- From Traditional to Digital: Insurance Industry Shifts

- 1. Customer experience

- 2. Product Development

- 3. Business Restructuring

- 4. Digital Transformation

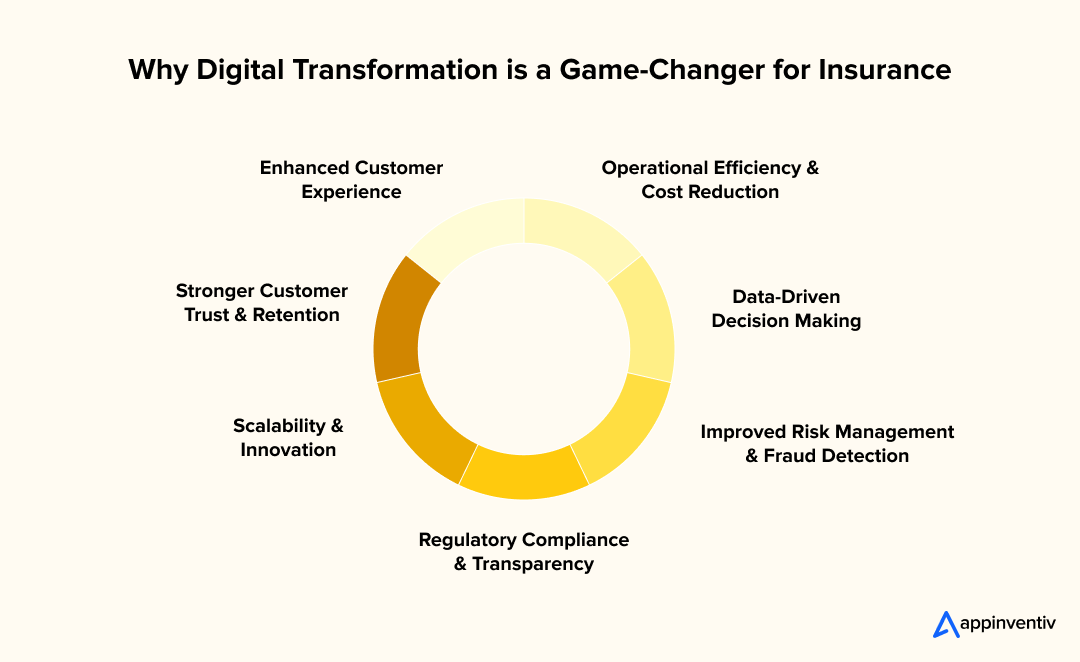

- Benefits of Digital Transformation in the Insurance Sector

- Enhanced Customer Experience

- Operational Efficiency & Cost Reduction

- Data-Driven Decision Making

- Improved Risk Management & Fraud Detection

- Regulatory Compliance & Transparency

- Scalability & Innovation

- Stronger Customer Trust & Retention

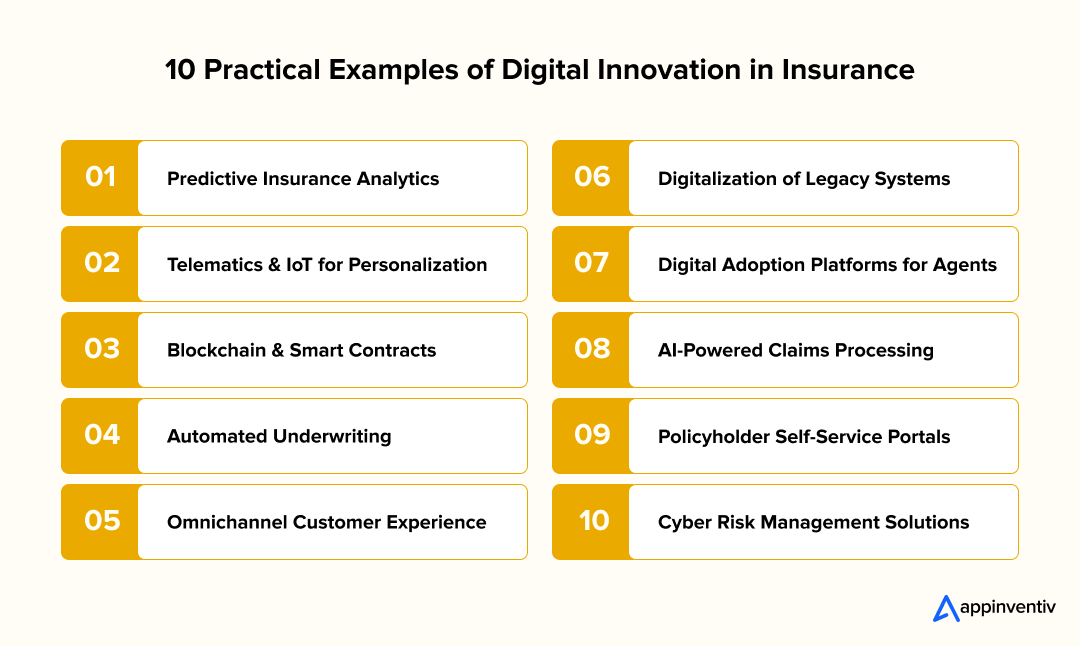

- Top 10 Applications With Real-Life Examples of Digital Transformation in Insurance

- 1. Predictive Insurance Analytics

- 2. Telematics & IoT for Personalization

- 3. Blockchain & Smart Contracts

- 4. Automated Underwriting

- 5. Omnichannel Customer Experience

- 6. Digitalization of Legacy Systems

- 7. Digital Adoption Platforms for Agents

- 8. AI-Powered Claims Processing

- 9. Policyholder Self-Service Portals

- 10. Cyber Risk Management Solutions

- Technologies Impacting the Insurance Industry

- Predictive Analytics

- Artificial Intelligence

- Augmented Reality/ Virtual Reality

- Blockchain

