- Understanding Legacy Systems in Banking

- Why Some Banks Still Rely on Legacy Systems

- Common examples of legacy systems in the banking industry

- The Core Challenges of Legacy Systems: Why Change is Inevitable

- The Shrinking Talent Pool

- Rising Maintenance Costs

- Security and Compliance Risks

- Lack of Agility, Scalability, and Innovation

- Poor Customer and Employee Experience

- The Competitive Gap

- Choosing Your Path: Strategic Approaches to Legacy Banking Modernization

- Replatforming (The "Lift and Shift")

- Refactoring (The "Renovation")

- API Wrapping (The "Smart Connector")

- Replacement (The "Rip and Replace")

- The Hybrid Approach (The "Progressive Build")

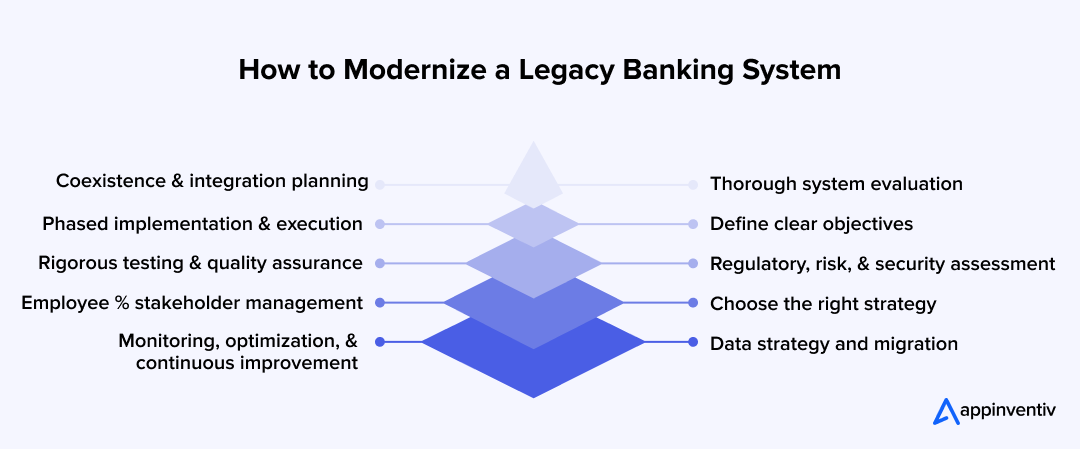

- A Step-by-Step Roadmap for Banking Legacy Software Modernization

- 1. Complete System Evaluation

- 2. Set Clear Goals

- 3. Check Rules, Risks, and Security

- 4. Choose Your Modernization Strategy

- 5. Plan Data Strategy and Migration

- 6. Plan Coexistence & Integration

- 7. Roll Out in Phases

- 8. Test Everything Thoroughly

- 9. Handle Employees and Stakeholders

- 10. Monitor, Optimize, and Improve

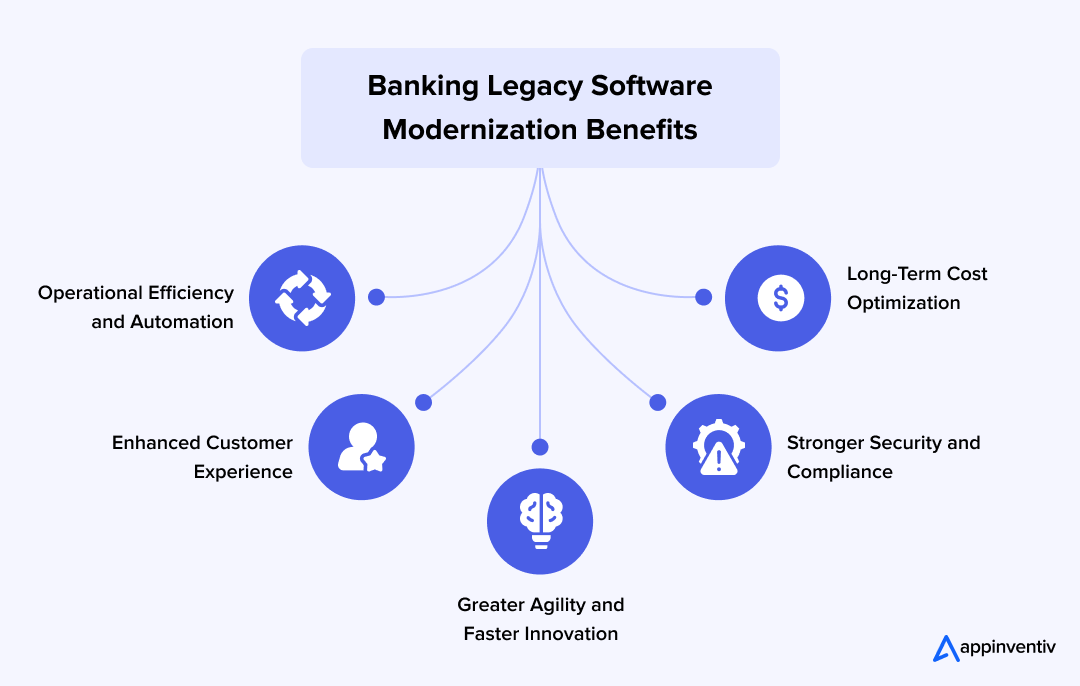

- Benefits of Modernizing Legacy Banking Systems

- 1. Operational Efficiency

- 2. Better Customer Experience

- 3. Quicker Innovation

- 4. Better Security and Compliance

- 5. Long-Term Money Savings

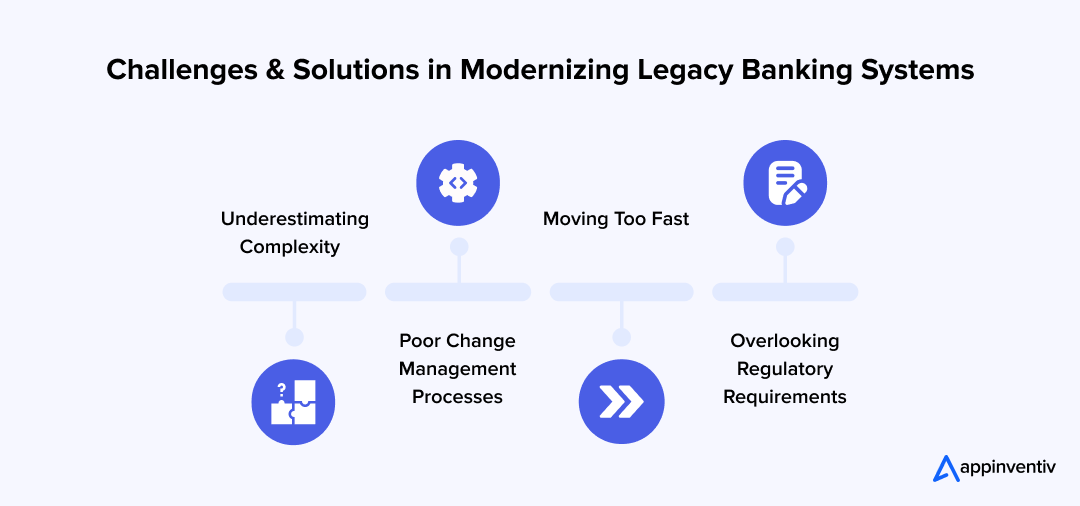

- Common Pitfalls in Legacy Banking Modernization and How to Avoid Them

- 1. Underestimating Complexity

- 2. Poor Change Management

- 3. Ignoring Regulatory Requirements

- 4. Moving Too Fast

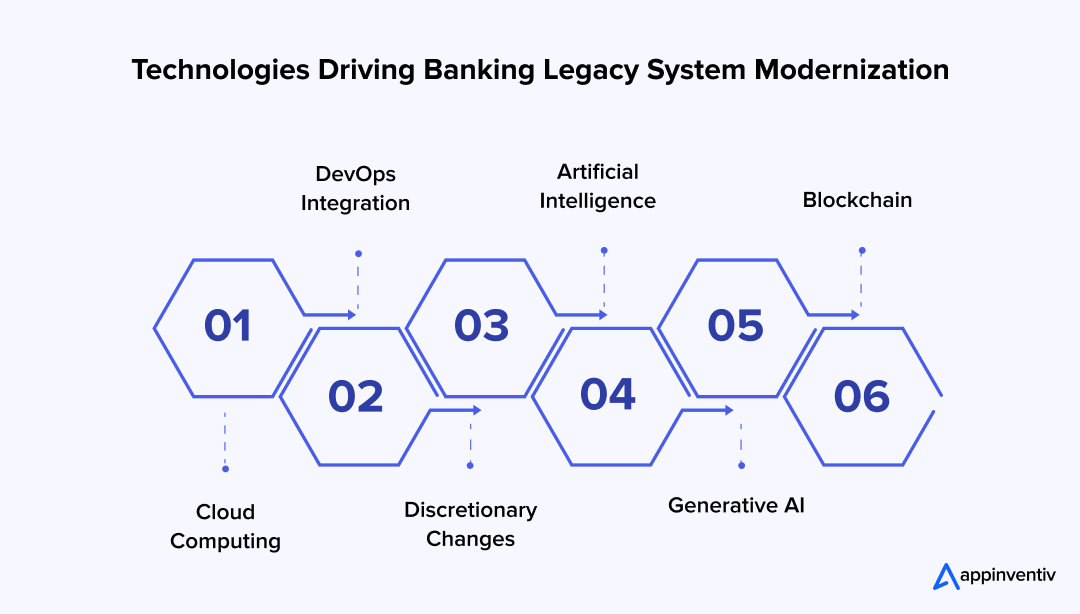

- How AI & Other Tech Trends Accelerate Banking Legacy System Modernization

- Cloud Computing: Getting Flexible

- AI: Smarter Decisions, Lightning Speed

- Generative AI: Unlocking Innovation

- Discretionary: Investing in Tech Transformation

- DevOps: Moving Fast Without Breaking Things

- Blockchain: Building Trust and Security

- Modernize Your Legacy Systems in Banking with Appinventiv

- FAQs

Key takeaways:

- Legacy systems burn cash and slow things down, so modernization is essential to stay compliant and competitive.

- Methods like replatforming, refactoring, or a hybrid approach let banks upgrade piece by piece without breaking everything.

- Tech trends like cloud computing, AI, and blockchain make modernization happen faster, fixing efficiency, customer service, and safety.

- Banks stopped just patching old junk and started putting money into discretionary tech transformation for actual growth.

- The cost of banking legacy software modernization ranges between $40,000 and 4400,000 or more.

Picture this: it’s payday, millions are trying to transfer salaries and pay bills, and suddenly, the system goes dark. This is not just a nightmare; it is the reality for many banks. For instance, in January 2025, Barclays suffered a major outage that froze mobile banking, card payments, and transfers for more than 20 million customers (Source: Financial Times). It wasn’t the first incident, and it won’t be the last.

A UK parliamentary review found banks clocked 158 IT failures between January 2023 and February 2025, amounting to 33 days of downtime (Source: The Guardian).

These meltdowns all have the same culprit: aging core systems held together with patches and prayers. Legacy platforms, many written in COBOL (Common Business-Oriented Language) decades ago, still run deposits, payments, and risk engines. They’ve served banks well, but today they’re a liability: expensive to maintain, hard to secure, and painfully slow to change.

This is why banking legacy software modernization has moved from an IT project to a boardroom priority. As Boston Consulting Group warns, “if banks continue with their current operations without modernization, their global cost-to-income ratio could rise to approximately 74% by 2030, compared to 63% in 2023.”

For established banks, this isn’t just a technology problem; it’s an existential threat. But worry not. This blog is your go-to roadmap to overcome legacy barriers. In this blog, we will break down everything you need to know about banking legacy modernization, from understanding the core challenges to implementing a successful strategy. We’ll explore the different approaches, the key technologies driving change, and the head-turning benefits that await on the other side. Let’s get started.

