- Understanding Banking Technology Consulting and Why the Market Is Accelerating

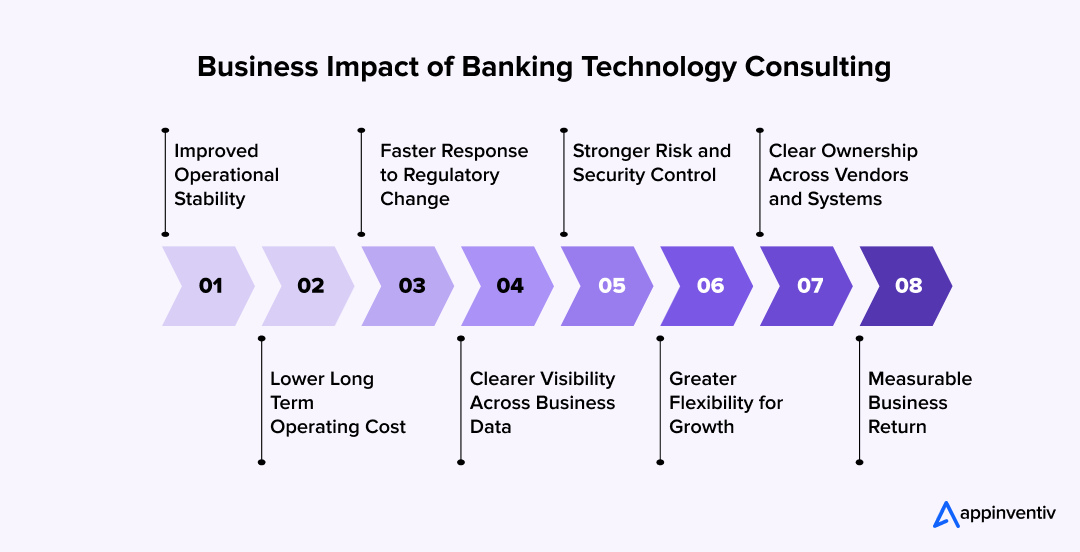

- Business Benefits of Banking Technology Consulting

- Improved Operational Stability

- Lower Long Term Operating Cost

- Faster Response to Regulatory Change

- Clearer Visibility Across Business Data

- Stronger Risk and Security Control

- Greater Flexibility for Growth

- Clear Ownership Across Vendors and Systems

- Measurable Business Return

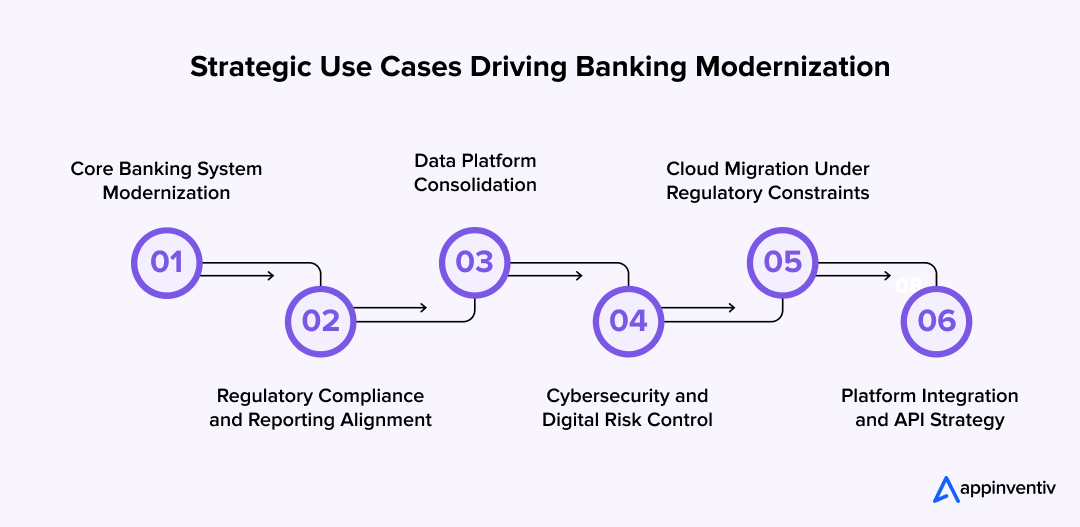

- Common Use Cases in Banking Technology Consulting

- Core Banking System Modernization

- Regulatory Compliance and Reporting Alignment

- Data Platform Consolidation

- Cybersecurity and Digital Risk Control

- Cloud Migration Under Regulatory Constraints

- Platform Integration and API Strategy

- Cost of Banking Technology Consulting

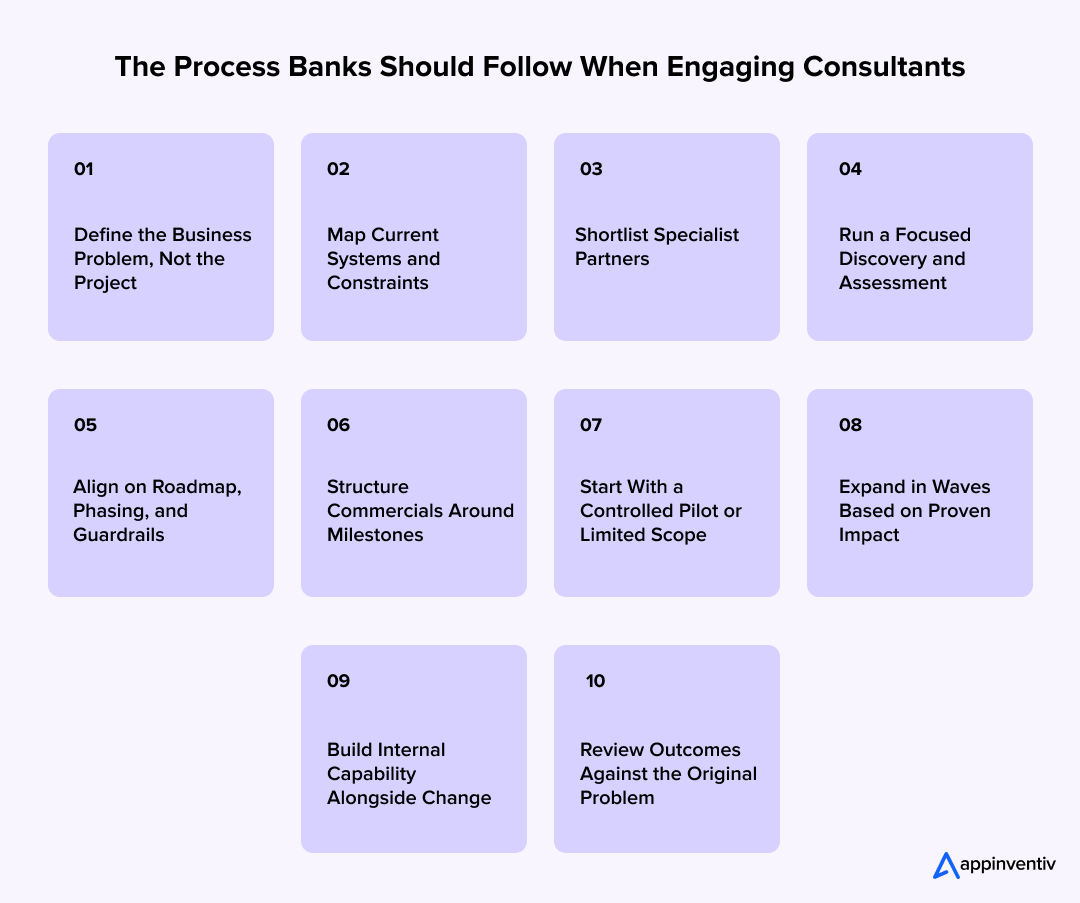

- Step-by-Step Process to Engage Banking Technology Consulting

- 1. Define the Business Problem, Not the Project

- 2. Map Current Systems and Constraints

- 3. Shortlist Specialist Partners

- 4. Run a Focused Discovery and Assessment

- 5. Align on Roadmap, Phasing, and Guardrails

- 6. Structure Commercials Around Milestones

- 7. Start With a Controlled Pilot or Limited Scope

- 8. Expand in Waves Based on Proven Impact

- 9. Build Internal Capability Alongside Change

- 10. Review Outcomes Against the Original Problem

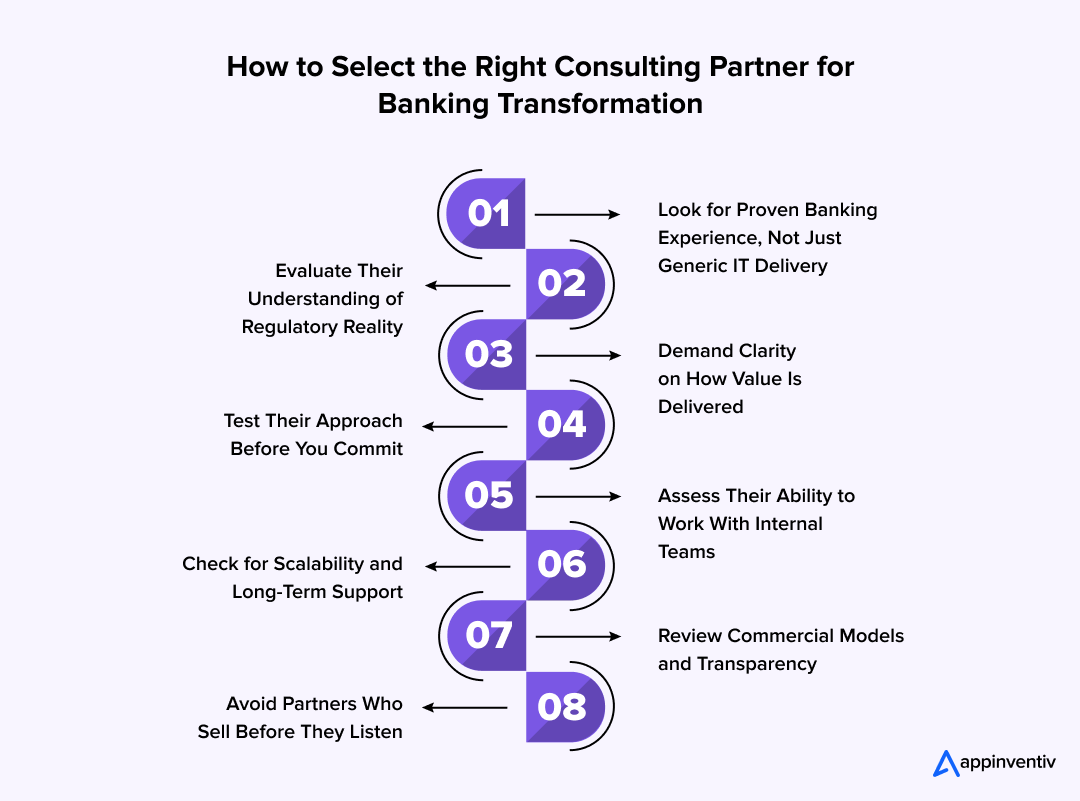

- How to Choose the Right Banking Technology Consulting Partner

