- Capital Structure Trade-Offs Enterprises Must Weigh in 2026

- Imperatives of Investments in Technology that Enterprises Cannot Ignore in 2026

- Artificial Intelligence and Automation: High CAPEX, Long Horizon

- Cloud Infrastructure Modernization: OPEX-Heavy but Scalable

- Cybersecurity: Non-Negotiable, Compliance-Driven

- Sustainability and Green Tech: Linked to ESG Financing

- The Capital and Tech Matrix Mapping Financing Models to Technology Priorities

- The Capital and Tech Matrix at a Glance

- Why Does This Matrix Matters

- How to Balance Risk, Governance, and Regulation in 2026?

- The Forward Look

- A Strategic Playbook for Enterprises in 2026

- How Appinventiv Helps Enterprises Maximize ROI?

- Structuring Capital as a Tech Enabler

- FAQs

- Strategic capital structuring is essential to fund innovation without sacrificing financial stability.

- Each tech investment, like AI, cloud, cybersecurity, and sustainability, requires a tailored financing approach.

- Misalignment between capital structure and tech strategy can stall growth or strain margins.

- Hybrid and structured financing models help enterprises balance risk, control, and agility in 2026.

In 2026, enterprise leaders find themselves at the intersection of capital structuring and technology investments. On one side, volatile global markets push CFOs toward cautious financing. On the other side, in most boardrooms, tech leaders are clear: AI, cloud, cybersecurity, sustainability – the investments can’t be delayed.

But here’s the bind. Wait too long, and rivals outpace you. Move too aggressively, and balance sheets start to strain, so much that according to PwC’s 2024 Cloud & AI Business Survey, 63% of organizations they classified as “Top Performers” in cloud and AI said their budgets would increase by 6% or more in their next planning cycle.

This is why the importance of capital structuring and technology investments has become a boardroom priority. The right enterprise capital structuring strategy is no longer just about balancing debt and equity. It’s about enabling transformation while protecting margins. An ill-timed debt raise could limit agility in downturns, while excessive equity dilution might erode control just as digital bets begin to pay off.

At the same time, the future of enterprise technology financing demands a new lens. Today’s projects aren’t side experiments; they are the backbone of competitiveness. The benefits of capital structuring and technology investments show up in ways leaders can measure: accelerated digital adoption, improved compliance, and stronger resilience against market shocks. But so do the risks. Misaligned technology investment planning for enterprises often results in stalled rollouts, budget overruns, and missed regulatory expectations.

For many boards, the real question is no longer whether to spend – it is how to link enterprise capital structuring strategy with an Enterprise technology investment strategy 2026 that can adapt to shifting markets. The challenge is bigger than financial engineering. It’s about designing a tech structure that can sustain innovation, fund growth, and handle regulation all at once. In short, leaders must see capital structuring for digital transformation as a strategic lever, not a compliance checkbox.

Through this lens, the article explores the use cases of capital structuring and technology investments, highlighting both successes and failures. We’ll examine how conservative models differ from aggressive ones, what risks in technology investments enterprises should weigh, and the future trends in enterprise capital structuring that every leader must track.

Most importantly, we’ll break down practical steps to link financing models with real enterprise IT and tech investments so that the enterprise capital structuring strategy is more than theory – it becomes the foundation for action.

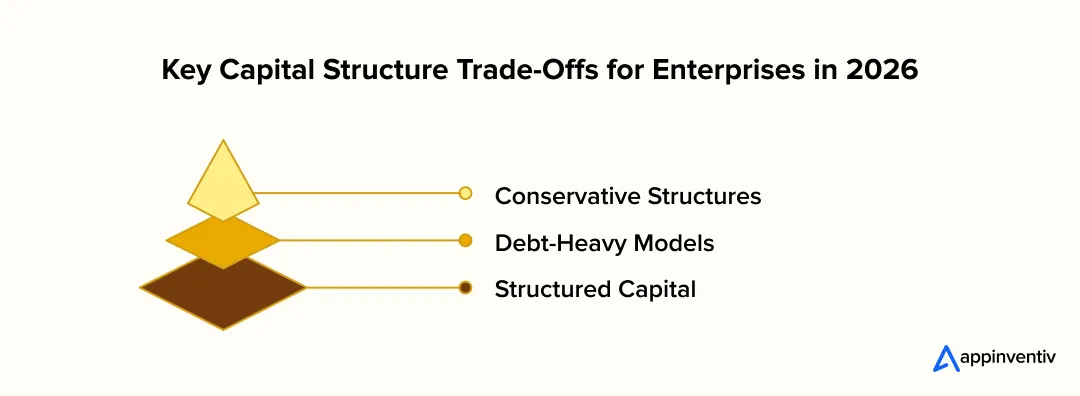

Capital Structure Trade-Offs Enterprises Must Weigh in 2026

Every enterprise entering 2026 faces the same crossroad: how to balance growth ambitions with financial discipline. Capital structuring is no longer just about optimizing the balance sheet – it shapes whether organizations can innovate, scale, or survive shocks. The wrong decision can slow digital adoption, while the right one can accelerate an entire digital transformation.

