- How is the Oil and Gas Industry Changing in 2026?

- 1. Slowing Global Demand Growth

- 2. U.S. Shale Production Is Flattening

- 3. More Investment in Digital Transformation

- 4. ESG and Regulatory Pressure Are Increasing

- 5. Surge in AI, IoT, and Automation

- 10 Innovative Business Ideas in the Oil and Gas Industry for 2026

- Digital Twin Solutions

- AI-Driven Emissions Monitoring and Reporting Tools

- Automated Drilling Optimization

- Supply Chain and Logistics Management Software

- Advanced Reservoir Modeling

- Real-Time Safety Monitoring Systems

- Energy Trading and Risk Management Software

- Remote Operations and Digital Collaboration Tools

- Environmental Impact Assessment Software

- What it Takes to Start a Tech Business in the Oil and Gas Sector in 2026?

- Mastery of Legacy Integration

- Compliance with Stringent Regulations

- Handling Harsh Operational Environments

- Addressing Cybersecurity in OT Environments

- Access to Industry-Grade Data and Expertise

- Capital and Long Sales Cycles

- Embracing Sustainability and Digital Transformation Goals

- Regulatory Certification and Testing

- Skilled Cross-Disciplinary Teams

- Robust Pilot Programs and Demonstrable ROI

- Appinventiv: Your Partner for Oil and Gas Solutions

- FAQs.

The oil and gas industry is in the midst of a high-stakes digital revolution. With rising global energy demands, increasing pressure to reduce emissions, and the complexity of upstream and downstream operations, enterprises are turning to software-first solutions to stay competitive. In 2026, this shift is not just a matter of time; it’s transformative.

According to Fortune Business Insight, the global digital oilfield market size was valued at USD 28.94 billion in 2024. The market size is projected to grow from USD 31.21 billion in 2026 to USD 44.05 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.04% during the forecast period.

This reflects the sector’s growing reliance on technologies like artificial intelligence, machine learning, digital twins, cloud computing, and the Internet of Things. These oil and gas business ideas are being deployed across exploration, drilling, production, logistics, and maintenance—not just to boost performance, but to ensure safety, transparency, and sustainability.

For software development companies, this digital acceleration opens up a wealth of opportunities. Whether it’s streamlining asset integrity management, enabling predictive maintenance, or powering intelligent analytics platforms, the need for tailored software is greater than ever.

In this article, we’ll explore ten cutting-edge, tech-centric oil and gas business ideas poised to disrupt and elevate the oil and gas industry in 2026. These ideas are crafted to help software providers identify high-impact opportunities that align with the industry’s digital roadmap – and solve its most urgent challenges.

Tap into the $44.05 billion digital oilfield market by 2032 with cutting-edge oil and gas software development services.

How is the Oil and Gas Industry Changing in 2026?

