- The Growing Need for Advanced Fraud Detection in Financial Services

- The Escalating Fraud Crisis

- Evolution of Cyber Thefts and Fraud Tactics

- Limitations of Legacy Fraud Detection

- Challenges, Solutions, and Opportunities in Implementing AI Agents for Fraud Prevention

- Challenges

- Opportunities

- Cost-Effectiveness and ROI of AI-Driven Fraud Detection Solutions

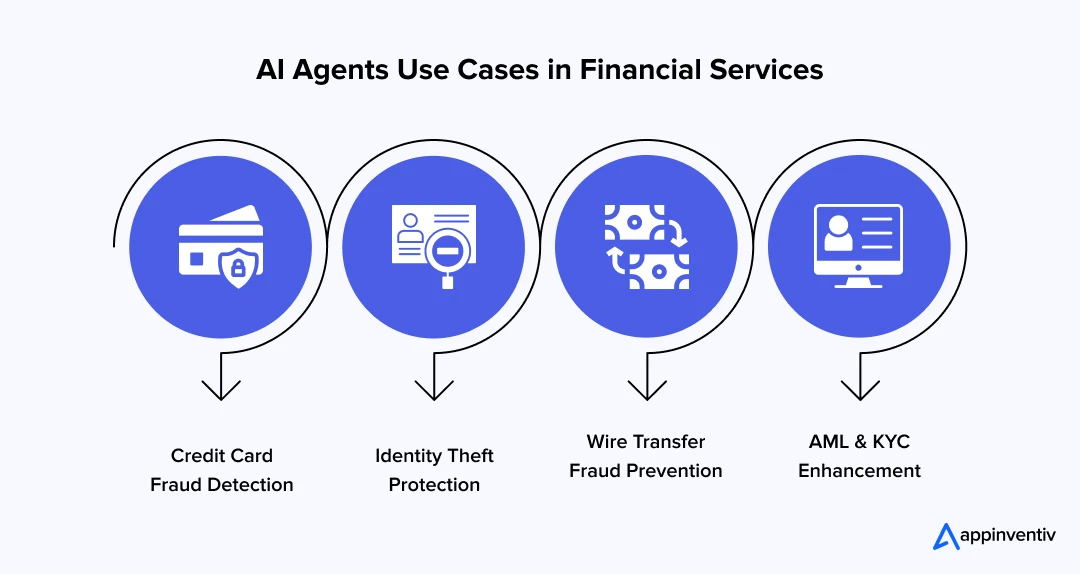

- Real-World Applications of AI Agents for Fraud Detection in Financial Services

- Credit Card Fraud Detection

- Identity Theft Protection

- Wire Transfer Fraud Prevention

- Anti-Money Laundering (AML) and Know-Your-Customer (KYC) Enhancement

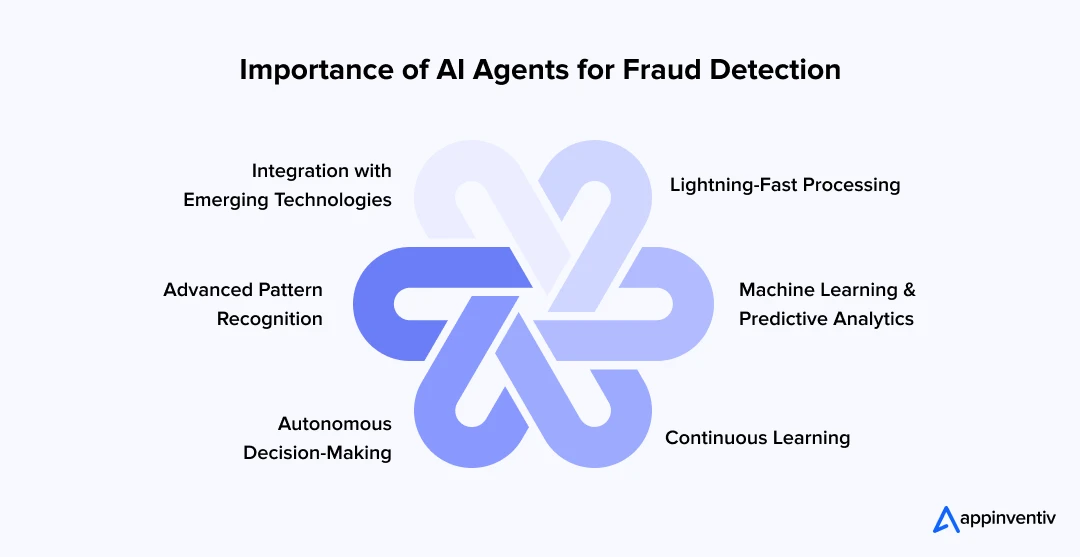

- Why AI Agents Are Ideal for Fraud Detection

- Lightning-Fast Processing

- Machine Learning and Predictive Analytics

- Continuous Learning

- Autonomous Decision-Making

- Advanced Pattern Recognition

- Integration with Emerging Technologies

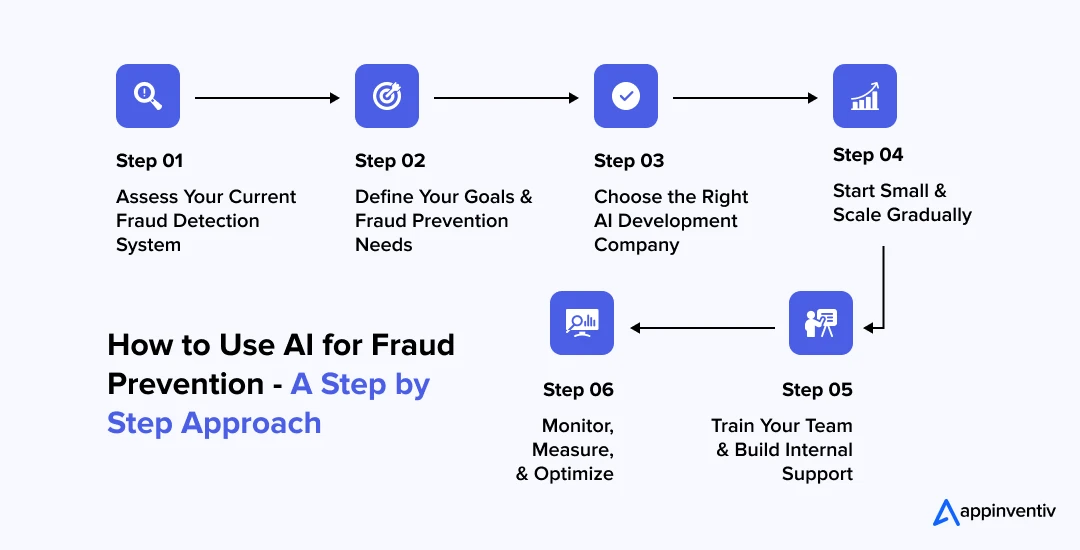

- How to Get Started with AI for Fraud Prevention in Your Organization

- Step 1: Assess Your Current Fraud Detection System

- Step 2: Define Your Goals and Fraud Prevention Needs

- Step 3: Choose the Right AI Development Company

- Step 4: Start Small and Scale Gradually

- Step 5: Train Your Team and Build Internal Support

- Step 6: Monitor, Measure, and Optimize

- The Future of AI Agents in Fraud Detection & Prevention for Financial Services

- Preparing for Tomorrow's Challenges

- Building a Fraud-Resilient Financial Future with Appinventiv

- FAQs

Key takeaways:

- AI agents are shaking up fraud detection, moving past old rule systems to offer smart, self-learning capabilities.

- The U.S. Treasury’s proven success in preventing significant fraud shows what AI agents in fraud detection can do.

- AI agents in financial fraud detection are super fast, accurate, and always getting better. This makes them vital for today’s financial security.

- Bringing in Agentic AI for fraud detection helps overcome the weaknesses of older systems, allowing for better real-time threat spotting and strong returns on investment.

- Partnering with an expert AI agent development company like Appinventiv is key to smooth integration and maximizing the benefits of AI in preventing fraud.

The financial world is a constant battleground against an invisible enemy: fraud. Every year, sophisticated schemes evolve, relentlessly targeting institutions and individuals alike. But what if there was a vigilant guardian, learning and adapting faster than any human, to stand against this tide? Enter the era of AI agents in fraud detection, transforming the landscape of financial security.

We’ve seen early signs of this revolution. For instance, the U.S. Department of the Treasury announced its enhanced fraud detection processes, including machine learning AI, that prevented and recovered over $4 billion in fraud and improper payments in Fiscal Year 2024, up from $652.7 million in FY23. This remarkable achievement, highlighted in their October 2024 statement, showcases the discernible power of a technology- and data-driven approach. It’s a clear signal that the future of financial protection lies with advanced AI.

