- Benefits and ROI of an Investment Portfolio Management System

- How to Build Investment Portfolio Management Software (Step-by-Step Process)

- Step 1: Discovery and Requirement Mapping

- Step 2: Architecture Design and Technology Choice

- Step 3: Prototype and MVP Development

- Step 4: Sophisticated Module Integration

- Step 5: QA, Compliance Checking, and Go-Live

- Step 6: Maintenance, Scaling, and Continuous Improvement

- Institutional Data Security in Portfolio Management Systems

- Core and Advanced Features Every Investment Portfolio Management Software Should Include

- Portfolio Operations & Analytics

- Risk, Compliance & Governance

- Trading & Execution

- Advanced Modules

- Administrative and Security Characteristics

- Types of Portfolio Management Applications and Software

- Essential Integrations for a Robust PMS Ecosystem

- How Much It Costs to Build Investment Portfolio Management Software?

- Why Appinventiv Is the Go-To Partner for PMS Development?

- FAQs

- Gain insight into how tailored PMS solutions maximize portfolio tracking, adherence, and decision-making of major financial entities worldwide.

- Learn all the basic and advanced features required to create investment analysis and portfolio management software that is efficient.

- Know the life cycle of a PMS development, requirement mapping, deployment, and continuous improvement.

- Discover the price perks when you build investment portfolio management software tailored to your needs and the way to maximize the development and ROI.

The requirements of a scalable, compliant platform have never been more evident as investment portfolio management software development continues to evolve, with financial institutions and wealth managers migrating to new, more integrated, AI-enabled solutions to replace their legacy systems.

It is not just about growth in assets under management (AUM), but also about increased demand for faster, more transparent decision-making. The stricter regulations and rapidly evolving financial environment demand that businesses re-examine their portfolio management and optimization strategies.

This guide outlines the main characteristics, development process, costs, and ROI of undertaking custom software development for investment portfolio management.

It offers an understanding of why businesses are implementing PMS, its most important advantages — such as real-time monitoring and support for compliance — and ways to create a system that fits your business.

We will also discuss why developing a portfolio management system for investment firms can be the right decision and what considerations and resources are needed to make it a reality.

By the end of this guide, you will know how a tailor-made PMS can help you achieve your growth, make your operations efficient, and address the constantly changing needs of your clients.

The right PMS could be the key to your success, whether you need to minimize manual operations, enhance customer satisfaction, or stay on top of regulatory demands.

Let’s explore the functionality of investment portfolio management software development and how such platforms can deliver quantifiable value to your organization.

Streamline portfolio management and see measurable efficiency gains with a custom PMS.

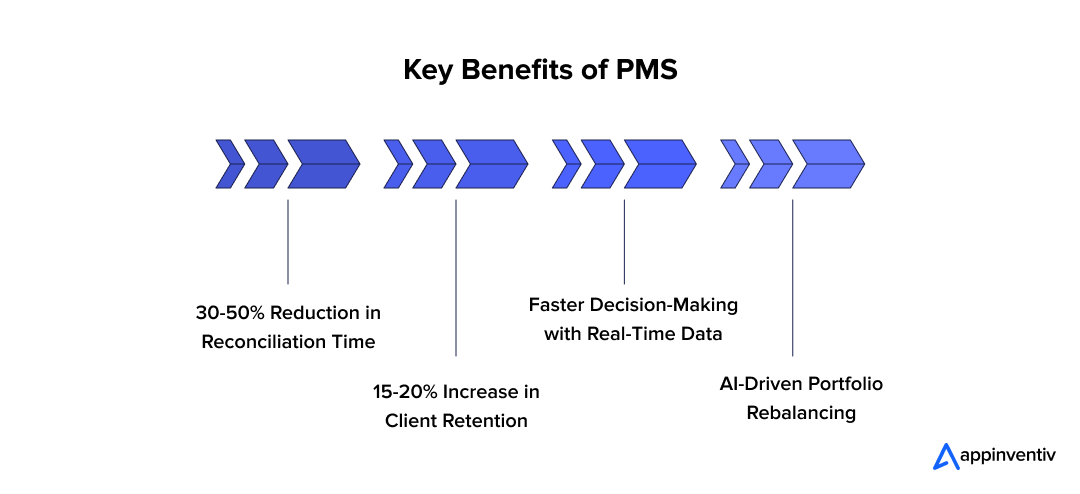

Benefits and ROI of an Investment Portfolio Management System

Financial portfolio management software development results in a custom-built solution that offers significant benefits in performance, compliance, and decision-making.

