- What Go to Market Risk Actually Looks Like Inside Enterprises

- Common organizational blind spots before launch

- How internal alignment issues quietly amplify market risk

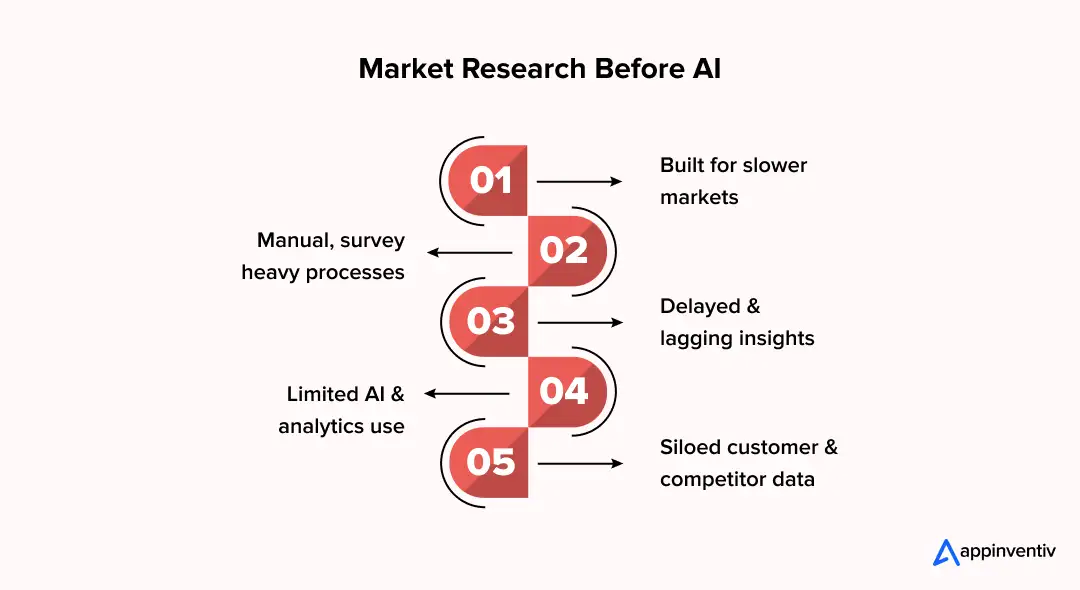

- Current State Of Market Research Before AI Adoption

- Generative AI And Simulated Societies In Market Research

- How AI Reframes Product Market Research From Validation to Risk Detection

- Why AI Alone Is Not Enough Without Consulting Context

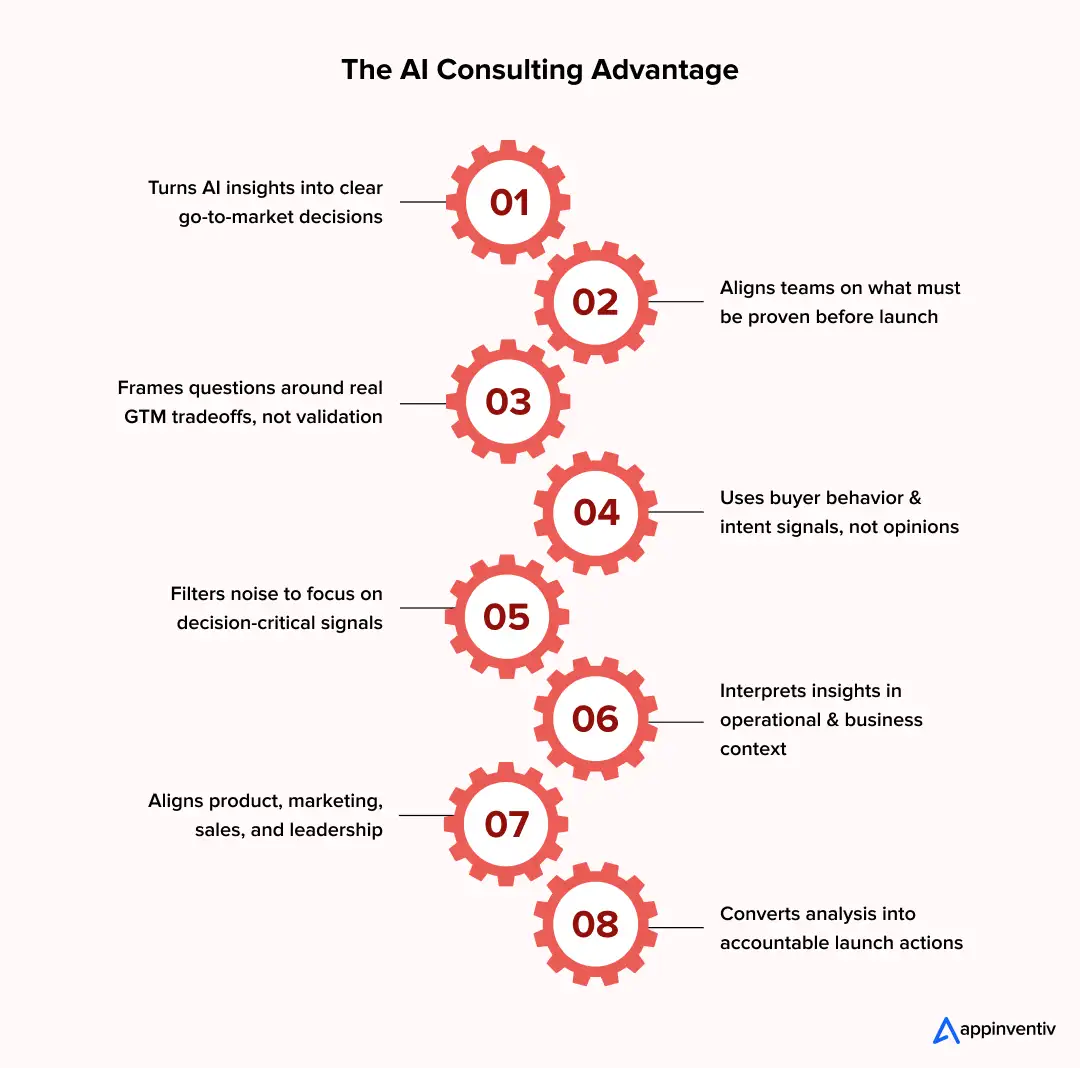

- The AI Consulting Advantage: Turning Market Signals Into GTM Decisions

- Hypothesis first, modeling second

- Decision led question design

- Data sources grounded in real buyer behavior

- Signal weighting and noise filtering

- Business context interpretation

- Cross functional alignment before action

- Turning insight into committed decisions

- Key Market Risks AI Consulting Helps Identify Before Launch

- Demand risk

- Pricing risk

- Positioning risk

- Timing risk

- Competitive risk

- Channel and adoption risk

- How AI De-risks Each Phase of the Go-to-Market Lifecycle

- Before Building: Pressure Testing Assumptions Early

- Before Launch: Shaping Smarter GTM Choices

- After Launch: Detecting Friction Before Revenue Declines

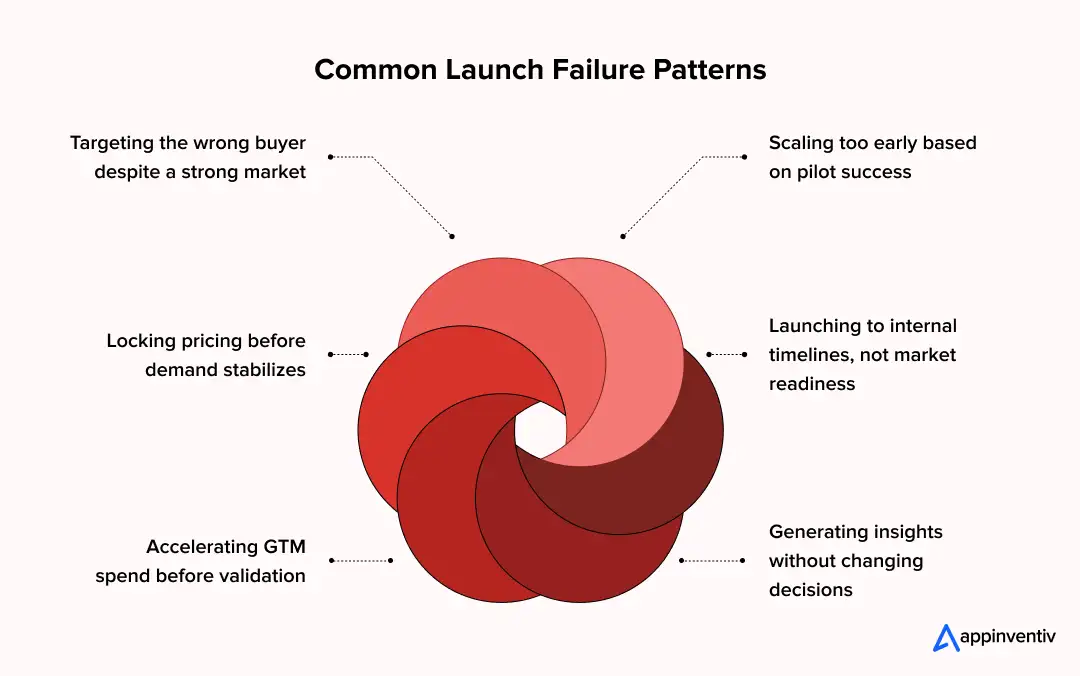

- Common Launch Failure Patterns AI Consulting Helps Prevent

- When The Market Is Right, But The Buyer Is Wrong

- When Early Traction Is Mistaken For Scale Readiness

- When Pricing Decisions Lock Too Soon

- When Launches Follow Internal Calendars, Not Market Readiness

- When GTM Spend Accelerates Ahead of Validation

- When Insights Exist, But Decisions Do Not Change

- Responsible Use Of AI In Market Research

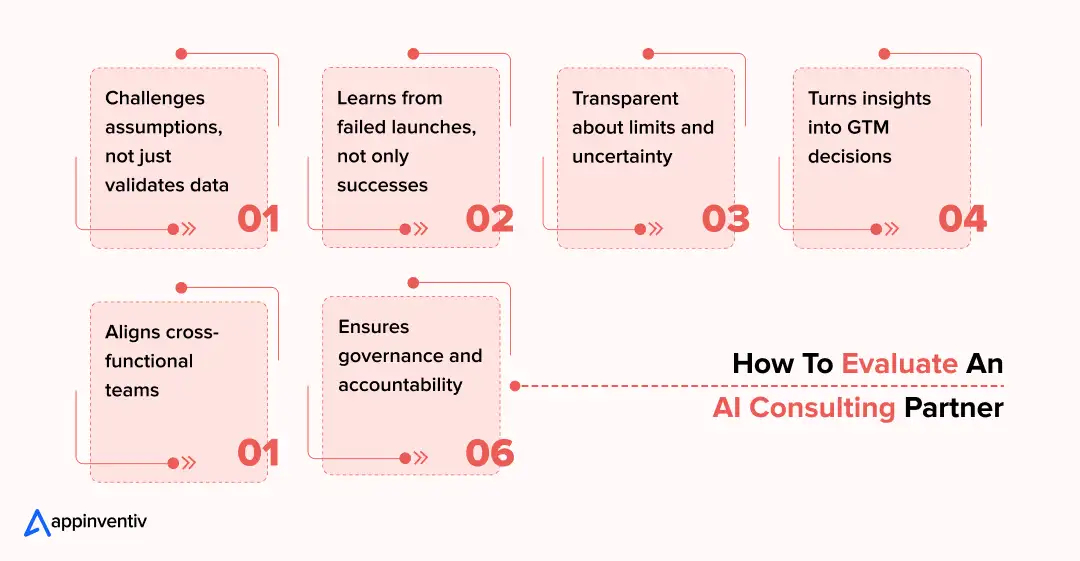

- How To Evaluate An AI Consulting Partner For GTM Risk Reduction

- Ability To Challenge Assumptions, Not Just Confirm Them

- Experience With Failed Launches, Not Only Successful Ones

- Transparency Around Limitations And Uncertainty

- Ability To Translate Insights Into GTM Actions

- Experience Working Across Cross-Functional Teams

- Governance, Accountability, And Decision Ownership

- Industry Impact And Future Outlook For Market Research

- What Enterprises Typically Discover in the First 30 Days of AI-Led Market Research

