- LLM Architecture in the Financial Sector

- User Interface Layer

- Orchestration Layer

- Data Processing and Retrieving

- Prompt Engineering

- LLM Interaction

- Response Delivery Validation

- Constant Upgrade and Feedback

- Benefits of Financial Large Language Model (LLM)

- Enhanced Data Analysis & Insight Creation

- Transforming Operating Costs & Efficiency

- Making Customer Experience and Engagement Great

- Helping Human Decision-Making Augment

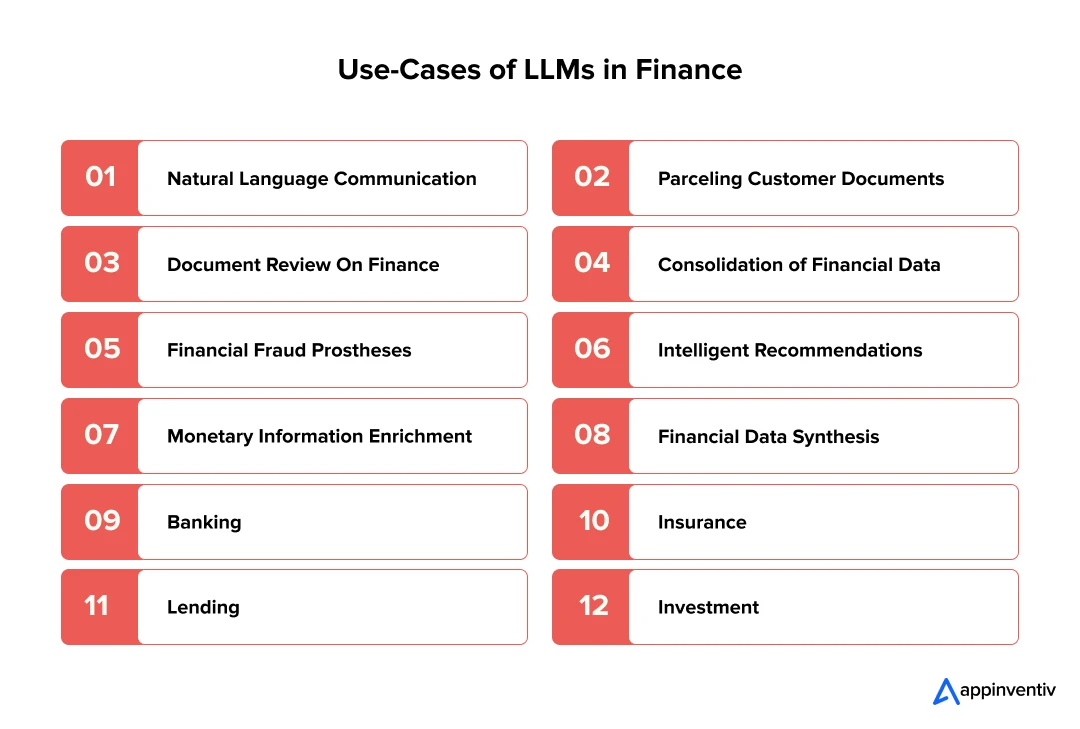

- Use Cases of LLMs in Financial Services

- General LLMs Models For Financial Services Applications

- Industry-Specific LLM Use Cases

- Real-World Corporate Finance LLM implementation

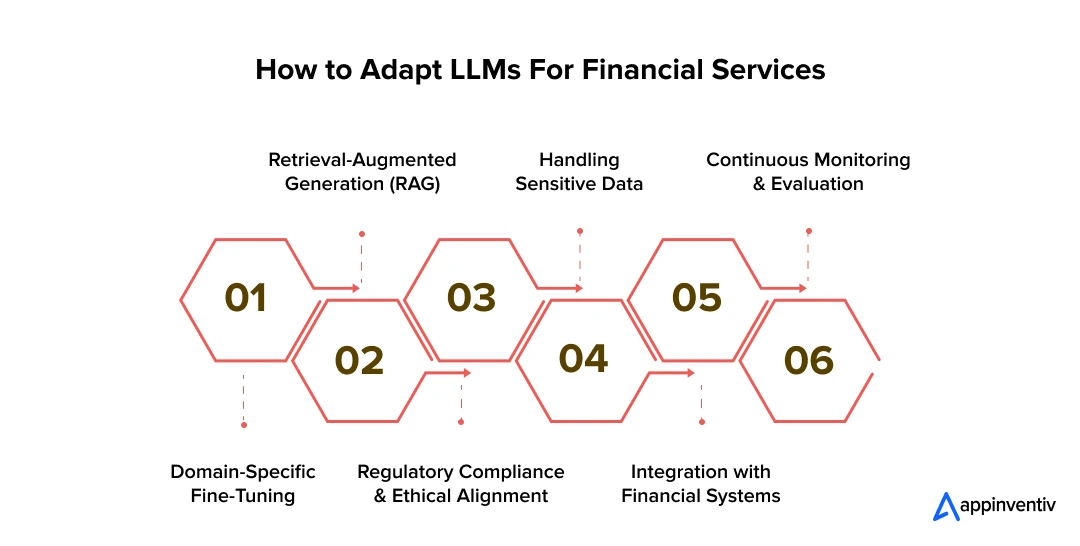

- Ways to Adapt LLMs for Financial Services

- Domain-Specific Fine-Tuning

- Retrieval-Augmented Generation (RAG)

- Regulatory Compliance and Ethical Alignment

- Handling Sensitive Data

- Integration with Financial Systems

- Continuous Monitoring and Evaluation

- Costs of Implementing an LLM Solution for Financial Services

- Factors Affecting the Cost of Implementing an LLM Solution for Financial Services

- Strategies for Optimizing the Cost of Implementing an LLM Solution for Financial Services

- Choose Appinventiv as Your Tech Partner to Develop LLM Solutions For Finance

- Why should you collaborate with Appinventiv to develop your LLM?

- FAQs

Key takeaways:

- LLMs in finance enhance data analysis by processing vast structured and unstructured datasets.

- Automation via LLMs reduces operational costs and frees staff for strategic tasks.

- Smart chatbots powered by LLMs improve customer experience with personalized advice.

- LLMs enable real-time fraud detection and risk assessment, enhancing security.

- Fine-tuning and RAG ensure LLMs deliver accurate, compliant financial solutions.

The financial world is undergoing a seismic shift, it is not a market crash or a new geopolitical confrontation that is causing it. It has an engine that is silent and smart, but is completely rewriting the rules of engagement: large language models for finance (LLMs).

Trading, compliance, and finance in general were developing over decades based on data analysis and human knowledge. However, what would be the implication of an AI assistant that was able to not only read market data in real-time but also could make sense of the subtle language of an earnings call of a CEO, a new policy of a regulator, or a complex customer request?

As a business leader in the sphere of finance, you are probably standing at a crossroads.

