- Traditional vs AI Credit Scoring Platforms

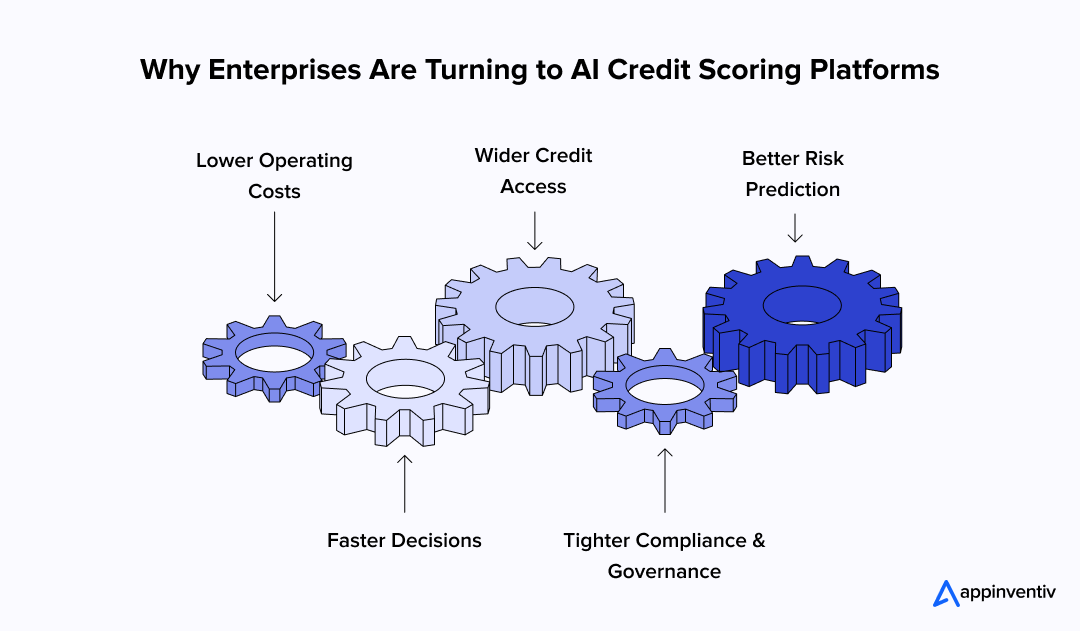

- Why Enterprises Are Turning to AI Credit Scoring Platforms: A Glimpse into the Benefits

- Lower Operating Costs

- Faster Decisions

- Wider Credit Access

- Tighter Compliance and Governance

- Better Risk Prediction

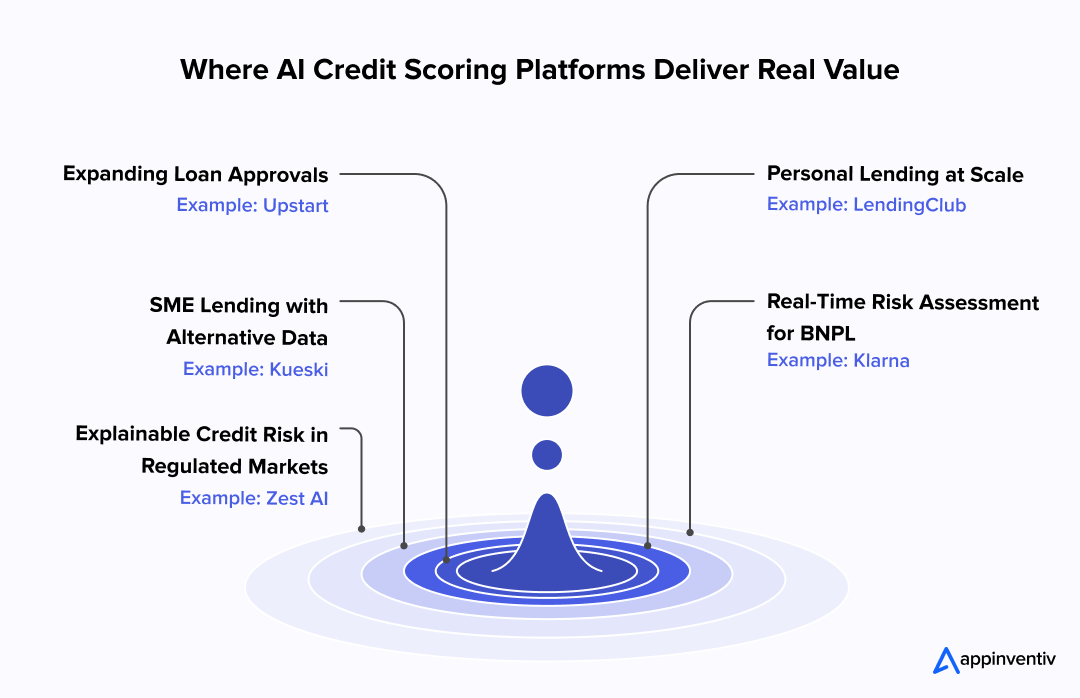

- Where AI Credit Scoring Platforms Deliver Real Value: Understanding the Applications

