- Personal Financial App Market Forecast -2032

- How Much Does it Cost to Build a Personal Finance App Like PocketSmith?

- Factors Affecting the Cost to Build a Personal Finance App like Pocketsmith

- Can You Lower the Cost to Build an App like Pocketsmith?

- What are the Must-have Features of an App like Pocketsmith Australia?

- Accounts & Transactions

- Budgets & Financial Planning

- Reporting & Insights

- Advanced Features That Drive Engagement

- Real Example: Mudra - AI-Powered Budget Management App

- What Design Elements Make a Personal Finance App Stand Out?

- What is the Best Tech Stack For Your Personal Finance App?

- What Does it Take to Develop a Personal Finance App Like PocketSmith?

- Product Discovery & Planning

- UX/UI Design

- Frontend & Backend Development

- QA & Testing

- Deployment & Launch

- Post-Launch Support & Updates

- The High Price of Misunderstanding Your Users

- The Unseen Cost of Wrong Assumptions

- How Appinventiv Can Help You Build a Personal Finance App That Wins

- FAQs

Imagine an app that knows when your rent is due, reminds you of upcoming bills, forecasts your savings 12 months ahead, and tells you if that third coffee this week is wrecking your budget. That’s the kind of experience apps like PocketSmith deliver, and it’s exactly why personal finance apps are becoming a must-have for Australians looking to get smart with their money.

Now, picture this: you have invested in the next big personal finance app development in Australia. One tailored for Aussie users, offers rich financial insights, and feels more like a personal CFO than a budgeting tool. Tempting? Absolutely. But before you dive in, there’s one big question: how much does personal finance app development like Pocketsmith cost?

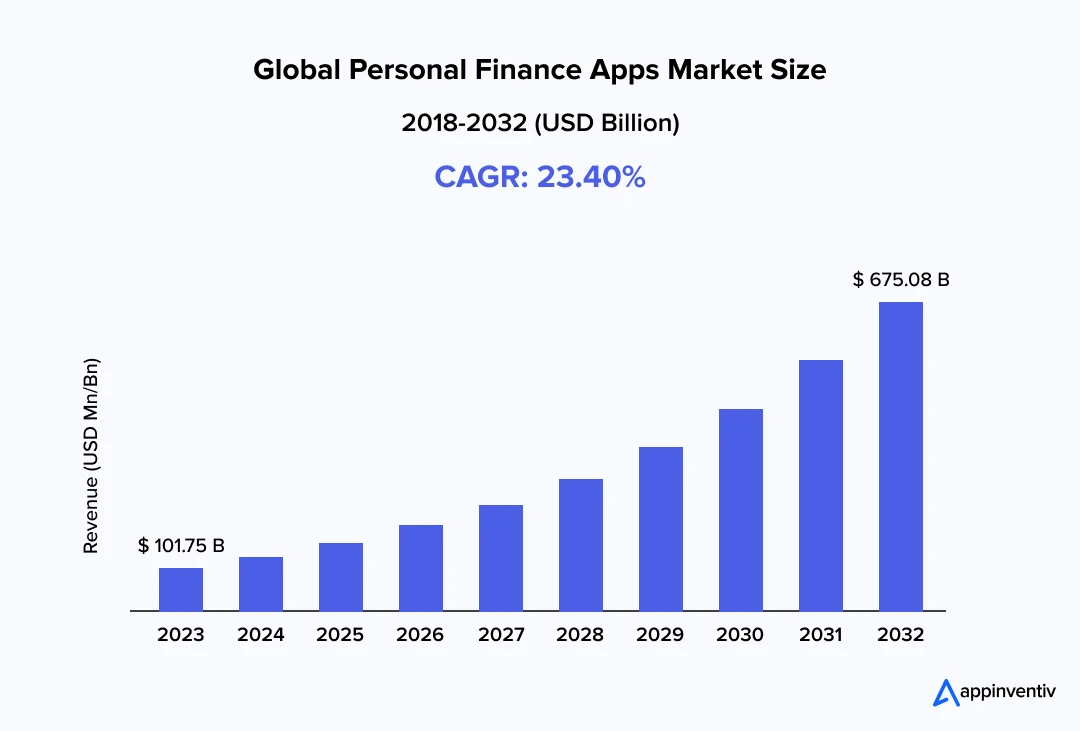

Personal Financial App Market Forecast -2032

The global personal finance apps market was worth around USD 101.75 billion in 2023 and is predicted to grow to around USD 675.08 billion by 2032 with a compound annual growth rate (CAGR) of roughly 23.40% between 2024 and 2032. (Source: Zion Market Research)

Let’s break it down, from features to frameworks, and of course, the dollars you’ll need to spend to bring your idea to life.

