- Traditional Debt Recovery vs AI-Powered Collections: The Real Difference

- Traditional Debt Collection vs AI-Powered Debt Collection

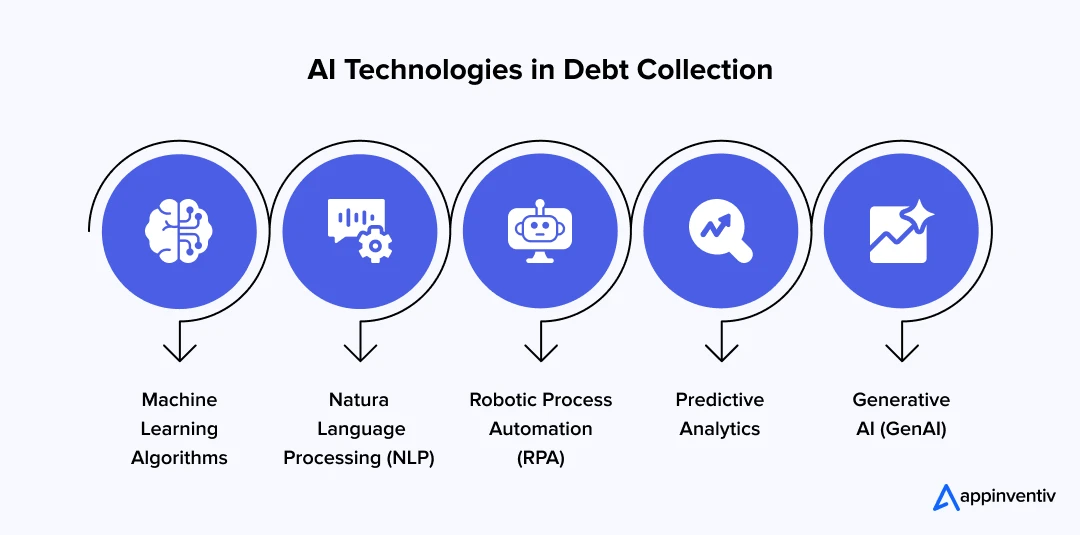

- The Core AI Technologies Powering Modern Debt Collection Strategies

- Machine Learning Algorithms

- Natural Language Processing (NLP)

- Robotic Process Automation (RPA)

- Predictive Analytics

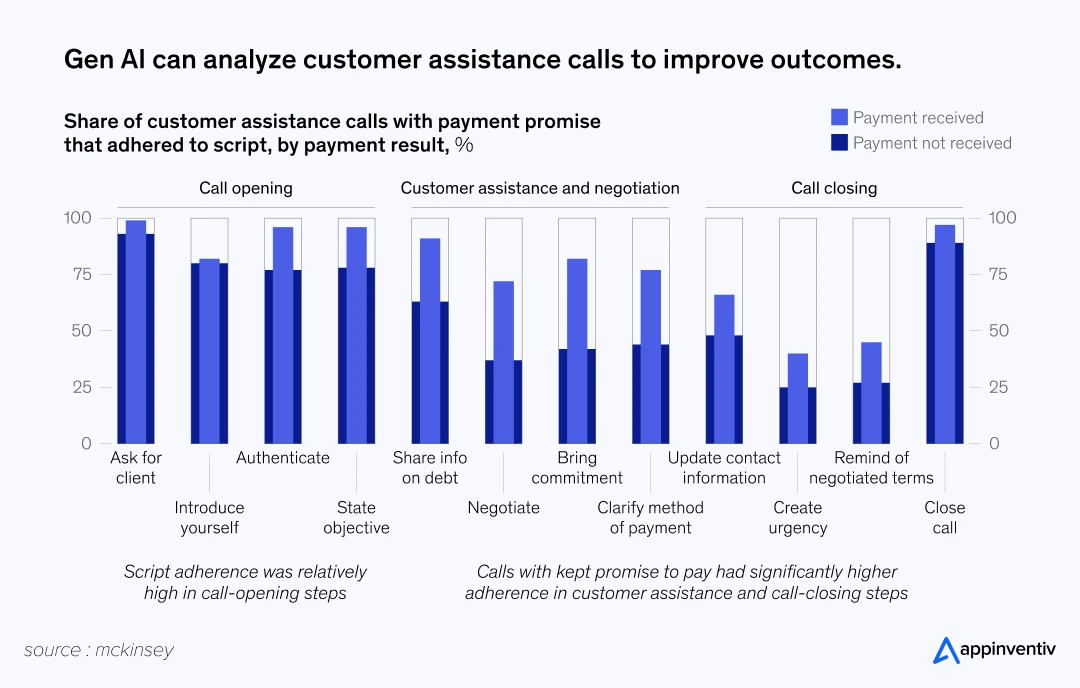

- Generative AI (GenAI)

