- Types of Money Transfer Apps You Can Build

- Peer-to-Peer (P2P) Transfer Apps

- Cross-Border Remittance Apps

- Business and Merchant Payment Apps

- Bank-Backed and Wallet-Based Transfer Platforms

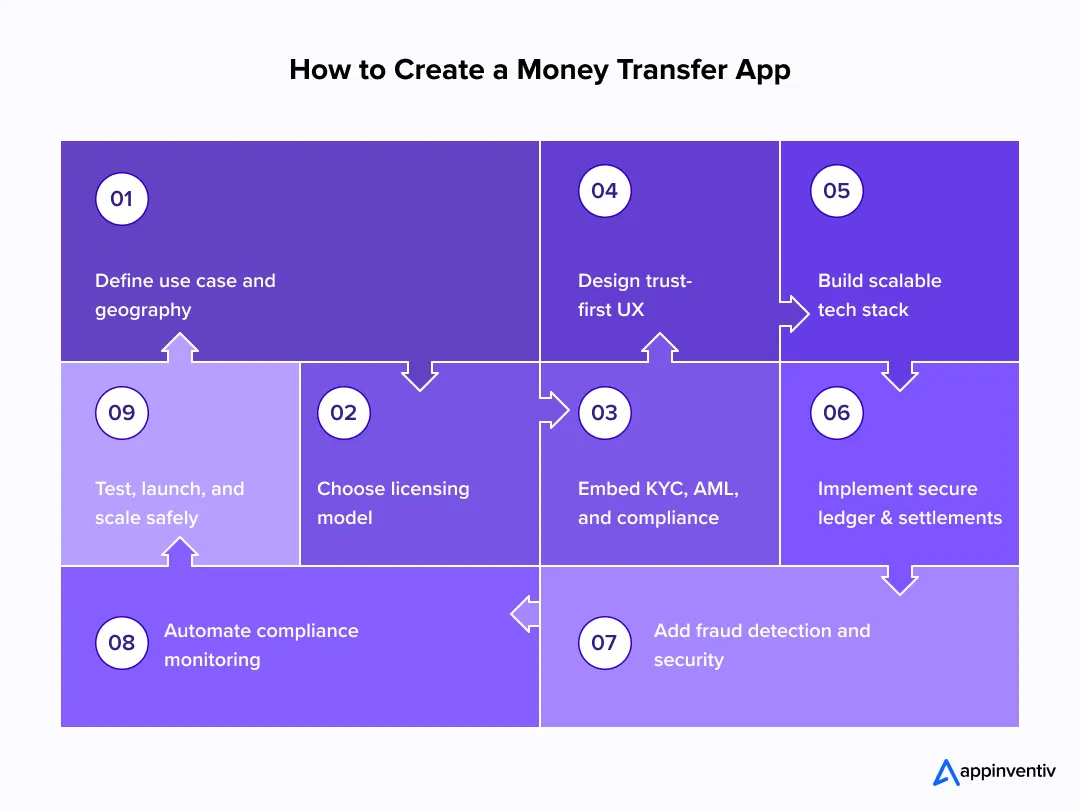

- How to Create a Money Transfer App

- Step 1: Define Use Case, Target Geography, and User Personas

- Step 2: Choose the Right Regulatory and Licensing Model

- Step 3: Plan Legal Standards in Fintech Compliance

- Step 4: Design Trust-Centric UX and User Journeys

- Step 5: Finalize the Money Transfer App Tech Stack

- Step 6: Build Core Payment and Settlement Logic

- Step 7: Implement App Security and Fraud Prevention Measures

- Step 8: Integrate Compliance Automation and Monitoring

- Step 9: Test, Certify, Launch, and Scale the Platform

- Costs of Building a Money Transfer Application in 2026

- What Pushes Costs Up or Down

- How Budget Changes by Build Scope

- Costs That Continue After Launch

- Sourcing Models for Money Transfer Application Development

- Key Features of a Money Transfer Application

- User Onboarding and Identity Verification

- Fund Transfer and Payment Processing

- Multi-Currency and FX Management

- Transaction Tracking and Notifications

- App Security Aspects for Money Transfer Applications

- End-to-End Encryption and Secure APIs

- Tokenization of Sensitive Financial Data

- Multi-Factor Authentication and Access Controls

- Fraud Detection and Incident Response

- What Legal Standards Apply to Fintech and Money Transfer Apps?

- KYC and AML Regulations Across Regions

- Payment Licensing and Reporting Requirements

- Data Privacy Laws Affecting Financial Apps

- Tech Stack for Money Transfer App Development

- Frontend and Mobile Frameworks

- Backend Architecture and APIs

- Payment Gateways and Banking Integrations

- Security and Compliance Infrastructure

- How AI and Emerging Technologies Are Reshaping Money Transfers

- AI-Powered Fraud Detection and Compliance

- Real-Time Risk Scoring and Automation

- Blockchain and Instant Settlement Innovations

- Choosing the Right Money Transfer App Development Partner

- Fintech Domain Expertise

- Regulatory and Security Experience

- Proven Delivery in Regulated Environments

- Future Trends in Money Transfer Apps Beyond 2026

- Why Enterprises Prefer to Work With Appinventiv for Money Transfer App Development

- FAQs

- Q. Why create a money transfer app?

