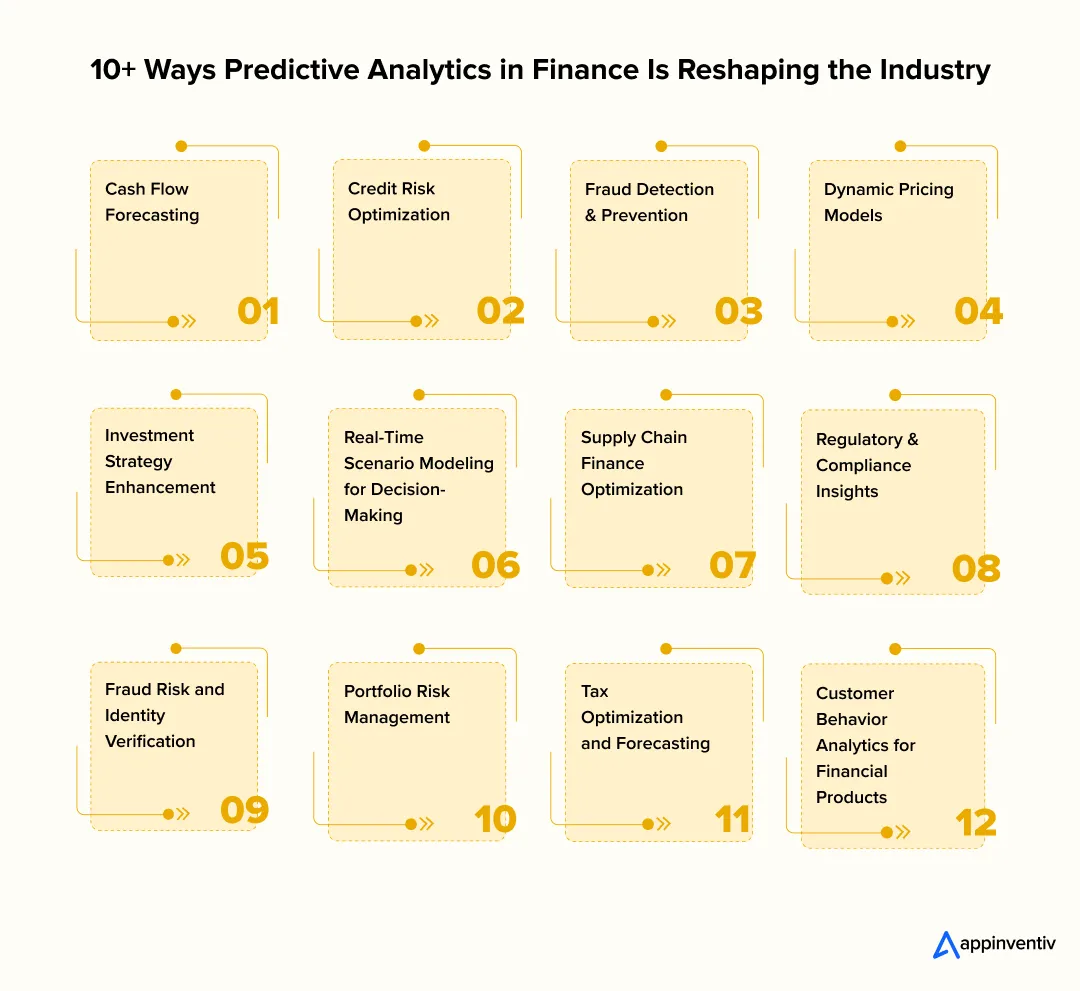

- 10+ Predictive Analytics Use Cases in Finance

- 1. Cash Flow Forecasting

- 2. Credit Risk Optimization

- 3. Fraud Detection & Prevention

- 4. Dynamic Pricing Models

- 5. Investment Strategy Enhancement

- 6. Real‑Time Scenario Modeling for Decision‑Making

- 7. Supply Chain Finance Optimization

- 8. Regulatory & Compliance Insights

- 9. Customer Behaviour Analytics for Financial Products

- 10. Fraud Risk and Identity Verification

- 11. Portfolio Risk Management

- 12. Tax Optimization and Forecasting

- Implementation Roadmap for Predictive Analytics in Finance

- Key Challenges in Predictive Analytics for Finance & How to Overcome Them

- 1. Data Quality and Integration

- 2. Model Reliability and Bias

- 3. Compliance and Regulatory Challenges

- 4. Resistance to Change

- Future Trends in Predictive Analytics for Finance

- 1. Generative AI: From Prediction to Simulation

- 2. The End of Latency

- 3. Data Mesh: Decentralizing the Architecture

- How Appinventiv Can Help Your Enterprise Build Predictive Analytics Solutions

- FAQs

- Predictive analytics in finance is transforming the industry by helping businesses forecast trends, manage risks, and make real-time, data-driven decisions.