- How Appinventiv Applies AI To Reduce Go-to-Market Risk

- FAQs

Key takeaways:

- Most product launches fail because market assumptions break under real conditions, not because the product itself is weak.

- Go-to-market risk accumulates through small, rational decisions that compound when assumptions are never challenged early.

- AI transforms market research from plan validation into continuous detection of demand, pricing, and positioning risks.

- AI insights reduce launch risk only when combined with consulting judgment that aligns teams and guides real decisions.

- Enterprises using AI-led market research gain stronger launch confidence by identifying risks early and avoiding costly post-launch corrections.

Launching a new product often looks straightforward on paper. The roadmap is clear, the research decks are approved, and teams feel confident about the opportunity ahead. Yet in practice, many launches fall short not because the product was poorly built, but because early assumptions about the market did not hold up once real buyers entered the picture.

McKinsey’s recent work on growth and scaling highlights this gap clearly, especially in how AI market research is used to validate early assumptions. Even when companies believe they have achieved product market fit, a large majority struggle to scale successfully beyond the initial launch phase. The issue is rarely execution alone. It is usually timing, positioning, pricing, or demand signals that were misunderstood or surfaced too late. These gaps quietly erode momentum long before performance metrics make the problem obvious.

This is where organizations are rethinking how they approach early validation. Instead of treating research as a one time checkpoint, leading teams are using AI for market research to continuously test assumptions as markets evolve. When combined with AI consulting for product market research, this approach helps teams surface risk earlier, align decisions across stakeholders, and enter go to market planning with fewer blind spots. That shift sets the foundation for reducing launch failure before budgets, timelines, and expectations are locked in.

What Go to Market Risk Actually Looks Like Inside Enterprises

