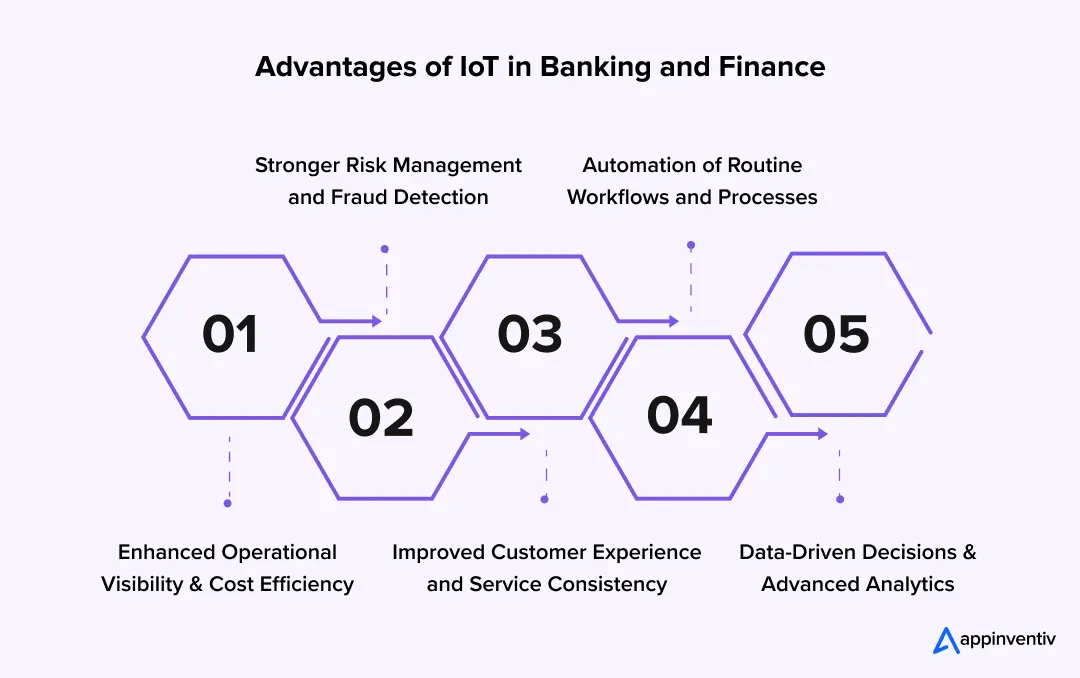

- What Are the Benefits of IoT in Banking and Finance

- Enhanced Operational Visibility and Cost Efficiency

- Stronger Risk Management and Fraud Detection

- Improved Customer Experience and Service Consistency

- Automation of Routine Workflows and Processes

- Data-Driven Decisions and Advanced Analytics

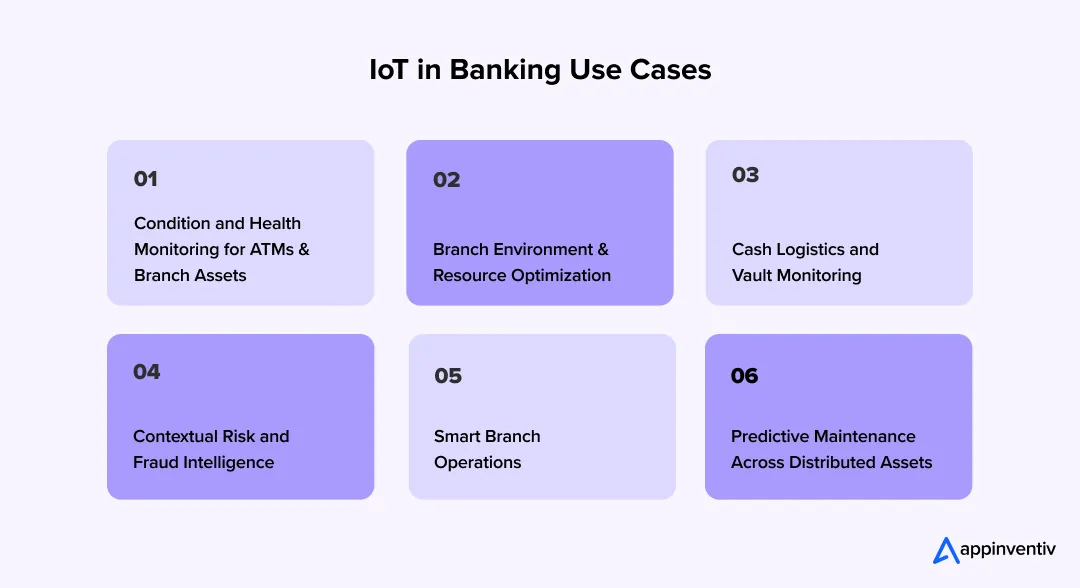

- What Are The Key Use Cases of IoT in Banking and Finance?

