- Overview of Cash Advance Apps Like Wagetap

- How Much Does it Cost To Develop an App Like Wagetap

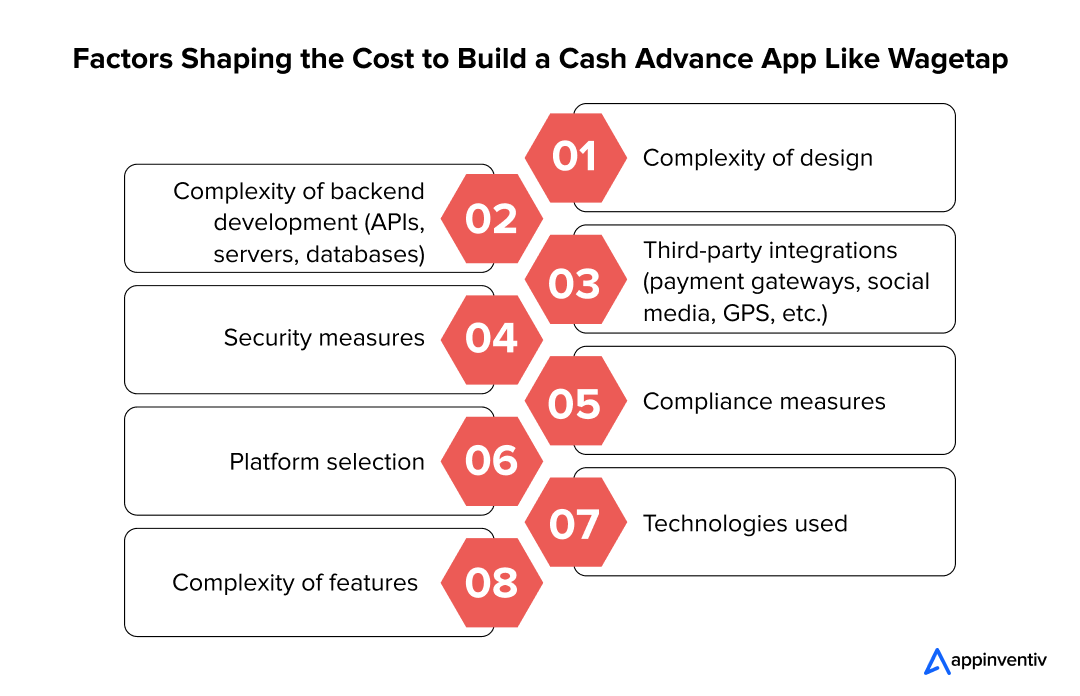

- Essential Elements That Drive the Cost of Building a Wagetap-Like App

- Complexity of Design

- Complexity of Backend Development

- Third-Party Integrations

- Security Measures

- Compliance Measures

- Platform Selection

- Technologies Used

- Complexity of Features

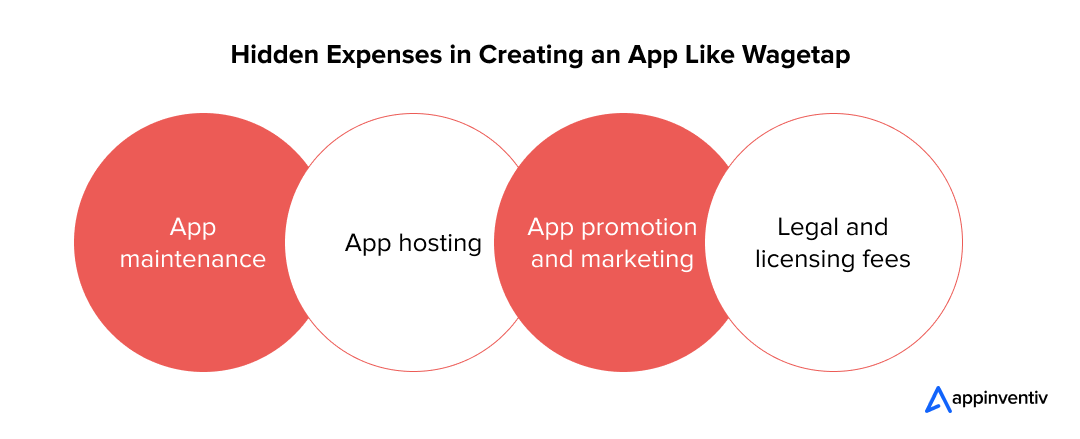

- Unveiling the Hidden Costs of Developing an App Like Wagetap

