- The Enterprise Shift: Blockchain Adoption Trends in Insurance

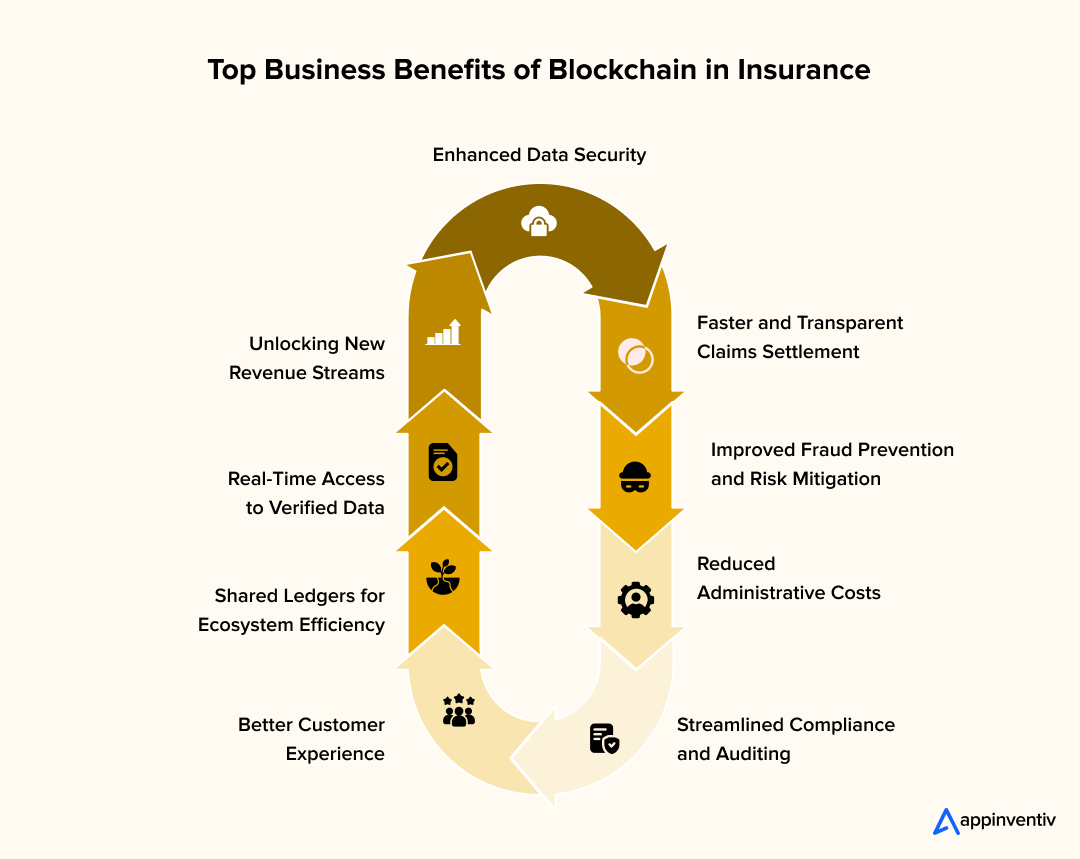

- Key Benefits of Blockchain in Insurance Industry

- Faster and Transparent Claims Settlement

- Enhanced Data Security

- Improved Fraud Prevention and Risk Mitigation

- Reduced Administrative Costs

- Streamlined Compliance and Auditing

- Better Customer Experience

- Shared Ledgers for Ecosystem Efficiency

- Real-Time Access to Verified Data

- Unlocking New Revenue Streams

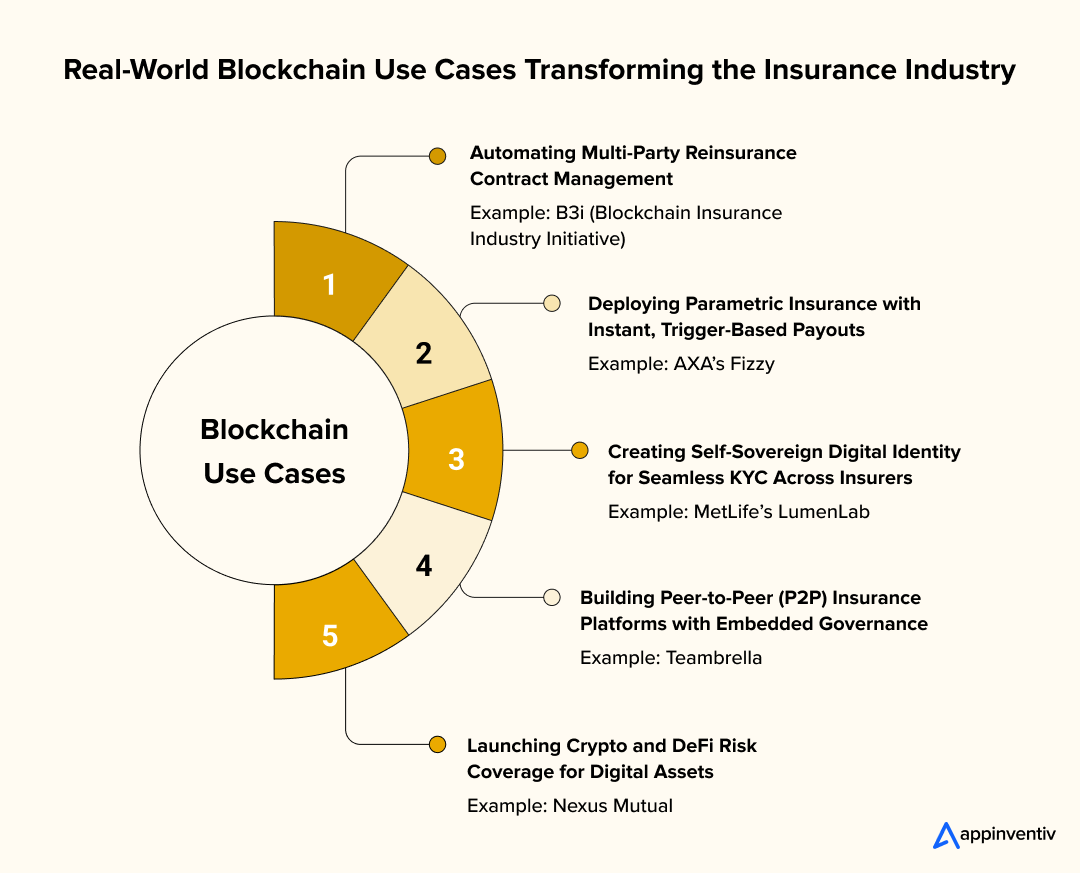

- Real-World Use Cases of Blockchain in Insurance

- Automating Multi-Party Reinsurance Contract Management

- Deploying Parametric Insurance with Instant, Trigger-Based Payouts