- Condition and Health Monitoring for ATMs and Branch Assets

- Branch Environment and Resource Optimization

- Cash Logistics and Vault Monitoring

- Contextual Risk and Fraud Intelligence

- Smart Branch Operations

- Predictive Maintenance Across Distributed Assets

- Real-World Examples of Banks Leveraging the Benefits of IoT in Banking and Financial Services

- HSBC – Infrastructure Visibility at Scale

- DBS Bank – Practical Use of Smart Branch Data

- Citibank – Smarter ATM Interactions

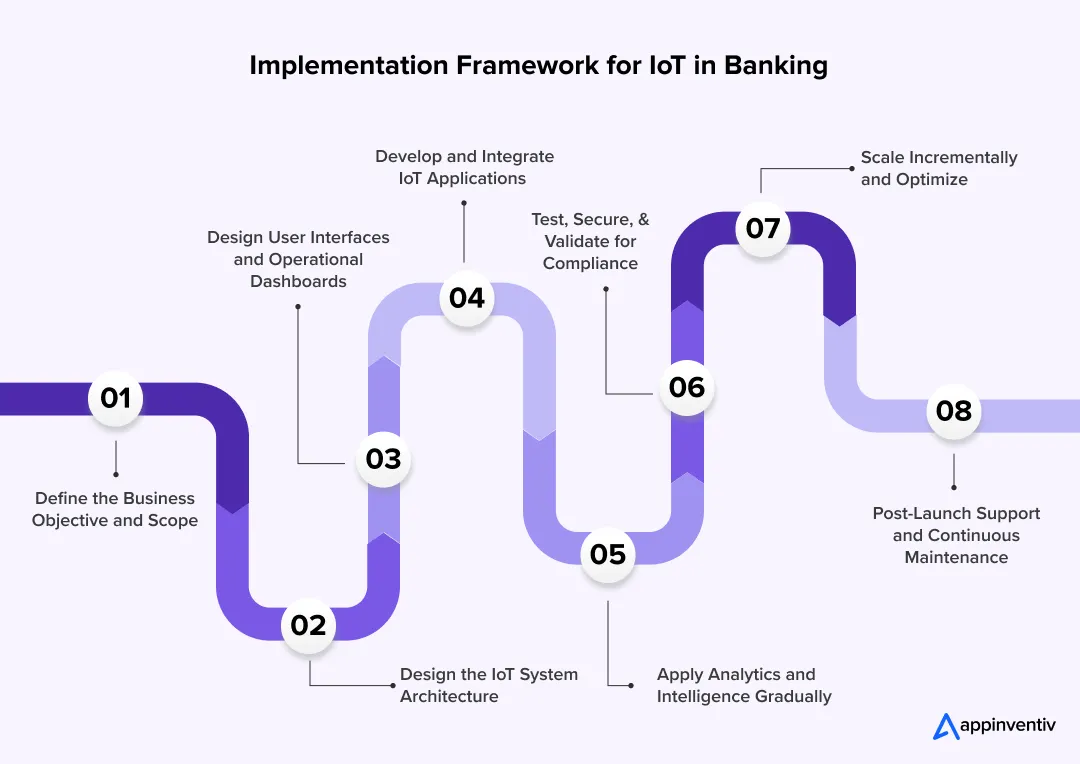

- How to Implement IoT in Banking and Finance: A Practical Execution Framework

- Step 1: Define the Business Objective and Scope

- Step 2: Design the IoT System Architecture

- Step 3: Design User Interfaces and Operational Dashboards

- Step 4: Develop and Integrate IoT Applications

- Step 5: Apply Analytics and Intelligence Gradually

- Step 6: Test, Secure, and Validate for Compliance

- Step 7: Scale Incrementally and Optimize

- Step 8: Post-Launch Support and Continuous Maintenance

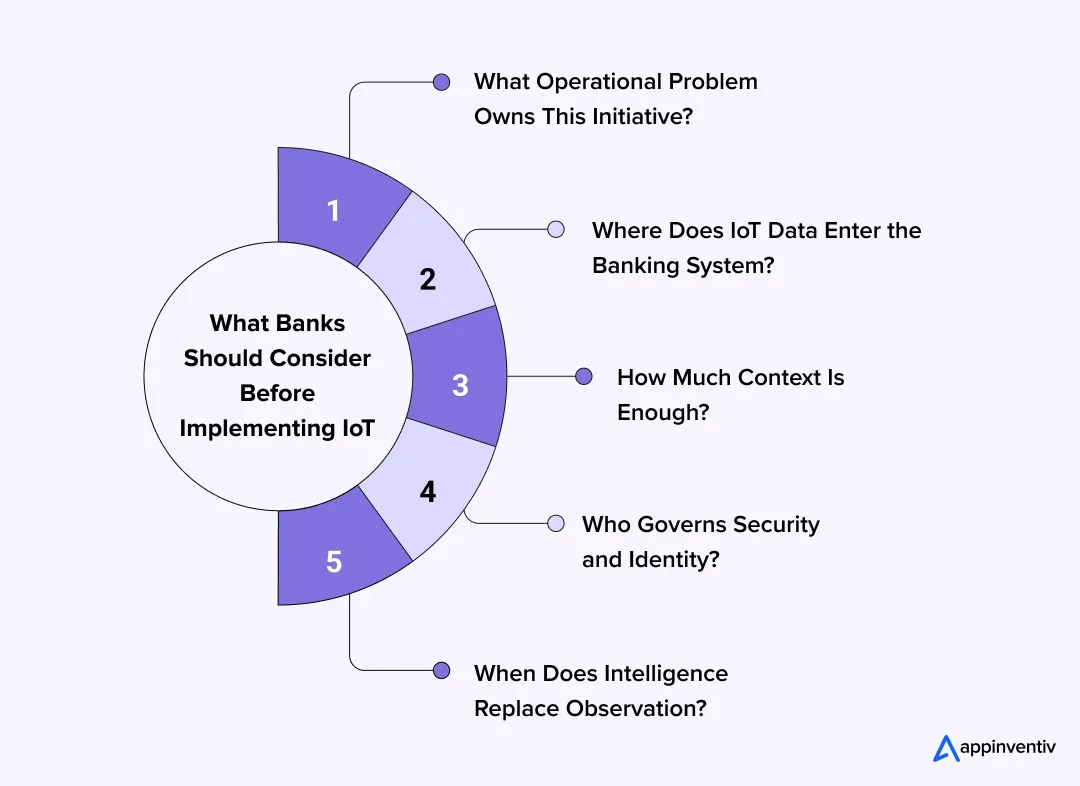

- What Banks Must Get Right Before Implementing IoT at Scale

- Decision 1: What Operational Problem Owns This Initiative?

