- Why Modern Insurers Need Custom Claims Management Systems

- From Automated Claims to Zero-Touch Claims

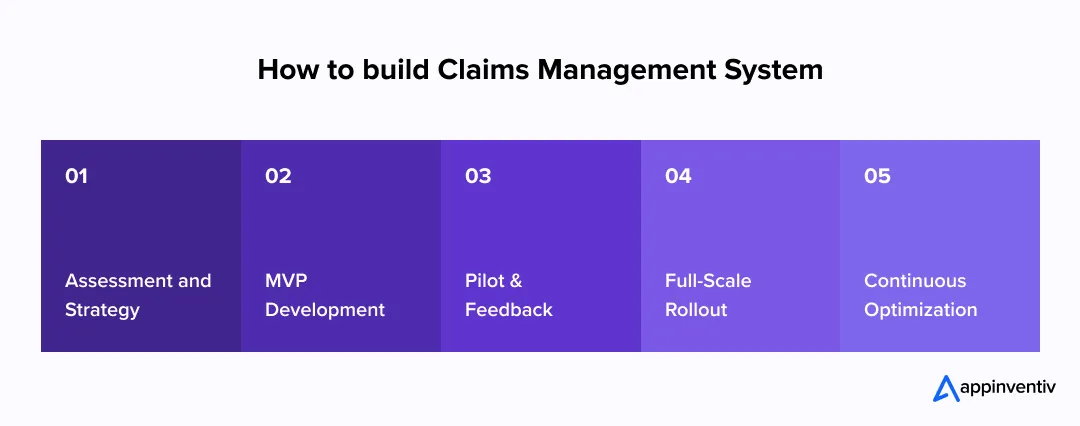

- How to Build a Claims Management System

- Phase 1 – Assessment and Strategy

- Phase 2 – MVP Development

- Phase 3 – Pilot & Feedback

- Phase 4 – Full-Scale Rollout

- Phase 5 – Continuous Optimization

- Architecting a Future-Ready Claims Management System

- Advanced Technologies Powering Modern Claims Systems

- Cost to Build a Claim Management System

- Key Features of Claims Management System

- Benefits of Claims Management Software

- Compliance & Data Governance Across Markets

- Challenges in Building a Claims Management System

- Future Trends in Claims Management

- How Appinventiv Helped Transform Insurance Operations

- FAQs

Key takeaways:

- Streamlined Processing: Insurance claims management software automates data, cutting claim cycle times from weeks to days.

- Tailored to Workflows: Custom software aligns with unique claims workflows, streamlining operations.

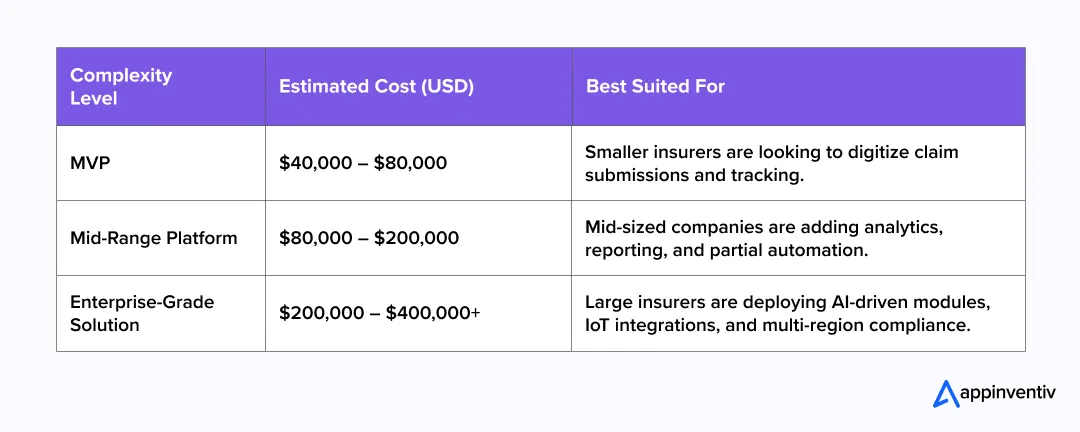

- Cost & Scalability: Development costs range from $40K to $400K, scaling with features like AI and IoT integration.

- Compliance & Security: Built-in compliance with GDPR, CCPA, and IRDAI ensures data protection and regulatory adherence.

- Agile & Future-Proof: Modular design allows easy scaling and feature integration, adapting as business needs grow.

Insurance runs on trust. When claims take weeks, involve endless emails, or stall over missing paperwork, that trust erodes fast. For many insurers, slow and manual claim processes are no longer edge cases; they are a structural problem.

