- Key Challenges in Maintaining Regulatory Compliance and Appinventiv’s Adaptive Approach

- Rapid Regulatory Evolution

- Cross-Jurisdictional Fragmentation

- Balancing Innovation Speed with Governance Rigor

- How Do We Solve Region-Specific Compliance Challenges

- Middle East: Innovation Under Watchful Eyes

- United States: Old Systems, New Demands

- Asia-Pacific: Diverse Rules, One Objective

- Canada: Strong Governance, Ethical Standards

- Europe: Where Privacy Defines Trust

- United Kingdom: A Global Leader in Financial Regulation

- Appinventiv Compliance Framework: A Blueprint for Trust

- Compliance-by-Design: The DNA of Every Project

- Layered Security Architecture

- Data Privacy & Governance Framework

- Continuous Monitoring & Automated Audits

- Reinforcing Trust through Strategic Partnerships & Certifications

- Compliance in Action: Real-World Examples from Our Portfolio

- Digital Banking in the UAE

- WealthTech Transformation in Europe

- Payments Software Modernization in the US

- Technology’s Role in Staying Compliant

- RegTech: The New Core of Modern Compliance

- Artificial Intelligence

- Machine Learning

- Blockchain

- Cloud Computing

- The Cost & ROI of Compliance-First Development

- Why Global Financial Enterprises Partner with Appinventiv

- FAQs

Key Takeaways

- Compliance fuels innovation. Appinventiv integrates governance at every stage, turning regulation into an enabler, not a roadblock.

- Global laws, local alignment. From GDPR to SAMA and PSD2, our frameworks adjust effortlessly to regional mandates.

- AI-powered vigilance. Predictive analytics and automated audits make compliance continuous and transparent.

- Smarter cost control. Early compliance planning cuts remediation costs by up to 40% while improving audit speed.

- Built for what’s next. With RegTech, blockchain, and ML integration, our clients stay ready for the next wave of financial regulations.

The fintech sector thrives on speed: instant payments, algorithmic lending, AI-backed wealth management, but beneath that agility lies an unrelenting truth: a single compliance misstep can collapse everything.

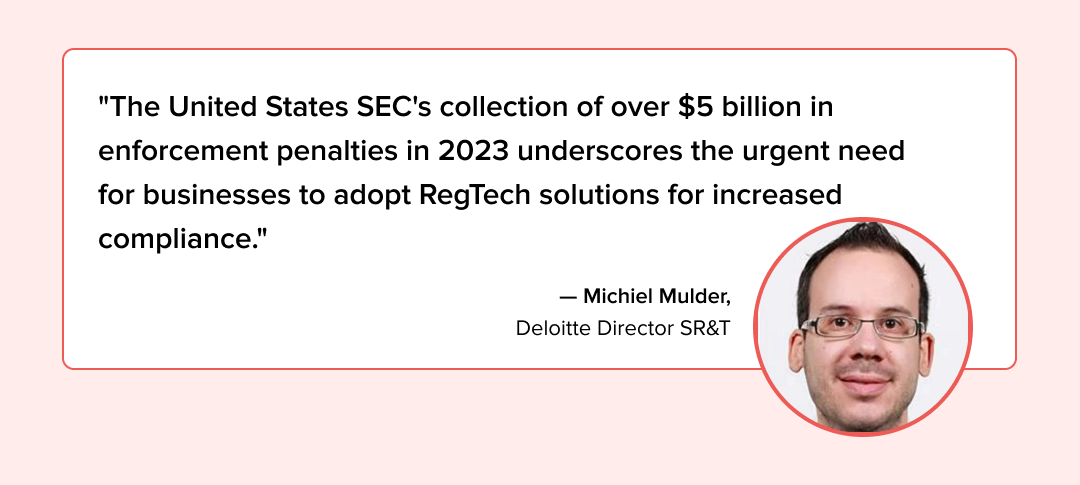

In 2024 alone, regulators worldwide imposed $4.5 billion in fines on banks for breaches tied to anti–financial crime protocols, consumer protection rules, and operational compliance. The most frequent cause? Failures in anti–money laundering (AML) compliance, particularly inadequate transaction monitoring and risk assessment systems.

