- What Exactly Is a Financial Data Warehouse?

- Why FinTechs Need Financial Data Warehouses

- Architecture & Technology Landscape

- Architectural Patterns That Matter

- Cloud and Hybrid Ecosystems

- Data Flow and Modeling

- Analytics and Machine Learning

- Key Benefits of a Financial Data Warehouse

- One Source Everyone Can Rely On

- A Clear View of the Past

- Quicker, Smarter Decisions

- Space to Grow Without Slowing Down

- Clean, Reliable Data

- Security That’s Built In, Not Bolted On

- Efficiency That Pays Off

- Top FinTech Use Cases of a Financial Data Warehouse

- Real-Time Fraud Detection & Transaction Monitoring

- Credit Scoring & Underwriting

- Regulatory Reporting & Audit-Ready Data

- Customer 360 & Personalization

- Open Banking & Aggregated Finance

- Treasury, Liquidity & Portfolio Management

- Implementation Process

- Step 1: Start with People, Not Platforms

- Step 2: Bring It All Together

- Step 3: Clean and Organize the Data

- Step 4: Build Security and Governance from Day One

- Step 5: Turn Data Into Insight

- Step 6: Keep an Eye on Performance

- Step 7: Let It Grow With You

- Challenges & How to Mitigate Them

- 1. Legacy Systems and Data Silos

- 2. Data Quality and Schema Drift

- 3. Regulatory Complexity and Compliance Pressure

- 4. Vendor Lock-In

- 5. Cost Management

- 6. Getting Teams to Actually Use the Data

- 7. Security and Privacy

- Real-World Implementations of Data & Analytics Infrastructure in FinTech / Finance

- 1. Stripe: Unified Data Pipeline for Global Reporting & Risk

- 2. Revolut: Real-Time Risk, Personalization & Compliance

- 3. HSBC (Wholesale Banking): Operational Analytics for Frontline Teams

- 4. Banking Client via Appinventiv: AI & Process Automation

- 5. PayPal: Real-Time Data Architecture for Fraud Detection

- Future Trends & Emerging Directions

- Data Lakehouse / Unified Analytics

- AI-Native Warehouses

- Federated Analytics & Data Mesh

- Edge / IoT-Driven Financial Data

- How Appinventiv Helps FinTechs Build the Future of Data

- FAQ’s

Key Takeaways

- FinTechs work better when their data finally talks to each other. A finance data warehouse makes that happen — one place, one version of truth.

- Real-time decisions need real-time systems. Modern warehouses bring together analytics, compliance, and scalability so teams move faster with confidence.

- From fraud checks to forecasting, everything improves when data is clean, connected, and easy to trust.

- Building a financial data warehouse isn’t just a tech project — it’s a mindset. Start with people, add structure, and keep security at the core.

- At Appinventiv, we help FinTechs make their data work harder. Our goal is simple: turn everyday numbers into powerful business decisions.

In the last decade, FinTech firms have become data powerhouses. Every transaction, API call, customer click, credit application, and regulatory log generates information. Yet many struggle to turn that into insights. This is a common challenge across the industry, making a well-designed data warehouse in financial services essential for turning raw data into usable intelligence.

Data ends up fragmented across multiple silos, payments, CRM, loan systems, external partners. As a result, decision-making slows, compliance becomes riskier, and innovation stalls.

This is where a financial data warehouse (FDW) becomes a strategic asset. It acts as a unified, audited, analytics-ready backbone for the entire FinTech stack. A modern finance data warehouse serves as the foundation for data-driven digital transformation and operational efficiency in banking.

Leading companies use it to shrink fraud windows, improve underwriting speed, personalize services, and automate compliance. A well-built FDW becomes more than infrastructure. It becomes a force multiplier for every team.

In this article, we explore what an FDW is, why FinTechs need it, the architecture and technologies involved, use cases, implementation process, challenges, and future direction. This guide also outlines how an enterprise data warehouse for financial services can transform scalability and compliance at every level.

What Exactly Is a Financial Data Warehouse?

An FWD is a specialized data warehouse designed to collect, clean, integrate, and store financial, operational, and customer data from across systems for analytics, reporting, machine learning, and governance.

Differences from other data paradigms

- Vs traditional data warehouse: A traditional warehouse often serves broad BI use cases across domains. A finance data warehouse is tuned for financial semantics, auditability, latency, and regulatory constraints.

- Vs data lake: Lakes store large volumes of raw or semi-structured data. FDWs store curated, structured, analytics-ready data. Many modern stacks use both (lake + warehouse) in a hybrid design.

- Vs data mesh / virtualization: In some architectures, data remains in domain silos and is accessed virtually. These approaches may suit certain microservices or low-latency domains, but often can’t guarantee consistent lineage, performance, or regulatory traceability in finance.

Build a finance data warehouse with Appinventiv and turn disconnected data into real-time intelligence.

Why FinTechs Need Financial Data Warehouses

FinTech companies move fast. But with that speed comes constant pressure, in order to scale up without cracks showing, to make real-time decisions, to stay compliant, and to keep one step ahead of competition that’s never slowing down.

