- Key Australian Regulations and Standards

- Privacy Act 1988 and the Australian Privacy Principles (APPs)

- Notifiable Data Breaches (NDB) Scheme and OAIC Reforms

- APRA CPS 234 – Strengthening Information Security in Financial Services

- The ACSC Essential Eight Framework

- Global Benchmarks: ISO 27001 and Beyond

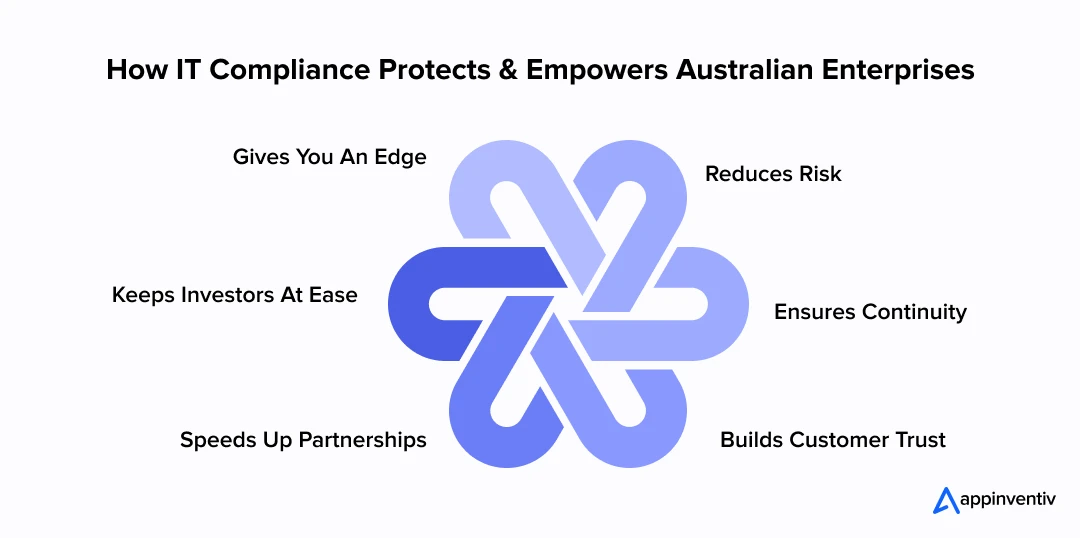

- Why IT Compliance for Australian Businesses Matters?