Go-to-market risk rarely shows up as a single, obvious failure. In most organizations, it builds quietly through a series of small decisions that seem reasonable in isolation. Each assumption feels defensible. Together, they compound into launch exposure that only becomes visible after momentum is already lost.

GTM risk usually accumulates through:

- Assumptions validated too early and never revisited

- Market signals interpreted without context

- Internal confidence growing faster than external proof

This is where many launches drift from strategy to guesswork, highlighting the need for AI for go-to-market risk mitigation.

Common organizational blind spots before launch

Most enterprises do not lack data. They lack shared clarity.

Typical blind spots include:

- Confusing interest with real buying intent

- Relying on limited pilot feedback as proof of scale readiness

- Treating historical success as a proxy for current market demand

- Underestimating how pricing sensitivity shifts across segments

These gaps often survive internal reviews because no single team owns the full picture.

How internal alignment issues quietly amplify market risk

Product, marketing, sales, and leadership often operate with different versions of “the market.” Each team optimizes for its own goals, using different inputs and timelines. Over time, these misalignments widen the gap between strategy and execution.

What this looks like in practice:

- Product teams build for a buyer marketing cannot clearly target

- Sales teams receive positioning too late to shape early conversations

- Leadership commits budgets before risks are fully surfaced

This is why AI for market research becomes most valuable when paired with cross functional alignment. And why AI consulting for product market research plays a critical role in connecting signals across teams, not just generating insights.

Also Read: AI in Risk Management: Key Use Cases

Current State Of Market Research Before AI Adoption

Before AI became embedded into decision-making, most organizations followed well-established market research processes. These approaches were structured, familiar, and widely accepted, but they were built for slower markets where customer behavior and competitive dynamics changed gradually. As markets accelerated, these methods began to show clear strain.

