- Why Barclays Stands Out

- Market Performance

- Technology Foundations

- A Comprehensive View of the Costs Involved

- Cost Breakdown by App Complexity

- Costs by Development Stages

- Costs by Region

- Estimating Total Cost

- Time & Effort

- Factors Affecting Barclays-like App Development Cost

- 1. Design Ambition & User Experience

- 2. Backend Complexity

- 3. Third-Party Services & Integrations

- 4. Security Depth

- 5. Compliance Load & Regulatory Buffer

- 6. Team Geography & Labour Economics

- 7. Emerging Technology Choices

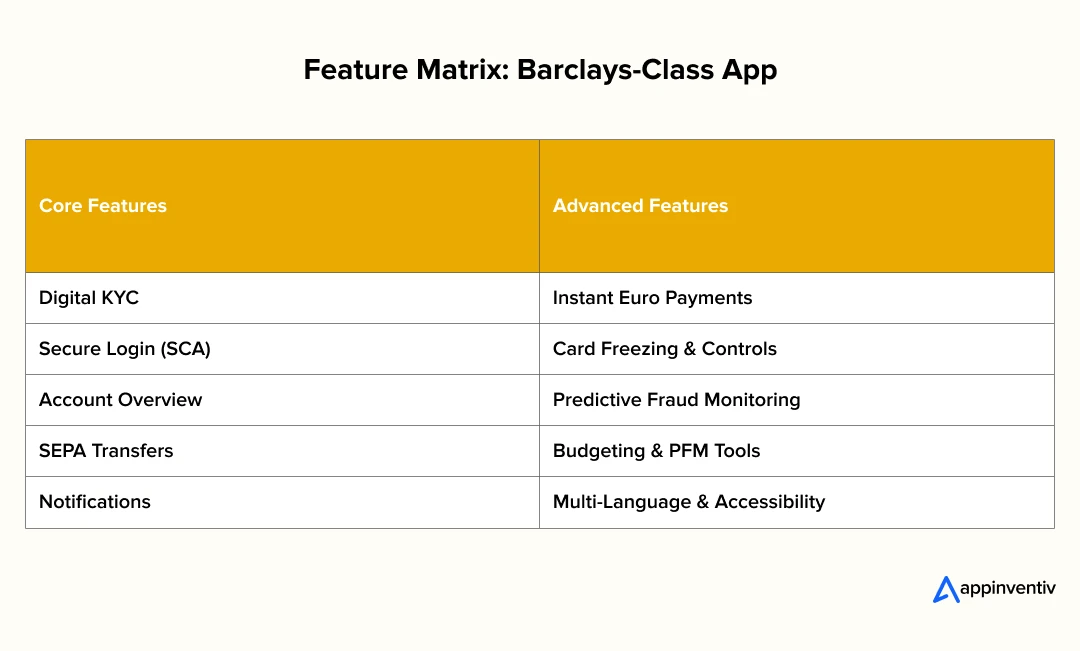

- Features in a Banking App Like Barclays

- Core Features

- Advanced Features

- Hidden & Often Overlooked Costs in Banking App Development

- Compliance Maintenance & Regulatory Change

- Cloud & Outsourcing Oversight

- Marketing & Trust Building

- Legal & Licensing Fees

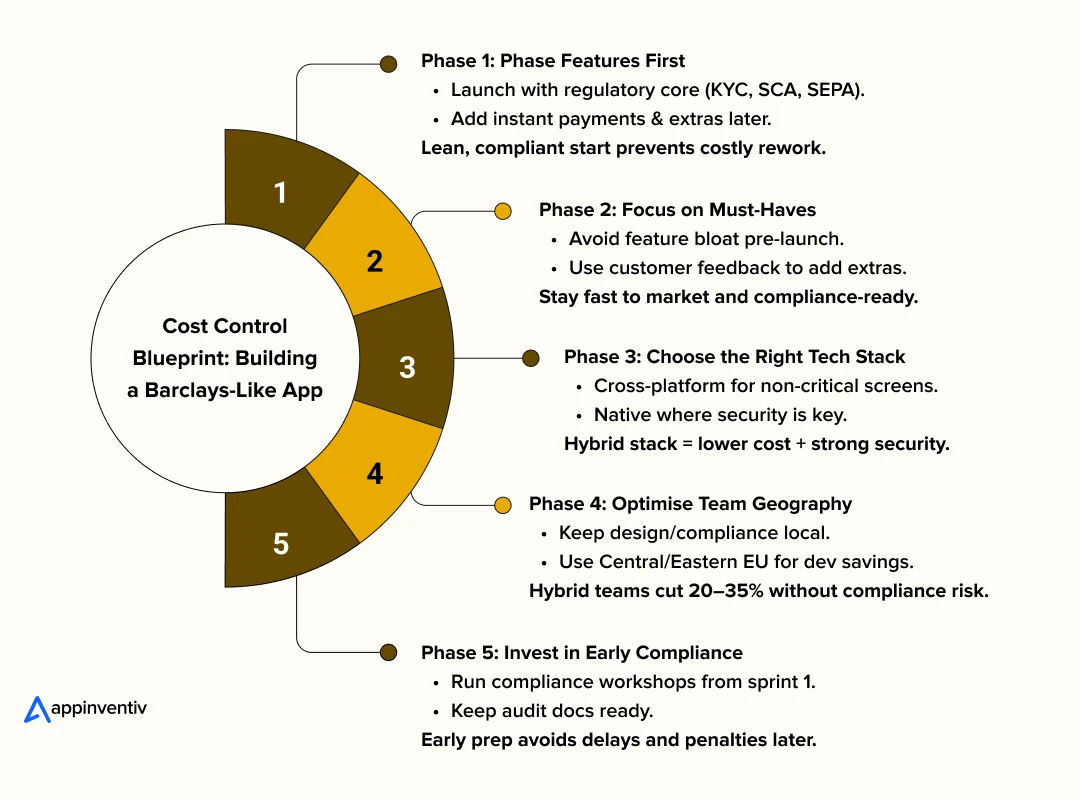

- Practical Strategies to Control and Optimise Development Costs

- Phase Features — Build the Regulatory Core First

- Focus on Must-Haves Before Nice-to-Haves

- Choose the Right Tech Stack

- Optimise Team Geography and Oversight

- Invest in Early Compliance Design

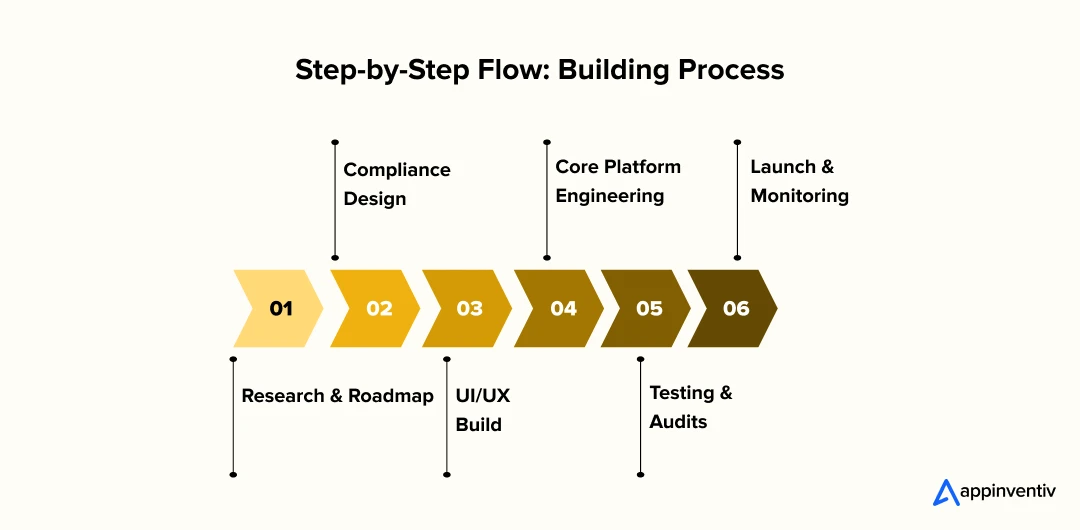

- Building Process of Barclays-like Banking App at a Glance

- 1. Research and Roadmap

- 2. Compliance Design

- 3. UI and UX Build

- 4. Engineering the Core Platform

