinTech App Development Cost in London, UK: A Simple Formula

The costs are often driven by two primary components: development hours and the hourly rate charged by the development team. A simple formula can help you estimate the overall FinTech app development cost in the UK.

| Development Hours × Hourly Rate = Total Cost |

|---|

For instance, making a FinTech app in the UK with moderately complex features requires 1,200 development hours at $50/hour = $60,000.

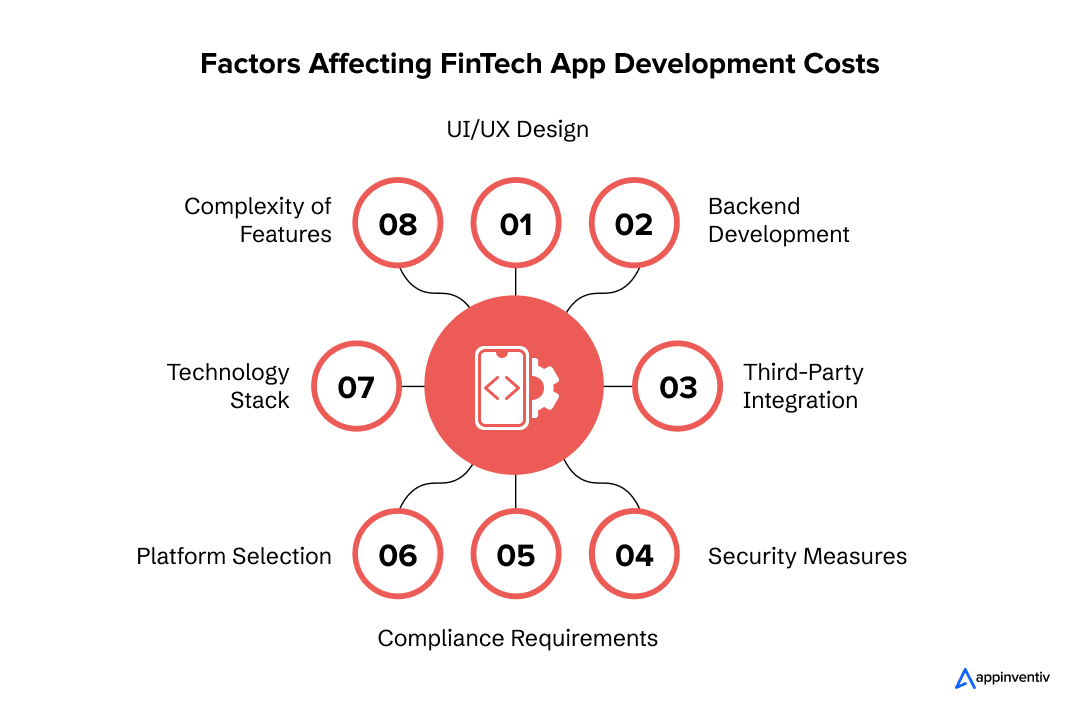

Factors Impacting FinTech App Development Cost in the UK

Multiple factors influence how much you need to invest in FinTech development. Below is a detailed breakdown of the key factors shaping the FinTech app development cost:

Complexity of UI/UX Design

The ease of navigation and visual appeal are the heart and soul of any mobile application, and a FinTech app is no exception. A well-designed, intuitive UI/UX drives user engagement and app success.

However, a high-quality UI/UX design enhances user engagement and increases the cost of FinTech mobile app development. The more interactive and advanced the UI/UX design, the higher the price.

Cost Comparison Based on Design Complexity

| Design Complexity | Estimated Cost |

|---|---|

| Basic UI/UX Design | $6,000 – $30,000 |

| Custom/Advanced UI/UX Design | $30,000 – $50,000+ |

Backend Development Complexity

The backend handles the app’s core operations, such as managing data, ensuring scalability, and processing transactions securely. Apps with straightforward features, such as a personal expense tracker, will have a simpler backend architecture.

In contrast, apps like Revolut or Monzo, which handle high volumes of concurrent transactions and offer multi-currency accounts, require robust servers, real-time databases, and microservices architecture. Adding these functionalities significantly escalates FinTech app development costs.