Over a period spanning nearly a quarter-century (2000-2024), the cumulative financial impact of regulatory enforcement for AML and sanctions breaches has reached $45.7 billion in major penalties globally. Each fine represents more than a fiscal penalty; it’s a public statement that in the digital finance age, governance is inseparable from innovation.

At Appinventiv, we understand that the cost of non-compliance can be huge and sometimes irreparable. That’s why we view compliance not as an obstacle to progress but as the scaffolding that allows innovation to stand tall. The financial software we engineer operates in markets where the smallest oversight can attract regulators’ scrutiny, delay product launches, or even revoke licenses. For us, compliance isn’t a cost center; it’s a quality standard.

Our approach to financial software development starts with a principle we hold firm:

“We don’t treat compliance as a barrier but as a foundation for high-quality, trusted software.”

This principle guides how we design systems, architect databases, and integrate third-party APIs. Compliance lives in our source code, not just our documentation. We build with laws like GDPR, CCPA, Basel III, KYC/AML, and PCI-DSS in mind from the first sprint, ensuring every product meets audit requirements before it reaches production.

Or, as we often say internally,

“Every product we build is compliant by design, not as an afterthought.”

It’s a multi-layered model where technology, process, and human expertise converge that keeps our fintech clients competitive in an environment where non-compliance isn’t just risky; it’s unsustainable.

Banks worldwide paid $4.5 billion in fines for ignoring AML and consumer-protection rules.

Start your compliance transformation now before regulators find the gaps.

Key Challenges in Maintaining Regulatory Compliance and Appinventiv’s Adaptive Approach

Building compliance-ready software is not a one-time milestone; it’s a continuous exercise in anticipation. Regulations evolve, markets expand, and digital ecosystems grow more complex. Beyond meeting regulatory requirements, financial institutions need an integrated cybersecurity risk management strategy that aligns compliance efforts with proactive threat detection, incident response planning, and continuous security monitoring.

Rapid Regulatory Evolution

Financial regulations shift faster than most development cycles. Each jurisdiction introduces frequent updates in AML, data protection, or open-banking laws.

Appinventiv’s Approach: Our in-house team of 1600+ tech experts functions as an intelligence hub, tracking regulatory changes across countries. The team translates these shifts into actionable engineering standards, ensuring our builds are future-aligned before deployment.

Cross-Jurisdictional Fragmentation

Global fintech operations must reconcile conflicting requirements like GDPR’s data minimization principle versus data localization mandates under RBI or SAMA.

Appinventiv’s Approach: We maintain a dynamic Global Compliance Knowledge Base that documents and compares regional standards. This repository informs our architecture design, helping clients achieve global scalability without breaching local mandates.

Balancing Innovation Speed with Governance Rigor

Product teams push for continuous release cycles, while regulatory audits demand documentation and testing. The tension between speed and governance can cripple time-to-market.

Appinventiv’s Approach: We embed automated compliance validation into CI/CD pipelines. Each code release passes through versioned policy checks, rule-based regressions, and instant audit readiness scoring, maintaining agility without compromising accountability.

This approach works best when paired with a structured software audit that evaluates whether governance controls actually hold up across real production environments.

How Do We Solve Region-Specific Compliance Challenges

No two markets look at compliance the same way. A digital-banking rule that passes in London might raise red flags in Singapore. For FinTech companies working across borders, this shifting ground is the real test: one product, many laws, zero tolerance for error.

Middle East: Innovation Under Watchful Eyes

FinTech is booming across the Gulf, but so are the guardrails. Bodies such as SAMA, VARA, and ADGM expect digital products to pass through rigorous cyber-security and consumer-safety reviews before launch.

For one UAE neobank, we built a compliance core that monitored transactions in real time while meeting local data-residency laws. The idea was simple: give regulators the transparency they need and give users the confidence they deserve.

United States: Old Systems, New Demands

American banks still carry the weight of legacy infrastructure. Yet they must meet the disclosure and audit rules of SOX, GLBA, and FINRA. Retrofitting compliance into dated systems often feels like replacing an engine mid-flight.