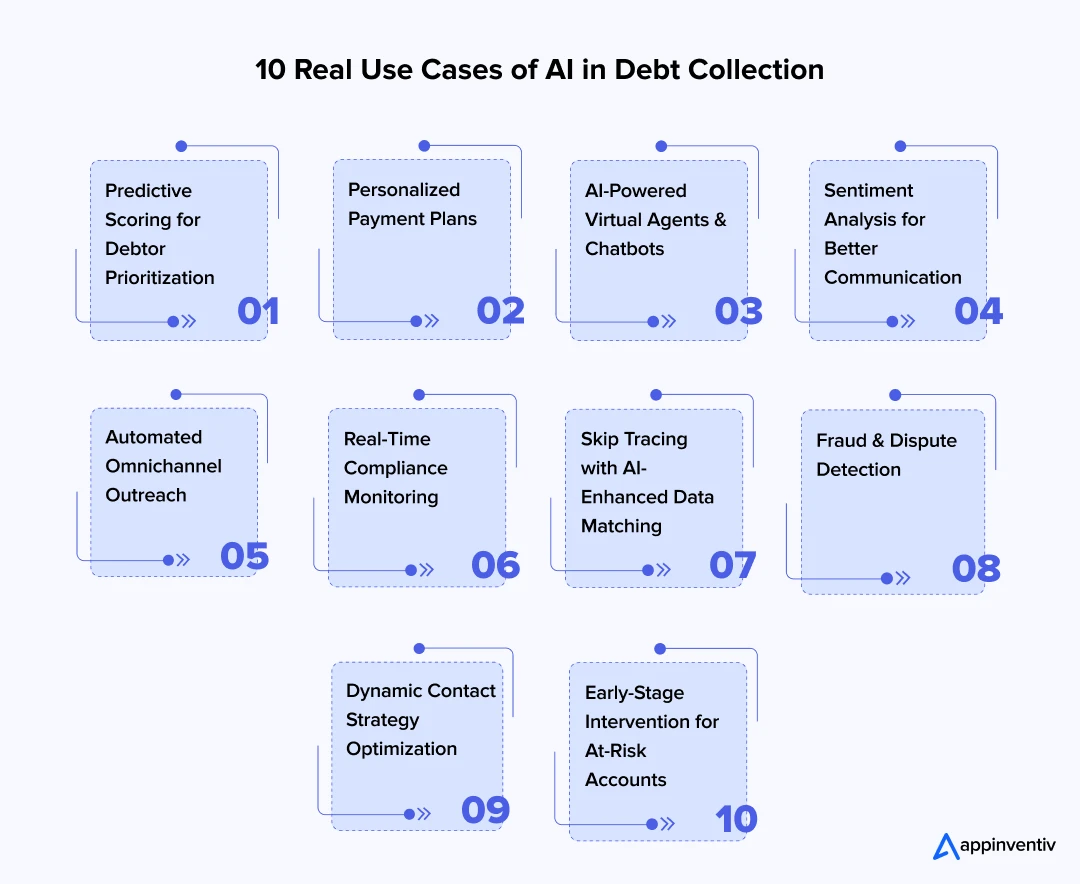

- Debt Recovery Reinvented: 10 Real AI Use Cases & Examples You Can’t Ignore

- Use Case 1: Predictive Scoring for Debtor Prioritization

- Use Case 2: Personalized Payment Plans

- Use Case 3: AI-Powered Virtual Agents & Chatbots

- Use Case 4: Sentiment Analysis for Better Communication

- Use Case 5: Automated Omnichannel Outreach

- Use Case 6: Real-Time Compliance Monitoring

- Use Case 7: Skip Tracing with AI-Enhanced Data Matching

- Use Case 8: Fraud & Dispute Detection

- Use Case 9: Dynamic Contact Strategy Optimization

- Use Case 10: Early-Stage Intervention for At-Risk Accounts

- Business Benefits of AI in Debt Collection

- Increased Recovery Rates

- Reduced Operational Costs

- Improved Compliance Posture

- Enhanced Customer Experience and Brand Trust

- Data-Backed Decision Making

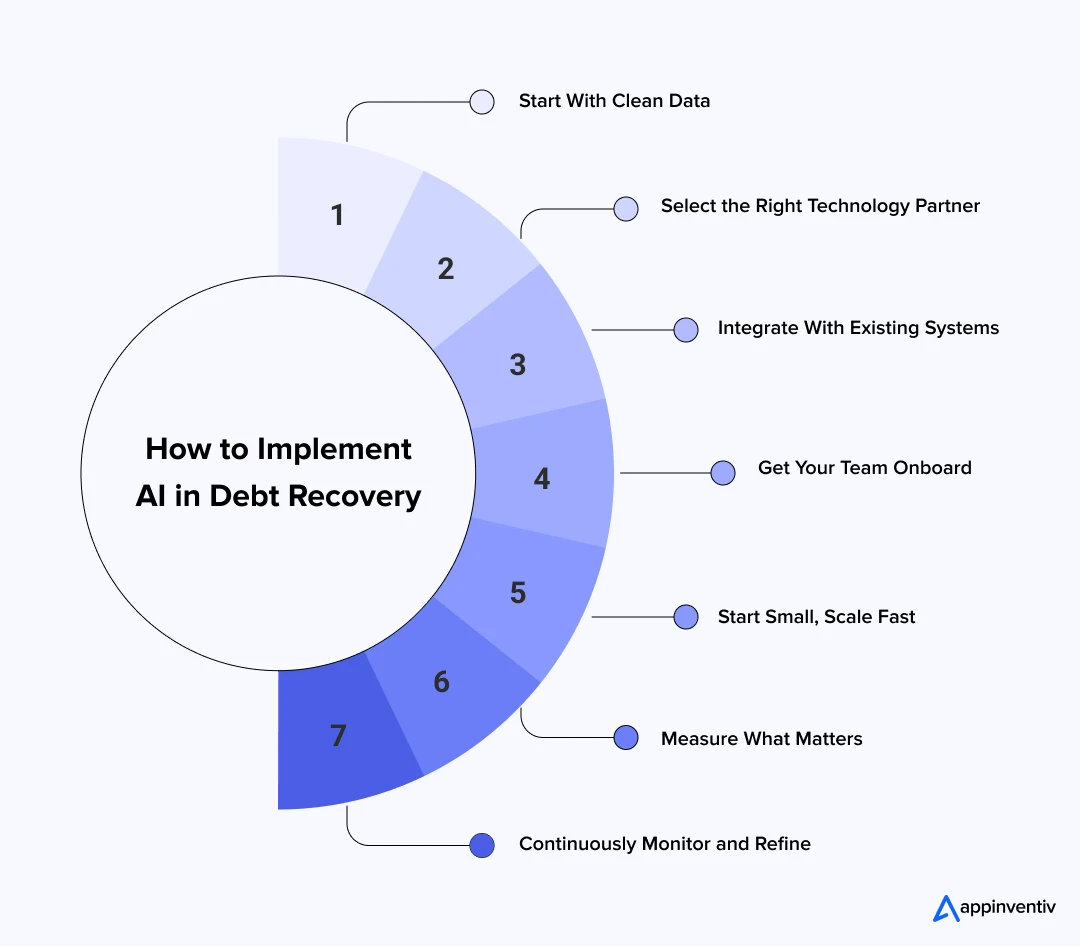

- Your Roadmap to AI Implementation in Debt Recovery: How to Do It Right

- Start With Clean Data

- Select the Right Technology Partner

- Integrate With Existing Systems

- Get Your Team Onboard

- Start Small, Scale Fast

- Measure What Matters

- Continuously Monitor and Refine

- Challenges in AI Debt Collection and How to Overcome Them

- Your Data Is Garbage

- Agents Think AI Is Taking Over

- Compliance Nightmares

- Integration Complexity

- Future Trends in AI and Debt Collection to Watch in 2025-26

- Why Partnering With Appinventiv for AI Debt Collection Delivers Proven Results

- FAQs