Conservative Structures

Enterprises that adopt conservative models – low leverage, reliance on internal cash flows – minimize downside risk. Playing it safe shields profits when markets swing and keeps governance simple. But the cost shows up quickly: initiatives like generative AI or large green infrastructure programs struggle to get the backing they need. You keep stability, but momentum slips.

Debt-Heavy Models

Debt-driven strategies look attractive when capital is cheap. Tax shields, predictable repayments, and access to quick liquidity can support aggressive enterprise IT and tech investments. But high debt loads limit flexibility in downturns. If AI or cloud programs take longer to generate ROI, repayments can squeeze margins and delay innovation. For boards, this makes debt-heavy models both an enabler and a limiter.

Structured Capital

Structured instruments – convertible bonds, mezzanine financing, securitized assets – are emerging as the bridge between risk and growth. These forms of enterprise capital structuring strategy allow companies to secure funding without full equity dilution and without over-leveraging debt.

For instance, securitization has been used to finance green data centers, while mezzanine deals have fueled AI-driven acquisitions. Structured plays are complex, but they are becoming central to capital structuring for innovation.

The reality is clear: each model carries a different technology impact on businesses. Conservative structures protect today’s stability, debt-heavy models unlock tomorrow’s expansion, and structured approaches balance both. For leadership, the trade-off in 2026 isn’t only financial. It is strategic – the enabler or limiter of digital transformation itself.

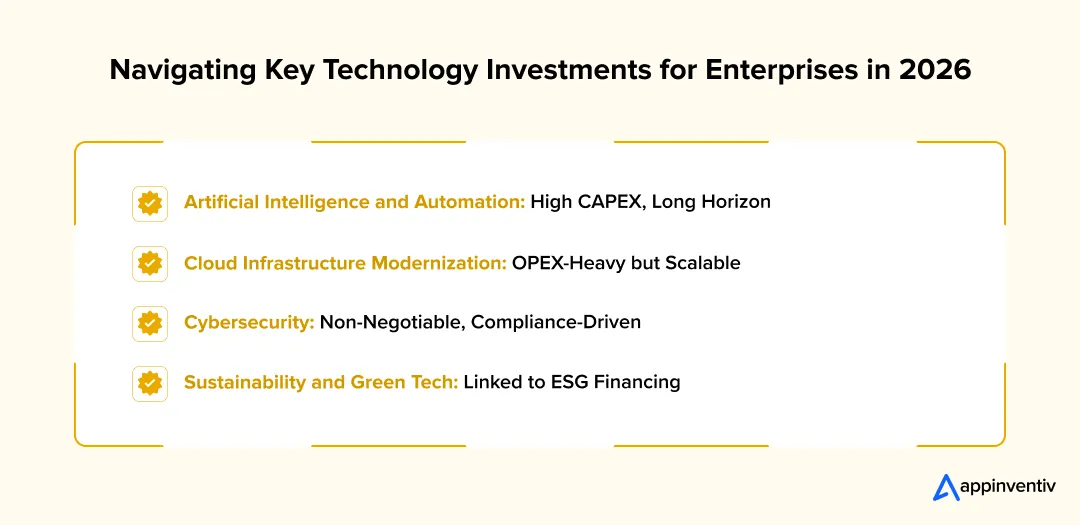

Imperatives of Investments in Technology that Enterprises Cannot Ignore in 2026

The coming year will not be defined by whether enterprises invest in technology, but by where and how much. Each category of spend carries its own financing profile – some demand heavy upfront capital, others create recurring operational costs. Gartner forecasts global IT spend to reach US $5.61 trillion in 2025, up 9.8% from 2024, so for boards shaping an Enterprise technology investment strategy 2026, understanding these differences is essential for aligning capital structuring and technology investments with growth.

Artificial Intelligence and Automation: High CAPEX, Long Horizon

AI programs – from large language models to automation platforms – require significant upfront spend on infrastructure, talent, and training datasets. Yes, the returns come – but not overnight. That delay puts finance teams under pressure to balance today’s margins with tomorrow’s edge. Companies sticking with conservative capital structures often end up underfunding these projects, while debt-backed approaches can speed adoption if leaders are clear-eyed about ROI timelines.