- App Maintenance

- App Hosting

- App Promotion and Marketing

- Legal and Licensing Fees

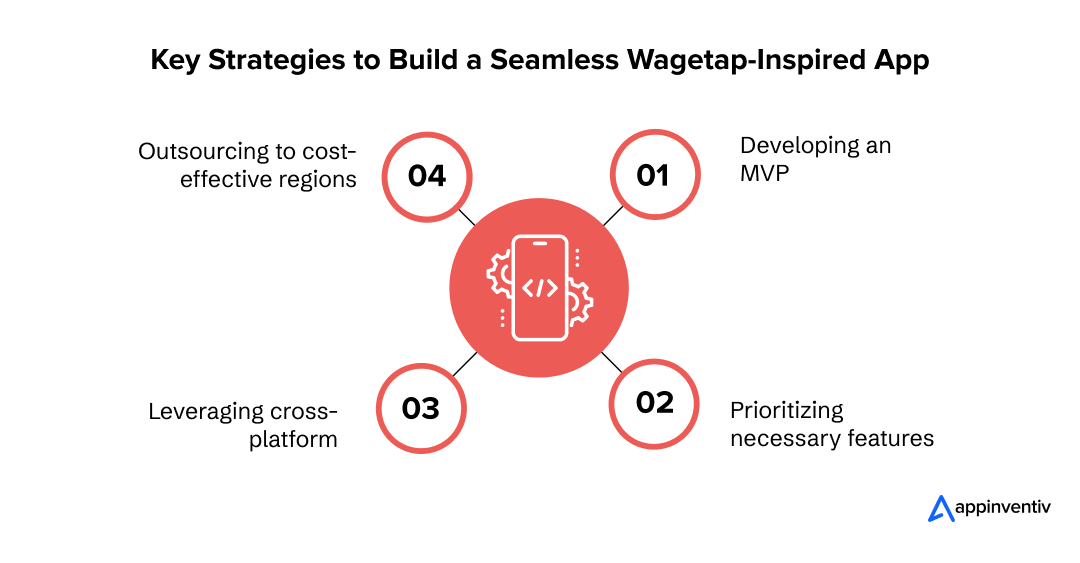

- Smart Strategies to Optimize App Development Costs Like Wagetap

- Developing an MVP

- Prioritizing Necessary Features

- Leveraging Cross-Platform Development

- Outsourcing to Cost-Effective Regions

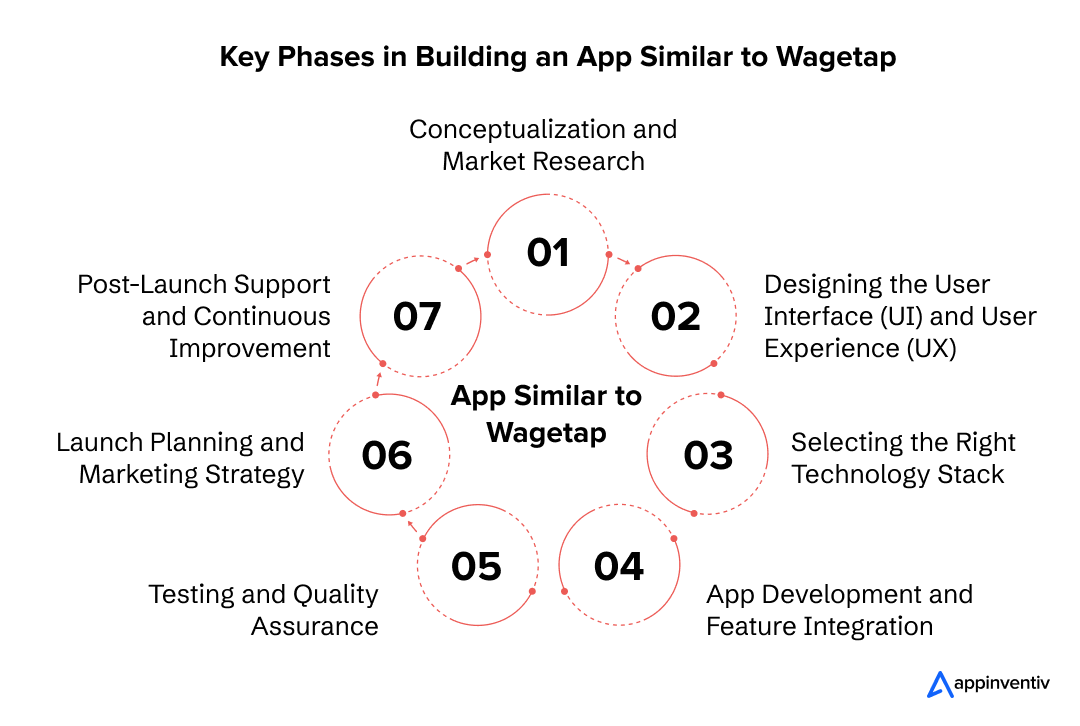

- The Process of Developing an App Like Wagetap

- Conceptualization and Market Research

- Designing the User Interface (UI) and User Experience (UX)