Key takeaways:

- AI is transforming debt collection into a smarter, more empathetic, and compliant process.

- Leading firms like FICO, TrueAccord, and LiveVox already report major gains in recovery and efficiency.

- AI adoption can reduce operational costs by up to 40% and increase recovery rates significantly.

- Future trends include proactive default prevention, voice biometrics, blockchain security, and hyper-personalized outreach.

- Appinventiv’s proven FinTech case studies, including Mudra and Edfundo, demonstrate our expertise in building scalable, fully-compliant AI debt collection solutions.

When you think of debt collection, what comes to mind? Probably a ringing phone and a scripted conversation. This old-aged system of debt collection is inefficient, costly, and frankly, not a great experience for anyone.

Now enter the AI age. This isn’t just about automating a few emails. It’s about a total overhaul. We’re moving from a one-size-fits-all approach to something smarter, more personal, and a lot more empathetic. It listens, learns, and adapts. It knows when to reach out, how to talk, and what deals work. It’s the human-touch upgrade to a fraught process.

Let’s imagine it! You unlock your phone. There’s a text about your overdue Visa bill. But you don’t panic this time. The message isn’t scary or threatening. It shows you options. Pay $75 every two weeks instead of $450 right now. You tap “yes” and set up auto-pay in 90 seconds.

That’s AI in debt collection working perfectly.