We usually solve this with an integration layer that adds encryption, role-based permissions, and trace logs without rewriting the institution’s entire core. The outcome is smoother audits and fewer operational shocks.

Asia-Pacific: Diverse Rules, One Objective

Across Asia-Pacific, regulation stretches from India’s RBI lending guidelines to Australia’s APRA and AUSTRAC standards. It’s a patchwork that demands flexibility more than uniformity.

Our approach is modular: compliance components that can be turned on or tuned differently for each jurisdiction. That’s how clients expand into new regions without rebuilding from the ground up.

Canada: Strong Governance, Ethical Standards

Canada’s regulatory landscape emphasizes strong consumer protection and data governance through regulations like PIPEDA (Personal Information Protection and Electronic Documents Act). With its robust compliance standards, Canada ensures that businesses protect personal data while promoting innovation.

We take a proactive approach by weaving privacy into the core of our solutions, ensuring compliance is built in from the start, helping clients foster trust with Canadian consumers. For our clients in Canada, partnering with us means implementing secure data-handling practices that prioritize individual rights every step of the way.

Europe: Where Privacy Defines Trust

Europe continues to lead with regulation that puts users, not institutions, at the center. The GDPR, PSD2, and the newer EU Data Act make data handling an ethical issue as much as a technical one. Every record needs a reason, every transaction a trace.

When we design systems for European clients, we start by mapping every data point: who collects it, where it lives, and who touches it. The platforms we build support live consent updates and local data-store segregation so that privacy isn’t just declared; it’s provable.

United Kingdom: A Global Leader in Financial Regulation

The UK’s regulatory framework is a benchmark for global standards. Regulations like the Financial Services and Markets Act (FSMA) and the FCA’s Conduct of Business Sourcebook (COBS) focus on consumer protection, ensuring that businesses handle customer data and transactions responsibly.

These regulations also set a high bar for transparency, requiring firms to be accountable and transparent in their dealings with consumers and regulators. We ensure compliance with these rules while maintaining the agility of new-age FinTech applications.

A Deloitte Report captured the importance of staying compliant with regulatory compliance, noting that the EU AI Act alone imposes penalties of up to $44.5 million / £35 million or 7% of a company’s global annual turnover for breaches involving prohibited AI systems.

For a digital engineering company like ours, this insight shapes every architecture decision. We don’t just build software for compliance, we build systems that adapt to regulation. Because the laws will change and the software must be ready when they do.

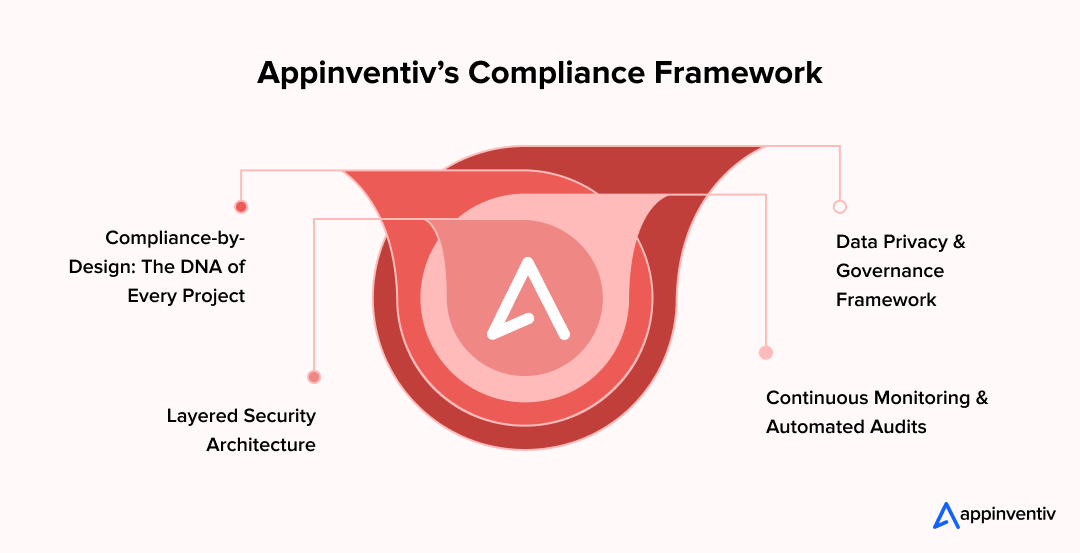

Appinventiv Compliance Framework: A Blueprint for Trust

To stay ahead in this environment, we designed what we call our Multi-Layered Compliance Framework, a continuous ecosystem where regulatory alignment, cybersecurity, and process governance function as one.