Get the no-BS blueprint to stand out and own your share—Build your custom financial app.

How Much Does it Cost to Build a Personal Finance App Like PocketSmith?

The cost to develop a personal finance app like Pocketsmith largely depends on how complex you want it to be. A simple app with basic budgeting features will be far less expensive than a full-blown financial forecasting tool that integrates with dozens of banks, automates categorization, and offers predictive analytics.

Here’s a breakdown of the cost to develop an app like Pocketsmith in Australia by complexity:

1. Basic Personal Finance App

Think simple budgeting, expense tracking, and manual data input.

Cost: USD $50,000–$80,000 | AUD $75,000–$120,000

2. Mid-Range App (PocketSmith-level)

Includes real-time bank feeds, cash flow forecasting, bill reminders, and smart categorization.

Cost: USD $100,000–$180,000 | AUD $150,000–$270,000

3. Advanced Finance App

AI-powered insights, multi-currency support, detailed reporting, investment tracking, and open banking integrations.

Cost: USD $200,000–$300,000+ | AUD $300,000–$450,000+

The final price tag to make a personal finance app in Australia, even after these complexity-defining ranges, will also depend on where your development team is based, the platforms you’re targeting (iOS, Android, web), and how much ongoing maintenance and compliance you need.

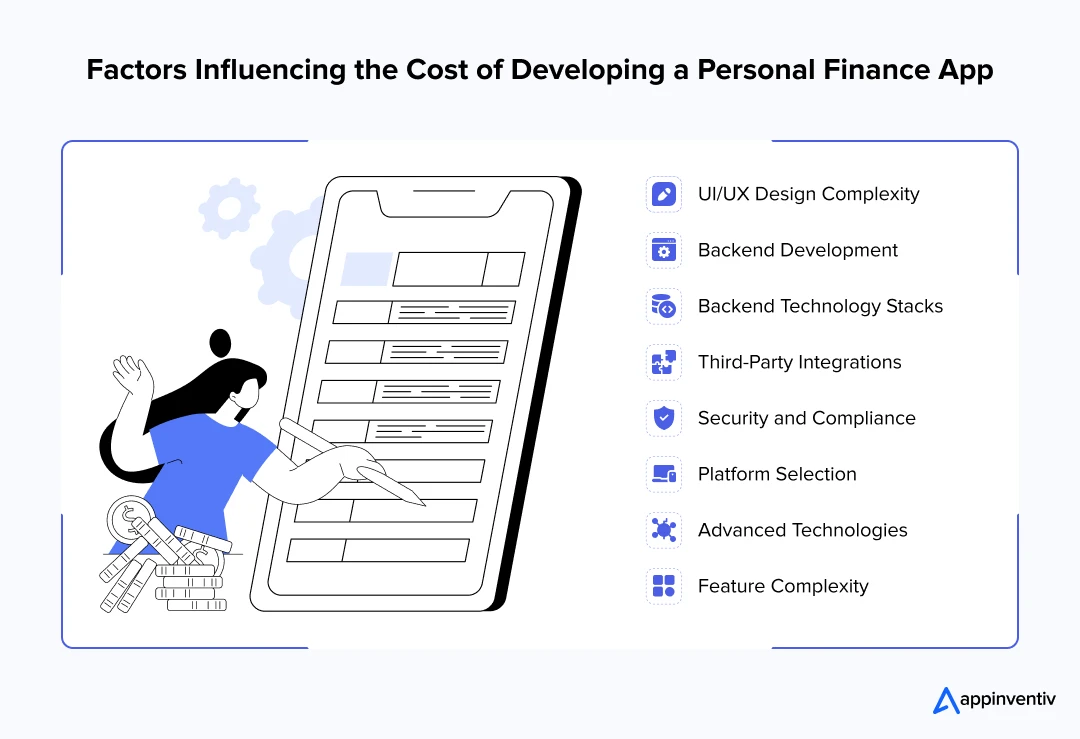

Factors Affecting the Cost to Build a Personal Finance App like Pocketsmith

Several factors impact the cost estimation of developing a personal finance app, ranging from design and technology choices to compliance requirements. Below are the key factors:

1. UI/UX Design Complexity: Creating detailed and easy-to-use designs with custom animations or visuals takes longer to develop and costs more than basic interfaces.

2. Backend Development: Building strong backend systems to handle tasks like user management, data processing, or transactions demands a lot of resources, which raises the overall cost.

3. Backend Technology Stacks: Choosing frameworks like Node.js, Python, or Java has an impact on costs because of differences in scalability required time, and the expertise of developers.

Bonus Read: Java vs Python Who is Winning the Coding Battle

4. Third-Party Integrations: Adding APIs such as those for payment gateways, banking, or analytics like Plaid and Stripe requires licensing fees and extra effort for integration.

5. Security and Compliance: Using encryption, providing secure logins, and following rules like GDPR or CCPA needs experts with specific skills. This increases expenses.

6. Platform Selection: Building apps for Android iOS, or both has an impact on costs because each option takes different tools and effort to complete.

7. Advanced Technologies: Adding tools like AI to give budgeting tips or blockchain to make payments more secure requires special skills. This can raise the overall price.

8. Feature Complexity: Complex features like live tracking automatic budget planning, or analyzing investments take more time and resources to create, which raises the cost.

