- How Telematics Insurance Works

- Capturing Comprehensive Driving Data

- Seamless Data Transmission and Processing

- Advanced Risk Assessment Through Behavioral Analysis

- Implementing Usage-Based Premium Models

- Flexible Implementation Options

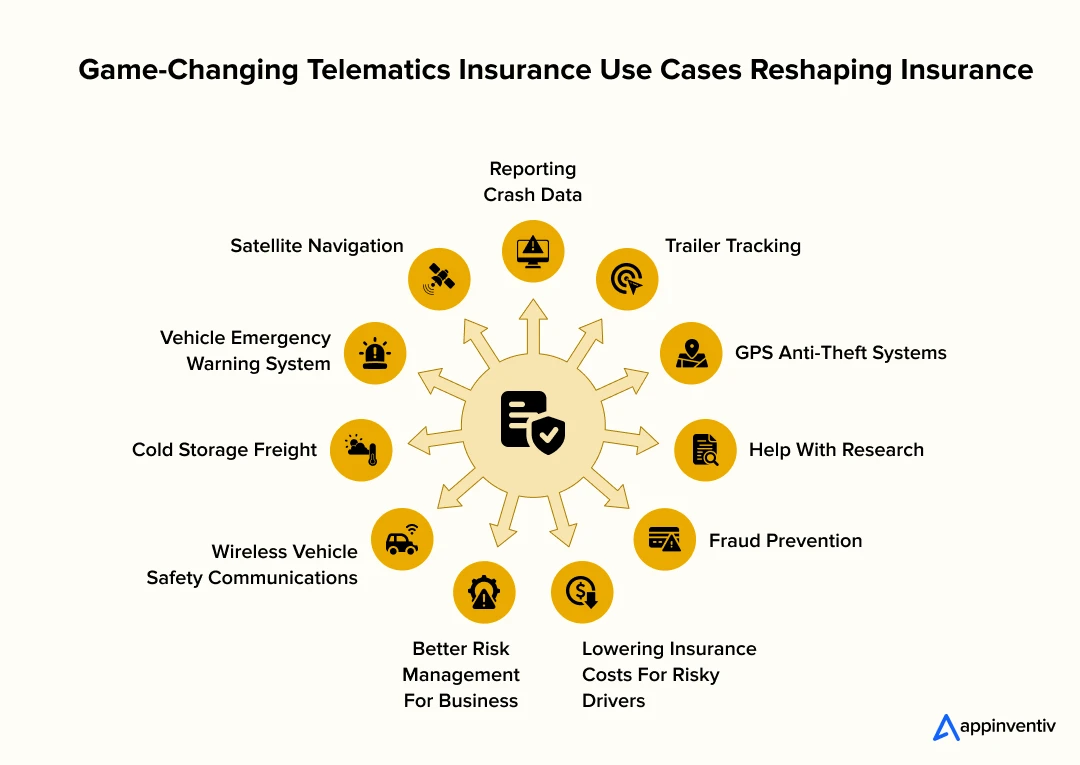

- Top Telematics Insurance Use Cases Driving Industry Transformation

- Reporting Crash Data

- Trailer Tracking

- GPS Anti-Theft Systems

- Help With Research

- Fraud Prevention

- Lowering Insurance Costs For Risky Drivers

- Better Risk Management For Business

- Wireless Vehicle Safety Communications

- Cold Storage Freight

- Vehicle Emergency Warning System

- Satellite Navigation

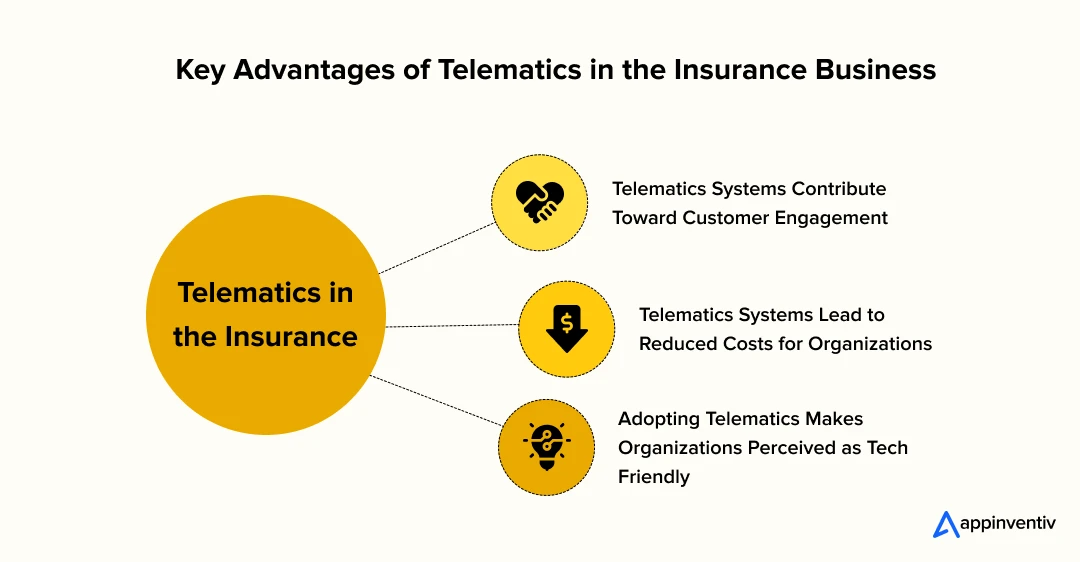

- Benefits of Using Telematics in the Insurance Business

- Telematics Systems Contribute Toward Customer Engagement

- Telematics Systems Keep Insurers Ahead of the Competition

- Telematics Systems Lead to Reduced Costs for Organizations

