- Understanding the App Funding in Australia

- Types of App Funding Businesses Can Get in Australia

- Venture Capital

- Angel Investment

- Government Grant

- Crowdfunding

- Bank Loans

- Bootstrapping

- Understanding the R&D Tax Incentive Australia: Government Support for Innovation and Technological Advancement

- Core R&D Activities and Supporting R&D Activities

- Application in Software Development

- Characteristics of Eligible App Projects

- Examples of Eligible App Projects

- Differences Between the Research and Development Tax Incentive for Software Houses and Other Industries

- Nature of Innovation

- Technical Challenges

- Documentation Requirements

- Eligibility Scope

- Importance of Documentation and Compliance

- Key Documentation for R&D Tax Incentive Applications

- Additional Supportive Documents

- Best Practices for Document Management

- Benefits of Applying for the R&D Tax Incentive

- Financial Support

- Encourages Innovation

- Competitive Advantage

- Improved Profitability

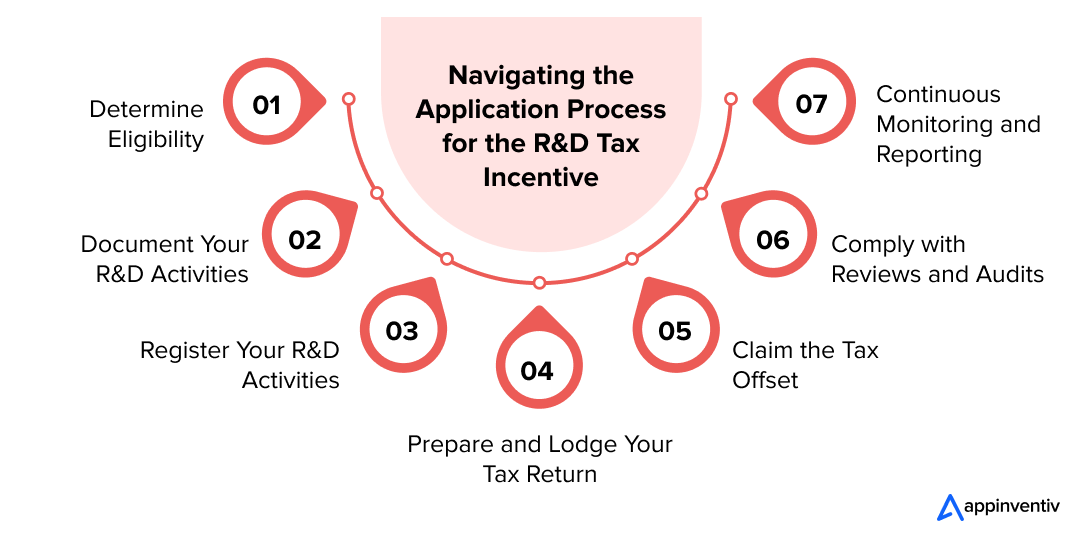

- Step-by-Step Guide on How to Apply for the R&D Tax Incentive

- Step 1: Determine Eligibility

- Step 2: Document Your R&D Activities

- Step 3: Register Your R&D Activities

- Step 4: Prepare and Lodge Your Tax Return

- Step 5: Claim the Tax Offset

- Step 6: Comply with Reviews and Audits

- Step 7: Continuous Monitoring and Reporting

- Challenges of Applying for the R&D Tax Incentive

- Partner with Appinventiv to Pave the Way for App Funding in Australia

- FAQs

Starting with an app idea is thrilling, and turning that idea into a usable piece of tech can feel like climbing Everest. But once the hard work of development is done, entrepreneurs hit the waiting game for the one thing that matters most: Funding.

It’s the fuel that powers the journey from prototype to market presence, and without it, even the most innovative apps can stall before ever making an impact. Navigating funding in Australia might feel as tricky as the coding in your app.

But here’s some good news: The R&D Tax Incentive (Research and Development Tax Incentive (R&DTI)) could be your golden ticket, giving you a financial lift that can take your project from tight budgeting to full-scale operation. The funding is about keeping things running and boosting your ability to innovate and grow.

Think of it as government support for pushing the boundaries of technology. If your app involves genuine research and development, you might be leaving money on the table if you are not tapping into this opportunity. And let’s be honest, who isn’t interested in some extra cash to make their app dream fly higher?

