- The Role of Big Data in FinTech

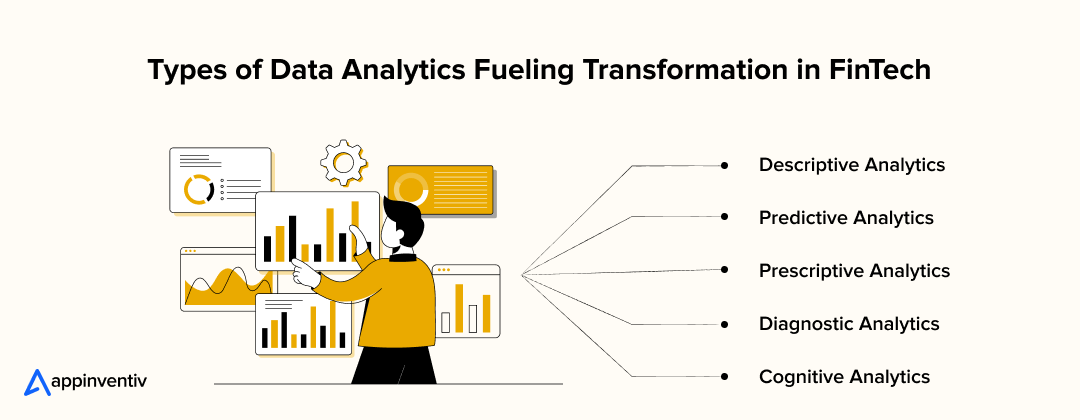

- Key Data Analytics Types Powering FinTech Innovation

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Diagnostic Analytics

- Cognitive Analytics

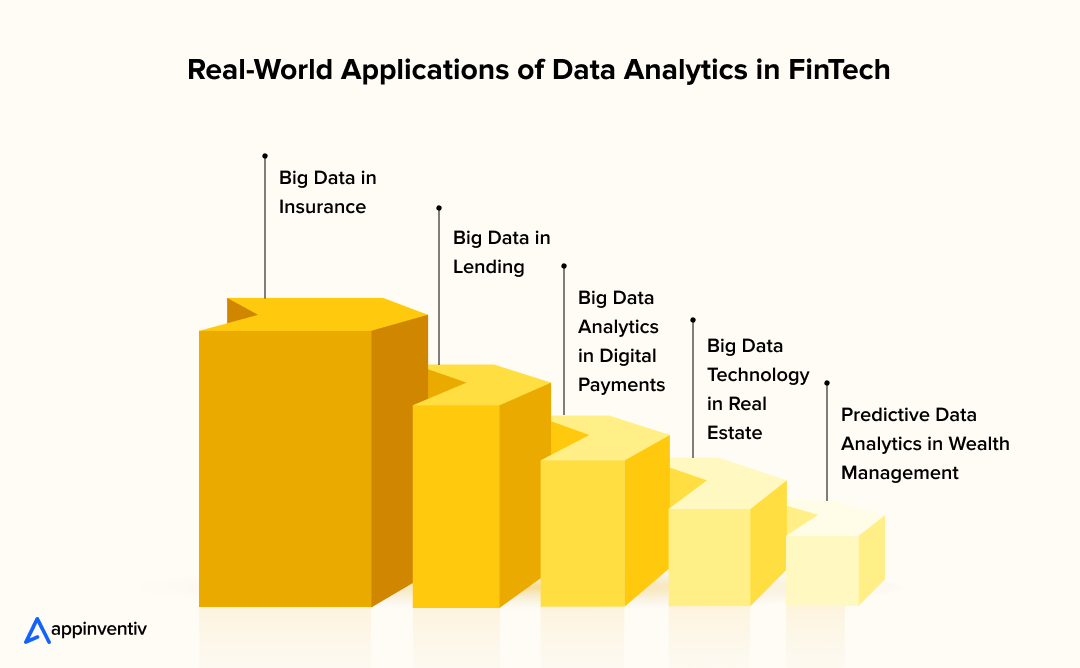

- Applications and Use Cases of Data Analytics in FinTech

- 1. Big Data in Insurance

- 2. Big Data Analytics in Digital Payments

- 3. Big Data Technology in Real Estate

- 4. Big Data in Lending

- 5. Predictive Data Analytics in Wealth Management

- How FinTech Firms Implement Data Analytics?