The urgency for such innovation couldn’t be clearer. According to the 2024 AFP Payments Fraud and Control Survey, a staggering 80% of organizations reported falling victim to attempted or actual payment fraud activity in 2023. This marks a concerning 15-percentage point increase over 2022, reaching the highest rate since 2018. The relentless evolution of payments fraud demands a response far beyond conventional methods.

This is where the AI agent revolution truly begins. We are moving beyond static, rule-based systems that are easily outsmarted. Today’s AI agents in financial fraud detection are autonomous, self-learning entities capable of identifying anomalies and threats with unprecedented speed and accuracy. They are designed not just to react, but to predict and prevent.

In this comprehensive blog, we’ll uncover how these intelligent fraud detection AI agents are reshaping financial security. We’ll dive into the escalating fraud crisis, the limitations of legacy systems, and the compelling reasons why Agentic AI for fraud detection is the strategic imperative for financial enterprises. We’ll also examine real-world applications, discuss the path to implementation, and look ahead at the future of AI in fraud prevention, ultimately guiding you on how to leverage expert AI agent development services to fortify your organization.

Is your organization ready for that level of protection? Reach out today and see how AI can strengthen your fraud prevention systems.

The Growing Need for Advanced Fraud Detection in Financial Services

The financial services sector operates at a pace unseen before. Transactions happen instantaneously, globally, and across myriad platforms. This accelerated digital transformation in the FinTech sector, while convenient, has also created fertile ground for fraudsters. Traditional fraud detection systems, often reliant on predefined rules and manual reviews, simply cannot keep pace with the sheer volume and increasing sophistication of modern fraud tactics. This inherent limitation is a significant pain point for institutions worldwide.

The Escalating Fraud Crisis

The numbers don’t lie. The FTC reported that consumers lost $12.5 billion to fraud in 2024, representing a significant jump from previous years (source: Federal Trade Commission). The percentage of people losing money to fraud jumped from 27% in 2023 to 38% in 2024.

This dramatic increase isn’t just about large, headline-grabbing breaches; it’s a pervasive threat affecting businesses of all sizes, eroding trust and causing substantial financial losses.

Evolution of Cyber Thefts and Fraud Tactics

Gone are the days when fraud was primarily about stolen credit cards. While still prevalent, fraudsters now employ multi-vector attacks, leveraging everything from phishing and malware to advanced social engineering and even generative AI.

For example, a Hong Kong firm wired $25 million to fraudsters in January 2024 after an AI-generated deepfake of their CFO participated in a video call. This incident, cited in a CNN blog, exemplifies how new technologies are being weaponized by criminals, making the detection of such schemes incredibly challenging for conventional systems. These tactics are designed to exploit human vulnerabilities and system loopholes simultaneously, demanding a dynamic and intelligent response.

Limitations of Legacy Fraud Detection

Many financial institutions still rely on legacy fraud detection systems built on static rule sets. These systems, while effective against known patterns, struggle with novel fraud types. They often generate high rates of “false positives,” flagging legitimate transactions as suspicious. This not only frustrates customers but also creates an overwhelming workload for fraud analysts, diverting their attention from genuinely high-risk activities.

Manual reviews are slow, expensive, and cannot scale to the volume of transactions processed daily. Without the ability to learn and adapt, these systems are perpetually playing catch-up, leaving financial enterprises vulnerable. This proves AI-powered fraud detection in financial services is no longer a choice but an unavoidable necessity to regain the upper hand.

You may like Reading: AI in Legacy Application Modernization – A Complete Guide

Challenges, Solutions, and Opportunities in Implementing AI Agents for Fraud Prevention

Adopting advanced technologies like AI agents for fraud prevention in banking comes with its own set of hurdles. However, there are ways to overcome these hurdles. Also, the opportunities they unlock far outweigh those challenges. This promises a future of incredibly reinforced security and operational efficiency for financial institutions.

Challenges

Implementing AI-enabled fraud detection for financial enterprises is not a simple plug-and-play operation. Financial institutions often grapple with:

- Integration Issues with Legacy Systems: Most financial institutions operate on decades-old core banking systems that weren’t designed for AI integration. Integrating new, complex AI agent frameworks with these legacy systems can be a massive undertaking.

- Data Privacy Concerns and Ethical Implications: AI in fraud detection in financial services raises complex privacy questions. AI systems require access to vast amounts of customer data to function effectively, but this access must comply with regulations like GDPR, CCPA, and industry-specific requirements.