The 2025 J.D. Power Property Claims Satisfaction Study shows average claim cycle times stretching to 44 days, the longest in over a decade. This gap feels even wider as customers grow used to real-time updates and self-service across other digital products.

By 2026, insurers will be shifting focus. The goal is not just faster claims, but also zero-touch workflows for routine, low-risk cases that are resolved automatically. This is where agentic AI comes in: it coordinates workflows, validates evidence, interacts with external systems, and triggers settlements in accordance with defined rules.

To support this shift, many insurers are investing in a modern claims management system. A well-designed insurance claims management software reduces manual effort, improves accuracy, speeds up settlements, and strengthens customer trust.

This blog breaks down how to build a claims management system, covering the development process, technologies, and costs that matter most for insurers driving digital transformation.

See how Appinventiv helps insurers cut claim cycle times and boost customer satisfaction with AI-driven automation.

Why Modern Insurers Need Custom Claims Management Systems

Every insurer runs differently, with different products, markets, and regulations. Off-the-shelf platforms can’t capture that complexity. That’s why leading enterprises are now choosing custom claims management systems built around their own processes, not someone else’s template.

When done right, a custom claims management software gives insurers control, clarity, and speed:

- Clear visibility: One dashboard where every claim — from first notice to final payout — moves in plain sight.

- Connected systems: Policy, underwriting, and CRM software working together without manual updates.

- Automation that works quietly: Routine checks, data entry, and document verification handled in the background.

- Insight over intuition: Real-time analytics flag fraud, spot trends, and help teams make quicker decisions.

- A better customer moment: Self-service portals and instant alerts that keep policyholders informed, not anxious.

At its core, a modern claims management system isn’t just software — it’s how insurers protect trust while staying profitable in a faster, digital-first world.

From Automated Claims to Zero-Touch Claims

Traditional claims automation focused on speeding up tasks. Modern insurance claims management software aims to eliminate manual touchpoints altogether.

In a zero-touch model, claims such as auto glass damage, minor property loss, or travel delays are processed end-to-end through intelligent orchestration. Data is ingested from multiple sources, validated in real time, scored for risk, and settled automatically if thresholds are met.

This requires more than bots. It demands agentic workflows, event-driven architecture, and explainable AI models that regulators and auditors can trust.

Moving beyond zero-touch workflows, insurers can maximize ROI by implementing AI agents for insurance claims that autonomously handle routine cases, escalate complex situations, and continuously learn from resolution outcomes.

How to Build a Claims Management System

Building a reliable insurance claims management software isn’t a quick deployment project. It’s a process of rethinking how your organization handles claims, from the first notice of loss to final settlement. The goal is simple: make it faster, clearer, and more accurate while keeping every stakeholder on the same page.

Here’s how most forward-looking insurers approach it, step by step.

Phase 1 – Assessment and Strategy

Everything starts with clarity. Before the coding step, insurers take a step back to understand what’s slowing them down. Maybe approvals are stuck in manual loops. Maybe data sits in disconnected systems.

This phase is where those gaps come to light. Teams:

- Audit existing systems and note what works — and what doesn’t.

- Assess data accuracy and ensure compliance with regulations such as GDPR, CCPA, or IRDAI.

- Define success in numbers: shorter claim cycles, fewer manual tasks, better fraud detection.

It’s the groundwork that ensures the new claims management system aligns with your long-term vision — not just immediate needs.

Phase 2 – MVP Development

Once the strategy is clear, the focus shifts to building something tangible.

Insurers begin with a minimum viable product (MVP) — a smaller, workable version that tackles the most critical pain points first.

In this phase:

- Core modules such as claim intake, routing, and dashboards come to life.

- Claims workflow automation is added to handle repetitive data entries and document checks quietly in the background.

- APIs connect policy, underwriting, and payment gateway systems to create seamless data flow.

- The system is designed to scale, leaving room for analytics and AI down the line.

This stage helps test real-world performance and see how teams interact with the new insurance claims management software before taking it enterprise-wide.

Phase 3 – Pilot & Feedback

The pilot phase is where theory meets reality. A limited rollout — often in one product line or geography — helps uncover what works and what needs fine-tuning.

For AI-powered claims workflows, pilot success is not just functional accuracy but model stability over time.

Insurers must introduce MLOps pipelines that monitor prediction accuracy, detect fraud-model drift, and retrain algorithms as claim patterns evolve. Without this loop, early AI gains degrade quickly as fraud tactics change.

Insurers use this stage to:

- Collect honest feedback from adjusters, underwriters, and customers.

- Track metrics like average claim duration, approval accuracy, and overall satisfaction.