- Selecting the Right Technology Stack

- Development and Integration

- Testing and Quality Assurance

- Launch and Marketing Strategy

- Post-Launch Support and Continuous Improvement

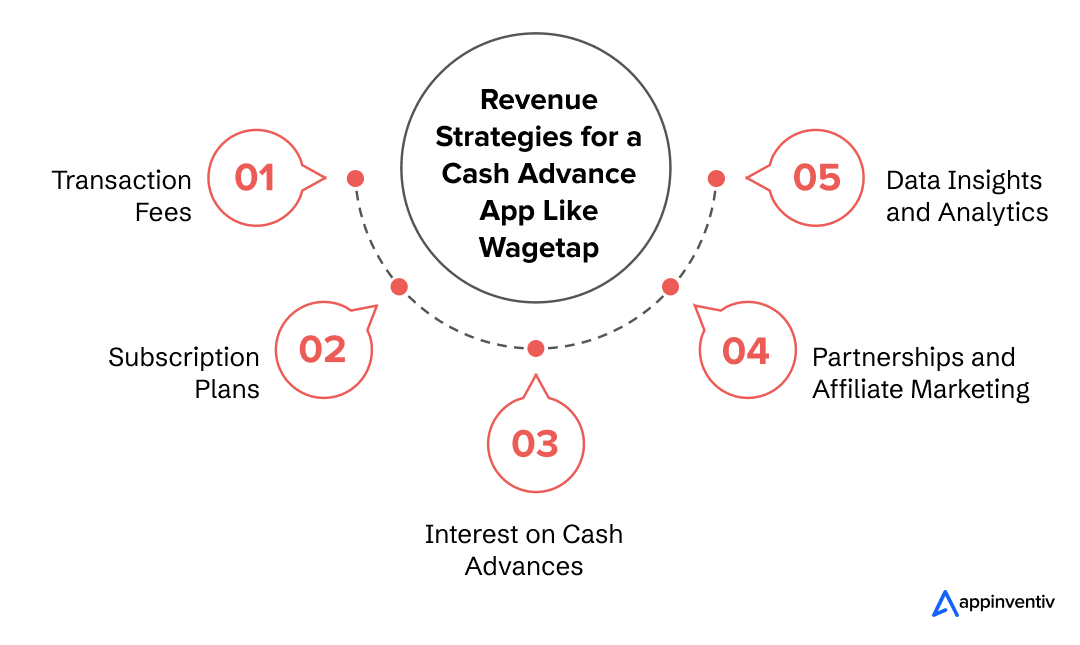

- Monetization Model of a Cash Advance App Like Wagetap

- Transaction Fees

- Subscription Plans

- Interest on Cash Advances

- Partnerships and Affiliate Marketing

- Data Insights and Analytics

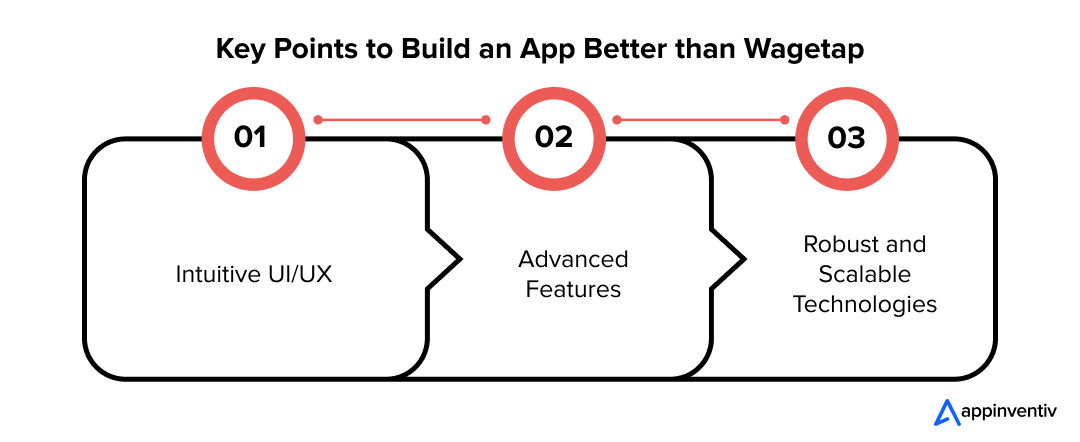

- Strategies to Create an App Superior to Wagetap

- Intuitive UI/UX Design

- Advanced Features

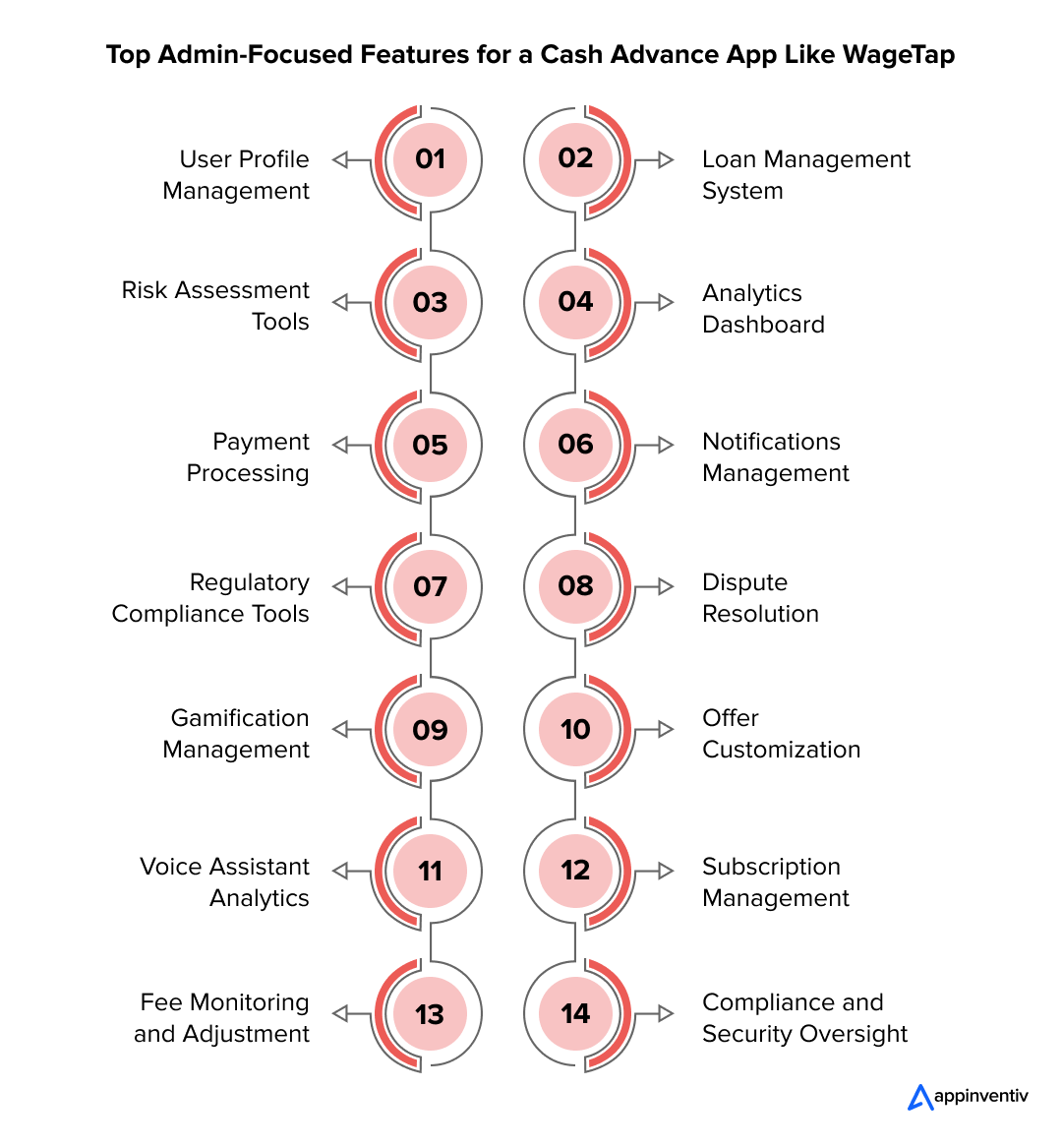

- Admin Side Features

- Robust and Scalable Technologies

- Partner with Appinventiv to Build Your Wagetap-Like App

- FAQs

Customer experience is no longer just a buzzword—it’s the defining factor that separates thriving businesses from those struggling to keep up. With individuals increasingly relying on technology for their daily needs, the expectation for seamless and immediate solutions is at an all-time high.

