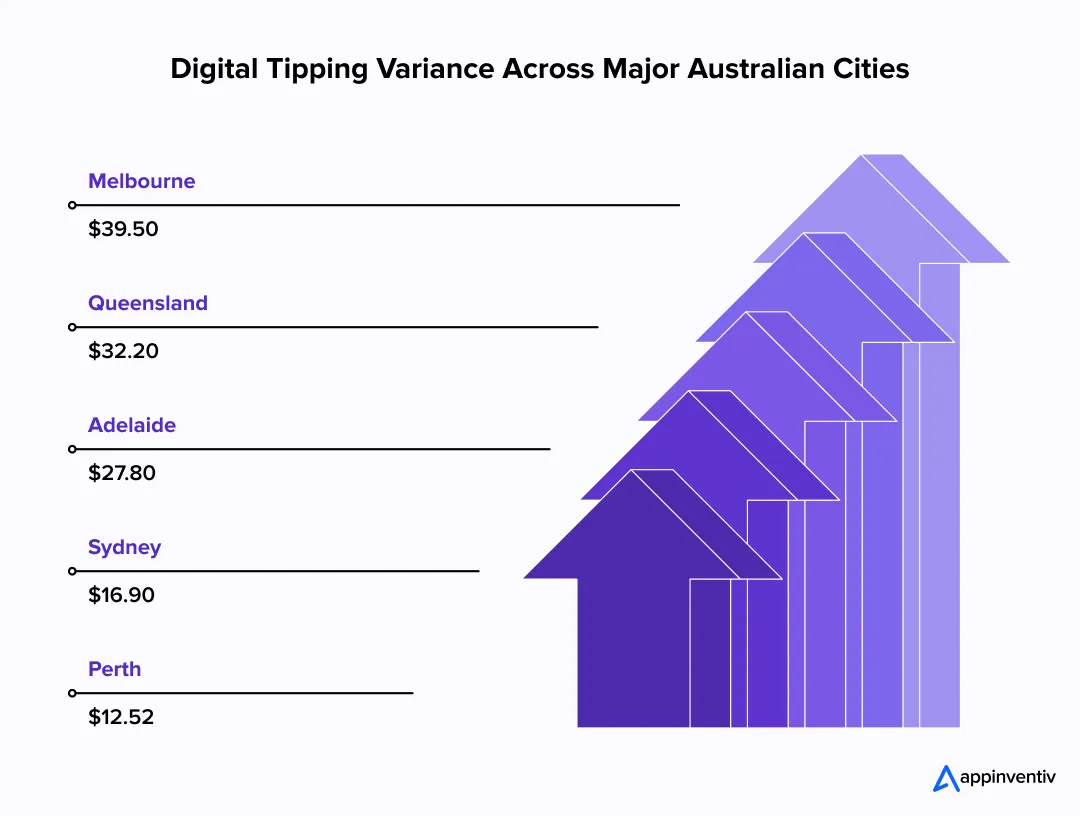

- How Digital Tipping Behaviour Varies Across Australian Cities

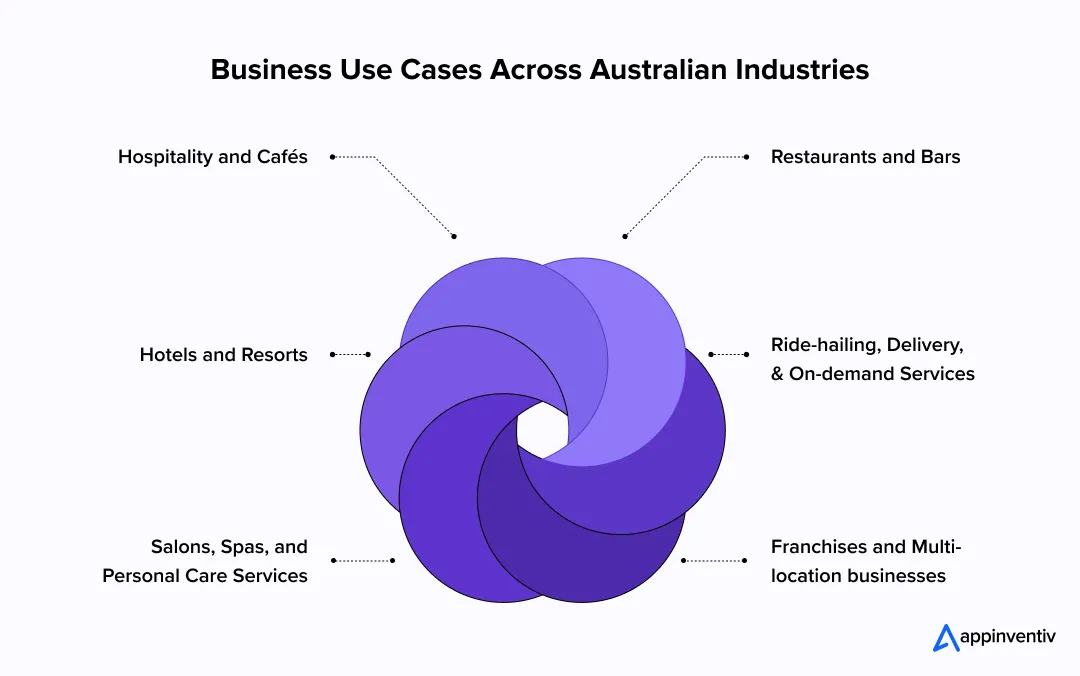

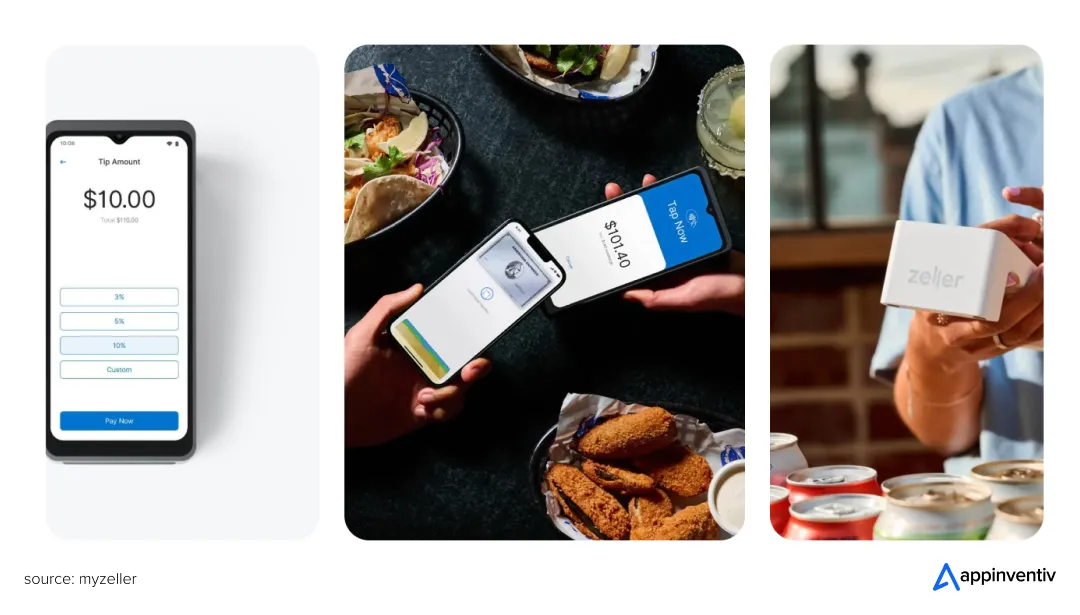

- Use Cases of Digital Tipping Platform Development for Australian Industries

- Hospitality Groups and Café Chains

- Restaurants and Bars

- Hotels and Resorts

- Ride-Hailing, Delivery, and On-Demand Services

- Salons, Spas, and Personal Care Services

- Multi-Location and Franchise Operations

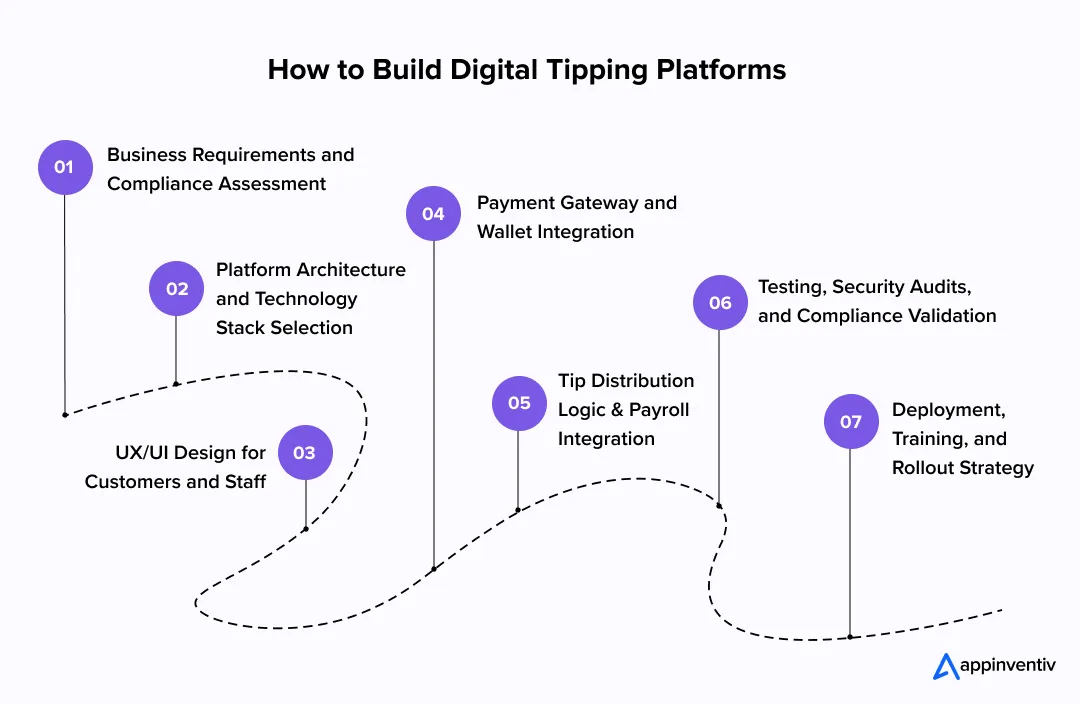

- How To Build a Digital Tipping Platform In Australia

- Business Requirements and Compliance Assessment

- Platform Architecture and Technology Stack Selection

- UX/UI Design for Customers and Staff

- Payment Gateway and Wallet Integration

- Tip Distribution Logic and Payroll Integration