Understanding Legacy Systems in Banking

When we talk about legacy systems in banking, we’re not just pointing at “old software.” We’re talking about the backbone of global finance; systems built 30 to 40 years ago, still quietly processing trillions every day. They were built for stability and batch processing, not for the always-on, API-first world your customers expect today.

What makes a system “legacy”?

- Age and language: Most cores run on COBOL or PL/I, languages that barely any new engineers learn.

- Architecture: Monolithic structures designed for batch processing, not real-time, API-driven services.

- Integration pain: They rely on file transfers and overnight jobs instead of event-driven systems.

In short, a system becomes “legacy” when it blocks agility rather than enabling it. If rolling out a new mobile feature means rewriting core deposit code from the 1980s, you’re staring at legacy debt.

Why Some Banks Still Rely on Legacy Systems

There are two reasons banks haven’t ripped out these systems:

- Reliability: These platforms are workhorses. They’ve cleared checks, settled loans, and balanced ledgers with near-flawless consistency for decades. No CIO or CTO wants to risk “breaking the bank” with a rushed replacement.

- Risk of change: Migrating a banking core is like operating a heart surgery while the patient is running a marathon. Downtime is unacceptable. Even partial failures can cause compliance issues, reputational damage, and customer churn.

Common examples of legacy systems in the banking industry

- Core banking systems managing deposits, loans, and general ledgers, often installed in the 80s or 90s.

- Payment engines are still reliant on batch cycles and struggling to meet instant payment demands.

- Risk and compliance platforms built before GDPR, PSD2, or open banking regulations even existed.