If you are worried about getting investors for your mobile app startups, stay calm; R&D Tax Incentive Australia is there to help you. But what exactly is the R&D Tax Incentive Australia, and how can it affect your funding strategy?

Qualifying for this incentive, however, isn’t just about ticking a few boxes. It involves understanding what qualifies as a Research and Development Tax Incentive, aligning your development activities with these criteria, and navigating the application maze. We agree that it sounds a bit daunting, but for many businesses that have walked this path successfully, their success stories can light the way for newcomers.

While the Australian R&D Tax Incentive for app funding plays a critical role, we want businesses like you to know that it is not the only option available. This blog will also explore all the funding techniques like venture capital, angel investors, government initiatives, crowdfunding, and more. Each of these can offer unique benefits and opportunities, depending on the stage of your app and the specific needs of your business. So, let’s dive right in.

We’ll hook you up with the R&D Tax Incentive to lock in funding and kickstart your journey to success. Don’t wait—level up now!

Understanding the App Funding in Australia

Understanding the landscape of app funding in Australia is essential for any entrepreneur looking to launch a new application. It involves recognizing the different stages of financing required as your project moves from concept to marketplace. Each stage of app development might attract different types of funding, and knowing where you are in the process can help you target the right resources.

At the early stages, funding is often about fueling initial development and market research. This is when you map out your idea, possibly build a prototype, and determine your target market. Here, the focus is generally on bootstrapping with your resources or securing small amounts of money from friends and family. This phase is crucial because it sets the groundwork for later stages that might attract larger investments.

As your app progresses, the need for more structured funding becomes apparent. This is when many developers look to formalize their business plans for their mobile app, prepare pitches for larger investors, or apply for business loans. Having a well-documented plan and clear insights into how your app will generate revenue is important. A detailed plan not only helps attract investors but also helps with strategic planning for your app’s development.

Finally, understanding the legal and financial implications of funding is crucial. Each type of funding may come with strings attached, such as equity stakes or specific milestones you must hit. Awareness of these conditions can help you decide which funding opportunities to pursue and how they might affect your business in the long term.

Let’s look at the detailed table below to give you a clear idea of the multiple stages of app funding. Each stage involves different challenges and focuses. Understanding where your app is in its lifecycle can guide you to the appropriate funding sources and help you prepare for each type of investment’s corresponding expectations and obligations.

| Stage | Key Activities | Funding Sources | Considerations | What Does it Represent |

|---|---|---|---|---|

| Concept & Validation | Idea generation | Personal savings | High risk; funding is typically limited | This initial stage is about brainstorming and validating the initial app idea. Entrepreneurs engage in market research to identify target audiences and potential demand. Early prototypes may be developed to refine the concept. Personal savings or funds from close associates are common as the idea is yet to prove its market viability. |

| Seed Stage | Developing a minimum viable product (MVP) | Angel investors | Need a clear and compelling pitch | After establishing a viable concept, the focus shifts to creating an MVP to demonstrate the app’s functionality. Funding from angel investors or seed venture capital can help cover development costs and initial marketing. This stage is crucial for gaining early traction and validating the business model with actual users. |

| Startup Stage | Product development | Venture capital | Increased funding but higher expectations and control | With a working MVP, the startup stage involves further product development and beginning full-scale operations. Venture capitalists and government grants for app development are common sources of funding. The goal is to enter the market, expand the user base, and start generating revenue while managing investor expectations and operational scalability. |

| Growth Stage | Scaling operations | Venture capital | Focus on sustainable growth and market expansion | During the growth stage, the app scales, enhance features, and possibly expands geographically. Funding might come from larger venture capital rounds, private equity, or debt financing. The focus is on optimizing the business model, increasing market share, and ensuring the company’s long-term viability and profitability. |

| Maturity Stage | Diversification | Initial Public Offering (IPO) | Focus on innovation and staying competitive | In the maturity stage, the company seeks to diversify its offerings and improve operational efficiencies. It may consider public offerings or strategic mergers and acquisitions for further expansion and to cash out early investors. The focus is on maintaining market position, exploring new markets, and innovating within existing product lines. |

Types of App Funding Businesses Can Get in Australia

Securing funding for app development in Australia involves exploring various types of financial support that cater to different stages of development and business needs. Whether starting out with a fresh idea or looking to scale an existing app, understanding the diverse options to fund your app idea in Australia can significantly enhance your strategy.

