- Why is Agentic AI RoI So Hard to Capture?

- The Cost Side of the ROI Equation

- One-Time Costs: Foundations for Scale

- Ongoing Costs: The Subscription Era

- Hidden Costs: The Unseen Drain

- Human & Organizational Costs

- Brief Cost–Benefit Horizon

- How to Calculate Agentic AI ROI?

- The Three ROI Lenses

- Five Checkpoints Before Funding Any AI Agent Project

- Cost Buckets Every CFO Should Watch

- Frameworks That Travel to the Boardroom

- How Early Agentic AI Deployments in Dubai and Beyond Are Shaping ROI?

- What Worked and What Risked Falling Short?

- Why Do These Examples Matter?

- Ensuring High ROI - What the Winners Do Differently

- Five Proven Patterns Behind High-ROI Deployments

- Closing the Talent and Capability Gap

- Checklist to Turn ROI Discipline Into Boardroom Action

- The Non-Negotiable CXO Checklist

- Why Boards Care About This Checklist

- From ROI Frameworks to Execution: Why Appinventiv Matters

- What Sets Appinventiv Apart?

- Turning Strategy Into Reality

- From Hype to Measurable Impact

- FAQs

Key takeaways:

- Sustainable agentic AI ROI in Dubai requires vertical, industry-specific use cases tied directly to measurable P&L drivers, generic pilots rarely scale into enterprise value.

- Hidden costs including integration complexity, regulatory compliance, talent scarcity, and change management can significantly erode projected returns if not governed early.

- ROI must be structured across efficiency, growth, and risk dimensions, with baselines defined before funding and performance reviewed quarterly at the board level.

- Enterprises that combine modular architecture, governance discipline, and region-specific execution expertise are more likely to achieve consistent, defensible ROI outcomes.

Over the past two years, few phrases have carried as much boardroom weight in Dubai as agentic AI ROI. Every vendor pitch deck, innovation team proposal, and advisory memo frames agentic AI as the inevitable next frontier – autonomous agents running workflows, optimizing compliance, and digitizing customer journeys.

Yet, reality is catching up with hype. Globally, over 40% of agentic AI projects are projected to be cancelled by 2027 due to rising costs, lack of clear business value, or insufficient organizational readiness. In Dubai and the broader UAE context, this sharpens a dangerous pattern: high investment, low realization. This is what many are calling the agentic AI ROI Dubai bubble – a rush of enthusiasm, not sustained value.

Even as expectations soar, a Capgemini survey shows that the average AI ROI currently hovers around 1.7× the initial investment, but with wildly uneven delivery across use cases. While this signals potential, the uneven trajectory underscores the difference between pilot excitement and enterprise value.

For Dubai CXOs, the critical question today isn’t “Should we still invest?” but rather “How do we make sure this investment is sustainable?” That difference defines the boundary between temporary applause and lasting transformation.

Leading enterprises already test for three key signals of bubble vs. sustainable ROI:

- Is the project explicitly tied to a P&L driver – such as compliance savings or new revenue?

- Are there global benchmarks or peer comparisons validating the value claim?

- Have ROI metrics been embedded into governance from day one, not after deployment?

Absent these signals, companies risk repeating the tech hype cycles of the past – promising pilots that never mature into profit-generating platforms. The agentic AI era can still be Dubai’s competitive edge – but only if ROI discipline is the foundation, not an afterthought.

Why is Agentic AI RoI So Hard to Capture?

Dubai enterprises are investing heavily in agentic AI in the Middle East, but the returns often fall short of expectations. Understanding the obstacles is essential for any CXO demanding accountability.

1. Misalignment: Horizontal vs. Vertical Use Cases

Across the UAE, many projects focus on “horizontal” deployments – chatbots and general assistants that make flashy headlines but rarely generate meaningful impact. In contrast, deep vertical use cases tied to specific domains like finance, logistics, or healthcare offer the greatest ROI, yet they require more complexity, domain expertise, and integration.