- 5. Testing and Audits

- 6. Launch and Ongoing Monitoring

- Making It Better Than Barclays

- Faster, Simpler Onboarding

- Frictionless but Safer Authentication

- Smarter Personal Financial Management (PFM)

- Why It Matters

- How Appinventiv Builds Cost-Efficient, Compliant EU Banking Apps

- FAQ’s

- Barclays sets the bar: Its speed, security, and money management tools show what EU users expect from modern banking apps.

- Costs vary a lot: A basic, compliant app can start around $40,000 (≈€30,000), while a feature-rich build can reach $400,000+ or more (≈€298,000+).

- Rules add real work: Meeting PSD2, GDPR, and instant payment rules can add 15–20% to your budget and stretch timelines.

- Where you build matters: Developer rates swing widely across Europe; mixing Western product teams with Eastern engineering can cut spend by 20–35%.

- Surprise costs don’t stop at launch: Staying compliant, updating for new payment rules, and managing vendors or legal checks can become yearly expenses.

- Start lean, grow smart: Launch with the essentials — payments, SCA, SEPA — and add instant transfers or advanced tools once adoption proves the need.

Across Europe, mobile banking has moved from convenience to expectation. Barclays sets a familiar benchmark; a polished app that handles payments in seconds, keeps fraud in check, and treats privacy as a design choice, not an afterthought.