Third-Party Integrations

Fintech apps often require third-party integration to extend functionality and improve user convenience. Payment gateway integrations include Stripe or PayPal, social media logins, and GPS for location-based services. For instance, adding a GPS feature to suggest nearby ATMs or a real-time currency exchange API for global users adds utility and development costs.

Also Read: How Does the Fintech and Banking Sector Use APIs?

Cost Comparison Based on Third-Party Integrations

| Third-Party Integration | Estimated Cost |

|---|---|

| Basic Integration (Single Payment Gateway) | $2,000 – $10,000 |

| Complex Integration (GPS, Multiple APIs, Real-Time Analytics) | $5,000 – $15,000+ |

Security Measures

Security is paramount for FinTech apps, as they manage sensitive user data and financial transactions. Basic security protocols like SSL encryption are essential. Still, advanced measures like biometric authentication, face detection, end-to-end encryption technology, and AI and ML-driven fraud detection are becoming industry standards. While these security measures add to FinTech app development costs, they are necessary to protect sensitive user data.

Cost Comparison Based on Security Measures

| Security | Estimated Cost |

|---|---|

| Basic Security Measures (SSL, Data Encryption) | $5,000 – $8,000 |

| Advanced (Biometrics, Multi-Factor Authentication, Encryption) | $15,000 – $100,000+ |

Compliance Requirements

FinTech apps operating in the UK must comply with relevant regulatory standards such as PSD2, PCI DSS, and GDPR. Meeting open banking protocols, ensuring data privacy under GDPR, and adhering to implementing KYC (Know Your Customer), anti-money laundering (AML), and other essential measures requires proven expertise and thorough audits, which can add to upfront and ongoing costs.

Non-compliance with the UK’s FinTech regulations can result in heavy fines, making these investments indispensable.

Platform Selection

Another crucial factor affecting the cost of building a FinTech app in the UK is platform compatibility (iOS, Android, or both).

- iOS apps demand higher development costs due to strict App Store guidelines.

- While potentially less expensive, Android apps require optimization for a wider range of devices.

- Cross-platform frameworks like Flutter or React Native offer a middle ground, allowing businesses to target both platforms efficiently while reducing development time and expense.

Cost Comparison Based on Platform Choice

| Platform | Estimated Cost |

|---|---|

| Single Platform (iOS or Android) | $30,000 – $100,000 |

| Cross-Platform (iOS and Android) | $100,000 – $300,000+ |

Technology Stack

The technology stack you choose for FinTech app development is critical in determining its cost. While using React Native, PHP, or Flutter is a cost-effective option, incorporating advanced technologies like Python, Node.js, Artificial Intelligence, or blockchain significantly raises the cost to create a fintech app.

You may like reading: PHP vs Python: Which Language Is Dominating The Market?

Cost Comparison Based on Tech Stack

| Tech Stack | Estimated Cost |

|---|---|

| Basic Tech Stack (React Native, Flutter, PHP) | $50,000 – $120,000 |

| Advanced Tech Stack (Python, AI, Blockchain) | $120,000 – $250,000+ |

Complexity of Features

The features you choose for your FinTech app development are vital in determining its cost. The more complex features your app has, the higher it will cost. For instance, basic features such as push notifications, secure logins, and user profiles are less expensive than advanced features like transaction tracking, multi-currency wallets, AI-driven chatbots, investment recommendations, and real-time analytics.

Each new feature significantly impacts development timelines and budgets.

Cost Comparison Based on Features

| Feature | Estimated Cost |

|---|---|

| Basic Features (Account setup, Secure logins, balance tracking) | $30,000–$50,000 |

| Advanced Features (AI investment advice, real-time analytics) | $100,000–$200,000 |

Hidden App Development Costs

The upfront cost variables mentioned above are crucial considerations when evaluating FinTech app development costs in the UK, as you can’t evade the hidden expenses that emerge during and after development. Overlooking these hidden factors can lead to budget overruns. Thus, you must consider them in your financial planning.

Annual Cost Breakdown of These Hidden Factors

| Expense | Details | Estimated Cost |

|---|---|---|

| Maintenance | Updates, bug fixes, new features | $10,000–$60,000 |

| Hosting | Cloud storage and server costs | $6,000–$60,000 annually |

| Marketing | User acquisition, ASO, digital campaigns | $20,000–$100,000 annually |

| Legal and Licensing | Compliance audits and licensing fees | $10,000–$50,000 annually |

App Maintenance

Development is a one-time process, but maintenance is an ongoing journey that ensures the uninterrupted performance of your FinTech application. For FinTech apps, maintenance includes upgrading security protocols to combat evolving threats, fixing bugs, adding new features, and releasing updates to ensure compatibility with the latest OS versions.

