- Xero Overview & Its Popularity Statistics: Why It Stands Out

- Preferred User Journey of Australia-specific Accounting Software like Xero

- Cost to Develop an Accounting Software like Xero: A Detailed Breakdown

- Cost Analysis Based on Complexity

- Cost Analysis Based on Development Stages

- Cost Analysis Based on Features

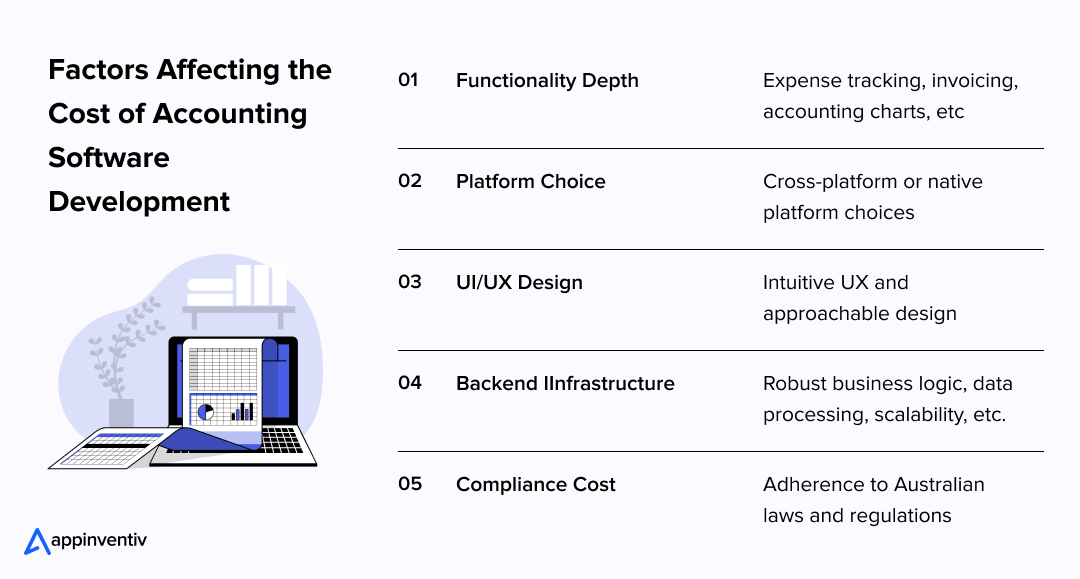

- Factors Affecting the Cost of Building Accounting Software in Australia

- Functionality Depth

- Platform Choice

- UI/UX Design

- Backend Infrastructure Development

- Compliance Cost

- Quick Formula to Estimate the Cost Of a Software Similar to Xero

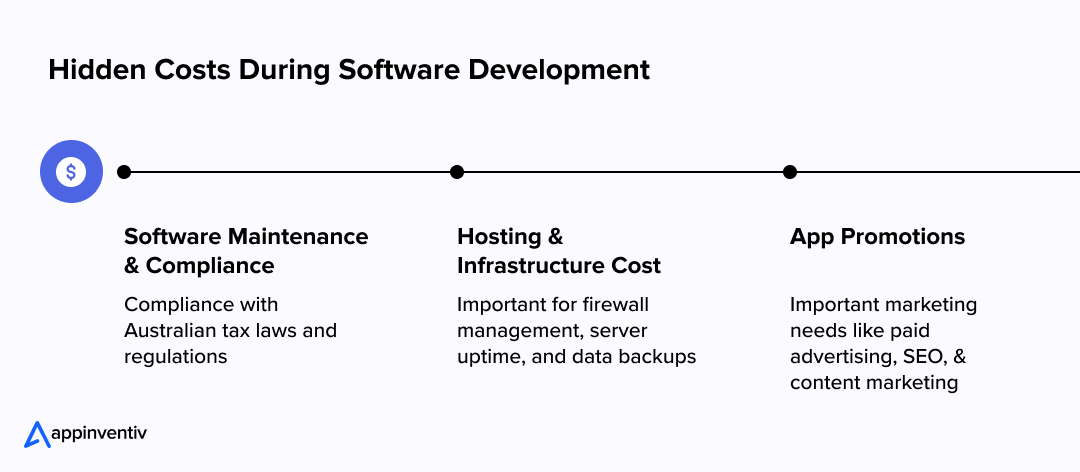

- Hidden App Development Costs

- Software Maintenance and Compliance

- Hosting and Infrastructure Cost

- App Promotions

- Industry-Specific Accounting Software Solutions Affecting the Development Costs