Venture Capital

Venture capital involves investors offering mobile app startup funding to small businesses with high growth potential. This funding is well-suited for apps needing significant investment and is expected to generate substantial profits.

Angel Investment

Angel investors are wealthy individuals who invest in startup businesses, typically in exchange for a share in the company or repayment through convertible debt. This pre-seed funding is ideal for early-stage companies that need initial capital to start their operations.

Government Grant

The Australian government offers grants to support innovative projects. These grants for app development or other entities can cover costs associated with research and development, marketing, and more and don’t require giving up any company equity.

Crowdfunding

Crowdfunding collects small amounts of money from many people, usually via online platforms. It’s a good way for app developers to validate their concept in the market and build a user base while funding development.

Also Read: IEO vs ICO: A Comparison Between Tokenized Crowdfunding Models

Bank Loans

Traditional bank loans provide significant capital that must be repaid with interest. This type of funding is typically pursued by businesses that can show they will have the steady cash flow needed to meet repayment terms.

Bootstrapping

Bootstrapping is another viable measure to fund your app idea in Australia. It means using your financial resources or the business’s revenue to fund the development of your app. This approach to getting mobile app startup funding is slower but allows you to maintain complete control over your business without giving up any ownership.

Understanding these funding types and selecting the right one can significantly impact the success of your app in the competitive Australian market. Each funding type offers different benefits and challenges, and let us offer you insight into the pros and costs of each to help you choose the best one per your app’s unique needs and your business’s financial situation.

| Funding Type | Pros | Cons | Best For |

|---|---|---|---|

| Venture Capital | Access to significant funds and expert guidance | Potential loss of control and high expectations | High-growth potential apps |

| Angel Investment | Flexible agreements and mentorship | Less formal agreements and variable interest | Early-stage development |

| Government Grants | Non-repayable and supports innovation | Competitive and specific criteria | R&D heavy projects |

| Crowdfunding | Market validation and high pre-sales revenue | Public disclosure and funding is not guaranteed | Consumer-focused apps |

| Bank Loans | Predictable terms and substantial funding | Requires repayment with interest, and collateral is often needed | Established companies with steady cash flow |

| Bootstrapping | Full control and no dilution | Limited by available resources and slow growth | Startups with limited initial capital |

Understanding the R&D Tax Incentive Australia: Government Support for Innovation and Technological Advancement

The R&D Tax Incentive is a cornerstone of Australia’s government policy to encourage industries to engage in research and development activities. This incentive offers significant financial benefits through tax offsets, aiming to boost innovation across various sectors, including technology and app development.

It is one of the most desirable types of app funding in Australia that encourages businesses to engage in research and development activities likely to benefit the Australian economy. The incentive offers:

- A refundable tax offset for entities with an annual turnover of less than $20 million.

- A non-refundable tax offset for entities with an annual turnover of more than $20 million.

- The program is jointly administered by the Department of Industry, Science and Resources and the Australian Taxation Office (ATO).

To qualify for the Australian R&D Tax Incentive for app funding, activities must meet specific criteria defined under sections 355–25 and 355–30 of the Income Tax Assessment Act 1997.

Key points include:

- Entity Type: Only corporations can apply; trusts, individuals, and other entities are excluded.

- Location: R&D activities must generally be conducted in Australia unless an “Overseas Finding” is granted.

After establishing the basic R&D tax incentive eligibility requirements based on entity type and location, it’s crucial to delve into what constitutes qualifying R&D activities under this.

This involves understanding two main categories of R&D activities that the Australian government encourages through tax offsets: Core R&D Activities and Supporting R&D Activities.

Core R&D Activities and Supporting R&D Activities

These categories define the scope of research and development efforts claimed under the incentive, which is particularly relevant for tech companies and software developers seeking to innovate.

Core R&D Activities

Core R&D activities involve primary experimental or research work aimed at acquiring new knowledge in a field of science or technology. For a business involved in software development, this might include:

- Creating innovative algorithms that significantly improve on current technology.

- Developing new software frameworks or architectures that solve existing technological challenges.

Supporting R&D Activities

Supporting activities, on the other hand, directly aid core R&D activities. These could involve:

- Setting up databases and server environments for testing new software applications.

- Conducting background research necessary to support the experimental development work.

