- Financial Services in the Age of Data: What's Changing and Why It Matters

- How Computer Vision Is Disrupting FinTech: 16 Powerful Use Cases

- Faster Customer Onboarding and KYC Processes

- Stronger Fraud Detection and Prevention

- Improved ATM and Kiosk Security

- Real-time Damage Assessment for Insurance

- Automated Document Processing and Data Extraction

- Trading Floor Surveillance and Behavioral Analytics

- Personalized Customer Experiences

- Digital Wallet and Contactless Payments

- Loan Origination and Credit Scoring

- Physical Asset Monitoring and Valuation

- Enhanced Cybersecurity

- ATM Skimming and Fraud Prevention

- Compliance and Regulatory Reporting:

- Monitoring Retail and Branch Traffic

- Augmenting Human Staff

- Remote Asset Inspection and Due Diligence

- Key Components and Algorithms of Computer Vision in Finance

- Practical Insights on Integrating Computer Vision In Your Finance Operations

- What’s Next? The Future of Computer Vision in Financial Services

- Transform Your Financial Operations with Appinventiv's Cutting-Edge Computer Vision Services

- Frequently Asked Questions (FAQs)

Key takeaways:

- Banks using computer vision in finance see real money saved—up to 90% less spent on KYC checks, fraud fighting, and paperwork processing.

- JPMorgan, Lemonade, and Wells Fargo already prove this works: customers get approved faster, accounts stay safer, and everything feels smoother.

- What’s coming next looks even better—AI that combines different data types, processing that happens right on devices, and systems that create new content.

- Smart rollout means picking partners who know banking rules and can scale technology properly across your whole operation.

Think about what slows your team down every day. Does everyone spend hours processing paper documents and manually checking information that computers could handle automatically? Are you constantly fighting new fraud tactics that seem to get smarter every month? Maybe your customer signup process takes so long that people give up before finishing it completely.

These problems aren’t minor inconveniences; they create serious friction that blocks innovation, damages customer relationships, and hands advantages directly to your competitors. Digital experiences have become mandatory for business survival, so what if the answer isn’t another software patch but completely changing how your systems actually see and understand information?

Technology that used to exist only in self-driving cars and factory automation now solves exactly these business problems. Computer vision is already transforming financial services in measurable ways. This isn’t a theoretical discussion anymore—it’s happening right now in banks and financial companies worldwide.

Computer vision isn’t some niche tech anymore—businesses everywhere actually use it now. The market hit $17.84 billion last year, and experts think it’ll reach $58.33 billion by 2032, growing about 15.9% yearly. Companies in banking, healthcare are using AI vision tools to make sense of visual stuff they couldn’t handle before. It’s changing how work gets done, not just adding fancy features.

This isn’t just a trend; it’s a strategic imperative. The question is, are you ready to harness its full potential to build a more secure, efficient, and user-centric FinTech organization?