That’s where a Financial Data Warehouse (FDW) earns its place. It gives FinTechs something they often lack, which is structure, speed, and trust in their data. Here’s what that looks like in practice:

Problem vs. Solution Table

| FinTech Challenge | FDW Solution |

|---|---|

| Data scattered across silos | Unified, auditable source of truth |

| Slow fraud detection | Real-time analytics & alerting |

| Compliance pressure | Built-in lineage & governance |

| High infra cost | Elastic scaling on cloud |

1. One Clear View of Every System

A typical FinTech connects to a maze of APIs, banks, payment networks, and KYC tools. Each holds a piece of the story, but not the whole thing. Without a central hub, it’s hard to see patterns or spot problems early. A financial data warehouse pulls everything together, turning fragmented data into a single, reliable picture of customers, risk, and operations.

2. Decisions That Happen in Real Time

Fraud checks, credit scoring, liquidity monitoring can’t wait until tomorrow. By combining live streaming data with stored records, an FDW helps FinTechs act fast. It gives teams the power to detect issues, approve transactions, and manage risk in seconds, not hours.

3. Compliance That Doesn’t Slow You Down

In finance, compliance isn’t optional. GDPR, PCI DSS, AML, KYC, they all demand accurate, traceable data. An effective financial data warehouse architecture connects performance, scalability, governance, and cost control, ensuring that every data-driven decision happens with both speed and accuracy.

4. Sharper Risk Management

Whether it’s detecting fraud or predicting defaults, models are only as good as the data they use. A warehouse makes that data clean, complete, and connected. It helps teams train better models, spot anomalies earlier, and act with confidence instead of guesswork.

5. Efficiency That Actually Saves Time

Without a shared data layer, every team builds its own systems — and ends up solving the same problem twice. A unified FDW removes that duplication. It keeps data consistent, reduces maintenance, and lets engineers spend time building products instead of cleaning spreadsheets.

6. Forecasts You Can Trust

Good decisions depend on good data. With everything structured in one place, forecasting revenue, liquidity, or default rates becomes faster and more accurate. The dashboards tell a story that’s finally worth believing. That’s the real strength of a data warehouse in financial services bringing precision and consistency to every forecast.

7. A Foundation for AI and Innovation

AI in finance needs one thing above all — high-quality data. As FinTechs build predictive lending models or fraud-detection systems, a clean, organized FDW becomes their strongest advantage. It feeds machine learning models the right data automatically, no manual patchwork required.

That same foundation also supports scalable banking data warehouse development efforts where automation and accuracy drive innovation.

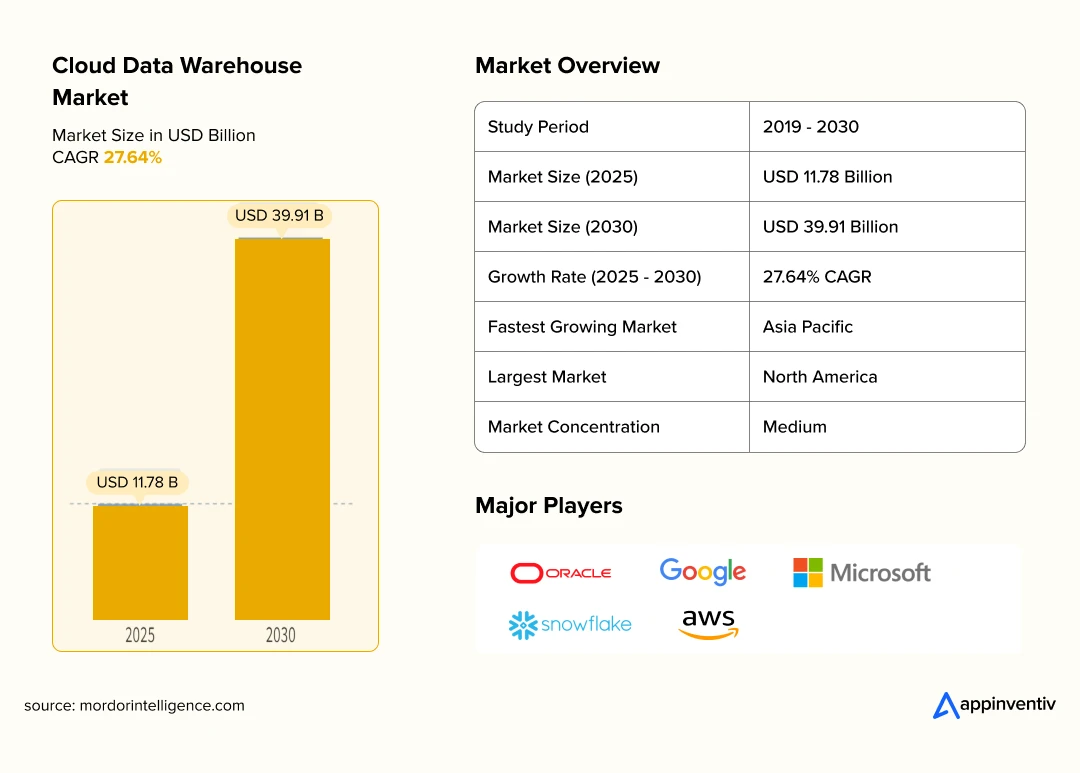

Finally, market signals support this shift: the cloud data warehouse market is projected to grow from USD 11.78 billion in 2025 to USD 39.91 billion by 2030 (CAGR ~27.6%) — and banking/financial services already account for ~28% of that share. Mordor Intelligence

Also Read: Cost to Build a FinTech App: What You Need to Know

Architecture & Technology Landscape

A well-designed Financial Data Warehouse (FDW) is more than a backend system. It’s what keeps a FinTech business running smoothly, turning raw data into insights, and insights into decisions. For most FinTech organizations, building a finance data warehouse is the first real step toward data maturity, aligning technology, governance, and business goals under one framework.