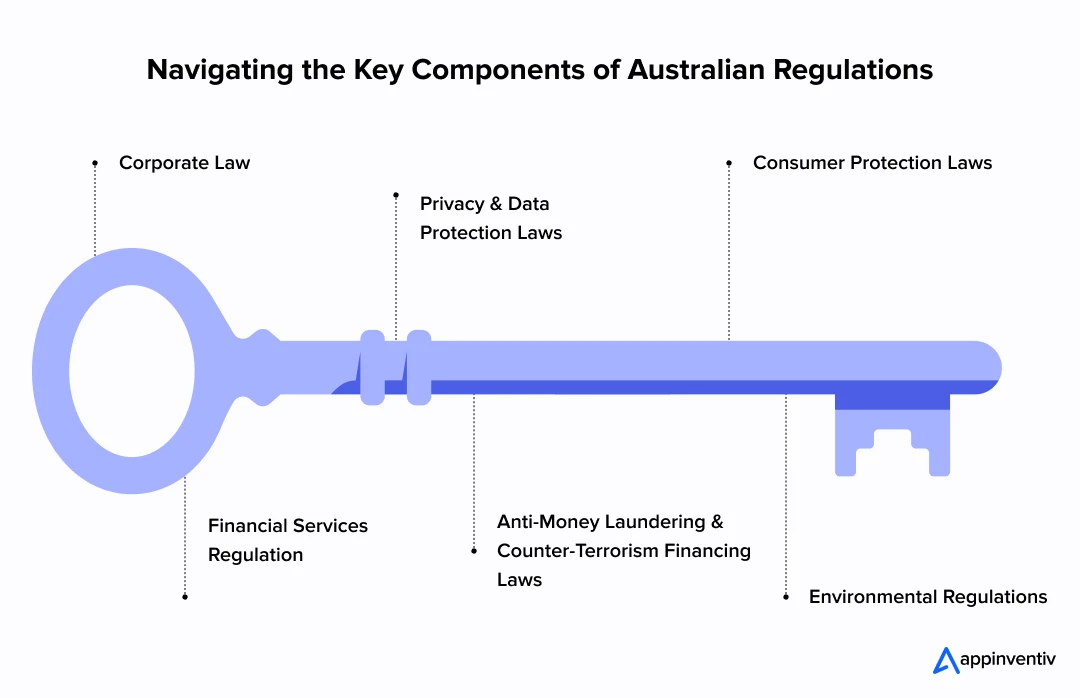

- The Key Components of the Australian Regulatory Framework

- Corporate Law

- Financial Services Regulation

- Privacy and Data Protection Laws

- Anti-Money Laundering & Counter-Terrorism Financing Laws

- Consumer Protection Laws

- Environmental Regulations

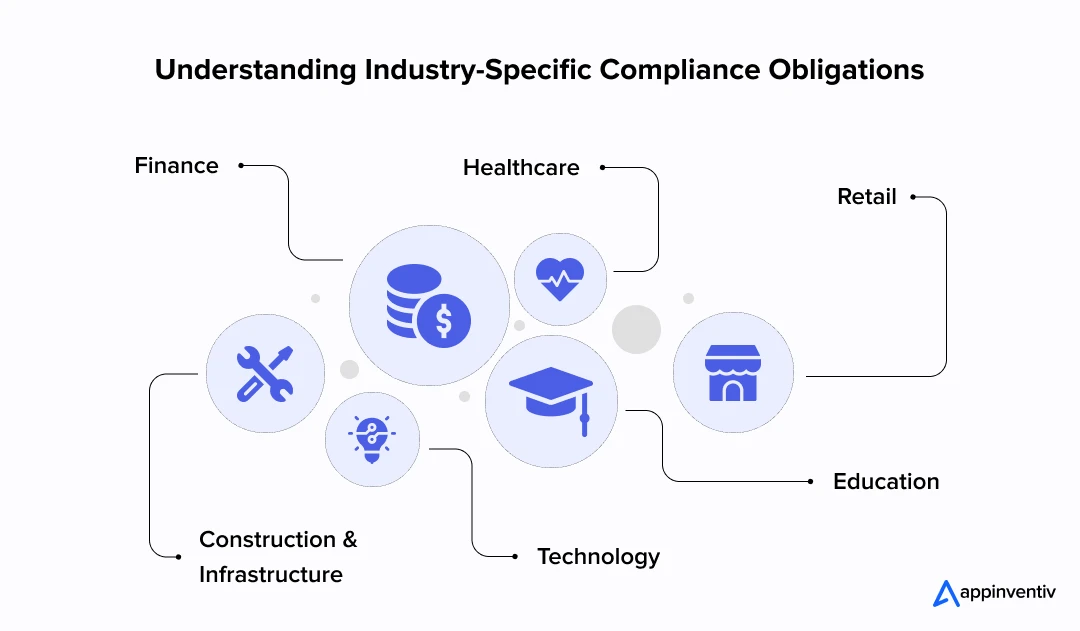

- Compliance Requirements Across Different Industries

- Finance

- Healthcare

- Retail

- Education

- Technology

- Construction & Infrastructure

- How do Compliance Requirements Vary by State in Australia?

