- How Decentralized Exchange (DEX) Works?

- Core Types of Decentralized Exchanges

- Automated Market Maker (AMM)

- Order Book DEX

- Hybrid DEX

- RFQ (Request-for-Quote) DEX

- P2P Escrow-Based DEX

- DEX Aggregator

- Benefits of a Decentralized Exchange Platform

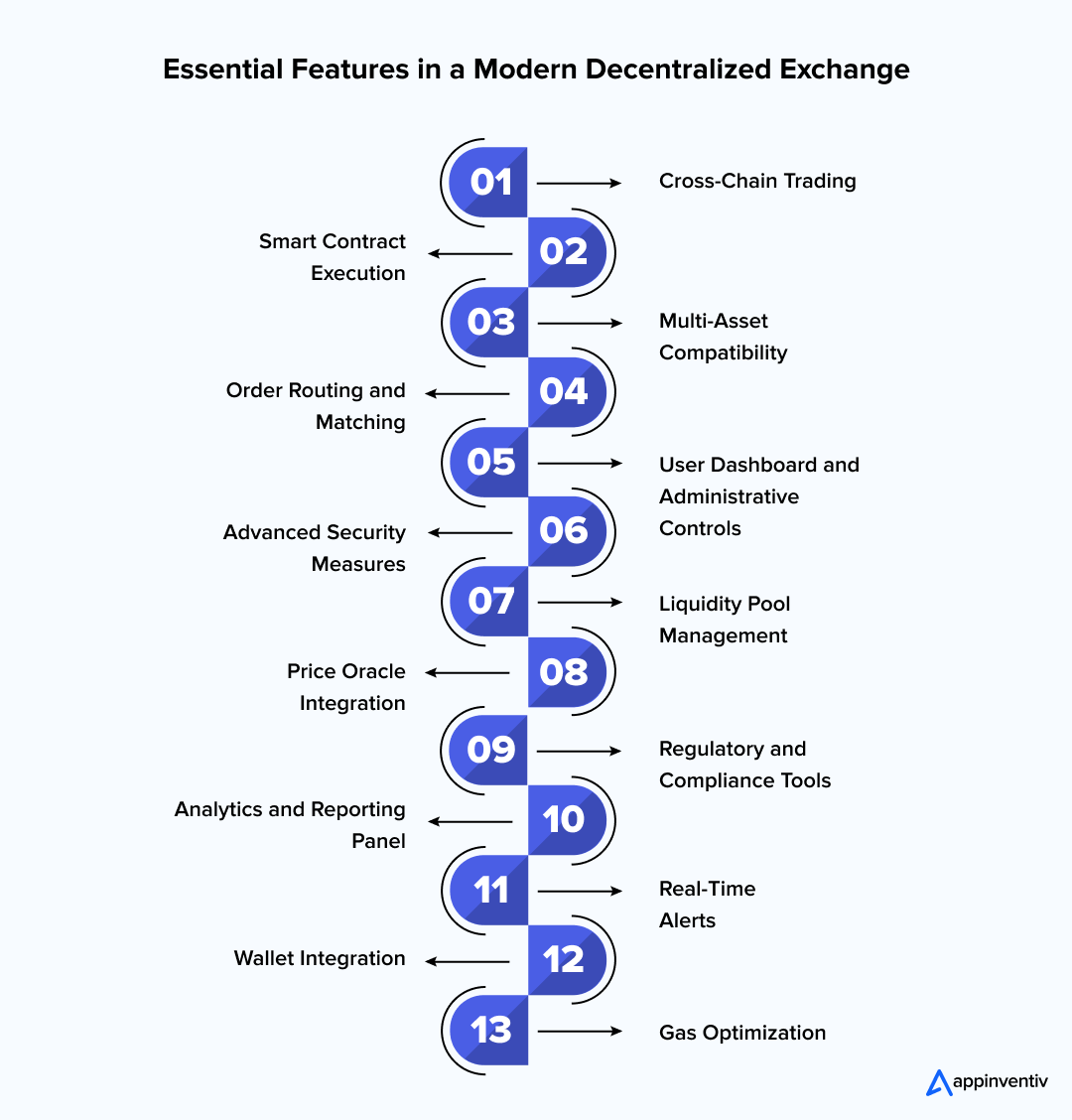

- Key Features of a Modern Decentralized Exchange

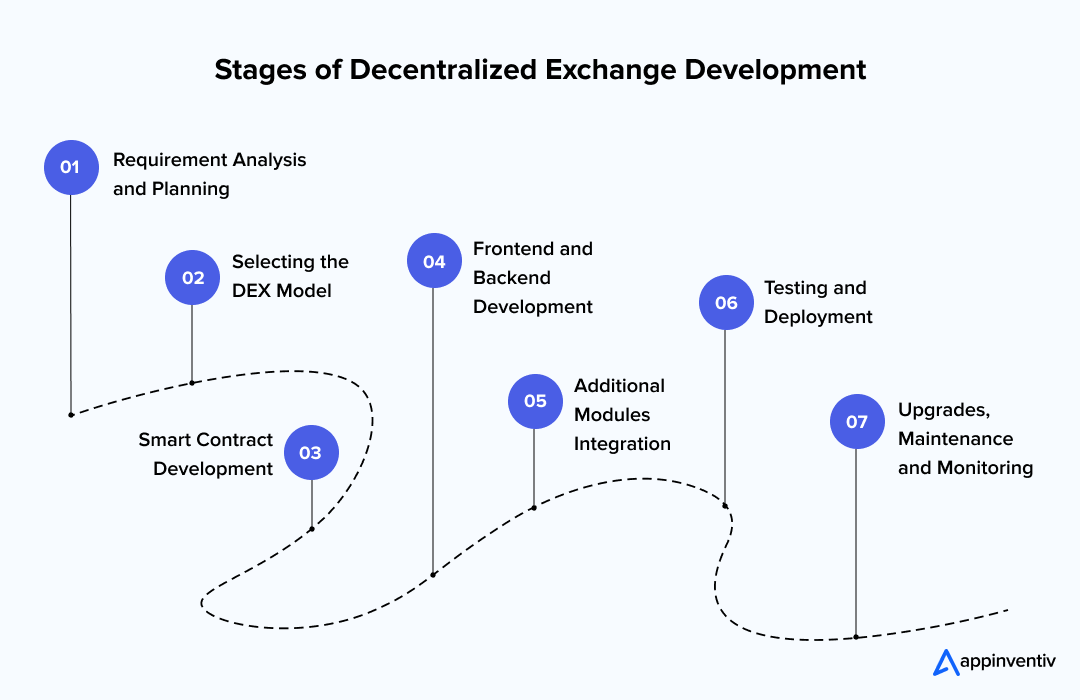

- Steps to Develop a Decentralized Exchange

- Requirement Analysis and Planning

- Selecting the DEX Model

- Smart Contract Development

- Frontend and Backend Development

- Additional Modules Integration

- Testing and Deployment

- Upgrades, Maintenance and Monitoring

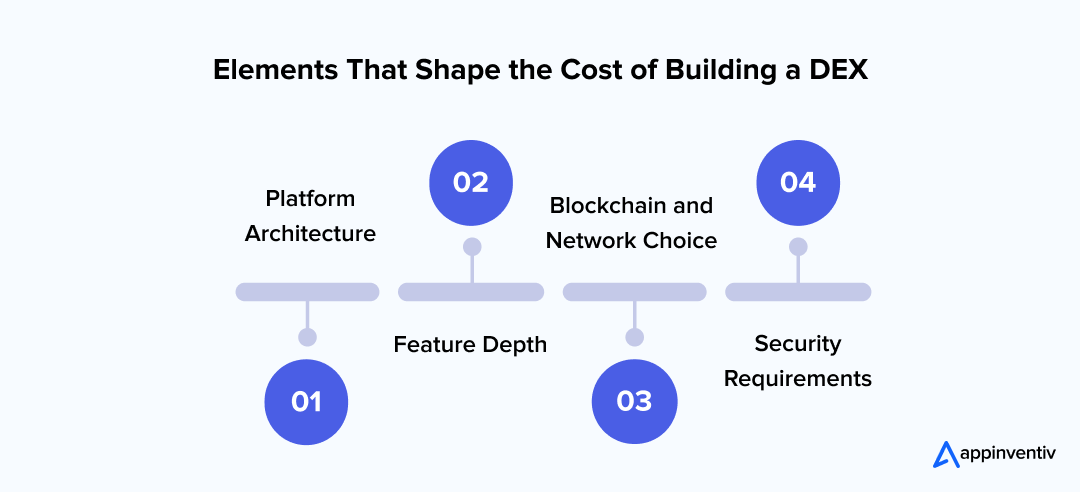

- What Determines the Cost of Building a DEX

- Factors That Directly Influence the Cost to Build a DEX

- Pricing Breakdown by Component

- Price Ranges for Different Project Sizes

- Cost-Saving Strategies Without Sacrificing Quality

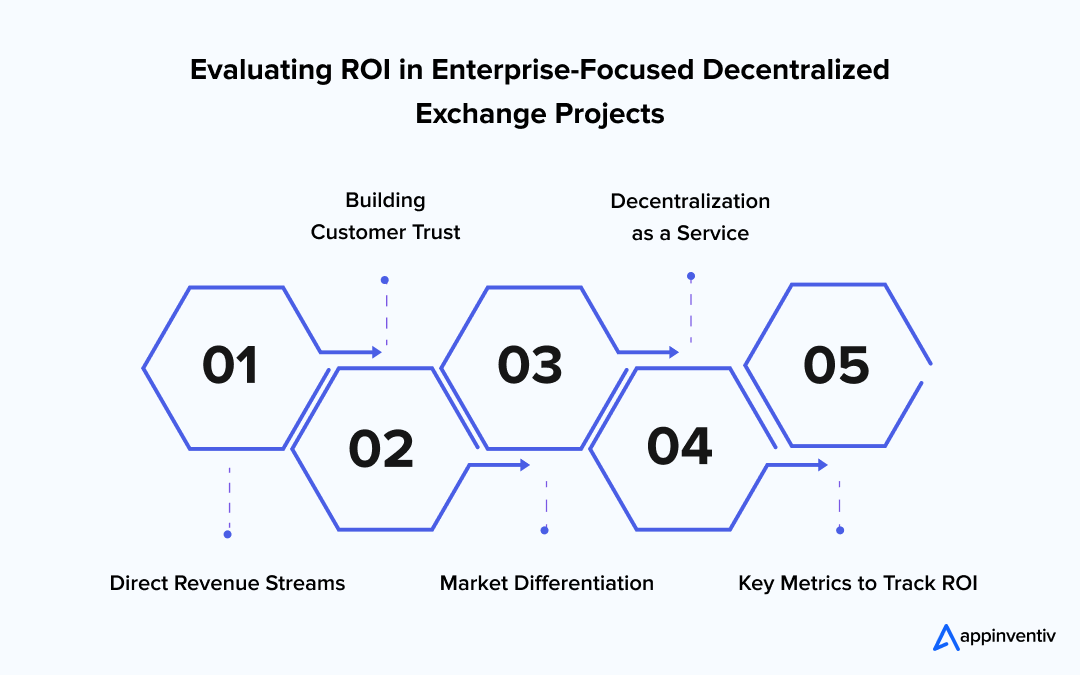

