- Understanding White-Label Tax Compliance Software

- Key Components of Tax Compliance Software

- How Much Does It Cost to Build a White-Label Tax Compliance Software

- Cost Breakdown Based on Features and Complexity

- Breaking Down the Development Process

- Factors Affecting the Cost to Develop a White-Label Tax Compliance Software

- Complexity of Tax Rules

- Customization Level

- Interconnection with Existing Systems

- Number and Type of Users

- Compliance and Security Features

- Maintenance and Support

- Features to Develop a Robust White-Label Tax Compliance Software

- Basic Tax Compliance Software Features

- Advanced Tax Compliance Software Features

- Hidden Costs That Impact the Cost to Develop a White-Label Tax Compliance Software

- The Reality of Perpetual Compliance

- Scaling for High-Volume Growth

- Continuous Security Fortification

- The Interoperability Imperative

- Strategies to Minimize the Cost of Developing a White-Label Tax Compliance Software

- Step-by-Step Process to Develop a White-Label Tax Compliance Software

- Requirement Gathering

- Design and Prototyping

- Development

- Testing and Quality Assurance

- Deployment and Going Live

- Maintenance and Updates

- Challenges in White-Label Tax Compliance Software Development

- Trends in Automated White-Label Tax Compliance Software Development

- Increased Use of AI and Machine Learning

- Cloud-Based Solutions

- Emphasis on Data Security

- Regulatory Technology (RegTech)

- Blockchain for Transparency and Security

- Integration with Other Financial Tools

- Why Appinventiv is the Best Tech Partner for Developing White-Label Tax Compliance Software

- FAQs

Key takeaways:

- Cost of Developing White-Label Tax Software: Expect to pay between $40,000 to $400,000, depending on complexity, features, and customization.

- Key Features for Success: Essential features include tax automation, real-time reporting, multi-jurisdiction support, and secure integration with financial systems.

- AI and Automation: Leverage AI-powered solutions and automation to reduce manual errors, increase efficiency, and stay ahead of changing tax laws.

- Customization & Scalability: Build a flexible, scalable system that adapts to multiple regions and grows with your business, ensuring long-term usability.

- Hidden Costs to Consider: Regular updates, security fortifications, and system integration add to the overall cost but are essential for keeping the software compliant and secure.

Tax compliance can be a real challenge for businesses, especially with the constant changes in regulations. That’s where white-label tax compliance software comes in—a straightforward solution that simplifies the process without the hassle. How to develop tax compliance software that can handle the complexities of modern regulations is a critical consideration for businesses today.

Imagine offering a tax software solution under your own brand, handling all the complexities of tax management for your clients. A white-label tool does just that, adding value to your business while easing your clients’ tax burdens. With more businesses turning to digital solutions, now’s the perfect time to explore this space. White-label tax compliance software development grows with your company, adapting to your needs and streamlining financial operations.

Of course, the cost of white-label tax compliance software development can vary, typically ranging from $40,000 to $450,000, depending on the complexity, scalability, and custom features. In this blog, we’ll break down everything you need to know to make an informed decision about investing in this software. Let’s dive in.

Reduce Tax Management Costs by 30% and enhance accuracy with white-label tax compliance software. Future-proof your business with seamless integration and automation.

Understanding White-Label Tax Compliance Software

Most firms lean on white-label tax compliance software because it helps them:

- Stay compliant with shifting tax laws

- Save time by automating repetitive tasks

- Protect sensitive financial information

- Provide faster, more accurate services to clients

With a white-label setup, you’re not just simplifying tax work. You’re offering clients a smoother, smarter way to manage their taxes under your own brand.