- Refine workflows and fix integration snags.

This feedback loop transforms your claims management system from functional to exceptional—tailored for the people who use it daily.

Phase 4 – Full-Scale Rollout

With insights in place, the system is ready to scale. This is where the transformation becomes visible — not just in operations but in results.

Insurers typically:

- Integrate AI-powered claim management system modules that predict risk, detect fraud, and analyze claims in real time.

- Move infrastructure to the cloud for speed, security, and scalability.

- Train teams to trust automation and use data-driven decision tools.

- Track improvements in cost reduction and settlement speed.

By this point, your blueprint becomes a living system — one that changes how claims are managed, measured, and experienced.

Phase 5 – Continuous Optimization

Even the most effective systems should develop. Markets move, regulations vary, and the expectations of customers become higher.

This is the reason why major insurers see optimization as a habit rather than a stage. They:

- Examine such KPIs as closure rates, automation coverage, and precision of fraud detection.

- Refine performance using real-time feedback and machine learning.

- Workflows and update algorithms to keep up to date and competitive.

This strategy would make your claims automation solution evolve, in the long term, into an intelligent, agile, and prepared solution to address the disruption and produce changes in the insurance environment.

Architecting a Future-Ready Claims Management System

Most insurers are not starting from scratch. They operate on legacy policy administration systems, mainframe databases, or tightly coupled SQL cores. Replacing them is risky and expensive.

Modern claims platforms solve this through event-driven architecture (EDA) and anti-corruption layers. Legacy systems publish claim events, while modern microservices consume and act on them without direct dependency. This approach allows insurers to modernize claims workflows without destabilizing core systems.

Every efficient claims management system has more than code behind it — it has intent, design, and a clear vision for scale. For insurers spread across multiple regions and product lines, success depends on how well the system can grow, connect, and earn trust at every step.

That’s where modern insurance claims management software comes in. It combines smart engineering and forward-looking design to create a platform that’s fast, flexible, and ready for whatever comes next.

The foundation always begins with architecture. Enterprise-grade systems are built piece by piece — each layer designed to keep operations flowing smoothly:

- Microservices frameworks make every function, from claim intake to payments, work independently. When one piece scales, the rest stay steady.

- API-first integrations let different tools — policy admin, CRM, underwriting — communicate without friction.

- Event-driven communication keeps everyone in the loop with instant claim updates.

- Cloud-native infrastructure ensures the system stays fast, secure, and accessible anywhere in the world.

- Built-in compliance and encryption protect data while meeting regulations like GDPR, IRDAI, and CCPA.

This kind of foundation doesn’t come from a plug-and-play setup. It’s crafted by a custom claims software development company that understands both how insurers operate and what their technology needs to do five years from now.

Advanced Technologies Powering Modern Claims Systems

Still, architecture is only half the story. What truly makes a modern platform powerful is intelligence — technology that learns, adapts, and gets sharper with every claim. That’s where automation and AI take over daily heavy lifting:

- AI in claims processing helps identify errors, detect fraud, and even assess damage from images.

- Machine learning refines predictions, improving how claims are scored and prioritized.

- IoT and telematics bring real-time insights straight from cars, sensors, and smart devices, reducing investigation time.

- Blockchain in insurance builds trust with transparent, tamper-proof records.

- RPA bots quietly handle repetitive data entry and document checks so teams can focus on judgment calls, not paperwork.

When these layers work together, they form an AI-powered claim management system that runs faster, makes smarter decisions, and gives customers the confidence that their insurer is working for them — not making them wait.

Also Read: How Telematics Insurance Is Redefining the Industry

Cost to Build a Claim Management System

The cost to build a claim management system can vary widely depending on what you’re trying to achieve — a simple claims intake app, a mid-level automation platform, or a full-fledged insurance claims management software with AI and analytics. Each layer of functionality adds complexity, which directly influences timelines, integrations, and cost.

Here’s a general breakdown of what insurers can expect:

Several factors influence these estimates:

- Project complexity: More modules — such as fraud detection or customer dashboards — mean more design and development effort.

- Third-party integrations: Connecting the system with policy admin, payment, and CRM tools increases scope and cost.

- The technology stack —cloud-based infrastructure, security and encryption, and data analytics tools—impacts development expenses.

- Post-launch support: Continuous optimization, updates, and regulatory alignment add ongoing investment.

Partnering with an experienced custom claims software development company helps balance cost with long-term value. A team that understands both insurance workflows and enterprise technology can build a scalable claims management system that grows with your business — without overspending on unnecessary complexity.

From strategy to rollout, our experts design scalable systems that transform how insurers handle claims.