- Decision 2: Where Does IoT Data Enter the Banking System?

- Decision 3: How Much Context Is Enough?

- Decision 4: Who Governs Security and Identity?

- Decision 5: When Does Intelligence Replace Observation?

- What Are The Challenges of Implementing IoT in Banking and How to Mitigate Them

- Challenge 1: Expanded Attack Surface Across Physical and Digital Layers

- Challenge 2: Regulatory and Audit Complexity

- Challenge 3: Data Overload Without Decision Clarity

- Challenge 4: Integration With Legacy Banking Systems

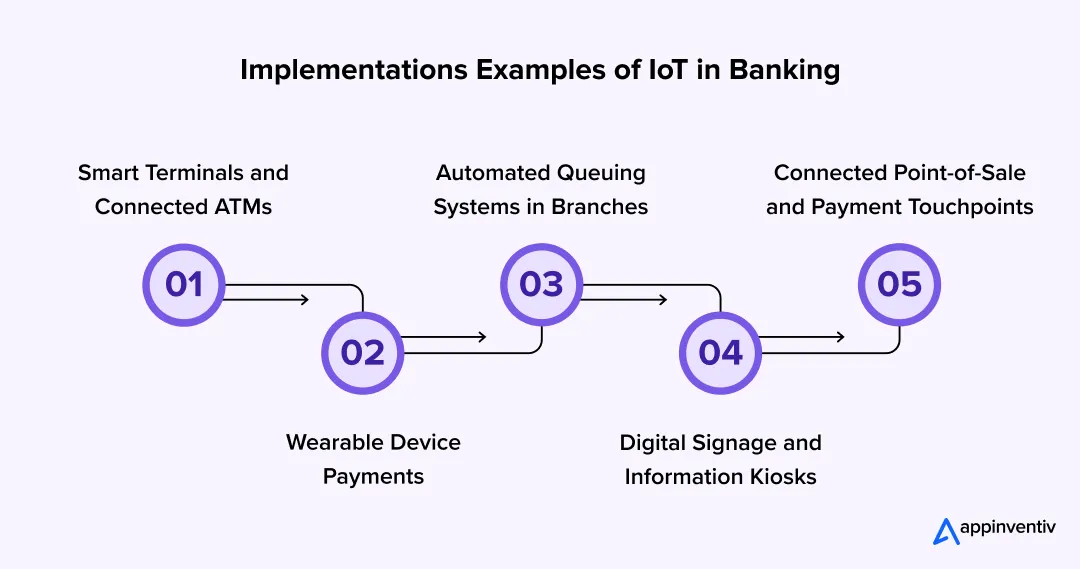

- What Are Some Most Common Implementations Examples of IoT in Banking?

- Smart Terminals and Connected ATMs

- Wearable Device Payments

- Automated Queuing Systems in Branches

- Digital Signage and Information Kiosks

- Connected Point-of-Sale and Payment Touchpoints

- Cost of Implementing IoT in Banking and What Actually Drives ROI

- What Influences the Cost Most:

- ROI of IoT in Banking: How Value Shows Up Over Time

- What’s the Future of IoT in Banking & Finance: Upcoming Trends

- How Appinventiv Supports IoT-Driven Banking System Development

- What This Looks Like in Numbers

- Where This Shows Up in Practice

- FAQs

- Q. How is IoT Used in Atm and Branch Automation?

- Q. How Does IoT Align With Soc 2 Requirements in Banking?

- Q. How Can Banks Ensure Regulatory Compliance for IoT Systems?

- Q. How Does IoT Support Real-time Banking Data Processing?

- Q. What Are the Security Risks of IoT in Banking?

Key takeaways:

- IoT in banking creates real value only when it is treated as a software and integration problem, not a hardware initiative.

- Security, governance, and audit readiness determine whether IoT programs scale or quietly stall in regulated environments.

- IoT implementation in banking typically ranges from $40,000 to $600,000+, with cost driven more by integration depth, security, and compliance requirements than by scale alone.

- The future of IoT in banking lies in real-time decision support that reduces uncertainty and operational surprises over time.

Most banks did not adopt IoT because of a digital roadmap. They adopted it because something physical kept failing.

For instance, in 2024, several Tier-1 banks across the US and UK traced recurring outages and disruptions back to unglamorous causes. Heat stress inside kiosks. Power instability at edge locations. Environmental drift that went unnoticed as signals passed slowly through siloed operational systems. Individually, these issues seemed minor. Collectively, they exposed a deeper problem. Banking platforms excel at processing transactions, but they remain largely blind to the physical environments that increasingly influence uptime, fraud exposure, and service reliability.

For large banking environments, these blind spots no longer remain operational inconveniences. They become cost, risk, and regulatory questions. This is the context in which IoT in banking has gained relevance. Not as a customer-facing innovation or a device-led initiative, but as an operational intelligence layer that surfaces what core systems cannot see.

What makes this transition consequential is not connectivity, but integration. When infrastructure telemetry feeds into risk models and operational workflows, the boundary between physical operations and digital finance starts to blur. Banks gain earlier insight, fewer surprises, and a clearer basis for decision-making across distributed environments.

This blog examines how IoT banking and finance is being used in practice, where it delivers measurable returns, and why banks that treat it as an isolated technology layer struggle to see value. We will focus on concrete use cases, real-world examples, implementation process, costs and the conditions under which IoT strengthens, rather than complicates, modern banking systems.

Speak with our IoT specialists to explore how IoT can be implemented without compromising security or compliance.