At a practical level, traditional research relied heavily on manual execution and delayed feedback loops. Teams depended on slow surveys, third-party recruiting, and predefined panels to gather inputs. Insights often arrived weeks or months after data collection began, which meant decisions were already underway by the time findings were reviewed.

Key limitations of the pre-AI research model included:

- Limited use of ai and machine learning beyond basic analysis

- Early, fragmented use of AI-powered surveys without scale

- Poor integration across technology and analytics stacks

- Siloed customer insights and competitor insights

These structural gaps explain why traditional research struggled under modern go-to-market pressure. The shift toward AI and generative AI did not replace market research, but addressed its core constraints before they translated into launch risk.

Generative AI And Simulated Societies In Market Research

Generative AI is expanding market research beyond traditional human panels by enabling simulated societies built from generative agents. These systems allow teams to explore consumer behavior at scale without relying solely on slow or biased samples.

Key capabilities include:

- Generative agents powered by large language models and multimodal models

- AI-moderated research using ai-native survey platforms and autonomous video interviews

- Retrieval-augmented generation (RAG) to ground outputs in real customer and competitor data

- Agent chaining that models peer influence and interaction patterns across groups

At scale, enterprises can run generative agent simulations of 1,000 people or more to test pricing, positioning, or feature changes before launch. Persistent memory architectures allow agents to retain context across interactions, making simulated societies useful for observing how sentiment and adoption may evolve over time.

In practice, these approaches complement traditional research rather than replace it:

- Enable faster scenario testing without third-party recruiting

- Reduce dependence on biased panels and lagging insights

- Support early risk detection before go-to-market commitments are locked

Used responsibly, generative AI helps teams explore “what-if” scenarios and surface second-order effects early. The goal is not prediction, but better preparation before market risk becomes costly.

How AI Reframes Product Market Research From Validation to Risk Detection

Product market research has traditionally been used to confirm decisions that teams already want to make. AI changes that role. Instead of asking research to provide proof, organizations now use AI for market research. This includes integrating AI chatbots for market research, to find-out uncertainty early and highlight where assumptions may not hold.

This shift changes the purpose of research:

- From confirming demand to testing whether demand is fragile

- From validating messaging to spotting confusion and resistance

- From one time approval to continuous signal monitoring

That reframing is what makes AI-driven product market research fundamentally different from traditional approaches.

At scale, machine learning in market research, supported by AI agents for market research, allows teams to analyze patterns across thousands of data points that humans cannot realistically connect. Behavioral signals, competitive movements, pricing responses, and sentiment shifts begin to form a clearer picture when viewed together. AI does not replace judgment, but it widens the lens through which risk is evaluated.

What matters most are not the loud signals, but the quiet ones. Small drops in engagement, inconsistent intent across segments, or early friction in positioning often appear long before revenue metrics react. These weak signals are easy to dismiss. With Predictive market intelligence, they become early indicators of go to market risk that teams can act on while change is still possible.

Also Read: Cost to Build an AI Agent: A Complete Guide

Why AI Alone Is Not Enough Without Consulting Context

AI can process enormous volumes of data, but AI for go-to-market risk mitigation requires context and judgment. Problems arise when teams start treating AI outputs as final answers instead of informed inputs. Dashboards look precise, models appear confident, and assumptions go unchallenged. This is where false certainty enters go-to-market planning.

Common risks when AI is used in isolation include:

- Taking correlations as proof of demand

- Overreacting to short term signals without context

- Applying insights uniformly across markets that behave differently

Without interpretation, speed becomes a liability rather than an advantage.

Another issue lies in how questions are framed. AI models reflect the assumptions built into them. When inputs are vague, biased, or incomplete, outputs follow the same path. Poor framing can amplify blind spots instead of revealing them, especially in early stage market analysis.

This is where AI consulting for product market research becomes essential. Consulting brings structure to the problem before models are applied and judgment after results appear. It helps teams connect signals to real decisions, align insights across stakeholders, and ensure that AI for market research supports strategy rather than driving it blindly.

The AI Consulting Advantage: Turning Market Signals Into GTM Decisions

The difference between insight and impact sits in how signals are framed, which is why [ADD: AI consulting for product validation] plays a critical role. AI consulting adds that decision layer, ensuring outputs lead to clear go to market choices rather than interesting but unused analysis.

Hypothesis first, modeling second

Before any AI model runs, consulting teams align stakeholders on what must be proven or disproven.

Key steps include:

- Identifying assumptions that could break the launch if wrong

- Prioritizing risks by business impact, not curiosity

- Defining what action each possible outcome should trigger

This discipline keeps AI for market research focused on decisions, not exploration.

Also Read: Executive Guide to AI Predictive Analytics & Growth

Decision led question design

Poor questions produce misleading confidence. Consulting helps structure questions that reflect real GTM tradeoffs.

This involves:

- Separating signal discovery from confirmation bias

- Testing willingness to change behavior, not just stated preference

- Designing prompts and inputs that expose friction early

It reduces the risk of treating AI outputs as validation.

Data sources grounded in real buyer behavior

Opinions are easy to collect. Behavior is harder and more reliable.