On the one hand, the expectation of incredible rates of efficiency, hyper-personalization of the client experience, and advanced risk management. And, on the other hand, the perfectly understandable reluctance: What are the actual dangers? Once you have it, how do you go about applying this technology without destroying your core business? And then how do you cut through the hype versus the real differences that can make a difference to the game?

Forecast: Large Language Model (LLM) Market Size Forecast 2034

In 2024, the market size of the large language model (LLM) was estimated to be USD 5.73 billion. The market would expand since the price of USD 7.79 billion in 2025 would be USD 130.65 billion in 2034, portraying a compound annual growth rate (CAGR) of 36.8 percent during 2025-2034. (Source: Polaris Market Research)

It is a deep dive for you. We shall cut through the hype and discuss the actual potential of LLMs in the field of finance, demystifying the headlines to bring forth useful uses of this technology, real-life case studies, and an objective understanding of the advantages and the pitfalls. Not only will you know why LLMs are the future of finance, but you will also have a roadmap of how LLM for finance work out.

Supercharge efficiency, personalize client experiences, and master risk management. All with a success-driven LLM solution now!

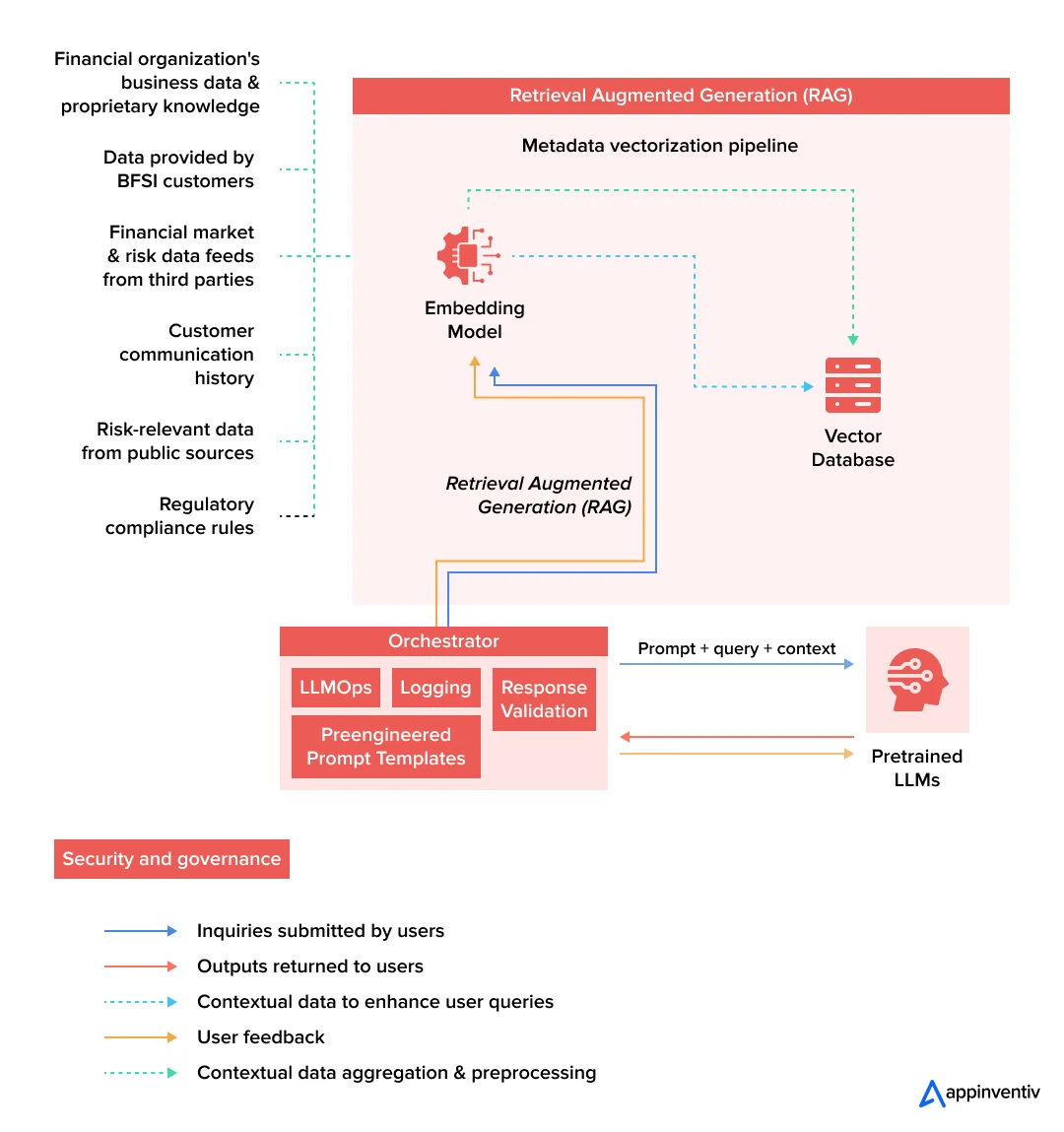

LLM Architecture in the Financial Sector

Before gaining a deeper understanding of how LLM operates in the financial sector, it is important to comprehend the key Financial LLM Solution Architecture. Overall, it would suffice to apply cost-effective techniques of Retrieval-Augmented Generation (RAG) and timely engineering techniques to achieve precise and relevant LLM responses in most instances. A sample RAG-enabled LLM in finance solutions architecture may be found below:

User Interface Layer

Role-Based Applications LLM:

- It means that dedicated applications of LLM in finance are interacted with by users (e.g., account managers, underwriters, claim specialists, BFSI customers).

- Apps are built to perform certain tasks to handle customized financial processes and needs.

Deployment Options:

- Dedicated use case standalone solutions.

- Integration into existing programs, including consumer credit administration systems, insurance portals, or mobile banking.

- Browser plug-ins provide a smooth entry in web-based workflows.

Orchestration Layer

Prompt Processing:

- Orchestrator accepts and swiftly processes user prompts in the application back end.

- Serves as the heart of the data retrieval, timely engineering, and LLM interaction.

Triggers of Data Retrieval:

- Checks details in the data storage of the financial firm to obtain prompt and imminent prepared data (e.g., names, dates, rates, indices).

- At the same time, it submits the query to the RAG embedding model to retrieve unstructured contextual data.

Data Processing and Retrieving

Structured Data Retrieval

- Retrieves structured data relevant to the company in support of the user prompt.

- Examples are account information of various customers, transaction records, or market indices.

Unstructured Data Retrieval (RAG Process):

Data Preparation:

- Unstructured data (e.g., financial records, history of customer interaction, regulatory policies, etc) is cleaned and chunked.

- Translated into multidimensional vectors for a semantic search.

- A vector database stores the data in a way that facilitates its retrieval.

Hybrid Search:

- The RAG embedding model is capable of retrieving pertinent unstructured contextual information depending on the prompt.

- A reranking model is used to retrieve results, rescore, and combine them into an ideal set of output.

Prompt Engineering

Prompt Enrichment:

- It is where the orchestrator integrates structured and unstructured data with the initial user prompt.