However, the challenge lies in building something fast enough to handle real-time needs but structured enough to stay compliant.

The key is balance: between performance, scalability, cost, and control. A well-structured enterprise data warehouse for financial services delivers this balance through modular and cloud-ready architecture.

Architectural Patterns That Matter

There’s no single way to design a finance data warehouse. The right architecture depends on how quickly data changes and what kind of answers you’re looking for.

- Lambda (Batch + Streaming): A balanced setup that combines historical and real-time data. It’s useful when you want long-term accuracy but still need dashboards that update in seconds.

- Kappa (Streaming-First): Perfect for time-sensitive tasks like fraud detection or instant lending decisions, where every millisecond counts.

- Lakehouse / Unified Architecture: This newer approach merges the flexibility of data lakes with the order and performance of warehouses. McKinsey calls it a critical step in helping banks modernize how they store and use data.

Cloud and Hybrid Ecosystems

Most FinTechs now rely on cloud-native platforms like Snowflake, Google BigQuery, Amazon Redshift, Azure Synapse, and Databricks. These platforms scale automatically, handle heavy workloads, and even come with built-in AI and ML tools so data teams can focus on solving business problems instead of maintaining servers. They also simplify banking data warehouse development by offering flexible data management, serverless compute, and near-zero downtime.

But going fully cloud isn’t always possible. Financial institutions have to follow strict rules around data privacy and residency, which makes hybrid setups more practical.

Data Flow and Modeling

The warehouse is only as good as the data flowing into it. Information arrives from APIs, Kafka streams, or Change Data Capture (CDC) pipelines — small, continuous updates instead of bulky daily uploads. Tools like dbt and Apache Spark then clean, transform, and organize it into models that are ready for analysis.

Most companies use star or snowflake schemas to connect facts (like transactions) with dimensions (like time, customer, or product). Add in partitioning, caching, and clustering, and you get faster queries and smoother performance — even with millions of records.

Analytics and Machine Learning

Once the foundation is set, the focus shifts to what you can do with the data. Business teams use Tableau, Power BI, or Looker for everyday reporting, while data scientists plug directly into the same warehouse to train and deploy machine learning models.

Whether it’s predicting loan defaults, detecting fraud, or personalizing user offers, these models rely on clean, governed data. Over time, feedback loops make them smarter — turning the FDW into more than just a reporting tool; it becomes the engine for innovation.

A modern financial data warehouse is not a static piece of infrastructure — it’s a living system. When built right, it helps FinTechs act faster, comply smarter, and make decisions based on truth, not guesswork.

Key Benefits of a Financial Data Warehouse

When a FinTech company starts growing fast, data usually becomes both its biggest strength and its biggest headache. That’s why modern warehousing finance strategies focus on consolidating data from every channel into one unified system.

There’s information everywhere from apps, partners, payment gateways, CRMs, and support systems, but it rarely speaks the same language. A financial data warehouse fixes that by turning scattered data into a single, reliable foundation that supports better decisions and sharper insight.

That’s the core of the benefits of data warehousing in finance, offering clarity, consistency, and faster access to the truth behind every number.

But that’s not it, here’s how it helps:

| Aspect | Before FDW | After FDW |

|---|---|---|

| Data accuracy | Inconsistent reports | Single, reliable view |

| Compliance | Manual audits | Automated, traceable logs |

| Decision-making | Reactive | Real-time and predictive |

| Cost control | Redundant systems | Consolidated and optimized |

One Source Everyone Can Rely On

In most FinTechs, data lives in silos. Finance pulls its own reports, marketing tracks engagement in another tool, and the risk team relies on separate models. Everyone works hard, but nobody sees the same picture.

With a financial data warehouse, everything connects. The numbers finally match. Teams stop arguing about whose report is right and start asking better questions. It makes meetings shorter, decisions faster, and collaboration a lot easier. When everyone works from the same source, trust in the data goes up — and so does confidence in the choices that follow.

A Clear View of the Past

Every business wants to know what’s next, but that’s impossible if you can’t see what’s already happened. Most day-to-day systems only keep recent data to stay fast. Older records get buried or deleted.

Integrating data warehouses in financial services keeps that history alive. It lets you compare years of performance, analyze customer behavior, and find trends that would otherwise stay hidden. Maybe repayment patterns shift during certain months, or certain loan products perform better with specific age groups. Having that perspective turns hindsight into foresight — and that’s where better strategy begins.

This kind of historical analysis is crucial for Data Analytics in Banking, which turns hindsight into foresight, and that’s where better strategy begins.

Quicker, Smarter Decisions

When reports depend on live systems, teams hesitate to dig deep because heavy queries slow everything down. It’s a constant trade-off between speed and insight.

A warehouse removes that tension. Analytics run separately, so exploring data never disrupts operations. Product managers can test new features, risk teams can model different scenarios, and finance can run forecasts instantly. Decisions stop being reactive. They become timely, informed, and precise.

Space to Grow Without Slowing Down

FinTech traffic isn’t steady. It spikes on payday, during the holidays, or when a new product launches. Traditional systems buckle under that kind of pressure.

