- Who Needs VARA-Compliant Blockchain Solutions?

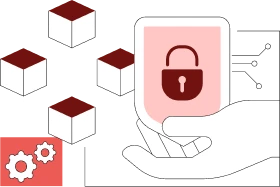

- KYC, AML, and Continuous Monitoring: Core Pillars of VARA's Regulatory Architecture for Enterprise Systems

- Anti-Money Laundering (AML)

- Know-Your-Customer (KYC)

- Data Privacy and Security Standards

- Reporting and Audit Trail Guidelines

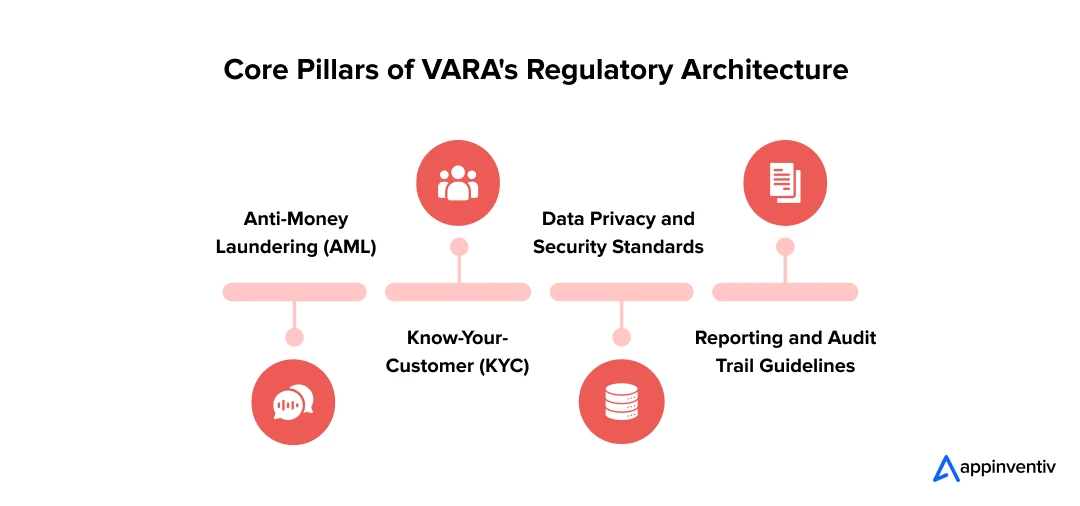

- Engineering Enterprise Blockchain Infrastructure for VARA Alignment

- Core Infrastructure Components for VARA Compliance

- Security Architecture: Building Multiple Layers of Defense

- Baking Compliance Into Your Design

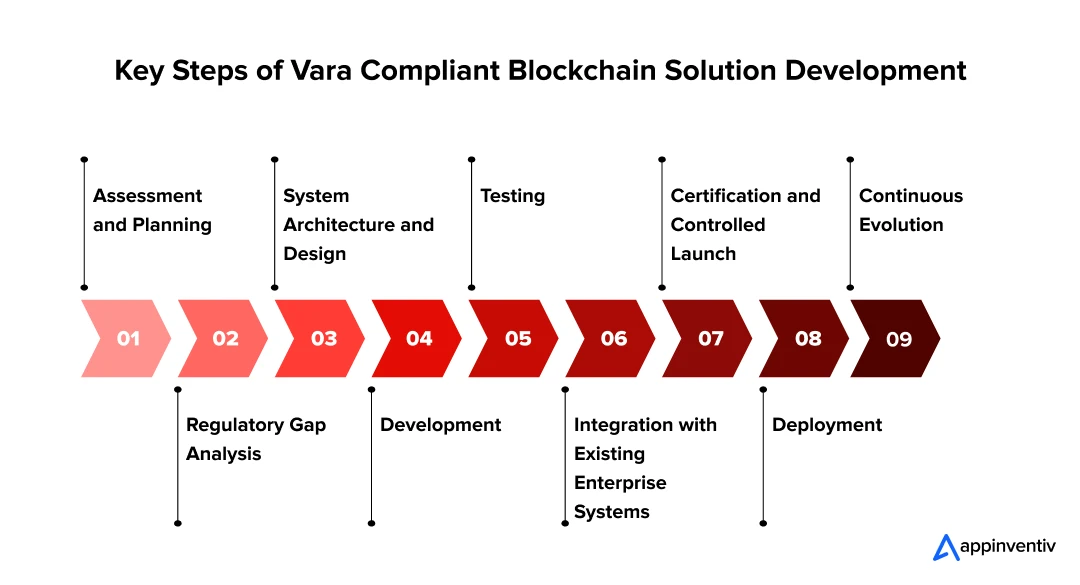

- Implementation Pathways: From Concept to Production

- 1. Assessment and Planning

- 2. Regulatory Gap Analysis

- 3. System Architecture and Design

- 4. Development

- 5. Testing

- 6. Integration with Existing Enterprise Systems

- 7. Certification and Controlled Launch

- 8. Deployment

- 9. Continuous Evolution

- Estimating the Cost, ROI & Risk of VARA-Compliant Blockchain Solutions

- Cost of VARA Enterprise Blockchain Development

- ROI of VARA-compliant Blockchain Solutions

- Risks of Non-Compliance: Why Getting VARA Right Matters

- Build VARA-Compliant Blockchain Solutions in Dubai with Appinventiv

- Why Choose Appinventiv for Your Blockchain Development?

- FAQs

Key takeaways:

- Dubai’s VARA framework mandates strict compliance protocols for blockchain enterprises.

- To comply with VARA in Dubai, enterprise blockchain systems should use private networks that only approved members can join.

- Choosing between Hyperledger Fabric, private Ethereum, Corda platforms, etc., significantly impacts long-term scalability, compliance automation, and maintenance costs.

- Enterprises implementing VARA enterprise blockchain development often achieve a 40-60% reduction in reconciliation costs and 70% faster transaction settlement times.

The United Arab Emirates has swiftly positioned itself at the forefront of blockchain innovation. When Sheikh Mohammed bin Rashid Al Maktoum launched the Dubai Blockchain Strategy in 2016, the goal was clear: transform Dubai into a fully blockchain-powered city by 2020. This ambitious move was aimed at saving billions through digital efficiency but innovation without governance can lead to chaos.

That concern shaped the creation of the Virtual Asset Regulatory Authority (VARA) in 2022. VARA was never intended as a brake on innovation. Instead, it introduced the guardrails needed to ensure growth was structured, secure, and credible. The authority provides Dubai with a framework that balances innovation against the protection of both investors and citizens. In practice, this is what makes blockchain adoption in the UAE not just bold but sustainable.