- Incorporates the data into a pre-engineered prompt template, and:

- Popular questions in the financial sphere.

- Terminologies and requirements of a financial nature.

- The LLM providers establish prompt length limits.

Custom Prompt Template:

- Leveraged to maximise the role of LLM in the FInance industry.

- Be relevant, precise, and conform to constraints in any given field.

LLM Interaction

Rout to Pretrained LLM:

- The augmented prompt is fed to the pretrained LLM embedded to handle it.

- It uses the LLM to receive the prompt and create a response, usually with source data links and citations where possible to be transparent.

LLMOps Framework:

Part of the orchestration layer to allow weekly communication between:

- LLM in finance applications.

- Pretrained models.

- Contextual sources of data.

Provides scalability, monitoring, and maintenance of LLM for finance operations.

Response Delivery Validation

Response Validation:

- The inference of the LLM is recorded, and the orchestrator checks accuracy/relevance.

- Make sure the answer correlates with the user’s request and the financial situation.

Response Delivery:

- The financial LLM app development interface sends the user validated responses.

- It has citations and references to source data, making it more transparent and reliable.

Constant Upgrade and Feedback

User Feedback:

- The users give comments as to the importance and adequacy of the response given by the LLM.

- The quality of output is evaluated with the help of received feedback.

LLM Reinforced Learning:

- The LLM for finance is optimized using reinforcement learning by user feedback.

- Enhances the performance of the model over time, resulting in higher accuracy and user satisfaction.

This architecture delivers a robust and scalable user-friendly RAG-enabled financial tailored LLM solutions for BFSI that encompasses a combination of structured and unstructured data and advanced Orchestration and continuous learning.

Benefits of Financial Large Language Model (LLM)

The financial industry is being transformed with large language models in finance, enabling the optimized management of data and operational rhythms, customer interactions, and decision-making. The best advantages and effects of their use are developed below in a structured manner.

Enhanced Data Analysis & Insight Creation

- Advanced Data Processing: LLM in finance perform better with large volumes of structured and unstructured data, such as news articles, market reports, social media, and legal documents, to identify complex relationships and patterns that human analysts might miss.

- Solving the Data Silo Problem: LLMs can combine disparate data, such as regulatory filings, market news, and internal transactions, to generate a coherent, contextual set of information that allows a comprehensive view of the financial world necessary to find risks, as well as opportunities.

- Democratisation of Financial information: LLMs bring clarity and accessibility to complex data, such as in the financial world, and demystify the so-called translation tax, allowing non-financial specialists to make use of economic knowledge, creating a culture of data-driven within companies.

Bonus Read: How Data Analytics in FinTech Drives Smarter Decisions

Transforming Operating Costs & Efficiency

- Task Automation: Task automation involves automating labor-intensive duties of financial reporting, earnings summaries, compliance document processing, and data entry, which can be significantly reduced both in time and resources with the help of LLMs, as they ensure minimal errors.

- Strategic Workforce Reallocation: As LLMs take up some routine jobs, finance professionals will now be in a position to dedicate time to high-value work such as sophisticated problem-solving and crucial decision-making, and building skills through upskilling of the workforce will be required.

- Faster Response and Detection of Discrepancies: Organizational ability to respond quickly to difficulties and/or flag issues in real time enhances organizational agility and responsiveness in the market and operations of organizations.

Bonus Read: Intelligent Automation: How should Enterprises get Started?

Making Customer Experience and Engagement Great

- Smart Chatbots and Virtual Assistants: LLMs are used to build AI-based chatbots that deliver online customer service instantly and based on individual needs, answer mundane questions (checking account balance) and walk customers through complex tasks (lending application process), resulting in lower wait time and higher satisfaction.

- Relational and Advisory Interactions: LLMs will see a paradigm shift away from the traditional chatbot to more originality in relating to customers and providing them with personalised investment advice and help to actualise this relationship as empathetic and investor relation building.

- Personalizing Financial Advice: LLMs can empower specialized financial advice to a much larger and underserved population, personalizing experience across the customer base depending on their needs, and providing financial skills to clients who would otherwise not be in the high-net-worth client realm.

Helping Human Decision-Making Augment

- Evidence-Based Forecasts & Predictions: LLMs can make predictions on market trends, fluctuations in stock prices, and economic behaviors based on information found in large data sets, allowing stakeholders in the finance industry to make proactive decisions informed by data.

- Efficient Strategic Analysis: LLM makes data aggregation and summary automated, enabling those organized with strategic planning to concentrate on the more diffuse strategic work of making the high-level choices, upgrading sources of analysis from the role of data handlers to strategic analysts.

- Real-Time Market Responsiveness: LLMs’ ability to quickly analyze real-time data enables rapid responses to market volatility, ensuring institutions have opportunities and a competitive advantage in rapidly evolving and fast-paced financial markets.

Bonus Read: Why Financial Analytics is Becoming Important For Enterprises

| Benefit Category | Influence on Finance |

|---|---|

| Improved Data Analysis & Insight generation | Facilitates predictive forecasting of opportunities in the market and risks. |

| Efficiency (cost reduction) | Lessens the operating costs and shortens timelines. |

| Improving Customer Experience & Engagement | Increases customer retention and increases access to services. |

| Human Augmentation | Enhances the accuracy of investment and planning effectiveness. |

Skyrocket retention by 20%, cut manual tasks by 35%, and boost ATM service by 92% with our LLM-driven AI solutions.

Use Cases of LLMs in Financial Services

These numerous Large Language Models Applications in Financial Services are providing perceptible changes that not only address financial issues but also enable the users to have the high-end automation power. Broadly, there are majorly 2 types of LLMs for financial applications. Now it is time to discuss various LLM use cases in BFSI ans see how how the challanges of financial services solved by LLM.

General LLMs Models For Financial Services Applications

Natural Language Communication

Challenges: With the widespread use of computerization in the banking/financial services sector, there has been a loss of the personal, human touch in customer interactions and encounters, which feels alien and distant. Moreover, staff members will have to spend a lot of time interpreting complicated financial information into a digestible presentation.

How LLM addresses this:

- LLMs drive smart chatbots and virtual assistants and can advise in an individualized and instant responsive manner in a simple, humanlike, and compassionate way.

- These models are capable of producing outputs such as emails written to clients or personalized explanations of portfolios in a manner that financial specialists and consumers expect.

- They also have the capability of simplifying complex financial terms to be understandable to the ordinary customer.

Impact: This can rebuild the personal contact, endearing greater trust and loyalty between the financial institutions and the clients. It is also able to democratize financial information and free employees to focus on more productive knowledge work since they no longer need to perform routine tasks.

Parceling Customer Documents

Challenges: Most of the processing of customer documents, such as loan applications and financial statements, is done traditionally and is also associated with human error. Many of the documents in an enterprise also have visually challenging and irregular layouts, which are difficult to interpret using traditional systems.

How LLM addresses this:

- These complex documents are handled, with remarkable accuracy, by using LLMs, usually in concert with Intelligent Document Processing (IDP), to automatically subdivide, label, and extract structured data such as from invoices, receipts, and other documents.