- Adopting Telematics Makes Organizations Perceived as Tech-Friendly

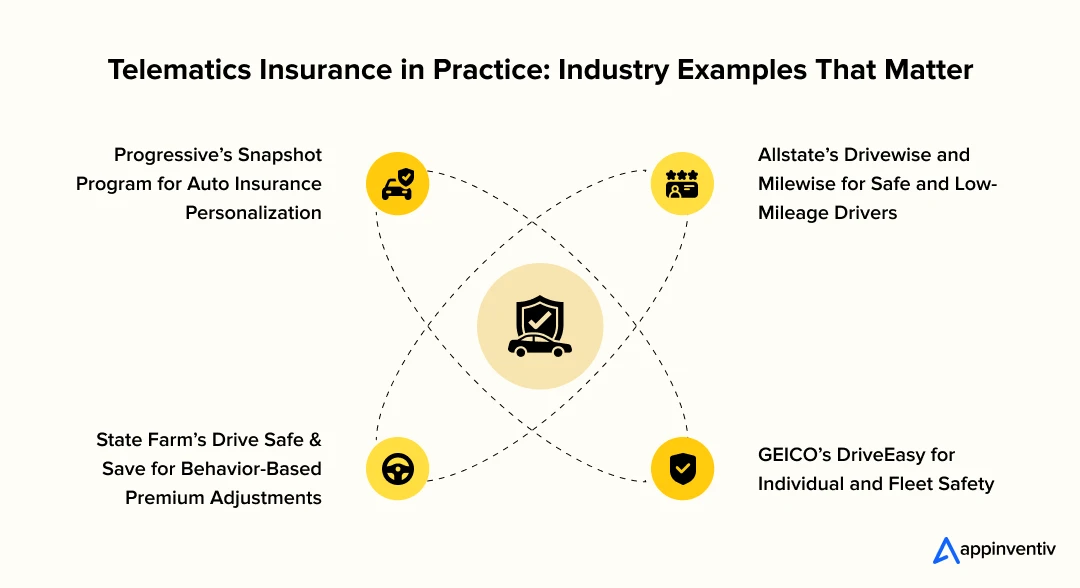

- Real-Life Examples of Telematics in the Insurance Industry

- Progressive’s Snapshot Program for Auto Insurance Personalization

- Allstate’s Drivewise and Milewise for Safe and Low-Mileage Drivers

- State Farm’s Drive Safe & Save for Behavior-Based Premium Adjustments

- GEICO’s DriveEasy for Individual and Fleet Safety

- Travelers’ IntelliDrive for Short-Term Driving Assessments

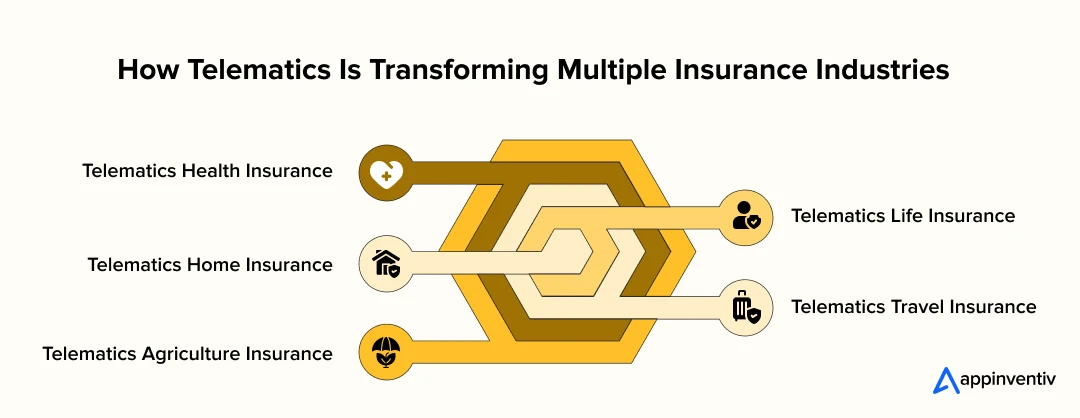

- Impact of Telematics in Other Insurance Sectors

- Telematics Health Insurance

- Telematics Life Insurance

- Telematics Home Insurance

- Telematics Travel Insurance

- Telematics Agriculture Insurance

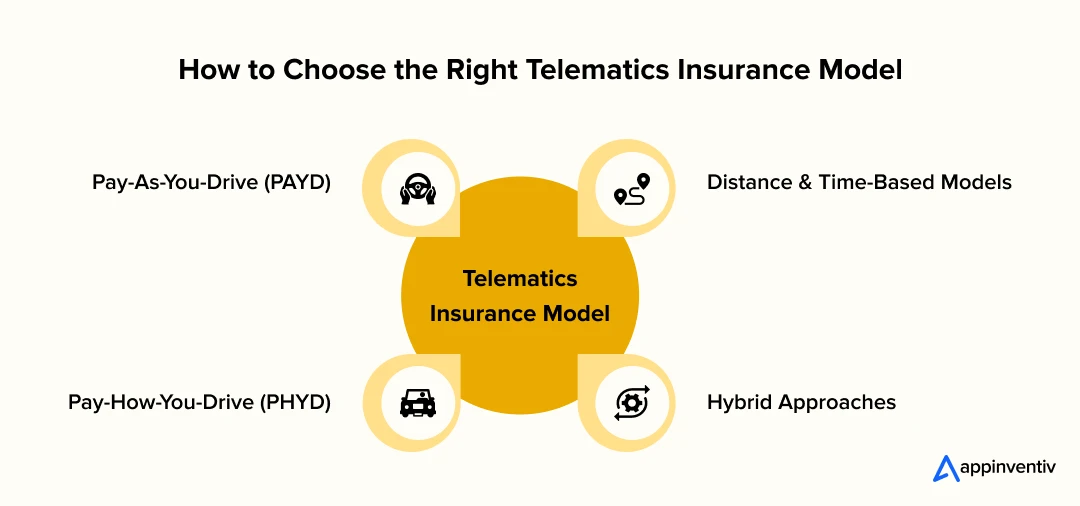

- Understanding Different Telematics Insurance Models: Finding the Right Fit for Your Driving Style

- Pay-As-You-Drive (PAYD)

- Distance and Time-Based Models

- Pay-How-You-Drive (PHYD)