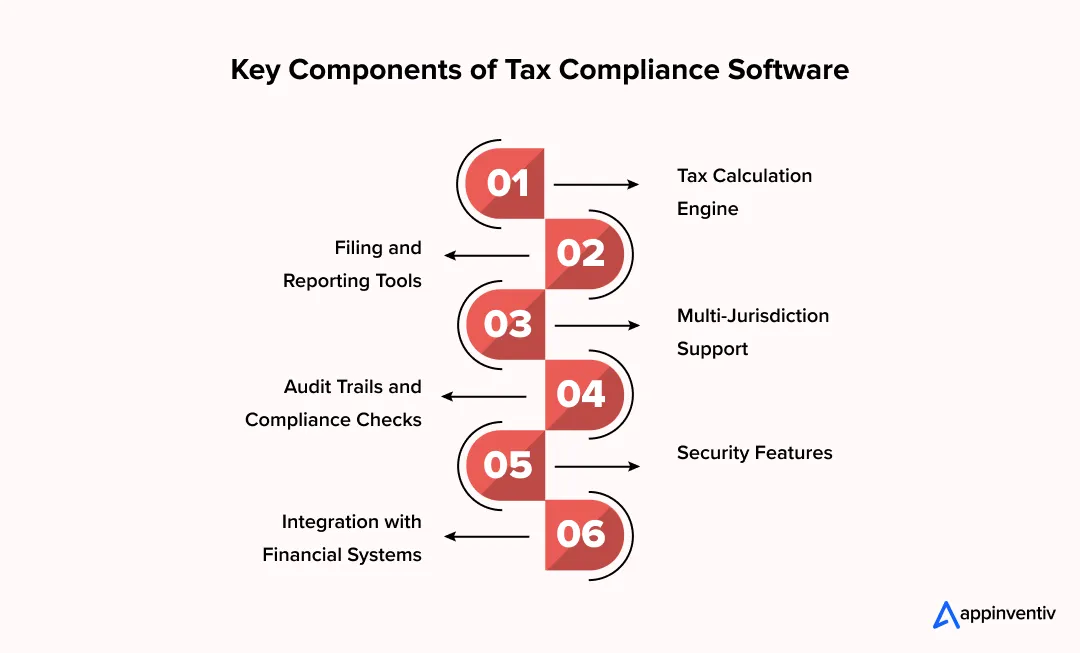

Key Components of Tax Compliance Software

When you’re exploring tax compliance software, the first thing to realize is that it’s not about fancy features; it’s about making life easier for your team. The tools you choose should actually solve daily obstacles, not create new ones. Here are the key features to prioritize when developing white-label tax compliance software.

- Tax Calculation Engine: This handles all calculations. No longer fearing whether a number was missed and having to check each number manually.

- Filing and Reporting Tools: The process of running reports and filing returns may consume hours per week. Most of that is automated with the appropriate software. Your staff no longer needs to spend time in Excel sheets but can concentrate on outcomes, which makes life much more enjoyable at the height of tax season.

- Multi-Jurisdiction Support: When your business operates in many states/countries, taxes can become complex quickly. This feature lets you have everything in a single place, so you don’t have to jump between different spreadsheets or systems for each region. It is a relatively minor thing that helps to save an unexpected amount of time.

- Audit Trails and Compliance Checks: All the transactions are tracked and documented. It means that in case an inspector requests you to provide any information, you can access all of it in the blink of an eye. No searching through emails and logs, it is only transparent, well-structured data that ensures that your business is compliant.

- Security Features: Financial information is confidential. Client and tax information is protected by strong security measures when stored or shared. It is not only compliance, but a peace of mind for your team and clients.

- Integration with Financial Systems: Your tax compliance software integrates best with your other tools, including ERP or accounting systems. Integration ensures smooth data flow, eliminating repetitive work and avoiding errors that can be both time- and money-wasting.

Investing in automated tax compliance software development isn’t just about getting a tool that works. It’s about giving your team a system that actually reduces errors, saves hours every week, and stays compliant with changing tax laws. When the software handles routine work, your team can focus on strategy and higher-value tasks instead of being bogged down by paperwork.

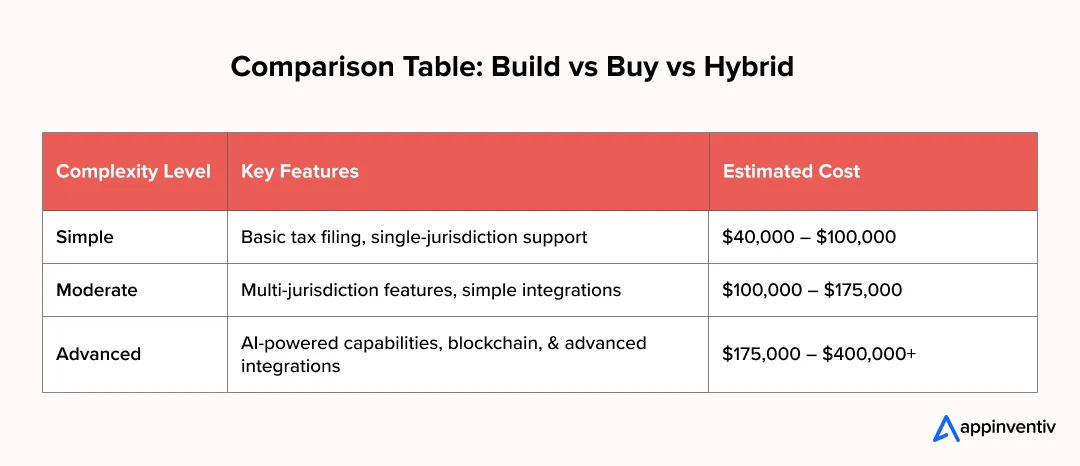

How Much Does It Cost to Build a White-Label Tax Compliance Software

When you’re thinking about white-label tax compliance software, one of the first questions is usually cost. And yes, the range is wide, anywhere from $40,000 to $400,000. That’s because no two businesses have the same needs. If you just need a basic filing tool, you’ll land on the lower end of the spectrum. But if your team handles multiple regions, wants automated workflows, or requires custom integrations, the number naturally goes up. Breaking it down a bit makes it a lot easier to understand. The tax and compliance software development lifecycle involves multiple phases and cost breakdowns, which will depend on the features and complexity needed.