- RPA & Straight-Through Processing

- Cloud Migration & Legacy Modernization

- Omnichannel & Self-Service Experiences

- Embedded Insurance

- Cyber Insurance & Dynamic Risk Management

- Data-Driven ESG & Sustainability Initiatives

- Spatial Computing

- Small Language Models (SLMs)

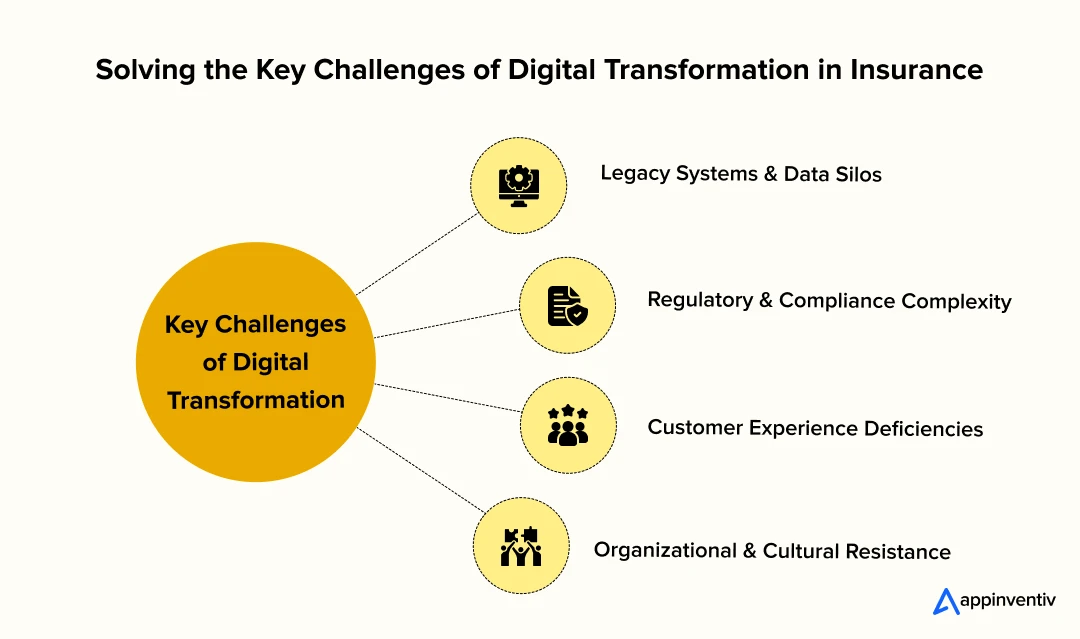

- How to Overcome Challenges in Insurance Digital Transformation

- Legacy Systems and Data Silos

- Regulatory and Compliance Complexity

- Customer Experience Deficiencies

- Organizational and Cultural Resistance

- Charting the Next Frontier of Insurance

- Drive Insurtech Excellence with Appinventiv’s Digital Expertise

- FAQs

Key takeaways:

- Despite numerous recent obstacles, the insurance industry is standing strong; however, the influx of digital-first insurtechs is putting pressure on competition in every segment, accelerating.

- AI systems, automated claims processing, and embedded insurance are needed to ensure competitive advantage and minimize loss ratios.

- The present pattern of customer expectations necessitates personalized and flawless experiences on par with other industries in digital business, thereby necessitating constant innovation of services.