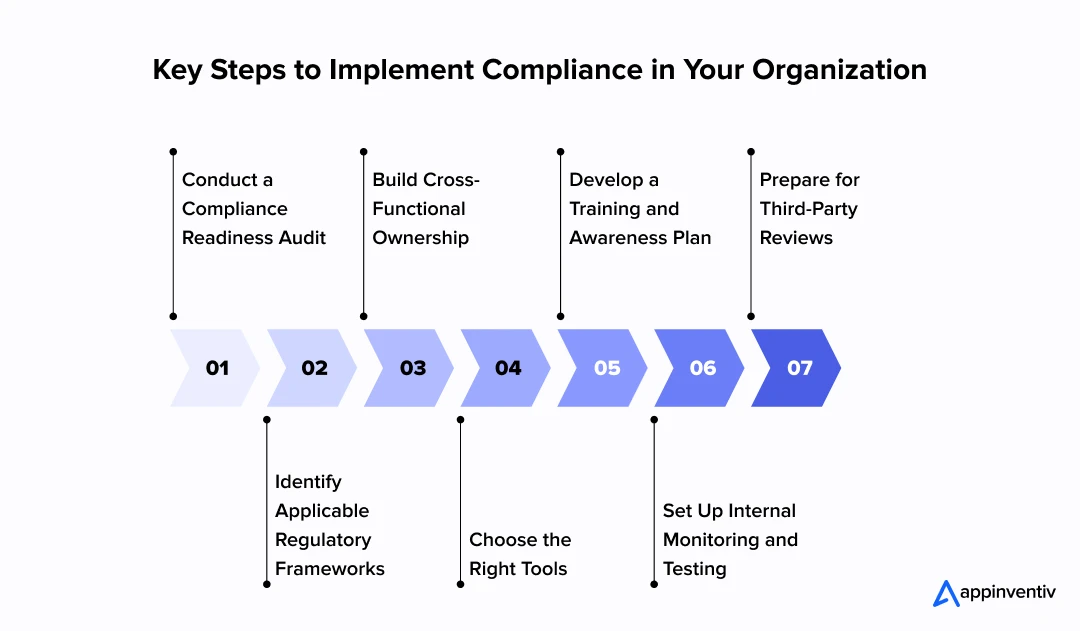

- What are the Steps for Implementing Compliance in Your Organization

- Are There Any Technology & Tools for Automating Compliance?

- What is the Role of IT Compliance Consultants in Australia?

- What is the Cost vs ROI of IT Compliance in Australia?

- What It Takes to Stay Compliant

- The Costs of Not Meeting the Laws

- What You Stand to Gain

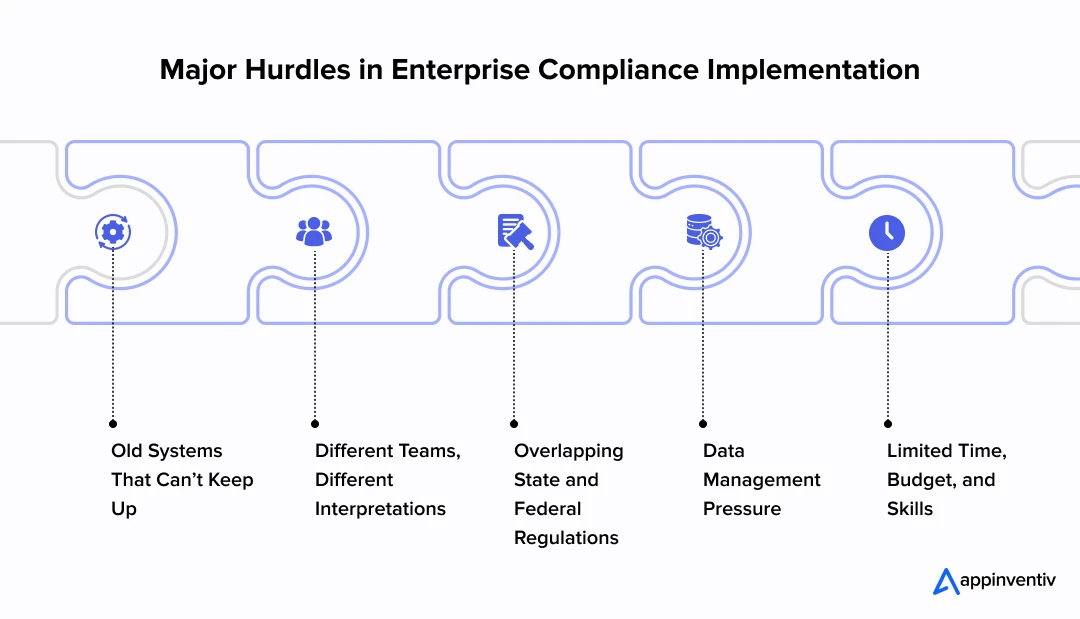

- Common Challenges Faced by Enterprises in Compliance Implementation

- Staying Ready for What Comes Next

- Final Thoughts

- FAQs

- Q. What are the key IT compliance regulations for businesses in Australia?

- Q. How do businesses usually handle IT compliance in Australia?

- Q. Which industries in Australia have the strictest IT compliance requirements?

- Q. What are the key IT compliance requirements for healthcare and fintech enterprises in Australia?

Key takeaways:

- IT compliance is essential for Australian businesses, fostering resilience, trust, and scalability beyond just avoiding penalties.

- Proactively investing in compliance reduces security risks, legal issues, and operational disruptions, enabling growth.

- Automation tools like GRC platforms and automated audits streamline compliance processes, saving time and minimizing errors.

- Legacy systems, complex regulations, and limited resources pose challenges to effective implementation, making it crucial to stay ahead of regulatory changes.