Application in Software Development

For businesses investing in software development, the practical application of these definitions means identifying and documenting the aspects of their development work that involve genuine innovation or advancement. It is crucial to delineate between routine development and activities that push technological boundaries, as only the latter qualify for the tax incentive.

Characteristics of Eligible App Projects

Innovative Technology

The project should aim to develop new or significantly improved technologies. This could involve creating new algorithms, developing novel user interfaces, or enhancing the functionality and efficiency of existing apps in ways that are not obvious to someone skilled in the field.

Technical Challenges

Eligible projects under the R&D rebate in Australia must address specific technical challenges that cannot be solved using standard or known methods. This includes overcoming significant technical hurdles or uncertainties inherent in the project.

Experimental Development

The project’s core should involve systematic experimentation to solve the technical challenges. This means planning, testing, and iterating, where each cycle contributes to a better understanding or development of the new technology.

Examples of Eligible App Projects

Let us offer you a quick insight into some of the R&D tax incentive program examples that showcase the variety of app projects that can qualify for this substantial financial support:

Machine Learning Implementation

Develop an app that utilizes machine learning algorithms to provide predictive analytics in an industry where this technology is underutilized. The project could involve creating new models that predict user behavior, market trends, or operational inefficiencies more accurately than existing systems.

R&D Activities:

- Research into machine learning frameworks that could be adapted to the specific industry.

- Development of unique algorithms based on the gathered data.

- Iterative testing and refining of these algorithms to improve prediction accuracy and efficiency.

Advanced Health Diagnostics

Create an app that uses AI to analyze medical images and provide diagnostic suggestions. This project could involve developing new machine-learning models that identify patterns in medical imaging that are not detectable by current technologies.

R&D Activities:

- Research and data collection from diverse medical imaging sources.

- Development of AI models that can analyze complex imaging data to detect health issues.

- Validation of diagnostic accuracy through clinical trials and expert reviews.

Integration of Disparate Systems

Develop an app that integrates multiple systems or platforms to provide a seamless user experience where previously these systems operated in isolation. This could involve syncing data across platforms in real time or enabling impossible functionalities before the integration.

R&D Activities:

- Evaluation of different system architectures and their compatibility.

- Designing and implementing middleware or APIs that facilitate the integration.

- Testing the integrated system to ensure it operates seamlessly and securely.

Real-Time Language Translation

Develop an app that provides real-time language translation through voice recognition and natural language processing. This project involves creating algorithms capable of instantly understanding and translating spoken language, which could significantly benefit communication in multilingual contexts.

R&D Activities:

- Research into natural language processing and machine learning techniques applicable to voice recognition.

- Development of real-time translation algorithms that accurately interpret and translate multiple languages.

- Extensive testing in diverse linguistic environments to ensure accuracy and responsiveness.

Advanced Security Features

Create an app that integrates a newly developed encryption algorithm to enhance data security significantly. This could involve designing algorithms that encrypt data more efficiently, making it harder for unauthorized entities to breach.

R&D Activities:

- Research into cryptographic principles and existing encryption methods.

- Development of a novel encryption algorithm that provides superior security.

- Comprehensive testing of the encryption algorithm against various security threats.

Differences Between the Research and Development Tax Incentive for Software Houses and Other Industries

The R&D Tax Incentive Australia provides substantial benefits across various sectors, yet its application can vary significantly between software development and other industries like manufacturing or pharmaceuticals. Here are some of the key differences:

Nature of Innovation

In software development, innovation usually comes from gradual improvements and updates based on user feedback. This iterative process differs from manufacturing industries, where innovations might be fewer but larger, such as a new product or a major process enhancement.

Technical Challenges

Software businesses often face complex, abstract problems like improving algorithms or integrating varied data sources. These challenges are less tangible than those in traditional industries, where issues might involve improving a material’s strength or making a machine more efficient.

Documentation Requirements

Software businesses must thoroughly document how their projects address specific technological challenges, such as enhancements in code efficiency or system performance. In contrast, industries with tangible products might focus on documenting physical experiments and prototype testing.

Read Also: The Power of AI in Intelligent Document Processing

Eligibility Scope

Software projects must show that they contribute to new technology or techniques to get an R&D Grant in Australia. This goes beyond upgrading existing software to developing entirely new methods or systems. For other industries, such as those benefiting from Australian manufacturing grants, the focus is also on innovation, but the outcomes are often more tangible and straightforward to demonstrate, like a new physical product or a more effective manufacturing process.