The Core Challenges of Legacy Systems: Why Change is Inevitable

The problems with legacy banking systems go way deeper than slow processing times or clunky interfaces. These systems create a cascade of challenges that touch every aspect of banking operations. Let’s talk about the legacy banking system modernization challenges in detail:

The Shrinking Talent Pool

Many banking cores still run on COBOL. It’s reliable, but here’s the problem: the engineers who know how to fix it are retiring. As older engineers retire, finding replacements is tough. The result? A shrinking talent pool.

Imagine relying on a system that only three of your employees can troubleshoot, and they, too, are about to retire, and you don’t find suitable replacement options. Sounds concerning? That’s the reality for some banks today.

Rising Maintenance Costs

Maintaining these systems is expensive. Banks spend huge portions of their budgets just keeping things running, from paying for old hardware to fixing constant issues. The worst part? It’s a cycle. Instead of investing in new innovations or customer-facing products, banks are stuck pouring money into outdated systems that don’t provide much value anymore.

Security and Compliance Risks

Legacy systems are meant to be built decades ago, before open banking, before GDPR, even before mobile banking apps. Though the security patches of old systems still can help to some extent, the architecture itself wasn’t designed for the threats banks face now. Regulators increasingly expect resilience and transparency. That’s hard to deliver by a system that wasn’t built for today’s rules.

Lack of Agility, Scalability, and Innovation

Modern consumers expect instant payments, smooth onboarding, and integrations with digital wallets. Legacy cores, tied to overnight batch jobs, are like trying to race a horse cart on a motorway. Every new product takes longer to build, test, and release. The result? Customers notice the lag, and competitors take advantage.

Poor Customer and Employee Experience

Legacy systems for customers show up as something that freezes often, transactions that take too long, and outages at the worst possible time. For employees, it’s outdated terminals, multiple logins, and manual workarounds. Result? Both employees and customers get frustrated, which eventually hits the bank’s bottom line.

The Competitive Gap

Digital-first banks don’t have these chains. They build on modular, cloud-native systems and can roll out features in weeks. The longer traditional banks rely on outdated systems, the wider that gap grows. At some point, no amount of marketing will cover for technology that can’t keep up.

These challenges signal that a shift is coming, and banks that fail to keep pace with the modernization trend will lag behind their competitors and even struggle for existence. This is the reason that banks are no longer asking if they should modernize, but when and how.

Choosing Your Path: Strategic Approaches to Legacy Banking Modernization

Embarking on a banking legacy system modernization journey isn’t about flipping a single switch. It is a complex and challenging process that calls for a wise strategy for legacy system modernization that aligns with your business goals, market demands, budget, and risk tolerance. Here are the proven implementation strategies for modernizing banking legacy software that you can hinge on.

Replatforming (The “Lift and Shift”)

Replatforming means migrating your entire application to a cloud environment (like AWS, Azure, or Google Cloud) from your on-premise data center with minimal code changes.

- Analogy: You’re moving your old, comfortable furniture into your new, modern house. The furniture is the same, but the house offers better utilities and security.

- Best for: Banks looking for a relatively quick and low-cost way to reduce infrastructure costs and gain some of the benefits of the cloud managed infrastructure without a major overhaul.

Refactoring (The “Renovation”)

Refactoring involves restructuring and optimizing existing code to improve its performance and efficiency. This approach often makes the system more cloud-native, without changing its external behavior.

- Analogy: You’re retaining the same frame of your house but gutting the old plumbing and wiring, replacing them with modern, efficient systems. The house looks the same from the outside, but it runs much better.

- Best for: Applications that are strategically important but are weighed down by technical debt. The goal is to make them more scalable and easier to maintain.

API Wrapping (The “Smart Connector”)

This approach is also known as encapsulation. It involves leaving the legacy system largely untouched but building a modern API layer around it. This allows new, modern applications to communicate and exchange data with the old core system.

- Analogy: You have a vintage record player you love, but you want to listen to its music on your new Sonos speakers. You use a special adapter (the API) to connect the two without modifying the record player itself.

- Best for: This is a cornerstone of Open Banking and embedded finance. It enables banks to quickly expose legacy functions to third-party developers and create new services without touching the core. This is a key part of any modern banking application modernization plan.

Replacement (The “Rip and Replace”)

This is the most common approach. This strategy completely decommissions the old system and builds or buys a new, modern one from scratch.

- Analogy: Demolishing the old house and building a new, modern-designed home on the same plot of land.

- Best for: When a legacy system is so outdated, fragile, and costly to maintain. This is a high-risk, high-reward strategy often used for creating a new core banking modernization system.