- Insurtech partnership and adoption of emerging technologies are vital to sustain this market leadership in this fast-changing environment.

The insurance industry finds itself at a critical crossroads. With annual real premium growth of 2.3% projected for 2026 according to Swiss Re Institute data, the sector demonstrates remarkable resilience despite economic turbulence and global uncertainties. These numbers reveal an industry that remains fundamentally solid, supported by stable capital reserves and consistent long-term demand.

Again, PwC’s survey with leading insurance companies reveals an interesting disconnect in digital transformation approaches. While all industry executives recognize digitization as essential, they define “digital transformation” quite differently across organizations.

Every insurer surveyed agreed that digital transformation in insurance means automating front-end and back-end processes, plus introducing better workplace tools. However, only two-thirds include new working methods like agile frameworks in their digital strategy. More surprisingly, just half consider legacy system modernization part of their transformation agenda — making a case for structured insurance technology consulting to bridge the gap between narrow automation fixes and full organizational change.

This variation suggests many insurers are pursuing narrow automation improvements rather than comprehensive organizational change, potentially creating competitive gaps as the industry evolves.

In this blog, we’ll explore how the insurance landscape has evolved with digital transformation, highlighting its benefits, key technology trends, and emerging innovation standards. We’ll also showcase 10 real-world examples of digital innovation, address implementation challenges, and look ahead to the future of digitally enabled insurance companies.

It’s your turn to innovate now!

From Traditional to Digital: Insurance Industry Shifts

Insurance is not the ball game it once used to be when the incoming customer used to feel indebted to a company for assured support in challenging times. Technological disruption has made entering the marketplace rather easier, giving rise to a legion of adversaries, making it one of the most investment-friendly Fintech domains. And that is just a quarter of the rising events that legacy insurers need to be concerned about. Below, we mention 4 critical changemakers:

1. Customer experience

- The entry of insurance startups into the fray makes meeting customer expectations a labyrinthine challenge to solve. That’s because more players now offer similar products at cut-throat prices, squelching the profits further.

- An abundance of choices makes loyalty prone to swings, causing nightmarish customer churn. Customer-centricity needs to be revisited.

- Quality post-sales service tops the agenda for most insurers, and that in turn rests on two pillars. First, employing an efficient frontline with updated product expertise and relationship management acumen. And second, packaging exciting add-ons as part of the insurance deal for policyholders.

2. Product Development

- Innovation in the insurance industry is relatively low compared to other professions. Currently, evolving customer demands are spurring it.

- Financial giants in the sector must understand that low-cost, short-term solutions will yield them nothing. There is a significant shift in introducing new service delivery models that overlap and extend beyond traditional life insurance schemes. In other words, technology innovation for sustainable development.

- For instance, if you are selling car insurance, why wait for the car to run its course, pun intended. Try coupling roadside assistance with 24/7 customer service. Over the last three years, insurers have benefited from injecting such service-based packages to their product lines.

3. Business Restructuring

- You might wonder if the same household names have been dominant here before, so why should they even consider changing anything? Precisely because of the pointers mentioned above.

- Fintech insurance startups are raising eyebrows with their quick-to-market schemes by leveraging new-age innovation. Although they are not enough on their own to shake things up, their rising traction is noticeable.

- The way forward for key insurance players is, therefore, to enter partnership agreements. You could join forces with niche players and/or insurance tech startups. The reason you do this is part survival, part progress.

4. Digital Transformation

- Legacy insurance businesses are hesitant to swiftly adopt new technology. There has been a significant increase in demand for mobile app development in the insurance sector. Some of it has to do with a lack of level-headed solution architects who can predict change and integrate it into the system.

- Much good would transpire if only the companies could timely welcome upcoming technologies such as blockchain, AI, data science, cloud-based insurance.

Benefits of Digital Transformation in the Insurance Sector

Digital Transformation in Insurance is unlocking new levels of efficiency, agility, and customer-centricity. From faster claims processing to smarter risk assessment, it helps insurers reduce costs, improve service quality, and stay competitive in a rapidly evolving market. Let’s have a look at the key benefits:

Enhanced Customer Experience

- Digital platforms have transformed how insurers issue their policies and process claims, providing a seamless experience for customers.

- AI chatbots offer immediate services on various platforms, whereas data insights enable corporations to develop products that truly serve people’s needs.

- Individual attention goes a long way in increasing customer satisfaction and long-term loyalty that one cannot get with traditional methods.