Key Features of Claims Management System

When an insurer decides to modernize, it’s not just about replacing old tools — it’s about creating a smoother, faster, and more reliable way to serve policyholders. A custom claims management system makes that possible by bringing people, data, and technology onto one intelligent platform.

Let’s look at the core features of a claims management system that truly make a difference:

- Simple Claim Submission – A clean, guided interface helps customers file claims in minutes. Smart validation checks keep data accurate right from the start.

- Workflow That Runs Itself – Through claims workflow automation, tasks are routed automatically to the right adjuster, reminders go out on time, and approvals move faster without constant supervision.

- Built-In Fraud Protection – Machine learning quietly scans every claim, spotting irregular patterns long before they become a problem.

- Real-Time Visibility – Adjusters and managers can track the entire process in one dashboard — from open claims to settlement — without having to chase updates.

- Secure Document Handling – All photos, invoices, and forms are stored safely in the cloud, easy to retrieve when needed, and fully traceable.

- Seamless Collaboration – Integrated communication tools keep everyone — from the policyholder to the agent — on the same page.

- Compliance by Design – Every update is logged automatically, building a complete audit trail that satisfies regulators and keeps data governance tight.

- Open and Scalable Architecture – APIs connect the system to existing policy and CRM platforms, making it easy to scale as the business grows.

When all these features come together, they create more than just software; they create an AI-powered claim management system that cuts delays, prevents fraud, and gives customers the confidence that their insurer is in control.

For insurers aiming to achieve this transformation, partnering with an experienced custom claims software development company ensures the system fits their exact workflows, scales effortlessly, and strengthens customer trust with every interaction.

Also Read: Automation in Insurance: A Complete Guide for Insurers

Benefits of Claims Management Software

Time and trust are all in insurance. The result of a dragged claim is that both the customers and the operations lose their money. That is where the modern claims management software comes in. It makes the work of the insurers easier, automates little things, and leaves people free to concentrate on what is really important: service and accuracy.

This is what insurers will get when technology and empathy are brought together using a modern claims management system:

- Faster claims, fewer delays: Paperwork with smart claims workflow automation moves by itself. The checks, data validation and follow-up occur silently in the background – reducing the number of weeks to days to settle.

- Fewer errors, less cost: Automation can perform repetitive tasks, which reduces errors that can end up slowing down teams or necessitating an additional investment to correct the errors.

- Fraud detection early: AI and analytics will examine each claim on a case-by-case basis in real time and identify potentially suspicious activity before it turns into a payout challenge.

- Improved customer experience: The policyholders will be able to track claims, upload documents, and receive updates instantly without making a single call to the support team. It is quicker, sharper and much more reassuring.

- More intelligent choices: Real-time dashboard provides managers with a full picture of claims, performance and risk- enabling them to make decisions based on facts and not assumptions.

- Built-in compliance: Any activity produces a digital trail, which results in an auditable record that keeps regulators happy and data secure.

When done right, this isn’t just software — it’s a quiet shift in how insurers work and communicate. It replaces chaos with clarity, silos with shared insight, and paperwork with progress. The real benefits of claims management software go beyond speed or savings — it’s about restoring confidence at every touchpoint.

Compliance & Data Governance Across Markets

In insurance, every decision comes down to trust — and trust depends on how securely you handle information. A single claim can carry everything from financial data to medical records, which means compliance isn’t a box to tick; it’s a responsibility that defines your brand.

That’s why a modern claims management system needs strong data governance built in from day one. It’s not just about staying out of trouble with regulators — it’s about showing policyholders that their information is safe in your hands.

As AI takes on decision-making roles, regulators increasingly demand explainability. When a claim is delayed or denied, insurers must provide clear, auditable reason codes.

Modern claims management systems embed Explainable AI (XAI) dashboards that surface the exact factors influencing a decision, such as late filing, inconsistent metadata, or historical risk signals. This transparency protects insurers from regulatory exposure while maintaining customer trust.

Each region plays by its own rulebook.

- In Europe, the GDPR gives customers the power to control their personal data — and expects insurers to honor that promise.

- In the United States, CCPA and newer state privacy laws demand transparency about how data is collected, used, and shared.

- The FCA in the U.K. looks closely at auditability and accountability across digital systems.

- And in India, IRDAI guidelines require insurers to maintain secure, traceable digital records for every step of a claim.

Good insurance claims management software adapts to all of this quietly. It encrypts sensitive data, limits access based on roles, and keeps a detailed activity trail without slowing anyone down. Alerts flag irregular access or policy violations before they become real issues.

As automation and AI take on a larger role in claims, responsibility becomes even more important. Algorithms that score fraud risk or predict claim severity must be explainable and fair — not black boxes that leave questions unanswered.