Estimating Your Development Costs

That broad pricing can look confusing at first glance, but it really comes down to complexity. Some teams only need a straightforward filing tool; others need a system that can handle multiple regions, integrate with existing platforms, or automate tasks. Knowing where you fall helps you estimate your range more confidently.

Cost Breakdown Based on Features and Complexity

The more complex the software, the higher the investment. A simple, single-jurisdiction setup is fairly affordable. Add multi-region support, smart automation, or advanced tech like AI or blockchain, and the price climbs. A good rule of thumb is to focus on features that make a real difference day-to-day, not the ones that look flashy on a brochure.

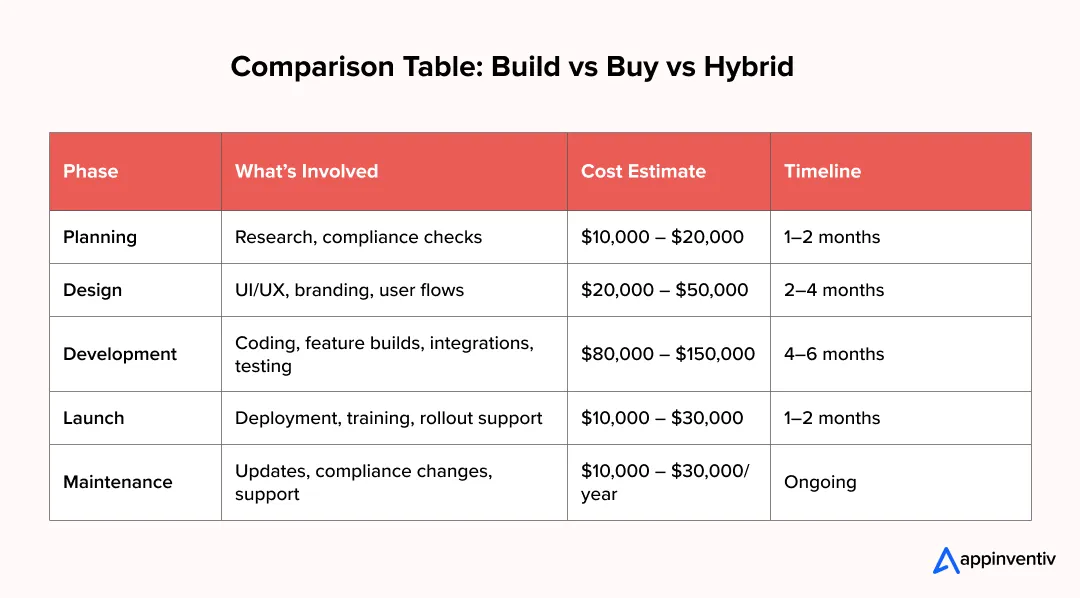

Breaking Down the Development Process

Building white-label tax compliance software usually moves through a few predictable stages. Each one shapes how the final product feels and how smoothly it runs for your users.

The initial build is only part of the picture. Tax rules shift constantly, so keeping your software up to date is just as important as developing it. That ongoing maintenance is what makes your white-label tax compliance software stay compliant, stable, and useful as your business grows.

Factors Affecting the Cost to Develop a White-Label Tax Compliance Software

When considering white-label tax compliance software development, it’s important to understand the factors contributing to the total cost. Each factor shapes the final product’s complexity, functionality, and effectiveness.

Complexity of Tax Rules

The complexity of tax rules a software needs to manage greatly impacts the automated tax compliance software development costs directly. Software that handles complex, multi-jurisdictional tax regulations requires sophisticated algorithms and extensive testing to ensure accuracy and compliance. The more intricate the tax rules are, the higher the cost is due to the need for advanced features that can accurately process varied tax scenarios.

| Tax Regulation | Impact on Software |

|---|---|

| VAT/GST Rules | Complex calculations and multiple rates per product/service. |

| E-commerce Taxation | Specific rules for digital goods and cross-border sales. |

| Transfer Pricing Regulations | Regulations on transactions between company divisions in different countries. |

Customization Level

Depending on how much a company wants to make the system its own, the cost of white-label tax compliance software development varies significantly. Standard filing and reporting are required for some businesses, while personalized dashboards, special workflows, or custom reports are desired for others. Every feature deployed takes time to design, code, and test.

For example, a finance team may require reports in the same format as in their old system, which will cost them additional weeks of development. The more detailed the needs, the greater the effort and cost.