Our Aussie team of dev experts can help you design & develop an app that’s not just cutting-edge but also perfectly positioned to harness Australia’s R&D tax incentives.

Importance of Documentation and Compliance

To claim the R&D Tax Incentive, it’s also essential to thoroughly document the entire R&D process. This includes detailing the technical challenges, the experimental activities undertaken to address these challenges, and the outcomes of these experiments. Proper documentation not only supports your claim but also helps in the effective management and execution of the project.

When applying for the R&D Tax Incentive or app funding in Australia, having the right documentation in place is crucial. This documentation proves the R&D activities and eligibility under the incentive’s guidelines. Here’s a breakdown of the types of documents needed to support an application:

Key Documentation for R&D Tax Incentive Applications

Project Descriptions

Comprehensive descriptions of each project claiming the incentive, outlining the scientific or technological uncertainties involved and the innovations to resolve these uncertainties. This clarifies the aims of the R&D activities, linking them directly to the advancement of technology or science.

Technical Reports

Reports that explain the experiments, prototypes, or trials conducted, including methodologies used and the progression from hypothesis to conclusions. This demonstrates the systematic approach to resolving the uncertainties and the findings contributing to new knowledge or capabilities.

Financial Records

Detailed accounting of all expenditures associated with the R&D activities, including personnel costs, materials, third-party contractor fees, and other relevant expenses. This verifies that the funds were spent directly on R&D activities and quantifies the total investment in the innovation efforts.

Experimental Results

Data and results from testing phases, including success, failures, and unexpected outcomes, are supported by data logs, test results, and analytical reports. This supports claims of technological or scientific advancements and demonstrates the iterative process of experimentation.

Staff Records and Labor Allocation

Records detailing the time staff spend on R&D activities are often supported by timesheets or project management tools. This confirms that the claimed personnel expenses are directly related to R&D efforts.

Additional Supportive Documents

When applying for the R&D Tax Incentive Australia, including supplementary documents can strengthen your application by showing the depth and authenticity of your R&D efforts. Here’s a breakdown of these documents:

Patent Applications or Intellectual Property Filings

These show that you protect the technologies or innovations developed during your R&D projects. Including these can demonstrate the novel nature of your work.

Correspondence with Experts

Sharing communications with experts or advisory bodies can help verify the technical aspects of your project. It shows you have sought external validation or guidance, which adds credibility to your R&D claims.

Prototype Designs and Changes

Keep records of how your product or process has evolved through the R&D process. Documenting each version or adaptation highlights the development journey and shows continuous improvement and innovation.

Best Practices for Document Management

Effective document management is crucial for maintaining compliance and enhancing efficiency, especially when navigating complex processes like the R&D Grand Australia. Here are essential strategies to ensure your documentation is well-organized and accessible.

| Best Practice | How to Implement | Tips |

|---|---|---|

| Keep Organized Records | Maintain organized and accessible records from the start of the R&D process. | Use digital tools to timestamp and securely store documents. Cloud storage and document management systems are recommended. |

| Regular Updates | Update documentation regularly to capture all developments and iterations throughout the R&D process. | Set periodic reviews to update records. Use project management software to track changes. |

| Consult Experts | Engage with R&D tax professionals or legal advisors to ensure compliance with tax incentive requirements. | Consult early and regularly. Retain experts who specialize in R&D tax incentives for app development. |

| Detailed Expense Tracking | Keep detailed records of all costs related to R&D activities, including personnel, materials, and external services. | Implement accounting software specifically designed for project-based accounting. |

| Proof of Experimentation | Document all experimental designs, tests, and outcomes thoroughly. | Maintain logs, lab notebooks, and test result files in an organized manner. |

| Staff Involvement Records | Keep detailed records of the time each staff member spends on R&D activities. | Use timesheet software that allows employees to record time spent on specific R&D projects. |

| Intellectual Property Logs | Document the creation and modification of intellectual property related to R&D activities. | Keep a register of IP filings and status updates, using IP management software when possible. |

| External Consultations | Record details of all consultations with external experts or advisory bodies. | Keep written records of meetings, emails, and reports from external consultations. |

| Compliance Checks | Review documentation to ensure it meets the compliance requirements of the R&D tax incentive. | Schedule compliance audits with your R&D advisor or internal compliance team. |

Benefits of Applying for the R&D Tax Incentive

Applying for the R&D Tax Incentive Australia offers significant advantages for businesses engaged in innovative projects. Here are some of the key benefits of app funding in Australia:

Financial Support

The incentive provides substantial tax offsets, reducing the financial burden of conducting research and development. This support can make a big difference in innovative projects’ overall viability and sustainability.