- Construction Accounting Software for Builders

- Retail Accounting Software

- Healthcare Accounting Software

- Finance Accounting Software

- Ways to Optimize Xero Software Development Clone Cost

- Starting with an MVP

- Prioritizing Necessary Features

- Leveraging Cross-Platform Functionality

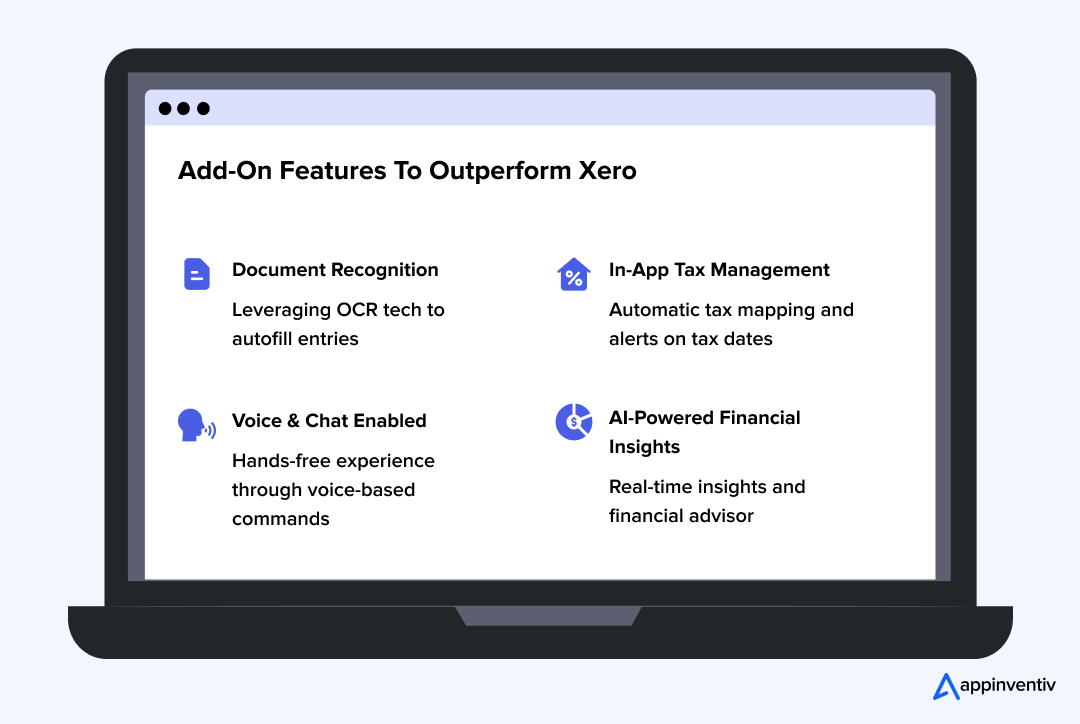

- How to Make A Better App than Xero: Potential Feature-Rich Add-Ons

- Document Recognition

- AI-Powered Financial Insights

- Voice and Chat Enabled

- In-App Tax Management

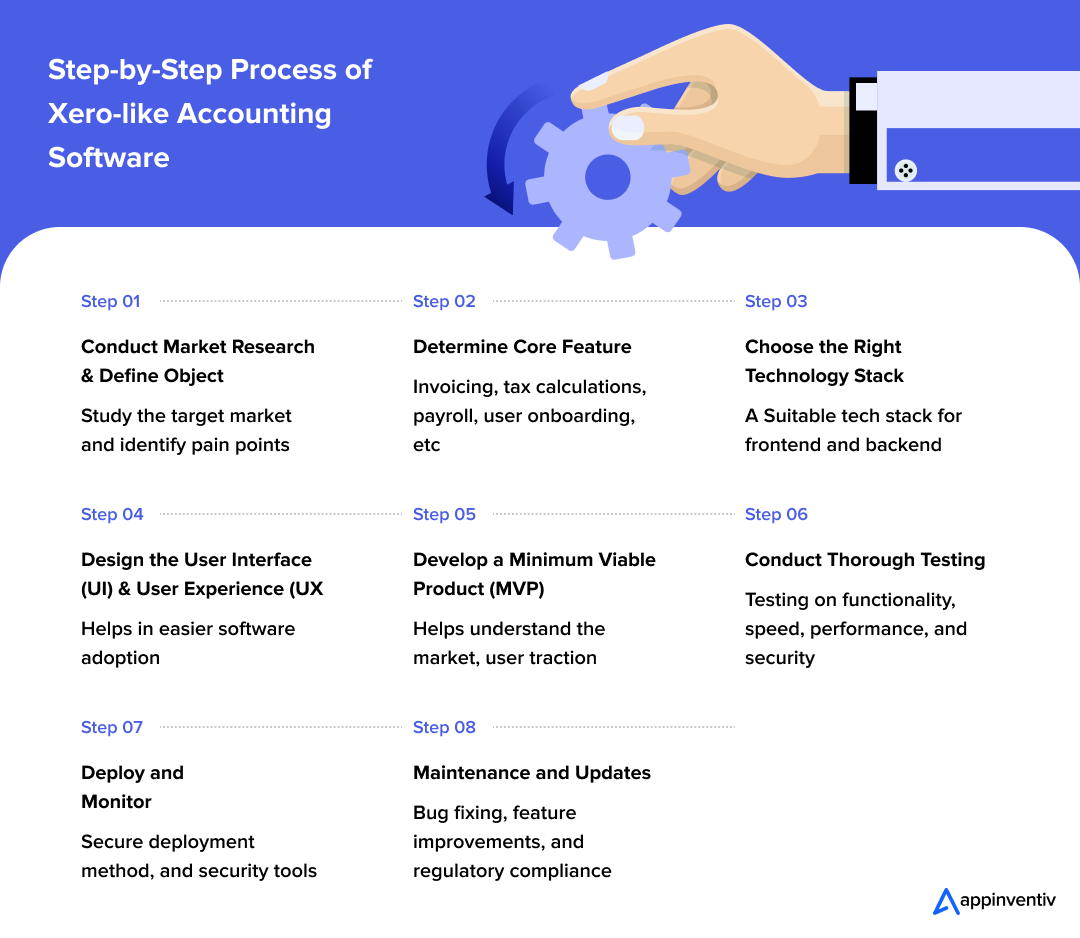

- Step-By-Step Process to Make a Software Like Xero

- Conduct Market Research

- Determine Core Features

- Choosing the Right Tech Stack

- Designing UI and UX

- Develop an MVP

- Conducting Thorough Testing

- Deploy and Monitor

- Maintenance & Updates

- How Appinventiv Can Help Build A Better App than Xero

- FAQs

Key takeaways:

- The cost to build an accounting software like Xero in Australia ranges from AUD 63,000 to AUD 468,000, depending on complexity and features.