But behind that seamless experience lies a significant digital banking app development cost that product leaders must evaluate before planning their own launch. The question product leaders ask is practical: what would it take, and what would it cost, to build something comparable for the EU market?

Two realities shape the answer. First, payments speed: the EU’s Instant Payments Regulation (IPR) is pushing 24/7/365 instant euro credit transfers, which forces product and infrastructure choices you can’t sidestep. Second, compliance: PSD2’s SCA requirements, GDPR’s DPIA/consent obligations, and DORA’s new operational resilience regime stack up into real engineering, testing, and governance hours long before your first user leaves a review.

In this article we are going to discuss in detail how much it costs to build a banking app like Barclays.

Why Barclays Stands Out

Barclays’ app has become a benchmark because it feels trustworthy and fast. It’s fully PSD2/SCA compliant (multi-factor login, dynamic linking for payments, device binding), offers SEPA credit transfers with a path to instant, and provides personal finance tools like spend insights and card controls, all behind a clean, multi-language UI.

Market Performance

Barclays is one of Europe’s most widely used mobile banking apps, with millions of people logging in each month. It reflects a bigger shift across the continent, over 70% of EU internet users now bank online, and mobile transactions keep climbing every year.

With adoption growing so fast, new players are looking closely at the cost of creating a mobile bank app like Barclays so they can plan budgets that match user expectations and strict regulations.

Technology Foundations

- Open banking APIs to integrate with account and payment services.

- Secure SCA flows to comply with PSD2.

- SEPA payment rails, including readiness for SCT Inst.

- Data privacy controls so customers can manage consent and view data.

These are now table-stakes capabilities for any EU banking or fintech product, and each of them shapes the overall cost of creating a mobile bank app like Barclays.

A Comprehensive View of the Costs Involved

Creating a banking app that meets EU users’ expectations and passes regulatory checks is a multi-layered effort. Understanding the full digital banking app development cost early helps avoid scope creep, missed deadlines, and expensive retrofits when regulators or auditors step in.

| Dimension | Breakdown | Cost (€, $) | Notes |

|---|---|---|---|

| Complexity (MVP) | Digital KYC, SEPA transfers, dashboards | €30k–€80k ($40k–$107k | Fast launch |

| Complexity (Growth) | Instant payments, card controls, fraud alerts | €80k–€150k ($107k–$200k) | Challenger banks |

| Complexity (Enterprise) | PFM, multi-language, AI fraud engines | €150k–€298k+ ($200k–$400k+) | Complete Barclays-Style Build |

Cost Breakdown by App Complexity

Basic MVP (PSD2 + SCA + SEPA): Starts around $40,000–$107,000 (≈€30,000–€80,000)

This is the leanest way to go to market while remaining regulation-compliant. It includes:

- Onboarding and digital KYC: remote identity verification and anti-fraud checks.

- SCA-ready login and payments: multi-factor authentication and dynamic linking for transactions to satisfy PSD2 RTS.

- Standard SEPA credit transfers: reliable euro payments, but without instant settlement.

- Basic dashboards and notifications to cover core user journeys.

It’s ideal if you want to validate the product with a limited feature set while staying inside EU legal boundaries.

Growth Version (Instant Payments, card controls, fraud alerts): Typically costs around $107,000–$200,000 (≈€80,00–€150,000)

Once you move beyond MVP, costs scale quickly. Drivers include:

- Instant payments: supporting SEPA Instant Credit Transfers with 24/7/365 clearing and strict timing rules adds backend complexity and monitoring.

- Card management: freeze/unfreeze, spending limits, virtual cards.

- Fraud detection: risk scoring, anomaly alerts, and integration with anti-money laundering (AML) partners.

- Performance & resilience: higher concurrency, faster ledger updates, better incident response.

This stage typically appeals to fintechs and challenger banks aiming to compete head-to-head with established brands.

Enterprise Grade (Barclays-level features): Can go up to $200,000–$400,000+ (≈€150,000–€298,000+)

This tier is for full market parity and enterprise-scale operations:

- Comprehensive personal finance management (PFM): spending insights, categorisation, goal-setting, budgeting.

- Multi-language and localisation: European customer bases expect German, French, Spanish, etc. with native UX.

- Operational resilience: disaster recovery, redundant hosting, rigorous ICT risk management to align with EBA outsourcing guidance.

- Advanced analytics and AI fraud engines with adaptive SCA flows.

It’s also where regulatory overhead multiplies, you’ll design for audits, incident reporting, and evolving instant payments mandates.

Costs by Development Stages

This stage view makes clear why budgeting just for build is misleading: ongoing compliance and resilience are real, recurring costs, and heavily influence the Barclays app development cost over time.