A modern data warehouse in financial services adjusts automatically. When transactions rise, it scales up to handle the load. When things quiet down, it scales back to save resources. The result is smooth performance year-round. No more overpaying for servers that sit idle or rushing to fix outages when the system can’t keep up.

Clean, Reliable Data

Every smart decision starts with good data. If your inputs are messy, your insights will be too. A financial data warehouse cleans and validates information before it ever reaches reports or dashboards. It standardizes formats, removes duplicates, and keeps everything traceable.

That reliability changes how teams work. Analysts trust their numbers. Compliance officers can see where data came from. And leaders know the reports they’re reading actually reflect reality. It’s a quiet but powerful shift that keeps mistakes from becoming expensive problems.

Security That’s Built In, Not Bolted On

FinTech data is sensitive by nature — customer identities, account numbers, transactions. It needs protection at every step.

A financial data warehouse takes that seriously. Encryption, role-based access, and continuous monitoring are part of its design, not afterthoughts. When your systems are secure by default, compliance becomes easier. Audit trails are already there, permissions are clear, and teams can focus on improving services instead of worrying about data breaches.

Efficiency That Pays Off

Running several databases across departments costs more than money. It costs time and attention. Each system needs upkeep, storage, and separate analytics. Over time, that chaos slows everything down.

A single data warehouse simplifies all of it. Compute and storage can scale independently, so you only pay for what you actually use. Less maintenance, fewer manual exports, and cleaner workflows mean your tech team can spend more time building and less time fixing.

A financial data warehouse might not be the flashiest investment, but it’s the one that keeps everything else running smoothly. It gives clarity to leaders, control to analysts, and structure to growth. Most importantly, it helps a FinTech company move forward without losing sight of what really matters — the truth behind its numbers.

See how we turn raw information into real-time intelligence for FinTechs.

Top FinTech Use Cases of a Financial Data Warehouse

A well-designed financial data warehouse (FDW) is more than infrastructure. It becomes a platform that powers mission-critical capabilities across the FinTech stack. Below are some of the highest impact use cases that lean heavily on timely, unified, and trustworthy data.

These data warehousing use cases in the financial industry show how a strong data backbone powers both innovation and compliance.

Real-Time Fraud Detection & Transaction Monitoring

One of the most dramatic wins from a robust FDW is in fraud detection, catching suspicious activity before it causes damage. By combining streaming ingestion (e.g. via Kafka or other event buses) with machine learning models trained on historical patterns, a FinTech can flag abnormal transactions in milliseconds.

For advanced detection, many utilize AI Agents in Fraud Detection to support near-real-time fraud response and system reliability.

Systems can score every transaction in real time, compare it to customer patterns, peer behavior, and known fraud signals, and then either block, challenge, or flag it. For example, AWS provides a reference architecture showing how a data pipeline with streaming ingestion and ML inference can support near-real-time fraud detection.

In practice, several FinTechs report big gains: one platform, after deploying real-time pipelines, cut fraud detection latency sharply, reduced false positives, and sped up regulatory reporting by reusing the same infrastructure. This is one of the most impactful data warehouse applications in financial services industry, enabling near-instant fraud response and system reliability. Nexusdata.global

Credit Scoring & Underwriting

Lending is a data game. When you can tap into both historical behavioral data (e.g. repayment history, transaction volume, spending patterns) and real-time signals (e.g. current balances, merchant behavior, anomalies), credit underwriting becomes smarter and more adaptive.

An FDW enables credit models that evolve continuously. Within warehousing finance, this adaptability helps institutions offer more accurate lending decisions and risk segmentation.

In practice, a FinTech can retrain scores overnight, push new models to live systems, and monitor model drift. Because the data warehouse in financial services holds full history and feeds live features, the underwriter isn’t blind to past behavior.

This reduces risk, shortens time-to-decision, and allows more nuanced segmentation (for example making micro-loans or dynamic credit lines).

Regulatory Reporting & Audit-Ready Data

Regulatory compliance is never optional in finance. FDWs shine in making that burden lighter. Because the warehouse tracks lineage, versions, and transformations, teams can generate audit-ready reports for AML, KYC, SAR, capital adequacy, and more with less manual effort.

Think of it as a system that not only answers “what changed and when,” but also supports rollback and investigation workflows. When data transformations have clear version histories, auditors and compliance teams can trace exactly how the data moved, was cleaned, or adjusted. That reduces friction during regulatory audits and inspections.

Customer 360 & Personalization

Today’s customers expect more than a generic experience. They want insights based on their context such as, spending habits, saving patterns, loans, and app behavior. With a financial data warehouse, all that data is brought together.

You can merge transaction history, app behavior, demographic info, and external signals into a unified profile. Then you can deliver personalized product offers (loans, rewards, savings), dynamic pricing, or real-time nudges (e.g., “you’re close to overdraft, want to auto-transfer?”).

Because the data is centralized and fresh, these recommendations feel relevant and timely, not stale or off-target.

Open Banking & Aggregated Finance

Open banking is transforming how customers and FinTechs share financial data across banks. An FDW plays a central role here by aggregating external banking data (with permission) into internal models and analytics.

When you standardize data from multiple bank APIs, fintechs can offer cross-institution views: consolidated account dashboards, cross-bank spending behavior, comparative insights (e.g. “you spend more than average in category X across all your accounts”).

Open banking is growing rapidly, and the data shows that global open banking user numbers will swell from 183 million in 2025 to over 645 million by 2029.