- Hybrid Approaches

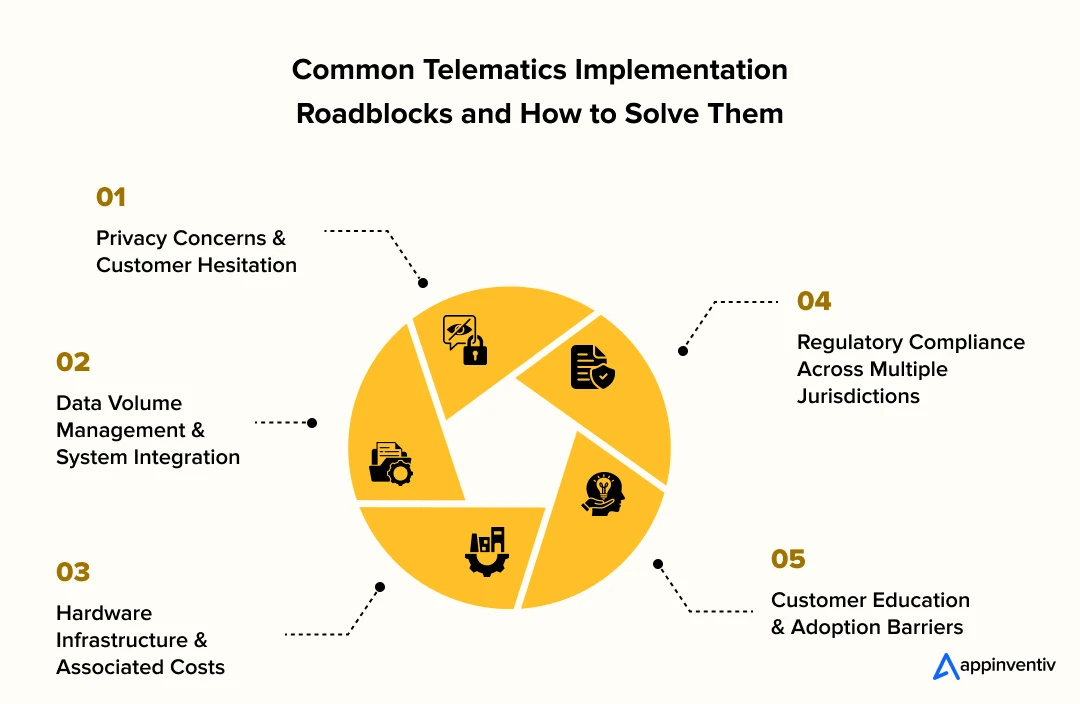

- Navigating Telematics Implementation: Common Roadblocks and Smart Solutions

- Privacy Concerns and Customer Hesitation

- Data Volume Management and System Integration

- Hardware Infrastructure and Associated Costs

- Regulatory Compliance Across Multiple Jurisdictions

- Customer Education and Adoption Barriers

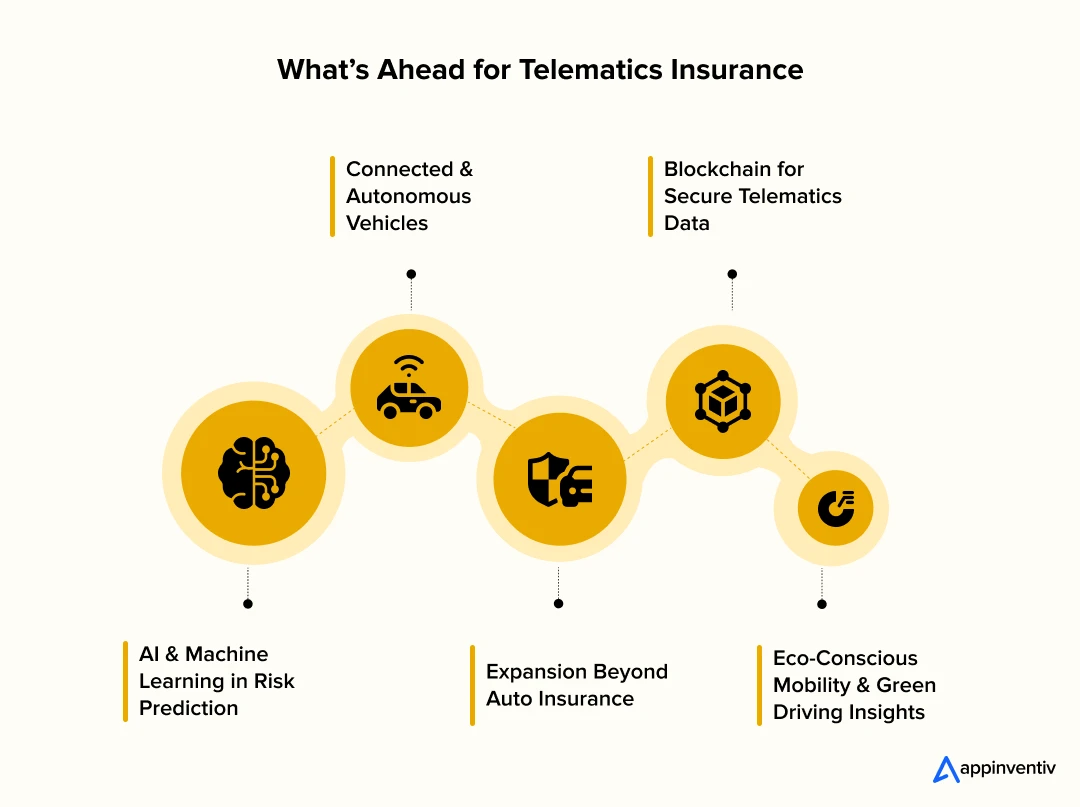

- Future Trends of Telematics in Insurance

- AI and Machine Learning in Risk Prediction

- Connected & Autonomous Vehicles

- Expansion Beyond Auto Insurance

- Blockchain for Secure Telematics Data

- Eco-Conscious Mobility & Green Driving Insights

- How Appinventiv Can Help Your Insurance Business With Telematics Implementation

- FAQs

- Telematics promotes eco-friendly driving habits, reducing harmful emissions, and improving safety by monitoring driving behaviors like speed, braking, and route choices.

- The global telematics insurance market is expected to reach $14.74 billion by 2030, driven by AI, IoT, 5G advancements, and the growing demand for personalized, fairer premiums.

- Telematics not only helps with crash data reporting and fleet management but also aids in fraud prevention, lowering insurance costs for responsible drivers, and improving risk management.

- Telematics is evolving beyond auto insurance, with applications in health, life, and home insurance, providing more comprehensive risk profiles and further driving down premiums for responsible behavior.

In just the first half of 2024, the U.S. saw nearly 19,000 road fatalities, according to the NHTSA report. For insurers and businesses alike, this raises a pressing question: how can we better manage driving risk before it turns into loss? Beyond the devastating human toll, accidents lead to soaring insurance claims, operational downtime, and significant financial strain for both individuals and organizations.

This is where telematics has emerged as a powerful solution. By leveraging real-time vehicle data such as speed, braking patterns, route choices, and driving times, telematics provides deeper insights into driving behavior. For businesses managing fleets, it means fewer accidents, lower fuel consumption, and better compliance with safety regulations. For individual drivers, it encourages safer, more efficient habits behind the wheel.

But the benefits don’t stop with safety. Telematics also supports environmental goals by reducing harmful emissions like carbon monoxide and nitrogen oxides through smarter, eco-friendly driving practices. And its impact is now extending directly into the insurance space.

Enter telematics insurance, a usage-based model that calculates premiums based on how, when, and where a vehicle is driven. Safer, more responsible driving results in lower costs, while high-risk behaviors are priced accordingly. This data-driven approach replaces outdated assumptions about risk with measurable, real-world insights.

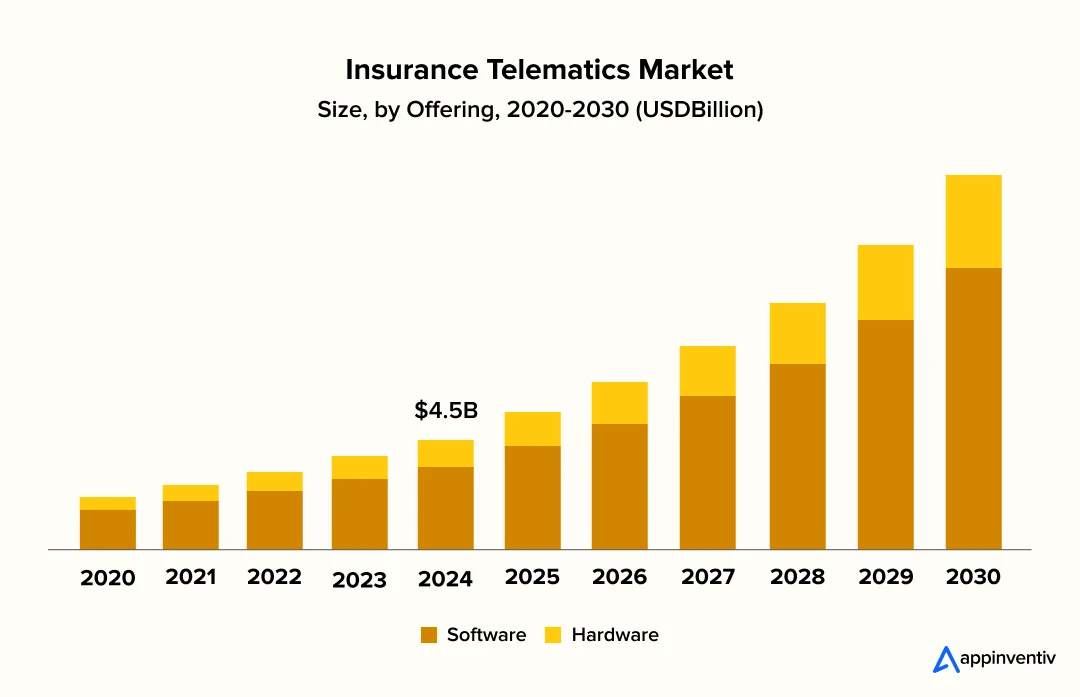

The global insurance telematics market is projected to reach $14.74 billion, growing at a 22.2% CAGR through 2030 (Source: GVR). This rapid expansion is driven by several factors, including stricter road safety regulations, growing adoption of connected vehicles, advancements in AI, IoT, and 5G, and rising consumer demand for fairer, personalized premiums.

Additionally, increasing awareness about reducing fraudulent claims and improving operational efficiency is pushing insurers to embrace telematics solutions more aggressively.

It’s clear that telematics insurance isn’t just an industry trend—it’s a complete shift in how risk is assessed, managed, and rewarded. In this blog, we’ll dive deeper into how telematics insurance is transforming the industry, redefining risk management, and creating new opportunities for businesses and policyholders alike.

To learn how to enhance your telematics insurance strategy and discover the benefits of insurance telematics for both you and your customers, read this article through to the conclusion.