- Testing, Security Audits, and Compliance Validation

- Deployment, Training, and Rollout Strategy

- Must-Have Features in a Digital Tipping Platform

- Employee & Admin Features

- Customer-Facing Features

- Business & Operations Features

- Security and Compliance Features

- Advanced Platform Capabilities

- Cost of Digital Tipping Platform Development in Australia

- Factors That Influence Development Costs

- Measurable Outcomes of Building a Digital Tipping Platform

- Key Challenges in Digital Tipping Platform Development & How to Overcome Them

- Adoption Resistance From Staff or Customers

- Compliance and Audit Readiness

- Payment Reconciliation Complexity

- Scaling Across Locations and Brands

- Legacy System Constraints and Integration Friction

- How Appinventiv Can Help Build a Digital Tipping Platform for Australia

- FAQs

Key takeaways:

- Digital tipping is now a system-level decision

Once tips move through digital payments, they intersect with payroll, reporting, and workforce trust. Informal handling does not scale. - Sector-specific design determines success

Cafés, restaurants, hotels, delivery services, and franchises each require different allocation logic and operational controls to reflect how work is delivered. - Cost reflects governance and integration depth

The development cost of tipping platforms ranges from AUD 70,000 to AUD 700,000, driven by project complexity, system integrations, and compliance requirements. - Benefits come from reduced friction, not tip volume

The returns typically show up in the form of fewer disputes, lower reconciliation effort, improved staff confidence, and clearer operational oversight.