Also Read: Harnessing AI for Business Transformation: A Comprehensive Guide

Cloud Infrastructure Modernization: OPEX-Heavy but Scalable

With cloud adoption, IT no longer means pouring money into capital-intensive servers – it’s now pay-as-you-go. That flexibility is valuable, but it also makes costs unpredictable. The technology impact on businesses here is two-sided: leaders get agility, but unless there’s tight technology investment planning for enterprises, operating expenses can quickly erode margins.

Hybrid capital strategies often prove most effective in balancing flexibility with control.

Cybersecurity: Non-Negotiable, Compliance-Driven

In regulated industries, cybersecurity is not optional. Budgets for defense, monitoring, and compliance tools must be secured regardless of the financing model. Here, the benefits of capital structuring and technology investments are clear – a well-designed enterprise capital structuring strategy ensures that compliance-driven investments remain insulated from budget cuts, protecting both reputation and financial standing.

Also Read: Top 10 Cybersecurity Measures for Businesses

Sustainability and Green Tech: Linked to ESG Financing

Sustainability efforts – from green data centers to renewable-powered supply chains – are no longer optional. Investors increasingly tie them to ESG-linked loans and track them against public commitments. The catch is that these projects require heavy upfront CAPEX. The reward, however, is long-term resilience and reputational strength. Companies that align capital structuring for digital transformation with ESG-linked financing often find better access to capital and stronger customer trust.

The takeaway is straightforward – every tech priority carries its own financial DNA. AI leans toward CAPEX-heavy models, cloud shifts spending into OPEX, cybersecurity relies on steady governance budgets, and sustainability thrives when matched with ESG-linked capital. For leadership, the importance of capital structuring and technology investments lies in building financing strategies that support innovation instead of suffocating it.

Also Read: How AI, IoT, and AR/VR Technologies are Helping Companies Achieve their Sustainability Goals

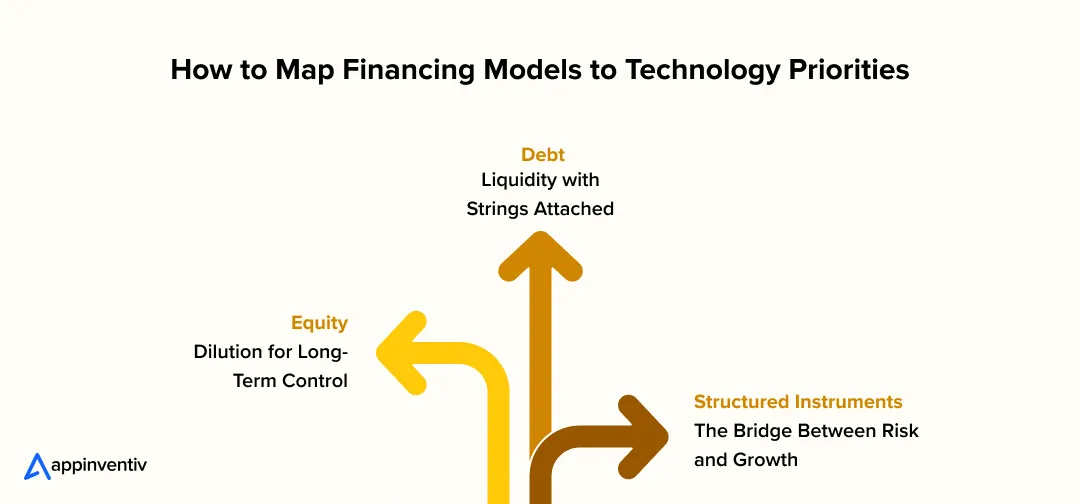

The Capital and Tech Matrix Mapping Financing Models to Technology Priorities

In 2026, the debate is not only about how much to spend on digital, but which enterprise capital structuring strategy aligns with the right tech priorities. Equity, debt, and structured instruments each carry unique implications. When leaders weigh capital structuring and technology investments, they need a clear lens to see how financing choices enable or constrain innovation.

Equity – Dilution for Long-Term Control

- Best fit: High-CAPEX programs like enterprise AI or next-gen automation.

- Trade-off: Equity raises fund massive initiatives but dilute board control. Still, for long-horizon bets, it aligns with patient capital.

Debt – Liquidity with Strings Attached

- Best fit: Cloud modernization, cybersecurity upgrades.

- Trade-off: Predictable repayments and tax shields help, but downturns can turn debt from leverage into a limiter.