This misalignment is a key reason why AI agents ROI often disappoints: companies invest in easy-to-launch pilots rather than high-value vertical applications where competitive advantage truly lies.

2. Heavy Local Costs, Data Silos & Cultural Barriers

Operational realities in the UAE make it harder to scale agentic AI:

- Data and tech fragmentation: One-third of UAE enterprises struggle to define and measure AI impact due to outdated systems and siloed data.

Before investing in agentic AI, Dubai enterprises must assess their AI readiness and maturity to ensure they have the foundational capabilities needed for successful deployment.

- Talent scarcity: UAE holds 0.4% of the global AI talent pool – ranking in the top 20 globally, but still creating intense competition and cost pressure.

- ROI limitations: Only 37% of UAE finance leaders say they have achieved positive ROI from AI, versus 66% globally.

These factors combine to suppress returns, especially for generic applications that lack domain specificity.

3. Expectation vs. Reality: Comparatives & Benchmarks

Dubai CXOs need more than bold statements; they need context.

- The AI ROI UAE landscape shows strong investment intent, yet struggling execution.

- 49% of UAE finance teams are already using AI, particularly in accounting and reporting, outpacing global adoption. Despite this, only 37% report a positive ROI.

- At the same time, 94% of UAE enterprises believe AI will drive business expansion, and 49% expect significant ROI within 1–2 years.

Yet compared to regions like Singapore or London, Dubai’s higher infrastructure, licensing, and talent premiums weigh down competitive margins.

| Barrier | ROI Impact |

|---|---|

| Horizontal deployments | Dilute resources without delivering revenue or cost benefit |

| Data silos & fragmented infra | Restrict model accuracy and adoption scalability |

| Talent sourcing pressure | Raises operational costs, especially for domain-specific AI development |

| Benchmark gap | High investment intent, but ROI lags global peers |

By pinpointing these challenges – misaligned use cases, fragmented ecosystems, and benchmark disparities – Dubai CXOs gain clarity on why ROI slips through the cracks.

The Cost Side of the ROI Equation

For every dirham spent on innovation, Dubai boards want to see measurable outcomes. But before calculating AI ROI UAE, CXOs must take a disciplined look at the full cost structure of agentic AI adoption. These costs fall into four major buckets: one-time, ongoing, hidden, and human/organizational.

One-Time Costs: Foundations for Scale

- Infrastructure & Cloud – High-performance GPUs, private cloud deployments, and sovereign data hosting often require seven-figure dirham outlays for enterprise scale.

- Data Integration – Connecting fragmented ERP, CRM, and operational systems is a top barrier. Agentic AI implementation challenges UAE are amplified by legacy silos, with many projects spending months on integration before pilots can even start.

- Licenses & Vendor Platforms – Large language model APIs and orchestration platforms are billed on consumption. Without tight monitoring, usage-based costs can spiral.

- Research & Testing – Pilot projects, PoCs, and sandbox testing are essential to validate safety and accuracy. A 2025 Deloitte survey found that more than 65% of organizations in the Middle East plan to increase investment in AI research and hypothesis studies.

Ongoing Costs: The Subscription Era

- Model Updates & Maintenance – Foundation models evolve quarterly. Ongoing spend is required for retraining, fine-tuning, and version migration.

- Regulation & Compliance – New UAE AI ethics and governance guidelines mean continuous auditing and certification.

- Cybersecurity & Monitoring – Autonomous agents expand the attack surface. Security hardening and monitoring are non-negotiable recurring expenses.

- Integration Costs – APIs, middleware, and enterprise service bus upgrades are rarely “one and done”; they require sustained updates to keep agents aligned with core business systems.

Hidden Costs: The Unseen Drain

- Failed Pilots – Gartner projects over 40% of agentic AI projects will be cancelled by 2027 due to ROI shortfalls or complexity.

- Vendor Lock-In – Dependence on one ecosystem drives up long-term licensing fees and limits flexibility.

- Shadow Projects – Teams launching unsanctioned pilots outside governance frameworks lead to duplicated spend and compliance risk.