Can You Lower the Cost to Build an App like Pocketsmith?

With a few strategically planned moves, you can manage the costs better in both the short and long run. Here are a few ways to bring costs down without compromising on the users’ experience:

- Start with an MVP: Focus on essential features for your personal finance software Australia first – budgeting, bank sync, and cash flow tracking. Add advanced forecasting or AI insights later.

- Use third-party APIs: Instead of building everything from scratch, integrate with APIs for bank feeds, categorization, or analytics.

- Leverage cross-platform frameworks: Tools like Flutter or React Native help you build once and deploy to iOS and Android.

- Outsource smartly: Working with experienced mobile app developers in Brisbane, Australia can significantly reduce costs without sacrificing quality.

- Prioritise automation: Use automation in back-end operations (like recurring transactions or categorization) to reduce future maintenance costs.

What are the Must-have Features of an App like Pocketsmith Australia?

Today’s users demand more from personal finance apps than just tracking expenses. They expect intelligent tools that provide clarity, control, and confidence over their money. So if you’re planning to build financial planning software for individuals in Australia, your feature set should go beyond the basics, offering everything from live bank feeds and long-term cash flow forecasting to real-time alerts and AI-powered insights.

These capabilities of Australia personal finance software development not only shape the user experience but also define how useful and sticky your app will be in a crowded market.

Below is a breakdown of the essential features users look for in a modern, well-rounded personal finance app – ones that will help you get the most out of the Pocketsmith-like app development benefits:

Accounts & Transactions

The backbone of any finance app, this feature, when you develop an app like Pocketsmith in Australia, brings transparency and ease to how users view and manage their money.

- Automatic Live Bank Feeds: Through your personal finance app development in Australia efforts, you aim to connect thousands of banks worldwide and pull in transactions in real time to eliminate manual entries.

- Multi-Currency Support: Track assets and liabilities in multiple currencies with automatic daily exchange rate conversions.

Bonus Read: Guide to Currency Converter App Development

- Smart Categorization & Tagging: Automatically classify transactions into relevant categories and allow users to add custom labels and notes.

- Advanced Search Functionality: It lets users instantly locate any transaction using powerful keyword filters and sorting logic.

Budgets & Financial Planning

Planning for the future becomes intuitive when budgeting tools are flexible, visual, and predictive. Adding these features when you develop a personal finance app like Pocketsmith could be the key to unlocking this.