- Maximizing Enterprise ROI Through Decentralized Exchange Development

- Direct Revenue Streams

- Building Customer Trust

- Market Differentiation

- Decentralization as a Service

- Key Metrics to Track ROI

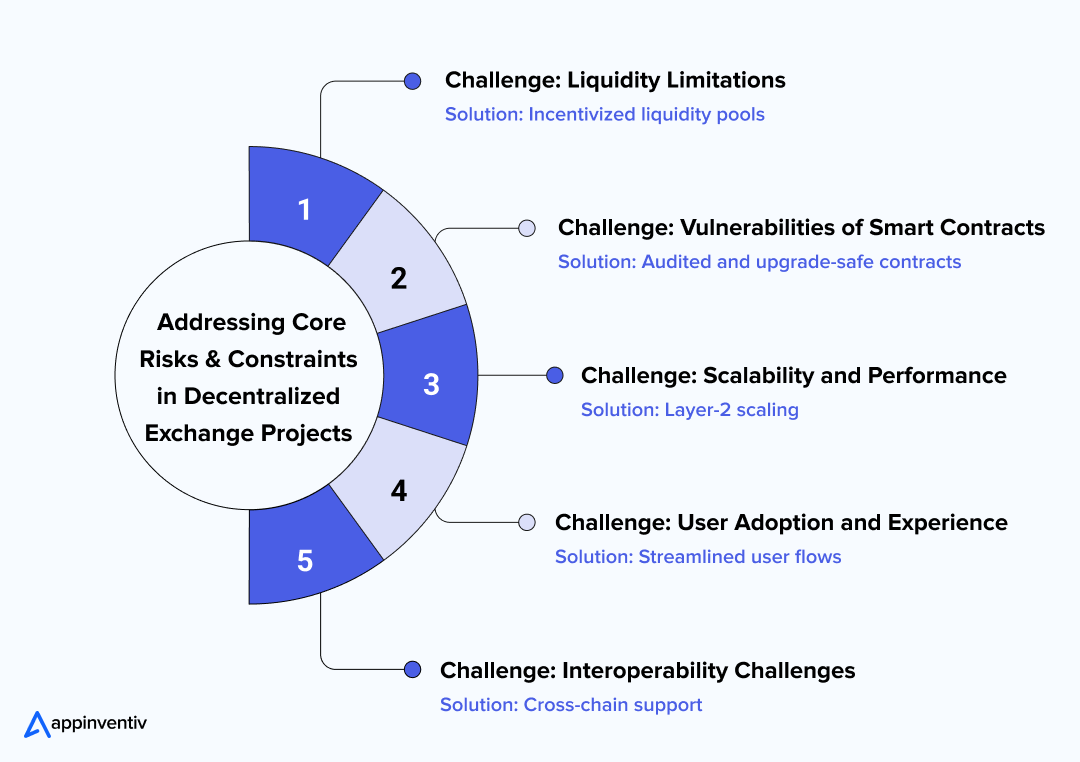

- Challenges in DEX Development and Solutions to Overcome Those

- Liquidity Limitations

- Vulnerabilities of Smart Contracts

- Scalability and Performance

- User Adoption and Experience

- Interoperability Challenges

- Partner with Appinventiv to Launch Your DEX Platform

- FAQs

Key Takeaways

- The development of a decentralized exchange will enable businesses to provide secure and user-controlled trading, improve transparency, and minimize the use of intermediaries.

- The cost of DEX development can vary depending on the platform’s features, the chosen network, and regulatory requirements, and the approximate cost is about $50,000, with higher costs for customization, up to $350,000 or more.

- DEXs additionally enhance new business prospects, such as direct fee revenue and white-label, and enable long-term and short-term financial objectives.

- It is important to address technical, operational, and liquidity issues early to maintain the platform’s stability, security, and user interest.

Decentralized exchanges are moving from a niche idea into the mainstream of enterprise technology. What began as small community-driven trading platforms has grown into a model that appeals to large organizations seeking clearer settlement processes and reduced dependency on intermediaries.

Many enterprises now view blockchain as a practical way to modernize internal systems, support new asset types, and streamline the way value moves across borders and business units. This shift shows up clearly in adoption patterns across global corporations.

Recent data show that Uniswap was the largest decentralized exchange (DEX), with its market share at 35.9% in 2025, highlighting how DEXs have matured into dominant, high-volume trading venues (Source: Coingecko).