Human & Organizational Costs

- Talent Acquisition & Retention – With 0.4% of global AI talent based in the UAE, salaries and retention packages climb sharply.

- Change Management – Reskilling employees, aligning processes, and overcoming cultural resistance all carry real costs.

- Training & Upskilling – Continuous training is needed for both technical and business staff to integrate AI into workflows.

Brief Cost–Benefit Horizon

- 6 months → Small automation wins; measurable efficiency in isolated processes.

- 18 months → Integrated projects deliver productivity savings and revenue-linked gains.

- 3 years → Mature enterprises align AI ROI UAE with digital transformation goals, capturing efficiency, growth, and risk-mitigation benefits at scale.

How to Calculate Agentic AI ROI?

For Dubai enterprises, proving value from agentic AI is no longer about experimentation; it is about board-level accountability. CXOs need structured, repeatable ways to measure and defend returns. The most effective approach combines three ROI lenses, disciplined checkpoints before funding, and constant CFO oversight of cost buckets. Together, these elements form the foundation of modern agentic AI frameworks.

The Three ROI Lenses

Every project should be assessed across three complementary lenses. Focusing on just one can distort results and hide the true value – or risk – of the investment.

Efficiency ROI

This measures cost and time saved through automation or process redesign.

- AI agents are cutting reconciliation cycles from days to hours in banking.

- Logistics routing optimization reduces fuel costs in last-mile delivery.

Growth ROI

This evaluates revenue expansion and customer acquisition driven by AI.

- Real estate firms are forecasting demand through AI and personalizing buyer engagement.

- Banks are increasing cross-sell and upsell opportunities with customer-facing agents.

Risk ROI

This captures avoided costs, fines, and losses by improving compliance and resilience.

- Healthcare providers are reducing regulatory penalties with automated compliance monitoring.

- Financial services firms are deploying fraud-detection agents that prevent millions in potential losses.

When viewed together, these three lenses provide the foundation for how to calculate agentic AI ROI in a way that satisfies both operational leaders and the board. But identifying ROI categories is only the first step. CXOs also need rigorous checkpoints before funding to ensure every proposed initiative can stand up to scrutiny.

Also Read: How Much Does It Cost to Build an AI App in Dubai?

Five Checkpoints Before Funding Any AI Agent Project

ROI discipline must start before a single dirham is invested. CXOs should apply five checkpoints at the funding stage:

- Is the use case tied to a P&L driver?

- What baseline metrics exist today, and how will ROI be tracked against them?

- What data and integration gaps must be resolved before deployment?

- What’s the realistic cost horizon – one-time, ongoing, and hidden?

- Is there a clear exit strategy if the project underperforms?

By forcing this discipline upfront, enterprises avoid vanity pilots and focus only on projects with measurable outcomes. Yet even the best-chosen projects can see ROI evaporate if cost governance is weak. That is why the next layer – CFO oversight of cost buckets is critical.

Cost Buckets Every CFO Should Watch

Even well-framed projects can fail if cost governance is weak. CFOs should track three distinct buckets:

- Capital Costs – infrastructure, licenses, and integration.

- Operational Costs – model updates, cybersecurity, compliance monitoring.

- Human Costs – recruitment, retention, and reskilling of talent.

Close monitoring of these buckets prevents ROI erosion and ensures board reporting is grounded in reality. Once this financial clarity is established, CXOs can connect the dots between spend and value using structured agentic AI frameworks.

Frameworks That Travel to the Boardroom

The combination of three ROI lenses, pre-funding checkpoints, and cost oversight creates the type of agentic AI frameworks that resonate at the board level. They are transparent, multi-dimensional, and globally benchmarkable – giving Dubai CXOs confidence that agentic AI is delivering not just hype, but sustained enterprise value.