Digital payment methods have become the norm in Australia’s service economy, reshaping how consumers interact with venues and how enterprises handle revenue flows. In 2024, Australians increased the average tip value to $25.20, a 25% rise from the previous year, while the frequency of tips recorded on electronic transactions also climbed. This indicates that tipping behaviour is changing alongside payment habits across the AU regions (details later).

That shift matters because tips are no longer ephemeral tokens exchanged in cash. When customers tap or scan to pay, often for services, meals, or rides, any gratuity they elect to leave enters the digital record stream. This creates expectations around timing, allocation, visibility, and accountability that informal systems cannot satisfy.

As the Australian Restaurant & Café Association has observed in industry discussions, nearly half (47%) of customers are more likely to tip when they understand that 100% of the gratuity goes directly to staff. This sentiment highlights that transparency and trust in tip handling are increasingly part of the tipping equation.

For businesses across hospitality, salons, delivery services, and multi-location brands, this evolution raises operational questions: how should tips be captured? How should they be distributed? How do we ensure payroll alignment without manual overhead? These are not questions about adding another checkbox to a payment terminal. They are decisions that shape how revenue flows integrate with workforce systems and customer experience.

This blog focuses on how to approach digital tipping platform development for Australia strategically, so you can design systems that enhance operational clarity, preserve staff confidence, and support sustainable tipping practices as digital transactions continue to dominate.

Also Read: Digital Transformation Strategy for Australian Enterprises

Design for payroll alignment, audit readiness, and multi-location scale from day one.

How Digital Tipping Behaviour Varies Across Australian Cities

Tipping patterns in Australia shift noticeably year by year. Local pricing, service norms, and customer expectations shape how and when Aussie customers tip, which means behaviour in one city rarely translates cleanly to another.

- Melbourne stands out with the highest average digital tip at $39.50, setting a clear benchmark nationally.

- Brisbane follows at $32.20, reflecting steady uptake of digital tipping across Queensland venues.

- Adelaide sits at $27.80, tipping 64% more than Sydney, and showing one of the fastest shifts in customer behaviour.

- Sydney, despite higher living and dining costs, records a lower average tip of $16.90, around 57% below Melbourne.

- Adelaide’s year-on-year growth is the most pronounced, with average tips increasing by 180%.

- Perth remains at the lower end, averaging $12.52, roughly 26% below Sydney and 68% behind Melbourne.

Use Cases of Digital Tipping Platform Development for Australian Industries

Digital tipping adoption varies by sector, but the operational drivers remain consistent: auditability, staff confidence, and operational control. Here is how the digital tipping systems work across the major Australian industries:

Hospitality Groups and Café Chains

In café and quick-service settings, tips accumulate in small amounts throughout the day. The operational strain appears later, during shift close and reconciliation. With frequent staff rotation and changing supervisors, manual handling quickly becomes repetitive overhead.

Digital tipping platforms absorb this work by applying predefined rules automatically, keeping attention on service rather than daily cleanup tasks.

Restaurants and Bars

Pooled and hybrid tipping models are common in restaurants and bars, but they rely heavily on trust. When allocation decisions sit with managers, even minor inconsistencies invite doubt.

A system-driven approach removes discretion from the moment digital tips enter the workflow, applying agreed rules uniformly and giving staff a clear view of how results are reached.

Hotels and Resorts

Hotels deal with tipping across multiple roles and service touchpoints, often with seasonal staffing patterns layered on top. Informal approaches rarely hold under that complexity.

Digital tipping allows gratuities to move quietly in the background, preserving guest experience while producing records that fit payroll cycles and internal control expectations.

Ride-Hailing, Delivery, and On-Demand Services

For drivers and couriers, tipping is closely tied to task completion. Delays or mismatches surface immediately.

Platforms designed for this environment prioritise attribution and timing, ensuring tips follow completed jobs without manual intervention, even as volumes rise and demand fluctuates.

Salons, Spas, and Personal Care Services

In personal care businesses, tips tend to reflect individual relationships and performance. Staff want clear credit, while owners need visibility without stepping into day-to-day allocation.

Digital tipping platforms support both by assigning tips directly and producing clean summaries that feed into payroll and reporting without constant oversight.

Multi-Location and Franchise Operations

Franchise models struggle with consistency. Local practices emerge quickly, increasing variance and risk.