Compliance-by-Design: The DNA of Every Project

At Appinventiv, compliance begins before a single line of code is written. During the discovery and scoping phase, our domain consultants, security analysts, and legal experts collaborate to interpret applicable regulations for the target geography. Whether the project involves a blockchain-based payments app in Europe or a wealth management portal in the GCC, compliance touchpoints are mapped early to eliminate rework later.

This design-first approach ensures that compliance isn’t retrofitted; it’s architected in. As our internal mantra goes, “If you build it compliant, you don’t have to fix it. ”

Every sprint cycle includes regulatory checkpoints alongside the usual quality and functionality assessments. This means the final product emerges audit-ready, whether it’s facing a PCI-DSS certification or a GDPR data review.

Layered Security Architecture

Security and compliance aren’t twins; they’re allies. We implement multi-layered protection through end-to-end encryption, multi-factor authentication, and zero-trust models that authenticate every request as potentially untrusted.

For a global banking client in the Middle East, this approach helped meet SAMA’s cybersecurity guidelines while keeping response times under 200 milliseconds. The architecture included distributed identity validation across private cloud nodes and compliance logs automatically synchronized with audit systems.

Our belief is simple: if your infrastructure is secure, compliance becomes verifiable. If it isn’t, no legal clause can save it.

Data Privacy & Governance Framework

Data today is the currency of trust. How it’s collected, processed, and stored determines the integrity of every financial product. We follow a robust governance model that blends data anonymization, field-level encryption, and region-specific storage protocols aligned with CCPA and GDPR compliance.

We also conduct periodic third-party penetration testing and data audits, ensuring every layer, from APIs to data lakes, meets or exceeds international standards. A dedicated internal committee oversees regulatory changes and updates policies accordingly, maintaining parity between evolving laws and deployed systems.

This transparency-driven structure doesn’t just mitigate risk, it builds brand credibility. When clients know their compliance is visible and verifiable, their trust in digital transformation for banking deepens.

Continuous Monitoring & Automated Audits

‘The pace of FinTech innovation demands vigilance, not reactivity. That’s why we integrate powerful tools to continuously monitor transaction patterns, data integrity, and regulatory thresholds in real time. AI-based rule engines detect anomalies before they trigger violations.

Machine learning systems flag suspicious activity, whether it’s potential AML breaches or unapproved API calls, creating instant alerts for compliance teams. This automation not only shortens audit preparation time, but it also makes our clients’ ecosystems perpetually audit-ready.

In essence, compliance stops being a quarterly exercise and becomes a daily assurance.

Reinforcing Trust through Strategic Partnerships & Certifications

Partnerships: Compliance gains credibility only when it’s verified. Over the years, we’ve built alliances with leading cloud providers, security auditors, and risk-management firms to keep our processes continuously tested.

Our proven partnerships that strengthen compliance assurance are:

- AWS, Azure & Google Cloud: Used for secure, compliant cloud deployments and AI model governance under ISO and SOC frameworks.

- ServiceNow & MuleSoft: Enabling automated workflows for incident tracking, access control, and audit trail management across regulated environments.

- SAP & Oracle: Supporting financial integrity, data traceability, and standardized reporting within multi-entity banking operations.

- Snowflake & Databricks: Providing scalable, compliant data lakes with field-level encryption and governance models aligned with GDPR and PCI-DSS.

- Red Hat & Docker: Building secure, containerized microservices with embedded compliance checks for deployment and lifecycle management.

- Stripe & Salesforce: Ensuring transaction transparency, KYC automation, and customer data protection across fintech and payment ecosystems.