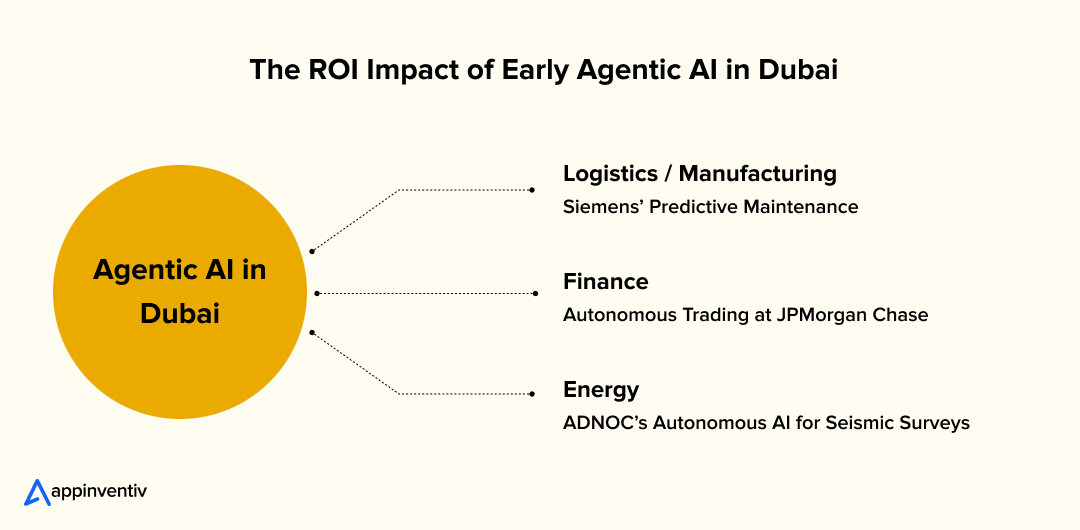

How Early Agentic AI Deployments in Dubai and Beyond Are Shaping ROI?

Frameworks and checkpoints help CXOs decide how to calculate ROI, but the question that follows is always the same: “Who has actually achieved it?” Numbers on a slide are one thing; proof on the ground is another. That’s where real-world deployments become critical. By mapping actual implementations against the three ROI lenses – efficiency, growth, and risk – we can see how agentic AI applications in key Dubai industries are starting to show measurable returns for ones investing strategically in enterprise AI adoption Dubai 2025.

- Logistics / Manufacturing – Siemens’ Predictive Maintenance

- One of the top agentic AI examples can be seen in how Siemens deployed agentic AI to monitor industrial sensor data and predict equipment failures.

- This implementation led to a 25% reduction in unplanned downtime, translating directly into operational savings and production continuity.

- Finance – Autonomous Trading at JPMorgan Chase

- JPMorgan’s “LOXM” system uses agentic AI to execute high-frequency trading in response to rapid market shifts.

- While precise ROI figures aren’t disclosed, results show clear gains in speed, precision, and resilience compared to manual execution.

- Energy – ADNOC’s Autonomous AI for Seismic Surveys

- ADNOC, in collaboration with G42 and Microsoft, is pioneering agentic AI in the UAE energy sector.

- The AI is expected to reduce seismic survey timelines from months to days, while boosting production forecast accuracy by up to 90%.

What Worked and What Risked Falling Short?

| Organization | Industry | Outcome Highlights | Risk/Constraint Highlighted |

|---|---|---|---|

| Siemens | Manufacturing | 25% less downtime via proactive maintenance | Sustained value requires integration with legacy systems |

| JPMorgan Chase | Finance | Faster, automated trading operations | Regulatory oversight and model risk remain key considerations |

| ADNOC (UAE) | Energy | Seismic data acted upon in days; forecast accuracy +90% | Full ROI realization depends on governance and safety controls |

Why Do These Examples Matter?

- These are not hypothetical proofs; they are functioning implementations with tangible outcomes.

- The drivers of ROI – operational efficiency, risk mitigation, and improved accuracy are sector-agnostic and replicable in verticals like logistics, healthcare, and finance.

- While not all details are publicly available, they illustrate how Agentic AI applications in key Dubai industries might be similarly deployed for high-impact results.