Encourages Innovation

By reducing the financial risks associated with R&D, the incentive encourages companies to pursue new and experimental projects. This leads to breakthroughs and advancements that might not have been financially feasible otherwise.

Competitive Advantage

Companies that engage in R&D can develop unique products and processes, setting them apart from competitors. The tax incentive helps fund these activities, enhancing a company’s market position.

Improved Profitability

Successful R&D projects can lead to new products or more efficient processes that improve profitability. The tax incentive supports the initial investment in these projects, potentially leading to higher returns in the long run.

Step-by-Step Guide on How to Apply for the R&D Tax Incentive

Applying for the R&D Tax Incentive involves several key steps to ensure your business maximizes its potential benefits while adhering to the program’s requirements. Here are the straightforward steps to apply for the R&D Tax Incentive:

Step 1: Determine Eligibility

Before you start the application process, confirm that your projects meet the criteria for R&D activities as outlined by the Australian Taxation Office (ATO) and the Department of Industry, Science, Energy, and Resources. This includes assessing whether your activities involve genuine innovation or technological advancement.

Step 2: Document Your R&D Activities

Keep detailed records of all R&D activities, including project plans, expenditures, experimental results, and staff involvement. This documentation will be crucial for supporting your claim.

Step 3: Register Your R&D Activities

To claim the incentive, you must register your R&D activities with the Department of Industry, Science, Energy, and Resources each year. Registration must be done within ten months after your company’s income year ends.

Step 4: Prepare and Lodge Your Tax Return

Include your R&D claim in your company’s tax return. This is where you apply for the tax offset by detailing the expenditure on your registered R&D activities. Ensure you lodge your tax return by the due date.

Step 5: Claim the Tax Offset

Once your tax return is processed, if eligible, the tax offset will be applied. This could be a reduced tax liability or a refund, depending on your company’s financial situation and the type of offset claimed (refundable or non-refundable).

Step 6: Comply with Reviews and Audits

The ATO or the Department of Industry may review your R&D Tax Incentive claim to ensure compliance with the program rules. Be prepared to provide all necessary documentation and explanations of your R&D activities.

Step 7: Continuous Monitoring and Reporting

Keep monitoring your R&D activities and maintain up-to-date records throughout the year. Annual registration and consistent documentation are key to successfully claiming the incentive in subsequent years.

Challenges of Applying for the R&D Tax Incentive

Applying for the R&D Tax Incentive Australia can be complex and demanding, often presenting several challenges that businesses must navigate carefully. Below is a detailed table outlining common challenges encountered while applying for app funding in Australia and practical solutions to help enterprises successfully secure the incentive.

| Challenges in Australian app funding | Solution |

|---|---|

| Understanding Eligibility Criteria | Educate your team on the R&D Tax Incentive requirements by frequently reviewing the latest guidelines from the Australian Taxation Office (ATO) and the Department of Industry. This ensures your team fully understands what qualifies as R&D. |

| Documenting R&D Activities Accurately | Implement a robust documentation system using project management tools to systematically track and record all R&D activities, capturing all necessary details from the start of the project. |

| Managing Complex Tax Forms | Seek professional tax advice by hiring a tax advisor or accountant specializing in R&D claims to help prepare and review your tax filings, ensuring compliance and accuracy. |

| Meeting Registration Deadlines | Set internal deadlines ahead of official dates and create a timeline with milestones leading up to the submission date to ensure all documentation and applications are ready well in advance. |

| Demonstrating Technological Innovation | Develop clear project descriptions and outcomes, preparing detailed reports that outline the innovative aspects of your R&D activities and their potential impact on technology or industry. |

| Partnering for Enhanced Development | Partner with a dedicated mobile app development company in Australia to collaborate with experts who understand the intricacies of mobile app technology and can provide additional insight and validation to your R&D efforts. |

| Dealing with Audits and Reviews | Maintain readiness for compliance checks by keeping all R&D documentation organized and accessible for easy retrieval during audits or reviews by the ATO or other governmental bodies. |

| Allocating Sufficient Resources | Plan your budget to include necessary resources for R&D activities, ensuring adequate funding and personnel are allocated from the start, considering the long-term benefits of a successful tax incentive claim. |

| Keeping Up with Regulatory Changes | Subscribe to updates from regulatory authorities and industry associations to stay informed about any changes in the R&D Tax Incentive program or related tax laws that could affect your eligibility or the claiming process. |

Kick back while we craft a custom app to snag those Aussie dev perks! Don’t miss out—hit the button below to chat with our dev pros.