Interconnection with Existing Systems

Many firms already use ERP, CRM, or accounting software. These systems do not automatically connect to new tax software. A lack of integration would mean that staff spend hours manually relocating information or searching for errors. Establishing trustworthy links consumes additional time, yet when this is completed, data transmissions occur smoothly and with fewer errors. Just imagine trying to get various office machines to speak to one another — and it is patience, but in the long run, it makes life much simpler.

Number and Type of Users

Cost is also determined by how many people will use the software and what they can do with it. A small-team platform is quite straightforward, but when hundreds of workers are involved with a variety of permissions, the structure must be stronger. Role-based access systems, the presence of multiple approval layers, and the views of various users require additional development effort to ensure everyone can work effectively and safely.

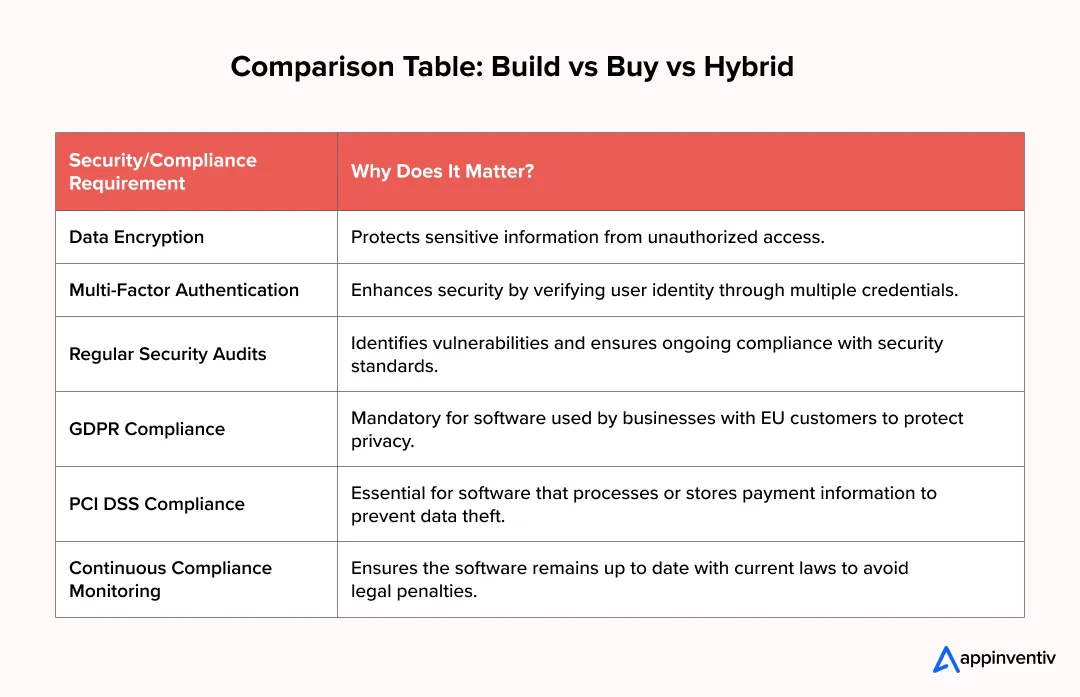

Compliance and Security Features

Tax and compliance software development should adhere to strict regulations and safeguard sensitive financial data. Features like encryption technology, audit trails, and automatic compliance testing are crucial. These are not just add-ons; they must be well planned, tested, and executed to avoid exposing your business to mistakes or legal issues.

Maintenance and Support

Ongoing maintenance and support are essential for the software’s longevity and relevance. Regular updates ensure the system remains compatible with new tax laws and technological advancements but add to the overall white-label tax compliance software development costs.

Features to Develop a Robust White-Label Tax Compliance Software

The successful development of a white-label tax compliance software platform hinges on embedding core capabilities alongside sophisticated features. This ensures that the resulting software is not just a tool, but a comprehensive, highly secure, and flexible solution ready to adapt to diverse client needs and complex regulatory landscapes.