- Financial institutions are using predictive models to optimize cash flow, enhance credit risk assessments, and prevent fraud before it happens.

- Companies like Walmart and Progressive are leading the charge, leveraging predictive analytics to optimize supply chain finance and set dynamic pricing.

- The future of finance lies in real-time, scenario-based decision-making, with tools like generative AI and data mesh revolutionizing how firms operate.

- Predictive analytics is no longer optional; it’s essential for staying competitive, driving smarter strategies, and improving operational efficiency in finance.

The finance world is changing, and predictive analytics are playing a big part. Instead of just reviewing past data, companies now use predictions to stay ahead, manage risks, and move quickly.

For instance, the financial predictive analytics market is expected to grow significantly from $4.68 billion in 2025 to $11.82 billion by 2034, according to The Business Research Company. This shows a shift in how finance teams operate. Today, leaders need to look ahead, not just behind. They’re making decisions based on what could happen, not just what has.

With predictive analytics in banking, businesses can improve cash flow forecasts, make better credit decisions, spot fraud early, change pricing instantly, and help decision-makers act quickly.

In this blog, we’ll dive into how predictive analytics for banking & financial services is changing finance, shaping decision-making, and why companies need to adopt it. We’ll also explore the challenges of using these tools and how businesses can overcome them.

Learn how predictive analytics can transform your finance team’s decision-making.

10+ Predictive Analytics Use Cases in Finance

Predictive analytics in finance is rapidly transforming the financial world. By anticipating future outcomes rather than simply reacting to the past, finance teams are evolving into proactive strategic partners. Below are some predictive analytics use cases in finance where this shift is most pronounced.

1. Cash Flow Forecasting

Old-school forecasting was often just “last year plus 5%.” That doesn’t cut it anymore. Modern predictive analytics for finance models allow teams to ingest messy, real-world variables, such as shifting supplier behavior or sudden market volatility, to build forecasts that actually hold water. It turns cash flow management from a defensive necessity into a strategic weapon.

KPMG’s “Intelligent Forecasting” recognized that traditional variance analysis was too slow. Their “Intelligent Forecasting” approach moved away from manual spreadsheets to algorithmic models that link operational decisions directly to the P&L. The result? They stopped managing working capital in the rearview mirror. By analyzing historical patterns against real-time signals, they helped clients slash financial risk and make capital allocation decisions with confidence.

2. Credit Risk Optimization

Static credit scores are a snapshot of the past; they don’t tell you what a borrower is doing today. Finance leaders are now using predictive analytics in banking to watch the film in real-time. By analyzing dynamic data points, organizations can identify a deteriorating credit position weeks before a payment is actually missed, allowing them to adjust exposure instantly.

JPMorgan Chase stopped looking at borrowers in a vacuum. They re-tooled their risk models to ingest macroeconomic trends and real-time market conditions alongside individual payment history. This created a high-definition view of repayment likelihood. The payoff was clear: a significant drop in loan defaults, simply because they could distinguish between borrowers facing a temporary crunch and those facing structural failure.

3. Fraud Detection & Prevention

Fraudsters don’t work 9-to-5, and they don’t use the same tricks twice. Legacy defenses just can’t keep up. The industry standard has shifted to predictive anomaly detection, catching the threat in the split second before the money moves.

PayPal is the blueprint for this. They don’t wait for a user to report a stolen card; their machine learning models analyze transaction patterns in real-time. If the data looks slightly off, the system freezes the action instantly. It’s proactive, not reactive, which is the only way to maintain trust in a digital economy.

4. Dynamic Pricing Models

The days of “one size fits all” pricing for loans and insurance are ending. Financial institutions are moving toward dynamic models that price risk based on actual, real-time behavior rather than on static demographics, showcasing a powerful use case for predictive analytics in the banking industry.