- Q. How do money transfer apps make money?

- Q. What are the legal standards in money transfer apps?

- Q. Should we build or buy a money transfer platform?

- Q. How much does it cost to build a money transfer app?

- Q. How long does it take to launch a money transfer app?

Key Takeaways

- Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later.

- Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase.

- Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation issues at scale.

- AI-driven risk scoring and monitoring improve fraud detection while keeping legitimate transfers fast and low-friction.

- Long-term success depends as much on sourcing strategy and operational readiness as on core payment features.

- Money transfer app costs typically range from $40K to $400K, driven mainly by compliance scope, payment rails, and scale requirements rather than UI complexity.

Sending money has quietly changed over the last few years. What once involved bank visits, delays, and high fees now happens in seconds from a phone. Industry reports from Business Wire projected the global money transfer app market to grow by $52 billion by 2030, at a compound annual growth rate (CAGR) of about 15 percent, offering a clear money transfer app market overview for enterprises planning long-term investments.

The reason behind this growth is simple. Users no longer compare money transfer apps only with banks. They compare them with the best digital experiences they use every day. Speed matters. Transparency matters. These expectations reflect the real benefits of using a money transfer app in today’s digital-first economy.

And this shift opens up meaningful opportunities for startups, banks, and enterprises. For newer players, it creates room to enter markets that legacy systems struggle to serve efficiently. For established financial institutions, it offers a way to modernize payment infrastructure, retain customers, and unlock new revenue streams tied to digital services rather than branch-led operations.

But building for this space is not just about moving fast. Anyone looking to create a money transfer app in 2026 has to navigate regulatory requirements, security risks, and scalability challenges from day one. The sections ahead provide the money transfer app development guide, including step by step, with a clear focus on technology, compliance, and long-term viability.

Turn this growth into a compliant, scalable product strategy with expert guidance.

Types of Money Transfer Apps You Can Build

Choosing the right app category early is critical when you build money transfer app platforms and evaluate how to make a money transfer app sustainable over time.

As this decision will have a direct impact on architecture, compliance effort, and long-term operating cost. Many platforms struggle later not because of poor execution, but because the initial model was misaligned with scale, regulation, or transaction behavior.

Below are some of the most popular options that you should consider, when

Peer-to-Peer (P2P) Transfer Apps

P2P apps are built around speed and frequency. Most rely on internal ledgers to reflect balances instantly, while actual bank or card settlements happen in the background. This requires event-driven systems, real-time balance checks, and strong retry logic to handle partial failures without duplicating transactions.

When developing a P2P payment app at scale, enterprises run into issues around reconciliation and fraud. Traffic spikes, failed callbacks from payment rails, and account takeover attempts can all create balance inconsistencies if the system is not designed carefully. Monitoring and transaction idempotency become just as important as the transfer flow itself.

Cross-Border Remittance Apps

Cross-border platforms deal with currency conversion, country-specific regulations, and multi-step settlements. International money transfer app development often depends on routing logic that can switch between payout partners based on cost, speed, or availability, while keeping FX rates accurate and transparent.

The enterprise challenge in international money transfer app development is operational complexity. Each new corridor adds compliance rules, settlement timelines, and exception handling. Without configurable FX engines and modular compliance layers, teams end up relying on manual fixes that slow growth and increase risk.

Business and Merchant Payment Apps

Business and merchant apps focus on reliability, auditability, and integration rather than instant consumer speed. These platforms support bulk payouts, payroll, and marketplace settlements, often tied directly to invoices or contracts.

Pain points usually appear in reconciliation and approvals. When payment systems do not align cleanly with ERP or accounting tools, finance teams absorb the overhead. Strong ledger design, role-based approvals, and clean APIs are essential to avoid operational drag as volumes grow.

Bank-Backed and Wallet-Based Transfer Platforms

Bank-backed and wallet-based platforms offer stored balances, instant internal transfers, and regulated access to banking infrastructure. They typically integrate with core banking systems or licensed partners while maintaining real-time wallet ledgers.

Enterprises struggle when tight banking integrations slow product changes. The technical goal is separation: core financial logic must remain stable and compliant, while customer-facing features stay flexible. Without this balance, innovation in digital wallet app development slows down as regulatory dependencies grow.

How to Create a Money Transfer App

Building a money transfer product is not a linear engineering task for teams figuring out how to create a money transfer app that can scale under regulatory and operational pressure.

It is a sequence of business, regulatory, and technical decisions that compound over time. Most enterprise failures in money transfer application development do not come from poor code quality, but from early misalignment between use case, compliance scope, and system design.

The nine steps below reflect how successful platforms approach how to build money transfer app systems in practice.

Step 1: Define Use Case, Target Geography, and User Personas

Every money transfer app that scales well starts with a narrow, well-defined use case. The biggest early mistake enterprises make when trying to create a money transfer app is to support domestic and cross-border flows, consumers and businesses, all at once. That decision multiplies complexity before the foundation is ready.

Key decisions to lock early:

- Domestic transfers vs cross-border remittances

- Single-country launch vs multi-region roadmap

- Consumer users, SMBs, or enterprise clients

This step directly impacts compliance scope, settlement logic, and even UI expectations. Teams that skip this clarity often end up rebuilding core flows within the first year.