- Creating Self-Sovereign Digital Identity for Seamless KYC Across Insurers

- Building Peer-to-Peer (P2P) Insurance Platforms with Embedded Governance

- Launching Crypto and DeFi Risk Coverage for Digital Assets

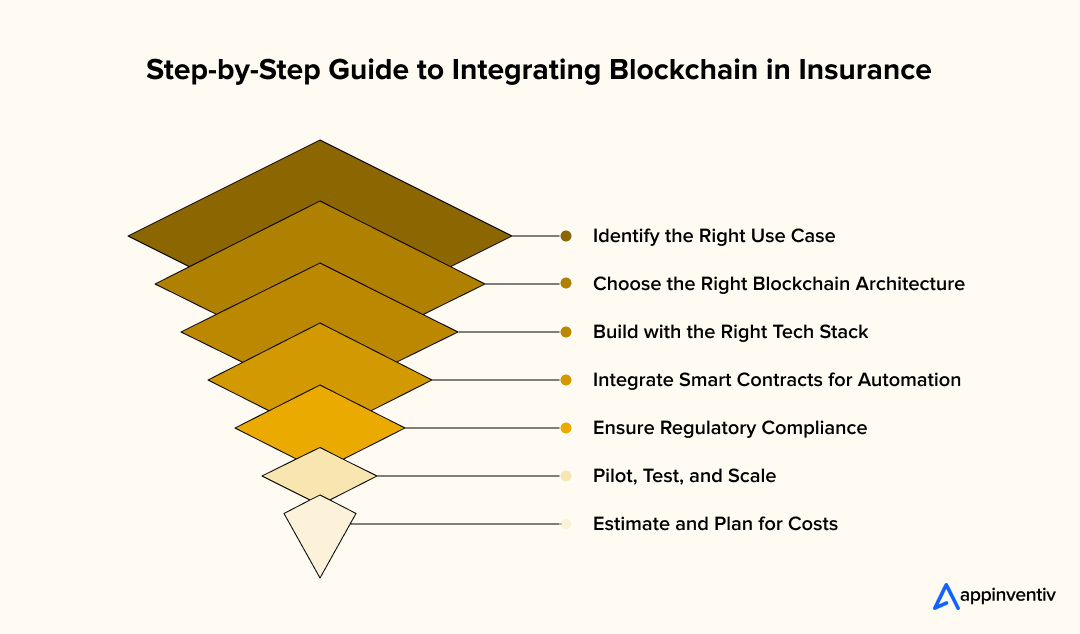

- How to Integrate Blockchain in Insurance Operations

- Identify the Right Use Case

- Choose the Right Blockchain Architecture

- Build with the Right Tech Stack

- Integrate Smart Contracts for Automation

- Ensure Regulatory Compliance

- Pilot, Test, and Scale

- Estimate and Plan for Costs

- Challenges & Solutions of Blockchain in Insurance

- Regulatory and Compliance Considerations in Blockchain Insurance

- What Are the Key Compliance Areas?