Look at Progressive. They disrupted the auto insurance market by using predictive analytics in banking to monitor how people actually drive, not just who they are on paper. This allows them to adjust premiums dynamically. It’s a win-win: safe drivers get better rates, and Progressive protects its margins by accurately pricing high-risk behaviors.

5. Investment Strategy Enhancement

Gut feeling doesn’t cut it in asset management anymore. The top firms are using predictive analytics and AI in asset management to stress-test their portfolios against thousands of market scenarios, allowing them to adjust their positions before the market turns.

BlackRock proves this every day with Aladdin. Their platform doesn’t just track assets; it uses massive datasets and ML to simulate risks and spot opportunities that human analysts might miss. It turns risk management from a defensive task into a strategic advantage.

6. Real‑Time Scenario Modeling for Decision‑Making

The days of the static annual budget are over. When market conditions flip overnight, sticking to a plan made six months ago is a liability. Finance leaders are using predictive analytics in financial services to run continuous “what-if” scenarios and stress-test their liquidity and revenue assumptions against real-time data.

Global enterprises like Microsoft are the prime example of this in action. They don’t wait for month-end reports to adjust course. By running constant simulations on financial scenarios, they can pivot their capital allocation strategies immediately. It turns risk management into a competitive advantage, allowing them to capitalize on volatility while others are still updating their spreadsheets.

7. Supply Chain Finance Optimization

Supply chain isn’t just about logistics anymore; it’s a working capital game. Finance teams are using predictive analytics in the supply chain to link demand forecasts directly to cash outflows. If you can predict exactly when materials are needed, you can optimize payment timing and free up trapped cash.

Walmart has mastered this. They use predictive analytics in banking to forecast demand spikes with extreme precision, allowing them to align supplier payments perfectly with revenue generation. This doesn’t just smooth out cash flow; it minimizes the operational cost of holding inventory and strengthens vendor relationships by removing payment uncertainty.

8. Regulatory & Compliance Insights

In a constantly shifting regulatory environment, “reacting” is too expensive. Financial institutions are moving from defensive compliance to predictive oversight. Instead of cleaning up after a violation, they use models to scan internal data for patterns that signal potential non-compliance before auditors arrive.

Banks are deploying these tools to predict legislative trends and automatically flag high-risk transactions. By leveraging predictive analytics in the banking industry, it shifts the compliance function from a frantic game of catch-up to a proactive shield, keeping the organization audit-ready and avoiding the reputational damage of fines.

9. Customer Behaviour Analytics for Financial Products

The days of mass-marketing generic financial products are over. If you aren’t tailoring the offer, you’re losing the customer. Predictive analytics in financial services allows banks to move from demographic guessing to behavioral precision, matching the right credit line or investment product to the exact moment a user needs it.

Wells Fargo uses this approach to stop churn before it happens. By modeling spending triggers and income shifts, they don’t just send offers; they send relevant solutions, significantly boosting conversion rates and customer loyalty.

10. Fraud Risk and Identity Verification

The threat landscape has shifted from simple transaction theft to full-blown identity spoofing. The goal now is to verify who is behind the screen in milliseconds without ruining the user experience.

Wells Fargo (validated by FICO) has set the standard here, utilizing machine learning in banking to spot and block account takeover attacks in real-time, protecting both the bank’s assets and the customer’s trust.

11. Portfolio Risk Management

You can’t drive forward looking in the rearview mirror. While traditional models rely on historical averages, predictive analytics in finance allows managers to stress-test portfolios against thousands of future market scenarios. It’s about creating resilience against volatility before it hits.

BlackRock dominates this space. They use predictive modeling to give clients a granular view of exposure, ensuring that asset allocation is based on future probabilities rather than just past performance.

12. Tax Optimization and Forecasting

Tax planning used to be a reactive compliance task; now, it’s a predictive strategy. With regulations shifting constantly, static spreadsheets don’t cut it.

Predictive tools allow firms to model future liabilities against potential regulatory changes, ensuring that tax strategy supports the business rather than just costing it money. It turns tax from an annual headache into a manageable, forecasted variable.

Let us help you optimize cash flow, reduce risks, and improve decision-making with tailored predictive analytics solutions.