So, how exactly is AI playing out? In this blog, we’ll explore 10 Use Cases of AI in Debt Collection Process, each backed by real examples of AI debt collection in action—plus the benefits, implementation roadmap, challenges, and future trends. You’ll see what actually works and learn how to ace your AI game.

Share your AI vision with us and build your AI-powered collection system today.

Traditional Debt Recovery vs AI-Powered Collections: The Real Difference

Debt collection is getting a massive makeover. Old-school tactics are dying fast. Smart approaches are taking over. To know exactly why AI is taking over, let’s contrast the old and new ways.

The traditional process is all about manual labor. Human agents are on the phone all day, and letters are sent out without much thought. It’s expensive, prone to mistakes, and often creates a negative experience for the person.

On the other hand, AI-driven automated debt collection technology is a proactive, data-driven approach. It is automated, efficient, and designed to be a better experience for the debtor.

Most collection companies still operate like it’s the Clinton administration. They call from lists. Send form letters. Treat everyone exactly the same. It costs them $15-25 per account and annoys the customers. Plus, they keep getting sued. The CFPB’s Civil Penalty Fund has collected over $3.5 billion through 2024.

Artificial intelligence in debt collection flips this whole mess upside down. Companies using AI for debt collection witness a significant boost in their success rates. Plus, customers hate them less too. Smart algorithms pick who to call first. Conversational AI in debt collection answers questions at midnight. Everything works better.

Traditional Debt Collection vs AI-Powered Debt Collection

Here is a table outlining the key differences between the traditional debt collection approach and AI-powered debt collection methodology.

| What We’re Looking At | Yesterday’s Method | Today’s AI Way |

|---|---|---|

| Reaching Out | Same script for everybody | Custom messages for each person |

| Timing | Call at 9 AM whether you like it or not | Perfect timing based on actual behavior |

| Payment Plans | Take our standard deal or leave it | Plans that fit your real budget |

| Following Rules | Cross fingers and hope for the best | Every conversation is monitored live |

| Agent Output | Handle 20-30 accounts daily | Handle over 80-100 accounts with AI help |

| Customer Experience | Often stressful and negative. | Better, with self-service options. |

| Cost Per Account | High due to manual work. | Much lower because of automation. |

The Core AI Technologies Powering Modern Debt Collection Strategies

The whole AI revolution in this space is built on a few core technologies working in harmony. These AI technologies are completely changing how debt collection works. Each one fixes problems that have bugged the industry forever.

Machine Learning Algorithms

AI and machine learning in debt collection power the whole system. ML algorithms examine huge datasets and spot patterns humans miss completely.

It looks at payment history. Notes communication styles. Checks external financial signals. Then builds detailed profiles showing exactly how to approach each person.

Predictive modeling goes beyond basic risk scores. Advanced algorithms figure out the perfect payment amount, ideal timing, and best communication method for every individual. Results crush traditional approaches.

Natural Language Processing (NLP)

NLP lets automated debt collection software development systems understand human communication at scale. Written messages, phone calls, chat conversations – everything gets analyzed instantly.

Automated analysis means AI reviews every customer interaction. Checks for compliance problems. Measures how customers feel. Spots chances to improve. Quality stays consistent across thousands of daily conversations.

AI-driven sentiment analysis gives agents real-time insight, flagging when a conversation starts to deteriorate. Automated playbooks trigger the right responses, enabling rapid de-escalation and protecting customer relationships.

Robotic Process Automation (RPA)

RPA removes repetitive work such as data entry, account updates, and routine correspondence, so teams can focus on higher-value, complex cases.

Task automation covers complex workflows too. Payments process automatically. Accounts reconcile in the background. Automated debt collection technology works nights and weekends without complaining.

Integration means AI improvements plug right into current systems. No huge overhauls needed. Results show up in weeks, not years.

Predictive Analytics

Analytics platforms power AI-driven collection decisions by synthesizing historical performance, real-time trends, and external variables. The result is sharper strategies and smarter next-best actions.

Risk models do more than estimate payment odds. They figure out the best collection approach for each account. Aggressive tactics or gentle reminders? The AI decides.

Timing algorithms determine when, how often, and through which channel to contact people. This personal touch dramatically improves contact rates and results.

Generative AI (GenAI)

Generative AI is the newest force reshaping the FinTech industry. It doesn’t just analyze, it creates. In AI debt collection software development, GenAI in finance can draft hyper-personalized repayment proposals, customized follow-up emails, and even call scripts that fit the debtor’s history and tone.

Instead of sending generic notices, GenAI builds communication that feels human and tailored, increasing the chances of a positive response. It can also simulate debtor conversations, helping agents practice and refine their approach.

