- What Modern ACH Payment Software Actually Does

- Key Features of a Custom ACH Payment Software

- 1. Payment Origination and Management

- 2. Bank Account Verification

- 3. Automated Approval Workflows

- 4. NACHA File Generation & Validation

- 5. Real-Time Status Tracking and Exception Handling

- 6. Fraud Checks and Risk Controls

- 7. Predictive Balance Checks

- 8. Idempotency Keys

- 9. Automatic Reconciliation

- 10. Strong Security and Audit Logs

- 11. Dashboards and Reporting

- 12. Integrations With Banking and Internal Systems

- 13. ACH Payment Automation and Orchestration

- 14. Central Admin Panel

- 15. Intelligent Retry Logic & R-Code Management

- Compliance and Regulatory Requirements for Creating Enterprise ACH System

- Step-by-Step Process to Build a Custom ACH Payment Software

- Step 1: Discovery and Requirements Mapping

- Step 2: Architecture and System Design

- Step 3: Integration Setup

- Step 4: Development: Front-End, Back-End, and Middleware

- Step 5: Compliance, Security, and Testing

- Step 6: Deployment and Go-Live

- Step 7: Continuous Improvements and Scaling

- Benefits of Building a Custom ACH Payment Software

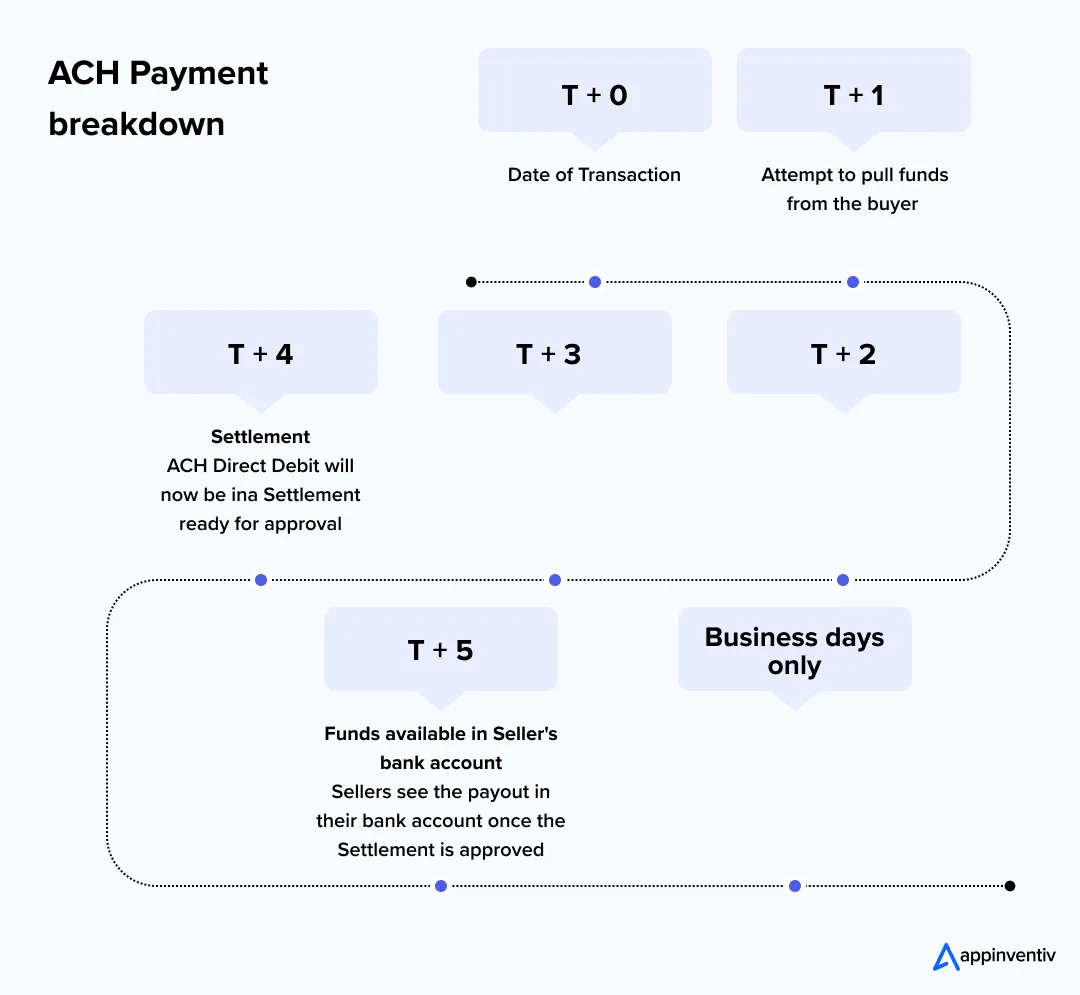

- Lower Processing Costs and Better Settlement Speed

- Stronger Compliance and Risk Controls

- Full Ownership of Data and Reporting

- Easy to Scale for High-Volume Payments

- More Automation for Daily Tasks

- Freedom to Add New Payment Use Cases

- Better Control Over User Access and Workflows

- Better Long-Term Reliability

- Strategic Assessment: Build vs. Buy for Enterprise Scaling

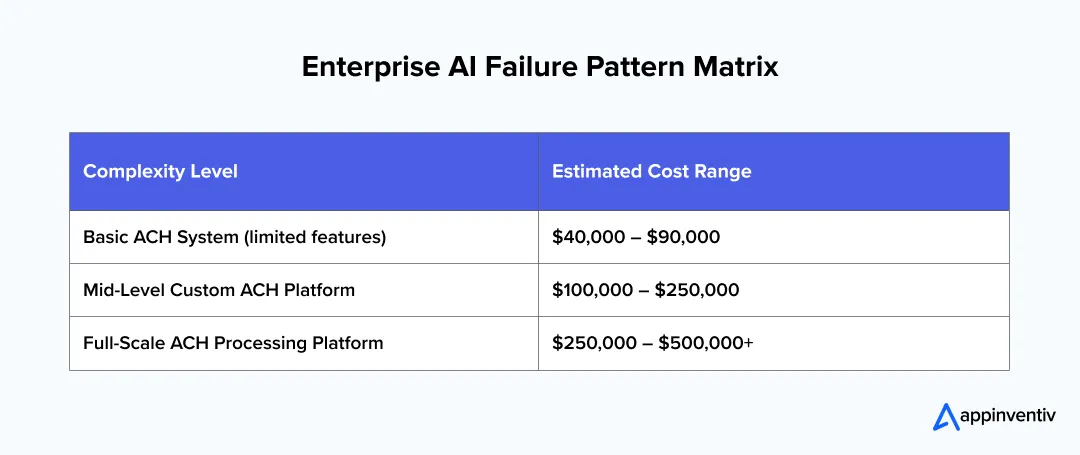

- Cost of Building a Custom ACH Payment Software

- 1. Scope and Feature Complexity

- 2. Number of Integrations Required

- 3. Security and Compliance Requirements

- 4. Architecture and Performance Needs

- 5. User Experience and Dashboard Needs

- 6. Team Strength and Project Duration

- Estimated Cost Summary

- The "Hidden" Efficiency of Custom Development

- Why Choose Appinventiv for ACH Payment Software Development

- Proven Experience in Financial and Banking Systems

- 1,600+ Experts Across Engineering, Design, and Compliance

- Strong Focus on Security and Compliance

- Experience With Complex Payment Workflows

- Frequently Asked Questions

Key takeaways:

- A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections.

- Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors.

- Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.

- The cost to build an ACH processing platform depends on features, integrations, security depth, and transaction volume needs.