Nowhere is this more evident than in the financial sector, where cash advance apps are transforming how people manage short-term monetary needs. These apps bridge critical gaps, offering users rapid financial relief while delivering convenience.

For businesses in Australia, entering this market is more than an opportunity—it’s a chance to redefine financial accessibility for a growing tech-savvy audience. That’s why the global cash advance services market is projected to reach $138.5 billion by 2032.

Understanding the costs of building such apps is crucial, as it involves more than app development. It’s about investing in features that resonate with user needs, robust technologies, and compliance with regulatory standards.

The cost to build a cash advance app like Wagetap australia can range from $40,000 to $300,000, depending on the app’s complexity, features, and scale.

This blog explores the cost considerations of building a cash advance app like Wagetap and the potential to create a cutting-edge solution that stands out in this competitive space.

Overview of Cash Advance Apps Like Wagetap

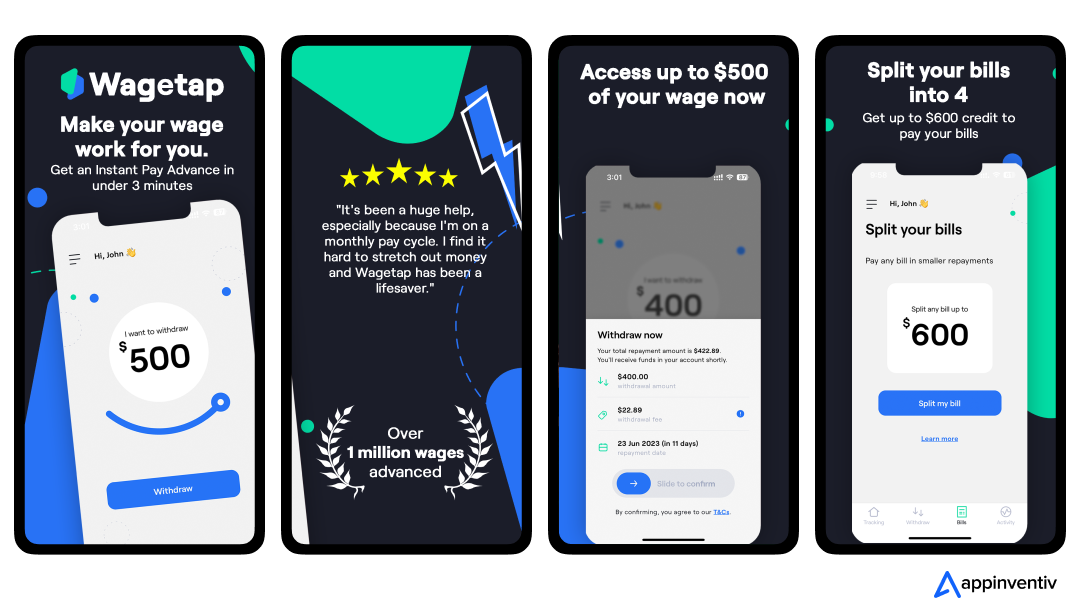

Wagetap is a leading cash advance app in Australia, trusted by over 300,000+ people and 150,000+ active users who rely on its quick and hassle-free services. With a remarkable record of lending $500+ million in advances, it has become a vital financial tool for many Australians.

Wagetap Australia ensures a seamless user experience, eliminates the need for lengthy loan approvals, and offers instant access to hard-earned wages with complete transparency and security.

Wagetap’s Wage Advance feature allows users to access earned wages before the next payday, making handling unexpected expenses or urgent financial needs easier. With this feature, users can borrow up to $2,000 of their salaries in advance, ensuring they can cover bills, groceries, childcare, and other immediate needs without delay.

Furthermore, Wagetap’s Bill Split feature lets users pay bills instantly, with up to $600 covered upfront. Repayments are split into three instalments for bills under $300 or four instalments for higher amounts, deducted on payday. This feature helps users manage unexpected expenses while adding revenue for Wagetap.

How Much Does it Cost To Develop an App Like Wagetap

Developing an app like Wagetap australia involves costs influenced by app complexity, platform choice, and features such as secure payment gateways and compliance measures. Advanced technology and tailored UI/UX design further add to the budget.

The cost to build a cash advance app like wagetap typically ranges between $40,000 and $300,000, depending on the app’s scale and requirements.

| App Complexity Levels | Features | Duration |

|---|---|---|

| Basic ($40,000 to $60,000) | 1. Simple UI 2. Basic Navigation 3. Limited Functionality 4. Standard Security Measures 5. Basic Database Integration 6. Essential Push Notifications 7. Single Platform Compatibility (iOS or Android) | 2 to 4 months |

| Moderate ($60,000 to $120,000) | 1. Enhanced UI 2. Improved Navigation Experience 3. Expanded Functionality 4. Enhanced Security Features 5. Integration with External APIs 6. Basic Offline Functionality 7. Cross-Platform Compatibility 8. Social Media Integration | 4 to 6 months |

| Complex ($120,000 to $300,000) | 1. Highly Polished UI/UX Design 2. Advanced Navigation Features 3. Rich Functionality with Custom Features 4. Robust Security Protocols 5. Seamless Third-party Integrations 6. Advanced Offline Capabilities 7. Real-time Updates 8. Advanced Analytics and Reporting 9. Multi-language Support 10. Cross-Device Compatibility | 6 to 9 months |

How to Estimate the Cost of Developing a Cash Advance App Like Wagetap in Europe: A Simple Formula

The cost is typically determined by two main factors: the number of development hours required and the hourly rate charged by the development team. A straightforward formula can help you calculate the overall cost of creating a cash advance app in Europe.

| Development Hours × Hourly Rate = Total Cost |

For example, developing a cash advance app like Wagetap in Europe with moderately complex features might require 1,200 development hours at an hourly rate of $50, resulting in a total cost of $60,000.