Effective AI-driven product market research draws from:

- Search and engagement patterns that indicate intent

- Competitive pricing moves and response elasticity

- Channel level interactions across the buying journey

- Early usage signals from pilots or adjacent products

This is where machine learning in market research delivers value at scale.

Signal weighting and noise filtering

Not every signal deserves equal attention. Consulting teams help rank relevance, often using AI agents for market research to continuously monitor signal strength.

They assess:

- Which signals are leading versus lagging

- Which patterns repeat across segments and regions

- Where anomalies reflect noise rather than opportunity

This improves confidence without oversimplifying complexity.

Business context interpretation

AI outputs must fit the reality of how the organization operates.

Consulting interpretation considers:

- Operational readiness at launch

- Sales and marketing enablement gaps

- Regulatory or compliance exposure

- Budget and timeline constraints

Without this layer, strong signals can still lead to poor execution.

Cross functional alignment before action

Insights fail when teams act on different versions of the truth.

Consulting ensures:

- Product, marketing, sales, and leadership see the same signals

- Tradeoffs are discussed before commitments are made

- GTM plans reflect shared priorities and constraints

This alignment is what allows AI consulting for go-to-market strategy to reduce risk in practice.

Turning insight into committed decisions

The final advantage is accountability.

Consulting translates analysis into:

- Clear launch recommendations

- Defined success and failure thresholds

- Agreed decision checkpoints post launch

That is how AI-powered market research consulting moves from analysis to execution, and why it consistently outperforms tool only approaches.

Key Market Risks AI Consulting Helps Identify Before Launch

Market risk rarely shows up in isolation, which is why product launch risk reduction using AI focuses on early signal detection. It appears as a mix of weak signals that are easy to overlook when teams are optimistic about a launch. AI consulting for product market research helps surface these risks early, while there is still room to adjust strategy, scope, or timing.

Demand risk

Early interest often gets mistaken for real demand. Page views, demo signups, or positive feedback, including responses captured through AI chatbots for market research, can feel encouraging, but they do not always translate into buying behavior.

AI helps teams:

- Separate curiosity from intent by analyzing behavioral depth, not surface engagement

- Detect drop-off patterns across the funnel that indicate hesitation

- Identify segments that look promising on paper but consistently fail to convert

This is a critical step in de-risk product launch AI initiatives, especially in crowded or emerging categories.

Pricing risk

Pricing decisions are often locked too early and revisited too late. Traditional research struggles to capture how price sensitivity shifts across segments and contexts.

With AI for go-to-market strategy, teams can:

- Understand willingness to pay across different buyer cohorts

- Identify pricing thresholds where demand drops sharply

- Spot pricing cliffs before launch instead of after churn begins

This reduces the chance of launching with a price point that limits adoption or erodes margin.

Positioning risk

Clear positioning inside the organization does not guarantee clarity in the market. Messaging that makes sense internally, even when tested through AI chatbots for market research, can confuse buyers or fail to stand out.

AI-driven analysis supports:

- Testing whether messaging resonates or creates friction

- Identifying gaps between product narratives and buyer expectations

- Detecting early signs of misinterpretation across channels

These insights strengthen AI-driven product market research by focusing on comprehension, not just awareness.

Timing risk

Markets can be aware of a problem without being ready to act on it. Launching too early or too late both carry significant risk.

AI helps teams:

- Recognize when awareness has not yet translated into urgency

- Track external signals that indicate readiness to adopt

- Avoid launches driven by internal deadlines rather than market conditions

This is where Predictive market intelligence becomes especially valuable.

Competitive risk

Competitor behavior often shifts quietly before it becomes visible in market share.

AI-based analysis helps uncover:

- Emerging competitors that traditional scans miss

- Subtle changes in competitor pricing or packaging

- Saturation signals that reduce differentiation at launch

This strengthens AI-based competitive market analysis before commitments are made.

Channel and adoption risk

Even strong products can fail if channels are misaligned.

AI consulting can reveal:

- Mismatch between buyer behavior and chosen channels

- Friction in onboarding or early usage signals

- Differences between pilot success and scaled adoption

By identifying these risks early, AI for market research moves from validation to prevention, helping teams enter go-to-market planning with fewer blind spots and more confidence.

How AI De-risks Each Phase of the Go-to-Market Lifecycle

Go to market risk evolves over time, especially in AI market research for new product launches where assumptions shift quickly. It does not appear all at once, and it cannot be addressed with a single research checkpoint. AI for market research plays a different role at each phase of the lifecycle, helping teams make fewer irreversible decisions too early.

Before Building: Pressure Testing Assumptions Early

This phase is where the highest leverage decisions are made, making AI product validation consulting especially valuable. AI helps teams slow down commitment using AI for demand forecasting and market sizing before budgets are locked.

Key ways risk is reduced when addressing pre-launch validation challenges:

- Stress testing demand assumptions before development budgets are locked

- Evaluating whether interest signals reflect urgency or passive curiosity

- Identifying markets or segments that are better delayed, deprioritized, or avoided

With AI consulting for product market research, early insights prevent teams from investing heavily in markets that are not yet ready.

Before Launch: Shaping Smarter GTM Choices

As launch planning begins, AI shifts from validation to optimization. The focus moves toward how to enter the market with fewer blind spots.