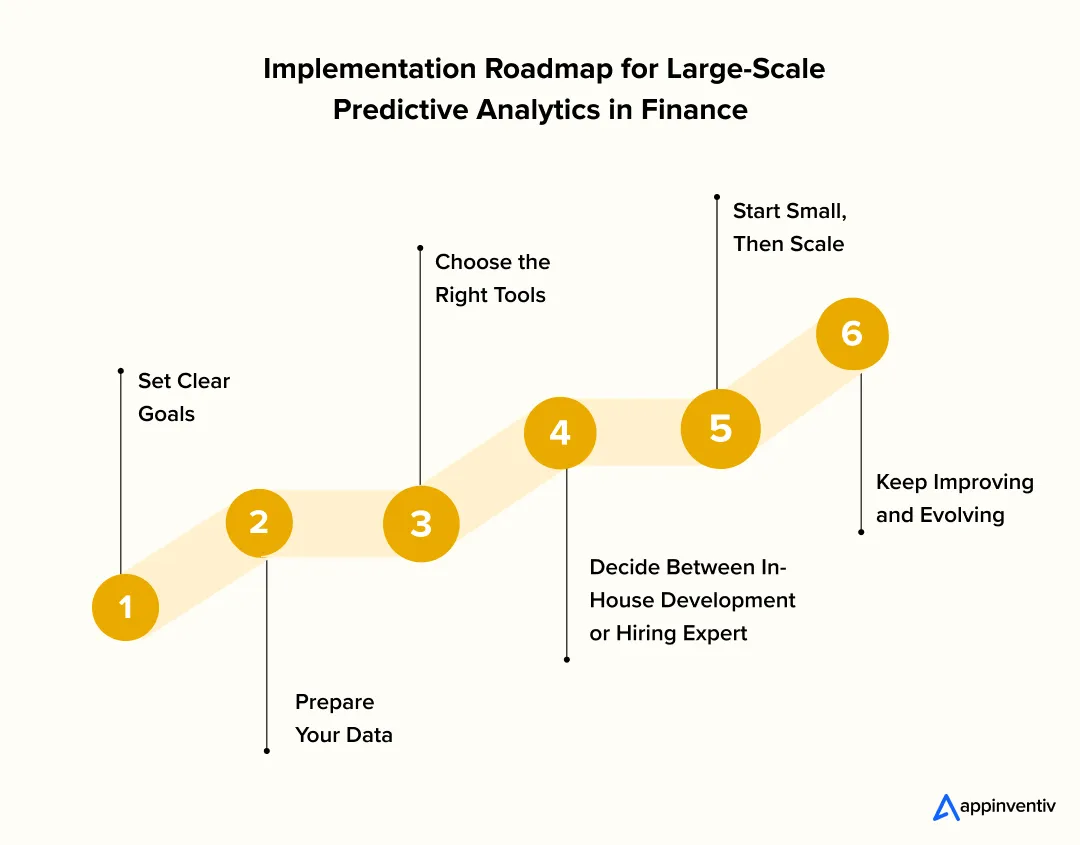

Implementation Roadmap for Predictive Analytics in Finance

The use of predictive analytics in the financial sector is not an overnight event. It is a journey that takes time, proper planning, and equipment. You will be required to integrate such tools into your existing systems, prepare your data, and onboard your team. This is a quick tip to get you on your way.

Step 1: Set Clear Goals

The last thing to provide before you do anything is to know where you want to go. Do you want to better predict cash flow, better manage credit risk, or detect fraud before occurrence? Whatever you want to achieve, make it clear from the onest and you will stay on track.

Step 2: Prepare Your Data

This is all supported by your data. When it is messy or difficult to access, your predictive models will not perform as well. Clean up your data, make sure it is well organized and ensure it is easy to extract from all the right sources. Predictive analytics in financial services works best when you have clean, accessible data.

Step 3: Choose the Right Tools

You will have to use tools that suit you well and align with your existing systems. Depending on whether it is an AI platform or collaboration with a financial analytics expert, ensure that the tools that you choose can accomplish whatever you expect them to accomplish. Predictive analytics for banking & financial services tools can help streamline the process and make the implementation smoother.

Step 4: Self-create or hire developers?

You will have to decide whether to develop your solution or hire outside specialists. In-house would provide greater control, if your group has the capability to do so. However, when you need to act with more speed and not make mistakes, cooperating with the seasoned vendors may save you time and frustration. Predictive analytics for finance can be complex, and working with experts could accelerate your results.