Costs by Region

Where you build has a huge impact on the cost of creating a mobile bank app like Barclays. Hourly rates and compliance comfort vary greatly across Europe:

- Western EU: €50–€120/h (≈$55–$130/h) — top hubs in Germany, France, Benelux, Nordics. Higher salaries and social charges push totals up but can help with regulatory comfort and proximity to core markets.

- Central/Eastern EU: €30–€70/h (≈$33–$75/h) — Poland, Romania, and the Baltics provide experienced banking engineers at lower hourly rates. Many EU fintechs blend Western product leadership with Eastern engineering to save 20–35% overall, but you must implement EBA outsourcing oversight (vendor registers, exit plans, risk audits).

According to Eurostat, hourly labour costs across the EU ranged from €10.6 in Bulgaria to €55.2 in Luxembourg in 2024, showing how developer salaries and overall build costs can vary by more than five times depending on region.

This is a major reason many companies mix Western product leadership with Central or Eastern European engineering.

Estimating Total Cost

A practical working model:

Total Cost ≈ (Features × Complexity × Team Hourly Rate) + Compliance & Testing Overhead. This formula gives a realistic way to estimate the cost to build a banking app like Barclays before committing budget and resources

- Features – number and depth of banking functions (basic accounts vs instant payments vs advanced PFM).

- Complexity – real-time infrastructure, fraud models, multi-language, cross-platform.

- Team Hourly Rate – strongly tied to region (Eurostat).

- Compliance & Testing – includes PSD2 audits, SCA edge cases, instant payments readiness (ECB), ICT risk programs (EBA).

Add a 15–20% buffer. Regulations evolve: PSD2 exemption changes or future ECB tweaks to instant payments may require adjustments.

Time & Effort

- MVP: about 4–6 months, typically with a small cross-functional team (PM, UX, compliance lead, 4–6 developers).

- Barclays-level: 9–15 months, because of complex integrations, multiple languages, high resilience testing, and stricter go-live reviews

Timeline and effort directly influence the cost to build a banking app like Barclays, since longer development and larger teams quickly raise total spend.

Factors Affecting Barclays-like App Development Cost

Even when two banking apps have the same headline features, their build costs can differ widely. For anyone calculating the cost of creating a mobile bank app like Barclays, these differences often come down to design ambition, compliance scope, and technical architecture.

1. Design Ambition & User Experience

A banking app that simply “works” is cheaper than one that feels polished and localised for EU markets.

- Multi-language support: covering English, German, French, Spanish, or even smaller markets like Dutch and Polish means extra design work. This is not just about translation but layout changes for long words and right-to-left scripts if you plan future expansion.

- Accessibility: meeting EN 301 549 and WCAG standards adds testing cycles and design tweaks (font scalability, voice control support, contrast checks). Although this costs more up front, it broadens your reach and protects you from accessibility-related complaints.

For practical patterns on multi-language layouts and accessible flows, see our guide on revamping user experience in mobile banking apps.

2. Backend Complexity

Payments infrastructure is rarely plug-and-play; how you connect to EU rails defines engineering spend.

- SEPA credit transfers are straightforward batch settlements, but SEPA Instant (SCT Inst) adds always-on availability and second-level confirmation windows. Systems must handle edge cases like instant rejection messages and retry flows, which increases development time and infrastructure spend (ECB).

- Integration with a bank’s core ledger or a licensed Banking-as-a-Service (BaaS) provider also changes cost; direct integration is harder but gives more control.

3. Third-Party Services & Integrations

Adding partners for compliance and user experience speeds development but adds both licence and oversight costs.

- KYC/AML providers: video KYC or biometric identity vendors charge per verification and require API hardening.

- Card issuing & network connections: linking with Visa/Mastercard or local debit schemes adds certification and extra testing rounds.

- Fraud detection: anomaly scoring and AML transaction monitoring mean new data pipelines and model integrations.

Dive into our article on AML software development to understand how backend logic, compliance checks, and integrations drive cost.

4. Security Depth

Under PSD2, security is not optional, it’s the starting point. Focusing on banking app security and compliance early prevents expensive rework and builds user trust from day one.

- Adaptive SCA (Strong Customer Authentication) requires dynamic linking, risk-based exemptions, and device binding.

- Encryption and key management: proper protection for card and PII data adds cloud/HSM (hardware security module) costs and specialist engineering, directly influencing the overall cost of creating a digital banking app.

- Penetration testing: critical for certification; skipping it early means expensive rework later.

5. Compliance Load & Regulatory Buffer

EU fintech is compliance-first; ignoring that inflates cost later. Compliance depth is one of the biggest drivers behind mobile banking app development pricing, since regulations like PSD2 and GDPR compliance force extra design, testing, and audit work.

- Payment initiation and account info services: registering as a PISP/AISP under PSD2 adds legal, security, and audit work (EBA).

- Outsourcing risk: EBA guidance requires vendor registers, risk assessments, and exit strategies. This is process and documentation work that doesn’t appear on user screens but is mandatory.