- ACH integration with core banking systems helps create smoother settlement cycles and improves day-to-day financial operations.

Many enterprises are moving away from third-party payment processors in favor of custom ACH payment systems that offer greater control, predictable costs, and alignment with internal financial workflows. As transaction volumes grow, limitations such as opaque settlement cycles, rising per-transaction fees, restricted automation, and rigid APIs begin to slow operations and increase risk.

For mid-to-large organizations, ACH is no longer a secondary payment method. It has become a core financial infrastructure that must support high volumes, strict compliance, and reliable settlement at scale. Relying on “black-box” aggregators makes it difficult to manage liquidity, optimize batch timing, or maintain visibility into payment failures and returns.

Building a custom ACH payment infrastructure allows CTOs and CFOs to move beyond basic money movement. It enables direct ODFI integration, automated ledger reconciliation, proprietary risk controls, and deeper visibility into payment performance—capabilities that are difficult to achieve with off-the-shelf platforms.

This guide outlines a technical and strategic roadmap for designing and building a secure, NACHA-compliant, enterprise-grade ACH payment software development in 2026, tailored for organizations that view payments as a long-term operational asset rather than a commodity service.

As payment volumes rise, businesses need stable and secure systems. Appinventiv builds custom ACH platforms that support large transactions, safe operations, and real compliance needs.

What Modern ACH Payment Software Actually Does

Modern Automated Clearing House (ACH) software development goes far beyond sending money from one bank account to another. It serves as a full payment system that helps businesses handle high-volume transfers, reduce errors, and maintain steady financial operations.

A reliable ACH setup supports both payouts and collections. It helps you manage recurring bills, vendor payments, customer refunds, payroll cycles, and large batch transfers without manual work. Many teams also use it to keep track of every payment stage, right from initiation to settlement.

Another key role is handling payment failures. Instead of teams digging through spreadsheets, the system identifies issues like wrong account details or insufficient funds and gives clear return codes. This helps fix errors faster and cut down on delays.