The Hybrid Approach (The “Progressive Build”)

Most large-scale modernizing legacy systems in banking projects use a hybrid strategy. This often involves using a microservices architecture to break down the monolithic legacy application into smaller, independent services and replacing them piece by piece over time.

- Analogy: Renovating a large old house while still living in it. Instead of demolishing the entire house and starting over, you modernize room by room.

- Best for: This approach works well for large-scale organizations that need to ensure business continuity while gradually improving their systems.

A Step-by-Step Roadmap for Banking Legacy Software Modernization

Modernizing legacy banking systems feels daunting, but you can do it easily. How? Breaking the entire process into chunks makes things manageable. Not sure how to do it right? Well, here are the steps to modernize legacy banking applications with ease and confidence:

1. Complete System Evaluation

Before changing anything, figure out what you’re working with. Check your current systems and spot the trouble areas. Which systems are ancient? Which ones still work okay? This helps you decide what needs fixing first without messing up critical operations.

A bank might discover its payment system is old but essential for business, while its customer service platform just needs minor tweaks.

2. Set Clear Goals

What’s your endgame with modernization? Maybe it’s improving customer experience or cutting operational expenses. Whatever your goal is, make it measurable. This keeps your strategy focused and everyone moving in the same direction.

For instance, if you want faster transactions, you’ll probably tackle payments and transaction processing systems first.

3. Check Rules, Risks, and Security

Regulations and security can’t be afterthoughts in modernization. Building new tech means ensuring it meets compliance and security standards. Review regulatory requirements your bank faces, like GDPR, PSD2, and new banking rules. Think about cybersecurity since old systems have more vulnerabilities. This protects your bank from compliance headaches and keeps operations secure.

When Barclays moved to the cloud, they had to handle security gaps and regulatory compliance to stay aligned with UK banking standards and EU data privacy rules like GDPR.

4. Choose Your Modernization Strategy

There’s no cookie-cutter approach to modernizing legacy systems. Choose based on risk, cost, and business needs. You might replatform, refactor, or completely replace legacy systems. Critical, complex systems might need refactoring over replatforming. Sometimes, full replacement is your only choice. Choose your strategy wisely based on your needs (details given above).

Big banks often use mixed approaches, combining different methods and modernizing specific areas before expanding.

5. Plan Data Strategy and Migration

Data migration to the cloud or modern systems needs careful planning. Map how you’ll move data between systems without losing or corrupting important information. Mess this up and you’ll have major disruptions. Data quality checks matter here; consistency, integrity, and security during transfer aren’t negotiable.

During Santander’s cloud migration, they focused on data integrity through strict testing and validation, ensuring smooth, secure transitions.

6. Plan Coexistence & Integration

During modernization, old and new systems often run together. Coexistence planning ensures legacy systems can still talk to new technologies during transition. Without a solid integration strategy, you risk service disruptions or errors.

A bank might run old payment systems alongside new cloud-based real-time systems for months, making sure everything integrates smoothly before switching completely.

7. Roll Out in Phases

Modernization isn’t all-or-nothing. Phased implementation lets you make gradual changes without overwhelming operations. Start small with non-critical systems like customer service or back-office management, then tackle bigger, complex components like core banking or payments. This lets you test new systems in real conditions and adjust before scaling.

Lloyds Banking Group used a phased approach when modernizing, starting with back-office functions and scaling to AI-driven banking systems after validating each phase.

8. Test Everything Thoroughly

Testing matters at every step of modernization. You can’t skip this part. Check individual code changes, integration points, and complete system functionality to make sure everything operates correctly. If you don’t test properly during migration, you’ll end up with serious disruptions, lost data, or compliance violations.

Catching problems early saves time and cash down the road. Banks need to budget enough for stress testing and security reviews to make sure new systems handle modern banking workloads and threats.

9. Handle Employees and Stakeholders

Getting modernization to work requires support from people inside your organization and staff members. Workers need education on new systems, and supervisors must help everyone grasp how changes impact their daily work. Without backing from important decision-makers, pushing through change and getting people to adopt new processes becomes much tougher.

Communication and education should be woven into the entire process. When Citibank updated their platform, they made employee education a priority for seamless integration.

10. Monitor, Optimize, and Improve

After new systems start running, your work isn’t finished. You need ongoing monitoring to track how systems perform, security status, and user happiness.

Following their cloud switch, Barclays kept watching performance and collecting user input to polish the system for lasting success.