- Step 1: Figure Out the “Why”

- Step 2: Get the Data House in Order

- Step 3: Add the Brains

- Step 4: Keep the Regulators Happy

- Step 5: Build the Right Mix of People

- Step 6: Keep Tuning

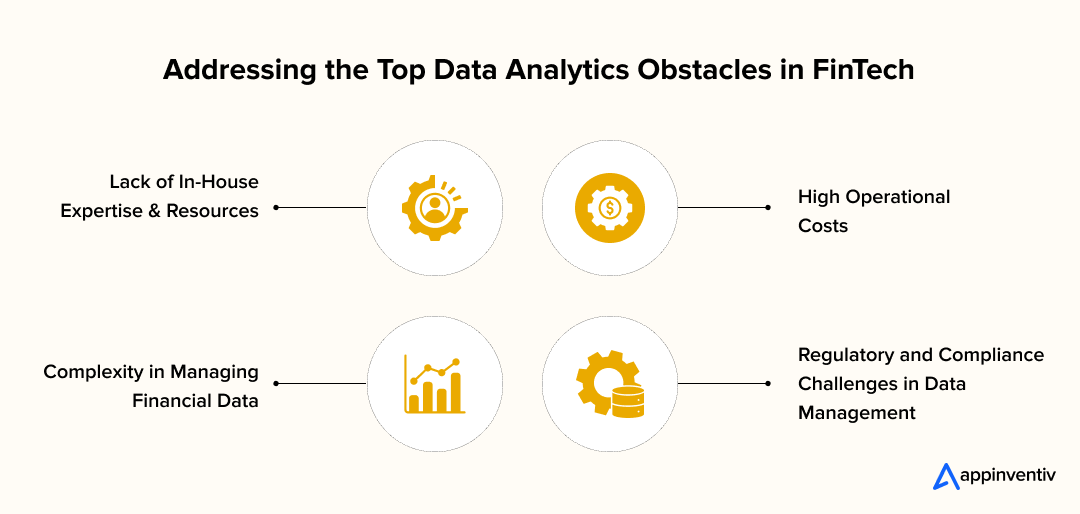

- Overcoming Data Analytics Challenges in FinTech

- Lack of In-House Expertise and Resources

- High Operational Costs

- Complexity in Managing Financial Data

- Regulatory and Compliance Challenges in Data Management

- Key Advantages of Data Analytics in FinTech

- Enhanced Customer Personalization and Experience

- Superior Risk Management

- Increased Operational Efficiency and Cost Reduction

- Improved Decision-Making

- Regulatory Compliance

- Innovation and New Product Development

- Why FinTech Businesses Need Data Analytics Outsourcing?

- Attracting Competent Talent

- Access to Best Technology and Practices

- Focus on Customer-Centric Services

- Cost Efficiency and Scalability

- Faster Time to Market

- Enhanced Innovation and Agility

- Access to Specialized Expertise

- Exploring Emerging Technologies and New Growth Avenues

- Tailored Data Analytics Solutions

- How to Choose the Right FinTech Development Outsourcing Company?

- Work Experience

- Security

- Risk Mitigation

- Domain Expertise

- Scalability and Flexibility

- Tech Stack and Innovation

- Communication and Collaboration

- How Can Appinventiv Help You with FinTech Data Analytics Solutions?

- FAQs

- Q. Why should a FinTech business consider outsourcing data analytics?

- Q. What are the key benefits of FinTech data analytics outsourcing?

- Q. How to use data analytics in FinTech?

- Q. How does data analytics help FinTech companies make significant progress?

- Q. What are the most common data analytics tools used in FinTech?

Key takeaways:

- Data analytics enables accurate decision-making, personalization, proactive risk management, and operational efficiency, with 66% of financial firms already leveraging cloud and analytics.

- FinTech industry utilizes diverse analytics techniques, including descriptive, predictive, prescriptive, diagnostic, and cognitive analytics.

- Big data analytics is revolutionizing insurance, digital payments, real estate, lending, and wealth management.