Typically, app maintenance costs can range from 15% to 20% of the total development cost annually.

App Hosting

Hosting ensures your app’s backend systems, databases, and APIs run seamlessly. Cloud platforms like AWS, Google Cloud, or Microsoft Azure are common choices, with costs depending on server size, data usage, and scalability.

For instance, a medium-complexity app could incur hosting costs of $500 to $5,000 per month, depending on user traffic.

App Promotion and Marketing

Building an app is the first step; reaching your target audience requires a solid marketing strategy. Digital campaigns, app store optimization (ASO), paid ads, and influencer collaborations are all part of the marketing effort. These help acquire users but incur a significant expense, especially in the competitive UK market.

Legal and Licensing Fees

Navigating the regulatory landscape in the UK is critical for FinTech apps but adds to the overall app development costs. This includes acquiring licenses to operate under FCA regulations, complying with GDPR, and adhering to anti-money laundering (AML) policies.

How to Optimize FinTech App Development Costs

As you have noticed, building a FinTech app involves significant investment from planning to development and beyond. However, strategic planning can help optimize this cost without compromising quality. Here are some proven tips to maximize cost:

1. Developing an MVP (Minimum Viable Product)

Instead of immediately launching a fully featured app, build an MVP—a stripped-down version of your app that includes only core functionalities.

2. Prioritizing Necessary Features

Every feature adds to the development timeline and cost. Thus, you must identify features essential for your app’s core functionality and user experience.

3. Leverage Cross-Platform Development

Developing separate apps for iOS and Android can be costly. Cross-platform frameworks like Flutter or React Native can reduce development time and costs by up to 40%.

4. Outsource to Cost-Effective Regions

Outsourcing app development is the best option in cost-effective regions to ensure quality without exceeding budget constraints.

| Tip | Cost-Saving Impact |

|---|---|

| Build an MVP | 25-50% reduction in initial costs |

| Prioritize Essential Features | Cutting unnecessary costs |

| Use Cross-Platform Development | 20-40% reduction in costs |

| Outsource to Cost-Effective Regions | 30-60% lower hourly rates |

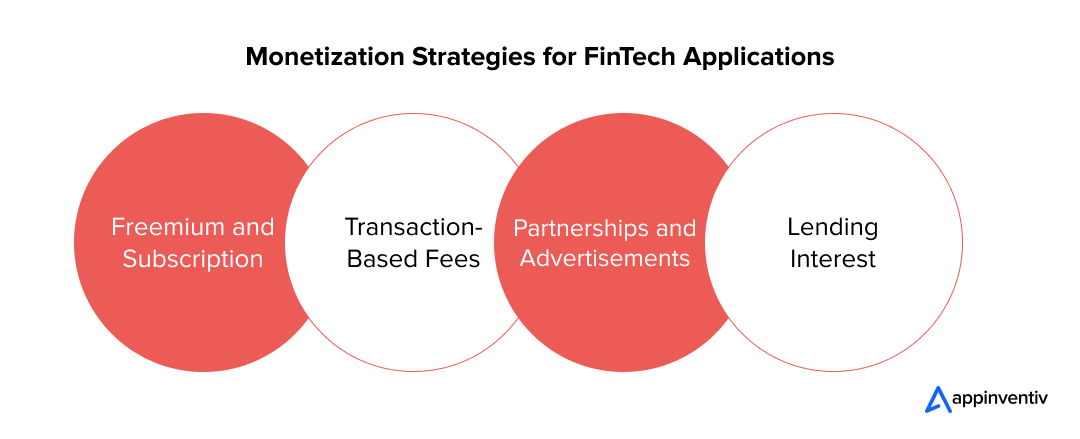

How to Make Money from Your FinTech App: Different Revenue Models

Once you have developed and deployed your Fintech app on the intended platforms, the next approach should be to build monetization strategies to generate a return on investment (ROI). You can leverage several revenue models to generate impressive ROI.