Operational Efficiency & Cost Reduction

- Artificial intelligence in insurance has put an end to mountains of paperwork and take care of the repetitive routine that previously consumed employee time. The meaning of digital transformation to insurance companies is that things are done at a high speed, and the administrative expenses are reduced by a great margin.

- It is then that teams are free to devote their energies to the projects that are strategic and those that in fact move the business forward instead of being mired in routine work.

Data-Driven Decision Making

- Centralized platforms can give the insurance professionals information about the customers, and the advanced analytics will inform them about the patterns that they could not see before.

- Companies can now understand how customers behave, make more accurate risk assessments, and identify new trends before their competitors. This enhances intelligent underwriting judgments, superior pricing policies and new products that people are willing to purchase.

Improved Risk Management & Fraud Detection

- Machine learning systems are remarkable at detecting unusual patterns and highlighting suspicious claims that human reviewers might miss.

- The predictive analytics and real-time monitoring have established a powerful security system and identify the issues in an early phase.

- The practice of digitalization in the insurance industry has been effective, particularly in minimizing financial losses and maintaining the speed of processing claims.

Also Read: Financial Fraud Detection Using Machine Learning

Regulatory Compliance & Transparency

- The RegTech solutions automate this process of reviewing and monitoring compliance, and thus they keep up with rapidly shifting regulations that do not demand a constant human check. The digital audit trails make clear recordings that regulations love and value.

- Digitization in the insurance industry gets rid of most of the headaches associated with compliance and can significantly reduce the number of human errors that cause regulatory issues and result in fines.

Scalability & Innovation

- Insurance companies have the possibility to develop rapidly to facilitate cloud infrastructure and API connections to provide multiple services and cooperate externally with InsurTech startups.

- The time it takes to bring new products to the market has never been shorter, which allows the established insurance corporations to keep up with the competition in the form of new entrants.

- In success stories of digital innovation in the insurance industry, it is common to emphasize the ability of companies to go through changes in the market and satisfy customer needs within a short period.

Stronger Customer Trust & Retention

- More prompt service, open operations, and trusted online experiences generate true customer confidence, an aspect that conventional insurance methodologies were unable to attain.

- Offers that are personalized will help to make the customers feel well understood instead of yet another policy number, and proactive communication will ensure that the customer is not going to go anywhere. These changes result into valuable relations which are directly converted to better retention and good referral word-of-mouth.

Top 10 Applications With Real-Life Examples of Digital Transformation in Insurance

New technologies, cloud solutions, and AI are completely changing how insurance companies work. From streamlining internal operations to creating better experiences for policyholders, digital innovation is transforming every aspect of the insurance business. Here’s what’s happening:

1. Predictive Insurance Analytics

Advanced analytics help insurers predict risks, identify fraud, and enhance pricing models. Processing large amounts of data in real-time enables companies to make more informed underwriting decisions and process claims more actively. This strategy minimizes losses and helps to develop more equitable premiums and serve customers in a better way.

Verisk Analytics is the keystone of key property and casualty insurance companies in terms of advanced data modeling. Their platform enables firms to predict risks more precisely, patterns of fraud, and optimization of the underwriting. Insurance companies that adopt these analytics in their business are able to fine-tune their premiums and proactively take care of claims, which translates to better loss ratios and more economical customer pricing.

2. Telematics & IoT for Personalization

Usage-based insurance plans allow the use of automotive telematics or healthcare wearables. Rather than blanket pricing, premiums are based on the actual mode of driving or a lifestyle. Digital transformation for insurance implies that policies are actually personal and that they help with the promotion of safer behaviors among policyholders.

The Snapshot program offered by Progressive illustrates a way to revolutionize the cost of auto insurance with the help of driving data devices and mobile apps. The program tracks any real driving practices and rewards safe drivers with premium discounts and aids Progressive with improving customer engagement because of the real personalized pricing practices.

You can explore more IoT in insurance use cases to see how connected data supports personalization across auto, home, and health policies.

3. Blockchain & Smart Contracts

Blockchain technology brings transparency, security, and automation to insurance processes. Smart contracts automatically trigger payouts when specific conditions are met, cutting down on fraud and speeding up settlements. The use of blockchain in insurance, particularly benefits the property, casualty, and travel insurance sectors with its immutable features.

Nationwide has emerged as a leader in blockchain adoption through its participation in the RiskBlock Alliance. The insurer leverages blockchain-enabled smart contracts to automate claim triggers for events like flight delays and weather incidents. This technology accelerates payouts while reducing fraud through secure, transparent ledger records that all parties can verify.