Step 5: Start Small, Then Scale

Start with a pilot project. This can be done by testing your predictive models at a smaller scale and, once you are confident everything is working correctly, implementing them across the entire company. Ensure that the new tools fit with your present operations. Start with a predictive analytics use case in finance and expand as you see the results.

Step 6: Keep Improving

After you have your predictive models running, you cannot set them in stone. Then you will have to tweak and update them as things evolve. Establish a procedure to periodically check and retest your models to keep them relevant and efficient. Predictive analytics in accounting and finance evolves with new data, so regular updates will be necessary.

With these steps, your finance team will be well positioned to leverage predictive analytics to enhance decision-making, risk management, and the development of intelligent strategies.

Also read: AI in Risk Management: Key Use Cases

Key Challenges in Predictive Analytics for Finance & How to Overcome Them

Adopting predictive analytics in finance can be tricky. It’s not always an easy ride, and many businesses face a few hurdles along the way. But once you tackle these challenges, the benefits of predictive analytics in finance can be huge.

1. Data Quality and Integration

Picture this: your sales team logs everything in Salesforce. Customer service uses a different system. Operations tracks inventory in spreadsheets that someone started in 2015. Now try building accurate forecasts from that mess. It’s a nightmare. The data’s everywhere, half of it contradicts the other half, and nobody’s sure which version is current.

The fix is boring but necessary; consolidate everything. One clean database. It takes weeks, sometimes months. But there’s no way around it. Predictive analytics for banking fed bad data give you bad predictions. Simple as that.

2. Model Reliability and Bias

A model learns from your past. If your historical data only covers urban customers, it won’t understand rural ones. If you trained it during a boom period, it’ll miss signals during a downturn.

Models can become less accurate over time. It’s important to regularly compare them to actual outcomes. If they start showing errors, update them by incorporating data from different segments, time periods, and scenarios. Without this, you’re only getting part of the picture and leaving the rest to chance.

3. Compliance and Regulatory Challenges

Banking, insurance, healthcare regulators watch how you use customer data. The rules change. Sometimes without much warning.

Get legal involved early. Use platforms built for compliance, not ones where you’re bolting it on later. Retrofitting is expensive and risky. Much easier to do it right from the start. Predictive analytics for financial services platforms often have built-in compliance features to help you stay ahead of changing regulations.

4. Resistance to Change

Your team has routines. They know how things work now. Then you bring in predictive analytics in banking, and suddenly, their workflow looks different. Some people adapt fast. Others don’t, especially if they don’t see the point.

You can’t force it. Show them what’s in it for them. Real training, not PowerPoints, actual hands-on work. When your sales team closes more deals because they’re chasing better leads, they’ll use the tool. When operations stop overstocking because demand forecasts are accurate, they’ll trust it.

Get these right, and predictive analytics stops being a project and becomes just how you operate. Better decisions, less waste, real competitive advantage.

Future Trends in Predictive Analytics for Finance

Predictive analytics in finance is no longer just about better spreadsheets. The toolkit is fundamentally changing. We are moving from simple trend analysis to complex, autonomous decision-making. In 2026, predictive analytics is moving beyond dashboards into agentic workflows, where AI systems not only forecast outcomes but autonomously prepare actions such as liquidity buffers, credit proposals, or risk mitigation strategies, pending human approval.

Here are the three shifts that will actually matter in the next cycle:

1. Generative AI: From Prediction to Simulation

The old models told you what might happen based on historical data. Generative AI in finance is different, it tells you what if. We are seeing a shift toward scenario generation, where models can simulate hundreds of potential market futures in seconds. This isn’t just forecasting; it’s dynamic stress-testing. It allows financial teams to build strategies that are resilient to shocks, not just optimized for the status quo.

Generative AI will play a pivotal role in predictive analytics in investment banking, where firms can model multiple market conditions and prepare for various scenarios, rather than relying on a single predicted outcome.

2. The End of Latency

The era of the “end-of-day report” is closing. In modern finance, stale data is a liability. The market is moving toward continuous, streaming analytics. We aren’t just talking about high-frequency trading anymore; we are talking about real-time fraud interception, instant credit decisioning, and dynamic portfolio adjustments that happen the moment new data hits the wire. If you are waiting for a batch process to run overnight, you are already behind.

Predictive analytics in financial services is shifting toward a continuous flow of data, allowing for immediate reactions to market changes, fraud detection, and customer behavior shifts.