- Essential features include invoicing, bank reconciliation, GST compliance, and financial reporting.

- Typically, the development timeline for accounting software development like Xero spans 9-12 months.

- Adhering to Australian standards such as Single Touch Payroll (STP) and GST is essential to avoid legal issues and build trust.

In a time when real-time financial insights have become a key to operational agility, many tech-forward companies are asking whether they should build their accounting software similar to Xero. Let’s explore what the data speaks.

- Xero, a popular accounting software in Australia, has almost 4.4 million subscribers worldwide.

- Organisations using cloud-based accounting software see a 20% increase in operational efficiency, followed by cost reduction and strategic decision-making possibilities. (Source: Skyline University)

- The 2024 Business Technology Report also shared its insights. It revealed that 53% of Australian businesses consider having a digital strategy. Cloud-based accounting software is a real need for today’s businesses dealing with finances. (Source: Accountants Daily)

Since you are convinced that accounting software should be included in your business, the question is now: How much does it cost to build accounting software like Xero?

Cloud-based accounting software development in Australia takes around 9-12 months and is estimated to cost $40,000 – $300,000+ (63,000 AUD—468,000 AUD).

A full-grade enterprise-level app would include advanced features like AI Recommendations, Insights, Voice, chat-enabled, etc. An MVP version of the software, with basic functionalities like user accounts, onboarding, tax info, and customer support, would cost between $30,000 and $150,000 (46,000 AUD—233,800 AUD).

Xero didn’t become a top accounting software overnight; it was a constant effort of years of iteration, development, and core domain knowledge. However, before allocating a set budget for such a solution, it’s important to understand what goes into creating such a platform.

This blog will provide a detailed breakdown of the cost to build an accounting software like Xero, a step-by-step process for building accounting software in Australia, and what features it should have. Multiple factors tend to influence the total production cost from the initial stages of conceptualization to the final product.

Create a sticky, flexible product like Xero with our software dev expert team.

Xero Overview & Its Popularity Statistics: Why It Stands Out

It is true in this context because a certain company can grow in gaining customers and sales, but if managing cash is not a priority, a fall is certain. This brings us to the need for an accounting software similar to Xero.

Xero is cloud-native accounting software with real-time collaboration functionality between business owners, accountants, and bookkeepers. The software efficiently handles financial tasks like expense tracking, tax compliance, financial reporting, invoicing, and billing.