This gives FinTechs the chance to build products that transcend a single institution. Another white paper from Citi also emphasizes the strategic case for open banking: integrating bank and non-bank data to enhance customer offerings. Citi

Also Read: The Ultimate Guide to Banking App Development

Treasury, Liquidity & Portfolio Management

For FinTechs managing large funds, lending pools, or investment products, treasury and liquidity functions matter deeply. An FDW helps here by unifying internal metrics (loan disbursement, interest accruals, defaults) with external market data, currency rates, and funding costs.

With all this data in one place, you can run simulation models to forecast liquidity stress, rebalance portfolios, or switch funding sources dynamically. You can also monitor credit exposure across segments and respond proactively before losses widen.

The power lies in being able to back-test various scenarios, adjust for changing macro inputs, and make real-time decisions driven by data rather than gut. Together, these represent the most transformative use cases of financial data warehouses driving the modern FinTech ecosystem.

Implementation Process

Building a financial data warehouse for a FinTech company takes time, patience, and a clear sense of purpose. It’s not just about setting up databases or pipelines — it’s about building something that people across the company can actually rely on.

Here’s a practical way to think about the process. Below, we’ve outlined the key steps to implementing a data warehouse for financial services, showing how each stage builds toward a reliable data ecosystem.

Step 1: Start with People, Not Platforms

Before thinking about tools, start by talking to the people who use the data every day. What’s missing? What takes too long? Finance might need cleaner numbers, compliance may want audit trails that don’t take days to trace, and product teams could be struggling to connect behavior with outcomes.

Once you understand what they need, figure out where the data lives. You’ll probably find it scattered — a few internal systems, some API feeds, old reports, maybe even spreadsheets that haven’t been updated in months. That’s fine. The goal is just to see the whole picture before deciding where to begin.

Practical notes:

- Focus on the biggest pain points, not everything at once.

- Pick two or three goals that will show visible results fast.

- Share progress often to keep people interested and confident.

Early wins make it easier to get everyone on board later.

Step 2: Bring It All Together

Once you know what matters most, start connecting your data sources. Some data moves fast — transactions, login attempts, or fraud alerts. Other data, like partner reports or customer details, updates less often. You’ll need to design for both.

Streaming works best for real-time events. Batch loads are fine for slower updates. What matters most is consistency and reliability. For teams focused on banking data warehouse development, combining both methods ensures consistent performance and data freshness.

Practical notes:

- Use streaming for live data, batch for scheduled updates.

- Keep a staging layer for raw data so nothing gets lost.

- Label every source and process so new team members can follow easily.

A solid data foundation doesn’t have to be fancy — it just needs to be stable.

Step 3: Clean and Organize the Data

Raw data is messy. It comes in different formats, has missing values, and doesn’t always tell the full story. Cleaning it is the part no one loves, but it’s what makes everything else possible.

After that, design how your data should be structured. A simple star schema might work for most teams, while a snowflake model fits better for larger, complex datasets. The key is to keep it usable.

Practical notes:

- Standardize names, formats, and measurements.

- Create separate spaces for departments — finance, risk, operations.

- Document every transformation clearly.

Clean, organized data is what makes people trust your reports instead of building their own.

Step 4: Build Security and Governance from Day One

In FinTech, trust is everything. That means security isn’t optional — it’s built into the foundation. Decide who gets access to what and track every change. Encrypt sensitive data and mask customer details wherever possible.

Governance isn’t about slowing things down. It’s about making sure people handle data the right way so that compliance becomes a natural outcome, not a fire drill. The same principle applies to every data warehouse in financial services, where control and speed must coexist.

Practical notes:

- Define user roles and update them regularly.

- Keep audit logs and version control for all datasets.

- Establish data ownership early so nothing slips through the cracks.

Good security doesn’t make your system rigid — it keeps it strong and trustworthy.

Also Read: Top 12 Compliance Pitfalls in FinTech App Development and How to Avoid Them

Step 5: Turn Data Into Insight

Once your foundation is solid, start making the data work for you. Connect it to BI tools for visualization and to machine learning systems that can predict behavior or risk.

This is where everything comes to life, when dashboards show live performance and predictive models start guiding decisions. It’s the point where warehousing finance stops being backend work and becomes a visible business advantage.

Practical notes:

- Use BI tools like Tableau, Power BI, or Looker for daily insights.

- Feed structured data to ML models for real-time scoring.

- Close the feedback loop by pushing model outputs back into the warehouse.

When everyone can see and use insights easily, the value of the system multiplies.

Step 6: Keep an Eye on Performance

Even the most reliable systems need attention. Data loads can slow down, costs can rise, and pipelines can fail. Regular monitoring keeps you ahead of those issues.

The best teams treat optimization as a habit. They check query times, storage usage, and pipeline health before anyone complains.

Practical notes:

- Monitor data latency and ingestion success rates.

- Review compute and storage usage regularly.

- Use alerts for failed jobs or unexpected spikes.

A bit of maintenance every week prevents a month of chaos later.

Step 7: Let It Grow With You

As your FinTech expands, your data landscape will too. New products, geographies, and regulations bring new sources and requirements. The warehouse should adapt, not break.

Add new data sources carefully, test them thoroughly, and make sure changes don’t affect what already works. Over time, think about regional setups, backup plans, and disaster recovery.