Modern ACH payment processing software development also helps automate day-to-day tasks. It can match transactions with bank statements, create reports, and route approvals to the right people. Many systems support straight-through processing, so payments move without manual checks unless something needs attention.

Also Read: How to Create a Payment Gateway- Cost, Benefits & Challenges

Security is another major part of how today’s systems work. You get role-based access, audit logs, and strong encryption, which keep data safe and support compliance needs. Many companies also connect their ACH software with ERPs, accounting tools, and banking APIs, creating a smooth flow of information across teams.

In simple terms, building an ACH processing platform doesn’t just send payments. It brings order, speed, and control to the entire payment cycle.

Key Features of a Custom ACH Payment Software

A robust ACH payment gateway system moves money quickly, accurately, and with steady control. Below are the core features that most businesses expect when planning ACH payment software development.

1. Payment Origination and Management

The system supports one-time payments, recurring billing, payroll cycles, and high-volume batch transfers. Teams can configure schedules, approval paths, and execution windows without manual intervention.

Multi-Format Payment Instruction Support (NACHA + ISO 20022)

Alongside standard NACHA and same-day ACH files, the platform supports ISO 20022 XML messaging. This enables rich, structured remittance data such as invoice references, standardized party details, and postal addresses; improving interoperability with modern ERPs and cross-border rails.

Structured Remittance for Finance Visibility

ISO 20022 fields enable accurate invoice matching, clearer audit trails, and straight-through posting into ERP systems. Finance teams gain granular cash flow attribution by invoice or contract, rather than aggregated transaction lines.

Engineering and Implementation Considerations

The system should include an NACHA–ISO 20022 translation layer to maintain backward compatibility. Structured remittance data must be stored as first-class ledger attributes, validated pre-transmission, and exposed via APIs and dashboards for reconciliation and reporting.

2. Bank Account Verification

Accurate account verification reduces failed payments, return rates, and downstream reconciliation issues. A robust ACH system should confirm both account ownership and account validity before initiating transfers.

Verification Methods (Micro-Deposits and Instant Verification)

The platform should support traditional micro-deposit verification as well as instant account verification through bank-grade APIs. This allows businesses to balance speed, cost, and coverage depending on user context.

Account Intelligence and Validation

Beyond ownership, verification should capture account type (checking/savings), status, and eligibility for ACH debits or credits. This prevents avoidable failures caused by unsupported or restricted accounts.

Implementation Considerations

Verification results should be cached securely, versioned, and tied to the account record in the ledger. Re-verification rules can be triggered automatically when accounts show elevated return behavior or long periods of inactivity.

3. Automated Approval Workflows

Approval workflows ensure that ACH payments follow internal controls without slowing down operations.

Rule-Based Approval Logic

Businesses can define approval paths based on amount thresholds, counterparty risk, payment type, or organizational role. High-risk or high-value transactions can require multi-level approvals.

Exception and Override Handling

Authorized users should be able to approve, reject, or escalate payments with full context. Overrides must be logged with reason codes to maintain audit integrity.

Implementation Considerations

Workflow engines should be configurable without code changes and integrated with identity and access management systems. All approval actions must be recorded immutably in the audit log.

4. NACHA File Generation & Validation

ACH reliability depends heavily on correct file creation and validation before submission.

Standards-Compliant File Construction

The system should generate NACHA files that conform to the latest operating rules, including batch headers, entry detail records, and addenda records.

Pre-Transmission Validation

Before transmission, the platform should validate routing numbers, SEC codes, batch balancing, and mandatory fields to reduce R-code returns.

Implementation Considerations

Validation should occur automatically as part of the submission pipeline, with actionable error messages surfaced to operations teams for fast correction.

5. Real-Time Status Tracking and Exception Handling

Visibility into the payment state reduces operational friction and speeds up issue resolution.

End-to-End Payment Lifecycle Tracking

Each payment should be trackable from creation through submission, settlement, and final posting, with timestamps for every state transition.

Clear Return and Exception Insights

When payments fail, the system should surface standardized return codes, human-readable reasons, and recommended next actions.

Implementation Considerations

Statuses should be event-driven and exposed through APIs and dashboards, allowing downstream systems to react automatically to failures or completions.

6. Fraud Checks and Risk Controls

Risk controls protect the ACH system without introducing unnecessary friction.

Rule-Based and Behavioral Monitoring

The platform should apply configurable limits, blocked accounts, velocity checks, and anomaly detection to identify suspicious activity.

Adaptive Risk Policies

Risk thresholds can vary by user, merchant, or transaction type, allowing tighter controls where needed and smoother flows elsewhere.

Implementation Considerations

Fraud checks should run in-line during orchestration, with outcomes recorded in the ledger for audit and model tuning.

7. Predictive Balance Checks

Predictive analytics reduces insufficient-funds returns before they occur.