As His Excellency Hamed Salem Kazim observed, “Dubai is creating an environment where innovation thrives within a framework of responsibility. VARA represents our commitment to building a sustainable virtual asset ecosystem that protects investors while fostering technological advancement.”

This dual focus, innovation and compliance, presents a complex challenge for enterprises. Retrofitting governance into existing infrastructure is rarely effective. To succeed, organizations adopting VARA-compliant blockchain solutions in Dubai must design systems with the VARA regulatory framework in mind from the outset.

Why does this matter? Because aligning enterprise blockchain with the VARA framework is not simply a regulatory obligation. It is a strategic advantage. This blog will share some critical insights from regulatory ambiguity to strategic clarity, outlining the architecture, compliance roadmap, and measurable ROI of embedding your enterprise blockchain solution within Dubai’s visionary regulatory landscape.

Partner with Appinventiv to develop and deploy scalable, secure, and VARA-compliant blockchain solutions that minimize risk and maximize ROI.

Who Needs VARA-Compliant Blockchain Solutions?

VARA’s regulatory framework applies to a wide range of businesses and activities in Dubai’s virtual asset sector. If your enterprise operates in or plans to offer any of the following, VARA compliance is essential:

- Crypto and Digital Asset Advisory Services

- Broker-Dealer Services (including OTC trading)

- Custody and Wallet Services

- Exchange Services (crypto exchanges, trading platforms)

- Lending and Borrowing Services

- Virtual Asset Management and Investment Services

- Transfer and Settlement Services (payments, remittances)

- NFT Issuance and Marketplace Operations

- Blockchain Governance & Project Management

If you are unsure whether VARA applies to your business model, a regulatory gap analysis (details later) is a critical first step.

KYC, AML, and Continuous Monitoring: Core Pillars of VARA’s Regulatory Architecture for Enterprise Systems

For enterprises, compliance with VARA is not a box-ticking exercise. It has to be embedded into the system’s DNA. Whether you are deploying blockchain for tokenization, internal operations, or cross-border transfers, these pillars define whether your platform can withstand regulatory scrutiny.