Bonus Read: The Role of Computer Vision in Business

Financial Services in the Age of Data: What’s Changing and Why It Matters

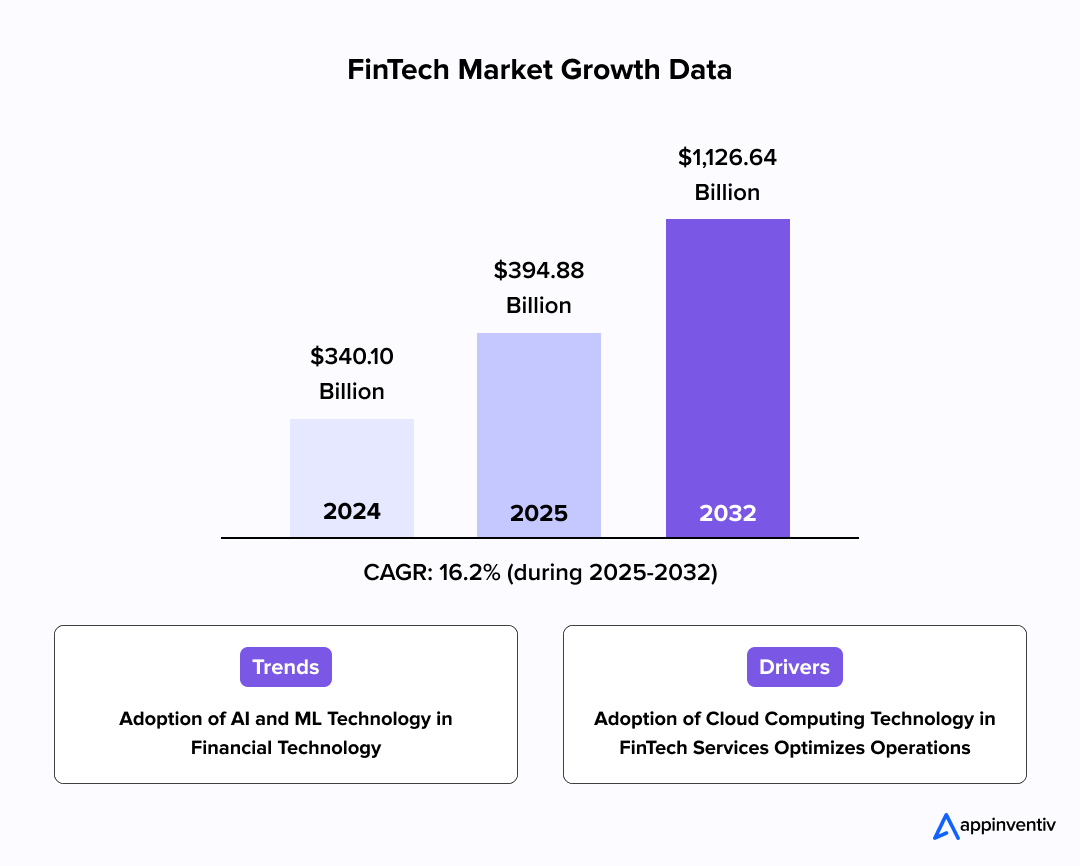

The fintech industry is a crucible of innovation, where technological advancements are constantly redefining market dynamics. The global fintech market, valued at $340.10 billion in 2024, is projected to reach $1,126.64 billion by 2032, with an overall CAGR of 16.2% through 2032.

This rapid expansion stems from businesses demanding smooth digital experiences and highly customized financial products. Companies that can quickly process and analyze massive data volumes now gain significant competitive advantages. Visual information, previously overlooked by most organizations, has become essential for discovering new insights and operational improvements.

Ignoring this trend means falling behind permanently.

Fintech expert Chris Skinner captured this perfectly: “Ignoring technological change in a financial system based upon technology is like a mouse starving to death because someone moved their cheese.”

The real challenge isn’t just adapting to these changes—it’s actively using computer vision technology to create strategic advantages over competitors who haven’t made this transition yet.