What Are the Benefits of IoT in Banking and Finance

The benefits of IoT in banking are often overstated in early pilots and underestimated in mature deployments. The real value does not appear when sensors are installed. It appears when banks change how they respond to the data those sensors produce. Here are some of the most tangible benefits of implementing IoT in banking and finance.

Enhanced Operational Visibility and Cost Efficiency

IoT in banking enables continuous observation of distributed assets such as ATMs, branch equipment, and infrastructure environments. This visibility helps anticipate failures, optimize maintenance schedules, and reduce costly breakdowns. Banks can shift resources from reactive fire-fighting to proactive planning when they understand what is happening before failure occurs, not after.

Some key benefits include:

- Real-time monitoring reduces unscheduled downtime.

- Predictive insights lower unplanned maintenance costs.

- Integration with core systems avoids disconnected alert silos.

These effects together drive tangible operational savings and reduce margin erosion that often escapes traditional IT systems.

Stronger Risk Management and Fraud Detection

IoT sensors and connected software systems add a layer of context that traditional transaction monitoring lacks. Physical condition signals such as sudden tampering, repeated access, or unusual device behavior when correlated with transaction data, enable earlier identification of risk or fraud patterns. This is a form of multidimensional signal intelligence, not just data collection.

Some key benefits include:

- Alerts for physical anomalies that precede fraud attempts.

- Correlation with banking risk engines enhances incident clarity.

- Continuous observability supports audit and compliance evidence.

The outcome is fewer blind spots and faster, defensible responses when security events arise.

Improved Customer Experience and Service Consistency

Banks that leverage IoT data to synchronize operational systems with customer interactions gain consistent service levels across channels and locations. Examples include branch queue estimations, ATM reliability notifications, and service status alerts that feed customer touchpoints in near real time.

Some key benefits include:

- Reduced customer wait times through dynamic service routing.

- Notifications about system availability improve trust.

- ICT convergence with digital interfaces enables smoother experiences.

While the effect on customer satisfaction isn’t always headline news, it shows up in fewer complaints, less churn, and stronger operational predictability.

Automation of Routine Workflows and Processes

A significant benefit banks realize is letting software manage what it is designed to manage. Connected systems can automate routine workflows, from simple alerts and reconciliations to orchestrated operational processes, which frees human teams for higher-value work.

Some key benefits include:

- Elimination of manual checks for equipment or branch conditions.

- Automated escalation to operations or risk teams when thresholds are met.

- Data-driven triggers feed existing process engines rather than creating stand-alone tasks.

This is where banks begin to see efficiency gains at scale rather than incremental improvements in isolated areas.

Data-Driven Decisions and Advanced Analytics

Because IoT amplifies the volume and velocity of operational data, banks can start to layer analytics (both descriptive and predictive) on top of pre-existing systems. This improves decision quality across planning, risk, and compliance functions.

Some key benefits include:

- Near real-time analytics reveal patterns that static reporting masks.

- Historical IoT signal data enriches risk models and scenario planning.

- Advanced dashboards correlate physical and transactional states.

Importantly, this benefit only materializes when IoT feeds into platforms that banking leaders already trust and use, rather than living in isolated dashboards.

Summing Up the Impact of IoT in Banking Benefits

IoT in banking is not a set of futuristic gadgets. It is a software-driven capability that:

- Makes the physical world legible to digital systems,

- Strengthens risk and compliance postures,

- Improves reliability and operational foresight,

- And enhances customer experience where consistency matters most.

The benefits above are what enterprise banking leaders care about: measurable risk reduction, predictable operations, and tighter integration with existing systems; all of which are essential for high-stakes, regulated environments.

Also Read: IoT in Fintech – How It’s Transforming the BFSI Sector

What Are The Key Use Cases of IoT in Banking and Finance?

The most effective use cases of IoT in banking do not begin with devices. They begin with friction. Specifically, areas where banks lose time, money, or control because physical reality moves faster than their systems can observe.

What follows are not hypothetical applications. These are the IoT in banking use cases that continue to receive budget because they solve problems executives already recognize.

Condition and Health Monitoring for ATMs and Branch Assets

Banks operate thousands of deployed devices that generate no insight until they fail.

IoT systems continuously monitor external conditions such as temperature, vibration, error states, etc. and feed these signals into operational platforms. Instead of discovering machine issues after customer complaints, operations teams see early indicators and schedule interventions before service gaps occur.

This use case keeps infrastructure visible and reduces the cost of reactive maintenance.

Branch Environment and Resource Optimization

What used to be manual audits are now automated. IoT sensors in banking and finance track occupancy, footfall, and environmental conditions in branch locations. That data helps operations teams balance staffing with real-foot traffic, reduce unnecessary energy use, and make branches more predictable. These systems work alongside resource planning tools rather than sitting in isolated dashboards.

This is about operational discipline, not flashy automation.

Cash Logistics and Vault Monitoring

Cash handling remains a risk-intensive process that banks cannot ignore.

IoT enables real-time tracking of vault conditions and cash movements. When integrated with compliance and audit systems, it reduces blind spots in cash flow and enhances investigation trails without adding layers of manual reconciliation.

The insight here is accountability, not simply visibility.

Contextual Risk and Fraud Intelligence

Modern risk engines look at transactional patterns. IoT adds a different view. Unusual device activity, repeated access outside business hours, or environmental anomalies can be correlated with transaction data to form richer risk signals. These signals do not replace fraud engines. They augment them, providing context that was previously invisible.

This kind of enrichment matters where physical and digital risks collide.

Smart Branch Operations

Branches are expensive to operate, and optimization often looks qualitative. IoT data feeds planning systems with occupancy trends, queue lengths, and equipment usage. Armed with this, banks can allocate staff more effectively and anticipate peak volumes without relying on intuition.

The payoff shows up in smoother service delivery, not gimmicks.