- How Do These Affect the Business?

- What Can Businesses Do to Stay Compliant?

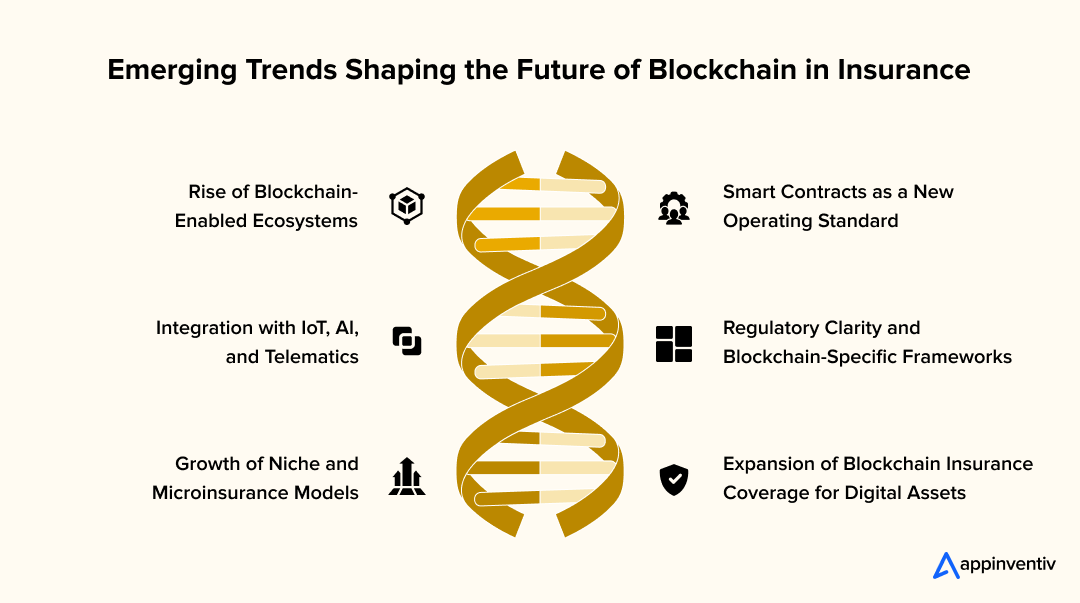

- Future Trends in Blockchain for Insurance

- 1. Rise of Blockchain-Enabled Ecosystems

- 2. Smart Contracts as a New Operating Standard

- 3. Integration with IoT, AI, and Telematics

- 4. Regulatory Clarity and Blockchain-Specific Frameworks

- 5. Growth of Niche and Microinsurance Models

- 6. Expansion of Blockchain Insurance Coverage for Digital Assets

- Why Appinventiv is the Right Partner to Leverage Blockchain Adoption in Insurance

- FAQs

Key takeaways:

- Blockchain in insurance enables faster, more transparent claims processing and improved efficiency.

- Smart contracts automate processes, reducing manual intervention and speeding up settlements.

- Shared ledgers help minimize fraud and build greater trust within the insurance ecosystem.

- Permissioned blockchain systems support regulatory compliance and address data privacy concerns.

- Insurers are already seeing measurable ROI from real-world blockchain implementations.

Let’s be honest—insurance operations are still too slow, too siloed, and too vulnerable to fraud. If you’re leading an enterprise insurer or reinsurance firm, you’ve likely seen it firsthand. Claims get stuck in backlogs. Customer trust is shaky. And compliance? It’s a constant tightrope. The good news? These are exactly the kinds of problems blockchain was built to fix.

You’ve probably heard the term blockchain in insurance tossed around a lot. But this isn’t about hype—it’s about practical transformation. Think faster claims settlements, shared ledgers between brokers and reinsurers, automated policy triggers, and real-time audits. With the right blockchain integration in insurance, you can reduce friction and boost transparency across the board.

More importantly, this isn’t just for innovation labs. We’re talking about enterprise-grade impact—blockchain for insurance that actually saves costs, prevents fraud, and enhances data security without overhauling your entire tech stack. And yes, it can scale.

In this blog, we’re cutting through the noise. You’ll get a clear view of where blockchain in insurance industry is headed, explore real use cases, understand the implementation process and compliance needs. If you’re ready to move beyond pilots and into production, this blog is for you.