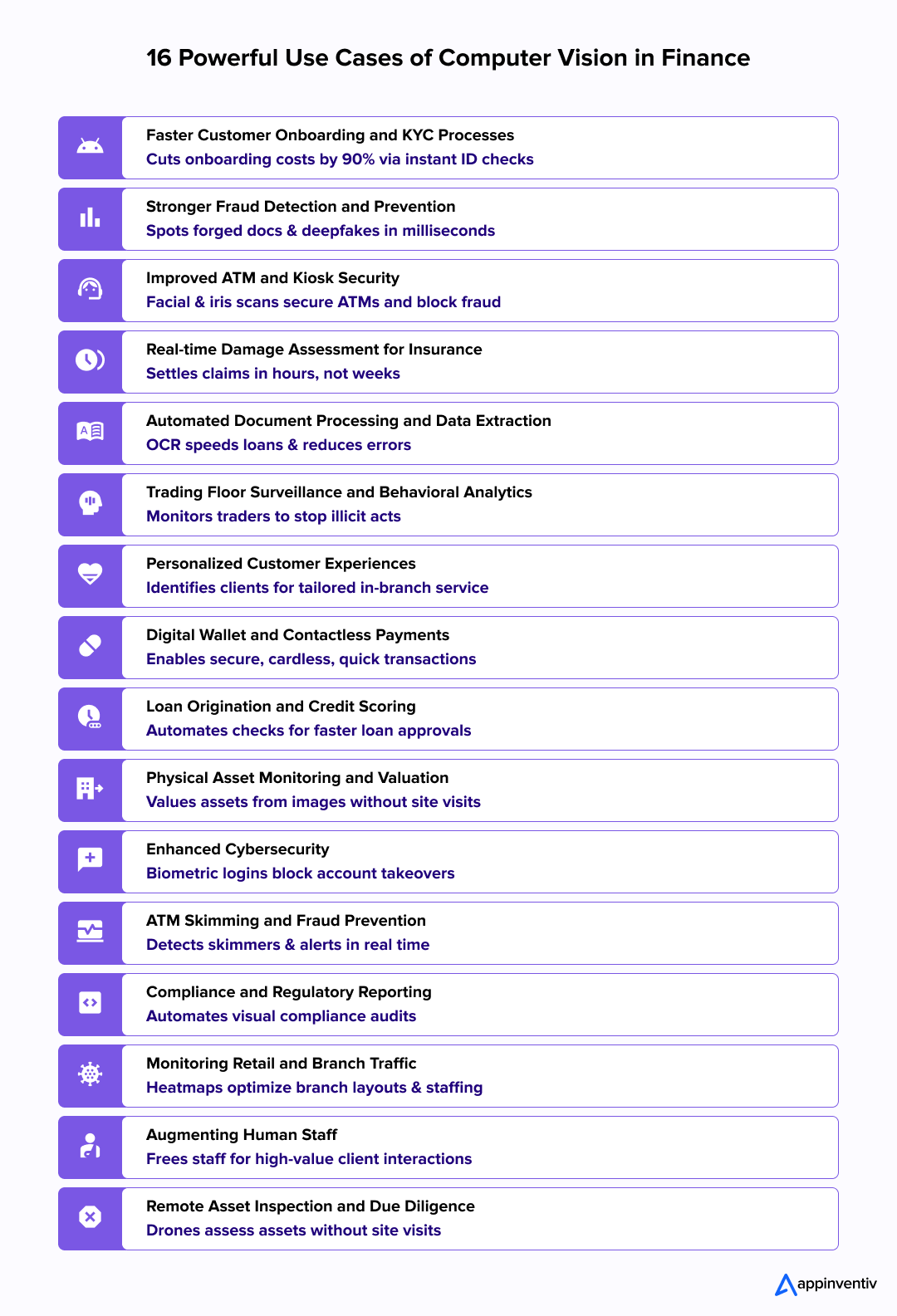

How Computer Vision Is Disrupting FinTech: 16 Powerful Use Cases

Computer vision has evolved from futuristic speculation into practical, scalable technology addressing urgent financial sector challenges right now. Teaching machines to interpret visual information creates unprecedented efficiency, security, and customer experience improvements. Strategic implementation of this technology delivers a measurable impact on your organization’s financial performance.

Here are 16 ways computer vision is revolutionizing the financial world:

Faster Customer Onboarding and KYC Processes

Computer vision has transformed previously tedious customer registration procedures completely. Customers simply use smartphone cameras to scan government identification documents. The technology automatically pulls relevant data, confirms document authenticity through watermark and security feature verification, and employs liveness detection, ensuring real people rather than photographs or videos. This critical use case, among the many computer vision use cases in finance, dramatically cuts manual data entry requirements and eliminates human verification errors.

Business Benefit: Digital identification solutions cut customer onboarding expenses by up to 90%. This speed boost significantly improves new client conversion rates through fast, smooth user experiences. Financial institutions gain powerful competitive advantages when first impressions feel effortless, driving stronger long-term customer relationships and loyalty. The scalability of these solutions enables institutions to handle 10x more applications during peak periods without proportional increases in operational staff.

Example: JPMorgan Chase started using AI to speed up their customer verification, cutting the time by around 90%. Their system reads documents, analyzes images, and spots patterns in customer information way faster than people can. This means new customers get approved quicker, and JPMorgan’s staff can work on more important tasks instead of sorting through paperwork all day.

Stronger Fraud Detection and Prevention

Financial companies constantly fight sophisticated fraud attempts. Computer vision analyzes visual information to identify inconsistencies and document forgeries effectively. The technology verifies check signatures, detects altered identification documents, and analyzes video content to spot deepfakes during video-based KYC processes. This advanced security approach surpasses traditional rule-based systems that only recognize previously known fraud patterns.

Business Benefit: Proactive real-time detection prevents financial losses while dramatically reducing false positive alerts, ensuring legitimate transactions process smoothly without unnecessary blocks that frustrate customers and damage their banking experience. The ability to detect fraud attempts within milliseconds enables institutions to prevent losses before they occur, rather than recovering funds after damage is done.