Practical notes:

- Add new pipelines slowly and validate them fully.

- Keep schema changes backward compatible.

- Automate what you can — alerts, cleanups, and scaling.

A good data warehouse is like an evolving organism, it learns, adjusts, and keeps supporting growth without falling apart. That adaptability defines a true enterprise data warehouse for financial services, where expansion doesn’t mean starting over.

Challenges & How to Mitigate Them

Even the smartest data architecture has its weak spots. FinTechs deal with more complexity than most — juggling legacy systems, regulatory hurdles, and tight budgets while trying to keep innovation alive. You can’t avoid every roadblock, but you can be ready for them. What matters is knowing what to expect and having a plan when things don’t go perfectly.

Here are some of the most common challenges teams face when building a financial data warehouse — and the practical ways to deal with them before they turn into bigger issues.

| Challenge | How to Handle It |

|---|---|

| Legacy systems & data silos | Connect old and new systems using data virtualization or hybrid connectors. Move gradually instead of attempting one massive migration. |

| Data quality & schema drift | Set up automated validation checks and alerts for anomalies. Keep every schema versioned and documented so you can trace issues quickly. |

| Regulatory complexity | Build flexible compliance modules that can be updated without breaking the whole system. Stay on top of rule changes through automated tracking or periodic reviews. |

| Vendor lock-in | Stick to open standards and cloud-agnostic designs. Avoid tying critical workflows to one provider’s proprietary tools. |

| Rising costs | Monitor cloud spending closely. Use auto-scaling, cache frequently used queries, and separate hot vs. cold data to optimize costs. |

| Adoption & culture | Train teams on how to read and use data. Create documentation that’s simple and encourage collaboration across departments. |

1. Legacy Systems and Data Silos

Many FinTechs start with systems built at different times for different purposes. The payment database doesn’t talk to the CRM, and customer records sit in separate silos. Trying to replace everything at once usually causes more chaos than progress.

The better approach: start small. Learn strategies on how tomModernize legacy systems in banking. Use virtualization tools to connect these systems and allow them to share data without a full rebuild. Integrate one layer at a time, and let people see real improvements as you go. It’s slower, yes — but far safer and easier to maintain.

2. Data Quality and Schema Drift

When you pull data from so many sources, inconsistencies sneak in. One table says “txn_id,” another says “transaction_id.” Sometimes values go missing or columns change without warning. Over time, this leads to confusion and errors that can break dashboards or ML models.

The fix: automate your sanity checks. Use scripts that validate structure, check completeness, and flag drift early. Keep schema versions under control, and always document how data changes over time. It saves you countless hours of troubleshooting later.

3. Regulatory Complexity and Compliance Pressure

Regulations never sit still. Between GDPR, AML, and local financial rules, you’re always one update away from needing another system tweak.

How to stay sane: build compliance into the design. Create modular layers for data retention, anonymization, and access control — so if laws change, you only need to update that layer instead of reworking everything. It’s also worth setting up a process to track regulatory changes automatically so you’re never reacting last minute.

4. Vendor Lock-In

Cloud tools make life easier — until they don’t. The deeper you go into one provider’s ecosystem, the harder and more expensive it becomes to move away.

How to avoid it: don’t tie your fate to one platform. Store data in open formats like Parquet or CSV, use APIs that aren’t proprietary, and keep your transformation logic portable. It takes a bit more planning, but it gives you control if costs rise or another provider offers a better deal later.

5. Cost Management

Cloud costs start small but grow quietly. More users, more data, more queries — and suddenly, the bill is double what you expected. It’s not unusual, but it’s preventable.

Here’s what helps: monitor usage regularly. Tag resources by project or department so you can see where costs come from. Enable auto-scaling so your system only runs what’s needed. Keep old or rarely used data in cheaper “cold” storage, and reserve high-performance “hot” storage for live workloads.

6. Getting Teams to Actually Use the Data

Technology doesn’t mean much if no one uses it. Some teams stick to their old spreadsheets even after the warehouse goes live. It’s not resistance — it’s usually a lack of comfort or understanding.

How to fix it: focus on education, not enforcement. Run short internal sessions showing how to read dashboards or query data. Make documentation easy to follow — screenshots, examples, not long technical paragraphs. Encourage small, daily use cases where teams see quick wins. Once people experience the benefits, adoption follows naturally.

7. Security and Privacy

Security deserves its own space here. In a 2024 study shared on arXiv, concerns around security, privacy, and data portability increased the chances of cloud non-adoption by nearly 26 times. In FinTech, that fear is justified. A single breach can destroy trust.

What to do: treat security as a built-in feature, not a separate process. Encrypt everything, both at rest and in motion. Control access by roles, not individuals, and record every activity for audits. Run regular vulnerability tests and have a clear response plan. It’s not just about compliance — it’s about keeping customers’ confidence intact.

When you start Building a Finance Data Warehouse, that reliability comes from designing it around real business needs, not just technology goals.

The Takeaway

Every FinTech that invests in data warehousing faces these challenges at some point. What separates the successful ones is mindset. They don’t chase perfection — they build systems that can bend without breaking, scale without chaos, and keep pace with how fast finance moves.

When teams plan for these bumps from the start, they spend less time fixing and more time building what actually matters — trust, insight, and speed.