- Interactive Budget Planner: AI for budget management empowers users to build budgets for daily, weekly, or monthly timeframes with visual progress indicators.

- Cashflow Forecasting: Provide future financial projections, often up to 30 or even 60 years, based on current spending and income trends.

- What-If Scenario Testing: Help users simulate life changes like new jobs, loans, or expenses to see long-term financial impacts.

- Calendar-Based Budgeting: Offer a timeline interface where users can schedule bills, incomes, and budgets in a natural, date-focused view.

Reporting & Insights

Numbers only matter when they’re easy to understand; features like the ones we have mentioned below don’t just offer meaningful visualizations of financial data but also help make the personal finance app development like Pocketsmith profitable.

- Custom Dashboards: Summarize all financial activities in one place with flexible, user-defined layouts.

- Income & Expense Breakdown: Generate detailed reports showing how much users earned and spent during any selected timeframe.

- Net Worth Tracker: Give users a clear picture of what they own versus what they owe by tracking loans, mortgages, and assets.

- Cashflow Statement: Automatically display a monthly overview of past and predicted financial activity, broken down by category.

Advanced Features That Drive Engagement

Make your app more than just a ledger. From predictive cashflows to smart alerts and financial forecasting, advanced features of an app like Pocketsmith Australia turn passive users into daily power users.

- Shared Account Access: Allow users to invite family members or financial advisors to collaborate securely within the app.

- Real-Time Notifications & Alerts: Push alerts for low balances, upcoming bills, suspicious activity, or when budgets are exceeded.

- Data Security & Compliance: Ensure the app meets local data protection standards like the Australian Privacy Principles and implements encryption, 2FA, and biometric logins.

- AI-Powered Insights: Optionally integrate an AI layer that offers financial tips, spending analysis, and behavioral nudges based on usage patterns to make yours one of the best personal finance software in Australia.

Real Example: Mudra – AI-Powered Budget Management App

Appinventiv’s AI experts have engineered an AI-powered Chatbot App – Mudra budget management solution. See how AI integration and automation align with advanced financial and banking principles by delivering personalized, efficient, and engaging user experiences:

- Personalized Engagement: Your digital money guide, the AI chatbot, analyzes your spending habits by pulling records from your bank cards. This bot is like your finance buddy, keeping tabs on where your cash goes.

- Smarter Decision-Making: Talking about making clever choices, Mudra uses some smart guessing tricks to figure out how you’ll use your money later, looking at what you did before, and the way you spend. It hands out tips you can use.

- Automation of Budget Monitoring: Automating expense tracking and offering tailored budget insights mirrors CRM’s focus on understanding customer behavior.

Results

Mudra: The Budget Management App turns budget management into a dynamic, user-focused experience. Its success, spanning 12+ countries, reflects this AI-aligned strategy, where technology solves practical problems while forging a trust-based bond with users.