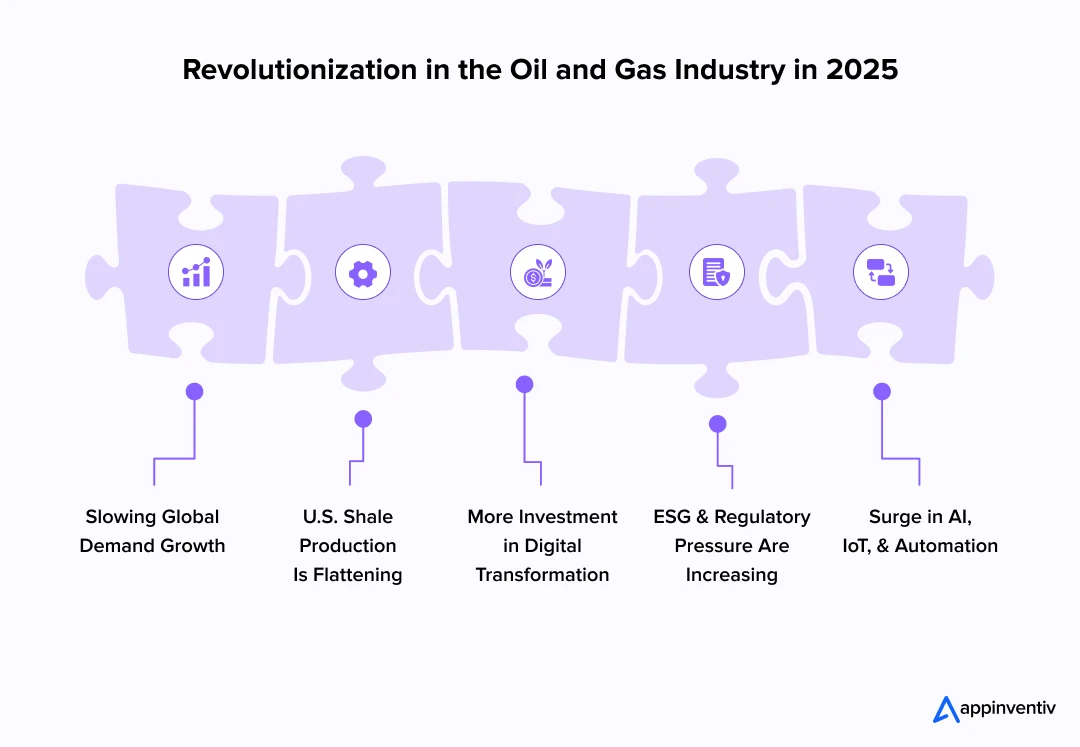

The oil and gas sector is undergoing a significant shift in 2026, driven by slowing demand growth, the plateauing of U.S. shale, digital transformation, and rising ESG compliance. Here’s what’s changing for the business ideas for the oil and gas industry.

1. Slowing Global Demand Growth

Oil demand growth is tapering off. The International Energy Agency (IEA) forecasts a slowdown, with demand increasing by just 650,000 barrels per day for the rest of 2026, compared to 990,000 bpd in Q1.

2. U.S. Shale Production Is Flattening

U.S. shale oil production is nearing its peak. S&P Global projects the first annual decline in shale output, outside of the pandemic, by 2026, as investment slows and resource quality diminishes.

3. More Investment in Digital Transformation

McKinsey reports that digital transformation in the oil and gas industry can reduce upstream costs by 10-20% and increase productivity by 6-8%. This includes business ideas for the oil and gas industry that adopt AI, digital twins, and IoT across the value chain.

4. ESG and Regulatory Pressure Are Increasing

The push for decarbonization is real. Companies are being held accountable for their carbon footprint, prompting investment in emissions tracking and ESG compliance, oil and gas business opportunities like Sweep and Sphera.

5. Surge in AI, IoT, and Automation

Tech like IoT in oil and gas, predictive analytics, and automation is being deployed to increase efficiency and safety. From remote asset monitoring to robotic inspections, the industry is rapidly going digital.