- Regulatory change: new ECB instant payments requirements or updates to SCA exemptions can shift scope after launch if you didn’t plan buffer time.

6. Team Geography & Labour Economics

Engineering rates vary widely across Europe (Eurostat).

- Western EU: Germany, France, Benelux typically range €50–€120/h (≈$55–$130/h).

- Central/Eastern EU: Poland, Romania, Baltics often run €30–€70/h (≈$33–$75/h).

A hybrid model with product and compliance roles in Western hubs, development squads in the Central/Eastern EU can cut total spend by 20–35%, but still requires compliance oversight per EBA outsourcing rules.

7. Emerging Technology Choices

Innovation can differentiate but also stretch budgets: these technology upgrades are also a big driver of fintech app development cost, especially when balancing speed to market with advanced capabilities.

- AI-driven fraud detection: model training, monitoring, and explainability add complexity but improve security and user trust. But they also increase the overall Barclays-like banking app cost, especially when aiming for enterprise-grade fraud resilience.

- Advanced personal finance tools: predictive budgeting, cash flow forecasting, and goal-based saving require data science capability and strong privacy controls to remain PSD2/GDPR safe.

Features in a Banking App Like Barclays

A true Barclays-level banking experience is built on a blend of regulatory-compliant core functions and advanced, user-focused extras. Understanding the features of a banking app like Barclays helps teams plan what to build now and what to phase in later. Here’s how those features look when broken down.

Core Features

- Registration & Digital KYC: When someone signs up for a new banking app, they want it quick and easy. Digital KYC helps do that by letting people prove who they are right from their phone.

They can scan an ID, the system checks names against sanction lists, and runs anti-money laundering checks quietly in the background. Done well, this keeps fraud out, keeps regulators happy, and stops new users from dropping out halfway through sign up.

- SCA-Secure Login & Payment Authorisation: Security should feel safe but not heavy. Strong Customer Authentication asks users to prove who they are with at least two things. It can be a password and their phone, or their fingerprint and a code.

The app can also change the check based on risk. Small, safe actions can stay simple with just a fingerprint. Bigger or unusual payments might ask for an SMS code or a quick confirmation inside the app.

- Account Overview & Transaction History: This is the dashboard that keeps users coming back daily. It’s not just a ledger of debits and credits; it’s structured to show balances clearly, surface pending or unusual transactions, and allow quick drill-down into details like merchant data, exchange rates, and cross-border fees.

- SEPA Credit Transfers: Core euro payments let users send and receive funds across the SEPA zone. Many teams pair these capabilities with mobile wallet and payment app development to offer seamless tap-to-pay and in-app card controls alongside SEPA transfers.

Advanced Features

- Instant Euro Payments (SCT Inst): Among the advanced features of a banking app like Barclays, instant euro payments (SCT Inst) stand out because they shift the experience from “money in a day or two” to “money in seconds.” It requires a constantly available infrastructure and user-friendly feedback — progress indicators, immediate confirmation, and real-time failure messages if a counterparty bank doesn’t support instant transfers.

- Card Freezing & Spending Controls: Giving customers control over card usage improves both trust and safety. Users can instantly freeze/unfreeze cards if lost, set spending limits per day or merchant type, and enable or disable foreign transactions. These features are also key in reducing fraud disputes and replacement card costs.

- Predictive Fraud Monitoring with Smart Step-Ups: Advanced fraud systems spot unusual activity before customers do. Instead of bluntly blocking a card, they can step up security in context for example, sending a push notification to confirm an unfamiliar transaction or requiring biometric reconfirmation. This keeps customers safe without making the app feel hostile.

- Budgeting Dashboards & Personal Financial Management (PFM): Barclays-style PFM features help users understand and control spending. Expect category breakdowns, monthly summaries, savings goals, subscription tracking, and even nudges to move spare funds to savings. Good PFM design keeps users engaged and increases retention.

- Accessibility & Multi-Language Support: Europe’s diversity means apps should go beyond English. Supporting key EU languages and designing for accessibility (screen readers, adjustable font sizes, colour contrast) widens reach and shows social responsibility. In regulated industries, inclusive design also signals that the institution is customer-centric and forward-looking.

Hidden & Often Overlooked Costs in Banking App Development

When teams plan budgets and look at the cost to build a banking app like Barclays, they usually focus on coding, testing, and UX. But some of the most significant, long-term expenses are not obvious at the start. Ignoring them leads to cost overruns or compliance risk later.

For example, many of the gaps are covered in our “Top 12 FinTech compliance pitfalls” post to help you anticipate hidden regulatory costs.

Compliance Maintenance & Regulatory Change

- Continuous updates: Regulations in Europe are living frameworks. and can raise the cost of creating a mobile bank app like Barclays long after the first launch if you don’t plan for them. PSD2’s Strong Customer Authentication rules evolve; new exemptions or interpretations can require design and code changes.