Step 2: Choose the Right Regulatory and Licensing Model

Licensing is not just a legal formality. It defines how fast you can launch and how flexible the platform remains long term. Options typically include operating as an EMI, registering as an MSB, or partnering with a licensed bank.

What enterprises usually underestimate:

- Licensing timelines vary widely by region

- Bank partnerships can reduce launch risk but limit control

- Switching models later is expensive and disruptive

For money transfer app development, the wrong licensing choice often shows up as delayed launches, restricted features, or forced architecture changes.

Step 3: Plan Legal Standards in Fintech Compliance

Compliance shapes product behavior, not just backend checks. KYC, AML, and CFT rules influence onboarding flows, transaction limits, and even how quickly users can start sending money.

Key compliance elements to design early:

- Identity verification depth and escalation paths

- Ongoing transaction monitoring rules

- Data retention and reporting obligations

Enterprise teams struggle when compliance logic is scattered across tools. Centralizing these controls early reduces audit pressure and manual intervention later.

Step 4: Design Trust-Centric UX and User Journeys

In money transfer apps, trust is built through clarity. Users want to know where their money is, how long it will take, and what it will cost. Confusing screens or hidden fees quickly erode confidence.

UX priorities that matter in practice:

- Clear onboarding with visible verification steps

- Upfront display of fees and FX rates

- Real-time transaction status and confirmations

For enterprises, poor UX shows up as higher support volume and lower repeat usage, not just lower conversion rates.

Step 5: Finalize the Money Transfer App Tech Stack

The tech stack must support compliance, scale, and reliability, not just fast development. Early shortcuts often turn into long-term constraints once transaction volume grows.

Foundational stack considerations:

- Frontend frameworks that balance performance and security

- Backend services built for concurrency and failure handling

- Infrastructure that supports monitoring, logging, and audits

Teams that build money transfer apps often regret optimizing only for speed to market. A modular, well-structured stack makes future expansion far less painful.

Step 6: Build Core Payment and Settlement Logic

This is the operational core of the platform. Money may move through bank rails, wallets, cards, or real-time payment systems, but the internal ledger must always remain accurate and consistent.

What needs careful design:

- Real-time balance updates with delayed external settlements

- Idempotent transaction handling to prevent duplicate transfers

- Reconciliation workflows between internal ledgers and external providers

- Triple-entry ledger models add cryptographically verifiable records to strengthen audit integrity. Optional triple-entry ledger models, where a cryptographically verifiable or immutable record is added to reduce internal manipulation and strengthen audit integrity

Enterprise pain often shows up when provider outages or delayed callbacks create balance mismatches. Strong retry logic and clear settlement states reduce manual intervention and customer disputes.

Step 7: Implement App Security and Fraud Prevention Measures

Security is not only about protecting data. It is about protecting trust. Encryption and secure authentication form the baseline, but modern fraud rarely looks obvious at first glance.

Key security layers to include:

- End-to-end encryption and tokenization of sensitive data

- Multi-factor authentication and role-based access controls

- Behavioral analysis to detect unusual transaction patterns

Enterprises that rely only on static rules see higher false positives, which frustrates users and overloads support teams. Adaptive monitoring helps balance protection with user experience.

Step 8: Integrate Compliance Automation and Monitoring

Manual compliance does not scale with transaction volume. Screening, sanctions checks, and audit trails must run continuously without slowing down legitimate transfers.

Areas that benefit most from automation:

- Real-time transaction screening and alerts

- Configurable rules for different regions and corridors

- Centralized audit logs and reporting

A common enterprise issue is fragmented compliance tooling. When monitoring systems are disconnected from payment engines, visibility drops and audit preparation becomes painful.

Step 9: Test, Certify, Launch, and Scale the Platform

Testing must reflect real-world conditions, not just happy paths. Regulatory certification, security testing, and load simulations reveal issues that functional testing often misses.

Critical launch considerations:

- Stress testing for peak transaction volumes

- Regulatory sign-off and security assessments

- Operational readiness for support and incident response

Scaling after launch amplifies every design decision. Platforms built with clean separation between core financial logic and feature layers adapt more easily as volumes, regions, and regulatory demands increase.

Costs of Building a Money Transfer Application in 2026

There is no single price for developing a money transfer app. Costs vary based on how regulated the product is when organizations build money transfer app solutions for scale.

Things like: how many payment rails it touches, and how much future growth the system is expected to handle, matters here. In 2026, most builds fall between $40K and $400K, with the gap driven by scope rather than code volume.

What Pushes Costs Up or Down

The biggest cost swings still come from compliance and integration decisions, but AI integration now plays a clear role in both build effort and long-term operating cost.

Key cost drivers include:

- Number of countries and currencies supported

- KYC, AML, and fraud controls required at launch

- Payment rails such as bank transfers, cards, wallets, or real-time systems

- Audit logging, reporting, and reconciliation requirements

- AI integration for fraud detection, risk scoring, and compliance automation

Where AI money transfer app development changes the equation:

- AI-based fraud monitoring increases upfront build cost but reduces manual review and chargeback losses over time

- Automated risk scoring can lower ongoing compliance operations costs

- Poorly scoped AI features often add cost without measurable ROI

This keeps AI grounded in cost impact, not hype, and fits naturally into enterprise decision-making.