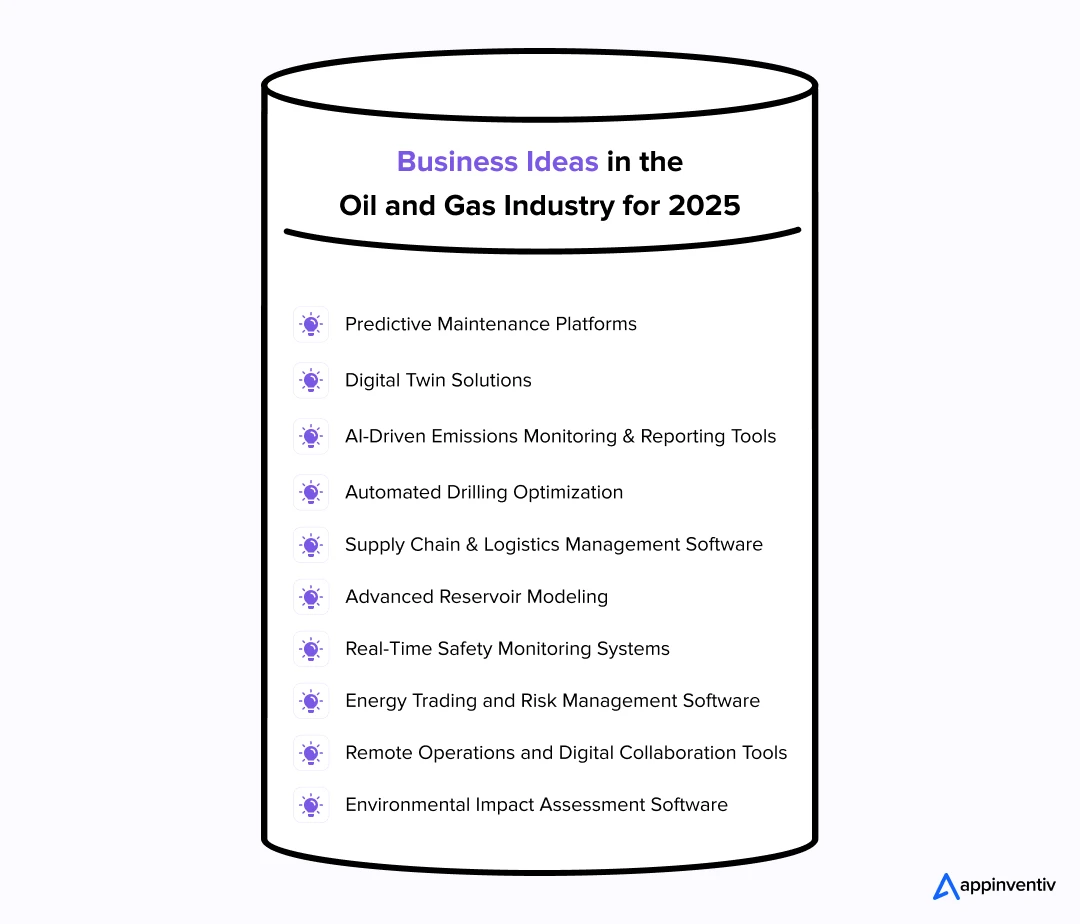

10 Innovative Business Ideas in the Oil and Gas Industry for 2026

With geopolitical uncertainty, tightening ESG regulations, and a plateauing demand for fossil fuels, oil and gas companies are under mounting pressure to reduce costs, enhance efficiencies, and digitize their aging infrastructure.

At the same time, AI in the oil and gas sector, cloud computing, and industrial IoT are reshaping how energy enterprises approach everything from exploration to asset monitoring, forming profitable business ideas for the oil and gas industry.

This shift has created space for a new kind of innovation—one led not by drilling rigs or refineries, but by code. Technology is no longer a backend utility; it’s a strategic lever. From field data digitization to autonomous inspection platforms, software-driven solutions are becoming critical to how oil and gas businesses operate and compete.

For companies in the software space, this opens up high-value oil and gas business ideas to build domain-specific platforms and products, designed for field operators, HSE teams, energy traders, logistics units, and more. Each solution must be engineered with domain logic, enterprise scalability, and operational resilience at its core.

The following business ideas reflect where the biggest gaps and needs lie in 2026 – opportunities where software can deliver measurable value across safety, compliance, performance, and profitability.

Predictive Maintenance Platforms

Predictive Maintenance Platforms

Equipment failure and unplanned downtime remain among the biggest cost drivers in oil and gas operations. Predictive Analytics in the oil and gas industry ensures predictive maintenance platforms utilize AI and IoT sensor data to analyze equipment health in real-time, enabling companies to anticipate failures before they occur.

By integrating data from pumps, compressors, valves, and pipelines, these oil and gas business opportunities generate alerts, schedule maintenance automatically, and optimize spare parts inventory. The result? Reduced downtime, lower repair costs, and extended asset lifecycles.

Enterprises are already seeing gains from these innovative ideas for the oil and gas business: a 2023 Deloitte report estimated predictive maintenance could reduce maintenance costs by up to 25% and increase equipment uptime by 10–15%.

