- Why AI Becomes the Embedded Engine of Modern Banking Software

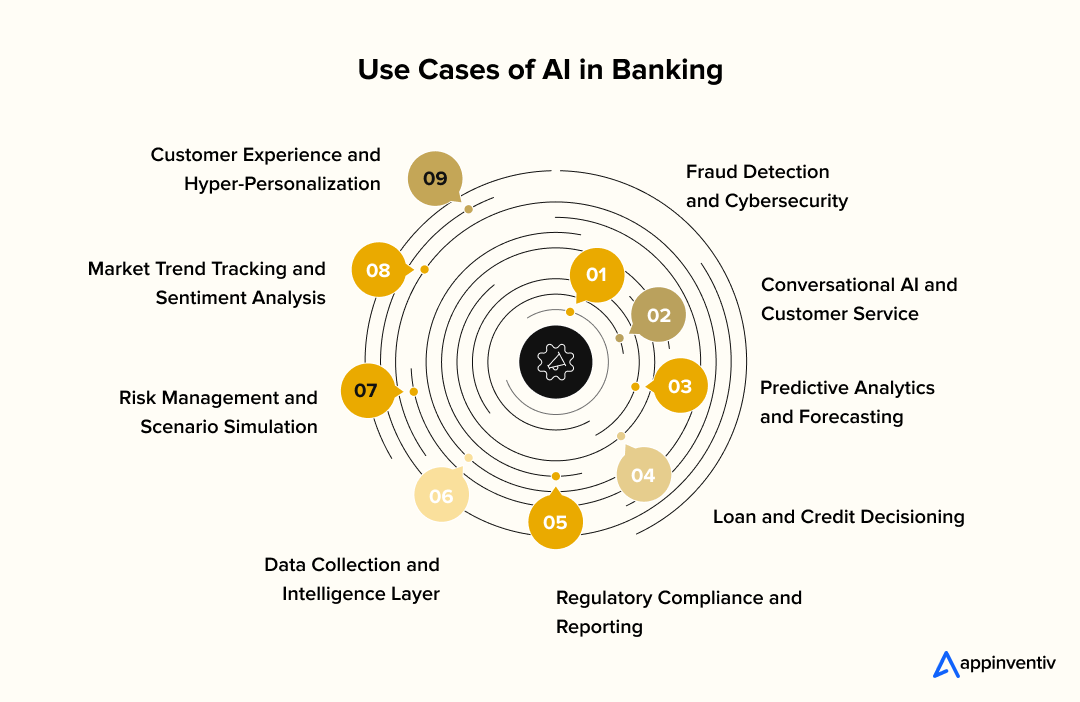

- 9 Powerful Use Cases of AI in Banking

- Conversational AI and Customer Service

- Predictive Analytics and Forecasting

- Loan and Credit Decisioning

- Regulatory Compliance and Reporting

- Data Collection and Intelligence Layer

- Risk Management and Scenario Simulation

- Market Trend Tracking and Sentiment Analysis

- Customer Experience and Hyper-Personalization

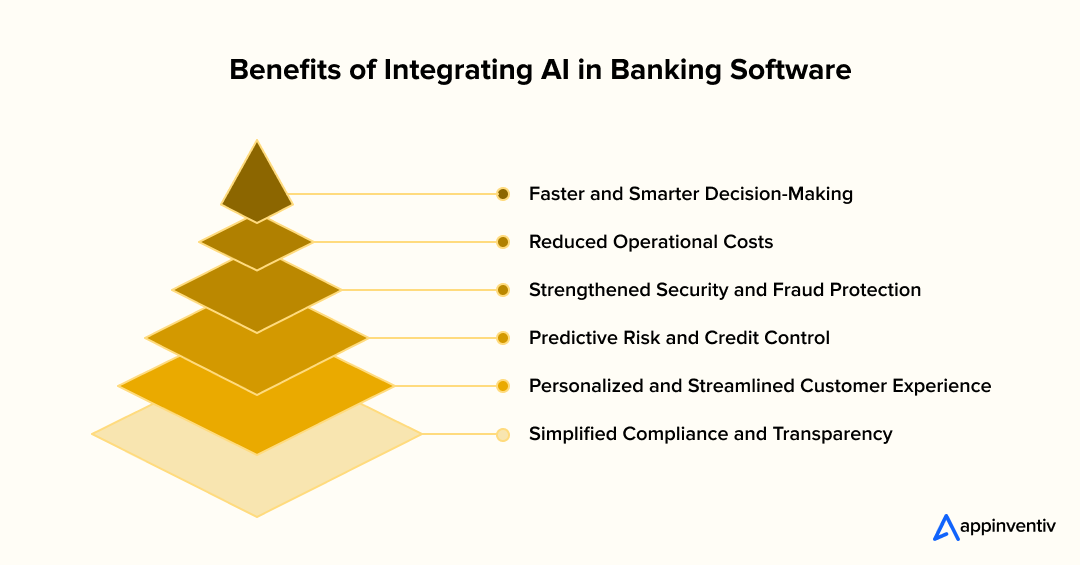

- Key Benefits of Integrating AI in Banking Software

- 1. Faster and Smarter Decision-Making

- 2. Reduced Operational Costs

- 3. Strengthened Security and Fraud Protection

- 4. Predictive Risk and Credit Control

- 5. Personalized and Streamlined Customer Experience

- 6. Simplified Compliance and Transparency

- Four Archetypes of AI in Banking and Financial Services

- 1. Highly Centralized

- 2. Centrally Led, Business Unit Executed

- 3. Business Unit Led, Centrally Supported

- 4. Highly Decentralized

- How to Build AI-Powered Banking Software

- 1. Define the Problem and Scope

- 2. Choose the Right Tech Stack

- 3. Collect, Clean, and Label Data

- 4. Develop the Model and Test It

- 5. Build the Prototype and MVP

- 6. Deploy and Monitor with MLOps

- 7. Prioritize Governance and Compliance

- 8. Scale and Evolve

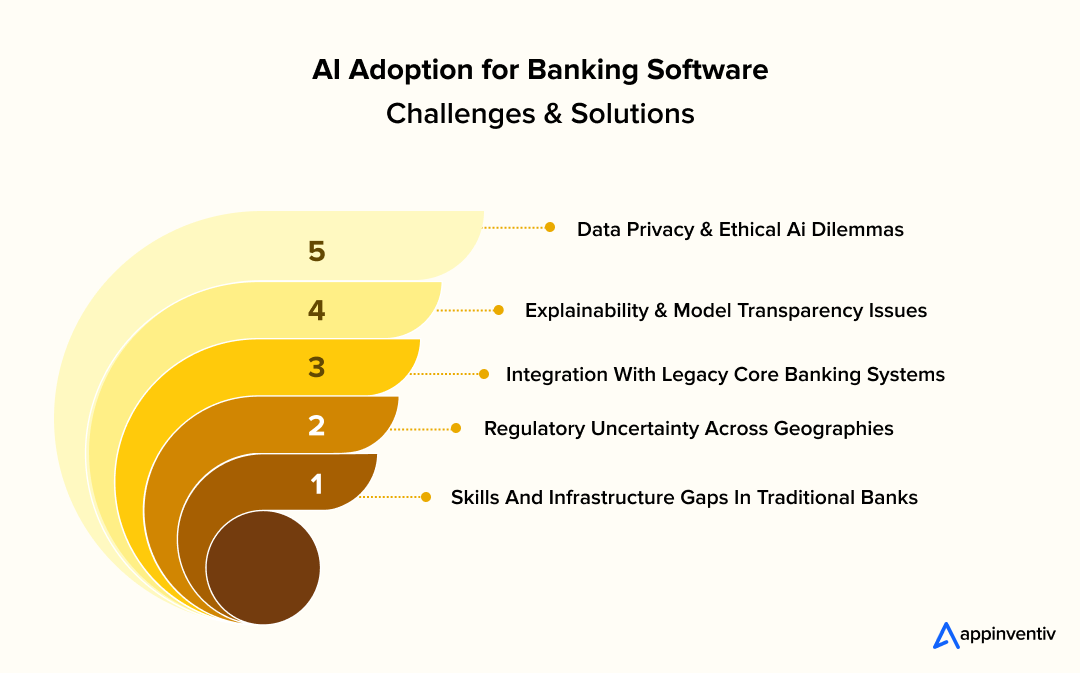

- Challenges in AI Adoption for Banking Software and How to Overcome Them

- 1. Protecting Data and Building Trust

- 2. Explaining the “Why” Behind AI Decisions

- 3. Dealing with Old Core Systems

- 4. Closing the Skills and Infrastructure Gap

- 5. Balancing Regulation and Human Change

- Cost of Developing AI-Powered Banking Software

- Factors That Shape the Final Cost

- Transforming Banking with AI: Key Technologies and Their Impact

- Top 10 Future Trends of AI in Banking Software Development

- 1. Agentic and Autonomous AI

- 2. Advanced Predictive Analytics

- 3. Autonomous Finance

- 4. Federated and Privacy-First AI

- 5. Deeper Integration with IoT

- 6. Enhanced Regulatory Compliance

- 7. Ethical and Responsible AI

- 8. Expansion of AI-Enabled Cybersecurity

- 9. Unified Intelligence Platforms

- 10. Human–AI Collaboration

- Why Partner with Appinventiv for AI Banking Software Development

- FAQs

Key takeaways:

- AI is the engine behind faster decision-making, smarter customer interactions, and improved fraud protection in banking.

- Generative AI could add up to $340 billion annually to global banking profits through productivity gains, automation, and faster software development.

- Leading banks like OCBC, Caixa Bank, and ADIB are using AI to eliminate fraud and enhance customer experiences.

- AI banking software development costs between $40,000–$600,000, depending on the project scope, complexity, and timeline.

The future of finance isn’t coming; it’s already here, and it speaks AI. What began as a cautious experiment a few years ago has now become the core engine of modern banking. From credit scoring to fraud detection, today’s financial institutions run on software that learns, predicts, and adapts in real time.

According to McKinsey, generative AI could add between $200 billion and $340 billion annually to the global banking sector’s operating profits, primarily through productivity and automation gains.

Meanwhile, Statista projects that in 2024, nearly 70% of financial services companies reported AI-driven revenue increases, with most achieving 5-10% revenue growth.

This transformation goes far beyond a chatbot or a fraud-scoring model. AI is quietly rewiring how banks design, deploy, and manage their core systems, making them faster, more adaptive, and significantly more secure. In practice, this means everything from automated underwriting and smart credit analysis to biometric face authentication and algorithmic compliance audits.

Consider a few real-world examples of AI in banking software development:

- OCBC Bank uses facial recognition at ATMs to authenticate customers across two million monthly withdrawals; a move that’s eliminated PIN dependence and created a fully contactless experience.

- Caixa Bank in Spain was among the first to bring facial authentication to its branch and ATM networks, drastically cutting fraud attempts.