AI supports this phase through predictive analytics for go-to-market strategy by:

- Refining positioning using behavioral and engagement signals

- Comparing competitive movement to spot saturation or whitespace

- Scenario testing different pricing, timing, and rollout paths

This is where AI consulting for go-to-market strategy helps teams make tradeoffs explicit instead of implicit.

After Launch: Detecting Friction Before Revenue Declines

Post launch signals often appear quietly. Early adoption friction, uneven engagement, or channel mismatch can surface long before revenue reflects a problem.

AI helps teams:

- Detect friction signals across cohorts and channels

- Separate short term noise from structural adoption issues

- Guide rapid iteration without chasing every data fluctuation

With Predictive market intelligence, organizations gain the confidence to adjust direction early, while recovery is still possible and learning is still affordable.

Common Launch Failure Patterns AI Consulting Helps Prevent

Launch failures tend to follow familiar paths. They do not look dramatic at first. They look reasonable, incremental, and justified at every step. AI consulting for product market research helps break these patterns by intervening early, before they harden into irreversible decisions.

When The Market Is Right, But The Buyer Is Wrong

Many teams correctly identify a growing market, yet build and position the product for the wrong decision maker. Usage looks promising, feedback sounds positive, but purchasing stalls.

Why this happens

Internal personas often reflect assumptions, not real buying behavior.

How AI consulting addresses it

With the help of machine learning in data labeling, AI analyzes behavioral and intent data across roles to distinguish users, influencers, and economic buyers. Consulting then aligns product scope and GTM messaging to the roles that actually drive purchase decisions.

When Early Traction Is Mistaken For Scale Readiness

Pilots succeed. Early adopters engage. Leadership assumes the product is ready to scale.

Why this happens

Small sample success hides friction that only appears at volume.

How AI consulting addresses it

AI detects repeatability gaps by comparing early engagement patterns with broader market behavior. Consulting teams help teams pause, refine, and retest before committing to aggressive expansion. This is a core benefit of de-risk product launch AI initiatives.

When Pricing Decisions Lock Too Soon

Pricing is finalized early to support forecasts, sales enablement, and launch messaging.

Why this happens

Traditional research struggles to capture how price sensitivity shifts across segments and competitive contexts.

How AI consulting addresses it

Using AI for market research, teams model willingness to pay across cohorts and simulate pricing response under different scenarios. Consulting ensures pricing remains flexible until demand signals stabilize.

When Launches Follow Internal Calendars, Not Market Readiness

Launch dates are often driven by board meetings, funding milestones, or roadmap commitments.

Why this happens

Market readiness is harder to defend internally than fixed deadlines.

How AI consulting addresses it

Through predictive market intelligence, AI surfaces signals around urgency, adoption readiness, and competitive timing. Consulting translates those signals into evidence leadership can act on, even if that means delaying or phasing a launch.

When GTM Spend Accelerates Ahead of Validation

Marketing and sales investments ramp up quickly after initial success.

Why this happens

Teams assume momentum will fix unresolved positioning or adoption issues.

How AI consulting addresses it

AI highlights fragile traction versus durable demand. Consulting helps stage GTM investment based on signal strength, protecting budgets while improving long term outcomes.

When Insights Exist, But Decisions Do Not Change

Research is completed, shared, and archived. Execution continues unchanged.

Why this happens

Insights are delivered as reports, not decision frameworks.

How AI consulting addresses it

Consulting connects AI outputs directly to go to market choices, tradeoffs, and checkpoints. This ensures AI for market research actively shapes decisions instead of passively informing them.

Responsible Use Of AI In Market Research

Responsible AI is not a side consideration in AI market research initiatives. It directly affects decision quality, leadership confidence, and long term go to market outcomes. When AI is applied without discipline, it can introduce new risks instead of reducing existing ones.

- Managing Bias In Data And Models: Bias most often enters through data selection rather than model design. Overreliance on historical or narrow data sets can reinforce outdated assumptions and hide emerging segments. For AI for market research to remain reliable, teams must regularly review data sources, test for imbalance, and validate signals across multiple inputs.

- Ensuring Explainability For Leadership Trust: Insights only drive action when leaders understand how they were formed. Black box outputs slow decision making and creates hesitation at critical moments. Explainable analysis helps leadership see tradeoffs, question assumptions, and align cross functional teams around shared reasoning. This is essential when AI consulting for product market research informs high impact GTM choices.

- Why Ethical Shortcuts Become GTM Risks Later: Shortcuts taken early rarely stay contained. Bias, weak governance, or unclear accountability often surface during scale, when course correction is hardest. Ethical gaps can distort pricing, positioning, and market selection, turning compliance issues into real GTM risk. Responsible use of AI for market research protects credibility as much as outcomes.

Also Read: How to Reduce Bias in AI Models

How To Evaluate An AI Consulting Partner For GTM Risk Reduction

Choosing the right AI consulting partner is less about technical capability and more about how effectively they reduce uncertainty before launch. A strong partner improves decision quality, not just analytical output. The evaluation should focus on how they challenge thinking, learn from failure, and communicate limits clearly, especially when evaluating enterprise product launch validation services.

Ability To Challenge Assumptions, Not Just Confirm Them

A credible partner does not treat existing plans as fixed inputs. They question how conclusions were reached and where confidence may be premature.

What to look for:

- Willingness to question demand assumptions and target segments

- Comfort pushing back on internally accepted narratives

- Ability to reframe problems before modeling begins

- Clear linkage between insights and the decisions they should influence

In AI consulting for product market research, this mindset is essential to prevent analysis from becoming a validation theater.