- Outsourcing data analytics offers FinTech access to specialized expertise, cost-efficiency, scalability, diverse solutions, and tailored approaches, freeing up internal resources for core business.

“Without data, you’re just another person with an opinion.” – W. Edwards Deming

In the world of FinTech, data is paramount. From preventing fraud to enhancing customer experiences and streamlining operations, data analytics is the secret sauce that powers innovation.

But here’s the thing: the ability to turn raw data into actionable insights is where the true value lies.

Data analytics in FinTech has become the engine behind more accurate decision-making, stronger customer personalization, and proactive risk management. From improving operational efficiency to identifying fraud before it happens, analytics is now at the heart of innovation across the financial services sector. As competition intensifies and user expectations rise, FinTech firms that invest in smart, data-driven strategies are better positioned to adapt, grow, and lead the way.

A report by PwC indicates that 66% of financial services organizations are turning towards cloud computing for growth and innovation, which often includes leveraging data analytics capabilities.

In this blog, we’ll explore why your fintech enterprises need data analytics, diving into the benefits, use cases, challenges, and how outsourcing data analytics can help your business thrive in a data-driven world.

But before we get into the details, let’s first understand the pivotal role big data analytics plays in shaping the future of the FinTech industry.

Ready to be one of them?

The Role of Big Data in FinTech

Big Data analytics in FinTech is reshaping the industry by enabling companies to gather and analyze massive amounts of information from diverse sources such as transactions, mobile applications, and social media platforms.

FinTech businesses can harness this data to create personalized products and features that cater directly to their customers’ unique needs when equipped with the right data analytics infrastructure. Together with fintech consulting services, this approach strengthens risk management by identifying fraud patterns and credit risks and enhances the customer experience through real-time insights into user behavior and preferences.

Transforming financial services with big data analytics has proven to be a game-changer. For example, according to IBM, organizations that leverage advanced data analytics can reduce fraud-related losses by up to 50%, highlighting the critical role of big data in securing financial operations. In summary, data analytics in FinTech empowers companies to:

- Deliver more customer-centric products through improved segmentation

- Strengthen fraud detection and risk management protocols

- Optimize operational efficiency while reducing costs

- Accurately forecast customer behavior and conduct sophisticated risk assessments

- Develop agile and innovative digital solutions to stay competitive in a rapidly evolving market.

Key Data Analytics Types Powering FinTech Innovation

Several types of data analytics play a pivotal role in driving FinTech innovation. Each serves a unique purpose, from understanding past performance to predicting future trends and recommending optimal actions. Let’s have a look at those.

Descriptive Analytics

Descriptive analytics analyzes historical data to provide insights into past performance and trends. It helps FinTech companies understand what has happened over a specific period by identifying patterns, summarizing transactions, and tracking key performance indicators (KPIs). This type of analytics is foundational for compliance, regulatory reporting, and internal performance reviews.

Predictive Analytics

Predictive analytics uses statistical models and machine learning algorithms to analyze historical data and predict future outcomes. In FinTech, it’s commonly used to assess credit risk, detect potential fraud, anticipate customer churn, and forecast market trends. Enabling proactive decision-making helps firms mitigate risks and seize opportunities.

Data analytics provides insights from structured data, while how computer vision is transforming FinTech operations focuses on extracting valuable information from visual and document-based sources.

Prescriptive Analytics

Prescriptive analytics builds on predictive insights by offering actionable recommendations for optimal outcomes. It utilizes advanced algorithms to simulate various scenarios and recommend the most effective course of action. FinTech businesses leverage this to refine loan approvals, personalize financial products, and improve customer retention strategies.

Diagnostic Analytics

Diagnostic analytics goes deeper than descriptive analytics by uncovering the root causes of past outcomes. It helps FinTech businesses understand why something happened by identifying correlations, anomalies, and contributing factors. For example, it can reveal why loan default rates spiked during a specific period or what triggered a sudden drop in app engagement.

Cognitive Analytics

Cognitive analytics mimics human reasoning by combining AI, natural language processing, and machine learning. It enables FinTech applications, such as intelligent chatbots, virtual financial advisors, and voice-activated banking tools. This type of analytics enhances personalization and customer interaction by interpreting unstructured data, such as speech, text, or sentiment.