Partner with our experts to create personalized, future-ready insurance offerings

How Telematics Insurance Works

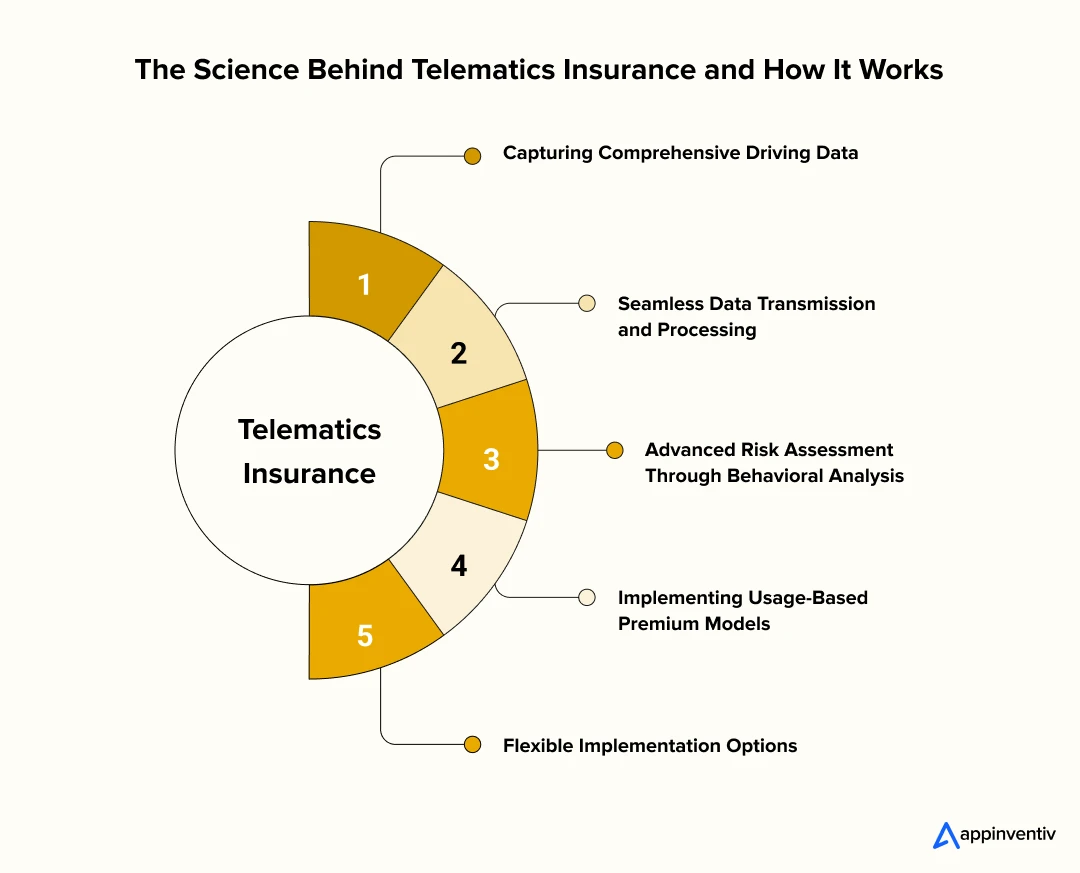

Telematics for insurance represents a fundamental shift from traditional risk assessment methods. Rather than basing premiums solely on demographics and vehicle specifications, insurers now access real-world driving data to create more accurate pricing models. This technology-driven approach delivers fairer rates by evaluating actual driving behavior instead of broad statistical categories.

Capturing Comprehensive Driving Data

The process starts with sophisticated data collection systems that monitor various driving metrics. These systems track daily mileage, speed patterns, driving times, and behavioral indicators such as hard braking or aggressive acceleration. Modern telematics fleet management solutions utilize multiple collection methods, including smartphone applications, OBD-II port devices, and integrated vehicle sensors to build comprehensive driver profiles.

Seamless Data Transmission and Processing

Once collected, driving information flows automatically to insurance providers through secure digital channels. This streamlined transmission happens either continuously or at predetermined intervals, eliminating manual reporting requirements. The automated nature of telematics software for insurance ensures consistent data quality while reducing administrative burdens for both drivers and insurers.

Advanced Risk Assessment Through Behavioral Analysis

Insurance companies analyze driving patterns to determine individual risk levels with unprecedented accuracy. Safe driving habits such as maintaining reasonable speeds, smooth acceleration, and gentle braking indicate a lower accident probability. Conversely, aggressive driving behaviors suggest higher risk exposure. This detailed analysis enables insurers to move beyond generic risk categories toward personalized assessments.

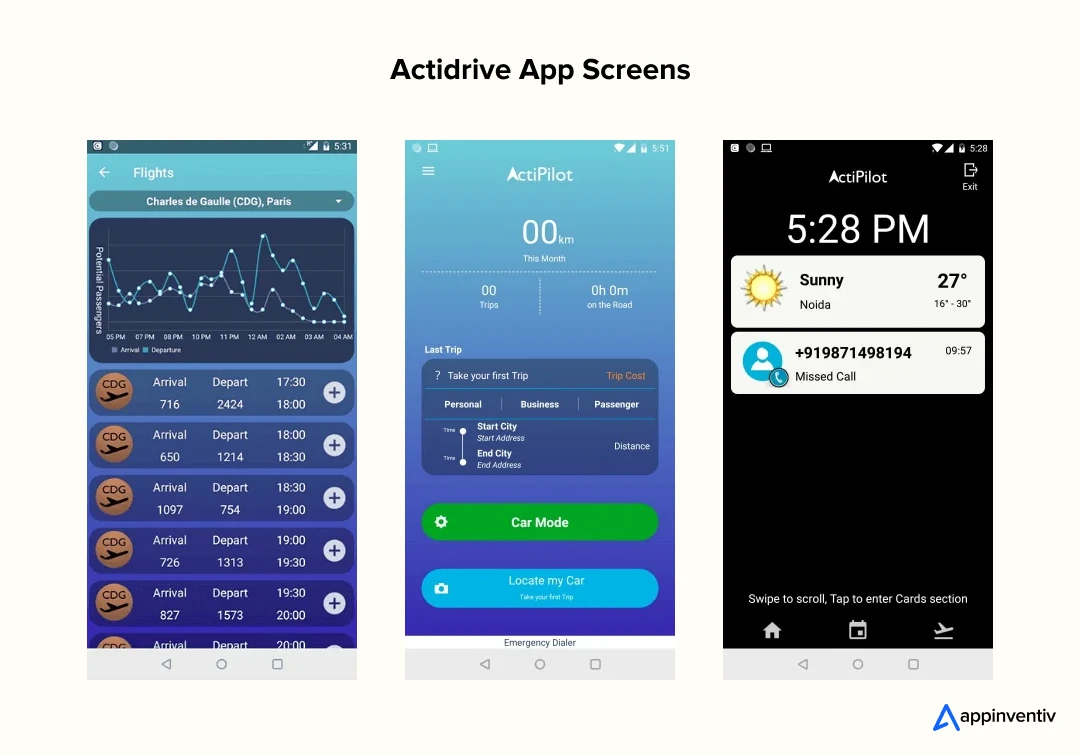

By leveraging advanced optical sensing and AI-driven analytics, our experts at Appinventiv built ActiDrive, a gesture-controlled app that prioritizes driver safety and convenience. It enables seamless, touch-free control of essential mobile functions, ensuring drivers stay focused on the road while maintaining complete access to their devices.

Beyond hands-free interaction, ActiDrive acts as a smart behavioral analysis tool. It records trip details such as routes, time durations, and distances while tracking driving habits to provide valuable insights into user behavior. Over time, it learns and adapts to individual driving patterns, helping improve road safety and enhancing the overall driving experience.

Implementing Usage-Based Premium Models

The analytical insights drive dynamic premium adjustments that reflect actual driving risk. A careful driver who travels short distances at moderate speeds typically pays less than someone who frequently covers long distances at high speeds. Telematics insurance services providers utilize this behavioral data to ensure premiums align with actual risk, rather than applying one-size-fits-all pricing structures.