- Resistance to Change Within Organizations: Many financial institutions face cultural resistance to AI adoption. Fraud analysts worry about job displacement, while executives question the reliability of “black box” AI decisions.

Solutions:

Addressing these challenges requires a holistic and systematic approach. Let’s see how organizations can overcome these hurdles

- Phased Integration and API-First Design: To overcome the challenges of integrating legacy systems, you need to adopt a phased rollout strategy, starting with pilot projects. You should also utilize API-first design principles to build flexible interfaces that allow new AI systems to communicate with existing infrastructure without a complete overhaul. This minimizes disruption and allows for gradual, manageable implementation.

- Robust Data Governance and Explainable AI (XAI) Frameworks: Mitigate data privacy and ethical concerns by implementing strict AI governance policies. Invest in Explainable AI (XAI) benefits that provide transparency into how AI models make decisions. Regular ethical reviews and bias detection mechanisms are also crucial.

- Change Management and Upskilling Programs: Address resistance to change through proactive communication, comprehensive training programs, and demonstrating the benefits of AI to employees. Frame AI as a tool that augments human capabilities, reducing mundane tasks and allowing staff to focus on higher-value work.

Opportunities

Businesses that can successfully overcome the AI challenges are bound to witness the potential benefits of Agentic AI for fraud detection. This includes:

- Enhanced Detection Speed and Accuracy: Automated fraud detection in financial services with AI delivers unprecedented performance improvements. Experts say that once sophisticated AI models are trained, they can sniff out suspicious transactions in mere milliseconds. This speed enables real-time fraud prevention rather than after-the-fact detection.

- Automation of Routine Checks: AI agents handle high-volume, low-risk transactions automatically, freeing human analysts to focus on complex investigations. This optimization can improve operational efficiency by 40-60% while maintaining higher accuracy rates.

- Real-Time Threat Identification and Response: Modern AI-enabled fraud detection for financial enterprises continuously monitors transaction patterns, device behaviors, and network activities. When threats emerge, these systems can automatically implement protective measures such as temporary account restrictions or additional authentication requirements.

Cost-Effectiveness and ROI of AI-Driven Fraud Detection Solutions

Investing in AI fraud detection applications for large enterprises requires upfront costs—think infrastructure upgrades, data cleansing, and vendor partnerships. But the long-term savings are staggering. AI-powered fraud detection in financial services slashes fraud losses, reduces manual review costs, and protects brand reputation.

Many business studies highlight that AI solutions significantly cut operational expenses by automating fraud reviews, with ROI often exceeding initial investments.

Consider the case of a major European bank that implemented an AI-powered AML system. According to research published in the Journal of Financial Crime, it reduced false positives by over 75%, saving millions in compliance costs (source: Quantum Zeitgeist Research). Similarly, PayPal achieved a 30% reduction in fraudulent transactions using AI.

The ROI is often substantial, with savings from reduced fraud, operational costs, and improved fraud detection accuracy more than compensating for the initial investment.

For financial enterprises, these savings translate into a competitive edge, making enterprise AI fraud detection solutions a no-brainer.

| Metric | Traditional Systems | AI-Driven Systems |

|---|---|---|

| False Positive Rate | Up to 98% | Reduced by up to 90% |

| Detection Speed | Hours to days | Milliseconds |

| Annual Cost Savings | Limited | Millions (e.g., $9M for RBS) |

| Scalability | Poor | High |

Note: These figures are based on industry reports and case studies from leading financial institutions.

Real-World Applications of AI Agents for Fraud Detection in Financial Services

AI agents for fraud detection in enterprise financial services demonstrate their value through diverse, practical applications across the financial ecosystem. These implementations showcase how intelligent automation transforms fraud prevention from reactive to proactive.

Credit Card Fraud Detection

Modern credit card fraud detection represents one of the most mature applications of financial enterprise AI solutions for fraud detection. AI systems analyze transaction patterns in real-time, considering factors like:

- Transaction Velocity: AI monitors the speed and frequency of transactions, flagging unusual patterns such as multiple purchases in different geographic locations within short timeframes.

- Merchant Category Analysis: Systems learn individual spending behaviors and identify when customers make purchases outside their typical merchant categories or price ranges.

- Device Fingerprinting: AI creates unique profiles for each device used in transactions, detecting when familiar accounts suddenly appear on new or suspicious devices.

- Geolocation Intelligence: Advanced systems combine GPS data, IP addresses, and mobile network information to verify transaction authenticity and detect location-based fraud attempts.