- Expanding Loan Approvals

- Personal Lending at Scale

- Real-Time Risk Assessment for BNPL

- SME Lending with Alternative Data

- Explainable Credit Risk in Regulated Markets

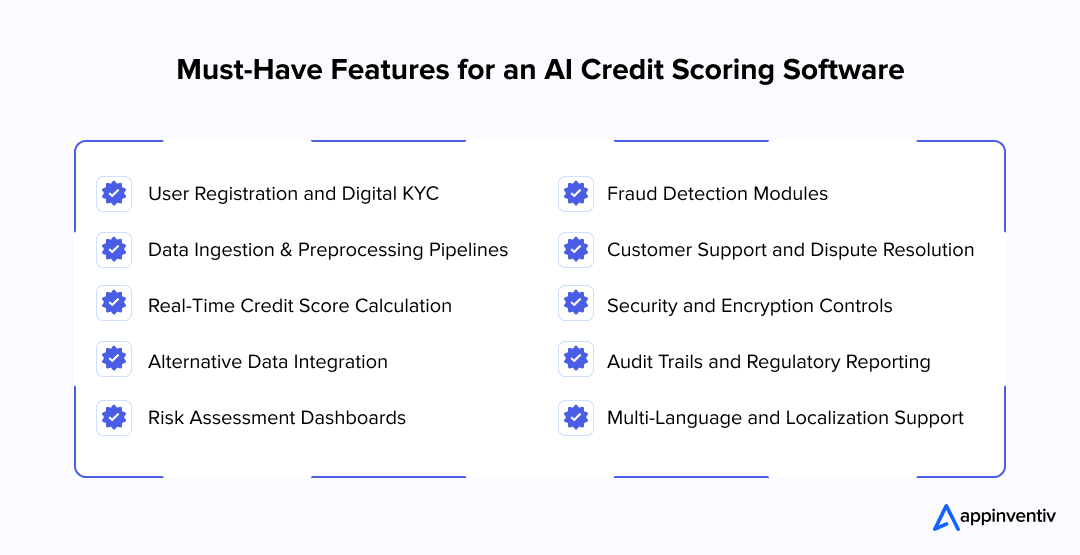

- Core Features of an AI Credit Scoring Platform

- User Registration and Digital KYC

- Data Ingestion and Preprocessing Pipelines

- Real-Time Credit Score Calculation

- Alternative Data Integration

- Risk Assessment Dashboards

- Fraud Detection Modules

- Customer Support and Dispute Resolution

- Security and Encryption Controls

- Audit Trails and Regulatory Reporting

- Multi-Language and Localization Support

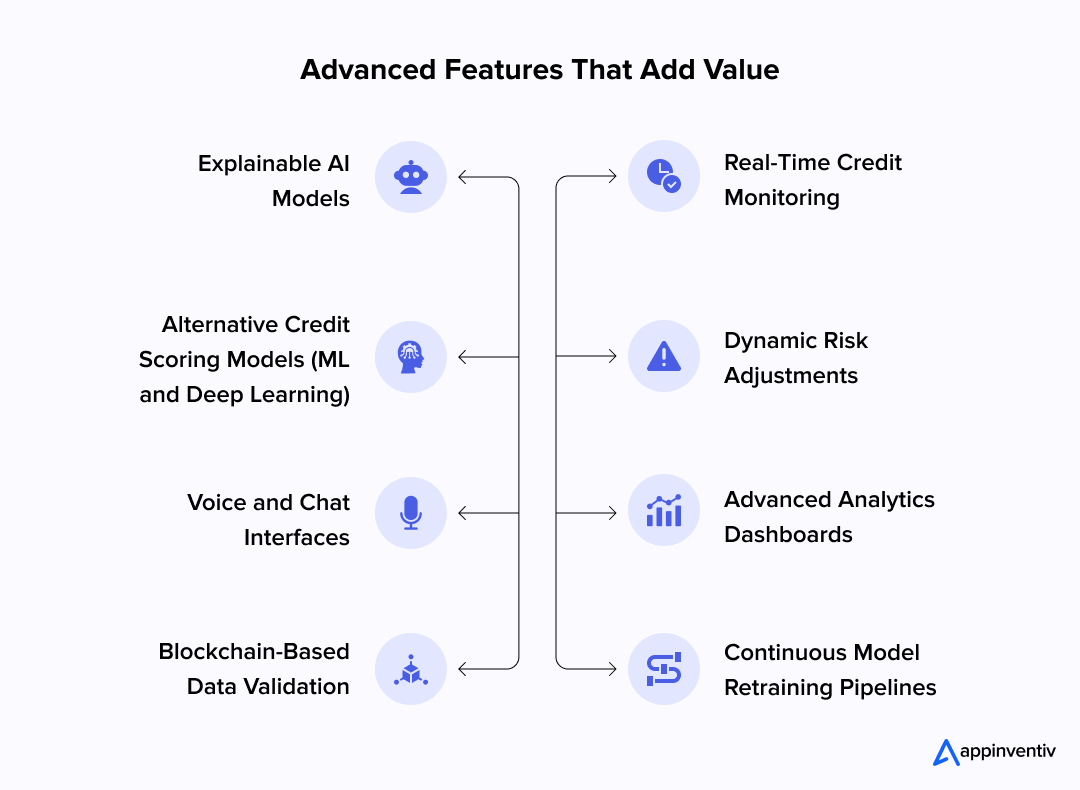

- Advanced Features to Elevate an AI Credit Scoring Platform

- Explainable AI Models

- Real-Time Credit Monitoring

- Alternative Credit Scoring Models

- Dynamic Risk Adjustments

- Voice and Chat Interfaces

- Advanced Analytics Dashboards

- Blockchain-Based Data Validation

- Continuous Model Retraining Pipelines

- How Much Does It Cost to Develop an AI Credit Scoring Platform?