Freemium and Subscription

Offering subscription-based premium features is another effective way to ensure recurring revenue. You can allow users to access basic services for free while charging monthly or yearly subscription fees for premium features, such as financial advisory or investment insights.

Transaction-Based Fees

A widely used revenue model for FinTech apps involves charging transaction fees. Apps that handle payments or money transfers, such as mobile wallets or remittance platforms, can charge a nominal fee for each transaction.

Partnerships and Advertisements

While ads are less common in FinTech apps due to the importance of trust and user experience, certain apps can benefit from contextual advertising. You can partner with banks and financial institutions to promote their relevant products or services, such as credit cards, to enhance the app’s revenue.

Lending Interest

Peer-to-peer lending platforms and similar apps often generate revenue by charging interest on loans. The app can earn a commission for every loan processed through its platform, turning loan facilitation into a sustainable profit model while expanding financial inclusion for underserved communities.

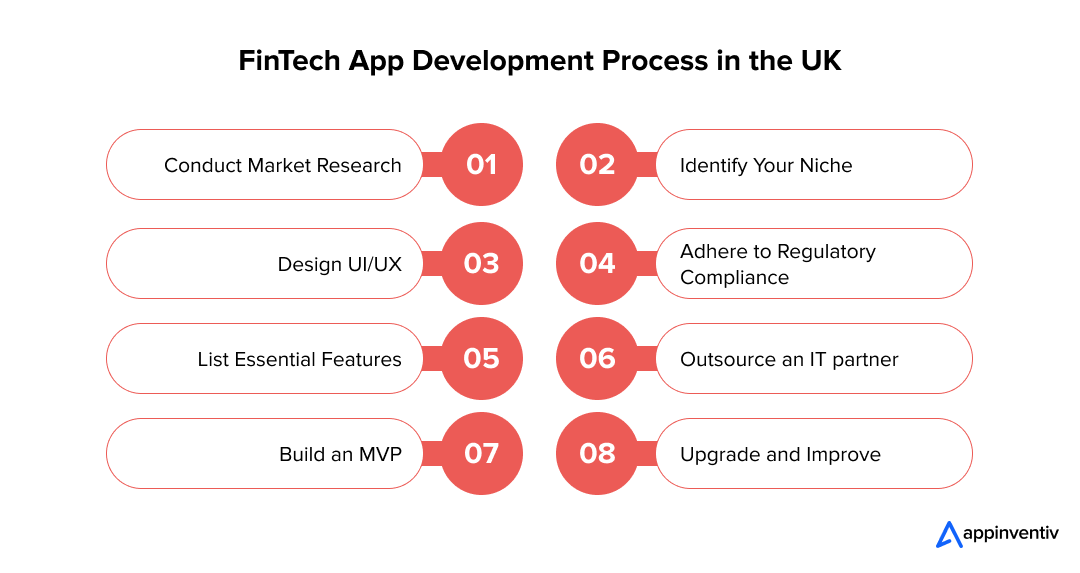

How to Develop a FinTech App in the UK

Developing a FinTech app in the UK is a challenging process that requires a structured approach to meet users’ demands while ensuring compliance with regional regulations. Here’s an overview of the FinTech app development process:

1. Understand Your Market

Every great app starts with understanding its audience. What do users in the UK want? Is it a budgeting app for young professionals or a trading platform for seasoned investors? Dive into surveys, check out competitors, and discover trends. The more you know your market, the better you can plan and proceed.

2. Find Your Unique Spot

The FinTech world is buzzing with countless apps. You must pick your niche first to stand out in this crowded realm. Are you aiming to revolutionize peer-to-peer lending or offer AI-powered investment advice? A focused niche attracts the right audience and makes your app a big hit in the market.