- Look for Proven Banking Experience, Not Just Generic IT Delivery

- Evaluate Their Understanding of Regulatory Reality

- Demand Clarity on How Value Is Delivered

- Test Their Approach Before You Commit

- Assess Their Ability to Work With Internal Teams

- Check for Scalability and Long-Term Support

- Review Commercial Models and Transparency

- Avoid Partners Who Sell Before They Listen

- Operational and Strategic Challenges Banks Encounter During Modernization

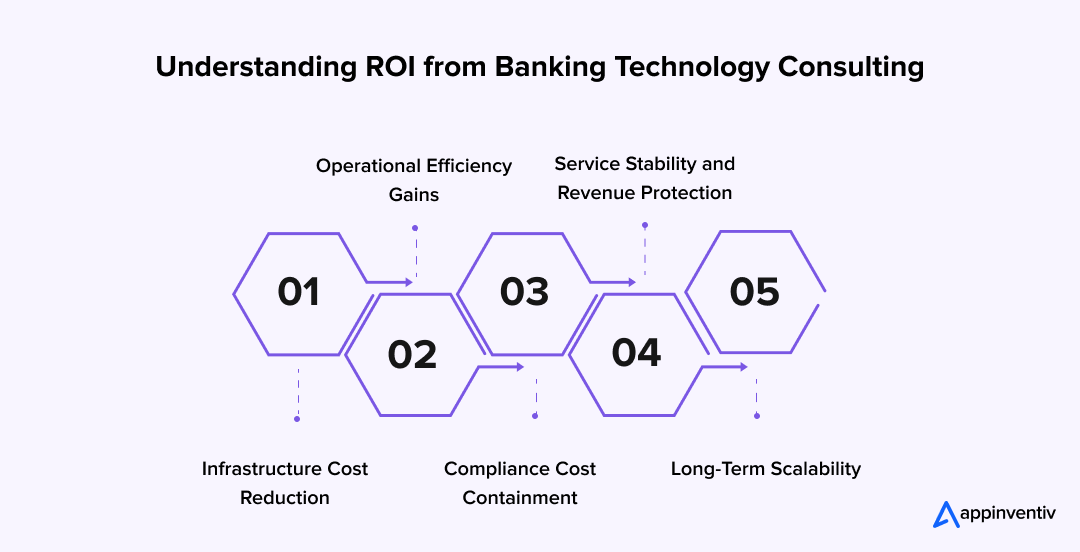

- Return on Investment from Banking Technology Consulting

- Infrastructure Cost Reduction

- Operational Efficiency Gains

- Compliance Cost Containment

- Service Stability and Revenue Protection

- Long-Term Scalability

- How Banking Businesses Should Move Forward Without Increasing Risk

- Start With a Banking-Specific Risk Assessment

- Prioritize Systems That Carry Regulatory and Revenue Risk

- Demand Governance That Matches Banking Reality

- Keep Engagements Phased and Contractually Controlled

- Embed Internal Teams Into Delivery

- Measure Success Through Risk Reduction

- Use AI to Reduce Risk Before It Becomes a Problem

- Why Appinventiv is the Right Partner for Banking Technology Consulting

- FAQs

Key takeaways:

- Banking modernization is now a strategic necessity, not a technology upgrade.

- Most banks lose value due to legacy complexity, fragmented data, and slow compliance response.

- Structured banking technology consulting delivers measurable gains in cost, stability, and governance.

- Core modernization succeeds when roadmaps, risk, and regulatory alignment are clearly defined.

- ROI comes from reduced incidents, cleaner audits, faster product releases, and scalable architecture.

- Choosing the right consulting partner determines whether modernization removes friction or adds more.

Most banking leaders are no longer worried about whether their systems run. They are worried about what those systems quietly cost them. Core platforms still process transactions, but the effort required to maintain them keeps rising. Integrations grow fragile, compliance updates take longer, data remains fragmented, and every change introduces risk. What once delivered stability now slows execution and limits growth.

This is where banking technology consulting shifts from an IT exercise to a strategic requirement. Modern bank technology consultants are not brought in to replace software in isolation. They are engaged to realign technology with business control, covering risk management, regulatory operations, scalability, and customer experience. Whether the focus is retail platforms or technology consulting for corporate banking, the objective remains the same: reduce operational friction while strengthening performance and governance.

The pressure to act is already visible in the market. According to KPMG’s 2025 global banking transformation report, nearly half of bank CEOs expect earnings growth between 2.5 and 5 percent over the next three years, while one in five expect growth above 5 percent.