- Operational Efficiency: Automates reconciliation and reporting, minimizing manual effort and errors, thereby enabling quicker execution.

- Improved Compliance: Moves data to one place, automates regulatory controls, and keeps in line with global standards, reducing compliance risk.

- Data-Driven Decisions: AI-based analytics and real-time data enable wealth managers to make more informed investment decisions and enhance portfolio performance.

The benefits or use cases of portfolio management software are tangible, and the efficiency, compliance, and client satisfaction can be measured and reported.

The next section will discuss the lifecycle of PMS development, covering all stages from concept to deployment.

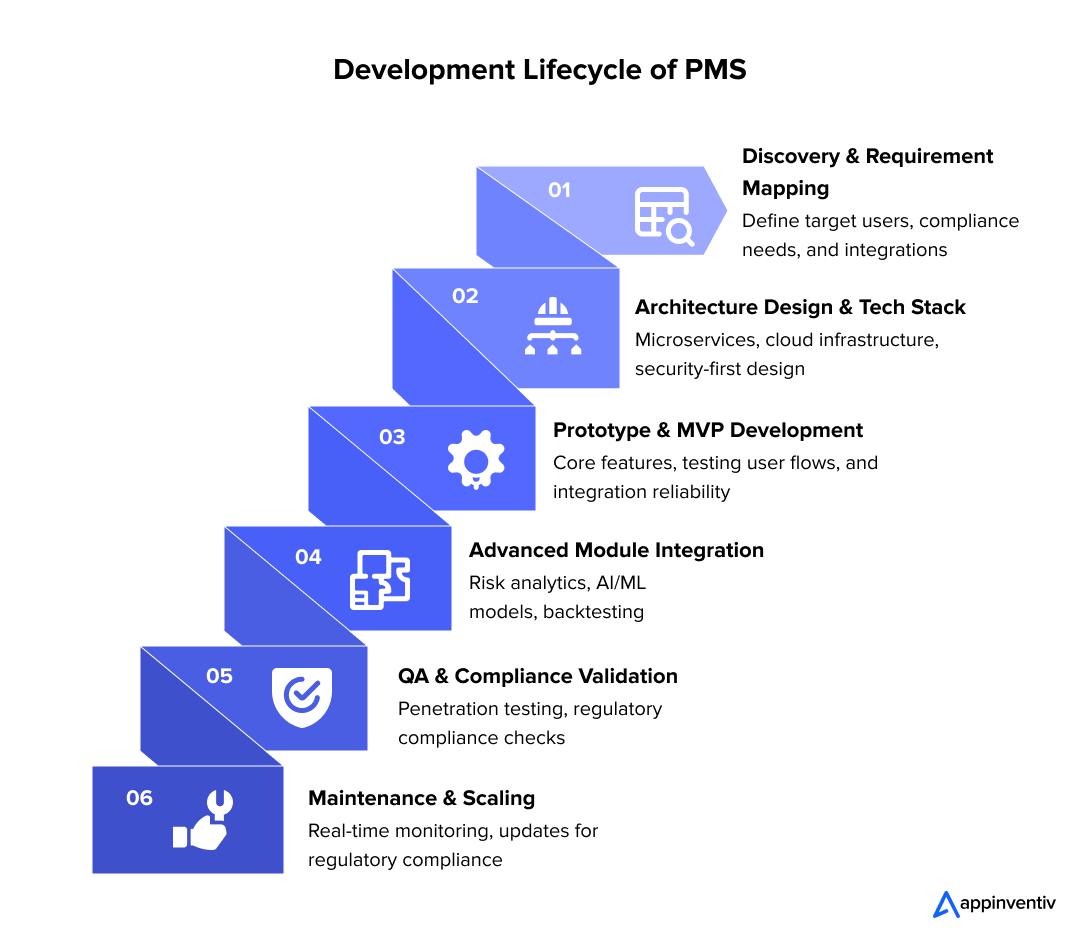

How to Build Investment Portfolio Management Software (Step-by-Step Process)

Investment portfolio management software development is a complex process with many important steps, each of which ensures security, scalability, and regulatory compliance.