Also Read: Guide to Detect Credit Card Fraud with Machine Learning

Identity Theft Protection

Identity theft protection has become a critical battleground where AI-based fraud detection in large organizations demonstrates its most sophisticated capabilities. These systems excel at identifying synthetic and stolen identity fraud through multi-layered pattern matching and behavioral analysis. This includes:

- AI-based fraud detection in large organizations excels at identifying synthetic and stolen identity fraud through sophisticated pattern matching:

- Document Verification: AI systems analyze identity documents using computer vision to detect alterations, forgeries, or inconsistencies that human reviewers might miss.

- Biometric Authentication: Advanced facial recognition and voice analysis technologies verify customer identities while detecting deepfake attempts.

- Cross-Reference Analysis: AI correlates identity information across multiple databases and sources to identify inconsistencies that suggest fraudulent identity creation.

Wire Transfer Fraud Prevention

Wire transfer fraud represents one of the highest-risk areas for financial institutions due to the irreversible nature of these transactions. AI fraud detection for enterprise risk management addresses this challenge through:

- Beneficiary Analysis: AI systems maintain profiles of legitimate wire transfer recipients and flag transfers to previously unknown or suspicious beneficiaries.

- Authorization Pattern Recognition: Systems learn the typical authorization patterns for different types of wire transfers and detect deviations that might indicate business email compromise.

- Real-Time Risk Scoring: Each wire transfer receives a dynamic risk score based on multiple factors, including amount, destination, timing, and historical patterns.

Anti-Money Laundering (AML) and Know-Your-Customer (KYC) Enhancement

AI agents for preventing financial fraud significantly improve AML and KYC processes through:

- Transaction Monitoring: AI systems analyze complex transaction patterns across multiple accounts and timeframes to identify potential money laundering schemes.

- Customer Due Diligence: Automated systems continuously monitor customer profiles and flag changes that require additional investigation or documentation.

- Sanctions Screening: AI-powered name matching systems reduce false positives in sanctions screening while ensuring comprehensive coverage of prohibited parties.

- Suspicious Activity Reporting: Intelligent systems generate more accurate and detailed suspicious activity reports, reducing regulatory compliance costs while improving detection effectiveness.

Appinventiv partnered with Edfundo to build a secure and scalable financial literacy platform. Our collaboration with this FinTech firm resulted in enhanced security, as well as helped our clients:

- Secure $500,000 in pre-seed funding.

- Prepare for a $3 million seed funding round.

- Forge strategic partnerships with Visa and NymCard.

- Transform the product vision into a SaaS-based platform.

- Expand the solution into a white-label offering for greater scalability.

We chose Appinventiv to build our financial literacy and money management app from start to finish. From the first call, we were very impressed with Appinventiv’s professionalism, expertise, and commitment to delivering top-notch results. Their team was very responsive and were always available to answer any questions we had. Their developers were extremely talented and delivered an amazing final product that exceeded our expectations.

Why AI Agents Are Ideal for Fraud Detection

What makes AI agents in fraud detection so effective? It’s their unique blend of speed, intelligence, and adaptability. Let’s know their capabilities for financial fraud detection in detail:

Lightning-Fast Processing

AI agents for fraud prevention in banking process transactions in milliseconds, ensuring real-time threat detection. This speed is critical for stopping fraud before it impacts customers or institutions.

Machine Learning and Predictive Analytics

Agentic AI for fraud detection uses machine learning to learn from historical data and predict future risks. For example, predictive analytics can flag a transaction that deviates from a customer’s typical behavior, even if it’s not explicitly fraudulent.

Continuous Learning

Unlike static systems, AI fraud detection solutions for enterprises evolve with each transaction. They adapt to new fraud tactics, reducing false positives and staying ahead of criminals.

Autonomous Decision-Making

AI agents in financial fraud detection can make decisions without human intervention, such as blocking a suspicious payment or triggering multi-factor authentication. This autonomy scales fraud prevention across millions of transactions.

Advanced Pattern Recognition

Using techniques like GNNs and deep learning, AI agents for fraud detection in enterprise financial services identify complex patterns that humans might miss. For instance, they can detect money laundering schemes spanning multiple accounts and jurisdictions.

Integration with Emerging Technologies

AI-powered fraud detection in financial services integrates with some emerging and established technologies for enhanced security. For example:

- Behavioral Biometrics: AI systems analyze typing patterns, mouse movements, and mobile device usage to create unique behavioral fingerprints for each user.