- Instant payments alignment: The EU’s move to mandatory SCT Inst means your app must stay in sync with infrastructure and cut-off changes — what’s compliant today may require tweaks tomorrow. Our guide on building a payment gateway also touches on compliance updates and infrastructure costs that mirror hidden banking app expenses.

- Operational resilience: Regulators expect ongoing testing and proof that systems can survive outages or cyber incidents. Building for this level of safety has a direct impact on the Barclays-like banking app cost, adding engineering and compliance overhead long after launch.

Impact: Compliance isn’t a one-time check; it’s an annual operating cost that can run into tens of thousands of euros each year.

Cloud & Outsourcing Oversight

- Third-party risk: If you use cloud providers or outsourced developers, you’re responsible for tracking and managing their risk. That means maintaining vendor registers, service-level agreements, and documented exit strategies. To see how integration choices affect long-term costs and risk, check our piece on fintech software integration

- Audits and reviews: External suppliers might trigger additional audit work to prove they meet security and availability standards. These oversight requirements also impact mobile banking app development pricing, especially when balancing vendor savings with regulatory obligations.

Impact: Even if outsourcing saves engineering cost, oversight and risk documentation add an ongoing line item.

Marketing & Trust Building

- App store localisation: Each European market has language and legal nuances like descriptions, screenshots, and privacy blurbs must be adapted for trust and compliance. These brand and trust elements also contribute to the cost to develop a banking app like Barclays, especially for multi-country launches.

- Security & privacy messaging: Communicating clearly about how data is handled and how transactions are protected builds adoption and retention but requires content strategy, copywriting, and updates as features change.

- Reputation management: In regulated industries, ratings and reviews are watched closely; you may need a budget for response workflows and crisis comms.

Impact: Without a marketing and trust plan, acquisition slows and retention suffers, raising long-term user acquisition cost.

Legal & Licensing Fees

- PSD2 authorisation: If you plan to act as a Payment Initiation Service Provider (PISP) or Account Information Service Provider (AISP), you’ll need legal guidance and regulator filings.

- Privacy legal reviews: Beyond technical compliance, privacy teams or law firms may need to review Data Protection Impact Assessments (DPIAs), terms of service, and consent wording.

- Ongoing counsel: Many fast-growing fintechs maintain a small legal budget for changes in payments law or cross-border expansion.

Impact: These costs aren’t huge individually but add up — ignoring them can delay launches and create risk exposure.

Why It Matters

Factoring these elements into your forecast early protects timelines and avoids sudden budget spikes. Many first-time fintech builders assume “done at launch,” but in reality, the run cost of staying compliant and trusted is just as critical as the initial build.

Practical Strategies to Control and Optimise Development Costs

Building a banking app for the EU market does not have to mean runaway spending. Smart planning and sequencing can make budgets predictable and keep compliance under control. But this is only possible if you understand the key factors affecting the banking app development cost early.

Phase Features — Build the Regulatory Core First

- Start lean but compliant: Launch with the essential regulatory and payment foundations such as digital onboarding, Strong Customer Authentication (SCA) and standard SEPA credit transfers. Taking time here to understand the banking app development cost upfront avoids rework and surprise overruns later. Not just that but also helps you test user experience and compliance early.

- Add complexity later: Once adoption and transaction volume justify it, roll out instant payments and other high availability features. This avoids the cost of maintaining always on real time systems before your user base needs them.

Focus on Must-Haves Before Nice-to-Haves

- Avoid feature bloat pre-launch: Features like deep personal finance analytics, advanced card controls or AI driven spend analysis can wait. A tight first release gets you to market faster and limits the number of compliance scenarios you must test.

- User-driven upgrades: Use early customer feedback and analytics to decide which extras bring retention or monetisation value before investing.

Choose the Right Tech Stack

- Cross platform where safe: Frameworks like Flutter or React Native can reduce cost and shorten development time for non critical surfaces such as dashboards and static content. These choices also directly impact the overall Barclays app development cost, especially when balancing speed with long-term compliance.

- Native where security critical: Payments authorisation, biometrics and authentication flows should remain native for stronger device binding and performance. A hybrid approach cuts cost without compromising safety.

Optimise Team Geography and Oversight

- Blend teams for cost efficiency: Keep product design, compliance and architecture close to your core market while using nearshore or offshore EU hubs for engineering. This hybrid approach can help control the European banking app development cost, balancing quality with competitive hourly rates.

- Maintain clear oversight: Even with a hybrid model you need strong processes to manage vendors. Clear service agreements, documented risk controls and contingency plans help keep outsourcing compliant and reliable.

Invest in Early Compliance Design

- Compliance first workshops: Bring legal and compliance experts into the first sprint. Fixing authentication journeys or privacy flows late is costly and may delay launch.