Across boardrooms and server rooms, one thing is becoming increasingly clear – IT compliance for Australian businesses is no longer just about avoiding penalties.

With evolving digital regulations, sector-specific mandates, and rising cyber risks, companies are expected to act rather than react. Whether you’re a fintech startup, a national retailer, or an enterprise dealing in sensitive data, understanding your compliance and regulatory requirements isn’t optional, it’s very fundamental.

Australia has one of the most detailed governance environments in the world. From data privacy laws for businesses to IT security compliance standards Australia, the scope of what’s required to build a secure app can feel overwhelming add to that the growing push to automate regulatory compliance frameworks, and you’ve got a landscape that’s both complex and in constant flux.

This guide breaks down what matters most:

- The core laws and frameworks

- Compliance requirements Australia across industries

- The tech tools that simplify implementation

- Steps, costs, challenges, and how to future-proof your systems

Whether you’re building your first IT compliance checklist, or reassessing existing systems under new rules, this article will help you get aligned and stay ahead.

Let our team guide you in building a secure and regulation-ready IT system.

Before implementing compliance measures, it’s essential to understand the regulatory frameworks that shape Australia’s IT compliance ecosystem.

Key Australian Regulations and Standards

IT compliance for Australian business revolves around adhering to a mix of federal, state, and industry-specific laws that protect data, maintain privacy, and strengthen cybersecurity posture. Here’s an overview of the key regulations shaping the nation’s digital compliance landscape:

Privacy Act 1988 and the Australian Privacy Principles (APPs)

The Privacy Act 1988 serves as the cornerstone of Australia’s data privacy framework. It governs how organizations collect, store, use, and disclose personal information. At its core are the Australian Privacy Principles (APPs), which set clear expectations for transparency and accountability in data handling.

Businesses must not only have a published privacy policy but also ensure that every internal process—from data collection to deletion—complies with these principles. For enterprises handling large volumes of personal data, compliance with the APPs is fundamental to maintaining trust and avoiding legal exposure.

Appinventiv’s own commitment to these principles is reflected in our Australian Privacy Principles Compliance Press Release, where we detail the measures taken to uphold privacy and regulatory excellence across projects delivered in Australia.

Notifiable Data Breaches (NDB) Scheme and OAIC Reforms

The Notifiable Data Breaches (NDB) Scheme, overseen by the Office of the Australian Information Commissioner (OAIC), requires organizations to promptly notify both the OAIC and affected individuals when a data breach is likely to cause serious harm.

Recent OAIC reforms have raised the stakes for compliance by increasing penalties for repeated or severe privacy violations and expanding the Commissioner’s enforcement powers. As a result, businesses can no longer take a reactive stance—continuous monitoring, risk assessment, and prompt incident reporting have become essential compliance practices.

APRA CPS 234 – Strengthening Information Security in Financial Services

For regulated entities in the financial sector—including banks, insurers, and superannuation funds—the Australian Prudential Regulation Authority (APRA) mandates adherence to CPS 234, a prudential standard specifically targeting information security.

CPS 234 requires organizations to maintain adequate safeguards against cyber threats and to ensure their service providers uphold the same standards. Aligning your IT compliance strategy with CPS 234 not only fulfills regulatory obligations but also strengthens resilience against evolving digital threats, ensuring that sensitive financial data remains protected under stringent governance controls.

The ACSC Essential Eight Framework

The Australian Cyber Security Centre (ACSC) developed the Essential Eight, a set of baseline mitigation strategies that help organizations protect themselves from common cyberattacks.

These strategies are:

- Application Whitelisting

- Patch Applications

- Configure Microsoft Office Macro Settings

- User Application Hardening

- Restrict Administrative Privileges

- Patch Operating Systems

- Multi-factor Authentication

- Daily Backups

Implementing these eight strategies, ranging from application control and patch management to user access restriction, significantly reduces exposure to targeted and opportunistic attacks. These controls are designed to be practical, measurable, and adaptable to organizations of all sizes, forming the foundation of a robust IT compliance posture.

Global Benchmarks: ISO 27001 and Beyond

While Australian frameworks such as the Essential Eight and CPS 234 address national standards, many businesses are complementing them with globally recognized certifications like ISO 27001; the international standard for Information Security Management Systems (ISMS).

Implementing ISO 27001 provides a structured, risk-based framework for identifying vulnerabilities, enforcing security controls, and continuously improving information-security performance. Its compatibility with Australian standards allows organizations to align local compliance initiatives with global benchmarks, enhancing credibility, operational consistency, and customer confidence across regions.