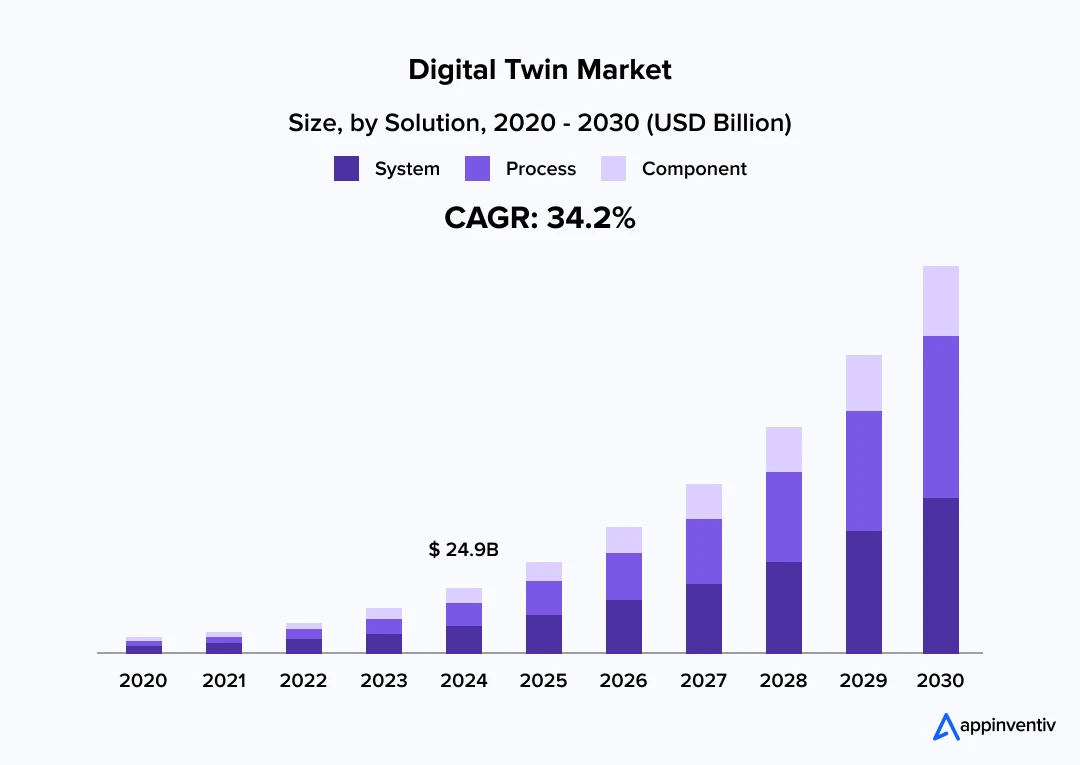

Digital Twin Solutions

Digital twins create a virtual replica of physical assets, processes, or entire facilities, enabling real-time monitoring, simulation, and optimization. In the oil and gas industry, digital twins can model wells, refineries, pipelines, or drilling rigs to predict performance under various conditions without risking actual operations.

These oil and gas entrepreneurship ideas help companies reduce risk, improve operational efficiency, and plan maintenance with higher accuracy. Shell, for example, utilizes digital twins in the oil and gas industry to minimize unplanned downtime and enhance production efficiency.

The global digital twin market size was estimated at USD 24.97 billion in 2024 and is anticipated to grow at a CAGR of 34.2% from 2026 to 2030.

AI-Driven Emissions Monitoring and Reporting Tools

Increasing environmental regulations require precise emissions tracking. AI-powered platforms analyze data from sensors and satellites to detect leaks, quantify emissions, and automate reporting, ensuring compliance and helping reduce carbon footprints. Companies like BP and ExxonMobil are investing heavily in emissions tracking technology as part of their Environmental, Social, and Governance (ESG) commitments, leaving room for new ideas in the oil and gas industry to be implemented.

Automated Drilling Optimization

Automated drilling platforms leverage machine learning algorithms to analyze vast drilling data in real-time, optimizing drilling parameters for enhanced efficiency and safety. By continuously adjusting variables such as drill speed and pressure, these systems reduce non-productive time and prevent costly errors.

Becoming an example of one of the most successful business plans for the Oil and Gas sector, Baker Hughes deployed automated drilling technology that helped reduce drilling time by up to 20%, significantly cutting operational expenses. As drilling operations become more complex, automation is proving vital for staying competitive and profitable.

Supply Chain and Logistics Management Software

Oil and gas enterprises face immense logistical challenges in managing equipment, raw materials, and product distribution. Innovative ideas for the oil and gas business built on advanced supply chain software that uses AI and blockchain to provide end-to-end visibility, optimize inventory levels, and streamline transport routes have a huge market potential.

Chevron recently implemented a blockchain-enabled supply chain platform, which has enhanced transparency and reduced procurement delays by 15%. By reducing bottlenecks and increasing efficiency, these tools improve margins and accelerate time to market.