- In the UAE, Abu Dhabi Islamic Bank (ADIB) now enables account opening via facial recognition within its mobile app; no branch visit required.

Each of these use cases represents more than operational efficiency; they signal a new era of AI-powered banking software development, where technology not only performs tasks but also thinks contextually and learns continuously.

For banks, the implications are enormous. Intelligent systems can detect fraud before it happens, predict loan defaults months in advance, and craft personalized customer experiences in milliseconds. And for decision-makers, this means redefining the way they approach custom AI banking software development; not as a one-time project, but as a long-term strategy embedded across every product line.

Interested in exploring more about the role of AI in commercial banking software development?

As we move deeper into this blog, we’ll explore how AI in banking software development is driving operational resilience, reshaping customer interactions, and laying the digital foundations for the next decade of financial innovation. We will also share estimated development costs, timeline, future trends and steps to build a secure and scalable banking software.

70% of financial services companies saw 5-10% revenue growth driven by AI in 2024. Tap into such AI potential with Appinventiv.

Why AI Becomes the Embedded Engine of Modern Banking Software

Artificial Intelligence has quietly become the core engine of modern banking software, not a side feature. Most leading banks now design their digital systems around AI rather than adding it later. From credit risk assessment to fraud analytics, intelligent algorithms are helping banks make faster, safer, and smarter decisions.

Gartner 2025 report reveals that banks are increasingly investing in AI deployment to boost revenue, manage risk, streamline operations and enhance customer experience. It is a shift that’s less about hype and more about survival (source). These systems are helping institutions reduce fraud losses, accelerate customer onboarding, and manage compliance with fewer errors.

One key area where banks see accelerated gains is through KYC automation, which streamlines verification and reduces repetitive manual reviews.

Earlier, AI tools worked in isolation: a banking AI chatbot here, a scoring model there. Now, the trend is to embed AI across the banking software stack. In this model, AI works at every layer —

- in customer engagement through virtual assistants and AI chatbots,

- in decision-making via predictive analytics, and

- in data pipelines that clean, label, and feed learning models.

This deep integration is what defines AI-powered banking software development today. The focus has moved from task automation to building adaptive systems that learn continuously from real data.

Banks are also finding clear business value. JPMorgan Chase, for instance, uses AI models to review thousands of contracts in seconds, cutting analysis time from weeks to minutes. HSBC employs similar systems in anti-money-laundering, flagging anomalies far earlier than manual checks.

In short, AI in banking software development isn’t just reshaping back-office operations; it’s redefining how financial systems think. The banks that treat AI as infrastructure, not an experiment, are already pulling ahead.

9 Powerful Use Cases of AI in Banking

The applications of AI in banking software development stretch far beyond automation. Today, intelligent systems sit at the heart of how banks detect fraud, assess risk, approve loans, and engage customers. The smartest institutions treat AI as an ongoing software capability, not a feature to check off.

Here is an in-depth look at how banks worldwide are using AI, the software mechanics behind it, and real world examples:

Fraud Detection and Cybersecurity

Fraud Detection and Cybersecurity

Security remains the beating heart of any financial system. AI’s ability to detect fraud patterns in milliseconds has made it indispensable to modern banking. Machine learning models in banks analyze transactional behavior, device fingerprints, and geolocation data to identify anomalies that humans would miss.