- When compared with traditional systems, LLMs are capable of understanding not only the text but also the meaning and the context of the information retrieved by the model, enabling it to deal with nuances and variations.

- Exploit a layout-sensitive generative language model that utilizes the bounding box data to reason about visual documents and outperforms the other state-of-the-art LLMs on document intelligence tasks.

Impact: This form of automation decreases the number of manual errors dramatically, and it increases document processing time, thereby enabling employees to engage in more valuable activities. It can also turn stagnant documents into practical knowledge that has not been seen before by uncovering concealed patterns and abnormalities.

Document Review On Finance

Challenges: It is said that, on average, it takes a financial analyst or a legal professional several full-time equivalents to sort through thousands of pages of financial reports, contracts, and regulatory filings. There are also risks associated with this manual process, as it can be prone to errors or lack details.

How LLM addresses this:

- LLMs are used as research assistants, helping to quickly sort through millions of documents to find and summarize important information across a variety of sources. They can derive valuable information in long reports such as SEC (10-K and 10-Q) and earnings transcripts.

- This is achieved by assisting its corporate bankers to prepare meetings with clients; this is done by researching and summarizing thousands of economic data points and other global statistics.

Impact: The technology saves a lot of time and effort in the process of due diligence and analysis, allowing human economists/experts to focus on the bigger picture and be more strategic and critical. This also enhances efficiency and hence limits human error.

Consolidation of financial data

Challenges: One major gripe that financial institutions have is the need to break the data silos, which prevent meaningful information from being centralized into a few connected databases and information sources, such as regulatory filings, market news, transaction patterns, and internal documentation. This highly diverse data traditionally encountered in different financial systems is not usually processed and unified, allowing multi-sided visibility to come into picture.

How LLM addresses this:

- LLMs can continue to interpret dissimilar flows of information into a single contextual picture. They may be able to recognize subtle risk patterns and market opportunities that a traditional rule-based system would fail to find.

- They are competent to analyse structured data, such as a spreadsheet, and unstructured data, such as an invoice, and a budget PDF.

- This enables them to derive important data points from different sources and condense them into actionable insights and reports.

Impact: This functionality eliminates the data silos, resulting in a more comprehensive, holistic view of making decisions. It converts stagnant documents into decisions and actions that provide insight into the regular paperwork, revealing patterns and aberrations previously unseen.

Financial Fraud Prostheses

Challenges: The detection of fraud based on rules cannot always keep up with novel and new fraud schemes. The main issue here is that fraudsters tend to create network patterns that resemble normal patterns, a process termed neighborhood camouflage to avoid detection by conventional systems.

How LLM addresses this:

- Graph Neural Networks (GNNs) can be combined with LLMs to detect delicate anomalies and patterns in user behavior and transactions. The method is useful in solving the neighborhood camouflage issue because one can use LLMs to recover the discriminative text from the transaction descriptions to reveal intrinsic attributes that distinguish between fraudulent and normal nodes.

- Generative AI can synthesize fraudulent activities that are used to train machine learning algorithms, which are furthermore more successful in identifying and distinguishing between genuine and fraudulent devices.

Impact: Through their ability to detect unusual behaviours more quickly than humans, LLMs have the potential to proactively inform customers about the possibility of scams in real time, preventing financial loss by warning the customer before being sent off. LLMs will increase the awareness of the fraud patterns and, therefore, enhance the safety and integrity of operations and decrease losses.

Intelligent Recommendations

Challenges: Delivering personalized financial advice and product recommendations is usually intensive in human resources and is reserved mostly for high-net-worth clients. Conventional recommendation systems are based on old trends and may struggle to provide novel recommendations until there is enough information.

How LLM addresses this:

- Virtual assistants and chatbots that LLM can power will be able to analyze an individual customer in terms of their financial history, desired investment goals, and up-to-date market rates to offer the best financial advice and active assistance with how and what to invest and save.

- They can interpret multi-faceted and complex questions, and keep conversational context over multiple turns so that their answers are relevant and elaborate.

- LLMs can also use common knowledge to suggest products based on certain life events (e.g., a mortgage on purchasing a house) and consider an existing portfolio of products to recommend a complementary one.

Impact: This has a democratization effect, opening access to high-quality financial advice to a large number of customers by leveraging human knowledge at scale. It also improves customer satisfaction and loyalty since it changes service to relational as opposed to transactional, providing empathetic, personal, and advisory customer service.

Monetary Information Enrichment

Challenges: The problem with not having adequate and good quality training data, especially on niches or emerging risks, is a common problem in the financial sector. Traditional credit scoring systems are based on narrowly defined structured data, and thus may exclude those with thin credit files or other non-traditional sources of income.

How LLM addresses this:

- Generative AI can generate synthetic data that faithfully mirrors real-world conditions and be utilized to construct and check models, in particular, in risk assessment and portfolio optimization.

- LLMs can also use the model to collect and incorporate a great variety of multi-dimensional unstructured data, such as reports from analysts and corporate disclosures, with the traditional structured data to create more comprehensive models.

- This facilitates supplementing conventional credit scoring with alternative data, such as payment history in a telecommunications or utility company and social media activity.

Impact: This method can be used in constructing powerful models even out of minimal original data and enhances financial inclusion, enabling the assessment of credit risk of a broader section of the population that would be ignored when using conventional models.

Financial Data Synthesis

Challenges: The problems stem from the lack of labeled data on a particular financial task, such as fraud detection, and thus, no robust machine learning model can be built. Moreover, such regulations as GDPR and FINRA restrict training on sensitive personal data of real customers.

How LLM addresses this:

- Generative AI can be used to generate synthetic data of fraudulent transactions to supplement machine learning models, enhancing their ability to detect fiducial patterns and distinguish between genuine and fraudulent ones.

- Equally, synthetic data that models and stress-tests new or complex risk scenarios underwriting and risk management can be generated using generative AI. This synthetic information is utilizable without any privacy and security issues connected with the purchaser’s information.

Impact: This helps to increase the accuracy of fraud detection, helps systems learn with newer fraud behaviors, and can be used to generate new risk datasets off underwriting without sensitive, real-world data.

Industry-Specific LLM Use Cases

large language models in finance are revolutionizing the financial sector by enhancing efficiency, personalization, and decision-making. In banking, insurance, lending, and investment, LLMs drive innovative use cases, streamlining operations and improving customer experiences while navigating complex regulatory landscapes.

Banking

Challenges: Balancing the requirements of efficiency alongside the will to give a more individual customer experience that has been lost during the digital era is the primary issue for the banks. Most of the time consumed by employees in an organisation involves doing manual and repetitive work, such as extracting important data from loan applications and handling simple customer inquiries, and this leads to bottlenecks in operations.

How LLM addresses this:

- LLM lets you create intelligent chatbots and virtual assistants that can give customized guidance to customers 24/7.

- With a vast number of queries possible, including balance checking, fraud detection, and proactive financial guidance based on a customer’s historical trends and risk profile, these tools can successfully operate on a large scale.