Partner with Appinventiv to Pave the Way for App Funding in Australia

Choosing the right partner is crucial when seeking funding for your app in Australia. Appinventiv stands out as a custom mobile app development company in Australia due to our extensive experience and expertise in navigating both R&D tax incentives for app development and various other funding avenues. Here’s why businesses should consider partnering with us:

Expertise in R&D Funding: Appinventiv deeply understands the R&D Tax Incentive process. We can guide you through the application, ensuring your projects meet all eligibility criteria and documentation requirements.

Tailored Funding Strategies: Beyond R&D, we help businesses explore and secure other types of funding. Whether it’s venture capital, angel investment, or government grants, we tailor our approach to your needs and goals.

Technology and Innovation Focus: As leaders in technological development, particularly in mobile app development, we ensure your projects are innovative and aligned with current tech trends and demands.

Comprehensive Project Management: Appinventiv manages all aspects of your project from initial concept to funding acquisition. This includes detailed documentation, project planning, and execution, all crucial for funding success.

Networking Opportunities: Leveraging our extensive network, we can connect you with industry experts, potential investors, and other key stakeholders, enhancing your project’s visibility and viability.

Regulatory and Compliance Guidance: Our team stays current with the latest regulations and requirements, ensuring your project adheres to all legal standards and maximizes its funding potential.

Get in touch with us to gain a collaborator who not only enhances your ability to secure essential funding but also supports the growth and development of your app to ensure long-term success in the Australian market.

FAQs

Q. How do you get funding for your app in Australia?

A. To get funding for your app in Australia:

- Start by clearly defining your app’s value proposition and target market.

- Next, explore various funding options such as venture capital, angel investors, and government grants like R&D rebate in Australia for projects involving innovation or technological advancements.

- Prepare a detailed business plan and pitch deck to present to potential investors, emphasizing your app’s potential for success and growth in the competitive market.

Q. Why does hiring an Australian app development company matter when applying for an R&D tax incentive?

A. Hiring an Australian app development company is crucial when applying for the R&D tax incentive because such firms are well-versed in the local regulatory and business environment. They understand the specific documentation and project management requirements to comply with the Australian Taxation Office guidelines. Moreover, their expertise in technology and innovation can help ensure that your app development project meets the criteria for technological advancement and innovation required to qualify for the incentive.

Q. How does your app qualify for the R&D tax incentive in AU?

A. Your app qualifies for the R&D tax incentive Australia if it involves the development of new or significantly improved technologies or software. The project must address specific technological challenges and cannot be based on existing solutions. You must demonstrate that your app’s development process involves systematic, investigative, and experimental activities to achieve technological advancements. Proper documentation of the research and development process, showing how the project experiments and overcomes these challenges, is essential for the application.

10 Industry-Wise 5G Use Cases Transforming Australian Businesses

Key takeaways: Industry Transformation: 5G is revolutionizing key sectors in Australia, including healthcare, manufacturing, agriculture, and logistics, by enabling real-time data processing, enhanced connectivity, and automation that improve operational efficiency and customer experiences. Enhanced Connectivity for Regional Areas: 5G technology bridges the connectivity gap in remote and regional areas of Australia, supporting industries like agriculture…

How to Build a Secure App in Australia in 2025? All You Need to Know

In today’s hyper-connected world, mobile apps aren’t just conveniences; they are the baseline of modern business. From banking and healthcare to retail and government services, apps power our daily lives. But this digital revolution has a dangerous downside: cyberattacks are escalating alarmingly. More than data exposure, this security breach costs businesses a lot, destroys customer…

How to Build a Ride-Hailing App Like Yango Ride?

Dubai's streets are buzzing with innovation. The city is fast becoming a playground for smart mobility, from AI-driven traffic systems to autonomous taxis. In the middle of it all, the decision to build an app like Yango has brought serious traction, offering seamless, affordable, and tech-savvy transport alternatives. But here’s the thing: success in this…