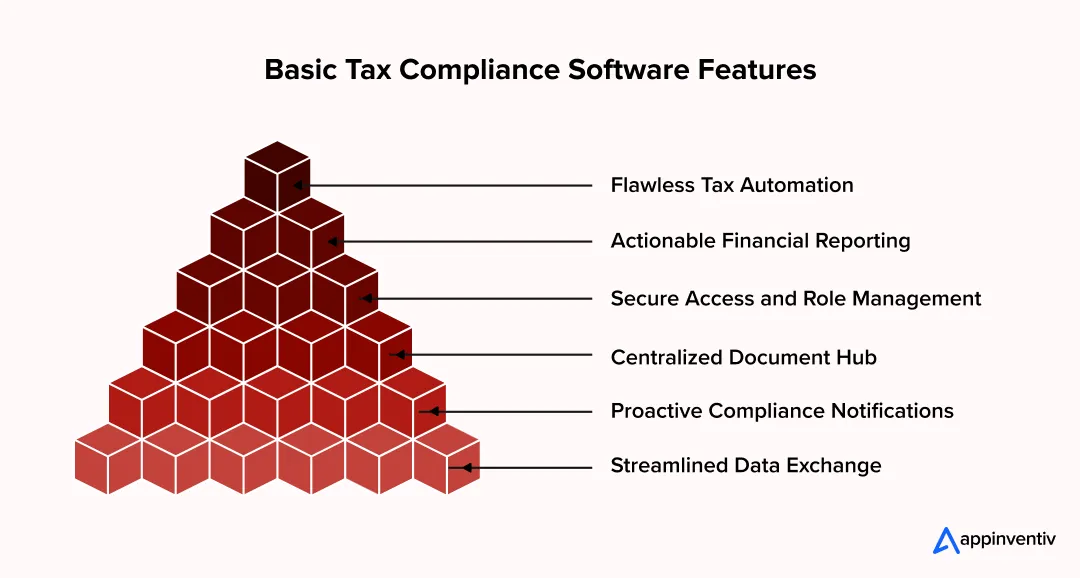

Basic Tax Compliance Software Features

These features are non-negotiable. They establish the platform’s reliability, streamline daily operations, and immediately reduce common compliance risks.

- Flawless Tax Automation: We build a system that calculates taxes instantly, using current, verifiable rates and rules. The value here is critical: eliminating manual error and drastically accelerating transactional speed.

- Actionable Financial Reporting: This enables businesses to quickly and easily pull all necessary financial and tax reports. It moves reporting from a burden to a seamless part of their operation.

- Secure Access and Role Management: Control is paramount. We implement robust systems to assign and manage user permissions, ensuring that sensitive financial data remains protected while maintaining efficient workflow governance.

- Centralized Document Hub: A single, secure repository for all tax documents, receipts, and source files. This isn’t just storage; it’s a systematic organization designed to minimize friction during internal review and, crucially, external audits.

- Proactive Compliance Notifications: The system serves as an early-warning mechanism. Users receive timely alerts and reminders for tax deadlines and critical legislative updates, making continuous compliance automatic.

- Streamlined Data Exchange: The platform must play well with others. We ensure easy, secure data transfer, allowing swift import from multiple internal systems and flexible export capabilities for external analysis or client data exchange.

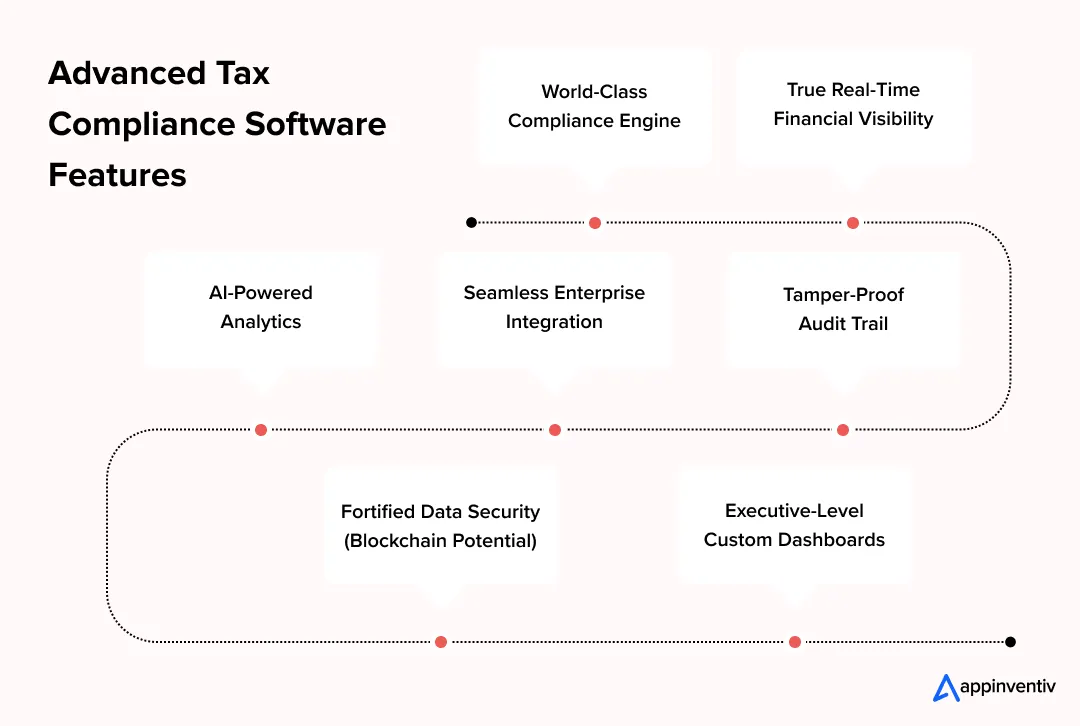

Advanced Tax Compliance Software Features

These are the features that genuinely transform the platform. They move the software past being a mere compliance tool, establishing it as a core business asset that delivers powerful complexity management, crucial foresight, and a competitive edge for your white-label solution.