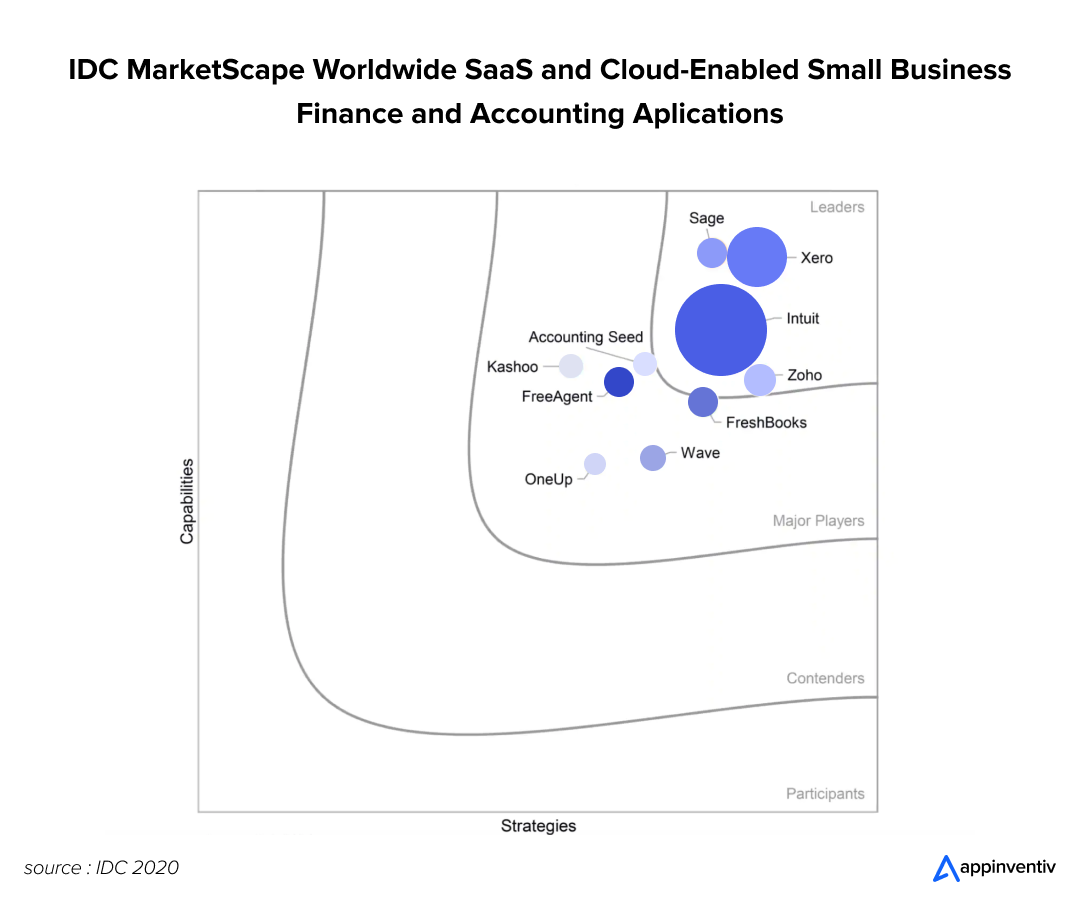

But why has it become so popular? One good reason was the market opportunity.

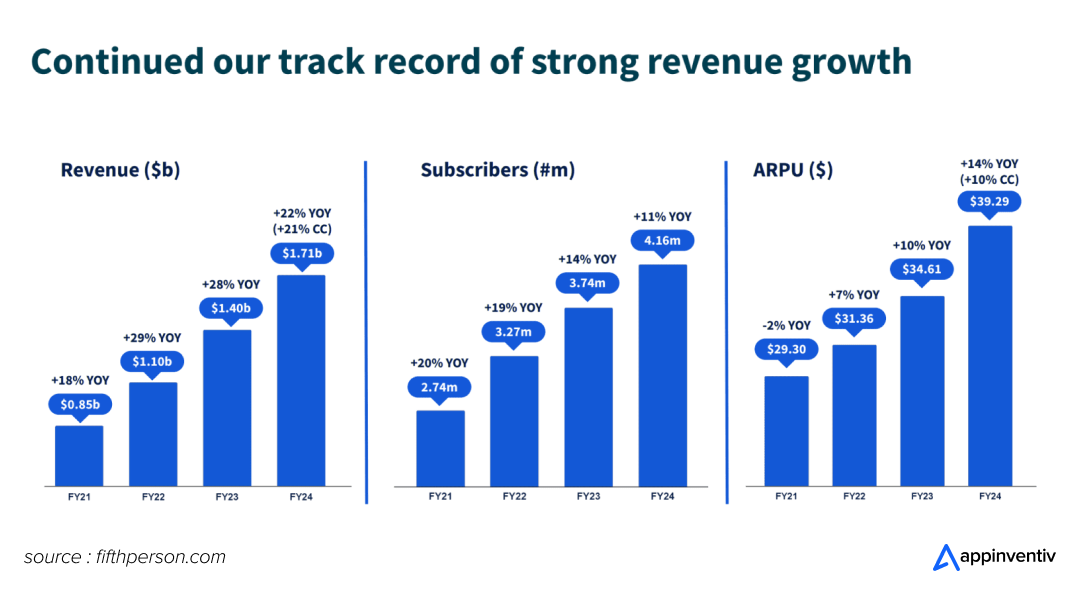

According to The Fifth Person, Xero thrived on growing cloud adoption and remote work. This shift to a SaaS-based model resulted in big and recurring revenues. Considering its strong financial performance in 2024, the platform experienced 11% YoY growth in subscribers, standing at 4.16 million, as of 2024.

In addition, support and partnerships with 1000+ apps and 300+ bank integrations have helped them clock big revenues, increase retention, and reduce churn. Today, it has an approximate market share of 75% in Australia and New Zealand. (Source: The Fifth Person)

- Cloud Native From the Beginning: Compared with legacy accounting systems, Xero utilized the opportunity to prioritize cloud infrastructure from the start. From the first day, Xero was built for the cloud, giving it the required speed, reliability, and user experience advantage.

- No Limit to User Access: Xero is known to allow unlimited users on all its plans without any extra fees, which was unusual in the industry at the time. This made it ideal for businesses with multiple members accessing their books.

- Core Integrations: Integration with over 1000+ third-party apps related to CRM, Payroll, and Inventory made Xero suitable for businesses looking to build tailored systems around their accounting systems.

Quote 1

“Don’t ever let your business get ahead of the financial side of your business. Accounting, accounting, accounting. Know your numbers.”

By Tilman Fertitta, CEO of Landry

Preferred User Journey of Australia-specific Accounting Software like Xero

Xero has dominated the accounting software market in Australia. With its integrated features and first-in-class cloud infrastructure, its scalability capabilities have made it a major player in the Australian accounting market.

1. The typical user journey of Xero and similar accounting software starts with onboarding and setup. Users are asked to enter the company name, financial year, tax information, and other similar details, followed by a prompt to connect their bank accounts.

But why is this an exclusive feature? It automatically pulls daily transactions into the software, eliminating the hassle of manually entering the details.

2. After this step, the core values of the software are experienced, which include:

a. Bill and expense management

b. Creating and sending invoices

c. Tracking cash flow

b. Payroll processing, etc

As the business grows, Xero’s reporting and forecasting tools come into play. The software offers customizable financial reports like cash flow summaries, balance sheets, profit and loss statements, etc. Its integration with various third-party apps adds to its charm as specialty needs like time tracking, inventory management, etc., are also catered to, making it a financial hub.