3. Data Mesh: Decentralizing the Architecture

As enterprises grow, the “centralized data lake” often becomes a swamp. The bottleneck slows everything down. The industry is moving toward a Data Mesh approach, decentralizing control so that specific business domains own their own data products. When you integrate this with AI, you get models that are fed by cleaner, domain-specific data streams, making the output sharper and the architecture far more scalable.

This shift will have a major impact on predictive analytics for finance, enabling financial institutions to access real-time, relevant data across different departments, helping decision-makers respond faster and more accurately.

As predictive analytics evolves, ensure your business is prepared. Learn how we can build future-proof solutions for your finance operations.

How Appinventiv Can Help Your Enterprise Build Predictive Analytics Solutions

At Appinventiv, we don’t just write code; we build financial clarity. For over a decade, we have been in the trenches of FinTech, shipping more than 200 products globally. Our job isn’t to just give you software; it’s to give you a competitive edge by turning your raw data into a predictive engine. As a leading provider of Data Analytics Services, we help organizations unlock the full potential of their data and transform it into actionable insights.

Our work speaks for itself:

- Mudra: We didn’t just build a budgeting app; we engineered a smart, AI-driven assistant that actively tracks spending and automates financial health for the millennial market.

- Edfundo: We tackled the complexity of family finance, building a secure, interactive banking ecosystem that combines financial literacy for kids with real-time parental controls.

Whether you need to tighten your cash flow forecasting or flag fraud before it hits the ledger, we build the systems that see around corners. We focus on practical, deployment-ready solutions through our banking software development services that impact the bottom line immediately.

Ready to transform your finance operations? Let Appinventiv guide you to the future of predictive analytics. Contact us today to get started!

FAQs

Q. Which predictive analytics models are used in financial forecasting?

A. In financial forecasting, various predictive analytics use cases in finance are employed, such as time series models, regression analysis, and machine learning algorithms. These models help finance teams anticipate future trends by analyzing historical data, market conditions, and economic indicators. Examples of predictive analytics in finance include cash flow forecasting, credit risk assessment, and fraud detection. Predictive analytics in corporate finance has become essential for improving financial decision-making.

Q. How is AI used in predictive analytics for finance?

A. AI plays a pivotal role in predictive analytics for banks by enabling machines to learn from historical data, identify patterns, and make data-driven predictions. Through techniques like machine learning and natural language processing, AI helps financial institutions improve credit risk assessments, detect fraud, and optimize pricing models. Predictive analytics examples in banking include AI-driven fraud detection systems and real-time credit scoring models. AI in predictive analytics for finance is revolutionizing how businesses make financial decisions.

Q. How can predictive analytics reduce financial risk?

A. Predictive analytics in banking helps reduce financial risk by identifying potential threats before they materialize. By analyzing real-time data and historical trends, financial institutions can better understand credit risks, market fluctuations, and fraud patterns. This proactive approach allows businesses to make informed decisions, minimizing the chances of unforeseen losses. Predictive analytics in the banking sector is key to managing risks effectively by flagging high-risk transactions and providing deeper insights into borrower behavior.

Q. Is predictive analytics accurate for stock market forecasting?

A. While predictive analytics stock market models cannot guarantee perfect accuracy, they significantly improve the forecasting process by analyzing historical market data, trends, and external factors. Predictive analytics examples in banking like dynamic pricing models and market trend analysis can be applied to stock market predictions. Predictive analytics in corporate finance also helps portfolio managers make better investment decisions by assessing potential risks and opportunities in real-time.

Q. How does machine learning improve predictive financial models?

A. Machine learning enhances predictive financial analytics by allowing models to learn from data over time. As more data is processed, the models become more accurate, helping financial institutions improve forecasting, risk management, and investment strategies. Machine learning adapts to changing market conditions, making predictive analytics in finance more responsive and dynamic. For example, predictive analytics in banking sector applications can automatically adjust risk models based on market fluctuations and real-time transaction data.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

How Much Does Accounting Practice Management Software Development Cost in Australia 2026?

Key takeaways: Custom accounting practice management software development in Australia for mid-to-large firms generally falls between AUD 70,000 and AUD 700,000. Adherence to the Privacy Act 1988 and ATO operational frameworks is a primary cost driver, not an add-on. A modular architecture and structured development approach ensure that the platform evolves with changing laws and…

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…