Blockchain in insurance is already cutting $10B in costs for reinsurers. Want in?

Let’s build smarter insurance tech—together.

The Enterprise Shift: Blockchain Adoption Trends in Insurance

The insurance industry is no longer asking if blockchain will bring value—it’s asking how fast it can scale it. As blockchain in insurance matures, insurers, reinsurers, and brokers worldwide are moving from experimentation to implementation, particularly in areas where cost efficiency, data transparency, and automation can offer a clear ROI.

According to a joint report by BCG and The Geneva Association, property and casualty (P&C) insurers and reinsurers are the most active segments in adopting blockchain for insurance. These players are focusing on high-friction areas such as:

- Claims processing and validation

- Reinsurance contract management

- Fraud detection and prevention

- Usage-based and on-demand insurance models

Life and health insurance providers are also joining the movement, though adoption here is more cautious due to stringent regulatory and privacy constraints. Still, several large life insurers are piloting blockchain applications in insurance for secure medical data exchange and simplified underwriting workflows.

Deloitte’s recent insights show that nearly 44% of insurance executives surveyed are actively investing in blockchain-powered insurance systems, particularly in the U.S., Europe, and Asia-Pacific. Use cases driving adoption include:

- Shared claims ledger networks between brokers, underwriters, and reinsurers for faster resolution

- Identity verification protocols to streamline customer onboarding

- Parametric insurance products, especially in agriculture and climate risk, using blockchain-backed smart contracts

McKinsey highlights that blockchain in insurance industry is evolving from “proof-of-concept” to “production-grade platforms.” Examples include B3i’s real-time reinsurance contracts and consortium models like RiskStream Collaborative, which bring multiple insurers together to test and scale interoperable blockchain solutions.

Despite regulatory and integration challenges, major industry players are actively building internal capabilities or partnering with external agencies for blockchain integration in insurance. According to PwC, 84% of insurance executives see clear competitive advantages in blockchain, yet only 15% believe their organization is fully ready to implement it at scale. This signals a growing awareness—and urgency—to bridge the gap between strategic vision and execution.

This enterprise adoption landscape makes one thing clear—blockchain isn’t just a buzzword. It’s already reshaping how leading insurers operate, reducing their overhead, and unlocking new product categories. If your insurance business is still waiting to explore this shift, now is the time to act before the advantage compounds with your competitors.

Key Benefits of Blockchain in Insurance Industry

As digital business transformation accelerates, insurers are looking for technology that can reduce inefficiencies, boost customer trust, and cut operational costs. This is where blockchain in insurance proves to be a high-impact enabler.

Faster and Transparent Claims Settlement

One of the major benefits of blockchain for insurance is real-time claims processing through smart contracts. Once the conditions are met, payouts are automatically triggered, reducing delays and disputes. The transparency of blockchain ensures all stakeholders can view the claim status on a shared ledger.

Enhanced Data Security

Insurers deal with massive volumes of sensitive customer and medical data. With data security in blockchain insurance, all information is encrypted, immutable, and accessible only to authorized parties. This significantly lowers the risk of breaches and data manipulation.

Improved Fraud Prevention and Risk Mitigation

Fraudulent claims cost the insurance industry billions every year. By combining blockchain with insurance fraud analytics, insurers can create tamper-proof, time-stamped records that make transactions more transparent. Shared ledgers also enable real-time detection of duplicate or suspicious claims across multiple insurers, strengthening fraud prevention and reducing overall risk.

Reduced Administrative Costs

Automation via smart contracts eliminates redundant paperwork and manual intervention. This reduces administrative overhead and improves operational efficiency. For large enterprises, it means scalability without proportional cost increases—core to blockchain-powered insurance systems.

Streamlined Compliance and Auditing

Regulators can benefit from blockchain’s built-in audit trails and transparency. Compliance becomes easier as every transaction is recorded immutably. Audits that once took weeks can now be conducted instantly with verified records.

Better Customer Experience

Customers no longer need to wait endlessly for claims, verification, or underwriting. With blockchain in insurance industry workflows, processes are streamlined and communication is faster, building customer trust and long-term loyalty.

Shared Ledgers for Ecosystem Efficiency

When insurers, reinsurers, and brokers operate on a common blockchain, data flows become seamless. This eliminates reconciliation errors and delays. Such blockchain integration in insurance also helps align cross-party interests for faster settlements and better risk-sharing.

Real-Time Access to Verified Data

With blockchain, all parties have synchronized access to real-time, verified data—be it claims, policies, or underwriting details. This forms the backbone of high-trust, low-friction ecosystems, making blockchain applications in insurance more scalable and reliable.