How Budget Changes by Build Scope

Instead of thinking in terms of features, it helps to think in terms of readiness. Each level reflects how much operational and regulatory pressure the system can handle.

Typical budget ranges:

- Foundational build ($40K–$100K): Single region, basic transfers, minimal integrations, limited compliance scope.

- Growth-ready platform ($100K–$250K): Multiple payment rails, stronger security, reporting, and modular architecture.

- Enterprise-grade system ($250K–$400K): Cross-border flows, advanced fraud detection, audit readiness, and scale support.

The higher tiers are less about “more features” and more about fewer operational surprises.

Costs That Continue After Launch

Once the app is live, recurring expenses become just as important as build cost. These costs scale with usage and geography.

Ongoing expenses often include:

- Per-user or per-transaction KYC and AML checks

- Payment processing and FX margins

- Cloud infrastructure, monitoring, and support

- Licensing renewals, audits, and regulatory reporting

Enterprises that budget only for development often find margins tightening post-launch. Accounting for these costs early leads to healthier pricing and more predictable growth.

Get a clear cost breakdown based on your region, compliance scope, and payment model.

Sourcing Models for Money Transfer Application Development

How you source development talent has a direct impact on speed, risk, and long-term ownership. In money transfer app development, the wrong sourcing model often shows up later as compliance gaps, slow releases, or heavy dependency on a few individuals. Each model below solves a different problem, and none is universally right.

| Sourcing Model | What It Enables | Key Trade-offs | Best Use Case |

|---|---|---|---|

| In-House Development Teams | Full internal control over roadmap and data | High hiring costs, slower ramp-up, and delayed fintech maturity | Organizations with existing payments infrastructure and regulatory depth |

| Outsourcing to Fintech-Specialized Partners | Faster launch using proven architectures, payment rails, and compliance patternsImmediate access to fintech, security, and regulatory expertiseLower risk during early build and market entry | Requires strong governance and clear IP ownership terms | Enterprises and startups that need to move fast while staying compliant across regions |

| Hybrid / Build–Operate–Transfer (BOT) | Speed of outsourcing with a structured path to in-house ownership | Needs disciplined transition planning | Companies that want external expertise initially, then full internal control |

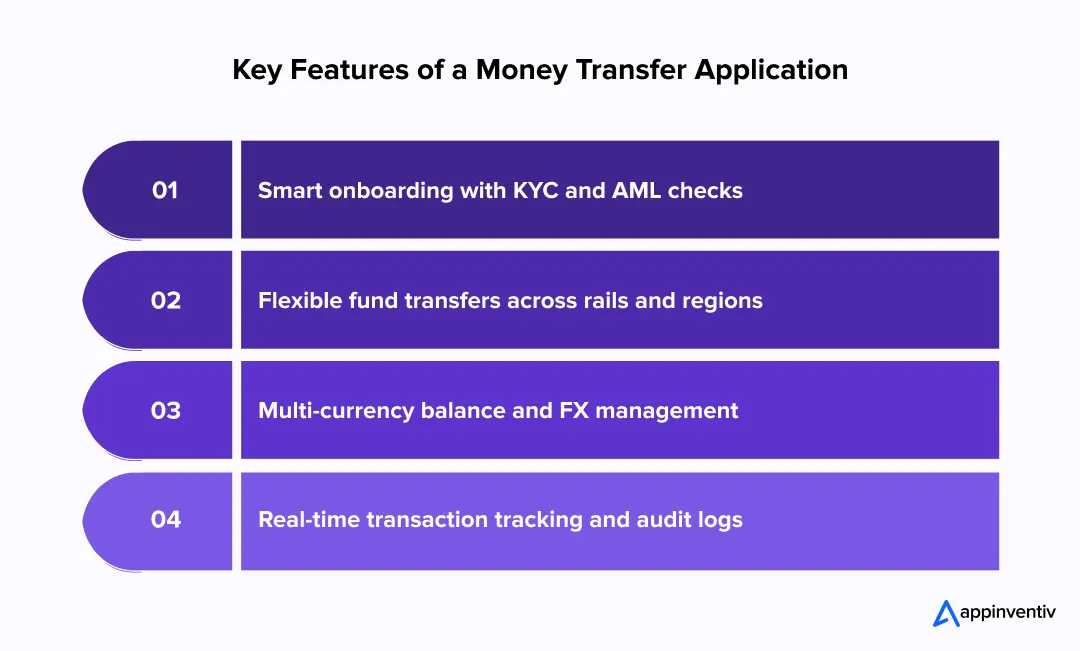

Key Features of a Money Transfer Application

A modern money transfer app is not defined by how fast money moves alone. At enterprise scale, features must reduce operational friction, support regulatory oversight, and handle edge cases without manual intervention. The sections below group the most critical capabilities around how users onboard, move funds, manage balances, and track activity.

User Onboarding and Identity Verification

Onboarding is where trust is either built or lost. For enterprises, weak onboarding creates long-term compliance risk, while overly rigid flows increase drop-offs and support load. Modern platforms balance automation with region-specific controls.