- At the back end, LLMs make employees more effective, as they extract information from documents, write emails, and analyze possible fraud, which promotes workflows.

Impact: This two-track strategy brings a personal touch back to the banking business and improves customer satisfaction and retention levels considerably through its detailed, compassionate client service. It also makes a dramatic difference in the productivity of employees, as the time it takes to complete a task can be accomplished in seconds as opposed to minutes, and this enables employees to concentrate on more complex and strategic undertakings.

Insurance

Challenges: Financial Services Solutions Issues that LLM can solve: The insurance industry has complicated and jargon-filled policies and restrictive guidelines that make it difficult to provide precise and regulatory-compliant customer service. The process of underwriting is labor-intensive and manual, and to make proper assessments of risk, there is a lot of manual sifting through a huge amount of unstructured data contained within emails, on contracts, and financial statements.

How LLM addresses this:

- LLM-enabled chatbots can respond to complicated customer questions regarding policy coverage and loss status through multi-turn conversations that obtain the requisite context to offer correct, compliant replies.

- Generative AI models can extract information from a wide variety of data sources, such as social media, public records, and contracts, and use it to create a risk profile of a customer that can be used in underwriting.

- Generative AI is also useful in generating synthetic datasets to test underwriting models against fairness and to model out different risk scenarios, e.g, new forms of accidents with driverless cars.

- In claims management, the LLMs can automate the document generation process, describe property damage in adjuster reports with details, and review claims paperwork for discrepancies.

Impact: LLMs can also save on expenses and can provide a form of speed and efficiency in responding to customers that humans are not. To the underwriters, the technology is time-saving, reduces human error incidents, and facilitates the production of customized insurance and improved risk evaluation. With the use of synthetic data, it is easier to detect fraud and also ensure that the models are fair and robust.

Lending

Challenges: Risk evaluation of credit has been done manually and tediously, by accessing a few financial histories, which can result in leaving out many credit-invisible individuals. This traditional system complicates the process of having a clear picture of the real appraisal of an applicant’s creditworthiness by the lenders.

How LLM addresses this:

- LLMs have the potential to streamline the credit risk evaluation procedure since they can examine a wider scope of elaborate data, such as spending habits and transaction history.

- They can combine the use of other data sets, including payments issued on mobile phones and publicly available records, to give a more comprehensive picture of the financial behaviour of an applicant.

- The LLMs will also have the capacity to reason credit decisions in natural language when combined with conventional models, providing greater transparency for both insiders and applicants.

Impact: LLMs accelerate the rates at which the loans can be approved and can lessen the amount of labor required to accomplish the aim. Access to alternative data increases the number of potential customers who can be served by lenders, thus making financial products more accessible to historically underserved groups who may otherwise be unable to access a loan.

Investment

Challenges: LLM can provide solutions to a range of problems facing the investment world. For a major investment firm, traders and portfolio managers require access to vast amounts of up-to-the-minute market information to make informed and time-sensitive decisions. The manual examination of news articles, reports, social media, and macroeconomic indicators is time-consuming, cumbersome, and may cause analysts to overlook small changes or opportunities in the market.

How LLM addresses this:

- LLMs analyze real-time feeds of news, sentiment scores, and market intelligence to make optimal decisions concerning the investments.

- Their strength lies in their ability to take advantage of subtle sentiment to interpret news headlines, analyst reports, and social media cues such as Twitter and turn this into trade signals based on the changing moods of the masses.

- It is also possible to analyze central bank speeches and earnings call transcripts to extract policy signals and risk factors that are looked upon as indicators of future movements in the market, benefiting state bank cash.

- LLM can use this to find out which of these policies and risk factors will influence future market trends.

Impact: The technology enables portfolio managers to react quickly to market changes, and this will improve the investment performance, as well as provide traders with a significant advantage over their competitors. The speed capabilities allow real-time analysis and interpretation of information, enabling flexible rebalancing of portfolios in response to macroeconomic movements to enhance the overall dexterity and reactiveness of a firm.

Real-World Corporate Finance LLM implementation

The theoretical potential of large language models in finance is increasingly being realized through specialized models and strategic institutional adoptions across the financial landscape. As financial institutions seek to enhance efficiency, improve decision-making, and deliver personalized services, LLMs are being integrated into various applications, from risk management to customer service automation.

Let’s explore real-world case studies that highlight how LLMs are driving financial innovation, showcasing their transformative impact through practical implementations.

| LLM/Institution | Type | Key Features | Application Impact/Benefit |

|---|---|---|---|

| BloombergGPT | Special LLM | 50B parameters, trained with a huge collection of financial data; can create BQL, news titles, and respond to financial inquiries. | Beats general LLMs at financial NLP tasks; simplifies access to and analysis of data. |

| FinBERT, FinGPT | Open-source Specialized LLMs | Financial sentiment and market forecasts adhere to new data. | Derives subtle sentiment elements of reports; assists in the interpretation of market sentiment to be used in trading strategies. |

| InvestLM, FinLlama | LLM Hashes (Fine-Tuned) | Question and answer relating to investment, the fairness of monetary sentiment in automated trading. | Good knowledge of financial text: gives rich insights that may be used in trading. |

| DocLLM | JPMorgan Chase Internal LLM | Layout-sensitive processing of graphically complex text (invoices, contracts); extracts critical data, and summarizes. | Trump’s other LLMs on document intelligence; extracts unstructured data forms. |

| Morgan Stanley & OpenAI | Institutional Partnership | Developed a chatbot for wealth management advisors, receives proprietary data. | Transforms the access to internal knowledge radically; The advisor’s time is unleashed with client-facing activity. |

| Erica | Virtual Assistant | 2.5B+ client interactions, balance inquiries, pay bills, receive alerts, including fraud warnings, and give personalised insights. | Decreases wait, increases digital interaction, and offers proactive, financial advice. |

| SouthState Bank | Institutional Adoption | ChatGPT trained on in-house data sets to assist with personnel work (emails, reports, fraud detection, policy overviews). | Faster completion of tasks (12-15 mins to seconds); 20 per cent increase in productivity. |

| PayPal | Fraud Detection System | AI-driven dynamic fraud detection, real-time alerts, a history of 1B+ monthly transactions. | It actively prevents losses, adjusts to the changes in threats, and detects unusual activities much quickly than people. |

| ROYAL BANK OF CANADA | S NOMI Virtual Assistant | Personalised insights, budgeting software, predictive savings. | Reviews cash flow to increase the rates of the household savings; provides active financial management. |

Leverage the Power of custom LLMs services to boost efficiency, sharpen decisions, and deliver unmatched client value.

Ways to Adapt LLMs for Financial Services

large language models in finance hold potentially transformative use-cases in financial services, allowing automation, more fine judgment, and customer experiences. Nevertheless, they are generic and thus need proper tailoring to fit the needs of the sector, such as compliance with regulations, data sensitivity, and accuracy related to the specific domain.