Ensuring High ROI – What the Winners Do Differently

For every disappointing pilot that fizzles out, there are a handful of enterprises proving that agentic systems can create lasting value. What sets them apart is not bigger budgets, but sharper discipline. The patterns emerging from successful implementations offer a roadmap for boards in Dubai who want to move past experimentation and toward measurable returns.

Five Proven Patterns Behind High-ROI Deployments

- Start vertical, not horizontal

Enterprises that focus on industry-specific problems like automated compliance using AI agents in finance or predictive logistics in ports – see sharper returns than those chasing generic chatbots. - Tie projects directly to P&L levers

Winning initiatives connect agentic systems to revenue or cost savings. This is where agentic AI benefits UAE enterprises most clearly: measurable gains in efficiency, new income streams, or reduced penalties. - Set ROI baselines before launch

Successful CXOs insist on quantifiable before-and-after comparisons. Without baselines, ROI becomes a narrative instead of a number. - Review ROI quarterly, not annually

The winners don’t wait for the year-end. They track AI-driven ROI in Dubai every quarter, adjusting scope or resources quickly if value creation lags. - Build modular, vendor-neutral architectures

Flexibility is key. Enterprises that avoid deep lock-in can swap in new models or tools as the technology matures – ensuring the benefits of Agentic AI implementation continue to compound over time.

Closing the Talent and Capability Gap

Even with the right patterns, ROI depends on execution. Here, Dubai enterprises face a familiar obstacle: limited access to specialized AI talent. With 0.4% of the global AI talent pool based in the UAE, competition is fierce and salary inflation is real.

The most resilient organizations are responding with hybrid strategies.

- Investing in cross-functional teams that combine AI engineers with deep industry experts.

- Local partnerships with UAE-based innovation hubs and universities to gain access to emerging talent.

- Selective offshore augmentation for specialized model training or integration skills, balanced by strict data sovereignty rules.

By pairing these talent strategies with disciplined investment patterns, CXOs give their enterprises the best chance of securing high and sustainable ROI.

By combining these proven patterns with a pragmatic talent strategy, Dubai enterprises can move beyond pilots and start realizing measurable returns. But knowing what works is only half the battle, as CXOs will also need a clear, actionable agenda they can carry into the boardroom tomorrow – one that translates these lessons into some concrete, actionable steps. That’s where the Dubai CXO guide to agentic AI checklist comes in.

Also Read: How to build an RFID asset tracking system in the UAE?