Core capabilities include:

- Account management for adding and updating personal details, billing addresses, bank accounts, and payment cards

- Geography-based KYC, AML, and OFAC verification aligned with local regulations

- Automated approval for low-risk accounts with escalation paths for exceptions

- Multi-language account support for global user bases

- End-to-end audit trails covering every account action and status change

Many enterprise platforms now add a digital assistant to help users resolve account issues without contacting support. This reduces ticket volume while keeping interactions logged for audit and compliance review.

Fund Transfer and Payment Processing

This is the most visible part of online payment transfer app development, and often the most complex behind the scenes. Users expect flexibility in how they send and receive money, while enterprises must ensure accuracy, reliability, and reconciliation across multiple rails.

A complete transfer feature set typically supports:

- Bank transfers using recipient name, address, account number, and SWIFT or IBAN for international payments

- Card-based transfers using cardholder details and expiry information

- In-app transfers via email address, phone number, or wallet ID

- Intrabank and interbank electronic transfers

- Domestic and cross-border payments across supported regions

- Multi-currency transfers, including optional cryptocurrency support

To reduce repeat effort and errors, platforms often allow custom templates for recurring payments such as utilities, telecom bills, insurance, and frequent P2P transfers. Automated fee calculation, instant receipts, transaction notifications, and structured refund requests are essential to avoid disputes and manual handling.

Multi-Currency and FX Management

Multi-currency support introduces more than exchange rates. It affects balances, reporting, fees, and settlement logic. Enterprises frequently struggle when FX handling is bolted on instead of designed into the ledger.

Key FX and balance capabilities include:

- Automated balance updates after every send or receive action

- Deposits from bank accounts, cards, or crypto exchange accounts

- Scheduled and on-demand withdrawals to supported payment methods

- Automatic conversion of balances and transfers into user-defined fiat or crypto currencies

- Dashboards showing live exchange rates and converted balances

When FX logic is centralized and configurable, platforms can add new currencies or corridors without rewriting core payment flows.

Transaction Tracking and Notifications

Transparency reduces support friction. Users want to know where their money is at every stage, and enterprises need visibility for audits, reporting, and issue resolution.

Modern tracking features usually include:

- Real-time views of sent and received funds filtered by date, country, amount, sender, or receiver

- Complete transaction history with clear status changes

- Automated reporting by period, category, transaction value, and geography

- Tracking of fees by type, including international transfer and withdrawal charges

Some platforms also maintain immutable transaction records using blockchain-based ledgers to improve traceability. While optional, this can simplify audits and dispute resolution in high-value or regulated corridors.

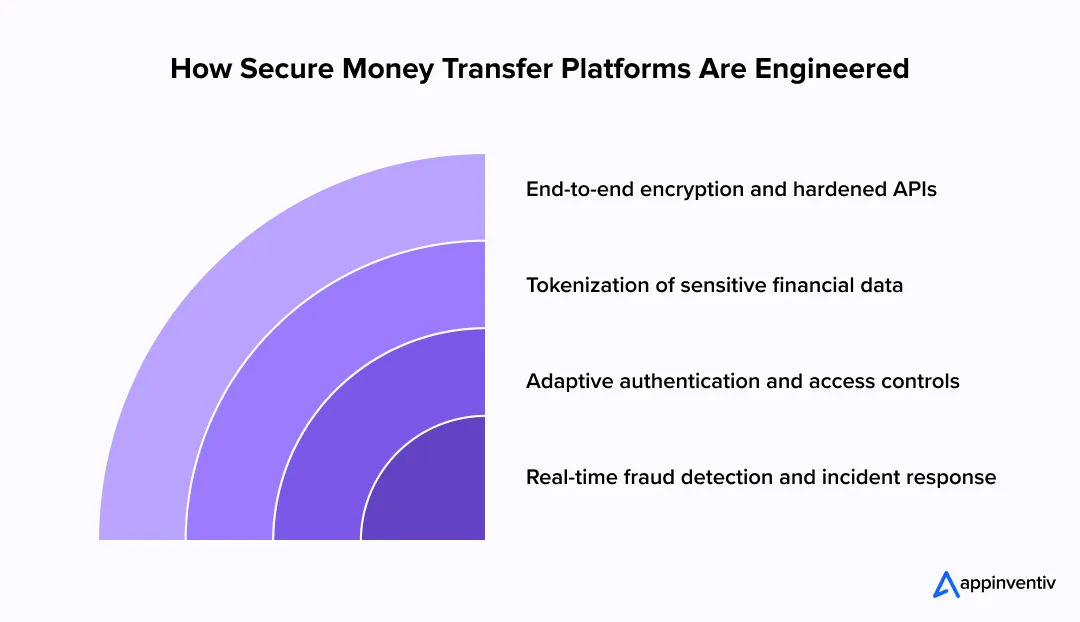

App Security Aspects for Money Transfer Applications

Security in a money transfer app is rarely about one big control. Problems usually appear in the gaps between services, during peak traffic, or when something breaks and teams are forced to respond quickly. That is why security needs to be built into how the system operates, not layered on after the product ships.

End-to-End Encryption and Secure APIs

Encryption should cover every place data moves, not just the obvious ones. External traffic between the app and backend must be protected using modern TLS standards. Inside the platform, services should also authenticate each other rather than assuming anything on the network is trusted.