- Audit readiness: Keep documentation, test evidence and risk assessments organised as you build. This preparation prevents last minute scramble when regulators or auditors request proof.

Building Process of Barclays-like Banking App at a Glance

Creating a Barclays-level banking app in Europe is less about rushing into code and more about following a structured, compliance-first roadmap.Think of this as your guide on the cost of developing a banking app as well as a step-by-step approach to avoid costly mistakes. Here each stage adds specific value and protects you from delays or unexpected costs later.

1. Research and Roadmap

Every successful app starts with a clear business case and market understanding. At this early stage, founders often estimate the cost of creating a digital banking app to align scope with budget before design begins.

- Customer and market analysis: Identify your target countries, typical user behaviour, and competing digital banking solutions. Look at what features matter most — fast payments, budgeting, card controls, or language support.

- Regulatory scoping: Check licensing requirements early if you want to act as a payment or account information service provider. Understand the differences between markets; for example, some EU states have stricter interpretations of PSD2 than others.

- Feature prioritisation: Decide on your minimum viable product (MVP) and long-term vision so you can phase development and avoid feature overload.

2. Compliance Design

This stage shapes the app’s skeleton to meet European banking and data protection laws.

- Strong Customer Authentication (SCA) flows: Map login and payment journeys, decide where step-ups will happen, and prepare fallback options for users without biometrics.

- ICT risk controls: Plan how to oversee technology providers, especially if you plan nearshoring or outsourcing. Document vendor dependencies and exit strategies early to avoid compliance gaps later.

- Data privacy measures: Design consent requests, privacy notices, and data minimisation before development starts.

3. UI and UX Build

Design isn’t just about looks, it drives trust and retention. UI and UX decisions also shape the Barclays app development cost.

- Multi-language readiness: Build screens that adapt well to different word lengths and scripts so you can localise easily.

- Accessibility: Ensure the interface supports screen readers, colour contrast needs, and adaptable font sizes.

- Trust by design: Show clear security cues like biometric prompts and explain why certain actions need extra verification without scaring users.

4. Engineering the Core Platform

This is where the architecture is built to meet both user and regulator demands.

- Core banking APIs: Connect to account and payment systems securely, handling balance checks and transaction updates in real time.

- SEPA integration: Build reliable euro payments that work across the Single Euro Payments Area.

- Instant payment readiness: Lay the groundwork for 24/7/365 payments and second-level confirmation once you decide to activate instant transfers.

- Security infrastructure: Encryption, secure storage of keys, and device binding from day one.

5. Testing and Audits

Testing goes beyond functional QA — it’s about proving safety and compliance. These late-stage quality checks can significantly influence the cost to develop a banking app like Barclays, as penetration tests and compliance audits add specialized work.

- SCA scenario validation: Simulate real user journeys, failed payments, and fraud attempts to check risk-based exemptions and step-ups.

- Performance and stress testing: Ensure the app can handle spikes in transactions during paydays or promotions.

- Penetration tests and security audits: Independent assessments help uncover vulnerabilities before regulators or bad actors do.

6. Launch and Ongoing Monitoring

Going live is just the beginning.

- App store readiness: Optimise listings for EU languages and privacy clarity.

- Operational resilience: Track incidents, maintain a clear reporting workflow, and run periodic failover tests.

- Regulatory change updates: Monitor changes to payment rules or SCA exemptions and plan timely updates to avoid compliance drift.

- User feedback loop: Collect reviews and support data to plan your next feature wave while keeping retention high.

These long-term adjustments add to the cost of creating a digital banking app, making post-launch budgeting just as important as pre-launch planning.

Making It Better Than Barclays

Reaching Barclays’ standard is an achievement, but going beyond it is how new entrants stand out. Before aiming higher, it’s essential to understand the banking app development cost tied to advanced features and regulatory safeguards so upgrades don’t derail the budget.

To help you plan better below are a few areas where a fresh digital bank can differentiate and deliver a better user experience while staying fully compliant.

Faster, Simpler Onboarding

- Fewer steps and less friction: Most banking apps still lose users during sign up because of long, confusing flows. Streamlining onboarding into clear, guided steps keeps people from dropping out. For example, combine personal data entry, identity verification and initial account setup into one smooth sequence.

- Smarter document capture: Use optical character recognition (OCR) and live photo checks to extract data from IDs automatically. This cuts typing, speeds up KYC and lowers support calls when a document is rejected.

- Progress indicators and save and resume: Showing clear status bars and letting users pause and continue onboarding helps prevent abandonment.

Frictionless but Safer Authentication

- Behavioural biometrics: Go beyond traditional SCA by adding continuous checks like typing speed, touch pressure or device movement patterns. These create invisible security signals that catch suspicious behaviour without asking customers to re enter codes.