This shift matters for DEX builders because the same forces driving corporate blockchain adoption, reduced counterparty risk, transparent settlement, and automated transaction logic, are what make decentralized exchange systems attractive to large organizations.

In this blog, we will analyze the ins and outs of decentralized exchange development, how it works, its types, benefits, key features, steps to develop one, implementation costs, how it maximizes RoI, and the challenges enterprises face in this space.

Let’s begin!

As more users move toward non-custodial trading, this is the right moment for your enterprise to take action and build long-term advantage.

How Decentralized Exchange (DEX) Works?

A decentralized exchange runs on smart contracts that execute trades without requiring a central authority to hold user funds. Instead of depositing assets into an exchange wallet, users trade directly from their own addresses, which removes custodial risk and keeps control with the trader.

When an order is placed, the smart contract checks available liquidity, confirms the trade parameters, and completes the swap through programmed logic. This model forms the foundation many teams rely on when working with a DEX development company to design secure, transparent trading systems.

Most decentralized exchanges use automated market maker frameworks or related algorithms that adjust token prices based on the proportion of assets within each pool. Liquidity providers supply these pools and receive a share of the fees, which maintains active markets.

Every transaction and fee distribution is recorded on the blockchain and can be verified publicly, strengthening trust in the system. This structure is one of the reasons enterprises explore decentralized crypto exchange development as part of their larger digital asset strategies.

Also Read: Cryptocurrency Exchange App Development Cost

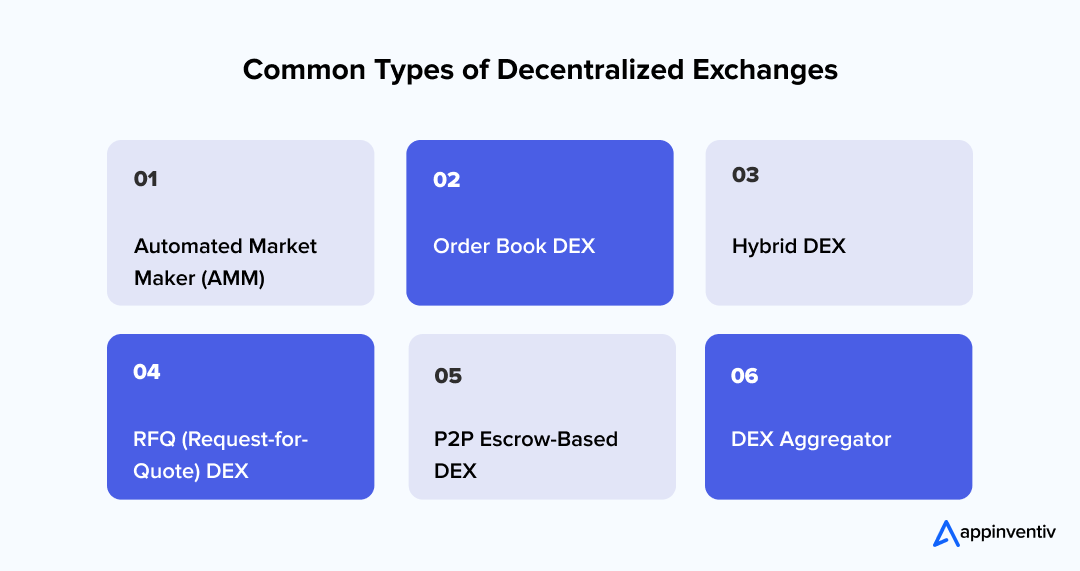

Core Types of Decentralized Exchanges

Different models of decentralized exchanges have emerged over the years, each built to solve specific trading needs and liquidity challenges. These variations help teams choose the structure that fits their technical goals, regulatory setting, and user expectations.

Automated Market Maker (AMM)

AMM platforms rely on liquidity pools and a pricing formula that adjusts with each trade. This structure keeps markets active even when demand shifts. It is often the starting point for teams planning early phases of DEX Development because the model scales well and remains predictable for both developers and users.

Order Book DEX

Order book exchanges maintain lists of bids and asks, and match them either fully on-chain or with partial off-chain workflows. The structure resembles traditional trading systems, which makes it easier for institutions to map their controls to a new environment. Decentralized exchange development for this model usually focuses on latency, order-handling rules and transparent settlement.

Hybrid DEX

Hybrid designs use off-chain matching for faster response while keeping settlement on-chain to protect user custody. This structure helps enterprises that want higher throughput without losing the open audit trail of blockchain platforms. It is commonly chosen for enterprise DEX development where performance, compliance checks and custody assurances must operate together.

RFQ (Request-for-Quote) DEX

RFQ systems allow traders to request firm quotes from selected liquidity providers. The model reduces slippage for large transactions and can support custom pricing logic for different asset groups. Many institutional desks prefer this approach because it produces more predictable fills.

P2P Escrow-Based DEX

Peer-to-peer systems route trades directly between users. Smart contracts hold assets in escrow until both parties confirm the exchange. This approach is useful in regions where direct fiat access is needed or where users prefer a slower but transparent settlement path.

DEX Aggregator

Aggregators search across several exchanges to locate the best available price and lowest transaction impact. They improve execution quality for users who do not want to compare rates manually. While not an exchange in the strict sense, aggregators have become an important layer in modern trading stacks and are often integrated into advanced DEX front ends.