The PMS market is projected to reach $13.12 billion by 2035, with a compound annual growth rate (CAGR) of 7.71%, highlighting the growing demand for sophisticated portfolio management solutions.

Understanding the development lifecycle for portfolio management software tools development will help you make informed decisions about your technology stack, required resources, and the time needed to develop a system that meets both business and technical requirements.

Here is a quick step-by-step guide to building investment portfolio management software:

Step 1: Discovery and Requirement Mapping

The goals, features, and requirements of the PMS need to be clearly defined before any development is done. This step is the precursor of all other things.

- Identify Target Users: Determine the stakeholders who will use the system, including asset managers, wealth managers, family offices, and traders. Understand their specific needs so the system can be tailored to their working procedures.

- Compliance Mapping: Find out what the global and regional regulatory provisions your PMS needs to comply with, including MiFID II, SEBI, and GDPR. These will affect the system’s architecture and data management protocols.

- System Integrations: Visualize the systems and other third-party tools (custodians, brokerages, CRM, data feeds) that should be integrated. Early mapping is necessary to make the system easy to connect to external sources.

Step 2: Architecture Design and Technology Choice

After mapping the requirements, the next step would be to develop the architecture and choose the tech stack for portfolio management software. This phase guarantees scalability, security, and performance.

Architecture Foundation

Most modern PMS platforms use a modular or microservices architecture to provide flexibility and independent scaling of key components such as trade execution, reporting, and analytics.

For institutional-grade PMS platforms, this architecture is extended with High-Frequency Data Ingestion layers and Event-Driven Architecture to support real-time pricing, trade events, and portfolio updates across markets.

Technologies such as Kafka or RabbitMQ enable real-time event streaming and low-latency data propagation across services.

Frontend and Backend Stack

Frontend technologies such as React or Angular are used to build responsive user interfaces for asset managers and traders.

Backend technologies such as Node.js or Python support real-time transaction handling and financial analytics processing.

Financial Data Layer

At the data layer, enterprise PMS platforms require Data Normalization pipelines that merge feeds from Bloomberg, Refinitiv, custodians, and brokers into a unified financial data model. This ensures consistency across valuation, risk, compliance, and reporting modules.

For large-scale institutional deployments, cloud data warehouses such as Snowflake or BigQuery store historical market data, transaction records, and performance datasets to support advanced analytics and regulatory reporting.

Database and Infrastructure

Databases such as PostgreSQL or Elasticsearch manage high-volume financial data retrieval for real-time valuation and reporting.

Cloud infrastructure on providers like AWS or Azure ensures scalability, resilience, and high transaction throughput. Microservices are managed using cloud-native orchestration tools such as Kubernetes.

Security-First Design

High-quality encryption, access controls, and secure API implementation are essential in a financial system. This is to ensure delicate client information is protected during rest and transit.

Step 3: Prototype and MVP Development

During this step, a prototype or Minimum Viable Product (MVP) is created. The MVP contains the basic functionality required to have the system operational, but on a small scale.

- Core Functionalities: This might include portfolio tracking, trade capture, and basic reporting. The aim is to create a working model that can interact with stakeholders and provide valuable feedback.

- User Testing and User Flows: At this stage, a user needs to be tested. Premeditate the fact that the interfaces of the system are easy to understand, and the data is distributed without any difficulties among various modules (trading, compliance, reporting).

- Integration Testing: Start integrating data feeds (market feeds, custodian feeds) to ensure external data is properly integrated into the platform.

Step 4: Sophisticated Module Integration

The second step is to add advanced functionality and modules to the MVP.