Certifications: We also hold several esteemed and valuable certifications. Each renewal involves external audits that probe how we handle data, govern access, and respond to incidents.

Our key certifications that form the bedrock of our operational excellence are:

- ISO 27001 – Validating our information security management and data risk controls.

- SOC 2 Type II – Certifying our commitment to maintaining integrity, confidentiality, and availability across systems.

- ISO 9001 – Demonstrating disciplined quality assurance and performance consistency across all projects.

- CMMI Level 3 – Recognizing process maturity and standardization in delivery practices.

These aren’t just certifications; they’re checkpoints that ensure our methods keep pace with evolving mandates like GDPR, Basel III, and PCI-DSS.

When clients work with us, they plug directly into this verified ecosystem. Their software inherits a framework already proven to regulators worldwide.

Compliance in Action: Real-World Examples from Our Portfolio

Compliance isn’t theory for us; it’s practice. Every project we deliver carries measurable proof of how regulatory precision and technical depth can coexist, even in highly governed financial ecosystems. Here’s how we’ve helped some leading financial institutions translate complex regulations into secure, scalable software that passes every audit with confidence.

Digital Banking in the UAE

A leading Gulf bank sought a secure digital banking platform that met SAMA and PCI-DSS regulations while reducing manual oversight.

We built an encrypted payment engine integrated with automated AML alerting and real-time compliance logging.

Results:

- 40% reduction in manual compliance workload after automation.

- 3x faster internal review cycles, cutting audit prep time from weeks to days.

- 100% audit readiness achieved under SAMA’s cybersecurity guidelines.

WealthTech Transformation in Europe

A pan-European wealth management firm needed to unify GDPR and MiFID II obligations while improving data transparency.

We delivered a consent-driven data management layer that empowered users to control, update, or revoke permissions seamlessly.

Results:

- 30% fewer regulator-driven data requests due to real-time consent visibility.

- Instant audit traceability for every data change across multiple EU jurisdictions.

- Higher client satisfaction scores, with transparency cited as a key differentiator.

Payments Software Modernization in the US

A US FinTech company operating under SOX and FINRA oversight needed to minimize reporting errors and fraudulent transaction alerts.

We developed an AI-based fraud detection engine that continuously learns from past anomalies to improve detection accuracy.

Results:

- 50% reduction in false positives within the first quarter of deployment.

- 2x faster compliance reporting turnaround, improving regulator response times.

- Stronger audit reliability, leading to cleaner quarterly submissions under SOX review

Work with Appinventiv to design software that regulators respect and users trust.

Technology’s Role in Staying Compliant

Technology has turned compliance from a defensive posture into a forward-looking discipline. What was once a manual, report-heavy process is now powered by intelligent systems that learn, adapt, and anticipate risk. Before diving into specific tools, it’s important to understand that the movement that connects them all is RegTech.

RegTech: The New Core of Modern Compliance

RegTech (Regulatory Technology) has become the foundation of how financial organizations manage, track, and prove compliance in real time. It combines automation, analytics, and secure infrastructure to make regulatory management continuous instead of reactive.

At Appinventiv, we integrate RegTech solutions that:

- Automate reporting and audit preparation across regions.

- Digitize KYC/AML checks using AI-driven pattern analysis.

- Map compliance frameworks like GDPR, PSD2, and SAMA to system logic.

- Deliver unified dashboards that flag potential breaches before they escalate.

Four powerful technologies that shape compliance integrity are:

Artificial Intelligence

AI sifts through millions of transactions to uncover risks humans might miss. Instead of reacting after a breach, institutions can adjust controls the moment patterns shift.

Machine Learning

Our machine-learning models evolve with each regulatory update. When thresholds for AML or fraud change, the model adapts, no manual rule-rewriting required. The payoff is fewer false alarms and faster verification cycles.

Blockchain

Immutable ledgers make every step auditable. We use blockchain to secure KYC validation and transaction history, ensuring regulators can verify provenance without accessing sensitive data directly.

Cloud Computing

The cloud gives compliance both scale and precision. We deploy region-locked private or hybrid environments that respect data-residency laws while keeping monitoring continuous.