The supply chain management software market in oil and gas is projected to reach $6 billion by 2026, driven by increasing demand for real-time tracking and data accuracy, making it one of the most prospective business opportunities in the oil and gas industry. (Source: MarketsAndMarkets)

Advanced Reservoir Modeling

Using AI-powered reservoir modeling software, companies can simulate fluid flow and rock properties with unprecedented precision. This technology enables better decisions on where and how to drill, maximizing resource extraction while minimizing environmental impact.

ExxonMobil utilizes AI reservoir models that have enhanced well placement accuracy by 15%, thereby reducing the number of costly dry wells and increasing overall production efficiency. These new ideas for the oil and gas industry support smarter investments and risk mitigation.

Reservoir simulation software in oil and gas is forecast to grow by 10% annually as firms increasingly rely on data-driven exploration strategies. (Source: MarketsAndMarkets)

Real-Time Safety Monitoring Systems

Safety remains a top priority in oil and gas operations. Real-time monitoring platforms, such as AI-powered surveillance systems, utilize computer vision, IoT sensors, and AI analytics to detect hazards, including gas leaks, equipment failures, or worker fatigue, instantly alerting teams to prevent accidents.

According to a study, Shell’s adoption of real-time safety systems resulted in a 30% reduction in on-site incidents over a three-year period, demonstrating the critical role technology plays in protecting personnel and assets.

With regulatory scrutiny intensifying, the adoption of safety monitoring technology is expected to surge, with the global market projected to reach $4 billion by 2027, making it one of the most innovative ideas for the oil and gas industry.

Energy Trading and Risk Management Software

Oil and gas companies increasingly use sophisticated software to manage energy trading portfolios, hedge risks, and comply with complex regulations. Backed by big data analytics, these platforms analyze market data, automate trades, and provide predictive insights to optimize revenue streams.

BP integrated an energy trading platform that improved trading efficiency by 25% and enhanced the accuracy of compliance reporting. Such oil and gas business model examples help enterprises react swiftly to market volatility and regulatory changes.

The energy trading and risk management software market is projected to reach $2.5 billion by 2026, underscoring its increasing strategic significance.

Remote Operations and Digital Collaboration Tools

With many oil and gas assets located in remote areas, digital collaboration tools enable seamless communication and remote management of operations. Cloud-based platforms allow teams to access real-time data, conduct virtual inspections, and coordinate workflows efficiently.

TotalEnergies deployed remote monitoring solutions that reduced site visit frequency by 40%, cutting travel costs and improving decision speed. As remote work gains momentum, such oil and gas business model examples are becoming vital for operational continuity.

The market for digital collaboration tools in the oil and gas industry is experiencing rapid growth, with an expected doubling in size by 2028.

Environmental Impact Assessment Software

As environmental regulations become stricter, oil and gas companies are adopting specialized software to assess and mitigate their ecological footprint. These platforms analyze data on emissions, water usage, and habitat disruption to guide sustainable practices.

ConocoPhillips utilizes environmental impact software to monitor and mitigate methane emissions, supporting its ESG goals and fostering stakeholder trust.

Build game-changing AI, IoT, or cloud solutions for predictive maintenance, digital twins, or emissions tracking.