Flexible Implementation Options

Insurance companies can deploy telematics technology through various channels depending on their specific needs and customer preferences. Options range from user-friendly mobile applications and simple plug-in devices to sophisticated GPS tracking systems and built-in vehicle sensors. Each approach serves the same fundamental goal: gathering reliable driving data to create transparent, personalized insurance pricing that benefits both insurers and responsible drivers.

Top Telematics Insurance Use Cases Driving Industry Transformation

Telematics technology has a broad spectrum of applications in the auto insurance sector, offering valuable benefits for both insurers and policyholders. By leveraging real-time data and behavioral insights, it enables smarter risk assessment, personalized pricing, and improved safety outcomes. Here are some of the most impactful applications of telematics in the insurance industry:

Reporting Crash Data

Reports can give insurance and car owners the required information about what caused an accident. Advanced telematics systems capture precise pre-impact data, including speed, braking patterns, and steering inputs that occurred seconds before collision.

This detailed forensic information helps determine fault more accurately while reducing claim processing time. Insurance adjusters can access objective data rather than relying solely on driver statements or witness accounts.

Trailer Tracking

Trailer tracking is a system that uses a location unit attached to the trailer to follow the motions and position of the trailer unit of an articulated vehicle. These systems monitor trailer separation from tractors, unauthorized movement, and dwell times at various locations throughout delivery routes.

Fleet operators gain visibility into trailer utilization rates and can optimize asset allocation across different operational areas. Insurance companies use this data to assess theft risk and adjust coverage accordingly.

GPS Anti-Theft Systems

GPS tracking gadgets are now commonly accepted and mandated by motor insurance on high-end automobile models, helping to prevent auto theft. These systems provide real-time location alerts when vehicles move without authorization and enable rapid recovery coordination with law enforcement agencies.

Some advanced systems include remote engine immobilization capabilities that prevent thieves from operating stolen vehicles. Insurance providers often offer premium discounts for vehicles equipped with certified anti-theft tracking technology.

Help With Research

Floating car data can give motor insurers useful statistical information about driving behavior that they can use to hone their intricate insurance models for calculating premiums. Aggregated driving patterns reveal traffic congestion trends, accident-prone locations, and seasonal risk variations across different geographic regions.

This population-level data helps actuaries refine risk assessment algorithms beyond individual driver profiles. Research insights support evidence-based policy development and regulatory compliance reporting requirements.

Fraud Prevention

Vehicle telematics can help uncover attempted fraud and explain the mysterious disappearance of automobiles. Continuous monitoring detects inconsistencies between reported incidents and actual vehicle movement patterns before alleged losses occur.

Time-stamped location data provides objective evidence that contradicts fraudulent claims about accident circumstances or theft timing. Insurance investigators use telematics records to verify claim validity and reduce fraudulent payouts.

Lowering Insurance Costs For Risky Drivers

Young drivers aged 18 to 25 typically face significantly higher insurance premiums due to their higher likelihood of being involved in accidents compared to other age groups. However, by installing a telematics device and showcasing safe driving habits, they can demonstrate greater caution than the average driver, potentially reducing their insurance costs substantially.

Safe driving scores based on actual behavior replace demographic assumptions about risk levels. Young drivers who maintain good driving habits can achieve premium reductions that reflect their individual safety records.

Better Risk Management For Business

Modern car telematics solutions provide information that gives insurance companies and their agents the tools to recognize fleet operators that uphold high traffic safety standards. Fleet safety metrics, including driver behavior scores, maintenance compliance, and incident rates, help underwriters assess commercial risk more accurately.

Insurance providers can offer customized coverage terms and pricing based on an individual’s demonstrated safety performance, rather than relying on industry averages. Risk management partnerships develop between insurers and fleet operators focused on continuous safety improvement.

Wireless Vehicle Safety Communications

This telematics system enables the real-time exchange of critical safety data, including road hazards, vehicle positions, speeds, and driving conditions. Vehicle-to-vehicle communication systems share real-time hazard information, including sudden braking, accident locations, and weather-related road conditions.

Connected infrastructure broadcasts traffic signal timing and construction zone warnings directly to approaching vehicles. Insurance companies monitor these communication networks to identify high-risk areas and adjust coverage recommendations accordingly.

Cold Storage Freight

To set off alarms and keep track of transactions, cold storage freight trailers are increasingly adding telematics to collect time-series data on the temperature inside the cargo container. A telematics system can guarantee that the temperature throughout the shipment remains within food-safety norms.

It can do this with an increasingly complex array of sensors being deployed, many of which use RFID technology. Insurance coverage for temperature-sensitive cargo relies on continuous monitoring data to validate proper handling procedures.

Vehicle Emergency Warning System

“Intelligent vehicles” are outfitted with technology to synchronize (or mesh) warning information with adjacent vehicles in the region of travel, intra-vehicle, and infrastructure. Emergency response systems automatically detect collision impacts and transmit location coordinates to emergency services without driver intervention.

Advanced systems provide medical information and vehicle occupant details to first responders before they arrive at accident scenes. Insurance companies use emergency response data to assess claim severity and coordinate medical coverage benefits.

Satellite Navigation

A GPS and electronic mapping system allow a driver to find their location, plan their trip, and navigate a route. Modern navigation systems integrate real-time traffic data to suggest optimal routes that avoid congestion and reduce accident exposure.

Dynamic route adjustments based on current conditions help drivers maintain safer speeds and reduce aggressive driving behaviors. Insurance telematics programs use navigation data to understand typical driving patterns and assess risk based on route choices.

These wide and dynamic applications and uses of telematics in the insurance industry make it the next technology frontier for your business!

Benefits of Using Telematics in the Insurance Business

While there must be complete clarity on the various applications of telematics in the insurance business, let us now look at a few precise ways in which insurers can exploit these use cases towards their business’s benefit.

Telematics Systems Contribute Toward Customer Engagement

By better understanding your customers, you can categorize them more efficiently and provide them with customized automobile insurance plans that suit their needs. Your items must be customized if you want to give exceptional consumer involvement and experiences. Data analytics in insurance can be used to develop a comprehensive picture of the consumer, which is necessary for personalized offerings.

Additionally, telematics systems frequently result in ongoing client interaction with the carrier via an app or other devices to monitor their usage. Rewards and point scoring are two gamification aspects that draw attention and help deter risky driving. High levels of customer interaction increase the likelihood that they will be pleased with the service and be prepared to pay extra.

Telematics Systems Keep Insurers Ahead of the Competition

What are the benefits of an insurance program that rewards customers for driving more safely while utilizing the equipment they already own? It serves as a good, concrete reason to follow traffic laws. It’s a mechanism that effectively lowers insurance rates for those who drive the safest on the road. Additionally, it enables insurance companies to identify those drivers who endanger other motorists, allowing them to raise their customers’ premiums while reducing those of safer drivers.

In the end, insurance firms may create more competitive pricing and rates thanks to mobile telematics and the deep knowledge from mobile data analytics, providing them a competitive edge over rival auto insurance providers. Insurance businesses that participate in UBI projects also have the chance to evaluate how their pricing structure will develop and alter over time, thanks to the collection of a plethora of data.

Telematics Systems Lead to Reduced Costs for Organizations

More insurance companies are using their clients’ smartphones as telematics technology advances. Since most people always have their smartphones with them, they have developed into a valuable tool for insurers because they already have sensors that enable measuring things like speed, travel distance, or information about the driver, like whether the car owner is behind the wheel or the driver’s age. Therefore, a smartphone app is the least expensive way to implement usage-based insurance.