Benefits of Modernizing Legacy Banking Systems

Modernizing legacy systems goes beyond just upgrading technology. It delivers real benefits that touch everything from customer happiness to operational costs. Here’s how modernization creates actual change:

1. Operational Efficiency

Legacy systems force banks to waste time on manual work or struggle with clunky, outdated software. Modern systems handle routine tasks automatically and smooth out workflows, giving staff more time for strategic projects. Things like automated transaction processing or real-time account monitoring can slash operational delays and human mistakes.

The payoff? Faster processes, fewer errors, and major cuts to operational expenses.

2. Better Customer Experience

Today’s customers want instant results. Slow transactions or buggy apps won’t cut it anymore. Modernizing infrastructure lets banks deliver superior, faster services – from instant payments to smooth online account management.

Monzo, a mobile-only bank, built everything around a mobile-first, real-time platform. Customers handle accounts, pay bills, and get instant alerts; all from their phones.

Also Read: Cost to develop an app like Monzo: Your financial innovation

3. Quicker Innovation

Updated systems simplify launching new capabilities significantly. Whether incorporating payment methods, introducing digital products, or addressing customer feedback, banks can develop and deploy new solutions considerably faster using modernized infrastructure.

Barclays and other banks using cloud-native systems release new features at speeds impossible with older, monolithic setups. This flexibility keeps them competitive in fast-moving markets.

4. Better Security and Compliance

Old systems weren’t designed for today’s tough security and compliance requirements. Modern systems include built-in security features and update easily when new regulations appear. Standards like GDPR, PSD2, and other data protection requirements function more effectively with systems designed for modern compliance frameworks.

Banks using blockchain or AI agents for fraud detection take a forward-thinking approach to security. These technologies spot suspicious activity before it becomes serious, stopping fraud and data breaches instantly.

5. Long-Term Money Savings

While initial modernization costs can be steep, long-term savings usually beat the investment. Moving away from legacy systems cuts maintenance expenses, reduces downtime, and boosts operational efficiency.

The ability to scale with cloud computing means banks skip expensive hardware maintenance, driving costs down further. These savings accumulate over time, making modernization a wise financial move.

Common Pitfalls in Legacy Banking Modernization and How to Avoid Them

Modernizing legacy systems brings huge benefits, but the journey has plenty of traps. But worry not, every problem has a solution. Here are the biggest barriers to modernizing legacy systems in banking and ways to overcome them:

1. Underestimating Complexity

Challenge: Many times, we think “updating” old systems will be quick and easy. Reality check: legacy systems often connect to other software in messy, complicated ways. Missing the full scope of these connections causes major disruptions and delays.

How to fix it: Do a complete assessment first. Map every system, every connection, every dependency before starting. Plan for surprises by adding extra time for unexpected complications.

2. Poor Change Management

Challenge: Without a solid plan for change management, you’ll upset employees and stakeholders. Employees resist new systems, especially when they don’t get proper training or information about what’s happening.

How to fix it: Talk early and keep talking. Keep everyone informed and provide training so staff feel prepared. Good internal communication makes transitions smoother and adoption faster.

3. Ignoring Regulatory Requirements

Challenge: In banking, compliance isn’t optional. It’s easy to forget regulatory factors when rushing to modernize, but compliance problems can kill projects instantly.

How to fix it: Think about regulatory requirements from day one. Work closely with compliance teams to ensure new systems meet existing rules like PCI-DSS, GDPR, PSP2, or SOX. Build compliance testing into your quality checks.

4. Moving Too Fast

Challenge: Modernization projects face pressure for quick results, tempting teams to rush. Moving too fast creates missed problems, bugs, or compatibility issues.

How to fix it: Hire legacy banking systems modernization services and use a step-by-step approach. Start with less important systems and gradually expand. Run pilot programs and small tests to fix problems before launching bigger systems.

How AI & Other Tech Trends Accelerate Banking Legacy System Modernization

Banks racing to modernize are turning to emerging technologies like AI, cloud computing, and blockchain as their secret weapons. These tools speed stuff up, slash expenses, and open new doors. Here are the key tech trends modernizing legacy banking infrastructure and making a difference.

Cloud Computing: Getting Flexible

Cloud computing for businesses lets banks ditch expensive, outdated servers for scalable, budget-friendly platforms. AWS and Google Cloud give banks access to advanced tech without the headache of managing physical hardware. This move makes scaling easier, pushes updates quicker, and speeds up innovation.

Capital One jumped on the cloud bandwagon to accelerate their services and slash IT expenses, freeing them up to focus on customer-facing innovations.

AI: Smarter Decisions, Lightning Speed

AI goes beyond making life easier; it makes everything smarter. Banks use AI to automate tedious and repetitive tasks like fraud detection and compliance reporting, eliminating the need for manual interventions. Plus, AI helps banks predict customer needs, suggest services, and find patterns in huge data mountains.