Structured Instruments – The Bridge Between Risk and Growth

- Best fit: Sustainability projects and AI-driven acquisitions.

- Trade-off: More complex to arrange, but mezzanine and securitization models are proving essential for capital structuring for innovation. They enable scale without the extremes of pure equity or heavy leverage.

The Capital and Tech Matrix at a Glance

| Tech Category | Equity Financing | Debt Financing | Structured Capital |

|---|---|---|---|

| AI & Automation | Strong fit: funds infra + R&D; dilution trade-off | Possible but ROI pressure if adoption is slow | Used selectively for AI-driven M&A or partnerships |

| Cloud Modernization | Overkill; equity too costly for recurring OPEX | Strong fit: predictable OPEX suits debt service | Rare; only for multi-cloud expansion deals |

| Cybersecurity | Works when compliance stakes justify equity | Strong fit: non-negotiable spend → debt efficient | Used for sector-wide consortia funding compliance tools |

| Sustainability | Equity fits ESG reputation but dilutes ownership | Debt possible, but limited for long ROI horizons | Best fit: securitization + ESG-linked instruments |

Why Does This Matrix Matters

This matrix illustrates the use cases of capital structuring and technology investments. For enterprises, it’s not about “which model is cheaper.” It’s about which model sustains growth without creating financial bottlenecks.

- Equity fuels moonshots like AI but reshapes governance.

- Debt supports non-negotiables like cybersecurity, but with repayment risks.

- Structured capital provides flexibility for projects tied to ESG or innovation.

In short, the future of enterprise technology financing depends on how well leaders map tech priorities to funding realities. Misalignment risks stalling innovation; alignment unlocks resilience and growth.

How to Balance Risk, Governance, and Regulation in 2026?

Every board knows that capital structuring and technology investments don’t exist in a vacuum. They sit inside a governance framework shaped by regulators, investors, and markets. In 2026, that lens is sharper than ever. The cost of ignoring risk, as any IT consulting services provider will tell you, is not just financial penalties – its reputational damage, restricted access to capital, and stalled transformation.

Compliance and Data Sovereignty

As enterprises roll out AI and cloud at scale, regulators are tightening rules around data residency, explainability, and consumer rights. For leaders, this means structuring capital with enough buffer to fund compliance upgrades. An enterprise capital structuring strategy that underfunds governance risks failed audits or costly retrofits.

ESG and Sustainability-Linked Financing

Capital markets are rewarding firms that can prove sustainability. Green bonds, ESG-linked loans, and securitized financing for renewable infrastructure are no longer optional. The technology impact on businesses here is direct: those who integrate ESG into their capital structuring for digital transformation gain cheaper access to capital and stronger investor trust.

Governance in Technology Investments

Strong governance is not only about compliance. It’s about ensuring that enterprise IT and tech investments align with strategy. Boards are increasingly demanding proof of ROI, scenario modeling, and transparent reporting before approving AI or cloud spend. The risks in technology investments become magnified without clear governance guardrails.

The Forward Look

The future trends in enterprise capital structuring will be driven by regulation and governance. We can expect more scrutiny on AI explainability, sustainability-linked financing to dominate debt markets, and investors rewarding enterprises that are able to connect financial discipline with digital accountability.

For leaders, the takeaway is simple – governance is not a barrier to growth, it is the foundation that will make growth sustainable. Those who embed risk management and compliance into their Enterprise technology investment strategy 2026 will find capital easier to raise – and innovation easier to scale.

A Strategic Playbook for Enterprises in 2026

By 2026, enterprises can’t afford to separate capital structuring for digital transformation from technology planning. The leaders who succeed will be the ones who use scenario modeling, adopt hybrid capital strategies, and phase investments so innovation is funded without weakening financial stability.

Scenario Modeling

Boards should test how different structures affect long-term tech adoption. What’s the importance of capital structuring and technology investments when debt markets tighten? How does an equity-heavy model impact an AI rollout? Running these simulations ensures you see risks before they show up in financial statements.

Hybrid Capital Strategies

Enterprises rarely thrive with a single funding route. Equity absorbs shocks, debt accelerates, and ESG-linked financing unlocks sustainability bets. A hybrid model gives you options, no matter how markets shift, and keeps technology investments for enterprises aligned with growth.

Phased Technology Investments

Phasing matters. Spreading out AI, cloud, or cybersecurity programs allows you to prove ROI before scaling. It’s a disciplined way to keep technology impact on businesses positive without exposing cash flow to sudden strain.

Decision Checklist for Leaders

- Does the capital structure match the investment horizon of the tech?

- Are we phasing spending in a way that preserves resilience?