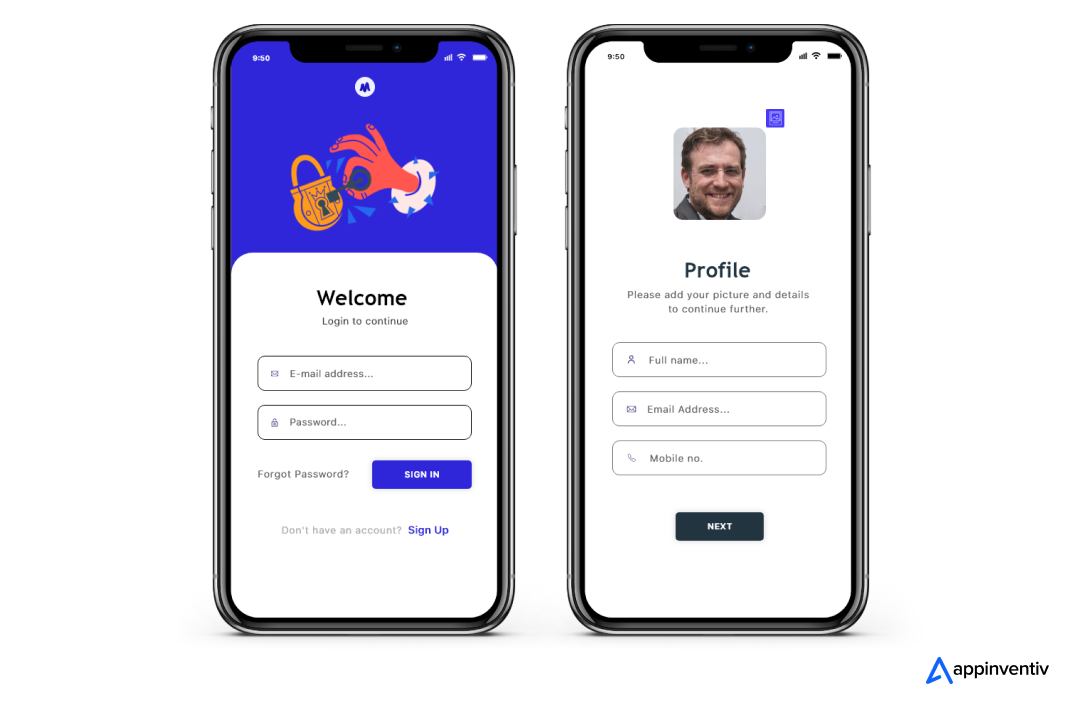

3. Craft a Compelling UI/UX

The next step in the FinTech app development process is to design a visually appealing UI/UX. No one likes to navigate through a clunky app; thus, your app should be interactive, intuitive, and user-friendly.

4. Don’t Skip the Legal Stuff

The UK has strict regulations around FinTech. From GDPR for data privacy to PSD2 for payments, compliance is not optional; it is indispensable for successful FinTech app development. This step might seem daunting, but building trust in users and avoiding legal penalties is crucial.

5. Outsource an IT Partner

Unless you are building this solo, you will need tech partners. Partner with a reputed FinTech app development company with a proven track record in developing financial applications. A good partner does not just develop products; they bring ideas and insights.

6. Start Small with an MVP

Develop a Minimum Viable Product with essential features to test market viability. Include the core features and get it out to users quickly. Gather user feedback to refine your app and align it with customer expectations before a full-scale launch.

7. Iterate and Evolve

Your app’s launch is not the end of the process but the beginning. Keep an ear out for user suggestions, fix bugs promptly, and roll out features that keep users engaged. Continuous improvement is how you stay ahead in this competitive space.

Real-Life Example: Mudra Fintech App

Mudra is a budget management app developed by Appinventiv that helps users worldwide monitor and manage their finances easily and precisely. The chatbot-centric application monitors users’ expenses and informs them when their budget gets out of hand.

- UI/UX Design: Every design element had to be chosen so that the users would have the provision to have a quick in-and-out experience and simultaneously have enough elements to interact with in case of long session time.

- Development: The development of the AI-powered chatbot started with deciding upon a closed and open system bot. Since the application’s intent was only centered around budget management, the development team decided to go with a closed system bot development, which would fetch users’ financial information through their debit and credit card history and then interact with them.

Result

The app’s widespread adoption across more than 12 countries subtly underscores the robustness and adaptability of our offshore development practices.

How Appinventiv Excels in Building a FinTech App

At Appinventiv, we specialize in overcoming the complexities of FinTech app development, delivering secure, user-focused, and scalable solutions. Our skilled team of 1600+ tech experts has worked on various FinTech projects, including crypto exchange platforms, digital wallets, peer-to-peer lending apps, and beyond.