Experience With Failed Launches, Not Only Successful Ones

Understanding why launches fail is more valuable than showcasing why they succeeded. Failure experience sharpens risk detection.

Signals of real experience:

- Familiarity with common GTM breakdown patterns

- Ability to identify early warning signs before scale

- Practical understanding of how optimism masks weak signals

- Examples of how course correction was enabled, not just outcomes achieved

This experience strengthens de-risk product launch AI efforts by focusing on prevention, not postmortems.

Transparency Around Limitations And Uncertainty

AI driven insights lose credibility when presented as certainty. Trust is built when limitations are clearly acknowledged.

A strong partner demonstrates transparency by:

- Explaining data gaps and confidence ranges openly

- Clarifying what AI can inform versus what requires judgment

- Avoiding overprecision in forecasts and recommendations

- Helping leadership understand tradeoffs, not just outputs

When AI for market research is applied responsibly, uncertainty becomes manageable rather than hidden.

Ability To Translate Insights Into GTM Actions

Insights only reduce risk when they change decisions, supported by predictive analytics for go-to-market strategy. Many partners stop at analysis, leaving internal teams to interpret what should happen next. This gap often turns strong signals into delayed or diluted action.

What strong partners demonstrate:

- Clear linkage between insights and GTM choices such as pricing, timing, and positioning

- Defined decision paths tied to specific signals

- Ability to support AI consulting for go-to-market strategy beyond dashboards

- Practical recommendations that account for execution constraints

This is where AI-driven GTM strategy for enterprises moves from theory to applied decision making.

Experience Working Across Cross-Functional Teams

Go-to-market risk rarely sits within one function. It emerges where product, marketing, sales, and leadership interpret signals differently. Partners who cannot navigate this complexity often fail to reduce real risk.

Signs of cross-functional maturity:

- Experience aligning product strategy with GTM execution

- Ability to tailor insights for different stakeholder priorities

- Comfort resolving conflicts between speed, scope, and certainty

- Proven experience in b2b product launch ai consulting environments

This capability ensures AI for market research informs shared decisions instead of creating fragmented interpretations.

Governance, Accountability, And Decision Ownership

AI-led insights lose value when ownership is unclear. Without governance, assumptions persist unchecked and decisions drift away from evidence over time.

What to expect from credible partners:

- Clear definition of who owns decisions informed by AI

- Structured checkpoints to revisit assumptions post launch

- Transparency around model updates, data refresh cycles, and confidence shifts

- Alignment with enterprise AI consulting for product strategy standards

Strong governance ensures product launch risk assessment AI remains an ongoing discipline, not a one-time exercise.

Industry Impact And Future Outlook For Market Research

AI is changing how market research shows up inside organizations. It is no longer something teams look at after decisions are mostly made. In many cases, it now shapes conversations while product and go-to-market choices are still open.

Where the impact is most visible:

- With AI in product development teams are testing product concepts earlier, before scope and timelines harden

- Marketing teams are answering positioning questions with evidence, not instinct, and improving content creation speed

- UX research is becoming continuous, informed by real behavior instead of periodic studies

- Customer service signals are feeding directly into customer insights, not staying siloed

What is also shifting is how insights move across the business:

- Research insights are being integrated into strategy, distribution, and operations

- Teams spend less time waiting for reports and more time acting on signals

- Decisions happen closer to real market conditions, not past snapshots

Looking ahead, the role of market research will keep expanding:

- Research teams will work closer to product and strategy leaders

- Competitive advantage will come from how well insights are used, not how much data is collected

The future of market research is less about producing outputs and more about influencing decisions in real time. Organizations that treat insights as a shared asset, rather than a separate function, will adapt faster as markets change.

What Enterprises Typically Discover in the First 30 Days of AI-Led Market Research

In the first few weeks of applying AI-led market research with consulting oversight, enterprises rarely uncover “new ideas.” What they uncover are hidden risks inside decisions that already feel approved.

Common discoveries include:

- Fragile demand behind early traction

Segments that appear promising based on interest or pilot feedback often reveal shallow intent when behavioral depth and funnel progression are analyzed. AI surfaces where demand is present but unstable, allowing teams to refine or deprioritize before scale. - Pricing cliffs invisible to traditional research

Willingness to pay frequently drops sharply at specific thresholds that surveys and small samples fail to capture. AI-led analysis reveals where minor pricing shifts could materially impact adoption or margin before pricing is finalized. - Misalignment between buyer intent and GTM messaging

What internal teams believe is clear positioning often creates hesitation or confusion in real buyer interactions. AI helps identify where messaging resonates superficially but fails to move buyers toward action. - Early signs of timing risk

Markets may acknowledge a problem without feeling urgency to solve it. AI-driven signal analysis helps distinguish awareness from readiness, reducing the risk of launching ahead of true demand. - Inconsistent signals across segments and channels

Early success in one cohort can mask structural issues elsewhere. AI helps teams see where traction is repeatable versus where it is fragile or context-specific.

These discoveries do not delay launches. They prevent irreversible decisions from being made on incomplete confidence.