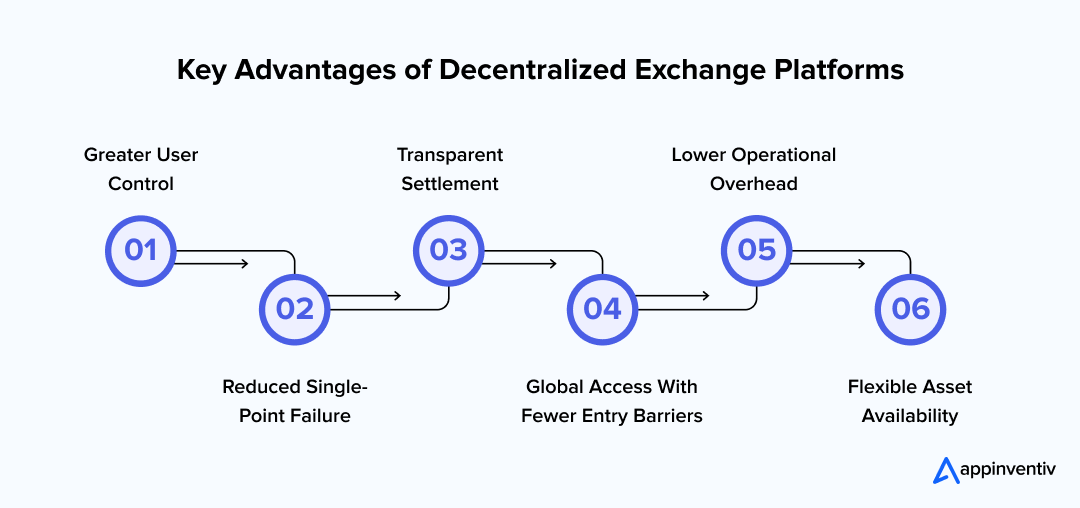

Benefits of a Decentralized Exchange Platform

A well-built DEX changes how trading systems operate by shifting control from a central operator to the users themselves. It brings a cleaner mix of transparency, resilience, and open access that traditional platforms struggle to match. Let’s have a look at some of the key benefits of DEX:

Greater User Control: A DEX allows traders to keep assets in their own wallets instead of handing custody to an exchange operator. This reduces exposure to platform failures and preserves direct control over funds.

Reduced Single-Point Failure: Since trading activity runs across distributed networks, there is no central system that can be taken down or compromised in one strike. It creates a steadier environment for high-volume activity.

Transparent Settlement: All swaps and liquidity movements appear on-chain. This helps users verify market activity on their own without depending on closed reporting systems.

Global Access With Fewer Entry Barriers: Anyone with a compatible wallet and network connection can trade. Users are not tied to regional infrastructure, which broadens participation and supports open markets.

Lower Operational Overhead: DEX systems do not depend on large centralized server stacks. Once the core contracts are deployed, ongoing operations tend to be lighter, which often supports a more efficient operating model.

Flexible Asset Availability: New tokens can be added through listing functions or liquidity pools without long approval cycles. This encourages experimentation and early-stage market activity.

Key Features of a Modern Decentralized Exchange

A well-designed decentralized exchange brings together security, transparency, and smooth trading flow in a single system. Each element helps the platform remain stable as trading volumes and market conditions change. Let’s have the key features of a decentralized exchange platform:

Cross-Chain Trading: Support asset movement across independent blockchains. Users can trade without relying on centralized bridges, which broadens liquidity access and keeps the platform flexible for future DEX development needs.

Smart Contract Execution: Trades run through self-governing smart contracts that verify conditions and settle activity automatically. This improves reliability and lowers the risk of execution errors across the exchange.

Multi-Asset Compatibility: Enable trading across a wide range of digital assets and token standards. This feature helps the platform evolve with market demand and supports long-term scale for decentralized exchange development as new protocols enter the ecosystem.

Order Routing and Matching: A fast matching engine reads available liquidity, routes orders intelligently, and prioritizes minimal slippage during high-traffic periods. This leads to smoother trade execution and stable performance.

User Dashboard and Administrative Controls: Traders receive a clear view of balances, open orders, and activity. Administrators have separate tools for monitoring liquidity pools, reviewing system health, and adjusting operational parameters.

Advanced Security Measures: Two-factor authentication, multi-signature wallet options, and continuous threat monitoring help protect user accounts. These layers maintain trust and reduce unauthorized access attempts.

Liquidity Pool Management: Users and institutions can supply liquidity and earn returns based on pool activity. Pool tools offer visibility into rewards, depth, and asset distribution so providers can track contributions easily.

Price Oracle Integration: Decentralized oracles supply accurate and tamper-resistant market data. Stable pricing is vital for swaps, risk checks, and defense against manipulation.

Regulatory and Compliance Tools: Integrated reporting, audit logs, and activity monitors help operators meet regional regulatory expectations. These tools support long-term governance and operational clarity for a decentralized crypto exchange environment.

Analytics and Reporting Panel: Detailed insights on trading patterns, liquidity movement, and user behavior help operators assess performance and guide system improvements with more confidence.

Real-Time Alerts: Push notifications for executed trades, market shifts, and account activity allow traders to respond quickly and maintain control over their positions as conditions change.

Wallet Integration: Users can trade directly from their personal wallets without handing over custody. This preserves autonomy while keeping the trading experience smooth and consistent.