Essential Elements That Drive the Cost of Building a Wagetap-Like App

Let’s explore the key elements that impact the cost to build a cash advance app like Wagetap. Every decision shapes the budget, from crafting an intuitive user experience to integrating robust backend technologies. Let’s begin!

Complexity of Design

The sophistication of the app’s user interface (UI) and user experience (UX) can significantly influence the cost to build a cash advance app like wagetap. Highly intuitive and visually appealing designs often require more resources and expertise. Customization and animations to enhance user engagement can further add to expenses.

Complexity of Backend Development

One of the essential factors affecting cash advance app development cost like wagetap is complexity of backend development. The app’s backend, including APIs, servers, and databases, impacts cost to develop a cash advance app like wagetap based on the complexity of its architecture and scalability needs. Apps requiring real-time data synchronization or extensive cloud storage will need more robust backend systems, increasing development time and expenses.

Third-Party Integrations

Integrations such as payment gateways, social media log-in, GPS services, and analytics tools add to development costs, depending on their complexity and licensing fees. Incorporating multiple integrations to enhance user experience often requires detailed testing and optimization, contributing to higher cost to develop a cash advance app like wagetap.

Security Measures

Implementing advanced security protocols to safeguard user data and transactions is crucial, and it can increase the overall cost to build a cash advance app like wagetap. Features like two-factor authentication, data encryption, and fraud detection systems ensure compliance with industry standards, adding to development efforts by enhancing Wagetap like cash advance app development cost in Australia.

Compliance Measures

Adhering to financial and regional regulations, such as GDPR or PCI-DSS, adds a layer of complexity and Wagetap-like cash advance app development cost in Australia. These measures ensure legal compliance and build user trust, requiring additional resources for legal consultations and audits.

Platform Selection

Choosing between iOS, Android, or cross-platform development affects both the development timeline and Wagetap-like cash advance app development cost in Australia. Developing natively for both platforms offers superior performance but at a higher cost, while cross-platform options provide wider reach with some trade-offs in functionality.

Technologies Used

Incorporating advanced technologies like AI, machine learning, or blockchain for added functionalities increases the cost to build a cash advance app like Wagetap. These technologies can enhance user experience by offering features like predictive analytics or personalized recommendations but require specialized expertise and Wagetap like cash advance app development cost in Australia.

Complexity of Features

Features such as real-time notifications, loan calculators, and credit scoring tools affect cash advance app development like WageTap. Due to their technical complexity and integration requirements, these functionalities significantly impact the cost to develop a cash advance app in Australia.

Advanced functionalities like multi-currency support or gamified user interactions can further elevate the development complexity and associated cost to develop a cash advance app like wagetap.

Unveiling the Hidden Costs of Developing an App Like Wagetap

Let’s explore the often-overlooked expenses businesses face when creating apps like Wagetap in Australia. Beyond development, costs like ongoing maintenance, robust hosting, strategic marketing, and compliance fees can add up significantly. Recognizing and planning for these hidden costs ensures your app’s financial readiness and sustained success.

App Maintenance

The cost of maintaining an app involves regular updates, security patches, and compatibility checks for new operating systems. Over time, these recurring expenses can account for 15-20% of the initial development budget annually, ensuring the app remains functional and user-friendly.

Action Points:

- Plan for regular updates and bug fixes in order to avoid Wagetap-like cash advance app development cost in Australia.

- Invest in automated testing tools to reduce manual intervention.

- Use scalable code architecture to minimize future changes and compatibility issues.

App Hosting

Hosting expenses cover server costs, cloud storage, and bandwidth usage, especially if the app has a growing user base. High-performance hosting solutions required for seamless functionality can significantly add to the monthly operational wagetap app development cost.

Action Points:

- Choose cost-effective cloud hosting solutions with scalable infrastructure.

- Optimize server performance to reduce unnecessary resource consumption.

- Regularly review hosting plans and adjust based on actual user traffic.

App Promotion and Marketing

Marketing expenditures include digital advertising, app store optimization (ASO), and social media campaigns. Launch promotions and ongoing user acquisition strategies can quickly escalate wagetap app development cost, sometimes exceeding development expenses.

Action Points:

- Focus on targeted digital marketing campaigns to reduce wasted spend.

- Use cost-effective ASO strategies to boost organic downloads by minimizing Wagetap-like cash advance app development cost in Australia,

- Prioritize social media engagement and influencer partnerships with proven ROI.

Legal and Licensing Fees

Ensuring regulatory compliance and obtaining necessary licenses, particularly for financial apps like Wagetap, can be a substantial investment. Additionally, costs for legal consultations and data protection measures add to the financial burden.

Action Points:

- Collaborate with legal experts familiar with financial app regulations.

- Use pre-built compliance frameworks to reduce custom legal costs.

- Implement robust data protection measures from the start to avoid hefty penalties.

Smart Strategies to Optimize App Development Costs Like Wagetap

Creating a high-performing app like Wagetap in today’s competitive market requires a strategic approach to ensure efficiency, cost-effectiveness, and scalability. Let’s explore the best strategies that can help optimize the cash advance loan app development in Australia and achieve exceptional results without compromising quality.

Developing an MVP

Building a Minimum Viable Product (MVP) is a cost-effective way to launch an app with core functionalities. By focusing on essential features first, you can gather user feedback, validate your idea, and make improvements before committing to a full-scale app. This approach minimizes risks and ensures resources are allocated efficiently by saving the cost to build an app like wagetap in Australia.