At the same time, 53 percent of leaders aim to cut operating costs by at least 10 percent by 2030, yet only 24 percent have been highly successful in doing so. This disconnect highlights why structured modernization matters. This guide shows how banks can move from recognizing the problem to executing modernization responsibly, with clear roadmaps, controlled risk, and measurable return on investment.

If complexity, slow change cycles, or compliance pressure are holding you back, our team can help you redesign your technology landscape with precision.

Understanding Banking Technology Consulting and Why the Market Is Accelerating

Banking technology consulting today operates at a structural level, not an implementation layer. It focuses on how operating architecture, compliance workflows, data platforms, and security controls work together at scale. This is why these initiatives are now treated as business decisions rather than technical upgrades.

Banks are increasingly turning to structured consulting because internal teams are under pressure from multiple directions at once. Systems are more interconnected, regulatory change is more frequent, and customer expectations are shaped by digital-native experiences. Managing all three without architectural clarity or digital transformation in banking is becoming unsustainable.

Key forces accelerating modernization in banking include:

- Faster and more complex regulatory change across regions

- Legacy platforms costing more to maintain than to modernize

- Security and data governance failures becoming board-level risks

- Vendor sprawl increasing integration and operating cost

- Fintech competitors setting new experience benchmarks

- Demand for real-time processing reshaping core system design

This acceleration is not driven by digital ambition alone. It reflects a shift in how banks invest in stability, resilience, and control. Banking software consulting has become essential for institutions that cannot afford operational disruption, while banking innovation consulting is increasingly focused on sustainability, predictability, and return rather than experimentation for its own sake.

Business Benefits of Banking Technology Consulting

Banking leaders rarely invest in change for technology reasons alone. The real driver is control. Control over systems that fail without warning, compliance processes that change mid-year, data that never lines up fully, and costs that grow quietly in the background. Well-executed modernization efforts help bring structure back into environments that have grown complicated through years of patchwork improvements. It replaces reactive operations with deliberate ownership of systems, data, and workflows across the bank.

Improved Operational Stability

When systems grow over time without architectural oversight, reliability becomes inconsistent. Consultants focus on simplifying system dependencies and reducing failure points rather than layering more tools onto weak foundations. As systems become more predictable, outages drop and operating teams gain confidence in day-to-day performance without needing constant workarounds.

Lower Long Term Operating Cost

Banks do not overspend because of innovation. They overspend because legacy systems require constant support and duplication. Banking IT consulting helps uncover where cost leaks actually exist, whether in contracts, infrastructure, or operations. Banking consulting then becomes a way to simplify design and remove technology that no longer adds value instead of continuously funding maintenance.

Faster Response to Regulatory Change

Rules no longer change slowly and are rarely isolated to one department. A well-designed technology foundation helps connect compliance changes directly into reporting structures and operational systems so updates no longer rely on manual intervention. When controls are built into technology rather than patched afterward, banks spend less time reacting and more time staying ahead.

[Also Read: Appinventiv’s Approach to Maintaining Regulatory Compliance in Financial Software]

Clearer Visibility Across Business Data

Teams struggle to make decisions not because they lack data, but because they do not trust what they see. Technology consulting for banks brings clarity by reducing fragmentation across platforms and aligning reporting with actual workflows. Leadership gains more consistent insight into performance trends, risk exposure, and customer behavior without waiting for reconciliation cycles.

Stronger Risk and Security Control

FinTech cybersecurity incidents rarely happen because of one failure. They happen because safeguards are scattered and ownership is unclear. A structured modernization approach strengthens how identity, access, and monitoring are designed. The result is not just a safer technology environment, but one where accountability is clearly defined and consistently enforced.

Greater Flexibility for Growth

Banking products evolve faster than systems were originally designed to support. With guidance from experienced banking technology consultants, platforms become easier to update without causing downstream disruptions. This matters even more in technology consulting for corporate banking, where performance issues directly impact client confidence and revenue.

Clear Ownership Across Vendors and Systems

When multiple vendors support overlapping platforms, responsibility becomes difficult to trace. A structured engagement introduces clarity into system ownership and accountability. Internal teams know who owns what, and external partners are more closely aligned with performance expectations.

Measurable Business Return

Success is rarely measured in delivered features. It is measured in fewer incidents, cleaner audits, faster product rollouts, and lower operational friction. Investments begin to pay back in avoided failures, reduced rework, and better control over how money flows through the organization.

Common Use Cases in Banking Technology Consulting

Banking modernization is rarely triggered by trends alone. Institutions typically initiate modernization when operational risk increases, delivery slows down, or compliance becomes harder to sustain at scale. These use cases reflect where banking consultants are typically brought in to stabilize growth, modernize infrastructure, and protect long-term performance.

Core Banking System Modernization

Legacy core platforms make change expensive and slow. Banking technology consulting services are commonly used to break dependency on monolithic systems and introduce modular core designs that reduce failure risk and improve processing speed. The focus of legacy banking systems modernization is not replacement, but is separating critical functions so systems can evolve without business disruption.

Example: DBS Bank (Singapore) completed a multi-year core modernization program that shifted its infrastructure from monolithic banking systems to a microservices-based platform. The program, driven through architecture redesign and delivery discipline, allowed DBS to deploy updates more frequently and significantly improve system reliability.