A shared digital tipping platform enforces common rules across locations while allowing limited flexibility, reducing exposure without undermining local operations.

Across these scenarios, digital tipping app development in Australia delivers value only when the platform mirrors real operating conditions, not abstract assumptions.

Also Read: AI Implementation in Australia (2026): Use Cases, Costs

How To Build a Digital Tipping Platform In Australia

Building a digital tipping platform is less about feature velocity and more about sequencing decisions correctly. Teams that rush into UI or payment integration often end up reworking core logic later. The steps below reflect how successful platforms are delivered when payroll alignment, staff trust, and operational clarity matter from day one. So, without further ado, let’s unveil the practical steps to build a digital platform in Australia for tipping:

Business Requirements and Compliance Assessment

Every tipping platform starts with policy. Before any technical decision is made, teams need agreement on how tips should behave across roles, shifts, and locations. This includes defining individual, pooled, or hybrid models and clarifying how edge cases are handled.

At this stage, teams typically validate their tipping approach against Fair Work Act 2009 obligations, particularly where gratuities influence take-home pay or interact with payroll processing.

Getting this right upfront removes ambiguity later. It also ensures the platform enforces consistent treatment rather than relying on venue-level interpretation.

Platform Architecture and Technology Stack Selection

At this stage, the focus shifts from policy to structure. The development team defines how customer-facing flows, business logic, and reporting layers interact without creating tight coupling. Clear boundaries here allow rules and integrations to evolve independently.

When selecting the tech stack for a cashless tipping platform in Australia, reliability and change tolerance matter more than novelty. Architecture decisions made now determine scalability, security posture, and long-term cost of ownership.

UX/UI Design for Customers and Staff

Once the structural foundation is clear, attention turns to interaction design. Customer-facing journeys must remain lightweight, optional, and fast. Any friction in UI/UX design directly affects completion rates and frontline experience.

Staff and admin interfaces serve a different purpose. At this stage, clarity outweighs aesthetics. Earnings visibility, allocation explanations, and payout timing must be immediately understandable, especially during onboarding.

Payment Gateway and Wallet Integration

With user flows defined, the next step is to integrate payment gateways. This step focuses on stability rather than breadth. Supporting common cards and digital wallets matters, but settlement behaviour and reconciliation accuracy matter more.

Decisions around instant versus scheduled payouts happen here. Each option carries implications for cash flow visibility, staff expectations, and operational workload.

Tip Distribution Logic and Payroll Integration

At this point, the platform begins to enforce policy at scale. Distribution rules are encoded into the system, so outcomes no longer depend on manager’s discretion. Consistency across shifts and locations becomes automatic rather than manual.

Clear, system-enforced allocation rules also support Fair Work Act compliance by reducing ambiguity around how discretionary income is treated once it enters payroll workflows.

Testing, Security Audits, and Compliance Validation

Once core workflows are in place, the QA teams validate how the platform behaves under real conditions. This includes payout cycles, peak usage, and exception scenarios.

Security testing focuses on transaction integrity and access control. Audit-ready logs ensure teams can answer questions quickly without reconstructing history later.

Deployment, Training, and Rollout Strategy

The final stage is about adoption, not technology. Pilot rollouts allow teams to validate assumptions before wider deployment. Training should focus on explaining how the system works and why it protects fairness.

Clear communication here reduces resistance and builds confidence, especially in tip-sensitive environments.

Must-Have Features in a Digital Tipping Platform

A digital tipping platform succeeds when its features reduce ambiguity rather than add operational layers. At scale, features must function as controls, not conveniences, ensuring tips move through the system in a way that remains explainable, consistent, and defensible over time. Considering this, here are some of the key features a digital tipping system should have:

Employee & Admin Features

Employee and administrative features establish trust in the system. They define who can receive tips, how allocations work, and how outcomes are reviewed, removing reliance on manual interpretation by managers or payroll teams.