Quick Tips:

- Identify the app’s most critical features for user satisfaction.

- Launch the MVP to test the market and collect user feedback.

- To build a cash advance app like Wagetap, use insights to refine and scale the app incrementally, saving cost.

Prioritizing Necessary Features

Rather than overwhelming the app with every possible feature, focus on what aligns with user needs and business goals. Prioritizing necessary functionalities ensures a smoother development process and reduces the cost to build an app like Wagetap in Australia, helping deliver a product that resonates with your audience.

Quick Tips:

- Conduct user research to identify must-have features by saving cost to develop a cash advance app like wagetap.

- Avoid overloading the app with non-essential elements initially.

- Incorporate advanced features post-launch based on user demand.

Leveraging Cross-Platform Development

Cross-platform tools like Flutter or React Native allow you to develop apps that work seamlessly on iOS and Android from a single codebase. This approach saves time and reduces costs while ensuring consistent performance across platforms.

Quick Tips:

- Choose frameworks like Flutter for high performance and flexibility.

- Test the app on multiple devices to ensure compatibility.

- Regularly update the app to address platform-specific updates.

Outsourcing to Cost-Effective Regions

Partnering with skilled developers in cost-effective regions offers significant savings without compromising quality. Outsourcing allows access to a diverse talent pool while reducing overhead costs associated with hiring and managing an in-house team.

Quick Tips:

- Choose outsourcing partners like Wagetap, which has a proven track record in cash advance app development.

- Ensure clear communication and project management practices.

- Focus on regions offering a balance of cost-effectiveness and expertise.

The Process of Developing an App Like Wagetap

Developing an app like Wagetap, a financial service platform allowing users to access earned wages before payday, involves several key steps. Here’s a simplified cash advance app development steps in Australia. Let’s explore!

Conceptualization and Market Research

The first step is defining the app’s core functionality and features. This involves identifying user needs like instant wage access, transaction tracking, and employer integration. Market research is crucial to understand competitors, target audience preferences, and regulatory requirements.

Designing the User Interface (UI) and User Experience (UX)

A clean, intuitive UI and seamless UX are critical for user adoption. Design wireframes to plan the app layout and user flows. The goal is to create a simple yet effective experience, making it easy for users to manage their finances and access their earned wages.

Also Read: Cost Breakdown For Designing & Developing Finance App Like PocketSmith

Selecting the Right Technology Stack

Choosing the right technologies is essential for scalability, security, and performance. Select frameworks for development for the front end (e.g., Swift, Kotlin) and back end (e.g., Node.js, Ruby on Rails). The technology stack should support key features such as secure payments and integration with payroll systems.

Development and Integration

This phase involves coding the app and integrating necessary features like wage tracking, payment gateways, and employer syncing. Work closely with development teams to ensure the app is scalable, secure, and optimized for performance.

Testing and Quality Assurance

Testing is essential to identifying bugs, fixing performance issues, and ensuring security. Conduct thorough QA to verify that all features work as intended and test across various devices and operating systems to ensure broad compatibility and smooth operation.

Launch and Marketing Strategy

Once the app passes testing, it’s ready for launch. Deploy it on app stores and execute a well-planned marketing campaign. Utilize digital marketing, influencer partnerships, and social media to drive downloads and raise brand awareness.

Post-Launch Support and Continuous Improvement

Ongoing support is key to user retention. Update the app regularly with bug fixes, security patches, and new features. Listening to user feedback and analyzing app performance ensures continuous improvement and helps keep the app relevant and user-friendly.

Monetization Model of a Cash Advance App Like Wagetap

Let’s explore the Wagetap app development revenue model. These models are designed to generate consistent revenue while ensuring value for users. Businesses can achieve financial sustainability and user satisfaction by implementing the right strategies.

Transaction Fees

One of the most common monetization models is charging a fee for each transaction processed through the app. This fee can be a flat amount or a percentage of the transaction, providing a steady income stream based on user activity. It also incentivizes users to manage transactions efficiently by saving the cost of developing a cash advance app in Australia.

Subscription Plans

Offering a tiered subscription model gives users access to premium features like faster cash advances or lower fees. Subscription plans can be monthly, quarterly, or annual, offering recurring revenue for the app. Such a wagetap business model also builds user loyalty by delivering exclusive benefits of wagetap like app development.

Interest on Cash Advances

A more traditional revenue generation method is charging interest on user cash advances. The interest rate can be set based on the loan amount and repayment term, creating a steady cash flow for the business. This model aligns with user repayment habits to balance profitability and user satisfaction and saves cost to develop a cash advance app in Australia.

Partnerships and Affiliate Marketing

Collaborating with financial institutions or other businesses can offer opportunities for affiliate marketing. The app can earn commission-based revenue from referrals and partnerships by promoting services, products, or financial offers. This strategy also boosts the app’s credibility through associated brands.

Data Insights and Analytics

By collecting anonymized data about users’ financial behavior, the app can offer valuable insights to financial institutions, insurance companies, and marketers. Monetizing this data through partnerships can provide a unique revenue stream. These insights drive innovation in financial products and services tailored to user needs.

Strategies to Create an App Superior to Wagetap

Three factors are crucial when developing an app better than Wagetap: UI/UX, features, and technologies. Let’s explore these aspects to understand their impact on cash advance app development like Wagetap in Australia.

Intuitive UI/UX Design

Create an app with a clean, user-centric interface that prioritizes simplicity and speed. Incorporating intuitive navigation, quick-access buttons, and visually appealing elements can enhance user interaction. Provide personalized dashboards, tooltips, and guided flows to ensure even non-tech-savvy users can easily navigate the cash advance features.

Key Components:

- Intuitive Navigation: Ensures users can access features effortlessly to save Wagetap like cash advance app development cost in Australia

- Clean Visual Interface: A modern and visually appealing design for engagement saves cost to develop a cash advance app in Australia.