Regulatory Compliance and Reporting Alignment

When reporting systems grow independently across departments, compliance becomes reactive instead of controlled. Banking IT consulting is used to redesign regulatory architecture so reporting is embedded into daily workflows rather than handled through manual reconciliation and post-processing.

Example: HSBC implemented centralized regulatory reporting frameworks across multiple geographies with support from banking technology consultants to meet evolving regulatory reporting obligations. This is one of the examples of consulting in banking technology modernization that helped the brand to unify reporting standards and reduce time spent on audit preparation and regulatory remediation.

Data Platform Consolidation

Most banks operate with fragmented data environments built up through years of mergers, system changes, and vendor additions. Banking software consulting helps unify data platforms so leadership and operations teams can rely on a single source of truth.

Example: Capital One migrated core banking data workloads to a centralized cloud-based data platform using guidance from external modernization partners. The move enabled real-time analytics and improved decision-making across fraud detection and customer insights.

Cybersecurity and Digital Risk Control

Technology modernization often exposes gaps in identity control and data protection. Banking innovation consulting is widely used to rebuild access management, monitoring systems, and audit control at an architectural level rather than patching security system by system.

Example: JPMorgan Chase restructured identity and access management across its global applications following internal security audits. External advisors played a role in introducing centralized authentication and improving account-level monitoring across business units.

Cloud Migration Under Regulatory Constraints

Banks cannot migrate to the cloud without balancing cost efficiency, security, and regulatory compliance. Technology consulting for corporate banking is often used to design hybrid and region-specific cloud strategies that support operations without violating regulatory frameworks.

Example: NatWest Group in the UK migrated large parts of its infrastructure to private and hybrid cloud models with support from bank technology consultants, ensuring compliance with FCA and PRA regulations while reducing long-term infrastructure cost.

Platform Integration and API Strategy

New digital products place pressure on legacy integration layers. A modern integration approach restructures how platforms communicate through standardized interfaces and APIs to simplify future expansion and partnerships.

Example: BBVA introduced an open banking platform with developer APIs as part of its digital transformation strategy. Its hired consultants supported platform design and governance, enabling BBVA to expand fintech partnerships without disrupting existing systems.

[Also Read: Unlocking the Power of FinTech APIs: A Pocket Guide]

Cost of Banking Technology Consulting

The cost of banking technology consulting depends on transformation depth, system complexity, and regulatory environment. A limited advisory engagement focused on assessment and planning is very different from a multi-year modernization program covering architecture, data, and operations. The cost of advisory help depends on how much of the organization is being changed, not just the number of consultants involved.

| Engagement Type | Scope of Work | Typical Cost Range | Duration | Primary Focus Areas |

|---|---|---|---|---|

| Advisory and Strategy Engagements | Assessment, roadmap creation, vendor evaluation, compliance planning | $150,000 to $300,000 | 6 to 12 weeks | Architecture assessment, business alignment, regulatory mapping, planning |

| Transformation and Redesign Programs | Partial modernization, integration cleanup, data restructuring | $500,000 to $1.5 million | 6 to 12 months | Platform consolidation, compliance workflows, system interface rework |

| Full Core Modernization Initiatives | Core platform change, migration planning, operational transition | $1 million to $5 million | 12 to 24 months | Core replacement, process redesign, system stability engineering |

| Enterprise Modernization and Multi-Region Programs | Multi-country frameworks, compliance architecture, platform overlays | $5 million to $12 million+ | 24 to 36 months | Regulatory governance, cloud transformation, operational standardization |

Step-by-Step Process to Engage Banking Technology Consulting

Most banks do not need more theory. They need a clear path from “we have a problem” to “we are working with the right banking technology consulting partner on the right scope.” The process below keeps it simple, reduces risk, and helps you link every step back to return on investment.

1. Define the Business Problem, Not the Project

Start with the impact, not the solution.

List where you are losing money, time, control, or sleep: outages, failed releases, audit findings, manual work, or stalled products. This becomes the base brief for bank technology consultants so they align the scope to outcomes, not just tools.

2. Map Current Systems and Constraints

Before you invite anyone in, document your reality.

Outline core systems, critical integrations, key vendors, major regulatory obligations, and known technology debt. This does not need to be perfect, but it gives potential partners a realistic view of what they are walking into and what they must protect.

3. Shortlist Specialist Partners

Look for experience where it matters, not just logos.

Shortlist firms that have prior experience in working with banking firms as well as in environments similar to yours: regional vs global, retail vs corporate, cloud vs on-prem, heavy regulation vs lighter markets. Ask for specific case studies, not generic transformation stories.

4. Run a Focused Discovery and Assessment

Begin with a contained engagement, not a full program.

Ask your chosen banking technology consultants to perform a structured discovery: architecture review, risk points, cost hotspots, and quick-win opportunities. This is where you see how they think, how they quantify issues, and how they connect problems with measurable ROI.

5. Align on Roadmap, Phasing, and Guardrails

Do not move to execution until you agree on sequence and limits.

Use the assessment to agree on a phased roadmap: what happens first, what must be protected, what cannot go wrong, and what triggers a pause. This is where banking technology consulting services should clearly show how value will be created and in what order.

6. Structure Commercials Around Milestones

Tie your spendings to progress, not just time.