Balance Sufficiency Scoring

AI-driven models analyze historical balances, cash-flow patterns, ACH timing, and prior returns to estimate the likelihood of successful settlement.

Risk-Based Payment Routing

Payments below a configurable confidence threshold can be delayed, rerouted, or sent for manual review.

Implementation Considerations

Scores should be generated pre-submission, stored in the ledger, and continuously refined using actual settlement outcomes.

Implementation note: run the predictive check as a pre-submission gate in the orchestrator and record the score in the ledger for audit and tuning.

8. Idempotency Keys

Idempotency prevents costly duplicate transactions caused by retries or network failures.

Duplicate Prevention at the API Layer

Each payment request includes a unique idempotency key that ensures retries return the original result instead of creating new entries.

Deterministic Payment Outcomes

Clients receive consistent responses even during partial failures, improving reliability and trust in the system.

Implementation Considerations

Keys and outcomes should be persisted atomically with payment intents, backed by database constraints and defined expiration policies.

Implementation note: enforce idempotency at the API gateway, persist the key and status atomically with the payment intent, and surface idempotency status in reconciliation reports.

9. Automatic Reconciliation

Fast reconciliation keeps financial records clean and audit-ready.

Statement and Ledger Matching

The system automatically matches ACH entries with bank statements using transaction IDs, amounts, and structured remittance data.

Exception Identification

Unmatched or partial entries are flagged immediately for investigation, reducing month-end delays.

Implementation Considerations

Reconciliation engines should support incremental updates and expose results via APIs for ERP ingestion.

10. Strong Security and Audit Logs

Security and traceability are foundational to ACH software.

Data Protection and Access Controls

Sensitive data should be encrypted at rest and in transit, with tokenization for account numbers and strict role-based access.

Comprehensive Audit Trails

Every system action: creation, approval, modification, and submission is logged with actor identity and timestamp.

Implementation Considerations

Audit logs must be immutable, searchable, and retained according to regulatory and organizational requirements.

Also Read: AI in Payments: Transforming Transactions & Security (2026)

11. Dashboards and Reporting

Dashboards turn raw payment data into operational insight.

Operational and Financial Views

Teams can monitor volumes, settlement timelines, pending items, and failure trends in real time.

Custom and Scheduled Reports

Reports can be generated on demand or delivered automatically to finance and leadership teams.

Implementation Considerations

Reporting layers should query read-optimized stores and support export formats compatible with enterprise BI tools.

12. Integrations With Banking and Internal Systems

Seamless integration reduces manual work and data inconsistencies.

Banking and ODFI Connectivity

The platform integrates with banks and processors for file submission, acknowledgments, and settlement updates.

ERP, CRM, and Accounting Integrations

Bidirectional integrations ensure payment data flows cleanly across finance and operations systems.

Implementation Considerations

Use standardized APIs, webhooks, and mapping layers to handle field-level differences between systems.

13. ACH Payment Automation and Orchestration

Automation keeps high-volume operations efficient and predictable.

Workflow-Oriented Payment Execution

Recurring billing, payouts, refunds, and vendor payments run on predefined schedules and rules.

Intelligent Routing Logic

Payments are routed based on risk, timing, and transaction type to optimize success rates.

Implementation Considerations

Orchestration engines should be event-driven and resilient to partial failures.

14. Central Admin Panel

A unified control plane simplifies system management.

Configuration and Access Management

Admins can manage rules, permissions, limits, and integrations from a single interface.

Operational Oversight

Real-time views into logs, queues, and system health support proactive issue resolution.

Implementation Considerations

Admin actions must be permissioned, logged, and reversible where appropriate.

15. Intelligent Retry Logic & R-Code Management

Smart retries reduce failures without increasing risk.

Return Code-Aware Handling

The system distinguishes between return codes such as R01 (Insufficient Funds) and R03 (No Account/Unable to Locate), triggering appropriate follow-up actions.

Automated and Manual Resolution Paths

Low-risk retries can be automated, while higher-risk issues prompt user updates or compliance checks.

Implementation Considerations

Retry policies should be configurable, auditable, and aligned with NACHA operating rules.