On the compliance side, GenAI can automatically rewrite communication templates to meet evolving regulations, ensuring Compliance with AI debt collection without slowing down operations. This blend of personalization and compliance is why GenAI is fast becoming the centerpiece of next-gen recovery strategies.

Debt Recovery Reinvented: 10 Real AI Use Cases & Examples You Can’t Ignore

Here’s where things get interesting. Companies are using AI to transform their operations. These aren’t pilot programs or experiments. These are live systems handling millions of accounts and generating real money. From smart scoring that finds the hottest prospects to debt collection virtual agents that never sleep, these applications prove AI makes collection both more profitable and more human.

Let’s see what actually works out there.

Use Case 1: Predictive Scoring for Debtor Prioritization

Challenge: Collection agencies treat every overdue account the same way. Agents waste days calling customers who’ll never pay. Meanwhile, accounts that would pay with the right approach get ignored.

AI Solution: Machine learning analyzes hundreds of data points and creates dynamic risk scores for every account. Payment history gets weighted. Current financial status matters. Communication responsiveness counts. Economic factors get included. The system ranks accounts by payment likelihood and recovery potential.

Real Example: Experian’s PowerCurve Collections looks at over 1,000 different factors per account. The system processes accounts every day, sending the hottest prospects to veteran agents while routing slam-dunk cases through automated workflows.

Use Case 2: Personalized Payment Plans

Challenge: Cookie-cutter payment plans fail because they ignore individual financial realities. A $500 monthly payment might be easy for one person and impossible for another. Broken promises damage relationships.

AI Solution: AI analyzes each person’s financial capacity, spending habits, and payment history to create custom payment plans. Income timing matters. Expense cycles count. Historical patterns get factored in. The result? Plans people can actually follow.

Real Example: FICO’s Debt Manager examines financial indicators to create personalized schedules. When someone’s money situation changes, the system automatically tweaks terms to stay doable while maximizing recovery.

Use Case 3: AI-Powered Virtual Agents & Chatbots

Challenge: Limited agent hours mean customers can’t get help when they need it most. Financial stress peaks on evenings and weekends when offices are closed. Customers scream for help, but nobody listens to them.

AI Solution: Debt collection virtual agents handle routine questions, payment processing, and account management around the clock. These systems use natural language processing to understand what customers want and respond personally. Tough issues get passed to humans smoothly.

Real Example: Capital One’s virtual assistant processes millions of customer interactions monthly in their collections department. The AI handles tons of problems without any human backup. Payment arrangements get set up instantly. Account updates happen immediately.

Also Read: Chatbots vs. Conversational AI: Which Suits Your Business?

Use Case 4: Sentiment Analysis for Better Communication

Challenge: Collections calls can escalate quickly. Financial stress turns into frustration, which drives non-payment, complaints, negative reviews, and even legal action.

AI Solution: Real-time sentiment analysis monitors every customer communication, from calls, emails, and chats to texts, and spots emotional stress. The system coaches agents immediately and suggests proven calm-down strategies when negative feelings get detected.

Real Example: CallMiner’s Eureka platform analyzes sentiment across all customer touchpoints for big collection agencies. The system pinpoints specific words and voice tones that lead to successful outcomes, helping agents adjust their approach on the fly.

Use Case 5: Automated Omnichannel Outreach

Challenge: Coordinating consistent messages across email, SMS, voice, and mail while respecting customer preferences and changing regulations creates chaos.

AI Solution: Automated debt collection technology orchestrates personalized campaigns across every communication channel. The system figures out optimal timing, frequency, and messaging for each customer while following all regulations perfectly.

Real Example: Collection agencies using AI-driven omnichannel platforms report way better contact rates and improved results. The system adjusts communication tactics based on how individuals actually respond, making sure each touchpoint builds toward resolution instead of creating message overload.

Use Case 6: Real-Time Compliance Monitoring

Challenge: Manual compliance monitoring is reactive and error-prone. By the time violations get discovered, damage is done. Fines, legal fees, and reputation hits cost millions.

AI Solution: AI watches every collection activity live, automatically flagging potential FDCPA, TCPA, and other regulation violations before they happen. AI Regulation and Compliance technology analyzes content, frequency, timing, and preferences to ensure complete compliance.

Real Example: FICO’s Collections Compliance processes interactions daily, stopping rule-breaking messages before they get sent and coaching agents in real-time.

Use Case 7: Skip Tracing with AI-Enhanced Data Matching

Challenge: Finding customers who moved or changed contact information traditionally required expensive services and manual detective work. Success rates are low, costs are high, and chaos is terrible.

AI Solution: AI-powered skip tracing analyzes multiple data sources simultaneously. It evaluates social media handles, public records, credit reports, utility databases, employment records, and more to find current contact information. Machine learning spots patterns and connections humans would never see.