JPMorgan Chase deployed AI to boost fraud detection by studying transaction patterns instantly. This approach catches fraud faster and better than old-fashioned ways.

Generative AI: Unlocking Innovation

Generative AI is playing a vital role in banking modernization, allowing banks to create new, innovative solutions. By leveraging Gen AI’s ability to generate content, models, or even customer interactions, banks can enhance customer experiences, automate document creation, and design intelligent financial solutions.

Many leading banks use generative AI to create personalized investment strategies or generate dynamic reports. This empowers them to offer customized financial advice in real-time, thereby increasing customer satisfaction and engagement.

Discretionary: Investing in Tech Transformation

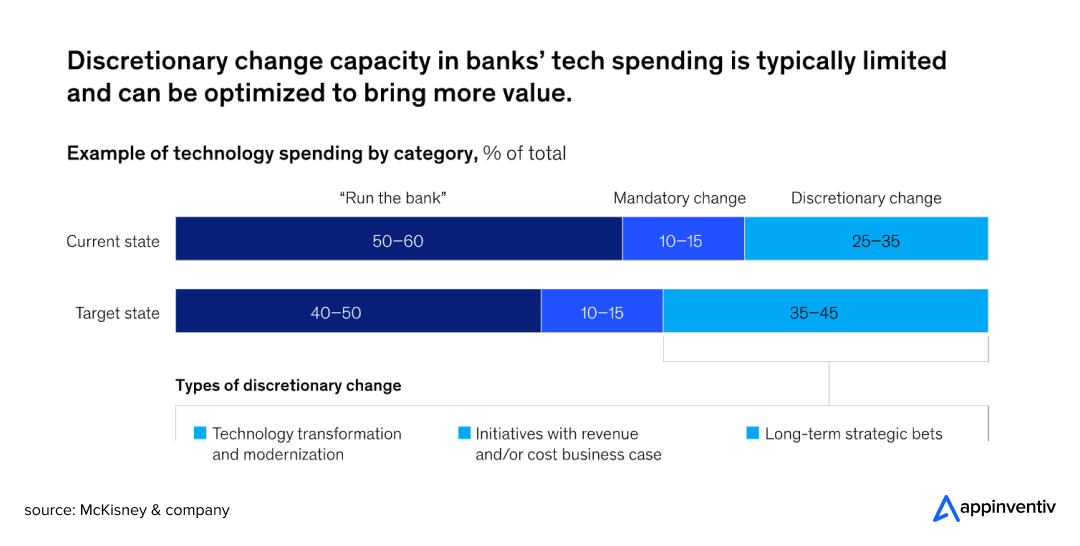

The focus of bank spending is shifting. Banks now shift budgets from just maintaining old systems to investing in discretionary tech transformation for long-term growth. While 50-60% of tech budgets are spent just to “run the bank”, more banks are re-allocating resources towards discretionary change, investing in technology transformation and modernization.

As a result, many banks are looking at ways to optimize their discretionary tech spending to bring more value, as shown in the chart below.

DevOps: Moving Fast Without Breaking Things

DevOps helps banks push software updates faster with fewer glitches. Using continuous delivery, teams can modify systems without causing outages. It also gets developers and operations crews working together better, boosting overall efficiency.

Barclays adopted DevOps to accelerate updates, make regular improvements, and keep their systems secure and reliable.

Blockchain: Building Trust and Security

Blockchain in banking offers clear and safe ways to handle money transactions. It rocks for stuff like cross-border payments, where speed and safety count most. Banks use blockchain to chop fraud and make transactions snappier and smoother.

HSBC runs blockchain for foreign exchange trades, cutting transaction times from days to hours.

Modernize Your Legacy Systems in Banking with Appinventiv

Modernizing legacy banking systems is no longer an option; it has been a dire necessity for business growth. Banks that embrace modern, cloud-based, and scalable infrastructures will see improved operational efficiency, enhanced customer experiences, and better regulatory compliance.

However, the journey to banking legacy software modernization is not a smooth road. It is a complex journey, full of bumps and barriers. It requires careful planning, proven expertise, and, of course, a trusted tech partner to provide next-gen banking software development services. This is where we come in.

At Appinventiv, we’ve helped financial institutions and FinTech companies navigate this transformation with success. With over 10 years of experience in the banking and FinTech industry, we have a proven track record of delivering 200+ secure, compliant, and scalable FinTech products and modernizing 500+ legacy systems.