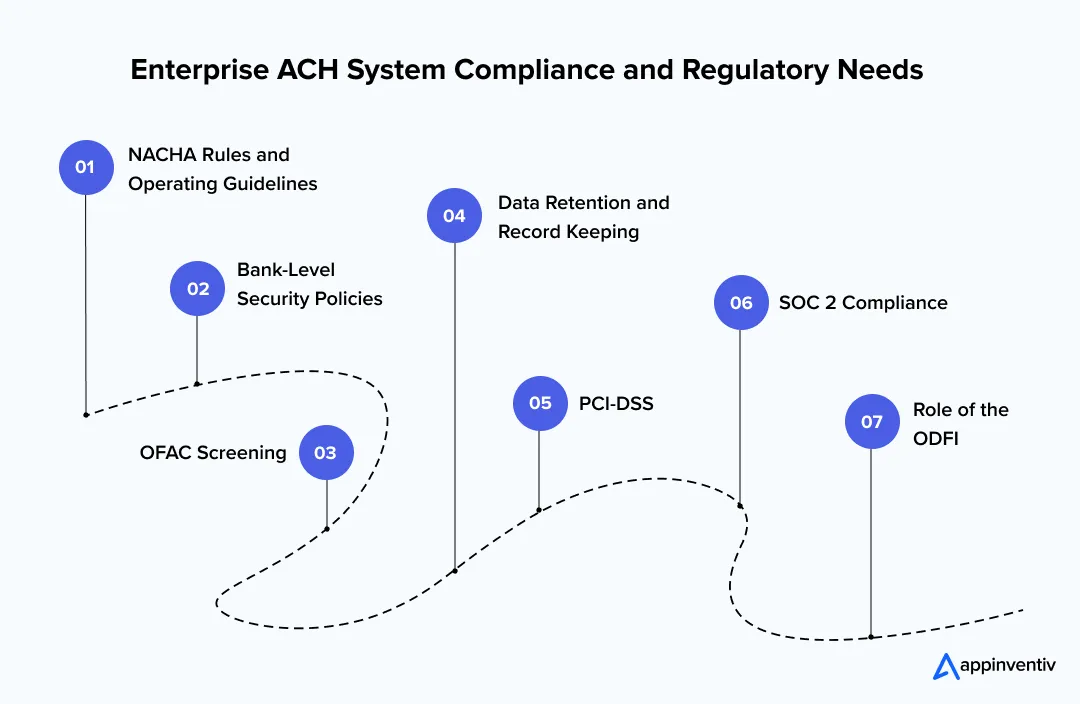

Compliance and Regulatory Requirements for Creating Enterprise ACH System

When enterprises build custom ACH payment software, they must follow strict rules to keep payments safe and accurate. These financial software regulatory compliances protect users, banks, and businesses that send or receive money. A custom ACH platform should follow all major guidelines from the start.

NACHA Rules and Operating Guidelines

Every ACH system must follow NACHA standards. These rules cover how files are created, how payments are approved, how returns are handled, and how audits are done. The system must support proper formatting, data accuracy, encryption, and clear reporting for yearly NACHA audits.

The system should also support the 2025/2026 Micro-Entry Rule updates, including specific formatting requirements and enhanced fraud monitoring for account validation deposits.

In line with the NACHA Risk Management Framework (2026), the platform should be built to support upcoming mandatory controls:

- Phase 1 (March 20, 2026): Monitoring and detection of False Pretenses transactions, with risk signals embedded at origination and batch creation.

- Phase 2 (June 19, 2026): Enforcement of standardized Company Entry Descriptions (for example, PAYROLL, PURCHASE, VENDORPAY) to enable consistent, risk-based monitoring across ACH files.

By embedding these controls at the system level, the ACH platform remains compliant with evolving NACHA mandates while giving banks and compliance teams clearer visibility into transaction intent and risk.

Bank-Level Security Policies

Banks expect strong security controls before they allow ACH file transfers. This includes safe API communication, encryption for sensitive data, and secure user access. Most banks also require clear logs that show who did what inside the system.

OFAC Screening

All payments must be checked against the OFAC list to prevent transfers to restricted parties. The software should run these checks automatically before a payment goes out. This reduces compliance risk and avoids penalties.

Real-time integration with the Consolidated Screening List (CSL) to ensure no funds are originated to sanctioned entities during the batch creation process.

Data Retention and Record Keeping

ACH records must be stored securely for the required retention period. The platform should preserve files, reports, audit logs, and return codes in tamper-evident storage with fast retrieval for audits and dispute resolution.

Data-in-transit should be protected using mTLS (Mutual TLS), while cryptographic keys are generated, stored, and rotated inside HSMs (Hardware Security Modules) to ensure banking-grade key management and access control.

PCI-DSS (If Cards Are Also Used)

Some businesses add card payments to the same platform. If that happens, the software must follow PCI-DSS rules for storing and handling card data. This helps protect users and reduces the risk of data breaches.

SOC 2 Compliance

SOC 2 guidelines focus on security, availability, and data integrity. A custom ACH system should be designed in a way that supports SOC 2 audits. This helps build trust with banking partners and internal teams.

Role of the ODFI

Every ACH payment goes through an ODFI (Originating Depository Financial Institution). Your system must follow the ODFI’s rules for file transfers, timing, and risk checks. Strong alignment with the ODFI helps payments move smoothly without delays.

Meeting these rules is not optional. It forms the base of a safe, stable, and trusted ACH payment system. When compliance is built into the software from day one, payments move smoothly, and teams stay confident during audits.