By integrating these frameworks holistically, Australian enterprises can future-proof their operations, reduce audit fatigue, and position themselves competitively in an increasingly compliance-driven market.

Why IT Compliance for Australian Businesses Matters?

For Australian companies, compliance is a critical part of building resilience, customer trust, and operational agility.

Organizations which proactively invest in IT compliance are better positioned to withstand regulatory audits, safeguard customer data, and scale without disruption.

The compliance with Australian standards benefits in more ways than just ticking regulatory boxes:

- It significantly reduces risk – Aligning with IT security compliance standards in Australia means fewer security breaches, legal battles, and sleepless nights for your leadership team.

- Ensures continuity – A strong compliance posture builds internal readiness, making disaster recovery faster and more coordinated.

- Builds customer trust – When you demonstrate commitment to Australian business data protection laws, you send a strong message about data ethics and safety.

- Speeds up partnerships – Many organizations won’t even start a conversation until they see that you have met baseline compliance and regulatory requirements.

- Keeps investors at ease – Strong compliance shows that you are managing risks well, which is a major factor during funding or acquisition talks.

- Gives you an edge – In competitive industries, showing that you take IT compliance for Australian business seriously can be the deciding factor for prospects.

In contrast, non-compliance isn’t just risky – it’s expensive. The penalties for non-compliance with Australian IT laws can include fines, reputational loss, and even business suspension in regulated industries.

From financial services to healthcare and retail, the role of IT compliance is growing fast – not just as a legal safeguard, but as a growth enabler in increasingly digital ecosystems.

The Key Components of the Australian Regulatory Framework

Australia’s compliance environment isn’t just dense, it’s layered, sector-sensitive, and closely tied to how you operate, store data, move money, and treat your customers. Here are some of the areas most businesses will need to get across:

Corporate Law

At its core, this is about how companies are structured, how directors are expected to behave, and what’s required in terms of reporting and governance. It’s not just for ASX-listed companies – even small operators can be pulled up for failing to meet basic standards under the Corporations Act.

Financial Services Regulation

If your business deals with credit, lending, insurance, investment, or super, you’re operating in ASIC territory. It’s one of the stricter regulatory arms and ties directly into compliance and regulatory requirements for finance businesses. Licensing, conduct, and disclosure rules apply and the watchdog isn’t known for leniency.

Privacy and Data Protection Laws

This one affects nearly everyone now. Under the Privacy Act, handling customer data comes with responsibilities. Whether you are a SaaS company, healthcare provider, or online retailer, staying in line with Australian data privacy laws for businesses is a non-negotiable, especially since there are several notifiable data breach schemes now in place.

Anti-Money Laundering & Counter-Terrorism Financing Laws

Think of AML/CTF as the financial hygiene rulebook. Businesses in sectors like crypto, banking, gaming, and remittance must have systems to verify customers, monitor transactions, and report suspicious activity. It’s not just legal, it’s linked to national and global trust.

Consumer Protection Laws

From refund policies to misleading ads, the Australian Consumer Law has a long reach. Most B2C businesses need to actively track this space, it’s one of the easier places to slip up and end up in a compliance dispute.

Environmental Regulations

If your operations impact air, water, waste, or land, you’re responsible for adhering to these laws. Environmental compliance often flies under the radar until a permit issue, community complaint, or audit brings it to light.

Compliance Requirements Across Different Industries

Regulatory compliance for Australian businesses isn’t one-size-fits-all – the rules shift depending on your industry, the kind of data you handle, and even who you serve. Here’s how it tends to play out across some key sectors:

Finance

From banks to fintech organizations, the finance sector faces some of the heaviest regulatory scrutiny in Australia. Businesses must meet licensing obligations under ASIC and AUSTRAC, implement AML/CTF programs, and ensure a clear disclosure and customer protection practices. Australian cybersecurity compliance framework – especially for anything tied to consumer wallets or credit.

Healthcare

Patient privacy is front and centre. Compliance in this space includes tight alignment with the Privacy Act, adherence to clinical governance frameworks, and – for many providers – reporting into government health records systems. Handling sensitive health data brings additional responsibilities most industries don’t have to worry about if their compliance and regulatory requirements are in place.

Retail

Retailers need to juggle consumer law, advertising standards, payment data compliance (like PCI DSS), and refund/returns rules – all while managing fast-paced online and in-store environments. For eCommerce platforms especially, meeting digital security and data protection standards is no longer optional.