4. Automated Underwriting

Underwriting systems that integrate with AI consider the applicant’s information, medical history, and associated risks in real-time. This eradicates piled-up paperwork and makes generation of quotes, and makes it fast, reducing the turnaround that used to take days to a few minutes. Customers receive more precise quotes tailored to their needs, with no delays to cause irritation.

One of the biggest insurance corporations collaborated with Neutrinos in order to introduce AI-based underwriting to a variety of global markets. Their system is crunching up medical records and risk data instantaneously and providing personalized quotes in minutes and not days. Such automation has also increased policy issuance workflows tremendously and with accuracy.

5. Omnichannel Customer Experience

Insurance companies now use integrated platforms that connect web portals, mobile apps, chatbots, and call centers seamlessly. This makes the interactions personal and consistent at all touch points so that the customers can easily access information, make a claim, or renew policies whenever they need any type of it.

Some of the largest insurers have also upgraded their customer experience platforms with Pega technology, and they have transitioned easily to email, mobile, web, chat, and contact-center-based communications. Emails automatically create cases and interface with current policy and claims systems, thus allowing responsive and holistic engagements within all the points of contact.

6. Digitalization of Legacy Systems

Outdated, disconnected systems are moving to the cloud, enabling better scalability and integration with modern tools. The digitalization in insurance industry practices improves operational flexibility, enhances data access, and reduces maintenance expenses, helping insurers respond quickly to market changes and customer needs.

A prominent insurer undertook an extensive modernization initiative with Newgen and Infosys, digitizing over 500,000 paper claims documents. The operating system used in this instance, which entailed a centralized document management system, drastically decreased the retrieval time, eradicated the necessity of having physical places to secure documents as well as enhanced multi-office collaboration.

7. Digital Adoption Platforms for Agents

Guided digital tools enable insurance agents to onboard, train, and automate workflows more quickly. This improves productivity and reduces human errors,as well as allowing agents to perform meaningful tasks such as customer relationship building rather than working on time-consuming paperwork.

To facilitate the onboarding of agents, the generation of quotes, and the processing of claims, American insurers are introducing ServiceNow platforms and extensive knowledge portals. The implementation of ServiceNow by one of the giant insurance firms helped provide agent self-service features, automate policy changes, claims search, and real-time reporting, thereby significantly reducing the number of help desk tickets.

8. AI-Powered Claims Processing

AI and automation streamline claims management by identifying unusual patterns, assessing damage through image analysis, and reducing manual work. The impact of digital transformation in insurance shows lower operational costs, faster claim approvals, and improved customer satisfaction through quicker settlements.

A top-tier insurer collaborated with Coforge to achieve remarkable efficiency gains: 75% reduction in processing costs, 55% decrease in paper claims, 65% increase in auto-adjudication rates, and 40% improvement in one-day claim payouts through AI and automation.

9. Policyholder Self-Service Portals

Modern customer portals give people direct access to their policies, payment options, claims tracking, and support services without depending on manual processes. This increases transparency, reduces call center volume, and gives policyholders more control over their insurance experience.

Tower Insurance’s “My Tower” portal in New Zealand and the Pacific region exemplifies comprehensive self-service capabilities, allowing customers to obtain quotes, make payments, file claims, and review policies online. This platform has substantially reduced call-center volume while enhancing transparency.

10. Cyber Risk Management Solutions

Compounded with real-time threat monitoring and best enabling enterprise cyber risk analysis tools, insurance firms are creating complex insurance products that allow dealing with hot risks.

One of the digital transformation adoption activities in the insurance sector is the cooperation between the industry and companies dealing with cyber threats to provide complete packages of protection against the latest and most serious threats to businesses that are evolving in a world of a great number of connections.

Large insurers are turning to advanced solutions such as CyberStrong and CyberSaint to provide full coverage cyber insurance policies that include the mapping and monitoring of threats in real-time and dynamic risk scoring. These solutions will be able to support insurers in offering dynamic premiums and adviser services that change with organizational risks changes, providing a more dynamic and efficient cyber protection solution.

Technologies Impacting the Insurance Industry

Having factored in the changemakers with examples, let us now familiarize ourselves with the key technology and insurance digital transformation trends responsible for most of the commotion in this field. Needless to say, the more this industry is flexible in working with such tech, the higher its chances of outreach to new customer cohorts.

Predictive Analytics

Insurance companies can be singled out for collecting extreme amounts of sensitive information on their customers. And though they deeply analyze their numbers before creating a new scheme, data analytics can further refine and augment that research.

Value-adding discoveries in Big Data analytics can lead to breakthrough predictions that prevent fraudulent transactions, indicate associated risk exposure in customer profiles, identify patterns in claims volumes, and target lead prospects with pinpoint accuracy.