Don’t believe us? Seek insight from our successful banking and FinTech projects:

Mudra: AI-Powered Budget Management for Millennials

We developed Mudra, an innovative chatbot-centric budget management application, designed specifically for millennials. The platform utilizes AI to automate budgeting processes, providing users with personalized insights and reminders based on their spending habits.

Edfundo: Financial Literacy Platform for Children

Our FinTech experts built Edfundo, the world’s first financial literacy hub tailored for children. The platform combines a digital learning lab with a prepaid debit card to teach kids essential money management skills. Through interactive courses, quizzes, and real-world financial experiences, Edfundo empowers young users to understand and manage their finances effectively.

Our team of 1600+ tech experts has an in-depth understanding of the latest banking regulations and regulatory requirements. This top-notch comprehension of compliance ensures your modernization efforts are fully compliant with GDPR, PCI-DSS, PSD2, SOX, and other banking standards. Our compliance-first approach means we build secure and scalable systems that are audit-ready from day one.

We’ve helped banks successfully migrate to the cloud while meeting the highest security standards, and we implement automated compliance reporting to ensure continuous adherence to regulatory changes.

What’s Next?

If your bank is ready to modernize, Appinventiv is here to guide you through every step. Our legacy modernization services can make your digital banking transformation seamless, secure, and successful.

So, why wait? Let’s connect and give wings to your legacy banking modernization journey.

FAQs

Q. What is legacy system modernization in banking?

A. Banking legacy software modernization is when banks update or replace their old core banking systems with newer, faster, and more flexible technology. It’s about moving away from outdated platforms that can’t keep up with today’s demands and making sure systems can support things like mobile banking, real-time payments, and secure data management.

Q. Why is modernizing legacy systems so important for banks?

A. Old banking systems can be a huge drain. They are expensive to maintain and don’t scale well. Moreover, they leave banks vulnerable to security breaches and can make it hard to meet new regulatory requirements.

Legacy software modernization in banking brings efficiency, reduces costs, and helps banks offer better services to their customers.

Q. What are the risks of not modernizing legacy banking systems?

A. If banks don’t modernize, they risk falling behind their competitors and failing to meet customer expectations. Old systems can also lead to:

- Security issues: Vulnerable to cyber threats.

- Compliance headaches: Harder to keep up with evolving regulations.

- High maintenance costs: Fixing old systems takes time and money.

- Customer frustration: Outdated tech can lead to slow services and bad user experiences.

Q. How to modernize legacy banking systems for future readiness?

A. Here are the key steps to modernize legacy banking applications:

- Start by identifying your goals: is it speed? Scalability? Better customer experience?

- Then, plan for data migration, choose the right tech stack, and ensure compliance is part of the plan.

- Don’t try to fix everything at once; start with the most critical areas like payments or compliance tools.

The aim is to make your systems work well for the next 5–10 years.

Q. How much does it cost to modernize a legacy banking system?

A. It really depends on the bank’s starting point and how big the project is. Replatforming can be cheaper than doing a full overhaul, but it’s still a significant investment.

On average, the cost of modernizing legacy systems in banking ranges between $40,000 and $400,000 or more, depending on your unique project requirements.

Contact us to get a more precise estimate tailored to your needs.

Q. How to accelerate modernizing legacy banking systems?

A. Here are the key approaches to accelerate legacy banking systems:

- Adopt cloud-native infrastructure

- Leverage AI for code analysis

- Use agile DevOps practices to fast-track modernization

- Utilize Gen AI for intelligent automation

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Banking Technology Consulting: A Strategic Roadmap for Core Modernization and Guaranteed ROI

Key takeaways: Banking modernization is now a strategic necessity, not a technology upgrade. Most banks lose value due to legacy complexity, fragmented data, and slow compliance response. Structured banking technology consulting delivers measurable gains in cost, stability, and governance. Core modernization succeeds when roadmaps, risk, and regulatory alignment are clearly defined. ROI comes from reduced…

How Gamification in Banking Helps Enterprises Build Lasting Customer Loyalty

Key takeaways: A winning banking gamification strategy isn't about badges; it’s about using behavioral psychology to form daily financial habits. Industry leaders like DBS Bank and Revolut prove the concept works, driving higher savings and millions in user acquisition. The cost to implement gamification in banking and financial services ranges between $40,000 and $400,000 or…

KYC Automation - Benefits, Use Cases, Steps, Tools and Best Practices

Key takeaways: KYC automation cuts verification from days to minutes and keeps checks consistent across teams. AI and ML reduce manual errors, catch risk earlier, and make compliance far easier to scale. Manual KYC drains time, increases cost, and slows onboarding — automation fixes all three. Automated workflows handle spikes in customer volume without compromising…