Let us look into salient approaches to making LLMs adaptable to the finance sector with an emphasis on practical techniques, problems, and good practices.

Domain-Specific Fine-Tuning

Fine-tuning is related to training an already trained LLM through a special dataset to improve its performance on financial tasks. This procedure relates the model to the vocabulary, peculiarities, and tasks inherent in financial services, e.g., risk assessment, fraud detection, or investment analysis.

Methods:

- Supervised Fine-Tuning (SFT): Supervised fine-tuning utilizes a labeled dataset of financial texts (examples: SEC filing, loan agreement, or earnings call transcript), involving teaching the model domain-specific behavior. As an example, one can finely adjudicate on historical financial reports to tune the model and generate correct summaries of earnings.

- Task Specific Fine-Tuning: Tune the model to the specific task, e.g., sentiment analysis of market news, credit scoring, or contract analysis. As an example, an LLM fine-tuned on mortgage contract data can even learn to extract key contract terms, such as interest rates or repayment schedules.

- Life-Long Learning: Periodically replace the model with new financial information to keep it contemporary based on changing market trends, changes in rules, or economic scenarios.

Challenges:

- Data Availability: Labelled financial data (of high quality) is usually unavailable or proprietary.

- Overfitting: The models can be overfitted when fine-tuned on smaller datasets, which limits generalization.

- Due to the sensitivity of the information found in financial data, some regulations must be adhered to, which may include GDPR or CCPA compliance when fine-tuning.

Best Practices:

- Apply synthetic data generation to expand small datasets and remain consistent with data privacy laws.

- Use differential privacy measures to keep sensitive information secure during fine-tuning.

- To mitigate overfitting, run the models on validation sets repeatedly to test the performance.

Retrieval-Augmented Generation (RAG)

RAG integrates LLMs with knowledge search on external websites, which helps to deliver the best-fit answers with references to the current context. With financial services, it is possible to input real-time market prices, changes in regulations, or internal company documentation to supplement the output of the model.

Methods:

- Knowledge Base Integration: Learn directly from a selective database that contains financial-related documents, i.e., Bloomberg Terminal data, regulatory filings, or internal risk reports, to deliver pertinent data during inference.

- Real-Time Data Feeds: There are ways to include live, up-to-date market data (e.g., stock prices, interest rates) to guarantee that the responses will be to current conditions.

- Contextual Prompting: Based on the retrieved documents, it will be possible to draft exact prompts by which the LLM will be able to provide precise and context-sensitive results, including investment advice or compliance reports.

Challenges:

- Data Latency: The integration of real-time data can only be achieved with a solid infrastructure to minimize latency.

- Information Overload: The ability to retrieve too much or irrelevant information can lower the quality of the responses.

- Security Risks: A third-party source of data should be vetted before being used to restrict unauthorized access to information or prevent data loss.

Best Practices:

- Get the right financial document: use the vector database (Pinecone, Weaviate).

- Put firm data controls in place and ensure that sensitive data sources are protected.

- Audit retrieved information regularly to ensure the accuracy and relevance of information.

Regulatory Compliance and Ethical Alignment

The financial industry is highly regulated, and LLMs have to comply with regulations (i.e., GDPR, CCPA, SEC regulations, anti-money laundering laws) and laws. Ethical alignment makes the models free of biases and gives reasonable and understandable results.

Methods:

- Bias Mitigation: Train models on a wide range of data sets to mitigate bias in credit scoring, loans granted, or customer profiling.

- Explainability Layers: Incorporate tools such as SHAP (SHapley Additive exPlanations) so that their outputs are interpretable, which is essential in regulatory audits and in ensuring customer trust.

- Compliance Filters: Use post-processing filters to ensure that any output does not violate any law or ethical regulations, such as avoiding the implication of insider trading in the investment recommendation.

Challenges:

- Complex Regulations: Model behavior has to be dynamically adapted to local regulations, which are being changed by each jurisdiction.

- Finding a balance between hyper-critical filtering that limits the model’s utility and slack filters that potentially do not comply.

- Auditability: Regulators can demand specific records of the decisions made by the model, which can be difficult to maintain.

Best Practices:

- Involve legal and compliance teams throughout the model development process to ensure compliance with the regulations.

- Utilize automated compliance checks that will report non-compliant outputs before implementation.

- Maintain detailed audit trails of inputs, outputs of the model, and decision processes.

Handling Sensitive Data

Financial services deal with sensitive data such as personally identifiable information (PII), transaction histories, and proprietary strategies. Training LLMs involves solid data security and privacy.

Methods:

- Data Anonymization: Eliminate or obscure PII in training sets to safeguard the privacy of the customers.

- Federated Learning: Train models on decentralized data (e.g., across banks) with/ no exchange of raw data, keeping them private.

- Secure Inference: Run LLMs in secure infrastructure, e.g., on-premises systems, or trusted cloud platforms, to avoid data leakage.

Challenges:

- Data Utility vs. Privacy: Anonymization may decrease the quality of the data, which can lead to underperformance of the models.

- Scalability: Federated learning is a process that demands significant computational and coordination resources.

- Third Party Risks: Data using cloud-based LLMs could be open to third-party vendors.

Best Practices:

- Apply encryption (e.g., network: TLS, AES; at rest: AES, etc.) to data in transit and at rest.

- Regularly audit and pen-test the deploy environments in use to test security.

- Use secure multi-party computation to train a model together.

Integration with Financial Systems

An ability to seamlessly integrate with the installed financial systems (e.g., core banking platforms, trading systems, or CRM systems) is key to practical use of LLMs.

Methods:

- API Development: Develop APIs to integrate LLMs with financial software to facilitate the exchange of real-time data and facilitate automation.

- Workflow Automation: Embodied Willful Ignorance: Concrete and LLM via workflows, e.g,. loan approval, compliance reporting.

- Legacy System Compatibility: Mainstream LLMs will be able to communicate with legacy systems by using middleware or data adapters.

Challenges:

- System Heterogeneity: There is usually a combination of legacy and modern systems being used, which creates difficulties in integration in financial institutions.

- Scalability: Due to high transaction volumes, sufficient infrastructure is needed to enable LLM inference.

- Maintenance: Development of integrated systems needs regular updates in line with the changing LLM capabilities.

Best Practices:

- Be agile with common APIs (e.g., REST, GraphQL).

- Install monitoring mechanisms to monitor the performance and measure the integration problems.

- Arrange gradual integration to minimize interference with the current processes.

Continuous Monitoring and Evaluation

The rate of change in the financial markets, including regulations, is fast, and it means that there is a need to monitor and scale the LLM’s performance and relevance constantly. |

Methods:

- Performance Metrics: Monitor key performance indicators such as accuracy, F1 score, or even customer satisfaction per task.

- Drift Detection: Be aware of a change in the distribution of the input data (data drift), a change in the financial patterns (concept drift) as a trigger to restart training.

- Feedback Loops: Accept user feedback from financial analysts or customers to improve model outputs.

Challenges:

- Dynamic Environments: The changes in the market can outdate models very quickly.