Gas Optimization: Tools that help users adjust gas settings based on current network conditions keep transaction costs manageable and reduce delays during congestion.

Steps to Develop a Decentralized Exchange

The decentralized exchange development is a multiphase procedure that requires planning, technical skills, and implementation. Following a structured approach ensures a secure, scalable, and user-friendly platform.

Requirement Analysis and Planning

Start by learning about the intended audience, trading characteristics and asset types supported. Identify company-specific requirements like compliance modules, reporting solutions and multi-chain support. This phase preconditions the process of developing a decentralized exchange platform, which will have everything clear in terms of scope, purpose, and the volume of resources.

Selecting the DEX Model

Select the exchange architecture to use, such as Automated Market Maker (AMM), Order Book, Hybrid, and others. All of them imply liquidity, user experience and performance. The decision has a direct impact on the DEX development process, such as smart contract development, matching mechanisms, and the implementation of the backend architecture.

Smart Contract Development

Create the smart contracts to regulate the trading, staking, liquidity provision, and governance. This is a very important step when it comes to security because the vulnerabilities may lead to the loss of funds. Carry out numerous audits, formal verification, and intensive testing on testnets, to ensure robustness in decentralized crypto exchange development.

Frontend and Backend Development

Design a user- and administrator-friendly interface and make sure that it is fully integrated with smart contracts. The backend components process transaction routing, price feed, order matching, and analytics. Maximizing the performance and usability during this stage boosts trader confidence and adoption.

Additional Modules Integration

Add advanced features such as cross-chain bridges, KYC/AML compliance solutions, analytics overviews, and liquidity management. DEX aggregator development platforms have the potential to combine various sources of liquidity to capture the best trades and price competitiveness.

Testing and Deployment

Test the platform in a controlled testnet to find bugs, stress-test the system under load, and evaluate security measures. Following extensive testing, live trading on the mainnet begins, with all components tested to work reliably in the real world.

Upgrades, Maintenance and Monitoring

When launched, keep a constant check on the performance, upgrade the smart contracts with security patches, and scale up the infrastructure to support the increased number of users. Consistent maintenance ensures continued reliability, compliance, and long-term adoption of the enterprise in the DEX development process.

What Determines the Cost of Building a DEX

A decentralized exchange requires coordinated work across smart contracts, user interfaces, integrations, and security. The cost to build a decentralized exchange platform typically ranges between $50,000 to $350,000, depending on scope, with additional features for multi-chain builds or bespoke enterprise builds. Below are the key cost drivers and the expected realistic investment of teams intending to undertake a DEX project.

Factors That Directly Influence the Cost to Build a DEX

The cost to build a DEX exchange platform involves several decisions that shape the overall budget, from the underlying blockchain to the depth of trading features:

Platform Architecture

Some teams choose an AMM because it is easier to maintain. Others need an order-book engine for tighter pricing. Each structure shapes the workflow and the depth of engineering involved, so planning usually starts with this decision before anything else moves forward.

Feature Depth

Extra functions tend to stretch both timeline and cost. Cross-chain swaps, liquidity tools, extended dashboards, or bridge links add more surfaces to test. Many firms borrow ideas from white-label DEX development practices, but the actual effort depends on how much of the system needs to be built specifically for the project.

Blockchain and Network Choice

Networks differ more than most expect. Some chains provide familiar tooling and solid documentation, which saves hours in the build. Others come with their own quirks, higher gas fees, or unusual contract patterns. These small details influence the pace of development and the size of the final bill.

Security Requirements

Audits, internal checks, and repeated testing make up a large part of the work. This is unavoidable for anyone serving institutions or regions that follow any form of DEX regulatory compliance, since every contract has to hold up under closer inspection. Strong security takes time, but it prevents far more costly fixes later.

Pricing Breakdown by Component

These figures offer a practical view of how different parts of the system contribute to the total cost.

| Component | Cost Range | Notes |

|---|---|---|

| Smart contract development | $15,000 – $60,000 | Core swap, pool, and governance logic |

| Frontend interface | $10,000 – $40,000 | UI, dashboards, wallet flows |

| Backend and APIs | $12,000 – $60,000 | InDEXing, routing, system operations |

| Integrations and oracles | $5,000 – $25,000 | Third-party services and market data |

| Testing and audits | $15,000 – $80,000 | Functional, load, and security tests |

| Deployment and maintenance | $8,000 – $30,000 | Monitoring, patches, upgrades |

Price Ranges for Different Project Sizes

Such ranges are used within teams to help them align expectations and actual project scope and make decisions concerning the extent of customization needed regarding long-term objectives.

| Project Level | Scope | Estimated Cost |

|---|---|---|

| Simple DEX | Simple swaps, small pools, one-chain only | $50,000 – $120,000 |

| Mid-Size DEX | Multi-asset support, analytics, enhanced security | $150,000 – $350,000 |

| Enterprise-Grade DEX | Multi-chain routing, compliance tooling, and high-volume performance linked to enterprise DEX development | $350,000+ |

Cost-Saving Strategies Without Sacrificing Quality

These approaches focus on controlling spend without weakening the platform itself. The emphasis stays on smart architectural choices, phased feature rollouts, and early decisions that reduce rework later. When planned carefully, cost discipline and system reliability tend to reinforce each other rather than compete.