- Key Factors Influencing the Cost to Build an AI Credit Scoring Platform

- Feature Complexity

- Data Sources and Integrations

- Security and Compliance

- Scalability and Infrastructure

- Customization and Explainability

- UI and UX Design

- Maintenance and Model Retraining

- Technology Stack

- Geographic Targeting and Localization

- Testing and Quality Assurance

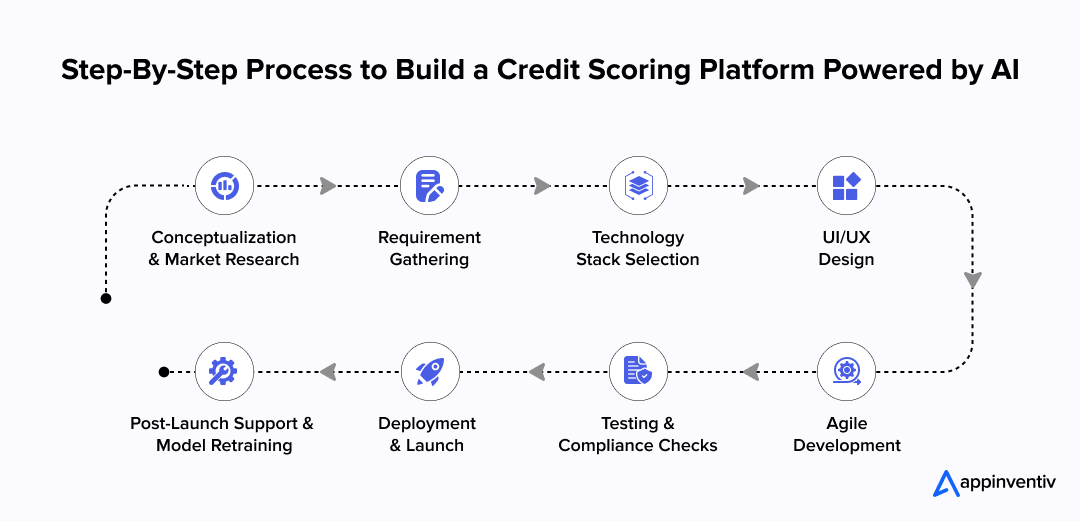

- Step-By-Step Guide to Developing an AI Credit Scoring Platform

- Conceptualization and Market Research

- Requirement Gathering

- Technology Stack Selection

- UI and UX Design

- Agile Development

- Testing and Compliance Checks

- Deployment and Launch

- Post-Launch Support and Model Retraining

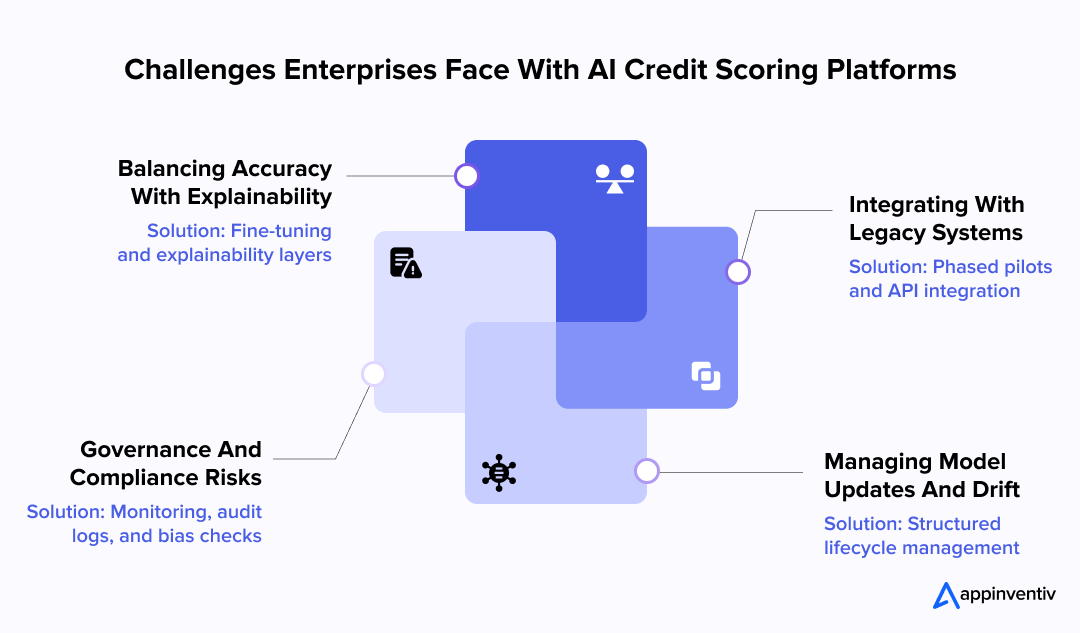

- Challenges Enterprises Face With AI Credit Scoring Platforms

- Balancing Accuracy With Explainability

- Integrating With Legacy Systems

- Governance And Compliance Risks

- Managing Model Updates And Drift

- Future Outlook: AI Credit Scoring Platforms for Modern Enterprises

- From Savings To Strategy

- Industry-Ready Models

- Side By Side With Traditional Models

- Why Choose Appinventiv to Develop Your AI Credit Scoring Platform

- FAQs

Key takeaways:

- AI credit scoring platforms expand approvals while reducing default risk.

- Traditional credit scoring is slower, less inclusive, and harder to explain.

- Alternative data like utilities, payments, digital footprints widens access to credit.

- Explainable AI ensures compliance with GDPR, AML, and KYC frameworks.

- Real-world players like Upstart, Klarna, and Zest AI prove the business impact.

- Building an AI credit scoring platform can cost $50,000–$300,000+, depending on scale, features, and compliance needs.

If you’re running a bank, a fintech, or even the lending division of a large enterprise, you already know credit scoring is no longer just about bureau files and repayment histories. In 2025, the way organizations assess and manage risk has shifted from static, one-size-fits-all models to intelligent, adaptive engines powered by AI. Customers demand instant approvals, regulators demand transparency, and your competitors are already experimenting with AI systems that learn and adjust in real time.

The industry is undergoing a seismic shift. Traditional scoring methods leave too many gaps like slow decisions, limited data coverage, and exclusion of new-to-credit customers. AI credit scoring platforms, by contrast, are rewriting the rules by drawing on broader datasets, improving prediction accuracy, and enabling faster, fairer decisions. For CEOs, CTOs, and risk leaders, this is no longer just a technology upgrade. It’s a strategic move that shapes customer experience, regulatory standing, and long-term competitiveness.

This blog explores how AI is being integrated into credit scoring, where it delivers the most value, and the real-world use cases already reshaping lending practices. We’ll look at the benefits enterprises are unlocking, the challenges they face, and why the shift to AI credit scoring is becoming a necessity rather than an option.

The question is, can your current system compete?

Market Overview: AI Credit Scoring Platforms in 2025

Credit scoring is no longer a back-office function. It has become a competitive differentiator, shaping how fast lenders can approve loans, how accurately they can manage risk, and how fairly they can extend access to new customers. In 2025, AI credit scoring platforms are moving from pilot projects to enterprise standards.

Global adoption is accelerating. Fintechs, neobanks, and traditional lenders are all investing in AI-based credit scoring platform development to stay relevant as customer expectations shift toward instant, transparent, and bias-aware lending.