Artificial Intelligence

There’s no telling how much paperwork is involved in filing a claim. Not to mention, the chances of human error, such as typos, which could be disastrous. Artificial Intelligence has the potential to remediate this and more. AI can be deployed in the insurance sector to enhance customer service and quick filing, leading to shorter response times.

It can add that wee bit of personalization in software-driven interactions that help customers convey their message clearly. The 21st century marks the beginning of the age of innovation and if insurers intend to propel, so must their backend systems.

Augmented Reality/ Virtual Reality

Lately, fintech app development has been focusing on integrating AR/VR-based specs in their products. Be it a customer buying insurance and or investing on part of a business into a new portfolio, AR/VR can suffice for both.

They add an extra level of comfort and convenience in claim handling (for customers) and accident reconstruction (for insurers). Insurance ventures will find it useful to educate and make their leads aware of related topics if their fintech application development can run AR/VR-powered video demonstrations.

Blockchain

Blockchain technology has established itself as a powerful force in the financial sector, delivering tangible benefits that insurance companies are now embracing. Financial institutions leveraging blockchain can protect their records with unprecedented security, creating an immutable ledger that significantly reduces cyber vulnerabilities and fraud attempts. This technology transforms how insurers handle sensitive customer data and transaction records.

The real game-changer lies in blockchain’s ability to automate claims processing through smart contracts. These self-executing contracts can trigger automatic settlements when predetermined conditions are met, enabling near-instantaneous payment releases without manual intervention.

RPA & Straight-Through Processing

Insurance has always been notorious for mountains of paperwork and endless manual processes. Robotic Process Automation (RPA) in the insurance sector is changing all that by taking over routine but essential tasks like claims processing, policy creation, renewals, and compliance reviews with virtually no human involvement needed. When you pair this with Straight-Through Processing (STP), insurers can handle everything from initial submission to final settlement without any back-office bottlenecks.

The benefits go far beyond just cutting costs. Response times drop dramatically, accuracy improves since you eliminate human mistakes, and staff can focus on meaningful work like building customer relationships. Digital transformation adoption in insurance means customers get faster claim approvals and smoother experiences, which builds genuine trust in the company’s capabilities.

Cloud Migration & Legacy Modernization

Many insurers are still reliant on legacy IT systems that operate in isolation, resist change, and incur significant costs to maintain. Switching to cloud-based platforms completely transforms the game, letting companies scale up or down easily, connect data across all departments, and launch new digital services at lightning speed. Cloud infrastructure also powers the advanced analytics, AI, and machine learning tools that need serious computing muscle.

Modernizing the technology backbone cuts infrastructure expenses while ensuring faster rollouts of new products, smooth connections with insurtech partners, and stronger cybersecurity. Digital transformation in the insurance sector really starts with cloud adoption—it’s the foundation that makes everything else possible.

Omnichannel & Self-Service Experiences

Modern customers want around-the-clock access to their insurance details, whether they’re checking policy information, tracking claims, or chatting with a virtual assistant. Smart insurers are building omnichannel strategies that deliver consistent, connected experiences across mobile apps, websites, chatbots, social platforms, and traditional call centers.

Self-service portals let customers handle simple tasks themselves, updating contact details, downloading documents, or starting claims—without waiting for an agent. This boosts satisfaction while reducing pressure on the call center. Most importantly, it brings insurance up to the convenience standards customers already expect from shopping sites and banks.

Embedded Insurance

Picture this: you’re booking a vacation online and get perfectly tailored travel insurance as part of checkout. Or you buy a new phone and automatically add device protection. That’s embedded insurance in action—coverage that fits seamlessly into other digital platforms like shopping sites, travel booking systems, car apps, and financial services.

For insurance companies, this creates fresh distribution channels and lets them reach customers exactly where they’re already shopping, without forcing people to hunt for coverage separately. Digital innovation in the insurance industry shows this approach is convenient for customers, cost-effective for insurers, and a smart way to expand reach without massive marketing budgets. Insurance digital transformation trends increasingly point toward these integrated, frictionless experiences.

Cyber Insurance & Dynamic Risk Management

Cyber threats are continually evolving, so insurers are abandoning traditional, static policies for AI-powered cyber insurance that dynamically adapts to current events. These policies automatically adjust coverage based on current threat intelligence, newly identified vulnerabilities, and emerging daily attack methods.

Companies can monitor risk environments in real-time and update protection automatically, ensuring businesses stay covered as the cybersecurity landscape constantly evolves. Digital adoption in insurance means this flexible approach doesn’t just reduce risk, it builds genuine client confidence during an era when digital threats never sleep.