- Risk and Compliance Modules: Incorporate a more powerful risk analytics solution (Value at Risk, stress testing, scenario modeling) to enable portfolio managers to manage risk. Equally, incorporate compliance modules that automatically compare trades and transactions against regulatory standards.

- AI and Machine Learning Models: In the context of predictive analytics, combine AI models to forecast performance and provide investment recommendations based on historical data. It is also possible to identify abnormal behavior of a portfolio and propose the rebalancing measures using machine learning algorithms.

- Performance Maximization and Backtesting: Backtesting enables wealth managers to test how portfolios would have performed in the past under different strategies. By including it in the PMS, you are right to ensure your clients can analyze the efficiency of different investments before implementation.

Step 5: QA, Compliance Checking, and Go-Live

Comprehensive testing and validation at this point are of utmost importance before the system’s launch.

- Penetration Testing and Security Audits: Verify system safety by assessing for vulnerabilities. This will be important to prevent unauthorized access and data breaches, which may have serious legal and financial implications.

- Compliance Validation: Ensure compliance with all required regulations and standards for the system. This involves certifying the existence of audit trails, KYC processes, and data protection.

- User Acceptance Testing (UAT): Allows a limited number of users to use the system to identify any problems with functionality or usability before the full release.

Step 6: Maintenance, Scaling, and Continuous Improvement

Once the system is live, it must be monitored and continuously improved to ensure its long-term success.

- Checking Data Validity and Latency: It is important to conduct periodic checks of portfolio value accuracy and trade execution to confirm that real-time updates are functioning as intended.

- Scalability: Consider increased demand as transaction volumes increase; ensure the system can sustain it. This can include scaling or optimizing cloud resources to serve additional users and larger datasets.

- Regulatory Changes: As financial regulations change, the PMS must be updated to remain compliant. This involves continuous improvement to add new compliance features and reporting functionality.

- Improvement of the Features: New features and optimizations can be introduced over time based on user feedback. This keeps the platform competitive and ensures it remains relevant to the needs of current and potential clients.

AI-Based Portfolio Management Software development leverages AI and machine learning to improve your PMS’s decision-making capabilities significantly. The AI in Banking application by Appinventiv is an ideal illustration of how AI technologies can be implemented in banking.

Using our AI-based banking solutions, we incorporate machine learning models that forecast market trends and identify irregularities in financial transactions.

The same approach could be tailored to the PMS platform, allowing for predictive analytics, performance forecasting, and intelligent portfolio management.

Institutional Data Security in Portfolio Management Systems

Most financial institutions do not discover security gaps in theory. They find them during audits, vendor assessments, or live incident reviews. That is why security in portfolio management systems must be engineered from day one, not layered on later.

A modern PMS handles sensitive client data, portfolio positions, and transaction flows across APIs, integrations, and user interfaces. Protecting this environment requires institutional-grade controls that operate continuously without disrupting daily operations or compliance workflows.

Key security foundations include:

- Zero-Trust Architecture: Every user, system, and request is continuously verified. This limits lateral movement risk across internal services and connected platforms.

- AES-256 and TLS 1.3 Encryption: Portfolio and client data is encrypted at rest and in transit, securing databases, APIs, integrations, and access layers.

- Immutable Audit Trails: All transactions, portfolio changes, and user actions are logged in tamper-resistant records to meet SEC, FINRA, MiFID II, and internal audit requirements.

Together, these controls ensure data sovereignty, regulatory alignment, and institutional trust across the portfolio management ecosystem.

Also Read: Software Product Development – Steps and Methodologies

Next, we will examine the essence and advanced capabilities that any PMS must contain to catalyze these benefits in the following section.