Education

Whether you’re a university, RTO, or private school, education providers have to navigate a blend of compliance areas – from student data privacy to accreditation requirements. With the move toward online learning, tech systems are under more scrutiny than ever.

Technology

Software companies and digital service providers may not be heavily regulated by default, but once they begin working with payments, personal data, or operating in regulated sectors, the Australian data privacy laws for businesses burden scales quickly. Data localisation, breach notifications, and consent management is all what matters here.

Construction & Infrastructure

Licensing, safety, environmental impact, and industrial relations all feature heavily in this sector’s compliance picture. It’s not just about ticking boxes – these requirements can influence project approvals, insurance eligibility, and public trust.

Whether you’re in finance, healthcare, tech, or retail, we help you build digital products and tailor compliance strategies that actually work in your world.

How do Compliance Requirements Vary by State in Australia?

When navigating compliance requirements in Australia, national laws form only a portion of the entire compliance picture. Each state and territory imposes their own operational, reporting, or data-handling obligations – especially when it comes to industries like healthcare, construction, and environmental services.

Here’s a snapshot of local nuances to be aware of:

- New South Wales: Tends to enforce stricter controls around workplace surveillance and employee monitoring tools.

- Victoria: Healthcare providers must meet state-specific privacy codes in addition to national Australian data privacy laws for businesses.

- Queensland: Businesses working with state contracts often face additional vetting around information security.

- Western Australia & Northern Territory: Often adopt mining- or resource-industry-specific compliance frameworks.

The complexity increases when your operations span multiple states. This is where regional knowledge or working with IT compliance consultants in Australia becomes crucial – not just to stay aligned, but to avoid contradictions in your compliance setup.

What are the Steps for Implementing Compliance in Your Organization

Whether you’re a startup or an enterprise, the process of implementing Australian compliance standards follows a core set of principles. These steps aren’t just about avoiding penalties – they also help future-proof your business operations and build stakeholder trust.

1. Conduct a compliance readiness audit

Start with a gap analysis. Map your current policies and controls against relevant IT security compliance standards Australia, privacy laws, and industry mandates.

2. Identify applicable regulatory frameworks

You may need to comply with multiple layers – from Australian business data protection laws to financial services regulation. Tailor your approach accordingly.

3. Build cross-functional ownership

Legal, IT, finance, HR – all must contribute. Creating silos in compliance planning usually leads to misalignment and blind spots.

4. Choose the right tools

To reduce manual errors and costs, look at platforms that automate regulatory compliance framework tasks like audit logs, access controls, and reporting.

5. Develop a training and awareness plan

The effectiveness of policies is directly dependent on how well they are understood and executed by businesses. Ongoing training helps reinforce expectations, especially around data handling.

6. Set up internal monitoring and testing

Regular testing – from internal audits to phishing simulations – ensures that your controls would work in real-world conditions as well.

7. Prepare for third-party reviews

If working with external vendors or auditors, have documentation ready. This includes proof of compliance with Australian standards, breach response plans, and user access reports.

Are There Any Technology & Tools for Automating Compliance?

In today’s landscape, staying on top of regulations does more than just tick a legal box, it directly impacts a business’s ability to grow and adapt. But let’s be honest: trying to manage regulatory compliance for Australian businesses manually only works for so long. Once multiple systems, teams, or state-level jurisdictions get involved, things can slip through the cracks.

In the context of IT compliance requirements in Australia, these tools aren’t just convenient; they’re becoming essential. They help shift compliance from a reactive scramble to a structured, preventative approach.

Here are some key technologies businesses are using to meet today’s IT compliance for different industries in Australia and broader regulatory compliance framework expectations:

- GRC platforms consolidate everything – policies, controls, risk registers into a central hub. They help align internal practices with external laws in a way that’s trackable.

- Tools built around Australian data privacy laws for businesses now integrate directly with cloud storage and internal systems, offering real-time alerts for policy violations or unauthorised access.

- Policy lifecycle management software ensures compliance documentation is always up to date and that people are actually reading it.

- Dashboards and auto-reporting features pull audit data with minimal manual effort, making compliance teams more responsive during assessments.

- Even employee compliance training is now streamlined, with tools that assign, track, and log completions based on job role and legal updates.

Also Read: Compliance Management Software Development – Benefits, Process, Costs

Automation won’t replace the need for good judgment. But when used wisely, it gives compliance teams the breathing space to focus on strategy instead of firefighting.

What is the Role of IT Compliance Consultants in Australia?