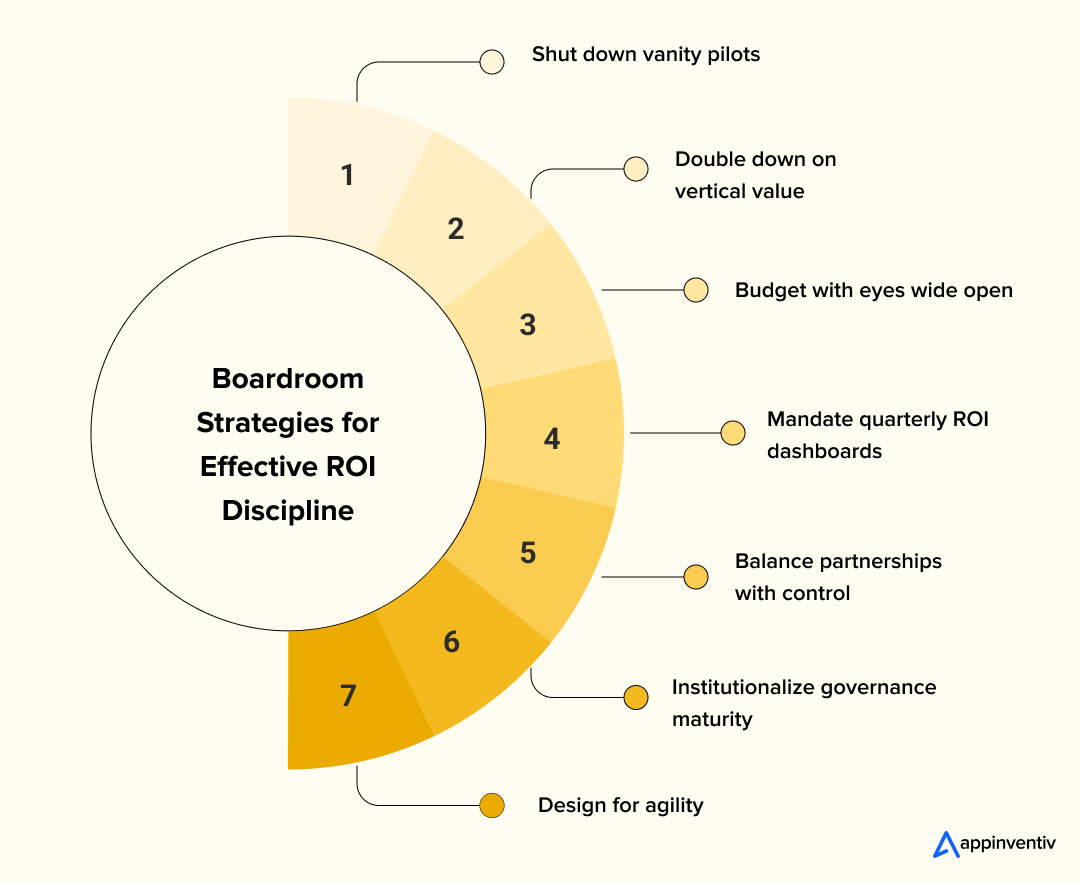

Checklist to Turn ROI Discipline Into Boardroom Action

Agentic AI is no longer about pilots, it’s about proving value. For Dubai CXOs, the difference between chasing hype and capturing measurable returns lies in execution discipline. The following checklist distills the steps that consistently separate winners from laggards in securing AI-driven ROI in Dubai.

The Non-Negotiable CXO Checklist

- Shut down vanity pilots. Don’t waste capital on horizontal agents that can’t tie back to P&L.

- Double down on vertical value. Prioritize agents in finance, logistics, and healthcare where ROI impact is proven. This is where AI agent ROI becomes tangible.

- Budget with eyes wide open. Account for one-time, ongoing, and hidden costs from the outset.

- Mandate quarterly ROI dashboards. Track efficiency, growth, and risk every quarter—not just annually.

- Balance partnerships with control. Work with UAE innovation hubs and vendors, but own governance internally.

- Institutionalize governance maturity. Define ethics, compliance, and exit strategies before scaling.

- Design for agility. Use modular, vendor-neutral architectures to preserve the AI-driven ROI in Dubai over time.

Why Boards Care About This Checklist

Investors and regulators are no longer impressed by “AI in progress” updates. They expect a disciplined, transparent, and financially accountable approach to agentic AI. For CXOs, this checklist is not a nice-to-have; it’s the bare minimum required to keep confidence high, budgets approved, and projects sustainable.

From ROI Frameworks to Execution: Why Appinventiv Matters

Frameworks, checklists, and case studies highlight what works. But the final question every enterprise in Dubai asks is simple: “Who can I trust to deliver this in my enterprise?”

This is where Appinventiv comes in. As a leading artificial development company in Dubai, we have been working with enterprises across finance, healthcare, logistics, and real estate to translate agentic AI from theory into operational impact.

MyExec

We teamed up with MyExec to tackle a problem that hits small businesses hard: they need smart, data-backed decisions but can’t afford expensive consultants or navigate complicated analysis processes.

We built a platform using a multi-agent RAG system that reads through business documents and produces personalized, practical insights. The outcome changed everything: small businesses now get immediate, customized recommendations that help them make better decisions fast, all without paying those steep consultant costs.

Healthcare

Built a Qatar-based AI-powered patient engagement platform that reduced administrative processing times by 30% while improving compliance accuracy.

Finance

Deployed an intelligent onboarding and fraud detection solution that cut verification cycles from several days to a few minutes.