Applications and Use Cases of Data Analytics in FinTech

FinTech and big data analytics are transforming the financial services industry by enabling organizations to extract actionable insights from vast amounts of data. The synergy of data analytics for FinTech enables online banks, FinTech startups, and established financial institutions to innovate rapidly, enhance customer experiences, and manage risk more effectively.

Let’s explore some prominent applications where FinTech, big data analytics, and advanced technologies deliver significant value.

1. Big Data in Insurance

Insurance companies have shifted from relying on outdated statistical models to embracing real-time data-driven decision-making. Leveraging FinTech data analysis allows insurers to develop personalized, low-risk insurance offers that are financially sound and customer-friendly.

Real-life example: Progressive Corporation

Progressive uses its “Snapshot” program to collect telematics data directly from drivers’ vehicles, analyzing driving behaviors such as speed and braking patterns. This use of data analytics and FinTech enables Progressive to accurately price insurance policies based on individual risk profiles. The approach enhanced underwriting precision and customer satisfaction by tailoring premiums to actual driving habits.

Also Read: Insurance Data Analytics: Driving Innovation and Efficiency

2. Big Data Analytics in Digital Payments

The intersection of data analytics for FinTech and machine learning is key to improving fraud detection and credit risk assessment in digital payments. Real-time analytics enable financial institutions to deliver instant credit approvals and seamless payment experiences.

Real-life example: JPMorgan Chase & Co.

JPMorgan Chase utilizes advanced FinTech big data analytics models to monitor transaction flows and detect fraudulent activities in real-time. Their ML-enhanced systems prevent fraud before it occurs, increasing customer trust. Additionally, their loan approval processes leverage FinTech data analysis to quickly evaluate credit risk, enabling instant financing options embedded within payment platforms and thus boosting conversion rates among consumers.

3. Big Data Technology in Real Estate

In real estate financing, continuous market monitoring and dynamic pricing depend heavily on accurate data analytics for FinTech. Integrating diverse data sources improves decision-making and minimizes loan default risks.

Real-life example: Wells Fargo & Company

Wells Fargo, one of the largest U.S. mortgage lenders, harnesses FinTech big data analytics to evaluate housing market trends, borrower credit profiles, and property valuations. Through sophisticated analytics models supported by data analytics outsourcing for FinTech firms, Wells Fargo fine-tunes lending criteria and mortgage rates in real time, ensuring reduced risk and enhanced customer alignment.

4. Big Data in Lending

AI-powered FinTech data analytics expands credit access by enabling more accurate and inclusive credit scoring models, and you can dive deeper into how lenders use analytics for credit scoring and loan approvals. This supports financial inclusion while promoting business growth.

Real-life example: Capital One Financial Corporation

Capital One utilizes cutting-edge FinTech data analysis solutions to analyze a broad spectrum of data, extending beyond traditional credit scores. Their FinTech data analysts incorporate transaction patterns, social data, and alternative credit sources to make smarter credit decisions, enabling wider loan accessibility with controlled risk and higher adoption rates.

5. Predictive Data Analytics in Wealth Management

Data analytics and FinTech converge to empower wealth management firms with predictive capabilities that tailor customer experiences and optimize portfolio management. By uncovering patterns in client behavior and market movements, firms can anticipate client needs and deliver highly personalized investment strategies.

Real-life example: Morgan Stanley

Morgan Stanley leverages predictive FinTech big data analytics to build detailed client profiles, combining investment behavior, demographics, and market trends. Their FinTech data analysts utilize these insights to anticipate client needs and personalize financial recommendations, significantly improving client retention and investment outcomes.

How FinTech Firms Implement Data Analytics?

In most FinTech companies, the real challenge isn’t finding data — it’s knowing what to do with it. The firms that get this right usually follow a few practical steps, though not always in a neat order.

Step 1: Figure Out the “Why”

Before throwing money at tools, the best teams decide what they actually want from analytics. Maybe they’re chasing lower fraud numbers, maybe they want loan approvals in minutes instead of days, or maybe they’re trying to give customers smarter product suggestions. Without a clear “why,” the rest doesn’t stick.