Together, these technologies shift compliance from burden to advantage. Instead of slowing development, they make it possible to innovate safely and stay one step ahead.

The Cost & ROI of Compliance-First Development

On average, building compliance-driven financial software can increase your development budget by around 10%. For instance, if your base project cost is $100,000, integrating regulatory features such as data encryption, AML checks, audit trail logging, and GDPR-ready architecture would add roughly $10,000 to your overall spend.

That additional investment covers risk mapping, compliance validation, and security audits, essentially future-proofing your platform against regulatory exposure.

Compliance may appear costly upfront, but the investment favors those who invest early. Typically, reactive remediation costs can exceed proactive compliance investments by more than threefold.

At Appinventiv, we’ve observed similar patterns. Allocating an additional 10–15% of project budgets to compliance engineering typically saves 30–40% in future remediation and legal expenses.

For instance, if your initial project cost for a fully compliant product was $110,000, it could save you anywhere between $30,000 and $40,000 in potential remediation, legal, and audit-related expenses down the line. Those savings don’t just protect capital; they preserve credibility and speed up future regulatory approvals.

That means avoiding extended downtime, reputational loss, and hefty fines, all while gaining faster audit approvals and investor confidence. In essence, beyond savings, compliance-first builds accelerate investor confidence and regulatory approval, making them both a financial and strategic asset.

Why Global Financial Enterprises Partner with Appinventiv

Today’s financial software must not only innovate, but it must also endure scrutiny. At Appinventiv, we design systems that meet the world’s toughest compliance standards from day one. Whether it’s an enterprise banking suite, a payments platform, or a DeFi ecosystem, our FinTech software development services ensure your product remains audit-ready, scalable, and regulator-approved.

This commitment to regulatory precision has made Appinventiv a trusted partner for financial enterprises worldwide. The organizations we work with, from digital-first banks to payment processors and wealth management firms, choose us for one defining reason: our ability to innovate securely while maintaining uncompromised compliance.

Our Track Record in Numbers

- 1,600+ domain specialists in FinTech, AI, and cybersecurity

- 3000+ successful projects, including 500+ banking and financial solutions deployed across 30+ regulatory territories

- 99.9% SLA uptime and 100% compliance success rate in audits

- 97% client satisfaction rate in the FinTech and banking domain

Each engagement is governed by the same principle that anchors our engineering philosophy:

“In finance, innovation without compliance is chaos. Our role is to turn complexity into confidence.”

Through structured governance models, validated architecture patterns, and region-specific expertise, we help institutions achieve the rare balance: innovation at speed with compliance at depth.

Have a project idea in mind? Don’t let compliance challenges stall your future growth. Connect with our fintech experts to explore how we can help you create software trusted by regulators and loved by users.

FAQs

Q. What compliance frameworks does Appinventiv align with?

A. Appinventiv works within a robust ecosystem of globally recognized compliance and quality frameworks. These include:

- ISO 27001: for information security management

- SOC 2 Type II: for data integrity and access control

- GDPR & CCPA: for data privacy and user consent

- PCI-DSS: for secure payment processing

- Basel III & PSD2: for banking resilience and open banking compliance

Every client engagement begins with a detailed compliance mapping workshop, where our teams analyze local mandates and tailor these global frameworks to the specific risk landscape of that region.

Q. What role does AI play in Appinventiv’s compliance ecosystem?

A. Artificial intelligence has moved from being a supportive feature to becoming the nerve center of compliance monitoring. We use AI for three primary functions:

- Predictive anomaly detection: AI models analyze millions of transactions to detect early-stage irregularities before they cross regulatory thresholds.

- Document intelligence: Natural Language Processing (NLP) helps parse new regulatory updates, mapping them automatically to affected system modules.

- Behavioral learning: Our custom-made models improve with every iteration, reducing false positives and highlighting genuine compliance risks that human reviewers might miss.

This combination of automation and intelligence ensures that our clients remain not just compliant but consistently audit-ready.

Q. How much does compliance-first software development typically cost?

A. The cost of compliance-first software development depends on the product scope, regulatory jurisdictions, and required certifications.