- Staff onboarding and identity verification

The platform must confirm staff identity at onboarding so tips always resolve to the correct person. This becomes critical when people rotate roles, move between locations, or change contracts mid-cycle. - Tip allocation rules (individual, pooled, hybrid)

Allocation logic needs to live inside the system, not inside manager judgement. Once rules are set, they should apply automatically across shifts and venues without manual intervention. - Real-time earnings visibility

Staff should be able to see accumulated tips as they are earned. Delayed visibility creates questions, and questions quickly turn into disputes during payroll periods. - Tax-ready reports and exports

Tip data should move cleanly into payroll and accounting without rework. Structured exports reduce manual handling and lower the chance of downstream corrections.

Customer-Facing Features

Customer-facing features should remain intentionally lightweight. Their role is to enable tipping without disrupting service flow or creating pressure to participate.

- Simple, frictionless tipping flow

The tipping journey must complete in seconds with minimal steps. Complexity reduces completion rates and distracts from the service experience. - Optional anonymity and receipt generation

Customers should be able to tip anonymously and receive confirmation if they choose. These options preserve comfort without adding operational overhead. - Multiple payment options (cards, wallets, BNPL, etc.)

Support for common payment methods removes friction at the point of interaction. The focus remains on reliability rather than breadth of choice.

Also Read: Cost to Develop a Buy Now Pay Later App like Zip

Business & Operations Features

Operational features are about control without interference. Teams need visibility and consistency without centralising every decision.

- Role-based dashboards

Different teams need different views. Managers, finance staff, and administrators should see only what is relevant to their role. - Compliance reporting

Reports must show how tips were captured, allocated, and paid. This simplifies internal checks and reduces effort during audits or reviews. - Audit logs and payout controls

Every adjustment and payout should leave a clear record. Controls around changes prevent unauthorised activity and simplify issue resolution. - Multi-location and franchise support

Shared rules should apply across locations, with limited room for local variation. This keeps reporting consistent while allowing operational flexibility. - Exception and dispute resolution workflows

Not every scenario fits clean rules. The platform should allow authorised teams to investigate and resolve misattributed tips, staff changes, or disputed transactions without breaking audit trails. - Configurable payout scheduling and settlement rules

Payout timing should align with payroll cycles and settlement preferences. Clear scheduling avoids confusion for staff and reduces reconciliation pressure for finance teams. - Payroll, POS, and finance system integrations (APIs)

The platform should exchange data reliably with existing systems. Direct integrations reduce manual reconciliation and prevent mismatched records as volume grows.

Security and Compliance Features

Security and compliance features protect the platform as transaction volumes grow. They ensure tipping data receives the same level of care as other employee-linked financial information.

- PCI DSS compliance

Payment handling must align with card security standards to reduce exposure around transaction data. - Data encryption

Sensitive data should remain encrypted in transit and at rest. This protects staff and payment information from unauthorised access. - Audit trails

The system must retain tamper-resistant records for all key actions, allowing issues to be reviewed without reconstruction. - Australian Privacy Act (APPs) compliance

Ensures tipping and staff earnings data is handled in line with Australian privacy requirements, with controlled access and defined retention practices. - Granular access controls and segregation of duties

Access should be tightly scoped so that no single role can view, change, and approve sensitive data. This reduces internal risk and strengthens audit confidence.

Advanced Platform Capabilities

Advanced capabilities add value only when they surface problems early rather than automate decisions blindly.

- Anomaly detection for tip distribution and payouts

AI powered applications for Australian tipping systems flag unusual allocation patterns, payout spikes, or reconciliation mismatches before they escalate into disputes or reviews. - Operational analytics and trend insights

Provides visibility into tipping behaviour across roles, locations, and time periods, supporting planning and operational decisions without manual analysis.

Cost of Digital Tipping Platform Development in Australia

The cost of building a digital tipping platform in Australia is shaped less by surface features and more by how deeply the platform integrates into payments, payroll, and reporting workflows. Teams that underestimate this often face rework later.

For most organisations, the cost to create an application for Australian tipping typically falls between AUD 70,000 and AUD 700,000, depending on complexity, integration depth, and compliance requirements.

Factors That Influence Development Costs

Several variables materially affect build effort and long-term ownership cost. These factors should be evaluated early, as they are difficult to reverse once development begins.