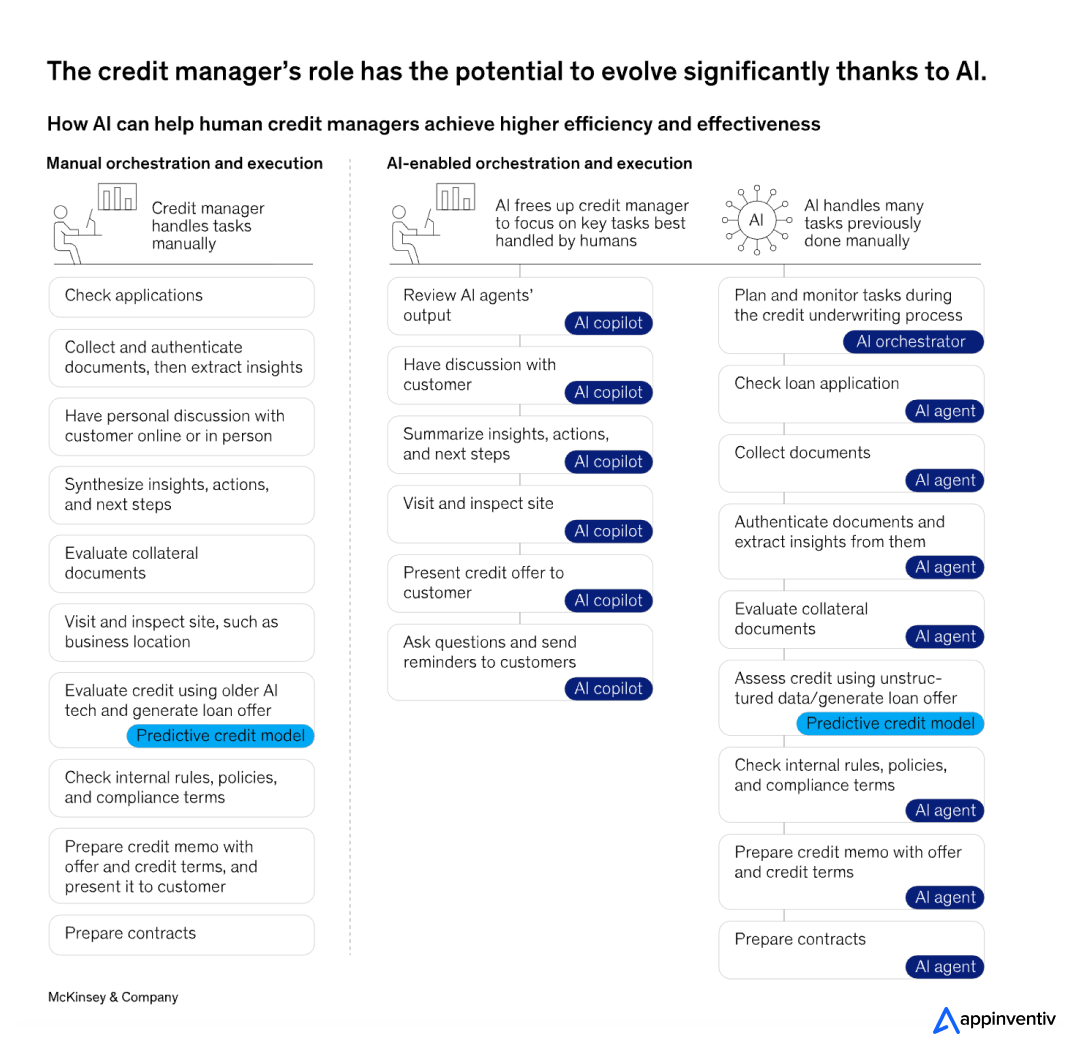

McKinsey highlights that the next generation of AI in banking is moving beyond predictive models into orchestrated multiagent systems. While today’s credit scoring engines powered by AI handle structured data well, businesses are also leveraging multiagent systems, allowing them to bridge the gap between unstructured inputs like customer documents, conversations, or collateral checks.

Think of a policy agent trained on lending rules, a collateral inspection agent spotting fraud in images, and an orchestration layer acting as a copilot for credit managers automating the entire credit workflow from application to approval. For lenders, this points to a future where credit scoring isn’t just faster, but smarter, explainable, and deeply integrated into the broader decision-making layer of the AI-first bank.

The research also shows the potential impact of multiagent systems on credit workflows. When applied to tasks like preparing credit memos, these systems helped banks achieve productivity gains of 20 to 60 percent for credit analysts, while also driving around 30 percent faster decision-making. For enterprises integrating AI in credit scoring, this demonstrates how orchestrated AI can go beyond risk prediction to reshape end-to-end lending operations.

So, what are the things driving the actual surge today? Three big forces include:

- Fintech adoption at scale: Challenger banks and BNPL players rely almost entirely on AI for credit scoring, enabling approvals in seconds instead of days.

- Regulatory push: Frameworks like GDPR, PSD2, and open banking rules require explainability and fairness in scoring models. AI-powered credit scoring with explainability layers is answering that call.

- Customer expectations: Borrowers, especially digital-first Gen Z and millennials, expect fast, fair credit decisions. Traditional bureau scores alone can’t deliver that experience anymore.

The spending signals are strong too. Another McKinsey report estimates that banks pour more than $600 billion annually into technology upgrades, and credit decisioning is now one of the top three investment priorities. Real-world evidence backs this up: Upstart’s AI-driven credit models have delivered up to 44% more approvals while reducing defaults by over 50% compared to legacy scoring methods. That kind of impact explains why lenders worldwide are rethinking their approach to credit risk.

Put simply: AI-powered credit scoring platforms for banks and fintechs are no longer experimental but are strategic. Institutions that delay adoption risk losing both market share and regulatory goodwill.

Before moving further, it’s important to pause and look at how credit scoring itself has evolved. Traditional bureau-driven methods are still in use, but their limits are becoming clear when stacked against what modern AI-powered credit scoring platforms can deliver.

Traditional vs AI Credit Scoring Platforms

Let’s look at the core differences between traditional credit scoring and AI credit scoring platforms. While both aim to measure borrower risk, the way they approach data, decision speed, compliance, and inclusion varies dramatically.

| Dimension | Traditional Credit Scoring | AI Credit Scoring Platforms |

|---|---|---|

| Data Sources | Relies mostly on bureau data, repayment history, and a narrow set of financial indicators. | Uses bureau data plus open banking APIs, utility payments, digital transactions, and behavioral signals for a fuller picture. |

| Decision Speed | Decisions often take hours to days, slowed by manual checks and static models. | Provides near real-time approvals, with AI models delivering results in seconds. |

| Risk Accuracy | Linear models with limited variables; higher chances of false approvals or rejections. | Machine learning models capture non-linear patterns, improving prediction accuracy and lowering defaults. |

| Compliance and Explainability | Basic compliance reporting; limited transparency on why decisions were made. | Built-in audit trails, explainable AI outputs, and compliance with GDPR, PCI DSS, AML, and KYC regulations. |

| Inclusion of New Borrowers | Excludes thin-file or new-to-credit customers due to lack of bureau history. | Incorporates alternative data to extend fair credit access to underserved and first-time borrowers. |

| Scalability | Difficult to adapt models for new markets or products without lengthy recalibration. | AI-based credit scoring platforms are modular and cloud-ready, allowing quick adaptation across geographies and lending products. |

| Cost Efficiency | Heavy reliance on manual underwriting and bureau checks increases operational costs. | Automation of risk assessment reduces underwriting costs and scales efficiently with loan volume. |

The contrast is clear: traditional credit scoring provides a foundation but struggles to keep pace with today’s lending demands. AI-powered credit scoring platforms, by comparison, unlock faster, more accurate, and more inclusive decision-making while satisfying regulators and reducing costs.