3. Users prefer to expand their usage as they become more familiar with the platform. Features like budgeting, project tracking, etc., are needed at later stages of the user journey.

With Xero offering frequent updates and improvements, competitors should regularly cater to their user base for utmost engagement and traffic. Users are further engaged through webinars, community support, and feature announcements.

Also Read: [Top FinTech Startup Ideas for Businesses to Consider in 2025]

Cost to Develop an Accounting Software like Xero: A Detailed Breakdown

The cost to build an accounting software like Xero is a complex calculation of additional features and functionality modules we are looking to integrate into our platform. This cost can be analyzed based on complexity, development stages, and features. Let us explore more:

Cost Analysis Based on Complexity

If we aim to build an MVP first with basic functionalities like user onboarding, profile setup, and customer support, the cost would be less. However, complex software with multiple security and platform integrations and AI and ML inclusion would cost a lot.

| Software Complexity | Features Included | Estimated Cost |

|---|---|---|

| Simple | Includes user onboarding, profile setup, tax information, customer support, etc | $40,000 – $100,000 (AUD 61,000 – AUD 154,000) |

| Moderate | Includes simple features + multilingual support, integrated payments, tracking cash flow, payroll processing | $100,000 – $198,000 (AUD 154,000 – AUD 308,000) |

| Complex | Includes Moderate features + AI, ML, advanced security, multi-platform integration support, project tracking, budgeting | $198,000 – $297,000 (AUD 308,000 – AUD 462,000) |

Cost Analysis Based on Development Stages

The development cost would vary depending on the feature complexity, ranging from $30,000 to $100,000 (AUD 46,000 – AUD 154,000) or more. The cost may also vary depending on refinement levels, biometric logins, offline mode, etc.

| Development Phase | Activities | Estimated Cost | Time and Effort |

|---|---|---|---|

| Planning | Market research, licensing | $10,000 – $20,000 (15,400 AUD – 30,800 AUD) | 1-2 months |

| Design | UI/UX design, prototyping | $20,000 – $50,000 (30,800 AUD – 77,000 AUD) | 2-4 months |

| Development | Coding, backend, integration | $80,000 – $200,000 (123,200 AUD – 308,000 AUD) | 4-6 months |

| Launch | Marketing, deployment | $10,000 – $30,000 (15,400 AUD – 46,200 AUD) | 1-2 months |

| Maintenance | Updates, server costs, and customer support | $10,000 – $50,000/year (15,400 AUD – 77,000 AUD) | Ongoing, varies annually |

Cost Analysis Based on Features

Below is a feature-by-feature cost breakdown explaining how adding each significant accounting-centric feature will increase the overall cost to develop accounting software like Xero.

| Feature Modules | Feature Description | Cost Estimates |

|---|---|---|

| Accounting Module | Recording journal entries, tracking debits & credits (multi-currency support) | $3000 – $6000 (AUD 4620 – AUD 9240) |

| Open Banking API Integration | To integrate as many bank providers as possible on the platform | $5000 (AUD 7700) |

| Payroll Management | Functionality modules like salary calculations, payslip generation, and employee onboarding | $10,000 (AUD 15,400) |

| Analytics & Reporting | Advanced features like filters, drill-down capabilities, visualizations, etc. | $10,000 – $15,000 (AUD 15,400 – AUD 23,000) |

| Third-Party API Integration | Extensive documentation, scalable API endpoints, and reliable authentication methods | $8000 – $10,000 (AUD 12,300 – AUD 15,400) |

| App & Software Development | End-to-end frontend and backend development | $30,000 – $100,000 (AUD 46,000 – AUD 154,000) |

Factors Affecting the Cost of Building Accounting Software in Australia

According to CommBank, accounting firms in Australia are directing technology investments towards improving client experience and operational efficiency. Around 80% of Australian firms perceive current business conditions positively. (Source: CommBank).

This percentage will likely increase with increased investments in Xero-like accounting software to boost financial transparency. Below are the factors affecting the cost of building accounting software in Australia:

Functionality Depth

When considering the cost to build accounting software like Xero, core accounting functions like expense tracking, invoicing, and account charts become important. The software also includes automation features (payment reminders), third-party integration capabilities like CRM integration, payment gateway integration, and analytics and reporting dashboards. Thus, more features = more time = higher development costs.

Platform Choice

Your software’s target platform choice would significantly impact the cost of accounting software development in Australia. Will the application be web, mobile, or available on both? But does it differ? It differs in the user experience and their preference.

Developing a native mobile app for an Australia-specific accounting software like Xero tends to increase cost as it requires its codebase and testing. To counter this, cross-platform frameworks like React Native are preferred, where developers can write just one codebase and run it on both Android and iOS. Even cross-platform sometimes struggle with performance-heavy functionalities or deep API integration.

If you are struggling to decide between Cross Platform or Native App, the following is a must-read: [React Native (Cross Platform) vs Native: What To Choose]

UI/UX Design

Any accounting software’s UI/UX design is critical to its acceptance and long-term success. A well-planned and intuitive UX can dramatically reduce cognitive load, leading to better protocol compliance, quicker approvals, and approachable tax filing. Furthermore, custom implementation of features like smooth transitions, accessibility compliance, etc., are additional improvements that improve user experience but increase development time.