Step-by-Step Process to Build a Custom ACH Payment Software

Building custom ACH payment software is not just a coding task. It is a structured project that touches finance, tech, legal, and operations. Here is a clear step-by-step view of how teams usually move from idea to working system.

Step 1: Discovery and Requirements Mapping

This is where planning starts. Your team identifies what the ACH system must do in real life:

- Type of payments: payouts, collections, subscriptions, B2B payments, payroll, and refunds.

- Expected transaction volume today and in the next 2–3 years.

- Risk level the business is ready to accept.

- Key security needs and compliance needs.

- How settlements, returns, and reconciliation should work day to day.

At this stage, you also decide if you want a pure ACH payment processing software development approach or a mix of ACH with other rails. The goal is to shape a clear view of the product and set the base for creating an enterprise ACH system that fits your payment flows.

Step 2: Architecture and System Design

At this stage, the team defines the technical foundation of the ACH platform. This includes decisions such as:

- Whether to use a microservices-based architecture or a simpler monolithic setup.

- How events move through the system, for example, using event-driven workflows.

- Which components operate in real time and which rely on batch processing.

- How to store and manage large volumes of payment and ledger data securely.

- How to design for high availability so the system remains operational even if one service fails.

In 2026, architecture planning should also account for a multi-rail payment strategy. A modern ACH system should not operate in isolation.

Through smart routing orchestration, the platform can dynamically route transactions based on metadata such as amount, urgency, risk score, and user preference. Cost-sensitive payments can flow through ACH, while time-critical transactions are routed via faster rails like FedNow or RTP.

This approach gives finance and operations teams flexibility without changing workflows, while the system automatically selects the most efficient rail for each transaction. A clean, scalable design like this keeps the platform stable as volumes grow and prepares it for advanced ACH payment automation and orchestration.

Step 3: Integration Setup

A modern ACH platform does not work in isolation. It needs to connect with other systems, such as:

- Bank APIs or an ODFI for file transfer and payment approval.

- Existing processors, if you choose a hybrid setup at first.

- ERP and accounting systems for posting entries.

- KYC/KYB tools to verify senders and receivers.

- Fraud and risk engines for screening transactions.

This stage is crucial, as ACH integration with core banking systems and internal tools affects how smooth your payment operations will feel to end users and internal teams.

Step 4: Development: Front-End, Back-End, and Middleware

Now, the actual payment Automated Clearing House (ACH) software development begins. Different parts of the system are built in parallel:

- The payment engine that creates, schedules, and routes ACH transactions.

- The risk module that runs checks, rules, and fraud controls.

- Admin and operations dashboards for finance and support teams.

- Workflows for approvals, exception handling, and returns.

- Logging and monitoring features to track system health.

The aim here is not just to build features, but to make sure they support real payment scenarios with simple, clear flows.

Step 5: Compliance, Security, and Testing

Once the core of the building ACH processing platform is ready, it is tested in many ways. This stage usually includes:

- ACH file testing to ensure correct NACHA formats.

- Testing of return codes, such as R01, R02, and other common responses.

- Load and stress tests to check how the system behaves under high volume.

- Failover tests to see what happens if a bank API or a service goes down.

- Role and permission testing to ensure users see only what they should.

- End-to-end testing with banks or partners before going live.

Here, the work from your earlier compliance section becomes real inside the product. This also helps keep ACH development costs in control by catching gaps before launch.

Step 6: Deployment and Go-Live

After testing, the system moves to production. Key tasks at this stage include:

- Setting up production environments, backups, and monitoring tools.

- Running trial batches with limited volume and real accounts.

- Checking batch timings, cut-off times, and settlement patterns.

- Training internal teams on how to use dashboards and handle exceptions.

Go-live is often done in phases. Some start with one payment type, such as vendor payouts, and then expand to payroll or customer collections. This reduces risk and keeps operations stable.

Step 7: Continuous Improvements and Scaling

Work does not end at launch. An ACH payment orchestration platform improves with ongoing tuning. Teams often:

- Refine rules based on failure patterns and fraud signals.

- Add new use cases, such as marketplace payouts or new billing models.

- Improve reporting and dashboards based on finance and leadership needs.

- Add support for higher volumes as the business grows.

Over time, this turns a basic ACH tool into a strong ACH payment gateway development and processing platform that supports many parts of the business.

Our team designs payment gateway systems that support safe transactions, stable payouts, and smooth integrations. If you want a custom ACH platform that fits your daily flow, we can help build it the right way.

Benefits of Building a Custom ACH Payment Software

Building custom ACH payment software gives businesses greater control over how money flows through their systems. It also helps cut costs, improve accuracy, and support steady growth. Here are the key benefits of an ACH processing platform.