- Do we have governance baked into financing from day one?

- What’s the exit strategy if a technology bet underperforms?

How Appinventiv Helps Enterprises Maximize ROI?

Appinventiv is not a financier – and we don’t pretend to be. Where we bring value is by aligning technology roadmaps with the capital realities enterprises face. As an IT consulting services partner, we’ve worked with global organizations that had ambitious transformation plans but struggled to match them with the right financing windows. By pacing investments, sequencing rollouts, and embedding governance into every stage of delivery, we’ve helped them realize returns without overstretching balance sheets.

Our strength lies in offering enterprise software development services that are tailored to each industry’s compliance, scalability, and operational requirements. For some clients, that has meant structuring AI adoption in phases so it matched board-approved CAPEX budgets. For others, it has meant re-architecting cloud platforms so operating costs didn’t spiral out of control.

What makes enterprises trust us isn’t just technical delivery. It’s that we operate like a partner – transparent about risks, realistic about timelines, and committed to outcomes that hold up under both financial and regulatory scrutiny. In other words, we don’t just build solutions; we help you maximize ROI by ensuring your technology investments work within the capital structures you have chosen.

Structuring Capital as a Tech Enabler

By 2026, enterprises that treat capital structuring as “just finance” will find themselves constrained. The real winners will be those who view it as a lever to unlock technology – from AI and cloud to cybersecurity and sustainability. The importance of capital structuring and technology investments lies in enabling innovation without eroding resilience.

The message is clear: capital choices aren’t abstract balance-sheet maneuvers. They decide how fast you can scale, how well you comply, and how confidently you compete. Enterprises that align financing with digital priorities will not only weather volatility – they’ll lead.

At Appinventiv, we help leaders close this gap by pairing deep technical expertise with an understanding of financial realities. Our role isn’t to sell financing models, but to ensure your technology investments for enterprises deliver measurable ROI within the structures you’ve chosen.

If you are planning your 2026 roadmap, now is the time to explore how to integrate capital structuring with digital transformation. Connect with our team now.

FAQs

Q. Why invest in the technology sector?

A. The short answer is growth. Companies that hold back usually end up spending more later just to catch up. Think AI, cloud, cybersecurity – these are not nice-to-haves anymore, they are what keep an enterprise competitive.

Q. What is capital structure in technology investment?

A. In practice, it’s just the way you fund your tech bets. Some boards lean on equity, others take on debt, and many mix the two. The goal is to modernize – whether that’s cloud migration or AI pilots – without putting financial stability at risk.

Q. Can you give an example of capital structure in tech investments?

A. A good one is banking. We’ve seen banks use debt financing to overhaul cybersecurity quickly, while keeping equity aside for longer-term AI research. In manufacturing, ESG-linked loans often cover green infrastructure while equity is used for cloud adoption.

Q. What risks do enterprises face if capital structure and tech strategy are misaligned?

A. What usually happens is either stalled innovation or financial strain. Underfund tech, and competitors outpace you. Take on too much debt, and margins suffer. Misalignment often shows up as delays, cost overruns, or projects that never deliver ROI.

Q. How does governance influence technology investment decisions?

A. Governance is the guardrail. Without it, boards end up surprised by things like hidden cloud licensing costs or regulators pushing back on AI bias. With it, both the capital structure and the tech program stay aligned with enterprise priorities.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Why Choose Managed IT Services in Dubai - Benefits, Cost, & ROI

Key Takeaways Managed IT services in Dubai replace reactive support with structured, SLA-driven IT operations, improving uptime, response times, and governance. The cost benefit of managed IT services is clearer when measured through TCO, helping reduce IT operational costs in the UAE without adding long-term staffing risk. Compliance-ready services in the UAE are essential, as…

Why Appinventiv Stands Out as the Leading Tech Consulting Provider for Digital-First Enterprises

Key takeaways: Appinventiv operates as a strategic partner, not just a service provider, focusing on business outcomes and ROI before technology. Success stories with global brands like KFC, IKEA, Adidas, etc., prove we tackle complex, enterprise-grade projects and deliver real results. Our capabilities span from AI-powered product building and cloud upgrades to custom software creation,…

Staff Augmentation vs In-House Hiring: Which Is the Better Model for Your Business?

Key takeaways: Cost Efficiency: Staff augmentation is less expensive when used in short-term projects, in contrast to in-house recruitment Scalability: Staff augmentation is swift at scaling teams, whereas in-house teams can be restricted Specialized Talent: With Augmentation, niche talent can be brought on at short notice; in-house is a long-term culture delivery mechanism. Control vs.…