- Accessibility Features: Optimized for inclusivity and usability across devices.

- Fast Load Times: Ensures a smooth and quick user experience by saving cost to develop a similar app like wagetap

Advanced Features

Like app development, WageTap’s benefits go beyond basic functionalities. Unique features such as real-time wage tracking, automated repayment scheduling, instant notifications, and detailed financial insights can set your app apart, enhancing user experience and driving engagement.

To encourage responsible financial management among employees, features such as in-app budgeting tools and integration with financial wellness tips should be included.

Key Components:

- Personalized Loan Options: Tailored plans based on individual financial needs.

- Quick Approval Process: Streamlined workflows for instant approvals.

- Financial Dashboard: Clear insights into balances, repayment schedules, and transactions are essential to minimize cost to develop a cash advance app in Australia.

- Automated Notifications: Timely reminders and updates to enhance user interaction, saving cost to develop a similar app like Wagetap.

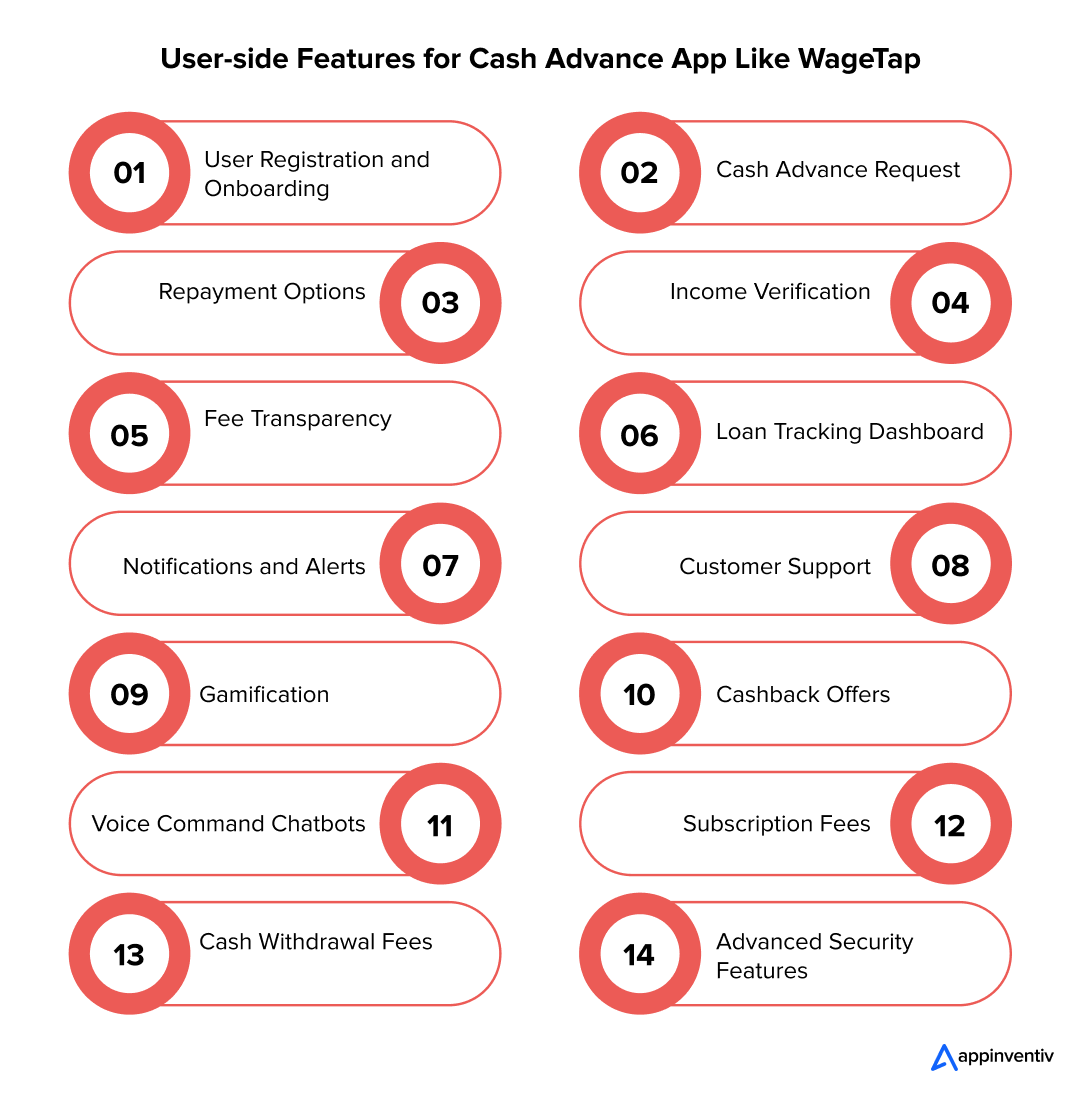

User Side Features

User Registration and Onboarding: Seamless and secure account creation with quick payroll or bank account integration for faster loan approvals.

Cash Advance Request: Flexible loan requests with adjustable amounts and transparent repayment terms tailored to user needs, reduce cost to develop a cash advance app in Australia.

Repayment Options: Convenient repayment options via auto-deductions or manual payments, supported by timely reminders and alerts.

Income Verification: Hassle-free income verification through payroll connections or document uploads, ensuring data security.

Fee Transparency: Clear, upfront breakdown of loan fees, interest rates, and repayment schedules to build trust and confidence.

Loan Tracking Dashboard: This intuitive dashboard displays active loans, repayment schedules, credit history, and financial tips for better planning.

Notifications and Alerts: To keep users informed, we send real-time notifications about loan approvals, due dates, and promotional offers.

Customer Support: 24/7 support through AI-powered chatbots, voice commands, or a robust FAQ system for instant issue resolution.

Gamification: Engage users with reward systems like points, badges, and milestone incentives for timely repayments or referrals.