Step 2: Get the Data House in Order

Financial data comes from everywhere — transactions, apps, third-party APIs, even social media. It’s messy. Companies that succeed usually invest early in solid data storage and pipelines so they’re not fighting fires later. Cloud warehouses, data lakes, and real-time feeds are common choices.

Step 3: Add the Brains

Once the data is in one place, they bring in analytics platforms, machine learning models, and AI tools. This is where risk models, fraud detection, and recommendation engines start taking shape.

Step 4: Keep the Regulators Happy

This is finance. Mess up on compliance and it’s game over. Encryption, access controls, and audit trails aren’t optional — they’re built into the process from day one.

Step 5: Build the Right Mix of People

It’s never just “the data team.” You’ll see engineers, compliance folks, product managers, and business leads all in the mix. Some companies grow this talent in-house, others hire outside help when needed.

Step 6: Keep Tuning

Analytics isn’t something you set up and walk away from. Models drift, markets change, and what worked last year might not work next quarter. The best firms keep tweaking, measuring, and scaling.

Overcoming Data Analytics Challenges in FinTech

While data analytics offers immense value to FinTech businesses, its implementation is not without hurdles. From limited internal expertise to complex compliance requirements, these challenges can slow innovation and decision-making. However, with the right strategies and tools, FinTech firms can overcome these barriers and unlock the full potential of their data assets. Here’s a look at the key challenges and how to address them effectively.

Lack of In-House Expertise and Resources

Many FinTech startups and mid-sized firms lack the in-house expertise needed to implement and manage advanced systems for data analytics in the FinTech industry. Partnering with external analytics specialists allows these firms to leverage data-driven insights without the burden of building internal capabilities from scratch.

Solution: Partnering with data analytics service providers or building AI-powered analytics platforms can bridge the talent gap. Investing in upskilling programs and certifications for existing staff also helps build internal capabilities over time.

High Operational Costs

Hiring, training, and retaining a full-scale data team is expensive, especially for companies with limited budgets.

Solution: Building cloud-based analytics solutions or Software-as-a-Service (SaaS) platforms with scalable pricing models offers cost-effective flexibility. Additionally, outsourcing analytics functions to specialized vendors can help reduce overhead while maintaining analytical rigor.

Complexity in Managing Financial Data

FinTech firms often deal with large volumes of unstructured and structured data, making it difficult to extract timely and actionable insights.

Solution: Implement modern data infrastructure with data lakes and real-time processing capabilities. Use AI/ML models and intuitive dashboards to simplify interpretation and support faster, data-driven decisions.

Regulatory and Compliance Challenges in Data Management

Navigating strict data privacy laws and financial regulations (e.g., GDPR, PSD2) can hinder analytics initiatives and increase legal risk.

Solution: Integrate robust data governance frameworks leveraging AI in data governance to enhance efficiency and ensure all analytics practices are audit-ready. Collaborate with compliance experts to align data processes with evolving regulatory standards, and utilize analytics tools equipped with built-in compliance features.

Our team simplifies, secures, and scales it. Talk to us about your toughest challenges.

Now that we have explored how data analytics insights can help your FinTech business, let’s see why you should be outsourcing these data management services.