Real Example: LexisNexis Accurint uses AI to cross-reference billions of records for skip tracing. Collection agencies report much better contact rates and lower costs. The system gives confidence scores for each contact method, helping agents prioritize their efforts.

Use Case 8: Fraud & Dispute Detection

Challenge: Fraudulent disputes and fake hardship claims can destroy recovery rates while requiring expensive investigation. Differentiating real claims from fake ones takes significant time and proven expertise.

AI Solution: AI agents in fraud detection do the magic. Machine learning analyzes patterns in dispute claims, payment methods, and customer behavior to identify potentially fraudulent activity. The system flags suspicious cases for human review while processing clearly legitimate disputes automatically.

Real Example: TransUnion’s fraud detection identifies suspicious disputes with high accuracy. The system learned to recognize coordinated dispute campaigns and fabricated hardship documentation.

Use Case 9: Dynamic Contact Strategy Optimization

Challenge: Static collection strategies can’t adapt to changing customer needs, market conditions, or seasonal factors. What worked last month might not work or may even be completely wrong this month, but traditional systems can’t adjust fast enough.

AI Solution: AI continuously analyzes outcomes to optimize contact strategies in real-time. The algorithms test different approaches, timing changes, and message variations to find the most effective methods for each customer segment.

Real Example: Portfolio Recovery Associates implemented dynamic optimization across their entire portfolio. The AI tweaks collection intensity, channels, and messaging based on customer responsiveness and payment behavior. The platform runs thousands of mini-experiments daily to identify what actually works.

Use Case 10: Early-Stage Intervention for At-Risk Accounts

Challenge: Traditional collection only starts after accounts become seriously delinquent. By then, relationships are damaged, and collection becomes much harder and more expensive.

AI Solution: Predictive models identify accounts at risk 30-90 days before they actually become past due. The system triggers proactive outreach with financial wellness resources, payment options, and early intervention programs.

Real Example: Wells Fargo’s early intervention uses AI to spot at-risk accounts and automatically offers hardship programs or payment modifications. Customers who get early help maintain better payment patterns long-term.

Business Benefits of AI in Debt Collection

Results speak louder than promises. AI in debt collection delivers measurable improvements across every metric that actually matters. Companies consistently report better recovery rates, lower costs, and way happier customers.

Increased Recovery Rates

AI-powered strategies help agencies move past the industry standard recovery rates. This improvement comes from much smarter account prioritization, personalized communication, and perfect timing. Advanced predictive models focus collection resources on accounts with the highest payment probability.

Reduced Operational Costs

Automated debt collection software development solutions slash operational costs through intelligent automation and dramatically improve efficiency. McKinsey data shows agencies can cut operational expenses by 40% with AI implementation. AI operates 24/7 without breaks, sick days, or vacations. It handles multiple interactions simultaneously and never gets tired or stressed out.

Improved Compliance Posture

Real-time compliance monitoring through AI dramatically cuts violations. This translates into massive savings through reduced fines, legal fees, and reputation damage.

AI never forgets compliance rules or makes judgment errors about communication restrictions. It automatically tracks contact frequency, time restrictions, and do-not-call preferences across all channels.

Enhanced Customer Experience and Brand Trust

Benefits of AI in debt collection extend to customer relationships. AI enables more respectful, personalized interactions focused on actual solutions rather than pressure tactics. Customers appreciate 24/7 service availability and resolving issues through their preferred channels. AI provides consistent, professional service that doesn’t vary based on agent mood or experience level.

Data-Backed Decision Making

AI platforms provide unprecedented insights into collection performance, customer behavior, and market trends. This data enables continuous strategy optimization and much smarter business decisions.

Real-time analytics help organizations spot emerging trends, amend strategies quickly, and measure change impact accurately. This business intelligence was previously impossible for most collection operations.

Your Roadmap to AI Implementation in Debt Recovery: How to Do It Right

Here’s the truth nobody tells you: most companies screw up AI implementation because they try to do everything at once. Smart organizations start small. Pick one problem that’s driving everyone crazy – maybe agents wasting hours calling disconnected numbers or compliance violations keeping lawyers busy. Fix that first.

Start With Clean Data

Your data is probably a mess. Decades of different systems and manual entry mistakes create chaos. Before any AI can work, you need clean information. Pick your 1,000 most problematic accounts. Clean that data manually. Look for duplicate entries, outdated phone numbers, and inconsistent data formats. Yes, it’s boring, but it’s the foundation that determines whether your AI succeeds or fails spectacularly.

Select the Right Technology Partner

Don’t just pick the vendor with the fanciest demo or lowest price. Look for a lending software development services provider who understands debt collection regulations, has experience with your type of accounts, and can explain their AI decisions clearly. Ask for references from similar-sized companies in your industry. The cheapest solution usually becomes the most expensive mistake.