- World-Class Compliance Engine: Forget operating within artificial borders. This system is engineered for global complexity, natively handling tax calculation and regulation across diverse international jurisdictions. It’s the single most essential tool for any client serving a global market.

- True Real-Time Financial Visibility: Why settle for yesterday’s data? We build the platform to process data instantly, giving decision-makers immediate, accurate financial reports. This capability ensures swift, informed strategic moves, avoiding the pitfalls of reactive decision-making.

- Tamper-Proof Audit Trail: Accountability must be absolute and transparent. Every system change and user action is automatically recorded and time-stamped. This transparent, traceable history is vital for governance and drastically simplifies external regulatory audits.

- Seamless Enterprise Integration: Silos kill operational efficiency. Our framework is designed to connect flawlessly with mission-critical client systems- think ERP, CRM, and core accounting platforms. This guarantees reliable data consistency and supercharges end-to-end efficiency.

- AI-Powered Analytics: Integration of artificial intelligence during automated tax compliance system software development paves the way for predictive analytics for tax planning and trend analysis, offering strategic insights to users.

- Fortified Data Security (Blockchain Potential): Security must be future-proof. Implementing advanced layers, potentially including blockchain technology, fundamentally enhances the integrity and security of core assets, especially the immutable audit trails and sensitive document storage.

- Executive-Level Custom Dashboards: Control must rest with the user. We provide fully customizable interfaces that allow executives and teams to curate their view, prioritizing the specific data and metrics most relevant to their individual responsibilities and strategic objectives.

Hidden Costs That Impact the Cost to Develop a White-Label Tax Compliance Software

When it comes to white-label tax compliance software development, several hidden costs can affect the product’s growth and long-term sustainability. These costs are often overlooked but are crucial for keeping the software compliant, secure, and scalable as it grows. Here’s what you need to keep in mind:

The Reality of Perpetual Compliance

Tax codes are fluid, they change constantly. Maintaining full compliance means dedicating regular, non-negotiable budget cycles for updates that address legislative shifts. This isn’t just about tweaking code; it demands rigorous, compulsory re-validation and testing to meet all regulatory standards. It’s an unavoidable, recurring operational expense that needs to be factored into budgeting for automated tax compliance software development.

Scaling for High-Volume Growth

As your client base grows, so will the demand for data management. The software must be able to scale efficiently without crashing or losing performance. Upgrading core infrastructure and re-architecting components to handle massive data volumes requires significant capital investment. Without proper scalability, the white-label tax compliance software could struggle to perform as data volumes increase, leading to delays or potential system failures.

Continuous Security Fortification

Handling sensitive financial data makes this platform a high-value target. Security isn’t a one-time feature; it’s a permanent commitment. As cyber threats evolve, you must continually invest in advanced defenses, penetration testing, and thorough security audits. This is an ongoing hidden cost that’s crucial to maintaining data integrity and your clients’ trust. For tax compliance software companies, securing the software’s infrastructure is critical to ensure it remains secure and up to date with the latest security protocols.

The Interoperability Imperative

The enterprise technology environment is always shifting. Your tax compliance system development must integrate seamlessly with new ERP systems, financial tools, and other third-party software solutions. The need for seamless interoperability requires continuous compatibility testing, API development, and potentially significant technical work. This adds complexity and unforeseen costs to the development roadmap, particularly when adapting to new technology in a fast-moving landscape.

Strategies to Minimize the Cost of Developing a White-Label Tax Compliance Software

Developing a best tax compliance software platform requires more than just capital, it demands smart, strategic financial planning. Our mandate is simple: control costs aggressively without ever sacrificing the quality or, critically, the security of the final product. By embedding specific strategies from the jump, you drastically reduce overall expenses while inherently boosting the software’s scalability and market appeal.

- Stick to the MVP: We must identify and build only the absolute core, essential features right out of the gate. What does this achieve? It immediately cuts initial capital outlay, slashes your time-to-market, and guarantees significant early savings by simply deferring non-critical work.

- Intelligently Leverage Open-Source: When appropriate, and secure, we should be incorporating vetted, free software libraries and tools. This tactic directly bypasses expensive third-party licensing fees and visibly shortens delivery timelines. It’s a low-risk, reliable path to reliable cost reduction.