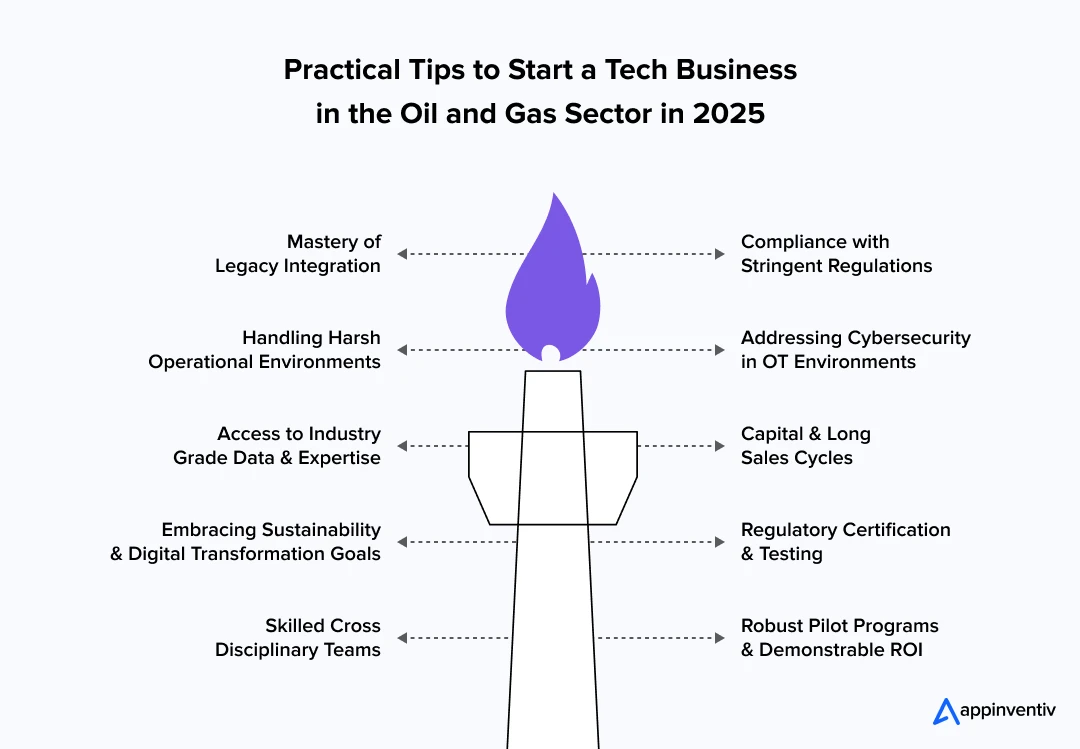

What it Takes to Start a Tech Business in the Oil and Gas Sector in 2026?

Launching a tech-driven business in oil and gas in 2026 requires navigating an intricate landscape shaped by legacy systems, industry-specific demands, and a growing push for sustainability. Unlike other sectors, the oil and gas business ideas are deeply regulated, capital-intensive, and relies heavily on real-time, mission-critical operations.

Here’s what entrepreneurs must focus on:

Mastery of Legacy Integration

Oil and gas companies rely on decades-old infrastructure and complex legacy software systems. New business ideas in the oil and gas industry must prioritize seamless integration with SCADA systems, PLCs, and industry-standard platforms, such as OSIsoft PI or Schlumberger’s DELFI. Compatibility with these entrenched systems is a non-negotiable starting point.

Compliance with Stringent Regulations

Meeting regulatory requirements such as API standards, OSHA safety rules, and environmental controls (e.g., EPA’s methane emissions regulations) is mandatory. Oil and gas innovation 2026 must be designed to automatically generate compliance reports, maintain audit trails, and enable real-time monitoring to avoid costly shutdowns or fines.

Bonus Read: IT Compliance Regulations for US Industries

Handling Harsh Operational Environments

Tech deployments often extend to remote drilling sites, offshore platforms, and pipelines, where connectivity is limited and hardware is exposed to extreme temperatures or corrosive conditions. Solutions must be resilient, with edge computing capabilities that can process data locally and sync when connectivity is restored.

Addressing Cybersecurity in OT Environments

Oil and gas infrastructure is a high-value target for cyberattacks. Unlike traditional IT, Operational Technology (OT) systems, which control physical equipment, require specialized security measures. The picture of oil and gas innovation 2026 is embedded with cybersecurity best practices specific to ICS/SCADA systems, including network segmentation and anomaly detection.

Bonus Read: Top 10 Cybersecurity Measures for Businesses in 2025

Access to Industry-Grade Data and Expertise

The ability to collect, analyze, and interpret sensor and operational data is a competitive advantage needed to execute unique ideas for the oil and gas business. However, acquiring accurate, real-world data often requires partnerships with operators or access to proprietary datasets. Collaborations with industry insiders accelerate product validation and refinement.

Capital and Long Sales Cycles

Oil and gas projects often involve lengthy procurement and implementation timelines, which can span several years. Unique ideas for the oil and gas business need sufficient runway and patient investors who understand the extended sales cycles and the gradual adoption typical in this sector.

Embracing Sustainability and Digital Transformation Goals

With increasing regulatory pressure to reduce carbon footprints and improve efficiency, businesses must align their solutions with decarbonization efforts, methane leak detection, and energy optimization initiatives. Tech products that support ESG goals are more likely to gain market acceptance.