Example: Onfido has developed sophisticated fraud detection technology through its dedicated Fraud Lab, which generates hundreds of thousands of fraud videos using masks, mannequins, and videos to train anti-fraud models. In just six months, Onfido’s Fraud Lab helped improve fraud detection rates on documents by 5X and on biometrics by 9X.

Must Read: AI Agents in Fraud Detection

Improved ATM and Kiosk Security

Modern ATMs and banking kiosks increasingly use biometric authentication through facial and iris recognition technology. Computer vision in financial industry applications ensures that only authorized individuals have access to their accounts securely. The systems also monitor users for suspicious activities, like people watching over their shoulders, and alert security teams immediately, creating proactive protection layers.

Business Benefit: This technology reduces card skimming and identity theft significantly, preventing financial losses and protecting institutional reputation from security breaches. Cardless transactions increase public trust while showing the bank’s real commitment to customer security and data protection.

Example: Wells Fargo has implemented comprehensive biometric authentication systems for both corporate and consumer customers, including eyeprint recognition, facial recognition, and voice authentication. Wells Fargo has implemented a cardless ATM system using mobile authentication, which reduces card skimming risk while improving convenience.

Real-time Damage Assessment for Insurance

Insurance companies now use AI and computer vision to handle auto, property, and health claims differently. When customers submit photos or videos of damaged cars or homes, these systems immediately evaluate the severity of the damage, determine which parts need fixing, calculate likely repair expenses, and spot suspicious claims automatically.

Business Benefit: This innovation accelerates the claims cycle from weeks to hours, which is the number one driver of customer satisfaction in the insurance sector. It also removes human subjectivity from the assessment process, leading to more consistent and fair payouts while drastically reducing the operational overhead and costs of sending out physical inspectors.

Example: Lemonade has revolutionized insurance claims processing through its AI system called “AI Jim,” which processes over 30% of claims without human intervention with an average settlement time of just 3 seconds. In 2021, Lemonade achieved a 30% reduction in claims processing costs attributed to the efficiency gains from AI-driven automation.

Bonus Read: Data Analytics in Insurance

Automated Document Processing and Data Extraction

Financial institutions are drowning in paperwork, from loan applications to invoices. Computer vision-powered OCR (Optical Character Recognition) technology can read and extract structured and unstructured data from documents, regardless of their format (scanned images, handwritten forms, PDFs). This system goes beyond simple text extraction to intelligently recognize document types and specific fields. This is a foundational element in many computer vision use cases in finance.

Business Benefit: Automating this task reduces data entry errors, freeing up employees for higher-value work. This drastically speeds up internal processes like loan approvals and credit risk analysis, directly improving the business’s agility and capacity to handle higher volumes without increasing headcount.

Example: USAA has pioneered mobile check deposit technology using computer vision, becoming the first bank to offer mobile deposit capture services. USAA has developed voice-guided mobile check deposit features specifically for visually impaired military members, demonstrating their commitment to accessibility through computer vision innovation.

Trading Floor Surveillance and Behavioral Analytics

For institutions engaged in trading, regulatory compliance is non-negotiable. Computer vision systems can monitor trading floors, not just for security, but to analyze employee behavior. The system identifies individuals, tracks their movements and interactions, and flags patterns that deviate from normal behavior, such as unauthorized meetings or unusual access to restricted areas.

Business Benefit: This shifts compliance from a reactive, post-facto audit to real-time monitoring. The ability to detect and prevent insider trading or other illicit activities before they occur protects the firm from massive regulatory fines, reputational damage, and catastrophic financial penalties.

Example: American Express improved fraud detection by 6% using advanced AI models, while PayPal enhanced their real-time fraud detection by 10% through AI systems running around the clock worldwide. Bank of America implemented Erica, an AI-powered virtual assistant with fraud detection capabilities that monitors transaction patterns and alerts customers to unusual activities in real-time, helping prevent millions in potential losses.

Personalized Customer Experiences

Computer vision can analyze customer behavior within physical bank branches or even through mobile app interactions. For instance, when a valued customer walks into a branch, the system can identify them, alert a relationship manager with a summary of their recent activity, and enable a highly personalized and efficient service experience.

Business Benefit: This personal touch elevates the in-branch experience, turning a routine visit into a relationship-building opportunity. This boosts customer loyalty, increases the chances of cross-selling and upselling, and ultimately makes the institution more competitive in a market where personalized service is a key differentiator.