- Blockchain Analysis: AI agents can trace cryptocurrency transactions and identify suspicious patterns in decentralized finance applications.

- IoT Security: As financial services expand into Internet of Things devices, AI systems provide security for connected cars, smart homes, and wearable payment devices.

Also Read: How to Ensure Cybersecurity in the Age of IoT

How to Get Started with AI for Fraud Prevention in Your Organization

Implementing AI-enabled fraud detection for financial enterprises may seem like a daunting task at first. But with the right approach, you can easily integrate AI-driven solutions into your existing systems and start reaping the benefits of enhanced security, faster fraud detection, and reduced operational costs. Let’s break down how you can get started with AI agents for fraud prevention in banking and ensure a smooth, impactful transition.

Step 1: Assess Your Current Fraud Detection System

Before jumping into AI adoption, it’s essential to understand where your current fraud detection systems stand. Take the time to assess your existing processes, tools, and technologies to identify the gaps where AI-powered fraud detection in financial services can make the most impact. This can include:

- Identifying repetitive tasks that could be automated.

- Spotting inefficiencies in manual fraud checks.

- Reviewing your fraud detection accuracy (Are false positives or missed fraudulent activities frequent?)

An in-depth evaluation will give you a clear picture of where AI can step in and enhance your system.

Step 2: Define Your Goals and Fraud Prevention Needs

Now that you have a clearer understanding of your current system, it’s time to define what you want to achieve with AI agents for fraud detection in enterprise financial services. What specific fraud risks are you trying to mitigate? Whether it’s credit card fraud, identity theft, wire transfer fraud, or something else entirely, having clear goals helps you pick the right AI-powered solution.

Questions to consider:

- Do you need real-time fraud detection or just periodic monitoring?

- Are you looking for a solution to prevent fraudulent transactions or detect them post-occurrence?

- Do you need AI to handle specific types of fraud, or should it cover the entire spectrum of financial fraud?

These answers will guide you in selecting the right tools and defining measurable success criteria for your AI implementation.

Step 3: Choose the Right AI Development Company

Choosing the right tech partner for developing AI fraud detection systems for financial services is crucial to ensuring a successful AI deployment. Look for a partner who:

- Has experience in financial services and understands the unique challenges of fraud prevention in banking.

- Can develop and integrate next-gen AI solutions with your existing infrastructure.

- Offers scalable solutions that grow as your needs evolve, from initial deployment to full-scale fraud prevention.

- Provides customization, monitoring, and maintenance services tailored to your organization’s specific needs.

Peep into their portfolio and clients’ testimonials to gauge their tech capabilities in developing AI fraud detection solutions for enterprises in the financial sector. This will give you a sense of their expertise and proven track record.

Step 4: Start Small and Scale Gradually

When implementing AI-powered fraud detection in financial services, it’s best to start with a pilot project. This allows you to test the waters, measure effectiveness, and make adjustments before a full rollout.

For instance, you could begin by automating basic fraud checks like real-time transaction monitoring or identity verification using AI. Once you’re confident in the technology’s performance, you can gradually expand AI’s role to cover more complex fraud detection tasks, such as:

- Pattern recognition in credit card fraud

- Predictive analytics for spotting new fraud tactics

- Machine learning-based anomaly detection for wire transfer fraud

This gradual scaling allows for a smoother transition and ensures that AI integration doesn’t disrupt your operations.

Step 5: Train Your Team and Build Internal Support

AI for fraud prevention isn’t just about technology—it’s also about users. Your team needs to be onboard with the change and understand how AI works to support fraud detection. Offering training sessions on how the AI system functions, what it’s designed to do, and how it enhances their work will help get everyone on the same page.

Internal communication is key here. Thus, make sure to emphasize that AI is here to augment human capabilities, not replace them. While AI can automate repetitive tasks and spot fraud faster, human oversight remains essential for complex decision-making.

Step 6: Monitor, Measure, and Optimize

After deploying AI agents for fraud detection, your work isn’t over. Continuous monitoring and evaluation are vital for ensuring that your AI systems are performing at their best. AI learns over time, but its success depends on fine-tuning and adapting to new fraud tactics.

Key things to track:

- Fraud detection accuracy: Are false positives reduced? Are more fraud attempts caught in real-time?

- Return on investment (ROI): Are you seeing significant savings in fraud-related losses or operational costs?

- Employee satisfaction: Is your team finding the AI systems easy to use and helpful?