Backend Infrastructure Development

Like accounting software development in Australia, backend development costs for Xero are among the most significant expenses. This component development includes all the business logic, data processing, and validation of user actions. This step involves choosing cloud providers and an architectural approach. The architectural approach here also refers to being serverless for auto-scaling and lowering ops expenses.

This step includes scalability considerations for increasing data volumes and users without slowdowns.

Compliance Cost

Adherence to regulatory compliance while building the best accounting software in Australia is a foundational requirement. Adherence to the Australian Privacy Act 1988 and APPs (Australian Privacy Principles) is necessary. These regulations govern how personal financial data is collected, handled, and stored. To learn more about developing regulatory compliance software for the financial industry.

Your accounting software must support the Australian GST system in tax compliance considerations. In addition, security and end-to-end encryption are necessary, considering the need to protect data and meet industry standards.

This further increases the cost of accounting software development in Australia. While these measures increase the overall cost, they are essential to gaining trust and operational transparency.

If you are interested in knowing how to start a fintech company, do read this blog.

Quick Formula to Estimate the Cost Of a Software Similar to Xero

Total Cost to build an accounting software like Xero = (Number of Hours×Hourly Rate) + Cost of Materials + Miscellaneous Expenses

For instance, 1,000 hours × AUD 185/hou = AUD 185,000.

*Development hours vary by app complexity, and hourly rates depend on the development team’s location and expertise.

Build a lean MVP, save up to 40%, and dominate your market now. Talk to our experts now!

Hidden App Development Costs

It is important to consider a layout map for Xero accounting software development. However, laying out a map for other hidden recurring costs is also important, as building the initial version is just the beginning of its lifecycle. While launching software like Xero, the top priorities are bug fixing and addressing security vulnerabilities.

Software Maintenance and Compliance

In accounting software, where sensitive financial data is involved, even small glitches in reliability and data accuracy could diminish your product’s market value and reputation. Therefore, your software must comply with Australian tax laws and regulations to avoid legal risks.

In addition, apps rely heavily on third-party integrations with bank APIs and payment gateways today. This means that the development team would have to routinely adjust the code to maintain efficient connectivity, even during times of high traffic.

An estimated 15%—25% of the initial development cost can be considered a recurring cost annually.

Hosting and Infrastructure Cost

In the overall cost to build an accounting software like Xero, its cloud-based functionalities are both convenient and necessary. Why? Because such an accounting platform would require

- Secure user authentication

- Real-time data synchronization

These operations demand highly robust cloud infrastructure. In addition, other services like firewall management, server uptime, data backups, etc., are other considerations that go well with the thought of recurring expenses of your accounting platform. These options help ensure your software works efficiently, as any downtime or cyber attack can easily erode trust in such scenarios.

The cost of building an MVP with such recurring expenses could cost $500 – $1000 (AUD 770 – AUD 1,540), and this expense increases as you transition from an MVP to a full-phase software development, ready for the masses.

App Promotions

App promotions and marketing are essential to the overall Xero software development clone cost. Building software or an app is only the first part of the development process. What makes the product popular is how users are initially attracted and retained. App promotions come to the forefront in this regard. To make your product a market champion, recurring costs over marketing needs, like paid advertising, SEO, and content marketing, are consumed. Influencer partnerships and well-managed customer support are other expenses under this corpus.

Altogether, an expense of $5000 – $30,000 (AUD 7700 – AUD 46,000) is invested in it as hidden costs necessary to gain a significant user base.

Industry-Specific Accounting Software Solutions Affecting the Development Costs

Certain industries in Australia require customized accounting software to meet their unique financial needs. This customization can affect development time and costs, as specialized features like job costing for construction or inventory tracking for retail must be incorporated. The more tailored the solution, the higher the development costs, but it ensures the software aligns with industry-specific compliance and operational requirements. Here are some common examples:

Construction Accounting Software for Builders

For builders, features like job costing, subcontractor management, and project-based billing are essential. These features increase development costs but are crucial for accurate expense tracking, budget management, and compliance with industry regulations.

Retail Accounting Software

Integrating POS systems and inventory management in retail software adds complexity and cost. These features ensure smooth operations by tracking sales and inventory, which are vital for efficient retail management.

Healthcare Accounting Software

For healthcare businesses, features like insurance claims management and patient billing drive up costs. However, these are crucial for managing complex billing cycles and staying compliant with healthcare regulations.

Finance Accounting Software

Financial reporting and budget management features in financial accounting software add to development costs. These tools help businesses track financial performance and ensure compliance with industry regulations.

Ways to Optimize Xero Software Development Clone Cost

Building a clone app of Xero or, preferably, a better app than that requires careful consideration of features and costs. Such software development requires a careful balance of feature depth, compliance, and technical scalability within a defined budget. Below are some cost optimization strategies that can help you get going in the market without burning all your chunks in this.

Starting with an MVP

Developing an MVP is one of the most cost-effective ways to manage costs and test the market suitability. Instead of replicating the full suite of features, starting with core functionalities that meet your immediate needs is smarter. Initial MVP features might include the basic functions like invoicing, financial reports, expense tracking, etc. Complex features like inventory management, payroll, and tax reports can be added later once it gets the desired traction and user feedback.