Regulatory Certification and Testing

Many oil and gas operators require third-party certifications or compliance with industry standards (e.g., ISO 27001 for security, API certifications for software tools) before deploying new systems. Early investment in certification processes builds credibility and facilitates smoother adoption.

Skilled Cross-Disciplinary Teams

The success of business plans in the oil and gas sector hinges on teams that are fluent in both petroleum engineering and software development. Engineers familiar with reservoir management or drilling operations paired with AI/ML experts create solutions grounded in practical realities, not just theoretical innovation.

Robust Pilot Programs and Demonstrable ROI

Due to high risk aversion, oil and gas companies require proof of concept through pilots that demonstrate measurable improvements in safety, cost savings, or operational uptime. Startups must design pilots with clear key performance indicators (KPIs) and scalable deployment plans.

Appinventiv: Your Partner for Oil and Gas Solutions

While the opportunities in oil and gas tech are immense, launching unique ideas for the oil and gas business isn’t plug-and-play. It requires a deep understanding of the domain, the strategic use of emerging technologies, and a partner who can translate complex industrial needs into intelligent, scalable solutions. That’s where Appinventiv comes in.

At Appinventiv, we understand that breaking into the oil and gas sector with a tech-first business requires more than just writing code – it demands industry fluency, systems-level thinking, and a strong grasp of real-world challenges like operational safety, regulatory compliance, and infrastructure resilience.

That’s why our oil and gas software development services go beyond surface-level software development to help you reach the future of the oil and gas business. We help enterprises and startups build robust solutions that integrate seamlessly with legacy systems, such as SCADA, PLCs, and ERP platforms.

Whether it’s predictive maintenance platforms powered by AI or field-force automation tools built on rugged IoT networks, we engineer products that work reliably, even in harsh, high-risk environments.

Our development pipelines for oil and gas software services are designed to meet global oil and gas regulations, with built-in controls for auditing, data encryption, access management, and ESG reporting. This ensures that your product aligns with the benefits of the oil and gas business. With experience across upstream, midstream, and downstream operations, Appinventiv delivers digital innovation that’s both practical and performance-driven.

Ready to bring your oil and gas tech idea to life? Let’s build solutions that power energy futures – efficiently, securely, and at scale.

FAQs.

Q. How to start an Oil and Gas business?

A. Begin by pinpointing a specific technology-driven opportunity within the plethora of business plans for the Oil and Gas sector. Conduct thorough market and regulatory research, then build partnerships with key stakeholders. Assemble a team skilled in both oil and gas operations and advanced technologies like IoT and AI. Start with a pilot project or Minimum Viable Product (MVP) to validate your concept, then refine and scale it based on feedback and industry demands.

Q. Is the Oil and Gas business profitable?

A. The oil and gas industry remains profitable, particularly for businesses that use digital technologies to boost operational efficiency and reduce costs. Companies that focus on automation, data analytics, and predictive maintenance can achieve higher margins and sustainable growth, even in the face of market fluctuations

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

10 Future-Ready Tech Business Ideas to Launch in Brisbane (2026 Edition)

Key takeaways: Brisbane’s Tech Surge: With $10.8B in value and 81% growth, Brisbane offers strong government backing, top talent, and global reach. Funding Boost: Programs like Advance Queensland have funded 8,100+ startups with up to $250K each. Scalable Sectors: AI healthcare, AgTech, and renewables thrive with solid R&D and industry support. Brisbane is buzzing with…

16 Game-Changing Startup Ideas in the UAE You Haven’t Considered Yet

Key takeaways: The UAE's strategic location and government support make it an ideal startup hub. AI, fintech, and green tech are booming sectors with vast opportunities for startups. Over $11 billion in funding is fueling growth in key industries like AI and e-commerce. Government initiatives like the “Dubai Future District Fund” support entrepreneurial growth. Niche…

10+ Climate Tech Startup Ideas to Launch in 2026

Key Takeaways 2026 marks a pivotal year for climate tech founders, as 45% of Fortune Global 500 companies commit to net-zero targets and governments roll out climate-friendly policies, such as the U.S. Inflation Reduction Act. AI and deep tech are reshaping climate innovation, with growing investor interest in solutions like AI-powered energy forecasting, climate risk…