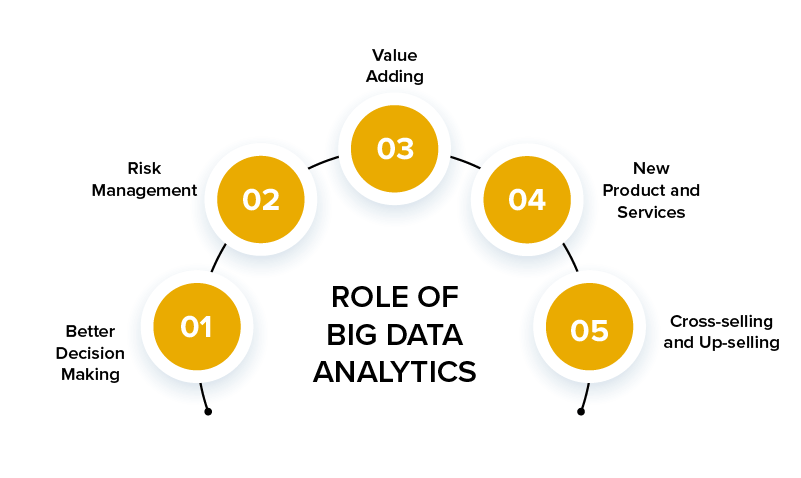

Key Advantages of Data Analytics in FinTech

The FinTech industry thrives on intelligence, and data analytics is its powerhouse. It’s the engine that converts raw financial data into actionable strategies, fundamentally reshaping how companies serve their clients, mitigate risks, and streamline operations. Let’s check some of the key advantages of data analytics in fintech:

Enhanced Customer Personalization and Experience

Data analytics provides a 360-degree view of customers, enabling FinTechs to create highly tailored financial products, offer proactive support, and deliver personalized recommendations that enhance satisfaction and loyalty.

Superior Risk Management

It empowers FinTechs with advanced fraud detection, enabling real-time identification of suspicious activities. Financial data analytics also refines credit scoring by incorporating diverse data points, leading to more accurate assessments and reduced defaults, while also improving market and operational risk analysis.

Financial data analytics also refines credit scoring by incorporating diverse data points, leading to more accurate assessments and reduced defaults, while also improving market and operational risk analysis, discover how predictive analytics reshapes finance across multiple dimensions.

Increased Operational Efficiency and Cost Reduction

By analyzing workflows, data analytics helps identify bottlenecks and automate repetitive tasks, significantly streamlining operations. This leads to reduced manual errors and optimized resource allocation, driving substantial cost savings.

Improved Decision-Making

Financial data analytics transforms raw data into actionable intelligence, enabling FinTech companies to make well-informed strategic and operational decisions. It supports predictive analytics to forecast trends and shifts, providing a crucial competitive advantage.

Regulatory Compliance

It simplifies adherence to complex financial regulations through automated data collection and reporting. Data analytics continuously monitors key risk indicators, ensuring ongoing compliance and mitigating the risk of penalties.

Innovation and New Product Development

By identifying unmet customer needs and emerging market trends, data analytics fuels the creation of innovative financial products and services. It also supports A/B testing and optimization, fostering continuous product refinement and market expansion.

Why FinTech Businesses Need Data Analytics Outsourcing?

Outsourcing data analytics in FinTech enables businesses to leverage advanced technologies, lower operational costs, and expedite decision-making. It allows companies to stay agile while focusing on their core competencies. Here are some of the key benefits of data analytics in FinTech:

Attracting Competent Talent

The outsourced team will comprise experienced professionals adept at handling complex tasks and tailoring solutions to meet business needs, which are critical for successful FinTech and big data analytics initiatives. Outsourced teams are more reliable in meeting deadlines, offering you a skilled and efficient resource pool.

Access to Best Technology and Practices

Reliable outsourcing firms stay updated with cutting-edge tools and techniques, making them ideal partners for data analytics for FinTech. This provides your business with access to powerful technologies and best practices, eliminating the need for heavy infrastructure investments.

Focus on Customer-Centric Services

Outsourcing partners often base their strategies on deep user research, delivering insights that improve customer engagement and product relevance. This synergy of FinTech big data analytics, and UX strategy helps create more meaningful and tailored financial services.

Cost Efficiency and Scalability

Outsourcing allows you to reduce costs by paying for services only when needed. Whether you’re launching a product or expanding operations, data analytics and FinTech outsourcing offer the flexibility and scalability to adapt quickly to changing demands.

Faster Time to Market

With a dedicated team concentrating on your projects, development cycles speed up significantly. This efficiency is crucial in a competitive space where a FinTech data analyst can be the difference between a first mover advantage and a missed opportunity.

Enhanced Innovation and Agility

Outsourced teams often bring diverse industry exposure and innovative methodologies. This external perspective fuels creativity and supports rapid experimentation, keeping your FinTech data analysis outsourcing efforts aligned with market shifts.

Access to Specialized Expertise

Outsourcing provides direct access to niche skill sets, such as AI/ML model development, fraud detection, and predictive analytics, which would otherwise be costly to develop in-house. With FinTech data analytics, your business becomes more data-driven and competitive.