- Mandate Full Test Automation: This is non-negotiable. Implement comprehensive automated tax compliance software development from day one. This singular practice enhances your CI/CD pipeline, drastically reduces human-induced errors, and significantly lowers long-term maintenance costs. This is your largest source of long-term savings.

- Embrace True Agile: We cannot afford wasted cycles. Utilize genuine agile development practices. Working in short, adaptive bursts allows the team to pivot instantly to regulatory changes or shifting business needs, effectively minimizing wasted effort and keeping resources laser-focused on the highest value tasks.

- Design for Future Load: Today, you must build the software architecture with scalability baked right in. This crucial foresight avoids the monumental expense, time, and sheer disruption required for a costly system overhaul when high user demand inevitably hits.

- Institute Rigorous Financial Oversight: Don’t wait for the quarterly report. Conduct frequent, zero-tolerance reviews of all expenditures against the budget. This discipline ensures the project stays financially disciplined, allowing leadership to spot and course-correct potential overruns immediately, thereby preventing financial surprises.

Let’s hook you up with killer features that’ll make your software the go-to choice in the game.

Step-by-Step Process to Develop a White-Label Tax Compliance Software

Developing a white-label tax compliance software involves a systematic approach to ensure that the final product is efficient, scalable, and ready to be rebranded by businesses. Following a clear, step-by-step process helps align the tax compliance technology development with business objectives, ensuring that all critical aspects are covered efficiently.

Requirement Gathering

Begin by collecting all the necessary details about what the software needs to do. This includes understanding the different tax rules it must handle and the features users want. Getting these details right from the start helps ensure the software meets real user needs and doesn’t waste time on unnecessary features.

Design and Prototyping

Once you know the requirements, start designing how the software looks and works. Create early versions or prototypes to show potential users and get their feedback. This early feedback can help make changes before the full development starts, saving time and reducing later fixes.

Development

Now, start building the software with the team. Use a flexible approach to make changes easily as you learn more from user feedback. Focus on creating a strong base that can handle growth and easily connect with other systems, which is important for white-label products.

Testing and Quality Assurance

Test the software thoroughly to ensure it works well and is error-free. Check how it integrates with other systems, and make sure it’s secure and follows all tax laws. This step is crucial to avoid problems when the software is live, ensuring users have a smooth experience.

Deployment and Going Live

During this tax compliance solution development phase, get everything ready for launch. Set up the servers, make sure all the data connections work, and prepare a plan for the launch to go smoothly. Also, guides and materials should be created to help users understand how to use the software from day one.

Maintenance and Updates

After the software is live, keep it updated with regular checks and improvements. Respond to user issues with a support team and update the software as tax laws change. Keeping the software current and running smoothly is key to keeping users happy and the product competitive.

After looking into the step-by-step process of tax compliance management system development, let us move ahead and take a good look at the challenges that can be incurred during the entire process.

Also Read: How to build a white-label grievance management software

Challenges in White-Label Tax Compliance Software Development

Developing white-label tax compliance software can pose various challenges that need strategic solutions to ensure the software is effective and meets market demands. Addressing these challenges properly is crucial for successfully deploying and operating the software. Let us look at them in detail below:

| Challenge | Why It’s a Challenge | Solution |

|---|---|---|

| Adapting to Various Tax Laws | Tax laws change often and vary by location, making compliance difficult. | Create a modular system that allows for easy updates specific to each region. |

| Ensuring Scalability | As more users join, the software must manage more data without slowing down. | Use scalable cloud technology and design the software to support more users as needed. |

| Maintaining Data Security | Financial information is sensitive, and security breaches can be damaging. | Use strong security measures, conduct regular security checks, and ensure compliance. |

| Integration with Other Systems | Businesses use different systems, and integrating them seamlessly is challenging. | Develop with adaptable APIs and ensure the software works well with common business systems like ERP and CRM. |

| Meeting Diverse User Needs | Users from various industries and business sizes have different requirements. | Perform thorough user research to guide design and offer customizable options for different user needs. |

| Cost Management | White-label tax compliance software development costs can increase unexpectedly, especially with unforeseen project needs. | Keep a strict budget and incorporate cost-effective methods such as using open-source software. |

| Technical Debt Management | Quick development might lead to shortcuts that cause issues later on. | Apply agile methodologies to continuously improve and update the software, keeping the code clean and efficient. |

Trends in Automated White-Label Tax Compliance Software Development

The white-label tax compliance software landscape is constantly evolving, influenced by technological advancements and changing regulatory environments. Awareness of the latest trends can help developers create more effective and competitive products. Here’s a look at some current trends shaping the development of white-label tax compliance software.