We bring together a cross-functional team of expert designers, developers, and compliance specialists who collaborate seamlessly to ensure your app meets and exceeds industry standards. From ideation to post-launch maintenance, our end-to-end approach ensures a smooth development journey, keeping user experience, data security, and functionality at the forefront.

As a leading service provider of FinTech app development in the UK, we have consistently demonstrated our expertise in delivering state-of-the-art FinTech solutions for global enterprises and startups. So, whether you want to create a basic app with essential features or a highly complex platform with advanced functionalities, we have the expertise to turn your vision into reality.

Don’t believe us?

Check out our portfolio, enriched with several impactful projects, such as Mudra and Edfundo, that highlight our experience building cutting-edge FinTech applications.

Whether you want to develop a feature-rich FinTech app from scratch, upgrade an existing one with advanced functionalities, or just find out about custom FinTech app development costs in the UK, get in touch with us. We have been a trusted tech partner for businesses looking to lead the digital financial revolution. Let’s collaborate to bring your FinTech idea to life.

FAQs

Q. What is the cost of custom FinTech app development in the UK?

A. The cost of developing a FinTech app in the UK varies widely based on several factors, including the project’s complexity, features, platform choice, and the development team’s expertise.

For instance, the cost to build a FinTech app in London, UK with basic features ranges between $30,000 and $100,000, while mid-range apps with more advanced functionalities can range from $100,000 to $200,000. On the other hand, a highly complex application incorporating technologies like AI, blockchain, or multi-platform compatibility can cost around $200,000 to $300,000 or more.

To give you a rough estimate, custom finance app development costs in London, UK, range between $30,000 to $300,000 or more.

Contact us to get a more accurate estimate for custom FinTech app development costs in the UK.

Q. How long does it take to build a FinTech app?

A. The time it takes to build a FinTech app in the UK ranges between 4 months to 1 year or more, depending on the app’s complexity, the expertise of FinTech app developers, platform compatibility, and so on.

Share your project idea with us to get a more precise estimate for UK FinTech app development cost and timeline.

Q. How to choose a FinTech app development company?

A. When selecting a FinTech app development company, you can follow these steps:

- Look for companies with a strong portfolio of successful FinTech projects and experience in developing secure financial apps.

- Ensure the team understands and adheres to relevant financial regulations, like GDPR and PCI-DSS.

- Prioritize companies proficient in using advanced technologies such as AI, blockchain, and cloud computing for FinTech applications.

- Choose a tech partner who can tailor solutions to your unique business needs and scalability requirements.

- Check reviews and case studies of the company to evaluate past performance and client satisfaction.

- Ensure the company provides post-launch support and maintenance service for seamless app operation.

Q. How to keep FinTech app development costs within budget?

A. To manage FinTech app development costs in London, UK, you can consider incorporating the below-listed strategies:

- Build a Minimum Viable Product to test your concept before scaling.

- Outsource the right development company from cost-effective regions.

- Prioritize must-have functionalities initially and plan for incremental updates later.

- Opt for cross-platform development listed for separate platforms for iOS and Androids.

10 Industry-Wise 5G Use Cases Transforming Australian Businesses

Key takeaways: Industry Transformation: 5G is revolutionizing key sectors in Australia, including healthcare, manufacturing, agriculture, and logistics, by enabling real-time data processing, enhanced connectivity, and automation that improve operational efficiency and customer experiences. Enhanced Connectivity for Regional Areas: 5G technology bridges the connectivity gap in remote and regional areas of Australia, supporting industries like agriculture…

How to Build a Secure App in Australia in 2025? All You Need to Know

In today’s hyper-connected world, mobile apps aren’t just conveniences; they are the baseline of modern business. From banking and healthcare to retail and government services, apps power our daily lives. But this digital revolution has a dangerous downside: cyberattacks are escalating alarmingly. More than data exposure, this security breach costs businesses a lot, destroys customer…

How to Build a Ride-Hailing App Like Yango Ride?

Dubai's streets are buzzing with innovation. The city is fast becoming a playground for smart mobility, from AI-driven traffic systems to autonomous taxis. In the middle of it all, the decision to build an app like Yango has brought serious traction, offering seamless, affordable, and tech-savvy transport alternatives. But here’s the thing: success in this…