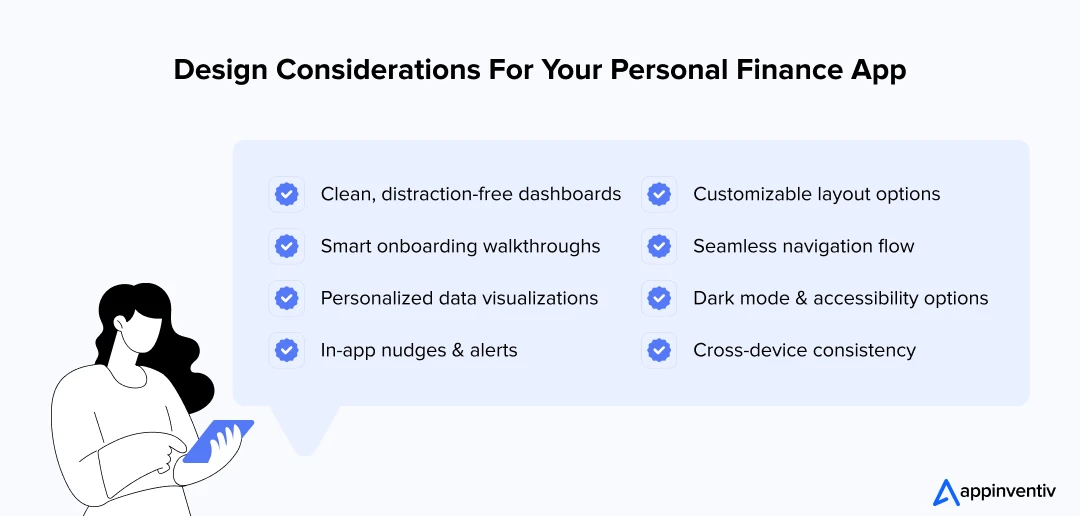

What Design Elements Make a Personal Finance App Stand Out?

If you aim to build a personal finance app that users stick with, design is one area you can’t afford to compromise on. When you make a personal finance app in Australia, it’s not about aesthetics – the right design choices can reduce drop-offs, simplify decisions, and turn casual users into power users. Here’s what to prioritize:

1. Clean, distraction-free dashboards: A finance app must reduce mental clutter. Clear visual hierarchy, color-coded categories, and intuitive icons help users understand their financial state at a glance.

Bonus Read: An Insider’s Guide to Mobile App Design

2. Smart onboarding walkthroughs: First impressions matter. An interactive walkthrough that explains features, syncs bank accounts, and sets budget preferences helps users feel confident right from the start.

3. Personalized data visualizations: Graphs that track spending over time, animated net worth trends, and pie charts breaking down expenses, these give users visual clarity without needing to dig deep. It is crucial to follow the best data visualization practices that delivers results.

4. In-app nudges and alerts: Gentle reminders for overspending, goal milestones, or upcoming bills improve the experience while driving engagement. Keep them subtle, not spammy.

5. Customizable layout options: When you build an app like Pocketsmith, some users would want a calendar view; others might prefer category-focused tracking. Offering layout choices (without overwhelming them) to match the varied needs can help boost user satisfaction.

6. Seamless navigation flow: Users should never be more than two taps away from major functions – like adding a transaction, checking budgets, or viewing reports.

7. Dark mode and accessibility options: Inclusive design isn’t optional anymore. Adding contrast options, font resizing, and dark mode makes your app friendlier for all users.

8. Cross-device consistency: Design consistency across mobile, tablet, and web ensures users don’t have to “relearn” the app every time they switch devices.

Although these design elements may not be overly complex to build individually, together, they elevate the app experience, ultimately improving retention and user satisfaction.

What is the Best Tech Stack For Your Personal Finance App?

Choosing the right tech stack is more than a backend decision—it directly affects your app’s performance, scalability, and long-term costs. Modern Australian personal finance software development typically includes a robust front end, a secure and scalable backend, and databases that can handle sensitive financial data. You’ll also need API integrations for banking data, analytics tools, and real-time currency conversion.

Each layer of this stack comes with its cost implications. Custom-built tools to develop personal finance software Australia are more flexible but require a bigger initial investment. In contrast, third-party tools and plug-ins can reduce time to market but increase monthly recurring expenses.

Striking the right balance between flexibility, speed, and budget is key to ensuring you don’t overspend in the early stages, or outgrow your stack too soon – things that make the cost to build a personal finance app like Pocketsmith a long-term investment.

Frontend (User Interface)

- React Native

- Flutter

- Swift (iOS) / Kotlin (Android)

Backend (Business Logic & APIs)

- Node.js

- Python (Django/Flask)

- Ruby on Rails

Database

- PostgreSQL

- MongoDB

- Firebase Realtime Database

Third-Party Integrations & APIs

- Plaid / Yodlee / Salt Edge – For live bank feeds and financial data aggregation

- Fixer.io / CurrencyLayer – For currency conversion APIs

- Stripe / PayPal – For in-app payments or subscriptions

- Mixpanel / Amplitude – For user behavior analytics

Authentication & Security

- OAuth 2.0 / JWT

- AWS Cognito / Firebase Auth

Cloud & DevOps

- AWS / Google Cloud / Azure

- Docker & Kubernetes

- CI/CD tools (Jenkins, GitHub Actions)

What Does it Take to Develop a Personal Finance App Like PocketSmith?