Integrate With Existing Systems

Plan for integration headaches because they’re coming. Your collection management system, phone platform, and compliance tools need to talk to each other seamlessly. Budget twice what vendors estimate for integration costs and timeline. Start with read-only connections first – let the AI observe your operations before giving it permission to take actions.

Get Your Team Onboard

Be straight with agents. Some repetitive tasks will disappear. But AI can’t handle complex negotiations or show empathy during tough situations. So, make sure your agents aren’t being replaced; they’re being upgraded. Train your skilled professionals to become AI supervisors handling high-value, complex work.

Start Small, Scale Fast

Pick one specific problem for your pilot. Don’t pilot with easy accounts. Pick challenging ones that represent real problems your agents face daily. Run it for 90 days minimum – the first month is bugs, the second is patterns, the third is magic. Once you prove ROI on a small scale, expansion becomes much easier to justify and execute.

Measure What Matters

Forget fancy dashboards. Focus on stuff that counts: Are agents spending less time on data entry? Are compliance violations dropping? Are customers complaining less? Are recovery rates improving? Remember, if you can’t answer these clearly, your implementation isn’t working.

Continuously Monitor and Refine

AI isn’t set-it-and-forget-it technology. Monitor performance regularly. Track metrics that actually matter, like contact rates, compliance violations, and customer satisfaction scores. The system should get smarter over time, but only if you’re feeding it feedback and adjusting strategies based on real results.

If you are interested in implementing AI for debt collection but are not sure how to build one for your business, here is your Guide to Debt Collection Software Development

Turn your AI vision into reality now

Challenges in AI Debt Collection and How to Overcome Them

While the benefits of AI in debt collection are substantial, there are real-world hurdles that can slow adoption. Here’s what barriers can come on the way and how to overcome them:

Your Data Is Garbage

The Problem: Customer records look like drunk toddlers entered them. Phone numbers with letters. Addresses that don’t exist. Names are spelled in several different ways.

What Happens: Companies spend $100K on AI software, feed it garbage data, then wonder why it makes terrible decisions.

Solution: Fix your data first. Start with high-value accounts. Clean everything manually. Verify phone numbers. Merge duplicates. Then let the AI loose.

Agents Think AI Is Taking Over

The Problem: Experienced agents who know customers personally are told that a computer will do their job better.

What Happens: Your most skilled and trusted professionals quit. Productivity tanks. AI gets blamed for everything.

Solution: Be honest about changes. Repetitive tasks disappear, but AI is terrible at handling complex situations or showing empathy. Turn experienced agents into AI supervisors handling high-value work.

Compliance Nightmares

The Problem: AI makes thousands of daily decisions. Regulators want to know exactly why it called Mrs. Johnson at 8:47 AM but not Mr. Garcia.

What Happens: Companies implement “black box” AI that works great but can’t explain decisions. First compliance audit fails spectacularly. Legal fees skyrocket. Management panics and blames the technology.

Solution: Use explainable AI from day one. Every decision needs a clear reason. Document everything. Build audit trails. Make compliance your vendor’s problem.

Integration Complexity

The Problem: Your systems were built decades ago. Everything runs on different platforms that don’t talk to each other.

What Happens: AI vendor promises “seamless integration.” Six months later, data syncing fails randomly. Reports show conflicting numbers. Your IT team threatens to quit.

Solution: Work with a provider experienced in system integrations, API development, and automated debt collection software development to bridge gaps without disrupting operations.

Future Trends in AI and Debt Collection to Watch in 2025-26

Future trends in AI and debt collection point toward sophisticated applications that blur lines between customer service and collection activities. Emerging technologies promise more predictive, personalized, and preventive debt recovery. Here’s what’s shaping the next wave.

Advanced natural language processing applications will let AI conduct complex negotiations and handle emotional conversations with greater nuance. These systems will understand context, emotion, and cultural differences for truly personalized service.

Blockchain integration will provide transparent, unchangeable records of all collection activities. This addresses compliance concerns while enabling new automated dispute resolution and payment verification.

IoT data analytics will provide real-time insights into customer financial situations through spending patterns, location data, and lifestyle indicators. This enables proactive intervention before accounts become delinquent.

Predictive analytics will evolve from reactive collection to proactive financial wellness programs. AI will identify customers at risk of financial distress and automatically offer resources to prevent delinquency.

Why Partnering With Appinventiv for AI Debt Collection Delivers Proven Results

The debt collection industry is no longer a game of volume. It’s a precision-driven process that blends intelligence, empathy, and compliance. AI in debt collection brings all three together, transforming recovery from a reactive pursuit into a proactive, strategic advantage.