Exploring Emerging Technologies and New Growth Avenues

Emerging technologies, such as cloud computing, blockchain, and advanced analytics, present vast growth opportunities. By embracing data analytics outsourcing for FinTech, you can tap into these innovations more swiftly, enhancing business models and unlocking new revenue streams.

Tailored Data Analytics Solutions

The entire finance industry is established on data collection and analysis. By outsourcing your financial software development needs, you gain access to tailored FinTech solutions that help you analyze customer data more effectively. The software solutions result in increased sales and promote customer loyalty. This way, you can monitor every prospect carefully, right from credit scores to users’ buying patterns.

How to Choose the Right FinTech Development Outsourcing Company?

Outsourcing has become essential for addressing FinTech demands, especially when it comes to data analytics in the FinTech industry. Here are a few key tips to consider for effective analytics outsourcing.

Work Experience

The primary factor to consider is the reliable experience in developing high-quality FinTech solutions. Keep a note of previous FinTech projects that the company has worked on and their success rate. The portfolio of the outsourced company must guarantee reliable services, easy integrations, and maintenance of data analytics solutions.

Security

Security identification and authentication are another critical factor to consider for outsourcing FinTech data analytics needs. FinTech is one area that requires great precision and safety in all operations and data. Therefore, ensure your outsourced team prioritizes security and not as an afterthought.

Risk Mitigation

Risk management is a primary decision-making process that evaluates, identifies, and mitigates risks to minimize potential losses. Remember that your business data is at stake; hence, ensure that your outsourced team is ready with a backup plan just in case your primary development plan fails.

Domain Expertise

Selecting a partner with strong domain expertise in FinTech is crucial. The outsourced company should understand financial regulations, compliance standards, and market-specific challenges. This expertise enables them to develop functional solutions that align with industry requirements. A deep understanding of financial data analytics techniques further enhances the quality of delivered solutions.

Scalability and Flexibility

Your FinTech app should be able to grow with your business. Ensure that the outsourcing company can scale development resources as needed and adapt to evolving requirements without causing delays or disruptions. This flexibility highlights the importance of data analytics in FinTech, especially when planning for long-term growth.

Tech Stack and Innovation

The right outsourcing partner should be well-versed in modern technologies, including AI, ML, big data, and blockchain. Their ability to integrate innovative technologies into FinTech products will help you stay competitive in a rapidly evolving market. This is especially true when leveraging advanced data analytics services for FinTech to stay ahead of digital transformation trends.

Communication and Collaboration

Efficient communication is key to a successful outsourcing partnership. Look for companies that follow transparent communication practices, use modern collaboration tools, and provide regular updates on progress and roadblocks. Strong collaboration ensures smoother outcomes when transforming big data analytics for financial services.

Partner with us for razor-sharp expertise that drives real results.

How Can Appinventiv Help You with FinTech Data Analytics Solutions?

As the FinTech sector evolves, utilizing big data analytics in FinTech has become a key driver of innovation and growth. Outsourcing your data analytics needs can give you faster access to advanced technologies and expert insights, helping you stay ahead of the curve.

At Appinventiv, our FinTech data analysts collaborate closely with your in-house team and bring our expertise. From interpreting complex data to creating intuitive dashboards, we help you make sense of your data and turn it into actionable strategies. Our data analytics services team seamlessly integrates advanced analytics into your systems, providing real-time insights, scalable solutions, and strong data security.

If you’re looking to improve decision-making, reduce risks, or enhance customer engagement, we’re here to build analytics solutions that deliver real results.

Reach out to discover how we can partner for your success.

FAQs

Q. Why should a FinTech business consider outsourcing data analytics?

A. Outsourcing can provide access to specialized skills, reduce operational costs, speed up data processing, and allow the business to focus on core activities. It also brings in advanced tools and techniques that may be costly to implement in-house. Moreover, expert outsourcing partners ensure compliance, security, and scalability tailored to the evolving needs of the FinTech sector.

Q. What are the key benefits of FinTech data analytics outsourcing?

A. Here are some of the key benefits of outsourcing data analytics for FinTech companies:

- Cost Efficiency: Outsourcing eliminates the need for building an in-house analytics team, reducing overhead, infrastructure, and hiring costs.