Real-World Implementations of Data & Analytics Infrastructure in FinTech / Finance

In practice, financial data architectures and analytics platforms show their value when they deliver measurable outcomes. An enterprise data warehouse for financial services enables that scale by connecting multiple systems and markets under one analytical framework.

Below are five real examples showcasing how companies are leveraging finance data warehouse, AI layers, or unified platforms in financial contexts. These financial data warehouses examples highlight how modern institutions use analytics to achieve measurable business impact.

1. Stripe: Unified Data Pipeline for Global Reporting & Risk

Stripe’s internal “Data Pipeline” pushes large volumes of transaction, billing, and event data into BigQuery. This architecture supports analytics, reporting, and risk modeling across Stripe’s global operations. They also built “Ledger,” an immutable log system, to provide an auditable, trustworthy source of financial movement.

This setup means Stripe can monitor performance slices in near real time and detect anomalies faster.

2. Revolut: Real-Time Risk, Personalization & Compliance

Revolut doesn’t just run on code; it runs on trust, speed, and scale. To keep all three in balance, the company built its backbone on Google Cloud. That move lets Revolut handle millions of transactions without the usual trade-off between performance and security.

Behind the scenes, it’s a blend of data streaming, automation, and machine learning quietly doing the heavy lifting — catching odd patterns in payments, helping personalize what customers see, and even taking care of compliance chores that used to slow teams down.

What makes this setup work isn’t just the tech, though. It’s how Revolut uses it — scaling on demand, keeping response times fast, and giving engineers room to experiment safely. The result? A system that grows as quickly as its users do, without ever feeling out of control.

3. HSBC (Wholesale Banking): Operational Analytics for Frontline Teams

HSBC’s wholesale banking unit rolled out a unified analytics platform that empowers sales, client services, and risk teams with data visibility. By consolidating data into a single architecture, they reduced latency in decision making and improved cross-team alignment.

Their transformation illustrates how a traditional bank can adopt data-first models internally to stay competitive.

4. Banking Client via Appinventiv: AI & Process Automation

Appinventiv worked with a leading European bank to automate processes and enhance customer experience using AI. The project involved ingesting large volumes of banking transaction, application, and behavior data and applying ML models to detect patterns, score customers, and deliver actionable insights.

As a result the bank improved customer retention by about 20%.

5. PayPal: Real-Time Data Architecture for Fraud Detection

PayPal handles billions of transactions every year, which makes real-time fraud prevention a core part of its data strategy. To keep up with rapid data growth and evolving fraud patterns, the company adopted an in-memory, hybrid data architecture built on Aerospike. This move replaced its older NoSQL systems, enabling PayPal to process millions of events per second while maintaining consistent performance across global operations.

The new setup allows PayPal to meet 99.95% of its fraud detection SLAs and quickly identify anomalies using real-time analytics.

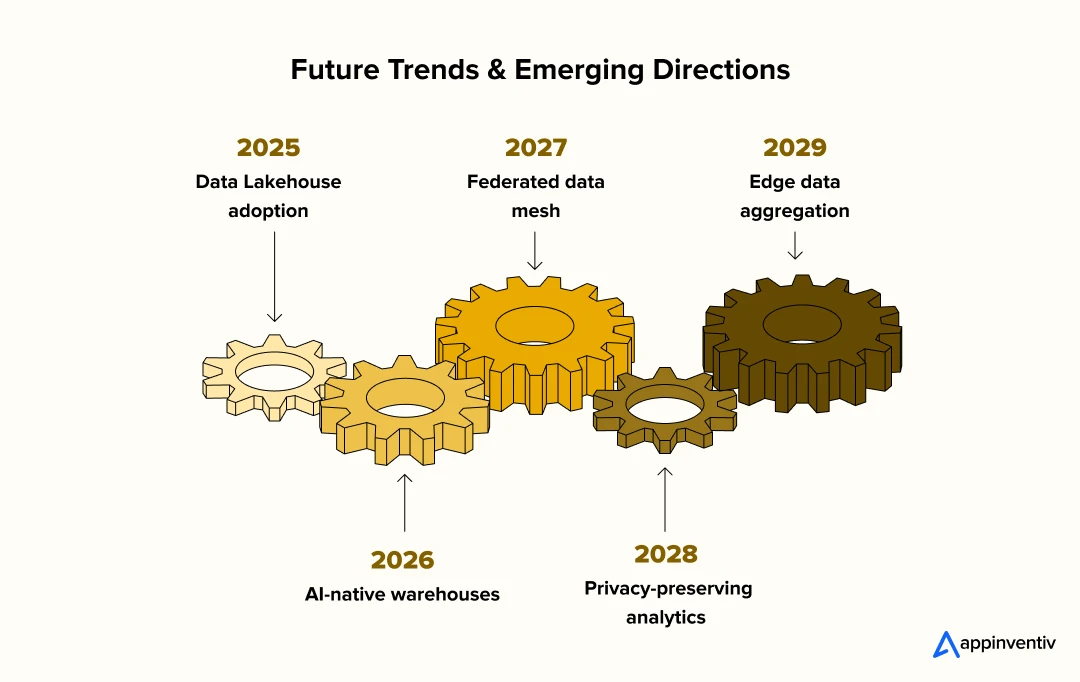

Future Trends & Emerging Directions

As FinTechs evolve, the architectures they build today must be ready for tomorrow’s demands. The next frontier pushes beyond “just a data warehouse” toward systems that adapt, embed intelligence, protect privacy, and operate at the edge.