Now that we’ve seen how the two approaches stack up, let’s look deeper into the benefits that are driving enterprises to adopt Artificial intelligence credit scoring platforms at scale.

Why Enterprises Are Turning to AI Credit Scoring Platforms: A Glimpse into the Benefits

For lenders, the debate is no longer whether to use artificial intelligence in credit risk, but how to do it without creating new risks or runaway costs. Boards have signed off budgets, regulators have raised the bar, and customers expect instant approvals. That combination is why AI credit scoring platform development is moving from pilot to production across banks, fintechs, and alternative lenders. Let’s look at the benefits of AI credit scoring platforms in detail below:

Lower Operating Costs

Traditional credit scoring systems rely on rigid models and manual checks. AI-based credit scoring platforms automate much of this work, cutting underwriting costs and reducing the need for large back-office teams.

Faster Decisions

Borrowers don’t want to wait days for an answer. AI-powered credit scoring delivers decisions in real time, sometimes in seconds, helping lenders approve more applications while keeping default risk under control.

Wider Credit Access

By analyzing alternative data like utility bills, digital payments, even behavioral signals, artificial intelligence-based credit scoring opens lending to thin-file customers often ignored by bureau-only models. This creates new revenue streams while addressing financial inclusion.

Tighter Compliance and Governance

Regulators increasingly demand explainability in credit decisions. Modern AI in credit scoring platforms embed audit trails, fairness checks, and explainable AI outputs that show why a loan was approved or declined.

Better Risk Prediction

AI can process more variables and detect non-linear patterns traditional models miss. This leads to more accurate default predictions and healthier loan portfolios.

This graphic from McKinsey highlights how AI changes the daily reality of credit managers. Instead of spending hours checking loan applications, authenticating documents, and preparing memos manually, AI credit scoring platforms take over much of this orchestration. Tasks like document validation, collateral checks, and predictive scoring are handled by AI agents, while managers step in as copilots, reviewing outputs, interacting with customers, and making final calls.

Where AI Credit Scoring Platforms Deliver Real Value: Understanding the Applications

AI credit scoring is no longer an experiment. It is being deployed in lending ecosystems worldwide to solve real challenges like improving approval rates, expanding access, and tightening risk oversight. Below are practical AI credit scoring use cases, with examples of how financial institutions and fintechs are already applying them.

Expanding Loan Approvals

Traditional credit scoring often leaves out qualified borrowers because it relies too heavily on narrow bureau data. AI-powered credit scoring platforms can analyze a broader set of inputs, allowing lenders to safely approve more customers without increasing default risk.

Upstart demonstrates this clearly. By combining bureau data with education, employment, and spending behavior, its AI models have helped banks and credit unions approve up to 27 percent more loans while lowering default rates by 16 percent compared to legacy scorecards.

Personal Lending at Scale

As volumes of consumer loan applications rise, manual checks and static scorecards slow down underwriting. AI-based credit scoring automates large portions of the process, making it possible to handle scale without sacrificing accuracy or compliance.

LendingClub is a strong proof point that can help you understand the role of Artificial Intelligence in credit scoring. The platform used by the firm analyzes personal loans and small business lending, using bureau data alongside income and transaction patterns. The result is faster decisioning, customized loan offers, and smoother portfolio management.

Also Read: P2P Lending Software Development – Process, Costs, Features, Timelines

Real-Time Risk Assessment for BNPL

Buy Now, Pay Later app development should be backed by decisions at checkout. Traditional scoring methods simply cannot deliver at that speed. AI credit scoring makes it possible to run affordability checks in real time, balancing convenience with risk controls.

Klarna puts this into practice every day. Its AI-powered credit scoring system evaluates millions of BNPL transactions in seconds, factoring in repayment history and behavioral patterns. This helps the company keep approvals fast while maintaining discipline on defaults.

[Also Read: How Much Does it Cost to Build a BNPL App like Klarna?]

SME Lending with Alternative Data

Small businesses and thin-file borrowers often struggle with limited credit histories. AI-integrated credit scoring platforms can incorporate non-traditional data sources such as utility bills, mobile payments, or e-commerce transactions to give these applicants a fair chance.

Kueski in Mexico illustrates this use case well. It uses a credit scoring platform powered by AI that integrates digital behavior and payment histories, enabling thousands of SMEs and first-time borrowers to secure credit that would have been inaccessible under traditional bureau-driven models.

Explainable Credit Risk in Regulated Markets

In markets with strict oversight, lenders need to show not just the decision but the reasoning behind it. AI credit scoring platforms now embed explainability layers that provide clear, auditable trails for regulators and borrowers alike.

Zest AI is one of the leaders here. It builds explainable AI models for banks and credit unions in the U.S., allowing them to expand access to underserved groups while meeting compliance expectations. Every decision is supported by transparent reasoning, satisfying both business goals and regulatory demands.

Core Features of an AI Credit Scoring Platform

A credit scoring app built on artificial intelligence is more than just a scoring engine. It needs the right mix of usability, compliance, and transparency to win trust from banks, fintechs, and end users. Below are the core features that shape any competitive AI credit scoring platform.

User Registration and Digital KYC

Onboarding needs to be secure and seamless: identity verification, document uploads, biometrics, and multi-factor checks ensure compliance with AML and KYC rules while minimizing friction.

[Also Read: AML Software Development – A Detailed Guide for CEOs]

Data Ingestion and Preprocessing Pipelines

AI credit scoring apps depend on structured and unstructured data like bureau records, open banking feeds, behavioral signals. A strong ingestion system cleans, standardizes, and prepares data for model training and scoring.

Real-Time Credit Score Calculation

Instant scoring decisions are now the standard. Platforms must deliver results in seconds, allowing lenders to integrate the score directly into loan origination or customer onboarding flows.

Alternative Data Integration

Beyond bureau scores, modern systems pull telecom, utility, and transaction data. This widens access to underserved groups and improves predictive accuracy.

Risk Assessment Dashboards

Credit managers and underwriters need clear dashboards with drill-downs into key risk drivers, rather than just a single score. Transparency builds confidence, leading to maximum traction.

Fraud Detection Modules

AI algorithms can flag unusual patterns or synthetic identities. Running these checks alongside scoring helps lenders avoid exposure to fraudulent applications.

Customer Support and Dispute Resolution

Borrowers expect ways to raise disputes or clarify scores. Integrating chat, ticketing, or API-based support tools ensures a complete user journey.