Logistics

Partnered with a regional supply-chain operator to integrate predictive AI agents that would boost delivery efficiency and reduce the costs per shipment.

Each of these initiatives wasn’t about deploying AI for visibility. They were designed, from day one, with ROI baselines and measurable outcomes.

What Sets Appinventiv Apart?

- ROI-first methodology → Every single one of our engagement models begins by mapping out your cost structures, baselines, and measurable KPIs.

- Hybrid expertise → We are a cross-functional team of AI engineers, domain consultants, and compliance specialists.

- Regional alignment → Experience with UAE-specific governance and Smart Dubai initiatives ensures projects meet both regulatory and strategic expectations.

- Scale delivery → From proof of concept to enterprise integration, we bring execution muscle that prevents pilots from stalling.

Turning Strategy Into Reality

Many CXOs now understand the frameworks, lenses, and risks around agentic AI Dubai. The difference between those who achieve ROI and those who remain stuck in the pilot phase lies in execution. With our track record in the region, we offer Dubai enterprises a partner that can de-risk adoption and ensure agentic AI contributes to the bottom line.

From Hype to Measurable Impact

Agentic AI is at a crossroads in Dubai. The initial wave of enthusiasm has already given way to harder questions from boards and regulators: Where is the ROI? The answer is clear: ROI doesn’t appear by chance; it comes from discipline: choosing vertical use cases tied to P&L, embedding ROI baselines early, managing costs across their full horizon, and building hybrid teams capable of execution.

The message for CXOs is straightforward: agentic AI will either be remembered as another bubble or as the engine that powered Dubai’s digital transformation. The difference depends on leadership choices being made today.

- Enterprises that keep chasing vanity pilots risk financial erosion and lost credibility.

- Enterprises that demand AI ROI UAE discipline will set new benchmarks for competitiveness and resilience.

- Those that integrate ROI frameworks, cost oversight, and governance maturity into their strategy will achieve sustainable Agentic AI ROI Dubai.

As this article has shown thorough frameworks, case studies, and boardroom checklists, the path forward is clear. Now, the execution challenge begins.

For Dubai enterprises ready to move from strategy to measurable results, Appinventiv stands as a proven artificial development company in Dubai, a partner that has already delivered AI systems designed around ROI from day one. With its regional expertise, ROI-first methodology, and track record across healthcare, finance, logistics, and real estate, Appinventiv helps CXOs turn vision into measurable outcomes.

In the end, ROI is the gatekeeper. Those who master it will not just adopt agentic AI Dubai effectively, they will define the next chapter of the UAE’s digital economy.

Connect with our AI experts in Dubai now.

FAQs

Q. How do AI agents deliver ROI in enterprise workflows?

A. They take over the boring stuff – data entry, checks, routine follow-ups, so your people can focus on work that actually drives revenue. AI agents ROI comes from time saved, fewer mistakes, and processes moving faster without extra headcount.

Q. What are the best agentic AI use cases for Dubai enterprises?

A. In Dubai, the strongest use cases are the ones tied to industry verticals:

- Finance: automated compliance checks, fraud detection, faster onboarding.

- Healthcare: patient scheduling, triage support, and documentation compliance.

- Logistics: predictive routing, smart port operations, customs clearance.

- Real estate: demand forecasting and hyper-personalized sales journeys.

These are the domains where agentic AI already shows measurable business impact.

Q. How should a CAIO measure AI ROI?

A. A Chief AI Officer shouldn’t just look at “hours saved.” ROI needs three lenses: efficiency (cost and time reduction), growth (new revenue or customers), and risk (losses or fines avoided). A CAIO’s role is to make sure every pilot has baselines for all three, and that results are tracked quarterly, not annually.

Q. What are some Agentic AI governance checklists for regulated sectors in UAE?

A. In banking, healthcare, or government-linked enterprises, the checklist usually boils down to five things:

- Define who owns and monitors the agent.

- Embed compliance rules into workflows from day one.