In practice, teams implement this by:

- Enforcing TLS 1.2 or higher for all external connections

- Using mutual TLS between internal services so each request is verified

- Securing APIs with OAuth-based access tokens and request signing

- Adding rate limits and payload validation at the gateway layer

Where enterprises get caught out is key handling. Secrets stored in code or shared across services become liabilities over time. Centralized key management with regular rotation and access logs makes a noticeable difference once the platform starts scaling.

Tokenization of Sensitive Financial Data

Holding raw financial data is a risk most platforms do not need to take. Tokenization replaces sensitive values with stand-ins that are useless if exposed, while the real data stays locked away.

A practical approach looks like this:

- Use compliant token services for card and bank details

- Keep real values in isolated vaults with strict access rules

- Pass tokens, not raw data, between internal systems

This setup reduces compliance exposure and limits the blast radius of incidents. Teams often run into trouble when tokens are treated as permanent identifiers. Planning for token expiry, re-issuance, and revocation avoids painful migrations later.

Multi-Factor Authentication and Access Controls

Authentication should adapt to context. Logging in, changing account details, and sending high-value transfers do not all carry the same risk, and the controls should reflect that.

In well-run platforms, this means:

- Using secondary factors such as one-time codes or biometrics when risk increases

- Applying stronger checks for sensitive actions, not just logins

- Restricting internal access through role-based permissions

Many security issues do not come from users at all. Internal access is often broader than necessary, and actions go unreviewed. Tight permissions, clear separation of duties, and detailed logs help prevent small mistakes from becoming serious incidents.

Fraud Detection and Incident Response

Fraud rarely announces itself clearly. It usually blends in with normal activity until patterns emerge. Static rules help, but they only catch what is already known.

More resilient fraud detection software combine:

- Real-time risk checks before transactions are completed

- Ongoing monitoring that looks for unusual behavior over time

- Automated alerts and reports when thresholds are crossed

Detection alone is not enough. Teams need to know what to do next. Clear response plans for freezing accounts, handling refunds, and notifying regulators turn stressful incidents into controlled processes rather than fire drills.

When security is handled this way, it stops being a constant bottleneck. It becomes part of the platform’s stability, making audits easier, partners more confident, and growth less risky.

What Legal Standards Apply to Fintech and Money Transfer Apps?

In money transfer apps, legal rules are felt long before anyone reads a compliance report. They show up in onboarding friction, transfer limits, delayed launches, and questions from partners or regulators. For enterprises operating across regions, the real challenge is not knowing the rules exist, but handling overlaps without slowing growth or rebuilding systems later. Teams that factor legal standards into product and architecture decisions early tend to move faster, not slower.

KYC and AML Regulations Across Regions

KYC and AML rules define who can use the platform, how quickly they can transact, and what happens when activity looks suspicious. While most countries follow the same high-level principles, the way those rules are enforced varies widely.

What enterprises usually need to account for:

- FATF guidelines as the global reference point for AML software development and counter-terrorist financing

- In the US, FinCEN requirements including customer identification, ongoing monitoring, and SAR filings

- In the EU and UK, AMLD5 and AMLD6 rules, stronger checks for higher-risk users, and alignment with strong customer authentication

- Across APAC and the Middle East, local regulators often impose stricter onboarding steps, transaction limits, or data access requirements

A frequent mistake is assuming one KYC automation flow can work everywhere. In reality, document types, review depth, and approval timelines need to flex by country to stay compliant without hurting conversion.

Payment Licensing and Reporting Requirements

Licensing determines who is legally allowed to move money and how that activity is supervised. The choice made here affects not only legal exposure, but also technical architecture and partner dependencies.

Most platforms follow one of these paths:

- Registering as a Money Services Business in the US

- Operating under an EMI or Payment Institution license in the EU or UK

- Partnering with a licensed bank that sponsors payment activity

Licensing is only part of the picture. In the EU, upcoming frameworks such as PSD3 are pushing stricter expectations around payment authorization, fraud liability, and platform accountability, directly influencing how money transfer apps design authentication and dispute handling.

Data Privacy Laws Affecting Financial Apps

Money transfer apps sit at the intersection of identity data, financial records, and behavioral signals. Privacy laws shape where that data can live, how long it can be stored, and who is allowed to access it.

Regulations enterprises commonly need to design around include:

- GDPR in the EU, with strict rules around consent, access, and data deletion

- CCPA and CPRA in the US, which emphasize transparency and user control

- PDPL frameworks across the Middle East and parts of Asia, often tied to local data residency

- Cross-border data transfer restrictions that limit how financial data moves between regions

- The EU AI Act, which introduces governance requirements for AI-based risk scoring, fraud detection, and automated decision-making used in financial platforms

In practice, this means building clear consent flows, limiting data retention by default, and tightly controlling internal access. Tension often arises between privacy requirements and fraud or analytics needs, which is why legal and engineering teams have to stay closely aligned.

When legal standards are treated as part of the product foundation rather than a follow-up task, compliance becomes easier to manage. For global money transfer platforms, this approach reduces launch delays, simplifies audits, and avoids the cycle of constant fixes that slow teams down over time.