Prioritizing Necessary Features

During full-scale Xero accounting software development, it can be tempting to replicate every feature that Xero offers. However, this approach could result in delayed launches, complexity malalignments, and scope creep. The best approach is to start with features that your target users require. Developing a feature roadmap that aligns with the core user demands is essential.

This consideration helps save crucial development resources, which could be invested further in aligning the app with the target users instead of adding fewer functionalities that would be less used.

Leveraging Cross-Platform Functionality

Cross-platform technologies can help reduce the overall cost and code complexity during accounting software development in Australia. Frameworks like Flutter and React Native are ideal for startups due to their behavior and UI consistency across devices.

For instance, with the help of Flutter, you can build a responsive mobile dashboard to view variables like income, expenses, etc. However, the same framework can be used further for reusable components like invoice creation, transaction entry, etc. This also simplifies ongoing maintenance, frequent updates, and installations. Thus, cross-platform consideration is necessary to make the best small business accounting software in Australia to save initial costs.

How to Make A Better App than Xero: Potential Feature-Rich Add-Ons

Developing a better app than Xero means two things:

- Firstly, the app’s core accounting facilities should be no less efficient than the ones already provided by Xero.

- Secondly, there is always room for enhanced features that are smart and user-focused.

Below are some niche features that can outperform Xero in multiple aspects:

Document Recognition

Automated document recognition that leverages OCR tech can be a powerful feature for your software. This document recognition feature is already in Xero. However, you can enhance the software’s capability by going beyond basic data capture, offering real-time auto-match with system entries, reducing reconciliation time and errors.

This could be helpful for businesses managing large volumes. But yes, it would increase the overall cost to build accounting software like Xero. Accounting software like Xero or any similar app is done either through native features or by embedding it using third-party APIs.

Bonus Read: Guide to Leverage AI in Document Processing

AI-Powered Financial Insights

Most accounting software focuses on static reports and old data. If you are making accounting software similar to Xero, you can incorporate AI-driven intelligence that provides real-time, actionable insights into your accounting software. AI models can help scan financial records to detect unexpected patterns regarding vendor payments, duplicate expenses, etc.

AI-powered accounting software provides AI-driven insights that can also help offer real-time suggestions on saving money on specific expenses, ways to optimize tax deductions (personalized suggestions), etc. Therefore, you can level up your software from a bookkeeping tool into an AI-driven financial advisor.

Voice and Chat Enabled

This feature could allow users to interact with the app through chat and voice-based commands. Instead of manually entering the information, users can chat or talk to perform tasks. With it, users can record and feed the expenses and balance checking. Integrating an inclusive chatbot would instantly support any user stuck on a query. Such an accounting software would feel more conversational, thus earning the potential to earn a massive user base.

Surely, it would add to the total cost to develop an accounting software like Xero, as it will require NLU frameworks and complex backend integration.

In-App Tax Management

Businesses must comply with GST rules, BAS (Business Activity Statements), and the Australian Taxation Office guidelines. This is where the benefits of developing an accounting software like Xero kick in. With GST summaries and secure digital channels, the app can automatically map your financial activity. The system could also send automatic alerts for key tax dates.

Through this inclusion, the app can generate detailed tax reports with a button click. This allows your to-be app to become a trusted compliance partner instead of just a bookkeeping app.

Step-By-Step Process to Make a Software Like Xero

We have previously discussed the core cost breakup of Xero accounting software development. However, it is necessary to understand the development process of such software so that expenses are evenly distributed and no money is wasted mid-development due to ineffective planning. Let us go through each step now:

Conduct Market Research

The first step is to comprehensively study the target market and current trends in the industry. It is necessary to identify pain points and how your solution will address them. Defining a clear business goal is important, as it informs whether you are serving small businesses or big enterprises. In addition, it also helps guide development decisions, including budget planning.

Determine Core Features

Consider outlining important features of your accounting software in Australia. These may include invoicing, tax calculations, payroll, etc. It is also necessary to prioritize features based on user needs and what the competition offers, as this helps prioritize spending and manage development expenses.

Choosing the Right Tech Stack

It is important to choose the right tech stack for Xero accounting software development. A suitable tech stack ensures consistent efficiency and long-term maintainability of the platform. For example, choosing Angular or React for the front end can be complemented by Node.js or Django for the backend, followed by AWS for hosting.

Designing UI and UX

A good UI and UX design helps facilitate software adoption on a massive scale. Many business owners tend to ignore the role of good UI/UX during software development. Specifically, for accounting software development in Australia, it is often recommended to focus on simplicity, accessibility, and intuitiveness, as accounting tasks can be highly complex.

Develop an MVP

The accounting software development process is usually time-consuming and resource-intensive. Thus, building an MVP version of your vision significantly helps in understanding the market, user traction, and module functionality. It also helps enable real-world testing with a real user base to gather genuine feedback. Keeping it lean helps ensure that you can change the development direction if things do not seem clear.

Conducting Thorough Testing

It is usually recommended that you test your product on various variables like functionality, speed, performance, usability, and security. Both automated and manual testing are necessary to derive an effective, user-friendly experience. This kind of robust testing pre-product launch is required to test the data’s functional and financial security. It is also critical to be recognized as one of the best accounting software in Australia.