Security and Encryption Controls

Encryption at rest and in transit, secure APIs, and tokenized access are critical to safeguard sensitive financial data and stay compliant with global regulations.

Audit Trails and Regulatory Reporting

Every decision must be logged with reasoning trails. Regulators increasingly demand explainable outputs and this feature is no longer optional.

Multi-Language and Localization Support

Global platforms need language support, currency conversion, and regional compliance baked into the core design.

Advanced Features to Elevate an AI Credit Scoring Platform

Once the essentials are in place, advanced features differentiate leaders from followers. These features deepen transparency, improve risk accuracy, and enhance user engagement. They also raise development costs but often deliver long-term returns.

Explainable AI Models

Explainability is key for regulators and lenders. Platforms that show why a decision was made including the factors influencing approval, weightings, and risk scores build trust and satisfy compliance requirements.

Real-Time Credit Monitoring

Scoring isn’t a one-time event. Real-time monitoring tracks customer behavior and updates scores dynamically, reducing exposure to defaults.

Alternative Credit Scoring Models

Using machine learning and deep learning expands reach. Models can incorporate non-traditional data like social signals, digital payments, behavioral trends to improve access for thin-file borrowers.

Dynamic Risk Adjustments

AI-based credit scoring platforms can adapt to macroeconomic conditions or lender-specific rules. This feature allows institutions to adjust thresholds quickly when markets change.

Voice and Chat Interfaces

For lenders and partners, voice and chatbot interfaces make interacting with the platform faster, querying scores, checking applicant details, or running bulk checks without needing complex dashboards.

Advanced Analytics Dashboards

Visual insights into approval rates, default trends, and risk segmentation allow executives to see portfolio health in real time, not weeks later.

Blockchain-Based Data Validation

Ledger technology can verify the authenticity of submitted documents or credit histories, reducing fraud risk and improving trust across stakeholders.

Continuous Model Retraining Pipelines

The best systems don’t go stale. Built-in retraining cycles keep models aligned with new data, ensuring accuracy and compliance without heavy manual intervention.

How Much Does It Cost to Develop an AI Credit Scoring Platform?

Building an AI-integrated credit scoring platform is not a routine software job. You’re dealing with sensitive data, strict regulations, and models that need constant training. That makes the investment bigger, but also more strategic.

For context, the AI credit scoring platform development cost platform usually starts at about $50,000 for a basic MVP. That kind of build will cover data ingestion, a simple scoring engine, and a dashboard. At the other end of the spectrum, a full enterprise system with explainable AI, fraud detection, and deep integrations into banking or fintech ecosystems can cross $300,000 or more.

The math behind it is straightforward:

Development hours × hourly rate = total platform cost

- Development hours depend on scope. Training AI models, building APIs, and setting up compliance workflows can stretch from a few months to close to a year.

- Hourly rates vary as per the expertise of the AI developers.

Here’s what a typical cost breakdown looks like:

| Phase | Timeline | Estimated Cost (USD) |

|---|---|---|

| Research & Data Strategy | 2–4 weeks | $5,000 – $15,000 |

| UI/UX Design | 3–6 weeks | $8,000 – $25,000 |

| Core AI Model Development | 3–6 months | $30,000 – $150,000 |

| Security & Compliance (GDPR, PCI DSS, AML/KYC) | Ongoing | $15,000 – $50,000 |

| Testing & Quality Assurance | 1–2 months | $10,000 – $30,000 |

| Deployment & Launch | 2–4 weeks | $3,000 – $12,000 |

| Maintenance & Model Retraining | Ongoing (monthly) | $2,000 – $12,000/month |

The reality is that AI credit scoring platform development cost will always track back to choices you make. A fintech startup may want a lean build focused on alternative data and faster approvals. A U.S. bank will spend more to cover full compliance, explainability, and scale across millions of decisions every day.

Key Factors Influencing the Cost to Build an AI Credit Scoring Platform

When budgeting for an AI-powered credit scoring platform, the cost depends on choices you make around scope, compliance, and scale. Each lever has a direct impact on timelines and budgets, and understanding them early helps avoid surprises.

Feature Complexity

The level of features you want in an AI-integrated credit scoring app directly affects both cost and delivery time. A minimal build with core credit scoring functions can be delivered in a few months, while advanced AI-based credit scoring platforms with explainability modules, fraud detection, and real-time dashboards require longer cycles and deeper expertise.

| Complexity Level | Estimated Development Time | Estimated Cost (USD) |

|---|---|---|

| Basic | 2–3 months | $50,000 – $80,000 |

| Moderate | 4–6 months | $80,000 – $150,000 |

| Advanced | 6–9 months | $150,000 – $250,000 |

| Enterprise | 9+ months | $250,000 – $300,000+ |

Data Sources and Integrations

AI powered credit scoring platforms use a mix of bureau data, open banking APIs, alternative data, and even behavioral information. Every new integration adds development time, especially when dealing with legacy systems or third-party connectors.

Security and Compliance

Credit scoring is highly regulated. Meeting standards like PCI DSS, GDPR, AML, and KYC means encryption, audit trails, and explainable AI need to be built into the platform. These are non-negotiable and often one of the most significant contributors to AI credit scoring platform development cost.

Scalability and Infrastructure

The infrastructure required for a small fintech is different from that of a multinational bank. Global platforms need scalable cloud services, load balancing, high availability, and disaster recovery. Building this capacity into a credit scoring platform increases upfront cost but ensures long-term stability.

Customization and Explainability

Off-the-shelf scoring models are cheaper, but they rarely meet enterprise requirements. Custom AI models with explainability (XAI) and personalized decision workflows increase accuracy and compliance, but they also raise the cost of development.

UI and UX Design

The engine may run in the background, but risk managers and underwriters interact with the front-end. A user-friendly AI credit scoring application with dashboards, clear workflows, and accessibility support takes time to design and test, yet it reduces friction and rework later.

Maintenance and Model Retraining

AI-based credit scoring platforms are never finished. Models degrade without retraining, compliance rules evolve, and new data streams become available. Ongoing retraining, updates, and customer support are part of the total cost.

Technology Stack

Most AI-powered credit scoring platforms for banks and fintechs use stacks built on Python, TensorFlow, or PyTorch, combined with modern back-end frameworks. The choice of stack affects developer availability and cost. Specialized tools often require scarce expertise, which raises rates.

[Also Read: Choosing the Right AI Tech Stack – The Why’s and How’s for Businesses]

Geographic Targeting and Localization

An AI credit scoring platform targeting multiple countries needs localization for language, currency, and regulatory frameworks. The U.S. Fair Credit Reporting Act has different requirements than Europe’s GDPR, and compliance with both adds complexity and spend.