On average, the cost of fully compliant finance software development ranges between $40,000 and $400,000 or more.

Q. Beyond banking, which industries can benefit from Appinventiv’s compliance expertise?

A. Regulatory discipline isn’t exclusive to banking; it’s becoming a cross-sector expectation. Our teams have applied the same compliance-first approach to industries that face similar governance pressure, such as:

- Insurance and InsurTech

- Digital Lending and WealthTech

- Blockchain, DeFi, and Digital Assets

- Healthcare and GovTech (Emerging Overlaps)

Each industry brings its own regulatory dialect, and our job is to translate that into clean, reliable software logic that auditors can trust. For instance, in industries like healthcare, where data intersects with financial services like telehealth billing or medical financing, we align solutions with HIPAA and PCI-DSS simultaneously.

Q. Why should a FinTech enterprise choose Appinventiv as its compliance technology partner?

A. Because compliance here isn’t an afterthought; it’s built into the DNA of our engineering process. We combine:

- Global reach: 30+ countries covered, from the U.S. and UK to GCC and APAC.

- Deep domain experience: 300+ fintech projects delivered with zero audit failures.

- Technology strength: AI-led monitoring, blockchain audit trails, and scalable hybrid-cloud deployments.

- Operational reliability: 99.9% SLA uptime and 100% regulatory conformity across projects.

Appinventiv doesn’t just help you “meet compliance.” We help you turn it into a differentiator; a measurable advantage that wins user trust, regulatory goodwill, and investor confidence.

Q. What is the future of regulatory compliance adherence in FinTech solutions?

A. The regulatory landscape is moving from human oversight to tech-enabled intelligence. Emerging technologies are redefining how institutions interpret, apply, and audit compliance.

1. RegTech and AI-Driven Auditing

Artificial intelligence is transforming compliance documentation into real-time verification. Future systems will interpret policy text as machine-readable logic, automating the enforcement of rules across data flows.

2. Decentralized KYC and Identity Infrastructure

Decentralized identity (DID) frameworks are reducing the need for repetitive KYC checks by allowing institutions to validate credentials across networks without storing sensitive data redundantly.

3. Predictive Compliance Intelligence

Machine learning models will soon predict regulatory risk before incidents occur, flagging deviations from acceptable behavior or upcoming legal shifts that may impact operations.

4. Smart Contracts for Automated Enforcement

Blockchain-powered smart contracts are enabling auto-execution of compliance rules, ensuring policy adherence is baked into the system logic, not dependent on human intervention.

Q. What are the key regulatory challenges faced by FinTech companies when expanding internationally, and how do different regions approach compliance?

A. As FinTech companies expand across borders, they encounter a complex and evolving regulatory landscape. Each region has its own set of rules that impact everything from data privacy to financial reporting, and the challenge lies in understanding these jurisdictional nuances to maintain compliance while innovating. Here’s a breakdown of the key regulatory frameworks across some of the world’s major regions:

US: In North America, the frameworks of SOX, GLBA, and FINRA form the bedrock of transparency, data privacy, and financial reporting. Each regulation introduces layers of accountability, especially for institutions handling sensitive investor or consumer data.

EU: Across Europe, the focus has turned toward data sovereignty and consumer rights. The GDPR, PSD2, and the EU Data Act collectively dictate how user data can be processed, shared, or monetized. Non-compliance isn’t an option as GDPR fines can reach up to 4% of a company’s global turnover, making data ethics a direct financial liability.

GCC: In the Gulf Cooperation Council (GCC), rapid digital transformation has brought a parallel surge in compliance frameworks. The Saudi Arabian Monetary Authority (SAMA), ADGM, and Dubai’s VARA compliance have each built fintech-specific compliance sandboxes designed to ensure innovation grows within safe regulatory boundaries.

Asia-Pacific: Meanwhile, Asia-Pacific markets remain some of the most dynamic and complex. From India’s RBI guidelines on digital lending and KYC to Singapore’s MAS TRM mandates and Australia’s APRA standards, the region demands rigorous attention to security, storage, and auditability.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…