Safe drivers lower the cost of claims, making insurance more beneficial. Additionally, usage-based insurance promoting safe drivers will likely draw less risky clients. Drivers with a history of accidents or speeding fines are unlikely to enroll in a usage-based insurance program.

Claims can be decreased by improved behavior and positive selection. Additionally, data enrichment helps insurance companies identify incidents early and notify services. The service can then make more precise liability choices based on location or time information. In addition, the First Notification of Loss (FNOL) enables the insurer to manage claims in minutes rather than several days.

Adopting Telematics Makes Organizations Perceived as Tech-Friendly

Imagine that a motor insurance provider offers a mobile telematics insurance alternative while continuing to serve most of its other clients using the conventional insurance approach. Only a tiny but significant portion of the company’s customers have joined the mobile usage-based program after a year or two. This may be because the company hasn’t had time to market its UBI service effectively. Is the attempt at usage-based insurance a failure?

No, and for one very important reason: it demonstrates to customers that their insurance provider is innovative and constantly coming up with new concepts and insurance programs that can help their customers, even those who (at this time) choose not to use the mobile UBI model. Even if a consumer decides that mobile telematics isn’t for them right now, they can have a change of heart in the future. They will also be pleased with their insurance company’s innovative strategy for boosting its line of services.

Of course, there are benefits of telematics in the insurance industry for the clients who join a mobile telematics program. They will see a decrease in their premiums if they maintain safe driving habits, which will make them believe that their insurance company genuinely cares about compensating them for driving safely. A cautious driver will be less inclined to sever their links with their provider in favor of another auto insurance business because the relationship that develops between the insurance company and the client will be closer and more personalized.

Real-Life Examples of Telematics in the Insurance Industry

Telematics is revolutionizing insurance by enabling real-time risk assessment, behavior-based pricing, and smarter claims management. Here are leading examples of how top insurers leverage connected devices and data-driven insights to transform their services.

Progressive’s Snapshot Program for Auto Insurance Personalization

Progressive uses its Snapshot telematics program to personalize auto insurance pricing based on actual driving behavior instead of generic risk factors like age or ZIP code. The plug-in device or mobile app monitors mileage, hard braking, rapid acceleration, time of day, and mobile phone distractions to generate a driving score. Safer drivers earn up to 43% discounts, while riskier drivers may see higher premiums.

By adopting telematics for insurance, Progressive reduces claims frequency, attracts low-risk drivers, and positions itself as an early innovator in usage-based insurance (UBI), improving customer loyalty through behavior-based savings.

Allstate’s Drivewise and Milewise for Safe and Low-Mileage Drivers

Allstate employs telematics to both reward safe driving habits and create affordable options for low-mileage users. Drivewise, a mobile app, tracks speeding, harsh braking, cornering, night-time driving, and phone usage to calculate a safety score that can unlock up to 40% discounts.

Milewise uses telematics to record the exact miles driven, enabling a pay-per-mile pricing model ideal for urban or infrequent drivers. By combining these offerings, Allstate enhances risk-based pricing while relying on robust telematics software for insurance to engage customers and improve retention with transparent, data-driven insights.

State Farm’s Drive Safe & Save for Behavior-Based Premium Adjustments

State Farm’s Drive Safe & Save program adjusts premiums according to driving behavior instead of only traditional risk categories. A mobile app, paired with a Bluetooth beacon or integrated connected-car data, tracks total miles, speeding, hard braking, acceleration, cornering, and distracted driving. Safe drivers can save between 30% and 50% on their premiums.

This telematics-driven approach enables State Farm to encourage safer road habits, retain low-risk customers, and enhance underwriting accuracy. It also aligns with the broader shift toward connected solutions offered by modern telematics insurance services providers.

Also Read: How much does State Farm-like auto-insurance app development cost?

GEICO’s DriveEasy for Individual and Fleet Safety

GEICO uses DriveEasy to target individual drivers, offering a smartphone app that monitors braking, acceleration, speeding, and phone usage, with potential discounts of up to 20%. For commercial clients, DriveEasy Pro integrates telematics devices with dashcams to provide real-time fleet tracking and improve driver safety.

These programs enable GEICO to refine pricing accuracy, reduce accident-related losses, and enhance risk management for both personal and business customers. By scaling telematics, GEICO strengthens its competitiveness in usage-based insurance while appealing to a broad customer base.

Travelers’ IntelliDrive for Short-Term Driving Assessments

Travelers’ IntelliDrive program collects driving behavior data over a 90-day assessment period using a smartphone app powered by TrueMotion. It monitors braking, acceleration, cornering, speeding, and time of day to calculate a driver risk score. Safe drivers can earn up to 8–9% discounts, while poor driving habits may trigger modest surcharges.

This short-term telematics approach allows Travelers to quickly assess risk, reward good behavior, and enhance underwriting accuracy without requiring long-term tracking. It provides a balanced way to engage customers while managing claims costs effectively.

Impact of Telematics in Other Insurance Sectors

For now, other insurance markets do not use usage-based insurance (UBI) in the same way that the auto sector does. However, it might not be long until health insurance firms, life insurance firms, and home insurance firms start using, at least in part, telematics-based data or telematics insurance statistics. Let’s see how telematics and the insurance sector merge together:

Telematics Health Insurance

Health insurers have long been benefiting from a digitalized insurance sector. The insurers have been using data to assess the risks involved in providing coverage for each client. Even the simpler decisions that health insurers make, like whether or not to offer coverage to a particular person, frequently involve data. Applicants are frequently profiled by companies in the health insurance sector, with important details like age, medical history, smoking/non-smoking status, and other aspects used to determine price and whether to accept or deny coverage.

Health insurance companies can collect the same information from fitness monitors through telematics technology. Then, telematics insurance industry companies can utilize that information to offer activity-based reward programs or discounts to new insurance applicants willing to disclose such information. Other health parameters can be coupled with various health-related data items, including distance traveled, elevation gains, and active minutes.

Telematics Life Insurance

Telematics technology can customize life insurance programs to receive more relevant premium quotes. The firm can use tracking systems to gather information on client behavior and develop customized offers for them.

You may learn more about a person’s activity levels, among other things, by gathering data through wearables or even ingestible. You will be able to determine how risky it can be for your business to insure him or her as a consequence. A lot of guessing may be removed with telematics-based health and life insurance.

Telematics Home Insurance

Smart home technology is revolutionizing how insurance companies evaluate property risks. Connected devices that monitor fire hazards, water leaks, temperature fluctuations, and break-ins provide instant alerts to both homeowners and their insurers, often preventing costly damage before it escalates. Home insurance programs are beginning to reward customers who install IoT security systems and protective devices with reduced premium rates.

A homeowner with smart water leak detectors, for instance, significantly lowers their risk of extensive water damage, creating benefits for everyone involved. This approach transforms home insurance from simply paying claims after disasters occur to actively preventing problems through data-driven risk management strategies.

Telematics Travel Insurance

Travel insurance is embracing telematics to track trip patterns, destination choices, and even traveler health data during journeys, enabling more accurate risk assessment in real time. Frequent travelers who consistently visit safer destinations often qualify for premium discounts, while those heading to higher-risk areas may see modest increases in their coverage costs.

Telematics also speeds up claims processing by automatically tracking flight delays, baggage issues, and medical emergencies as they happen abroad. When insurers combine travel behavior data with personal health information and location tracking, they can deliver more tailored coverage options while providing customers with faster, clearer claims resolution processes.

Telematics Agriculture Insurance

Agricultural insurers are leveraging sensor technology to monitor soil quality, crop conditions, weather changes, and farm equipment performance across entire operations. This comprehensive data allows insurance companies to assess risk factors more accurately, including early warnings about potential crop losses or machinery failures. Farmers who adopt precision agriculture technology and IoT monitoring systems often qualify for lower insurance rates, as these tools demonstrate more effective risk management practices.