Predictive Maintenance Across Distributed Assets

Rules-based monitoring catches manual thresholds. Predictive maintenance anticipates patterns.

IoT enables banks to build models that identify slow degradation across distributed systems. Over time, this prevents minor issues from escalating into customer-facing outages. In environments where uptime equals trust, this makes a tangible difference.

Unlike reactive maintenance, this use case shifts teams from firefighting to foresight.

What These Use Cases Share

Across these applications of IoT in banking, the consistent theme is this: IoT signals matter only when they feed systems that already shape decisions. Banks do not benefit from sensors in isolation. They benefit when those sensors provide context that operational, risk, and compliance systems can act on.

That means the real value emerges not from data alone, but from how that data is used to reduce uncertainty, improve control, and inform decisions that matter to regulated financial environments.

Real-World Examples of Banks Leveraging the Benefits of IoT in Banking and Financial Services

Banks rarely talk about IoT as a strategic win. When they do mention it, the language is usually cautious. That restraint is telling. In most institutions, IoT entered through operations teams, not innovation labs. It showed up after repeated incidents, budget overruns, or audit pressure made inaction harder to defend than change. The examples below reflect that reality.

HSBC – Infrastructure Visibility at Scale

HSBC’s reporting on operational resilience points to a steady increase in technology-led monitoring across its global operations. While the bank does not frame these efforts purely as IoT programs, the underlying model is familiar. Continuous sensing, environmental awareness, and early risk detection are used to protect uptime and reduce exposure across complex, distributed infrastructure.

DBS Bank – Practical Use of Smart Branch Data

DBS Bank has spoken openly about using sensors and connected systems inside branches to better understand how spaces are actually used. Data on occupancy, temperature, and energy consumption feeds into decisions around cost management and sustainability. The value of IoT in investment banking here is operational clarity. Branch environments become easier to manage, more predictable, and less wasteful, without introducing unnecessary complexity.

Citibank – Smarter ATM Interactions

Citibank’s exploration of beacon and proximity-based technologies around ATMs was not positioned as a radical shift, but as a way to remove small points of friction in everyday customer journeys. The work focused on making ATM access quicker and more intuitive while keeping authentication and security controls unchanged. It is a good example of how IoT in the finance industry solves specific problems rather than chasing large-scale transformation narratives.

How to Implement IoT in Banking and Finance: A Practical Execution Framework

Implementing IoT for banking is not a single rollout. It is a coordinated program of structured steps that touches infrastructure, security, analytics, and core systems. Below is a step by step process of implementing IoT in banking that banks typically follow to adopt IoT in finance without disrupting existing operations.

Step 1: Define the Business Objective and Scope

Every successful IoT initiative starts with a narrowly defined objective. Banks that attempt broad deployment early often struggle to justify ROI. At this stage, the focus is on identifying where IoT can solve a measurable operational problem rather than introducing new technology.

Key activities include:

- Identifying high-cost or high-risk physical assets (ATMs, branches, vaults, data centers)

- Defining success metrics such as downtime reduction, cost avoidance, or risk visibility

- Aligning stakeholders across operations, IT, and compliance

This clarity ensures IoT in banking stays outcome-driven from the start.

Step 2: Design the IoT System Architecture

Once objectives are clear, the next step is designing how data will flow across devices, platforms, and banking systems. This phase determines whether IoT becomes part of the core banking ecosystem or remains a siloed system.

Architecture design typically covers:

- Selection of sensors and edge devices based on environmental and operational needs

- Secure data ingestion pipelines from devices to cloud or on-prem systems

- Integration touchpoints with core banking, risk, or monitoring platforms

This is where Appinventiv’s experience in banking software development services becomes critical, as integration complexity often outweighs hardware costs.

Step 3: Design User Interfaces and Operational Dashboards

IoT data is only useful if teams can interpret and act on it. Thus, in the next phase of designing UI and UX, the key focus is on translating raw telemetry into operational insight without overwhelming users. Different teams see different views, depending on responsibility.

UI/UX considerations include:

- Role-based dashboards for operations, maintenance, and compliance teams

- Clear alert prioritization to avoid notification fatigue

- Visual trends instead of raw data streams

In a well-designed IoT for banking system, dashboards support decisions, not just observation.

Step 4: Develop and Integrate IoT Applications

This stage involves building the IoT software layer that connects devices to business workflows. IoT app development in banking requires strict attention to security, latency, and reliability, especially when data feeds into regulated systems.

Development activities include:

- Backend services for data processing and validation

- API integrations with existing banking platforms

- Security controls such as device authentication and encrypted communication

At this point, IoT in finance shifts from concept to operational system.

Step 5: Apply Analytics and Intelligence Gradually

Analytics should follow stability, not precede it. Banks that succeed with IoT introduce intelligence in stages, starting with rule-based alerts before moving toward predictive or AI-driven models in banking.

Typical progression includes:

- Threshold-based alerts for maintenance or risk events

- Pattern recognition across historical device data

- Gradual introduction of AI models once data quality stabilizes

This phased approach supports the long-term application of AI and IoT in banking without creating opaque decision systems.

Step 6: Test, Secure, and Validate for Compliance

Before scaling, IoT systems must be validated against banking security and regulatory standards. This phase often determines whether an initiative moves beyond pilot.

Validation includes:

- Penetration testing and device-level security audits

- Compliance checks aligned with PCI-DSS, SOC 2, GDPR, and internal banking policies

- Failover and resilience testing under real-world conditions

Banks that treat this as a checkbox exercise often face delays later during audits.

Step 7: Scale Incrementally and Optimize

Full-scale rollout is rarely immediate. Banks expand IoT deployments gradually, refining configurations based on real-world performance and operational feedback.