- Tip allocation complexity

Individual, pooled, or hybrid models increase logic and testing effort, particularly across shifts and locations. - Integration requirements

Connecting with POS systems, payroll software, or accounting platforms significantly increases build scope and validation time. - Security and compliance depth

Stronger audit trails, access controls, and data protection measures add necessary effort but reduce downstream risk. - Scalability expectations

Platforms designed for multi-location or franchise use require more robust architecture and configuration controls.

Cost Breakdown by Platform Complexity

The table below reflects indicative ranges based on common delivery patterns observed in Australian builds. Actual costs vary by organisation context and delivery approach.

| Platform Complexity | Indicative Cost Range (AUD) | Typical Scope |

|---|---|---|

| Foundational Platform | 70,000 – 150,000 | Single-brand deployment, basic allocation rules, limited integrations |

| Growth-Ready Platform | 150,000 – 350,000 | Multi-location support, payroll integration, advanced reporting |

| Enterprise-Grade Platform | 350,000 – 700,000 | Franchise scale, complex allocation logic, audit-grade controls |

Measurable Outcomes of Building a Digital Tipping Platform

Once a digital tipping platform is operational, its value shows up in daily operations rather than headline metrics. The most meaningful gains emerge where friction is removed from payroll handling, staff interactions, and customer touchpoints. Over time, these outcomes compound as transaction volumes and operational scale increase. Some of the most outcome-driven benefits of digital tipping apps for businesses include:

Reduction in Cash Handling and Disputes

Digital capture and system-led allocation remove manual counting and subjective decisions, significantly lowering dispute frequency and reconciliation effort.

Improved Staff Satisfaction and Retention

Clear visibility into earnings and predictable payout behaviour builds trust, particularly in tip-dependent roles where turnover risk is high.

Efficient Operational Transparency and Compliance

Structured records and enforced allocation logic simplify internal reviews and reduce effort during audits or payroll checks.

Enhanced Customer Experience

Fast, optional tipping flows remove awkward interactions and maintain service momentum without pressuring participation.

Reduced Administrative Overhead and Cost Predictability

Automation across allocation, reporting, and reconciliation reduces manual effort and creates more predictable operating costs as volumes grow.

Key Challenges in Digital Tipping Platform Development & How to Overcome Them

Most challenges surface not because of technology gaps, but due to misalignment between policy, systems, and human behaviour. Addressing these early prevents friction once the platform scales.

Adoption Resistance From Staff or Customers

Challenge

Changes to tipping logic often surface doubts on the floor before they appear in reports. Staff question outcomes when numbers shift, while customers pull back if the experience feels staged or intrusive.

Solution

Treat adoption as a rollout issue, not a UX one. Show earnings clearly, explain changes once, and let customers opt in quietly without prompts that disrupt service.

Compliance and Audit Readiness

Challenge

Tipping data becomes fragile when rules live in documents instead of systems. Once payroll or internal reviews start asking questions, gaps appear quickly.

Solution

Move allocation logic into code and keep records that stand on their own. If a result needs explanation later, the system should already have the answer.

Payment Reconciliation Complexity

Challenge

Tips rarely settle on the same schedule as core transactions. As volumes grow, small timing differences turn into hours of manual checking.

Solution

Design settlement logic alongside payroll timing from the start. When reconciliation follows a predictable pattern, finance teams stop chasing edge cases.

Scaling Across Locations and Brands

Challenge

What works in one venue rarely survives expansion unchanged. Local workarounds spread fast, and consistency erodes before anyone notices.

Solution

Set non-negotiable rules centrally, then allow limited variation where operations demand it. Scale works only when flexibility has boundaries.

Legacy System Constraints and Integration Friction

Challenge

Older POS and payroll platforms were never built for live data exchange. When modern tipping logic meets rigid formats, teams fall back on manual fixes.

Solution

Introduce an intermediary layer that reshapes data before it hits legacy systems. This keeps existing infrastructure intact while removing operational bottlenecks.

Rapid Teachers, Lite N’ Easy, Multinail

How Appinventiv Can Help Build a Digital Tipping Platform for Australia

Digital Tipping Platform Development for Australia requires more than application development capability. It demands clarity around policy, confidence in execution, and discipline in handling systems that directly affect staff earnings and payroll processes. This is where many initiatives fail, not due to technology gaps, but due to misalignment between intent and delivery.