Modern AI engines now blend graph analytics and behavioral biometrics, creating self-learning systems that grow stronger with every transaction analyzed.

Real-World Example: Mastercard now uses AI to monitor over 75 billion transactions each year, intercepting fraudulent activity long before manual systems could react.

Conversational AI and Customer Service

The modern customer doesn’t want to “call the bank.” They want answers instantly, across any channel. This is where conversational AI in banking services makes its mark. Using NLP (Natural Language Processing) and LLMs (Large Language Models), banks now deploy digital assistants that engage with customers like real human agents.

Real-World Example: Bank of America’s “Erica” serves more than 37 million users, handling tasks from spending insights to bill reminders (source). Similarly, OCBC Bank in Singapore introduced a voice-enabled AI assistant that answers investment and insurance queries with context-based recommendations.

At Appinventiv, we built Mudra, an advanced chatbot-driven budget management platform crafted to solve everyday personal finance challenges.

After six months of focused design and development, Mudra successfully launched across 12+ countries. Packed with interactive features, the app redefines user engagement and sets a new benchmark in the FinTech space.

Predictive Analytics and Forecasting

Data has always been the fuel of banking; AI turns it into foresight. Predictive analytics models use years of transaction data to forecast customer behavior, lending demand, and liquidity trends.

Real-World Example: Citi Bank employs AI systems to monitor global credit exposure and predict repayment risks, enabling quicker strategic shifts. These systems process structured and unstructured data, from market signals to news sentiment, to generate actionable insights.

Banks leveraging AI API integration in digital banking transformation can deliver faster, more context-aware services while keeping compliance intact.

Loan and Credit Decisioning

Traditional credit analysis depends on static financial records and human judgment. AI changes that. With access to real-time data streams: income, spending behavior, credit utilization, predictive models can evaluate loan applicants in seconds.

Failing to invest in this area leads to slower disbursals, missed lending opportunities, and higher defaults. In essence, AI not only improves credit accuracy; it democratizes access to fairer, data-driven lending.

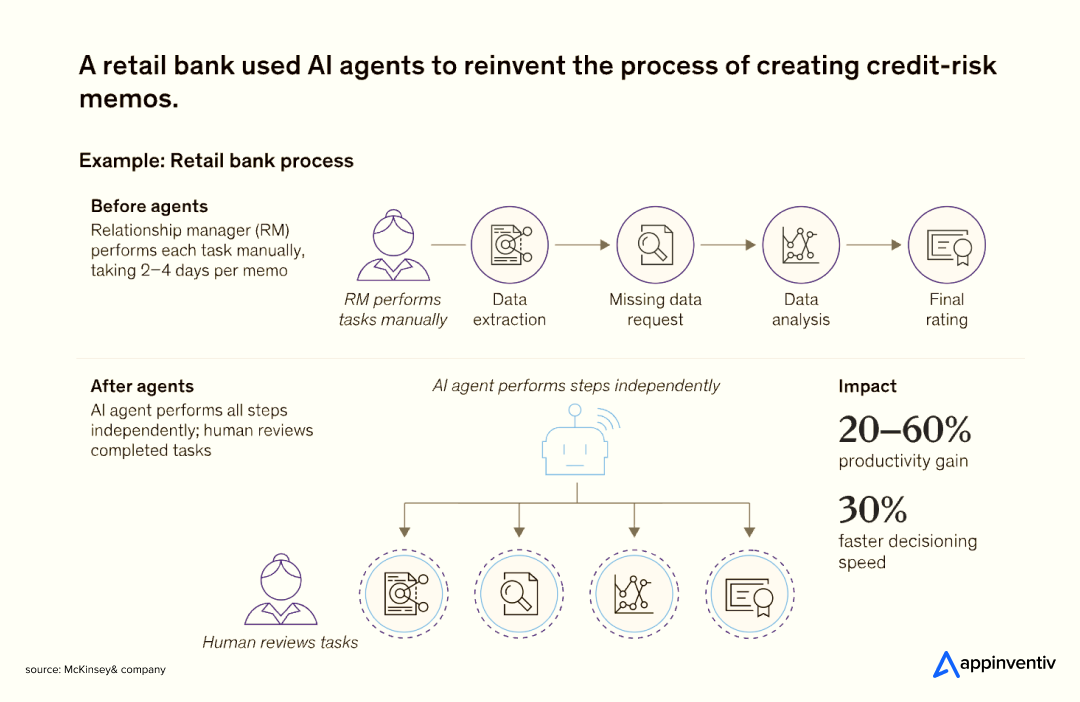

Real-World Example: A McKinsey case study shows how a major retail bank automated its credit memo process using AI agents that collect, summarize, and analyze data before presenting a recommendation. The result? A 20 to 60% improvement in productivity, including a 30% improvement in credit turnaround (source).

Regulatory Compliance and Reporting

In a world of tightening regulations, compliance has become one of the most resource-intensive banking functions. AI now automates much of it, verifying documents, screening transactions for AML/KYC anomalies, and preparing reports that comply with regional standards.

Real-World Example: HSBC has successfully implemented AI-driven AML detection systems that flag suspicious activity early and with high accuracy (source). These systems rely on explainable AI to ensure transparency, a critical factor for regulators.

Data Collection and Intelligence Layer

Before models can learn, they need clean, connected, and contextual data. AI helps banks build robust data lakes and pipelines that automatically classify, cleanse, and label incoming information.

Using AI, banks can turn fragmented datasets into a unified 360° customer view. For example, predictive systems can detect early signs of churn by analyzing a mix of transaction histories, feedback, and engagement patterns.

The cost of skipping it? Poor-quality inputs that sabotage every downstream AI initiative.

Real-world examples: ING Bank built an AI-based data management framework that centralizes customer data across regions, improving model accuracy for downstream analytics. Similarly, DBS Bank in Singapore employs AI to detect inconsistencies in customer data before it reaches production systems.

Risk Management and Scenario Simulation

Every financial institution lives and dies by its risk models. AI supercharges these models by adding real-time monitoring, stress testing, and macroeconomic simulation capabilities. Banks can now simulate how loan portfolios respond to changes in interest rates or regional inflation; it is a scenario that once took weeks to analyze.

Real-World Example: UBS uses AI to assess credit migration risks and portfolio exposure dynamically, improving capital allocation decisions.

Market Trend Tracking and Sentiment Analysis

AI also plays a growing role in interpreting the broader financial ecosystem. NLP-driven systems can read thousands of articles, social feeds, and analyst reports to assess market sentiment in real time.

For traders and portfolio managers, this data becomes gold. It powers algorithmic strategies, detects bubbles, and informs investment recommendations. Without it, banks rely on delayed, human-filtered insights that miss opportunities in volatile markets.

Real-World Example: Goldman Sachs applies NLP algorithms to monitor global financial news and social media sentiment for portfolio optimization. Morgan Stanley similarly integrates AI-driven trend analysis tools to anticipate investor sentiment shifts.