- Resource Intensity: Website monitoring requires significant server and human resources.

- Finding the right balance between automation and observation: To the extent that observation systems are automated, unobvious issues may be missed.

Best Practices:

- Install automated performance degradation detection tools.

- Set up regular retraining of the models depending on the results of drift detection.

- Gather quantitative data and qualitative feedback to make a full analysis.

Costs of Implementing an LLM Solution for Financial Services

The costs associated with implementing a Large Language Model (LLM) solution within the financial services sector vary based on the nature and scale of its implementation.

Costs of financial LLM software implementation range from $45000 to $600,000+, depending on the factors including complexity.

The approximate costs of simple, medium, and complex implementations are now clear, according to industry knowledge and average project demands.

| Implementation Level | Cost Range | Description |

|---|---|---|

| Basic | $45,000 – $100,000 | Investment in entry-level solutions employing pre-trained LLMs with little to no modifications. Best suited for scaled small to medium businesses, for supporting customer interactions, or more advanced summarisation. |

| Medium | $200,000 – $300,000 | Includes moderately customised solutions, LLMs with pre-trained LLMs, and application to specialised financial sectors. Use Fraud and Compliance Monitoring as an example of integrated use cases with existing systems. |

| Advanced | $400,000 – $600,000 | Highly customised solutions requiring extensive pre-trained LLMs and proprietary model crafting using the more advanced financial systems. Applications include risk management and algorithmic trading. |

Factors Affecting the Cost of Implementing an LLM Solution for Financial Services

Several factors influence the cost of deploying an LLM solution in financial services, driven by the unique requirements of the industry, such as regulatory compliance and data security.

| Factor | Impact on Cost | Details |

|---|---|---|

| Model Complexity | High | The need for additional sophisticated models, especially those with increased parameters, raises computational and expert resource expenditure, thus increasing costs. |

| Data Preparation | Medium to High | Financial datasets require extensive cleansing, anonymisation, and labelling to be aligned with compliance frameworks like GDPR and CCPA relative to other datasets. |

| Integration Needs | Medium to High | The LLM needs to be custom integrated with legacy systems, trading platforms, or CRM systems, which require custom design and extensive validation. |

| Regulatory Compliance | High | Bank compliance with financial regulations, such as the SEC and FINRA, results in extra costs due to auditing and validation. |

| Scalability | Medium | The overall expenses are higher with constructed systems designed to manage heightened transaction volumes or require real-time processing. |

| Maintenance & Updates | Medium | Increased long-term costs are associated with continual model retraining and adapting to upgrades driven by changes in regulations or market factors. |

Strategies for Optimizing the Cost of Implementing an LLM Solution for Financial Services

Financial institutions face challenges when trying to manage costs while ensuring performance and compliance with LLC solutions. The following cost optimisation strategies can be used to enhance efficiency.

| Strategy | Cost Impact | Implementation Details |

|---|---|---|

| Leverage Pre-trained Models | High Savings | Utilisation of pre-trained LLCs, such as through xAI’s API at x.ai, can greatly decrease financial LLM software products development and infrastructural costs. |

| Cloud-based Deployment | Medium Savings | Access to advanced cloud-based services like AWS and Azure enables on-demand payment options. |

| Automate Data Preparation | Medium Savings | Utilisation of automated services can reduce cleaning and labelling costs, increasing manual engagement efficiency and compliance. |

| Modular Integration | Medium Savings | Creating modular integrations enables code reusability across applications, reducing development costs. |

| Regular Cost Audits | Low to Medium | Monitoring costs such as cloud services, API calls, and Financial LLM maintenance can highlight areas of redundant spending. |

| Outsource Non-core Tasks | Medium Savings | Vendors can be utilised to streamline non-critical tasks such as basic model training and infrastructure setup. |

Our team of LLM experts is ready to provide a precise cost estimation for developing a custom LLM tailored for your financial firm.

Choose Appinventiv as Your Tech Partner to Develop LLM Solutions For Finance

The matter of creating tailor-made LLM solutions for an enterprise is a challenging task that requires meticulous planning, technical expertise, and a visionary approach. Whether it is initial data preparation and intelligent chunking to its complexities of retrieval, reranking, and model integration, every stage has its challenges.

When implementing LLMs in financial services, selecting the right LLM deployment model is critical for maintaining regulatory compliance while maximizing AI capabilities.

The possibility of whether to build in-house or partner with an expert is a critical question because a home-built solution, in most cases, demands major and continued investments in skilled personnel, complex IT infrastructure, and continuous maintenance.

Here, we, at Appinventiv, are building ourselves as the perfect AI development partner to help in this regard through our suite of customized and tailored AI consulting services. Having a staff of more than 1,600 tech evangelists, we have more than 10 years of experience in the production of smart and AI-native solutions to help clients innovate and become disruptors in their industries.

We know that adopting AI is not simply a technological endeavour but one whose application needs to show a real ROI.

Why should you collaborate with Appinventiv to develop your LLM?

We experiment not only with models but also realize their solutions that can be used in production. Our LLM expertise involves action-based developments that look into the actual application rather than the score of tests. This is the reason why companies place their faith in our abilities to provide them with accuracy, speed, and maintenance of high uptime.

- This is core to our antipathy to Domain-Focused Data Craftsmanship. We have in-house subject-matter experts well-versed with customizing the Fintech consulting services to your needs. Our models are trained to specifically use the language of finance, and rendered without incorrect or misleading information, whether in curating, labeling, and refining the datasets.

- We use MLOps and Built-In Governance to oversee the whole cycle of your LLM solution. This involves management of integration, stringent testing, versioning, and drift inspection via safe pipelines.

- Our professionals guarantee that your models will be in line with the important regulations like GDPR, HIPAA, SOC 2, and PCI DSS at all times of their operation, giving you the assurance in a highly regulated field.

- At Appinventiv, we bake security into all our Layers of solutions. We do not see security as a bolt-on; it is built into the day one. Protecting your intellectual property and customer information is end-to-end and multi-layered, using data-at-rest encryption, VPC, secret rotation, and performing penetration testing on a routine basis.

- Numerous industry awards evidence successes in AI innovation and digital transformation. Among our awards are:

- Our capacity to offer full-service LLM solutions for finance can also be amplified by our strong alliances with a range of major technology providers, which allow us to develop scalable, sturdy, and safe AI solutions continuously. These include: AWS, Azure, GCP, ServiceNow, Adobe, Databricks, AWS Sagemaker, AWS Bedrock, Oracle, Salesforce, SAP, Snowflake, and Hubspot, amongst others.

Collaborate with us to develop a bespoke large language model specifically designed to meet your business requirements, utilizing modern AI to generate innovation, efficiency, and growth. Contact us today to unleash the potential of your data, with a feature-secure, scalable, and industry-specific LLM solution.

FAQs

Q. What LLMs Can Do for Financial Services?

A. Large language models for finance offer transformative capabilities for the financial services industry by leveraging their natural language processing and data analysis strengths. They can automate customer service through intelligent chatbots that handle inquiries, provide account information, and guide users through financial products, improving response times and customer satisfaction.