Set up commercial terms where key payments follow specific milestones: discovery completed, architecture signed off, pilot run, rollout phase, stabilization. This helps you link cost to risk reduction and progress, and keeps the consulting engagement focused on delivery.

7. Start With a Controlled Pilot or Limited Scope

Avoid “big bang” unless there is no alternative.

Begin with a pilot: a single product line, region, channel, or workflow. Use this to validate the consulting approach, test assumptions, and prove both technical and business ROI before you scale.

8. Expand in Waves Based on Proven Impact

Scale only after you see real results.

Once the pilot stabilizes and shows reduced incidents, faster change cycles, or lower operating effort, expand the same patterns to other areas. The engagement then moves from a cost line to a repeatable model for improvement.

9. Build Internal Capability Alongside Change

Do not let all the knowledge sit with the partner.

Ask your consultants to coach internal teams during delivery: architecture, DevOps, compliance, and operations. Over time, this reduces your dependency on external support and improves long-term ROI.

10. Review Outcomes Against the Original Problem

Close the loop deliberately.

At agreed checkpoints, compare outcomes with the original issues you listed: fewer outages, cleaner audits, lower manual work, faster releases, reduced spend. This is how you quantify the return on modernization investment and decide where to invest next.

After you understand the process, the next real risk is choosing the wrong partner. Not every firm offering banking technology consulting delivers strategic value. The right partner simplifies complexity. The wrong one adds to it. Before engaging any consulting provider, leaders should treat the selection itself as a business decision with long-term impact.

How to Choose the Right Banking Technology Consulting Partner

Selecting a banking technology consulting firm is not about credentials alone. It is about alignment, accountability, and depth in the areas that matter most to your institution’s risk profile, operating model, and growth plans.

Look for Proven Banking Experience, Not Just Generic IT Delivery

Banks should choose partners who understand how regulated environments work, how audits shape design choices, and how compliance influences technology decisions. The right consulting provider brings hands-on experience with banking systems, regulated workflows, and complex integrations—backed by real examples of modernization work that delivered measurable outcomes, not just technical deployments.

Evaluate Their Understanding of Regulatory Reality

Banking IT consulting fails quickly when compliance is treated as a checklist. A credible consulting partner should speak clearly about risk management, audit readiness, and regulatory architecture. If they cannot explain how technology supports compliance in practice, they will struggle during execution.

Demand Clarity on How Value Is Delivered

The strongest consulting services articulate how progress is measured. Look for partners who define success through reduced incidents, simplified systems, lower cost, or improved control. Avoid firms that talk only about tools and frameworks without connecting them to results.

Test Their Approach Before You Commit

Start with a limited engagement before launching large programs. A well-run assessment phase reveals how a partner thinks, documents risk, and structures change. Bank technology consulting should feel organized from the first interaction, not improvised.

Assess Their Ability to Work With Internal Teams

Modernization does not succeed if knowledge stays outside the organization. Banking consulting should include training, transition planning, and internal enablement. A good partner strengthens your team rather than replacing it.

Check for Scalability and Long-Term Support

Choose banking innovation consulting partners who can scale with you. A large transformation requires continuity, not frequent changes in delivery teams. The right provider stays when the work becomes complex, not just when it is strategic.

Review Commercial Models and Transparency

Contracts should align with delivery, not just time spent. The best bank technology partner structures engagements around milestones and outcomes. Transparent pricing reflects confidence in execution. Ambiguity in commercials usually hides risk.

Avoid Partners Who Sell Before They Listen

A reliable consulting partner should ask more questions than they answer initially. If solutions are offered before problems are fully understood, the engagement will be built on assumptions rather than disciplined analysis.

We help leadership teams define scope, validate priorities, and progress through modernization in controlled phases.

Operational and Strategic Challenges Banks Encounter During Modernization

Modernization is rarely a technical exercise alone. It exposes structural gaps in ownership, governance, architecture, and operating discipline. Systems that once worked in isolation must suddenly operate as a single environment. Processes that were manually manageable begin to break at scale. These challenges surface not at kickoff, but once systems, teams, and deadlines start colliding.

Leaders who prepare for these risks early shorten delivery cycles, avoid rework, and protect customer experience during transformation. Let’s look into the challenges of technology consulting in banking and how to resolve them:

| Challenge | What This Looks Like During Execution | How to Address the Risk |

|---|---|---|

| Fragmented system landscape | Applications operate in silos, causing duplicated logic, reconciliation errors, and dependency failures when one system changes | Simplifying architecture, standardizing interfaces, and reducing the number of platforms before expanding functionality |

| Unclear technology ownership | Multiple teams control overlapping components, leading to slow decisions and unresolved accountability when issues arise | Assigning formal system owners and establishing clear escalation and decision authority |

| Regulatory drift | New or revised rules emerge while projects are in flight, creating scope shifts and compliance uncertainty | Embedding regulatory checkpoints into delivery timelines and involving compliance leadership in governance |

| Weak data foundations | Reports differ across departments due to inconsistent definitions and incomplete integration | Building unified data models and centralizing governance to restore trust in information |

| Legacy lock-in | Outdated platforms cannot be retired because too many systems depend on them | Introducing phased replacement strategies that remove dependencies without disrupting operations |

| Unrealistic delivery timelines | Business expectations ignore complexity and operational constraints | Segmenting delivery into realistic stages and validating timelines with engineering and operations leaders |

| Operational disruption | Core services experience instability during migration | Maintaining temporary parallel environments until stability is proven |

| Budget overruns | Costs increase due to delays, changing scope, or underestimated effort | Enforcing strict financial governance and milestone-based funding |

| Skill gaps | Internal teams lack experience in modern platforms | Providing training alongside delivery and strengthening internal capability |

| Security exposure | Access control and monitoring weaken as systems expand | Redesigning identity management and applying consistent protection methods |

Once organizations understand the risks involved in large-scale modernization, the next logical question is not whether to continue, but whether the effort truly pays off. Leaders do not fund complex initiatives for progress alone. They fund them to improve control, stability, and financial performance.