The steps to build a personal finance app in Australia is a multi-phase journey. From planning to deployment, each stage carries its own time and financial investment. Here’s a clear look at how it unfolds – along with the average costs involved.

Product Discovery & Planning

This is where ideas are turned into strategies. You’ll define user personas, competitor benchmarks, key features, monetization models, and data flows.

Estimated cost:

- USD: $5,000 – $15,000

- AUD: $7,500 – $23,000

UX/UI Design

Your app’s interface needs to feel both intuitive and trustworthy. This personal finance app development process includes wireframes, prototypes, visual design, and user journey mapping.

Estimated cost:

- USD: $8,000 – $20,000

- AUD: $12,000 – $30,000

Frontend & Backend Development

This is where your app comes to life. It includes dashboard creation, data syncing, budget planning tools, forecasting engines, and multi-currency support. The backend involves user authentication, bank API integrations, security logic, and more.

Estimated cost:

- USD: $40,000 – $100,000

- AUD: $60,000 – $150,000

QA & Testing

You can’t afford bugs when it comes to money. This part of the personal finance app development process involves functional, performance, and security rigorous app testing (especially with bank-level encryption standards).

Estimated cost:

- USD: $5,000 – $15,000

- AUD: $7,500 – $23,000

Deployment & Launch

This is your go-live prep stage, covering everything from setting up cloud infrastructure to app store submissions. You’ll also need analytics tools and error monitoring systems.

Estimated cost:

- USD: $3,000 – $10,000

- AUD: $4,500 – $15,000

Post-Launch Support & Updates

This part of the steps to build a personal finance app in Australia – App maintenance and its cost – is not optional. Depending on user feedback, you’ll need regular updates, bug fixes, server monitoring, and maybe new features.

Estimated monthly cost:

- USD: $2,000 – $8,000

- AUD: $3,000 – $12,000

Get a tailored roadmap to launch your finance app—compliant, secure, and market-ready.

The High Price of Misunderstanding Your Users

Too many founders approach personal finance app development like Pocketsmith like a checklist: add bank feeds, sprinkle in charts, throw in AI, and it’ll work. But in the personal finance app space, especially in Australia, what separates fleeting downloads from long-term user loyalty is not how many features you have, but whether they solve real financial pain points.

The Unseen Cost of Wrong Assumptions

Think about it: A budgeting tool built for Gen Z that assumes users are managing multiple credit cards might fall flat, because that demographic is more focused on savings automation and micro-investing.

Or a debt tracker that requires manual input might frustrate older users who expect plug-and-play functionality. Misalignment like this doesn’t just lead to app churn; it quietly drains your budget through rework, support costs, and marketing to replace lost users.

Here’s a hypothetical example to make it more real for you.

An Australian startup spent over $250,000 in cost to build a personal finance app like Pocketsmith with portfolio tracking, tax calculators, and multi-account sync – only to find that early users felt overwhelmed and abandoned it in favor of simpler tools like Pocketbook. A quick round of usability testing early on could’ve saved them six figures.

Market Snapshot: What Users Expect from Personal Finance App Development in Australia in 2025 and Beyond

- Financial Clarity, Not Just Data: With inflation pressure and rising cost of living, users want apps that show why they’re overspending, not just where.

- Personalisation at Scale: Australians increasingly expect tailored recommendations, whether it’s cutting subscriptions or hitting savings goals faster.

- Open Banking Adoption: With the Consumer Data Right gaining traction, apps that offer secure, real-time access to all bank accounts and providers are no longer a luxury; they’re a user expectation.

- Sustainability & Ethical Finance: There’s growing interest in understanding the environmental or social impact of spending. Apps that offer such insights are gaining early traction.

The Future Is User-Driven

A finance app that doesn’t adapt to Australian users’ evolving psychology, habits, and lifestyle won’t survive the next three years. The efforts to develop a personal finance app like Pocketsmith would be a waste unless you realize that user discovery, behavioral data, and regional financial norms aren’t “nice-to-have”, it’s the most critical decision you can make.