Unlocking New Revenue Streams

Beyond cost savings, blockchain in insurance opens the door to entirely new product categories. Insurers can build microinsurance, parametric insurance, and usage-based offerings powered by smart contracts. These flexible models allow for personalized, low-cost policies that appeal to previously untapped customer segments.

Real-World Use Cases of Blockchain in Insurance

The most successful implementations of blockchain in the insurance sector go far beyond technical proofs—they solve real, entrenched problems across underwriting, claims, customer experience, and fraud management. These use cases highlight how global insurers are moving from pilot to production, with blockchain delivering measurable ROI and competitive edge.

Automating Multi-Party Reinsurance Contract Management

Reinsurance contracts often involve multiple parties—primary insurers, reinsurers, retrocessionaires—each maintaining separate records and relying on emails, spreadsheets, and middleware for data exchange. This fragmentation causes mismatches in claims data, delays in settlements, and significant reconciliation costs. With blockchain integration, all parties can access a shared, immutable ledger that updates in real time, ensuring data consistency across all touchpoints. Smart contracts can automate premium settlements, trigger claim events based on external data, and provide a transparent audit trail for compliance and dispute resolution. This not only eliminates friction but also reduces settlement cycles from weeks to days, or even minutes.

Example:

B3i (Blockchain Insurance Industry Initiative), formed by major players like Munich Re and Swiss Re, has developed a production-ready blockchain platform to streamline reinsurance contract creation, management, and claims settlement. Insurers now co-author contracts, monitor obligations, and settle losses collaboratively on a unified blockchain ledger.

Deploying Parametric Insurance with Instant, Trigger-Based Payouts

Parametric insurance offers predefined payouts based on trigger events like natural disasters, crop loss, or flight delays. However, its success depends on real-time access to reliable data and immediate execution of payouts—something traditional systems struggle with. Blockchain for insurance makes parametric models viable at scale by using oracles to feed external data into smart contracts that execute payouts instantly once conditions are met. This eliminates lengthy documentation, verification lags, and manual approvals. It’s especially valuable in regions with limited infrastructure, where trust in traditional insurers may be low, but mobile-first blockchain apps can deliver seamless claim experiences.

Example:

AXA’s Fizzy project is one of the real life examples of blockchain in insurance. It uses Ethereum to offer blockchain-backed travel insurance. Customers were compensated automatically if their flights were delayed beyond two hours. The smart contract pulled live data from flight tracking systems and executed payouts without needing claims to be filed—making the experience transparent and instant.

Creating Self-Sovereign Digital Identity for Seamless KYC Across Insurers

Know Your Customer (KYC) processes in the insurance industry are often fragmented, costly, and repetitive across departments and geographies. Every time a user buys a new policy or switches providers, the KYC process restarts, creating friction and poor CX. With blockchain applications in insurance, insurers can implement decentralized digital identity systems that store verified customer credentials immutably. Once KYC is completed and recorded on the blockchain, customers can control access and reuse that identity across services or even providers. It enhances privacy, reduces fraud, and accelerates onboarding across lines of business.

Example:

MetLife’s LumenLab explored blockchain-based digital identities for life insurance customers in Singapore. The prototype allowed verified identities to be reused securely, significantly cutting down time for issuing new policies and improving operational efficiency while remaining fully compliant with regulations.

Building Peer-to-Peer (P2P) Insurance Platforms with Embedded Governance

Traditional insurance requires intermediaries to pool risk, manage claims, and ensure solvency. Blockchain removes the need for centralized authorities by enabling trustless, peer-driven insurance models. In a blockchain setup, communities can pool premiums into a smart contract, vote on claims, and approve payouts with full transparency. Every transaction—contribution, vote, payout—is recorded immutably. This empowers underserved or niche segments to create custom insurance pools with clear governance and minimal administrative overhead.

Example:

Teambrella operates a P2P insurance model where users back each other financially using Bitcoin. Claims are approved through group consensus, and every transaction is logged on blockchain, removing the insurer as an intermediary and distributing decision-making power to the community.

Launching Crypto and DeFi Risk Coverage for Digital Assets

Crypto assets, NFTs (non-fungible tokens), and smart contracts have opened new risk categories that traditional insurers are unequipped to handle. The lack of historical data, unclear regulation, and real-time value fluctuation demand a new approach to risk pooling and claims processing. Blockchain for insurance offers a natural solution by enabling decentralized protocols that underwrite, price, and pay claims related to on-chain risks. This includes hacks, smart contract exploits, oracle failures, and rug pulls. Insurers can also use DAO-based governance to assess claims collaboratively while maintaining a secure, transparent ledger.

Example:

Nexus Mutual provides insurance against smart contract bugs and protocol failures in decentralized finance (DeFi). It uses Ethereum smart contracts to manage funds and process claims, and relies on community voting to determine valid claims—blending blockchain-native governance with decentralized underwriting.