Example: Bank of America’s Erica virtual assistant can replicate virtually any customer interaction with the bank and is as easy to use and conversational as commonly used home AI assistants like Amazon’s Alexa. Customers can perform transactions like checking balances or finding out how much money they spent at specific merchants like Starbucks within the chatbot, providing a much better experience than traditional call center interactions.

Digital Wallet and Contactless Payments

Many modern payment systems, from facial recognition at a point-of-sale terminal to QR code payments, are powered by computer vision. This technology enables secure, cardless, and contactless transactions, a feature of computer vision in finance that is increasingly popular with consumers who prioritize speed and convenience.

Business Benefit: Offering seamless and secure payment options enhances the user experience, drives higher transaction volumes, and increases merchant adoption. This frictionless payment experience is a significant competitive advantage, attracting a younger demographic and positioning the institution as a market leader in innovation.

Example: A payments bank successfully used AmyGB’s VisionERA Intelligent Document Processing Platform for FASTag verification, utilizing computer vision, OCR/ICR, Machine Learning, and Neural Linguistic Programming to detect fraudulent transactions. The implementation resulted in an improved scale of operations with the ability to process more applications in less time.

Loan Origination and Credit Scoring

The process of loan origination is typically document-intensive. Computer vision can automatically analyze income statements, bank records, and other financial documents submitted by applicants. The extracted data is then fed into credit scoring models, leading to faster, more accurate assessments. It can even assess the quality of the documents themselves, flagging poor-quality scans that might hide fraud. This is a key example of computer vision in finance.

Business Benefit: The automation of this process dramatically shortens the loan application timeline, improving the borrower experience. For the lender, it leads to more consistent, objective, and faster risk assessments, which increases the volume of loans processed while reducing human bias and the risk of default.

Example: JPMorgan Chase implemented advanced ML-driven fraud detection and risk management solutions that use machine learning algorithms and predictive analytics to monitor real-time transactions and identify anomalies. JPMorgan Chase’s use of AI for credit risk assessment represents a significant leap in banking technology, improving operational efficiencies and reducing risks while making decisions faster, smarter, and more client-centric.

Physical Asset Monitoring and Valuation

Computer vision is used to analyze visual data of physical assets, such as real estate or vehicles, for valuation and risk assessment. For a mortgage application, for example, a system can assess the condition of a property from images, a key step in ensuring the collateral value is accurate.

Business Benefit: This replaces expensive and time-consuming manual site visits, especially for remote assets. For insurers and lenders, it enables faster, more accurate risk assessments and valuations, ensuring the collateral is correctly valued and preventing unexpected losses in the underwriting process.

Example: Cape Analytics employs computer vision to analyze satellite imagery for property insurance, with their system identifying roof conditions and potential damage while detecting features relevant to insurance risk assessment. Ant Financial uses computer vision to streamline vehicle insurance claims through their app, which identifies and assesses vehicle damage from photos, recognizes specific damaged parts, and estimates repair costs.

Enhanced Cybersecurity

Biometric login methods, such as facial recognition and fingerprint scanning on mobile banking apps, are driven by computer vision. These methods offer a more secure alternative to traditional passwords and PINs, and the technology’s use of “liveness detection” ensures that a fraudster cannot use a photo or video to gain access, making it highly secure.

Business Benefit: This builds a robust defense against account takeover fraud, a major concern for digital platforms. It provides customers with a higher level of security assurance than traditional passwords, reinforcing trust in the digital platform and reducing the costly fallout from security breaches.

Example: Wells Fargo has implemented comprehensive biometric authentication across its mobile applications, allowing customers to use face or fingerprint recognition instead of usernames and passwords. More importantly, Wells Fargo does not store this biometric information – it remains securely on the customer’s device.

ATM Skimming and Fraud Prevention

Computer vision can detect the presence of skimmers or other fraudulent devices attached to ATMs. The system is trained on what a normal ATM looks like and can immediately detect the visual anomaly of a foreign object—such as a credit card skimmer or a hidden camera—and send a real-time alert to security personnel.

Business Benefit: This shifts the security paradigm from detecting fraud after the fact to preventing it in real-time. It protects a vast number of potential victims from a single compromised machine, saving the institution millions in potential losses and associated chargeback fees, while also protecting its brand reputation.