Anti-Money Laundering (AML)

Under VARA enterprise blockchain development, AML cannot run on periodic reviews alone. Regulators expect real-time analysis that detects anomalies the moment they appear, such as unusual transaction spikes, suspicious geographies, or connections to sanctioned addresses.

What often gets missed is integration. These systems cannot operate as standalone tools. They need to sit deep inside the transaction layer, recording every compliance check immutably. That’s how you prove controls were applied, not just claimed.

Know-Your-Customer (KYC)

KYC checklist extends beyond initial onboarding. VARA expects dynamic risk profiling that adjusts based on transaction patterns, geographic exposure, and relationship duration.

In practice, your blockchain infrastructure must comply with KYC to maintain versioned customer profiles, track all verification updates, and provide auditable evidence of risk assessments performed at critical transaction thresholds.

Data Privacy and Security Standards

VARA sets strict demands on transparency, while UAE data protection laws restrict how personal data is stored. The tension is real: how do you prove immutability and still protect identity?

The common solution is hybrid design. Transaction hashes and metadata remain on-chain for audit integrity. Personally identifiable information is pushed off-chain into encrypted stores, with the chain maintaining pointers. This way, transparency and privacy requirements are both satisfied.

Reporting and Audit Trail Guidelines

Manual reporting is no longer realistic. VARA compliance expects automated reporting pipelines that pull directly from blockchain records. Systems should generate audit-ready, regulator-formatted outputs with cryptographic proof attached. The goal is to produce reports that regulators can trust as exact reflections of on-chain activity.

With the compliance foundations in mind, it’s time to examine how to engineer blockchain infrastructure that aligns with VARA requirements from day one.

Engineering Enterprise Blockchain Infrastructure for VARA Alignment

Building a VARA-compliant enterprise blockchain involves choosing the right platform, designing the right architecture, and ensuring security measures are in place to meet the regulator’s requirements.

Platform Selection: Matching Technology to Regulatory Requirements

Platform Selection: Matching Technology to Regulatory Requirements

Your choice of underlying technology and its architectural implementation will directly determine your capacity to achieve and maintain compliance. A poorly conceived architecture introduces regulatory vulnerabilities that become exponentially more difficult and costly to remediate over time.

Permissioned vs. Permissionless Ledgers

A primary architectural decision is the selection of your distributed ledger model. For most enterprise systems under VARA’s regulatory, permissioned (private) blockchains or permissionless are the superior strategic choice.

Unlike public (permissionless networks), where participation is open, permissioned networks restrict access to a finite group of known, vetted participants. This inherent control is critical. It provides the necessary foundation to enforce KYC, manage identities with certainty, and ensure that only authorized nodes can validate transactions.

Also Read: How to Create a Private Blockchain: A Step-by-Step Guide

Hyperledger Fabric

Hyperledger Fabric dominates enterprise blockchain infrastructure for VARA deployments for compelling reasons. Its permissioned architecture aligns naturally with VARA’s identity verification requirements.

Every network participant carries verified credentials, enabling granular access controls and comprehensive audit trails. Fabric’s channel architecture allows enterprises to isolate sensitive transactions while maintaining overall network integrity. This is critical when managing multiple business units with varying compliance requirements.

Ethereum-Based Private Networks

Private Ethereum networks offer different advantages. Organizations already invested in Ethereum smart contract development can leverage existing expertise while implementing private validator sets and restricted network access. However, Ethereum’s account-based model requires additional architectural layers to achieve the identity verification rigor VARA demands.

Corda

Corda targets financial services use cases with privacy-by-design principles. Unlike broadcast-based blockchains, Corda shares transaction details only with directly involved parties. This selective disclosure aligns with financial privacy requirements while maintaining cryptographic proof of transaction validity. Organizations in trade finance, securities settlement, or regulated asset tokenization often find Corda’s legal prose contract integration particularly valuable.

Other Emerging Platforms

The emerging landscape includes Polygon Enterprise, Avalanche subnets, and various layer-2 solutions. These platforms promise public blockchain benefits with private network control. However, regulatory clarity remains evolving. VARA focuses on operational substance rather than specific technologies, but enterprises should carefully evaluate regulatory precedent before selecting these platforms.

Core Infrastructure Components for VARA Compliance

This is truly an integral consideration, as it is something that determines what you are actually building. The architecture of a VARA-compliant blockchain should include:

Consensus Mechanisms and Validator Nodes

Blockchain systems must employ secure and transparent consensus mechanisms to validate transactions. These mechanisms ensure the integrity of the blockchain, and validator nodes must meet specific security standards outlined by VARA to guarantee that no unauthorized parties can manipulate data.