How to Integrate Blockchain in Insurance Operations

Bringing blockchain in insurance from concept to execution requires thoughtful planning, the right tech stack, and seamless integration with existing systems. Here’s a step-by-step breakdown of how insurers can begin the transformation.

Identify the Right Use Case

Not every insurance process needs blockchain. Start by pinpointing the high-friction areas where transparency, automation, or multi-party data sharing can make a real difference. Common areas include reinsurance, KYC, claims processing, and blockchain for insurance fraud prevention. Choosing the right problem ensures a faster ROI and smoother adoption.

Choose the Right Blockchain Architecture

Select between public and private blockchains based on your enterprise needs. Public chains offer openness, while private and consortium models provide more control—ideal for regulated industries like insurance. For instance, blockchain integration usually favors permissioned networks for better data governance and security.

Build with the Right Tech Stack

Your tech stack for blockchain in insurance should support scalability, security, and integration with core insurance platforms, with particular attention to implementing smart contracts in insurance for automated claims and policy management. This includes a blockchain framework (like Hyperledger Fabric or Ethereum), smart contract platforms, APIs for integration, and cloud infrastructure. Choosing interoperable tools ensures your blockchain layer complements existing workflows.

Integrate Smart Contracts for Automation

Smart contracts are at the heart of most blockchain applications in insurance. They help automate claims processing, policy issuance, and premium calculations based on pre-set rules. These contracts live on the blockchain and execute automatically—removing manual steps and ensuring fairness and speed.

Ensure Regulatory Compliance

Given the highly regulated nature of insurance, it’s critical to align blockchain use with data protection and industry laws. Work with legal experts to understand compliance for the blockchain and the insurance industry, especially around customer data, digital signatures, and cross-border transactions. Regulatory sandbox testing can help before a full rollout.

Pilot, Test, and Scale

Begin with a limited pilot in one product line or region. Monitor results and user feedback before scaling further. Pilots allow your team to validate the blockchain model, understand integration gaps, and refine smart contracts. Once validated, the model can be scaled across multiple lines of business.

Estimate and Plan for Costs

The cost to integrate blockchain in insurance sector depends on factors like project complexity, chosen tech stack, team expertise, and whether you’re building in-house or outsourcing. While initial investments can be high, long-term savings from automation, fraud reduction, and efficiency often justify the spend.

Challenges & Solutions of Blockchain in Insurance

While blockchain in insurance offers transformative value, implementing it at an enterprise level requires navigating complex hurdles—technical, operational, and cultural. Below is a comprehensive view of key challenges and actionable solutions insurers can use to drive successful adoption.

| Challenge | Description | Solution |

|---|---|---|

| Regulatory Uncertainty | Insurance regulations vary across regions and continue to evolve in response to blockchain use. This makes compliance difficult and delays innovation. | Engage with regulators early. Use sandbox testing to validate compliance models. Ensure legal teams are familiar with compliance and other industry frameworks. |

| Legacy System Compatibility | Traditional insurance platforms are siloed and rigid, making it hard to embed decentralized workflows into existing operations. | Adopt middleware and APIs to enable blockchain integration in insurance systems. Use parallel deployments to minimize business disruption. |

| High Initial Investment | The cost to integrate blockchain in insurance sector includes infrastructure, development, and reskilling—especially for enterprise-scale rollouts. | Start with narrow blockchain in insurance use cases like fraud detection or parametric claims to prove value quickly. Calculate ROI across multiple business units. |

| Data Privacy and Ownership | Storing and managing sensitive customer data on a shared ledger poses legal and ethical risks, especially under GDPR and HIPAA. | Use private permissioned networks. Store only encrypted hashes on-chain while keeping personal data off-chain. Focus on data security in blockchain insurance. |

| Low Internal Expertise | Lack of internal blockchain talent can stall adoption or lead to poorly designed systems. | Partner with blockchain consultants and upskill teams. Develop internal knowledge hubs focused on blockchain implementation. |

| Scaling Across Ecosystems | Blockchain value grows with network effect, but insurers struggle to scale across partners, regions, and product lines. | Join blockchain consortiums like B3i. Use interoperable frameworks and modular rollouts to scale blockchain integration across entities. |

| Interoperability Between Platforms | Different insurers may use different blockchain platforms, causing compatibility issues in multi-party processes like reinsurance or claims. | Use standardized protocols and cross-chain bridges. Focus on interoperability layers in your tech stack. |

| Smart Contract Vulnerabilities | Errors in smart contract logic can lead to fraud, loss of funds, or denial of valid claims. | Perform rigorous testing and third-party audits. Use proven libraries and governance models for blockchain applications in insurance. |

| Scalability of Blockchain Networks | As transaction volumes grow, public or semi-public blockchains may struggle with speed, cost, or throughput. | Choose enterprise-grade platforms like Hyperledger or Corda. Optimize for speed and use off-chain processing where needed to scale blockchain in insurance industry operations. |

| Change Management Resistance | Large insurance organizations often face internal resistance from leadership, IT, or underwriting teams. | Build business cases with measurable KPIs. Use success stories and pilot results to show impact. Highlight proven blockchain in insurance use cases to drive buy-in. |