We support organisations through the full lifecycle of mobile app development services in Australia, from early design decisions through to deployment and scale. Our work focuses on building platforms that remain stable as transaction volume increases, rules evolve, and operational scrutiny intensifies.

Across Australia, we have deployed 3000+ digital assets, supporting organisations across 35+ industries, with a 78% client retention rate. Our team of 1700+ tech experts brings 10+ years of APAC delivery experience, supported by 5+ agile delivery centres across Australia, allowing us to balance local operational expectations with delivery depth.

Our approach prioritises structure over speed. We work with your in-house teams to define allocation logic, integration boundaries, and reporting requirements before development begins. This reduces rework later and ensures the platform enforces the agreed policy rather than relying on manual intervention.

Operational outcomes matter. Platforms we deliver operate under security compliance SLAs of 99.50%, while clients report up to 35% efficiency gains through reduced manual handling, clearer reporting, and fewer disputes. These results come from disciplined execution rather than feature expansion.

Our role is not to push a predefined solution. It is to help businesses design and build a tipping platform that fits their operating model, supports staff confidence, and remains defensible as the organisation grows.

Get in touch with us to discuss your project vision.

FAQs

Q. How does digital tipping work in Australia?

A. Digital tipping allows customers to leave gratuities through cards, wallets, or QR-based flows. The platform captures, allocates, and reports tips based on predefined rules, ensuring consistency and visibility for staff and operators.

Q. How much does it cost to build a digital tipping platform?

A. The cost to create a digital tipping platform in Australia typically ranges from AUD 70,000 to AUD 700,000, depending on allocation complexity, integrations, security requirements, and scalability expectations.

Q. How long does it take to create a digital tipping app?

A. The timeline of digital tipping platform development for Australia varies based on discovery depth, integration scope, testing requirements, and rollout strategy.

On average, the time it takes to create a digital tipping system ranges from 4-12+ months or more, depending on your project requirements.

Q. Can I hire dedicated tipping app developers from Appinventiv?

A. Yes. We provide dedicated development teams aligned to Australian delivery and cybersecurity standards, supporting both full platform builds and phased modernisation efforts.

Q. What is the future of digital tipping platforms in Australia?

A. Digital tipping platforms are evolving into governed income systems, increasingly integrated with payroll, workforce analytics, and compliance reporting as organisations prioritise transparency and audit readiness.

Q. What are the necessary compliances for developing digital tipping platforms?

A. The necessary compliances required for digital tipping software development in Australia are:

- Fair Work Act 2009 (Cth)

- Australian Privacy Act 1988 (APPs)

- PCI DSS (Payment Card Industry Data Security Standard)

- ATO Payroll and Reporting Requirements

- Consumer Data Protection Obligations

- Electronic Transactions Act 1999 (Cth)

- State and Territory Workplace Regulations

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

MVP to Market: Realistic Cost, Timelines & Tech Stack for MVP App Development in Australia

Key takeaways: MVP development costs in Australia typically land between AUD 50,000 and AUD 200,000+, driven by integration depth, security, and delivery shape. Time-to-market can vary from 8 to 20 weeks, influenced by integrations, compliance, and feature scope. Choosing the architecture and best tech stack for building mvp app early reduces rebuild risk when traction…

Building a Future Ready Real Estate Platform in Qatar for Vision 2030

Key Takeaways Future-ready real estate platforms in Qatar are treated like infrastructure, not apps. They’re built to last, with strong data, clear governance, and room to adapt as policies and projects evolve. Off-the-shelf tools work only until complexity shows up. Once approvals, compliance, and multiple stakeholders are involved, custom platforms usually hold up far better.…

Investing in the Future: Why Arabian Education App Development is Surging

Key Takeaways: Education apps in the Arabian region are no longer stopgap solutions. They’re becoming part of how learning actually runs day to day. Schools, universities, and governments are choosing platforms that scale quietly and fit real teaching routines. The apps that succeed focus on stability, integration, and usability rather than packed feature lists. Most…