At this stage, the conversation must shift from managing disruption to understanding business return. This is where return on investment becomes the central lens. It is not about theoretical benefit, but about what changes inside operations, finance, and governance when transformation is done correctly.

Return on Investment from Banking Technology Consulting

Return does not arrive in the form of a single metric. It appears gradually through lower operating costs, fewer business interruptions, and smarter use of internal resources. The strongest returns are built not on innovation headlines, but on reducing friction across everyday operations.

Infrastructure Cost Reduction

Legacy platforms are expensive to operate and difficult to scale. As outdated systems are retired, compute costs fall, data handling becomes more efficient, and vendor expenses decrease. Over time, institutions see reductions in hosting costs, maintenance contracts, and duplicated licensing.

Operational Efficiency Gains

Modernized systems require fewer manual interventions. Teams spend less time fixing failures, reconciling data, and managing workarounds. This improves productivity while reducing overtime, rework, and escalation workloads.

Compliance Cost Containment

Regulatory reporting becomes faster and more reliable when controls are designed into workflows instead of applied afterward. Audit preparation effort decreases and remediation costs fall as systems enforce compliance automatically.

Service Stability and Revenue Protection

Fewer system outages mean fewer failed transactions and customer complaints. Reliable platforms translate into steadier revenue flow and improved service confidence, especially in high-value transaction environments.

Long-Term Scalability

As systems become easier to modify and extend, growth no longer requires reinvention. New services can be launched without destabilizing existing operations, allowing banks to scale without repeatedly increasing cost.

How Banking Businesses Should Move Forward Without Increasing Risk

Banking technology consulting is meant to reduce operational exposure while modernizing critical systems. Risk rises when transformation is treated like a technology rollout instead of a business redesign. In banking environments, mistakes carry regulatory, financial, and reputational consequences, so execution must be controlled, not rushed.

Start With a Banking-Specific Risk Assessment

Before engaging any consultant, leaders should require a detailed assessment of core platforms, regulatory systems, data flows, and recovery processes. This helps banking technology consultants identify high-risk systems early and prevents migration activity from interfering with daily operations.

Prioritize Systems That Carry Regulatory and Revenue Risk

Not all systems are equal inside a bank. Customer access platforms, payment engines, and reporting systems must be stabilized before modernizing peripheral platforms. Technology consulting services offer the most value in banking when change begins in the highest-risk areas rather than the most convenient ones.

Demand Governance That Matches Banking Reality

Technology consulting in banking fails quickly without structured governance. Clear ownership, decision authority, and escalation paths must be in place before execution begins. Bank technology partners should work with leadership to formalize accountability across systems and vendors to avoid decision paralysis.

Keep Engagements Phased and Contractually Controlled

Large engagements become risky when scope remains vague. Contracts should define milestones, responsibilities, and outcomes clearly. Phased delivery protects the bank from operational shock and makes progress measurable from the first stage.

Embed Internal Teams Into Delivery

Successful delivery does not end with reports and code. Internal teams must be embedded into architecture, security, and compliance work from the start. Banks that treat consulting as knowledge transfer rather than outsourcing retain long-term control.

Measure Success Through Risk Reduction

Progress should be evaluated through fewer audit issues, stronger platform stability, faster regulatory response, and improved incident recovery. Modernization value when risk visibly decreases, not just when systems change.

Use AI to Reduce Risk Before It Becomes a Problem

AI inside banking environments should serve one purpose first: risk control at scale. Modern technology consulting increasingly uses AI to monitor system behavior, flag anomalies, and identify compliance gaps before they result in failure. Instead of reacting after incidents occur, leaders can use AI-driven analysis to surface early warning signals from transaction patterns, system logs, and performance trends. When applied well, AI does not replace decision-making.

Discover how we helped a leading European bank digitally transform its daily operations with AI-powered banking solutions, leading to a 20% increase in customer retention rate and 35% reduction in manual processes!

Why Appinventiv is the Right Partner for Banking Technology Consulting

We hope this guide has helped you understand how banking technology consulting shapes core modernization, reduces operational risk, and creates measurable return. Once leaders see the scale of decisions involved – architecture, compliance, data, security, and operating models – the next step is choosing a partner who can translate strategy into reliable execution.

We have deep experience working inside the banking environments where precision is non-negotiable. As a leading banking software development services provider, our teams understand how core systems behave under volume, how regulatory workflows drive design, and how data, security, and operations must align for modernization to hold up in the real world. This expertise allows us to design and deliver modernization programs that strengthen control rather than add complexity.