Customer Experience and Hyper-Personalization

The modern customer expects relevance at every touchpoint. AI makes this possible by tailoring offers, product recommendations, and advisory messages to individual financial behaviors.

A customer with recurring travel spending might automatically be offered a foreign-exchange-optimized credit card, while another who receives frequent salary credits could get early access to loan pre-approvals. These dynamic journeys are now built into AI-powered banking software development platforms using recommendation algorithms and generative content models.

Real-World Example: HSBC UK uses AI to personalize digital banking offers, boosting product uptake. NatWest Group relies on predictive models to anticipate customer needs, helping improve retention rates.

Below is a snapshot of how banks are applying AI across their digital ecosystem and what it costs to build or ignore these capabilities.

| AI Use Cases in Banking | Avg. Development Timeline | Estimated Cost | Key ROI Driver | Cost of Inaction |

|---|---|---|---|---|

| Fraud Detection | 6–12 months | $80K–$200K | Reduced fraud losses and improved trust | Escalating fraud incidents, potential regulatory fines, and customer attrition due to security concerns |

| Conversational AI / Chatbots | 3–6 months | $50K–$120K | Lower call center costs, improved CX | Rising operational costs, slower response times, poor customer satisfaction |

| Credit & Loan Decisioning | 6–9 months | $100K–$180K | Faster loan approvals, accurate risk profiling | Lost lending opportunities, increased defaults, reputational risks |

| Predictive Analytics & Forecasting | 6–9 months | $70K–$150K | Smarter planning, better liquidity management | Missed market opportunities, reactive decision-making, lower profitability |

| Regulatory Compliance & Reporting | 9–12 months | $120K–$250K | Reduced fines, audit readiness, automated AML/KYC | Compliance failures, penalties, and erosion of brand credibility |

| Risk Management & Scenario Simulation | 6–12 months | $100K–$220K | Improved capital allocation, early risk detection | Inefficient capital use, late response to financial shocks |

| Market Trend Tracking & Sentiment Analysis | 4–8 months | $60K–$130K | Real-time market insights, faster portfolio decisions | Missed investment trends, delayed responses, revenue volatility |

| Customer Experience & Personalization | 3–5 months | $70K–$140K | Higher retention, personalized offers, stronger loyalty | Increased churn, low engagement, and stagnant growth |

| Data Collection & Intelligence Layer | 6–9 months | $90K–$160K | Unified data view, cleaner insights for AI models | Fragmented data silos, inaccurate models, inefficiency in analytics |

Key Benefits of Integrating AI in Banking Software

Integrating AI in banking software development has become a defining move for financial institutions seeking speed, resilience, and accuracy in decision-making. It’s not just about automation anymore; it’s about transforming how banks think, analyze, and serve customers through intelligent systems that continuously learn and adapt.

1. Faster and Smarter Decision-Making

AI allows banking systems to process and interpret enormous datasets in real time. Instead of relying on fixed rules, models learn from historical and behavioral data to make informed decisions instantly. This results in faster approvals, reduced manual verification, and higher accuracy.

Through AI platform development for banking, institutions can embed intelligence directly into their workflows, enabling risk assessment and compliance reviews to happen in seconds, not hours.

2. Reduced Operational Costs

Automation sits at the core of AI-powered banking solutions development. Tasks such as document validation, reconciliation, and data entry that once required entire teams can now run autonomously. The result is leaner operations, fewer errors, and measurable cost reductions.

Over time, this efficiency compounds, freeing teams to focus on strategic analysis, product innovation, and customer engagement rather than repetitive administrative work.

3. Strengthened Security and Fraud Protection

Security no longer depends solely on manual oversight. AI models monitor transactional data in real time, identifying anomalies, unusual spending behavior, or suspicious access patterns within seconds.

By embedding AI-powered banking management systems, banks can build proactive security frameworks that evolve continuously, reducing fraud exposure while maintaining regulatory integrity.

4. Predictive Risk and Credit Control

The ability to anticipate risk is a core strength of AI. Predictive models assess early warning signals, spending behavior, repayment trends, and liquidity gaps, allowing banks to act before a potential default occurs.

5. Personalized and Streamlined Customer Experience

AI enables deeper personalization at scale. Every interaction, from loan offers to investment tips, can be tailored to customer intent and context.

For banks, this personalization enhances satisfaction and retention while reducing churn, forming the basis of long-term relationship banking.

6. Simplified Compliance and Transparency

Automated checks, explainable AI models, and continuous monitoring have made regulatory compliance less of a burden.

By integrating AI-driven auditability features into software, banks can ensure every decision, from onboarding to lending, is traceable, secure, and regulation-ready. This supports both compliance accuracy and faster reporting cycles.

In summary, the benefits of AI in banking software development go far beyond efficiency. They create a digital infrastructure that learns, scales, and improves over time; one that positions banks to thrive in a market where speed, precision, and transparency define success.

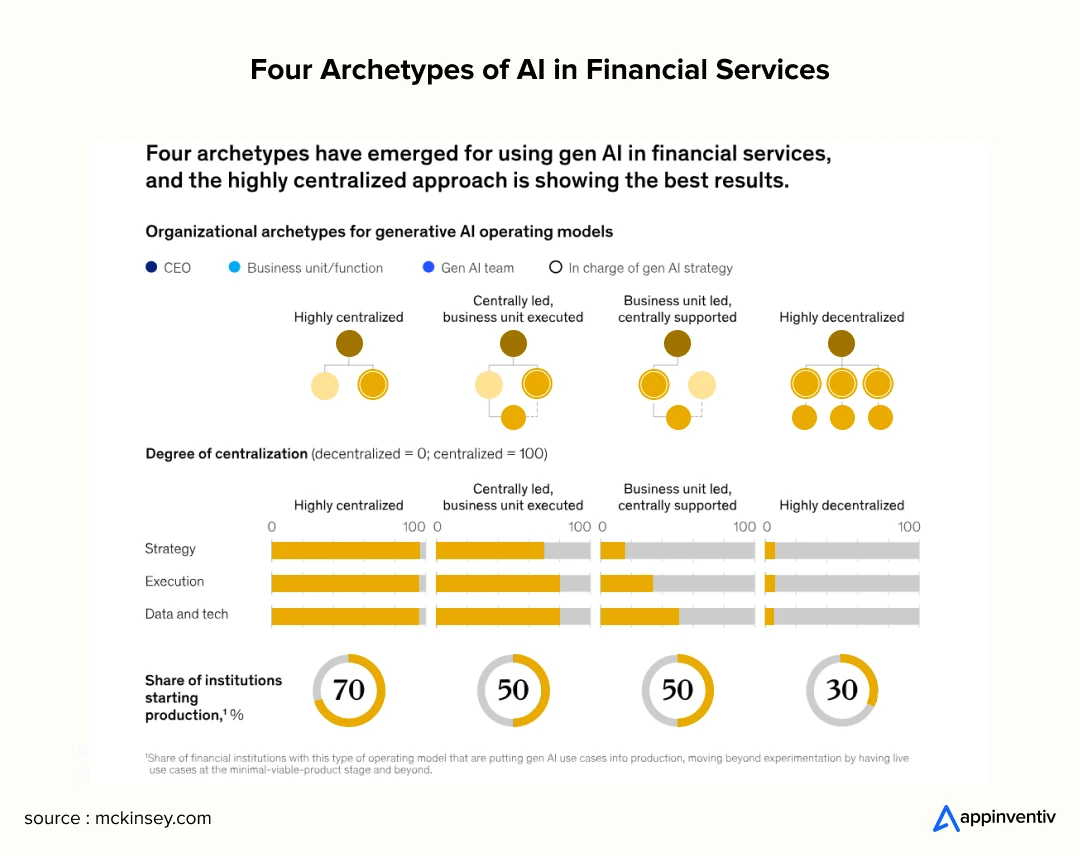

Four Archetypes of AI in Banking and Financial Services

When banks adopt AI, the way they organize their teams and distribute tasks impacts how fast they innovate and scale. Here’s a breakdown of the four common models used for the implementation of AI in banking software development:

1. Highly Centralized

In this model, a central team makes all the AI decisions. They can quickly adopt new technologies, but there’s a risk of disconnect from actual business needs, as they may not always understand the specifics of day-to-day operations.

2. Centrally Led, Business Unit Executed

Here, the central AI team creates the strategy and ensures compliance, while individual business units apply AI solutions based on their needs. This approach balances consistency with flexibility, especially in larger organizations.

3. Business Unit Led, Centrally Supported

Business units lead the charge in AI innovation, with the central team providing support. This encourages innovation from the ground up but can sometimes lead to inconsistent strategies across different units.

4. Highly Decentralized

Each business unit runs its own AI operations independently. This model boosts responsiveness and innovation, but it can lead to redundant efforts and misalignment. Success relies heavily on strong leadership at the unit level.

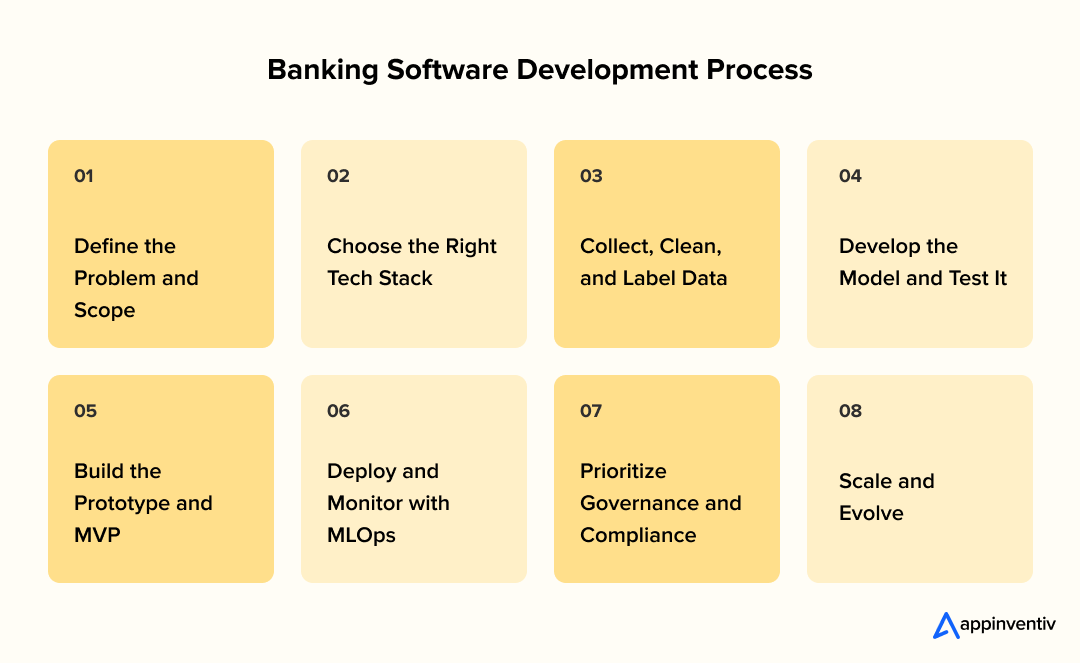

How to Build AI-Powered Banking Software

Building an intelligent banking system isn’t about adding one more feature. It’s about re-engineering how your software thinks, learns, and reacts. Successful AI-powered banking software development blends business logic, secure infrastructure, and human judgment into a single, learning ecosystem. Below is a roadmap that most banks and FinTech frisk follow when turning an AI concept into a fully functional product.

1. Define the Problem and Scope

Every great build starts with a clear question: What problem are we solving? Are you aiming to reduce fraud losses, speed up loan approvals, or personalize customer journeys? Defining the goal or a use case helps set priorities for data collection, model choice, and budget. At this stage, involve compliance and product teams early so AI consulting solutions align with both customer needs and regulatory limits.

2. Choose the Right Tech Stack

Modern banking systems rely on modular, open-source, and cloud-ready tools. Here is a list of ideal AI tech stacks suitable for banking software development.

| Category | Technologies |

|---|---|

| Programming Languages | Python, R, Java, C++, Swift, Kotlin, Scala |

| AI Models | GPT-4, Claude 3, Google Gemini, Phi-2, Llama-2, Whisper AI |

| Machine Learning and NLP | YOLO, BERT, Eliza |

| Frameworks and Libraries | PyTorch, MXNet, Chainer, NVIDIA Caffe, spaCy, Sonnet, TensorFlow Probability, Tensor2, Neuroph, Keras |

| Open-source AI and ML Platform | Hugging Face, Kaggle, Wandb.ai, Replicate |

| Toolkits | Core ML, Microsoft Cognitive Toolkit |

| Neural Networks | CNN, RNN, Manifold Learning |

| Vector Database Management | Apache Cassandra, Azure Cosmos DB Integrated Vector Database, Chroma, Pinecone |

| Databases | MySQL, PostgreSQL, MongoDB, OracleSQL |

| Cloud Platforms | AWS, Azure, or Google Cloud |

This combination of tech stack gives teams flexibility while keeping the core banking software compliant and scalable; a must for any enterprise AI banking software development project.

3. Collect, Clean, and Label Data

Good AI starts with good data. Gather transactional records, user interactions, and financial reports from trusted sources. Then clean, de-duplicate, and label them.

Banks often build internal “feature stores” repositories of ready-to-use, pre-processed data that make modeling faster and more accurate. The goal here isn’t volume; it’s quality and context.

4. Develop the Model and Test It

Once data is ready, teams move to experimentation. Models are trained, validated, and stress-tested against real-world conditions. For example, a fraud-detection model should be able to catch edge-case transactions without triggering too many false alarms. At this stage, set clear KPIs: accuracy, latency, and explainability.

5. Build the Prototype and MVP

Before scaling, create a small-scale working model: your Minimum Viable Product (MVP). Test it with limited users or a single process, such as loan underwriting or chatbot assistance. The aim is to prove value quickly and collect feedback from both customers and staff. If it works in one branch or one department, it can work anywhere.