Reuse Audited Templates: Developers often start with audited contract libraries when possible. It shortens review cycles and reduces the likelihood of major flaws slipping into production.

Prioritize High-Value Features: Teams sometimes begin with essential modules and leave secondary items for later phases. This not only controls cost but also keeps early releases easier to manage.

Choose Efficient Networks: A chain with predictable gas fees and reliable support saves money during development and after launch. It also avoids unexpected delays tied to less mature environments.

Keep the Architecture Clean: A simple structure makes future updates easier. Modularity helps teams add new functions without reworking the entire system, which keeps long-term costs steady.

Let our experts guide you through upfront cost planning to ensure your platform balances features, compliance, and scalability.

Maximizing Enterprise ROI Through Decentralized Exchange Development

A decentralized exchange offers substantial strategic and financial benefits for modern enterprises. These platforms go beyond just offering a trading venue; they create new, sustainable revenue streams and solidify customer confidence in the brand. Here’s how DEX development helps enterprises maximize their RoI:

Direct Revenue Streams

Firms can generate money right away by collecting trading fees on almost every transaction that happens on the platform. Other streams include rewards for users who stake assets and incentives for people who provide liquidity.

These mechanisms encourage greater pool participation and keep platform activity high. Basically, these tools create a self-sustaining financial model that naturally grows as more people start using the exchange.

Building Customer Trust

Security and transparency are two huge built-in benefits of DEXs. This naturally builds confidence among users, especially because they keep complete control over their funds.

By cutting out the middleman and allowing people to verify operations on the blockchain, enterprises significantly boost their credibility. That trust then translates into users sticking around longer and showing greater loyalty to the platform.

Market Differentiation

When a business offers a decentralized trading platform that also includes enterprise-grade compliance and security tools, it instantly looks like a major innovator in financial technology.

This kind of differentiation is critical. It helps attract new institutional clients, partners, and individual users seeking transparent, secure alternatives to centralized exchanges.

Decentralization as a Service

Enterprises have a chance to boost their return on investment (ROI) by offering their DEX technology as a white-label solution or by integrating their platform into various partner networks.

This strategy lets the business monetize the underlying tech stack itself. It also extends the company’s brand reach, creating a valuable stream of indirect revenue that’s separate from just collecting trading fees.

Key Metrics to Track ROI

To actually measure your return on investment, you need to closely track a few core metrics. These include overall transaction volume, the pace of liquidity growth, the rate of user adoption, and how often users return to trade.

Monitoring these numbers helps enterprises continuously refine features, adjust the incentive structures to keep them attractive, and make sure their DEX remains fully competitive in the very fast-moving DeFi ecosystem.

Challenges in DEX Development and Solutions to Overcome Those

There are special technical, operational, and strategic challenges in building a decentralized exchange. These concerns should be tackled by enterprise teams that are involved in the DEX development to have a safe and scalable system. Let’s have a look at those:

Liquidity Limitations

One of the usual barriers may be low liquidity, which may lead to increased slippage and trade execution. Lack of sufficient funds in trade pools results in a poor user experience and slowed uptake.

Solution: Introduce liquidity provider incentive programs, including staking rewards, yield farming or collaborations with established market makers. Early involvement in the pools will stabilize the ecosystem and increase trading volumes, supporting sustained growth in decentralized exchange development.

Vulnerabilities of Smart Contracts

The greatest threat in any DEX is security vulnerabilities in smart contracts. Exploits may result in loss of funds, unauthorized activations or even breakage of service.

Solution: Perform superior code reviews, use formal verification, and implement deployables that are upgradable and have well-established governance guidelines. Testnet simulations are conducted regularly, and security evaluations can significantly reduce risk and increase enterprise confidence in the platform.

Scalability and Performance

As user and transaction volumes grow, on-chain bottlenecks may slow execution and increase fees. This issue directly affects the platform’s adoption and credibility.

Solution: Employ layer-2 scaling systems, sidechains, or hybrid on-chain/off-chain systems. These solutions allow for rapid execution without compromising the decentralization and security on which DEX development is based.

User Adoption and Experience

Even a robust underlying technology may be discouraged because of complex interfaces and technical barriers that may prevent new users. Improper onboarding restricts trading and the enterprise’s development.

Solution: Invest in an intuitive UI/UX, support a wide range of wallets, and provide extensive informational resources. The transparent interactions are seamless, which would make both retail and institutional users interact with the platform and develop confidence in your decentralized exchange development strategy.

Interoperability Challenges

Single-chain DEXs are limited in their assets and market coverage. Lack of cross-chain functionality can make users resort to other competitors that are more expensive.

Solution: Implement cross-chain bridges or multi-chain support to increase the tradable assets. For platforms that consider DEX aggregator development, it is possible to combine different sources of liquidity and routing options to deliver the best pricing and execution, thereby increasing the platform’s competitiveness in enterprise applications.

Partner with Appinventiv to Launch Your DEX Platform

The future of decentralized exchanges points toward markets that can operate with greater transparency, steadier performance during peak activity, and a stronger focus on user control. As liquidity models mature and cross-chain pathways grow more dependable, DEX platforms are expected to play a central role in how digital assets move across global networks. This next stage calls for careful engineering rather than surface upgrades, which is where a seasoned partner becomes essential.