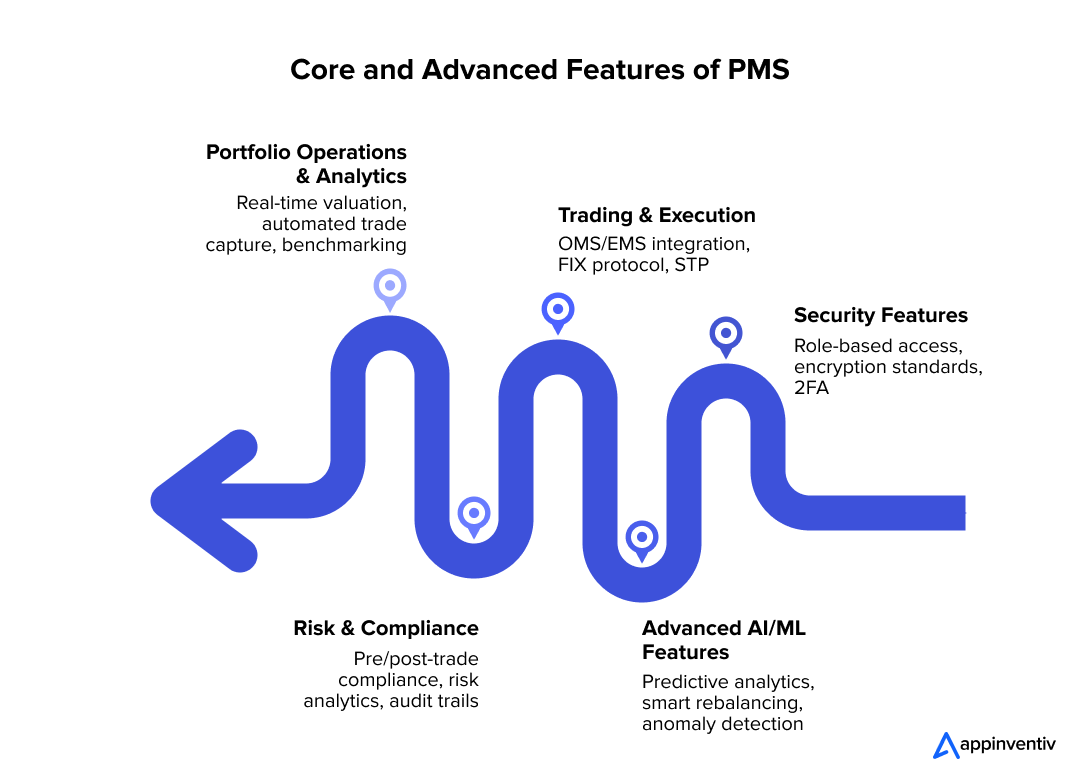

Core and Advanced Features Every Investment Portfolio Management Software Should Include

When engaging in customizable portfolio management software development for asset managers, it is important to know which features are critical and which are sophisticated, as these will distinguish your platform.

Core features for investment portfolio management software not only address the minimum requirement of tracking your portfolio, but also provide you with the provisions to expand and adjust to the changing market needs.

Portfolio Operations & Analytics

A robust PMS enables instant portfolio valuation, performance measurement, and reporting for numerous assets. The capital features of wealth management portfolio software enable the wealth managers and asset managers to track the health of their portfolios in real time and actively adjust them.

- Portfolio Valuation in Real Time: View the portfolio value in real-time for all asset types.

- Automated Trade Capture: Ensures data is entered accurately and reduces manual errors.

- Benchmarking: Compare your portfolio’s performance to potential benchmarks to determine success.

Such features enable more efficient portfolio management by providing accurate, immediate information.

Risk, Compliance & Governance

The two largest problems in investment management are regulatory compliance and risk management. A PMS ought to ensure that you remain in compliance with local and international rules and regulations, and to note potential risks m advance so they do not impact your portfolio.

- Pre- and Post-Trade Compliance Audits: Ensure all trades comply with regulations.

- Risk Analytics: Value-at-risk (VaR), stress testing, and scenario modelling tools can be used to forecast and avert financial risk.

- Audit Trails and Regulatory Reporting Dashboards: Ease of compliance with regulations using automated audit trails and straightforward reporting.

These aspects not only help prevent costly compliance errors but also proactively control risk across portfolios.

Trading & Execution

The trade implementation is the most important part of modern portfolio management. An integrated Order Management System (OMS) and an Execution Management System (EMS) enable smooth routing and execution, accelerating the process and saving money.