Q. What are the Ways to Adapt LLMs for Financial Services?

A. Adapting LLMs for financial services requires tailoring their capabilities to meet the industry’s unique demands. One key approach is fine-tuning models on domain-specific datasets, such as financial reports, contracts, or regulatory texts, to improve accuracy in understanding industry jargon and context.

Another method is to implement retrieval-augmented generation (RAG), which allows LLMs to pull relevant information from internal knowledge bases for more precise responses.

Q. How Long Does It Take to Develop and Deploy an LLM in Finance?

A. The timeline for developing and deploying an LLM in the finance sector typically ranges from 6 to 18 months, depending on the project’s complexity and requirements.

- Initial stages, including defining objectives, gathering domain-specific data, and selecting a suitable model, can take 1-3 months.

- Fine-tuning the LLM on financial datasets and integrating it with existing systems, such as trading platforms or compliance tools, may require 3-6 months, as it involves rigorous testing to ensure accuracy and reliability.

- Compliance with regulatory standards, such as data privacy and financial reporting, adds another 2-4 months for audits and validation.

- Deployment, including pilot testing and scaling, typically takes 2-5 months, with additional time for user training and system optimization.

Q. What services do Financial LLM Providers offer?

A. Financial LLM Providers provide solutions for:

- Customer Support: AI-driven chatbots for 24/7 personalized support, e.g., Klarna’s OpenAI-powered assistant.

- Fraud Detection: Analyzing transaction patterns to identify anomalies, as seen with PayPal.

- Sentiment Analysis: Gauging market trends from news and social media, supported by models like FinLlama.

- Regulatory Compliance: Automating compliance checks with regulatory data, as offered by FinLLM.

- Risk Assessment: Evaluating creditworthiness and market risks, used by Deutsche Bank.

- Personalized Advice: Tailoring investment and budgeting recommendations, as implemented by Wealthfront.

Q. How Do We Ensure Finance LLM Compliance with Data Privacy?

A. Ensuring LLMs in finance comply with data privacy regulations, such as GDPR, CCPA, or industry-specific standards like PCI-DSS, involves multiple safeguards. First, data anonymization techniques should be applied to sensitive customer information during model training and inference to prevent exposure.

Implementing robust access controls and encryption for data storage and transmission protects against unauthorized access. Using federated learning or on-premises deployment can keep sensitive data within secure environments, reducing reliance on external servers. Regular audits and compliance checks, aligned with regulations like FINRA or SEC requirements, ensure ongoing adherence.

Q. What tasks can LLM copilot for finance professionals perform in financial workflows?

A. LLM copilot for finance professionals can perform the key tasks:

- Auditing: Automates data pulling and reconciliation from ERP systems, identifying inaccuracies with natural language prompts.

- Collections: Simplifies processes by generating communication drafts and accessing customer data directly from tools like Outlook.

- Financial Reporting: Accelerates report creation and variance analysis, offering insights into trends and anomalies.

- Forecasting: Analyzes historical data to predict cash flow, revenue trends, and financial risks.

- Data Visualization: Creates charts and tables in Excel or Teams based on natural language queries.

Q. What are the key technologies required to implement LLMs in the finance sector?

A. Key technologies for implementing LLMs in finance include:

- Machine Learning Frameworks: TensorFlow, PyTorch, and Hugging Face Transformers for building and fine-tuning LLMs.

- Natural Language Processing (NLP) Libraries: spaCy, NLTK, and Hugging Face’s Tokenizers for text preprocessing and analysis.

- Cloud Platforms: AWS, Google Cloud Platform (GCP), and Microsoft Azure for scalable model training and deployment.

- APIs and Integration Tools: REST APIs, FastAPI, or Flask for integrating LLMs with financial systems.

- Data Storage and Processing: SQL databases (e.g., PostgreSQL), NoSQL databases (e.g., MongoDB), and big data tools like Apache Spark for handling financial datasets.

Q. Can LLMs predict stock prices accurately?

A. LLMs for finance can analyze historical data and market sentiment to provide forecasts, but stock prices are influenced by unpredictable factors. Their predictions are probabilistic and should be used cautiously alongside other tools.

Q. What are the Challenges of implementing LLMs in Finance and their solutions?

A. Challenges of Implementing LLMs in Finance and Solutions:

- Data Privacy

- Challenge: Sensitive data risks leakage; regulations (e.g., GDPR) complicate compliance.

- Solution: Use encryption, anonymization, and federated learning; conduct regular audits.

- Model Bias

- Challenge: Biased data leads to unfair outcomes in lending or investments.

- Solution: Apply fairness-aware algorithms and diverse datasets; monitor fairness metrics.

- Explainability

- Challenge: LLMs’ “black box” nature hinders transparency for regulatory needs.

- Solution: Use SHAP/LIME for explanations; implement human-in-the-loop validation.

- Computational Costs

- Challenge: High resource demands increase costs for smaller institutions.

- Solution: Leverage cloud solutions, model quantization, and pre-trained models.

- Regulatory Compliance

- Challenge: Strict rules (e.g., SEC) limit deployment and require documentation.

- Solution: Design models with compliance in mind; maintain audit logs.

- Data Quality

- Challenge: Noisy or limited data impacts performance in fraud detection or predictions.

- Solution: Preprocess data; use synthetic data or external sources.

- Real-Time Needs

- Challenge: LLMs’ complexity slows responses for trading or fraud detection.

- Solution: Optimize with pruning, distillation, or GPU/TPU deployment.

These solutions enable financial institutions to use LLMs effectively while ensuring compliance and trust.

- In just 2 mins you will get a response

- Your idea is 100% protected by our Non Disclosure Agreement.

Open Banking in Australia: A Practical Guide for Businesses

Key takeaways: Open banking-driven “Smart Data” initiatives are projected to contribute up to $10 billion annually to the Australian economy. Enterprises that follow a phased rollout covering readiness assessment, compliance alignment, API integration, cybersecurity, and scaling achieve faster deployment and lower operational risk. Constant CDR updates, accreditation complexity, and modernising legacy banking systems continue to…

Financial Wellness App Development: Process, Features and Costs

Key Takeaways Strategic ROI: Financial wellness apps are no longer "perks"; they are critical tools for reducing financial presenteeism and improving institutional retention. Technical Integrity: Successful deployment requires seamless integration with Human Capital Management (HCM) systems and secure Open Banking APIs. Compliance-First: Enterprise-grade solutions must prioritize SOC2, GDPR, and ISO 27001 standards to protect sensitive…

Money Transfer App Development: Building Secure Payment Apps in 2026

Key Takeaways Money transfer apps in 2026 succeed when compliance, security, and scalability are designed into the platform from day one, not added later. Choosing the right app type early helps avoid costly rework as transaction volumes, regions, and regulatory demands increase. Strong internal ledgers, clear settlement states, and automation are critical to preventing reconciliation…