Not every business has the in-house resources or expertise to keep up with ever-evolving regulations – especially when there are so many industry-specific standards and regional differences to juggle. That’s where IT compliance consultants in Australia come in. Their role isn’t just to help you meet obligations but also ensure systems, processes, and tech stack are set up to support ongoing compliance – without slowing business growth.

From performing readiness assessments to recommending governance frameworks, consultants directly help businesses lower risk, tighten internal controls, and align tech initiatives with current laws. They often work alongside internal teams, plugging in where gaps exist – especially in high-stakes sectors like finance, healthcare, and education.

At Appinventiv, we take it a step further. As a custom software development company in Australia, we don’t just advise on compliance – we build tools that make it easier. Whether you need automated audit trails, secure data processing systems, or role-based access layers tailored to sector-specific rules, we design digital solutions that keep regulatory needs front and centre.

Because when compliance and regulatory requirements are built into your systems – not bolted on after – it becomes a competitive advantage, not just a legal checkbox.

At Appinventiv, we design secure, regulation-ready systems that evolve with Australia’s compliance landscape.

What is the Cost vs ROI of IT Compliance in Australia?

The cost of IT compliance in Australia depends on your business type, risk exposure, and operational scale but it’s almost always cheaper than the cost of doing nothing.

What It Takes to Stay Compliant

Here’s what companies typically invest in regulatory compliance for Australian businesses:

Initial setup (for SMEs)

$20,000–$50,000 AUD to cover documentation, tools, internal audits, and aligning with basic compliance requirements in Australia.

Enterprise-scale or high-risk sectors

$150,000–$500,000+ AUD, especially for healthcare, fintech, or firms handling sensitive data – where Australian data privacy laws for businesses apply more stringently.

Annual maintenance

Around 8–12% of your IT budget, including certifications, audits, and meeting the Australian cybersecurity compliance framework standards.

The Costs of Not Meeting the Laws

The real cost shows up in the penalties, downtime, and reputation hits.

Breach of data laws:

Up to $50 million AUD in fines under the amended Privacy Act. This doesn’t include legal costs or customer losses.

Operational shutdowns:

A 3-day halt in systems (due to non-compliance) can bleed $100,000–$500,000 AUD, depending on the industry.

Non-alignment with state-level requirements:

Failing to meet specific compliance requirements in Australia (especially across state jurisdictions) could lead to contract losses or regulatory bans.

What You Stand to Gain

Compliance done right is a growth enabler.

- Following a proper IT compliance checklist for Australian companies gives a clear path to risk management, investor confidence, and market trust.

- Companies that automate regulatory compliance frameworks have seen up to 30% reductions in audit prep time and faster risk detection.

- Working with a custom software development company in Australia helps businesses tailor compliance systems to their operational needs – reducing manual workload and future-proofing internal controls.

If you view compliance purely as a cost centre, you’re missing the point. For many, it’s become the foundation for scalable, secure, and efficient growth, especially in a landscape where IT compliance for Australian businesses is under the spotlight like never before.

Common Challenges Faced by Enterprises in Compliance Implementation

Even with the best intentions, getting compliance right isn’t always straightforward. For many Australian companies, the real challenge begins not with knowing the rules – but putting them into practice. Some of the major challenges faced by enterprises in compliance implementation include:

Old Systems That Can’t Keep Up

Legacy tools tend to come short when we adapt new compliance workflows. Businesses may need to rework entire IT systems to align with current regulations.

Different Teams, Different Interpretations

Compliance touches multiple departments – from IT and legal to operations. Without a central IT compliance checklist for Australian companies, misunderstandings and inconsistencies crop up quickly.

Overlapping State and Federal Regulations

Australia’s mix of state and national rules can create grey areas. If you’re not tracking both, you risk falling short on compliance requirements in Australia.

Data Management Pressure

Following Australian data privacy laws for businesses means staying on top of every data that you collect, how they are stored, and who has access to them. This often would mean rethinking current practices.

Limited Time, Budget, and Skills

Some businesses simply don’t have the internal resources to manage compliance properly – especially when multiple frameworks are in play.

Staying Ready for What Comes Next

Regulations evolve. Cyber threats shift. Customer expectations grow. In light of this, compliance strategies can’t stay static either.

To stay resilient, businesses need to look ahead. Here’s how to prepare:

Automate Where You Can

Automation isn’t just about saving time – it’s about keeping up. Teams using tech to automate regulatory compliance frameworks are better at spotting risks and adapting fast.