Testing and Quality Assurance

Unlike standard apps, AI-integrated credit scoring platforms must be tested not only for functionality but also for bias, fairness, and regulatory explainability. This requires deeper QA cycles and specialized audit tools, which increase project cost but are essential for trust.

Smart lenders are moving to AI credit scoring to cut costs and boost approvals.

Step-By-Step Guide to Developing an AI Credit Scoring Platform

Building an AI credit scoring platform is not just another software project. It mixes regulation, sensitive data, and lender trust. Without a clear roadmap, costs spiral and adoption slows. The process below is how most successful players approach it.

Conceptualization and Market Research

This is the stage where the foundation of the platform is set. Teams define the purpose: is the platform for retail lending, SME loans, or BNPL? They identify the regions of operation as compliance varies accordingly. Market research comes next: scanning existing players like Upstart or LendingClub, identifying gaps in speed, inclusion, or explainability. Regulators are also mapped early, because rules like FCRA in the U.S. or GDPR in Europe dictate what’s possible from day one.

Requirement Gathering

Once the “why” is established, focus shifts to the “what.” Here, business leaders and tech teams lock down the scope: core scoring engine, explainable AI layers, fraud detection modules, and real-time dashboards. Features are listed, ranked, and tied directly to compliance mandates like KYC and AML. The outcome is a blueprint: a clear, shared understanding of what the platform will deliver and under what constraints.

Technology Stack Selection

The stack decides performance and maintainability. Most AI credit scoring systems are built on Python with TensorFlow or PyTorch for modeling, supported by SQL or NoSQL databases. Deployment usually sits on AWS, Azure, or GCP, each offering scalable infrastructure for large datasets. Decisions made here influence costs and flexibility for years ahead: do you need GPU-heavy servers for deep learning, or lighter infrastructure for smaller models? The wrong stack locks you into high costs, while the right one balances speed, scale, and budget.

UI and UX Design

A powerful engine is wasted if users can’t operate it. This stage is about designing dashboards and workflows for risk managers, underwriters, and compliance officers. Prototypes are built, tested, and refined: simple navigation, drill-downs into score drivers, alerts for fraud risks. Good UI/UX builds trust in AI-based credit scoring decisions, making it easier for teams to adopt the platform in real lending scenarios.

Agile Development

Development doesn’t happen in one go. Work is broken into sprints: first the scoring engine, then the integration of data pipelines, then the explainability modules, and finally fraud detection or advanced dashboards. Agile means testing after every sprint, adjusting models, and refining integrations before scaling. This agile staged approach reduces late surprises, keeps budgets under control, and ensures features align with lender needs.

Testing and Compliance Checks

This is not just about fixing bugs. Testing covers multiple layers: accuracy of predictions, model fairness across demographic groups, and explainability under rules like GDPR or FCRA. Bias audits, penetration testing for data security, and stress testing for high transaction volumes are conducted. Compliance checks run parallel: every model output must be logged, auditable, and regulator-ready. Passing this stage is what makes the platform trustworthy.

Deployment and Launch

The platform is now prepared for production. APIs are connected to loan origination systems, data pipelines are secured, and onboarding flows are tested. Rollouts usually begin with a pilot lender: smaller loan volumes, controlled datasets, limited geographies to fine-tune performance. Once validated, the launch scales to larger networks: banks, fintech partners, and regional markets. This staged deployment reduces risk while proving ROI early.

Post-Launch Support and Model Retraining

For us, the platform development process doesn’t end at launch. Models degrade over time as borrower behavior and market conditions change and it is a problem known as model drift. Post-launch work includes retraining models with new data, updating compliance rules as laws evolve, and refreshing dashboards with new metrics. Customer support also plays a role: onboarding new lenders, handling disputes, and monitoring performance. This is an ongoing cost, but without it, the platform quickly loses accuracy and trust.

Challenges Enterprises Face With AI Credit Scoring Platforms

AI-integrated credit scoring platforms bring speed, fairness, and transparency into lending but they’re not without hurdles. Executives need to understand where the pressure points are so they can plan realistically. Below are the main challenges of developing AI credit scoring platforms, along with practical ways to solve them.

Balancing Accuracy With Explainability

The core trade-off is simple: the more complex the AI model, the harder it can be to explain to regulators and customers. Black-box decisions may raise questions of fairness and bias.

Solution: Fine-tune models on domain-specific lending data and add explainability layers that show which factors influenced the score. This balances accuracy with transparency.

Integrating With Legacy Systems

Most banks and lenders still rely on legacy systems for loan origination, risk reporting, and compliance checks. Plugging in an AI credit scoring platform can expose compatibility gaps.

Solution: Run phased pilots in selected loan products and connect through tested APIs or middleware before scaling. This approach prevents disruption to existing workflows.

[Also Read: How to Fast-Track Legacy Application Modernization with Artificial Intelligence]

Governance And Compliance Risks

Credit scoring is highly regulated. Without the right safeguards, even advanced credit scoring platforms can pave the way for AI risks like biased or non-compliant outcomes.

Solution: Build compliance from day one. That means dashboards for monitoring, audit logs, bias testing, and explainability reports that can stand up to regulatory scrutiny.

Managing Model Updates And Drift

AI models degrade if not retrained. Market conditions change, borrower behaviors evolve, and regulations tighten. Running outdated models is risky for both compliance and portfolio health.

Solution: Adopt structured lifecycle management. Schedule regular retraining cycles, maintain version control, and assign ownership across risk and IT teams. Treat the scoring engine as a living enterprise asset, not a one-off build.

Future Outlook: AI Credit Scoring Platforms for Modern Enterprises

AI credit scoring is no longer just about cutting underwriting costs but is becoming part of the enterprise backbone. Here’s where the shift is heading over the next few years.

From Savings To Strategy

Today, many institutions adopt AI-based credit scoring tools to lower operational costs and speed up decisions. Tomorrow, it will be central to how lenders design new products, reach underserved markets, and meet compliance with confidence.

Industry-Ready Models

We’ll see more pre-trained, domain-specific models enter the market that are tailored to banking, fintech, or regional regulations. Instead of building from scratch, enterprises will be able to adopt models already aligned to industry rules, shortening deployment cycles.

Side By Side With Traditional Models

Traditional scoring won’t vanish overnight. But AI-powered credit scoring platforms will increasingly run alongside bureau scores, offering dual checks: one for compliance, one for accuracy and reach. Over time, AI systems will carry the bulk of decision-making, with traditional scores playing a supporting role.