Telematics data from tractors, irrigation equipment, and field sensors can verify responsible farming methods, reducing the probability of insurance claims. Through telematics integration, agricultural insurance is shifting toward proactive risk prevention rather than simply compensating for losses after they occur.

Understanding Different Telematics Insurance Models: Finding the Right Fit for Your Driving Style

Modern insurance companies offer several telematics-based pricing models, each designed to match premiums with actual driving patterns. From simple mileage-based calculations to comprehensive behavior monitoring, these models help drivers pay for coverage that truly reflects their individual risk and usage patterns.

Pay-As-You-Drive (PAYD)

This straightforward approach ties your premium directly to how much you actually drive. If you’re someone who only uses your car for weekend errands or occasional trips, you’ll pay significantly less than daily commuters racking up serious mileage.

A driver putting on just a few hundred kilometers monthly will see much lower costs than someone clocking thousands of kilometers regularly. The beauty of PAYD lies in its simplicity – your actual road time determines your bill, making it perfect for light drivers who’ve been overpaying under traditional models.

Distance and Time-Based Models

These models get sophisticated by considering not just where you drive, but when you’re on the road. Cruising through quiet suburban streets during midday gets you better rates than navigating busy highways during rush hour. Late-night driving or frequent trips through high-accident zones will bump up your costs.

This approach works particularly well for businesses implementing telematics in insurance for fleet management, where different routes and schedules create varying risk levels.

Pay-How-You-Drive (PHYD)

PHYD digs deeper into your driving habits rather than just counting miles. This model tracks everything from how often you speed to whether you brake smoothly or slam on the brakes. Sharp turns, late-night driving, and aggressive acceleration all factor into your risk profile.

The concept of telematics in auto insurance is simple yet powerful. Drivers who maintain steady speeds, avoid harsh braking, and follow safe driving practices earn genuine discounts, while those who frequently drive aggressively or at high risk face higher premiums. It works like an ongoing driving assessment where consistent good habits translate into monthly savings.

Hybrid Approaches

Most modern telematics insurance programs combine multiple factors for a more complete picture. These hybrid models weigh both your total mileage and your driving quality, creating a balanced assessment that feels fair to most drivers. Rather than focusing solely on one metric, they consider your complete driving profile.

This comprehensive approach has become the preferred method across the telematics in the insurance industry, offering accurate pricing while remaining easy for customers to understand. The result is a premium that truly reflects your individual risk level rather than lumping you in with broad demographic categories.

Navigating Telematics Implementation: Common Roadblocks and Smart Solutions

While telematics for insurance offers tremendous potential for creating fairer, data-driven pricing models, rolling out these systems comes with real challenges. Insurance companies worldwide are discovering that success requires more than just good technology – it demands careful strategy around privacy, costs, and customer acceptance. Here’s what industry leaders are facing and how they’re tackling challenges associated with telematics implementation.

Privacy Concerns and Customer Hesitation

Customer reluctance often stems from legitimate concerns about location tracking and driving behavior monitoring. Many policyholders question how insurers will use this personal information and whether it might be shared with third parties.

Successful companies address these concerns through comprehensive data protection frameworks that include advanced encryption, clear data usage policies, and explicit customer consent mechanisms. Establishing transparent communication about data collection purposes and providing customers with granular control over their information sharing preferences builds the foundation for broader program acceptance.

Data Volume Management and System Integration

Telematics programs generate continuous data streams that can overwhelm traditional insurance processing systems. Without adequate infrastructure, valuable behavioral insights become inaccessible due to storage limitations and processing bottlenecks.

Organizations have found success implementing scalable cloud-based analytics platforms designed specifically for high-volume data processing. These systems filter relevant information while maintaining integration capabilities with existing policy management and claims processing systems.

Hardware Infrastructure and Associated Costs

Physical device deployment across large customer bases creates substantial capital expenditure requirements, particularly when considering ongoing maintenance, replacement, and technology upgrade cycles.

Many organizations have shifted toward smartphone-based telematics solutions that leverage existing customer devices rather than requiring additional hardware investments. Strategic partnerships with automotive manufacturers enable telematics fleet management integration during vehicle production, distributing costs more effectively across the value chain while reducing retrofit requirements.

Regulatory Compliance Across Multiple Jurisdictions

Telematics software for insurance operates within complex regulatory environments where data protection requirements vary significantly between regions. Compliance challenges multiply for insurers operating across multiple jurisdictions with different privacy laws and consumer protection standards.

Leading organizations build regulatory flexibility into their platform architecture from the outset, enabling rapid adaptation to changing legal requirements. Maintaining close relationships with regulatory bodies and legal experts ensures proactive compliance rather than reactive adjustments that can disrupt ongoing operations.

Customer Education and Adoption Barriers

Driver skepticism often centers on concerns that minor driving incidents will result in immediate premium increases. This perception creates resistance to program participation even among customers who would benefit from usage-based pricing.

Effective adoption strategies include structured pilot programs that allow customers to experience benefits without long-term commitments. Educational initiatives that clearly demonstrate how safe driving translates to tangible premium reductions help shift customer perceptions from skepticism to engagement.

Let our experts help you implement innovative insurance models that balance technology, compliance, and customer satisfaction

Future Trends of Telematics in Insurance

The insurance industry is witnessing a technological revolution, and telematics sits at the heart of this transformation. What started as simple mileage tracking has evolved into something far more sophisticated. Today’s telematics systems collect vast amounts of data, but we’re only scratching the surface of what is possible.

The convergence of AI, IoT, blockchain, and autonomous vehicles is creating exciting opportunities for insurers to understand risk better and serve their customers. These telematics and usage-based auto insurance trends are transforming how we approach coverage, pricing, and customer relationships.

AI and Machine Learning in Risk Prediction

AI in the insurance sector is transforming how insurers assess and mitigate risks by analyzing vast amounts of telematics data in real-time. AI models can detect complex patterns in driver behavior, traffic conditions, and environmental factors, allowing insurers to predict accident-prone situations with higher accuracy. Beyond risk prediction, AI-powered analytics enable proactive interventions, helping drivers improve their habits while reducing claims frequency.

Machine Learning takes this a step further by not only predicting risks but also enhancing fraud detection. ML algorithms continuously improve, becoming increasingly accurate at predicting individual risk profiles. This creates opportunities for truly personalized insurance policies that reflect each driver’s unique circumstances.

Connected & Autonomous Vehicles

Self-driving cars are generating unprecedented amounts of data, transforming telematics in insurance use cases through detailed insights into vehicle performance and external conditions. Vehicle-to-Everything (V2X) communication enables cars to exchange information with other vehicles and road infrastructure, providing a comprehensive picture of driving conditions.

The use of AI in self-driving cars enables better fault determination in accidents and more accurate risk assessment based on real-time traffic conditions. As autonomous features become standard, insurance liability will shift from individual drivers to vehicle manufacturers and software providers.

Expansion Beyond Auto Insurance

Automotive telematics principles are expanding across multiple insurance sectors, with wearable devices tracking health metrics and smart home sensors monitoring water leaks and break-ins for property coverage. This multi-domain approach enables insurers to create comprehensive risk profiles across various aspects of individuals’ lives.

Responsible drivers often exhibit healthy lifestyle patterns and diligent home maintenance, resulting in better rates across all policies. Implementing telematics in insurance beyond automotive applications requires careful consideration of privacy, but the potential for accurate risk assessment makes expansion inevitable.

Blockchain for Secure Telematics Data

Blockchain technology addresses data security concerns by creating immutable, decentralized records that can be shared securely between insurers, customers, and third parties. This provides transparency, allowing customers to see exactly what data is collected while reducing fraud through tamper-proof driving behavior records.