- OMS/EMS Integration: Automates order routing for efficient, fast processing.

- FIX Protocol Support: Unified communication between trading systems to execute faster.

- Straight-Through Processing (STP): This speeds up the settlement process and removes the human factor.

These characteristics will greatly reduce the time required to conduct trades and effect transactions, and limit settlement risk.

Advanced Modules

There is an increasing trend of machine learning and AI in investment management. PMS platforms will be able to provide superior decision-making tools beyond conventional approaches because of the application of sophisticated analytics.

- Predictive Analytics: Use AI to forecast a portfolio’s performance based on past data and market trends.

- Algorithmic Advisory: Deploying ML models for high-fidelity asset allocation aligned with client objectives and risk profiles.

- Anomaly Detection: Identify abnormalities in a portfolio’s performance that may be due to portfolio risks.

The features help wealth managers make smarter, data-driven decisions to optimize portfolio returns.

Administrative and Security Characteristics

A PMS should also secure sensitive information of your organization and its clients. Robust security protocols are non-negotiable for maintaining data sovereignty and institutional trust.

- Role-Based User Access: Only authorized people should gain access to sensitive data.

- Two-Factor Authentication (2FA): An additional protection of client and firm information.

- Encryption Standards: Ensure data integrity and prevent unauthorized access.

Security is a must when handling financial data, and these features would help ensure your PMS meets industry data protection standards.

Speaking about advanced modules such as AI-powered analytics or machine learning-based rebalancing, it is useful to refer to real-world AI applications that have already proven valuable.

Indicatively, Mudra, an artificial intelligence (AI)- based budget management application, incorporates chatbot technology that assists users in making financial decisions in real time.

The same technology could be used in a PMS to provide real-time portfolio information and to recommend rebalancing plans based on market conditions and client demand.

Types of Portfolio Management Applications and Software

The software and applications of portfolio management are of many types, categorized according to the business needs and various levels of the users. These kinds of types are usually:

- Personal Portfolio Management Software: This is used by an individual investor to monitor personal investments, manage a portfolio, and calculate performance.

- Investment Portfolio Management Software (IPMS): Asset managers, wealth managers, and financial institutions use it to manage and track client portfolios, analyze performance, and ensure compliance.

- Robo-Advisory Platforms: They are automated financial advice and portfolio management services that involve minimal human intervention due to algorithms.

- Enterprise Portfolio Management Software (EPM): This type of software is typically used by large financial institutions to manage complex portfolios, automate trading, and provide more sophisticated risk management and compliance functionality.

- Risk Management Software: Specialized in detecting and addressing risks at portfolios, it offers features such as stress testing, scenario modeling, and VaR (Value at Risk) analysis.

- AI and ML-Based Portfolio Management Solutions: These solutions rely on predictive analytics (AI and ML), portfolio optimization, and auto-rebalancing.

Each type is designed to address specific requirements based on portfolio size, complexity, and regulatory requirements.

The following section discusses the key integrations required to achieve a round and scaled PMS platform capable of supporting the increasing demands of your enterprise.

Essential Integrations for a Robust PMS Ecosystem

An investment Portfolio management Software (PMS) does not run on its own. It should seamlessly integrate with other key systems and data sources within your organization to support enterprise-level operations. A networked PMS enables improved data alignment, simplified processes, and better decision-making.

- Custodian and Brokerage Integrations.

A PMS must be able to interface with custodians and brokers to promptly coordinate position and transaction information. Such integrations ensure that the portfolio positions are up to date and trades are not done manually.

- Position and Transposition Data Synchronization: Timely updates from the PMS and custodians will ensure accurate reporting of portfolio holdings and movements.

- Trade Settlement: As part of the brokerage integration, trade settlement will be automatic and executed promptly.

- Market Data Providers

Live market pricing and benchmark information are needed to correctly value and track the portfolio. A PMS must be connected to market data suppliers to receive real-time pricing, benchmarks, and analytics feeds.

- Real-Time Pricing: Values portfolios in real time based on recent market trends.

- Benchmark Data: It allows the portfolio to be compared with appropriate benchmarks to aid performance evaluation.