Deploy and Monitor

After the test phase, the product is deployed to the live environment using a secure deployment method. Monitoring tools are used to track variables like performance, uptime, user behavior, real-time traffic, etc. This phase also ensures that issues are addressed before they start affecting multiple users.

Maintenance & Updates

This is the last but highly significant addition to your post-app development process. Your product should be complemented by ongoing support regarding immediate bug fixing, feature improvements, and compliance with the regulatory landscape. Plan regarding ongoing costs like hosting, development, and 24*7 customer support. This approach also helps you preserve software performance and user trust.

Craft a wicked, scalable product that obliterates Xero and equips your customers with elite financial tools.

How Appinventiv Can Help Build A Better App than Xero

Developing an accounting software clone like Xero requires technical expertise, deep domain expertise in product vision, and a forward-thinking development approach.

This is where our team at Appinventiv stands out. We bring a strategic combination of top-level consulting and product design excellence. As a renowned software development company in Australia, our strength lies in utilizing Agile methodology, combined with DevOps and a user-first approach. This gives us enough space for continuous iterations based on feedback from both users and clients.

With 3000+ solutions delivered to our clients worldwide, Appinventiv provides Fintech software development services in australia that ensure that they know what it is doing. From product strategy to cloud hosting and post-launch maintenance, we follow a full circle and are known to offer end-to-end support without overstretching your budget.

We aren’t just a vendor that aims to deliver your product; we are a technology partner committed to helping you differentiate your product from the ones already booming in the market. Connect with us here and let’s discuss your vision.

FAQs

Q. How much does it cost to develop an accounting software like Xero?

A. Building a clone or better software than Xero would typically cost between $30,000 and $500,000 or more, depending on core complexities and platform support. Additional maintenance and legal compliance costs as post-launch expenses would be recurring expenses, but they would be worth enough to support the expanding user base and complex feature integration. Initially, building an MVP would cost less and would probably be better to test the market presence.

Q. How long does it take to build accounting software in Australia?

A. To build an accounting software in Australia, it takes around 9-12 months for a full-scale enterprise-grade app. The typical development timeline revolves around 4 months for an MVP, with core features like expense tracking, invoicing, user onboarding, etc. If the development is done through a reputed software development firm in Australia, this time may be reduced due to effective team size and software development approach, preferably Agile and DevOps combined.

Q. What is the future of accounting software in Australia?

A. With AI and automation, the future of accounting software in Australia is on for rapid innovation. With more users relying on smartphones for business tasks, the mobile-friendly features mentioned in the blog would significantly help scale your accounting software idea. With open banking APIs fully available in Australia, accounting platforms are integrating directly with banks, creating a customized ecosystem.

Q. What technologies are best suited for building a cloud-based accounting software like Xero?

A. Developing a cloud-based accounting software would require a robust yet scalable tech that supports:

- Compliance and Integration

- Real-Time Data Processing, and

- Multi-User Access

Therefore, the frontend and backend would need to be incorporated with frameworks like Flutter (for cross-platform), Angular (for responsive interface), and PostgreSQL (for database handling). Similarly, cloud platforms like AWS and Google Cloud would be used to manage hosting and file storage needs.

Q. What are the challenges with Xero-like software development?

A. Developing Xero-like software is not an easy task. The procedure becomes complex with the potential inclusion of various feature-rich modules that require deep domain expertise. Secondly, challenges with regulatory compliance are another factor. The software handles highly sensitive financial data, so adherence to all data laws becomes important here. Additionally, seamless integration with banks and other third-party platforms becomes challenging due to diverse API standards and security protocols.

Q. What regulatory and security considerations should be prioritized in Australia?

A. When developing accounting software for the Australian market, it’s crucial to prioritize:

- ATO Compliance: Ensure the software supports Single Touch Payroll (STP), Business Activity Statement (BAS) lodgement, and Goods and Services Tax (GST) calculations.

- Data Security: Implement strong encryption methods, secure data storage solutions, and regular security audits to protect sensitive financial information.

- Privacy Laws: Adhere to the Privacy Act 1988 and the Australian Privacy Principles (APPs) to safeguard user data and maintain trust.

By addressing these considerations, you can develop accounting software that not only meets legal requirements but also ensures the security and privacy of your users.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

The ROI of Strategic Insurance Technology Consulting for Legacy Modernization

Key takeaways: Insurance technology consulting delivers ROI only when modernization is tied to real workflows, not system replacement. Most legacy modernization failures stem from weak ROI definition and tracking, not from technology limitations. The strongest returns come from reduced operational friction, faster change cycles, and tighter claims and underwriting control. Delaying modernization incurs hidden costs…

Key Takeaways Use a scorecard-driven RFP and a technical assessment to compare vendors on capability, compliance, and delivery risk. Local partners provide regulatory and cultural alignment; hybrid teams often pair that with offshore cost efficiency. Start with a scoped pilot or MVP, milestone-based contracts, and clear IP/SLAs to reduce procurement risk. Require demonstrable security controls,…

A Strategic Framework for Proof of Concept Software Development

Key takeaways: Most enterprise PoCs fail due to a lack of decision clarity, not technical feasibility or innovation potential. A disciplined PoC framework reduces delivery risk before budgets, teams, and timelines are committed. Enterprise-grade PoCs validate feasibility, compliance, and scale assumptions under realistic operating constraints. Clear success metrics and governance turn PoCs into reliable inputs…