Smart Contracts and Integration Layers

The use of smart contracts is a critical component. Smart contracts embody your business logic while enforcing compliance rules. The implementations that work best embed policy checks right into the contract code. Transactions automatically fail when KYC verification is missing, transaction limits are exceeded, or addresses are identified as sanctioned.

This compliance-by-design approach outperforms external enforcement mechanisms, which often create gaps between what your policy states and what actually occurs.

Identity and access management systems

Identity management is one of the most critical infrastructure pieces. VARA-aligned blockchain architecture requires cryptographic identity binding, which means every transaction must link to a verified real-world entity.

Certificate authorities issue credentials after completing VARA-mandated verification processes. Smart contracts validate these credentials before authorizing any transactions. Your system needs to handle credential revocation, identity updates, and multi-signature authorization patterns for institutional accounts.

API Gateway and Integration Layer

An API gateway is the bridge between your blockchain platform and the rest of the enterprise ecosystem. It translates the blockchain’s event-driven transactions into the request–response formats that legacy systems still expect. Done right, it becomes more than just a connector.

Well-designed gateways also handle rate limiting, request authentication, and input validation before anything touches the blockchain layer.

Off-chain Storage Solutions

Off-chain storage addresses one of blockchain’s toughest dilemmas: how to reconcile permanent records with privacy rules and practical storage limits. The principle is simple: put only what must be immutable on-chain, and move everything else off-chain.

That usually means document hashes, transaction summaries, and compliance metadata are recorded directly on-chain, ensuring tamper-proof integrity. Meanwhile, full documents, sensitive personal data, or large media files are held in encrypted off-chain repositories, linked back through cryptographic proofs.

Security Architecture: Building Multiple Layers of Defense

Encryption Standards

Security protocols within a VARA-compliant blockchain system must include strong data encryption techniques for both data at rest and in transit. It’s not enough to rely on HTTPS. Databases, backups, and stored files should run on AES-256 encryption with strict key rotation.

Transactions moving between nodes must use TLS 1.3 with certificate pinning. These are no longer optional checkboxes; they are baseline requirements for any system operating under regulatory oversight.

Keys Management Systems and HSM Integration

Keys are the crown jewels of blockchain operations. Validator node keys, signing keys, master encryption keys; none should ever sit in a place where ordinary software can reach them. This is why Hardware Security Modules (HSMs) matter.

They are physical devices designed to store and manage keys securely. Yes, blockchain integration in Dubai adds cost and complexity. But without HSMs, organizations leave themselves open to insider abuse and advanced external attacks.

Penetration Testing and Vulnerability Management

Testing cannot be a one-off exercise. Before production and every year after, systems require full penetration testing. Blockchain-specific tests dig into areas that generic scans miss, like smart contract logic flaws, weak node communication channels, and insecure integration points. Standard infrastructure testing still has value, but alone, it won’t cover blockchain’s unique threat surfaces.

Baking Compliance Into Your Design

Immutable Audit Trails and Logging

Auditability is one of blockchain’s natural strengths, but it must be designed with intent. Every state change should record not just what changed, but who authorized it, what compliance checks ran, and what context surrounded the decision. These detailed audit logs let regulatory examiners do their work without extensive manual data reconstruction.

Automated Compliance Reporting Modules

Manual reporting introduces risk and inefficiency. VARA’s standards require automated reporting pipelines that extract data directly from blockchain sources. Transaction volumes, suspicious activity alerts, and periodic attestations; all should flow automatically through reporting engines. The payoff is twofold: reduced compliance workload and greater reporting accuracy.

Real-time Transaction Monitoring Systems

Real-time transaction monitoring operates fundamentally differently from traditional batch analysis. Stream processing engines examine every transaction as it occurs, applying rules that flag potential issues before blocks get finalized. This proactive approach allows you to reject transactions before compliance violations occur, rather than discovering problems after the fact.

Data Residency and Sovereignty Controls

Distributed ledgers face unique challenges in handling data residency. While VARA does not mandate UAE-only storage, many enterprises choose regional data controls to reduce regulatory risk.

A common approach: maintain consensus-critical data across global validators, while keeping personally identifiable information (PII) in encrypted databases within regional borders. This hybrid model balances sovereignty, resilience, and compliance.