Interested in gaining an in-depth understanding of how to build a secure and scalable system to detect and prevent financial fraud? Well, here is our detailed guide on Fraud Detection Software Development to help you get started in a structured approach.

Get in touch with our team to develop and integrate scalable AI agents to detect financial fraud and reinforce your organization’s security today.

The Future of AI Agents in Fraud Detection & Prevention for Financial Services

Here’s what keeps fraud prevention leaders awake at night: just when you think you’ve got fraudsters figured out, they evolve. The good news? AI agents for preventing financial fraud are evolving even faster. We’re entering an era where your fraud prevention system won’t just detect threats – it’ll predict them, prevent them, and adapt to new ones before they even happen. Let’s throw light on some game-changing trends:

Generative AI is Revolutionizing Defense

Beyond ChatGPT for enterprises writing poetry, generative AI is creating synthetic training data that protects customer privacy while building smarter fraud models. These systems simulate thousands of potential fraud scenarios, letting your AI practice against attacks that haven’t even been invented yet.

Predictive Protection

The next generation won’t just spot fraud in progress – it’ll recognize criminal intent before any crime occurs. AI systems will analyze communication patterns, device behaviors, and contextual clues to identify when someone is planning fraudulent activity. Imagine your system automatically adjusting security based on emerging threats before fraudsters even strike.

Autonomous AI Revolution

Future systems will manage themselves – continuously learning, evolving detection methods, and updating policies based on new threats and regulations. Think of it as having a fraud expert who never sleeps and gets smarter every day.

Customer-First Security

The best fraud prevention is invisible. Future AI will provide seamless, personalized security that adapts to individual customer behaviors and preferences, delivering protection that feels like premium service.

Preparing for Tomorrow’s Challenges

Federal Reserve Governor Michael Barr emphasizes that banks must evolve their AI to combat deepfake attacks using facial recognition, voice analysis, and behavioral biometrics (source: Banking Dive).

Smart organizations aren’t waiting – they’re building AI foundations now that can evolve with tomorrow’s threats. Don’t let your financial services fall behind. Opt for Appinventiv’s FinTech Software Development Services to ensure your fraud detection systems remain effective against evolving threats.

Building a Fraud-Resilient Financial Future with Appinventiv

AI agents in fraud detection are no longer optional—they’re essential for financial enterprises aiming to stay ahead of fraudsters. From reducing false positives by up to 90% to saving billions in losses, AI-powered fraud detection in financial services offers unmatched security and efficiency.

Whether it’s catching credit card fraud, strengthening AML processes, or verifying identities, AI fraud detection for enterprise risk management is transforming the industry.

At Appinventiv, we specialize in crafting enterprise AI fraud detection solutions tailored to your needs. Our work with Mudra showcases our ability to deliver secure, scalable platforms for the FinTech industry.

Here are some other reasons, giving you enough motives to opt for our AI agent development services for fraud detection:

- Proven Track Record: With over 3000 successful project deliveries and recognition from leading industry analysts, Appinventiv demonstrates consistent execution excellence in AI implementations.

- Award-Winning Excellence: We are proud to have earned numerous industry accolades, including Clutch’s ‘Top App Development Company’ and Deloitte’s Tech Fast 50 Awards in both 2023 and 2024.

- Financial Services Expertise: Our team of 1600+ tech experts includes AI developers, compliance specialists, and fraud investigation experts who understand the nuanced requirements of financial services organizations.

- End-to-End Capabilities: From strategy development through implementation and ongoing optimization, Appinventiv provides comprehensive services that ensure successful AI adoption.

- Technology Leadership: As a Microsoft Gold Partner and AWS Advanced Partner, Appinventiv leverages leading platforms and tools to deliver industry-leading solutions.

- Global Delivery Excellence: With development centers across multiple time zones and expertise in international regulatory frameworks, we support organizations operating in global markets.

- Innovation Focus: Our dedicated AI research and development team continuously explores emerging technologies and methodologies to ensure our clients stay ahead of industry trends.

The question isn’t whether to implement AI-driven fraud detection – it’s how quickly you can capture the competitive advantages these technologies provide.

Ready to secure your financial future? Partner with Appinventiv today to build a fraud-resilient enterprise.

FAQs

Q. What is Agentic AI in fraud detection?

A. Agentic AI in fraud detection means using intelligent systems that act autonomously to spot and stop financial fraud.

These AI agents analyze transactions in real time, learn from new patterns, and make quick decisions. The most interesting part? They do all this without human input.