We help businesses overcome regulatory, technical, and operational roadblocks to build secure, scalable, and future-ready insurance software.

Regulatory and Compliance Considerations in Blockchain Insurance

For insurance enterprises exploring blockchain, compliance isn’t optional—it’s foundational. Regulatory challenges can slow down adoption or even lead to reputational and financial risks if not addressed early. Here’s what insurers need to know.

What Are the Key Compliance Areas?

Insurers dealing with blockchain in insurance must align with several overlapping regulatory frameworks, including:

- Data privacy laws like GDPR, HIPAA, and India’s DPDP Act

- Financial reporting standards

- Anti-money laundering (AML) and Know Your Customer (KYC) regulations

- Cross-border data sharing restrictions

- Regulatory auditability and transparency

Each of these frameworks directly impacts how blockchain integration in insurance systems is designed, especially when it comes to handling personal and financial data.

How Do These Affect the Business?

Ignoring compliance while adopting blockchain can lead to severe consequences:

- Legal penalties for mishandling personal data

- Delayed product launches due to lack of regulatory approval

- Erosion of customer trust if privacy concerns aren’t addressed

- Difficulty scaling across jurisdictions with inconsistent rules

- Pushback from regulators, slowing innovation and affecting partnerships

For enterprise insurers, non-compliance doesn’t just hurt operations—it affects brand credibility and market access.

What Can Businesses Do to Stay Compliant?

Businesses looking to adopt blockchain in insurance industry must make compliance a part of their implementation strategy from day one. Here’s how:

- Use permissioned blockchain networks to control access to sensitive data

- Store only encrypted hashes or metadata on-chain to maintain data security in blockchain insurance workflows

- Conduct regular smart contract audits to ensure alignment with changing regulations

- Engage with local regulators early through sandbox programs and proof-of-concept pilots

- Appoint a compliance lead on your blockchain transformation team to track evolving legal guidelines

Enterprise insurers should also collaborate with legal experts and blockchain consultants to design systems that meet both technological and regulatory needs.

Future Trends in Blockchain for Insurance

As blockchain matures, its role in the insurance industry is set to expand far beyond claims automation or fraud prevention. Here are the most important trends shaping the future of blockchain in insurance, along with practical steps insurers can take to stay ahead.

1. Rise of Blockchain-Enabled Ecosystems

Insurers, reinsurers, brokers, and regulators are starting to collaborate within blockchain-powered ecosystems that share policy data, claims, and customer interactions in real-time. These networks reduce duplication, improve trust, and enable seamless inter-company transactions.

Practical Tip:

Start by joining consortiums like B3i or RiskStream Collaborative. These platforms offer a low-risk way to explore blockchain integration alongside industry peers.

2. Smart Contracts as a New Operating Standard

As underwriting and claims grow more complex, smart contracts will become the default for automating multi-party processes and ensuring compliance. Their transparency and immutability reduce disputes and streamline operations.

Practical Tip:

Identify high-volume workflows—like motor or travel claims—and run smart contract pilots with clearly defined rules. This lays the groundwork for scaling blockchain applications in insurance.

3. Integration with IoT, AI, and Telematics

The next wave of blockchain in insurance trends involves combining blockchain with IoT and AI to enable dynamic pricing, usage-based insurance, and real-time risk assessment. Together, these technologies will help insurers launch highly personalized products.

Practical Tip:

Invest in IoT data partnerships now. Use blockchain to store and verify sensor data securely, and apply AI to derive insights for new policy models.

4. Regulatory Clarity and Blockchain-Specific Frameworks

Governments and regulatory bodies are moving toward creating blockchain-specific compliance frameworks. This will provide the confidence enterprise insurers need to scale their solutions without fear of legal exposure.

Practical Tip:

Stay informed about evolving standards from organizations like NAIC, EIOPA, and MAS. Build your architecture with compliance in mind—even before regulations become law.

5. Growth of Niche and Microinsurance Models

Blockchain reduces the operational costs of managing small policies, making niche and microinsurance viable at scale. From crop insurance to gig worker protection, expect new models to emerge with automated, low-cost delivery.