Challenges in Building a Claims Management System

Transforming claims isn’t about installing new software — it’s about reshaping the way an insurer works. That’s rarely easy. Most organizations start with good intentions, but soon realize how tangled their systems, data, and habits really are.

The biggest hurdles often come from within:

- Aging systems: Many insurers still rely on platforms built years ago. Connecting them with modern APIs or cloud tools takes more time than expected.

- Scattered data: Policy, billing, and claim information live in different places, forcing teams to piece things together manually.

- People, not tech: Adjusters and underwriters who’ve worked the same way for decades need time and training to trust automation.

- Compliance overload: Rules change fast across regions, and keeping up drains both focus and budget.

- Scaling the pilot: What works for one business unit can fall apart when you roll it out company-wide.

These challenges don’t mean transformation should wait — they just mean it needs to be planned carefully.

Future Trends in Claims Management

Claims are no longer an off-office activity, but the core of customer confidence. What will happen over the coming years is that insurers will no longer rely on manual reviews but engage in intelligent automation and data-driven systems that are predictive, process-forming and preventative.

The following is what is influencing that change:

- Greener automation: AI will sort simple claims immediately, leaving adjusters to handle more complex ones.

- Predictive fraud control: These systems will indicate suspicious claims before they can be paid out.

- Related information: IoT devices, telematics, and sensors will check the incidents in real-time.

- Conversational service: Sales of claims will be made via chat or voice; tracking claims will be made via chat.

- Native cloud flexibility: Ope, API platforms will ensure that the insurers remain flexible and future-aligned.

The goal isn’t to replace people, it’s to give them smarter tools. The insurers that combine automation with empathy will lead the next era of claims management system innovation.

Lead the next wave of innovation with intelligent, data-driven claims management solutions.

How Appinventiv Helped Transform Insurance Operations

At Appinventiv, we see claims not as transactions but as moments of truth. Through our insurance software development services, we’ve helped insurers modernize legacy systems, automate workflows, and deliver faster, more transparent claim experiences that customers actually trust.

When we partnered with a leading European financial brand, our AI-driven platform reduced manual processing by 35% and improved fraud detection by 20% — real outcomes that strengthened customer confidence.

With Mudra, we created an intuitive budget management platform that helped users effortlessly control spending.

With 1,600+ experts and 3,000+ digital products delivered, Appinventiv helps insurance leaders replace outdated tools with intelligent, AI-powered claim management platforms built for the future. Our insurance claims management software is built to enterprise security standards, including SOC 2 Type II controls and ISO 27001-aligned data governance frameworks.

Insurance transformation isn’t just about technology — it’s about rebuilding trust, one claim at a time. Whether you’re modernizing legacy systems or building an intelligent claims ecosystem from the ground up, Appinventiv brings the expertise, discipline, and creativity to make it happen. Let’s talk!

FAQs

Q. How can AI improve claims processing efficiency?

A. AI is changing the speed and accuracy of claims like never before. In a modern claims management system, AI handles repetitive tasks — from document checks to fraud detection — allowing adjusters to focus on complex cases. By analyzing claim patterns and automating routine decisions, AI can cut processing time by up to 40%, helping insurers deliver faster, more reliable service to customers.

Q. How much does it cost to build a custom claims system?

A. The cost to build a custom claims management system depends on the project’s scope, integrations, and technology stack. On average, insurers spend between $100,000 and $400,000 for an enterprise-grade solution. The price varies based on features like automation, analytics, and compliance modules. Partnering with an experienced insurance software development services provider ensures you get the right balance of performance and scalability.

Q. What are the latest trends in insurance claims technology?

A. The latest insurance claims management software trends focus on automation, predictive analytics, and seamless digital experiences. AI-powered claim validation, IoT-based incident verification, and conversational interfaces are becoming standard. Cloud-native and API-first architectures now dominate, allowing insurers to scale faster and integrate third-party services easily.

Q. What should insurers look for in a claims management software development company?

A. When choosing a claims management software development company, insurers should look beyond coding skills. The right partner understands insurance workflows, regulatory frameworks, and customer expectations. They should offer expertise in custom claims management software, data security, system integration, and AI-driven automation — ensuring the solution fits both business goals and compliance needs.

Q. What ROI can insurers expect from a modern claims management platform?

A. A modern insurance claims management software can deliver measurable ROI within the first year. Most insurers report a 25–40% reduction in claim cycle times, lower operational costs, and improved fraud detection accuracy. The automation and analytics embedded in today’s claims management systems not only save time and money but also elevate customer satisfaction — turning claims from a cost center into a competitive advantage.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…