Appinventiv brings that grounding. The firm has worked across several blockchain environments and has delivered products that handle complex trading activity with consistent reliability. Projects such as AVATUS, Nova, and Empire show how a structured approach to architecture, security, and interface logic can turn early concepts into fully operational platforms. Each project reflects a clear method, steady testing cycles, and a design sense shaped by real user behaviour.

For instance, we worked with AVATUS to set up a cloud infrastructure built for security, scale, and variable usage patterns tied to its digital avatar platform. A private cloud environment was implemented to protect user data and maintain platform stability as traffic fluctuated.

Cost and capacity were managed using Spot.io, allowing resources to scale automatically during peak demand while keeping baseline spend under control. Ongoing monitoring and adjustments helped balance performance with operating efficiency. Over time, this approach supported consistent platform reliability while keeping infrastructure costs predictable.

For organizations preparing to enter the decentralized trading space, we offer both technology depth and a practical understanding of financial workflows. As a trusted custom blockchain development company, we build DEX systems that align with regulatory expectations and long-term scaling plans. With this foundation, your development journey can take shape with clarity and purpose.

Wondering how our expertise converts into results?

During the last ten years, our projects have been cited in various industry awards and media, including recognition in AI Product Engineering by The Economic Times, Deloitte Tech Fast 50, CIO Klub, Clutch Global 2024, and others covered in our media coverage section. You can also have a quick look at our client testimonials and explore the type of projects we worked on through our extensive portfolio.

Get in touch to share your project idea!

FAQs

Q. How long does it take to develop a decentralized exchange?

A. Timelines vary depending on architecture, feature depth, and the number of supported chains. An enterprise MVP development will typically require 10 to 14 weeks. With routing across multiple chains, audit, performance tuning, and other elements, an enterprise-level build in a wider DEX development roadmap may require 4-8 months.

Q. Which features actually matter in a DEX for enterprises?

A. Here are some of the top DEX features that you must consider implementing:

- Strong security layers, including audited smart contracts and protected wallet flows

- A stable trade engine that manages high volumes without delays

- Reporting and monitoring features that support evolving DEX regulatory compliance needs

- Cross-chain connectivity and dependable liquidity tools

- Dashboards that offer clear visibility into user activity and system performance

Q. How much does it cost to build an enterprise-grade DEX?

A. The costs are based on the complexity of smart contracts, blockchain integrations, liquidity modules, and compliance. Basic platforms can cost between $50,000 and $120,000. Mid-size platforms are usually priced between $150,000- $350,000. Completely personalized deployments associated with major decentralized exchange development projects can go as high as $500,000 or above.

Also Read: How Much Does Blockchain App Development Cost in 2026?

Q. How do I ensure security in decentralized exchange development?

A. A reviewed contract, robust key management and strong wallet communication initiate security. Constant surveillance, formal testing, and third-party inspection are still relevant. The processes of upgrades are clear, and the release cycles are controlled in the environment of professional DEX development services.

Q. Which industries can benefit the most from decentralized exchanges?

A. Here are some of the top industries that benefit most from DEX platforms:

- Financial institutions building non-custodial trading systems

- Tokenized asset platforms offering programmable settlement

- Gaming ecosystems supported by in-game asset markets

- Supply chain networks using transparent transaction records

- Digital identity and credential systems that rely on verifiable data flows

Q. Which are the most optimal technology stacks to use in developing the decentralized exchanges?

A. The choice of the best tech stack for decentralized exchange development is based on secure smart contracts, a robust backend and a well-designed user interface. Precise selection is determined by the chains where you prefer to patronize; however, the majority of enterprise teams are based on a combination of the following:

- Ethereum, BNB Chain, Polygon, Avalanche, or Solana blockchain networks

- Smart contract languages Solidity, Vyper, or Rust

- Order flow, inDEXing and API services Node frameworks like Node.js or Go

- Web3 wallet connectivity and frontend frameworks like React or Vue

- Off-chain activity and analytics, Databases like PostgreSQL or MongoDB

- Contract development and testing Tools like Hardhat, Truffle, Foundry or Anchor

- InDEXing and query layers, InDEXers such as The Graph or custom inDEXers

- Audit, static and continuous monitoring security tools

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Step-by-Step Guide to Crypto Trading Bot Development in 2026

Key takeaways: Crypto trading bot development in 2026 functions as full-scale trading systems, not experimental scripts. They require the same engineering discipline as any financial platform. Execution quality drives results more than strategy logic. Latency control, order handling, and risk limits shape real-world performance. AI-based strategies work only when supported by reliable data flows, controlled…

Key takeaways: Dubai's VARA framework mandates strict compliance protocols for blockchain enterprises. To comply with VARA in Dubai, enterprise blockchain systems should use private networks that only approved members can join. Choosing between Hyperledger Fabric, private Ethereum, Corda platforms, etc., significantly impacts long-term scalability, compliance automation, and maintenance costs. Enterprises implementing VARA enterprise blockchain development…

How Much Does It Cost to Build a Crypto Trading App Like Swyftx?

Key takeaways: Swyftx’s Rise: Australia’s top-rated crypto exchange app attracts 1.1M+ users with its easy UX, pro tools, and learning features. Development Costs: A Swyftx-like app development can cost AUD 30K–500K, based on scope and functionality. Crypto Market Momentum: With Layer-2 tech and ETF approvals, the market is booming, and transaction costs are dropping. Winning…