- Adaptive challenges: Instead of one size fits all authentication, adjust the strength of verification to the risk of each transaction. A low risk transfer between a user’s own accounts might need only biometrics, while a new payee or unusual location triggers a stronger check.

- Clear feedback: Make security actions feel reassuring and not intimidating. Use plain, localised language when you ask for extra verification.

Smarter Personal Financial Management (PFM)

- Personalised insights: Move past simple spending categories and show users actionable advice. For example, highlight subscription creep, upcoming bills or savings gaps based on their habits.

- Predictive tools: Offer cash flow forecasting or nudges like “You are on track to overspend this month” or “You could save €100 if you pay your credit early.”

- Goal based saving and investing: Enable flexible goals such as emergency fund, travel or investments and let users automate contributions.

- Contextual education: Blend short financial literacy tips into the experience so users understand choices and trust the platform more.

Why It Matters

These upgrades make the app feel personal, safe and empowering. Faster onboarding increases conversion, smarter authentication builds confidence without slowing transactions and advanced PFM keeps customers coming back. Together, these insights can serve as a guide on the cost of developing a banking app that competes beyond Barclays.

We help you launch right.

How Appinventiv Builds Cost-Efficient, Compliant EU Banking Apps

Building a digital banking platform in Europe isn’t just about great design, it’s about getting compliance right from the start. Every feature, from authentication to consent, affects the overall digital banking app development cost. Regulations like PSD2 and Strong Customer Authentication (SCA) leave little room for error, so planning early makes all the difference. At Appinventiv, our teams design with compliance in mind from the first sprint, mapping privacy flows, audit requirements, and secure integrations upfront. It’s how we keep development on track, reduce rework, and make sure products are ready to launch confidently across EU markets.

This approach allows you to begin with standard SEPA and scale to real-time euro payments when the user base and transaction volume justify it, keeping the cost of creating a mobile bank app like Barclays manageable and future-ready.

As a trusted fintech app development company in the UK, we combine Western EU product strategy with Central and Eastern European engineering to optimise resources safely. Our model follows European Banking Authority ICT risk management best practices so outsourcing remains compliant and low-risk.

By blending local market understanding with cost-efficient development, we help control the overall cost to build a banking app like Barclays while delivering reliable, enterprise-grade results for clients looking for mobile app development service in the United Kingdom and beyond.

Talk to Appinventiv to estimate your EU banking app cost.

FAQ’s

Q. How long does it take to develop a mobile banking app like Barclays?

A. It depends how far you want to go. A simple first version with payments and compliance basics can come together in four to six months if the team is focused. Matching Barclays with fast transfers, personal finance tools, several languages, and rock solid testing is closer to nine months to a year and sometimes a bit longer once regulators review the build.

Q. How much does it cost to develop a banking app?

A. There is no single number. A straightforward app that just meets PSD2 rules might cost around €250k to €400k. Adding things like instant payments, card controls, and better fraud checks can double that. Big builds for established banks with advanced analytics and higher uptime often go past €1M. And remember: it is not one and done. Staying compliant and secure means ongoing yearly spend.

Q. How much does it cost to develop a banking app like Barclays?

A. If you want to match Barclays, expect the starting point to be roughly €30k ($40k) and budgets can easily reach €298k+ ($400k+) or more. The total depends on what you include, how strict compliance needs to be, and where your developers sit. You will also need to plan for updates, security tests, and regulatory changes every year.

Q. What features affect the cost of a banking app?

A. Costs go up when security gets tighter. Things like SCA and GDPR protection take time to do right. Payments also matter because instant euro transfers add complexity compared to standard ones. If you want the app to feel local and inclusive, multiple languages and accessibility add work. Features like money tracking, savings nudges, and smart fraud alerts make the app stronger but increase scope too.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does It Cost To Build a Chat App Like Arattai?

Key takeaways: Creating a chat app like Arattai will cost you anywhere from $40,000 to $400,000, depending on how complex you want it to be. The essential features you need are real-time messaging, multimedia sending, and user authentication. Layering advanced features such as voice/video calls, group messaging, AI-driven bots, and end-to-end encryption takes the app…

How Much Does It Cost to Build a Car Rental App like Hertz?

Key takeaways: The cost to build a Hertz-like app ranges roughly $40,000–$300,000+. Complexity, automation, and scale matter more than just the number of features. Real costs continue after launch: infra, maintenance, support, and compliance. Smart planning and MVP-first approach help keep budgets under control. Revenue comes from rentals, add-ons, subscriptions, partnerships, and fleet sales. You…

How Much Does It Cost to Build a Route Planning App Like Komoot

Europe doesn’t just love the outdoors- it thrives on it. From the Alps to Amsterdam’s bike lanes, cycling and hiking fuel an industry worth $53.3 billion in 2024, projected to grow at nearly 11% CAGR through 2033, as reported by GrandViewResearch. And leading this charge is Komoot, the route-planning app trusted by 40+ million users.…