Lower Processing Costs and Better Settlement Speed

A custom ACH setup reduces dependence on third-party aggregators and gives enterprises direct control over how payments move. In mature implementations, payments are transmitted directly to the ODFI via secure SFTP or bank APIs, eliminating the “aggregator tax” that often adds $0.50 or more per transaction.

For an enterprise processing 50,000 ACH transactions per month, this alone can translate into $25,000+ in monthly fee savings, excluding additional gains from faster exception handling and cleaner reconciliation.

Direct ODFI file transmission also provides tighter control over batch cut-off times and settlement windows, helping teams reduce delays, lower return rates, and improve cash-flow predictability at scale.

Stronger Compliance and Risk Controls

Custom systems follow NACHA rules and include built-in checks. You can add fraud rules, monitor payment behavior, and track every change in the system. This improves safety and makes audit processes simple and clear.

Full Ownership of Data and Reporting

All payment data stays within your system. You can create dashboards that match your needs and get real-time updates on payment status. This helps teams handle issues faster and maintain clear records for finance and audits.

Easy to Scale for High-Volume Payments

A custom setup supports growing transaction volume without slowing down. It works well for subscription billing, vendor payouts, payroll, lending, and marketplace payments. This stability helps teams stay prepared as the business grows.

More Automation for Daily Tasks

ACH payment automation helps remove repetitive steps such as reconciliation, exception routing, and approval checks. This saves time and keeps financial operations steady. It also reduces manual mistakes and makes the payment cycle smoother.

Freedom to Add New Payment Use Cases

You can introduce new flows whenever your business needs change. This includes refunds, instant payouts, multi-party settlements, and more. A custom setup gives flexibility without waiting for third-party platforms to add features.

Better Control Over User Access and Workflows

Custom ACH payment processing software development includes robust role-based access controls. Teams can set limits, define who approves what, and track all activity. This creates safer and more predictable operations.

Better Long-Term Reliability

A custom ACH payment orchestration platform is built around your real payment process. This makes the system more stable, easier to maintain, and simpler to expand over time. It also keeps you free from sudden changes in third-party pricing or policies.

Strategic Assessment: Build vs. Buy for Enterprise Scaling

Before committing to the capital expenditure of a custom build, it is essential to evaluate the long-term ROI against existing third-party aggregators (like Stripe or Plaid). While aggregators offer a faster time-to-market, they often “tax” your growth through percentage-based fees and data silos.

For enterprises processing over 5,000 transactions monthly, the shift to a custom ACH infrastructure typically pays for itself within 12–18 months by eliminating intermediary margins and optimizing liquidity.

| Feature | Third-Party Aggregators | Custom ACH Infrastructure |

|---|---|---|

| Transaction Fees | $0.20 – $1.50 + % basis points | Near-zero (Fixed bank fees only) |

| Data Control | Shared with provider (PII Risk) | 100% Data Sovereignty |

| Settlement Speed | 3–5 Business Days (Standard) | T+0 or Same-Day ACH support |

| Customization | Standard API limits | Tailored Workflows & Retries |

| Treasury Management | Limited to provider’s ecosystem | Direct ODFI relationships |

If your roadmap requires deep integration with internal ERPs or the ability to manage your own float, a custom system isn’t just a “feature”—it is a competitive financial asset.

Cost of Building a Custom ACH Payment Software

Custom ACH development costs typically start at $40,000 and can go up to $500,000 or more. The final budget depends on how complex the system is, how many features are needed, and how deeply the platform must connect with your existing tools and banking partners.

ACH payment software development is a major project, and the cost reflects the level of security, compliance, automation, and scale the system must support.

Below is a clear breakdown of the factors that affect ACH development costs.

1. Scope and Feature Complexity

A simple ACH platform with basic payment flows costs far less than a full-scale ACH payment orchestration system. Features that increase the budget include:

- Real-time status tracking

- Automated approval workflows

- Fraud checks and risk scoring

- Account verification tools

- Custom dashboards and reports

- Same-day ACH support

- Built-in reconciliation

The more features you include, the higher the ACH development costs, as each one requires design, testing, and integration.

2. Number of Integrations Required

Integration work impacts cost more than most teams expect. A typical system connects with:

- Banking APIs

- ODFI partners

- ERP and accounting tools

- KYC/KYB verification tools

- Fraud engines

- Internal systems and data stores

ACH integration with core banking systems often requires deeper engineering and longer testing cycles. Each integration adds to development time and raises the total project budget.

3. Security and Compliance Requirements

ACH software must follow strict NACHA rules. The system also needs:

- Data encryption

- Tokenization

- AML and OFAC checks

- Audit logs

- Access controls

- Secure file handling

The more layers of compliance you need, the higher the cost. Systems that support SOC 2 or PCI-DSS (for mixed payment rails) also require extra engineering effort.

4. Architecture and Performance Needs

The project cost depends on how large the system must scale. A platform designed for a small payment volume is simpler and cheaper.