Scaling focuses on:

- Rolling out to additional locations or asset classes

- Optimizing alert thresholds and workflows

- Measuring ROI against original objectives

This is where IoT in the banking and financial services market investments begin to show compounding returns.

Step 8: Post-Launch Support and Continuous Maintenance

IoT implementation in banking does not end at rollout. Once systems are live, sustained value depends on how well platforms are monitored, maintained, and adapted to changing operational and regulatory conditions.

Post-deployment activities typically include:

- Continuous monitoring of data pipelines, integrations, and platform performance

- Ongoing security updates, device lifecycle management, and patching

- Fine-tuning analytics models, alert thresholds, and dashboards based on real usage

For banks, this phase is critical. Without structured monitoring and maintenance, IoT platforms lose relevance over time.

Also Read: Enterprise IoT – Benefits, Use Cases, and Real Examples

What Banks Must Get Right Before Implementing IoT at Scale

Most IoT programs in banking do not fail at deployment. They fail earlier, during decisions that feel minor at the time and irreversible six months later. Successful IoT in banking implementation is less about rolling out devices and more about resolving a few uncomfortable questions upfront. Banks that answer them honestly tend to see value. Those who postpone them accumulate technical and regulatory debt.

Decision 1: What Operational Problem Owns This Initiative?

IoT initiatives often begin in technology teams because the tooling sits there. That is usually the first mistake.

Banks that extract value anchor IoT to a clearly owned operational problem. ATM availability, cash logistics losses, branch cost volatility, or infrastructure audit gaps. When ownership is vague, IoT data floats without authority. Dashboards exist, but no one is accountable for acting on them.

Before devices are procured, banks that succeed decide who is responsible for outcomes, not implementation. This clarity determines whether IoT becomes operational intelligence or background noise.

Decision 2: Where Does IoT Data Enter the Banking System?

IoT data has little value on its own. Its usefulness depends entirely on where it lands.

In mature implementations, IoT signals feed into existing banking systems. Incident management platforms. Risk engines. Maintenance workflows. Compliance logs. When IoT is isolated in parallel dashboards, adoption stalls after the pilot phase.

This is where banking software development services become relevant. Integration effort consistently outweighs device costs. Banks that underestimate this spend often label IoT as expensive when the real issue is architectural fragmentation.

Decision 3: How Much Context Is Enough?

There is a temptation to capture everything. Temperature, motion, vibration, power, and access frequency. More data feels safer. In practice, it creates confusion.

Banks that implement IoT effectively define decision thresholds early. What constitutes an alert. What remains informational. What triggers escalation. This discipline reduces noise and builds trust in the system.

In the IoT in finance context, trust matters. Operations teams will ignore systems that cry wolf. Risk teams will question signals that lack interpretability.

Decision 4: Who Governs Security and Identity?

Every IoT device is an identity. Every identity expands the attack surface.

Successful banks treat IoT endpoints as regulated entities, not peripherals. Device authentication, encryption, firmware controls, and lifecycle management are defined before rollout. Not after the first audit question.

This is especially important when IoT data intersects with transaction or customer systems. Security gaps here undermine confidence in the entire initiative, regardless of operational benefits.

Decision 5: When Does Intelligence Replace Observation?

IoT delivers value in phases. First visibility. Then correlation. Only later, prediction.

Banks that rush directly into AI models without stabilizing data quality often struggle. Those that allow IoT data to mature before applying analytics see steadier returns. This is where the application of AI and IoT in banking becomes practical rather than aspirational.

The transition from observation to intelligence should be paced by confidence, not ambition.

Also Read: Key Strategies to Ensure IoT Project Success

Engage Appinventiv to implement a secure, compliant IoT solution without disrupting your core banking operations.

What Are The Challenges of Implementing IoT in Banking and How to Mitigate Them

IoT in banking introduces a different category of risk than traditional software programs. The challenges are not abstract. They sit at the intersection of physical infrastructure, regulated data, and long-lived systems that banks cannot simply replace.

Institutions that succeed with IoT in finance do not eliminate these challenges. They design around them early, with clear controls and realistic expectations.

Challenge 1: Expanded Attack Surface Across Physical and Digital Layers

Every connected device introduces a new endpoint. In banking environments, this is not a theoretical concern. Devices operate in public or semi-public spaces, often outside tightly controlled data centers.

The risk is less about sophisticated breaches and more about unmanaged exposure over time. Outdated firmware, weak device identity, or inconsistent patching can quietly undermine security posture.

How banks mitigate this:

- Enforcing strong device identity and authentication from day one

- Encrypting data at rest and in transit, even for non-customer telemetry

- Managing firmware updates and device lifecycles centrally

- Treating IoT endpoints as regulated assets, not peripheral hardware

In mature IoT in banking sector deployments, security governance extends to every sensor, not just core platforms.

Challenge 2: Regulatory and Audit Complexity

IoT systems generate operational data that increasingly intersects with regulated processes. Auditors want to know how data is collected, stored, accessed, and retained. Informal or undocumented IoT deployments quickly become liabilities.

Banks often underestimate how early compliance questions surface, especially when IoT data supports risk or operational decisions.

How banks mitigate this:

- Designing IoT architectures with auditability in mind

- Maintaining clear data lineage and access logs

- Aligning retention policies with existing compliance frameworks

- Involving risk and compliance teams during design, not post-deployment

This approach ensures IoT supports governance rather than complicating it, which is critical in the IoT in banking and financial services market.

Challenge 3: Data Overload Without Decision Clarity

IoT systems can produce more data than teams know how to consume. When everything is measured, nothing feels actionable.

Operations teams often disengage when alerts are frequent but inconclusive. Over time, this erodes confidence in the system.