In short, AI-powered credit scoring platforms are moving from efficiency tools to core decision engines. They are faster, more inclusive, and easier to align with compliance than legacy models and they will soon define the way modern enterprises lend.

Why Choose Appinventiv to Develop Your AI Credit Scoring Platform

AI credit scoring platform development isn’t generic app work but sits at the intersection of finance, compliance, and machine learning. You need a partner who knows the lending platform development ecosystem by heart. That’s where Appinventiv fits.

- Fintech expertise: Years building apps for banks and fintechs, with focus on compliance-heavy use cases.

- Security-first approach: GDPR, PCI DSS, AML, KYC, all built into the process, not tacked on at the end.

- Customized builds: Every lender is different, so every AI credit scoring app we deliver is tailored, including their features, data flows, reporting.

- Cross-platform delivery: Web and mobile experiences that integrate smoothly with legacy systems and modern APIs.

- Ongoing retraining and updates: We don’t hand off and walk away. Support covers model drift, new compliance needs, and feature refreshes.

- End-to-end partnership: From concept validation through global scaling, the team works alongside you and not as contractors but as long-term tech partners.

By leveraging our AI integration services, you get more than software. You get an AI credit scoring platform built for compliance, scale, and market trust.

FAQs

Q. How Does AI-Based Credit Scoring Work?

A. AI-based credit scoring is designed to move faster and use more signals than the old bureau-only approach. Instead of just relying on a static score, it brings together different data points, runs them through trained models, and produces a decision in real time. That’s the core idea behind AI for credit scoring functions.

Here’s how the flow typically works:

- Data collection: Information is pulled from credit bureaus, banking feeds, utility bills, digital payments, and sometimes behavioral data.

- Data preparation: The raw inputs are cleaned, standardized, and matched so they can be used consistently.

- Feature extraction: Key patterns such as repayment history, income stability, or transaction behavior are identified.

- Model training: Machine learning models are trained on past outcomes, learning which combinations of signals predict repayment and which point to default.

- Scoring in real time: When a new application is received, the model runs the data and delivers a score instantly, often within seconds.

- Explainability: Modern platforms also show which factors influenced the score, helping meet compliance requirements and building trust with lenders and regulators.

- Ongoing updates: Models are retrained regularly with fresh data so they stay accurate as customer behavior and market conditions change.

This setup helps banks, fintechs, and lending arms approve more borrowers safely, reduce defaults, and meet regulatory expectations at the same time.

Q. How AI-Based Credit Scoring is Different from Traditional Models?

A. Traditional credit scoring models rely heavily on bureau reports and repayment history, which limits their ability to assess new-to-credit or thin-file customers. They are often slow, rigid, and miss broader financial signals. AI-integrated credit scoring, on the other hand, draws on a much wider range of data including banking transactions, utility payments, and digital spending behavior and applies machine learning to identify patterns beyond the reach of legacy methods. This enables lenders to deliver faster decisions, more accurate risk assessments, and fairer access to credit for a wider customer base.

A credit scoring platform powered by AI is stronger, but it is not a full replacement yet. Both approaches often work together- AI widens access by analyzing alternative data and improving risk accuracy while traditional models remain necessary for regulatory compliance and standardized benchmarks. Many lenders now run hybrid systems that blend bureau data with AI insights.

Q. How much does it cost to build an AI credit scoring platform?

A. The cost depends on the scope, compliance needs, and integrations you plan. On average, AI credit scoring platform development ranges between $50,000 and $300,000 or more.

- Basic MVPs with core scoring functions: $50,000–$80,000

- Moderate builds with dashboards and integrations: $80,000–$150,000

- Advanced systems with explainability and fraud detection: $150,000–$250,000

- Enterprise-grade platforms serving global banks: $250,000–$300,000+

Q. How long does it take to develop an AI credit scoring system?

A. Timelines vary based on complexity, features, and compliance requirements. A typical build can take anywhere from 3 months to over a year.

- Basic MVP: 2–3 months

- Moderate platform with integrations: 4–6 months

- Advanced builds with real-time risk modules: 6–9 months

- Enterprise-grade system with full compliance: 9–12+ months

Q. What are the main compliance requirements?

A. Any AI-integrated credit scoring app must embed strict regulatory standards from day one. Key frameworks include:

- GDPR and CCPA: Data privacy and customer consent

- AML and KYC: Identity verification and anti-fraud controls

- FCRA (US) and EU PSD2: Credit reporting and open banking requirements

- PCI DSS: Payment security if financial transactions are involved

- Audit trails and explainability: Showing regulators why a score was approved or declined

Q. Is outsourcing AI credit scoring development a good idea?

A. Outsourcing can be a smart move if managed well, especially for banks and fintechs without in-house AI expertise.

- Pros: Access to skilled AI developers, lower upfront cost, faster delivery

- Cons: Dependency on vendor expertise, potential compliance gaps if not carefully managed

- Best approach: Keep core scoring logic and sensitive data governance in-house, while outsourcing specific modules like fraud detection, model training, or UI/UX development.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

AI-Powered Booking Optimization for Beauty Salons in Dubai: Costs, ROI & App Development

Key Highlights AI booking optimization improves utilization, reduces no-shows, and stabilizes predictable salon revenue streams. Enterprise salon platforms enable centralized scheduling, customer insights, and scalable multi-location operational control. AI-enabled booking platforms can be designed to align with UAE data protection regulations and secure payment standards. Predictive scheduling and personalization increase customer retention while significantly reducing…

Data Mesh vs Data Fabric: Which Architecture Actually Scales With Business Growth?

Key takeaways: Data Mesh supports decentralized scaling, while Data Fabric improves integration efficiency across growing business environments. Hybrid architectures often deliver flexibility, governance, and scalability without forcing premature enterprise-level complexity decisions. Early architecture choices directly influence reporting accuracy, experimentation speed, and future AI readiness across teams. Phased adoption reduces risk, controls costs, and allows architecture…

Governance vs. Speed: Designing a Scalable RPA CoE for Enterprise Automation

Key takeaways: Enterprise RPA fails at scale due to operating model gaps, not automation technology limitations. A federated RPA CoE balances delivery speed with governance, avoiding bottlenecks and audit exposure. Governance embedded into execution enables faster automation without introducing enterprise risk. Scalable RPA requires clear ownership, defined escalation paths, and production-grade operational controls. Measuring RPA…