- CRM and Accounting Systems

This can be enhanced by integrating with your customer relationship management (CRM) and accounting systems so that client data and financial records are correlated with the portfolio data. This simplifies reporting and client servicing, ensuring that all teams have the most recent information at their fingertips.

- Client Data Synchronization: Integrate portfolio data performance with CRM data to provide 360-degree insight into each client.

- Financial Records Alignment: To ensure accounting teams are not at a disadvantage, ensure they have updated, precise portfolio information necessary for invoicing and reporting.

- RegTech and KYC Modules

To comply and ensure that your investments are lawful and ethical, a PMS must be integrated with RegTech (Regulatory Technology) and Know Your Customer (KYC) modules. These integrations aid in onboarding new clients, monitoring transactions, and checking for anti-money laundering (AML) compliance.

- KYC and AML Compliance: Simplify the customer registration system and ensure compliance with all procedures.

- Transaction Monitoring: This will be used in conjunction with AML tools to indicate suspicious activity and address compliance with regulatory requirements.

- Reporting and BI Tools

Timely, actionable intelligence is important to enterprises. Investment performance reporting software can be integrated with business intelligence (BI) tools, such as Power BI, Tableau, or custom reporting systems, to develop interactive dashboards and create detailed financial reports for internal and client users.

The requirements of a scalable, compliant platform have never been more evident as financial institutions and wealth managers migrate to new, more integrated, AI-enabled enterprise investment portfolio software to replace their legacy systems.

- Custom Dashboards: Help managers visualize portfolio performance, risk metrics, and investment results.

- High-Level Reporting: Automate compliance, client, and internal analysis report creation.

Mobile app development and user experience should be prioritized to achieve your PMS scales and ensure compatibility with other solutions.

An excellent example of such an application of a properly designed mobile app is Edfundo, a financial literacy app created by Appinventiv; it provides a user-friendly experience while incorporating complex financial information.

In the same vein, PMS must have a user-friendly interface and easy integration with market data providers, custodians, and regulatory tools to ensure ease of use and accessibility for all users, including asset managers and clients.

Appinventiv’s Insight Box

The value of a PMS lies in its ability to integrate with multiple systems. Without smooth data exchange with custodians, brokers, market data providers, and compliance systems, your PMS becomes a siloed data repository rather than a strategic decision engine.

The most successful PMS platforms automate and ensure every piece of data is integrated in real time, thus providing actionable insights. This level of integration enhances accuracy, accelerates decision-making, and enables your firm to scale without adding complexity.

Next, we will discuss the development costs of investment and portfolio management software, from initial development through to maintenance.

How Much It Costs to Build Investment Portfolio Management Software?

Depending on the system’s complexity and features, the decision to build investment portfolio management software can be costly. The average cost ranges, depending on the extent of the project, are as shown below.

- Cost Ranges by Scope

| Type | Typical Cost Range | Timeframe |

|---|---|---|

| MVP / Proof of Concept | $40K to $120K | 3 to 6 months |

| Mid-Level PMS with Analytics | $120K to $250K | 6 to 9 months |

| Enterprise-Grade PMS | $250K to $500K+ | 9 to 18 months |

- Key Cost Drivers

Factors that may greatly influence the development cost are as follows:

- Integration Complexity: The more integrations with 3rd-party systems (e.g., brokers, data providers), the more it costs.

- Regulatory Compliance: Adherence to global regulations such as automated MiFID II reporting, SEC Rule 206(4)-7 compliance controls, and GIPS (Global Investment Performance Standards) alignment increases development complexity and costs, but serves as a critical trust signal for institutional asset managers.

- Security and Cloud Infrastructure: Data security and scalability must be highly assured, which increases development and maintenance costs.

- Personalized UI/UX and AI Capabilities: Developing customized interfaces and incorporating AI/ML models will require additional time and resources.

- Cost Optimization Tips

To maintain costs under control, consider the following:

- Modular Architecture: Design features modularly and add functionality as required.

- Open APIs: Open up to third-party applications instead of developing everything in-house.