Increased Use of AI and Machine Learning

Machine learning and artificial intelligence are increasingly integrated into compliance software to automate complex calculations and predict future tax liabilities. This technology helps enhance accuracy and efficiency, making software more intuitive and proactive in handling tasks. The AI-based tax compliance software development allows for more sophisticated data analysis, enabling businesses to not only comply with current regulations but also forecast potential changes and prepare in advance.

Cloud-Based Solutions

The shift towards cloud-based tax compliance solutions is prominent, offering greater scalability, enhanced security, and better integration capabilities. Cloud platforms facilitate remote access and real-time updates, crucial for managing tax data across multiple jurisdictions.

Emphasis on Data Security

As tax compliance involves sensitive financial data, there is a heightened focus on implementing robust security measures. Encryption, multi-factor authentication, and secure cloud storage are becoming standard features to protect data from breaches and unauthorized access.

Regulatory Technology (RegTech)

RegTech solutions are becoming integral to white-label software, helping businesses comply with tax regulations efficiently. These solutions use technology to simplify the compliance process, reduce risks, and manage regulatory reporting more effectively.

Blockchain for Transparency and Security

Blockchain technology is being explored for its potential to add layers of security and transparency in tax compliance software. It’s particularly useful for audit trails, secure data sharing, and enhancing the integrity of financial transactions.

Integration with Other Financial Tools

Due to the financial solutions needs of businesses, tax compliance programs are becoming increasingly compatible with the rest of the company’s economic applications, including accounting, payment systems, and business management. This integration ensures a unified ecosystem that streamlines all financial operations.

Stay ahead of the curve with a scalable, secure, and efficient tax solution tailored to your business needs.

Why Appinventiv is the Best Tech Partner for Developing White-Label Tax Compliance Software

Choosing the right technology partner is crucial for success as you navigate the complexities of building white-label tax compliance software. As a leading fintech software development company, Appinventiv offers the expertise and innovative solutions to tackle challenges and effectively leverage the latest trends. Here’s why we are your ideal partner for success:

Extensive Industry Experience

We deeply understand the financial and compliance sectors, bringing valuable industry insights to every project. Our experience ensures that your software meets all regulatory requirements while optimizing performance.

We have delivered robust fintech applications to our clients, including Mudra, EdFundo, and more, paving the way for their streamlined business operations and millions of dollars in funding.

Cutting-Edge Technology

We employ the latest technologies, such as AI, machine learning, and blockchain, to enhance the functionality and security of your tax compliance software, ensuring it is powerful and future-proof.

Customizable Solutions

Being a renowned software development company, we can help you build highly customizable products, allowing them to be tailored to specific business needs and client preferences, ensuring flexibility and scalability.

Robust Security Measures

Security is paramount at Appinventiv. We integrate advanced security protocols and measures to protect sensitive data, building a product you and your clients can trust.

Seamless Integration Capabilities

As one of the leading automated sales tax compliance software providers, we design our software to integrate smoothly with existing business systems and financial tools, enhancing user experience and operational efficiency.

Get in touch with us for a product and a lasting technology solution that adapts to your needs and market demands, positioning you as a leader in the tax compliance software market.

FAQs

Q. How much does it cost to develop white-label tax compliance software?

A. The cost to develop white-label tax compliance software can vary widely, typically from $50,000 to $250,000. This range depends on the complexity of the tax rules the software needs to accommodate, the level of customization required, and the specific features you want to include. Factors like integration capabilities and security measures also significantly shape the final cost.

Q. How much time do you take to create custom tax compliance software?

A. Custom sales tax compliance software development takes 6 to 12 months. The exact timeline of the tax compliance software development lifecycle can be extended or shortened based on the project’s scope, the number of jurisdictions it needs to cover, and the complexity of integrations with other systems.

Q. Why invest in tax compliance software development?

A. Investing in white-label tax compliance software development is a strategic move for businesses aiming to provide a value-added service to other companies. By developing a customizable solution, your business can cater to a wide range of clients, offering them a tool to streamline their tax processes, ensure adherence to complex regulations, and reduce errors. This enhances operational efficiency for your clients and positions your business as a crucial facilitator in improving tax management across different industries. Additionally, providing such software as a service allows for continuous revenue through licensing fees, updates, and support services, creating a sustainable business model.

Q. What are the types of tax compliance software?

A. There are multiple types of tax compliance software businesses need to know of:

- Transactional Tax Software: Designed to calculate taxes for sales and transactions in real-time, ensuring accurate billing and record-keeping.

- Income Tax Software: Helps businesses and individuals prepare and file their income tax returns, optimizing deductions and simplifying the filing process.

- International Tax Compliance Software: Facilitates compliance with tax regulations across multiple countries, ideal for multinational corporations.

- Property Tax Software: Assists in managing property taxes, including assessments, payments, and document management.

Trust and Estate Tax Software: Specialized software for handling the complexities of trust and estate taxation, including filing and compliance monitoring.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…