Tech Stack for Money Transfer App Development

When enterprises build money transfer app infrastructure, their tech stack must answer three questions early: can it handle failures without breaking balances, can it satisfy audits without manual work, and can it evolve without vendor lock-in. Everything else is secondary.

Frontend and Mobile Frameworks

The frontend is responsible for more than screens. It controls how sessions are protected and how safely users interact with money.

Practical choices:

- Native iOS and Android when biometrics, secure storage, and performance are critical

- Cross-platform frameworks when speed matters, backed by native layers for payments and auth

Design considerations:

- Use OS-level secure storage for tokens and keys

- Enforce re-authentication for high-risk actions

- Design UI states that prevent duplicate transfers during network issues

Backend Architecture and APIs

The backend must behave like a financial system, not a typical application. Every transaction should be traceable, reversible where possible, and consistent under retries.

What to prioritize:

- Clear separation between ledger, payment orchestration, and compliance logic

- Event-driven processing for provider callbacks and settlement updates

- Idempotent APIs and explicit transaction states

What often breaks at scale:

- Multiple systems claiming ownership of balance truth

- Missing audit context when failures occur

Payment Gateways and Banking Integrations

Payment integrations are the most unstable part of online payment transfer app development, especially across regions. Providers change terms, go down, or behave differently across regions.

How to design for this:

- Abstract all providers behind internal services to support cleaner integrations for money transfer software

- Support multiple rails based on geography and use case

- Centralize FX and fee calculation

What enterprises regret later:

- Hard-coded provider logic that blocks expansion or pricing changes

Security and Compliance Infrastructure

Security tooling should support operations, not slow them down. Teams need visibility and control when something goes wrong.

What belongs in the stack:

- Centralized logging with tamper-evident audit trails

- Managed key storage with rotation and access tracking

- Real-time fraud signals tied directly to transaction flow

- Automated compliance checks with review workflows

What usually causes friction:

- Logs and alerts spread across tools, making audits and incidents harder to manage

For ESG-focused enterprises, inefficient infrastructure also increases cost and carbon footprint, making cloud optimization and workload efficiency part of emerging Green Fintech considerations

How AI and Emerging Technologies Are Reshaping Money Transfers

Money transfer systems used to scale by adding more infrastructure, but AI-led automation has become one of the strongest money transfer app development trends, especially in AI Money Transfer App Development. AI and newer technologies are changing how platforms make decisions, not just how fast money moves.

AI-Powered Fraud Detection and Compliance

Fraud rarely looks obvious anymore. Most attempts blend into normal user behavior until patterns emerge over time. AI models help by learning what “normal” looks like for a platform and flagging behavior that quietly deviates from it. This could be an unusual sequence of transfers, device changes, or timing that static rules would ignore.

On the compliance side, AI is increasingly used to sort signal from noise. Instead of overwhelming teams with alerts, systems can rank cases by risk and surface the ones that actually need attention. For enterprises, this reduces manual workload and makes compliance reviews more consistent as transaction volume increases.

Real-Time Risk Scoring and Automation

Risk used to be assessed after money had already moved. That model does not hold up at scale. Real-time risk scoring evaluates a transfer as it is happening, using inputs like user history, recent activity, location shifts, and transaction velocity.

The practical benefit is control without blanket friction. Low-risk transfers clear immediately. Higher-risk ones trigger extra checks or short delays. This approach keeps everyday payments fast while still giving teams levers to slow things down when something does not look right.

Blockchain and Instant Settlement Innovations

Blockchain tends to attract attention for the wrong reasons. In practice, most money transfer platforms are not replacing banks with blockchains. Instead, they use distributed ledgers selectively where traceability or settlement speed is a real problem.

For certain cross-border corridors or internal settlement flows, blockchain-based records can simplify reconciliation and reduce disputes. The value is not theoretical decentralization, but clearer transaction histories and fewer settlement delays. Used carefully, it becomes another tool in the stack rather than a wholesale replacement.

Choosing the Right Money Transfer App Development Partner

Choosing a development partner to build money transfer app platforms is less about coding capacity and more about risk management. Payments sit at the intersection of regulation, security, and user trust. The wrong partner can move fast early and still leave you blocked at launch or during audits. The right one helps you avoid those moments altogether.

Fintech Domain Expertise

Money transfer platforms behave very differently from standard consumer apps. They involve ledgers, settlement timing, reversals, and failure scenarios that only show up at scale. A partner with real fintech experience understands these edge cases before they become production issues.

What to look for:

- Experience building payment flows, wallets, or remittance platforms

- Familiarity with multi-rail transfers and reconciliation logic

- Ability to design systems that stay consistent under retries and outages

Teams without this background often learn through trial and error, which is expensive in regulated environments.

Regulatory and Security Experience

In fintech, delivery speed means little if the product cannot pass compliance checks. A capable partner should understand how regulations affect architecture, onboarding, and data handling, not just documentation.

Key indicators:

- Hands-on experience with KYC, AML, and transaction monitoring workflows

- Knowledge of regional compliance expectations across major markets

- Strong security practices embedded into development, not added later

Enterprises frequently struggle when compliance and security are treated as separate phases. Partners who design with these constraints upfront reduce rework and launch delays.

Proven Delivery in Regulated Environments

Past delivery matters more than promises. Regulated products expose weaknesses quickly, whether through audits, partner reviews, or real-world incidents. A partner that has already navigated these environments brings practical judgment, not just technical skill.