- Agile Methodology: Agile development involves developing and testing features in small steps, then refining them based on feedback.

- Established Developers: Far more efficient and effective to build with an established fintech development firm such as Appinventiv.

Knowledge of the cost structure in building an investment platform with PMS will help align expectations and the budget with the long-term value it may deliver. In the following section, let’s explore the reasons why Appinventiv is the appropriate partner to develop your PMS.

Also Read: A Comprehensive Guide to Estimating Custom Software Development Costs

Customize your PMS with AI, real-time analytics, and more to meet your unique business needs.

Why Appinventiv Is the Go-To Partner for PMS Development?

Appinventiv is the best company to work with in designing a custom Investment Portfolio Management Software (PMS). With 200+ fintech products and 10+ years of fintech experience, we focus on developing secure, scalable, and compliant financial institutions globally.

We know the fintech sphere very well, which enables us to build investment portfolio management software that meets business and regulatory needs and delivers long-term value.

It could be facilitating flawless integrations, optimizing performance, or ensuring compliance, but in any case, we provide custom fintech software development solutions that enable growth and innovation.

An Investment Portfolio Management Software (PMS) is a tailor-made application that may change how your firm manages portfolios, complies with regulations, and makes evidence-based decisions.

A PMS offers concrete value to your organization by automating your core processes, improving the efficiency of your operations, and improving your risk management. The long-term gains, such as improved client satisfaction and scalability, make it worthwhile, though the development process requires a careful approach.

Appinventiv, as your investment portfolio management software development partner, would help you have a secure, compliant, and business-specific PMS that would keep your firm competitive in a fast-changing market.

FAQs

Q. How to choose the right investment portfolio management solution for your organization?

A. In selecting a PMS, you need to evaluate the unique requirements of your firm, i.e., the type of assets under management, regulatory requirements, and volume of operations. The solution must fit with your current systems, be customizable, and scale with future expansion. Pay attention to platforms that are flexible and align with your long-term business strategy.

Q. How does Appinventiv support enterprises in implementing investment portfolio management software?

A. Appinventiv provides full service to the whole process of investment portfolio management software development, including the requirements collection process and the final deployment.

Our specialists ensure the software is configured to your specific business requirements, integrates seamlessly, and is secure and compliant with data regulations. Our extended maintenance and support services are also available to ensure the system grows in tandem with your firm’s expansion.

Q. What is the typical cost-benefit or ROI model for building vs. buying a PMS platform?

A. Building personal investment portfolio management software is worth more money in the long run than purchasing one that is not custom-made because it can be configured to meet the needs of your firm, and it will expand with you. Custom solutions enable more effective data management, more efficient operations, and integration with other systems.

Although off-the-shelf PMS solutions may be cheaper in the short run, they are not always as flexible as needed to meet the business’s changing needs, which may prove more expensive in the long run.

Q. How does Appinventiv integrate AI/ML for predictive analytics, scenario modeling, and smart rebalancing in PMS platforms?

A. Appinventiv is an AI-based approach to portfolio management, which gives insight into the predictive market trends and the performance of the portfolio. Our AI-driven applications can be used for predictive analytics of asset valuations and returns, and for machine-learning-based rebalancing, ensuring that portfolios are in line with client objectives and risk tolerance to maximize returns and minimize risk.

Q. What regulatory and data governance standards does Appinventiv follow during PMS development?

A. Appinventiv guarantees that any PMS solutions are in line with the global regulatory requirements, such as MiFID II, SEBI, and GDPR. Our team has developed a high level of data governance to safeguard sensitive financial information, ensure its security, and adhere to industry regulatory policies and best practices in data security and privacy. We do not add these standards to the system architecture later and remain compliant in the long term.

Q. Why hire Appinventiv as your portfolio management software development partner?

A. Having a history of experience in custom software development for investment portfolio management, delivering 200+ secure, scalable, and compliant fintech products, Appinventiv is highly skilled in its work.

Our end-to-end services are 100 percent tailored to your business needs, remain in compliance with regulatory standards, and offer flexibility to accommodate your business as it expands.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…