Practical Tip:

Explore launching a blockchain-based microinsurance product with parametric triggers. It’s a fast, low-risk way to reach underserved markets and test smart contract functionality.

6. Expansion of Blockchain Insurance Coverage for Digital Assets

As crypto, NFTs, and Web3 adoption grows, insurers will need to provide protection for digital assets. Blockchain offers native infrastructure to underwrite, manage, and validate these policies.

Practical Tip:

Collaborate with Web3-native platforms or DeFi insurers to co-develop coverage products. This helps you understand emerging risks while positioning your business in a new market segment.

Why Appinventiv is the Right Partner to Leverage Blockchain Adoption in Insurance

We hope this blog has helped you understand the transformative power of blockchain in insurance—from streamlining claims and reinsurance to enhancing compliance, trust, and operational efficiency. As the industry moves from exploration to execution, having the right technology partner can make all the difference.

At Appinventiv, we specialize in building custom blockchain applications in insurance that are enterprise-ready, secure, and scalable. Our team has deep domain expertise in insurance tech and hands-on experience in delivering blockchain-powered systems that integrate seamlessly with legacy infrastructure. Whether it’s creating smart contracts, implementing permissioned ledgers, or building full-stack blockchain platforms, we help you unlock new value without disrupting your core operations.

As a custom blockchain development company, we understand the nuances of compliance for blockchain in insurance industry, especially across highly regulated markets like the U.S., EU, and APAC. Our experts design solutions that align with evolving data protection, KYC, and audit requirements—so you can innovate confidently and compliantly. We also offer full support for blockchain integration in insurance systems, from discovery workshops and pilot programs to deployment, governance, and scaling.

Most importantly, we don’t just deliver code—we deliver strategy. Appinventiv works closely with your leadership, product, and IT teams to identify the most impactful use cases and architect long-term solutions that generate ROI. Whether you’re building fraud-resistant systems, launching microinsurance, or exploring on-chain asset coverage, leveraging our insurance software development services can help you lead.

If you’re ready to explore what blockchain for insurance can mean for your organization—or want to discuss the cost to integrate blockchain in insurance sector—our consultants are just a call away. Let’s build the future of insurance, together.

FAQs

Q. How can blockchain technology be used in the insurance industry?

A. Blockchain can be used in the insurance industry to streamline claims processing, improve data transparency, automate underwriting through smart contracts, and reduce fraud. It enables multiple stakeholders—insurers, reinsurers, brokers, and regulators—to securely share and verify data in real time, increasing efficiency and trust across the ecosystem.

Q. How long does it take to integrate blockchain in insurance operations?

A. The timeline to integrate blockchain in insurance operations depends on the use case and complexity. A basic pilot like claims automation or fraud detection can take 3–6 months, while full-scale blockchain-powered insurance systems may take 9–18 months, including development, testing, compliance, and stakeholder onboarding.

Q. How does blockchain work for insurance fraud detection?

A. Blockchain helps prevent fraud by maintaining a transparent, immutable record of all transactions. Once a claim or policy is recorded on the blockchain, it cannot be altered without consensus. This makes it easier to detect duplicate claims, verify asset ownership, and flag suspicious activity across insurers—supporting effective blockchain for insurance fraud prevention.

Q. How much does it cost to build a blockchain app for insurance?

A. The average cost to integrate blockchain in insurance sector ranges from $30,000 to $300,000, depending on project complexity, tech stack, required features, and whether it’s built in-house or outsourced. Custom solutions with smart contract automation, advanced security layers, and multi-party access typically fall at the higher end of this range.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Step-by-Step Guide to Crypto Trading Bot Development in 2026

Key takeaways: Crypto trading bot development in 2026 functions as full-scale trading systems, not experimental scripts. They require the same engineering discipline as any financial platform. Execution quality drives results more than strategy logic. Latency control, order handling, and risk limits shape real-world performance. AI-based strategies work only when supported by reliable data flows, controlled…

Decentralized Exchange (DEX) Development: Features, Implementation Cost, and Enterprise ROI

Key Takeaways The development of a decentralized exchange will enable businesses to provide secure and user-controlled trading, improve transparency, and minimize the use of intermediaries. The cost of DEX development can vary depending on the platform's features, the chosen network, and regulatory requirements, and the approximate cost is about $50,000, with higher costs for customization,…

Key takeaways: Dubai's VARA framework mandates strict compliance protocols for blockchain enterprises. To comply with VARA in Dubai, enterprise blockchain systems should use private networks that only approved members can join. Choosing between Hyperledger Fabric, private Ethereum, Corda platforms, etc., significantly impacts long-term scalability, compliance automation, and maintenance costs. Enterprises implementing VARA enterprise blockchain development…