- Maintain human override for sensitive decisions.

- Audit outputs regularly for bias, accuracy, and transparency.

- Document everything for regulators.

This is how enterprises in regulated sectors keep projects safe and defensible.

Q. What are the data sovereignty requirements for AI in the Middle East?

A. In the UAE and wider Middle East, regulators are strict about where sensitive data sits. Most CXOs will need to host data locally (on UAE cloud zones or private infrastructure) and prove that AI models don’t ship personal or financial data abroad without safeguards. It’s less about banning AI and more about making sure data remains under UAE jurisdiction.

Q. What should be the Agentic AI platform selection criteria for finance/healthcare in UAE?

A. If you’re in finance or healthcare, the first question is not “Which platform is the most advanced?” but “Which one meets my compliance obligations?” The key filters are:

- Local data residency support.

- Ability to integrate with legacy systems.

- Vendor transparency and auditability.

- Exit flexibility (to avoid lock-in).

Cost and performance matter, but in regulated sectors, compliance trumps everything else.

Q. What is agentic AI and how is it different from generative AI?

A. Generative AI creates things – text, images, code. Agentic AI does things. An agent doesn’t just write an email draft; they can schedule the meeting, file the notes, and update the CRM. In other words, generative AI produces content, agentic AI produces outcomes.

Q. Where does agentic AI deliver the fastest ROI?

A. Fastest ROI usually comes from processes that are high-volume and rules-based. In Dubai, this means:

- Financial compliance and KYC in banks.

- Documentation-heavy tasks in healthcare.

- Customs clearance and shipment routing in logistics.

These areas deliver payback quickly because the savings and speed gains are immediate and easy to measure.

Q. How do I measure agentic AI ROI beyond cost savings?

A. You have to expand your definition of AI agents ROI. Beyond costs, ask:

- Did revenue per customer increase because of better personalization?

- Did we avoid fines or losses by catching fraud earlier?

- Did speed-to-market improve enough to capture new business?

If you only measure cost savings, you miss half the value agentic AI creates.

Q. Do I need a CAIO to scale ROI from AI?

A. If AI is central to your strategy, yes. A Chief AI Officer gives projects executive ownership, connects them to P&L, and ensures ROI baselines aren’t forgotten after pilots. Smaller firms may get away with CIO/CTO oversight, but in large Dubai enterprises, a CAIO is becoming a necessity.

Q. What KPIs should Dubai enterprises track for agentic AI?

A. Boards want clarity on AI agents ROI. Useful KPIs for this can include:

- Efficiency: process cycle time reduction, cost per transaction.

- Growth: new revenue contribution, customer conversion rates.

- Risk: number of compliance breaches prevented, fraud cases caught.

- Adoption: percentage of workflows run by agents, user satisfaction scores.

Together, these KPIs tell the real ROI story – not just cost cuts.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

The Enterprise Buyer’s Checklist Before Hiring an AI Development Partner

Key takeaways: Choosing an AI development partner is less about technical demos and more about real-world fit, governance, and operational reliability. Internal alignment on outcomes, data ownership, and integration realities is essential before engaging any enterprise AI partner. Strong partners demonstrate delivery maturity through governance controls, security discipline, and lifecycle management, not just model accuracy.…

Proving the ROI of Copilot AI Sales Enablement Software for Global Teams

Key Takeaways The ROI of Copilot AI sales enablement software shows up in revenue moments, not in generic productivity reports. Organizations that treat Copilot as an AI-powered sales enablement platform tied to sales process maturity see measurable outcomes within two quarters. Global sales teams require region-aware deployment models to avoid uneven adoption and misleading ROI…

Real Estate Chatbot Development: Adoption and Use Cases for Modern Property Management

Key takeaways: Generative AI could contribute $110 billion to $180 billion in value across real estate processes, including marketing, leasing, and asset management. AI chatbots can improve lead generation outcomes by responding instantly and qualifying prospects. Early adopters report faster response times and improved customer engagement across digital channels. Conversational automation is emerging as a…