Signs of maturity:

- Case studies or references in fintech or adjacent regulated sectors

- Experience supporting audits, certifications, or regulatory reviews

- Clear delivery processes with documentation and knowledge transfer

Ultimately, the right partner acts as a stabilizing force. They help you move faster by avoiding the mistakes that slow teams down later, especially once real money and real regulators are involved.

Future Trends in Money Transfer Apps Beyond 2026

Money transfer apps are slowly disappearing into the products people already use. Instead of opening a separate app to send money, users are starting to move funds as part of doing something else, whether that is paying a freelancer, buying a service, or settling a subscription.

Embedded Finance and Invisible Payments: Payments are becoming a background function. For businesses, this means building transfer capabilities into their platforms rather than pushing users through separate payment flows. The challenge will be keeping those payments compliant and traceable even when they are barely noticed by the user.

Interoperable Global Payment Networks: Cross-border transfers are still more complicated than they should be. Over time, better links between domestic payment systems will reduce delays and intermediaries. Platforms that plan for this flexibility now will find expansion easier later.

Hyper-Personalized Financial Experiences: Not every user needs the same checks or limits. Future apps will adjust how they behave based on usage patterns and risk, tightening controls where needed and staying out of the way when things look normal. Doing this without making users uncomfortable will matter more than clever features.

The direction is clear. Money transfer apps will feel quieter and simpler on the surface, even as the systems behind them become more capable.

Why Enterprises Prefer to Work With Appinventiv for Money Transfer App Development

Enterprises building money transfer platforms look for partners who understand that payments are systems of record, not just user-facing apps. What differentiates Appinventiv is its ability to design platforms that handle transaction integrity, compliance pressure, and scale from the outset, rather than treating these as later-stage fixes. This approach reduces launch risk and avoids costly architectural rework as volumes grow.

With deep experience in payment software development, Appinventiv focuses on the foundations that matter in regulated environments. Ledger accuracy, settlement workflows, reconciliation logic, and audit readiness are addressed early, so enterprises are not forced to patch gaps once real money and regulators enter the picture. This system-first mindset is especially critical for cross-border and multi-rail payment platforms.

Appinventiv’s fintech app development services are shaped by hands-on delivery of financial products that deal with sensitive user data and real financial behavior. Work on platforms like the Mudra budget management app and the EDFundo financial literacy app reflects an understanding of how users interact with money, how trust is built through clarity, and how financial products must balance simplicity with responsibility.

For enterprises, this translates into fewer surprises after launch. Teams benefit from a partner that has already navigated security reviews, compliance expectations, and scale-related edge cases, allowing internal stakeholders to focus on growth instead of firefighting.

If you are planning to create a money transfer app or scale an existing one, partnering early with a team that understands regulated fintech can make the entire journey more predictable and far less disruptive. Don’t wait, consult with us.

FAQs

Q. Why create a money transfer app?

A. Most businesses move in this direction when existing payment tools start feeling restrictive. Money transfer app development gives enterprises control over how money moves, how fees are structured, and how users experience transactions. It also reduces dependency on third-party platforms and opens the door to embedded payments, cross-border services, and new digital revenue streams.

Q. How do money transfer apps make money?

A. Revenue usually comes from small cuts taken at different points. Transaction fees and foreign exchange margins are common, especially for cross-border transfers. Some platforms earn through premium features, subscriptions for business users, or B2B services like bulk payouts and APIs. Over time, value-added services tend to matter more than basic transfer fees.

Q. What are the legal standards in money transfer apps?

A. Legal requirements depend heavily on where the app operates. Most platforms need to follow KYC and AML rules, maintain transaction records, and meet licensing or reporting obligations. Data privacy laws also apply, especially when handling financial and identity data. The challenge is not knowing these rules exist, but building systems that can adapt as regulations change across regions.

Q. Should we build or buy a money transfer platform?

A. Buying or white-labeling can get you to market quickly, but it often comes with limits around customization and long-term flexibility. Building takes more time upfront, but it allows tighter control over compliance, integrations, and user experience. That’s why how to build a money transfer app is a common question many enterprises ask. However, it is advised to choose based on how central payments are to their product and how much ownership they want over the platform.

Q. How much does it cost to build a money transfer app?

A. Costs vary widely, but most projects in 2026 fall somewhere between $40,000 and $400,000. Simpler, single-region apps sit on the lower end. Platforms that support multiple countries, a key requirement in international money transfer app development, move toward the higher end. Compliance and integrations usually cost more than UI design.

Q. How long does it take to launch a money transfer app?

A. Timelines depend on scope. A basic domestic app can launch in a few months. Products that involve licensing, cross-border transfers, or deeper compliance checks take longer, often closer to six to nine months. Regulatory reviews and integration testing tend to be the biggest variables.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Building a Custom ACH Payment Software - Benefits, Features, Process, Costs

Key takeaways: A custom ACH payment system helps enterprises cut payment fees, reduce delays, and gain full control of payouts and collections. Modern ACH payment software development supports high-volume transactions, real-time tracking, and faster handling of errors. Strong compliance with NACHA rules, bank-grade security, and role-based access remain core parts of an enterprise ACH setup.…