Example: Onfido has launched the first Fraud Lab capable of creating synthetic attacks at scale, with the ability to mass-produce synthetic attacks to deliver faster, more accurate AI-powered fraud protection. Onfido processes millions of identity verification requests every year, helping many clients detect fraud across 2,500 document types from 195 countries, and has detected and stopped over 267 global fraud rings to date.

Compliance and Regulatory Reporting:

The financial industry operates under strict regulatory scrutiny. Computer vision can help by automatically monitoring and flagging specific compliance-related visual data. This could include ensuring all necessary signatures are present on a contract or auditing security footage to confirm standard procedures are being followed.

Business Benefit: This moves compliance from a manual, spot-checking process to an automated, continuous audit. It drastically reduces the risk of non-compliance fines and legal action, while also freeing up the legal and compliance teams to focus on more complex, strategic issues that require human judgment.

Example: Bank of America implemented AI systems that continuously learn and adapt to new patterns in fraud as criminals evolve their tactics, with the AI agents successfully identifying and preventing fraudulent transactions before they affect customers. The implementation resulted in a noticeable decrease in fraud cases, improved detection speed with real-time flagging of irregularities, and increased customer satisfaction due to enhanced security measures.

Monitoring Retail and Branch Traffic

By analyzing video feeds from bank branches or retail outlets, computer vision can provide insights into customer foot traffic, queue lengths, and popular areas. This data, often presented in the form of heatmaps, can be used to optimize staffing, improve branch layout, and enhance the in-person customer experience.

Business Benefit: The insights gained from this data can be used to optimize staffing levels during peak hours, rearrange the branch layout for better flow, and place promotional materials where they are most likely to be seen, thereby maximizing the efficiency and effectiveness of the physical space and improving customer retention.

Example: Abu Dhabi Islamic Bank (ADIB) now offers account opening through their mobile app using facial recognition, eliminating branch visits while maintaining robust security standards.

Augmenting Human Staff

Computer vision isn’t about getting rid of people – it’s about helping them do better work. For example, a loan officer can use a computer vision tool that automatically pulls information from a customer’s papers. This means they can spend more time talking with the customer and giving helpful advice. This changes the worker’s job from typing data into computers to being a smart advisor.

Business Benefit: This makes workers happier and more interested in their jobs because they can focus on important tasks that need human thinking and people skills. It also makes customer service better because customers talk to someone who really knows their stuff instead of someone who’s busy with paperwork.

Example: JPMorgan Chase built a smart system called COiN (Contract Intelligence) that reads and understands business loan papers. It can look through thousands of documents in seconds – work that would take people 360,000 hours every year. While it was mainly built to make work faster, this technology also helps catch fraud by spotting weird things in documents that might mean someone’s trying to cheat.

Remote Asset Inspection and Due Diligence

For a variety of financial services, including commercial lending and property insurance, computer vision enables remote inspection of assets. Drones equipped with high-resolution cameras can survey a property, and computer vision can identify and report on its condition, defects, or value changes. This is a practical application of Integrating computer vision in financial operations.

Business Benefit: This eliminates the need for expensive and time-consuming physical inspections, especially for large or remote assets. It enables faster, more scalable, and more consistent asset evaluation, which is a significant competitive advantage for commercial lenders and insurance firms, allowing for faster and more confident decision-making.

Example: Zurich conducts AI-powered drone inspections at the Dübendorf Air Base in Switzerland. Drones equipped with high-resolution cameras capture detailed images of infrastructure, which AI models analyze to detect defects such as cracks in runways. This approach reduces the need for manual inspections, lowers costs, and enhances safety by minimizing human exposure to hazardous environments.

Prioritize your highest-impact computer vision opportunities.

Key Components and Algorithms of Computer Vision in Finance

To understand how computer vision really works, you need to know the basic building blocks that make it possible. This technology mixes special computer parts, software, and smart math rules to help computers see, study, and understand pictures and videos from the real world. Recent improvements have made these tools really powerful and useful.

The main types of computer vision technologies include recognizing pictures, finding objects, identifying faces, and reading text from documents. Each one does different jobs in banks and in customer service.

Here are the main parts and smart systems that make it work:

- Deep Learning and Neural Networks: Today’s computer vision uses deep learning – basically, computer networks with many layers that work like human brains do. Convolutional Neural Networks are really good with pictures, finding patterns and identifying things with accuracy that seemed impossible just a few years ago.