How banks mitigate this:

- Defining alert thresholds tied to operational decisions

- Separating informational data from escalation triggers

- Prioritizing signal quality over volume

- Reviewing and refining alert logic as usage patterns evolve

In effective applications of IoT in banking, fewer alerts drive better outcomes.

Challenge 4: Integration With Legacy Banking Systems

Most banking environments rely on legacy cores, monitoring platforms, and risk engines. IoT data that cannot integrate cleanly becomes isolated and underused.

This challenge is organizational as much as technical. Ownership gaps between teams often slow progress.

How banks mitigate this:

- Using API-led integration rather than point-to-point connections

- Aligning IoT data models with existing operational systems

- Partnering with companies experienced in upgrading legacy systems

- Phasing integration instead of attempting full convergence upfront

Banks that plan integration early avoid rework and stalled pilots.

What Are Some Most Common Implementations Examples of IoT in Banking?

Banks do not implement IoT as a checklist. They adopt it where existing systems leave gaps in visibility, risk insight, or operational control. The following are some of the most frequent real-world implementations of IoT observed in modern finance environments.

Smart Terminals and Connected ATMs

Smart terminals and ATMs use IoT-enabled software layers to continuously report device status, cash levels, environmental conditions, and error states. This data feeds monitoring and maintenance systems, allowing banks to predict failures, optimize cash replenishment, and reduce unplanned downtime across large ATM networks.

The value comes from integration with operations platforms, not from the terminal itself.

Wearable Device Payments

Wearable payments extend existing digital payment ecosystems to devices such as smartwatches and bands. IoT plays a role in enabling secure device authentication, real-time transaction validation, and usage monitoring, all governed through backend payment and fraud systems.

Banks treat this as a software extension of card and wallet platforms, with strict controls around identity and authorization.

Automated Queuing Systems in Branches

IoT-enabled queuing systems capture real-time data on customer flow, wait times, and service demand inside branches. This information integrates with branch management and workforce planning tools, helping banks allocate staff dynamically and reduce congestion during peak hours.

The outcome is smoother service delivery without redesigning core branch operations.

Digital Signage and Information Kiosks

Connected digital signage and kiosks deliver real-time, context-aware information to customers inside branches. IoT platforms manage content updates, usage analytics, and device health remotely, ensuring consistency across locations.

These systems are typically integrated with marketing, service notification, or branch communication platforms rather than operating in isolation.

Connected Point-of-Sale and Payment Touchpoints

IoT-enabled POS systems in banking environments monitor transaction health, device performance, and connectivity in real time. When linked to payment gateways and monitoring tools, they help reduce transaction failures and support faster issue resolution.

This implementation is especially relevant in high-volume retail banking and partner locations.

Cost of Implementing IoT in Banking and What Actually Drives ROI

There is no fixed price tag for implementing IoT in banking, and banks that look for one usually underestimate the effort. Most of the cost does not sit in devices or connectivity. It sits in software work that makes IoT data usable inside regulated banking systems.

In practice, IoT initiatives in banking typically start around $40,000 for narrowly scoped pilots and move upward to $600,000 or more when platforms are designed to operate across regions, integrate with core systems, and meet audit expectations. The difference between these numbers is rarely scale alone. It is deep.

What increases cost is how tightly IoT data is woven into existing banking workflows, how much real-time behavior is expected, and how much responsibility the system is allowed to carry.

What Influences the Cost Most:

- Whether IoT data is observed passively or used to trigger actions

- How many existing banking systems must consume the data

- Security and compliance expectations tied to uptime and auditability

- The need for real-time processing versus batch analysis

- How much flexibility the platform needs to support future use cases

- Complexity of the system where you need to integrate an IoT system

- Experience, expertise and location of banking software development service providers

Banks that treat IoT as a standalone monitoring layer spend less upfront, but often rebuild later. Those that design for longevity pay more early and less over time.

Here is an estimated timeline and cost of implementing IoT in banking and finance, based on project complexity

| Project Level | Typical Scope | Estimated Cost | Timeline |

|---|---|---|---|

| Basic | Single operational use case, limited integration, simple visibility | $40,000 – $120,000 | 3-4 months |

| Mid-Complex | Multiple use cases, secure APIs, alerting and dashboards | $120,000 – $220,000 | 4-6 months |

| Advanced | Core system integration, analytics, access controls, compliance alignment | $220,000 – $350,000 | 6-12 months |

| Enterprise-Grade | Multi-region rollout, real-time pipelines, AI-assisted insights, audit-ready design | $350,000 – $600,000+ | 12-18 months |

ROI of IoT in Banking: How Value Shows Up Over Time

The return on IoT in banking is rarely dramatic in the first quarter. It accumulates quietly.

Banks see value first through avoided incidents rather than new revenue. Fewer unexpected outages. Fewer emergency maintenance calls. Fewer situations where teams are reacting without context.

Over time, predictive maintenance and automation reduce operational drag, while real-time visibility improves confidence during audits and incident reviews.

The strongest ROI appears when IoT data is allowed to influence decisions that already exist, instead of creating new parallel processes. In those cases, IoT does not feel like a new system. It feels like the bank has fewer surprises.

What’s the Future of IoT in Banking & Finance: Upcoming Trends

IoT adoption in banking is settling into a more practical phase. The focus is no longer on connecting more assets, but on deciding which signals are worth acting on and which systems should trust them. Here are some latest trends which are posited to redefine the banking and finance landscape

- Predictive maintenance across distributed banking assets

IoT is increasingly used to anticipate failures across ATMs, branch equipment, and infrastructure before they impact customers. This is moving from pilot to baseline expectation in large banking environments. - IoT data embedded into core banking and operations platforms

Standalone IoT dashboards are fading. The clear trend is direct integration of IoT signals into operational, risk, and monitoring systems that banks already trust and govern. - AI-driven filtering and prioritization of IoT signals

As IoT deployments scale, banks are applying AI to reduce noise, detect anomalies, and surface only actionable insights. This makes IoT usable at enterprise scale without overwhelming operations teams.