Being a dedicated fintech consulting services firm, we also bridge the advisory-to-delivery gap that often weakens transformation. Our architects, engineers, and domain specialists work as a unified team, ensuring that every strategic decision is shaped by operational realities – release cycles, resilience patterns, regional regulations, and business continuity requirements. This reduces failure points and accelerates return on investment.

We work shoulder-to-shoulder with internal teams so capability grows inside your bank, not outside it. Knowledge transfer, co-design, and transparent governance are built into our delivery model. Our goal is to leave your organization stronger, more self-reliant, and better equipped to manage its technology landscape long after the program is complete. Get in touch with our experts now!

FAQs

Q. How can consultants improve cybersecurity for digital banking?

A. Banking technology consultants strengthen cybersecurity by looking at the entire banking environment, not just one system at a time. They study authentication, access control, data movement, and how platforms behave under real load. Through banking technology consulting, they uncover weak points that internal teams may overlook, such as outdated encryption, legacy code paths, inconsistent monitoring, or unclear identity ownership. Their priority is to make security stable, predictable, and aligned with the way banking operations actually run.

They also reshape security architecture so controls are built into the system rather than added later. This includes modernizing IAM structures, improving threat detection capabilities, tightening vendor access, and aligning all decisions with compliance expectations. With the right bank technology consultants, banks gain fewer incidents, stronger governance, and a more controlled digital footprint across all channels.

Q. How much does banking technology consulting cost?

A. Cost varies depending on the depth of transformation and the complexity of existing systems. Smaller advisory engagements in banking IT consulting, such as architecture assessments, roadmap design, or compliance reviews, fall at the lower end, typically between $150,000 and $300,000. These efforts focus on discovering issues, mapping risk areas, and defining priorities so banks understand where control is weak and where investment will deliver the highest return.

Larger modernization programs require more significant budgets because they involve core redesign, system consolidation, integration cleanup, data restructuring, or multi-region alignment. Transformation initiatives usually range from $500,000 to $1.5 million, while full core modernization programs often fall between $1 million and $5 million. Enterprise-scale or multi-country modernization efforts can exceed $5 million when regulatory constraints, legacy complexity, and operating-model redesign are involved. Scalability and long-term stability ultimately shape the final investment.

Q. How can GenAI improve customer service in banking?

A. GenAI improves customer service by reducing the effort needed to resolve queries and by providing faster, more accurate responses. Unlike basic bots, GenAI can interpret context, process lengthy questions, and reference policies instantly. When integrated through banking software consulting, it becomes part of the bank’s service workflow rather than a standalone tool, which reduces manual workload and improves operational speed.

GenAI also supports internal teams by summarizing customer cases, flagging compliance concerns, and suggesting next steps based on historical patterns. Through structured technology consulting services, banks can embed GenAI into their service desks, mobile platforms, and knowledge systems. The result is fewer escalations, more consistent decisions, and smoother service across all customer touchpoints.

Q. Which banking regulations impact technology adoption?

A. Several regulatory frameworks influence how banks choose and implement technology. Requirements around data privacy, reporting accuracy, cybersecurity standards, and operational resilience shape nearly every decision. Through technology consulting, institutions map these regulatory obligations to their architecture and operating model so modernization does not create compliance gaps.

Regulators now expect clearer audit trails, tighter identity controls, and greater transparency in how data is managed. Banking technology consultants translate these expectations into technical rules that shape access management, encryption, monitoring, and reporting structures. Without this alignment, technology adoption becomes risky because every new integration or change must withstand regulatory scrutiny.

Q. How can consultants help with API-ready banking systems?

A. Banking technology consultants begin by examining how current systems expose data, handle authentication, and manage transaction flows. Many legacy environments were never designed for open interfaces, making integration slow, brittle, and operationally risky. They focuses on creating stable foundations, so APIs can operate safely without compromising internal systems.

Once the environment is ready, consultants help banks build API strategies that support growth. This includes partner onboarding, corporate banking integrations, real-time processing, and new digital product lines. When handled by experienced banking tech consultants, the result is a scalable API ecosystem that supports innovation while preserving control, security, and compliance.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Gamification in Banking Helps Enterprises Build Lasting Customer Loyalty

Key takeaways: A winning banking gamification strategy isn't about badges; it’s about using behavioral psychology to form daily financial habits. Industry leaders like DBS Bank and Revolut prove the concept works, driving higher savings and millions in user acquisition. The cost to implement gamification in banking and financial services ranges between $40,000 and $400,000 or…

KYC Automation - Benefits, Use Cases, Steps, Tools and Best Practices

Key takeaways: KYC automation cuts verification from days to minutes and keeps checks consistent across teams. AI and ML reduce manual errors, catch risk earlier, and make compliance far easier to scale. Manual KYC drains time, increases cost, and slows onboarding — automation fixes all three. Automated workflows handle spikes in customer volume without compromising…

How to Modernize Legacy Systems in Banking: Key Strategies and Steps

Key takeaways: Legacy systems burn cash and slow things down, so modernization is essential to stay compliant and competitive. Methods like replatforming, refactoring, or a hybrid approach let banks upgrade piece by piece without breaking everything. Tech trends like cloud computing, AI, and blockchain make modernization happen faster, fixing efficiency, customer service, and safety. Banks…