- Optical Character Recognition (OCR): This technology takes any kind of document – scanned papers, PDFs, photos – and turns the words into something computers can use. Banks use this all the time to pull information from financial papers, bills, and legal documents without someone having to type it all in.

- Facial Recognition: This technology maps the special features in someone’s face to check who they are. Bank security uses it now – unlocking phone apps, checking ATM users, and stopping fraud. The best systems make sure it’s a real person so criminals can’t trick them with photos or videos.

- Object Detection: These systems spot and follow specific things in pictures or live video. Banks might use them to find forgotten bags in waiting areas, count customers in line to decide how many staff they need, or watch for people going into areas they shouldn’t.

- Convolutional Neural Networks (CNNs): These networks are a main part of modern computer vision. They’re built to recognize patterns in pictures, looking at images in layers to find things like edges, shapes, and textures. In banking, these networks help with face recognition, catching fraud, and security monitoring, making picture analysis faster and more accurate.

Also Read: Benefits of Facial Recognition Software Development

These features of computer vision in finance work in concert to create robust systems that not only see but also understand the nuances of the financial world. They form the building blocks for the innovative solutions discussed throughout this article. But what about the practicalities of getting started?

Must Read: Business Applications of Artificial Neural Networks

Practical Insights on Integrating Computer Vision In Your Finance Operations

Rolling out advanced technology like computer vision needs careful planning that balances business objectives with realistic implementation steps. Success depends less on the technology itself and more on having a smart rollout strategy that actually delivers measurable results.

Bonus Read: How to Bring Resiliency in Financial Services Business

Here’s how to start using computer vision in the financial industry:

Pick One Big Problem First: Don’t try to fix everything at once. Find one specific problem where computer vision can help right away, with results you can measure. Maybe processing documents takes forever and causes lots of mistakes. Or maybe fake identities when people sign up keep getting worse. Choose one focused computer vision in financial industry use that proves the technology works and gets people in your company excited about using it more.

Figure Out Real Costs vs Benefits: The Cost of implementing computer vision in financial industry projects usually costs $50,000 to $350,000 for complete custom solutions. But smart fraud-catching systems are expected to save billions of dollars across the whole industry. These savings, plus keeping more customers happy and avoiding damage to your reputation, make the investment worth it. To actually make money back, you need to focus exactly on which business problems you’re really solving.

Pick Your Development Partner Smart: Computer vision setup gives you two main choices: build everything yourself or work with experts. Most companies find working with specialists works better and costs less. When looking at possible partners, focus on these important things:

- Industry Knowledge: Have they actually built solutions for banks, fintech companies, and insurance companies before? Real experience matters more than just general tech skills.

- Strong Technical Skills: Can they prove they’re experts in machine learning, picture processing, and making AI systems work for production environments that handle lots of transactions?

- Clear Talk and Ongoing Help: Good partners talk honestly about how long things will take and what they’ll cost, give reliable help after launch, and use simple pricing. The right partner becomes your strategic helper, guiding you through technical problems while making the setup successful faster.

Roll Out Computer Vision Slowly: Following the steps in implementing computer vision in financial services works best when done step by step. Once you’ve found the problem and picked your development partner, use a staged rollout plan. Start with a small test to check basic features, then expand to a pilot program with real users, and finally use it across your whole company. This approach reduces risks, gets valuable user feedback, and makes sure your solution actually works reliably before everyone counts on it..

Our deep industry knowledge and technical skills make us the ideal partner for your phased fintech transformation

The discussion has moved beyond theoretical computer vision possibilities toward practical integration strategies that deliver measurable business results. How will your organization position itself to lead this technological shift rather than follow competitors?

What’s Next? The Future of Computer Vision in Financial Services

Computer vision innovation keeps accelerating, with emerging trends set to reshape financial services even more dramatically. Here’s what’s coming for future trends of computer vision in finance:

- Multimodal AI: Next-generation multimodal AI platforms will combine visual data with text, audio, and other information sources to understand situations more completely, like humans do. Picture a system analyzing customer service videos while simultaneously listening to conversations and reading screen text to gauge customer satisfaction levels accurately.

- Edge Computing Integration: Visual data processing will happen directly on local devices—ATMs, branch terminals—instead of cloud servers. This approach cuts response times, strengthens security, and enables real-time applications where split-second decisions matter most.