These trends are driving adoption across the IoT in the banking and financial services market, which continues to grow as banks prioritize operational reliability, risk control, and real-time visibility.

Also Read: 18 Must-Know IoT Trends for Entrepreneurs to Watch

How Appinventiv Supports IoT-Driven Banking System Development

IoT in banking becomes meaningful only when it operates inside systems that are already under regulatory, uptime, and performance pressure. That is the environment Appinventiv has worked in for over 10+ years, supported by a team of 1600+ technology experts building and scaling enterprise-grade banking and fintech platforms.

We, as a trusted provider of IoT and banking software development services, do not introduce new layers of complexity, but help banks absorb real-time operational data into software systems that are already mission-critical.

Across banking and adjacent financial platforms, our experience consistently centers on secure data flows, resilient architectures, and decision-ready applications, which are the same foundations required for IoT-led banking systems to function at scale.

What This Looks Like in Numbers

- 300+ banking and fintech transformation projects delivered, where platform reliability and system integration were non-negotiable

- 99.90% SLA uptime achieved in core banking applications, a prerequisite when IoT signals influence live operations

- 100M+ transactions processed securely, relevant when IoT-driven insights trigger automated or near-real-time actions

- 98% fraud detection accuracy in financial systems, demonstrating readiness for converged physical and digital risk signals

- 40% efficiency gains delivered through selective automation, without introducing opaque decision logic

- 250+ connected IoT platforms delivered, focused on software layers such as ingestion, processing, analytics, and integration

- 100% compliance with international IoT security standards, essential when IoT data intersects with regulated banking environments

- 25+ countries supported with regulated platforms, reflecting experience across varied compliance landscapes

Where This Shows Up in Practice

To see how we design secure, data-intensive financial platforms in practice, explore our work on the Mudra Budget Management App and Edfundo Financial Literacy App, where complex financial logic is translated into scalable, governed digital systems.

We developed Mudra as a secure financial platform designed to ingest and process sensitive user financial data at scale. Our team built robust data validation and analytics workflows to deliver real-time insights while maintaining platform stability under continuous data updates. This same engineering discipline applies when we design systems where operational or IoT-generated data feeds into banking workflows.

We built Edfundo to structure complex financial logic into clear, explainable digital experiences. Our focus was on accuracy, governed data flows, and responsible information delivery at scale. These capabilities closely mirror the requirements of IoT-driven banking systems, where insight must be reliable, interpretable, and defensible.

IoT in banking does not succeed because devices connect. It succeeds when software platforms can absorb new data streams without breaking trust, uptime, or compliance. The metrics above reflect that capability, not experimentation.

If you are evaluating how IoT data can be operationalized within your banking platforms, our teams can help you assess feasibility, architecture, and ROI before you commit to scale. Contact us now.

FAQs

Q. How is IoT Used in Atm and Branch Automation?

A. In banking environments, IoT is primarily applied to improve operational visibility rather than automate customer interactions.

- Enables real-time monitoring of ATM and branch infrastructure, including device health and environmental conditions

- Supports predictive maintenance and uptime management through software platforms

- Feeds operational data into incident-management and monitoring systems used by banking teams

Q. How Does IoT Align With Soc 2 Requirements in Banking?

A. From a compliance standpoint, IoT strengthens controls when it is designed as part of the core platform architecture.

- Provides continuous visibility into system availability and operational integrity

- Strengthens access control and activity logging for infrastructure-related processes

- Supports audit evidence through consistent data capture and traceability

Q. How Can Banks Ensure Regulatory Compliance for IoT Systems?

A. Banks ensure compliance by treating IoT data as part of their regulated operational landscape. This means designing platforms with encrypted data flows, clear access controls, and documented data lineage. When IoT systems integrate directly with existing compliance and risk frameworks, audit readiness becomes a byproduct rather than an afterthought.

Q. How Does IoT Support Real-time Banking Data Processing?

A. IoT enables continuous data ingestion from distributed environments into event-driven banking platforms. Instead of waiting for periodic reports, systems can detect anomalies or performance degradation as it happens, allowing teams to respond within defined governance boundaries.

Q. What Are the Security Risks of IoT in Banking?

A. Security risks typically arise from unmanaged device identities, inconsistent firmware controls, and poorly governed access to operational data. Banks mitigate these risks by enforcing centralized device management, strong authentication, encryption, and by aligning IoT security with existing banking security architectures.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

IoT in Wearables: An Enterprise Guide to Architecture, Integration, and Scalable Deployment

Key Takeaways IoT wearables are shifting from pilot projects to enterprise infrastructure across the healthcare, industrial, and logistics sectors. Secure integration, compliance readiness, and data architecture determine wearable success more than device hardware alone. Continuous wearable data enables predictive healthcare, workforce safety optimization, and new enterprise operational intelligence capabilities. AI-driven analytics are transforming wearable data…

IoT in Mining: Modernizing Operations for Enterprise Efficiency and Safety

Key takeaways: The Internet of Things in mining turns scattered operational signals into live, decision-ready visibility across fleets, fixed plants, people, and the environment. The biggest wins usually show up first in uptime, then in safety response, and finally in energy and process stability. “More data” does not automatically mean better performance. Value comes when…

Key takeaways: IoT in insurance moves decisions from static risk estimates to real-time insights drawn from vehicles, homes, and personal devices. Connected sensors help insurers lower fraud, detect issues early, and settle claims faster with clear evidence instead of guesswork. The biggest IoT use cases today include telematics for driving habits, smart home leak and…