6. Deploy and Monitor with MLOps

Deploying AI in banking isn’t a one-and-done event. Continuous monitoring keeps the system reliable as data patterns change. MLOps tools automate retraining, track performance, and flag issues early.

Think of it as preventive maintenance for intelligence; your models stay sharp and compliant without manual intervention.

7. Prioritize Governance and Compliance

Trust is the currency of banking. Every AI deployment should have a transparent governance layer that records data lineage, model updates, and decision logs. Regular bias tests and audit reports ensure compliance with standards like GDPR, PCI DSS, and emerging AI regulations.

When governance is embedded into your custom AI banking software development, regulators see readiness, and customers see reliability.

8. Scale and Evolve

Once the foundation is solid, scale gradually. Expand from one use case to multiple: fraud, risk, and personalization, all feeding into the same intelligence layer. Over time, this evolves into a unified AI-powered banking management system capable of learning across departments and improving itself.

In essence, building AI for banking isn’t a sprint; it’s a continuous build-and-refine cycle. The most successful projects are those that start small, stay compliant, and grow through constant learning. The reward? A banking ecosystem that’s faster, safer, and smart enough to stay ahead of the next financial curve.

Partner with us to future-proof your financial services.

Challenges in AI Adoption for Banking Software and How to Overcome Them

Bringing AI into banking software is exciting, but it’s not always smooth sailing. Between strict data rules, legacy systems, and the pressure to stay compliant, most banks find the real challenge isn’t in building models; it’s in making them work inside existing operations. Here’s what usually stands in the way and how leading teams are solving it.

1. Protecting Data and Building Trust

Banks sit on oceans of sensitive information. If that data is misused or exposed, trust disappears overnight.

How to fix it: Start by designing every system with privacy in mind. Use encrypted data, anonymized samples, and secure storage to train models safely. Regular bias audits and model reviews show regulators and customers that your AI plays by the rules.

2. Explaining the “Why” Behind AI Decisions

When an algorithm declines a loan or flags a transaction, there has to be a reason users can understand.

How to fix it: Use explainable AI tools that break down how results are formed. Combine them with human checks so decisions stay fair, traceable, and easy to defend during audits.

3. Dealing with Old Core Systems

Many banks still rely on systems built long before AI existed. Integrating modern models into those setups can feel like forcing new tech into an old machine.

How to fix it: Instead of replacing everything at once, modernize step by step. Build microservices that connect to old cores through APIs. This lets you test, scale, and improve without risking downtime.

4. Closing the Skills and Infrastructure Gap

AI projects need engineers, data scientists, and analysts who understand both tech and finance. Most teams don’t have enough of them.

How to fix it: Invest in training and work with AI development partners experienced in banking. Move complex workloads to secure cloud or hybrid environments that can handle model training and large-scale data processing.

5. Balancing Regulation and Human Change

AI moves fast. Regulations and people don’t. Many employees worry automation might replace them, while leaders worry about compliance risks.

How to fix it: Start small: launch pilots that solve one pain point at a time. Be open about what AI can and can’t do. Once teams see the results, adoption happens naturally.

Cost of Developing AI-Powered Banking Software

There’s no fixed price tag for building AI banking software. The cost of banking software development depends on multiple factors, like what you want the system to do, how complex it is, and how tightly it needs to fit within your bank’s ecosystem. A chatbot pilot costs very differently from a full-blown AI risk engine that handles thousands of live transactions.

Factors That Shape the Final Cost

- Scope and complexity: More AI modules, integrations, and automation layers mean higher development effort.

- Data quality and volume: Cleaning and labeling large datasets takes time and cost.

- Compliance and security: Projects in regulated markets require extra encryption, audit trails, and documentation.

- Technology stack: Custom AI models, MLOps, and advanced analytics increase infrastructure spend.

- Team expertise: Senior AI engineers and compliance consultants come at a premium but ensure accuracy and reliability.

To give a sense of what real projects usually look like, here’s a broad view of cost and time across four typical development stages.

| Type of Software | What’s Included | Estimated Cost (USD) | Timeline |

|---|---|---|---|

| MVP | A single AI feature like a chatbot or fraud-detection model, built for limited users. | $40,000 – $80,000 | 4 – 6 months |

| Moderate Build | A few integrated AI tools like customer analytics, credit scoring, and automation. | $80,000 – $180,000 | 6 – 8 months |

| Advanced Solution | A broader setup with real-time analytics, predictive modeling, and compliance workflows. | $180,000 – $350,000 | 8 – 12 months |

| Enterprise Platform | A full-scale ecosystem with Generative AI in banking software development, multi-branch MLOps, and global compliance layers. | $350,000 – $600,000 | 12 – 18 months |

Don’t Forget Maintenance

AI software isn’t a one-time build; it needs continuous care. Models drift, regulations evolve, and new data keeps flowing in. Thus, after launch, AI systems need constant tuning. Most banks set aside 15–25% of the initial build cost per year for updates, retraining, and support.

It’s an ongoing investment but one that keeps the software accurate, secure, and aligned with how your customers actually use it.

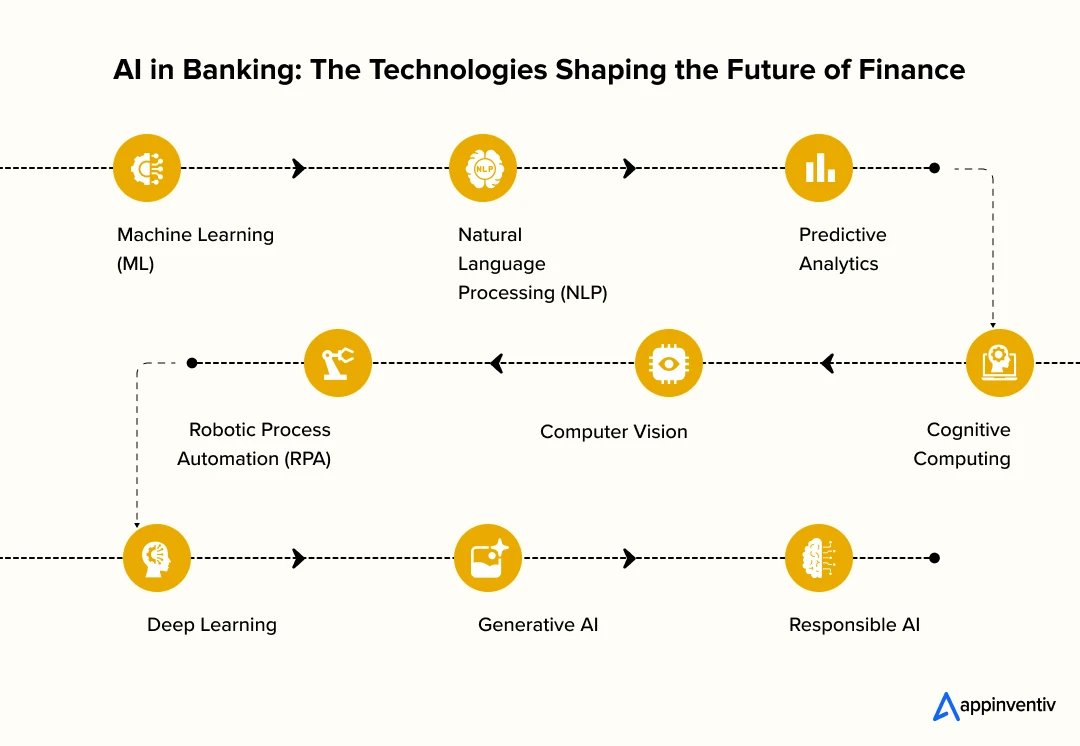

Transforming Banking with AI: Key Technologies and Their Impact

AI is revolutionizing the banking sector by improving efficiency, security, and customer experience. With AI, banks can better manage risks, enhance decision-making, and offer personalized services. Here’s a breakdown of key AI technologies reshaping the industry:

Machine Learning (ML)

ML analyzes vast datasets to detect patterns for fraud detection and credit assessments. It improves risk evaluations by looking beyond traditional credit reports, helping banks make better lending decisions.