Understanding the future trends in data warehousing for finance helps organizations design systems that remain agile and insight-driven in the years ahead. Below are the trends expected to shape the future of FinTech in the coming years.

Data Lakehouse / Unified Analytics

The boundary between lakes (raw data) and warehouses (curated, structured data) is fading. The lakehouse model combines the flexibility of a data lake with the performance, governance, and rigor of a warehouse. With it, you can store raw, semi-structured, and structured data in one system, while still running BI queries, ML models, and governance checks in the same platform.

McKinsey now describes data lakehouse as one of the major architectural archetypes alongside mesh and fabric, and notes that banks and financial institutions are starting to lean on these hybrid models to balance flexibility and control.

To prepare: design your pipelines so that raw data is always preserved, and build transformations in modular layers so you can evolve or replace them without starting over.

AI-Native Warehouses

The next generation of warehouses won’t just store data, they’ll think with it. Imagine systems where:

- You ask a question in natural language, and the warehouse translates it into optimized SQL or vector queries.

- The warehouse suggests joins, aggregations, or indexes based on workload patterns (adaptive indexing).

- Generative AI helps assemble dashboards or summaries automatically.

Some financial institutions are already planning for this. McKinsey writes about banking organizations rewiring for AI, not as an add-on, but as a core capability woven into their data and decision systems.

If you’re building your FDW today, leave room for generative AI hooks, metadata layers that support prompts, and feature stores that can speak to higher-level models.

Federated Analytics & Data Mesh

Centralizing all data isn’t always practical or desirable, especially in highly regulated, multi-domain environments. Data mesh or federated analytics lets business domains own their data and pipelines, but still contribute to a governed, enterprise-wide ecosystem.

McKinsey sees this as a core trade-off: centralization yields control but can be rigid, while decentralization offers agility but must be balanced with oversight.

In practice, you can use domain-level data hubs, standardized APIs, and governed protocols to let each domain (risk, compliance, product) run its stack while still participating in enterprise reporting and audit. Build in federated catalogs and global governance rules from day one.

Edge / IoT-Driven Financial Data

As more devices — from wearable wallets to smart sensors — embed payment or credit signals, more financial data originates outside your central systems. Edge aggregation (pre-processing) becomes important so the FDW isn’t overwhelmed by raw noise.

For example, micro-ATM kiosks or mobile pop-up branches may buffer transactions locally, run lightweight scoring, then sync with the central warehouse.

The architecture shifts: local inference, minimal transmission of raw data, intelligent aggregation.

This requires making your warehouse able to ingest pseudo-streamed batches, handle out-of-order arrival, and correct for edge latencies. Also, edge caching, conflict resolution, and data reconciliation strategies become key.

Partner with Appinventiv to design a finance data warehouse that scales with confidence and clarity.

How Appinventiv Helps FinTechs Build the Future of Data

At Appinventiv, we help financial organizations turn complex data ecosystems into simple, scalable systems that drive better decisions. Our teams work at the intersection of finance data warehouse design, Big Data Services, and intelligent automation — building platforms that make analytics faster, cleaner, and more reliable.

With deep experience in fintech consulting services, we’ve helped banks, digital lenders, and payment platforms unify fragmented systems, automate compliance workflows, and modernize legacy architectures for the cloud. Whether it’s building a real-time risk engine, migrating to a data lakehouse, or setting up a secure analytics environment, our goal is to make data work harder for your business.

If your organization is ready to rethink how financial data flows, talk to our experts. Together, we’ll design a future-ready architecture that grows with you.

FAQ’s

Q. Why is a finance data warehouse important in finance?

A. Most financial institutions handle massive amounts of data every day, but it’s often scattered across different systems. A finance data warehouse brings it all together in one trusted space. It organizes information from transactions, customer accounts, and partner networks so teams aren’t stuck reconciling reports or guessing which numbers are right. With everything connected, it’s easier to see trends, fix problems early, and make decisions that actually move the business forward.

Q. How can a finance data warehouse help with risk management?

A. Risk management is all about seeing trouble before it hits. A finance data warehouse helps by pulling together data from payments, credit records, and user behavior so you can spot patterns early. Whether it’s detecting fraud, assessing exposure, or tightening lending policies, having one connected view of risk lets teams act faster and with more confidence instead of reacting after the fact.

Q. How can a data warehouse improve your financial forecasting?

A. Forecasting gets a lot more reliable when the data behind it is complete and current. A warehouse stores your historical records and blends them with real-time updates, so you can see how numbers are shifting and plan accordingly. Instead of working with disconnected spreadsheets, finance teams can compare trends, test what-if scenarios, and build forecasts that reflect what’s really happening in the business.

Q. How can a data warehouse improve decision-making in finance?

A. When everyone’s looking at the same set of numbers, decisions get a lot simpler. A data warehouse keeps everything aligned — reports, metrics, and KPIs — so teams don’t waste time debating which version is correct. With consistent, up-to-date information at hand, leaders can move faster, back up their choices with real evidence, and respond to market changes without hesitation.

Q. How does a data warehouse integrate with existing financial systems?

A. A good data warehouse doesn’t replace your current systems — it connects to them. Using APIs and real-time data connectors, it pulls information from tools like your banking software, CRM, or ERP and brings it into one unified view. That means your existing setup stays intact, but now everything works together seamlessly, giving you a single, reliable picture of your business.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…