However, success with artificial intelligence in debt collection requires much more than simply mastering the technology. Organizations need foolproof planning and expertise of an AI development services provider who can execute that plan in action with utmost efficiency.

This is where we come in. At Appinventiv, we’ve partnered with over 500 FinTech companies to implement lending software development services that combine predictive analytics, conversational AI in debt collection, and real-time compliance monitoring. Our proven track record of delivering 3000+ successful solutions, including AI debt collection software development, ensures you will get a technologically advanced, fully compliant, and scalable platform tailored to your specific operational model.

Our FinTech expertise isn’t just theoretical; it’s proven in real-world results, for instance.

- Mudra: We built Mudra, an AI-powered, chatbot-driven budget management app designed for millennials. With playful interactions, personalized financial insights, and intuitive automation, Mudra helps users manage expenses effortlessly.

Results? It’s now live in 12+ countries, showcasing our strength in scalable, AI debt collection software development.

- Edfundo: Our tech experts developed Edfundo. This is the world’s first financial intelligence platform for kids, featuring a prepaid card, interactive learning lab, and parental controls—all built from ideation through deployment by Appinventiv.

Results? The project helped Edfundo raise $500K in pre‑seed funding and earn recognition as FinTech Startup of the Year.

These projects demonstrate our ability to apply AI beyond theory, delivering measurable improvements in recovery rates, compliance adherence, and customer trust.

Whether you’re running a pilot project or embarking on a full-scale modernization, the competitive edge is clear: early adopters of AI in debt recovery are the ones setting industry benchmarks. The future isn’t just about automated debt collection technology. It’s about intelligent, adaptive systems designed for sustainable success. And at Appinventiv, our team of 1600+ tech wizards builds them.

Let’s collaborate to bring AI into action now.

FAQs

Q. How is AI used in debt collection?

A. AI in debt collection serves multiple functions, including predictive scoring for account prioritization, automated communication across channels, real-time compliance monitoring, and personalized payment plan creation. AI systems analyze massive data to determine optimal collection strategies for each account, resulting in higher recovery rates and improved customer experiences.

Q. Why does AI debt collection matter?

A. AI debt collection matters because it fixes fundamental problems of traditional methods. Manual processes are expensive, inconsistent, and often ineffective. AI provides 24/7 availability, personalized communication, predictive insights, and automated compliance monitoring.

Q. Why are AI agents better than chatbots in debt collection?

A. Debt collection virtual agents powered by AI are superior to traditional chatbots because they understand context, emotion, and complex financial situations. While basic chatbots follow scripted responses, AI agents use natural language processing and machine learning for personalized solutions. They negotiate payment plans, analyze customer sentiment, and escalate complex issues to humans seamlessly.

Q. How does AI in debt collection ensure compliance with data protection regulations?

A. Compliance with AI debt collection involves implementing transparent algorithms auditable for fair lending and discrimination prevention. AI systems must include explainable decision-making, data privacy protections, and regulatory reporting capabilities. Real-time monitoring ensures communications comply with FDCPA, TCPA, and other regulations while maintaining detailed audit trails.

Q. How does AI detect fraud in debt collection?

A. AI detects fraud by analyzing patterns in customer behavior, payment methods, and dispute claims. Machine learning algorithms identify anomalies indicating fraudulent activity, such as coordinated dispute campaigns or fake hardship documentation. Systems provide confidence scores for fraud likelihood and automatically flag suspicious cases for human investigation while allowing legitimate transactions to proceed normally.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Governance vs. Speed: Designing a Scalable RPA CoE for Enterprise Automation

Key takeaways: Enterprise RPA fails at scale due to operating model gaps, not automation technology limitations. A federated RPA CoE balances delivery speed with governance, avoiding bottlenecks and audit exposure. Governance embedded into execution enables faster automation without introducing enterprise risk. Scalable RPA requires clear ownership, defined escalation paths, and production-grade operational controls. Measuring RPA…

How AI Overhauling Industrial Automation in Australia

Key takeaways: AI is shifting industrial automation from rule-based to data-driven decision ecosystems Predictive and autonomous operations are improving efficiency and cost optimisation Australian industries are leveraging AI to solve workforce, sustainability, and compliance challenges Enterprises adopting AI early gain competitive, operational, and economic advantages Industrial automation in Australia is no longer just an engineering…

Implementing Retrieval-Augmented Generation in Healthcare Systems: Challenges, Use Cases & ROI

Key takeaways: RAG helps clinicians make better decisions by connecting AI responses to trusted clinical data sources. Healthcare organizations are gradually adopting domain-specific AI to improve efficiency, compliance, and operational clarity. Successful RAG deployment usually depends on strong governance, interoperability planning, and secure data practices. Retrieval-backed AI can ease documentation workload while improving accuracy, productivity,…