A platform built to support high-volume payouts or marketplace flows requires:

- Strong infrastructure

- High availability

- Failover setups

- Event-driven workflows

- Large storage systems

These elements add to the development budget while keeping the system stable as payment volume grows.

5. User Experience and Dashboard Needs

Some businesses want simple screens. Others need full dashboards with charts, custom filters, settlement views, and financial reports. More complex dashboards add more design, development, and testing hours.

6. Team Strength and Project Duration

ACH payment processing software development usually takes 3 to 10+ months, depending on complexity. Longer timelines increase cost because more engineering, QA, DevOps, and security efforts are involved.

Systems that handle sensitive data also require multiple test cycles, including return code tests, load tests, and failover tests.

Estimated Cost Summary

Here’s a simple breakdown to guide planning:

Costs rise when the system includes advanced automation, payment orchestration, deep integrations, and real-time fraud monitoring.

The “Hidden” Efficiency of Custom Development

While the initial investment is higher ($100k+), the Internal Rate of Return (IRR) is realized through:

- Elimination of “Success Fees” charged by aggregators.

- Reduced OpEx via Automated Reconciliation (matching $10k+ transactions manually is a significant labor cost).

- Lower Return Rates through integrated bank account validation (IAV).

Stop letting third-party margins erode your bottom line. Our fintech engineers help you build a high-performance ACH ecosystem designed for high-volume processing and bank-grade security.

Why Choose Appinventiv for ACH Payment Software Development

Building an ACH system is not a small project. It needs strong technical skills, banking knowledge, secure engineering, and steady execution. Appinventiv offers payment gateway software development services that bring all of these together with a proven history of building financial platforms that handle large transactions, strict compliance checks, and sensitive user data. We are your ideal software development company because of:

Proven Experience in Financial and Banking Systems

Our portfolio includes several large-scale financial projects that require the same care and precision needed to build custom ACH payment software. This includes fund transfers, automated payouts, settlement tracking, audit flows, and secure user verification.

1,600+ Experts Across Engineering, Design, and Compliance

Our team includes specialists in backend engineering, cloud architecture, DevSecOps, payment orchestration, and financial compliance. This ensures the ACH platform is built by people who understand both technical and regulatory needs.

Strong Focus on Security and Compliance

ACH systems demand banking-grade security. Appinventiv follows strict industry standards such as:

- ISO 27001

- SOC 2 readiness

- OWASP guidelines

- Secure SDLC practices

- Regular internal and external audits

These practices help keep sensitive financial data safe while supporting NACHA rules and ODFI requirements.

Experience With Complex Payment Workflows

Our team has worked on systems that manage payouts, collections, refunds, and multi-party settlements. We also build features like:

- Risk scoring

- Exception handling

- Return code processing

- Batch scheduling

- Payment routing

- Compliance checks

This experience fits well with the needs of ACH payment orchestration and automation.

Appinventiv offers end-to-end product ownership. Our fintech work has earned long-term trust from global organizations. Our experts can help in building an ACH processing platform that is stable, secure, and compliant financial systems.

Frequently Asked Questions

Q. What is the Automated Clearing House (ACH) Network?

A. The ACH Network is a system that moves money between bank accounts in the United States. It handles things like payroll deposits, bill payments, refunds, vendor payouts, and recurring transfers. It is known for being safe, low-cost, and suitable for high-volume payments.

Q. What does it cost to build an ACH processing platform?

A. The cost to build an ACH platform usually starts at $40,000 and can go up to $500,000 or more. The price depends on features, integrations, security, compliance needs, and the expected payment volume. Complex systems with automation, fraud checks, dashboards, and core banking integrations fall on the higher end.

Q. How long does it take to develop an ACH system from scratch?

A. Most ACH systems take 3 to 10 months to build. A simple platform can be ready in a few months. A full-scale ACH payment system with automation, reporting, and compliance checks takes more time because it needs deeper testing and stronger security.

Q. How do ACH payments fit into a modern payment stack?

A. ACH payments are used for slow but stable money movement. They sit beside faster options like cards, instant payouts, and wallets. ACH helps reduce fees, support recurring payments, and handle large batch transfers. Many businesses use ACH for predictable, everyday payment needs.

Q. How do you ensure NACHA compliance in a custom ACH system?

A. Compliance starts by following NACHA rules for file formats, approvals, security, and record keeping. The system must support encryption, audit logs, OFAC checks, and accurate return code handling. Regular reviews and testing with your ODFI (bank partner) also help keep the platform compliant.

Q. How do you implement ACH payments?

A. To implement ACH payments, you need:

- A connection with an ODFI bank

- A system that can create NACHA files

- Secure user verification

- Payment schedules and approval rules

- A way to track return codes and fix errors

Many teams build custom software to manage all of this in one place, especially when payment volume grows.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…