Implementation Pathways: From Concept to Production

Successful VARA-compliant enterprise blockchain development is not about experimentation; it requires a staged, well-governed approach. Skipping any of the integral phases can lead to expensive redesigns when regulatory gaps appear. The journey from concept to production involves the following stages:

1. Assessment and Planning

The assessment phase establishes business case clarity. Which operational inefficiencies will blockchain address? What quantifiable metrics define success? How will you measure return on investment? These fundamental questions demand honest answers before technical work begins.

Don’t just deploy blockchain because “everyone else is doing it,” rather focus on solving specific business problems. Predictably, these initial struggles will yield great value in the long run.

2. Regulatory Gap Analysis

Enterprises must identify where they fall short, whether in KYC workflows, AML checks, or reporting systems. Gap analysis compares current operational capabilities against VARA requirements.

Most enterprises discover significant gaps: inadequate KYC procedures, insufficient audit trail capture, missing transaction monitoring, or incomplete security controls. Identifying these gaps early enables realistic budgeting and timeline estimation.

3. System Architecture and Design

Architectural design translates business requirements and compliance obligations into technical specifications. This phase determines platform selection, infrastructure topology, integration approaches, and security controls.

At this stage, enterprises must also address scalability and interoperability in VARA-compliant systems. Architecture must handle growing transaction volumes without compromising performance, while security mechanisms such as strong consensus algorithms, cryptographic protections, and penetration testing protect against fraud and cyberattacks.

4. Development

The development phase consumes the majority of implementation time. Smart contract development requires specialized expertise, as blockchain-specific programming languages, cryptographic primitives, and distributed system patterns differ significantly from those used in traditional application development.

5. Testing

Security testing is critical in blockchain environments because of immutability. Once a smart contract is deployed, flaws cannot be fixed with a quick patch, as is the case with traditional software. Instead, correcting errors often requires complex contract migration or even full redeployment, which can disrupt operations and increase compliance risk.

6. Integration with Existing Enterprise Systems

VARA-compliant blockchain systems must connect smoothly with legacy enterprise systems such as databases, ERP systems, and external applications. Blockchain architecture should include API integration layers to ensure secure and efficient data flow between the blockchain and off-chain systems.

7. Certification and Controlled Launch

Before production, systems must pass through independent audits and third-party security assessments. Enterprises prepare VARA submission documents, identifying and remediating issues in controlled environments rather than during regulatory review. The launch is typically phased, beginning with low-risk transaction sets to validate controls under real-world conditions.

8. Deployment

Deployment demands careful coordination. Unlike traditional applications that allow incremental rollback, blockchain deployments require higher confidence before production release. Staff training extends beyond technical teams to business users, compliance personnel, and management.

9. Continuous Evolution

A VARA-compliant blockchain project is never “complete.” Regulations evolve, and so must the system. Continuous monitoring, recurring audits, and team retraining ensure compliance remains intact as the platform scales across new business models.

Don’t wait! Ensure full VARA compliance from day one to avoid fines, regulatory penalties, and operational delays.

Estimating the Cost, ROI & Risk of VARA-Compliant Blockchain Solutions

Adopting a VARA-compliant blockchain solution requires massive upfront investment. But the ROI it generates in the long run is substantial. To understand the financial impact of VARA compliance and blockchain adoption, you need to evaluate both the adoption costs and associated ROI.

Cost of VARA Enterprise Blockchain Development

On average, the cost of a VARA-compliant blockchain development solution in Abu Dhabi and Dubai ranges between $40,000 and $400,000 / AED 147,000 to AED 1,470,000 or more. The cost range varies, depending on several critical components, such as:

- Blockchain development: Building or integrating blockchain platforms tailored to VARA compliance.

- Regulatory compliance: Legal fees, audit costs, and expenses for meeting AML/KYC standards.

- Infrastructure: Costs for servers, data centers, and cybersecurity measures.

- Training: Educating staff about VARA regulations and compliance best practices.

Also Read: How Much Does it Cost to Build a Blockchain App in the UAE?

| Cost Component | USD | AED |

|---|---|---|

| Blockchain Development | $25,000 – $250,000 | AED 92,000 – AED 917,000 |

| VARA AML/KYC compliance | $5,000 – $50,000 | AED 18,000 – AED 183,000 |

| Infrastructure (Servers, Data Centers, Cybersecurity) | $10,000 – $100,000 | AED 37,000 – AED 367,000 |

ROI of VARA-compliant Blockchain Solutions

When you first look at the cost of building a VARA-compliant blockchain system, the numbers can feel immense. But here’s the truth: the real expense comes when companies delay compliance and then have to retrofit controls into an already running platform.