Blockchain technology in insurance enables secure data sharing between insurance providers, making it easier for customers to switch without losing their accumulated driving history. Early pilots show promising results in security and operational efficiency, suggesting broader adoption as the technology matures.

Eco-Conscious Mobility & Green Driving Insights

Telematics, combined with AI, is also enabling eco-conscious mobility by analyzing fuel consumption, emission patterns, and driving styles. Insurers can reward eco-friendly driving behaviors such as reduced idling, optimal route selection, and the adoption of electric vehicles with lower premiums.

Machine learning models identify driving practices that minimize carbon footprints, encouraging drivers to adopt sustainable habits. This not only supports environmental goals but also aligns insurers with ESG (Environmental, Social, and Governance) initiatives, creating a win-win for both policyholders and the planet.

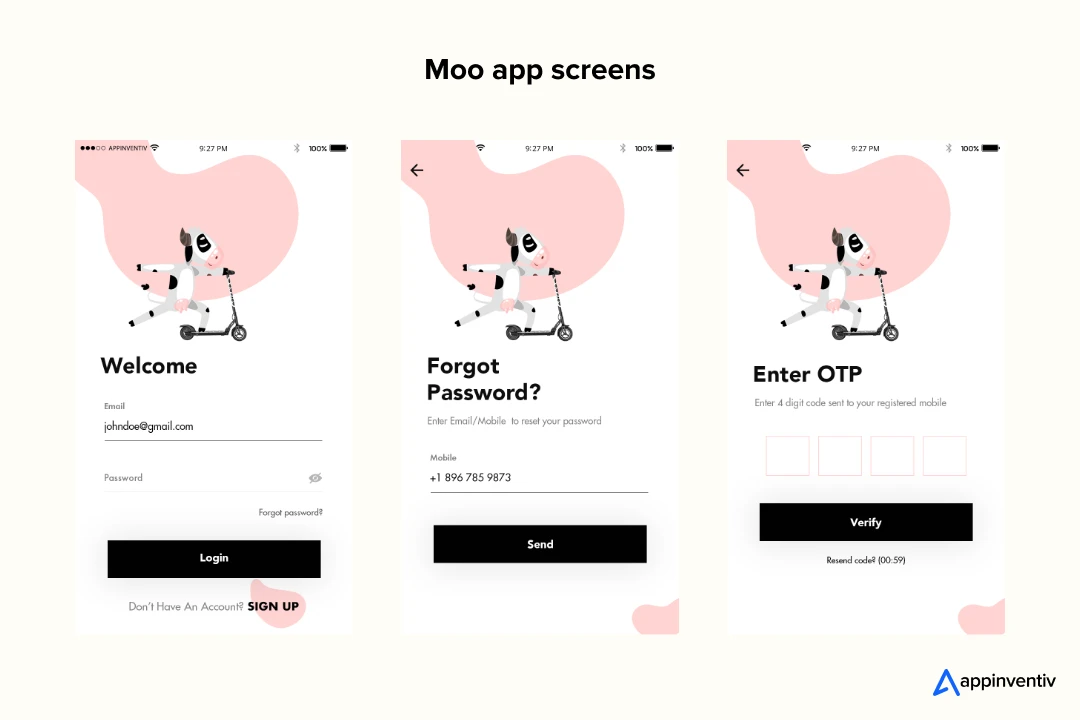

With urban pollution on the rise, Moo set out to transform short-distance commuting by replacing gas-emitting vehicles with sustainable eScooters. Partnering with Moo, Appinventiv built a connected platform where users could easily locate, unlock, and pay for eScooters, making eco-friendly travel simple and affordable.

From ideation to IoT integration, we handled the entire development process, ensuring seamless smartphone-to-scooter connectivity and secure interactions. The result was a scalable, user-friendly solution promoting green mobility, now set to expand across multiple UK cities and drive a cleaner, more sustainable future.

How Appinventiv Can Help Your Insurance Business With Telematics Implementation

While telematics technology has gained the most traction in the auto insurance sector, its potential extends far beyond vehicles. From health and life insurance to property, travel, and even agriculture, telematics is paving the way for data-driven, personalized policies that benefit both insurers and policyholders. By leveraging real-time insights, insurers can accurately assess risks, reduce fraudulent claims, improve customer engagement, and deliver fairer premiums—all while staying ahead of the competition.

At Appinventiv, we help insurance businesses harness the true power of telematics. As a leading insurance software development services partner, we specialize in building end-to-end telematics solutions that seamlessly integrate with your existing systems. Whether it’s usage-based insurance for automobiles, activity-based health rewards, or smart home risk monitoring, our telematics insurance solutions development services enable you to deliver smarter, more customer-centric products.

We empower insurers to attract and retain clients with competitive, behavior-based pricing models, while enhancing user experience through features like safe driving tips, trip details, driving behavior analytics, trip logs, and real-time alerts. Our expertise in AI, IoT, and cloud-based platforms ensures your telematics system is not only scalable but also secure and compliant with industry regulations.

If you’re looking to future-proof your insurance business and stay ahead in the rapidly evolving market, our experts are ready to help. Connect with a reputable custom software development company like ours to discover how telematics can enhance your insurance offerings and drive sustainable growth.

FAQs

Q. How does telematics help insurance companies?

A. With telematics motor insurance, also known as UBI, insurance providers would better understand the car owner’s risk profile based on mileage, average speed, frequency of use, and general driving prowess. Real-time data analysis aids in the investigation of claims by insurers and aids in detecting fraud claims.

Q. How does telematics insurance improve customer experience?

A. One of the most popular technologies utilized by auto insurers is telematics in the insurance industry. It collects drivers’ driving information and builds a profile based on their habits. It is a crucial step because it aids in creating a personalized auto insurance policy and determines the cost. The expense of coverage may not be incurred by the car owners, who only pay the premium set forth for their specific policy.

The anti-theft systems provided by telematics technology can also help consumers secure their automobiles against theft. When a user purchases a car insurance policy, their premium may be reduced if the vehicle is equipped with pre-installed anti-theft devices, such as steering wheel locks, alarms, and immobilizers, with the help of telematics insurance. These all contribute towards an improved customer experience.

Q. Why do insurance companies use telematics?

A. Insurance companies utilize telematics to refine risk evaluations and tailor premiums. By utilizing real-time driving data through apps or devices, insurers can assess driving habits like speed and braking. This allows for more precise risk profiling, facilitates usage-based insurance models, and rewards safe driving with lower premiums. Additionally, telematics aids in fraud detection and enhances customer service by enabling more accurate policy pricing.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Why Every Automotive CEO Needs an SDV Strategy - Benefits, Architecture, Challenges & More

Key takeaways: SDVs vary in architecture—from embedded software enhancements to software-first EVs—each posing different OEM challenges. Turning the vehicle into a platform unlocks faster updates, better UX, recurring revenue, and data monetization opportunities. A unified tech stack and tight integration between software and manufacturing drive long-term SDV success despite high initial costs. Challenges like legacy…

Custom Development or White Label Solutions: Which is Right for Your Business?

Key takeaways: 77% of companies are prioritizing digital transformation; the right tech approach is crucial for staying competitive. Custom development offers tailored solutions for unique needs, flexibility, and long-term scalability. Whereas, white-label solutions provide quick market entry, cost-efficiency, and easy customization for standard needs. Appinventiv’s expertise helps you navigate custom development vs white-label to choose…

ERP Integration in Australia - Why It Is Essential and How to Do It Right

Key takeaways: ERP integration enables operational efficiency, reduced costs, and enhanced decision-making. Healthcare, finance, manufacturing, retail, and all the other sectors are benefiting from ERP integrations in Australia. While ERP integration can be costly, ranging from AUD 45,000 - AUD 450,000, it leads to significant long-term savings and scalability. Compliance with Australian regulations is critical,…