Natural Language Processing (NLP)

NLP powers chatbots and virtual assistants, enabling continuous customer support. It also speeds up document processing for tasks like loan approvals, reducing errors and enhancing customer onboarding.

Predictive Analytics

By analyzing historical data, predictive analytics helps banks forecast market trends, understand customer preferences, and identify potential risks, allowing for proactive measures and informed decision-making.

Robotic Process Automation (RPA)

RPA in banking automates repetitive tasks like data entry and account reconciliation, increasing operational efficiency, reducing errors, and freeing up staff to focus on higher-value tasks.

Computer Vision

Computer vision technology supports document verification, facial recognition, and automated check processing, strengthening security and improving mobile banking reliability.

Cognitive Computing

Cognitive computing systems enhance customer experience by analyzing preferences and behaviors to recommend personalized financial products and efficiently handle inquiries.

Deep Learning

Deep learning, a subset of ML, is used for advanced fraud detection and voice recognition, identifying complex fraud patterns and authenticating customers via voice during phone banking interactions.

Generative AI

Generative AI solutions for finance and banking create personalized financial reports, marketing materials, and legal documents. It simulates financial scenarios to help banks predict market conditions and customer behaviors.

Responsible AI

Responsible AI ensures ethical use in banking, focusing on fairness, transparency, and bias prevention, particularly in credit scoring and loan approvals, to maintain customer trust and regulatory compliance.

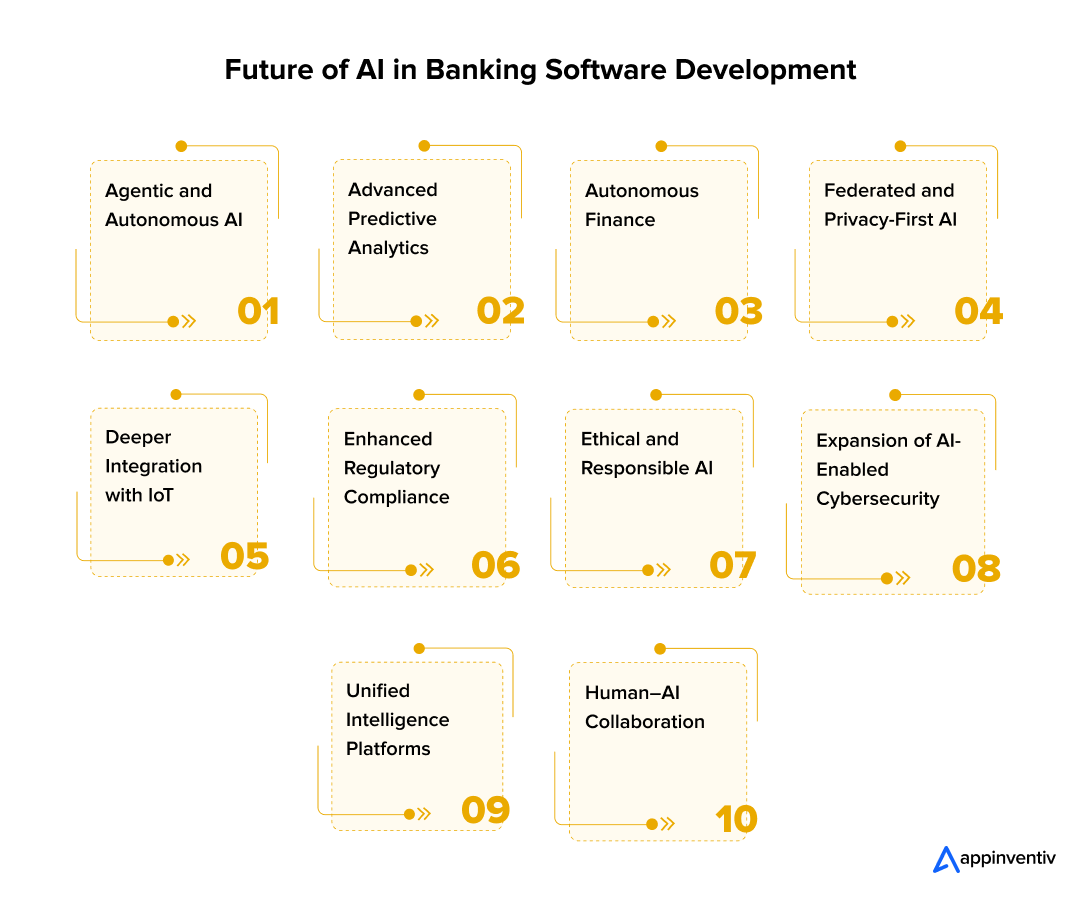

Top 10 Future Trends of AI in Banking Software Development

The future of AI in banking software development isn’t just about faster systems or smarter predictions. It’s about building digital intelligence that understands context, adapts instantly, and strengthens the trust between banks and their customers. The next decade will see banking evolve from digital to truly cognitive, where software doesn’t just automate but thinks alongside humans. Let’s look at the AI trends already reshaping the road ahead.

1. Agentic and Autonomous AI

The biggest leap will come from agentic AI use in banking; intelligent agents capable of managing full workflows without constant human input. These systems won’t wait for commands; they’ll detect needs, act on data, and make suggestions in real time.

It is like a virtual compliance officer that reads new regulations overnight and updates the bank’s internal policies before anyone logs in.

2. Advanced Predictive Analytics

AI’s predictive power will keep improving. Future systems will forecast customer behavior, market changes, and credit risks with near-human intuition but at machine speed. Banks will use these insights to make decisions before problems appear, tailor products to individual goals, and build resilient risk models.

In short, predictive intelligence will become the core of decision-making across lending, investment, and compliance.

3. Autonomous Finance

AI is steadily moving toward full automation of personal and enterprise finance. Imagine systems that automatically rebalance a customer’s portfolio, optimize payments, or plan budgets based on spending habits; all in real time.

This shift toward autonomous finance will make financial advice accessible, proactive, and tailored to each customer’s goals. It’s personalized banking without the wait times or human bottlenecks.