- Generative AI Capabilities: Advanced computer vision won’t just analyze images—it will create them too. Banks could generate realistic training simulations, produce synthetic data for better model performance, or design personalized marketing visuals automatically.

Bottom Line

The challenges & benefits of computer vision in finance present a clear trade-off. Yes, significant investments in technology, data infrastructure, and specialized talent are required upfront. However, the returns, stronger security, streamlined operations, and exceptional customer experiences far outweigh these initial costs.

Financial institutions face a defining choice right now. Will you watch from the sidelines while competitors harness this transformative technology, or will you take decisive strategic action? Industry leaders will emerge from organizations that don’t just adopt computer vision but actually master its practical implementation.

The discussion has evolved beyond basic “what is computer vision?” questions toward strategic “how do we leverage this technology effectively?” conversations. Action becomes essential now.

Transform Your Financial Operations with Appinventiv’s Cutting-Edge Computer Vision Services

The financial industry stands at the cusp of a visual intelligence revolution, and Appinventiv emerges as your trusted partner to navigate this transformation. With our advanced computer vision development services, we empower financial institutions to revolutionize fraud detection, automate document processing, enhance KYC verification, and streamline customer onboarding through intelligent visual recognition systems. Our solutions enable real-time authentication, automated cheque processing, and sophisticated risk assessment capabilities that traditional methods simply cannot match.

As a globally recognized technology leader with over 3,000 successful project deliveries across 35+ industries, Appinventiv brings unparalleled expertise to fintech software development as well. Our prestigious client portfolio includes industry giants like American Express, demonstrating our capability to deliver enterprise-grade solutions that scale seamlessly.

Why Choose Appinventiv:

- Award-Winning Excellence: Consecutive Deloitte Technology Fast 50 Awards (2023 & 2024), Tech Company of the Year at Times Business Awards 2023

- Certified Security: ISO 9001:2008, ISO 27001, and SOC 2 certifications ensuring robust security protocols

- Proven Track Record: 1,600+ tech experts delivering solutions for Fortune 500 companies and innovative startups

- Industry Recognition: Best Place to Work 2023 (Outlook India) and Clutch Global Award 2025 winner

Our comprehensive AI and machine learning capabilities, combined with deep domain expertise in financial services, enable us to deliver future-ready solutions that not only meet today’s challenges but also anticipate tomorrow’s opportunities. From startups to Fortune 500 companies, we’ve consistently delivered measurable results with a 97% client retention rate, helping businesses achieve 40% cost reduction and 60% enhanced operational efficiency through our innovative technology solutions.

Ready to revolutionize your financial operations with intelligent computer vision? Contact us today and let our experts transform your vision into reality.

Frequently Asked Questions (FAQs)

Q. How Can Computer Vision Be Used in Finance/Banking?

A. Computer vision in finance reshapes it across numerous applications: streamlined document handling for loans and KYC requirements, mobile check deposits that immediately capture and authenticate check images, plus sophisticated fraud prevention through facial recognition and transaction behavior analysis. Banks implement it for customer verification, ATM surveillance, and branch protection. Insurance providers automatically evaluate property damage claims using visual assessment. Investment companies examine satellite imagery and visual information for trading insights, while compliance teams benefit from automated document validation and audit workflows.

Q. What Are the Security Benefits of Computer Vision in Financial Institutions?

A. Computer vision strengthens financial security through biometric systems that block unauthorized access and prevent identity theft effectively. Real-time fraud detection analyzes facial expressions, behavior patterns, and suspicious transaction activities automatically. ATM and branch monitoring identifies threats and unusual activities instantly.

Document verification becomes more reliable through automated detection of forged signatures, modified documents, and counterfeit identification cards. Computer vision also watches employee behavior to catch internal fraud, examines transaction flows for money laundering indicators, and controls access to restricted areas securely.

Q. How Can Computer Vision Enhance Customer Experience in Financial Services?

A. Computer vision transforms customer experiences in financial services by allowing instant mobile check deposits that eliminate branch trips completely. Facial recognition streamlines login processes, cutting wait times and removing password hassles entirely. Smart ATMs provide touchless operation and customized user interfaces automatically. Document submission becomes effortless when customers photograph forms for immediate verification processing.

Branch visits improve through automated line management and personalized service recognition systems. Insurance claims move faster with photo-based damage evaluations, while investment platforms deliver visual portfolio analysis and market trend displays that help customers make smarter financial decisions.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…