[Also Read: Business Process Automation: Benefits, Applications & Steps to Automate]

Invest in Smart Architecture

A scalable system makes it easier to pivot as rules change. That’s why many firms turn to a custom software development company in Australia to build solutions tailored to their industry and scale.

Track Regulatory Updates Early

Don’t wait for the law to go into effect to act. Stay ahead in the curve by following trends and changes in the Australian data privacy laws for businesses and related domains.

Build a Learning Culture

Your tools are only as strong as the people who are implementing them. Keeping your team updated on changes in regulatory compliance for Australian businesses helps ensure nothing falls through the cracks.

Final Thoughts

Compliance in Australia is no longer just a box to tick. It’s become a lens through which customers, partners, and regulators assess your business – from data handling to digital infrastructure.

Ignoring it isn’t an option. But treating it as an opportunity? That’s where smart businesses stand out.

Whether you’re grappling with the cost of compliance requirements in Australia or trying to align with evolving policies, it helps to have a clear strategy and partner like Appinventiv – an experienced ISO-certified software development company in Australia – can help you build systems that work now, and adapt later.

From defining the right steps for integrating IT compliances, to addressing long-term scalability – it all starts with action. Schedule a call!

FAQs

Q. What are the key IT compliance regulations for businesses in Australia?

A. IT compliance for Australian businesses has no rulebook – it depends on your industry and what kind of data you’re dealing with. Most businesses need to stick to the Privacy Act 1988, especially the Australian Privacy Principles (APPs). But if you’re in healthcare, finance, or running any digital service that collects customer data, things get stricter. You might also need to factor in APRA’s CPS 234, ASIC obligations, or the Notifiable Data Breaches (NDB) scheme. And then, if you operate across states or internationally, you could be juggling a few extra frameworks too.

Q. How do businesses usually handle IT compliance in Australia?

A. IT compliance for Australian businesses often starts with figuring out what laws and standards actually apply — which can be trickier than it sounds. From there, most companies look at tightening up internal processes: data access, staff training, backups, breach notifications, and so on. Many use a custom-built IT compliance checklist for Australian companies to stay on track. Lately, there’s been a shift toward using automation tools – not to replace people, but to reduce the manual grind and keep an eye on things that might get missed.

Q. Which industries in Australia have the strictest IT compliance requirements?

A. Definitely healthcare and finance – no surprise there, given the kind of data they handle. But it’s not just them. Government services, insurance, education providers, and even ecommerce businesses are all under pressure to tighten up. If you’re collecting personal data, handling payments, or operating cloud-based platforms, you’re probably being watched more closely. In those cases, frameworks like the Australian cybersecurity compliance framework and industry-specific rules become part of everyday operations.

Q. What are the key IT compliance requirements for healthcare and fintech enterprises in Australia?

A. In healthcare, it’s mostly about secure storage and consent, making sure patient data doesn’t land in the wrong hands. You’ve got to follow My Health Record regulations, meet APP requirements, and probably do regular system audits. Fintech companies? They’re juggling AML/CTF checks, APRA’s cybersecurity rules, and real-time risk alerts. For both, compliance isn’t just a box to tick – it’s built right into how systems are designed and monitored.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Why Choose Managed IT Services in Dubai - Benefits, Cost, & ROI

Key Takeaways Managed IT services in Dubai replace reactive support with structured, SLA-driven IT operations, improving uptime, response times, and governance. The cost benefit of managed IT services is clearer when measured through TCO, helping reduce IT operational costs in the UAE without adding long-term staffing risk. Compliance-ready services in the UAE are essential, as…

Capital Structuring and Tech Investments: What Enterprises Must Consider in 2026?

Key takeaways: Strategic capital structuring is essential to fund innovation without sacrificing financial stability. Each tech investment, like AI, cloud, cybersecurity, and sustainability, requires a tailored financing approach. Misalignment between capital structure and tech strategy can stall growth or strain margins. Hybrid and structured financing models help enterprises balance risk, control, and agility in 2026.…

Why Appinventiv Stands Out as the Leading Tech Consulting Provider for Digital-First Enterprises

Key takeaways: Appinventiv operates as a strategic partner, not just a service provider, focusing on business outcomes and ROI before technology. Success stories with global brands like KFC, IKEA, Adidas, etc., prove we tackle complex, enterprise-grade projects and deliver real results. Our capabilities span from AI-powered product building and cloud upgrades to custom software creation,…