In short, they are like sharp, tireless guards, adapting to tricky fraud tactics to keep your money safe.

Q. How can AI agents improve fraud detection in financial services?

A. Think of AI agents as your fraud team’s superpower. They never sleep, never miss a pattern, and can spot suspicious activity faster than any human analyst. Here’s how AI agents in fraud detection make a difference:

- Lightning-fast analysis – Process thousands of transactions instantly

- Pattern recognition – Catch subtle fraud signals humans might miss

- Real-time blocking – Stop fraudulent transactions before they complete

- Learning capability – Get smarter with every fraud attempt they encounter

The biggest win? Your customers enjoy smoother transactions while fraudsters face tougher barriers.

Q. What is the role of AI agents in preventing fraud in the financial sector?

A. AI agents in financial fraud detection act as tireless digital sentinels. They continuously:

- Monitor: Watch over financial activities across all channels.

- Analyze: Use smart algorithms to uncover complex fraud schemes.

- Predict: Anticipate potential fraud before it happens.

- Adapt: Learn from new tactics in real-time to stay ahead of criminals.

- Protect: Automatically put safeguards in place when threats are detected.

Q. How can financial enterprises leverage AI agents to combat fraud?

A. Smart enterprises don’t try to transform everything overnight. Here’s the winning approach to use financial enterprise AI solutions for fraud detection:

Start Small, Think Big

- Launch pilot programs in high-risk areas

- Focus on transaction monitoring first

- Learn what works before expanding

Build Gradually

- Add account opening fraud detection

- Integrate AML compliance monitoring

- Scale to full autonomous systems

Prepare Your Foundation

- Clean up your data sources

- Train your team on new processes

- Ensure smooth integration with existing systems

Success comes from patience and proper planning, not rushing into complex deployments.

Q. What are the challenges of implementing AI fraud detection in the financial industry?

A. Let’s be honest – implementing AI fraud detection isn’t always smooth sailing. Here are the main hurdles:

- Technical Headaches: Most banks run on decades-old systems that weren’t built for AI integration. Getting everything to work together can be like fitting a smartphone into a rotary phone.

- Privacy Concerns: AI needs lots of data to work effectively, but regulations like GDPR make data handling tricky. Balancing effectiveness with privacy protection requires careful planning.

- Staff Problems: Your fraud analysts might worry about job security, while executives question whether they can trust AI decisions. Change management becomes crucial for success.

- Ongoing Maintenance: AI models need constant tuning and updates. It’s not a “set it and forget it” solution.

Q. What benefits do AI fraud detection tools offer to financial decision-makers?

A. AI fraud detection applications for large enterprises deliver benefits that directly impact your bottom line and competitive position:

Financial Impact

- Dramatically reduce fraud losses

- Cut operational costs through automation

- Faster ROI than most technology investments

Operational Excellence

- Fewer false alarms mean happier customers

- Automated compliance reporting saves time

- Staff can focus on complex investigations instead of routine checks

Strategic Advantages

- Superior security becomes a competitive differentiator

- Better customer experience drives loyalty

- Regulatory compliance becomes easier to maintain

The real value isn’t just in stopping fraud – it’s in transforming how your entire organization thinks about security and customer protection.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Unveiling 10 Use Cases, Benefits and Examples of Physical AI

Ever wondered what factory work will look like in the next 10 years? Just visit a Tesla facility. Most people know Tesla uses industrial robots for assembly, painting, and welding. What's different now is their Optimus project: humanoid robots designed to handle physical tasks throughout their manufacturing facilities. This technology has moved well beyond concept…

How to Build an AI Copilot for Enterprises? Process, Costs, and Features

Key takeaways: Strategic Planning: Define target use cases, user personas, and pain points to align Enterprise AI Copilot development with business goals. Feature Design: Incorporate context-awareness, anticipatory help, and actionable interfaces for intuitive, high-value AI Copilot functionality. Technical Foundation: Select robust LLMs, implement RAG, and build a secure, scalable AI stack for seamless enterprise integration.…

How Agentic AI is Revolutionizing the Financial Sector: A Deep Dive for the C-Suite

Key takeaways: Enhanced Efficiency: Agentic AI automates complex tasks, saving up to 90% time. Real-Time Decisions: Adapts instantly to market changes and fraud threats. Hyper-Personalization: Delivers tailored customer experiences 24/7. Proactive Compliance: Reduces risks with automated regulatory tracking. New Revenue Streams: Unlocks innovative business models for growth. The financial services industry has been under pressure…