Data-Driven ESG & Sustainability Initiatives

Insurance companies are getting serious about aligning their products with Environmental, Social, and Governance (ESG) objectives. Using analytics and IoT data, they can reward customers for eco-friendly driving habits, offer incentives for energy-efficient homes, and support businesses that prioritize sustainability.

Insurance innovation strategies now include policies that provide discounts when customers adopt green technologies or hit specific sustainability targets. Digital innovation in insurance industry applications is creating measurable ESG results, helping insurers become active partners in global sustainability efforts rather than just observers on the sidelines.

Spatial Computing

Spatial computing merges the digital and physical worlds into interactive 3D environments that feel remarkably real. For insurance companies, this technology opens up fascinating possibilities like virtual risk assessments, hands-on training programs for claims adjusters, and even interactive policy explanations that customers can actually experience.

Picture a homeowner virtually walking through their property to see potential hazards and understand exactly what their coverage protects against. Digital transformation in insurance industry applications like this make risk evaluation much more accurate while helping customers truly grasp what they’re buying.

Small Language Models (SLMs)

While massive AI systems need enormous computing power and infrastructure, SLMs are designed specifically for focused areas like insurance operations. These streamlined models can deliver real-time, on-device policy recommendations, smart claims sorting, and personalized customer support that works even when internet connections are spotty.

Digital transformation in insurance operations benefits from their efficiency, making them perfect for personalized digital assistants and specialized features within insurance apps. This approach improves accessibility for customers everywhere while keeping technology costs manageable, proving that digital transformation for insurance doesn’t always require the biggest, most expensive solutions.

Let our experts handle your digital transformation needs with precision

How to Overcome Challenges in Insurance Digital Transformation

The primary obstacles to digital transformation in insurance include legacy system constraints, regulatory complexities, and organizational resistance to change. However, strategic approaches can transform these challenges into catalysts for innovation and sustainable growth.

Legacy Systems and Data Silos

The Challenge: Outdated infrastructure creates rigid operational frameworks and fragmented data ecosystems, severely limiting scalability and comprehensive customer insights. Organizations face increased operational inefficiencies, delayed decision-making processes, and escalating maintenance expenditures.

Strategic Solutions: Implementing phased cloud migration strategies, establishing API-driven integration frameworks, and deploying centralized data management platforms modernize infrastructure while maintaining operational continuity.

Microservices architecture and data lake implementations enable real-time analytics capabilities, enhanced scalability, and reduced operational overhead. Leading digital transformation in insurance industry initiatives prioritize infrastructure modernization as foundational elements.

Regulatory and Compliance Complexity

The Challenge: Rapidly evolving regulatory frameworks and data protection requirements create significant compliance burdens. Non-compliance results in substantial financial penalties, reputational damage, and eroded stakeholder confidence.

Strategic Solutions: RegTech platforms automate compliance monitoring and reporting processes. AI-powered risk detection systems provide proactive identification of compliance gaps. Implementing privacy-by-design methodologies, conducting systematic audit procedures, and maintaining alignment with domestic and international regulatory standards ensures operational transparency while minimizing compliance-related risks.

Customer Experience Deficiencies

The Challenge: Traditional insurance delivery models lack personalization capabilities, responsiveness, and seamless engagement mechanisms. Extended claims processing cycles and outdated communication channels fail to meet contemporary customer expectations.

Strategic Solutions: AI-powered customer service platforms, predictive analytics engines, and omnichannel engagement systems deliver personalized, continuous support experiences. Robotic process automation streamlines claims processing workflows, significantly reducing resolution timeframes.

Hyper-personalized product offerings strengthen customer relationships and enhance retention rates. Digital innovation in insurance industry leaders demonstrates measurable improvements in customer satisfaction metrics.

Organizational and Cultural Resistance

The Challenge: Employee resistance stems from technology adoption concerns and skills gaps, while leadership hesitation can impede transformation initiatives. Without organizational alignment, even well-designed digital strategies may encounter implementation failures.

Strategic Solutions: Comprehensive change management frameworks, continuous professional development programs, and executive sponsorship facilitate smoother technology adoption. Establishing digital transformation champions, implementing innovation incentive structures, and recognizing early achievements cultivate transformation-ready organizational cultures.

Charting the Next Frontier of Insurance

The insurance industry is undergoing a major transformation driven by emerging technologies, evolving customer expectations, and complex risks. Innovations like AI, blockchain, telematics, and spatial computing are reshaping underwriting, claims, and fraud detection, while embedded insurance integrates coverage seamlessly into daily life.