Because the scariest cost isn’t overspending on development, it’s launching a product no one needs.

How Appinventiv Can Help You Build a Personal Finance App That Wins

At Appinventiv Australia, our mobile app developers in Brisbane don’t just build apps—they help you build the right one, one that’s not just functionally robust but deeply aligned with user needs, regulatory demands, and the Australian financial landscape. Backed by our digital engineering services, we ensure every application is architected for scalability, resilience, and long-term business value.

Whether you’re starting from scratch or looking to scale an MVP, our team brings experience in fintech, data security, and AI solutions to the table. From integrating live bank feeds and building multi-currency support to crafting predictive budgeting tools and visual dashboards, our experts have done it all.

We go beyond development. Our UX strategists help you uncover user pain points early, our product consultants work with you to prioritize features and eliminate unnecessary spending, and our engineers bring the latest tech stacks—AI-driven categorization, automation, real-time analytics—into your product without compromising compliance.

With over 1,500+ digital products launched globally, including several in regulated industries, we understand the nuances that make or break a finance app and the ways to optimize your cost to build a personal finance app like Pocketsmith. Because we’re grounded in agile delivery, we keep your timeline lean and your budget accountable.

In short, if you’re looking to invest in personal finance app development in Australia that leads to an outcome which feels like it belongs in 2025, not 2015, we’re your ultimate tech partners in making that happen. Just contact us and share your app’s vision.

FAQs

Q. How much does it cost to build an app like Pocketsmith?

A. The cost to build a personal finance app like Pocketsmith can range from USD 150,000 to USD 500,000 (approximately AUD 230,000 to AUD 770,000), depending on feature depth, design quality, integrations (like live bank feeds), and the level of automation and AI included. The cost increases if you want multi-currency support, forecasting, and compliance features immediately.

Q. How long does it take to develop a personal finance app like PocketSmith?

A. You’re looking at a personal finance app development in Australia timeline of 6 to 12 months, broken into design, development, testing, and deployment stages. This could extend if you’re planning for real-time syncing with banks, advanced reporting, or launching across platforms (iOS, Android, and Web) simultaneously.

Q. What are the challenges while developing a personal finance app in Australia?

A. While Australia offers a strong tech ecosystem and a digitally savvy user base, when it comes to the efforts to build an app like Pocketsmith, it comes with its own set of hurdles – some technical, some regulatory, and some strategic.

- Challenge: Regulatory Compliance & Financial Licensing

Solution: Ensure compliance with ASIC and APRA standards

- Challenge: Open Banking Integration Complexity

Solution: Leverage custom workarounds

- Challenges: Data Privacy Expectations Under Australian Law

Solutions: Follow secure cloud architecture and encryption

- Challenge: Fintech Competition & UX Expectations

Solution: User-Centric designs approach and testing cycles

- Challenge: Talent Availability and Hiring Costs

Solution: Choose offshore development partners

Q. What is the future of personal finance app development in Australia?

A. Australia’s open banking reforms and growing demand for financial literacy tools fuel a new wave of personal finance app development like Pocketsmith. Users expect hyper-personalised insights, AI-driven budgeting, voice interfaces, and embedded investment services. The market is becoming less about “just tracking” and more about “intelligent financial decision-making.” With more users shifting away from spreadsheets to smarter apps, the opportunity for founders is immense – but only if they truly understand user pain points and build for long-term engagement.

Q. Can I reduce the cost of building my personal finance app without compromising quality?

A. Yes. Starting with an MVP that focuses on your app’s core differentiator, like forecasting or automated budgeting, can help you go to market faster and at a lower cost. You can also use third-party APIs for bank feeds and budgeting logic in early stages, then replace them with custom-built logic later as you scale.

Q. What compliance considerations should I know when building a finance app in Australia?

A. Personal finance software Australia dealing with financial data must comply with Australian Privacy Principles, ASIC guidelines, and increasingly, Consumer Data Right regulations. If your app connects with bank data, you’ll need robust encryption, audit trails, and likely a long-term compliance roadmap, especially if you plan to scale or expand into other regions.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…