How Appinventiv Applies AI To Reduce Go-to-Market Risk

At this stage, reducing go-to-market risk is less about adopting more tools and more about working with teams that have applied AI in real enterprise environments. Appinventiv brings that perspective through execution, not theory being the most favourable AI consulting company. The team has delivered 300+ AI-powered solutions, trained and deployed 150+ custom AI models, and completed 75+ enterprise AI integrations across regulated and high-scale industries.

That experience is reflected in how AI is applied to complex product and GTM challenges through enterprise AI consulting for product strategy. From healthcare platforms like the YouComm Health app, where AI supports personalized care and compliance-driven workflows, to enterprise initiatives in the AI-led banking domain that demand security, explainability, and scale, the focus remains consistent. AI is used to reduce uncertainty and support better decisions, not to add complexity.

As an AI consulting company offering end-to-end AI Development Services, Appinventiv treats AI as a strategic layer across product validation, market intelligence, and launch planning. Rather than isolating insights in dashboards, the approach connects AI for market research directly to decisions teams must make around timing, positioning, and investment.

For organizations navigating high-stakes launches, working with a partner that combines AI capability with enterprise judgment can make the difference between confidence and guesswork.

If you are evaluating how AI can strengthen your next go-to-market strategy, exploring how Appinventiv approaches AI-led market research and GTM risk reduction is a practical place to start.

FAQs

Q. How Can AI Consulting Reduce Go-to-Market Risks for Enterprises?

A. AI consulting reduces go-to-market risk by helping enterprises identify weak assumptions before they turn into costly mistakes. Instead of relying on static reports, AI for market research continuously tracks demand signals, buyer behavior, and competitive movement. When enterprises hire an AI consultant for product launch, they gain structured decision support that highlights where timing, pricing, or positioning risks are emerging early enough to act.

Q. Why Do Product Launches Fail and How Can AI Help Prevent It?

A. Most product launches fail not because of poor execution, but because teams misread demand, overestimate readiness, or lock decisions too early. AI helps prevent this by uncovering early warning signals that traditional methods miss. Compared to AI consulting vs traditional market research, AI-driven approaches surface real behavioral data instead of relying only on opinions, helping teams course-correct before scale magnifies the problem.

Q. How Does AI-Driven Market Research Improve Product-Market Fit?

A. AI-driven market research improves product-market fit by moving beyond what customers say to what they actually do. By analyzing usage patterns, intent signals, and adoption friction, AI for market research helps teams refine features, pricing, and messaging continuously. This is especially valuable when AI insights are applied early in AI in product development, where small adjustments can significantly improve market alignment.

Q. What Role Does AI Consulting Play in Enterprise GTM Strategy?

A. AI consulting plays a strategic role by translating market signals into clear go-to-market decisions. It ensures insights are aligned across product, marketing, sales, and leadership teams. Unlike tool-only approaches, AI consulting focuses on judgment, governance, and accountability, which is why enterprises often compare AI consulting vs traditional market research when evaluating long-term GTM risk reduction.

Q. How Can Appinventiv Help Enterprises De-risk Product Launches Using AI?

A. Appinventiv supports enterprises by combining AI expertise with real-world delivery experience. Recognized among top AI market research consultants, Appinventiv helps organizations apply AI for market research in a way that directly informs product validation, GTM planning, and launch sequencing. For enterprises looking to hire an AI consultant for product launch, Appinventiv offers a practical, execution-led approach that reduces uncertainty without slowing momentum.

Q. What ROI Can Enterprises Expect From AI-Led Market Research?

A. The ROI from AI-led market research typically shows up as avoided costs and faster decision-making rather than short-term revenue spikes. Enterprises benefit through reduced rework, better pricing decisions, improved launch timing, and more focused GTM investment. By integrating AI in product development and launch planning, organizations using AI for market research often see stronger early adoption and lower post-launch correction costs compared to traditional research-led approaches.

Q. How do simulated personas and digital twins improve modern market research?

A. They use synthetic personas built from demographic, psychographic, and behavioral data to simulate interaction patterns, generate synthetic data, and test target-audience profiles in virtual surveys or virtual sales environments using large language models, while validating insights against ground truth and managing pro-human bias through silicon samples.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How to Develop an AI Chatbot for Education Platforms in UAE: Architecture, Cost, and Timeline

Key Takeaways AI chatbots are helping UAE institutions handle repetitive queries, reduce response delays, and improve the availability of student support. Bilingual capability, PDPL compliance, and integration with LMS and student systems are essential for successful deployment. Costs typically range from AED 150,000 to AED 1.47M ($40K–$400K), depending on integrations, personalization, and language support. AI-powered…

How AI in Healthcare Administration Cut Staff Workload by 40%

Key takeaways: AI automates claims, scheduling, intake, and documentation, cutting repetitive work and freeing staff to focus on oversight and patient coordination. AI validation tools flag incomplete records before submission, reduce avoidable denials by 10–20%, and improve clean-claim performance, enhancing revenue predictability. EHR and note-processing AI reclaim thousands of staff hours in large health systems,…

How AI Chatbots for eCommerce are Driving 3x More Sales in 2026

Key takeaways: AI chatbots for eCommerce have a direct impact on revenue. When aligned with buying intent, they lift conversions, increase order value, and drive repeat purchases. The strongest impact comes from personalization and guided selling, helping shoppers decide faster and buy with greater confidence. Abandoned cart recovery is a major revenue driver in 2026.…