At the same time, adaptive cyber policies and predictive analytics enable insurers to move from reactive protection to proactive risk prevention. By embracing IoT data, ESG-focused products, and partnerships with insurtechs, insurance companies are evolving from policy providers into trusted advisors focused on resilience, prevention, and sustainable value.

Drive Insurtech Excellence with Appinventiv’s Digital Expertise

Based on everything we’ve explored, the insurance industry’s future depends on building strong partnerships with innovative startups. It also entails the adoption of innovative technologies like metaverse in the insurance sector that can create meaningful connections with industry peers and encourage innovation from leadership down through every level of the organization.

We’re looking at a future where insurers must leave behind outdated systems and adopt a digital-first approach to remain competitive. By combining flexibility with innovation, traditional companies can evolve into truly connected, customer-focused organizations.

Insurance software development companies like Appinventiv help established financial institutions with ready-to-deploy software systems tailored to their specific operational needs and scale requirements.

With extensive experience creating scalable, secure, and future-ready insurtech solutions, Appinventiv helps enterprises streamline their operations, cut costs, and provide smooth digital experiences for their customers. Digital transformation in insurance industry applications range from AI-powered claims automation to blockchain-enabled smart contracts, and our solutions expand what’s achievable in modern insurance.

Most of the time, our work portfolio demonstrates our capabilities, but sometimes a conversation works better! If that sounds appealing, send us an inquiry and we’ll be glad to connect. We have undertaken some of the top fintech ventures such as Mudra, Edfundo, and an AI-based banking platform that facilitates smooth financial processes, delighting customers, and facilitating secure digitalization.

Let’s reimagine insurance’s future together, where innovation becomes the essential driver of industry excellence, not just a value-added feature.

FAQs

Q. What makes digital an urgency for the insurance industry?

A. Insurance companies are facing customers who expect instant, seamless service just like they get from their favorite apps. Those old, clunky systems are not only slow but expensive to maintain, while nimble InsurTech startups are stealing market share with sleek, digital-first approaches.

Add in tighter regulations, sophisticated fraud schemes, and the demand for personalized products, and you’ve got a perfect storm pushing companies toward transformation. Going digital means faster claims processing, smarter underwriting decisions, better risk prediction, and happier customers; it’s no longer a nice-to-have but essential for survival.

Q. How to implement digital transformation in insurance companies?

A. Rolling out successful digital innovation in the insurance industry requires a strategic approach:

- Modernizing legacy systems by moving to cloud-based platforms that can scale and integrate with new tools.

- Leveraging data analytics and AI to make underwriting, pricing, and claims management more intelligent and accurate.

- Automating repetitive workflows to eliminate manual bottlenecks and boost overall efficiency.

- Adopting omnichannel customer engagement through user-friendly mobile apps, helpful chatbots, and comprehensive portals.

- Partnering with InsurTechs and RegTechs to access cutting-edge innovation and stay compliant.

- Fostering a digital-first culture by training teams and redesigning processes around new technologies.

Q. How LLMs & chatbots improve customer service in insurance?

A. Large Language Models and AI-powered chatbots are revolutionizing insurance customer service by providing 24/7 instant support for policy questions and claims. These systems deliver personalized responses based on customer history while reducing call center workload by handling routine requests independently.

They improve accuracy in recommendations through advanced language understanding and boost agent productivity with real-time insights. Insurance innovation strategies utilizing these technologies create faster, more consistent customer experiences while reducing operational costs and freeing human agents for complex, relationship-building tasks.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How To Build a Digital Twin App? All You Need To Know

Key takeaways: IoT, AI, cloud computing, and data analytics are the main technologies for making real-time, predictive digital twins. Digital twins are revolutionizing the manufacturing, healthcare, and energy sectors and providing significant operational efficiency and cost reduction. 5G, edge computing, and AR/VR not only lift digital twin performance but also provide fast data processing and…

How Enterprises Can Successfully Integrate Emerging Technologies into Their Workflows

Key Takeaways Big changes fail when rushed. Begin with small pilots, measure results, and use emerging tech to scale without breaking what works today. Clean, connected data and strong security are the backbone of successful technology integration. Get those right before layering on AI, IoT, or automation. Don’t chase every new tool. Match tech to…

Digital Transformation Strategies You’ll Wish You Knew Sooner

Key takeaways: Think Big, Not Small: Digital transformation market will reach USD 3,289.4 billion by 2030. Update Legacy Tech: Outdated systems? Modernize them now to boost efficiency and save costs. Go Cloud and API First: Focus on flexible, scalable cloud solutions and APIs for faster, more efficient operations. Make Tech Work for Business: Your tech…