However, over time, businesses that prioritize compliance tend to save on regulatory penalties and reputational damage, which can be costly in the long run.

Key ROI Benefits:

- Efficiency Gains: Streamline operations by automating processes, reducing transaction times, and cutting administrative overhead.

- New Revenue Streams: Opportunities from tokenization, Blockchain-as-a-Service (BaaS), and DeFi solutions to generate additional income.

- Risk Mitigation: Avoid costly fines, penalties, and reputational damage from non-compliance, safeguarding business continuity.

- Scalability: Blockchain’s ability to scale seamlessly allows businesses to grow without significant incremental costs.

- Enhanced Market Access: VARA compliance opens doors to Dubai’s growing blockchain ecosystem and international markets, attracting investors and business partners.

The bottom line: compliance is not a cost center. It’s a growth enabler. By aligning with VARA early, you’re not only reducing risks, you’re positioning your company to expand confidently in Dubai’s evolving blockchain market.

Risks of Non-Compliance: Why Getting VARA Right Matters

The consequences of failing to comply with VARA’s requirements are severe and can include:

- Financial Penalties: Fines range anywhere from AED 10,000 up to half a million, depending on severity.

- License Suspension or Revocation: VARA can suspend or revoke your license to operate in Dubai’s virtual asset sector.

- Civil and Criminal Liability: Failures tied to money laundering or fraud may result in lawsuits or worse, criminal prosecution.

- Reputational Damage: Perhaps the hardest to recover from. Once your credibility takes a hit, winning back investor and customer trust can take years.

This is why VARA compliance isn’t just a box to tick; it’s a competitive advantage. Getting it right from day one protects your present operations and secures your long-term position in the market.

Build VARA-Compliant Blockchain Solutions in Dubai with Appinventiv

Navigating the complexities of VARA-compliant blockchain development in Dubai is not an easy journey. It requires expertise in both blockchain technology and regulatory frameworks. But don’t worry, you are not alone in this journey.

Appinventiv, a leading blockchain development services company, stands by you at every step until you reach your destination and even beyond. Our skilled team of 1600+ tech experts specializes in building tailored, VARA-compliant blockchain solutions that align with Dubai’s evolving regulatory standards.

Why Choose Appinventiv for Your Blockchain Development?

- Expertise in VARA Compliance: We have in-depth experience in creating scalable and secure blockchain solutions that meet VARA’s strict AML and KYC guidelines.

- Custom Blockchain Architecture: Whether you need a private blockchain for secure internal processes or a more scalable enterprise blockchain infrastructure, we help your business meet both these business needs and regulatory requirements.

- Smart Contract Development & Audits: We ensure that your smart contracts are designed for security, transparency, and compliance with VARA standards. We achieve this by conducting thorough audits from start to end.

- End-to-End Solutions: From initial consultation and system design to deployment and ongoing maintenance, Appinventiv provides comprehensive blockchain development services to ensure that your VARA-compliant solution scales effectively.

Let’s peep into one of our clients’ case studies to understand how we help businesses achieve VARA-compliant blockchain solutions

Challenge: A Dubai-based logistics company was struggling with inefficiencies in its supply chain management, particularly with cross-border cargo tracking and documentation processing. Due to manual paperwork, they were frequently experiencing delays and hurdles with regulatory compliance adherence. What was even worse was that they were regularly getting trapped in fraud, particularly related to bill-of-lading discrepancies.

How We Helped:

Our tech experts developed a VARA-compliant blockchain solution in Dubai to automate the entire supply chain. Key features of the product we delivered included:

- Smart contracts for automating cargo release and payment, ensuring compliance with KYC/AML protocols.

- Blockchain-enabled tracking that provided real-time updates and an immutable audit trail, reducing errors and manual interventions.

- Seamless integration with existing enterprise systems for smooth data flow across processes.

Results:

- 65% reduction in documentation processing time,

- 40% decrease in cargo delays

- Near elimination of bill-of-lading fraud,

However, despite these improvements, the project faced a 30% budget overrun and required an additional eight months to complete due to early planning gaps.