- Scalability: It allows FinTech companies to scale analytics efforts up or down based on changing business needs and market demands.

- Access to Advanced Tools and Expertise: Outsourcing partners bring specialized knowledge and state-of-the-art technologies that may be too costly or complex to adopt internally.

- Improved Data Security: Experienced outsourcing providers follow best practices for data protection, ensuring compliance with financial regulations and minimizing the risk of breaches.

- Faster Insights for Decision-Making: With real-time analytics and expert support, businesses can extract actionable insights quickly, enabling smarter, faster decisions.

Q. How to use data analytics in FinTech?

A. FinTech companies can apply data analytics to monitor user behavior, detect fraud, assess credit risk, personalize customer experiences, and optimize financial operations. It helps businesses make smarter, faster, and more accurate decisions backed by real-time insights.

Q. How does data analytics help FinTech companies make significant progress?

A. The application of data analytics in the FinTech industry has become a transformative force, enabling companies to make smarter decisions, enhance customer experiences, and streamline operations. Here are some of the key ways it has driven progress:

- Smarter Loan Approvals: By leveraging FinTech data analytics, companies can assess creditworthiness more accurately and automate loan approval processes for faster decision-making.

- Improved Customer Segmentation: Advanced analytics enables personalized marketing and product offerings by segmenting users based on behavior, preferences, and risk profiles.

- Enhanced Fraud Detection: Application of big data in finance helps detect fraudulent activities in real time by identifying unusual patterns across vast volumes of transaction data.

- Operational Efficiency: Automated data processing reduces manual workloads, optimizes resource use, and improves internal workflows across departments.

- Stronger Customer Trust: Transparent use of analytics builds customer confidence by improving service accuracy, personalization, and security.

- Competitive Advantage: Companies that integrate data analytics for FinTech gain deeper insights into market trends, allowing them to adapt quickly and stay ahead of the competition.

Q. What are the most common data analytics tools used in FinTech?

FinTech companies rely on a mix of data storage, processing, and visualization tools to handle financial data effectively. Commonly used tools include:

- Data Storage and Processing: AWS Redshift, Google BigQuery, Snowflake, Apache Spark

- Machine Learning and AI: TensorFlow, Scikit-learn, PyTorch

- Business Intelligence and Visualization: Tableau, Power BI, Qlik Sense

- Data Integration: Apache Kafka, Talend, Fivetran

These tools help manage large datasets, run advanced analytics, and present insights in a way that decision-makers can act on.

Q. How is big data different from data analytics in FinTech?

Big data refers to the vast, diverse, and fast-moving datasets generated in the financial sector — from transaction logs and customer interactions to social media activity. Data analytics, on the other hand, is the process of examining that data to uncover patterns, trends, and actionable insights.

- Big Data: The “raw material” — massive volumes of structured and unstructured information.

- Data Analytics: The “processing and interpretation” — turning raw data into meaningful strategies and decisions.

In short, big data is what FinTech firms collect, while data analytics is how they make sense of it.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How to Hire Data Engineers for Your Enterprise? All You Need to Know

Key takeaways: Hiring data engineers individually slows execution and increases delivery risk at enterprise scale. Partnerships give faster access to senior talent without long recruitment cycles or retention issues. Cost depends more on capability and responsibility than salary alone. The right hiring model directly affects business speed, stability, and ROI. Partnering with experienced teams converts…

How Data Analytics is Shaping the Future of UK Businesses Across Sectors

Key Takeaways Data has moved from support to strategy. UK companies no longer treat analytics as an add-on; it’s shaping how they forecast demand, design products, and compete for customers. Every sector is finding its own rhythm. From retail and healthcare to energy and education, organizations are using data differently, but the goal is the…

Is Your Business Model Compliant with the EU Data Act? A Checklist for C-Suite Executives

Data has quietly become the backbone of modern business. Whether it’s a retailer predicting what you’ll buy next week or a car maker tracking vehicle performance in real time, every decision today leans on streams of information. But with that power comes a tough question: who really owns the data, and who gets to use…