Cashback Offers: Exclusive cashback rewards on timely payments, referrals, or app-specific promotions to enhance user loyalty.

Voice Command Chatbots: AI-driven voice-enabled assistants for streamlined loan requests, balance checks, and support queries.

Subscription Fees: Premium subscription plans offer benefits such as lower fees, higher loan limits, priority customer support, and exclusive features.

Cash Withdrawal Fees: A transparent withdrawal fee structure for instant cash advances saves on Wagetap-like cash advance app development cost in Australia.

Advanced Security Features: State-of-the-art multi-factor authentication, biometric login, and data encryption to safeguard user information.

Admin Side Features

User Profile Management: Manage and monitor user accounts, income details, and borrowing histories to ensure seamless administration.

Loan Management System: Approve or reject loans efficiently with automated eligibility checks and risk analysis.

Risk Assessment Tools: Leverage AI-based tools for credit scoring and dynamic rules to minimize default risks.

Analytics Dashboard: Access comprehensive insights into user behavior, loan performance, and financial trends with real-time metrics.

Payment Processing: Automate loan disbursals and repayments, ensuring smooth transaction handling and error-free payment workflows.

Notifications Management: Customize and automate user notifications for approvals, reminders, and promotional updates.

Regulatory Compliance Tools: Maintain compliance with Australian financial regulations through audit logs and secure data management.

Dispute Resolution: Efficiently handle repayment disputes, user complaints, and refunds with a transparent and user-friendly process.

Gamification Management: Configure and track gamification rewards, ensuring increased user engagement and satisfaction.

Offer Customization: Create and manage cashback programs, promotional offers, and user incentives for retention and growth.

Voice Assistant Analytics: Monitor chatbot and voice command interactions, refining AI performance for better user experiences.

Subscription Management: Oversee premium plan registrations, benefits allocation, and renewal processes to maximize subscription value.

Fee Monitoring and Adjustment: Dynamically adjust cash withdrawal fees based on transaction patterns and user behaviors to optimize operations.

Compliance and Security Oversight: Regularly audit security systems and ensure adherence to regulatory standards to protect user data.

Robust and Scalable Technologies

Utilize cutting-edge technologies to build a scalable and reliable app. Leverage cloud infrastructure for real-time data storage and fast retrieval, integrate advanced encryption methods to ensure data security and use AI-driven algorithms for fraud detection and risk assessment. Embrace frameworks like React Native for cross-platform development to maintain cost efficiency and speed.

Key Components:

AI-Powered Algorithms: For risk assessment and accurate credit scoring.

Robust Data Analytics: Efficient analysis to drive strategic business decisions.

Advanced Security Protocols: Strong encryption and fraud prevention measures.

Scalable Architecture: It ensures long-term growth and seamless performance by saving Wagetap, like cash advance app development costs in Australia.

Partner with Appinventiv to Build Your Wagetap-Like App

Appinventiv is renowned for its top-tier mobile app development services in Australia, helping businesses across industries turn their ideas into reality. With a deep understanding of the financial sector and extensive expertise in app development, we are well-equipped to build a robust, user-friendly app like Wagetap.

- Proven Track Record with 3000+ Successful Projects: Appinventiv has delivered over 3000 projects across industries, showcasing its expertise and commitment to excellence.

- Global Team of 1600+ Experts: With a diverse team of 1600+ skilled professionals, Appinventiv offers a perfect blend of creativity, technical proficiency, and industry knowledge.

- Innovative and Streamlined Development Process: Our client-centric development process ensures transparency, timely delivery, and solutions tailored to your business needs, making our fintech app development services the ideal choice for your financial technology goals. Appinventiv in Australia is dedicated to elevating your fintech solutions with cutting-edge technology and strategic insights. We prioritize client engagement and satisfaction, ensuring a seamless and successful project outcome.

- Recognition for Excellence: We were awarded ‘Tech Company of the Year’ at the Times Business Awards 2023, establishing us as a leader in mobile app innovation.

Partner with Appinventiv to create an app that meets and exceeds industry standards.

FAQs

Q. What is Wagetap?

A. Wagetap is a cutting-edge cash advance app that empowers employees to access their earned wages before payday. It offers a seamless, transparent, and quick solution to financial challenges by eliminating the need for traditional payday loans and providing instant liquidity.

Q. How does Wagetap work?

A. Wagetap connects directly with payroll and HR systems, enabling employees to effortlessly request partial access to their wages. The app’s smart algorithms process these requests in real-time, ensuring instant fund transfers with a user-friendly interface and minimal administrative intervention.

Q. What is the average cost of cash advance app development?

A. The cost to develop a robust cash advance app like Wagetap can range between $40,000 and $300,000, depending on factors like platform choice (iOS/Android), design complexity, backend scalability, and integration with third-party services like payment gateways and databases.

Q. How long does it take to make an app like Wagetap in Australia?

A. Developing a sophisticated cost to build a cash advance app like Wagetap typically takes 6 to 9 months or more. This timeframe is influenced by backend infrastructure setup, security protocols, UI/UX design intricacies, and ensuring scalability and integration with existing payroll and HR systems.

How Much Does it Cost to Build a Personal Finance App like Pocketsmith?

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for…

How Much Does it Cost to Build a Mobile Banking App Like Halifax in the UK?

The way people bank has changed dramatically. Gone are the days of waiting in long queues or rushing to a branch before closing hours. Today, mobile banking apps like Halifax have redefined convenience, allowing users to check balances, transfer funds, pay bills, and even apply for loans from their smartphones, anytime and anywhere. This shift…

How to Approach Currency Converter App Development?

Imagine you’re about to travel abroad and need to quickly check how much your local currency is worth in another country, or perhaps you run an international business and constantly deal with multiple currencies. In both cases, a currency converter app is an indispensable tool. With global transactions becoming the norm and forex markets fluctuating…