This case highlights the importance of making the right technical choices and planning thoroughly before starting a blockchain project. By selecting the proper platform and partnering with VARA-compliant blockchain consulting firms early, enterprises can avoid costly delays and budget overruns.

The success of the project also demonstrates that VARA-compliant blockchain solutions can deliver significant efficiency gains and fraud reduction when implemented correctly.

Partner with us now to build VARA-compliant blockchain solutions in Dubai, UAE.

FAQs

Q. What are VARA-compliant blockchain solutions for enterprises in Dubai?

A. VARA-compliant blockchain solutions in Dubai are enterprise systems built with regulation in mind: KYC at onboarding, AML checks during use, continuous monitoring, and automated reporting. In short, they’re designed to pass audits without extra retrofitting.

Q. How can my company ensure blockchain compliance with VARA regulations?

A. To ensure blockchain compliance with VARA regulations, you must follow these steps:

- Conduct a regulatory gap analysis to identify missing compliance areas.

- Use a permissioned blockchain network.

- Set up real-time transaction monitoring.

- Integrate smart contracts that enforce compliance rules.

- Automate compliance reporting to VARA.

Q. What does VARA Rulebook 2.0 mean for enterprise blockchain development in Dubai?

A. VARA Rulebook 2.0, implemented in late 2023, introduces several key updates affecting blockchain development. Typically, it brought three shifts:

- Internal-use blockchains may be exempt from VASP licensing.

- Independent smart contract audits are now mandatory.

- More focus on governance and risk management than paperwork.

Bottom line: less red tape for internal projects, more scrutiny where customer assets are at risk.

Q. How do VARA-compliant blockchain solutions impact ROI for enterprises?

A. ROI from VARA-compliant blockchain solutions in Dubai includes both operational benefits and strategic positioning. Often, ROI shows up in four ways:

- Efficiency: 40–60% cut in reconciliation costs.

- Risk reduction: fewer fines, fewer breaches.

- New revenue: tokenization, BaaS, DeFi.

- Scalability: systems grow without heavy redesign.

Q. How does VARA compliance affect smart contract governance?

A. VARA compliance mandates independent audits, clear key management, and processes for upgrades. This means contracts must be thoroughly audited by independent third parties before deployment to identify security flaws.

There must also be a clear, secure, and auditable process for upgrading or patching contracts. Governance frameworks must be established to manage administrative keys and control access to critical contract functions, ensuring they cannot be unilaterally or maliciously altered.

Q. What is the cost of implementing a VARA-compliant enterprise blockchain?

A. The of implementing VARA-compliant blockchain solutions varies depending on scale and complexity. On average, the cost of VARA enterprise blockchain development ranges between $40,000 and $400,000 / AED 147,000 to AED 1,470,000 or more.

Q. How do VARA regulations ensure AML/KYC compliance for blockchain platforms?

A. VARA regulations ensure AML and KYC compliance by implementing stringent protocols through three layers:

- Risk-based KYC at onboarding and beyond.

- Real-time monitoring for anomalies.

- Mandatory suspicious activity reports to the FIU.

Q. What happens if my business fails to comply with VARA?

A. Non-compliance with VARA can lead to heavy fines, loss of license, legal action, and irreparable reputational damage.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Step-by-Step Guide to Crypto Trading Bot Development in 2026

Key takeaways: Crypto trading bot development in 2026 functions as full-scale trading systems, not experimental scripts. They require the same engineering discipline as any financial platform. Execution quality drives results more than strategy logic. Latency control, order handling, and risk limits shape real-world performance. AI-based strategies work only when supported by reliable data flows, controlled…

Decentralized Exchange (DEX) Development: Features, Implementation Cost, and Enterprise ROI

Key Takeaways The development of a decentralized exchange will enable businesses to provide secure and user-controlled trading, improve transparency, and minimize the use of intermediaries. The cost of DEX development can vary depending on the platform's features, the chosen network, and regulatory requirements, and the approximate cost is about $50,000, with higher costs for customization,…

How Much Does It Cost to Build a Crypto Trading App Like Swyftx?

Key takeaways: Swyftx’s Rise: Australia’s top-rated crypto exchange app attracts 1.1M+ users with its easy UX, pro tools, and learning features. Development Costs: A Swyftx-like app development can cost AUD 30K–500K, based on scope and functionality. Crypto Market Momentum: With Layer-2 tech and ETF approvals, the market is booming, and transaction costs are dropping. Winning…