Also Read: Autonomous Agents: From Theory to Practical Applications and Implementation Techniques in Business

4. Federated and Privacy-First AI

With stricter data laws emerging globally, banks will turn to federated learning; a model that allows algorithms to train across multiple datasets without sharing sensitive information. This privacy-first approach enables collaboration across subsidiaries and partners without moving or exposing customer data.

The result? Powerful insights without breaching regulatory lines.

5. Deeper Integration with IoT

As Al connects with the Internet of Things in banking, banks will move closer to real life. Cars, wearables, and even smart appliances will feed real-time data that influences financial decisions, from insurance premiums to instant credit offers.

This AI–IoT convergence will make services more contextual and responsive. For instance, a car’s telematics system could signal a loan pre-approval when it detects upcoming maintenance costs; a seamless mix of physical and financial intelligence.

6. Enhanced Regulatory Compliance

Compliance will no longer be reactive. AI will constantly scan evolving regulations, interpret changes, and adapt workflows automatically. This means faster reporting, fewer manual reviews, and almost zero regulatory lag.

Such AI-enabled compliance tools will help banks manage complex frameworks like the EU AI Act, Basel IV, and GDPR with unmatched accuracy and speed.

7. Ethical and Responsible AI

With great capability comes great scrutiny. The next wave of AI in the banking industry will focus on ethical and responsible AI frameworks that ensure fairness, transparency, and accountability. Banks will deploy bias detection tools, fairness audits, and explainability dashboards to ensure AI systems don’t unintentionally discriminate or distort decisions.

Ethical governance will evolve from a checkbox exercise into a competitive differentiator; a visible mark of trust for customers and regulators alike.

8. Expansion of AI-Enabled Cybersecurity

The rise in cyber threats has made AI-powered cybersecurity a top priority. Future systems will detect, respond, and neutralize attacks almost instantly; often before they’re noticed.

AI will correlate millions of digital signals in real time, identifying fraud attempts and breaches long before traditional security tools catch up.

In this future, defense will be proactive, not reactive; a continuous shield built into every transaction and endpoint.

9. Unified Intelligence Platforms

Today, banks operate multiple isolated AI models: one for credit, one for fraud, and another for marketing. The future lies in unified AI backbones, where one intelligence layer powers everything: from customer interactions to risk management.

This shift will create truly enterprise AI banking software development ecosystems that are faster, cleaner, and capable of self-optimization across all departments.

10. Human–AI Collaboration

AI won’t replace people; it’ll work with them. Teams will delegate analysis, reporting, and prediction to machines, while focusing on judgment, relationships, and strategy. This partnership, where humans guide and AI amplifies, will redefine productivity across every banking function.

Why Partner with Appinventiv for AI Banking Software Development

The future of banking isn’t just digital; it’s intelligent. AI is transforming how financial institutions operate, from core risk systems to front-line customer interactions. And while many banks are still experimenting, the real differentiators are those turning AI into operational muscle, creating systems that adapt, predict, and protect in real time.

At Appinventiv, we’ve been helping global enterprises turn that vision into measurable success for nearly a decade. With a team of 1,600+ experts and 3,000+ digital solutions delivered across 35+ industries, we’ve built deep domain expertise in fintech innovation, powering secure, compliant, and scalable systems for banking leaders across the US, Europe, the Middle East, Asia and beyond.

For instance, our AI based banking software developers created Edfundo, an app focused on financial literacy and money management for kids. Through interactive modules and parental oversight, it teaches sound money habits.

The Outcome?

- Secured $500K in pre-seed funding

- Won the #1 FinTech startup award

This collaboration reflects Appinventiv’s ability to merge AI, FinTech, and banking into one cohesive experience that drives both adoption and trust.

Why Global Banks Choose Appinventiv’s Banking Software Development Services

- 1,600+ domain specialists across AI, ML, and cloud engineering.

- 500+ banking and FinTech projects executed for leading and digital-first startups.

- Compliance expertise across GDPR, PCI DSS, and regional banking standards.

- 97% client satisfaction rate in banking solutions

- 99.9% SLA uptime in core banking products

- Proven record of building AI-powered banking management systems

- Recognized by The Economic Times as “The Leader in AI Product Engineering & Digital Transformation.”

If your organization is exploring the next step in intelligent transformation, our AI development services are for you. Our AI in banking software development expertise helps you plan, architect, and deploy AI-powered banking solutions tailored to your needs.

Let’s redefine banking with data, trust, and intelligence at the core. Connect with our experts today.

FAQs

Q. How much does it cost to develop AI-powered banking software?

A. The cost to develop AI-powered banking software depends on the project’s scope and complexity.

On average AI powered banking software development cost ranges between 40,000 to $600,000 or more.

We share detailed estimates only after assessing integrations, compliance needs, and long-term scalability goals.

Q. How does Appinventiv ensure compliance and data security?

A. All our AI development services for banking follow strict privacy-by-design principles. We apply encryption, anonymization, and role-based access control at every layer. Our systems align with GDPR, PCI DSS, and local banking standards, ensuring your data stays protected throughout development and deployment.

Q. How do you ensure the scalability of AI systems?

A. We design every solution with scale in mind. Using microservices, containerized environments, and MLOps pipelines, our systems can handle growing data volumes and user traffic without downtime. This modular structure makes future feature rollouts seamless and cost-efficient.

Q. What are the main use cases of AI in banking software development?

A. Banks are using AI for fraud detection, credit risk modeling, automated onboarding, regulatory compliance, and personalized banking experiences. Newer applications also include generative AI in banking for summarizing financial reports and automating client communication workflows.

These are some of the most remarkable AI applications in banking software development

Q. How does Appinventiv integrate generative AI in investment banking?

A. Integrate generative AI into investment banking workflows to help teams work faster and smarter. Our LLM-based models summarize research, analyze deal documents, and automate due diligence with built-in data traceability.

The system securely connects to internal data sources, letting analysts ask complex questions in plain language. This reduces manual effort, improves insight accuracy, and gives deal teams more time to focus on strategic decisions instead of document-heavy analysis.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Why Private AI Is the Future of Ethical and Secure AI Adoption for Enterprises?

Key takeaways: $109.1 billion was invested in global private AI in 2024, demonstrating enterprises’ commitment to secure AI. Private AI keeps data within your infrastructure for complete control; public AI processes data externally on shared cloud platforms. Private AI enables enterprises to scale AI responsibly with complete data sovereignty, regulatory compliance, and superior long-term economics…

How to Build an AI-powered Insurance Software in the UK?

Key takeaways: AI is changing how UK insurers handle claims, spot fraud, and serve customers. Big names like Aviva and Zurich UK are already using it to save money and settle claims faster. To build AI insurance software that works, you need good data, proper compliance, and a system people actually want to use. Expect…

10+ Use Cases and Examples of RPA in the Automotive Industry

Key takeaways: Streamlined Operations and Efficiency Gains: RPA automates repetitive tasks like invoice processing and data entry, improving overall efficiency and freeing up teams to focus on more strategic activities. Proactive Maintenance and Cost Reduction: By integrating RPA with IoT, automotive companies can predict and prevent equipment failures, reducing downtime and maintenance costs. Optimized Supply…